In this issue... Fathers of regen page 51 Gabe Brown visits the UK for Groundswell workshop Sustainable breeding strategies page 18 Champion of champions page 58 Forum of farming’s thought-leaders Look forward to LAMMA page 70 £3.99 Movers and shakers - new cereal, oilseed and pulse varieties

To claim two crop protection BASIS points, send an email to cpd@basis-reg.co.uk, quoting reference CP/112061/2122/g.

To claim two NRoSO CPD points, please send your name, NRoSO member number, date of birth and postcode to angus@cpm-magazine.co.uk

Editor’s pick

Copyright Kelsey Media 2022. All rights reserved. Kelsey Media is a trading name of Kelsey Publishing Ltd. Reproduction in whole or in part is forbidden except with permission in writing from the publishers. The views expressed in the magazine are not necessarily those of the Editor or Publisher Kelsey Publishing Ltd accepts no liability for products and services offered by third parties.

New varieties take centre stage in this issue,with profiles of the new AHDB Recommended Lists for cereals and oilseeds and PGRO’s Descriptive List for pulses. Peas and beans often don’t get the attention they deserve and it’s often been their markets which have let the crop down. But this could be changing as new opportunities open up for the crop and in Pulse Progress,we visit a farm with an ambition to produce net zero eggs by substituting some of the soya in hen rations to homegrown beans (page 26).

Continuing the focus on varieties, Theory to Field (page 14) tackles the changes that AHDB could make to the RL to provide better information to growers. With not long to go before spring barley planting gets underway, we have a closer look at brew-only variety Skyway in Insider’s View (page 22).

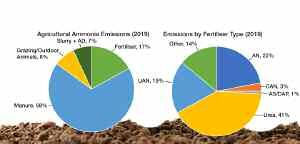

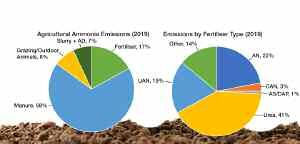

Plant nutrition again comes under the spotlight and is likely to remain as a focus of attention in 2023 as pressures grow to make sure every last bit of nutrition applied is used as efficiently as possible. In this month’s survey article, technology to best achieve this is assessed (page 41). Our first of two Research Briefings turns its focus to reducing ammonia emissions from urea-based fertilisers (page 38). In the second roundup of research, the role applied bacteria can play to make soil nutrients available to plants is investigated (page 44). It seems there are many ways to look at improving nutrient use efficiency.

Last month, Michael Kavanagh was awarded the accolade of CPM Climate Change Champion by readers. In a roundtable event that brought together some of the past three years’ champions, there was in-depth discussion about achieving net zero goals and we share the highlights on page 58.

Real Results Pioneers (page 55) features North Lincolnshire farmer Colin Chappell and takes a

fascinating look at his approach to sustainability, in particular how he breathes life into this concept at every level of his farming enterprise.

There’s been no shortage on farming events in October and November and we bring you a flavour of some of these; with reports from the CHAP/Soil Association ‘Fit for the Future’ plant breeding conference (page 18) and the BCPC Congress and the CropTec Show (page 33).

The father of regenerative agriculture Gabe Brown and his colleagues from US-based Understanding Ag visited the UK for the first time in October. CPM were amongst the 250 delegates who attended a fascinating workshop hosted by Groundswell in Hertfordshire (page 51).

It’s also the time of year when machine manufacturers unveil their latest developments and we report from the European machinery shows SIMA and EIMA (page 65), as well as a preview of next month’s LAMMA at the NEC (page 70). Väderstad chose a more exclusive setting to unveil its latest developments, with multiple launches revealed in Germany in October (page 76). CPM had a front seat view.

All of our farmer columnists have plenty to say this month. I’d like to thank Guy Smith, Claire Eckley, Martin Lines, Richard Styles and Andrew Wilson for every single word they’ve written this year, especially in the busy times when keeping to deadlines has meant burning the midnight oil.

And a big thank you to you, the reader, for the support you’ve given me and the CPM team this year Wishing you a very merry Christmas and a prosperous New Year.

I hope you’ve enjoyed reading this December issue of CPM as much as I’ve enjoyed putting it together.

24 Number 11 December 2022

& advertising sales

Ser vice

Reader registration hotline 01959 541444 Advertising copy

Volume

*the claim ‘best read specialist arable journal’ is based on independent reader research conducted by McCormack Media 2020 Editorial

CPM Ltd, 1 Canonbury, Shrewsbury, Shropshire SY3 7AG Tel: (01743) 369707 E-mail: angus@cpm-magazine.co.uk Customer

Kelsey Media, The Granary, Downs Court, Yalding Hill, Yalding, Kent ME18 6AL, UK

Brooks Design, Tel: (01743) 244403 E-mail: fred@brooksdesign.co.uk CPM Volume 24 No 11. Editorial, advertising and sales offices are at CPM Ltd, 1 Canonbur y, Shrewsbur y, SY3 7AG England. Tel: (01743) 369707. CPM is published eleven times a year by CPM Ltd and is available free of charge to qualifying far mers and far m managers in the United Kingdom.

Editor Lucy de la Pasture Sub-editor Rachael Harper Writers

Design and production Brooks Design

Publisher Steve Kendall Commercial Director Angus McKirdy

Mike Abram

Tom Allen-Stevens

Adam Clarke

Charlotte Cunningham

Melanie Jenkins

Rob Jones

Martin Lines

Lucy de la Pasture

CPM (Print) ISSN 2753-9040

Guy Smith Richard Styles Andrew Wilson

CPM (Online) ISSN 2753-9059

3 crop production magazine december 2022

Smith’s Soapbox - Views and opinions from an Essex peasant…

Nature Natters - A nature-friendly perspective from a Cambs farmer.

Styles’ Stance - A tongue-in-cheek look at farming.

Talking taties - Plain talking from a Yorkshire root grower.

Last Word - Topical insight from CPM’s Editor.

AHDB RL 2023/24 – The movers and shakers

We look at the new AHDB Recommended Lists for cereals and oilseeds, announced earlier this month.

Theory to Field – Evolution of a grower’s favoured tool

Change is afoot with the RL but it’s not too late to have your say and influence the outcome of AHDB’s review.

Plant breeding – The diverse paths to resilience

As the Genetic Technology Bill made its way through Parliament, plant breeders and innovators met to discuss other routes to a sustainable future.

Insider’s View – Taking the Skyway

As thoughts turn towards spring planting, we take a closer look at a brew-only variety that’s reaching new heights.

Pulse Progress – Eggs and beans

The substitution of soya in livestock diets with homegrown protein is lowering the carbon footprint of Scottish eggs.

Pulse varieties – Heptad of new pulses for 2023

With the launch of the PGRO Descriptive List, we look back at the new additions and how they compare with more established varieties.

BCPC/CropTec – Managing uncertainty

Highlights from seminar sessions at last month’s BCPC Congress in Harrogate and the CropTec Show in Peterborough.

Research Briefing – Shield for the easy win

A look at new trials which quantify potential N losses (as ammonia) to the air and how this can be mitigated to conform with new industry guidelines.

Nitrogen use survey – Measure, monitor,manage

We find out how technology is being utilised to assist decision-making for nutrient planning and fertiliser application.

Research Briefing – Biological solutions to nitrogen challenges

How trials of a biological seed treatment suggest it could potentially help farmers reduce nitrogen requirements.

Better buying,better selling – Unprecedented times

A look at how different farmers are managing market volatility, input inflation and the all-important cashflow.

Regen Pioneers – Advice from the fathers of regen

We joined growers who gathered at Groundswell to hear from Gabe Brown, Dr Allen Williams and Shane New of Understanding Ag.

Real Results Pioneers – Finding a better balance

Colin Chappell has breathed life into the concept of sustainability on his farm in North Lincolnshire. We find out how.

Climate Change Champions – Time is ticking on the carbon carrot

As this year’s champion of champions was crowned, we get valuable insights from CPM’s group of past and present champions.

Green Horizons – The basis for the right balance

A soil-led approach links the progress of two large, productive arable systems in Wiltshire and Kent.

European shows – European shows provide plenty of innovation

Highlights from Europe’s two premier machinery shows, SIMA in France and EIMA, in Italy which took place last month.

LAMMA preview – Starting January boldly

A look at some of the show’s features and the machinery, technology and innovation that will be on display.

Väderstad launches – Target: outstanding

emergence

We travel to Germany where Vädertad sets out its lofty ambitions and the machinery it will be delivering to help achieve them.

Potatoes – Foresight means minimising surprises

Growing potatoes is a risky business but technology could help keep growers on the right path to hit market spec.

33 58 70 76

Opinion

6 50 64 82

83

51 55 58 61 65 70 76 76 Sustainable

Roots Technical 8 14 18 22 26 30 33 38 41 44 47 In this issue 5 crop production magazine december 2022

Machinery

farming

The drudgery and disaster of olde farming ways

I’d guess that I’m not the only one who has witnessed the two immediate generations who came before me start to disappear and now I wish I’d spent more time talking to them. The key testimony of the generation of farmers and farm workers that were born before

the Second World War is they can recollect a very different style of farming to that which we know today.

As a lad I grew up with men and women who worked on farms powered by horses and human muscle rather than by tractors and machines. What struck me at the time was that none of them talked in terms of ‘the good old days’. They all preferred the work on mechanised farms. Many, then in their forties and fifties, bore the scars and infirmity of years of repetitive manual labour –– armed with hand hoes, shovels and pitchforks.

For me as a teenager, dead lifting hundredweight hessian sacks full of wheat was seen as some sort of agricultural coming of age ritual. I remember at the time being told by my elders I’d live to

regret my weightlifting prowess. Now, as my lower back tweaks and grinds to wake me up in the night, I wish I’d paid them more heed.

One key reason it’s important to accurately document pre-war farming is that it’s starting to be seen largely through rose-tinted spectacles. There is an alluring nostalgia that paints an idealised picture of farming before machinery and pesticides became commonplace on arable farms. It’s now forgotten that it was common to lose crops to weeds, diseases and pests before the advent of herbicides, fungicides and insecticides.

While I’m enthusiastic about finding non-chemical forms for controlling these problems, I’m also mindful that it was for good reason that our forebears readily turned to pesticides when they became widely available in the fifties and sixties. They knew that even the best husbandry practice could be defenceless in the face of a June outbreak of yellow rust as it ruined a wheat crop in its final stages of ripening.

I remember one old boy telling me a story that as a young lad in the 1940s, he was sent to drill a two acre field with turnip rape. At the end of the day he noted, to his horror, he had forgotten to open the bag of seed that he had put in the hopper on leaving the yard. On confessing his sin to the foreman he was told not to worry as the farmer would never be any the wiser as most turnip rape crops were lost to various bugs and beetles before they had a chance to establish.

Even I can just about remember cereal crops festooned with thistles and couch grass before the wonder product that was Roundup became widely available. It’s interesting that many arable farmers under fifty today have forgotten that when it was first introduced, glyphosate was primarily a major step forward in

Guy Smith grows 500ha of combinable crops on the north east Essex coast, namely St. Osyth Marsh –– officially the driest spot in the British Isles. Despite spurious claims from others that their farms are actually drier, he points out that his farm is in the Guinness Book of Records, whereas others aren’t. End of.

@essexpeasant

controlling perennial weeds through its systemic action. It was so successful that weeds like thistles and couch grass are now almost forgotten, as is glyphosate’s part in their demise as major arable weeds. But we would forget this at our peril if we suddenly found glyphosate banned on the mistaken understanding that weed rakes would probably do the job instead.

By way of illustration, I include a picture from the 1930s of a field gang scratching up and burning couch grass roots by hand with pitch forks. You wonder if it’s only a matter of time until Countryfile feature some modern-day re-enacted version of this as evidence we wouldn’t miss glyphosate if it was banned. No doubt someone in Whitehall is thinking of giving such practice a grant on the understanding it would promote an old virtuous craft that needs to be revived.

Is there a tendency to look at the good old days with rose-tinted spectacles? It was brutal,hard labour.

6 crop production magazine december 2022

The movers and shakers

AHDB Recommended List

The AHDB’s updated Recommended List for cereals and oilseeds was revealed as last month came to a close. The new varieties across the different crops are delivering large yield increases,especially in barley and oilseed rape. CPM takes a closer look at the movers and shakers.

By Lucy de la Pasture

This time last year there was a massive influx of new varieties on to AHDB’s Recommended List,with a record 37 new additions. By comparison, the launch of the 2023/24 RL is a much more considered affair, with just 28 newcomers across winter and spring wheat, winter and spring barley, oats and oilseed rape

While the numbers may be lacking, which may well be welcomed by those who thought the RL was becoming unwieldy, there are some notable additions, including the first new winter malting barley and winter oat variety for several years, says Paul Gosling, who manages the RL at AHDB.

“We’ve seen relatively few new varieties on the lists this year Several years of plant-breeding advances mean the

recommendation bar is set high and relatively few candidate varieties per for med better than the best listed varieties to secure a recommendation.”

It was a season that could have tested the RL trials, due to the heat and prolonged dry weather during the spring and summer, says Paul, but yields held up ver y well across all crops with only a few anomalies that had to be taken out of the datasets.

“We had good conditions in the autumn so crops established well, including OSR. There was also lesspressure from cabbage stem flea beetle feeding than has been experienced over recent years,” he adds.

So what’s new on the 2023/24 RL and which varieties have now been superseded?

Wheat

With just five new additions, and three of these with regional recommendations only, the winter wheat list also loses four varieties KWS Barrel, KWS Kerrin, LG Spotlight and RGT Gravity.The newcomers sit across Groups with one new UKFM Group 2 bread-making variety and one new UKFM Group 3 biscuit wheat. The list also adds two new soft Group 4 feed varieties and a hard Group 4, all of which have regional recommendations.

Group 2 variety KWS Ultimatum has good market potential, classified by ukp as a variety with potential for export. Its yield sits between comparator varieties KWS Extase and KWS Palladium at 101% of the controls. Good grain quality is a plus, with high specific weight its standout attribute

at 79.6 kg/hl, which is higher than both Palladium (77.6 kg/hl) and Extase (79.4 kg/hl). It also has a decent Hagberg at 287, though this falls behind the other two comparators and its protein content at 12.3% follows the same trend.

Agronomically, Ultimatum is a relatively shor t variety which produces decent yields across rotational positions (based on some limited data). It has high resistance to yellow rust (9) and has given high untreated yields in UK trials at 93%, which is comparable with Palladium and below highly septoria resistant Extase (at 97%).

In Group 3 there is one newcomer for all regions, RGT Wilkinson, which is rated as a uks soft wheat for export and as medium for distilling. This new addition provides an incremental yield increase to its comparative varieties on the RL, KWS Brium (+1%) and LG Astronomer (+3%). Although its Hagberg is better than Astronomer, its Achilles heel may be its specific weight.

This short and stiff-strawed variety is high yielding in the West region, across rotational positions and on heavier soils. It has a very high yield potential in the East region and on lighter soils (based on limited data). Its breeders have also brought septoria resistance which may not be outstanding but offers a variety in this Group which has a non-Cougar lineage.

Wilkinson is relatively late-maturing and has high resistance to yellow rust and mildew. Limited data suggest that this variety may have a tendency to sprout,

8 crop production magazine december 2022

▲

so it should be given priority at harvest.

The remaining new additions to the RL have regional recommendations, with two soft Group 4s –– KWS Zealum and LG Redwald –– and one hard endosperm Group 4 in Oxford.

Zealum is a high-yielding, soft-milling feed variety recommended for the North region only, where its ‘medium’ rating for distilling may be attractive, though it is late in terms of maturity. With regard to yield, it’s equal to Skyscraper in this region.

It has good resistance to yellow rust (9) combined with resistance to orange wheat blossom midge and produces an untreated yield which is also on a par with Skyscraper (86%).

Pushing the yield boundaries in this Group is soft-milling LG Redwald, which is recommended in the East and West regions where it outperforms Skyscraper and RGT Bairstow by 4% and 6% respectively. Redwald has the distinction of having the highest septoria resistance in Group 4 at 6.7, which should add to its attractiveness in the West. Its all-round strong package translates into an untreated yield of 92%, though lodging may be a weakness.

Hard Group 4 variety Oxford is a very high-yielding, hard-milling feed variety recommended for the East and West regions, though it tends to produce grain with a lower specific weight which tends to

be less than KWS Dawsum but better than Champion.

This relatively late-maturing variety has moderate straw strength but responds well to plant growth regulators. It has high resistance to yellow rust (9), combined with resistance to OWBM and a respectable septoria rating of 6.4, which is just 0.3 behind Graham.

Three new varieties from KWS have been added to the spring wheat list, offering good grain quality and yields: UKFM Group 1 KWS Harsum, which has particularly high yield, and UKFM Group 2 KWS Alicium and KWS Lightum. All three varieties offer resistance to OWBM.

Barley

The RL 2023/24 includes several new barley varieties that bring strength to yield and disease resistance, including the first malting variety added since 2018, Buccaneer, from Saaten Union, It’s still under testing for its brewing potential but it offers a significant yield increase over the established two-row malting varieties, Craft and Electrum, alongside good disease resistance. Falling off the list are KWS Gimlet, Flynn, Jordan and Creswell.

Two new two-row and a new six-row hybrid varieties add strength to winter barley feed yields (compared with current favourites). The two rows are Bolivia, from Agrii (bred by Nordic Seed), and LG Caravelle from Limagrain. The latter offers a particularly high yield in the

East region and a good specific weight. The new six-row hybrid SY Nephin, from Syngenta, is notable for its disease resistance ratings of 8 for brown rust and rhynchosporium.

A closer look at Buccaneer reveals this relatively tall two-row variety has given its best relative performance in the East and North regions (based on limited data). Over the three years of testing, Buccaneer has shown no major disease weakness. It has high resistance to rhynchosporium and is resistant to the common strains of barley mosaic viruses (BaMMV and BaYMV strain 1).

The second two-row addition Bolivia is a feed variety with a UK-wide recommendation. Over the three years of testing, this variety has given low screening levels. Stiff-strawed, Bolivia has per formed well across a range of regions and soil types and has a very high treated yield potential in the East region. No major weaknesses in disease resistance have been identified in trials, with mildew resistance (7) a strength along with resistance to the common strains of barley mosaic viruses (BaMMV and BaYMV strain 1).

Topping the yield figures is LG Caravelle, which brings two-row yields into a similar ballpark to hybrid varieties for the first time. In spite of its high yield, Caravelle also has a ver y high specific weight. It per for med well across all regions and soil types and has a ver y high treated yield potential in the East (109%) and West regions (105%), as well as on heavier soils. It looks to have a decent all round disease resistance package with its one weakness being net blotch. It’s also resistant to the common strains of barley mosaic viruses (BaMMV and BaYMV strain 1).

Winter barley six-row feed variety SY Nephin is recommended for the UK, with a very high specific weight which is similar to SY Canyon. This variety has a ver y high

treated yield potential in the East and limited data suggests it’s high yielding in the North region but less impressive in the West. Growers should be aware that it’s a tall variety with moderate straw strength that requires careful management.

SY Nephin has the highest resistance to rhynchosporium on the RL and is resistant to the common strains of barley mosaic viruses (BaMMV and BaYMV strain 1).

There are six new spring barley varieties under evaluation by the Malting Barley Committee (MBC): three for brewing only, two for brewing and malt distilling, and one for malt distilling. These offer improvements in yield and/or disease resistance (compared with the current market leaders RGT Planet and Laureate).

Last year’s new additions all fell foul of making MBC standards so are amongst those removed from the RL ––Jensen, SY Bronte, Spinner, SY Tungsten, SY Splendor and Fairway.

“RL 2023/24 delivers exciting potential for brewing and distilling. However, it’s a tough market to break into, with varietal success deter mined by end users. As varieties can fail to make the grade, farmers should talk to merchants before growing them,” war ns Paul.

The spring barley list sees feed variety Hurler added. Bred by Secobra and available through Agrii, with high yields its standout feature.

Looking at the additions in more detail, Diviner is recommended for the UK, with potential for malt distilling use. This variety has a very high treated yield potential in the Nor th region at 105% (+3% over Laureate and Diablo) and is high yielding in the East and West regions (104%). It’s a short, stiff-strawed variety with high resistance to brackling (9). Diviner has ver y high resistance to mildew (9), but limited data suggests it is ver y susceptible to rhynchosporium (3).

▲ AHDB Recommended List

10 crop production magazine december 2022

Limagrain’s new two-row barley,LG Caravelle,brings yields on a par with hybrids for the first time.

Florence, Sun King and SY Signet are a trio under consideration as brew-only varieties. Florence offers a significant advantage in terms of yield, particularly in the East and West regions (106%) and has a high yield potential for the North region. It’s a short, stiff-strawed variety with high resistance to brackling (9) and mildew (8) which may help contribute to its untreated yields in UK trials (95%), which outper for ms both Planet and Laureate.

Sun King has a given high treated yields in both the East and North regions (104%), and limited data suggest it has a very high yield potential in the West region (107%). It’s a stiff-strawed variety with high resistance to brackling (9). Limited data suggests it’s susceptible to rhynchosporium (4) and tops the untreated yield data at 96%.

SY Signet looks relatively consistent across regions, averaging 104% above control variety yields in treated trials. Offering dual-purpose potential are KWS Cur tis and SY Tennyson. Tennyson has come up trumps in the East with yields at 107% of controls and has also performed well in both the Nor th (+4% above Laureate and Diablo) and West regions but tends to give a low specific weight. It’s a short and relatively stiff-strawed variety with very high resistance to mildew but is susceptible to brown rust and limited data suggest it’s very susceptible

to rhynchosporium.

KWS Curtis has a yield of 104% above controls across all regions and is a short, stiff-strawed variety with high resistance to brackling. It also has very high resistance to mildew and high resistance to rhynchosporium (based on limited data), but it is susceptible to brown rust.

Rounding off the new additions is feed variety Hurler which outper forms Skyway in terms of yield potential across all regions but tends to give a low specific weight (66.2 kg/hl). It’s a short, stiff-strawed variety with high resistance to brackling (9) and has given high yields in untreated UK trials, on a par with Skyway (94%). It’s susceptible to brown rust.

Oilseed rape

The winter OSR list features three new UK-recommended hybrid varieties: Vegas and Turing, from LSPB, and Attica, from Limagrain. Turing and Attica have especially high yields in the North region.

Recommended for the East/West region, Murray, from LSPB, has a high yield and a resistance rating of 8 for stem canker Recommended for the Nor th region, LG Wagner, from Limagrain, achieved the highest yield in this region and possesses good resistance to light leaf spot.

A new conventional variety for the UK, Tom, from CBI, offers a small yield increase but adds options for this important seed-market component.

▲

The new RL features the first winter oat variety to be added since 2018. Cromwell,from Senova,offers good yield and grain quality.

New winter wheats at a glance

Points to note

UKp bread wheat classified for export.UK recommended with high Hagbergs and specific weights.Relatively short with high resistance to yellow rust,mildew and fusarium.

UKs classified medium distilling and export.High yielding with UK recommendation but lower specific weight. Short,stiff strawed and relatively late maturing.High resistance to yellow rust and mildew but potential tendency to sprout.

High yielding,medium distilling with lower specific weight and recommended in East/West.Relatively late maturing,medium-tall and relatively weak strawed.No major weaknesses with high resistance to septoria, yellow rust and OWBM.

High yielding with North recommendation and medium for distilling. Relatively late maturing,moderate straw strength.High resistance to yellow rust,mildew,fusarium and OWBM.

Very high yielding recommended for East/West but tends to lower specific weight.Relatively late maturing, moderate strength.High resistance to yellow rust and OWBM.

New winter OSRs at a glance

Points to note

Added to NL as of 19 December.UK recommendation with very high GO.Resistant to lodging with good stem stiffness.Strong against LLS.

High yielding and very high GO in East/West and North.High lodging resistance,good stem stiffness.Strong disease resistance to LLS,and stem canker.TuYV and pod shatter resistant.

Very high GO in East/West and high in North.Strong lodging resistance and good stem stiffness.Very high LLS and stem canker resistance.

East/West recommendation.Very high GO,high resistance to lodging and good stem stiffness.Strong LLS and stem canker resistance.

Highest yielding conventional in East/West.Good resistance to lodging,very stiff and high LLS resistance.

Very high GO in North region.Very strong lodging,good stem stiffness.High LLS score,plus pod shatter and TuYV resistance.

North recommendation with specific tolerance. High lodging resistance and good stem stiffness. Pod shatter,stem canker and TuYV resistance.

New barleys at a glance

Points to note

Best performance in East and North regions with potential for malt brewing and high specific weight. Relatively tall with no major disease weaknesses.High rhynchosporium resistance and against common barley mosaic virus strains.

Very high yielding with UK recommendation.Very high specific weight,strong mildew resistance and against common barley mosaic virus strains. UK recommended. High-yielding with low screening levels. Stiff strawed and no major disease weaknesses. Strong mildew resistance and to common barley mosaic virus strains.

High yielding hybrid recommended for UK and very high specific weight.Tall with moderate straw strength. Highest resistance to rhynchosporium on RL and resistant to common barley mosaic virus strains.

Very high yielding with UK recommendation and potential brewing use.Short,stiff with high brackling resistance. Good resistance to mildew

Very high yielding with UK recommendation but has tendency for low specific weight.Has potential for brewing and malt distilling.Short,relatively stiff,high resistance to mildew but susceptible to brown rust and rhynchosporium.

High yielding with UK recommendation and potential brewing use.Stiff strawed with high brackling resistance.Strong against mildew but limited data suggests susceptible to rhynchosporium. High yielding with UK recommendation and potential for malt distilling.Short,stiff strawed and high resistance to brackling. Very high mildew resistance but limited data suggested susceptible to rhynchosporium.

UK recommended with very high yields and potential for brewing.Short,relatively stiff with very high resistance to brackling and mildew.

UK recommended with high yields,plus brewing and malt distilling use.Short with stiff straw and high brackling resistance.

Strong against mild and rhynchosporium but susceptible to brown rust.

Very high yielding with UK recommendation but lower specific weight.Short,stiff strawed with high resistance to brackling. Strong against mildew but susceptible to brown rust.

KWS Ultimatum Group 2 KWS VarietyScope and type Breeder/contact

Wilkinson Group 3 RAGT LG Redwald Soft Group 4 Limagrain KWS Zealum

Soft Group 4 Hard Group 4 KWS DSV

RGT

Oxford

LSPB

Scope and type Breeder/contact

Turing

Hybrid

Variety

Hybrid Limagrain

Hybrid LSPB

LSPB Hybrid

Attica

Vegas

Murray

Frontier Agriculture Conventional

Limagrain Hybrid

Tom

LG Wagner

Beatrix CL DSV Hybrid (Clearfield)

Buccaneer Two-row malting Saaten Union VarietyScope and type Breeder/contact LG CaravelleTwo-row feed Limagrain Bolivia Two-row feed Agrii SY Nephin Syngenta Six-row feed Florence Sy Tennyson Sun King Diviner Sy Signet KWS Curtis Hurler Senova Syngenta Agrii Agrii Syngenta KWS Agrii Spring malting Spring malting Spring malting Spring malting Spring malting Spring malting Spring feed New oats at a glance Points to note High kernel content and specific weight.Short,stiff straw but limited data suggests susceptible to mildew. Early maturing and moderate straw strength.Very high mildew resistance but limited date suggests susceptible to crown rust. Cromwell Winter husked Senova Variety Scope and type Breeder/contact RGT Vaughan Spring husked RAGT AHDB Recommended List 12 crop production magazine december 2022

Chris Guest stands in LSPB’s newlyadded Turing,the top yielding OSR variety on the 2023/24 RL,along with two other new varieties – Murray and Vegas – giving the breeder a total of three varieties in the top five of the RL.

The list also includes Beatrix from DSV, a new Clearfield variety for the North region.

Looking a little closer at the new arrivals –– half the number that were added to the RL last year –– there’s something for ever yone. Hybrids Turing and Attica look reliable bets in all regions with both posting high treated gross output throughout the UK at 107% of controls, which makes them joint top per for mers on the 2023/24 RL on a national basis.

Turing has a slight anomaly in that it hasn’t yet been added to the National List so its addition to the RL is conditional at the time of its launch that this will take place on 19 December, as anticipated.

Whereas Attica comes fully loaded with TuYV and pod shatter resistances, Turing doesn’t carry these resistance genes. However, it does have strong stem stiffness and resistance to lodging, it’s early flowering (8) and has good resistance to light leaf spot (7). Resistance to phoma stem canker is only moderate with a rating of 5.

Attica also boasts good stem stiffness and lodging resistance, with pretty good all round disease resistance, rated 7 for both light leaf spot and phoma stem canker.

The third hybrid with UK-wide approval is Vegas, which also has a very high gross output with an edge in the East and

West, though it’s yield is respectable enough in the North to have justified its broad approval by the RL panel. This variety has a high resistance to lodging (8), with a good stem stiffness at maturity (8). Vegas also has a superior package of disease resistance, with high resistance to light leaf spot (8) and the only 9 rating for phoma stem canker of the varieties on the list with approval in all regions of the UK.

The approval of Tom in all regions of the UK adds a high yielding conventional option –– with gross output 102% compared with contemporary Acacia (101%) and now outdated, though still widely grown Campus (99%). Tom also has pretty decent disease resistance characteristics, rated 7 for light leaf spot and 6 for phoma. Rounding off the package is good stem stiffness at maturity (9) and resistance to lodging (8).

Northern growers may be attracted by LG Wagner, which has been listed for use in this region where it performs significantly better than anything else, recording a gross output of 108% which is 4% better than the nor thern specialist amongst the UK-wide approvals, Aurelia at 104%. TuVY and pod shatter resistance some as part of its package of traits.

ALS-tolerant, Beatrix CL has also been added to those with Nor ther n-only approvals, where it performs very similarly to Matrix CL and will provide an alter native to growers who aren’t able to source Matrix seed.

The last of the new additions is an option for those growing in the East and West regions. Murray has per formed par ticularly well here, with gross output of 106% which tops those in this section. Like the other two varieties from LSPB, it’s a hybrid without pod shatter or TuYV resistance but does offer good disease resistance with a 7 rating for light leaf spot and 8 for phoma stem canker ■

▲

Evolution of a grower’s favoured tool

By Adam Clarke

It was almost 80 years ago that NIAB produced the first wheat Descriptive List, providing growers with information on 16 varieties.

Since then, what is now the AHDB Recommended List for Cereals and Oilseeds has evolved into a multi-million-pound project that recommends or describes varieties of 11 different crop types.

The project is managed by a consortium which consists of AHDB, British Society of Plant Breeders (BSPB), Maltsters’ Association of Great Britain (MAGB) and UK Flour Millers (UKFM).

Public review

Despite its Titanic size, the RL management team could be said to have done a fine job of avoiding any icebergs in recent years –– it achieved the highest score for levy payer satisfaction of any AHDB Cereals & Oilseeds offering in the recent Shape the Future industry consultation.

However, with arable producers in a period of rapid change, the project can’t rest on its laurels and must continue to evolve to reflect what is happening on the ground, according to AHDB’s head of crop

health and IPM, Jenna Watts.

AHDB will soon launch a large-scale public review of the current RL project phase –– each phase typically r uns for five years –– and Jenna encourages ever yone to have their say on potential improvements.

The Recommended Lists achieved the highest score for levy payer satisfaction of any AHDB Cereals & Oilseeds offering in a recent consultation.

The best way to steer the ship is to get on board and engage. 14 crop production magazine december 2022

“ ”

The Recommended List system has changed over the years and always scores high for grower satisfaction.Just ahead of a detailed review, CPM finds out how levy payers can have their say and what potential changes are on the horizon.

Theory to Field

She adds that consistently high importance and satisfaction scores underline how critical Recommended Lists are to crop management and has inspired the latest review to be the biggest and most detailed ever conducted.

“There are so many challenges facing growers at the moment and the RL must help meet some of these,” says Jenna. This review will cover every operational

aspect of the RL project, including costs, trials, data types and analysis, selection, and removal criteria, plus its presentation and communication.

The RL project has a total value of more than £22M, based on contributions from all consortium members in its current five-year phase. Levy payers are the largest contributors, with AHDB adding £8M of cash plus more on staff time,

RL updates may require higher levy

as they are currently laid out –– is not as straightforward as it might appear,he notes. Small plot drills are light and don’t have the ability to produce enough coulter pressure to work effectively.

However,testing varieties under no-till conditions to generate independent data will help cater for the increasing proportion of direct-drilling levy payers.

“Not everything can be done using no-till or regenerative standards,as practitioners remain in the minority.However,the system does need to produce a greater spread of information for levy payers working to those standards,”he adds.

There is plenty of noise around variety blends, too, which offers another conundrum for the RL management team.

knowledge exchange and communications work.

Understandably, there has been particular emphasis on costs and efficiency to ensure that the project delivers value for money for its primary funders –– the levy payer.

While economics will still be an integral part of the upcoming review, there will be an increased emphasis on what could be

Yorkshire-based AICC agronomist and RL review steering group chairman Patrick Stephenson agrees the list is not immune to change and must reflect the changing needs of industry.

However,there is a cost to making changes and a levy increase might be required to deliver some of the data that some growers and agronomists demand.

He says the RL has been fit for purpose during a stable period for arable producers,who have been supplied with an effective and diverse armoury of plant protection products.

But the landscape is rapidly changing,with pesticide pipelines slowing to a dribble and pressure increasing on growers to use fewer synthetic inputs.

This means it will be important to adjust RL trials protocols that currently show a variety’s genetic potential when treated with a fungicide programme costing about £240/ha.

“Historically, variety choice was a smaller part of the puzzle,but as we move to a more integrated approach,traits are a greater part of the equation. We must accept that pragmatism is required when it comes to trial protocols,” says Patrick.

Another hot topic is establishment method, with a move to less or no tillage gathering momentum. Current RL protocols do not reflect this reality, he says.

But incorporating direct drilling into RL trials ––

Evidence suggests that blends with a variety of strengths and weaknesses can help produce more stable yields across different seasons,but the difficulty of incorporating blends into a centralised testing system is that grower and market needs will vary greatly.

Various millers may have different requirements from a Group 1 blend,while a feed wheat blend in Cornwall will require different constituent parts to one grown in the Cambridgeshire fens.

“One potential solution is to trial a yellow rust blend near Kings Lynn,a septoria blend in Cornwall or South Wales.These would provide a benchmark on what blends can achieve in relation to other options in specific situations,” explains Patrick.

One change Patrick would personally like to see is how the system deals with data anomalies in some trials.

These outliers –– such as when a variety unexpectantly fails –– are taken out of the system, but that data may have some regional significance that some growers might find useful.

Also,up to the point of trial failure,there might be some data gathered,like vigour scores,that would also provide valuable insight.

“At the moment,all that information is lost,and I think it’s wasteful.What we’d like is a place at the back of the machine where growers can access that information where relevant,”he says.

The elephant in the room when discussing

these potential additions to the RL dataset is cost of additional trials and Patrick says inevitably, levy payers may have to pay more to see the potential benefits.

One of those levy payers is David Bell,who runs a mixed farming enterprise near St Andrews,Fife, and now sits on the RL review steering committee alongside Patrick.

He sees the RL as the cornerstone of integrated pest management (IPM) and one of the best sources of independent data to help growers with decision making and question commercial advice.

David sees a need to have an “adult conversation”about the levy,which has remained the same for 12 years and effectively resulted in a real-terms budget cut for AHDB Cereals and Oilseeds,restricting its ability to expand the RL’s remit as some demand.

He also stresses the importance of engaging with the upcoming review to help identify areas to improve and establish how much additional funding might be required.

“The best way to steer the ship is to get on board and engage, whether in meetings or via the questionnaire.

“If we do want change,then give AHDB some direction. The RL belongs to the levy payers, and we must communicate what we want and offer some constructive ideas on how we can make it better,”he adds.

15 crop production magazine december 2022

Patrick Stephenson says levy payers may have to pay more to see the potential benefits.

David Bell sees the RL as the cornerstone of integrated pest management.

▲

The project can’t rest on its laurels and must continue to evolve to reflect what is happening on the ground,says Jenna Watts.

fine-tuned or added to provide the most relevant information as the arable sector continues to evolve.

“Before, the reviews have very much looked at what we’ve got, but this time we want to look at specific growers’ needs when choosing varieties, and how the RL can deliver on those needs,” says Jenna.

That’s not to say there haven’t been any needs-based changes over recent years.

Review activities since the 2010s have highlighted the increased importance of disease resistance relative to treated yields.

In the last major RL review, between 2017 and 2019, most respondents rated disease resistance and untreated yield as very important or crucial when selecting a variety. This reflected increasing concern about controlling foliar disease with a dwindling and less effective fungicide armoury.

This resulted in visible changes to the RL since the early 2010s, with a line for untreated yields given more prominence, and some changes in the background, most notably the criteria for a variety to be automatically recommended.

Rather than just headline yield, varieties must pass minimum standards for disease resistance, with a score of 3 the bare minimum for most diseases. However, for the most important diseases in key crops, the minimum standard is higher and there are additional criteria for automatic recommendation.

For example, for automatic selection oilseed rape candidates in the East/West region need a 6 for both phoma stem canker and light leaf spot, while winter wheats must have at least a 5 for Septoria tritici in addition to a high treated yield/gross output.

Where a variety doesn’t meet these

specific thresholds, the relevant crop committee would take a forensic look at its overall package and make a balanced judgement on whether it is worthy of recommendation for a specific, useful characteristic such as quality.

The sheer number of varieties that are on the lists has been a nagging criticism over recent years, although recent feedback suggests that it is not an important issue for all users.

However, some believe it’s confusing and to help address this, AHDB recently developed the Variety Selection digital tools, which allow users to filter varieties and focus on those suited to their own situation.

Agronomic merit

This is achieved by giving certain traits greater agronomic merit, depending on where the grower is in the country. For example, brown rust might be of higher importance in the East than in the North.

“Agronomic merit brings together all disease resistance and lodging data and gives you a single figure, rather than having to delve into the whole list itself.

“Having lots of varieties brings choice, but there needs to be a way of narrowing down that choice to make the process much simpler,” says Jenna.

However, Jenna accepts that things may need to go further in the future, perhaps by presenting the data in a different way or developing the digital offering.

One idea is to have a tiered system, where the top yielding and agronomically robust varieties are in a Premiership table, with others suitable for specific markets or regions presented in other divisions.

This is a topic where Jenna would really value feedback from industr y, and there will be the oppor tunity to do so in grower focus groups planned as part of the upcoming RL review

There will also be an online questionnaire launched alongside the 2023-24 RL, plus ways to engage at events over winter

Infor mation on how to get involved in the focus groups and any other aspect of the review are on the AHDB Cereals and Oilseeds website (ahdb.org.uk/rl).

Gathered information will be analysed during the spring and after stakeholder meetings, which include the plant breeders, an action plan for the next phase of RL funding will be published in the autumn.

Jenna is reluctant to speculate on the outcome of the review, but areas such as variety per for mance when direct drilled

Feedback from industry on ideas such as a Premiership table will be gleaned from grower focus groups planned as part of the upcoming RL review.

and response to different fungicide regimes are potential topics that will be subject to detailed discussion.

“The Recommended List can’t be everything to everyone, so we need to have this discussion and take a balanced view of how we move for ward,” she adds. ■

AHDB recently developed the Variety Selection digital tools,which allow users to filter varieties and focus on those suited to their own situation.

Research roundup

From Theory to Field is part of AHDB’s delivery of knowledge exchange on grower-funded research projects. CPM would like to thank AHDB for its support and in providing privileged access to staff and others involved in helping put these articles together.

For further info: AHDB Project P2110377: AHDB Recommended Lists for cereals and oilseeds (2021-26) is led by a consortium,including AHDB, British Society of Plant Breeders (BSPB),Maltsters’ Association of Great Britain (MAGB) and UK Flour Millers (UKFM). For more detail about the project, visit https://ahdb.org.uk/rl-project

16 crop production magazine december 2022 ▲ Theory to Field

The diverse paths to resilience

Plant breeding

As the Genetic Technology Bill made its way through Parliament, plant breeders and innovators met to discuss other routes to a sustainable future. CPM summarises the discussion and the content of the new Bill.

By Tom Allen-Stevens

Diversity. Whether in the lab or the field, organic or precision-bred,nursery to row-crop, those from pre-breeding research through to the customer interface seem to agree that a wider genetic base will bring more resilience, productivity and a healthier future for crop production.

But there are diverse views on how to achieve it, with new precision-breeding technologies representing an ever-growing, ever-present elephant in the room whenever plant breeding’s future is discussed (see panel on p19). In a bid to explore diversity without being divisive, CHAP and the Soil Association clocked the elephant and manoeuvred it to one side at the Plant Breeding Fit for the Future conference they jointly hosted in Birmingham recently “Resilience in plant breeding does come from new traits, but it’s more about genetic

diversity,” said SA’s policy and strategy director Jo Lewis. “Farming systems that encourage this have a critical role to play, not a marginal one, but they’re starved of investment.”

Role underplayed

Dr Ruth Bastow, innovation director at CHAP, noted that plant breeding’s role is underplayed, despite the fact it underpins the entire food system human society depends on. “‘Just three crops –– wheat, rice and maize –– make up over 50% of the world’s calorie intake. Diversity of the food we eat and the systems that produce it will be our strength in the future.”

The conference started with perhaps the most doom-laden outlook ever presented to an agricultural audience by Prof Tim Benton, research director at Chatham House. “The only thing we can be certain about is that the future is uncertain,” he said.

Tim sees the world as TUNA ––turbulent, uncertain, novel and ambiguous –– and set about explaining why. A series of charts of various metrics did the job, with ever ything from inflationary pressures to economic growth either soaring to eye-watering highs or plunging into the abyss, depending on which you want to get more depressed about.

“Farmers will want to hedge against these risks,” he concluded, “so should plant breeders be looking for different targets?”

Paul Gosling championed the role of the AHDB Recommended Lists in making ‘the grade’, pointing out they’re a good “starting point” for growers. “The challenge

is to stay relevant with diversifying production systems. Everyone wants trials for their own system, but we simply don’t have enough trials.”

Digital was highlighted in the discussion that followed and heralded the second D of the day. “Is there a role for big data?” asked Dr Bruce Pearce of Garden Organic, noting the vast and varied datasets that services, such as the RL, produce that can be analysed against an increasing array of on-far m data.

“There’s so much knowledge, it’s a question of centralising that, which will help far mers understand what works in their own system,” noted Jen Bromley of Vertical Future.

Paul suggested growers “take the RL as a starting point and trial varieties in their own farming system.”

Farming

18 crop production magazine december 2022

What we want is the marriage of farmer-led innovation and digital analytics.

“ ”

systems that encourage diversity have a critical role to play,said Jo Lewis.

Plant breeding

While this may help incremental change, enabling plant-breeding for the future has a more fundamental barrier, highlighted by Bruce: “We’re trying to turn a tanker in a canal –– there’s a lot of conservatism in the industry,” he said.

This was a point picked up by Liz Bowles of the Farm Carbon Toolkit. “But do we know the direction it should go? If we can’t decide, it’ll be very difficult to turn it.”

Liz illustrated the need for change by pointing out that 40% of arable farming’s greenhouse gas emissions stem from its use of synthetic fertilisers. “We have a system that incentivises varieties that respond to fertiliser, and not those that grow their roots.”

Questions were raised over how the UK’s Plant Variety Rights (PVR) system can be improved to increase diversity. “It’s a system that very successfully increases choice to growers,” responded Sam Brooke of the British Society of Plant Breeders.

“It’s worth noting that where there is a good system, like PVR, we see more open-pollinated varieties, while where there is not, breeders tend to invest more in hybrids to protect their intellectual property. But there’s a lot of data that sits behind PVR and perhaps we should be making more of that –– we have the right tools to

There simply aren’t enough trials for everyone,so growers should use the RL as a starting point and trial varieties in their own farming system.

make it work better for us.”

Prof Tom MacMillan of the Centre for Effective Innovation in Agriculture looked in more detail at how research and innovation could be done better. He highlighted the UK’s low total factor productivity (TFP)

Genetic Technolog y Bill opens route for gene-edited crops

Legislation currently passing through Parliament will pave the way to allowing the commercial release and marketing of gene-edited crops and animals in England. The Genetic Technology (Precision Breeding) Bill has a new definition for a precision bred organism (PBO) that will no longer come under the tight restrictions required for a genetically modified organism (GMO).

Under the new legislation,plants and animals will qualify as PBOs if: ● any feature of their genome has come from modern biotechnology,which covers all organisms previously classed as GMOs,and ● ever y feature altered is stable,and ● every feature of their genome could have resulted from traditional breeding or natural transformation.

“We’re very keen to ensure that transgenes are removed from plants marketed as PBOs,but plants containing cisgenes maybe classed as PBOs,”said Louise Ball,GMO science and regulation adviser at Defra,speaking at the BSPB AGM (see panel on p21).

‘That’s not to say that GM legislation is fit for purpose for organisms not classed as PBOs.In our public consultation on genetic technologies, Defra set out its intention to carve out PBOs first then consider the case to regulate GMOs better.”

.”The Bill won’t drop the regulation on PBOs completely –– there’s still a requirement to notify the Defra Secretary of State,provide

evidence that it qualifies as a PBO,and this information is then held in a register.The Food Standards Agency has powers to include traceability measures.

Two distinct notification systems will be introduced: firstly for material going into field trials for research purposes only,not currently intended for commercialisation. These were relaxed earlier this year,allowing gene-edited crop trials to take place without the GM restrictions that most research organisations found prohibitively expensive.

The second form of notification will be for crops destined for commercialisation.

Extra authorisations will be required for precision-bred animals to ensure genetic changes haven’t caused differences that may result in welfare issues.And new powers in the Bill will come in to regulate food and animal feed derived from PBOs.

“The new Bill only applies to England,and devolved administrations haven’t yet made any changes to how GMOs are released to the environment,”noted Louise.

Scientists,such as director of the John Innes Centre,Prof Graham Moore,have generally welcomed the new legislation.“It will allow us to help UK farmers grow higher yielding,more resilient crops,and provide consumers with food that is healthier for them and the environment.”

NFU deputy president Tom Bradshaw noted the new Bill should ensure public confidence,

The new Bill classes plants as a PBO if any feature of their genome has been altered with modern biotechnology but where this could have happened naturally.

enable diverse and accessible innovation,and allow investment in products for the UK market. “We know gene editing is not a silver bullet. But if we are to make this a success,any new government regulation must be robust,fit for purpose and based on sound science.”

But the Soil Association is among organisations opposed.“History has proven that GM only benefits a minority of big businesses with a major rise in controlling crop patents and unwelcome,profitable traits such as herbicide-resistant weeds,” says Jo Lewis.

“The Bill must also establish clear safeguards for farmers,including organic farmers,and citizens who choose non-GM to ensure protection from cross-contamination.”

19 crop production magazine december 2022

There are vast and varied datasets that can be analysed against an increasing array of on-farm data.

▲

Plant breeding

Farmer groups should be stepping up to help researchers answer the complex,real-world questions that matter on the ground.

growth for agriculture, against a relatively high public expenditure. “In the OECD, only Belgium spends more and has less innovation to show for it. There is an innovation gap –– the research investment isn’t relevant enough to what farmers actually do.”

Tom, who founded Innovative Farmers during his time with the Soil Association, believes greater farmer involvement is the key to better alignment. “What we want is the

marriage of farmer-led innovation and digital analytics. Researchers often dumb down their methods when they work with farmers. We should be doing the opposite, stepping up to answer the complex, real-world questions that matter on the ground.”

He introduced the third D of the day ––decentralisation. “We have this dream where researchers, farmers and everyone team up more effectively –– a kind of big tent. Whereas the way it works at the

moment is more like after a music festival, with lots of little tents strewn about the place. So it’s encouraging to see Defra and UKRI’s Farming Innovation Programme recognise the value of farmer-led research. But the devil’s in the detail –– we should take care how risk is shared against who gets the rewards.”

Liz noted the potential value of farmers’ data to enrich research projects and provide a good, sound grounding from which to test innovations. “Experience with Innovative Farmers shows that arable farmers often have more sophisticated ways to measure yield effects than some researchers. So farmers have a lot more to bring to the table than perhaps they’re given credit for.”

Prof Katherine Denby of the University of York noted plant breeding doesn’t necessarily need more public funding, just better targeting of existing resources. “We have long projects that take at least five years to get results, which don’t suit the three-year model of a typical public-funded programme. But work may only be carried out in certain months of the year.”

Summarising the elements that make plant-breeding fit for the future, Jo added a

▲

GMO or PBO?

Any process that involves the introduction of foreign DNA or RNA classes the resulting product as GMO.But there are a number of ways through which a plant can undergo a genetic change:

Transgenesis is where DNA from another species has successfully been combined into the genome of the host plant.This confers a new trait,such as herbicide tolerance or longer shelf life.These organisms are universally classified as GMOs.

Cisgenesis is where DNA is artificially transferred between organisms of the same species,such as from a wild relative to an elite potato variety to confer blight resistance.In the UK at least,if this change could have happened naturally,this may now class the plant as a PBO, but it is considered a GMO in Europe.

Mutagenesis is a change or edit in the plant genome that confers a new trait.Such mutations occur naturally every day,when a plant comes

fourth D –– derisking. “Diversity remains key, and it’s a way to hedge. We must decentralise, making research more participatory and farmer-led to make it

under stress,for example,or it can be induced through human intervention.A small change in the genome may switch off the activity of a particular gene which allows or inhibits a property,and it’s these phenotypical changes breeders have sought out for generations to progress their lines.

For decades,scientists have induced mutagenesis to bring about new traits,using chemicals or radiation,and the Clearfield trait is an example.This is classified as traditional ––neither GMO nor PBO.

More recently,though,more precise geneediting techniques such as CRISPR-Cas9 have been introduced.CRISPRs are short RNA sequences introduced into the host plant that recognise a specific stretch of genetic code. Cas9 enzymes partner these sequences and cut the host DNA at specific locations.

The cell tries to repair the damage,and that’s when the mutation occurs.By using different

A genetically edited plant must contain no foreign transgene to be classed as a PBO.

enzymes and techniques,researchers can deactivate or alter –– edit –– specific parts of the genome,thereby conferring traits.

It’s this technique that previously resulted in an organism classed as a GMO,specifically because foreign RNA is introduced to make the edit.But this transgene is usually crossed out in the next generation.So organisms edited by CRISPR and free of any foreign RNA will now be classed as PBOs.

relevant. And we must harness digital to manage the complexity of that challenge in a cost-effective way.”

But the industry battles against

short-termism and inconsistency, both in policy and funding, she noted. “We can’t wait for our leaders to lead. Collaboration and co-development show the way ahead.” ■

Plant breeding

Insider’s View

Brew-only spring barley varieties don’t come along that often and although it’s only currently provisionally approved by the Malting Barley Committee (MBC), Skyway appears to be carving a path for itself. CPM finds out what elevates it from other spring barleys.

By Melanie Jenkins

While Laureate and RGT Planet remain firm favourites with brewers,hard on their heels is new variety Skyway. As well as an improved yield,with the second highest on the AHDB Recommended List at 105% of control,Skyway offers a step up in quality.

According to John Miles of Agrii, it was both Skyway’s yield and grain quality which really shone during trials. “Within our data set it was hard to ignore because of its yield potential and grain quality, which are hugely important characteristics for brew-only spring barley varieties.

“We often find that when breeders are pushing yields, they create more grain sites and this can be detrimental to specific weight, but with Skyway there’s something unique because it has both strong yields and high specific weight.”

Skyway is one of the lovechildren hailing

Taking the Skyway

from a union between Agrii, Nordic Seed and Throws Farm in Essex, which started in 2011, explains his colleague Colin Lloyd. “It became clear there was an opportunity to work together in the UK. After further meetings and visits to Nordic Seed in Denmark in 2012, the decision was made to start looking at early lines here to test their performance.”

Stow Longa trials

The first stage of this partnership involved winter wheat, but by the spring of 2013 several lines of spring barley were introduced the year prior to NL 1. “Great strides were made over the next few years under the watchful eye of Colin Patrick, seed trials manager at Throws, before Agrii entered Skyway into the National RL system,” says Colin.

One of Agrii’s aims while trialling the variety has been to determine its ability to combat blackgrass. “Skyway featured at the Stow Longa blackgrass site in 2022, being one of six blocks in the on-going rotations trials which is now in its eighth year.”

Having switched one rotation block to Skyway to assess its competitive effect on blackgrass populations, Colin was really pleased with the results. “It produced the highest gross margin after cultivations, drilling and all inputs when compared with the other blocks, which included winter beans, second wheats and spring oats.

“The ploughed area within this work led to a margin of £1537/ha, which was £200/ha more than either of the two second wheat blocks with the same cultivations,” he explains.

“There is no doubt that spring barley in

“ ”

Skyway provided us with some of the best samples of barley we saw last har vest.

the rotation helps greatly in the blackgrass battle –– better than second wheat –– and Skyway was easy to manage agronomically in this experiment, with no lodging or brackling.”

Skyway scores a 7 for resistance to lodging on the RL and has an 8 for brackling, confirms John. “Admittedly, we’ve seen less brackling than in previous years –– except in the West. We’re expecting its score to drop to 7. However, we believe the

22 crop production magazine december 2022

John Miles says that both Skyway’s yield and grain quality has shone during trials.

lodging score will remain the same, based on the data this year.”

Looking at Skyway’s characteristics, John points out that powdery mildew isn’t an issue as, like all new spring barley varieties, Skyway has the MLO gene which is effective against all races of the pathogen.

It scores 4 against brown rust which is lower than its rivals but its rhynchosporium score is rated 7 –– similar to Laureate, he admits. “It’s not the very cleanest of varieties, but realistically it’s Laureate and Planet we’re comparing it with. There’s no hiding the

scores but it comes back to yield, which is at least three percentage points higher than the two market leading varieties.”

But he believes this is enough to attract growers to it. “Spring barley is a lot easier to look after than winter wheat and while it might have a lower brown rust score, you should look at this in the same way as brown rust in wheat –– keep it out at T1, keep it clean.”

The yield and grain quality will also attract the attention of feed barley growers, adds John. “The combination of straw length and high tiller number should provide good straw yields.”

Agrii colleague Mark Glover has had farmers with Skyway for the past two years and notes the variety has been straightforward to grow. “It’s got a good lineage with Planet as a parent and I haven’t found any particular weaknesses in terms of disease, which is good.”

In Agrii’s direct drilling trials,Skyway has demonstrated a 0.6t/ha yield advantage over Planet.

Standing the test

Having an early maturing spring barley is a vital cog in the machine that is Freya Morgan’s farming enterprise.Working around 1500ha of owned, rented,share,contract and collaboratively farmed land near Huntingdon on the Bedfordshire/ Cambridgeshire border with her son Joshua, it’s important that crops fit together to enable them to manage the workload.

Growing winter wheat, winter barley,spring barley,winter oilseed rape (when conditions allow) and winter beans,Freya uses spring barley to take some of the pressure off in the autumn.“We’ve always grown spring barley to ease autumn management and because we’re on heavy clay and blackgrass can be quite a big problem. It’s really helped us get it under control,on the whole,and has been a really good cashflow tool.”

But when it comes to har vest, the crop tends to come ripe when she’s in the middle of combining winter wheat. “We grew Laureate before and it would end up brackling, with quite a lot of heads ending up on the floor if we couldn’t har vest it on time.”

So when her agronomist asked her to grow Skyway,Freya was interested to try it.“We first put it in the ground in spring 2021 so we could compare it with Laureate. Skyway stood up, didn’t brackle and was really straightforward to

The seed crop Mark managed last year was direct drilled behind grass and didn’t get the kindest start, but despite this it got away very nicely.

“In some ways it was a boring variety to grow. It has a robust agronomic package ––

Skyway is one of the lovechildren hailing from a union between Agrii,Nordic Seed and Throws Farm in Essex,says Colin Lloyd.

it’s brackling resistance looks pretty good, lodging resistance with a little PGR applied is decent, it’s not overly tall and it’s neither early nor late,” he explains. “Skyway’s yield potential compared with the control is up 4-5% and its specific weight is better than most.

“It’s also pretty consistent in the East or ▲

har vest.” Because of this, she decided to grow 100% Skyway in 2022 and plans to do the same in 2023.

Ahead of drilling, the ground is lightly subsoiled in the autumn before being tined and left stale over winter to get a good blackgrass kill. “Ideally we direct drill with a 6m Kverneland tine drill into the stale seed but,if need be,we cultivate in the spring ahead of drilling,” she says.

“We drill seeds at about 200kg/ha and use 120kgN/ha and 30kg SO3/ha.It’s a relatively cheap crop to grow and because it was so dry this year,we only spent £16/ha on herbicides, £10.50 on fungicides and £8/ha on trace elements. But each year the weather is different, so we tr y to utilise the characteristics of each variety.For example,Skyway has a 9 for mildew and a 4 for brown rust.”

At har vest Skyway really stood out, she notes. “It stood up and didn’t brackle.This meant we could prioritise cutting winter wheat if we need to get the quality and leave Skyway a bit longer before cutting it.This helps keep our work rate up and our combine operator is happy that it’s easy to har vest. Even the man who bales the straw really likes it,claiming that it doesn’t smash up,”explains Freya.

Skyway achieved yields of 5.5-6.5t/ha, with grain nitrogen ranging from 1.59% to 1.79%

Freya Morgan was really pleased with the Skyway’s yield,especially considering the crop had no rain after it was drilled.

and specific weights averaged between 66.3kg/hl and 69.9kg/hl in 2022. “We were pleased with the Skyway,especially considering the crop had no rain after it was drilled,”says Freya. “The sample had a nice bold grain, low screenings and coped well in the extreme heat.”

Freya’s Skyway is grown on contract and has gone for malting the past two years. “It has a nice little premium on it and the maltsters seem happy with it,so hopefully it’s got a good future going forward.”

23 crop production magazine december 2022

Insider’s View

Skyway scores a 7 for resistance to lodging on the RL and has an 8 for brackling.

▲

the West, which is an advantage for both the breeder and the farmer –– especially with our unpredictable seasons. This gives the variety a good robustness,” adds Mark. According to John, a lot of spring barley is being used in direct drilling situations at the moment. “There’s a bit of commentary about the sustainability of varieties for direct drilling, so we thought it was sensible to look at how Skyway’s habit suits this situation. We had seven strip trials last spring and results so far, from six of the trials, show that Skyway averaged 0.6t/ha more in yield compared with Planet. Its performance really stuck out in a direct drilled situation.”

As far as market potential goes, Tom Eaton of Viterra believes that Skyway has scope, both in terms of on-farm

performance and for maltsters. “The growers we’ve spoken to have all been very positive and want to grow more for Harvest 23 and beyond.

“We’ve sent small samples to maltsters to trial and the feedback from them is good,” he says. “The expectation is for the variety to get full malting approval in the second quarter of 2023. If it gets this, I think it’s likely that Skyway will take market share from other staple varieties as it will definitely be supported on farm. And it looks as though there could be good premiums available for next harvest.”

Boortmalt has been trialling Skyway for the past few years and feel it could provide a successor to Planet, according to the firm’s Jonathan Roberts.

“We favour standalone, brew-only varieties, and at the moment that’s Planet but we see

Direct drilled farm strip trials yield difference between Skyway and RGT Planet

0.9 0.8 0.7 0.6 0.5 0.4 0.3 0.2 0.1 0 Cambridgeshire Dorset

Dorset Hampshire Keny Somerset Wiltshire

Source:Agrii,2022

Skyway at a glance

dual-purpose varieties, so Skyway bucks this trend.

“Skyway provided us with some of the best samples of barley we saw from harvest 2021, in terms of tests and analytical parameters,” he explains. “It looked good, and the maltsters were very happy with how it performed throughout the process. We’ve built on the couple of hundred tonnes we had last year and now have more from Harvest 22 that we will begin to take in from January. If Skyway continues to produce positive results, then we will look to build on this.”

Although Skyway looks like it could take market share from other mainstay varieties, Jonathan feels that Laureate will remain the market leader. “I think Laureate will continue to be the biggest variety but, for us, it’s important not to get into a monoculture of varieties. It’s good to have options, of which Skyway could be one in the future.”

like Planet and Laureate.”

Skyway as a variety that could replace it. There aren’t many brew-only varieties coming down the track as there seems to have been a decision by breeders to pursue

Mark agrees that Skyway could potentially take market share from the more established varieties. “It’s the end market which will determine whether Skyway gets traction or not –– even if it has the best qualities for the grower, such as yield and standing ability. But if the demand is there from maltsters, it could take market from established varieties

Because of its performance, Boortmalt is a keen supporter of Skyway getting approval, says Jonathan. “If its performance stays positive, Boortmalt will deliver a report to support the approval process. The variety could be a useful option for southern farmers to avoid cropping moving towards varieties that can only be exported.” ■

Yield (% treated controls) UK treated104.6 UK untreated94.0

treated106.2

Grain Quality Specific weight (kg/hl)69.4 Screenings (% through

mm) 0.9 Nitrogen content (%)1.5 Agronomics Resistance to lodging without PGR

Straw height without

Ripening (+/-KWS Orwell)+1 Disease resistance Mildew 8.8 Brown rust 4.3 Rhynchosporium 7.0

East region

West region treated106.1 North region treated102.2

2.25

6.5

PGR (cm)74.5

Source:AHDB Recommended List,spring barley 2022/23.

Mark Glover feels that Skyway could potentially take market share from the more established varieties.

Insider’s View

Eggs and beans

Pulse Progress

Growing beans has a multitude of known benefits, be it improved soil health or retained nitrogen for the following wheat crop,but what about replacing soya in laying hen feed to produce a carbon neutral egg?

CPM investigates.

By Melanie Jenkins

With COP27 only just wrapped (at the time of writing), the conversation surrounding cutting carbon emissions is as sharp as it’s ever been. One farm in Scotland has taken it upon itself to reduce its carbon emissions and attempt to produce a carbon neutral egg.

Arable far mers could play a crucial role in decarbonising egg production, with the farm in question cutting its use of impor ted soya by adding beans to its arable enterprise.

Rotationally, beans and peas are underutilised in the UK, states Roger Vickers of PGRO. “About 4% of the UK’s arable cropping area is used to grow pulses. When these are included in a

rotation, it’s sensible to have them one in ever y five years, meaning 20% of the cropped area could potentially be pulses.

“One of the upsides of legumes is that they don’t require any nitrogen fertiliser and can help to produce a higher yield ––of anything up to 1t/ha –– in the subsequent wheat crop,” he says. “This comes from improved soil fer tility and the N left behind by the crop, which averages around 70kgN/ha –– but this can vary significantly.”

Bean benefits

As well as residual N, the interaction of root exudates with minerals in the soil helps to release them into a more readily available form for the following crop, explains Roger. “There’s also a very strong mycorrhizal association with pulses.

“Growers often comment on how nice seedbeds are after the crop, which can mean fewer cultivations are needed, easier preparations, reduced machine use, lower diesel consumption and minimised impact and damage to soils as a result.”

And in terms of marketing, the largest outlet for beans in the UK is for livestock feed, but a new market could potentially be opening up for human food ingredients. As producers look to cut their carbon emissions this has driven them to assess feed inputs, with soya beans standing

out as a prime candidate for substitution due to their environmental impact from deforestation in South America, says Roger

“I think there’s a massive opportunity for domestically grown beans and peas as a substitute for soya in livestock feed,” he explains. “But such is the volume of soya that’s consumed in the UK that we couldn’t replace all of it with homegrown pulses. Soya meal also has a much higher protein content than pulses, so it wouldn’t be