CONTRACT AWARDS ON THE

DECOMMISSIONING

Vysus Group P.04 AGR P.24 Hydrasun P.25 Global Maritime P.26 NZTC P.28 Elemental Energies P.30 SHFCA P.32 Leyton P.34 Sword Group P.35 READ ONLINE AT READ ON PAGE 4 In this issue... Hydrogen & ccs AUG 2023 - ISSUE 71 GLOBAL ENERGY NEWS

PROJECTS MAP

THEME

& TECH

HYDROGEN & CCS

WORLD

MONTHLY

INNOVATION

RENEWABLES

MOVE

STATS & ANALYTICS

LEGAL & FINANCE EVENTS

A WORD FROM OUR EDITOR

Welcome to the August edition of ‘OGV Energy Magazine’ where we will be exploring the theme of ‘Hydrogen and CCUS’.

A big thank you to our front cover partner Vysus Group, and you can read all about their new partnership with Siccar is helping their clients to securely report on their ESG targets on pages 4 and 5 inside.

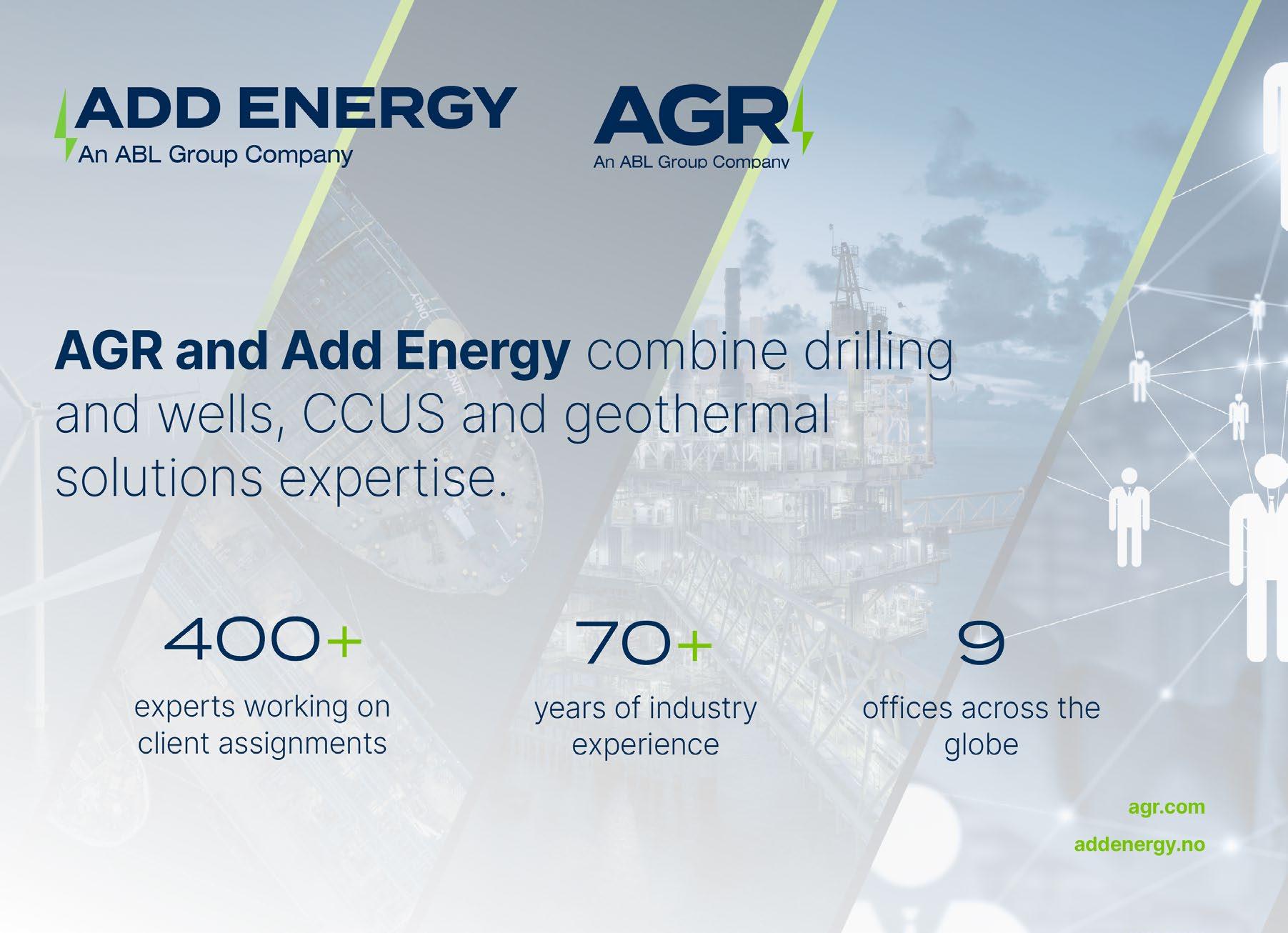

We also have contributions from the Scottish Hydrogen Fuel Cell Association, The Net Zero Technology Centre, Hydrasun, Global Maritime, Elemental Energies and AGR.

The rest of this month’s magazine as always provides you with a review of the Energy sector in the North Sea, Europe, the Middle East, the US and Australasia along with industry analysis and project updates from Westwood Global Energy Group, the EIC and Renewables UK.

Daniel Hyland, Sales and Operations Director, OGV Energy Media Group

3 CONTENTS FOLLOW US VIEW THE OGV MAGAZINE ONLINE AT www.ogv.energy/magazine @OGVENERGY OGVENERGY @OGVENERGY OGV-ENERGY COVER FEATURE OGV COMMUNITY NEWS GLOBAL ENERGY NEWS WORLD PROJECTS MAP HYDROGEN & CCS INNOVATION & TECH RENEWABLES CONTRACT AWARDS ON THE MOVE DECOMMISSIONING STATS & ANALYTICS LEGAL & FINANCE EVENTS P.04 P.08 P.10 P.20 P.22 P.34 P.36 P.38 P.40 P.42 P.44 P.46 P.47

4 8 26 25 28 36 40 32 24

TRUST PASSION PARTNERSHIP & CARBON

Interview with Vysus Group

MM - I'm delighted to have David Clark and Dominic McCann from Vysus and Siccar with me today. Thanks for joining the show. Can you introduce yourselves and your organisations, please?

DC - I'm David Clark, the CEO of Vysus group. We're an energy consultancy, both technical and regulatory. We were created back in November 2020 as a carve out from Lloyd's Register. We're a relatively new name, but we're a business with global footprint and decades of history working with clients around the world.

DM - I’m Dominic McCann, the Chief Executive of Siccar. We are a scale up technology company based out of Edinburgh with footprints in London and various other geographies that our clients reside in. We're about seven years in business and have launched a platform around information security

MM - Brilliant. It's great to have you. Tell me why have your companies come together today?

DC - In our business, we've been working with clients over many years and helping customers assess their emissions and provide assurance certificates on those emission metrics. Across the industry, process has been very paper driven for many years, and our team saw a clear opportunity to digitalise and automate that process and create a solution that would allow our customers to acquire information on a continuous basis. We were really delighted and excited to meet with the Siccar team and when we started to understand their capability and the underlying technology that they could provide, there was a fantastic fit between that requirement and the customer need.

DM - We are in the technology business, and for the past few years we've been pioneering a new level of security for how people share

information with each other. We've seen an explosion in technologies looking at how data is stored, and we’ve seen how networks are trying to keep up with that exponential increase in consumption and generation. At Siccar, we often refer to the “three Vs” - the variety, volume and velocity of data.

Our foundation platform is pioneered to be able to handle these massive volumes. Vysus, with the long standing relationships they have, are really the perfect fit for where we'd like our technology to be utilised.

The coming together of the two organisations has been such a great fit.

MM - Is this data box technology really enabling carbon scoring?

DC - Yes, typically our customers have a requirement to understand and measure their carbon metrics. What our team provides is a way to go in and look in detail at how they actually calculate those metrics. We're able to take all of the input metrics and then calculate in a really robust engineered fashion what is the actual tonnage of carbon equivalent that those processes or systems use.

MM - What does your ideal client look like?

DC - Ultimately everybody's a client, but clearly we are tackling our existing customer base, which in the Vysus world is predominantly across the energy sector and complex process industries.

MM - How does the energy transition benefit from this digitalisation?

DC - The measures of ESG metrics are going to be increasingly required by all sorts of stakeholders and companies. They would need to be able to understand where they are today

to get a clear benchmark and then be able to tackle how they can significantly reduce their carbon footprint.

MM - In your experience, why are companies really interested in this capability?

DC - As we've seen around the world, shareholders and stakeholders are becoming much more focused on how their investments are being spent and the impact it will have in terms of the climate. We've seen huge initiatives of companies setting up, trying to really focus on green or low carbon industries and technologies. For many of our existing customers, they're grappling with how they benchmark themselves, how do they understand where their current emission levels are, and critically, how can they make progress?

MM - It seems to me that potentially, data box could be managing some really quite sensitive information. How do you ensure security?

DM - We use the best encryption technology to ensure security. It has been built to the highest possible level it could be, and is designed to be the next generation in protecting shared data.

MM - ESG reporting is extremely important just now. Do you think the efficiency and ability to monitor carbon is actually going to start affecting companies values?

DC - There are a couple of things here. Firstly, it's not done very well today generally - most companies and most industries are really now only just starting to build an understanding and a depth of capability to really measure efficiently their full carbon footprint. To answer your question, this is becoming critical for companies and will become very mission critical for them and their ability to attract capital. They will need to be able to

4 www.ogv.energy I August 2023 COVER FEATURE

Moray Melhuish - MM

David Clark - DC

Dominic McCann - DM

David Clark

Dominic McCann

demonstrate to their customers what they are contributing to. All the way down that supply chain, suppliers need to demonstrate the carbon cost for each step that we provide or each service or solution that we provide. Therefore, increasingly in the years ahead, this will become very much a license to operate for.

DM - Even in the months ahead. There's going to be huge amounts of pressure on everyone to get better at how we’re reporting due to the current climate.

MM - Data box sounds like it's got a huge amount of value to us, but what sort of footprint have you got as a business? What is your capability and capacity to roll this out across the industry?

DC - Vysus is a company that's two and a half years old as a name and a brand, but we are actually a business with decades of legacy. We operate across the globe; we have operations in the Americas, Europe, Middle East, Asia, and Australia. As you can see, we are truly a global business, and importantly, we've a long history of working with industries not only oil and gas but right across the energy world.

One of the things that our business has done over the last couple of years is really helped our customers and shifted the focus of the sectors into the transition and renewables place. We see that as important because the energy world is becoming much more integrated and complicated. Our experience base across those different sectors, those different geographies, is helping our customers with a lot of these new transition based technologies.

MM - I'd love to know, what are the opportunities to get involved, what types of people do you think you're going to be recruiting?

DM - We typically bring in very innovative people. We don't want to be hierarchical and structured and say our people are pigeonholed into a specific role. We are running a graduate program at the moment that's been very successful and gives young people the opportunity to dabble in whatever they want. Our graduates get some experience in sales, tech, finance, and partnerships, whilst learning about the energy industry.

I would say just be brave, ask questions, challenge us and find your place in the company because there really is an unlimited number of roles that we can offer you.

MM - Brilliant. I'd love to find out a little bit more about you individually. Can you each take me through your career?

DM - I didn't start out in technology or in energy markets. I was originally an economist, and I headed down to London, where I ended up joining Andersen Consulting where it was all about risk. I was

modeling the risk around derivative products on the trading floor. With that analytics and modeling experience I moved into big US tech firms over the years. The majority of my time was spent at SAS, one of the largest private software companies where I saw a huge opportunity for oil and gas.

I was living in Australia at the time, and got sponsorship from the owner of the company to start building predictive solutions as what I saw was just an amazing operating environment with such high risk and high accuracy. I was at SAS for ten years and absolutely loved every minute of it.

I then got pulled out of there by some colleagues to go and start a tech company that we took to just south of half a billion dollar valuation. That brought me into distributed ledger data technology and security, where I saw the potential for Siccar. About five/six years ago I joined the board of Siccar and recently came in to head up. It's been an absolute blast and I wouldn't have changed it for anything.

DC - I am an engineer, but have not done any real engineering for many years. I was an electrical engineer, but I quickly decided I wanted to be outside of traditional engineering and went into the energy markets. My first job was in central Sudan shooting seismic, I then went into the oilfield services sector and spent a number of years in Asia before coming back to the UK for the first time to run a really interesting business here in the UK.

I then ran operations in oilfield services and the facilities engineering businesses world facilities in various parts of the world, and I spent four or five years building what became quite a major business in the Middle East before coming back to the UK for a few years. Along the way, I had two or three years running an IT services business out of London. It’s been and incredibly interesting career so far. I came into my current organization about four years ago. It's been an incredible journey as we reshaped the organisation before carving this out as a new company with the creation of Vysus Group.

MM - What's been the secret to your success as you have built your own careers and companies?

DC - For me, it's people. Every business has to be about the people, the team, and therefore getting the right team dynamics, getting people aligned, getting people clear on where we are going. Every business has its bad days and any job you ever have will have good days and bad days but as an organisation, if you're able to give direction and move the business forward, then people are on that journey with you, and of course, to have a little fun along the way.

MM - How do you define success for your business?

DC - There are two or three things for me. Number one is about creating an organisation

that's clear on where it's going and it's successful in terms of growing the business. We're able to create new solutions and help our customers. This means we are scaling the business up, creating value for us as a business, and therefore generating profits and being commercially successful.

However, it is also about innovation. How can we really help bring new solutions? What is the most significant challenge for us as a planet and how do we become a low carbon world? Our businesses can help our customers right across the globe, and we're really excited about being able to do that.

DM - Yeah, absolutely echo that. Just be the change, I suppose. Can we change the way that people and businesses interact with each other through information and data.

MM - Great. How do you define success for yourself?

DM - I often joke that I recruit to put myself out of a job. Every time we're bringing someone in, they're just better and better and it augments the team. I need to be challenged to go out and find the next best things for the organisation. Success for me is not getting hauled into the office in Edinburgh or down to London, but that I'm able to think and innovate with the likes of David as to what's next, what can we do that's absolutely a change for both businesses and the market.

DC - Absolutely echo that point. As I said earlier it's about building teams and building capability. The next generation is really critical to that. I'm an absolute believer as well in pulling people up, you can get young junior individuals who have what appears to be limited experience, but you can stretch people really quite well and that creates exciting opportunities for them.

MM - In each episode of the podcast, we ask our guests to set a question for our next guest without knowing who they're going to be. In the last episode, we were out at the Kincardine wind farm with Flotation Energy.

We had Kirstine Wood and Dan Wright. They left this question for you: In terms of the energy transition and skills passporting, what skills are you looking for?

DC - Our skill set and requirements are around engineering. We're looking for domain expertise in multiple areas, such as mechanical, materials, process, chemical, electrical, risk - a broad range of technical and regulatory skills.

Our business doesn't typically deploy people to do stuff on facilities. Therefore, from a passporting requirement, we've got limited leverage on that. It's more about the breadth of technical skills that we have.

5 COVER FEATURE

watch full interview www.ogv.energy/play www.vysusgroup.com

STATS GROUP

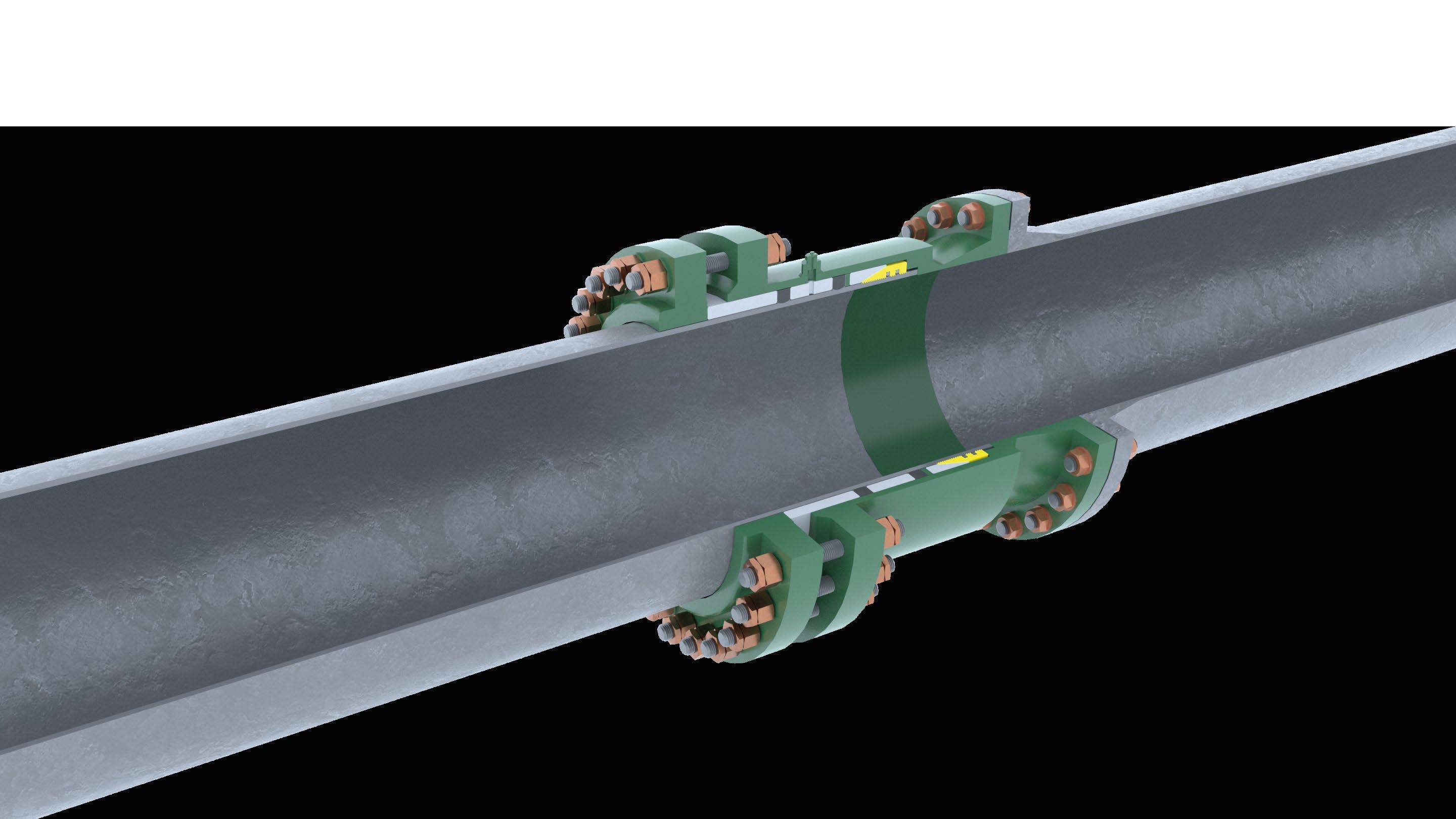

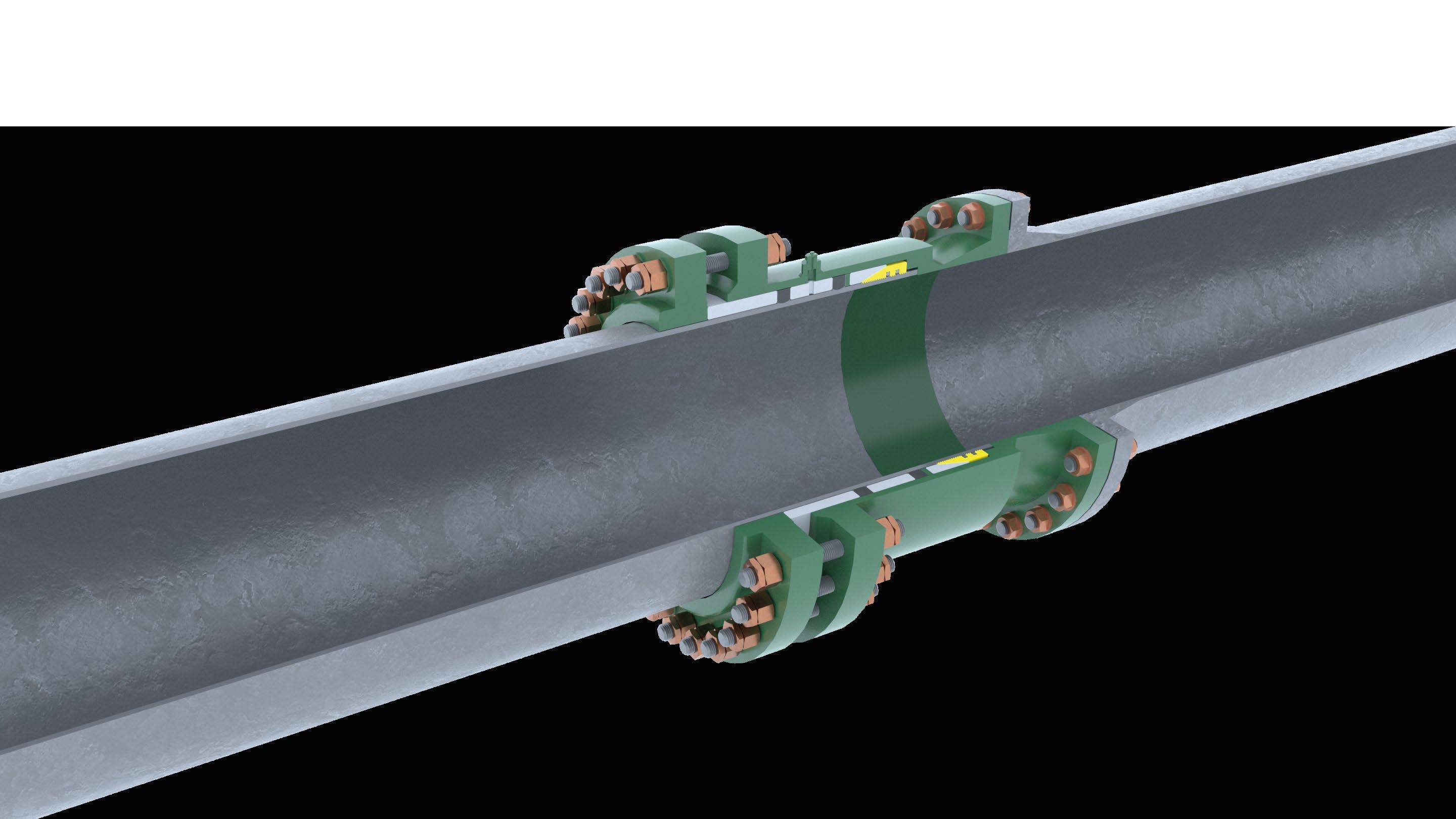

Managing Pressure, Minimising Risk

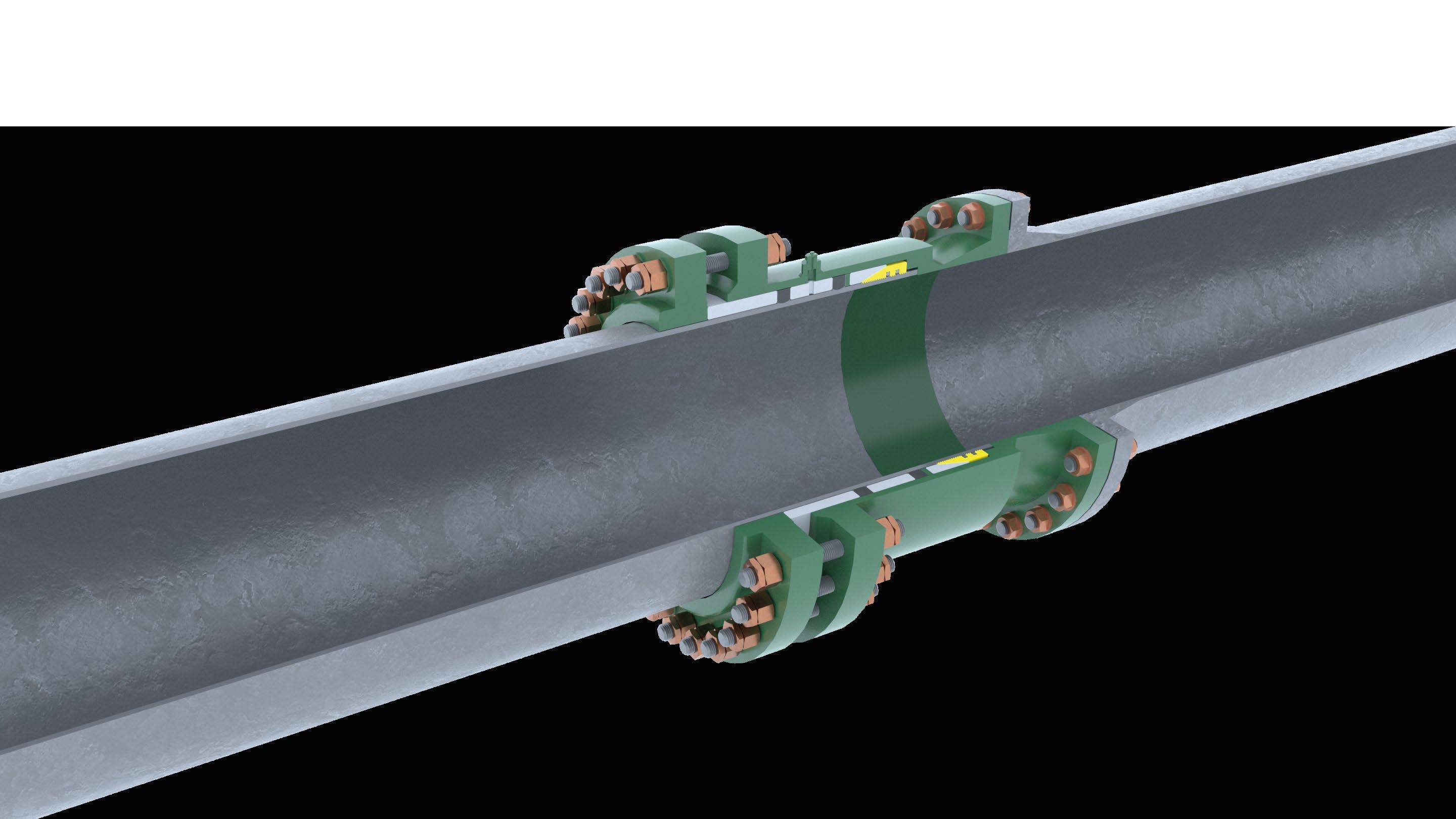

Mechanical Pipe Connector

Piping Repair, Tie-In or Capping

seal vertification port

DNV TYPE APPROVAL

Permanent pipe to flange connection where welding may be undesirable. The slipover design and external gripping assembly enables a quick and cost-effective solution, with no specialist installation or testing equipment required.

dual graphite seals

taper lock grips

dual graphite seals

taper lock grips

Header Disclaimer: The views and opinions published within editorials and advertisements in this OGV Energy Publication are not those of our editor or company. Whilst we have made every effort to ensure the legitimacy of the content, OGV Energy cannot accept any responsibility for errors and mistakes. OUR PARTNERS TRAVEL MANAGEMENT PARTNER LOGISTICS PARTNER Leading provider of logistics services to this industry, offering its customers airfreight, road freight, sea freight, project forwarding, customs compliance, training and consultancy, packing, crating, lashing & securing services warehousing, distribution, freight management, rig relocation and mobilisation services and offshore logistics. Corporate Travel Management (CTM) is a global leader in business travel management services. We drive savings, efficiency and safety to businesses and their travellers all around the world. Editorial newsdesk@ogvenergy.co.uk +44 (0) 1224 084 114 Advertising office@ogvenergy.co.uk +44 (0) 1224 084 114 Design Jen McAdam Ben Mckay Journalist Tsvetana Paraskova www.quanta-epc.co.uk YOUR ASSET IN SAFE HANDS Safe, efficient and low-cost delivery of Asset Management projects, ensuring best value every time. Operations Maintenance Repair orders Technical support VIEW our media pack at www.ogv.energy/advertise-with-us or scan the QR code ADVERTISE WITH OGV CONTRIBUTORS

Simon Cowie, managing partner at Infinity Partnership, has been named a finalist in the Practice Leader of the Year Category at the 2023 Accounting Excellence Awards. He won the Practice Pioneer Award at last year’s event. Simon previously won the individual honour at the British Accountancy Awards – another major industry event – in 2016. The Accounting Excellence winners will be announced at a gala ceremony at The Roundhouse in Camden, London, on Tuesday, October 3 [2023].

Simon said: “It’s a tremendous honour be shortlisted once again. It’s true what they say: you’re only as good as your team and we have an excellent team at Infinity."

asset55 are excited to announce a major project award from ExxonMobil affiliate ExxonMobil Guyana. They look forward to supporting the Uaru FPSO with their Validate and Execute software. The Validate software will ensure that the Uaru FPSO project data is validated and correct through execution phase and life of asset. In turn, their Execute software will be setup to support early execution planning and will support the project through construction, commissioning and startup. asset55’s Validate and Execute software is currently deployed on 8 major capital projects with a combined budget of over $60 billion.

Mandos Software was established in 1999 to develop software to help organisations to run more efficiently & effectively, and comply with appropriate legislation and standards, by defining and communicating their key business processes. Their Author software is used in a range of organisations of varying sizes, both in the UK and overseas. It is based on a pragmatic view of business processes and management practice and is relevant for all business sectors.

Prism Energy is a leading project & risk management consultancy company that has developed Prism Apps, its own cloudbased project management system for risk management, action management, lessons learned and management of change. The system is used extensively in the oil & gas and renewable industries.

Family-owned Scottish business, ACE Winches, announces its expansion into the Middle East with a new location and key hire in Dubai.

The opening of the new office marks a significant milestone for the company, as the organisation continues to expand its presence in the Middle East. ACE Winches have been operating in the region for several years, but strong customer demand for its products and services prompted the move to set-up a base.

OEG Offshore UK (OEG), a leading global provider of specialist offshore equipment, is proud to announce the complete integration and rebrand of Harran Ltd, a renowned aviation refuelling expert. The move follows the acquisition of Harran Ltd in 2019 and marks OEG’s ongoing growth plans to solidify their market presence and cater to the increasing demand for specialist offshore equipment and services.

Clive Hoskisson, Managing Director of OEG Offshore UK, commented on the integration: "We are delighted to finally welcome the Harran team fully into the OEG Offshore UK family."

Kloeckner

This prestigious certification is a testament to the company's continued commitment to creating anoutstanding workplace culture that empowers employees and drives success. Kloeckner Metals UK firmly believes that its employees are its most valuable asset. They arethe heart and soul of the organisation, making it a truly one-of-a-kind business built on thestrength of character, spirit and unwavering commitment of its people. Their unique skills, vast knowledge and extensive experience allow Kloeckner Metals UK to make a significantdifference in the industries it serves.

Quanta, is teaming up with Blyth’s Bede Academy to help inspire and shape the future careers of students. Quanta’s Chief Commercial Officer, Steven Brett has been appointed as Enterprise Adviser for the North East Local Enterprise Partnership (LEP) and will work with Bede Academy to develop a strong careers support framework. The Enterprise Adviser Network is a national initiative of the Careers and Enterprise Company. Steven will engage with students to increase their knowledge and understanding of the world of work, particularly around engineering and the global energy sector.

8 www.ogv.energy I August 2023 OGV COMMUNITY NEWS

FIND ALL THE FULL COMMUNITY NEWS ARTICLES ON OGV ENERGY'S WEBSITE DO

YOUR NEWS FEATURED ON OUR MAGAZINE, WEBSITE & DIGITAL PLATFORMS? JOIN THE OGV COMMUNITY TODAY!

Prism Energy Acquires Mandos Software for Undisclosed Sum

YOU WANT

asset55 wins major FPSO project award from ExxonMobil Guyana

Metals UK Achieves Great Place to Work® Certification

Leading Aberdeen accountant shortlisted for top UK award

Leading aviation refuelling company rebrands as OEG Offshore

Quanta teams up with Bede Academy to inspire students and shape future careers

ACE Winches opens new Middle East office to support company growth and investment in the region

Prism Energy, an Aberdeen-based project & risk management consultancy to the energy sector, announced it has acquired Mandos Software for an undisclosed sum.

We are the leader in the design, manufacture and hire of lifting, pulling and deploying solutions in a wide range of applications including shore approach, topside and jacket installation, pipe pull, riser installations and much more. ACE Winches is the trusted partner in the offshore oil and gas, renewable and marine sectors

www.ace-winches.com

The backbone of organisation-wide resilience, providing a single source of truth across safety, security, risk & critical event management alongside a robust integrations ecosystem.

www.restrata.com

Specialists in Flexible Pipe Riser and Flowline Integrity Management. TIG are also dedicated to developing a knowledge hub for flexible pipe understanding and research by utilising joint ventures with operators.

theimpulsegroup.com

Kloeckner Metals UK is the largest mill independent multi-metal stockholder & distributor in the UK, and a key member of the Klöckner & Co. group, one of the largest independent distributors of steel and other metal products as well as one of the leading steel service centre companies worldwide.

www.kloecknermetalsuk.com

We delivering leading industry software, worldclass consulting & critical cloud solutions. The super skills and industry knowledge you need to realise your digital potential. From design to delivery and ongoing optimisation, Cegal is the perfect partner for your journey to the cloud. Give your people the ability to work at their best, every day, from everywhere.

www.cegal.com

Revive Intra is a specialised procurement company that creates an efficient custom-built workspace, designed to suit your business. From offshore installations and mobile units to office, receptions and leisure facilities, we draw on our years of experience to source quality products for you, at the very best competitive value.

www.revive-intra.com

Engineering, design, fabrication, installation, service and maintenance of offshore assets and comprehensive project management across all phases of energy projects.

www.semcomaritime.com

OceaneeringWe provide engineered services and products to the oil and gas, defense, entertainment, logistics, aerospace, science, and renewable energy industries.

www.oceaneering.com

Rysco Corrosion Services Inc. is an Oilfield Services company dedicated to providing corrosion monitoring solutions to oil and gas producers. We can provide a timely response to the service needs of producers. Our field crews travel from North East British Columbia to South West Manitoba, and all points in between.

www.ryscocorrosion.com

At Superior Recruitment Group, we connect talented individuals with exceptional companies, creating meaningful and fulfilling careers that drive our clients' and candidates' success and growth. We strive to provide unparalleled service and support throughout the recruitment process, ensuring a seamless experience that fosters lasting partnerships and lasting impact.

www.superior-recruitment.com

Providing E2E Corporate Training, Compliance & Education Solutions in Virtual & Augmented Reality. IoT Integration with predictive AI models, leveraging best-in-class data analytics and visualisation for collaboration and Actionable insights.

riiot.digital

Caledonia Competence is a Competence and Learning & Development Consultancy providing specialist services in the area of personnel assessment and development. Core services included are the set-up, auditing and health checks of client Competence Management Systems.

caledoniacompetence.com

JOIN THE OGV COMMUNITY FOR JUST £30 A MONTH

LATEST OGV COMMUNITY SIGN-UPS

www.ogv.energy/register

August 2023

UK NORTH SEA Oil & Gas Review

By Tsvetana Paraskova

By Tsvetana Paraskova

The UK government will “max out” the remaining oil and gas reserves in the UK North Sea, Energy Minister Grant Shapps told the Financial Times in an interview at the end of July.

The minister’s comments came after Labour leader Keir Starmer had said that if his party wins the next election, the UK would not award any new licences for oil and gas drilling in the North Sea, but would not rescind contracts already in place.

“What Labour foolishly and irresponsibly want to do is deliberately pursue a policy of self-harm by not taking that [North Sea] oil and gas but buying it from abroad,” Shapps told FT.

Offshore Energies UK (OEUK), together with Robert Gordon’s University (RGU), has produced a roadmap that outlines how the UK can support jobs, economic growth, and innovation well into the future.

According to the roadmap, the offshore energy sector, including oil and gas operators and wind developers, could invest up to £200 billion on UK energy production and technology projects by the end of this decade to help deliver the government’s energy targets. More than £90 billion of this investment could go to UK supply chain companies over the next decade if the roadmap is delivered and both government energy production and local content targets are met, OEUK said.

Supply chain companies comprise the backbone of the UK’s offshore energy industry. They account for more than 80% of OEUK’s membership, with the majority consisting of small to medium enterprises, supplying goods and services to oil and gas plus wind farm developers while driving technological innovation, Katy Heidenreich,

Director, Supply Chain & People at Offshore Energies UK, wrote in a foreword to the report.

Opportunities for the supply chain include development and licensing of new technologies, production of equipment, installation and maintenance of assets, and the eventual decommissioning of offshore energy projects, OEUK says.

Delivering the Roadmap’s goal by 2030 would enable the UK’s supply chain to accelerate the changes required to deliver net zero carbon emissions in the UK by 2050.

It could also create an additional £10 billion of cumulative value from more UK-built and delivered projects and 2,800 more turbines across 40 new wind farms. The UK could produce 10 GW of low-carbon hydrogen and develop four offshore transport and storage hubs with up to 1 million tonnes/year of carbon stored, Heidenreich added.

“Supply chain companies won’t invest without a predictable, sustainable pipeline of activity. Early investment will build a competitive supply chain that can deliver the energy transition,” OEUK said in the report.

More than three quarters of the UK’s existing oil and gas supply chain has direct cross-over with CCUS, offshore wind, and hydrogen, the industry body noted, adding that “We must grow the supply chain to capture as much value as possible in the UK.”

The North Sea Transition Authority (NSTA) re-launched in early July the digital wells database, with improved functionality and greater flexibility, which would make carbon storage well consents easier to obtain and help improve compliance with regulations.

“We have updated the system with the needs of users in mind. It is now much quicker, easier to use and responsive to their real day-to-day requirements,” Nic Granger, NSTA Director of Corporate, said.

“The more accurate and more detailed information it now collects will be very useful in making decisions about potential reuse and repurposing of wells and siting of carbon storage locations.”

www.ogv.energy I August 2023

The ongoing political debate on the future of the oil and gas licences in the UK North Sea, opportunities for the UK offshore supply chain, and a large increase in the resource estimates at one of the latest gas discoveries were the highlights of the UK North Sea oil and gas sector in the past month.

UK NORTH SEA REVIEW SPONSORED BY

10

The case for new UK oil and gas is strong, but the UK North Sea upstream sector has seen an unpredictable and volatile year with the Energy Profits Levy (EPL) posing political and fiscal barriers to operators, Wood Mackenzie said in a report in July.

“Even in a scenario where global warming is kept below 1.5 °C, UK demand for both oil and gas will continue to outstrip domestic supply,” WoodMac’s Neivan Boroujerdi, Research Director, Upstream Oil and Gas, said.

“Despite the introduction of a de facto price floor in June 2023, it does not remove the long-term uncertainty that has engulfed the sector with the prospect of a new government adding to the headwinds facing UK developments,” Boroujerdi added.

In the near future, the development of the Rosebank and Cambo oil fields would be the barometer for the future of the North Sea oil and gas, Malcolm Forbes-Cable, Vice President of Energy Consulting (Upstream, EMEA) at Wood Mackenzie, said in a recent presentation.

“From an economic perspective, the business-case for the development of these two fields is compelling and there is the added benefit of the additional energy security it would bring to the UK,” Forbes-Cable said.

Rosebank and Cambo, which have yet to proceed to full approvals and final investment decisions, would have much lower emissions when electrified compared to imports of oil into the UK, according to WoodMac. Estimates by the energy consultancy have shown that the additional emissions from imports would be 500% more than the hydrocarbons from electrified Rosebank and Cambo.

“With final investment decisions looming [FID], both Rosebank and Cambo act as barometers for the future of oil and gas production in the UK North Sea,” Forbes-Cable said.

“If neither of these fields go to full development, it will be difficult to make a clear economic case for fields with less potential.”

In company news

Deltic Energy Plc, Shell’s partner in the Pensacola natural gas discovery, said in early July that the discovery could contain double the resources initially expected. Following a post well analysis, Deltic now estimates the Pensacola structure to contain gross P50 initially in place volumes of gas and oil of 342 million barrels of oil equivalent.

“Well data indicates that Pensacola contains close to double our original estimate, representing one of the most significant discoveries in the North Sea in many years,” said Graham Swindells, CEO at Deltic Energy.

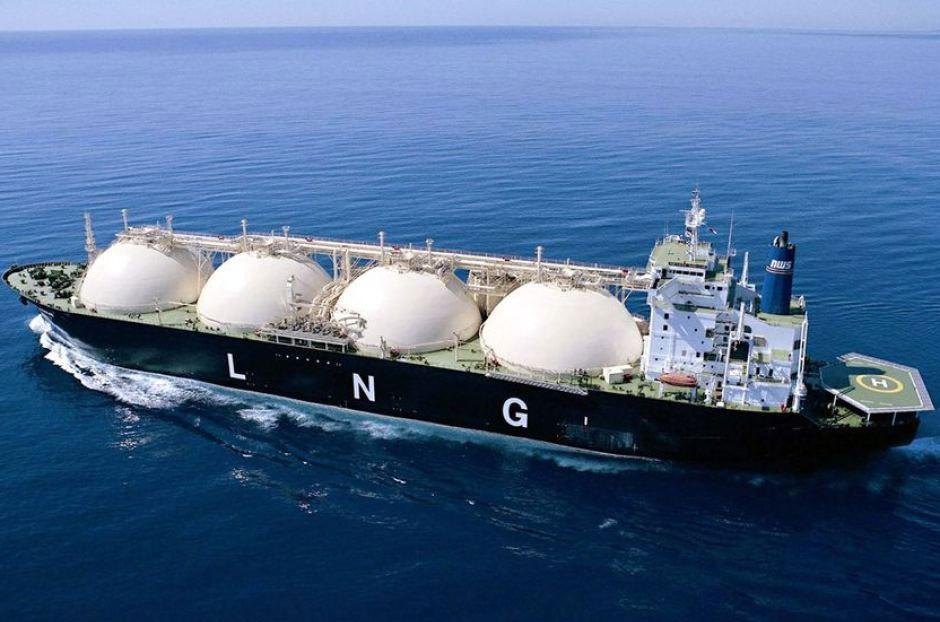

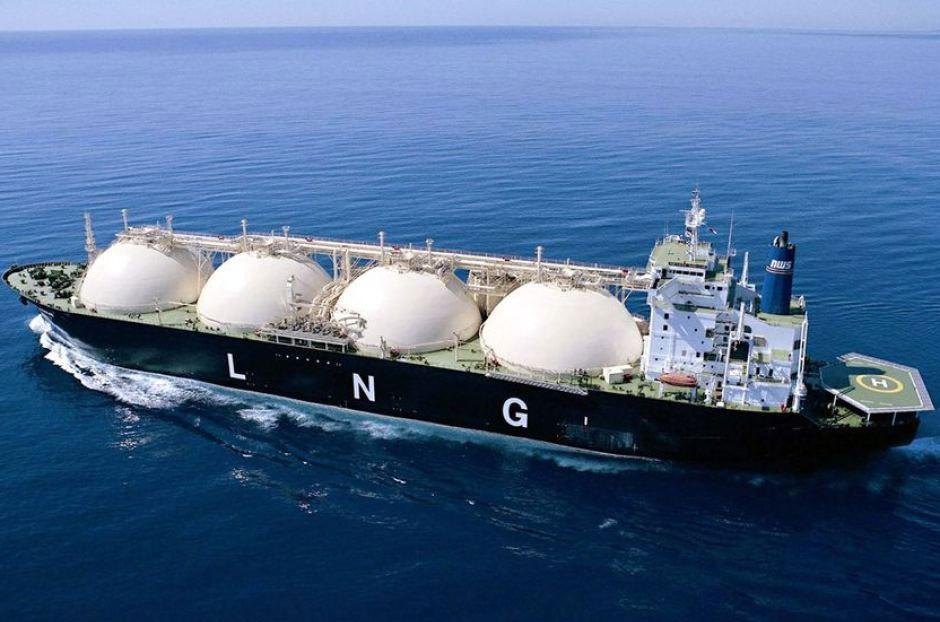

Centrica and Delfin Midstream Inc signed a longterm agreement for the supply of 1.0 million tonnes per annum (MTPA) of LNG for 15 years on a free on board (FOB) basis at the Delfin Deepwater Port, off the coast of Louisiana. The agreement will see Centrica take delivery of around 14 LNG cargoes per year and could provide enough energy to heat

5% of UK homes for 15 years. The deal, valued at $8 billion, is yet another step from Centrica to ensure gas supply after a three-year supply agreement with Equinor and the reopening of the Rough gas storage facility in October 2022.

Hartshead Resources has appointed corporate finance energy sector specialist, Carlingford, to assist the company in finalising third-party financing for the Phase 1 gas fields development. Hartshead and RockRose Energy have recently submitted the Anning & Somerville Field Development Plan. Hartshead has also retained energy sector specialist LAB Energy Advisors to support the company with project finance or further equity divestment.

Reabold Resources plc said that Shell, the operator of licence P2332 in the Southern North Sea adjacent to the licence containing the Pensacola well, made a decision to relinquish the licence. Reabold Resources is high-grading its North Sea licences, as part of its disciplined approach to capital allocation, which has led to the prioritisation of the highest potential return assets in the Board’s view.

Ithaca Energy has signed an agreement to buy the 40% stake in the Fotla Discovery it doesn't already own and three exploration licences from Spirit Energy Resources Limited. The acquisition will bring Ithaca Energy’s working interest in the Fotla Discovery to 100% at completion, providing Ithaca Energy with full control over pre-final investment decision work and timing. Fotla Discovery is located approximately 10 kilometres southwest of the Ithaca Energy-operated Alba field.

Jersey Oil & Gas has finalised the Greater Buchan Area (GBA) development solution. The preferred development solution is via the redeployment of a Floating, Production, Storage and Offloading (FPSO) vessel and it is the lowest cost and lowest full-cycle carbon footprint option. With the GBA development solution now identified, work is progressing on the engineering studies that are required prior to submission of the development plan in 2024, Jersey Oil & Gas said.

The company also announced in early July that the NSTA had approved an extension to the Second Term of the P2170 Verbier licence by three years to 29 August 2026. The extension was requested in order to provide the licensees with the time required to prepare a Field Development Plan for the Verbier discovery, as part of a phased GBA development plan. The first phase of the planned GBA work programme involves re-development of the Buchan field, with production start-up targeted for 2026.

Finder Energy announced the results of their interpretation of the new Big Bird 3D reprocessing and interpretation and the high-grading of a number of appraisal and exploration opportunities within the P2530 Seaward Production Licence in the UK North Sea.

“The Big Bird 3D reprocessing project has de-risked a number of opportunities in P2530, ranging from appraisal of the Wagtail oil discovery to low-risk exploration prospects like Bancroft and Marsh,” Finder Energy’s Managing Director, Damon Neaves, said.

The licence is located in the prolific Central North Sea close to existing production facilities, which could open up the potential for fast and cost-effective pathways to first production, Finder says. The company will shortly be initiating a farmout process to secure an industry partner to fund drilling activity.

Repair, Conversion & New Build of Marine and Offshore Living Quarters & Technical Buildings Aberdeen | Blyth | Las Palmas | Dubai | Abu Dhabi | Qatar | Bahrain | KSA | Baku Proud Sponsor of the UK North Sea Review modutec.com

Europe Energy Review

By Tsvetana Paraskova

By Tsvetana Paraskova

Carmen ranks as the largest discovery on the Norwegian Continental Shelf since 2013, the company said.

“Norway is the gift that keeps on giving,” DNO’s Executive Chairman Bijan MossavarRahmani commented.

Norway’s government has approved the development of 19 offshore oil and gas projects worth more than $20 billion (200 billion Norwegian crowns) in investments. The projects include new developments, additional development of producing oil and gas fields, and investments to increase resource recovery in producing fields, the Norwegian Ministry of Petroleum and Energy said at the end of June. The projects are being led by Aker BP, Equinor, Wintershall Dea, and OMV.

The new investments in oil and gas will create jobs and value for Norway and contribute to Europe’s energy security, Petroleum and Energy Minister Terje Aasland said.

Oil & Gas

Norwegian oil and gas operator DNO ASA announced in early July a significant gas and condensate discovery on the Carmen prospect in the Norwegian North Sea license PL1148 in which the company holds a 30% interest. Preliminary estimates indicate gross recoverable resources in the range of 120-230 million barrels of oil equivalent. At 175 million boe, the mid-point of this range,

SPONSORED BY

A day after the projects were approved, Greenpeace Norway and Natur og Ungdom (Nature and Youth) filed lawsuits with the Oslo district court, saying they believed the development of the new oil and gas fields Yggdrasil, Breidablikk, and Tyrving in the North Sea had not taken into account the impact on climate and future generations and violate a Supreme Court ruling from 2020 that required the government to assess global impacts on the environment

ENGINEERED TO TRUST

At Brimmond we specialise in the design, manufacture, rental and repair of lifting, mechanical and hydraulic equipment for industry, from our base in Aberdeenshire, Scotland.

www.brimmond.com

From hydraulic power units and pumps packages to marine cranes, umbilical reelers and filtration equipment, we offer one of the most diverse ranges of specialist hydraulic and mechanical equipment in the UK, available for deployment across the globe.

from field developments. The Supreme Court issued this ruling when it dismissed a previous attempt of campaigners to halt Arctic drilling.

In the latest lawsuits, Greenpeace and Nature and Youth argued that the assessment of the global climate impacts of the fields had been either non-existent or extremely insufficient.

“The government defies climate science and our own Supreme Court when it allows new oil fields without investigating whether these are compatible with a livable environment,” Frode Pleym, head of Greenpeace Norway, said in a statement.

Exploration and production firm Longboat Energy confirmed that its transaction with Japan Petroleum Exploration Co., Ltd to establish a joint venture in Norway had been completed with the initial investment of US$16 million received by the renamed entity Longboat JAPEX Norge AS. Longboat JAPEX is owned 50.1% by Longboat and 49.9% by JAPEX.

“In the near term, we are looking forward to the drilling of the high impact Velocette exploration well (JV 20%) which is expected to spud in September,” said Longboat’s CEO Helge Hammer.

Norway, Western Europe’s top oil and gas producer, can continue to be a stabile

www.ogv.energy I August 2023 12 GLOBAL ENERGY REVIEW

New oil and gas projects and a large discovery offshore Norway, plans for a UK nuclear energy revival, and a landmark German offshore wind tender featured in Europe’s energy industry in the past month.

RENTAL EQUIPMENT DESIGN & MANUFACTURE REFURBISHMENT & SERVICE

MARINE CRANES

Pixabay/fietzfotos

supplier of oil and gas and contribute to Europe’s energy security for many years to come, but that means that it must continue to develop the Norwegian shelf, Torgeir Stordal, Director General of the Norwegian Petroleum Directorate, said at a conference on 19 July.

“Many question whether Europe will need all this gas in a longer-term perspective. What we know is that Europe’s own production will continue to fall in the years ahead,” Stordal said, adding that “Norwegian gas is transported to Europe by direct pipelines, which makes this a very competitive solution.”

“If we want to maintain our role as a significant supplier over the longer term, we must continue to invest on the shelf, both in further development of fields, development of discoveries and exploration for new resources,” Stordal noted.

Low-Carbon Energy

UK Energy Security Secretary Grant Shapps announced in mid-July the creation of a new nuclear regulatory body, Great British Nuclear (GBN), as the government launched a competition for small modular reactor (SMR) technology, which could result in billions of pounds of public and private sector investment in SMR projects.

“By rapidly boosting our homegrown supply of nuclear and other clean, reliable, and abundant energy, we will drive down bills for British homes and make sure the UK is never held to energy ransom by tyrants like Putin,” Shapps said in a statement.

The Crown Estate announced at the end of June a record £442.6 million net revenue profit for the 2022/2023 fiscal year, up by £129.9 million compared to the previous year, mostly thanks to fee income from the signing of Agreements for Lease for six offshore wind farms through the Round 4 leasing programme.

The Crown Estate has also set out how developers will be required to recognise the critical role of ports when bidding to build new floating offshore wind farms in the Celtic Sea. In an initial phase of development, up to 4 gigawatts (GW) of floating wind in the Celtic Sea could be developed.

Scottish Renewables and the British Hydropower Association have written a joint letter to the Prime Minister calling on the UK Government to urgently support the deployment of long-duration electricity storage, including pumped storage hydro (PSH). In the letter to Prime Minister Rishi Sunak, the trade bodies highlighted that by supporting investment in long-duration electricity storage the UK Government can reduce consumer bills, CO2 emissions, and the UK’s reliance on imported gas.

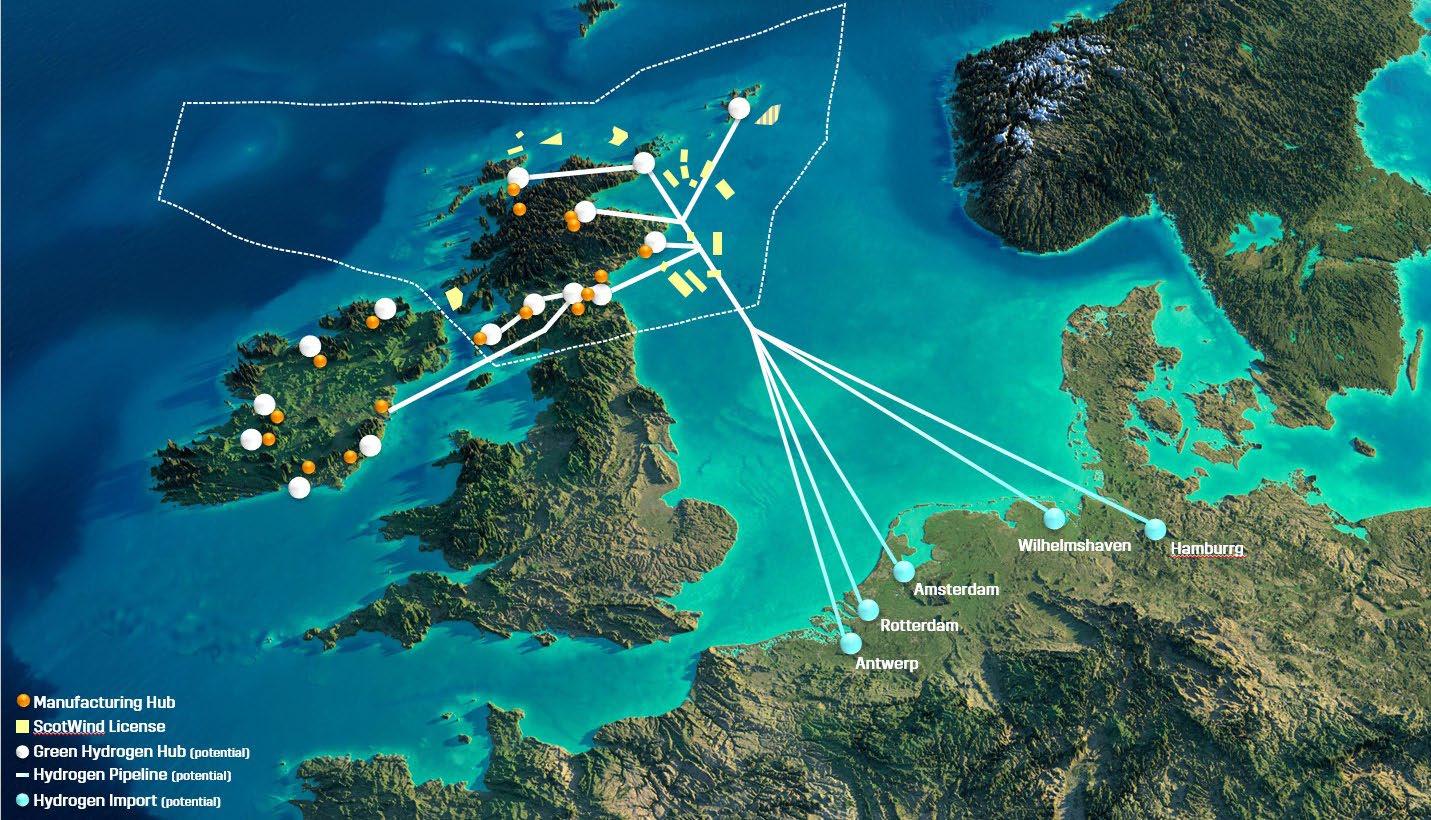

Aberdeen’s local authorities have approved plans for the first phase of a scalable,

green hydrogen production, storage and distribution facility in Aberdeen. The Aberdeen Hydrogen Hub is being delivered by bp Aberdeen Hydrogen Energy Limited (bpAHEL) – a joint venture between bp and Aberdeen City Council.

The Hornsea 4 offshore wind farm has been granted consent by the Secretary of State for the Department of Energy Security and Net Zero, developer Ørsted said in early July.

While Ørsted will look to develop Hornsea 4, Swedish utility Vattenfall said it would stop the development of the offshore wind power project Norfolk Boreas in the UK, due to soaring costs and challenging market conditions.

“The announcement from Vattenfall is a major wake up call for the UK Government who are failing to take account of the increased cost pressures and economic challenges facing offshore wind developers,” Claire Mack, Chief Executive at industry body Scottish Renewables, said.

Lhyfe and Centrica have agreed to jointly explore combining their expertise to collaborate on a pilot green hydrogen production site in the Southern North Sea, in a first for the country.

“Hydrogen is going to play a key role in decarbonising the UK’s power supply by 2035 and our long-term ambition is for Rough, our gas storage site, to be the world’s largest hydrogen store, offering up to 16TWh of storage capacity,” Martin Scargill, Managing Director of Centrica Storage, said.

RWE, Mitsui, and the Port of Tilbury have formed a partnership to investigate developing a hydrogen project at the Port of Tilbury in Essex as part of a recently signed memorandum of understanding (MoU) for two green hydrogen projects. The project will also look at wider options to support the port’s decarbonisation.

RINA, the inspection, certification and consulting engineering multinational, and AFRY, a European engineering, design, and advisory services firm, have found in an initial study that the Gulf region and Europe could be linked directly with a pipeline to transport low-carbon hydrogen.

“The concept of a hydrogen pipeline connecting Qatar, Saudi Arabia, Egypt, and traversing the Mediterranean Sea to Europe may seem ambitious, but initial assessment indicates its feasibility,” the companies said.

bp and TotalEnergies won leases at Germany’s landmark offshore wind auction in early July. Germany awarded four offshore wind farm areas in the German North Sea and Baltic Sea with a capacity of 7 GW, with bp and TotalEnergies each winning two offshore concessions. The tender supports Germany’s target of having 30 GW of offshore wind projects installed by 2030, at least 40 GW by 2035, and at least 70 GW by 2045.

bp was awarded the rights to develop two offshore wind projects in the German North Sea, which marks the UK supermajor’s entry into offshore wind in continental Europe. Subject to receiving the necessary permits and approvals, the two sites with a total potential generating capacity of 4 GW would be bp’s first offshore wind projects in Germany and are fully aligned with the company’s integrated energy company strategy and disciplined capital allocation.

TotalEnergies was also awarded two offshore sites, one in the North Sea and one in the Baltic Sea. With capacities of 2 GW and 1 GW respectively, these two potential wind farms would provide electricity equivalent to the consumption of over 3,000,000 homes. The next step for TotalEnergies will be to carry out the studies required to obtain the environmental permits, as well as the technical analyses on these sites, leading to investment decisions in 2027 and commissioning by 2030.

Commenting on the tender, Stefan Thimm, managing director at Germany’s Federal Association of Wind Farm Operators Offshore, BWO, said,

“It brings us much closer to our goal of installing at least 2030 gigawatts of offshore wind by 30. And it paves the way for a new economic miracle through offshore wind, triggered by billions in investments in offshore wind expansion.”

Energy storage developer Eku Energy has signed a framework agreement with European consulting, trading, and development group Renera Energy to develop over 1 GW of battery storage projects in Italy.

As part of the agreement, Eku Energy is already funding projects with a combined capacity of over 100 MW in southern Italy.

Italy aims to generate 65% of its electricity from renewable energy sources by 2030, by which time it is predicted to be the thirdlargest energy storage market in Europe, said Eku Energy, which was initially established by Macquarie’s Green Investment Group and is now jointly owned by a Macquarie Asset Management managed fund and British Columbia Investment Management Corporation (BCI).

13 EUROPE EUROPE NEWS SPONSORED BY

Claire Mack, Chief Executive at industry body Scottish Renewables

Energy Review

By Tsvetana Paraskova

By Tsvetana Paraskova

In the Short-Term Energy Outlook (STEO) for July, the US Energy Information Administration (EIA) expects global oil inventories to move from inventory builds, on average, during the first half of 2023, to consistent inventory draws until the fourth quarter of 2024, putting upward pressure on global oil prices over the forecast period. In the first half of 2023, global oil inventories increased by an average of 600,000 barrels per day (bpd), while they will decrease by an average of 700,000 bpd in the second half of the year. Inventories will continue to fall by an average of 400,000 bpd in the first three quarters of 2024 before increasing by 100,000 bpd in 4Q24. The EIA forecasts the Brent crude oil spot price will average $79 per barrel in 2023 and $84 a barrel in 2024, down from an average of $101 per barrel in 2022.

In natural gas, EIA expects US dry natural gas production to continue to be flat this year. This, combined with year-over-year growth in natural gas consumption, would see US natural gas inventories reducing the surplus to the five-year average, which will put upward pressure on prices.

The administration raised by 4.6% its estimate of US LNG exports in 2024, and expects those to average 13.3 billion cubic feet per day (Bcf/d) next year, up from an expected average of 12 Bcf/d this year. The jump in LNG exports next year will be the result of two new LNG liquefaction projects coming online, Golden Pass in Texas and Plaquemines in Louisiana, the EIA said.

International natural gas market conditions are currently favourable for more US LNG exports as prices at the price hubs in Europe and Asia are relatively high compared with the benchmark US natural gas prices.

The EIA assumes that US LNG exports will continue to replace pipeline natural gas that had previously been exported from Russia to Europe.

“Relatively little growth in global LNG export capacity in the next two years will increase demand for flexible LNG supplies, mainly from the United States, to meet incremental growth in global demand,” the administration said in the STEO.

www.ogv.energy I August 2023 14 GLOBAL ENERGY REVIEW

From flare tip to the jacket, Digitising Reality can create a digital twin of your offshore asset so you can efficiently manage your resources effectively.

Assets Digitised. Savings Realised. digitisingreality.com

A proposed rule that could raise the cost of drilling on federal lands and the approval of a new major LNG export project were some of the highlights in the US oil and gas industry in the past month.

SPONSORED BY

EIA expects global oil inventory draws to boost prices

New US LNG export project approved

In the medium term, LNG exports out of the US are set for further growth, considering that US developers have already approved three new projects so far this year. The latest final investment decision (FID) on a US export project came in the middle of July from NextDecade, which decided to go ahead with the construction of the first three liquefaction trains (Phase 1) at the its 27 million tonnes per annum (MTPA) Rio Grande LNG (RGLNG) export facility in Brownsville, Texas.

“The $18.4 billion project financing for RGLNG Phase 1, is the largest greenfield energy project financing in U.S. history and underscores the critical role that LNG and natural gas will continue to play in the global energy transition,” NextDecade said in a statement.

Phase 1, with nameplate liquefaction capacity of 17.6 MTPA, has 16.2 MTPA of long-term binding LNG sale and purchase agreements with TotalEnergies, Shell NA LNG LLC, ENN LNG, Engie, ExxonMobil LNG Asia Pacific, Guangdong Energy Group, China Gas Hongda Energy Trading Co, Galp Trading, and Itochu Corporation.

TotalEnergies, which will have a 16.67% stake in the joint venture in charge of this first phase, will also offtake 5.4 MTPA of LNG from the production of this phase for 20 years.

“This project gives TotalEnergies access to competitive LNG thanks to its low production costs,” said Patrick Pouyanné, Chairman and CEO of TotalEnergies.

“LNG from this first phase will boost TotalEnergies U.S. LNG export capacity to over 15 Mtpa by 2030, and thus our ability to contribute to European gas security, and to provide customers in Asia with an alternative form of energy that is half as emissive as coal,” Pouyanné added.

Oil and gas executives of companies active in Texas, New Mexico, and Louisiana expect West Texas Intermediate (WTI) crude oil to end the year as high as $80 a barrel, according to the latest monthly Energy Indicators from Dallas Fed. Employment growth in the oil and gas sector is increasing at a slower rate compared with last year’s period of heightened energy prices, but it is still at robust levels. At the same time, input costs are expected to remain elevated through 2023.

Proposed reform of oil and gas leasing on federal lands

The US Department of the Interior proposed at the end of July reforms concerning oil and gas leasing on federal lands, which would raise the price of leasing lands for oil and gas production.

Noted API’s Vice President of Upstream Policy Holly Hopkins

and gas industry is incompatible with a world being ravaged by climate change, a crisis induced primarily by the industry itself,” said Josh Axelrod, senior policy advocate with the Natural Resources Defense Council (NRDC).

Evergreen Action Policy Lead Mattea Mrkusic said,

“Big Oil has benefited from handouts and de facto government subsidies for decades. Look where it’s left the American people: high energy costs, a volatile power market, scarred public lands, and a climate catastrophe.”

API’s Vice President of Upstream Policy Holly Hopkins noted that the proposed reforms would further burden oil and gas producers.

“Amidst a global energy crisis, this action from the Department of the Interior is yet another attempt to add even more barriers to future energy production, increases uncertainty for producers and may further discourage oil and natural gas investment,” Hopkins said.

“This is a concerning approach from an administration that has repeatedly acted to restrict essential energy development.”

The rule proposes to increase the minimum lease bond amounts, the royalty rates, and the minimum bids.

“The existing lease bond amount of $10,000 -- established in 1960 -- no longer provides an adequate incentive for companies to meet their reclamation obligations, nor does it cover the potential costs to reclaim a well should this obligation not be met,” the Interior Department said.

“Federal onshore oil and gas royalty rates are historically consistently lower than on state-issued leases and federal offshore leases; in fact, onshore royalty rates hadn’t been raised in over 100 years prior to the Biden-Harris Administration taking office. Likewise, bonding levels have not been raised for 60 years, while minimum bids and rents remained the same for over 30 years,” the Biden Administration noted.

“This proposal to update BLM’s oil and gas program aims to ensure fairness to the taxpayer and balanced, responsible development as we continue to transition to a clean energy economy,” said Bureau of Land Management (BLM) Director Tracy Stone-Manning.

Environmental groups welcomed the proposed reform, while the oil industry’s main lobby, the American Petroleum Institute (API), criticised the proposal as yet another hurdle to boosting US energy production and energy security.

“The Biden administration is recognising that over a century of business as usual by the oil

Republican US Senator John Barrasso of Wyoming, a ranking member of the Senate Committee on Energy and Natural Resources, commented on the proposed rule,

“President Biden’s assault on affordable, available and reliable American energy knows no bounds. With the stroke of a pen, the Biden administration will put American oil and gas workers on the unemployment line.”

“The president has vowed to end drilling on federal lands. This rule confirms it’s a vow he intends to keep. Last year, the onshore oil and gas leasing program returned more than $43 to American taxpayers for every dollar spent. The destructive and punitive rule will end up costing the taxpayers far more than it helps them,” Barrasso said.

API has also recently published a new poll conducted by Morning Consult showing that 90% of voters agree that natural gas and oil play an important role in strengthening the US economy. The polling further shows that an overwhelming majority of voters believe lawmakers should consider the economic importance of these resources when assessing new energy policies and regulations, API said.

Employment in the US oilfield services and equipment sector remained steady as the overall US labour market slowed in June, an analysis by Energy Workforce & Technology Council showed in July.

“While overall the labor market is cooling and the jobs market is tight, the oilfield services sector is still hiring,” said Molly Determan, President of the Energy Workforce & Technology Council.

15 USA US NEWS SPONSORED BY

Big Oil has benefited from handouts and de facto government subsidies for decades. Look where it’s left the American people: high energy costs, a volatile power market, scarred public lands, and a climate catastrophe.

MIDDLE EAST Energy Review

By Tsvetana Paraskova

Saudi arabia extends output cut into August

Saudi Arabia, the top producer in OPEC and the world’s leading crude exporter, said in early July it was extending its unilateral 1 million barrels per day (bpd) production cut into August. The move “comes to reinforce the precautionary efforts made by OPEC Plus countries with the aim of supporting the stability and balance of oil market,” Saudi Arabia added.

The extended cut means that Saudi Arabia will pump around 9 million bpd for each of the months of July and August.

While the Kingdom’s extended cut failed to materially drive oil prices higher, analysts and traders turned more bullish on oil market balances, expecting a deficit in the third quarter of the year.

Shortly after the Saudi announcement of extension of the production cut, Russia, the key OPEC partner in the OPEC+ agreement, said on the same day, 3 July, that it would voluntarily reduce its oil supply in August by 500,000 bpd by cutting its exports to global markets by that quantity.

OPEC, the organisation dominated by the Middle Eastern oil producers, acknowledged

SPONSORED BY

Smart Procurement

At Craig International, procurement isn’t just about processes, products and numbers. We promote a culture of ownership among our people, who are trusted to get on with the job on your behalf. We’re proud of how we serve clients.

www.craig-international.com

We’re always looking for new ways to add value and routinely introduce new technological solutions to make service delivery even simpler, smoother, faster.

the cuts at its meeting on 5 July and thanked both Saudi Arabia and Russia for their voluntary reduction of supply in August.

OPEC raises 2023 oil demand growth outlook

Later in July, OPEC revised up its global oil demand growth forecast for 2023 in its closelywatched Monthly Oil Market Report, which also offered a first view at OPEC’s demand projections for 2024.

Thanks to higher oil demand in China in the second quarter, OPEC revised up its global demand growth estimate for 2023 by around 100,000 bpd compared to the June assessment. The organisation now sees global oil demand growing by 2.4 million bpd this year.

Next year, global economic growth is expected at 2.5%, slightly below the forecast for this year’s growth of 2.6%, OPEC said in its first estimates about the global economy and oil market in 2024.

Tight monetary policies are assumed to continue and key policy rates to peak by the end of 2023. Moreover, central banks are expected to engage in more accommodative monetary policies by the second quarter of 2024, according to OPEC’s latest forecasts.

16 www.ogv.energy I August 2023 GLOBAL ENERGY REVIEW

Saudi Arabia’s latest crude oil output cuts, higher oil demand growth forecast from OPEC, the annual statistics of the organisation, and a series of deals featured in the Middle East’s oil and gas industry over the past month.

Solid global economic growth amid continued improvements in China is expected to boost oil consumption in 2024. Global oil demand is set to rise by 2.2 million bpd year over year, with total world oil demand projected to average 104.25 million bpd.

China and India are expected to lead an annual increase of nearly 2 million bpd of oil demand in non-OECD countries, while OECD will see oil demand up by 260,000 bpd next year compared to 2023, OPEC said.

Oil demand in the US is forecast to reach the pre-pandemic level, mainly due to the recovery in jet fuel consumption and improvements in gasoline and light distillates demand, according to the organisation.

“In terms of oil products, transportation fuels –including jet fuel and gasoline – are expected to drive oil demand growth in 2024, with air travel expected to see a further recovery and expansion,” OPEC noted.

US liquids production growth in 2024 is forecast at 700,000 bpd, mainly from Permian crude and non-conventional NGLs, as well as from the Gulf of Mexico. Oil production in Canada, Guyana, Brazil, Norway, Kazakhstan, and Argentina is also expected to increase, thanks to new field start-ups, ramp-ups, or the optimisation of existing projects.

OPEC Oil exports and revenues jumped in 2022

OPEC’s member countries exported an average of 21.39 million bpd of crude oil in 2022, a jump of about 1.73 million bpd, or 8.8%, compared to 2021, OPEC said in its Annual Statistical Bulletin 2023. OPEC’s crude exports remained slightly below the levels seen before the pandemic.

Following the pattern from previous years, the bulk of crude oil from OPEC— 15.20 million bpd or 71.1% — was exported to Asia. Considerable volumes of crude oil — about 3.86 million bpd — were also exported to OECD Europe in 2022, compared with 3.27 million bpd recorded in 2021. OECD Americas imported 1.07 million bpd of crude oil from OPEC, which was 13.9% above the 2021 volumes.

As exports increased and oil prices rallied, the value of OPEC’s petroleum exports jumped by 54% year over year to $873.6 billion in 2022, the statistical bulletin showed.

Deals and projects

Qatar’s state-owned firm QatarEnergy expects to provide 40% of all the new LNG that will come to the market by 2029, Saad Sherida Al-Kaabi, Minister of State for Energy Affairs and the President and CEO of QatarEnergy, said at an LNG conference in Vancouver, Canada, in July.

Qatar’s state-owned firm QatarEnergy expects to provide 40% of all the new LNG that will come to the market by 2029.

McDermott has secured a major contract from Qatargas Operating Company Limited to deliver engineering, procurement, construction, and installation (EPCI) for the North Field Production Sustainability (NFPS) Offshore Fuel Gas Pipeline and Subsea Cables Project, COMP1. The contract award follows the North Field Expansion Project (NFXP) contract awarded to McDermott in 2022, which is currently under execution and remains one of the largest contracts McDermott has been awarded in its company history.

In the United Arab Emirates (UAE), Abu Dhabi National Oil Company (ADNOC) confirmed in mid-July that, following initial exploratory discussions, it had entered into formal negotiations with OMV AG about the potential creation of a new combined petrochemicals holding entity, through the proposed merger of their respective existing shareholdings in Borouge plc and Borealis AG. Borouge, listed on the Abu Dhabi Securities Exchange, is 54% owned by ADNOC, 36% by Borealis, and 10% by retail and institutional investors. Borealis is owned 75% by OMV with ADNOC holding 25%.

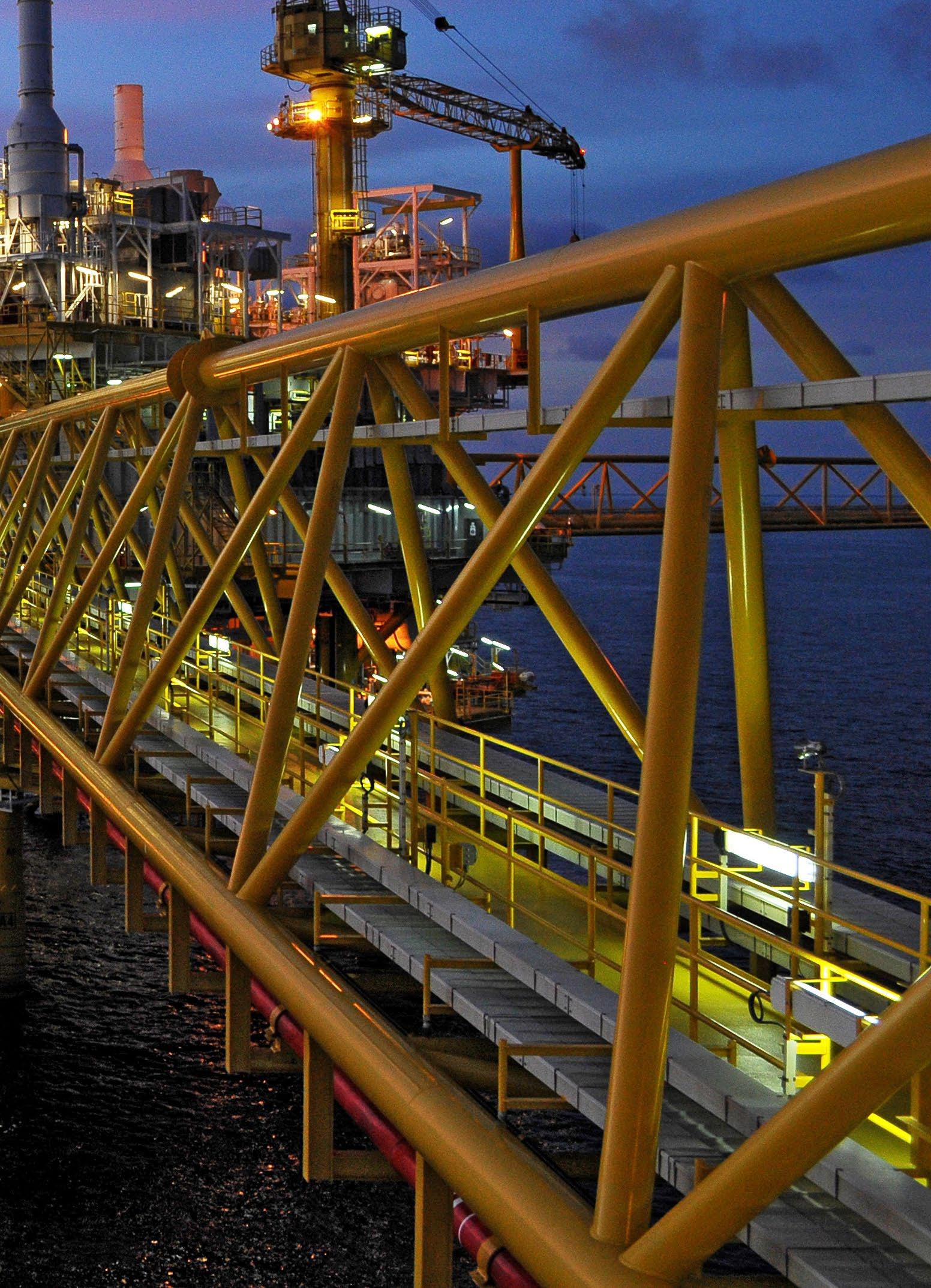

In early July, ADNOC Gas plc awarded $1.34 billion in contracts to Petrofac Emirates LLC and the consortium between National Petroleum Construction Co. PJSC and C.A.T International Ltd. for the expansion of its natural gas pipeline network. As part of the sales gas pipeline network enhancement (ESTIDAMA) programme, the new pipeline will extend ADNOC Gas’ existing pipeline network from around 3,200 kilometres to over 3,500 km, enabling the transportation of higher volumes of natural gas to customers in the Northern emirates of the UAE.

Scope 1 and Scope

Our aim is to create circular solutions for plastic waste, while also making progress on our ambition to achieve net-zero

2 greenhouse gas emissions across our wholly-owned operated assets by 2050.

“40% of all the new LNG that will come to the market by 2029, when all our projects are up and running, is going to be from QatarEnergy,” the official added.

“Gas will always be needed as the cleanest fossil fuel for the base-load required for electricity production and for powering industrial and manufacturing factories,” Al-Kaabi noted.

Qatar believes that its LNG carbon intensity is probably the lowest in the world, he said, adding that QatarEnergy would supply lower-carbon LNG thanks to increased capacity for carbon dioxide (CO2) sequestration.

ADNOC Gas is also looking to boost its presence on the global market as it announced a 14-year supply agreement with Indian Oil Corporation Ltd (IOCL) for the export of up to 1.2 million metric tonnes per annum (mmtpa) of LNG valued in the range of $7 billion to $9 billion over its 14-year term.

In Saudi Arabia, state oil giant Aramco said that together with TotalEnergies and SABIC it had successfully converted oil derived from plastic waste into ISCC+ certified circular polymers, for the first time in the Middle East and North Africa. The plastic pyrolysis oil, also called plastic waste derived oil (PDO), was processed at the SATORP refinery jointly owned by Aramco and TotalEnergies, in Jubail, Saudi Arabia. It was then used as a feedstock by SABIC affiliate PETROKEMYA to produce certified circular polymers.

“This achievement illustrates the importance of the petrochemical sector in creating more sustainable products and solutions,” Mohammed Y. Al Qahtani, Aramco’s President of Downstream, said.

“Our aim is to create circular solutions for plastic waste, while also making progress on our ambition to achieve net-zero Scope 1 and Scope 2 greenhouse gas emissions across our wholly-owned operated assets by 2050.”

17 MIDDLE EAST MIDDLE EAST NEWS SPONSORED BY

Saad Sherida Al-Kaabi, Minister of State for Energy Affairs and the President and CEO of QatarEnergy said.

Mohammed Y. Al Qahtani, Aramco’s President of Downstream said.

We are exhibiting! Come and speak with us at the ogv pavilion

BRENT OIL PRICES OVER THE YEARS

THE DIGITAL MEDIA STRATEGIST

UNLOCKING THE POWER OF DIGITAL INFLUENCE: THE OGV STUDIO

1 Year Ago - $103.70

OPEC’s Secretary General Haitham Al Ghais blamed policymakers, lawmakers, and insufficient oil and gas sector investments for high prices. The price of Brent crude hit an all time high in March following Russia’s invasion of Ukraine, and although prices had since declined into August, they still remained high for consumers and businesses globally.

By Eric Doyle

In a world inundated with digital noise, how do you ensure your commercial voice stands out, resonates, and inspires action within your target sectors?

How do you ensure that your efforts in digital media are pulling through directly to your bottom line? In the fast-paced digital age, having a minimal online presence is not enough; it's about crafting a consistent and compelling multi-channel narrative that captivates your audience and sets you apart from the competition.

Digital Media is a celebration…

What We Do:

Our portfolio of services is as diverse as the brands we serve. From brand development that goes beyond a logo to articulate your WHY, HOW, and WHAT, to social media management that strategically connects you with your audience, we create cohesive strategies and training programmes that fuel your commercial success.

5 Years Ago - $72.96

There was around a 10% rise in the price of Brent in August with widespread perceptions that the global oil market was tightening and could run short in the months that followed. In addition to support from geopolitical events, there were worries that natural disasters could impact the market with concerns over a potential storm off the coast of Africa.

It's a celebration of your company history, your specialism and expertise, and the solutions you bring to your industry…..and it's a celebration of your culture.

If it's done well, it transforms your commercial world, if it's done poorly, it does nothing - so it's crucial to get it right. Your website, your performance on social media, your digital advertising, video and graphics, how you are communicating to your audience and…how you are listening and reacting…all working in harmony.

It needs to be balanced…..digital balance. And it needs to mean something, it must have a measurable purpose…

When it comes to video production, we breathe life into your brand story, producing visually stunning videos that captivate and inspire. Our graphics and animations elevate your branding and content, making it unforgettable in the digital landscape.

In the digital age, mastering the art of communication is essential for standing out in a sea of voices.

Why We Do What We Do:

10 Years Ago - $111.41

Brent crude rose to hit a six-month high as the threat of Western countries’ involvement in Syrian conflicts stirred concerns over Middle East oil supplies. Oil markets had already been put on edge due to a steep drop in exports from Libya, where a month-long strike by armed security guards shut the main export ports.

When an organisation trusts us to handle their digital media, its a huge responsibility for us because we become part of their commercial DNA…it's important and that's why we take it seriously.

Who We Are:

At The OGV Studio, we are trailblasers in the world of digital media and creative communications. Our team of experts, storytellers, designers, and strategists collaborate closely with clients to unlock the essence of their brand.

At the core of our mission lies the belief that exceptional digital media empowers brands to become leaders in their sectors. We understand that commercial success in the digital era goes beyond mere metrics; it's about connecting with your audience on a profound level, inspiring loyalty, and commercial interaction. Our focus is on delivering measurable and repeatable success that can be scaled to align with your growth targets.

Everything we do is done to make people and companies the leading technical and commercial digital influencers in their sectors…it's that simple.

Eric Doyle is the Managing Director of The OGV Studio, a Digital Media Strategy company whose mission is to Energise your Media for growth. Eric is a Fellow of the Institute of Sales Professionals.

10 YEARS AGO 5 YEARS AGO 1 YEAR AGO BRENT OIL PRICE August 2023 $82.74

“GOOD MEDIA MAKES PEOPLE VISIBLE, GREAT MEDIA MAKES THEM

COLOMBIA Tayrona Block –Uchuva Discovery

Petrobras

$500 million

Petrobras is reportedly working on contracting a rig to drill two appraisal wells in Tayrona. The operator's early concepts propose the development of a subsea tie-back structure to shore, involving the installation of a gathering platform on the continental shelf.

SAUDI ARABIA

Abu Safuh Field Expansion

Saudi Aramco

$500 million

Saipem has ensured the continuity of the ongoing activity of the Perro Negro 7 jack-up drilling unit from the second half of 2023 by securing a ten-year extension to the existing contract.

ANGOLA

Block 18 Infill

Development

Azule Energy

$200 million

TechnipFMC has been awarded a substantial contract to supply subsea production systems. The current field layout will be reconfigured to accommodate new equipment that will support Azule's production expansion plan. TechnipFMC will design and build subsea trees, a manifold, subsea distribution equipment, topside controls, jumpers, flowlines, and umbilicals.

CHINA

Baodao

CNOOC

Gas Discovery

$500 million

CNOOC is considering an option to jointly develop three fields surrounding the Baodao discovery to maximise the economic viability and save costs on the project. CNOOC is planning to deploy a semisubmersible production platform tied back to about 34 subsea trees for the project.

SPONSORED BY

Energy projects and business intelligence in the energy sector

www.eicdatastream.the-eic.com

The EIC delivers high-value market intelligence through its online energy project database, and via a global network of staff to provide qualified regional insight. Along with practical assistance and facilitation services, the EIC’s access to information keeps members one step ahead of the competition in a demanding global marketplace.

The EIC is the leading Trade Association providing dedicated services to help members understand, identify and pursue business opportunities globally.

It is renowned for excellence in the provision of services that unlock opportunities for its members, helping the supply chain to win business across the globe.

The EIC provides one of the most comprehensive sources of energy projects and business intelligence in the energy sector today.

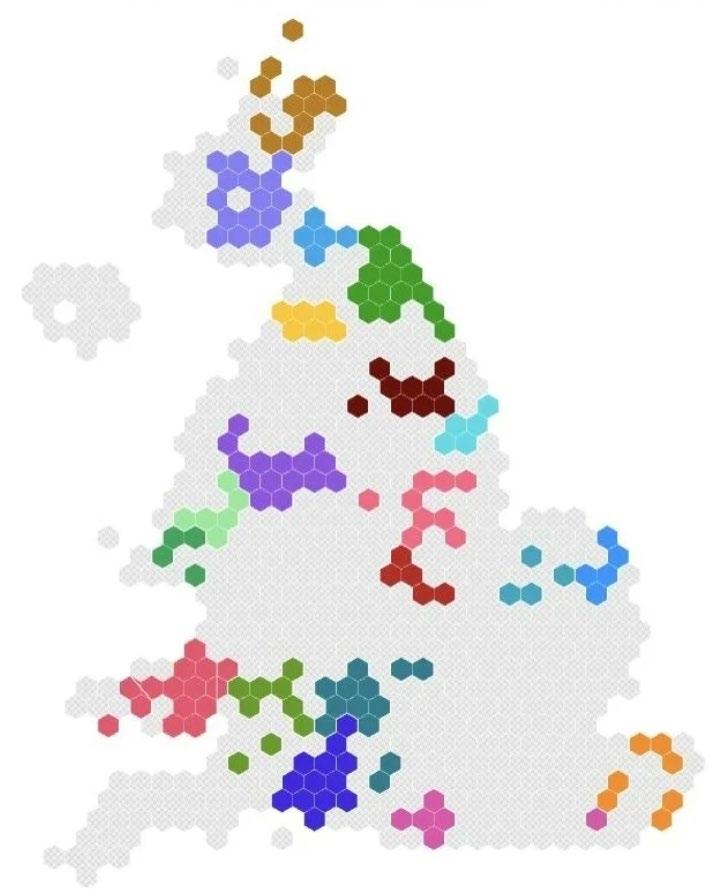

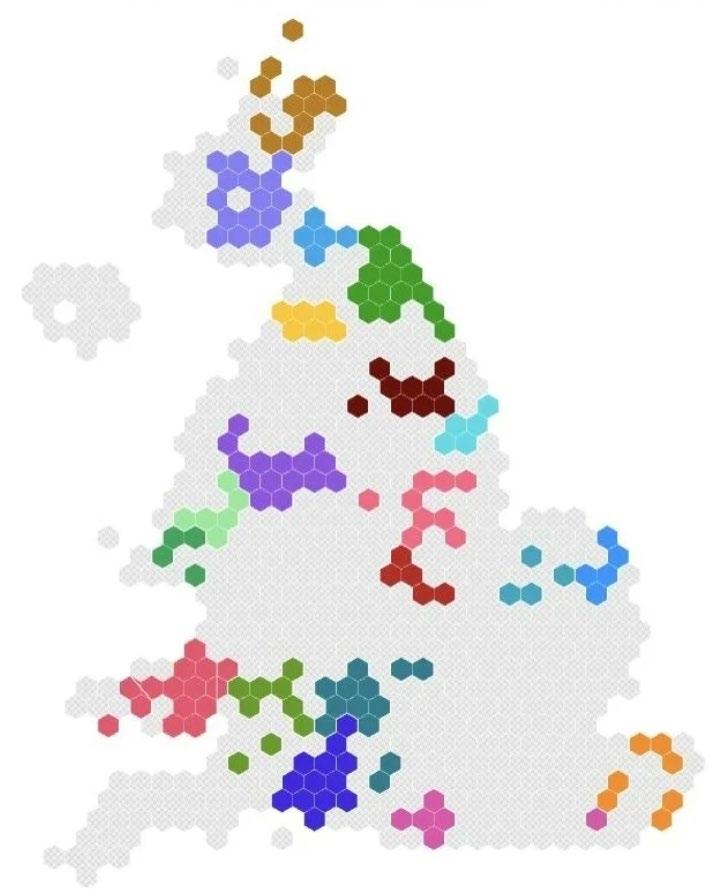

www.ogv.energy I August 2023 20 WORLD PROJECTS

3 9 6 10 1 1 7 3 2 4 5 12 2 8 11 4

BRUNEI Brunei Shell Offshore Asset Services

Brunei Shell Petroleum Company

$250 million

Wood Group company has been awarded a US$250mn contract for the rejuvenation of BSP's offshore energy asset portfolio. The contract covers brownfield engineering, procurement, construction and commissioning (EPCC) services as well as the management of its offshore marine fleet. The contract will be valid until February 2026.

ARGENTINA Fenix Gas Field TotalEnergies

$706 million

The construction of the project has commenced with the installation of offshore pipelines. The campaign will primarily focus on installing two 35km pipelines near the Vega Pléyade platform in Tierra del Fuego. Total has chosen Saipem for the pipeline construction. The pipelay work, scheduled for August, will be carried out by the Saipem Castorone vessel to connect the new production platform to Vega Pléyade. Once the initial phase is completed, the production platform will be transported from Rosetti Marino SPA's shipyard in Italy to Argentina, where it will be installed by Heerema Marine Contractors' Aegir vessel.

EGYPT West Delta Deep Marine (WDDM) –Phase 10

Burullus Gas Company

$250 million

Partners in Burullus have signed an agreement to begin the development of Phase 10 on the WDDM concession located in the Nile Delta. The project involves drilling three new development wells, with drilling activities anticipated to start in late 2023 upon receiving regulatory approvals.

QATAR North Field Production Sustainability Compression Project – Phase 1 & 2

Qatargas

$5 billion

McDermott International has been awarded the EPCI contract for the offshore fuel gas pipeline and subsea cables project called COMP1. The scope of works are the installation of 190 km of 32-inch diameter subsea pipelines, 17 km of subsea composite cables, 186 km of fibre optic cables and 10 km of onshore pipeline. The work will be carried out by McDermott's office in Doha and the fabrication will take place in QFAB.

AUSTRALIA Stybarrow and Eskdale Fields Decommissioning

Woodside Energy

$200 million

McDermott has been awarded the engineering, procurement, and removal contract for offshore decommissioning work for the full removal of the Stybarrow disconnectable turret mooring (DTM) buoy, as part of the decommissioning of the Stybarrow field.

McDermott will provide project management and engineering services for the recovery, transportation and offloading of the DTM buoy to a suitable onshore yard facility for dismantling and disposal.

MEXICO Trion Offshore Oil Field

Woodside Energy

$7.2 billion

Hyundai Heavy Industries (HHI) was formally awarded EPC work for the FPU vessel on 30 June 2023 following a US$1.2bn proposal. The vessel will be built at HHI's Ulsan yard, in South Korea, and is planned for delivery in April 2027. First oil is expected in 2028.

NORWAY Carmen Gas and Condensate Discovery

Wellesley Petroleum AS

$500 million

DNO ASA announced a significant gas and condensate discovery on the Carmen prospect in the Norwegian North Sea license PL1148. According to preliminary estimates, gross recoverable resources range between 120 and 230 MMboe. The discovery is located close to existing infrastructure with clear routes towards commercialisation.

ROMANIA Neptun Block (Domino and Pelican South Fields)

OMV Petron

$4.4 billion

OMV Petron and Romgaz have sanctioned the development plan for the Domino and Pelican South fields. The plan will be submitted to the National Agency for Mineral Resources for endorsement. The two operators intend to invest nearly US$4.4 billion, in the project's development phase, which will take place primarily between 2024 and 2026 and will allow for the production of approximately 100 Bcm of gas.

21 WORLD PROJECTS WORLD PROJECTS SPONSORED BY 12 9 5 6 10 11 8 7

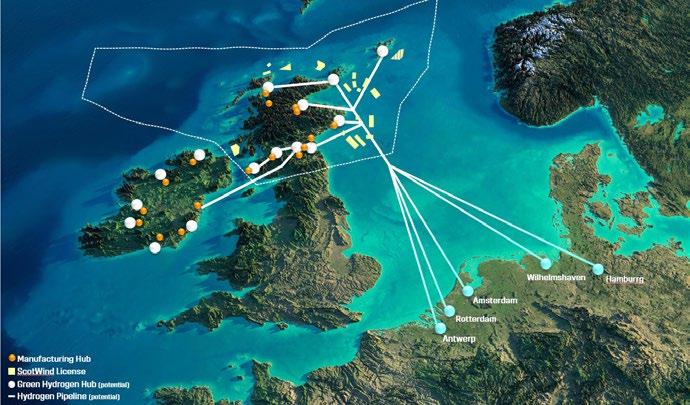

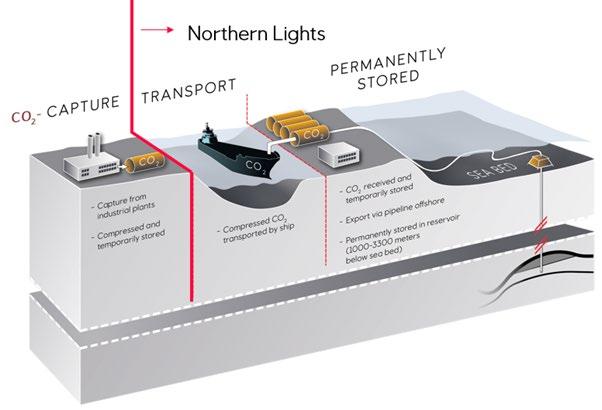

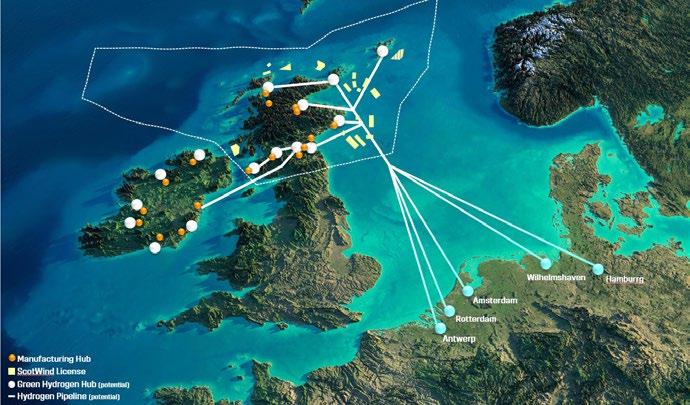

Energy security with a focus on homegrown resources, net-zero commitments, and government incentives for clean energy technologies are set to accelerate the development of the hydrogen and carbon capture and storage (CCS) industries.

Economies will need much more capacity, commitments, and financing in the future if they have a chance to achieve net-zero emissions by 2050 and reduce the hardto-abate emissions from sectors such as steelmaking or construction. But investments are on the rise and set to further grow, driven by various incentives for hydrogen production and CCS, or carbon capture, utilisation, and storage (CCUS) projects.

Low-Carbon Investments Rising

Early this year, Rystad Energy, the independent energy research and business intelligence company, said in a report that low-carbon investments are set to rise by US$60 billion, to reach US$620 billion, in 2023 as inflation weakens, with spending on hydrogen and CCUS technologies surging.

While low-carbon energy investments will be led by wind power developments, the 10% annual increase in spending will also be driven by a significant rise in funding for hydrogen and CCUS infrastructure, Rystad Energy research shows. Hydrogen and CCUS are set to see the largest annual increase in percentage terms, with investments soaring

HYDROGEN AND CCS DEVELOPMENT IS AT A TURNING POINT

By Tsvetana Paraskova

by 149% and 136%, respectively. Total hydrogen spending will approach US$7.8 billion in 2023, while CCUS investments will total about US$7.4 billion, Rystad Energy reckons.

“The outlook for hydrogen and CCUS is especially rosy as technology advances, and the large-scale feasibility of these solutions improves,” said Audun Martinsen, Rystad Energy’s head of supply chain research.