Requiem for a hemp association

CBD NOW

It promised health and wealth—then nearly wrecked the hemp industry. But the molecule isn’t done yet.

Who’s still standing

Public companies struggle but hold on Europe out front

UK’s $2 billion market advancing

Meloni’s War

Italy’s unjust crackdown on flowers

The latest research

CBD for autism and epilepsy

Kehrt Reyher

Editor & Publisher [Europe]

Steve Allin

Carringer Business

Reyher

SENIOR ADVISORS

International Hemp Building Association

Richard Rose

The Hemp Nut Consultancy; CannaCoach, USA

Boaz Wachtel

Roots Sustainable Agricultural Technologies Ltd., Israel

Boris Baňas

CBDepot Czech Republic

Wolf Jordan †

Wolf Jordan & Co. Belgium

NORTH AMERICA

Daniel Kruse SYNBIOTIC SE Germany

Hana Gabrielová Hempoint Czech Republic

Sanford Stein Cannabis Law LLC USA

Tony Budden Hemporium South Africa

Rachele Invernizzi SouthHemp Italy

GLOBAL ADVISORS

Robert Clayton Fi Bear, Inc. Florida, USA

Carl Martel

ABBRI Canada

Robert Ziner

Advanced Bio-Material Technologies Toronto, Canada

Mike Leago iHEMPx Colorado, USA

Pamela Bosch

Highland Hemp House Washington, USA

Paul J. von Hartmann California Cannabis Ministry USA

Joel T. Bedard

Ashnan Resource Management Vermont, USA

Caren Kershner

EUROPE

Sergiy Kovalenkov Hempire Ukraine

Rafael Dulon Hanf Farm GmbH Germany

Monika Brümmer Cannabric/CANNATEKTUM Spain/Morocco

Marcin Krzyzkowiak CannArch Poland

Marijn Roersch van der Hoogte MR Hemp, Germany

Debora Paulino

Obelisk Farm Portugal/Latvia

Nando Knodel CarbonConnect Germany

Heinrich Wieker

HHH Hemp Harvesting Technology Germany

Herbal Extraction Resource Specialists Colorado, USA ASIA

LATIN AMERICA

Diego Bertone

Hemptech Argentina

Lorenzo Rolim da Silva

Latin-American Industrial Hemp Association Brazil

Karen Viviana

Castaño Coronado

Latin-American Industrial Hemp Association Colombia

Dhiraj & Nivedita Shah Shah Hemp Inno-Ventures Nepal

Riki Hiroi Each Japan, Inc. Japan

Yosuke Koga Prossimo Japan

Harumi Kikuchi

Hokkaido Industrial Hemp Assn. Japan

Muhammed A Quayyum Fytocina Spain/Pakistan

Driving Sustainable Growth and Innovation Across the Value Chain

High-Growth Markets. Untapped Potential: Building the future of the European cannabis industry.

Pioneering the MedCan Landscape:

Expanding access through alternative dosage forms.

ADVERTISING 03

Tripling Revenue. Turning Profit: Scaling fast, building a business that lasts.

SYNBIOTIC SE, Germany ID SBX | ISIN DE000A3E5A59

Contact us at IR@synbiotic.com for exclusive investor opportunities.

Profitable by 2025: Revenues over €45M by 2027. Sustainable growth built on efficiency and vision.

Hemp dreams, hard truths

Why I’m giving up my noble venture into the CBD business

By Steve Groff

Like many other farmers, I saw dollars dancing in my head when industrial hemp was legalized here in Pennsylvania on December 20, 2018. I had been preparing for that day since 1999, when I was first introduced to the idea and value of growing industrial hemp. Then, in 2016, a friend of a friend from Colorado stopped in at my farm and told me that once hemp is legalized, he wanted me to grow CBD hemp for him. Inquisitively, I asked, “What is CBD hemp?”, as I had never heard of it. He explained about CBD and the dozens of other cannabinoids that cannabis plants produce. I was intrigued and immediately took a crash course to learn about the numerous medical benefits this cannabinoid has to offer. Hemp was then legalized, and I immediately began my roller coaster journey into the CBD hemp business!

Life changing profits?

Rumors were rampant about the potential life-changing profits. I did the math and projections many times over, and even the worst-case scenario would be profitable. I had three CBD hemp contracts with processors worth over $2 million. I was going to be able to pay off debt and have fun growing a new industry! But, as most of you can probably guess, not one penny of those contracts was honored.

Then we heard of clever social media experts who found workarounds to reach the masses with our message, even though we were selling CBD products. After spending thousands of dollars on these self-proclaimed social media gurus, we still hadn’t cracked the code for strong online sales. We were eventually able to garner a small but loyal group of customers; however, this did not generate enough profits to recoup past investments. Operating in the red is not fun, especially when you don’t see a light at the end of the tunnel. Our partners had to take other jobs as our CBD business did not generate enough revenue to support our financial needs. In 2024, we put our CBD business up for sale.

Over several months, we received a few serious inquiries that progressed to the point of inking a deal, but ultimately, they pulled back, stating that a small CBD business is too risky as a profitable entity. Currently, there are very few small CBD businesses that are still operational.

I had always expected to launch my own CBD brand, having successfully launched other brands over the years. However, the plan was expedited when I realized I’d have to take the bull by the horns and embrace the process of extraction, manufacturing, branding, and marketing the finished product, as I did not have a home for the 60,000 lbs. of CBD biomass I’d grown.

A compelling story

We collaborated with friends to form a partnership and establish our brand, Cedar Meadow Farm. Our plan was to leverage our experience and sell our products online since our product was high value and shipping costs were negligible. In addition, we assumed our presence on social media would be a low-cost and effective way to educate potential customers and subsequently make sales. We also had a very compelling story of how our CBD was grown in healthy soil using regenerative agriculture principles. In addition, we were family-based with our product being grown, processed, and shipped locally.

The theory was noble, but what we did not anticipate was the crackdown that social media imposed on items for sale that are not FDA-approved, such as CBD products. Not only that but mentioning the word “hemp” in any part of a social media post or landing page would relegate us to being shut down and treated like an unlawful drug dealer. And that happened four times! Apparently, most social media platforms considered hemp to still be a category one drug.

Dark foreshadowings

As I reflect on the past six years, there are a few aspects that foreshadowed a doomed effort like this. First of all, I acknowledge that I did not conduct thorough research to determine how many bottles of CBD oil can be produced from one plant. Simple math would have indicated that the expected planting of tens of thousands of acres of CBD hemp in 2019 would have made many times over what the actual demand was estimated to be.

Secondly, it should have been required to conduct random third-party testing on the finished product. There have been several instances where there was not one milligram of CBD in a bottle that was branded as containing CBD. This has hurt the industry’s integrity, as some customers have rightly noted they did not experience any benefits from using the product. Thirdly, and this is also due to a lack of regulation, it should never have been allowed to sell CBD products in gas stations. It devalues the medicinal value CBD has to offer. It also tends to be a cheaply made option, which makes it challenging to compete on price for smaller, high-quality brands.

Good luck

In light of all this, I am getting out of the CBD business and am now focused on industrial hemp. Yes, there are similarities to CBD hemp in that it’s a nascent industry. However, it does not have a “get rich quick” vibe, which will set the foundation for developing a healthier industry.

I commend the few remaining small-scale CBD businesses that have managed to survive and wish them all the best as they navigate the challenges ahead.

Steve Groff is the owner of Pennsylvania-based Cedar Meadow Farm, and the author of The Future-Proof Farm: Changing Mindsets in a Changing World

RICHARD ROSE

Does hemp’s right hand know what its left is doing?

For years social media platforms shadow-ban our posts, and sometimes outright ban us altogether. But so does “our” side. With everyone in their own little siloes, hemp’s right hand doesn’t know what the left is doing, and rarely even acknowledges its existence. With a 95% drop in U.S. acres over five years, there appears to be no imperative for success, too much grant and institutional money at play. Despite grain for food being hemp’s best chance for global success, rivaling the soybean industry, my articles on it are often met with surprise even among hemp fans.

Biggest obstacle

Since the beginning, the “hemp = fiber” mindset has long been the food side’s obstacle among hempsters. For instance, it would be natural for the hemp building industry to incorporate more lifestyle considerations in their movement, after all, don’t their hemp houses have kitchens? And many hemp associations are so focused on the easier aspect, fiber, to the exclusion of grain despite the symbiosis of the two.

Building walls is nice but feeding people is a noble calling, and people eat daily. Despite not even being fully legal yet, hemp grain for fodder gets way more attention from the Universities with hemp programs than the one segment long with the most consumers, retailers, sales and profits: grain for food. The irony is compounded by the fact that including hemp grain for food in their programs would allow them to expand to include other post-ag harvest school departments, such as nutrition, food process engineering and operations, food product R&D, marketing and communications, package design, etc. Consumer packaged foods, medical foods, industrial food ingredients... the market is huge and needing replenishment daily, yet ignored. The new medical and nutritional discoveries in the seed monthly, the potential for hemp grain as a legitimate food ingredient is vast, rivalling soya.

Petty fears

While the hemp industry pre-2018 Farm Bill was built on cooperation, the post-legalization hemp industry is being destroyed by ignorance and petty fears of competition. Has any media, university, expo speaker, or association told you that USDA has been publishing the prices of hempseed foods every Friday for years, with a link so you could read them yourself? Didn’t think so.

Yes, hemp grain for food is just that big, yet is mostly supplied by companies in China and Canada. “Made In USA” hemp grain could easily take that market share, giving the retailer a red, white and blue halo that can build on the hemp seed’s huge success story keeping the industry alive in the dark years a generation ago. It’s also the easiest way for a visionary company to “get into hemp,” or for an entrepreneur to start; no farm, factory or finances needed.

Millions of consumers, thousands of retailers, fat margins, global sales, near 100% addressable market renewed daily. . . .yet only crickets from those who demand the right to educate us. No wonder acres are down 95% while they pat themselves on the back.

Nice threads, Emperor.

The author writes and produces The Richard Rose Report

BUILDING

3 - 5 October 2025

Lower Sioux Indian Community Morton, Minnesota, US

BRAD TRUMAN

Honest numbers can help reshape hemp’s public image

Transparency and honesty are essential values in any business, but they are particularly critical in the hemp industry. Hemp continues to struggle with outdated misconceptions due to its association with cannabis. This persistent image problem demands that hemp stakeholders commit to higher standards in data collection, business practices, and communication with consumers and regulators.

Accurate, well-presented data is central to this effort. To build credibility and trust, the hemp sector needs a strong foundation of facts that clearly define its size, scope, and potential. Reliable data allows stakeholders to understand their position in the supply chain, identify trends, and make informed decisions. It also helps attract investment, guide public policy, and strengthen consumer confidence.

Not there yet

Developing meaningful data begins by understanding the audience that will use it. In hemp, this includes farmers, processors, investors, regulators, and consumers. Each group needs different kinds of information, but all rely on fundamental industry truths. For mature industries, dependable sources of performance metrics have evolved over time. Hemp is not there yet. What it needs now is clear, accurate information in a concise format that is both accessible and actionable.

A logical starting point includes gathering statistics on imports and exports, acreage planted and harvested, and the number of active companies in various sub-industries. Understanding the location and capacity of processing facilities is also vital. These basic facts would create a clearer picture of the supply chain and support data-driven decisions across the industry.

One major challenge is the lack of consistent and dependable data. While organizations such as the USDA have some authority and recognition, their hemp-specific data remains incomplete. Encouraging consistent participation in surveys and data-sharing initiatives is critical. If companies and producers respond honestly and regularly, the resulting information would benefit the entire sector—particularly in the U.S.

Long-term payoff

Building a reliable data infrastructure will require time, effort, and collaboration. Farmers, processors, industry groups, and government agencies must work together to create accurate reporting systems. The long-term payoff is substantial. Better data will help position hemp as a transparent, trustworthy, and forward-looking industry with strong economic and environmental contributions.

Data also dispels myths and enables the industry to measure progress and establish benchmarks. It fosters accountability and promotes best practices. In a world where information is power, the hemp industry must be able to clearly show what it does, how it does it, and why it matters.

Ultimately, transparency and reliable data are about more than just statistics. They shape the public narrative of hemp as a legitimate part of agriculture and manufacturing. By committing to honest, cooperative data collection, the hemp sector can overcome stigma, boost credibility, and unlock its full potential.

The author is a research analyst at U.S.-based Canna Markets Group

High-Throughput Fibre Decortication Line Fully Operational at CTC

The Cretes Technology Centre (CTC) has launched its upgraded fiber cleaning line, now fully operational and ready for demonstration. Designed for both hemp and flax, the system delivers higher throughput, less downtime, and greater reliability—offering stakeholders a real-world view of advanced fiber processing in action.

Integrated Design for Efficiency and Quality

The decortication line has been redesigned for higher throughput and now includes a new fiber cleaning stage, creating an end-to-end process from raw stalks to cleaned fibers. The system removes nearly all core content—achieving fiber purity below 1% and resulting in finer fibers. The line is built for easy maintenance and modular adjustments, allowing efficient runs across various input materials.

Versatile Testing and Development Platform

More than a showcase, the CTC serves as a handson development hub for fiber processing. Manufacturers and researchers can run tests with various hemp and flax inputs, optimize settings, and evaluate performance under real-world conditions. The facility supports industrial-sized trials, process refinement, and ongoing technology development in close collaboration with Cretes engineers.

Interested in seeing the new fiber cleaning line in action?

Demonstrations are now being scheduled at the CTC. Interested parties can book a demo via info@cretes.be.

“The hemp industry is still maturing, and the biggest gaps right now are in processing and fiber quality.”

Miles Gathright CO-FOUNDER, BOARDWURKS

Fiber forward

Regional sourcing and next-gen composites drive Boardwurks’ growth strategy

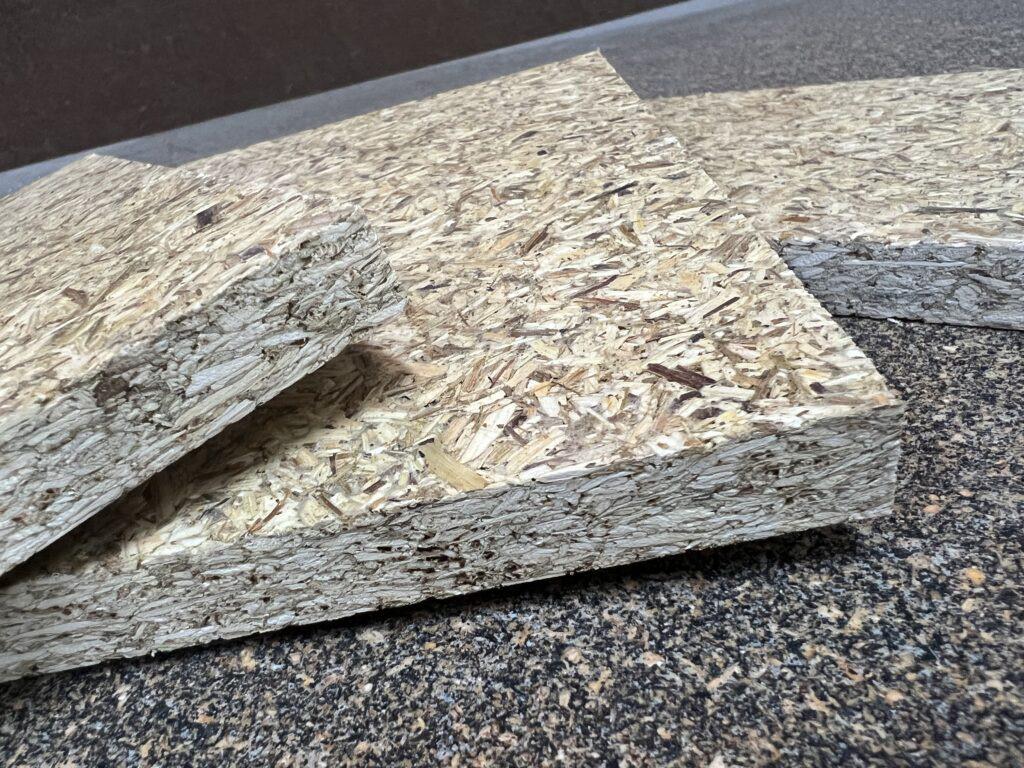

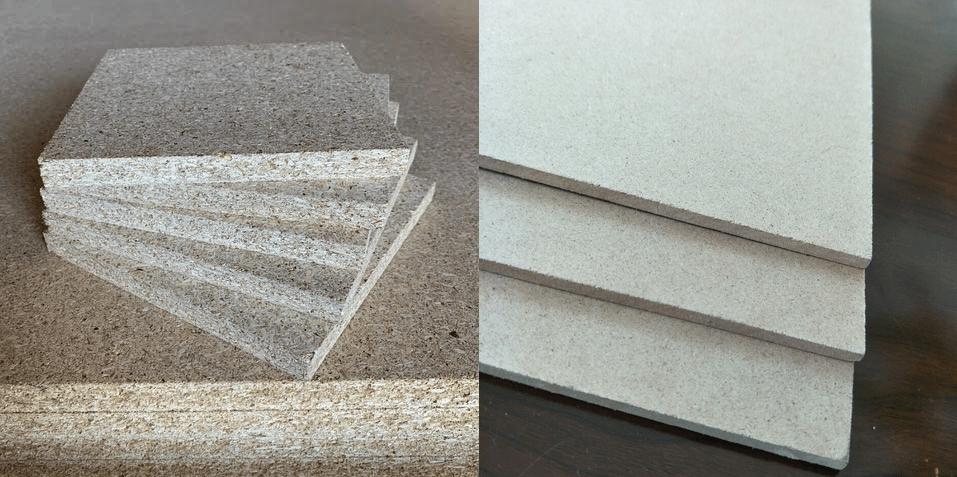

MILES GATHRIGHT is co-founder of Boardwurks Biocomposites, a Florida-based innovator developing carbon-smart construction panels made from hemp hurd and recycled composites. With more than two decades in the performance composites industry, Gathright brings deep technical expertise and a sustainability-first mindset to the challenge of replacing conventional materials with natural, circular alternatives.

HempToday: Boardwurks is clearly rooted in sustainability. What problem were you trying to solve when you started the company?

Miles Gathright: Boardwurks was founded to address a critical gap in sustainable construction materials. Traditional composites and building panels are heavily reliant on fossil fuels and toxic adhesives, contributing significantly to carbon emissions and landfill waste. We saw an opportunity to turn waste into value by upcycling decommissioned wind turbine blades, derelict fiberglass from marine vessels, and agricultural byproducts like bagasse and corn stover. We also focused on purpose-grown sustainable crops like hemp, kenaf, and miscanthus, which not only sequester carbon but thrive with low environmental impact. Our mission is to transform these waste streams and sustainable fibers into high-performance, carbonsmart construction materials that challenge conventional particleboard and MDF in both durability and sustainability.

HT: You’ve worked in composites for more than 20 years. How did hemp enter the picture?

MG: Hemp entered the picture as part of our commitment to finding sustainable and renewable feedstocks that perform. Its exceptional strength, rapid growth cycle, and ability to sequester carbon made it an ideal material for our composite panels. When we looked at decarbonizing our footprint without sacrificing performance, hemp stood out as a perfect solution. Integrating hemp hurd into our thermocompression process allowed us to produce panels that are stronger, lighter, and far more sustainable than conventional alternatives.

HT: The hemp sector often struggles with quality and supply consistency. How are you managing those challenges?

MG: We’ve tackled this head-on by establishing long-term partnerships with decorticators and farmers. Our supply agree-

ments prioritize quality control and sustainable farming practices. We also diversify our sourcing with a regional strategy: partnering with processors in areas where hemp production is stable and growing. This layered approach ensures we maintain consistent quality and supply, even during market fluctuations.

HT: From a sustainability perspective, how does Hempboard compare to traditional particleboard or MDF?

MG: Hempboard sets a new standard for sustainable construction. Unlike traditional particleboard or MDF, which rely on formaldehyde-based adhesives and fossil-fuel-derived resins, Hempboard is made with natural fibers and eco-friendly binders. It’s formaldehyde-free, water-resistant, and stronger per weight. Additionally, the hemp we use sequesters significant amounts of carbon during its growth, making Hempboard not just carbonneutral, but carbon-negative. It’s a solution that’s better for the environment without compromising on performance.

HT: Do you see the future of biocomposites as competing with conventional materials—or displacing them entirely?

MG: We see biocomposites as more than just competition—they’re the future of sustainable building. As demand for low-carbon materials grows, traditional particleboard and MDF are losing ground. With advancements in processing and supply chain efficiency, biocomposites like Hempboard and our DerelictBOARD made from reclaimed FRP are poised to replace these conventional materials outright. We’re committed to driving that shift through innovation and scalability.

HT: What kinds of buyers or industries are showing the most interest in your materials right now?

MG: Currently, we’re seeing strong demand from non-structural applications where sustainability is a core priority. Right now, the primary hurdle is certification for

structural applications under International Building Code (IBC) and International Residential Code (IRC). Pursuing these certifications is a top priority for Boardwurks, and we are collaborating with academic partners to expedite testing and validation. Achieving IBC and IRC approval is essential for broader market adoption, including bigbox retailers and structural insulated panel (SIP) manufacturers. This effort is significant, not just for us but for the entire biocomposite industry.

HT: How important is regional fiber supply to the Boardwurks model—and how do you view the growth of U.S. hemp processing?

MG: Regional fiber supply is fundamental to our model. Our “75-Bale Mile Radius” strategy means positioning microplants adjacent to first-transformation decorticators or waste stream processors to minimize transport emissions and processing costs. We’re working with local agricultural waste streams—bagasse in Florida, corn stover in the Midwest— and blending them with higher-value, purpose-grown materials An exciting development we are pioneering is our “super-hybrid” composites, which combine carbon-sequestering natural fibers like hemp with reclaimed FRP from decommissioned wind turbine blades. This innovation is setting a new standard for sustainable, high-performance building materials. We see the growth of U.S. hemp processing as crucial to scaling this model, supporting local economies while reducing carbon footprints.

HT: Finally, what advice would you give to other innovators looking to bring hemp-based products to market?

MG: My advice is to prioritize quality and consistency in your supply chain. The hemp industry is still maturing, and the biggest gaps right now are in processing and fiber quality. Work closely with farmers and processors, build relationships that prioritize sustainable practices, and don’t cut corners on material testing. Also, be prepared to invest in certifications - gaining market acceptance requires meeting stringent standards, and that’s a challenge worth tackling head-on.

Missouri Promise

‘If we can make hemp work for farmers, we’re moving in the right direction’

KEVIN HALDERMAN is President of Carbon Ag Co, a partner in Hemp Hemp Hooray, and a member of the National Hemp Growers Association. His company develops highquality CBD products, collaborates with manufacturers in developing exclusive formulations, and supports wholesale distribution for small retailers. With expertise in hemp advocacy, product development, and the new farming startup, Halderman is committed to growing the industry and increasing market acceptance of hemp-based products.

HempToday: How was last year’s hemp farming season for you in Missouri?

Kevin Halderman: It was a tough year. Weather played a huge role. Missouri had some major storms come through in early June, including a typhoon-like event that dumped about eight inches of rain, wiping out hundreds of acres of hemp and devastating some SE Missouri producers. Followed by extreme drought, some fields never saw rain for up to 60+ days. That’s the reality of farming. You can have everything lined up perfectly, but nature has the final say.

HT: What do you see as the biggest challenge for hemp farmers right now?

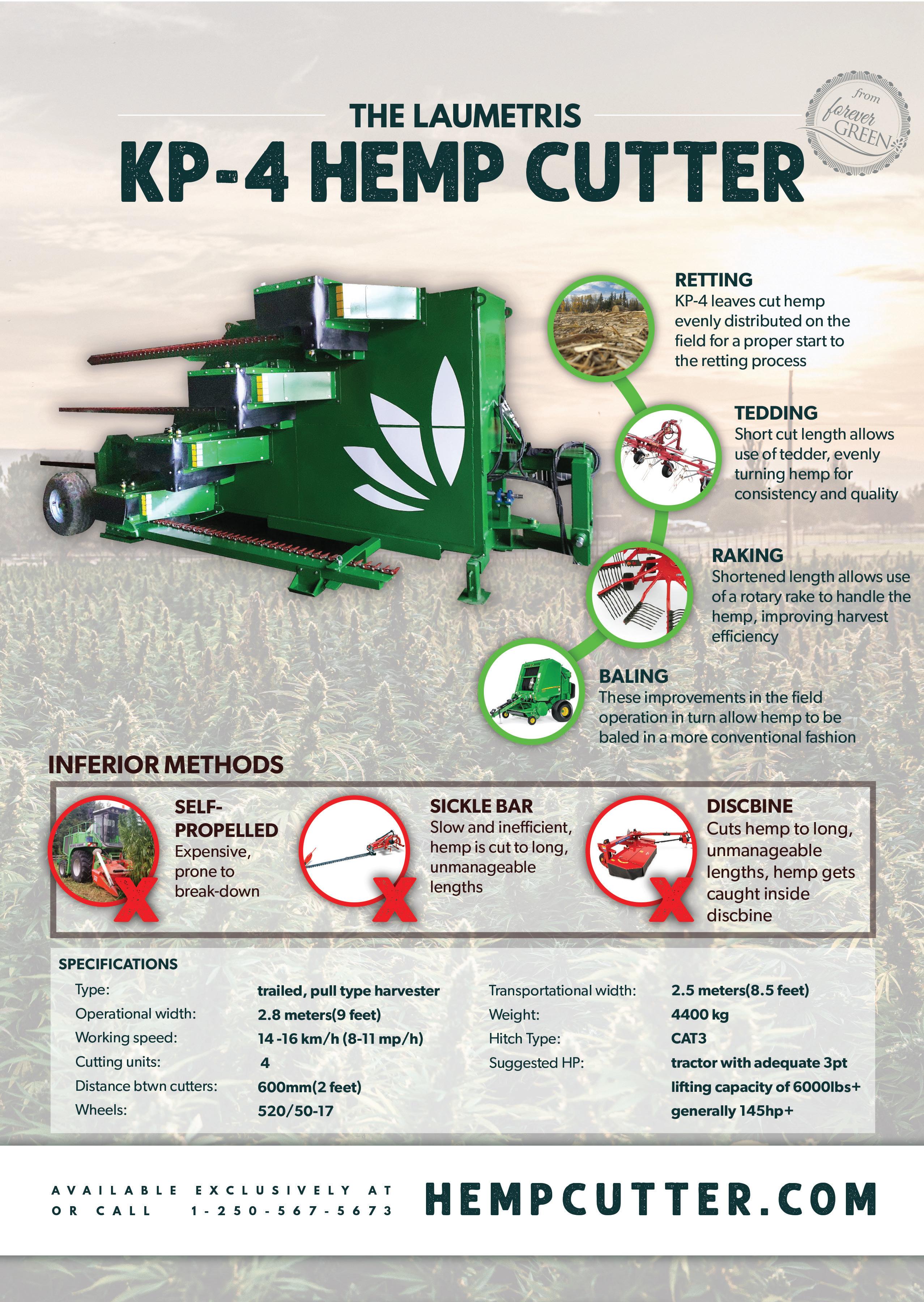

KH: Quality grain or fiber materials harvesting still is a major challenge. People say, “hemp grows anywhere,” but that doesn’t mean it’s profitable to harvest. We’ve seen great-looking fields that should have produced thousands of pounds of grain, but once you get to harvest, everything just shatters and ends up on the ground. The right genetics and harvest timing are critical, and our industry is still playing catch-up compared to other crops.

HT: What’s your take on where the CBD market stands today?

KH: The CBD market has changed a lot. Early on, it was a gold rush, but now it’s more about survival. Federal and state regulations are still unclear, and there’s a flood of low-quality products out there, which makes it hard for good businesses to stand out. We’ve focused on highquality formulations, things that work— like our pain salve infused with delta-8 THC and our THCV chocolate bars that help with appetite suppression.

HT: Are you still producing CBD yourself?

KH: Yeah, we work with several extraction facilities in Union, Missouri. We’ve

focused more on specialty cannabinoids like THCV, CBDV and CBG rather than intoxicating hemp products. There’s already plenty of that in the market.

HT: How does biochar fit into your hemp farming?

KH: We’re using biochar in a few ways. First, it’s great for soil health— when properly inoculated, it helps retain nutrients and water. But another key use is in poultry farming. We’re working with a group in Missouri that has approval for using biochar in large-scale poultry barns. It helps absorb ammonia and improves bird health, which in turn reduces mortality rates. That’s real value.

HT: Have you looked into carbon credits for hemp farming?

KH: We’re interested, however, the process within the U.S. is still developing. We should have a new plan in place this year to begin addressing actual carbon sequestration in our hemp fields. Several companies have developed very affordable units that we are considering implementing.

HT: What’s the state of fiber processing in Missouri?

KH: It’s been a struggle. We had four fiber decorticators trying to get up and running over the past few years—Tiger Fiber in St. Louis, Midwest Fiber in Sykeston, and a couple of others. But bad weather, financial challenges, and just the difficulty of scaling fiber processing have made it hard for them to stay in business. We don’t have a local processor, so right now, we’re diverting our fiber biomass into sustainable farming practices. Our company focus will be to bring hemp into traditional Missouri farms through grain production.

HT: Missouri has been involved in

pushing hempseed as animal feed, particularly for poultry. Where do things stand?

KH: Hempseed meal got approved for egg-laying hens last year, but it’s still not approved for meat birds. Our industry is so complex due to state vs federal oversight on regulations. Hemp grain is not recognized as GRAS (Generally Recognized as Safe) by the FDA. We need to have more conversations with our federal representation in government about this issue.

HT: Are you testing egg-layer poultry feed on your farm?

KH: Yes, we’re just getting started. We’ve been working with regenerative agriculture experts to develop a sustainable feed program. We’ll have a couple tests by the end of June to check our own hemp-based feed with poultry from our local hatchery.

HT: You’re working with a hemp variety called HOCOMO. Can you tell us about it?

KH: HOCOMO is a developing tri-crop variety in Southeast Missouri. It’s designed for grain, fiber, and cannabinoids. The fiber yield is great – we’ve seen 6,000 to 8,000 pounds per acre – with very good yield on the grain production. We need to boost the cannabinoid content a bit more. That’s our next focus.

HT: What’s the goal for this variety long term?

KH: If we can get all three components – grain, fiber, and cannabinoids – to commercially viable levels, it will be a game-changer. Most hemp today is grown for just one or two uses, but a true tri-crop variety could make the economics of hemp farming much more attractive.

HT: What’s your biggest goal for this year?

KH: It all comes down to harvesting. If we can get grain in the bin and fiber processed, we’ll be in a good position. The hemp industry still has a lot of challenges, but if we can make hemp work for farmers – whether through grain, or fiber – then we’re moving in the right direction.

on regulations.’

‘Our industry is so complex due to state vs federal oversight on regulations.’

CBD NOW

As hype fades and rules tighten, surviving companies are pivoting toward function, compliance and long-term credibility.

In the United States, Europe and beyond, the the CBD industry, while fragmented and still maturing, is persistently undervalued.

U.S. companies are clawing their way back from a market crash that wiped out most of the early players. Though share prices remain depressed and profitability elusive, several public companies are stabilizing operations, cutting costs, and rethinking product lines. After all, they’ve already been through the worst, having endured oversaturation, regulatory chaos, and the rise of intoxicating hemp compounds.

In Europe, a slower but arguably healthier recalibration is underway, driven by regulatory scrutiny, novel food pathways, and narrowing consumer expectations. Meanwhile, markets in Asia, Africa and Latin America are cautiously liberalizing or refining their frameworks, often with an eye toward export potential.

The portrait that emerges shows CBD at a crossroads—not the miracle molecule once imagined, but not a failed experiment either. CBD companies that survive are doing so by refocusing on quality, compliance, and medical or functional applications rather than trend-chasing. At the same time, policy decisions being made today—from the U.K.’s novel foods approvals to Canada’s potential reclassification—will shape the trajectory of CBD for years to come.

game. A new flavor of the day. There’s no anchor like you have in tobacco or alcohol.”

UNITED STATES: After years of explosive growth and harsh correction, the U.S. CBD market is searching for a second act. As regulations take shape and companies adapt, some see a chance to rebuild consumer trust and reposition CBD in wellness and retail.

The over-the-counter (OTC) cannabidiol (CBD) market in the United States is struggling through a sustained downturn that has left most companies either bankrupt, pivoting, or barely afloat. Once the centerpiece of the post-2018 Farm Bill hemp boom, CBD is now a beleaguered sector weighed down by oversupply, waning consumer novelty, and looming federal regulations that could further restrict or redefine the market.

“It’s 40% of our sales total,” said Kevin Halderman, a Missouri-based retailer and processor. “But there’s some stores you can’t give away CBD right now. I’ve struggled over the last year just to find true CBD cultivars being grown anymore.”

Though hemp has deep roots as a food and fiber crop, the explosion of interest in CBD following the 2018 Farm Bill made

the compound synonymous with hemp itself. Middlemen flooded the space, promising riches to farmers, many of whom were later “burned” when demand collapsed. Initial enthusiasm was buoyed by hyped medical claims, loose regulation, and a brief period of retail proliferation—but it proved unsustainable.

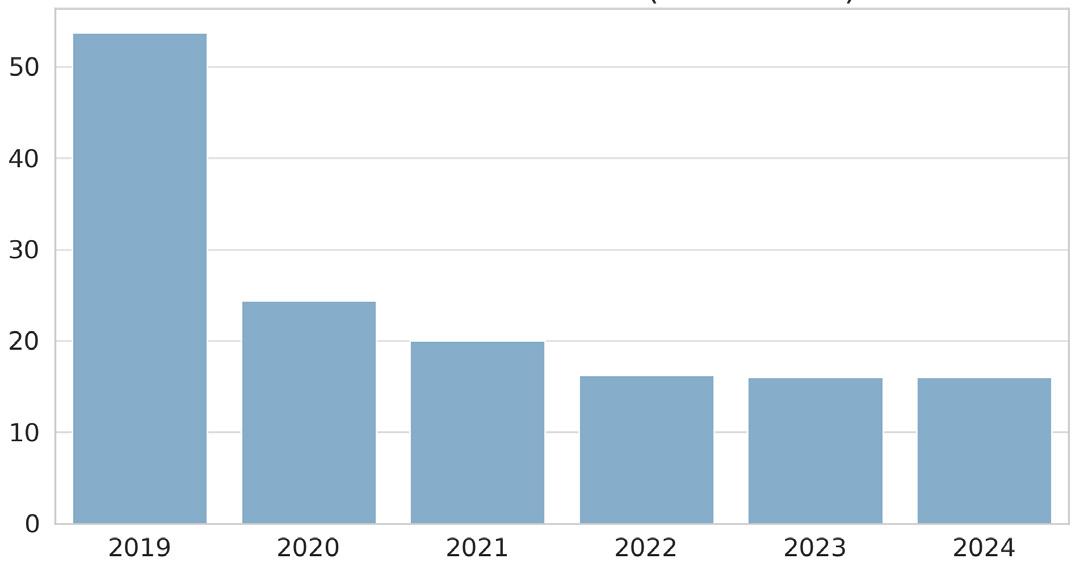

Shock contraction

The contraction came swiftly. By some estimates, up to 90% of CBD-related companies in the U.S. have failed since 2019. Publicly traded survivors such as Charlotte’s Web, CV Sciences, cbdMD, and Elixinol have watched their stock values plummet while continuing to post quarterly losses. Revenue has sagged across the board, and recovery has proven elusive even as some companies attempt restructuring.

“There’s no brand loyalty in this space,” Halderman noted. “It’s a price-point

Stagnation

CV Sciences, which reported Q1 2025 revenue of $3.6 million (down 8% from the prior quarter), acknowledged the stagnant state of the market but emphasized efforts to maintain gross margins, which rose to 46%. “We are pleased with our results,” CEO Joseph Dowling said on a recent earnings call. “We continue to focus on expanding gross margin and improving the balance sheet.”

cbdMD took a similar tone. After years of steep losses, the company reported its first-ever positive net income in early 2025. However, revenue in Q2 ($4.7 million) was down 8% from Q1. CEO Ronan Kennedy remains optimistic: “Profitability is achievable,” he said. “We are proving that a sustainable, thriving business model is within reach.”

Charlotte’s Web, while still unprofitable, has trimmed more than $22 million in operating expenses and expanded its retail reach to 847 Walmart stores and Chewy.com. The company expects its new mushroom-enhanced wellness gummies and pet CBD products to be growth drivers in 2025.

Still, the overall market remains challenging. Elixinol Wellness reported a 10% revenue decline in its U.S. CBD business in 2024, citing ongoing regulatory uncertainty and fierce price competition. The company reported an 80% increase in revenues in 2024, but that was

Retailer Deep Six CBD has closed some stores, but most remain open, primarily in Pennsylvania and South Carolina.

RAYMOND CLARKE IMAGES

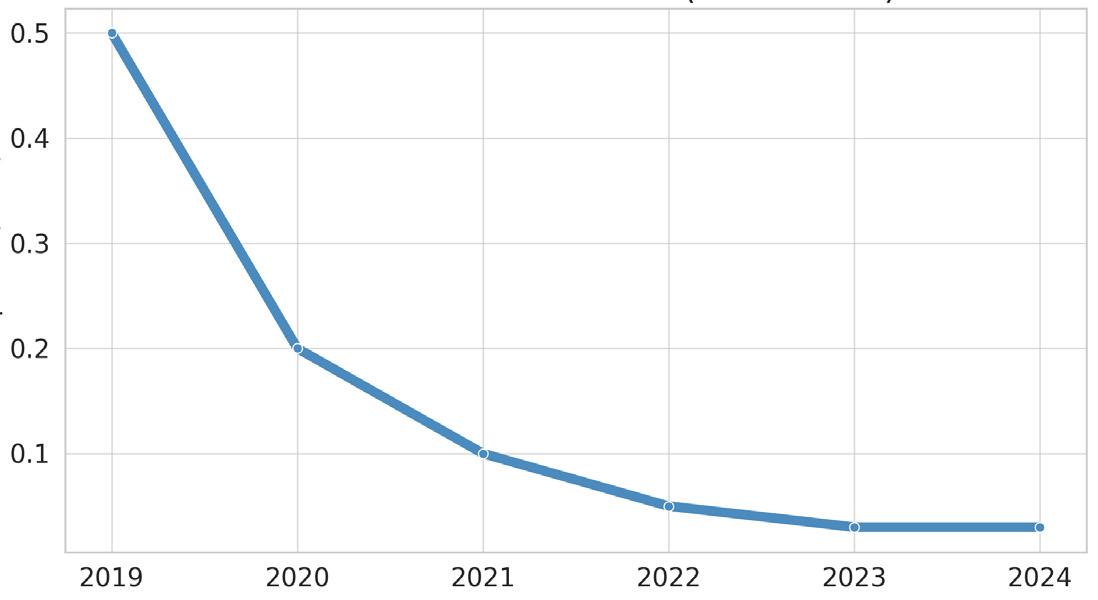

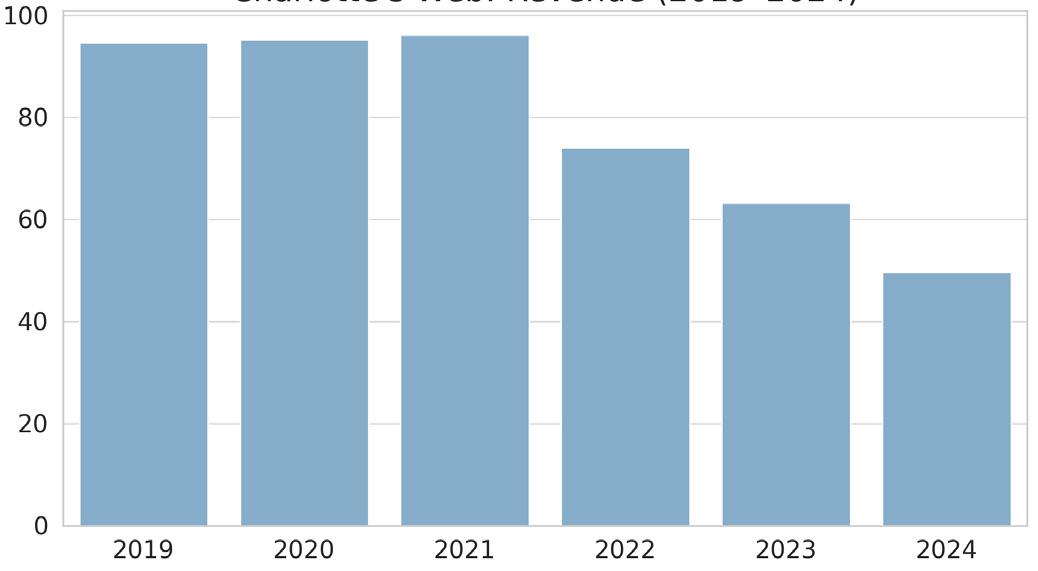

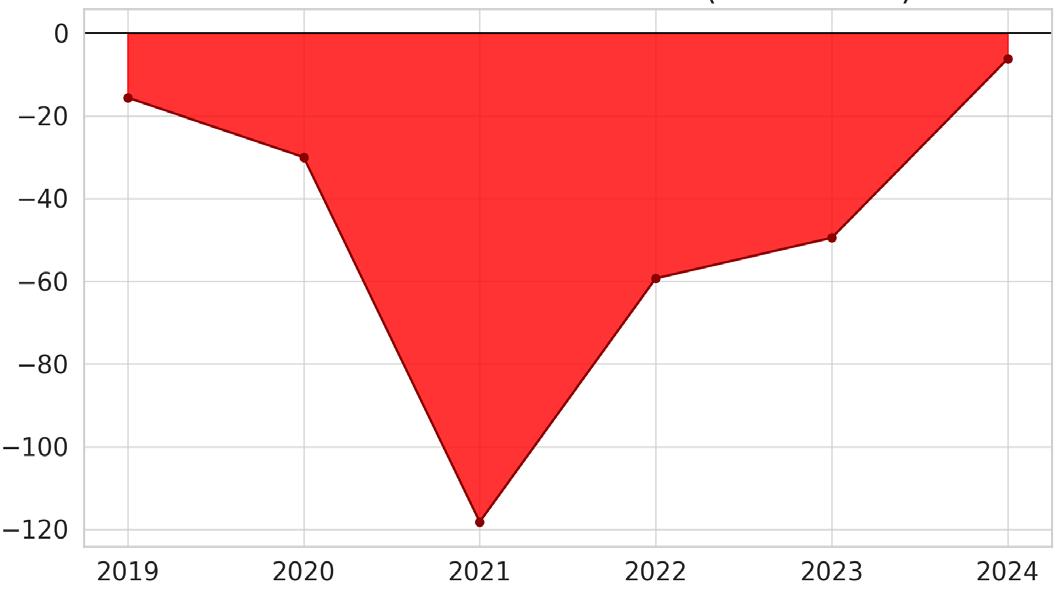

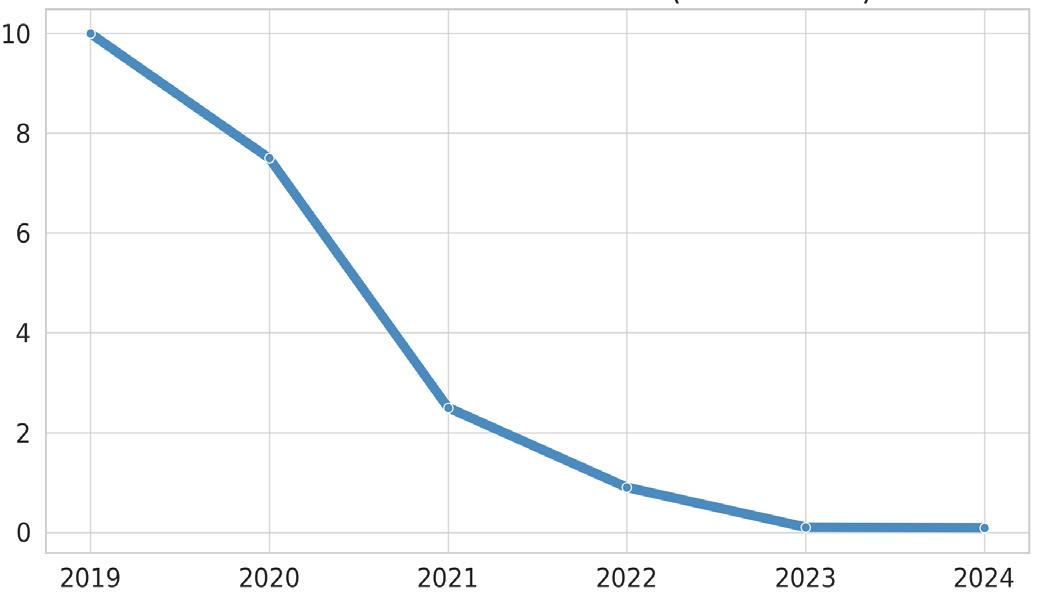

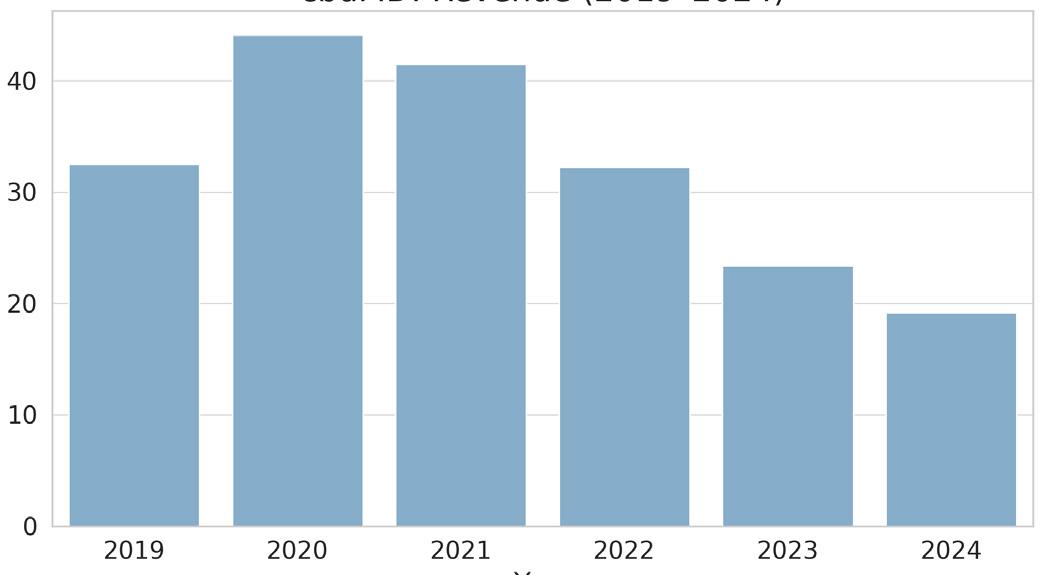

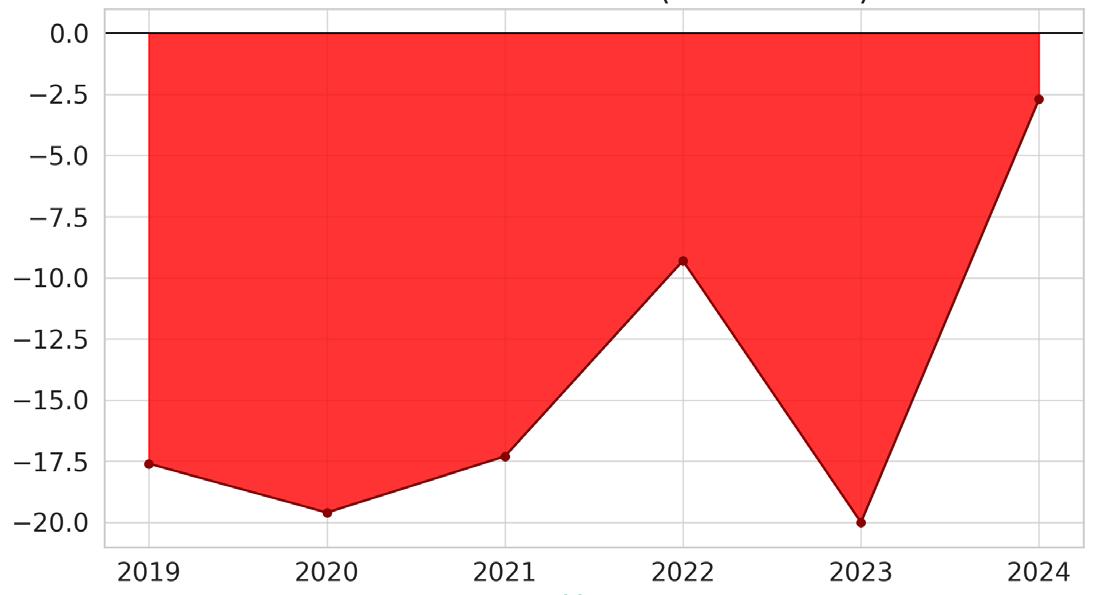

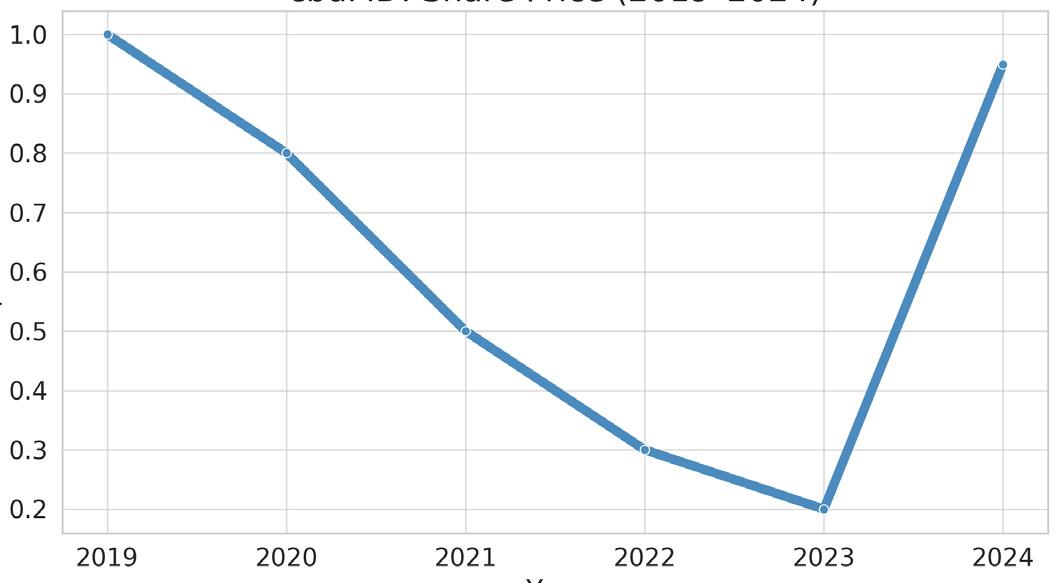

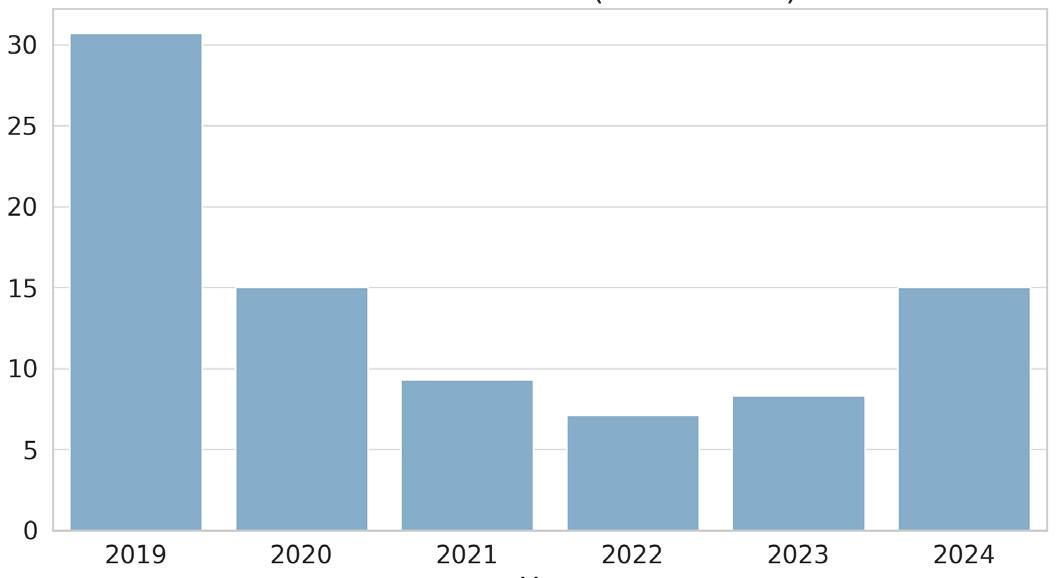

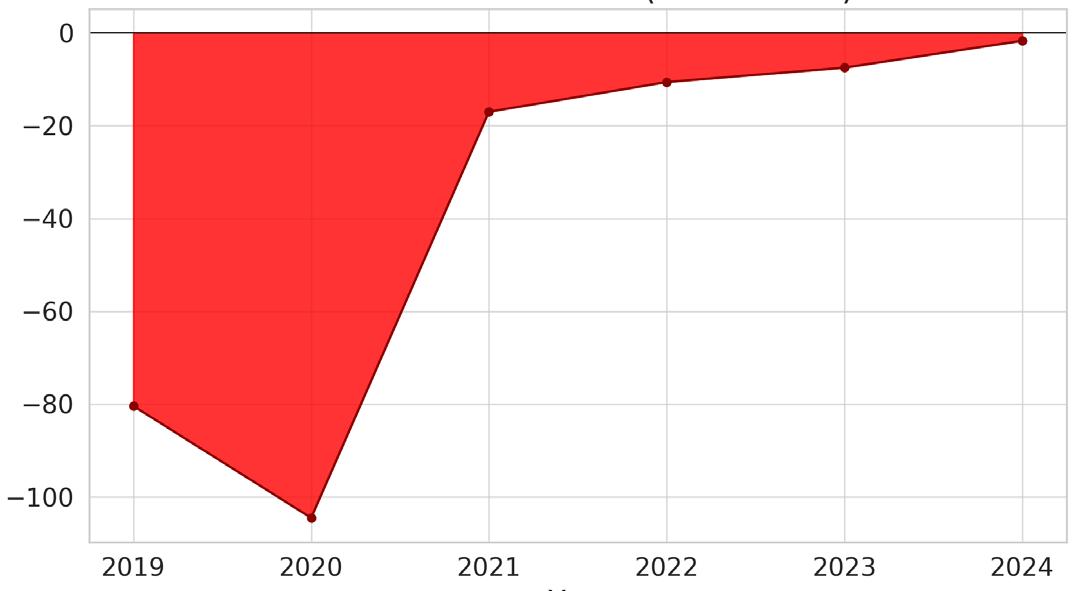

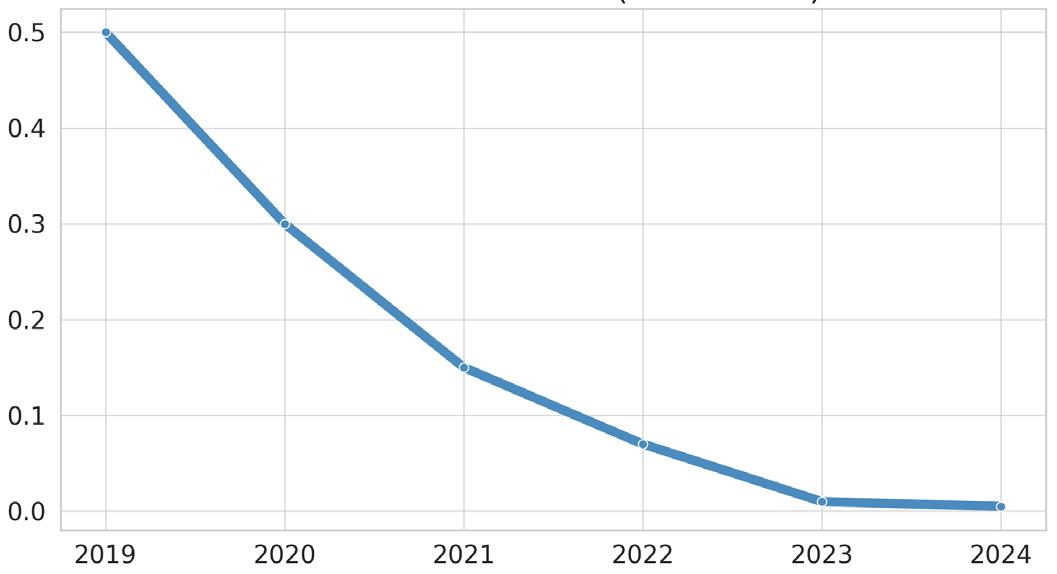

Course correction

A reset is underway in the U.S. CBD sector, where once-soaring companies are cutting losses, stabilizing operations, and edging closer to break-even. At publicly traded companies, revenues are down, losses persist, and share prices have collapsed—but signs of discipline and recalibrated investor expectations are beginning to emerge. Compiled from publicly available financial statements and market data.

CV Sciences (CVSI)

Revenues ($millions)

Net losses ($millions)

Share price ($00.00)

due to the acquisition of two Australian food companies in late 2023.

The rise of intoxicating hemp products—particularly semi-synthetic forms of THC such as Delta-8 and THC-A— has further marginalized traditional CBD categories. Halderman said most growers and processors he knows have abandoned CBD extraction in favor of THC-A flower, which commands a higher price and attracts more consumer attention.

“Most everybody’s transitioned over to

Charlotte’s Web (CWBHF)

Revenues ($millions)

Net losses ($millions)

Share price ($00.00)

some form of THC-A stuff,” he said. “It’s sad. Our market wasn’t supposed to be that—but that’s what it is now.”

The rush into intoxicating hemp has redirected infrastructure and research away from cannabidiol. “Try to find me a Hawaiian Haze or some new strain,” Halderman said. “We can’t find them.”

At the same time, the CBD market has not evolved fast enough to establish new footholds in functional health or consumer packaged goods. While companies like

Charlotte’s Web and cbdMD are leaning into wellness branding, gummies, and pet CBD, others are still grappling with eroding shelf space and consumer fatigue.

Regulatory threats

CBD stakeholders face a double bind: while synthetic intoxicants remain largely unregulated, the traditional CBD market operates in a policy vacuum. The longdelayed 2023 Farm Bill may finally ad-

cbdMD (YCBD)

Revenues ($millions)

Net losses ($millions)

Share price ($00.00)

dress this discrepancy, but federal action could simultaneously restrict hemp-derived THC while imposing new compliance burdens on CBD companies.

“The entire cannabinoid side is about to get squeezed,” said Steve Groff, a Pennsylvania hemp farmer and regenerative agriculture advocate. “If we see federal rules banning intoxicating hemp, the wholesale CBD market will collapse even further.” Groff, who remains active in hemp-based construction and agricultural inputs, said the CBD sector “still hasn’t sorted itself out.”

Another unaddressed pressure point is international dumping. Halderman warned that low-cost CBD distillate— produced as a byproduct in countries where sales are restricted—is flooding the U.S. market. “They produce a lot of

Elixinol (ELLXF)

Revenues ($millions)

Net losses ($millions)

Share price ($00.00)

hemp, they use a lot of fiber and biomass—but none of their citizens can use a CBD product. So it’s dumped on our market,” he said, naming China and India as likely sources.

This glut has undermined U.S. producers who invested in extraction capacity when CBD was fetching far higher prices per kilogram. Today, most biomass remains unprocessed, and many farmers have left the industry altogether.

A market in search of a reason

Despite personal belief in CBD’s health value, Halderman said he plans to exit the retail cannabinoid business entirely if his industrial fiber operations prove viable in 2025. “I believe everybody should have CBD in their diet every day,”

he said. “But I wouldn’t have a retail side next year if I could avoid it. The market is just not there.”

Groff agreed, noting that the market remains flooded with low-quality products and inconsistent labeling. “There’s still no serious enforcement,” he said. “And consumers don’t know what to trust.”

Public companies acknowledge a credibility gap. In Charlotte’s Web’s latest report, the company emphasized quality, traceability, and third-party testing as central to its strategy. Similarly, cbdMD is investing in direct-to-consumer education and brand consistency to distinguish itself from less reputable players.

But even for the most resilient brands, the stakes remain high. As regulatory and economic pressures mount, CBD companies face a stark choice: evolve—or exit.

Stakeholders are anxiously waiting to see if their products will be approved by the FSA under UK novel food rules.

EUROPE: The CBD sector is trading hype for hard-won discipline. As regulations advance and unrealistic expectations fade, resilient companies are finding new footing in niche markets and smarter positioning—marking a quieter, more sustainable chapter.

Europe’s once-hyped CBD sector is transitioning into a more disciplined and segmented phase, shaped by regulatory gridlock, fading retail enthusiasm, and shrinking margins. While many players have exited entirely, a few resilient manufacturers and extractors continue to adapt, serving niche markets that remain stable—if no longer growing.

From the UK to the Balkans, companies report that CBD sales have fallen well below the peak years of 2018–2019. “The market might be shrinking slightly, but there is a market,” said Maciej Kowalski, CEO of Poland’s Kombinat Konopny. “It’s already saturated. But the market for sausages is also not growing. It might not be sexy, but it’s still there.”

Sasha Bajilo, CEO of Croatia-based Ilesol Pharmaceuticals, noted that market

volume is down by roughly 80% from its peak. “Currently, everybody knows the market is stagnating,” he said. “The peak for us was 2019... I would say that we are maybe at 20 percent of that volume.”

No miracles

Joscha Krauss, managing director of Germany’s MH medical hemp GmbH, said public expectations never matched CBD’s real utility. “By many players on the market, it was considered and sold as a miracle drug,” he said. “But with the concentration of active ingredients required for an immediate effect, it is a medicine. With a lower, health-supporting concentration, it could be a dietary supplement, but this does not yet have the necessary approval.”

All three companies have adjusted their strategies. Ilesol has postponed the

launch of a new branded product line until compliance is secured. MH medical hemp made a more decisive shift: the company has exited the branded consumer products business entirely, pivoting to focus solely on related raw materials, intermediate products and pharmaceutical supply. Kowalski continues to serve a core clientele with minimal overhead. As the dust settles, what’s left is a leaner, more pragmatic industry— still viable, but without illusions.

UK advances, EU stagnates

The United Kingdom is outpacing the EU in CBD regulation, with its Food Standards Agency (FSA) processing novel food applications that may result in a fully legal market later this year. If approvals move forward as expected, the UK could become the first country in Europe—and possibly the world—with a fully regulated national CBD marketplace.

For companies like Ilesol, which is in the final risk management stage of UK approval, that regulatory progress could be a major turning point. “We see this as a big opportunity for supplying mainstream brands,” said Bajilo.

Yet optimism isn’t universal. Kowalski is wary that UK progress may invite increased competition from corporate players. “The moment they say yes, isolated cannabidiol is a novel food will actually make my life slightly more difficult,” he said. “It will open the doors for larger companies... right now they’re staying out because it’s too complicated.”

Novel food: Lifeline or landmine?

Throughout the European Union, the novel food approval process remains the central regulatory bottleneck. Krauss sees it as essential to rebuilding market access and trust: “Once novel food is online and we are allowed to sell the product legally... then the gates open again.”

Others are more cautious. Bajilo believes compliance is key to rebuilding credibility: “We have never had access to the full market, just to the niche market,” he said. “What we need is compliance in the food supplement sector. Then this product can slowly develop again, with some stability.” Kowalski, however, prefers regulatory ambiguity, arguing that EU rulemaking could increase compliance burdens and invite large-scale competition. “I keep my fingers crossed that the EU does what it does best—which is nothing,” he said.

Many companies are now reckoning with the legacy of inflated promises. Krauss said shifting rules and vague classifications have created years of uncer-

tainty for consumers. “It’s super confusing,” he said. “It’s not very trust gaining from consumers.”

Bajilo points to irresponsible marketing as a major factor in consumer disillusionment. “False advertising is wrong on many different levels,” he said. “CBD is natural medicine, but not for everything, not for everybody and not for everyone.”

Unlike the United States, where synthetic intoxicants like delta-8 THC have flooded the market, Europe has so far avoided this disruptive trend. Bajilo warned these substances could destabilize global CBD markets. “This situation can really complicate the CBD business worldwide—and honestly, it can shut it down,” he said.

Kowalski put it more bluntly: “I’ve been seeing all those CBD lemonades on the gas station in the U.S. I mean, who needs that?”

Drawing lines

Whether Europe maintains this distinction will depend on how tightly it draws the regulatory line between therapeutic cannabinoids and intoxicating hemp derivatives.

Europe’s CBD sector is no longer driven by hype, celebrity endorsements, or runaway projections of explosive growth. The excitement that once surrounded cannabidiol has given way to something quieter—but perhaps more enduring: a slow, steady recalibration of what this market can realistically support.

For the companies that remain, survival increasingly depends on fundamentals: supply chain control, regulatory compliance, modest margins, and credibility with both customers and authorities. Many are learning to operate more like traditional health supplement or pharmaceutical firms than startup disruptors.

Give us a normal market

That means trimming bloated product lines, shelving unsanctioned health claims, and working within—or pushing against—evolving legal frameworks. It also means recognizing that CBD is not a cure-all or a revolution in itself, but one tool among many in broader wellness and medical markets.

“We don’t want to be seen as some crazy cannabis people, pushing products under the desk,” said Bajilo. “We want to be part of a normal market.”

In that vision—less hype, more structure—may lie the sector’s best hope for lasting relevance. Europe’s CBD industry isn’t dead. But its next chapter will be written not in booms and buzzwords, but in staying power, smart positioning, and long-term trust.

ASIA PACIFIC

Cautious liberalization, strategic growth

Asia has historically been conservative in its approach to cannabis and hemp, but there are signs of gradual liberalization.

• China, the world’s largest hemp producer, allows CBD for cosmetic use only, restricting its inclusion in food and dietary supplements. However, the country remains a major exporter of CBD isolates and raw materials to other markets.

• Japan technically permits CBD as long as it is extracted from stalks and seeds – which it isn’t. Sellers have simply skirted the rules by labeling their products as compliant, and the government apparently turns a blind eye. The market in wellness and skincare sectors is growing steadily.

• Thailand briefly positioned itself as a leader by legalizing cannabis for medical and wellness purposes, but policy reversals in 2024 have created uncertainty. The government is reevaluating its approach to recreational and medical cannabis, which will impact CBD’s long-term prospects.

• South Korea and India have limited medical cannabis frameworks, but strict regulations prevent the widespread adoption of CBD products.

AFRICA

Early-stage market with export potential

Africa’s CBD market is in its infancy, but several countries are exploring the economic potential of hemp cultivation. Overall, Africa’s main advantage is low-cost hemp farming, making it attractive for export markets, but internal demand for CBD remains minimal.

• South Africa leads the way, having legalized CBD products with a maximum daily dosage limit of 20mg. The country has a growing domestic market but remains constrained by high regulatory barriers.

• Lesotho and Zimbabwe have positioned themselves as export hubs, granting licenses for large-scale hemp cultivation aimed at supplying international markets, particularly Europe.

• Malawi, Rwanda, and Uganda are also issuing licenses for hemp cultivation, though domestic demand remains limited due to low consumer awareness and purchasing power.

LATIN AMERICA

Cannabis liberalization driving growth

Latin America could emerge as a key CBD market if progressive cannabis policies are put in place.

• Colombia has positioned itself as a major CBD and medical cannabis exporter, benefiting from favorable cultivation conditions and regulatory support. However, domestic consumption remains modest.

• Brazil allows medical CBD products via prescription, but import regulations remain complex and costly, limiting market access.

• Mexico, despite decriminalizing cannabis, has struggled with regulatory delays in establishing a clear CBD framework.

• Argentina and Uruguay have legalized CBD for medical use, with Uruguay also embracing recreational cannabis. Uruguay’s export-oriented industry could play a crucial role in supplying global markets.

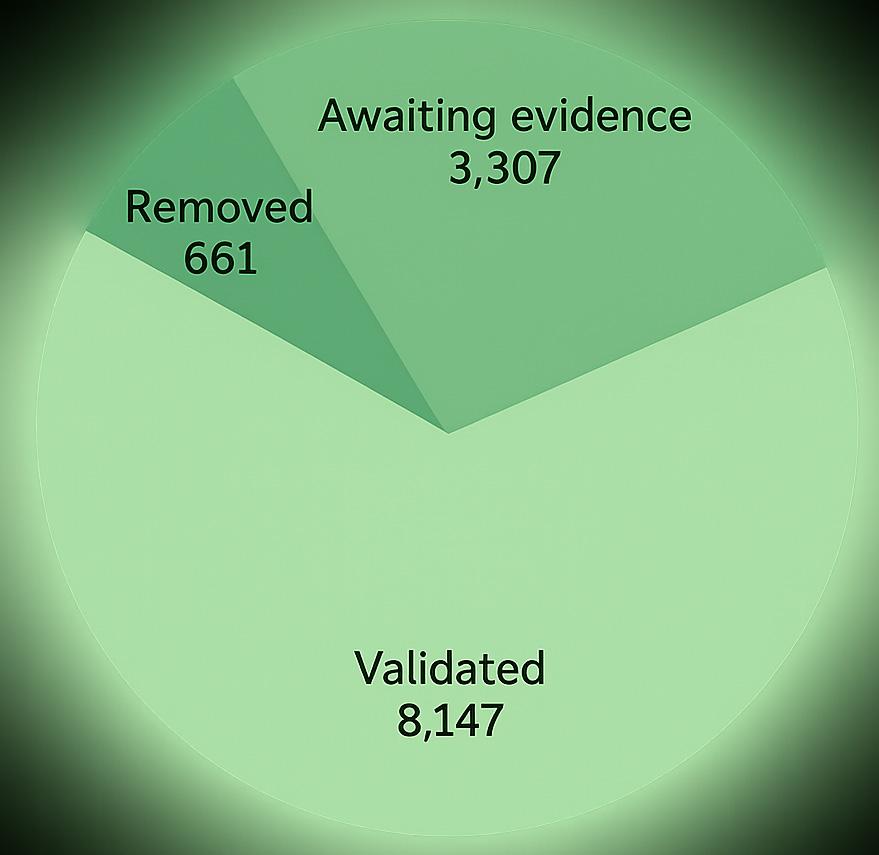

UK’s big CBD cleanup

Critics warn that low daily limits could hold back promising market

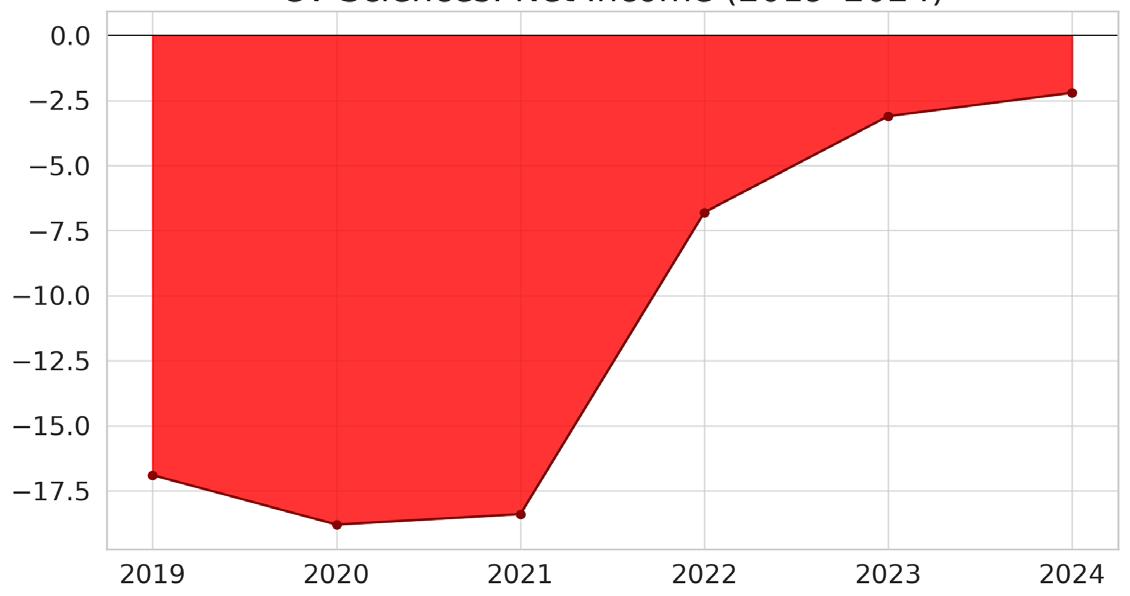

In a first for Europe, the United Kingdom is on the verge of becoming the only country with a functioning legal framework for cannabidiol (CBD) products—marking a turning point for the nation’s embattled hemp sector. After years of confusion and stalled applications, the UK’s Food Standards Agency (FSA) has begun approving novel food applications for ingestible CBD, moving the industry from legal limbo to regulatory legitimacy.

Five applications have passed the FSA’s safety review since January 2025, advancing roughly 850 individual products toward full authorization. The approvals come with stricter compliance demands, including clear labeling, traceability, and adherence to a 10mg acceptable daily intake (ADI) for CBD. Though controversial, these steps bring long-awaited clarity to a fragmented and uncertain market that has struggled since the FSA first classified CBD as a “novel food” in 2019.

The Cannabis Trades Association said the regulatory expectations are now clearer, stricter, and more aligned with scientific evidence and public safety.

Stricter rules in force

Updated guidance from both the FSA and the Medicines and Healthcare products Regulatory Agency (MHRA) has reaffirmed a hard line on compliance. The MHRA stated that any CBD product making medicinal claims must be regulated as a medicine and cannot be sold without marketing authorization.

Simultaneously, the FSA has confirmed that only ingestible, non-medical CBD products with validated novel food applications will be permitted on the market. With the closure of the so-called CBD Public List, products without progressing applications are now deemed non-compliant. Businesses can no longer use “white labeling” to rebrand a single approved formulation under multiple names. Each product must have its own distinct, traceable application.

Rebecca Sudworth, director of policy at the FSA, reaffirmed in a letter to the CTA that applications are reviewed based on the order received and on the quality of submissions. Since January 2019, the FSA has processed more than 12,000 submissions.

The FSA has also reiterated its controversial decision to apply a 10mg

Novel food sweepstakes

Right: 12,115 products remain at various stages of the FSA review

Below: Leading applications and the number of products they carry.

acceptable daily intake as the binding threshold for CBD consumption. This marks a steep reduction from the previous 70mg benchmark, blindsiding many in the industry when it was introduced in October 2023.

All five applications approved so far in 2025 adhere to the 10mg limit. The largest came from a joint application by TTS Pharma in Liverpool and Californiabased distributor HERBL, advancing over 830 products. Other approvals were granted to Brains Bioceutical, Mile High Labs, cbdMD, and Bridge Farm Group. Industry groups argue the ADI is being misapplied as a rigid cap rather than flexible guidance. The CTA said the limit does not account for important differences between isolates, distillates, and full-spectrum formulations. Critics warn that such low thresholds could stifle the market, render products ineffective, and deter investment in CBD innovation. For comparison, the European Industrial Hemp Association has proposed a 17.5mg daily limit as a more balanced alternative.

Despite the criticism, the recent approvals are being widely interpreted as a shift toward full market regulation. The

FSA plans a 12-week public consultation to review the first set of final authorizations. These initial decisions are expected to establish key benchmarks on THC content, product labeling, and formulation standards. Once the consultation is complete, the FSA and Food Standards Scotland will recommend approved products to ministers across Great Britain for legal sale.

Slow but visible

The CTA acknowledged the slow but visible progress, stating that the FSA’s actions now reflect a more science-based, transparent approach to CBD regulation. The association has encouraged companies to engage with the consultation process to ensure future rules balance public health with commercial viability.

While the UK’s novel food framework has drawn criticism for its delays, shifting criteria, and uneven enforcement, many now see it as the first truly operational system for CBD products in Europe. With the FSA’s new clarity, the UK is poised to become a regulatory model for other nations navigating the rapidly evolving hemp and CBD landscape.

UK Food Safety Agency

EIHA consortium (RP 427)

B3 (UK) + Mile High Labs (USA) (RP349 ) TTS Pharma (Jevalex, HERBL) (RP521)

Meloni’s War

Legal experts, regions, and farmers rise against controversial decree

Italy’s escalating campaign against hemp and CBD has sparked fierce backlash at home and abroad, with legal experts, business leaders, and European officials warning that Prime Minister Giorgia Meloni’s policies are not only economically destructive—they likely breach EU law.

The flashpoint is a sweeping “Security Decree,” enacted in April by Meloni’s administration, which classifies industrial hemp flowers and non-psychoactive cannabinoids like CBD, CBG, and CBN as narcotics regardless of THC content. By bypassing Parliament and invoking emergency powers, the government criminalized the cultivation, sale, and possession of hemp flower products across Italy.

The move comes on the heels of a separate ban on oral CBD compositions, upheld by Italy’s Lazio Regional Administrative Court, which declared CBD a pharmaceutical substance restricted to prescription use only. Both actions have stunned Italy’s hemp sector and ignited a full-scale legal and civic mobilization.

EU position on CBD

The European Union has long supported the legality of CBD and hempderived products with THC levels below 0.3%, recognizing them as agricultural goods subject to the internal market’s free movement of goods. In 2020, the European Court of Justice ruled that CBD is not a narcotic and that member states may not prohibit its sale unless scientific evidence of health risks exists. The European Commission’s Cosing database also lists CBD as non-psychoactive and nonaddictive, approving its use in cosmetics and food supplements.

Meloni’s decree, critics say, flagrantly ignores these guidelines.

Regional councilors for agriculture—aligned under the powerful Italian Confederation of Agriculture (Cia)—have issued a rare unified rebuke of the decree. Calling it “ideological,” they warned that it erases a thriving supply chain that supports sustainable farming, construction, and bioplastics. Legal scholars have echoed the concern, arguing that the decree law violates Articles 25 and 77 of Italy’s Constitution, as well as the EU treaties guaranteeing free movement of legal goods.

Court greenlights ban

While earlier courts had suspended the CBD ban citing lack of evidence, a surprise ruling from Lazio’s TAR on April 21 allowed the measure to stand, citing the EU’s “precautionary principle” on public health concerns. The Ministry of Health had warned of potential psychiatric and liver risks—but had not sought updated evaluations from scientific bodies. Experts from La Sapienza University and EU regulators say such risks are overstated.

The decision has left thousands of businesses in legal limbo.

In response, Italy’s hemp associations have launched a wide-ranging strategy to challenge the decree. Their campaign includes legal appeals in regional courts, constitutional challenges, and EU-level complaints. They are mobilizing both domestic and foreign companies to trigger scrutiny under EU free-trade rules and preparing class-action lawsuits for compensation due to economic losses. They also advise stakeholders to obtain legal insurance and are organizing public support efforts, encouraging businesses

to join trade associations, document enforcement actions, and contribute to legal defense funds. Organizers stress that early court victories could set precedent with industry-wide impact.

Legal experts say the emergency decree fails both scientific and legal tests. Under Italy’s Constitution, emergency laws must be justified by urgency and necessity—and must be ratified by Parliament within 60 days. Critics argue that no imminent public threat was evident and that the decree’s vague language criminalizes lawful business retroactively, violating legal certainty and due process.

“This is an act of unprecedented gravity,” said Imprenditori Canapa Italia in a public statement. “Thousands of honest entrepreneurs have been reclassified as criminals overnight.”

What’s next

The decree now faces an uncertain fate. President Sergio Mattarella has not yet signed the measure into permanent law. Parliament must ratify or reject it by early June.

Meanwhile, Italy’s hemp industry— once hailed as a model for sustainable agriculture—is shrinking under legal pressure. Over 3,000 businesses and up to 30,000 jobs are now at risk in a sector worth nearly €2 billion.

As the European Commission evaluates the case, stakeholders say a robust response is essential—not just for Italy, but for the integrity of the EU’s common market.

“The world of industrial hemp is not willing to silently suffer illogical and unconstitutional decisions,” said Canapa Sativa Italia.

PHOTO: Copyright: © EU/Christophe Licoppe

Brazil study backs therapeutic potential in cases of epilepsy

Acomprehensive analysis by researchers from Tiradentes University and the University of São Paulo has reinforced the potential of cannabidiol (CBD) as a treatment for patients with drug-resistant epilepsy. The study also calls for more clinical research to confirm long-term outcomes and refine treatment protocols.

Published in *Acta Epileptologica* (Springer Nature), the review evaluated six key clinical trials—three focused on Dravet syndrome and three on LennoxGastaut syndrome—selected from nearly 1,500 initial studies. Both forms of epilepsy are severe and frequently unresponsive to standard drug therapies.

Seizures reduced

The findings showed that patients treated with CBD experienced an average 41.1% reduction in seizure frequency, compared to 18.1% among those receiving a placebo— a 127% higher efficacy rate. However, researchers noted side effects such as sleepiness, decreased appetite, and diarrhea, and emphasized the need for more advanced methods of data collection, citing the unexpectedly high placebo response.

“Given these results, it is possible to conclude that the therapeutic response of cannabidiol is worthy of consideration in new protocols,” the authors wrote, recommending that public health systems evaluate CBD for their treatment plans.

The review adds to the growing body of research supporting CBD’s antiepileptic benefits. High-concentration, medicalgrade CBD is already approved for treating epilepsy-related conditions in children.

CBD dominates

Brazil’s evolving CBD landscape is being closely watched by global cannabis companies. With more than 200 million residents and growing acceptance of cannabis-based medicines, the country is viewed as a high-potential market. According to Statista, Brazil’s demand for medical cannabis was expected to reach \$185 million in 2024, with CBD accounting for as much as 80% due to fewer regulatory barriers than THCbased products.

Despite encouraging results, regulators continue to caution against potential risks, particularly for pregnant women, children, the elderly, and those with liver or reproductive system concerns, underscoring the need for continued research.

New path opens in Canada as consultation is underway

Health officials in Canada have launched a public consultation seeking feedback on a regulatory framework that could open up the market for over-the-counter CBD products. Currently regulated like marijuana under the Cannabis Act of 2018, CBD is limited to sales through licensed cannabis dispensaries under strict rules. The proposed framework would change all that by making CBD products available through grocery stores, pharmacies, and health food retailers.

While the regulated market has already reached nearly a half-billion U.S. dollars, if CBD were reclassified as a natural health product or dietary supplement, it could drastically expand the market. Under the current rules, forecasts show only modest growth for CBD.

Lowering costs

A reclassification would also streamline distribution, lowering costs for producers and retailers. With fewer regulatory hurdles, prices could drop, and more companies could enter the market, leading to innovation and increased competition, stakeholders have suggested.

Health Canada, the government health agency, opened the consultation March 7; it runs through June 5. The consultation invites input from industry stakeholders, health professionals, researchers, Indigenous partners, consumer organizations, and the general public.

The suggested pathway would permit CBD to be included as a medicinal ingredient in natural health products (NHPs), with a strict THC limit of 10 parts per million (ppm). Products would undergo comprehensive safety and efficacy assessments, aligning with existing

NHP approval processes, according to the proposed changes. Activities such as manufacturing, packaging, labeling, and importing CBD-containing products would require specific licensing, and import/export regulations under the Cannabis Act would still apply.

Key questions

In the consultation, stakeholders are asked if drug licenses and enhanced security controls are necessary for CBD and whether additional raw material good manufacturing practices (GMP) standards should apply to CBD suppliers.

There is also a discussion around the need for a certificate of analysis to support product quality, and whether the products should carry warning labels due to potential interactions with prescription drugs. Feedback is also sought on clinical trials, sales locations, and packaging considerations to optimize consumer safety and promote informed usage.

Pet products included

Health Canada is also considering regulating CBD health products for animals as non-prescription veterinary drugs under the Food and Drug Regulations.

Stakeholders are encouraged to share views on whether a streamlined regulatory pathway is appropriate for pet products. Specific questions include the level of scientific evidence required for manufacturing processes, and the need for certificates of authorization to ensure product quality. There are also considerations on the sale and promotion of CBD pet products, particularly in veterinary clinics and pet stores, along with post-market safety monitoring.

New oral drug enters Phase 2 trials for autism

The U.S. Food and Drug Administration (FDA) has authorized Phase 2 clinical trials for an oral CBD solution intended to address autism spectrum disorder (ASD).

The initiative to develop the drug is under DeFloria, Inc., a collaboration formed in 2023 among three entities –Charlotte’s Web Holdings, Inc., Ajna BioSciences PBC, both of Colorado, and British American Tobacco (BAT) PLC.

The Phase 2 trials, scheduled to start this summer, are designed as an openlabel, 12-week study involving 60 patients aged 13 to 29. The primary objectives are to assess the safety, tolerability, and efficacy of the drug, “AJA001,” in adolescents and adults with ASD, and to obtain data on which to base larger Phase 3 trials.

Strategic alignment

DeFloria brings together Charlotte’s Web’s expertise in hemp cultivation, Ajna BioSciences’ focus on botanical drug development, and strategic investment from British American Tobacco.

The group hopes to develop AJA001 as a treatment for behavioral symptoms associated with ASD, addressing a critical need for more effective drugs to improve social communication and interaction, and quell restricted and repetitive behaviors. Irritability and impulsivity are common symptoms that can impact the quality of life for those who suffer the condition, and their families.

Phase 1 trials showed that AJA001 was well-tolerated across a range of doses, data that went into determining appropriate dosing protocols for the forthcoming Phase 2 study.

The drug could still be as long as eight years away. Phase 2 trials, which assess efficacy, take two to three years; Phase 3, where the drug will be tested in a larger population, typically lasts 3 to 5 years. Once Phase 3 trials are complete, the company submits a New Drug Application to the FDA, which can take another year to approve.

AJA001 represents BAT’s first entry into clinical-stage cannabis research, as the tobacco giant has steadily expanded into the cannabis sector in a strategy that goes beyond tobacco, picking up assets in next-generation cannabis products that include both THC and CBD, vaping, and CBD-infused oral nicotine pouches.

Legal challenge expected after crackdown in Portugal

Portuguese regulators are facing criticism over their decision to withdraw several cosmetic products containing cannabidiol (CBD) from the market, a move that contradicts European Union law regarding the free movement of goods.

Infarmed, Portugal’s National Authority for Medicines and Health Products, argues that CBD extracted from resins, tinctures, or extracts of the cannabis plant constitutes a narcotic under EU regulations. However, this interpretation directly conflicts with a 2020 ruling by the European Court of Justice (ECJ), which determined that CBD is not a narcotic and should not be restricted in trade among EU member states.

Infarmed has ordered the immediate withdrawal of multiple CBD-infused cosmetic products from brands such as SVR, Naturasor, and Dermacol. The agency cites European regulations which prohibits narcotic drugs listed under the 1961 United Nations Single Convention on Narcotic Drugs in cosmetic products. Infarmed contends that CBD derived from cannabis extracts falls under this restriction, making its inclusion in cosmetics unlawful in Portugal.

Flawed thinking

The move follows a pattern of sporadic enforcement by Infarmed, which has previously issued similar notices for CBDcontaining products. The regulator appears to base its stance on the argument that the inclusion of an ingredient in the Cosmetic Ingredients Database (CosIng) does not equate to formal approval or authorization for its use. As such, Infarmed insists that CBD obtained from plant-derived resins or tinctures remains banned in cosmetics.

Infarmed’s approach clashes with EU law, particularly the ECJ’s landmark 2020 ruling in the KannaVape case. The court ruled that CBD extracted from the cannabis sativa plant, including from its flowers, does not qualify as a narcotic under the 1961 UN Convention. Moreover, the ruling established that EU member states cannot prohibit the sale of CBD products legally produced in another member state without providing scientific evidence of potential harm.

Prohibited barrier

The ECJ’s decision binds all EU institutions and requires member states to align their national regulations with this interpretation. As a result, Portugal’s restrictions on CBD cosmetics appear to violate the fundamental EU principle of free movement of goods. By blocking the trade of CBD products, Infarmed is effectively imposing a non-tariff barrier that EU law prohibits.

The Portuguese cosmetics market has seen significant growth in demand for CBD-infused products, mirroring trends across Europe. Consumers increasingly seek CBD for its perceived skincare benefits, and numerous brands have entered the space. However, Infarmed’s crackdown disrupts the sector, forcing companies to reformulate products—potentially with synthetic CBD—to circumvent regulatory challenges.

Moreover, the lack of clear guidance on CBD’s legal status in Portugal creates uncertainty for businesses and investors. Infarmed’s interpretation sets a precedent that could deter companies from entering the Portuguese market, putting the country at odds with broader European trends, where regulatory frameworks are becoming more CBD-friendly.

Whither ‘true hemp’?

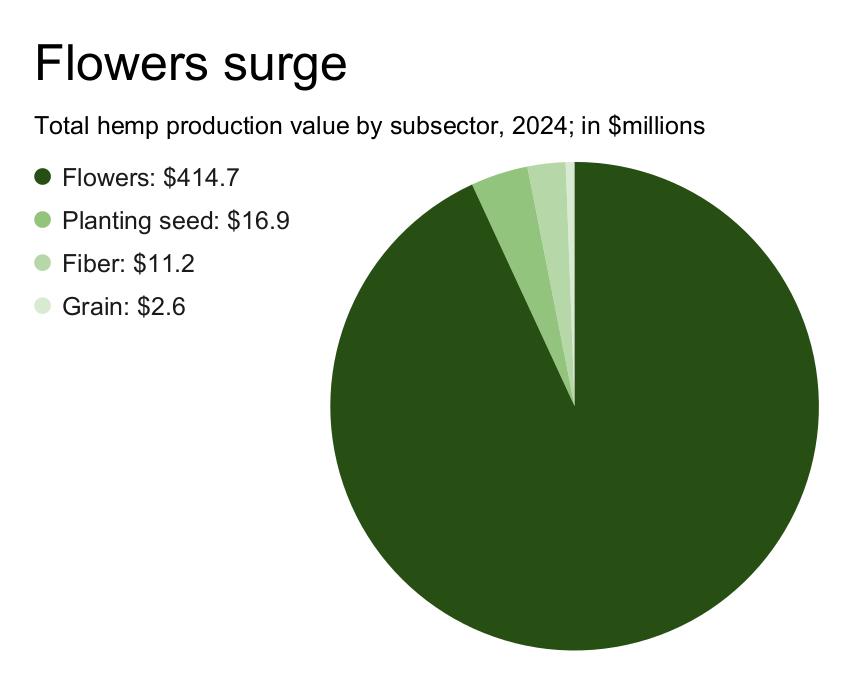

U.S. market value jumps 40% as intoxicants fuel flower surge

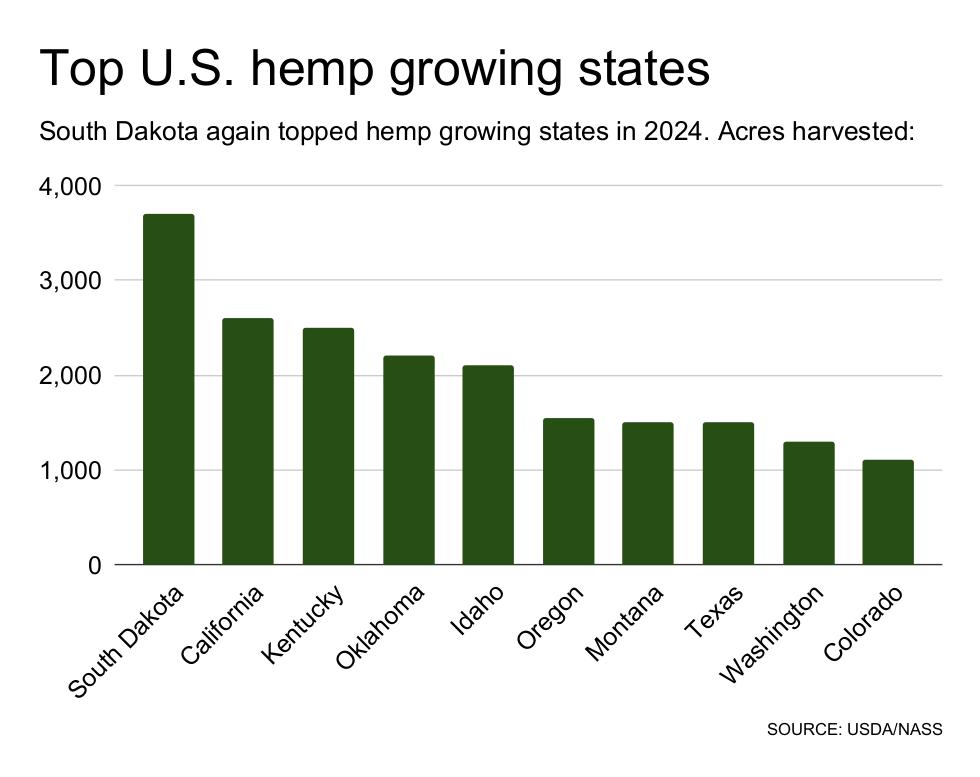

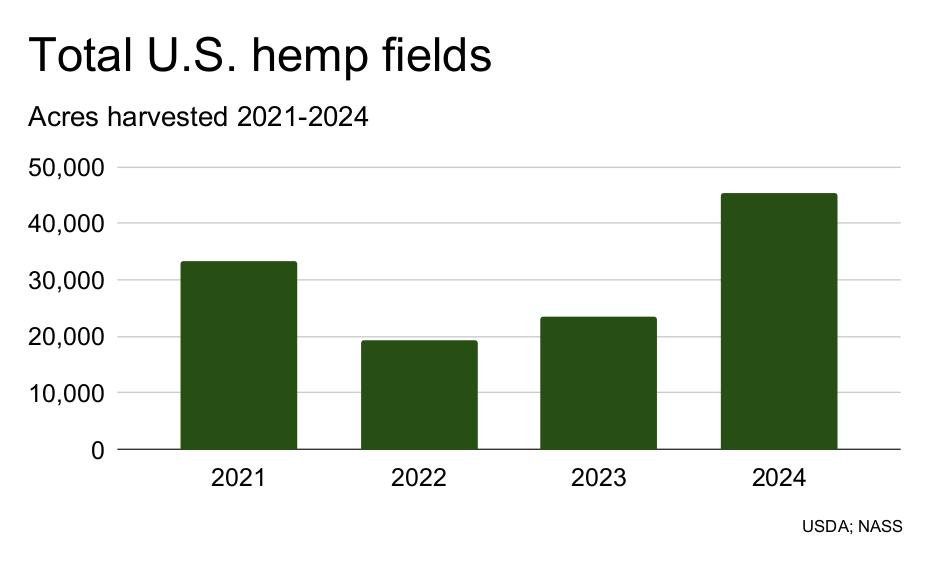

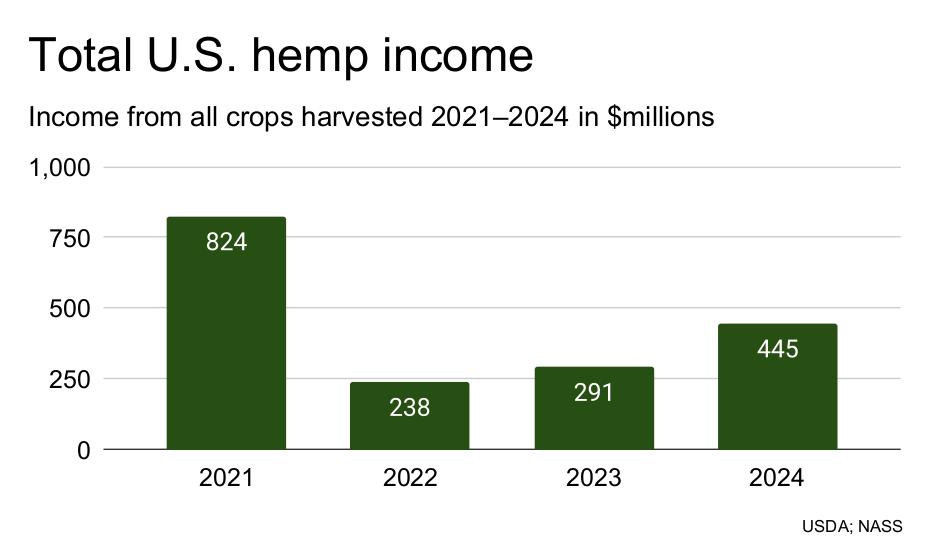

The total value of U.S. hemp production jumped 40% to $445 million in 2024, according to the latest National Hemp Report from the United States Department of Agriculture (USDA). While the spike could signal renewed momentum in a sector still recovering from the spectacular CBD crash that followed the 2018 legalization boom, the story is far more complex—and far less reassuring.

Nearly all of the growth came from hemp flowers, cultivated primarily to produce unregulated intoxicating products derived from them. Hemp fiber and grain, meanwhile, remained stuck in lowvalue territory, with falling prices and stubbornly underdeveloped infrastructure, according to the report, from USDA’s National Agricultural Statistics Service (NASS).

“We’re seeing a bifurcation of the market,” said industry analyst Joseph Carringer of Canna Markets Group. “On one side, you’ve got the synthetic THC boom, which is short-term and legally precarious. On the other, you have fiber and grain, which are structurally sound in theory but not yet economically viable in

practice.”

The report, released yesterday, paints a picture of a hemp economy growing more reliant on controversial cannabinoid conversions than “true hemp” – grain and fiber – even as states and lawmakers move to rein them in.

Hemp flowers remained the economic engine of the industry in 2024. Farmers harvested 11,827 acres (up 60% from 7,383 acres in 2023), yielding 20.8 million pounds (up 159% from 8.0 million pounds). Despite a sharp increase in volume, pricing held firm, resulting in a total market value for flowers grown both outdoors and indoors of $415 million (up 43% from $302 million in 2023).

The average yield per acre for flowers also rose to 1,757 pounds (up from 1,088 pounds in 2023), suggesting improved genetics, practices, or environmental conditions.

Window closing for intoxicants?

Still, most of this value came from hemp flowers destined not for CBD wellness products but for intoxicating derivatives like delta-8 THC. These syn-

thetic substances are produced through lab conversion of CBD and continue to skirt marijuana regulations due to a gap in federal law—though that window is rapidly narrowing as more states and lawmakers push back.

Fiber fields up 56%

Farmers harvested 18,855 acres of fiber hemp in 2024 (up 56% from 12,106 acres in 2023), producing 60.4 million pounds of material (up 23% from 49.1 million pounds). But yields dropped sharply to 3,205 pounds per acre (down 21% from 4,053 pounds in 2023), and average prices continued to fall.

As a result, the cash value of fiber production fell 3% to $11.2 million, down from $11.6 million in 2023. The disconnect between rising volume and falling value reflects continued weakness in processing capacity, supply chain maturity, and market pricing. Even as more fiber is grown, there’s still no robust infrastructure to absorb it economically.

Hemp grown for grain rose modestly in 2024. Farmers harvested 4,863 acres (up 22% from 3,986 acres in 2023), yield-

Photo: Matt Barton

ing 3.41 million pounds of grain (up 10% from 3.11 million pounds). However, yields fell to 702 pounds per acre (down from 779 in 2023), and pricing remained flat.

Still, total value increased 13% to $2.62 million, up from $2.31 million the previous year. While not a breakout, it was a step in the right direction for a category where the U.S. continues to lag behind Canadian imports.

Breakout growth for seed

The strongest percentage growth in 2024 came from hemp cultivation seed. Growers harvested 2,160 acres (up 61% from 1,344 in 2023), producing 697,000 pounds of seed (down 7% from 751,000 pounds in 2023 due to lower yields of 323 pounds per acre, down from 559).

Yet despite reduced yield, prices surged, and the total value of seed reached $16.9 million—a massive 482% increase from just $2.91 million in 2023. The category’s strong performance reflects growing demand for specialized genetics and improved varietals as the market matures.

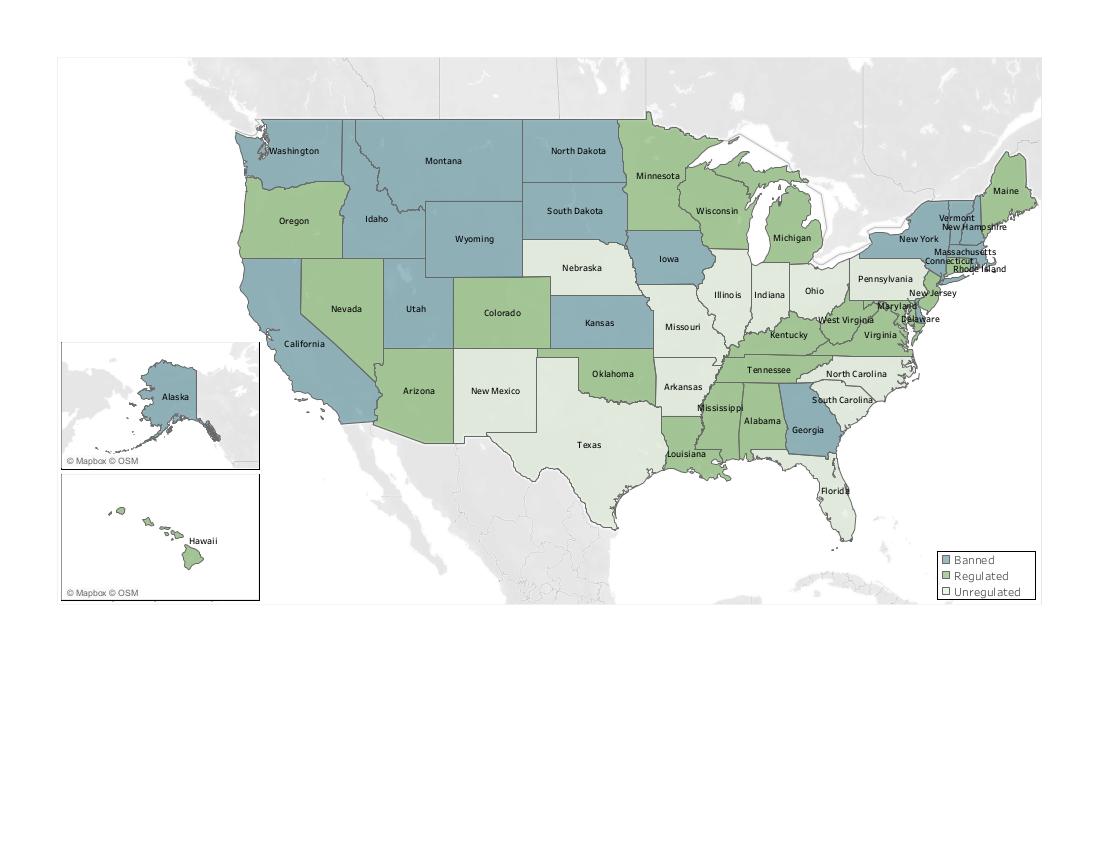

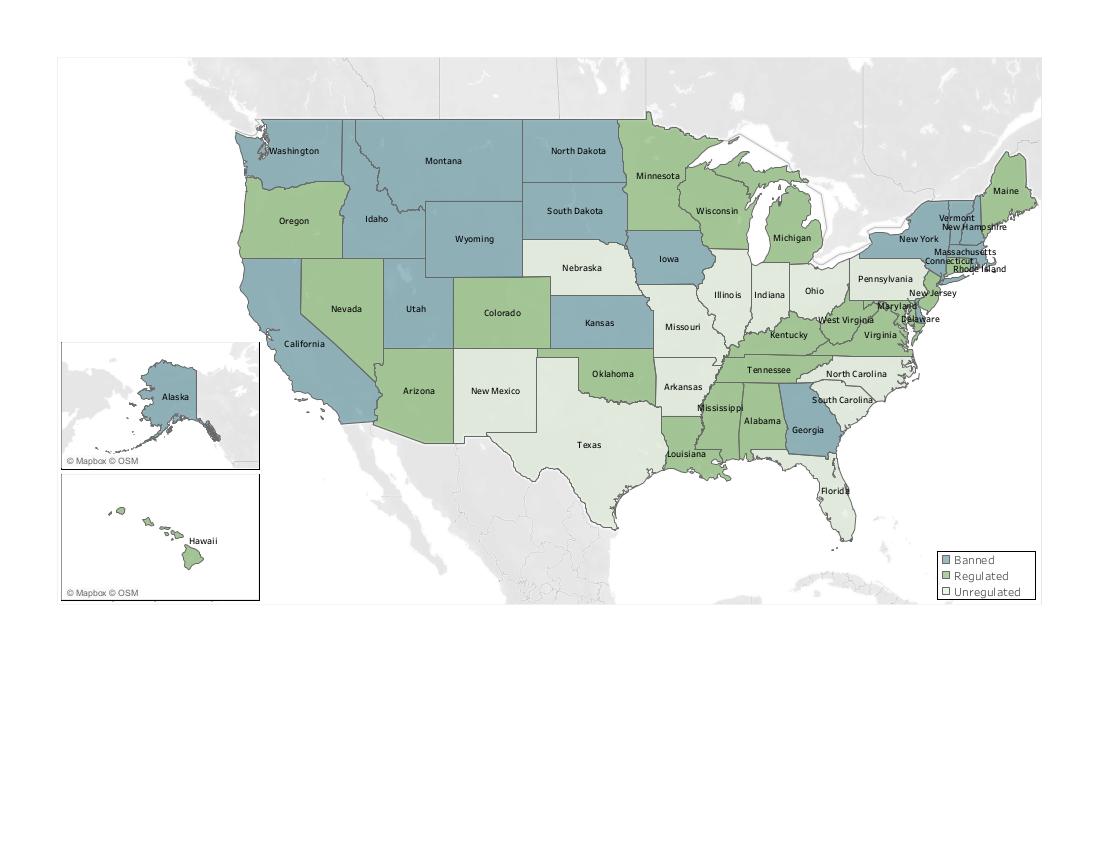

Status of intoxicating hemp products across the USA.

intoxicating hemp-derived products. These substances, often synthesized from hemp-derived CBD, include delta-8 THC, delta-10 THC, HHC, and other compounds that can produce a psychoactive effect similar to marijuana. Due to a loophole in the 2018 Farm Bill, which legalized hemp and its derivatives as long as they contain less than 0.3% delta-9 THC, these products have been marketed without federal oversight— frequently with no age restrictions, no mandatory testing, and packaging that appeals to children.

States step in

As a result, state governments have been forced to step in. The regulatory response has been swift and uneven. Some states have banned the products entirely. Others have imposed limits, licensing schemes, or adult-use requirements. Several still lack clear rules. The result is a patchwork of laws that has created uncertainty for businesses and confusion

non-intoxicating cannabinoid products, such as CBD, are now subject to serving limits and must be sold only to those 21 and older. Officials cited concerns about child safety and a lack of product controls in the growing market for hempderived intoxicants.

Critical divide

This situation has highlighted a critical divide in the hemp industry. On one side are the producers, processors, and innovators focused on hemp’s long-term value in food, fiber, construction materials, and regenerative agriculture. On the other are operators in the cannabinoid market—some legitimate, others less so—who have turned to intoxicating derivatives as a revenue stream following the collapse of the overhyped CBD boom.

Many in the traditional hemp sector argue that the public is now conflating “hemp” with these psychoactive substances, eroding the distinction between

federal research support.

A growing number of industry voices and policymakers are calling for federal clarity. The upcoming Farm Bill could address the problem by refining the legal definition of hemp to exclude synthetically produced intoxicants. National labeling standards, age limits, and potency thresholds are also under discussion.

Meanwhile, responsible companies are urging lawmakers to preserve access to legitimate, non-intoxicating hempderived compounds such as CBD—while clearly separating them from products designed to mimic marijuana.

Keep the promise

The hemp industry is broad, sciencebased, and rooted in agricultural and environmental promise. To ensure that promise is not lost, the upcoming Farm Bill must protect public safety, reinforce clear product categories, and help restore the public’s understanding of what hemp is—and what it is not. Banned

© 2025 Canna Markets Group

Banned Regulated Unregulated

■ Colorado: June 7, 2023, Colorado enacted SB 23-271, establishing a regulatory framework that classifies cannabinoids into non-intoxicating, potentially intoxicating, and intoxicating categories. The law sets specific THC limits and CBD-to-THC ratios for hemp products and requires licensing for the manufacture and sale of products containing intoxicating cannabinoids.

■ Connecticut: January 1, 2025, Connecticut implemented new regulations requiring hemp-derived products containing certain levels of THC to be sold exclusively through licensed cannabis establishments. This change aims to regulate products that, while derived from hemp, possess psychoactive properties due to THC content.

■ Delaware: Delaware classifies all tetrahydrocannabinols (THC) and their isomers, including Delta-8 THC, as Schedule I controlled substances. This classification renders the manufacture, distribution, sale, and possession of Delta-8 THC illegal within the state, regardless of its hemp-derived origin.

■ Florida: The Florida House and Senate ended the legislative session without agreeing on a unified framework to control the state’s booming market for high-potency hemp products.

■ Georgia: As of October 1, 2024, Georgia enforces stringent regulations on hemp-derived cannabinoids under SB 494. The law mandates that all consumable hemp products must contain no more than 0.3% total THC, which includes both Delta-9 THC and THCa. This effectively bans high-THCa hemp flower. Additionally, the sale of consumable hemp products is restricted to individuals aged 21 and over, and retailers must obtain proper licensing.

■ Hawaii: As of May 2025, Hawaii is implementing stricter regulations on hemp-derived cannabinoids. House Bill 1482, passed by the legislature in April 2025, mandates registration for manufacturers and retailers of hemp products, with enforcement beginning January 1, 2026. The bill also introduces penalties for unregistered sales and grants inspection authority to the Department of Health and Attorney General. Additionally, House Bill 302 aims to crack down on unlicensed CBD stores selling cannabis illegally, enhancing enforcement against unregulated hemp products. While these measures indicate a move toward regulation, a complete ban on hempderived cannabinoids has not been enacted.

■ Idaho: Based on the most recent and credible sources, Idaho enforces stringent regulations on hemp-derived cannabinoids. The state mandates that all hemp-derived products must contain 0.0% THC, effectively prohibiting any detectable amount of THC in such products. This regulation applies to both in-state and out-of-state manufacturers, and any product exceeding this limit is subject to law enforcement actions.

■ Illinois : As of May 2025, Illinois does not have specific regulations governing hemp-derived cannabinoids like delta-8 THC. Proposed legislation to regulate these products stalled in the Illinois House in January 2025 due to internal disagreements among lawmakers. Consequently, the sale and distribution of hempderived cannabinoids remain unregulated in the state.

■ Indiana: As of May 2025, Indiana is in the process of regulating hemp-derived cannabinoids, particularly Delta-8 THC. Senate Bill 478 has passed the Indiana Senate and is under consideration in the House. This legislation aims to establish a regulatory framework for Delta-8 THC products, including licens-

0.3% total THC. Certain products, such as vapes and edibles, are excluded from this exemption. Enforcement actions have been taken against non-compliant products.

■ Maine: Delta-8 THC and similar hemp-derived cannabinoids are legal but regulated under Maine’s cannabis laws, requiring licensing and adherence to potency limits.

■ Maryland: Delta-8 THC and similar hemp-derived cannabinoids are legal but regulated under Maryland’s cannabis laws, requiring licensing and adherence to potency limits.

■ Massachusetts: Intoxicating hemp-derived products, including Delta-8 THC, are prohibited outside of licensed cannabis dispensaries. Enforcement is inconsistent due to regulatory gaps.

■ Michigan: Delta-8 THC and similar hemp-derived cannabinoids are legal but regulated under Michigan’s cannabis laws, requiring licensing and adherence to potency limits.