AUGUST 2020OCT 2022 - ISSUE 61 GLOBAL ENERGY NEWS WORLD PROJECTS MAP MONTHLY THEME INNOVATION & TECH RENEWABLES CONTRACT AWARDS ON THE MOVE DECOMMISSIONING STATS & ANALYTICS LEGAL & FINANCE EVENTS UK’s N o . ENERGY SECTOR PUBLICATION 1 DECOMMISSIONING FEATURING Stena Wells - ASCO Group Decom North Sea - Cesscon Decom Norwell Engineering - Brimmond Ashtead Technology - NSTA Proserv

EQUIPMENT AND PERSONNEL HIRE Renewables Decommissioning Subsea Hydraulics Well Services Pipeline Industrial Cleaning 31 October3 November 2022 Abu Dhabi, United Arab Emirates We are exhibiting at ADIPEC 2022. Visit our STAND: 8450 HALL: 8

Welcome to the October edition of ‘OGV Energy Magazine’, where this month our theme is on ‘Decommissioning’, at a time when opportunities in the sector seem to be growing at pace.

This month we are delighted to welcome Stena Wells as our front cover partner and you can read all about how the launch of their new start-up company will provide a fully managed well construction and decommissioning service to the global operating community inside.

We also have contributions from Decom North Sea, the North Sea Transition Authority, Cesscon Decom, Asco Group, Brimmond Group, Proserv, Ashtead Technology, Norwell Engineering, Zync360 and Sword Group.

The rest of this month’s magazine as always provides you with a review of the Energy sector in the North Sea, Europe, the Middle East, the US and Australasia along with industry analysis and project updates from Westwood Global Energy Group, the EIC and Renewables UK.

As we gear up for ADIPEC at the end of the month, please take a look at our event page if you are going as we would be delighted to welcome you to the golf day, business breakfast and drinks evening!

Have a great month and we hope to see you there!

CONTENTSFOLLOW US

VIEW THE OGV MAGAZINE ONLINE AT www.ogv.energy/magazine @OGVENERGYOGVENERGY @OGVENERGYOGV-ENERGY WISH TO CONTRIBUTE TO NEXT MONTH'S PUBLICATION? Contact us to submit your interest daniel.hyland@ogvenergy.co.uk COVER SPONSOR OGV COMMUNITY NEWS GLOBAL ENERGY NEWS WORLD PROJECTS MAP MONTHLY THEME INNOVATION & TECH RENEWABLES CONTRACT AWARDS ON THE MOVE DECOMMISSIONING STATS & ANALYTICS LEGAL & FINANCE EVENTS P.04 P.08 P.11 P.20 P.22 P.32 P.36 P.38 P.40 P.42 P.44 P.46 P.47

KENNY DOOLEY MAIN EDITOR

4 24 25 26 272730 31 33 14 3

Stena Wells look at the future –Decommissioning versus EPL

Where does the focus lie when two government policies conflict?

As the industry recovers from price wars and pandemics, there is promise of light at the end of the tunnel. Finally, there is a feeling of inertia building for decommissioning operators with cash flow sufficient to commence large-scale projects.

There is, however, an opportunity for the industry to claw back a significant portion of the EPL through an investment allowance for future investment within a three-year window.

In short, those paying the Energy Profit Levy can reclaim up to 91 pence on the pound.

Source EPL factsheet

This is where the potential conflict begins:

Has big Decomm arrived?

In a world of ever-changing forces, inflation, and the requirement for energy security, the UK government chose to react by implementing the Energy Profit Levy or EPL.

The EPL came into law in late May 2022 – in effect, an additional 25% tax on UK oil and gas profits on top of the existing 40% headline rate of tax, this takes the combined rate of tax on the profits to 65%.

Source – Commons Library Parliament UK

The introduction of the levy potentially creates two competing policies; the first of these being the appetite to reinvest and recover the above-mentioned EPL, the second being driven by the regulatory bodies to expedite well decommissioning.

At a recent Well Decommissioning event, there was genuine surprise at the sheer number of wells being brought forward by operators for near-term decommissioning.

This raises a question – and in some way an assumption – where will operators focus near term? The assumption being a finite resource pool cannot accommodate both work scopes in full.

Safe, predictable & cost effective operations

In this case where there is a drive to undertake both drilling and decommissioning activities, there is one company is preparing to meet both demands.

With the Plug and Abandonment (P&A) schedules of many operators reading unchanged from their commitments precovid, it is no surprise there is a significant pressure to liquidate the work near term.

Stena Wells has been created to accommodate and cater for this situation. The company was launched in mid-2022 with the following remit.

Stena Wells will provide safe, predictable, and cost-effective solutions for Well Construction and Well Decommissioning.

COVER FEATURE

Stena Spey

4 www.ogv.energy I October 2022

The company aims to combine the capability of the Stena Drilling assets with an experienced capable engineering and execution team.

Stena Wells is led Led by Dillan Perras, an industry expert in UKCS well operations and decommissioning, a previous co-chair, and a current sitting member of the OEUK guidelines workgroup.

When asked about the current EPL policy and the potential effects on the decommissioning sector, Dillan said, “The summer of 2022 will be a turning point for many of the operators in the UKCS, the full effect of this has yet to been seen” – adding, “We are in the middle of what is typically the operators budget season – operators will be finalising and setting their 2023 budgets. This change in policy may significantly change their near-term strategies.”

“Companies may look to the current resource pool of rigs in the UK and realise there is a significant crunch point coming, the market has moved significantly with many rigs contracted – the ability to reclaim EPL could be resource constrained’.

Stena Wells aim to offer premium summer drilling opportunities alongside ‘cost surety’ for decommissioning activities. By creating strategic partnerships and aligning commercial objectives, the team will be in position to deliver on our client’s requirements.

“We believe this to be unique in the market –an adaptable solution for an ever-changing environment.”

Driving safe, cost-effective operations in Well Construction and Well Decommissioning. Stena Wells is the strategic partner of choice. www.stenawells.com

Driving safe, cost-effective operations in Well Construction and Well Decommissioning. Stena Wells is the strategic partner of choice. www.stenawells.com

COVER FEATURE

5

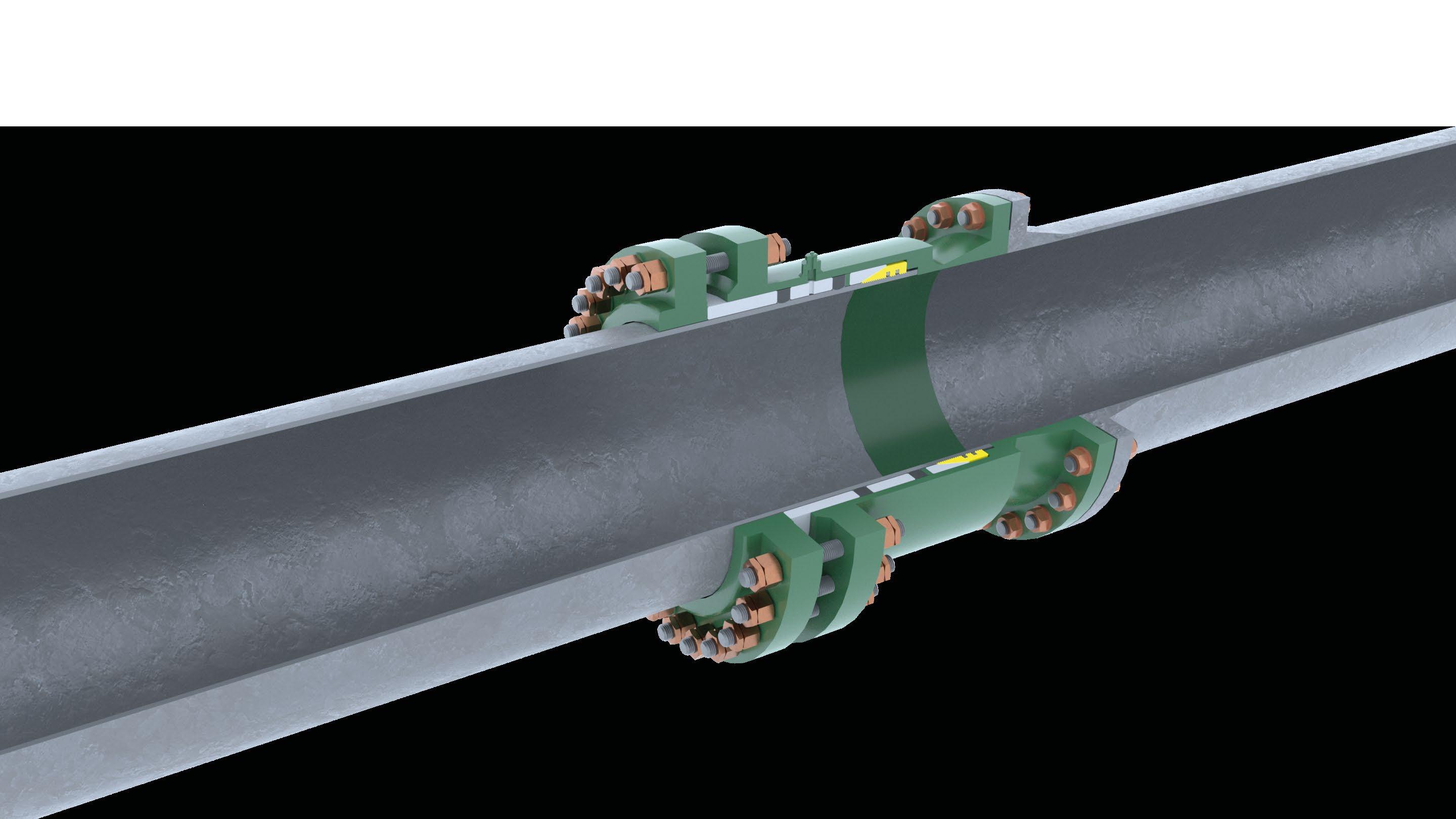

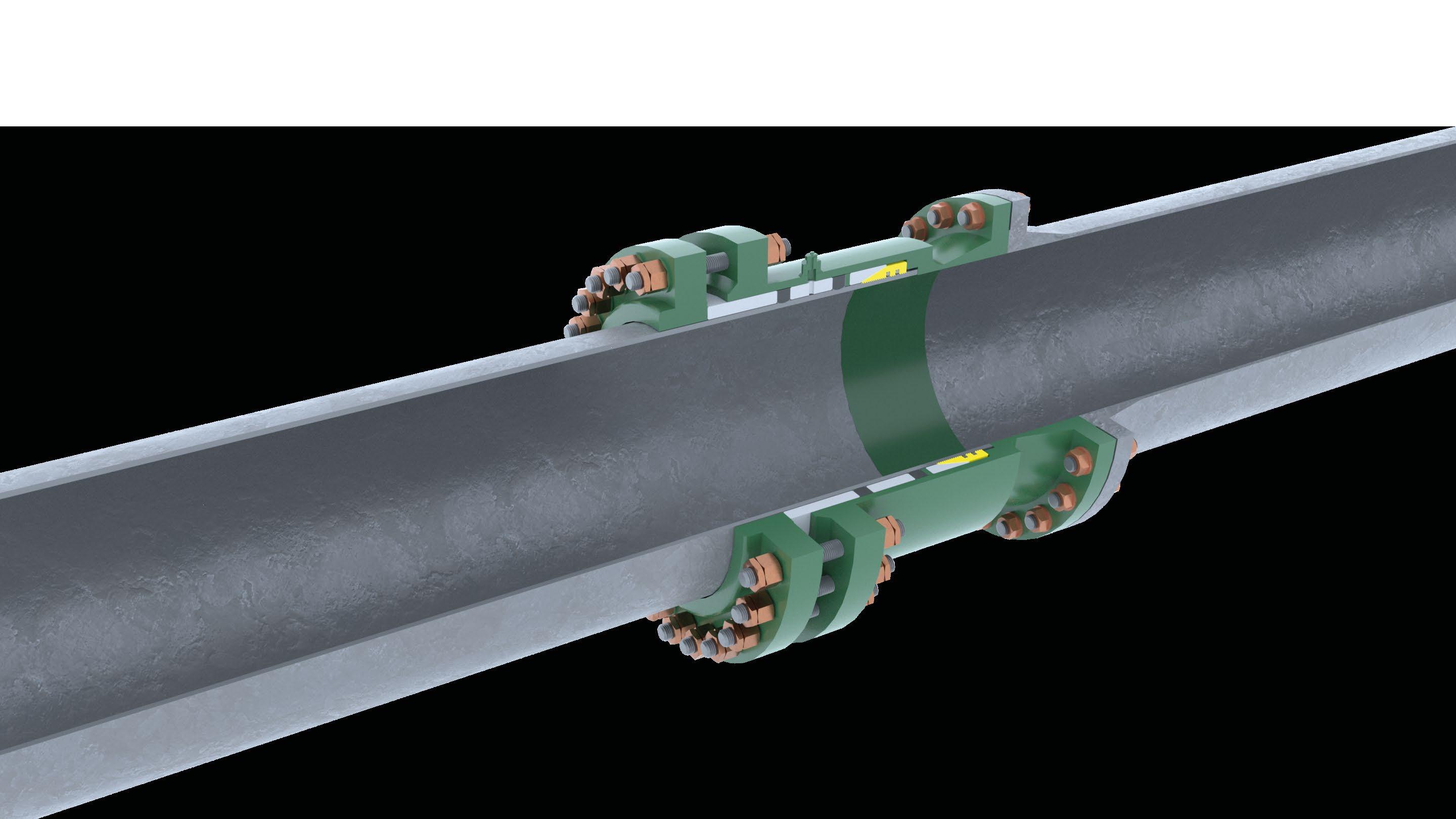

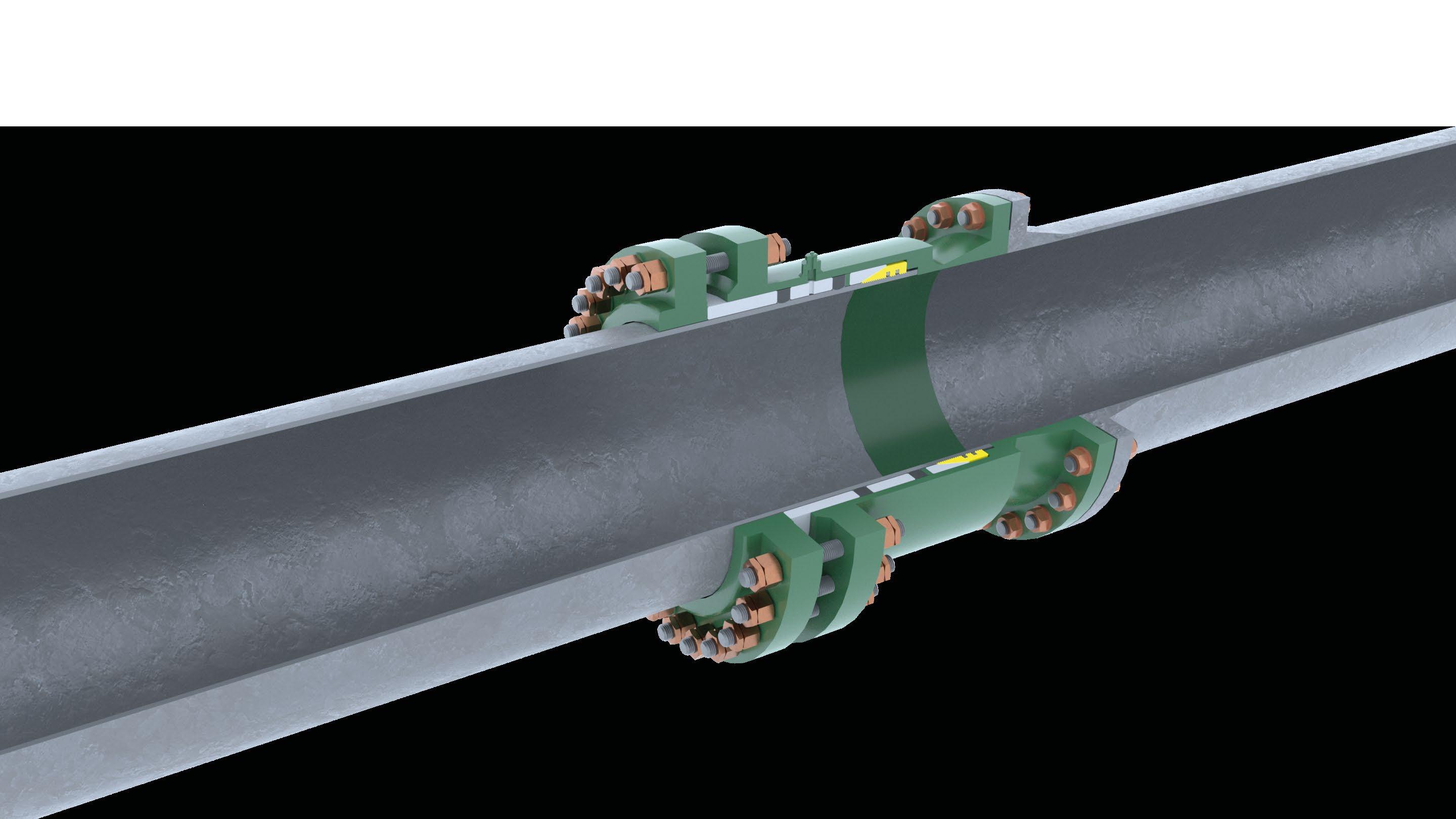

STATS GROUP Managing Pressure, Minimising Risk Mechanical Pipe Connector Piping Repair, Tie-In or Capping seal vertification port DNV TYPE APPROVAL dual graphite seals taper lock grips Permanent pipe to flange connection where welding may be undesirable. The slipover design and external gripping assembly enables a quick and cost-effective solution, with no specialist installation or testing equipment required.

Disclaimer: The views and opinions published within editorials and advertisements in this OGV Energy Publication are not those of our editor or company. Whilst we have made every effort to ensure the legitimacy of the content, OGV Energy cannot accept any responsibility for errors and mistakes. CONTRIBUTORS OUR PARTNERS TRAVEL MANAGEMENT PARTNER LOGISTICS PARTNER Leading provider of logistics services to this indus try, offering its customers airfreight, road freight, sea freight, project forwarding, customs compliance, training and consultancy, packing, crating, lashing & securing services warehousing, distribution, freight management, rig relocation and mobilisation services and offshore logistics. Corporate Travel Management (CTM) is a global lead er in business travel management services. We drive savings, efficiency and safety to businesses and their travellers all around the world. Editorial newsdesk@ogvenergy.co.uk +44 (0) 1224 084 114 Advertising office@ogvenergy.co.uk +44 (0) 1224 084 114 Design Ben Mckay Journalist Tsvetana Paraskova www.quanta-epc.co.uk YOUR ASSET IN SAFE HANDS Safe, efficient and low-cost delivery of Asset Management projects, ensuring best value every time. Operations MaintenanceRepair orders Technical support VIEW our media pack at www.ogv.energy/advertise-with-us or scan de QR code ADVERTISE WITH OGV

Earlier in the summer Controlled Flow Excavation (CFE) and Suspended Jet Trenching market leader, Rotech Subsea, wrapped up a four month cable de-burial and re-burial campaign at an offshore wind farm off France’s Atlantic coast. Contracted by a global submarine cable system giant, which had retained the Aberdeen-based subsea trenching and excavation specialist on a similar scope of work in November 2021, Rotech Subsea’s RS2 CFE equipment spread carried out cable de-burial and re-burial on omega joints and cable ends at the Saint-Nazaire OWF off the Guérande peninsula.

Baker Hughes, Mocean Energy and Verlume have signed a triparty memorandum of understanding (MoU) to identify and discuss potential opportunities for collaboration on integrated wave energy and subsea energy storage solutions for the emerging subsea clean energy market.

In the drive towards lower carbon operations, the MoU will explore the opportunities for integrated wave energy, energy storage and power delivery

solutions to facilitate the electrification of subsea assets as well as the utilisation of renewable energy within harsh, deep-sea environments.

Over an initial two-year period, the MoU will see the three parties utilise and share their combined capabilities within the subsea market to enable the deployment of a reliable, uninterrupted power supply located at point of use for cost-effective and market-competitive electrical power solutions. This could be within temporary, permanent or back-up use cases, including for charging systems for underwater vehicles and subsea production control systems.

Within the scope of the MoU, Baker Hughes will bring its expertise as a leader in the design and manufacture of subsea production equipment, by supplying subsea hardware including controls systems, power systems and other ancillary equipment. Verlume’s scope of supply will focus on the design and delivery of its Halo subsea energy storage system and Mocean Energy will be concentrated on the design and delivery of its Blue Star wave energy converters.

Opening Up Down Under - Torque Specialist Marks Milestone

Aberdeen-headquartered problem-solving company, STC INSISO, has announced an extension to its contract with one of the largest port groups in the UK, Peel Ports. The extension follows the successful completion of the original scope of work which included health and safety health checks of all of Peel Ports’ container terminals in the UK. The contract extension, bringing the overall value to £200k, will see the scope of work expanded to include health checks of all of Peel Ports’ non-container ports within the UK.

An Aberdeen-based torque machine specialist has reached a significant milestone in its ambitious growth journey by announcing the opening of a new office in Australia. EnerQuip Ltd, which is based at Findon on the outskirts of the city, has created EnerQuip Torque Solutions PTY Ltd. to better serve a growing client base in the APAC region with Craig Jackson to make the move from Scotland to head up operations on the ground, on a permanent basis. The move follows hot on the heels of a recent major portfolio expansion thanks to the acquisition of the AMC product line from Forum Energy Technologies.

Nucore Group, a Scottish-based specialist engineering company which provides safety products and services for hazardous environments, is continuing its major expansion programme as it prepares to open two new offices to service rapid business growth across England and Wales. The company, which is headquartered in Aberdeen, has appointed industry veteran Joe Oberlé to the key role of sales director, with responsibility for building the company’s business across the UK, and leading its diversification into new sectors.

Rovco, an experienced global provider of subsea robotics and hydrographic survey solutions to the marine renewable and wider energy sectors, has its sights set on supporting the energy transition in the US market with the strategic appointment of Mitchell (Mitch) Johnson as the company’s new Director – Americas. Mitch joins Rovco at an exciting time as the company seeks to expand its international offering, bringing operational excellence, learning and expertise from its extensive portfolio of offshore wind projects across the UK and Europe.

Salus Technical, has today (8 September) launched an online, on-demand training course which covers the fundamentals of managing process safety in high-hazard industries. With reports from over two thirds of managers in the energy industries that safety training was cancelled or postponed during the COVID-19 pandemic, the course has been designed to upskill personnel with vital knowledge and understanding in a convenient and timeefficient format.

OGV COMMUNITY NEWS

Rovco enters US market with strategic appointment

Tripartite subsea energy MoU signed between Baker Hughes, Mocean Energy and Verlume

FIND ALL THE FULL COMMUNITY NEWS ARTICLES ON OGV ENERGY'S WEBSITE

Salus Technical launches process safety training course to address pandemic backlog

DO YOU WANT YOUR NEWS FEATURED ON OUR MAGAZINE, WEBSITE & DIGITAL PLATFORMS? JOIN THE OGV COMMUNITY TODAY!

STC INSISO secures six-figure contract extension with Peel Ports

Nucore continues expansion plans with two new offices in England

Rotech Subsea returns to Saint-Nazaire OWF for global submarine cable player and clinches new USA contract

8 www.ogv.energy I October 2022

At our core, we are a software engineering technology company. We bring together highly experienced industry engineers combined with leading software developers to drive real and positive change within the energy sector.

www.assetfiftyfive.com

Better results from your recruitment advertising. We're a media buying agency, helping recruiters reach candidates faster and more effectively. Programmatic advertising, performance management, tracking and reporting. It's all here. www.talentnexus.com

We are a SaaS Organisation providing NCSC certified Cyber & Information Security, and Data Protection training through our digital platform. We enable organisations to reduce risk, improve cyber resilience and demonstrate compliance in the digital age.

ospcyberacademy.com

Innovative, industrialized approach to deliver low cost, low environmental impact and high local content floating offshore wind developments and mooring & anchoring foundations.

offshoresolutionsgroup.com

Oilenco design, engineer and manufacture specialised tooling to support the global oil and gas industry. Our diverse range of well intervention tools reduce the time and cost of your operations.

www.oilenco.com

Human Factors training started in earnest in aviation - an industry with an excellent performance in safety compared to other high-risk industries.

www.humanfactormatters.com

Since 1889 Dräger products protect, support and save lives. German Engineering since 1889. Dedicated to saving lives with innovation and reliability. German Engineering. Reliable. www.draeger.com

Enerquip is the first choice partner for Torque Machines and Associated Products. We utilise our years of experience to support client operations to ensure their Torque Machines and Bucking Units are always running to their full potential.

www.enerquiptorque.com

The World's Smallest, Lightest, Most Affordable Nodes - Stryde High-density land seismic, for any industry

www.strydefurther.com

Unity is leading provider of well integrity solutions to the global upstream oil and gas industry. We are experts in ensuring asset longevity.

www.unitywell.com

Our unrivalled experience and innovative multisector solutions safely and reliably improve asset management and performance, delivering fully integrated projects. We make it our mission to provide solutions that enable you to visualise projects from beginning to end, from the big picture, down to the smallest detail www.zynq360.com

Consortiq provides precision data acquision & management solutions globally, through drone services & digital asset modeling, for organizations who need precise data quickly, and with minimal job site disruption. We’re not afraid to fly in high-traffic areas or over crowded skies because our clients deserve the best! www.consortiq.com

JOIN THE OGV COMMUNITY FOR JUST £30 A MONTH WWW.OGV.ENERGY/REGISTER

LATEST OGV COMMUNITY SIGN-UPS

9

energyresourcing.com +44 1224 291176

PEOPLE IN ENERGY

Energy Resourcing is a global technical recruitment agency. We’re passionate about matching high-quality candidates to the clients that need them. With offices in Australia, Asia, Europe and North America, we provide personalised customer experience through our dedicated support teams, day or night!

Our team of proactive recruitment professionals are experts in what they do. We specialise in providing robust workforce solutions and placing talent in typically hard to fill roles. So, whether you’re looking for your next job opportunity or need to hire technical talent to drive your next project, Energy Resourcing is here to help.

What are main challenges for the Oil & Gas Decommissioning sector at present and how can they be addressed?

At EnQuest, our licence to operate is based on trust that we do the right thing and remove or get the right permissions to leave the infrastructure that was put in place by ourselves or other operators to produce Oil and Gas over the years. The biggest challenge I find is managing the drive to make decommissioning cost efficient whilst performing the work safely and making the right considerations to protect the environment. This can bring many conflicts along the way that have to be carefully managed.

We have to be deeply aware of the regulatory constraints and work with all our stakeholders to devise the right decommissioning programmes to suit individual assets and their particular situations. This can be complex, detailed work.

WILL BLACK

Decommissioning Project Manager EnQuest

I am a chartered project professional with over 23 years’ experience working in the Oil and Gas sector,15 of those in Major Capital Projects. I have managed projects for over 10 years and transferred these skills into the decommissioning sector in 2014. I now work in the Decommissioning Directorate within EnQuest where we take mature assets to the end of their productive life and decommission them in a safe, efficient and environmentally responsible manner. Thinking this was going to be a short assignment before returning to Capital Projects I have never looked back. The challenge of decommissioning offshore installations in this sector is just too big to be drawn away from.

How did you get into the Energy sector and how long have you been working in it?

I began my Career in Oil and Gas as a Software Engineer for a Subsea Control company called Kvaerner. Starting in 1998 I was quickly involved with designing and installing patches to prevent the millennium bug halting production in the North Sea. I have now been working in the Energy Sector for 23 years.

What does your job involve on an average day?

As a Project Manager for a major decommissioning project in the North Sea my job varies so much. No two days are the same. I carry out a range of work to ensure the project is staying on track, this includes engaging with partners and external stakeholders, attending pre-mobilisation visits to vessels and visiting the offshore installation to meet with the workers at the sharp end.

What are main barriers to international growth for ambitious companies and what advice do you have for them?

EnQuest has interests in the UK and Malaysia, but our decommissioning programme is currently focused on the UK with four assets in decommissioning. We are however looking to build EnQuest as a decommissioning business which could have global reach. We also see that option within the organisation helps support the UK though the Energy Transition.

What has been the highlight of your career so far?

Without doubt the recognition I received within my profession when I received my Project Professional Chartership was a great moment in my career. I felt that the Project Management Profession was not properly recognised as a skill. For too long there was an expectation that an engineer would develop through their career and natural progression would be a Project Management role. It really is a different skillset and this is better recognised across industries. I always say I was a pretty good engineer but I’m a great Project Manager!

What ambitions have you still got to fulfil professionally in your career?

I am finding now that, although I still enjoy the Project Management side where I have to pull a team together towards a common goal, I do think more about the next challenge. I do enjoy creating and energising my teams but what I would really like to do is create something different and unique. I would like to find a new and exciting way to deliver decommissioning across the UK and one area where I am involved in the early stages is an initiative called Subsea Decommissioning Collaboration. This could revolutionise the way Subsea Decommissioning is approached, moving to a more industrialised approach and saving both operators and the British taxpayer millions of pounds.

Who has been the most influential person in your life professionally?

For work I have had many people influence my careers from MDs to line managers to graduates and my project engineers. I have discovered that I like to learn by watching people. For me, this is so much easier than reading a book or attending a training course. From a non-work perspective, the most influential celebrity I admire is Tiger Woods. His work ethic, focus and ability to adapt to a situation is incredible. I also think over the past few years we are now also beginning to see his influence in the locker room with the rest of the golfers. These attributes are all key to a successful career.

Over the next 10 years, what changes would you like to see in the energy sector with respect to D&I?

In a decade’s time I would like to see D&I so embedded in our culture that it becomes the norm. However, I know that this is a monumental change for people who have been conditioned with certain biases established at an early age. I challenge myself often on my unconscious bias when making choices. In 10 years, the landscape will definitely include more females, people from diverse ethnicities and career backgrounds and I want to ensure that all people are given an equal chance to succeed.

Given the experience you have now, what advice would you give a graduate just starting his career in the Energy sector?

Work hard, actively listen and don’t be scared to fail. I think a good work ethic is so important to success and it is so visible. It is a way to demonstrate commitment to succeed. But to succeed you must listen and act upon what you are being told. Feedback is the greatest gift you will be given in your career.

Finally, go for it. If you fail at something, think about it as a learning opportunity and pick yourself up and go again.

If you were inviting guests to a dinner party, which 3 people would you invite and why?

I would like to invite my grandparents, three of which are now dead. Family is very important to me and looking back on my time with them I was very focused on just me while I was growing up. When I then had my own family you get caught up in your own life. It would be great to have the opportunity to learn more about their lives and discovering our similarities across the generations.

I would also like to invite Alex Ferguson. When it comes to leadership his name often comes up. The main attribute I admire about Alex is sustainability. He created a product that never stood still. He had to reinvent the team many times over to ensure success. He created an amazing team spirit that gave them a strong foundation for success.

PEOPLE IN ENERGY SPONSORED BY

SPONSORED BY Recruitment experts, placing top technical talent around the globe, with workforce solutions tailored to you

The new government’s strategy to increase domestic energy production and support households and businesses, the annual economic report for the UK offshore energy, and field development updates were the highlights of the UK North Sea oil and gas sector this past month.

UK NORTH SEA Energy Review

By Tsvetana Paraskova

By Tsvetana Paraskova

The new UK government is taking the next steps to boost domestic energy production, including by lifting the 2019 moratorium on fracking in England and pursuing the award of more than 100 new oil and gas licences in the North Sea in a new licensing round.

The licensing round is expected to lead to over 100 new licences, forming part of the government’s plans to accelerate domestic energy supply. Under the new licensing round, which follows the outcome of the Climate Compatibility Checkpoint, the North Sea Transition Authority (NSTA) is expected to make a number of new ‘blocks’ of the UK Continental Shelf available, for applicants to bid for licences. The government also formally lifted on 22 September the pause on shale gas extraction and will consider future applications for Hydraulic Fracturing Consent with the domestic and global need for gas in mind and where there is local support.

The British Geological Survey’s scientific review into shale gas extraction found that the UK had limited current understanding of UK geology and onshore shale resources, and the challenges of modelling geological activity in relatively complex geology sometimes found in UK shale locations.

“Lifting the pause on shale gas extraction will enable drilling to gather this further data, building an understanding of UK shale gas resources and how we can safely carry out shale gas extraction in the UK where there is local support,” the government said.

The UK is also doubling down on scaling up renewables, nuclear, and lower-carbon energy sources.

“In light of Putin’s illegal invasion of Ukraine and weaponisation of energy, strengthening our energy security is an absolute priority, and – as the Prime Minister said – we are going to ensure the UK is a net energy exporter by 2040,” Business and Energy Secretary Jacob Rees-Mogg said in a statement.

Continues >

UK NORTH SEA REVIEW

US AT

OCTOBER 2022 ENERGY NEWS

office@ogvenergy.co.uk

CONTACT

SPONSOR THIS SECTION

Jacob Rees-Mogg

11

Cuadrilla Resources—the company operating Britain’s only two shale gas wells in Lancashire, which had to stop drilling after the government announced the moratorium in 2019 – welcomed the formal lifting of the ban.

“Communities across the North of England stand to benefit most from today’s announcement. Cuadrilla is determined that a portion of all shale gas revenue should be delivered to local residents as a community dividend,” Cuadrilla’s CEO Francis Egan said.

Commenting on the lifting of the shale gas moratorium, Wood Mackenzie analysts said:

“While there are very few details on the UK’s net export plan, we believe shale gas faces too many political, technical, economic and funding headwinds to make a material impact this decade.”

“Even if drilling were to start straight away, 2023 volumes would be negligible relative to immediate energy issues. With only a handful of wells drilled to date, the exploration and appraisal process could easily run into the latter half of the decade,” WoodMac noted.

Offshore Energies UK, the leading offshore industry body, published in early September its ‘Economic Report 2022: A focus on UK energy security’, which urged the UK’s new government to accelerate investment in North Sea gas, oil, and wind – and reform power markets to ensure fair tariffs.

The report praised the UK offshore industry’s response to the energy crisis as it has boosted offshore domestic gas production by 27 percent since January.

The report also cited data from the North Sea Transition Authority, suggesting that the UK continental shelf still contains gas and oil equivalent to about 15 billion barrels of oil. The UK’s total energy consumption equates to about a billion barrels of oil a year so these reserves could support UK energy security for decades to come, with the right investment, OEUK says in the report.

“As we have learned over the last year, energy is a precious resource which must be properly managed, in the short and long term. Our sector has many of the answers and through constructive work with governments and regulators, we can boost the UK economy, cut emissions, secure jobs and most important, heat and power homes and industries with energy produced here, for decades to come,” OEUK said.

“In practical terms we need the new government to rapidly announce the next round of oil and gas exploration licenses and speed up production approvals,” OEUK’s acting CEO Mike Tholen said in a statement.

“We are also encouraging the UK government’s focus on tariff reform. Right now, our energy markets are being controlled by President Putin who is driving up the price of gas to break ours and Europe’s resolve over Ukraine. We cannot let that continue. We need to move away from a system that allows the price of gas to control the cost of electricity,” Tholen added.

The North Sea Transition Authority has granted the required approvals and consents to Centrica Offshore UK Limited (COUK), for Phase 1 of the Rough gas storage site off the East Coast of England in the Southern North Sea. Centrica has now received all of the required NSTA regulatory approvals to commence gas storage operations.

The NSTA published on 21 September its latest Emissions Monitoring Report, which showed that North Sea greenhouse gas emissions were cut by an estimated 14.6 percent to 14.3 million tonnes of CO2e last year, adding up to an overall reduction of 21.5 percent since 2018.

Thus, the North Sea oil and gas industry is on track to meet early emissions reduction targets after posting cuts of more than a fifth between 2018 and 2021, according to NSTA’s analysis.

NSTA projections indicate the sector is on track to meet interim emissions reduction targets –of 10 percent by 2025 and 25 percent by 2027 – which were agreed in the North Sea Transition Deal (NSTD) between the sector and the UK government in 2021.

“However, bold measures will be needed to hit the 2030 goal of halving emissions.

Upgrading platforms to run on clean electricity, instead of gas or diesel, is essential – the NSTD will not be delivered without it. At least two electrification projects should be commissioned by 2027,” NSTA said.

In company news

TechnipFMC was awarded a significant subsea engineering, procurement, construction and installation (EPCI) contract by Shell for the Jackdaw development in the North Sea. For TechnipFMC, a “significant” contract is between $75 million and $250 million. The contract covers pipelay for a 30-kilometre tieback from the new Jackdaw platform to Shell’s Shearwater platform, as well as an associated riser, spoolpieces, subsea structures, and umbilicals.

Allseas has been awarded a major decommissioning contract by TAQA UK for the removal and disposal of multiple Northern North Sea (NNS) facilities. The combined weight of the topsides and jackets to be removed is around 114,000 tonnes, making this the single largest offshore UK Continental Shelf decommissioning contract scope to date, Allseas said.

Kistos said in its latest corporate outlook that it expected GLA development and exploration programmes to commence imminently, utilising the investment allowance under the terms of the UK Energy Profits Levy. In addition, the Glendronach development is on track to be sanctioned by the end of this year, with production anticipated to begin by the end of 2024. Kistos is also preparing to drill the 638 Bcf Benriach gas prospect in 2023.

EnQuest is assessing the potential to use its existing infrastructure and subsea projects expertise to facilitate the electrification of nearby offshore oil and gas assets and planned developments by way of a grid connection supplemented with renewable power, the company said in early September.

“Through our Infrastructure and New Energy business, we intend to repurpose and utilise existing assets to progress new energy and decarbonisation opportunities, including carbon capture and storage, electrification, and the production of green hydrogen,” EnQuest CEO Amjad Bseisu said.

Tailwind announced on 12 September first oil from its 100-percent operated Evelyn field in the UK Central North Sea ahead of schedule. Evelyn is now producing via the Triton FPSO and is expected to substantially increase Tailwind’s gas production. As part of the same subsea campaign, the project team installed a second subsea production line from its 100-percent owned Gannet-E field, which already produces via Triton.

i3 Energy plc announced on 22 September the spud of the Serenity appraisal well. The drilling programme is expected to last approximately 30 days.

Neptune Energy announced the award of a $30 million decommissioning contract to WellSafe Solutions, for a campaign covering more than 20 wells located across eight Dutch and UK North Sea fields.

Favourable fiscal and macroeconomic developments have further bolstered interest in Jersey Oil and Gas plc’s ongoing Greater Buchan Area (GBA) farm-out process, the company said on 22 September. Substantial progress has been made, with the majority of interested parties expected to complete their technical due diligence in October 2022, Jersey Oil and Gas added.

bp’s BP Exploration Operating Company

Limited has exercised the first of four months of options through 21 December 2022 for the charter of the Safe Zephyrus to continue providing gangway connected operations supporting the Seagull project at the ETAP central processing facility in the UK North Sea, Prosafe said on 22 September.

Petrofac has secured a three-year contract extension for maintenance services from Serica Energy. Under the terms of the agreement, Petrofac will continue with the provision of maintenance execution, maintenance consultancy, and metering services to Serica Energy’s Northern North Sea asset, the Bruce platform complex which processes production from its Bruce, Keith, and Rhum fields.

ENERGY NEWS UK NORTH SEA

office@ogvenergy.co.uk CONTACT US AT SPONSOR THIS SECTION

EnQuest CEO Amjad Bseisu

12 www.ogv.energy I October 2022

THE SOCIAL STRATEGIST

Digital communities, ecosystems, and partnerships

By Eric Doyle

In 2018 I was the Managing Director of an Energy Service company.

I had a selection of ‘tools and techniques’ that I used to grow businesses back then. On the Sales side I was very much into the ‘Challenger’ thinking. You may have read the book…

"Instead of leading with information about their company and its solutions, Challengers provide customers with surprising insights about how they can save or make money", we put this to effective use back in the day and it got us to commercial positions we could not dream of getting to by using other means. My tools and techniques worked very well for a time, then I noticed they were becoming less and less effective. More calls, more emails, more adverts, more PR, more shows…. declining results.

The rise of Digital.

Back then, ‘Digital Transformation’ meant ERP systems and Project Management systems. Things that would make life easier once we had won projects and were managing them, but Digital began to spread into other areas of business.

Digital HR portals, Digital HSE systems, Digital Quality processing…

I noticed the Digital Impact on Sales, Marketing and Business development in 2018, but I didn’t understand it.

It was becoming increasingly difficult for us to get to the right tables. If we did get there, we were increasingly late in the process. Trudging through analogue mud as the world turned digital…

In previous articles I’ve discussed how influence over broadcasting is key to progress in the strategic application of social media. Buyers tell us that they are more interested in your teams thought leadership content than your marketing materials and product sheets, they want to hear from the people not the brand…

People are winning the battle over the brands… Buyers are cutting out the ‘door openers,’ choosing which doors they want to open and opening them themselves.

Buyers want thought leadership content to allow them to assess whether you really understand their issues and can solve their problems, so it makes sense to have your team dominate the thought leadership space in your sector.

But so often we see organisations stuck in a corporate rut of stiff, glossy brochureware that is blending into the mass of other stiff, glossy brochureware that is not in any way creating influence in their sectors?

Influence comes from people connecting with people on a technical, commercial, and personal level, the means bringing personality into the picture.

Lean into the army of technical and commercial influencers you have in your team. Look outside your office or on your next team video call… your army is right there, and they have untapped agency.

“But Eric, we are an (insert your specialism) company, surely this doesn’t apply to us…?” Yes, it does…

If your business model requires businesses to buy your products and services…it applies to you.

Modern sales and marketing is all about creating digital communities

If you’d come into my office in 2018 and said…"we can see into the future and it’s all about digital communities, ecosystems and partnerships", I would have fallen off my chair laughing.

…it’s a commercial reset.

• We must be thinking influence over broadcasting and creating a space that people want to walk towards and join in.

• We must understand that the engine room for this is in our people, not out brochures.

• We must be thinking about training the internet to see us as the answer to all those questions that we need to be the answers to. Then we need a process and a framework to convert all of this into relationships, conversations, orders, revenue, and other meaningful business results.

The world has changed, your business world had changed whether you accept it, or not. Your people build digital communities, ecosystems, and partnership, not your marketing materials and products sheets.

The battle lines for order intake, revenue and ebitda in your sector are drawn, and they are online…do your people have the skills and expertise to build digital communities, ecosystems, and partnerships?

BRENT OIL PRICES OVER THE YEARS

October Review

YEAR1AGO

- BRENT OIL PRICE 2021 - $84.67

Oil prices continued to rise into the month of October with reports from OPEC and IEA confirming global supply shortages, improving mobility, and an increased demand.

OPEC countries had struggled to increase output due to both a lack of operating capacity and compliance with planned output cuts. The rising price was also helped by high natural gas prices, which was encouraging a switch to oil for power generation.

5AGO

YEARS

- BRENT OIL PRICE 2017 - $57.82

Oil giants, BP, announced in October that they had more than doubled profits in the third quarter after securing a 14% rise in oil and gas production. This update from BP came amongst a brighter outlook for oil companies across the world as the price of Brent crude reached its highest price for 2 years.

YEARS10AGO

- BRENT OIL PRICE 2012 - $112.58

Brent crude oil dropped with concerns that slower economic growth would curb oil demand. The World Bank cut its economic growth forecasts for East Asia and the Pacific region, home to two of the world’s largest oil consumers, and said there was a risk the slowdown in China may go on longer than expected.

Eric Doyle

Eric is a Co-Founder of Crux Consultancy Limited who train and coach cross sector B2B teams in the art and science of Strategic Social Media through Social Selling & Influence.

www.consultcrux.com

Europe Energy Review

By Tsvetana Paraskova

The energy crisis in Europe, exacerbated by Russia shutting down the key Nord Stream gas pipeline to Germany, and the EU’s plan to tackle the consequences of the crisis, once again dominated Europe’s energy scene this past month. A new gas pipeline from Norway to Poland was inaugurated, while more offshore oil and gas developments were approved in September. In low-carbon energy, Scotland unveiled its government programme, UK associations called for acceleration of renewables development, and companies announced wind, solar, batteries, and carbon capture projects.

Oil & Gas

Russia shut down in early September the Nord Stream gas pipeline to Germany, claiming technical issues with gas turbines at compressor stations and saying the pipeline would not open until the West lifts the sanctions against Russia which, Moscow says, currently prevent repairs of those turbines outside Russia.

At the end of September, Sweden, Denmark, and Germany suspected a sabotage at both Nord Stream pipelines which leaked gas in the Baltic Sea. Sweden and Denmark issued vessel navigation advisories, while Norway heightened the emergency preparedness for infrastructure, onshore, and offshore installations on the Norwegian Continental Shelf.

“Based on the information we have seen so far, much indicates acts of sabotage,” Norway’s Petroleum and Energy Minister Terje Aasland said on 27 September.

A day earlier, the Petroleum Safety Authority Norway (PSA) urged increased vigilance by all operators and vessel owners on the Norwegian Continental Shelf (NCS), after operator companies had recently given warnings and notifications of a number of observations concerning unidentified drones/aircraft close to offshore installations.

On the same day, the leaders of Norway, Denmark, and Poland inaugurated the Baltic Pipe natural gas pipeline from Norway to Poland via Denmark and the Baltic Sea. The Baltic Pipe project, running from the Norwegian sector of the North Sea, crossing Denmark from west to east and landing in Poland via the Baltic Sea, will bring gas from Norway to Poland. The benefits will go beyond Poland.

“The Baltic Pipe is a key project for the security of supply of the region and the result of an EU policy drive to diversify sources of gas. The pipeline will play a valuable role in mitigating the current energy crisis,” European Commissioner for Energy, Kadri Simson, said.

To tackle the soaring costs of energy for households and businesses, the European Commission proposed a cap on the revenues of companies that produce electricity at a low cost and a “crisis contribution” tax on fossil fuel companies. The Commission hopes the proposals – if approved – would raise 140 billion euros for EU member states to directly cushion the blow from the surging energy prices, European Commission President Ursula von der Leyen said in her State of the Union address.

The Commission also proposed an obligation for the EU to reduce electricity consumption by at least 5% during selected peak price hours.

The plan to cap revenues may fall short of the intended goals, at least where renewable energy ambitions are concerned, Rystad Energy said in research.

“The renewable industry is Europe’s best shot at producing affordable and secure power, but this policy reduces the private sector power providers’ ability to invest,” said Victor Signes, analyst renewables at Rystad Energy.

“The renewable power industry is not only helping to keep the lights on in Europe, but also picking up the bill too. If renewables are to take their proper place in Europe’s power mix, they will need support in turn in the not-too-distant future,” Signes added.

Commenting on the planned EU intervention on the energy market, Fabian Rønningen, senior power analyst at Rystad Energy, said: “Despite the unprecedented size and scale of the intervention it is designed to be short term

ENERGY NEWS ENERGY NEWS

14 www.ogv.energy I October 2022

and does not address longer term supply issues. The stage is set for bigger and potentially more forceful interventions as Europe continues to decouple its energy supply from Russia.”

The Danish Energy Agency approved on 21 September a plan for development of the Solsort oil and gas field west of Denmark’s coast in the North Sea. The expected start of production at the field, operated by Ineos, is at the end of 2023. The Solsort field is expected to account for 12% of Danish oil production and 5% of gas production in 2024.

Low Carbon Energy

First Minister Nicola Sturgeon said on 6 September that Scotland “will do all we can to speed up our development and use of renewable energy.”

This autumn, Scotland will seek approval for the Fourth National Planning Framework, which will support the delivery of renewable energy projects, Sturgeon said in a speech presenting the Programme for Government 2022-2023.

“We will press the UK government to speed up fundamental reform of the energy market and break the link between the cost of gas and the price of renewable and low carbon electricity,” she added.

The UK’s North Sea Transition Authority (NSTA) received 26 bids in the UK’s first-ever carbon storage licensing round. A total of 19 companies expressed interest in the 13 areas on offer, which are off the coasts of Aberdeen, Teesside, Liverpool, and Lincolnshire, NSTA said on 22 September. The NSTA will now evaluate the bids with a view to awarding licences in early 2023. The first carbon injection could take place as early as 2027, the authority said.

RenewableUK urged in early September the new Prime Minister Liz Truss to speed up the roll-out of new renewable energy projects to help bill payers and boost the nation’s energy security.

“Industry wants to work with Government on our plans to break the link between the exorbitant cost of gas and the price of electricity. This will enable billpayers to benefit more from the vast amounts of low-cost electricity being generated by wind and other renewables, by no longer allowing gas to call the tune in the energy market,” RenewableUK’s CEO Dan McGrail said.

77% of people throughout the UK think the new Government should use new wind and solar farms to reduce electricity bills, and 76% of people support building renewable energy projects in their local area, a poll by Survation commissioned by RenewableUK showed.

The overall pipeline of onshore wind projects –operational, under construction, consented, or being planned – in the UK has increased by over 4 gigawatts (GW) in the last twelve months, from 33 GW in October 2021 to 37 GW today, a new report by RenewableUK showed in early September.

“Industry wants to work with Government on our plans to break the link between the exorbitant cost of gas and the price of electricity. This will enable billpayers to benefit more from the vast amounts of low-cost electricity being generated by wind and other renewables, by no longer allowing gas to call the tune in the energy market,”

said RenewableUK’s CEO Dan McGrail

The current pipeline of blue hydrogen projects is expected to exceed the 2030 targets in the UK, according to an analysis from Westwood Global Energy Group. Blue hydrogen projects account for over 16 GW of total announced hydrogen capacity in the UK and Norway, equivalent to around 90% of the hydrogen projects total for the same region. The UK alone accounts for 13 GW capacity.

“The scale of blue hydrogen developments makes them a necessity to ensure 2030 regional targets are met –in fact, the current pipeline of announced capacity for UK projects would exceed targets if all achieved their planned start-up dates,” said David Linden, Head of Energy Transition at Westwood.

In the EU, the Commission approved in September “IPCEI Hy2Use”, the second Important Project of Common European Interest in the hydrogen value chain. The project involves 29 companies and 35 projects from 13 EU Member States: Austria, Belgium, Denmark, Finland, France, Greece, Italy, the Netherlands, Poland, Portugal, Slovakia, Spain, and Sweden. IPCEI “Hy2Tech” is focused on the development of novel technologies for the production, storage, transportation, and distribution of hydrogen as well as applications in the mobility sector. The Member States will provide up to 5.2 billion euros in public funding, which is expected to unlock additional 7 billion euros in private investments.

In company low-carbon energy projects, Flotation Energy and Vårgrønn announced an offshore wind partnership to support oil and gas decarbonisation in Scotland. Together the partners will generate renewable energy from offshore wind farms to enable the electrification and decarbonisation of offshore oil and gas installations in the North Sea. Any excess power will be made available to benefit UK consumers, the firms said.

Carlton Power has chosen to build its third hydrogen hub in the UK on land within the Langage Energy Park, the first of its kind in Devon and Cornwall. The 10-MW hydrogen hub project will provide local companies - for example energy intensive industries or those with transport fleets – with easy access to hydrogen fuel.

Equinor and Wintershall Dea have agreed to pursue the development of an extensive Carbon Capture and Storage (CCS) value chain connecting continental European CO2 emitters to offshore storage sites on the Norwegian Continental Shelf. An approximately 900-kilometre-long open access pipeline is planned to connect the CO2 collection hub in Northern Germany and the storage sites in Norwayprior by 2032.

“The scale of blue hydrogen developments makes them a necessity to ensure 2030 regional targets are met – in fact, the current pipeline of announced capacity for UK projects would exceed targets if all achieved their planned start-up dates,”

Horisont Energi and Neptune Energy signed a Memorandum of Understanding (MoU) to develop the Errai Carbon Capture and Storage (CCS) project in Norway.

France-based hydrogen producer Lhyfe opened the world’s first offshore renewable hydrogen production pilot site at the end of September. Lhyfe will produce the first kilograms of renewable green hydrogen at quay and then at sea, operating automatically, in the most extreme conditions. The company has voluntarily set the bar high by installing its production unit on a floating platform, connected to a floating wind turbine, Lhyfe said.

Saipem and Siemens Energy have signed a Memorandum of Understanding (MoU) to jointly develop a concept design for a 500 MW high-voltage alternating current (HVAC) floating electrical substation for use in offshore wind farms.

“The new joint solution will significantly optimize critical technical parameters, such as weight, electrical efficiency, and asset longevity, thus lowering the production costs and enabling an unprecedented number of countries to benefit from large-scale offshore wind generation,” said Agustin Tenorio, Vice President Transmission Systems at Siemens Energy.

EUROPE

said David Linden, Head of Energy Transition at Westwood

15

SPONSORED BY

What’s Ultimate Cement Placement?

In a few words: smooth, efficient and painless.

When’s the last time you gave your offshore cementing operations a critical review? Is everything “just fine” or can it be better… much better? Do you even know?

Check out what our customers have discovered working with us across the globe.

Ultimate Cement Placement. It's what your drilling team deserves.

www.deltatekglobal.com/ogv

ENERGY REVIEWUS

By Tsvetana Paraskova

By Tsvetana Paraskova

US upstream and oilfield services employment rose for yet another month in August as the oil and gas industry continues to see part of the jobs lost during the pandemic recovered. Yet, despite solid overall demand for oil in the United States and the highest estimated petroleum exports on record, the US cannot come to the rescue and alleviate the energy crisis in Europe.

US Oil Production Growth Could Be Below Forecasts

Current forecasts of US crude oil production growth may have to be significantly revised down. The recent flattening in the number of active drilling rigs in the top US shale basin, the Permian, suggests that output may disappoint due to supply chain constraints and cost inflation. The number of active drilling rigs in the Permian is up by more than 80 since September 2021, but the number has more or less remained unchanged since May 2022, per data from Baker Hughes.

oil production during a year. The current record is 12.3 million bpd, set in 2019. In natural gas, production has been rising relatively steadily since the first quarter of 2022, when it averaged 94.6 billion cubic feet per day (Bcf/d). The EIA expects US dry natural gas production to average 99.0 Bcf/d in the fourth quarter this year and then rise to 100.4 Bcf/d for 2023.

However, US shale executives themselves admit that America’s oil production growth would likely be below expectations.

US oil production is set to grow this year, but the growth pace would likely be lower than previously expected due to cost inflation in the double digits, supply chain issues and bottlenecks, and infrastructure and services constraints.

Shale producers prioritize returns to shareholders and paying down debts to significantly boosting production, and even those planning an increase in drilling activity face supply chain delays and up to 20% higher costs.

According to the September Short-Term Energy Outlook (STEO) by the Energy Information Administration, US crude oil production is expected to average 11.8 million barrels per day (bpd) in 2022 and 12.6 million bpd in 2023, which would set a record for the most US crude

Scott Sheffield, chief executive officer at Pioneer Natural Resources, one of the top US shale producers, said at the Barclays CEO EnergyPower Conference in early September that US oil production could grow by 500,000 bpd in 2022 compared to 2021. Next year, the growth could be even slower than this year’s expected 500,000-bpd increase, due to supply chain and infrastructure issues, as well as rising costs.

“There could be more downside,” Sheffield said at the conference, as carried by Reuters.

The EIA currently expects US oil output to rise by around 800,000 bpd in 2023 compared to 2022.

ENERGY NEWS

Source: Getty Images

16 www.ogv.energy I October 2022

Main Oil Producers’ Group Calls For Clearer Federal Policies, Again

Meanwhile, the American Petroleum Institute (API), the main oil producers’ group, said in a monthly report on 21 September that US oil demand remained resilient in August, while inventories – including commercial and strategic petroleum reserves –dipped to their lowest level since 2003.

“The current situation shows the need for increased development of domestic energy that is supported by cogent and supportive policies – including access to resources, infrastructure, and conducive trade and tax policies – that foster investment, job growth and, therefore, economic growth and security,” API’s chief economist Dean Foreman said.

“Unfortunately, we don’t have clear, strong policies supporting domestic oil and natural gas production – to meet domestic needs and to back up America’s recent promises to supply energy to our European allies and others internationally,” Foreman added.

“The most recent response from Washington was a veiled threat by U.S. Energy Secretary Jennifer Granholm to ban U.S. exports of diesel fuel and other distillates if winter conditions increase demand and put upward pressure on prices,” API’s chief economist noted.

API’s Monthly Statistical Report with August data showed that U.S. petroleum demand remained solid above 20.0 million bpd as fuel prices fell along with those of crude oil and indicators of industrial production and consumer sentiment reinforced demand in August 2022. Domestic petroleum demand remained solid over the first eight months of 2022 too, rising by 2.9% year over year. US refining activity exceeded 16 million bpd for a sixth straight month, and the capacity utilization rate was over 92% for a fourth month in a row.

As domestic refining sustained historically strong throughput levels, record-high natural gas liquids (NGL) production – at 6.0 million bpd – offset a decrease in U.S. crude oil production. U.S. petroleum exports of 10.1 million bpd and net exports at 1.8 million bpd rose to the highest for any month on record since 1947, API said.

A combination of solid demand and refining activity, flat production, and record-high exports resulted in the lowest combined U.S. commercial and governmentcontrolled (Strategic Petroleum Reserve, SPR) crude oil inventories since 2003, API noted.

In its Industry Outlook for the third quarter of 2022, API says that despite slowing economies in the US and Europe, the main forecasters still expect global economic growth in the near term that historically has required more oil and natural gas to fuel the economy.

“By contrast, with continued work force, supply chain, financial and energy policy headwinds, the amount of global investment in oil and natural gas development has risen from the prior quarter but remained historically low. This is seen in API’s tracking of the global flow of capital expenditures and the recent backlog of projects under construction in the U.S., which at $158 billion was nearly cut in half compared to where it was at the end of 2020,” API’s Foreman said.

“Upstream employment is growing steadily alongside the world’s demand for affordable, reliable energy. The Texas oil and natural gas industry continues to play its leadership role in enhancing national and energy security in our nation and for our trade allies around the world,”

“To supply global oil and natural gas demand that has remained historically strong – and by EIA estimates could reach new record-highs in 2023 – it is imperative to have the cogent energy policies that support the industry’s resource access and its abilities to expand infrastructure, execute capital projects, attract investment capital and build and sustain a productive work force,” the chief economist of API noted.

Job Growth Continues in US Oil & Gas Industry

Upstream oil and natural gas employment in Texas, the largest US oil-producing state, grew in August by 2,600 jobs from July, according to data released by Texas Workforce Commission in September.

Since the low point in employment September of 2020, the upstream oil and gas industry in Texas has added 44,700 jobs, averaging growth of 1,943 jobs per month, the Texas Oil & Gas Association (TXOGA) said in a statement. At 201,700 upstream jobs, August 2022 jobs were up by 33,400, or 19.8 percent, from August 2021. August’s employment was the first time to break the 200,000 mark since March of 2020.

“Upstream employment is growing steadily alongside the world’s demand for affordable, reliable energy. The Texas oil and natural gas industry continues to play its leadership role in enhancing national and energy security in our nation and for our trade allies around the world,” said TXOGA president Todd Staples.

In oilfield services, employment in the US oilfield services and equipment sector rose by an estimated 6,854 jobs to 648,914 in August, according to preliminary data from the Bureau of Labor Statistics (BLS) and analysis by the Energy Workforce & Technology Council. Gains in August make OFS employment the highest since the beginning of the COVID-19 pandemic, but still off the pre-pandemic mark in February 2020 of 706,528 jobs.

“The August job increases are very encouraging as our sector continues to rebuild the workforce from pandemic losses,” said Energy Workforce & Technology Council CEO Leslie Beyer.

“The current situation shows the need for increased development of domestic energy that is supported by cogent and supportive policies – including access to resources, infrastructure, and conducive trade and tax policies – that foster investment, job growth and, therefore, economic growth and security,”

“Our industry is meeting the challenge of growing global demand by producing at almost pre-pandemic levels, reducing emissions industry wide, all while continuing to make gains in the workforce.”

US

said TXOGA president Todd Staples

API’s chief economist Dean Foreman said

US NEWS SPONSORED BY 17

SPONSORED BY www.craig-international.com

MIDDLE EAST Energy Review

By Tsvetana Paraskova

By Tsvetana Paraskova

The token output cut from the OPEC+ group, the Saudi warning of very low spare production capacity, and a number of deals and collaborations marked this past month’s oil and gas industry news flow from the Middle East.

OPEC+ Reverses Small Output Increase

At the meeting in early September, OPEC+ decided to cut their collective oil production target by 100,000 barrels per day (bpd) for October, reversing the increase of the same amount approved for September in early August. The energy ministers of the OPEC+ production pact agreed to return the targeted production levels to the August quotas, with OPEC saying that the 100,000-bpd increase was intended only for September.

“The Meeting noted that higher volatility and increased uncertainties require the continuous assessment of market conditions and a readiness to make

Smart Procurement

At Craig International, procurement isn’t just about processes, products and numbers. We promote a culture of ownership among our people, who are trusted to get on with the job on your behalf. We’re proud of how we serve clients.

We’re always looking for new ways to add value and routinely introduce new technological solutions to make service delivery even simpler, smoother, faster.

immediate adjustments to production in different forms, if needed, and that OPEC+ has the commitment, the flexibility, and the means within the existing mechanisms of the Declaration of Cooperation to deal with these challenges and provide guidance to the market,” OPEC said in a statement after the short meeting on 5 September.

The next OPEC+ meeting is scheduled to be held on 5 October

The small cut in the production target for October is actually quite irrelevant considering that OPEC+ is estimated to be more than 3.5 million bpd behind collective quotas.

But the more important outcome of the September meeting was the decision of the OPEC+ group to “request the Chairman to consider calling for an OPEC and non-OPEC Ministerial Meeting anytime to address market developments, if necessary.” This statement, analysts said, means that the group – and its de facto leader Saudi Arabia – could call an emergency meeting and take any steps it considers appropriate to stabilise the il market and prices.

The OPEC+ alliance, however, is nowhere close to reaching its oil production targets. The gap between the quota and the actual oil production from OPEC+ countries widened to as much as 3.58 million bpd in August, Argus reported in mid-September, citing delegates and OPEC data it had seen. In August, the two biggest laggards in production quotas were Russia of the nonOPEC group and Nigeria of OPEC, the data showed. Russia’s oil production was 1.25 million bpd below its target, while Nigeria was 700,000 bpd behind its quota. The underperformance in September is expected to be even higher because the group lifted its collective target by 100,000 bpd for the month of September.

Saudi Aramco Warns of Low Spare Capacity

Global spare capacity is at very low levels, mostly because of years of underinvestment in the oil and gas industry, Amin Nasser, chief executive at Saudi Arabia’s oil giant, Aramco, said at the Schlumberger Digital Forum on 20 September.

ENERGY NEWS

18 www.ogv.energy I October 2022

“These are the real causes of this state of energy insecurity: under-investment in oil and gas; alternatives not ready; and no back-up plan. But you would not know that from the response so far,” the CEO of the world’s biggest oil firm and top crude oil exporter said.

Commenting on the current energy crisis, Nasser said “oil inventories are low, and effective global spare capacity is now about one and a half percent of global demand.”

“Even with strong economic headwinds, global oil demand is still fairly healthy today. But when the global economy recovers, we can expect demand to rebound further, eliminating the little spare oil production capacity out there. And by the time the world wakes up to these blind spots, it may be too late to change course,” Aramco’s chief executive noted.

He also reiterated Saudi Arabia’s long-held view that the world needs a realistic energy transition plan which acknowledges the role of oil and gas as energy sources needed for decades to come.

“Because when you shame oil and gas investors, dismantle oil- and coal-fired power plants, fail to diversify energy supplies (especially gas), oppose LNG receiving terminals, and reject nuclear power, your transition plan had better be right,” Nasser said.

“Instead, as this crisis has shown, the plan was just a chain of sandcastles that waves of reality have washed away. And billions around the world now face the energy access and cost of living consequences that are likely to be severe and prolonged,” he added.

Major Deals in the Middle East

Saudi Aramco and major oilfield services provider Schlumberger announced plans in September to collaborate and develop a digital platform that will provide sustainability solutions for hard-to-abate industrial sectors. The proposed platform will enable companies in industries such as oil and gas, chemicals, utilities, cement and steel to collect, measure, report and verify their emissions, while also evaluating different decarbonization pathways, Schlumberger said.

Saudi Arabian Investment Minister Khalid Al-Falih met Eni’s chief executive

Claudio Descalzi to discuss views about the role of Saudi Arabia based on current energy market challenges. During the meeting, Eni and the Saudi Ministry of Investment (MISA) signed a memorandum of understanding to promote cooperation between Eni, Saudi institutions, and companies in the field of sustainable development around the country, and speciality conversion chemicals.

In the United Arab Emirates, Abu Dhabi National Oil Company (ADNOC) awarded a $548 million (AED2.01 billion) contract to build a new main gas line at its Lower Zakum field offshore of Abu Dhabi. The award will increase Lower Zakum field’s gas production capacity from 430 million to 700 million standard cubic feet per day, supporting ADNOC’s plans to enable gas self-sufficiency for the UAE and cater for increasing global energy demand.

ADNOC has also awarded five framework agreements valued at $1.83 billion for Directional Drilling and Logging While Drilling (LWD) to support its efforts to expand production capacity of its low-carbon oil and gas resources.

ADNOC made its first shipment of low-carbon ammonia from the UAE bound for Hamburg, Germany—the first ever cargo of low-carbon ammonia to be shipped to Germany.

“Our collaboration with customers in Germany also underlines ADNOC’s ambitious growth plans for the production of clean hydrogen, and its carrier fuels such as ammonia, which will play a critical role in decarbonizing hard-toabate industrial sectors,” said Sultan Ahmed Al Jaber, UAE Minister of Industry and Advanced Technology and ADNOC Managing Director and Group CEO.

The top executives of ADNOC and Italy’s Eni discussed in Abu Dhabi in September further opportunities to help increase global gas supply security. The executives discussed the acceleration of the multi-billion-dollar Ghasha project, which is estimated to hold significant recoverable gas and is expected to produce more than 1.5 billion cubic feet of gas per day (bcfd) in addition to more than 120,000 barrels of high-value oil and condensates per day.

Petrofac said it had been awarded a twoyear Field Maintenance Services contract

extension with ADNOC Group. Under the agreement, Petrofac will continue to support operations at the Haliba oil field, located onshore along the south-east border of Abu Dhabi, providing specialist personnel to maintain and support facilities.

In Qatar, QatarEnergy has selected TotalEnergies as the first international partner in the North Field South (NFS) expansion project, which comprises 2 LNG mega trains with a combined capacity of 16 million tons per annum (MTPA) and will raise Qatar’s total LNG export capacity to 126 MTPA.

QatarEnergy’s affiliates QatarEnergy Renewable Solutions and Qatar Fertiliser Company (QAFCO) signed agreements for the construction of the Ammonia-7 Project, the industry’s first world-scale and largest Blue Ammonia project.

“Our investment in this project speaks to the concrete steps we are taking to lower the carbon intensity of our energy products, and is a key pillar of QatarEnergy’s sustainability and energy transition strategy,” said Saad Sherida Al-Kaabi, the Minister of State for Energy Affairs, President and CEO of QatarEnergy.

QatarEnergy also signed a Memorandum of Understanding (MoU) with General Electric (GE) to collaborate on developing a carbon capture roadmap for the energy sector in Qatar. The focus of the MoU is to explore the feasibility of developing a world-scale carbon hub at Ras Laffan Industrial City, which as of today, is home to more than 80 GE gas turbines.

The roadmap will target to develop a carbon capture and sequestration hub in Qatar, utilize low-carbon fuels such as hydrogen in GE gas turbines to reduce carbon emissions, and explore the potential of using ammonia as a fuel in GE gas turbines globally.

MIDDLE EAST

MIDDLE

EAST NEWS SPONSORED

BY

Minister Khalid Al-Falih

19

ENERGY PROJECTS MAP

USA (GoM)

Leon Offshore Oil Field (Salamanca FPU)

LLOG

$500 million

Audubon Engineering has been selected by LLOG Exploration to provide detailed design, procurement and vendor equipment management, in addition to support in the construction, pre-commissioning and offshore commissioning areas. The Independence Hub hull, topside truss, cranes and lifeboats will be reused, while topside equipment (including piping, electrical and instrumentation systems) will be new..

CYPRUS

Cronos Gas Discovery Eni

$500 million

Eni has made a significant gas discovery a the Cronos-1 well in Block 6, 160 km offshore Cyprus. The Cronos-1 wildcat was drilled in 2,287 metres of water depth.

Preliminary estimates indicate approximately 2.5 Tcf of gas in place. Eni is considering two development options to advance the project; Floating LNG or transporting gas to Egypt, depending on the drilling results.

Drilling on the second exploration well is ongoing and is due to be completed in November 2022.

CHINA

Bozhong 26-6 and Bozhong 9-2 Oil Discoveries CNOOC $1 billion

Talos Energy is planning to spud Puma West’s second appraisal well in Q4 2022, with results set for early 2023. The developer has been authorised to drill this appraisal well to a depth of over 8,100 metres using Diamond Offshore Drilling’s Ocean BlackHornet drillship. The discovery is located west of the BP-operated Mad Dog field.

UAE

Lower Zakum – Long Term Phase-1 ADNOC $650 million

ADNOC has awarded NPCC a $548 million EPC contract for an 85km subsea gas pipeline from Zakum West Super Complex to Das Island. The contract also includes constructing, installing and testing a new platform at the Zakum West Super Complex and the new gas facility located at Das Island.

SPONSORED BY

Energy projects and business intelligence in the energy sector

The EIC delivers high-value market intelligence through its online energy project database, and via a global network of staff to provide qualified regional insight. Along with practical assistance and facilitation services, the EIC’s access to information keeps members one step ahead of the competition in a demanding global marketplace.

The EIC is the leading Trade Association providing dedicated services to help members understand, identify and pursue business opportunities globally.

It is renowned for excellence in the provision of services that unlock opportunities for its members, helping the supply chain to win business across the globe.

The EIC provides one of the most comprehensive sources of energy projects and business intelligence in the energy sector today.

WORLD PROJECTS

1 12 3 9 5 2 6 10 11 8 7 4

8 1 23 4 20 www.ogv.energy I October 2022

www.eicdatastream.the-eic.com

INDIA

Mumbai High Redevelopment – Phase 5 ONGC

$400 million

ONGC started the tender process for the fifth development phase of the Mumbai High field. Technical and commercial offers are likely to be submitted by October 2022, with ONGC expected to finalise its preferred contractor before the end of 2022.

CANADA

Core Bay du Nord Equinor $10 billion

A request for expressions of interest was launched for the FEED stage of the project in August, with a formal bidding process set take place during Q4 2022. The contract could be awarded in Q1 2023, with the FEED work expected to take up to 12 months.

NORWAY

Halten Øst-Sør Development Equinor

$150 million

Wood plc has been awarded a contract to deliver the detailed design of subsea pipelines for Halten East Development. The work will be undertaken by Wood's subsea and pipeline engineering team in Norway after the completion of the concept design and FEED works. The contract was awarded under an evergreen master services agreement for engineering services with Equinor.

SURINAME

Block 53 – Baja-1 Discovery Apache $500 million

Apache Corporation (APA) has announced its first discovery at Block 53 with the successful drilling of the Baja-1 exploration well. The well was drilled to a total depth of 5,290 metres using the Noble Gerry de Souza drillship, which led to 34 metres of net pay of good quality light oil and gas condensate being discovered.

PAPUA NEW GUINEA

Elk-Antelope Gas Field Total Energies $1.5 billion

Technip Energies has been awarded the FEED contract for the development of the Elk and Antelope onshore gas fields, including the well pads and a large central processing facility. Technip stated that it will conduct the work in a consortium with Clough.

USA (Alaska)

Pikka Field Development Santos $2.6 billion

Santos has announced a final investment decision (FID) to proceed with the first development phase of the $2.6 billion Pikka project. The field will have an initial output of 80,000 b/d when production starts in 2026.

ANGOLA

Northern Gas Complex Azule Energy

$2 billion

Saipem has secured three EPC contracts worth approximately $900 million, one onshore and two offshore. Saipem will handle the engineering, procurement, and construction of the Quiluma platform and the associated onshore natural gas processing plant, as well as hook-up and commissioning assistance.

GERMANY/NORWAY

Norwegian-German (NOR-GE) CCS Project Equinor $3 billion

Equinor and Wintershall Dea are planning to develop a 900km long open access pipeline to connect a carbon dioxide (CO2) collection hub in Northern Germany to storage sites in Norway. The pipeline will have an estimated capacity of 20 - 40 million tonnes per year by 2037. The project partners will look to deploy an early transport solution where CO2 is transported by ship from the export hub to the storage sites.

PROJECTS

WORLD PROJECTS

WORLD

SPONSORED BY

912 5 6 10 11 78 21

Oil & Gas Decommissioning: Opportunities and Challenges

By Tsvetana Paraskova

By Tsvetana Paraskova

Spending on decommissioning is set to increase every year over the next two decades as offshore oil and gas fields reach their end of life, especially in mature basins such as the North Sea, while onshore wells at the end of their production life need to be safely plugged. Removing and repurposing the infrastructure from decommissioned offshore and onshore assets creates long-term opportunities for the supply chain of oilfield services.

Decommissioning costs have been steadily falling offshore the UK, but the industry faces a highly ambitious cost reduction target.

(Credit: Shell)

Globally, the high oil and gas prices have not resulted yet in a renewed focus on decommissioning, which, analysts say, could threaten the targets for decommissioning backlog. Delays in decommissioning work could translate into more expensive decommissioning down the road, according to an analysis by Boston Consulting Group from June this year.

Oil and gas companies are mobilizing to invest in extending the life of existing assets, growth across the oil and gas value chain, decarbonization, and lowcarbon energy businesses. The largest international companies plan a combined $110 billion in capital expenditure in 2022, which would be around 25% higher than in 2021, Philip Whittaker, Partner & Director at Boston Consulting Group, said.

“As money flows into the sector, companies have the opportunity to invest in both sustainability and competitive positioning. Delivering on decommissioning commitments is core to this,” Whittaker wrote.

“But so far, this upcycle has not coincided with a renewed emphasis on decommissioning. We believe this poses a threat to targets for decommissioning backlog liquidation and performance, intensifying the risk of value erosion,” the BCG director noted.

Pushing back decommissioning could also threaten the emissions targets of oil and gas companies, according to the analysis.