AUGUST 2020 DEC 2022 - ISSUE 63 GLOBAL ENERGY NEWS WORLD PROJECTS MAP MONTHLY THEME INNOVATION & TECH RENEWABLES CONTRACT AWARDS ON THE MOVE DECOMMISSIONING STATS & ANALYTICS LEGAL & FINANCE EVENTS UK’s N o . ENERGY SECTOR PUBLICATION 1 RISK & SAFETY MANAGEMENT FEATURING Brimmond - QHSE Aberdeen STC Insiso - Salus Technical Re-Gen Robotics - RenewableUK 3t Transform EXPANSION, INVESTMENT & DIVERSIFICATION THE FUTURE IS BRIGHT FOR BRIMMOND www.brimmond.com Read on page 4

EQUIPMENT AND PERSONNEL HIRE Renewables Decommissioning Subsea Hydraulics Well Services Pipeline Industrial Cleaning Download Our Product Catalogue

Welcome to the December edition of ‘OGV Energy Magazine’, where this month our theme is on ‘Risk & Safety Management’, as we head towards the Christmas holidays.

Our front cover partner this month is Brimmond Group and you can read all about their transformational year on pages 4 & 5, which included new board appointments, the absorption of their sister company and diversification into new markets.

We also have contributions from Viper Innovations, Zync360, QHSE Aberdeen, PIM Ltd, Re-Gen Robotics Salus Technical and STC Insiso.

The rest of this month’s magazine as always provides you with a review of the Energy sector in the North Sea, Europe, the Middle East, the US and Australasia along with industry analysis and project updates from Westwood Global Energy Group, the EIC and Renewables UK.

CONTENTS FOLLOW US

25

Happy Christmas!

VIEW THE OGV MAGAZINE ONLINE AT www.ogv.energy/magazine @OGVENERGY OGVENERGY @OGVENERGY OGV-ENERGY WISH TO CONTRIBUTE TO NEXT MONTH'S PUBLICATION? Contact us to submit your interest daniel.hyland@ogvenergy.co.uk COVER SPONSOR OGV COMMUNITY NEWS PEOPLE IN ENERGY GLOBAL ENERGY NEWS WORLD PROJECTS MAP MONTHLY THEME INNOVATION & TECH RENEWABLES CONTRACT AWARDS ON THE MOVE DECOMMISSIONING STATS & ANALYTICS LEGAL & FINANCE EVENTS P.04 P.08 P.10 P.11 P.20 P.22 P.28 P.32 P.34 P.36 P.38 P.40 P.42 P.43 KENNY DOOLEY MAIN EDITOR 4 28 27 27 38 8 32 24 3

Kenny Dooley

AN IMPORTANT YEAR FOR BRIMMOND

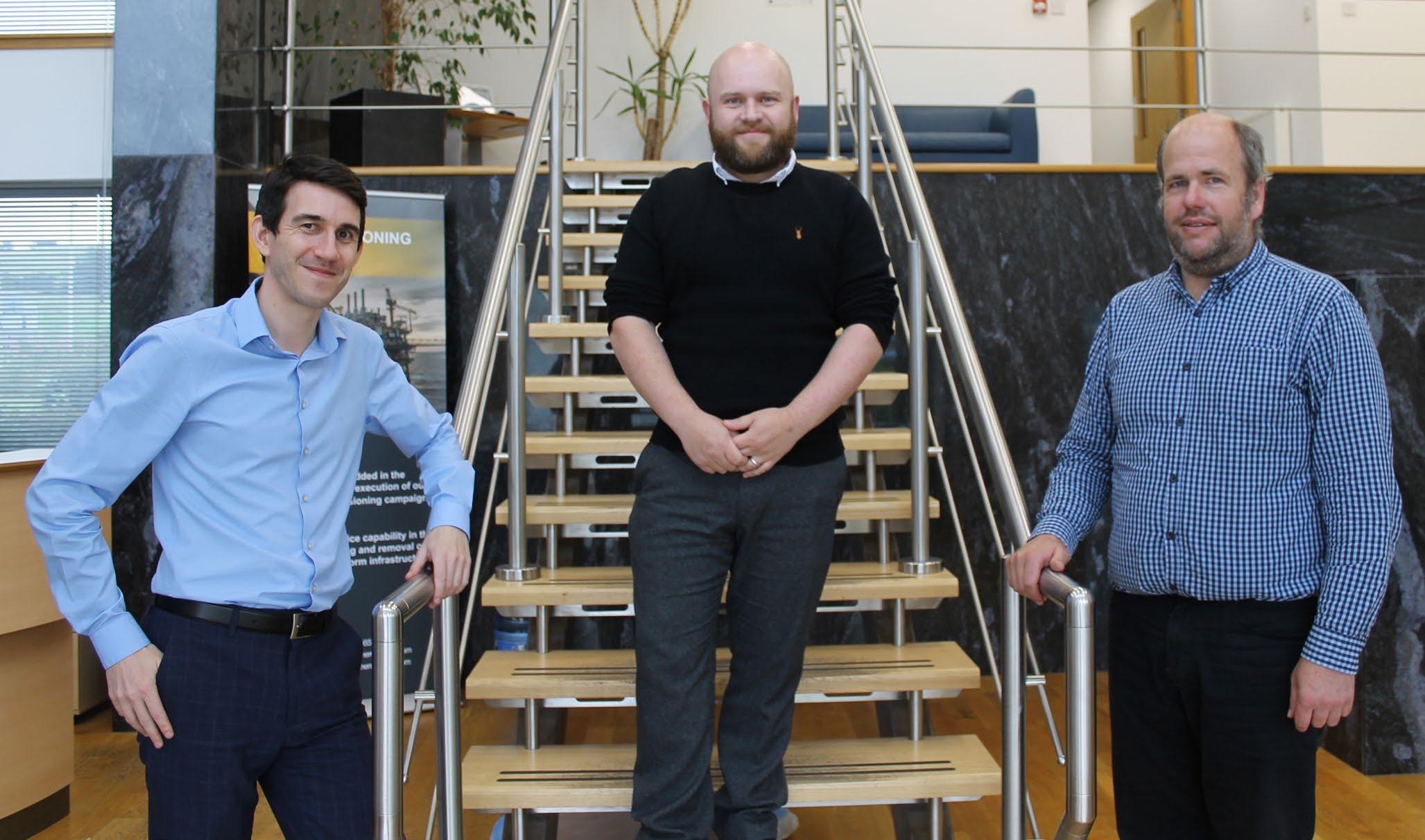

This year has been an important one for Brimmond, the Aberdeenshire-based provider of hydraulic, lifting and mechanical equipment and services.

Starting the year off strong, Brimmond secured UK distributorships with KAMAT pumps and Heila Marine Cranes - both critical components to the company’s continued diversification - and has continued to go from strength to strength reporting its highest-ever turnover of £6 million.

Significantly in 2022, Brimmond integrated the divisions of its business by absorbing sister company Rigrun Europe. The company, which also rebranded after dropping ‘Group’ from its title, announced Tom Murdoch as Managing Director of the newly unified entity in June.

Reflecting on the company’s recent journey, Tom said: “Unifying the business has created a stronger organisation, more capable of achieving growth in domestic and international markets as demand for our services continues to increase.

“The rebranding and restructure followed a successful year as we celebrated our 25th anniversary and secured contracts spanning the renewables, nuclear and marine sectors. It’s been a busy but very substantial year for us. Looking towards the end of March for the next financial year, we have an incredible pipeline of projects we are very close to securing.”

Key to this growth, Brimmond is in the process of implementing a new ambitious strategy to diversify into new markets including marine, aquaculture and renewables.

To further strengthen its board, in addition to Tom, as well as Operations Director Stewart Findlay and Technical Director Alan Glennie, Nigel Jenkins has recently been appointed as Non-Executive Director.

Nigel, who specialises in business improvement and growth, has been integral in the development of the new three-year strategy, as Tom explains: “Nigel has an outstanding business track record and brings a wealth of experience and knowledge to Brimmond’s board, particularly in functions and processes that grow businesses and generate revenues.”

With a 25-year history in tailor-made design and manufacture of safe and cost-saving machinery for a wide range of sectors, oil and gas remains pivotal to Brimmond’s core business.

Tom adds: “Oil and gas will continue to be the primary source of income for us. This coming year I’d estimate it to have been 60-70% of the work. However,

diversification is critical as the industry adapts to navigate the energy transition. We’re actively targeting opportunities for sustainable growth in other sectors and pleased to be increasing both our presence and product offering in emerging lowcarbon markets.

“We have invested a lot of time in the Fit4OffshoreRenewables programme to ensure we can keep up, and excel at, our incoming renewables and energy transition opportunities.

“To support the recent growth, and achieve our objectives within new sectors, we are expanding the Brimmond team. Our people are at the very core of our company – we have a strong track record in the bespoke design and innovative manufacture for a wide range of sectors with a global reach, and this is down to the wealth of experience and calibre of our in-house team. We want to enable them to develop and grow along with the industry.”

Brimmond currently employs 33 members of staff and is looking to recruit another six including engineering roles, a business administrator and a workshop apprentice, with the hope of rolling out an apprentice programme in the future.

4 www.ogv.energy I December 2022

Not only does Brimmond invest in its people, but the company has also invested over £1million into various areas of the business, including rental fleet, stock Heila Cranes and the facility. New rental equipment includes another 175 Tonne Meter crane, capable of 27m of reach and various hydraulic power units. And a dedicated fabrication extension onto their current building in Kintore is also in the works to increase capacity.

Amid an exceptionally busy year, the Brimmond team also found the time to get involved in a variety of creative fundraising activities through its charity partnership with Charlie House. Throughout the year, Brimmond has continued to boost its efforts to raise awareness and critical funds for the charity, which supports local children with life-limiting conditions, hitting the impressive milestone of £25,000.

Brimmond is on track to beat this year’s £6 million turnover by around 10% with an exciting pipeline of projects and contracts in various sectors lined up for 2023. “We’ve got an exciting new product for a new industry, and it's looking as though next year is going to be a very busy and hugely rewarding year,” concludes Tom.

Brimmond designs, manufactures, rents and services a range of hydraulic, mechanical and lifting equipment. The company’s core equipment includes diesel and electric hydraulic power units (HPUs), marine cranes, umbilical reelers, spoolers, flushing units and pump units of all shapes and sizes.

www.brimmond.com COVER FEATURE

At Brimmond we specialise in the design, manufacture, rental and repair of lifting, mechanical and hydraulic equipment for industry, from our base in Aberdeenshire, Scotland.

5

Brimmond is on track to beat this year’s £6 million turnover by around 10% with an exciting pipeline of projects and contracts in various sectors lined up for 2023.

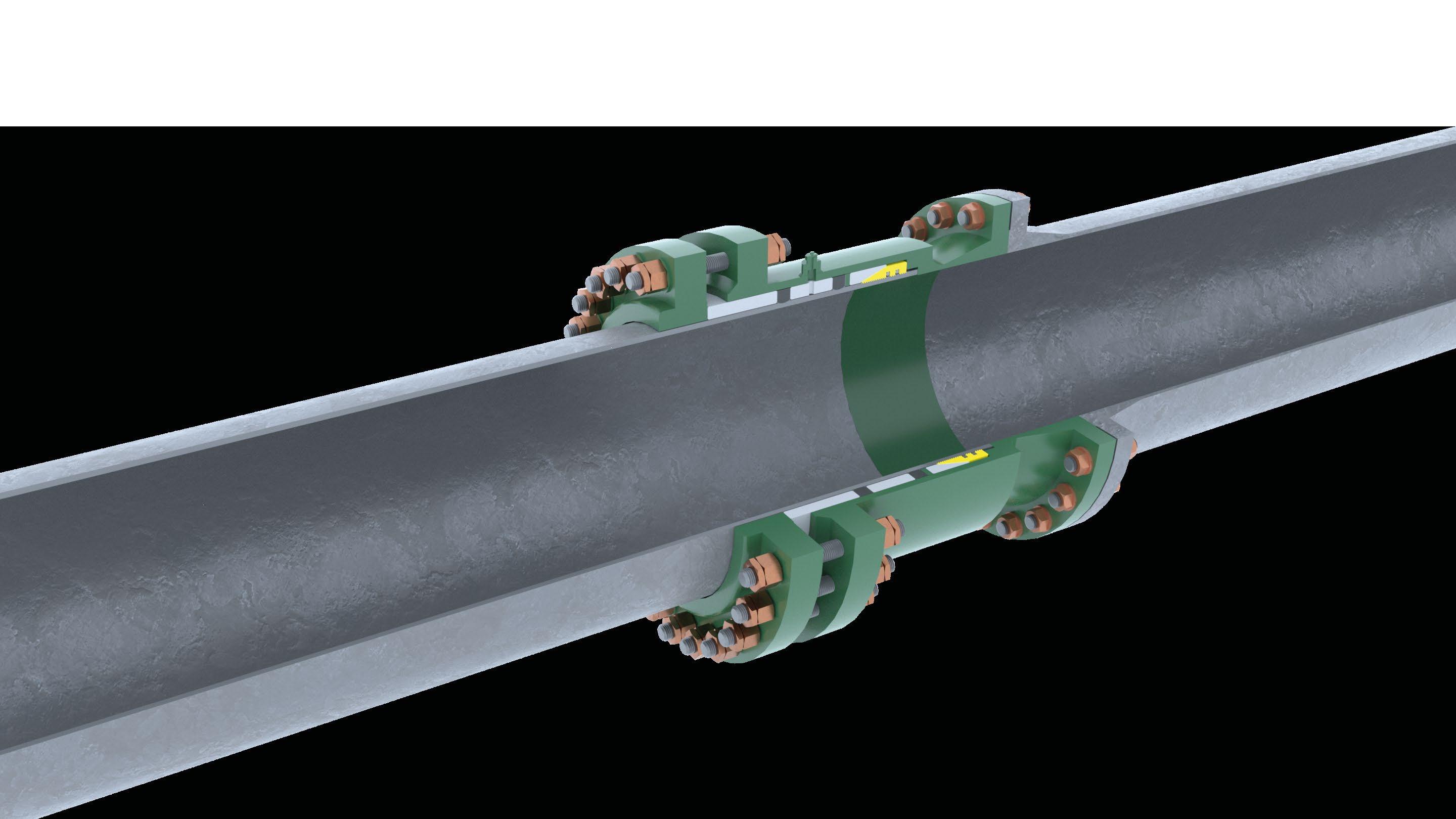

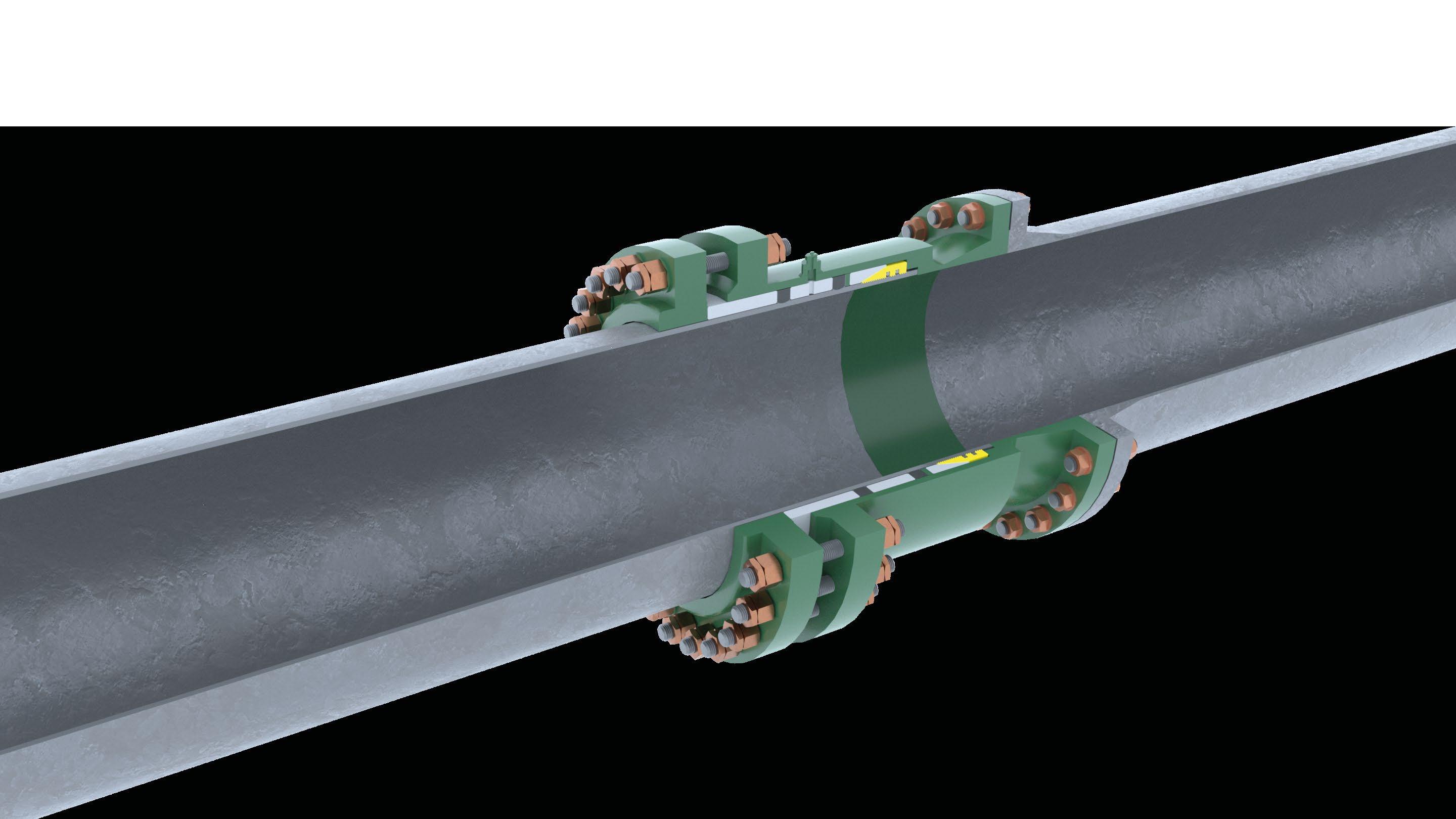

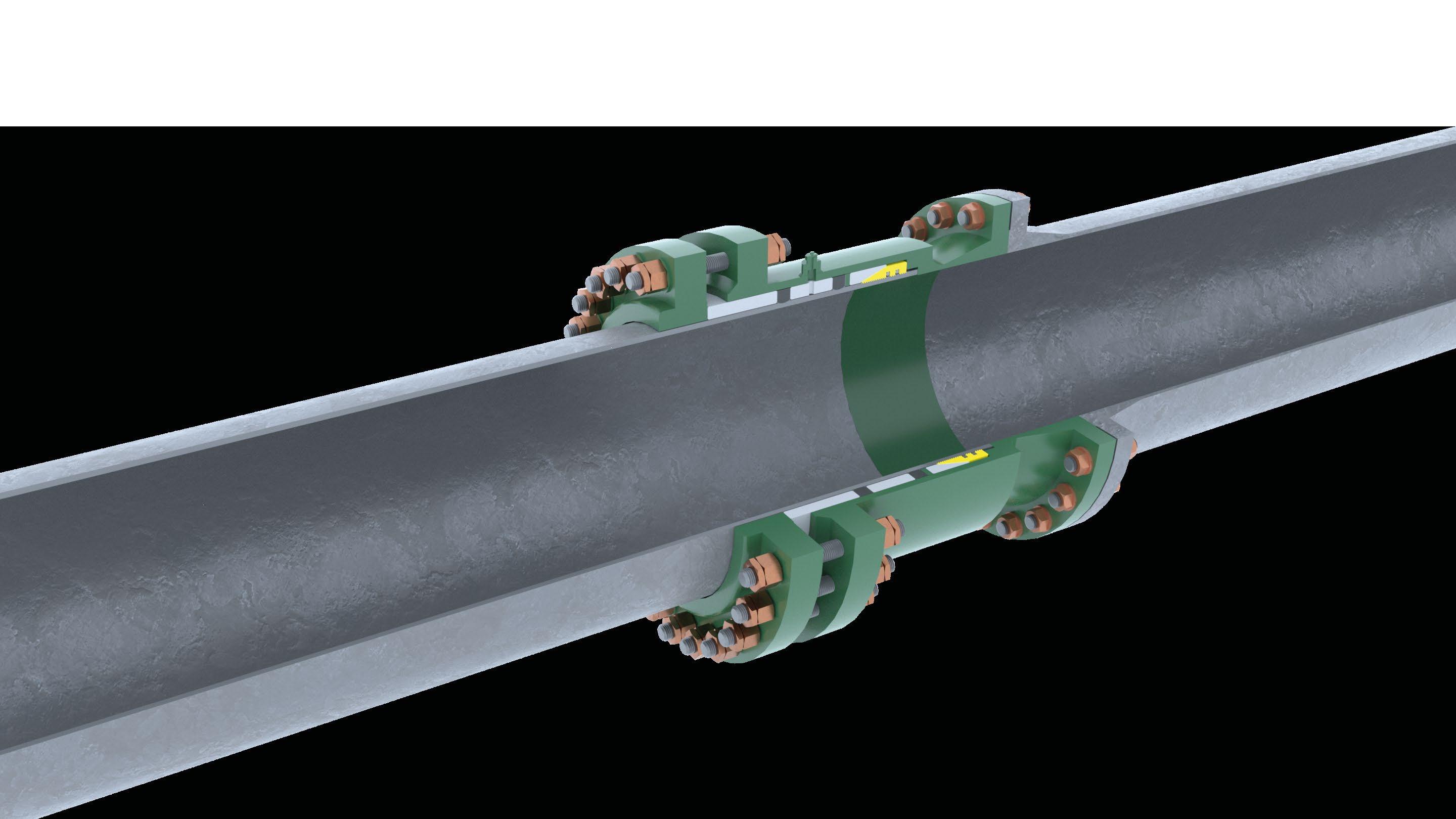

STATS GROUP Managing Pressure, Minimising Risk Mechanical Pipe Connector Piping Repair, Tie-In or Capping seal vertification port DNV TYPE APPROVAL dual graphite seals taper lock grips Permanent pipe to flange connection where welding may be undesirable. The slipover design and external gripping assembly enables a quick and cost-effective solution, with no specialist installation or testing equipment required.

CONTRIBUTORS OUR PARTNERS TRAVEL MANAGEMENT PARTNER LOGISTICS PARTNER

logistics

Editorial newsdesk@ogvenergy.co.uk +44

114 Advertising

+44

114 Design Ben Mckay Journalist Tsvetana Paraskova www.quanta-epc.co.uk YOUR ASSET IN SAFE HANDS Safe, efficient and low-cost delivery of Asset Management projects, ensuring best value every time. Operations Maintenance Repair orders Technical support VIEW our media pack at www.ogv.energy/advertise-with-us or scan de QR code ADVERTISE WITH OGV

Disclaimer: The views and opinions published within editorials and advertisements in this OGV Energy Publication are not those of our editor or company. Whilst we have made every effort to ensure the legitimacy of the content, OGV Energy cannot accept any responsibility for errors and mistakes.

Leading provider of

services to this industry, offering its customers airfreight, road freight, sea freight, project forwarding, customs compliance, training and consultancy, packing, crating, lashing & securing services warehousing, distribution, freight management, rig relocation and mobilisation services and offshore logistics. Corporate Travel Management (CTM) is a global leader in business travel management services. We drive savings, efficiency and safety to businesses and their travellers all around the world.

(0) 1224 084

office@ogvenergy.co.uk

(0) 1224 084

An international leader in the provision of creative solutions for the oil and gas completions market has cemented its commitment to the Middle East with a move to larger premises to accommodate a growing team.

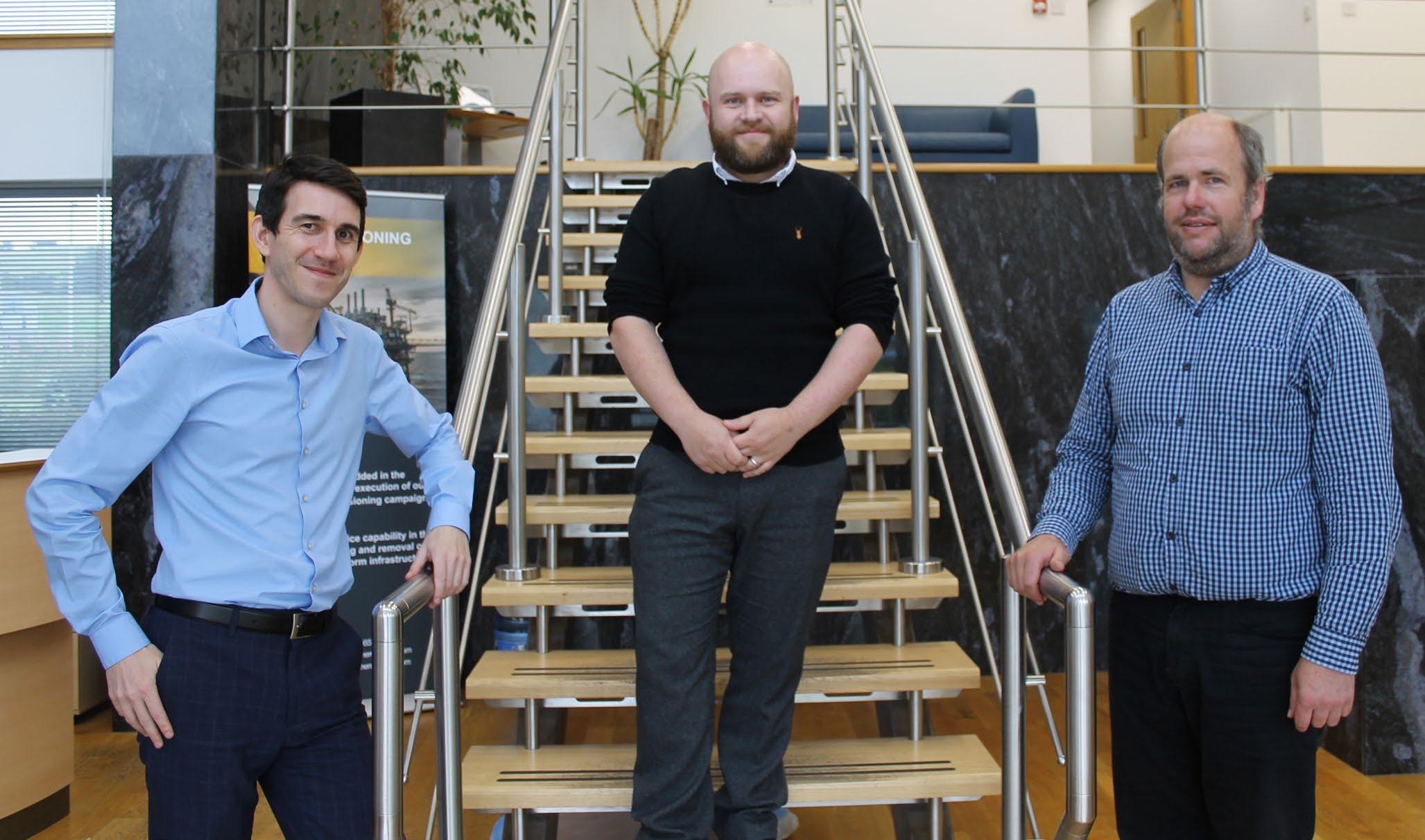

Vulcan Completion Products (VCP) has relocated its regional office to a new, larger office space in Dubai. From here, the recently expanded team – which now comprises four people – will enhance VCP’s foothold within the Middle East region, which is deemed to be of paramount strategic importance, both historically and in the company’s ambitious growth plans.

Multi award-winning North east company EnerQuip has celebrated the landmark opening of its first sales and service centre in the Middle East, and the creation of a strategic alliance with the announcement of a record $2.5 million contract award for delivery to Abu Dhabi in 2023.

The ambitious seven-year-old company has just opened premises in Abu Dhabi, UAE and hired full-time local staff in a move which will establish

a permanent physical presence in this key growing market. The creation of the local entity, EnerQuip Torque Solutions, to serve the Middle East market from a local base demonstrates commitment to the region but also at a local level, particularly in Abu Dhabi, given the importance of local investment to support In Country Value (ICV) objectives.

In establishing this new entity, EnerQuip has partnered with Al Yaseah Oil & Gas Industry Supplies & Services LLC to harness future opportunities in the region, including the securing of a significant multimillion dollar, multi package deal. The deal will see EnerQuip deliver several packages of their MTU (Mobile Torque Unit) that will be capable of fully automated offline make ups of threaded casing and drill pipe up to 20” diameter, and 120,000ft.lbs of torque.

The latest announcements represent further ambitious steps forward for the company which recently announced a significant expansion to its portfolio thanks to a key product line acquisition.

Colleagues from across Vysus Group‘s network of offices continue to take part in a range of community and charitable activities, to mark the company’s second anniversary.

Teams have been giving back to local communities by holding food drives, collecting and distributing donations to families in need, taking part in clean-ups, supporting local charities and entertaining residents in care homes.

Aker software company Aize establishes Aize Inc. and opens first office outside Europe, in Houston, Texas.

Aize, a provider of software for heavy-asset industries, has announced further expansion into the U.S. market with the opening of a new location at The Ion in Houston.

Aize creates domain-specific software that enables faster and leaner project execution and efficient operations for exploration and production companies. Developed by and for domain experts, the Aize workspace allows users to search, visualise and navigate assets digitally, making collaboration more efficient.

Just one year on from establishing a new entity in Australia, pipeline technology specialist STATS Group (STATS), is looking forward to a bright future after securing frame agreements with some of the region’s largest Tier 1 operators.

A wider market understanding of the company’s patented BISEP® double block and bleed isolation technology has laid the foundations for growth which is being realised with contract wins and formal longterm strategic relationships.

Subsea controls engineering specialists J+S Subsea have lifted the Operational Support Company of the Year title in the Corporate LiveWire Global Awards.

The Aberdeenshire-based business has taken the top spot in the awards, based on its quality of service, innovation and sustainability initiatives.

Managing director Phil Reid said: “We pride ourselves on understanding customer drivers and priorities so receiving this award is brilliant recognition for our efforts”

Controlled Flow Excavation (CFE) specialist, Rotech Subsea, has consolidated its position as the cable trenching partner of choice for the offshore wind sector, completing three remedial cable burial scopes of work offshore Germany for a European electricity cabling giant. Aberdeen-based Rotech Subsea mobilised its state-of-the-art RS1-2 Hybrid CFE tool for the operations, deploying it at various locations across multiple export cables.

OGV COMMUNITY NEWS

J+S celebrates strong year with global award

OGV

EnerQuip

announces record new contract award to mark opening of Middle East office FIND ALL THE FULL COMMUNITY NEWS ARTICLES

ON

ENERGY'S WEBSITE

STATS technology come of age with increase in Australian pipeline market frame agreements

Rotech Subsea completes trio of German Offshore Wind Farm cable burial operations

Aize announces first location in Houston, U.S.

Vysus Group gives back to mark its second anniversary

Maximum Growth in Middle East for Vulcan Completion Products

8 JOIN THE OGV COMMUNITY FOR JUST £30 A MONTH www.ogv.energy/register

events organised or media partners in 2022 17 videos and interviews posted in 2022 120+ podcasts conducted 2020-22 45+ Statistics issues published 63 social media platforms 6 social media followers 75,000+ newsletters sent out each month 200,000+ magazines monthly readers 30,000+ 1,451,706 unique page views in NOV 2022 240+ OGV Community members offices in 3 continents Our business platforms Energy News Media | Events Broadcast 13 graduate internships in 3 years OUR JOURNEY SO FAR INTERESTED IN ADVERTISING WITH US? VIEW OUR 2023 MEDIA PACK

PEOPLE IN ENERGY

SPONSORED BY

energyresourcing.com +44 1224 291176

PEOPLE IN ENERGY

LOUISE GRADY

Global HSEQ & CMS Manager Energy Resourcing

Louise has worked for Energy Resourcing for the past 22 years. Her role from the beginning always involved the Quality aspect later developing into a role that also covers HSE and Contractor Management Service (CMS). Initially supporting the UK business, Louise has moved into a global role to provide support to all Energy Resourcing regions.

How did you get into the Energy sector and how long have you been working in it?

I started working within the business as a summer placement and once I completed University, I took a full-time role. I have been within the sector for the past 22 years and have done varying roles particularly those related to Quality and HSE.

What does your job involve on an average day?

As I work with all regional locations within Energy Resourcing, my days are not always typical. Working with time zones and a variety of needs is always a challenge which keeps me on my toes. A lot of my time is spent looking at systems we use to be able to provide resource to our customers. Having recently implemented system in to all Energy Resourcing locations has meant that I have been able to engage and work with each team to tailor their specific needs for the use of the system. Alongside this some activity that I often carry out is audit related and where appropriate visiting sites to conduct a HSE safety tour to ensure our contractors are well looked after.

Recruitment

experts, placing top technical talent around the globe, with workforce solutions tailored to you

Energy Resourcing is a global technical recruitment agency. We’re passionate about matching high-quality candidates to the clients that need them. With offices in Australia, Asia, Europe and North America, we provide personalised customer experience through our dedicated support teams, day or night!

Our team of proactive recruitment professionals are experts in what they do. We specialise in providing robust workforce solutions and placing talent in typically hard to fill roles. So, whether you’re looking for your next job opportunity or need to hire technical talent to drive your next project, Energy Resourcing is here to help.

energyresourcing.com

What are main barriers to international growth for ambitious companies and what advice do you have for them?

Looking at this from the role I carry out, systems certainly stands out to me. Having a system that your business uses at all levels and in all locations improves the opportunity to facilitate international growth. Systems being managed at a global level helps to speed up process, move people between countries and ensure we can manage where are contractors are working.

What has been the highlight of your career so far?

For me the fact, I have never felt the need to leave the Company I work for. During my time here I have always held roles that have offered me a lot of variety so no two days are the same. I am also proud of the fact I can now share my knowledge and expertise to support our business on a global level.

What ambitions have you still got to fulfil professionally in your career?

My main goal is to gain ISO 9001 and ISO 45001 on a Global level. Ensuring we are working cohesively and to a worldwide recognisable standard is valuable. As I have for many years ensured we have and maintain these accreditations in our UK business this will allow me to use my knowledge to assist all our regions in achieving this goal.

Who has been the most influential person in your life professionally?

I was mentored by a senior colleague Early on in my career I had a manager who invested a lot of time in supporting me on my career path. He would always push me, guide me and ensure I was enjoying my work. The lessons I learnt from him and the knowledge

I gained over those years are invaluable to me and I will always remember this. I like to think his influence has shaped me with how I engage and work with my colleagues.

Over the next 10 years, what changes would you like to see in the energy sector with respect to D&I?

I can clearly see that the sector has made improvements in D&I however there is still a lot of work to be done. Engaging from an early age is something I would like to see more of. As a mother of a 6 year old daughter I can see small steps at her School and the subjects they are starting to cover even at that age. I think its important that it continues throughout the education system at all levels to help make the industry as diverse as we can.

Given the experience you have now, what advice would you give a graduate just starting his career in the Energy sector?

Make the most of the opportunity, learn as much as you can and have fun along the way!

If you were inviting guests to a dinner party, which 3 people would you invite and why?

Sir Alex Ferguson – as a season ticket holder at Manchester United for the last 30+ years there are so many things I’d love to ask him!

Dame Judi Dench – such an iconic actress and after seeing a recent interview with her I want to learn more and her the amazing stories she has to tell! She would definitely keep the dinner party entertained.

Gino Di Campo – Of course a chef is required to make the dinner! Aside from delicious food, I think he would bring some fun and humour to the table!

PEOPLE IN ENERGY SPONSORED BY

The hike in the UK windfall tax on the profits of oil and gas operators in the North Sea and its implications for the industry, decommissioning challenges and opportunities, and field and prospect updates featured in the UK oil and gas industry this month.

UK NORTH SEA Energy Review

By Tsvetana Paraskova

The UK government raised the windfall tax from 25% to 35%, drawing criticism from the industry and making some firms rethink their investment plans.

In the Autumn Statement in the middle of November, the government said that “The Autumn Statement sets out reforms to ensure businesses in the energy sector who are making extraordinary profits contribute more.”

The Energy Profits Levy will be increased by 10 percentage points to 35% and extended to the end of March 2028, from December 2025, and a new, temporary 45% Electricity Generator Levy will be applied on the extraordinary returns being made by electricity generators. The investment allowance for oil and gas operators will be reduced to 29% for all investment expenditure (other than decarbonisation expenditure), broadly maintaining its existing cash value. The hike in the Energy Profits Levy is expected to raise over £40 billion in total over the next six years, the government said.

After the announcement of higher windfall taxes, the leading industry association, Offshore Energies UK (OEUK), warned that the UK’s offshore industry would be “hit hard by the chancellor’s latest tax changes, which threaten to drive out investors, drive up imports and leave consumers increasingly exposed to global shortages.”

The offshore sector was paying 40% tax on oil and gas production even before the windfall tax was imposed in May. Since then, it has been paying 65%. The latest rise takes the overall tax rate to 75% from January 2023, OEUK said.

Deirdre Michie, OEUK’s chief executive, said that consumers were suffering, and it was right for all sectors to play their part but added: “These tax changes will undermine one of the UK’s most important industries. The UK offshore industry generates jobs for 200,000 people plus billions of pounds in taxes. The oil and gas it produces buffers the nation against global shortages. These changes put all those benefits at risk.”

DECEMBER 2022 ENERGY NEWS

Continues >

Repair, Conversion & New Build of Marine and Offshore Living Quarters & Technical Buildings Aberdeen | Blyth | Las Palmas | Dubai | Abu Dhabi | Qatar | Bahrain | KSA | Baku Proud Sponsor of the UK North Sea Review modutec.com 11

The latest budget, warned OEUK, means much of the necessary investment in all energies could dry up.

“If it does then oil and gas production will plummet so fast that, by 2030, the UK could be forced to import up to 80% of its gas – double the current level,” OEUK said.

Commenting on the new tax, supermajor Shell said it would be re-evaluating its £25 billion planned investment in the UK energy system.

“We're going to have to evaluate each project on a case by case basis,” Shell’s UK Country Chair David Bunch said at the Confederation of British Industry's annual conference in Birmingham on 21 November.

“When you tax more you're going to have less disposable income in your pocket, less to invest,” Shell’s top executive for the UK said.

In March 2022, Shell revealed plans to invest £2025 billion in the UK energy system over the next 10 years, with more than 75% of this intended for low and zero-carbon products and services.

Neptune Energy warned that some of the new development opportunities across its global portfolio “are at risk from potentially poorly targeted windfall taxes, particularly in the UK, Germany and the Netherlands. Neptune is supportive of a fair level of taxation, but mechanisms must not discourage investment in incremental production to support energy security priorities, as well as carbon reduction initiatives.”

EnQuest said in an operations update, “While the recently announced increase and extension of the duration of the Energy Profits Levy is particularly disappointing and threatens the delivery of UK's twin objectives of long-term energy security and decarbonisation, we remain committed to the UK North Sea and delivery of value to our stakeholders.”

At a decommissioning conference in St Andrews on 22 November, OEUK’s chief executive Deirdre Michie warned that the UK’s oil and gas production would drop in the coming years unless it supports energy companies in further North Sea exploration.

At the conference, OEUK presented its latest Decommissioning Insight report, which found that more than 2,000 North Sea wells involved in oil and gas extraction are to be decommissioned at a cost of around £20 billion over the next decade.

“The decommissioning opportunity is snowballing and could be worth around £20bn to the supply chain between now and 2031,” OEUK said in the report.

Decommissioning spend is forecast to increase dramatically over the next four years. Between 2019 and 2021 the average annual spend was £1.23 billion, or roughly two thirds

what had been forecast for the period 20222025.

A tenth of UKCS oil and gas expenditure went on decommissioning in 2021, a proportion set to rise to 13.7% this year and to 19% by 2031. Overall, decommissioning will account for 15% of UK offshore expenditure over the next ten years, OEUK said.

However, an upturn in activities throughout the UKCS will pose a challenge for the UK supply chain.

“Continued pressure from new energies also adds to this challenge as the UKCS battles to meet increasing demand for labour and materials,” OEUK said.

The North Sea industry has made great strides cutting the overall cost estimate for decommissioning, by 25%, or £15 billion, since the start of 2017, but it can go further, the North Sea Transition Authority (NSTA) said on 22 November and challenged the sector to reduce costs by further 10% in next five years.

“The NSTA is challenging the sector to build on its strong progress by lowering the total estimate for decommissioning redundant platforms, wells and pipelines by an additional 10%, from £37 billion to £33.3 billion, between 2023 and end-2028,” the authority said.

OEUK’s Exploration Insight report showed in November hat unpredictable fiscal conditions are denting the confidence of offshore energy-producing companies to invest and revitalise oil and gas exploration activity.

“The waters off the coast of the UK still contain oil and gas reserves equivalent to 15 billion barrels of oil equivalent (boe), enough to fuel the UK for 30 years, but more investment in exploration is needed to slow down the decline in domestic production to safeguard the nation’s energy security,” OEUK said.

At the end of October, NSTA warned the industry that it would not hesitate to take action against companies that fail to meet their licence obligations. An investigation has been opened into whether a company, which was awarded a licence in the 28th Licensing Round in 2014, has failed to comply with several obligations, including drilling an exploration well and shooting a 3D seismic survey, NSTA said. Operators must meet their licence commitments to ensure a level playing field for all, the authority noted.

NSTA also moved to cut red tape and scrap the requirement for Cessation of Production (CoP) reports, which will help industry to make significant savings in time and money.

“This move frees up time for operators to focus on those core tasks and creates time for NSTA staff to support the energy transition,” Brenda Wyllie, NSTA Area Manager, said.

In company news, Centrica has announced the reopening of the Rough gas storage facility, having completed significant engineering upgrades over the summer and commissioning over early autumn. The work done so far means that Rough is operating at around 20% of its previous capacity this winter, immediately making it the UK’s largest gas storage site once again and adding 50% to the UK’s gas storage volume.

Deltic Energy confirmed that operator Shell UK had started drilling on the Pensacola gas prospect with the Maersk Resilient rig.

“Pensacola is a high impact, potentially play opening prospect and represents what we hope will be the first of many wells as the Company continues to implement its strategy to identify opportunities and discover gas to support the UK's energy needs,” Deltic Energy CEO Graham Swindells said.

Reabold Resources completed the sale of the entire issued share capital of Corallian to Shell for £32 million gross.

Hurricane Energy said in early November that it had decided to launch a formal sale process in order to establish whether there is a bidder prepared to offer a value that the Board considers attractive. Crystal Amber Fund Limited, Hurricane Energy’s largest shareholder with 28.9%, has indicated to the Board its desire to monetise the value of its shareholding, Hurricane Energy said. In an update two weeks later, Hurricane Energy said that the sale process was progressing, “with multiple expressions of interest received from credible counterparties.”

Finder Energy has entered into three farmout transactions with Dana Petroleum for three licences in the Central North Sea. Finder is assigning 40% in each of the three licences to Dana Petroleum, while retaining 60% in them.

“Finder retaining a 60% interest allows for secondary farmouts to secure funding for wells whilst still retaining meaningful levels of participation in any discovery,” the company said.

Wood has been appointed integrated services partner by Centrica Storage for the company’s UK Southern North Sea operations. The five-year contract includes the provision of engineering, procurement and construction solutions, operations and maintenance services, as well as project management services for the Rough gas field and the Easington Gas Terminal in East Yorkshire. Wood’s scope also includes working with Centrica Storage to support their ambition to drive the UK’s clean energy transition by redeveloping Rough into the world’s biggest hydrogen storage facility.

ENERGY NEWS UK NORTH SEA

UK NORTH SEA REVIEW SPONSORED BY

12 www.ogv.energy I December 2022

DavidBunch GrahamSwindells

THE SOCIAL STRATEGIST

Eric Doyle

By Eric Doyle

By Eric Doyle

At many points in my career, I’ve been involved in the management of risk.

From task-based to business risk. I’ve found the process of identifying, assessing, and mitigating risk, fascinating through the years.

The mere fact that good risk assessment and management saves lives, reduces waste, lowers cost and saves time is impressive enough but, the mindset and process also encourage us think about opportunity.

Opportunities for improvement, for progress and growth.

As time moved on my focus turned to business risk, often centred around cashflow, profit & clients.

I’ve seen some fantastic, active corporate risk registers in my time and some dreadful examples of stale, inactive box ticking exercises. I even remember a time with a board in the 2010s where the Chairman spent 30 minutes arguing that we should remove “Global Pandemic” from our risk register as it was “a ridiculous waste of time focussing any energy on this nonsense”…

Nowadays my focus is on managing modern commercial risk.

Every organisation we talk to is experiencing challenges . Many have problems recruiting good people and retaining the people that they have…but for most the challenge centres round three areas - pipeline - visibility - credibility

them data/arguments/reviews “pricing” that you’re better than the competition doesn’t cut it because the competition are doing exactly the same.

Your commercial world has turned to Digital and knowing how to operate and be successful in your Digital sectors is now crucial.

“As leaders, we are at a crossroads – Analogue or Digital..?”

Do we hold fast and keep doing what we are doing or convert to Digital commercial practices and take what’s rightfully ours...?

The Digital Twin of your sector is already in build. Companies that have rewired their commercial processes to Digital are prospecting, networking, growing communities, building new relationships, and converting all of this to commercial interaction.

The access point to your commercial future is through Strategic Social Media.

We meet leaderships team from across sectors who tell us they have no pipeline. They tell us they have no leads and are existing on historic relationships with those 1 or 2 clients that “always come to us”.

We show them what modern Digital commerce looks like, how it works and what they should see in return….it answers their problems on revenue, ebitda, recruiting, ,market share….and more.

Then someone usually asks the question “How will we find the time to do this in our already busy days...?”

We hear this a lot.

The subtext in the introduction was “nothing we are doing is working and we are struggling to make ends meet”.

They now see a way ahead but are worried that it’s going to get in the way of all the things that they are doing that aren’t working.

BRENT OIL PRICES OVER THE YEARS

BRENT OIL PRICE DEC 2022 - $96.13

YEAR AGO 1

- BRENT OIL PRICE 2021 - $73.71

The price of oil continued a steady rise throughout December last year. This was despite the Omicron variant spreading rapidly, as there were hopes that the COVID-19 variant would have limited impact on global demand heading into 2022.

Earlier in the month, the firm behind the controversial ‘Cambo oil field’ off Shetland announced they were “pausing” the project. This announcement came following Shell pulled out of the North Atlantic development.

AGO 5

YEARS

- BRENT OIL PRICE 2017 - $63.81

Brent oil prices spiked to the highest level in two and a half years following news that a major pipeline in the North Sea would shut down for repairs. The forties pipeline was set to be closed for several weeks while its operator, INEOS, repaired a crack in the pipe that had been discovered. The pipeline was responsible for transporting around 40% of the North Sea’s output.

YEARS AGO 10

Pipeline = External

sales Marketing = Credibility & visibility

Even those organisations that have been fortunate to have had a couple of good years of sales have invariably realised that those days are gone or drying up and, they not only have no pipeline today…but they have no reliable mechanism for regenerating it. For visibility and credibility, the stark truth is that old techniques don’t work anymore. That’s not a huge surprise as marketers only one tools, words. You can tell people that your product is amazing/class leading/world beating, and you can say you are ‘customer focused and market leading’…but so can all of your competitors.

The truth is that your prospects (the individuals within your target organisations) are going to make potentially a career-limiting mistake by choosing the wrong supplier and simply giving

This is why we talk about resetting the commercial brain of the company and the team to Digital.

Becoming the leading technical and commercial Digital influencers in your sector isn’t a ‘bolt on’, it’s the way we need to be working now.

Many of our clients realise this as we go through our programme and begin offloading things that don’t work and redefining their commercial processes for the modern age.

So, as we move into 2023., how does your Digital commercial strategy look?

Are you moving with the times or holding onto old ideas and method…more adverts, more emails, more phone calls?

Are you building Digital communities and ecosystems around your people or are you hoping everything goes back to the way it was…?

Eric is a Co-Founder of Crux Consultancy Limited who train and coach cross sector B2B teams in the art and science of Strategic Social Media through Social Selling & Influence. www.consultcrux.com

- BRENT OIL PRICE 2012 - $110.57

The US government’s energy agency decided to adopt North Sea Brent crude as their benchmark for oil forecasts, dropping their domestic benchmark in the process, saying it no longer accurately reflects the price paid for oil by U.S. refineries. The move from the U.S. Department of Energy reflected a migration of large parts of the oil market to Brent.

What does your 2023 Digital commercial strategy look like?

By Tsvetana Paraskova

Europe Energy Review

and gas field developments offshore Norway, the UK windfall tax on low-carbon electricity generators, and many low-carbon energy deals marked the last month in Europe’s energy sector.

Oil

Oil & Gas

Norway’s Equinor and its partners in the Wisting prospect in the Barents Sea have decided to postpone the investment decision scheduled for December 2022. The maturation of the project continues, aiming for an investment decision by end of 2026.

“Many people have been working hard to realise Wisting, and the decision is demanding. However, in the current supplier market postponing the investment decision to ensure an economically sound development and robustness in the execution phase of the project is the right decision. When the pressure in the supplier market subsides, the Wisting project will be possible to execute in a good way,” said Geir Tungesvik, Equinor’s executive vice president, Projects, Drilling & Procurement.

Equinor and partners will now further mature the development concept, the power-fromshore solution, and consider new supplier models for Wisting.

The Norwegian company, however, has decided to develop the Irpa gas discovery, formerly known as Asterix, in the Norwegian Sea north of the Arctic circle. Equinor and partners Wintershall DEA, Petoro, and Shell will invest $1.5 billion (14.8 billion Norwegian crowns) to develop the discovery, the plan for which was submitted to Norwegian authorities at the end of November.

The Irpa discovery has expected recoverable gas resources equivalent to 124 million barrels of oil equivalent or the consumption of nearly 2.4 million British households over a period of seven years, Equinor said. The gas field is scheduled to come on stream in the fourth quarter of 2026. There will be joint production from Irpa and Aasta Hansteen through 2031 and then Irpa will continue to produce until 2039.

The gas will be phased into existing infrastructure over Aasta Hansteen and transported to the Nyhamna gas processing plant via Polarled. From there, gas will be transported via the Langeled pipeline system to customers in the UK and continental Europe.

“This is a good day—the development of Irpa will contribute to predictable and long-term deliveries of gas to customers in the EU and the UK,” Equinor’s Tungesvik said.

OKEA became operator of the Brage field with effect from 1 November 2022 after completing a sale and purchase agreement with Wintershall Dea. Through the acquisition, OKEA adds a new operatorship to its portfolio and increases production and reserves by 30-40%.

US firm Excelerate Energy signed at the end of October an agreement with Germany’s Government to charter the floating storage and regasification unit (FSRU) Excelsior

to help provide energy security and supply diversification to Germany while supporting the country’s transition to renewable energy.

“The deployment of the FSRU Excelsior to Germany demonstrates our commitment to strengthening energy security at a time when traditional energy sources have proven unreliable,” said Steven Kobos, President and CEO of Excelerate.

Neptune Energy and its licence partners announced in mid-November that hydrocarbons had been encountered in the Calypso exploration well in the Norwegian Sea. The operations in the reservoir section remain at an early stage and it has yet to be confirmed if commercial volumes are present, said Neptune Energy which views Calypso as an exciting prospect that could be tied-back to existing infrastructure in case of a commercial discovery.

Low Carbon Energy

The UK government introduced a 45-percent temporary tax on the extraordinary returns of low-carbon electricity generators, the Chancellor of the Exchequer Jeremy Hunt said in the Autumn Statement.

“The structure of our energy market means high oil and gas prices are driving up the cost of otherwise cheap low-carbon electricity in the UK. The government will introduce a new, temporary 45% Electricity Generator Levy on these extraordinary returns from 1 January 2023. This will help fund government support for energy bills and vital public services,” the UK government said.

For the purposes of the tax, extraordinary returns will be defined as the aggregate revenue that generators make in a period from in-scope generation at an average output price above £75/MWh. The tax will be limited to generators whose in-scope generation output exceeds 100 GWh across a period and will only then apply to extraordinary returns exceeding £10 million. The tax will apply to extraordinary returns arising from 1 January

ENERGY NEWS ENERGY NEWS

14 www.ogv.energy I December 2022

2023 and will be legislated for in Spring Finance Bill 2023.

The windfall tax on low-carbon electricity generators risks severely damaging investment in vital renewable energy projects, RenewableUK warned after the new tax was announced.

“This windfall tax on low carbon power risks deterring investment, at a time when the Chancellor should be incentivising clean energy. Unlike in oil and gas, under this levy companies which are making significant investments in renewables will get no tax relief and will be hit by a higher windfall rate,” RenewableUK's CEO Dan McGrail said.

“We need to attract more than £175bn in new wind farms and our supply chain over the course of this decade, so we need to make the UK one of the most attractive destinations for private investment in renewables. Ministers now need to work with the industry to ensure that the implementation of these plans ensures a level playing-field, rather than imposing unfair burdens on renewables,” McGrail added.

Scottish Renewables also criticised the tax on low-carbon electricity generators, with Chief Executive Claire Mack saying, “Today’s announcement by the Chancellor damages this country’s reputation as a leader in renewable energy, chiefly by continuing to offer investment allowances to oil and gas extraction while failing to do the same for this industry.”

“Additionally, many renewable energy generators on older contracts have sold their power far in advance, so are not benefitting from excess profits from wholesale price rises caused by the cost of gas,” Mack added.

“The UK needs £1.4 trillion to fund its transition to net-zero by 2050. To raise that money, international investors look to the UK Government to provide a stable policy environment which incentivises investment in clean power.”

The Association for Renewable Energy and Clean Technology (REA) also criticised the new tax, saying the Government had sent wrong signals to investors with renewable energy taxes which compare unfavourably with the oil and gas sector.

“While the REA and its members recognise the immense economic challenges facing this country, we would question the wisdom of subjecting the cheaper, greener renewable power sector to a more punishing tax system than its oil and gas counterparts,” said Frank Gordon, Director of Policy at REA.

“We note the exemption for smaller sites, but I would strongly urge the Government to fix this disparity as there is a strong need for tax relief for low carbon investments to help stabilise energy prices and offer long-term energy security. This is crucial for getting investments in renewables moving again following the pause that resulted from the last few months of political and policy uncertainty,” Gordon added.

In projects and deals, Crown Estate Scotland confirmed in early November that all three successful ScotWind Clearing applicants now have seabed option agreements in place meaning that their projects can move into the

"This windfall tax on low carbon power risks deterring investment, at a time when the Chancellor should be incentivising clean energy. Unlike in oil and gas, under this levy companies which are making significant investments in renewables will get no tax relief and will be hit by a higher windfall rate"

RenewableUK's CEO Dan McGrail said

development stage. Full seabed leases are granted at a later stage once applicants have the necessary consents from regulators, such as Marine Scotland, and have secured grid connections and financing.

ENGIE and Google signed at the end of November a 12-year corporate power purchase agreement (PPA) supporting Moray West offshore wind development. ENGIE will provide Google with more than 5 TWh of green power from the Moray West project, a nearly 900 MW offshore wind farm set to begin generating power from 2025, the project’s developer Ocean Winds said.

The developers of the Ossian Wind Farm off the East Coast of Scotland have identified a potential increase in the overall project capacity, from 2.6 GW to up to 3.6 GW, SSE Renewables said. SSE Renewables as well as Japanese conglomerate Marubeni Corporation and Danish fund management company Copenhagen Infrastructure Partners (CIP) are the developers of the project.

“If realised, this change would position the project among the top five largest floating projects in the world, demonstrating its epic scale,” said David Willson, Senior Project Manager for Ossian.

Solent Local Enterprise Partnership, ExxonMobil, and the University of Southampton announced on 1 November The Solent Cluster, the first major decarbonisation initiative that would substantially reduce CO2 emissions from industry, transport, and households across the Solent and Southern England.

Eni UK announced the launch of the Bacton Thames Net Zero (BTNZ) Cooperation Agreement, which is aimed at decarbonising industrial processes in the South-East of England and the Thames Estuary area, near London, by means of capturing and storing CO2.

Equinor said that power production from the first turbine in the floating wind farm Hywind Tampen in the North Sea started on 13 November. The power was delivered to the Gullfaks A platform in the North Sea.

“While the REA and its members recognise the immense economic challenges facing this country, we would question the wisdom of subjecting the cheaper, greener renewable power sector to a more punishing tax system than its oil and gas counterparts,”

said Frank Gordon, Director of Policy at REA.

In the UK, Equinor and Centrica signed a cooperation agreement to explore developing a low-carbon hydrogen production hub at Easington in East Yorkshire. Under the plan, the Centricaoperated area at Easington could transition to a low carbon hydrogen production hub over the coming decade.

Equinor also announced its interest in developing gigawatt scale floating offshore wind in the Celtic Sea, with the upcoming Celtic Sea floating wind seabed leasing round in view. As the developer and soon to be operator of two of the world’s first floating offshore wind farms, Equinor views new floating opportunities in the Celtic Sea with great interest. The Crown Estate is planning a seabed leasing round in the Celtic Sea in 2023.

“We are committed to industrialising floating offshore wind and the Celtic Sea is an optimal region for further development of this important technology,” said Catherine Maloney, Head of Business Development, UK Offshore Wind, at Equinor.

EUROPE

15

ENERGY REVIEW US

By Tsvetana Paraskova

US oil and gas producers and refiners reported strong third-quarter results, drawing renewed criticism from President Joe Biden, while inventories of distillate fuel in America are at their lowest in decades just as the winter heating season begins, and US oil supply growth could be lower than earlier estimates.

What’s Ultimate Cement Placement?

In a few words: smooth, efficient and painless.

When’s the last time you gave your offshore cementing operations a critical review? Is everything “just fine” or can it be better… much better? Do you even know?

Check out what our customers have discovered working with us across the globe.

Ultimate Cement Placement. It's what your drilling team deserves.

www.deltatekglobal.com/ogv

US President Criticises Record Oil & Gas Earnings

President Biden said at the end of October that oil and gas supermajors – which had made $100 billion in profits in the last six months – were “profiteering” from the Russian invasion in Ukraine and not investing enough to bring down petrol prices in the United States.

“I think they have a responsibility to act in the interest of their consumers, their community, and their country; to invest in America by increasing production and refining capacity. Because they don’t want to do that. They have the opportunity to do that — lowering prices for consumers at the pump,” President Biden said.

“You know, if they don’t, they’re going to pay a higher tax on their excess profits and face other restrictions. My team will work with Congress to look at these options that are

available to us and others. It’s time for these companies to stop war profiteering, meet their responsibilities to this country, and give the American people a break and still do very well.” President Biden’s comments came a week before the US midterm elections, in which voters were widely expected to be influenced by the high petrol and energy prices and the state of the economy.

Responding to President Biden’s remarks, the American Petroleum Institute (API) released a statement from President and CEO Mike Sommers, who said, “Rather than taking credit for price declines and shifting blame for price increases, the Biden administration should get serious about addressing the supply and demand imbalance that has caused higher gas prices and created long-term energy challenges.”

“Today, the President proposed to raise taxes on the U.S. natural gas and oil industry that is competing globally to produce the fuels

ENERGY NEWS

SPONSORED BY

16 www.ogv.energy I December 2022

Image: Manuel Balce Ceneta/AP

Americans need every single day. Oil companies do not set prices—global commodities markets do. Increasing taxes on American energy discourages investment in new production, which is the exact opposite of what is needed,” Sommers added.

“American families and businesses are looking to lawmakers for solutions, not campaign rhetoric,” the API’s president and CEO noted.

US Distillate Stocks at Record Lows

US inventories of diesel and heating oil have been below averages this year, and now sit at their lowest level for this time of the year since 1951, just as the heating season started and the EU embargo on Russian oil product imports is set to come into force in February 2023.

The historically low stocks have stoked a much steeper increase in diesel prices than the smaller rises in petrol and crude oil prices this year. Since diesel is the primary fuel of the economy and long-haul transportation, the high diesel prices continue to fuel inflation.

In a November overview of the diesel market in the United States, the US Energy Information Administration (EIA) said that strong demand for diesel had led to high prices and tight inventories going into winter. In October 2022, the United States had just 25 days of supply of distillate fuels, the fewest since 2008, according to the administration. To compare, the stocks of diesel in the United States averaged 34 days between 2017 and 2021.

Reduced refining capacity in the United States and globally since 2020 is one of the main reasons for low distillate inventories in the United States, the EIA said.

Distillate fuel consumption this year through August remained below pre-pandemic levels but was higher than in 2020. The US Northeast—the combined New England and mid-Atlantic regions—has had even tighter inventories than the US average. Lower inventories have contributed to rising prices in the region.

Moreover, households in the US Northeast who rely on heating oil for space heating will see 27% higher bills this winter compared to last winter, the EIA said in its Winter Fuels Outlook in October.

“Our forecast for heating oil margins this winter reflects price pressures that have currently been affecting the U.S. distillate market, including low inventories, low imports, and limited refining capacity,” the EIA said.

Demand for distillates, mainly diesel fuel and heating oil, increased by 12.0% month on month in October despite indications of weaker freight shipping by truck, API’s chief

“Overall, the October data should demonstrate to energy policymakers that oil, natural gas and natural gas liquids have remained essential to U.S. economic activity and consumer health – as winter begins, OPEC has implemented its announced November production cuts and the Russia G7 price cap plus EU sanctions risk disruptions to global oil markets,”

API’s Foreman wrote.

Overall, US petroleum demand of 20.3 million barrels per day (bpd) in October was marked by the second highest demand for “other oils” (that is, naphtha, gasoil, propane/ propylene) on record since 1965, as well as a 12% monthly increase for distillates. Refining throughput and capacity utilization rates rose to their highest levels for the month of October since 2018, per API’s estimates.

US petroleum demand was solid at 20.3 million bpd in October and also 20.3 million bpd on average for the first 10 months of 2022. The year-to-date average was within 1.3% of its highest level over the past five years.

US petroleum net exports rose to 2.1 million bpd, the highest for any month on record since 1947, according to API.

“Overall, the October data should demonstrate to energy policymakers that oil, natural gas and natural gas liquids have remained essential to U.S. economic activity and consumer health – as winter begins, OPEC has implemented its announced November production cuts and the Russia G7 price cap plus EU sanctions risk disruptions to global oil markets,” API’s Foreman wrote.

US Oil Production Growth Slows Down, Gas Output Surprises to the Upside

Constraints in the oilfield services sector are set to slow US oil production growth, Enverus Intelligence Research (EIR) said in a report in the middle of November. EIR cut its forecast for US production growth, due to the headwinds created by oilfield services limitations, the risk of recession, and reduced performance from wells drilled recently in the Permian Basin.

“In U.S. gas markets, mild weather through the first half of November has helped storage build, lifting inventories to approximately 3.6 Tcf before winter withdrawals start. On average for winter, we expect a storage deficit to the five-year average of 170 Bcf with prices at $5.30/MMBtu,”

said Jonathan Snyder, report author and a vice president at EIR.

EIR slashed its Lower 48 oil production forecast, and now expects growth of around 450,000 bpd end-to-end for 2022 and 560,000 bpd growth for 2023.

US natural gas supply growth has surprised on the upside, touching 100 Bcf/d sooner than anticipated, EIR said, anticipating now strong growth for 2022 at around 3.4 Bcf/d.

“In U.S. gas markets, mild weather through the first half of November has helped storage build, lifting inventories to approximately 3.6 Tcf before winter withdrawals start. On average for winter, we expect a storage deficit to the five-year average of 170 Bcf with prices at $5.30/MMBtu,” said Jonathan Snyder, report author and a vice president at EIR.

The research firm expects the gas inventory deficit to flip to a surplus by the early summer of 2023, further reducing prices toward $3.50/MMBtu until 2026.

US

economist Dean Foreman wrote in API’s latest Monthly Statistical Report in November.

US NEWS SPONSORED BY 17

MIDDLE EAST Energy Review

By Tsvetana Paraskova

OPEC published its annual report with estimates of global energy demand through 2045 and it cut again its demand growth outlook for this year and next, while the largest state oil and gas firms in the Middle East signed major contracts to expand their production and processing capabilities.

OPEC Lowers 2022-2023 Oil Demand Growth Estimates

OPEC again revised down its global oil demand growth for this year and next in its Monthly Oil Market Report (MOMR) in November, citing significant global economic uncertainties in the coming months.

The organization led by Middle Eastern producers revised down each of its 2022 and 2023 oil demand growth forecasts by 100,000 barrels per day (bpd) from the previous month’s estimates due to China’s still-strict COVID policy and economic challenges in Europe.

“The significant uncertainty regarding the global economy, accompanied by fears of a global recession contributes

At Craig International, procurement isn’t just about processes, products and numbers. We promote a culture of ownership among our people, who are trusted to get on with the job on your behalf. We’re proud of how we serve clients.

We’re always looking for new ways to add value and routinely introduce new technological solutions to make service delivery even simpler, smoother, faster.

to the downside risk for lowering global oil demand growth. In addition, China’s strict adherence to the ‘zero COVID-19 policy’ adds to this uncertainty, making the country’s recovery path even more unpredictable,” OPEC said.

This year, global oil demand growth is expected at 2.5 million bpd in 2022, OPEC said after slashing the fourth-quarter demand projections by nearly 400,000 bpd.

Total oil demand is set to average 99.6 million bpd in 2022, with developed economies in the Americas seeing the highest rise in demand, led by the US on the back of recovering gasoline and diesel demand, the cartel said. Light distillates are also projected to support demand growth this year, OPEC added.

For 2023, OPEC now expects oil demand growth at 2.2 million bpd, down by 100,000 bpd from the growth expected in the October report. World oil demand is set to average 101.8 million bpd, “supported by expected geopolitical improvements and the containment of COVID-19 in China,” according to OPEC. Next year, US demand is expected to exceed 2019 levels, thanks to a recovery in transportation

fuels and light distillate demand. However, OECD Europe and the Asia Pacific are not expected to rise above 2019 consumption levels, the cartel said.

“While risks are skewed to the downside, there exists some upside potential for the global economic growth forecast. This may come from a variety of sources. Predominantly, inflation could be positively impacted by any resolution of the geopolitical situation in Eastern Europe, allowing for less hawkish monetary policies,” OPEC noted.

OPEC’s World Oil Outlook: The world needs to add on average 2.7 million boepd annually to 2045

In the World Oil Outlook (WOO) 2022 with projections through 2045, which OPEC launched at ADIPEC, the organization expects the world economy to more than double in size, and global population to rise by 1.6 billion between now and 2045. Global primary energy demand is forecast to continue growing in the medium- and long-term, jumping by 23% in the period to 2045. Therefore, all forms of energy will be needed to address future energy needs, OPEC said, noting that the world needs to

ENERGY NEWS

SPONSORED BY

Smart Procurement

www.craig-international.com

18 www.ogv.energy I December 2022

annually add on average 2.7 million barrels of oil equivalent a day to 2045.

With the exception of coal, all major types of energy will see growth through 2045, according to OPEC. Moreover, oil is expected to retain the largest share in the energy mix throughout the outlook period, accounting for almost a 29-percent share in 2045. But renewables –mainly solar, wind, and geothermal energy – are set to expand by 7.1 percent per year on average, significantly faster than any other source of energy.

The oil-exporting nations’ organization expects that globally, oil demand is projected to increase from almost 97 million bpd in 2021 to around 110 million bpd in 2045. Non-OECD countries will drive oil demand growth, expanding by nearly 24 million bpd to 2045, whereas the OECD demand would decline by over 10 million bpd between 2021 and 2045. India is set to be the largest contributor to incremental oil demand, adding around 6.3 million bpd to 2045.

To meet demand, the global oil sector will need cumulative investment of $12.1 trillion in the upstream, midstream, and downstream through to 2045, equating to over $500 billion each year, OPEC said.

Saudi Aramco Boosts Profit, Generates Record Free Cash Flow

Saudi Aramco, the Saudi state giant which is the world’s biggest oil firm in terms of production and market capitalization, reported in November a third-quarter net income that surged by 39% year over year to $42.4 billion, while free cash flow surged to a record $45.0 billion from $28.7 billion for the third quarter of 2021.

“Market conditions slightly softened in the third quarter as continued economic uncertainty driven by inflationary pressures slowed crude oil demand growth. Despite this, Aramco delivered strong earnings and record free cash flow reflecting its ability to generate significant value through its low-cost Upstream production and strategically integrated Downstream business,” Aramco said in the earnings report.

“Aramco’s long-term view is that oil demand will likely continue to grow for the rest of the decade, as will the world’s need for more affordable, reliable, and sustainable energy,” the Saudi oil giant added.

Deals and Contracts

Aramco and IBM announced preliminary plans for a strategic collaboration to establish an Innovation Hub in Riyadh, Saudi Arabia. The collaboration aims to use hybrid cloud, AI, and quantum computing to address objectives including circular economy, materials science, supply chain, sustainability, security, and digitization.

In the United Arab Emirates (UAE), Abu Dhabi National Oil Company (ADNOC) announced several deals and contracts over the past month.

Aramco said in the earnings report.

ADNOC set a new Upstream Methane Intensity target of 0.15 percent by 2025—the lowest such target in the Middle East.

ADNOC’s methane intensity target means the company will be ranked in the Gold Standard category, by the Oil and Gas Methane Partnership 2.0 (OGMP 2.0), a multi-stakeholder initiative launched by the United Nations Environment Program (UNEP) and the Climate and Clean Air Coalition, the company said.

ADNOC and GAIL (India) Limited signed at the end of October a Memorandum of Understanding to explore collaboration opportunities in liquefied natural gas (LNG) supply and decarbonisation, including short and long term LNG sales agreements. The agreement also includes potential optimization of LNG trading activities, the review of joint equity investments in renewables, and the monitoring of greenhouse gasses for LNG cargoes, to support low carbon LNG supplies.

In early November, ADNOC awarded three framework agreements valued at $4 billion for integrated drilling fluids services (IDFS) to support the ongoing expansion of its production capacity.

In the middle of November, ADNOC Logistics & Services (ADNOC L&S), the shipping and maritime logistics arm of ADNOC, announced the successful closing of its acquisition of Zakher Marine International (ZMI), an Abu Dhabi-based owner and operator of offshore support vessels, with the world’s largest fleet of self-propelled jack-up barges. Financial details of the transaction were not disclosed.

The acquisition extends ADNOC L&S’s regional footprint, broadening its services to include critical support assets for offshore operations, including ZMI’s maiden offshore renewables project in China.

QatarEnergy announced it had selected ConocoPhillips as its third and final international partner in the North Field South (NFS) expansion project, which comprises two LNG mega trains with a combined capacity of 16 million tons per annum (MTPA).

In Qatar, state firm QatarEnergy announced it had selected ConocoPhillips as its third and final international partner in the North Field South (NFS) expansion project, which comprises two LNG mega trains with a combined capacity of 16 million tons per annum (MTPA). Per the agreement, ConocoPhillips will have an effective net participating interest of 6.25% in the NFS project, out of a 25% interest available for international partners. QatarEnergy will hold the remaining 75%.

The Qatari giant also signed in November the longest gas supply agreement in the history of the LNG industry with China Petroleum & Chemical Corporation (Sinopec) for the supply of 4 million tons per annum (MTPA) of LNG to China for 27 years. The contracted LNG volumes will be supplied from QatarEnergy’s North Filed East (NFE) LNG expansion project expected to come online in 2026. The agreement with Sinopec is also the first long-term LNG offtake agreement from the NFE Expansion project, and comes on the heels of QatarEnergy’s conclusion of the formation of eight international partnership agreements for the North Field East and North Field South (NFS) projects, which are expected to come online in 2026 and 2027, respectively.

MIDDLE EAST

MIDDLE EAST NEWS SPONSORED BY

“Aramco’s long-term view is that oil demand will likely continue to grow for the rest of the decade, as will the world’s need for more affordable, reliable, and sustainable energy,”

19

CHINA

Wushi Oil Field Development

CNOOC $320 million

Studies are underway to capture carbon dioxide emitted from power generation at the nearby Datang Leizhou power plant and reinject it into reservoirs at the Wushi oilfield which is currently under development. CNOOC stated that the scheme will be able to store 15 million tonnes of carbon dioxide and enhance oil recovery by 2 million tonnes.

ENERGY PROJECTS MAP

SPONSORED BY

USA Fast LNG 1 Export Terminal

New Fortress Energy $1.2 billion

Sembcorp Marine has been awarded a master service agreement for the engineering, conversion, topside fabrication and integration of two Sevan cylindrical drilling vessels into floating LNG facilities. The agreement would include the fabrication and integration of LNG topside modules. The delivery of the first FLNG liquefaction facility is estimated to be in H1 of 2024.

Each FLNG facility will have a capacity 1.4 mtpa.

SENEGAL

Greater Tortue-Ahmeyim Phase 2

BP $600 million

Joint venture partners BP, Kosmos, Petrosen, SMH and the governments of Senegal and Mauritania are in advanced discussions on the development concept for Phase 2 development of the field. The partnership will select a solution which leverages the infrastructure from Phase 1 and allows the partnership to access attractive gas marketing opportunities.

ANGOLA Block 15 Redevelopment Project

ExxonMobil

$600 million

ExxonMobil has made a discovery at Bavuca South-1 Exploration well, which is part of the redevelopment project. The well encountered 30 metres of high-quality, hydrocarbonbearing sandstone. It is located approximately 365 kilometres northwest off the coast of Luanda and was drilled in 1,100 metres of water by the Valaris DS-9 rig. The discovery is the 18th made in Block 15, and the first since 2003.

www.eicdatastream.the-eic.com

Energy projects and business intelligence in the energy sector

The EIC delivers high-value market intelligence through its online energy project database, and via a global network of staff to provide qualified regional insight. Along with practical assistance and facilitation services, the EIC’s access to information keeps members one step ahead of the competition in a demanding global marketplace.

The EIC is the leading Trade Association providing dedicated services to help members understand, identify and pursue business opportunities globally.

It is renowned for excellence in the provision of services that unlock opportunities for its members, helping the supply chain to win business across the globe.

The EIC provides one of the most comprehensive sources of energy projects and business intelligence in the energy sector today.

WORLD PROJECTS

1 3 9 6 10 7

8 1 3 2 4 5 12 2 8 11 4 20 www.ogv.energy I December 2022

ISRAEL

Block 12 – Zeus Discovery

Energean $250 million

Energean announced that it had made a commercial discovery with the Zeus exploration well. Preliminary estimates indicate that the well has discovered recoverable natural gas resources of 466Bcf. The operator is undertaking post-well analysts of the data collected during drilling.

BRAZIL

Bijupirá-Salema Wells Decommissioning Shell

$50 million

Helix Energy Solutions has been awarded a contract by Shell for a well plugging and abandonment campaign at the Bijupirá-Salema oil fields. Helix will employ the Q7000 DP3 well intervention vessel for the work. The contract will start in 2024 and take 12 months.

GUYANA

Uaru Oil Field Development Project

ExxonMobil $6 billion

Modec has been awarded the FEED contract for the Uaru FPSO. The contract is expected to lead to an EPCI award once the project is approved by the government and secures a final investment decision (FID). Should Modec take forward the EPCI it will be the first FPSO contract in Guyana not to be awarded to SBM Offshore.

AUSTRALIA

Scarborough Gas Field Woodside $5.7 billion

COSCO Shipping Heavy Industry has started building the hull of the large floating production unit (FPU) destined for Scarborough gas field. It is mentioned that the hull is set for delivery in H2 2024. It is stated that McDermott has awarded the floater’s topside engineering, procurement and construction work, and the hull-topsides integration to Qingdao McDermott Wuchuan Offshore Engineering (QMW).

TIMOR LESTE

TL-SO-19-16 PSC: Chuditch Gas Discovery SundraGas

The operator has increased the estimated recoverable gas volumes at the field to 3.6 Tcf. The development concept for the field comprises a floating LNG vessel connected to several offshore platforms at the field. The development would also include a 140-kilometre carbon dioxide pipeline would connect the field to the Bayu-Undan offshore platform, which is planned to become a carbon capture and storage facility.

OMAN

Marmul and Grater Sarqar Field – Integrated Drilling Services Agreement

PDO

$500 million

Petroleum Development Oman (PDO) awarded Weatherford International a five-year contract worth more than $500 million to provide Integrated Drilling Services in the Marmul and Grater Saqar fields. The operations are expected to start in the fourth quarter of 2022. This award builds on Weatherford's ongoing collaborations with PDO, where Weatherford will deliver 700+ wells in the Marmul and Grater Saqar fields.

MEXICO

Trion Offshore Oil Field Woodside $11 billion

Woodside has launched a tender for the supply of the semi-submersible production platform and the floating storage and offloading (FSO) unit at the field. The semi-submersible platform is expected to have an oil processing capacity of 100,000b/d. A final investment decision for the project is expected in 2023.

INDONESIA

Banyu Urip Infill Drilling Campaign

ExxonMobil

$240 million

ExxonMobil is planning on spending US$240 million for the planned infill drilling and clastic appraisal program at the Banyu Urip field. The planned program, which involve the drilling of seven infill wells, is planned to commence in 2023.

WORLD PROJECTS SPONSORED BY

WORLD PROJECTS

12 9 5 6 10 11 8 7 21

Risk Management IN THE OIL & GAS INDUSTRY

By Tsvetana Paraskova

By Tsvetana Paraskova

The energy industry, which has always paid special attention to risk management to ensure safe and reliable operations of oil and gas assets, has faced this year new challenges in managing risks after the Russian invasion of Ukraine.

Risk management – all the processes and precautions to ensure continuity and stability of production and all other operations – now has to cope with increased physical threats to infrastructure, higher risks of cyber attacks, and the impacts of highly volatile prices and sudden tax changes on financial performance. In addition, in the extreme market volatility and very high uncertainty regarding both supply and demand of oil and gas in the near term, companies face more work on managing financial and supply and demand risks.

Risks Have Multiplied Since the Russian Invasion of Ukraine

“In my nearly 30 years of looking at oil markets, I can't think of a time when geopolitically there was as much uncertainty over potential high and low points in terms of prices, supply and demand,” Raad Alkadiri, Managing Director, Energy, Climate & Resources, at Eurasia Group, said in a KPMG insight about the top risks facing the oil and gas industry this year.

The Russian invasion of Ukraine has created a lot of uncertainties about supply, while slowing global economic growth and China’s zero-COVID policy continue to weigh on the demand outlook for the end of this year and well into 2023.

So this year and next, the global energy industry has to contend with heightened geopolitical risks on top of uncertain global economic growth and increased oil and gas

price volatility. That is certain to create more work at risk management departments.

The war in Ukraine has had a direct impact on the oil and gas markets, as Russia stifled pipeline gas supply to Europe while the EU, the UK, and the US are banning imports of Russian crude oil and products by sea.

Priorities Have Changed

Governments are now looking first to ensure security of supply amid the energy crisis. Just a year and a half ago, decarbonization was the top priority of developed nations and energy investors. But the Russian invasion in Ukraine, the first war fought in Europe since World War II, has drastically changed priorities.

“The world needs a Paris-style agreement for the energy trilemma – not just emissions. That’s what I took away from this year’s ADIPEC conference in Abu Dhabi,” bp’s chief executive Bernard Looney said in early November.

RISK & SAFETY MANAGEMENT 22 www.ogv.energy I December 2022

“Yes, societies need an energy system that is lower carbon – that’s imperative. But they also need one that is secure and affordable. And unless we focus on all three parts – security, affordability AND lower carbon – we won’t build an energy system that works,” Looney added.

Physical Risks To Assets Grow

Along with working to meet current oil and gas demand, companies globally have increased vigilance and are monitoring energy assets more than ever as a precaution to increased risks to their physical integrity. This is especially true for oil and gas assets offshore Norway, especially after the explosions at the Russiato-Germany gas pipelines Nord Stream 1 and Nord Stream 2 in the Baltic Sea, just outside Danish and Swedish waters. The explosions were caused by sabotage, according to the early findings of the ongoing investigation, Sweden said in the middle of November.

After the explosions, which occurred at the end of September, Norway – Western Europe’s largest producer of oil and gas – posted in early October soldiers from its Home Guard to protect energy infrastructure. Soldiers from the Home Guard provide increased security at petroleum facilities in the counties of Rogaland, Vestland, and Møre og Romsdal, the Norwegian Armed Forces said. The deployment of the soldiers comes after Norwegian police requested assistance from the Army to prevent incidents. The Army is ready to post soldiers at more facilities if the police request it, the Armed Forces said.

Norway started increasing security at its energy facilities after spotting drones flying over oil and gas assets and after the explosions on the lines of the Nord Stream pipeline in the Baltic Sea.

On September 26, the Petroleum Safety Authority Norway (PSA) of Norway urged increased vigilance by all operators and vessel owners on the Norwegian Continental Shelf, after companies operating offshore Norway

had recently given warnings or notifications of a number of observations concerning unidentified drones or aircraft close to offshore installations.

Cyber Risks Have Increased

Since the end of September, the Norwegian police have investigated several reports of drones of unknown origin flying over oil or gas processing plants and facilities in the country.

Norway has arrested several people in connection with drones spotted over facilities in the country, Prime Minister Jonas Gahr Støre said at the end of October.

Norway’s police and national security are working together to defend the country against cyber threats, he added.

“It is a real and serious threat, including to the oil and gas industry,” the prime minister added.

Half a world away, in Saudi Arabia, the world’s biggest oil firm in terms of both production and market capitalisation, Aramco, says that cyber security risks are now one of the biggest threats.

“Another emerging challenge is cyber-security. Cyber-attacks are one of the top risks we face at Aramco – on a par with natural disasters or physical attacks,” Saudi Aramco’s chief executive officer Amin Nasser said during a speech at the Global AI Summit 2022 in Riyadh in September.

“But while these attacks are growing in scale and severity, AI is helping fend off some of the threat. So our efforts should not only focus on greater efficiency or deeper customer insights, but also on security and resilience,” Nasser added.