AMP2017

The 2017 Asset Management Plan for the City of Kawartha Lakes

Figure

Figure

The 2017 Asset Management Plan for the City of Kawartha Lakes

Figure

Figure

Infrastructureisinextricablylinkedtotheeconomic,socialandenvironmentaladvancementofa community.Municipalitiesownandmanagenearly60%ofthepublicinfrastructurestockin Canada.Asanalyzedinthisassetmanagementplan(AMP),theCityofKawarthaLakes’ infrastructureportfoliocomprisesthefollowingassetclasses:roadnetwork,bridges&culverts, buildings,storm,water,sanitary,machinery&equipment,landimprovements,vehiclesandnatural resources ThereplacementcostoftheCity’sassetportfolioisestimatedtobeabout$3.2billion, excludingsocialhousing.Ofthis,onlyabout$1.8billionisphysicallydepreciableandthereforefully analyzedwithinthisAMP.

Strategicassetmanagementiscriticalinextractingthehighesttotalvaluefrompublicassetsatthe lowestlifecyclecost.ThisAMP,themunicipality’ssecondfollowingthecompletionofitsfirst editionin2013,detailsthestateofinfrastructureofthemunicipality’sserviceareasandprovides assetmanagementandfinancialstrategiesdesignedtofacilitateitspursuitofdevelopingan advancedassetmanagementprogramandmitigatelong-termfundinggaps.

Inadditiontoobservedfieldconditions,historicalcapitalexpenditurescanassistthemunicipality inidentifyingimpendinginfrastructureneeds,andguideitsmedium-andlong-termcapital programs.Themunicipalityhascontinuouslyinvestedinitsinfrastructurecontinuouslyoverthe decades.Investmentsfluctuatedduringthe1970sand1980sandthenpeakedintheearly2000s. Duringthistime,$215millionwasinvestedwith$94millionputintotheroadnetwork.Since2015, $50millionhasbeeninvestedwithafocusonroads,thewatersystemandlandimprovements.

Basedon2016replacementcost,andprimarilyconditiondata,over70%ofassets,withavaluation of$1.2billion,areingoodtoverygoodcondition;18%areinpoortoverypoorcondition The municipalityhasprovidedconditioninformationfor78%ofassetsbasedon2016replacement cost.Nearly90%oftheassetsanalyzedinthisAMPhaveatleast10yearsofusefulliferemaining. However,4%,withavaluationof$69million,remaininoperationbeyondtheirestablisheduseful life.Anadditional3%willreachtheendoftheirusefullifewithinthenextfiveyears.

InorderforanAMPtobeeffective,itmustbeintegratedwithfinancialplanningandlong-term budgeting.Thedevelopmentofacomprehensivefinancialplanwillallowthemunicipalityto identifythefinancialresourcesrequiredforsustainableassetmanagementbasedonexistingasset inventories,desiredlevelsofservice,andprojectedgrowthrequirements.TheCityhasdeveloped suchaplan,attachedheretoasAppendix2,whicheliminatestheinfrastructuredeficitby2021, phasesinsustainabletaxandwater/wastewaterratesupportover2018-2021andbuildshealthy capitalreservebalancesby2018.

AcriticalaspectofthisAMPisthelevelofconfidencethemunicipalityhasinthedatausedto developthestateoftheinfrastructureandformtheappropriatefinancialstrategies.The municipalityhasindicatedahighdegreeofconfidenceintheaccuracy,validityandcompletenessof theassetdataforallcategoriesanalyzedinthisAMP

AcrossCanada,themunicipalshareofpublicinfrastructureincreasedfrom22%in1955tonearly 60%in2013.Thefederalgovernment’sshareofcriticalinfrastructurestock,includingroads,water andwastewater,declinedbynearly80%invaluesince1963.1

Ontario’smunicipalitiesownmoreoftheinfrastructureassetsintheprovincethanboththe provincialandfederalgovernment.TheassetportfoliosmanagedbyOntario’smunicipalitiesare alsohighlydiverse.TheCityofKawarthaLakes’capitalassetportfolio,asanalyzedinthisAMPis valuedat$3.1billionusing2016replacementcosts.Themunicipalityreliesontheseassetsto provideresidents,businesses,employeesandvisitorswithsafeaccesstoimportantservices,such astransportation,recreation,culture,economicdevelopmentandmuchmore.Assuch,itiscritical thatthemunicipalitymanagetheseassetsoptimallyinordertoproducethehighesttotalvaluefor taxpayers.ThisAMPwillassistthemunicipalityinthepursuitofjudiciousassetmanagementforits capitalassets.

1 LarryMiller,UpdatingInfrastructureInCanada:AnExaminationofNeedsAndInvestmentsReportoftheStandingCommitteeon Transport,InfrastructureandCommunities,June2015

Assetmanagementcanbebestdefinedasanintegratedbusinessapproachwithinanorganization withtheaimtominimizethelifecyclecostsofowning,operating,andmaintainingassets,atan acceptablelevelofrisk,whilecontinuouslydeliveringestablishedlevelsofserviceforpresentand futurecustomers.Itincludestheplanning,design,construction,operationandmaintenanceof infrastructureusedtoprovideservices.Byimplementingassetmanagementprocesses, infrastructureneedscanbeprioritizedovertime,whileensuringtimelyinvestmentstominimize repairandrehabilitationcostsandmaintainmunicipalassets

Table 1 Objectives of Asset Management

Objective

Description

Inventory Captureallassettypes,inventoriesandhistoricaldata

CurrentValuation Calculatecurrentconditionratingsandreplacementvalues

LifecycleAnalysis IdentifyMaintenanceandRenewalStrategies&LifecycleCosts.

ServiceLevelTargets DefinemeasurableLevelsofServiceTargets

Risk&Prioritization Integratesallassetclassesthroughriskandprioritizationstrategies

SustainableFinancing

ContinuousProcesses

DecisionMaking& Transparency

IdentifysustainableFinancingStrategiesforallassetclasses

Providecontinuousprocessestoensureassetinformationiskeptcurrentand accurate

Integrateassetmanagementinformationintoallcorporatepurchases,acquisitions andassumptions.

Monitoring&Reporting Atdefinedintervals,assesstheassetsandreportonprogressandperformance

TheInstituteofAssetManagement(IAM)recommendstheadoptionofsevenkeyprinciplesfora sustainableassetmanagementprogram.AccordingtoIAM,assetmanagementmustbe:2

Principle Description

Holistic

Systematic

Systemic

Risk-based

Optimal

Sustainable

Integrated

Assetmanagementmustbecross-disciplinary,totalvaluefocused.

Rigorouslyappliedinastructuredmanagementsystem

Lookingatassetsintheirsystemscontext,againfornet,totalvalue

Incorporatingriskappropriatelyintoalldecision-making

Seekingthebestcompromisebetweenconflictingobjectives,suchas costsversusperformanceversusrisksetc.

Plansmustdeliveroptimalassetlifecycles,ongoingsystems performance,environmentalandotherlongtermconsequences.

Attheheartofgoodassetmanagementliestheneedtobejoined-up.The totaljigsawpuzzleneedstoworkasawhole-andthisisnotjustthe sumoftheparts.

2 “Key Principles”, The Institute of Asset Management, www.iam.org

ThisAMPisonecomponentofKawarthaLakes’overarchingcorporatestrategy.Itwasdevelopedto supportthemunicipality’svisionforitsassetmanagementpracticeandprograms.Itprovideskey assetattributedata,includingcurrentcompositionofthemunicipality’sinfrastructureportfolio, inventory,replacementcosts,usefullifeetc.,summarizesthephysicalhealthofthecapitalassets, enumeratesthemunicipality’scurrentcapitalspendingframework,andoutlinesfinancialstrategies toachievefiscalsustainabilityinthelong-termwhilereducingandeventuallyeliminatingfunding gaps(i.e.infrastructuredeficits)

Aswiththefirsteditionofthemunicipality’sassetmanagementplanin2013,thisAMPisdeveloped inaccordancewithprovincialstandardsandguidelines,andnewrequirementsundertheFederal GasTaxFund(GTF)stipulatingtheinclusionofalleligibleassetclasses.Thefollowingassetclasses areanalysedinthisdocument:roadnetwork;bridges&culverts;water;wastewater;storm; facilities;machinery&equipment;landimprovements;andvehicles Naturalresourcesandroad baseareincludedsolelytoshowthevalueownedbythemunicipality.

Themunicipality’sdatasetfortheassetclassesanalyzedinthisAMParemaintainedinPSD’s CityWide®TangibleAssetsmodule.ThisdatasetincludeskeyassetattributesandPSAB3150data, suchashistoricalcosts,in-servicedates,fieldinspectiondata(asavailable),assethealth,and replacementcosts.

Municipalitiesimplementastraight-lineamortizationscheduleapproachtodepreciatetheircapital assets.Ingeneral,thisapproachmaynotbereflectiveofanasset’sactualconditionandthetrue natureofitsdeterioration,whichtendstoacceleratetowardtheendoftheasset’slifecycle. However,itisausefulapproximationintheabsenceofstandardizeddecaymodelsandactualfield conditiondataandcanprovideabenchmarkforfuturerequirements.Weanalyzeeachasset individuallypriortoaggregationandreporting;therefore,manyimprecisionsthatmaybe highlightedattheindividualassetlevelareattenuatedattheclasslevel.

Asavailable,actualfieldconditiondatawasusedtomakerecommendationsmoremeaningfuland representativeofthemunicipality’sstateofinfrastructure.Thevalueofconditiondatacannotbe overstatedastheyprovideamoreaccuraterepresentationofthestateofinfrastructurethandoes agealone.ThetypeofconditiondatausedforeachclassisindicatedinChapterV,Section2.

InthisAMP,theaverageannualrequirementistheamount,basedoncurrentreplacementcosts, thatmunicipalitiesshouldsetasideannuallyforeachinfrastructureclasssothatassetscanbe replaceduponreachingtheendoftheirlifecycle.

Todeterminecurrentfundingcapacity,allexistingsourcesoffundingareidentifiedandcombined toenumeratethetotalavailablefunding;fundingforthepreviousthreeyearsisanalyzedasdatais available.Thesefiguresarethenassessedagainsttheaverageannualrequirements,andareusedto calculatetheannualfundingshortfall(surplus)andforformingthefinancialstrategies.

Inadditiontotheannualshortfall,themajorityofmunicipalitiesfacesignificantinfrastructure backlogs.Theinfrastructurebacklogistheaccruedfinancialinvestmentneededintheshort-term tobringtheassetstoastateofgoodrepair.Thisamountisidentifiedforeachassetclass.

TheAMPisacomplexdocument,butonewithdirectimplicationsonthepublic,agroupwithvaryingdegreesoftechnicalknowledge.To makecommunicationsmoremeaningfulandtheAMPmoreaccessible,we’vedevelopedanInfrastructureReportCardthatsummarizes ourfindingsincommonlanguagethatmunicipalitiescanuseforinternalandexternaldistribution.Thereportcardisdevelopedusing twokey,equallyweightedfactors:FinancialCapacityandAssetHealth.

Amunicipality’sfinancialcapacitygradeisdeterminedbytheleveloffundingavailable(0-100%)foreachassetclassforthepurposeof meetingtheaverageannualinvestmentrequirements.

Usingeitherfieldinspectiondataasavailableorage-baseddata,theassethealthcomponentofthereportcardusescondition(0-100%)to estimatehowcapableassetsareinperformingtheirrequiredfunctions.Weusereplacementcosttodeterminetheweightofeach conditiongroupwithintheassetclass.

VeryGood

B Good

C Fair

Theassetisfunctioningandperformingwell;onlynormalpreventivemaintenanceisrequired.Themunicipalityisfullypreparedforits long-termreplacementneedsbasedonitsexistinginfrastructureportfolio.

Themunicipalityiswellpreparedtofunditslong-termreplacementneedsbutrequiresadditionalfundingstrategiesintheshort-term tobegintoincreaseitsreserves.

Theasset’sperformanceorfunctionhasstartedtodegradeandrepair/rehabilitationisrequiredtominimizelifecyclecost.The municipalityisunderpreparingtofunditslong-terminfrastructureneeds.Thereplacementofassetsintheshort-andmedium-term willlikelybedeferredtofutureyears.

D Poor

F VeryPoor

Theasset’sperformanceandfunctionisbelowthedesiredlevelandimmediaterepair/rehabilitationisrequired.Themunicipalityis notwellpreparedtofunditsreplacementneedsintheshort-,medium-orlong-term.Assetreplacementswillbedeferredandlevelsof servicemaybereduced.

Themunicipalityissignificantlyunderfundingitsshort-term,medium-term,andlong-terminfrastructurerequirementsbasedon existingfundsallocation.Assetreplacementswillbedeferredindefinitely.Themunicipalitymayhavetodivestsomeofitsassets(e.g., bridgeclosures,arenaclosures)andlevelsofservicewillbereducedsignificantly.

Severallimitationscontinuetopersistasmunicipalitiesadvancetheirassetmanagementpractices.

Asavailable,weusefieldconditionassessmentdatatoillustratethestateofinfrastructureand developtherequisitefinancialstrategies.However,intheabsenceofobserveddata,werelyon theageofassetstoestimatetheirphysicalcondition.

Asecondlimitationistheuseofinflationmeasures,forexampleusingCPI/NRBCPItoinflate historicalcostsintheabsenceofactualreplacementcosts.Whileareasonableapproximation, theuseofsuchmultipliersmaynotbereflectiveofmarketpricesandmayover-orunderstate thevalueofamunicipality’sinfrastructureportfolioandtheresultingcapitalrequirements.

OurcalculationsandrecommendationswillreflectthebestavailabledataatthetimethisAMP wasdeveloped.

ThefocusofthisplanisrestrictedtocapitalexpendituresanddoesnotcaptureO&M(operating andmaintenance)expendituresoninfrastructure.

Highdataqualityisthefoundationofintelligentdecision-making.Generally,therearetwoprimarycausesofpoordecisions:inaccurateor incompletedata,andthemisinterpretationofdataused.Thefigurebelowillustratesanabbreviatedversionofourworkorder/workflow processbetweenPSDandmunicipalstaff.ItisdesignedtoensuremaximumconfidenceintherawdatausedtodeveloptheAMP,the interpretationoftheAMPbyallstakeholders,andultimately,theapplicationofthestrategiesoutlinedinthisAMP.

GAPANALYSIS:CITYWIDETA

Reviewclientdatabaseand assessagainstbenchmark municipalities

DATAVALIDATION1

CollaboratewithEngineering andFinancetovalidateand refinedata

GAPANALYSIS:CITYWIDECPA

Reviewclientdatabaseand assessagainstbenchmark municipalities

DATAVALIDATION2

CollaboratewithFinanceto validateandrefinedataprior tothedevelopingfinancial strategy

AMENDFINANCIALSTRATEGY

Collaboratewithclientto redevelopfinancialstrategy

ISSTRATEGY APPROVED?

FINANCIALSTRATEGY

PSDsubmitsfinancialstrategyto clientforreview

FIRSTDRAFT

PSDsubmitsfirstcomplete draftoftheAMP

AMENDDRAFT

Incorporateclientfeedback andresubmitdraft

ISDRAFT APPROVED?

SUBMITFINALAMPDRAFT

PSDdevelopsreportcardand submitsfinaldraftforclient approvalandprojectsign-off

DATAAPPROVAL

Clientapprovesallassetand financialdatabeforePSDcan developfinancialstrategy

StaffconfidenceinthedatausedtodeveloptheAMPcandeterminetheextenttowhich recommendationsareapplied.Lowconfidencesuggestsuncertaintyaboutthedataandcan underminethevalidityoftheanalysis.Highdataconfidenceendorsesthefindingsandstrategies, andtheAMPcanbecomeanimportant,reliablereferenceguideforinterdepartmental communicationaswellasamanualforlong-termcorporatedecision-making.Havinganumerical ratingforconfidencealsoallowsthemunicipalitytotrackitsprogressovertimeandeliminatedata gaps.

DataconfidenceinthisAMPisdeterminedusingfivekeyfactorsandisbasedontheCityof Brantford’sapproach.Municipalstaffprovidetheirlevelofconfidence(score)ineachfactorfor majorassetclassesalongaspectrum,rangingfrom0,suggestinglowconfidenceinthedata,to100 indicativeofhighcertaintyregardinginputs.Thefivefactorsusedtocalculatethemunicipality’s dataconfidenceratingsare:

Thedataisuptodate. Thedataiscomplete anduniform.

Thedatacomesfrom anauthoritative source Thedataiserrorfree. Thedatais verifiedbyan authoritative source.

Themunicipality’sself-assessedscoreineachfactoristhenusedtocalculatedataconfidencein eachassetclassusingEquation1below.

Inthissection,weaggregatetechnicalandfinancialdataacrossallassetclassesanalyzedinthis AMP,andsummarizethestateoftheinfrastructureusingkeyindicators,includingassetcondition, usefullifeconsumption,andimportantfinancialmeasurements.

TheassetclassesanalyzedinthisAMPforthemunicipalityhadatotal2016valuationof$3.2billion,ofwhichroadscomprised48%, followedbynaturalresourcesat13%.Theownershipperhousehold(Figure4)totaled$120,000basedon38,444householdsforallasset categoriesexceptforwaterserviceswith12,766householdsandwastewaterserviceswith11,104households.Notethatnatural resourcesandroadbases,whicharepartoftheroadnetwork,areincludedsolelytorepresentthetotalvalueofassetsownedbythe municipality.

Observeddatawillprovidethemostpreciseindicationofanasset’sphysicalhealth.Intheabsence ofsuchinformation,theageofcapitalassetscanbeusedasameaningfulapproximationofthe asset’scondition.Table4indicatesthesourceofconditiondatausedforthevariousassetclassesin thisAMP.Themunicipalityhasconditiondatafor78%ofallassetsbasedon2016replacement cost.

Table 4 Source of Condition Data by Asset Class

Gravel 100%Assessed–2016

Assessed–2016

RoadsNetwork

Assessed–2016

Assessed–2016

Remainingsegments Age-based

Bridges&Culverts Bridges Age-based Culverts

WaterSystem All

SanitaryServices All

Storm All

Buildings Structure

Remainingsegments

Machinery&Equipment Furniture

LandImprovements

Age-based

Assessed–2016

Assessed–2016

Assessed–2016

Age-based

Assessed–2016 Gear&Devices

Systems

AirportSiteworks

Siteworks

LandfillSiteworks

AirportSiteworks

Vehicles FireService

Remainingsegments

Assessed–2016

Assessed–2016

Assessed–2016

Assessed–2016

Assessed–2016

Assessed–2016

Age-based

Inconjunctionwithconditiondata,twoothermeasurementscanaugmentstaffunderstandingofthestateofinfrastructureand impendingandlong-terminfrastuctureneeds:installationyearprofileandusefulliferemaining.Using2016replacementcosts,Figure5 illustratesthehistoricalinvesmentsmadeintheassetclassesanalyzedinthisAMPsince1950.Often,investmentincriticalinfrastructure parallelspopulationgrowthorothersignificantshiftsindemographics;itcanalsofluctuatewithprovincialandfederalstimulsprograms. NotethatthisgraphonlyincludestheactiveassetinventoryasofDecember31,2016.

Themunicipalityhasinvestedinitsinfrastructurecontinuouslyoverthedecades.Investmentsfluctuatedduringthe1970sand1980sand thenpeakedintheearly2000s.Duringthistime,$215millionwasinvestedwith$94millionputintotheroadnetwork.Since2015,$50 millionhasbeeninvestedwithafocusonroads,thewatersystemandlandimprovements.

Whileageisnotapreciseindicatorofanasset’shealth,intheabsenceofobservedcondition assessmentdata,itcanserveasahigh-level,meaningfulapproxmiationandhelpguidereplacement needsandfacilitatestrategicbudgeting.Figure6showsthedistibutionofassetsbasedonthe percentageofusefullifealreadyconsumed.

Nearly90%oftheassetsanalyzedinthisAMPhaveatleast10yearsofusefulliferemaining. However,4%,withavaluationof$69million,remaininoperationbeyondtheirestablisheduseful life.Anadditional3%willreachtheendoftheirusefullifewithinthenextfiveyears.

Basedon2016replacementcost,andprimarilyconditiondata,over70%ofassets,withavaluation of$1.2billion,areingoodtoverygoodcondition;18%areinpoortoverypoorcondition.

Thissectiondetailskeyhigh-levelfinancialindicatorsforthemunicipality’sassetclasses.

Storm

Machinery

Land

Bridges

Wastewater

$1,088,000

$1,401,000

$2,394,000

$2,660,000

$3,341,000

$3,516,000

$4,987,000

$6,260,000

$22,977,000

$48,624,000

Theannualrequirementsrepresenttheamountthemunicipalityshouldallocateannuallytoeachof itsassetclassestomeetreplacementneedsastheyarise,preventinfrastructurebacklogsand achievelong-termsustainability.Intotal,themunicipalitymustallocate$48.6millionannuallyfor theassetscoveredinthisAMP.InAppendix2,thisfigureisadjustedtoreflectthenewinformation providedbythe2016RoadsNeedsStudywhich,duetotiming,couldnotbeincorporatedintothe mainbodyofthisAMP.

Wastewater

Machinery&Equipment

StormSewer

Facilities

Road

$0

$0

$0

$564,000

$3,630,000

$6,954,000

$8,875,000 $8,133,000

Total

Themunicipalityhasacombinedinfrastructurebacklogof$69.6million,withbridges&culverts comprising60%.Thebacklogrepresentstheinvestmentneededtodaytomeetpreviouslydeferred replacementneeds.Intheabsenceofassesseddata,thebacklogrepresentsthevalueofassetsstill inoperationbeyondtheirestablishedusefullife.

Inthissection,weillustratetheaggregateshort-,medium-andlong-terminfrastructurespendingrequirements(replacementonly)for themunicipality’sassetclasses.Thebacklogisthetotalinvestmentininfrastructurethatwasdeferredoverpreviousyearsordecades.In theabsenceofobserveddata,thebacklogrepresentsthevalueofassetsthatremaininoperationbeyondtheirusefullife.

Basedprimarilyonconditiondata,themunicipalityhasacombinedbacklogof$69.6million,ofwhichbridges&culvertscomprises$41 million.Aggregatereplacementneedswilltotal$62millionoverthenextfiveyears.Anadditional$91millionwillberequiredbetween 2021and2025.Themunicipality’saggregateannualrequirements(indicatedbytheblackline)total$48.6million.Atthisfundinglevel, themunicipalitywouldbeallocatingsufficientfundsonanannualbasistomeetthereplacementneedsforitsvariousassetclassesasthey arisewithouttheneedfordeferringprojectsandaccruingannualinfrastructuredeficits.Further,whilefulfillingtheannualrequirements willpositionthemunicipalitytomeetitsfuturereplacementneeds,injectionofadditionalrevenueswillbeneededtomitigateexisting infrastructurebacklogs.

ThemunicipalityhasahighdegreeofconfidenceinthedatausedtodevelopthisAMP,receivingaweightedconfidenceratingof82%. Thisisindicativeofsignificanteffortincollectingandrefiningitsdataset. Table 5 Data Confidence Ratings

Thestateoflocalinfrastructureincludesthefullinventory,conditionratings,usefullife consumptiondataandthebacklogandupcominginfrastructureneedsforeachassetclass.As available,assessedconditiondatawasusedtoinformthediscussionandrecommendations;inthe absenceofsuchinformation,age-baseddatawasusedasthenextbestalternative.

Table6illustrateskeyassetattributesforthemunicipality’sroadnetwork,includingquantitiesofvariousassets,theirusefullife,their replacementcost,andthevaluationmethodbywhichthereplacementcostswerederived.Intotal,themunicipality’sroadsassetsare valuedat$1.5billionbasedon2016replacementcosts.Theusefullifeindicatedforeachassettypebelowwasassignedbythe municipality.Itshouldbenotedthattimingdidnotpermittheupdatedroadsassetdatafromthe2016RoadsNeedsStudytobe incorporatedintothissection.

NotethattheAssetswithUnknownDataareshowninthetableaboveandFigure11tohighlightthetotalvaluationofownedassets. Theseassetsarenotincludedwithintheremainingfiguresinthissectionastheydonothavesufficientdata.However,theseassetsare accountedforwithintheannualrequirementsandfinancialstrategy.

Figure12showsthemunicipality’shistoricalinvestmentsinitsroadnetworksince1950.Whileobservedconditiondatawillprovide superioraccuracyinestimatingreplacementneedsandshouldbeincorporatedintostrategicplans,intheabsenceofsuchinformation, understandingpastexpenditurepatternsandcurrentusefullifeconsumptionlevels(Section1.3)caninformtheforecastingandplanning ofinfrastructureneedsandinthedevelopmentofacapitalprogram.Notethatthisgraphonlyincludestheactiveassetinventoryasof December31,2016.

Investmentsinthemunicipality’sroadnetworkhavegrownsince1950withalargeincreaseinthelate1970s.Intheearly2000s,the periodoflargestinvestment,$94millionwasinvestedwithover$56millionputintoHCBroads.

Inconjunctionwithhistoricalspendingpatternsandobservedconditiondata,understandingthe consumptionrateofassetsbasedonindustryestablishedusefullifestandardsprovidesamore completeprofileofthestateofacommunity’sinfrastructure.Figure13illustratestheusefullife consumptionlevelsasof2016forthemunicipality’sroadnetwork.

While86%ofthemunicipality’sroadnetworkhasatleast10yearsofusefulliferemaining,3%, withavaluationof$15million,remaininoperationbeyondtheirusefullife.Anadditional2%will reachtheendoftheirusefullifewithinthenextfiveyears.

Usingreplacementcost,inthissectionwesummarizetheconditionofthemunicipality’sroad networkasof2016.Bydefault,werelyonobservedfielddataasprovidedbythemunicipality.In theabsenceofsuchinformation,age-baseddataisusedasaproxy.Themunicipalityhasprovided conditiondatafor100%ofHCB,LCBandgravelroadassetsandfor99%ofguiderailassets

Basedprimarilyonassessedconditiondata,90%ofassets,withavaluationof$449millionarein goodtoverygoodcondition;6%areinpoortoverypoorcondition.

Inthissection,weillustratetheshort-,medium-andlong-terminfrastructurespendingrequirements(replacementonly)forthe municipality’sroadnetworkassets.Thebacklogistheaggregateinvestmentininfrastructurethatwasdeferredoverpreviousyearsor decades.Intheabsenceofobserveddata,thebacklogrepresentsthevalueofassetsthatremaininoperationbeyondtheirusefullife.

Inadditiontoabacklogof$8.1million,replacementneedsareforecastedtobe$12millioninthenextfiveyears;anadditional$26million isforecastedinreplacementneedsbetween2021-2025.Themunicipality’sannualrequirements(indicatedbytheblackline)foritsroad networktotal$23million.Atthisfundinglevel,themunicipalitywouldbeallocatingsufficientfundsonanannualbasistomeet replacementneedsastheyarisewithouttheneedfordeferringprojectsandaccruingannualinfrastructuredeficits.

Primarilyassessedconditiondataindicatesabacklogof$8.1millionandsignificant10-year replacementneedsof$38million.Themunicipalityshouldcontinueitsconditionassessments ofroadsurfaces(HCBandLCB),andexpandtheprogramtoincorporateallassetsinorderto morepreciselyestimateitsactualfinancialrequirementsandfieldneeds SeeSection2, ‘ConditionAssessmentPrograms’inthe‘AssetManagementStrategies’chapter.

Thedatacollectedthroughconditionassessmentprogramsshouldbeintegratedintoarisk managementframeworkwhichwillguideprioritizationofthebacklogaswellasshort,medium, andlongtermreplacementneeds.SeeSection4,‘Risk’inthe‘AssetManagementStrategies’ chapterformoreinformation.

Inadditiontotheabove,atailoredlifecycleactivityframeworkshouldalsobedevelopedto promotestandardlifecyclemanagementoftheroadnetworkasoutlinedfurtherwithinthe “AssetManagementStrategy”sectionofthisAMP.

Roadnetworkkeyperformanceindicatorsshouldbeestablishedandtrackedannuallyaspartof anoveralllevelofservicemodel.SeeSection7‘LevelsofService’.

Table7illustrateskeyassetattributesforthemunicipality’sbridges&culverts,includingquantitiesofvariousassets,theirusefullife, theirreplacementcost,andthevaluationmethodbywhichthereplacementcostswerederived.Intotal,themunicipality’sbridges& culvertsassetsarevaluedat$187millionbasedon2016replacementcosts.Theusefullifeindicatedforeachassettypebelowwas assignedbythemunicipality.

NotethattheAssetswithUnknownDataareshowninthetableaboveandFigure16Figure11tohighlightthetotalvaluationofowned assets.Theseassetsarenotincludedwithintheremainingfiguresinthissectionastheydonothavesufficientdata.However,theseassets areaccountedforwithintheannualrequirementsandfinancialstrategy

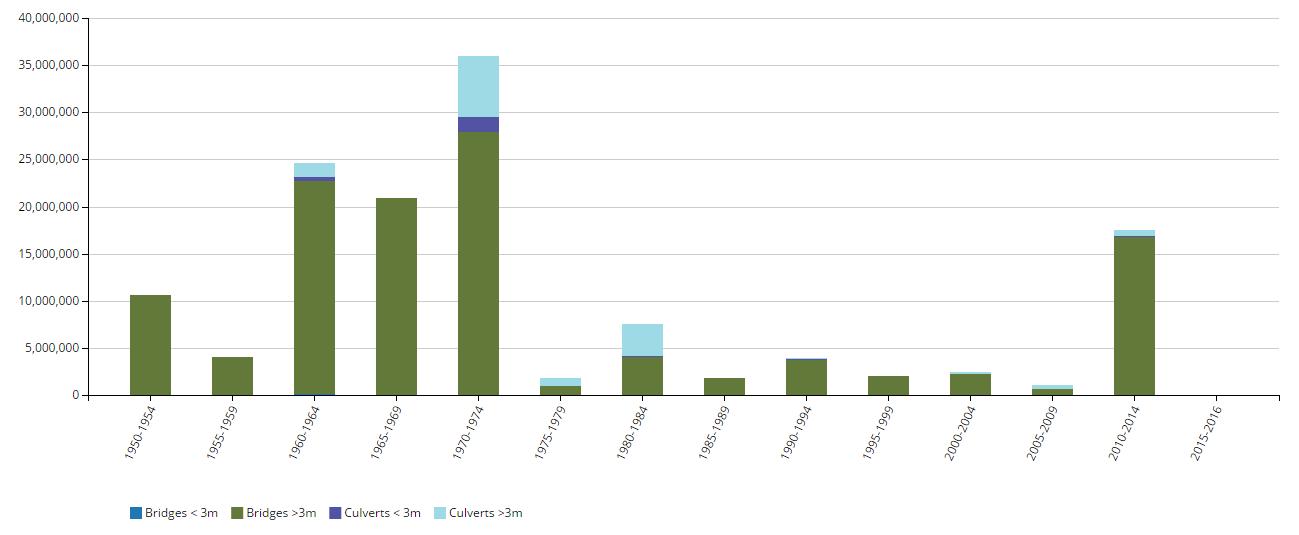

Figure17showsthemunicipality’shistoricalinvestmentsinitsbridges&culvertssince1950.Whileobservedconditiondatawillprovide superioraccuracyinestimatingreplacementneedsandshouldbeincorporatedintostrategicplans,intheabsenceofsuchinformation, understandingpastexpenditurepatternsandcurrentusefullifeconsumptionlevels(Section2.3)caninformtheforecastingandplanning ofinfrastructureneedsandinthedevelopmentofacapitalprogram.Notethatthisgraphonlyincludestheactiveassetinventoryasof December31,2016.

Themunicipalityhasinvestedsporadicallyinitsbridgesandculvertssince1950.Intheearly1970s,theperiodoflargestinvestment,$36 millionwasinvestedwith$28millionputintobridges>3m.

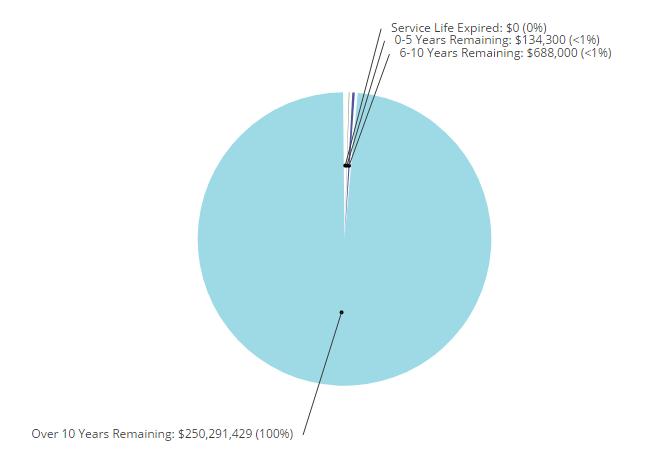

Inconjunctionwithhistoricalspendingpatternsandobservedconditiondata,understandingthe consumptionrateofassetsbasedonindustryestablishedusefullifestandardsprovidesamore completeprofileofthestateofacommunity’sinfrastructure.Figure18illustratestheusefullife consumptionlevelsasof2016forthemunicipality’sbridges&culverts

64%oftheassetshaveatleast10yearsofusefulliferemainingwhile23%,withavaluationof$41 million,remaininoperationbeyondtheirusefullife.Anadditional4%willreachtheendoftheir usefullifewithinthenextfiveyears.

Usingreplacementcost,inthissectionwesummarizetheconditionofthemunicipality’sbridges& culvertsasof2016.Bydefault,werelyonobservedfielddataadaptedfromOSIMinspectionsas providedbythemunicipality.Intheabsenceofsuchinformation,age-baseddataisusedasaproxy. Allassetsarebasedonage-baseddata.

Age-baseddataindicatesthatwhile15%ofthemunicipality’sbridges&culvertsareingoodtovery goodcondition,73%,withavaluationof$132.5million,areinpoortoverypoorcondition.

Inthissection,weillustratetheshort-,medium-andlong-terminfrastructurespendingrequirements(replacementonly)forthe municipality’sbridges&culverts.Thebacklogistheaggregateinvestmentininfrastructurethatwasdeferredoverpreviousyearsor decades.Intheabsenceofobserveddata,thebacklogrepresentsthevalueofassetsthatremaininoperationbeyondtheirusefullife.

Inadditiontoabacklogof$41million,replacementneedswilltotal$7.1millioninthenextfiveyears;anadditional$14.7millionwillbe requiredbetween2021and2025.Themunicipality’sannualrequirements(indicatedbytheblackline)foritsbridges&culvertstotal $2,660,000.Atthisfundinglevel,themunicipalitywouldbeallocatingsufficientfundsonanannualbasistomeetreplacementneedsas theyarisewithouttheneedfordeferringprojectsandaccruingannualinfrastructuredeficits.

Age-baseddataindicatesasignificantbacklogof$41millionand10-yearreplacementneedsof $21.8million.TheresultsandrecommendationsfromtheOSIMinspectionsshouldbe incorporatedintotheAMPanalysisandusedtogeneratetheshort-andlong-termcapitaland maintenancebudgetsforthebridgeandlargeculvertstructures.SeeSectionVIII,‘Asset ManagementStrategies’ .

Bridge&culvertstructurekeyperformanceindicatorsshouldbeestablishedandtracked annuallyaspartofanoveralllevelofservicemodel.SeeSectionVII‘LevelsofService’

Table8illustrateskeyassetattributesforthemunicipality’swatersystem,includingquantitiesofvariousassets,theirusefullife, replacementcosts,andthevaluationmethodbywhichthereplacementcostswerederived.Intotal,themunicipality’swatersystem assetsarevaluedat$251millionbasedon2016replacementcosts.Theusefullifeindicatedforeachassettypebelowwasassignedbythe municipality.

Figure22showsthemunicipality’shistoricalinvestmentsinitswatersystemsince1960.Whileobservedconditiondatawillprovide superioraccuracyinestimatingreplacementneedsandshouldbeincorporatedintostrategicplans,intheabsenceofsuchinformation, understandingpastexpenditurepatternsandcurrentusefullifeconsumptionlevels(Section3.3)caninformtheforecastingandplanning ofinfrastructureneedsandinthedevelopmentofacapitalprogram.Notethatthisgraphonlyincludestheactiveassetinventoryasof December31,2016.

Investmentsinthewatersystemhavebeensporadicsincethelate1950s.Intheearly2000s,theperiodoflargestinvestment,$73million wasinvestedinthewatersystemswith$49millionputintowatermains.

Inconjunctionwithhistoricalspendingpatternsandobservedconditiondata,understandingthe consumptionrateofassetsbasedonindustryestablishedusefullifestandardsprovidesamore completeprofileofthestateofacommunity’sinfrastructure.Figure23illustratestheusefullife consumptionlevelsasof2016forthemunicipality’swatersystem

Virtually100%ofassetshaveatleast10yearsofusefulliferemaining.

Usingreplacementcost,inthissectionwesummarizetheconditionofthemunicipality’swater services.Bydefault,werelyonobservedfielddataasprovidedbythemunicipality.Intheabsence ofsuchinformation,age-baseddataisusedasaproxy.Themunicipalityhasprovidedcondition dataforallofitswaterassets.

Basedonassesseddata,77%ofassetsareingoodtoverygoodconditionwhile5%,witha valuationof$11.8million,areinpoorcondition

Inthissection,weillustratetheshort-,medium-andlong-terminfrastructurespendingrequirements(replacementonly)forthe municipality’swatersystemassets.Thebacklogistheaggregateinvestmentininfrastructurethatwasdeferredoverpreviousyearsor decades.Intheabsenceofobserveddata,thebacklogrepresentsthevalueofassetsthatremaininoperationbeyondtheirusefullife.

Assessedconditiondatashowsnobacklogandminimal10-yearreplacementneeds.Themunicipality’sannualrequirements(indicatedby theblackline)foritswatersystemtotal$3,341,000.Atthisfundinglevel,themunicipalitywouldbeallocatingsufficientfundsonan annualbasistomeetreplacementneedsastheyarisewithouttheneedfordeferringprojectsandaccruingannualinfrastructuredeficits.

Conditiondatashowsnobacklogandminimal10-yearreplacementneeds.Themunicipality shouldcontinueitsconditionassessmentprogramofitswaterassetstopreciselyestimateits financialrequirementsandfieldneeds.SeeSection2,‘ConditionAssessmentPrograms’inthe ‘AssetManagementStrategies’chapter.

Thedatacollectedthroughconditionassessmentprogramsshouldbeintegratedintoarisk managementframeworkwhichwillguideprioritizationofshort,medium,andlongterm replacementneeds.SeeSection4,‘Risk’inthe‘AssetManagementStrategies’chapterformore information.

Inadditiontotheabove,atailoredlifecycleactivityframeworkshouldbedevelopedtopromote standardlifecyclemanagementofthewatersystemasoutlinedfurtherwithinthe“Asset ManagementStrategy”sectionofthisAMP

Waterdistributionsystemkeyperformanceindicatorsshouldbeestablishedandtracked annuallyaspartofanoveralllevelofservicemodel.SeeSectionVII‘LevelsofService’.

Themunicipalityshouldassessitsshort-,medium-andlong-termcapital,andoperationsand maintenanceneeds.

Anappropriatepercentageofthereplacementcostsshouldthenbeallocatedforthe municipality’sO&Mrequirements.

Table9illustrateskeyassetattributesforthemunicipality’swastewatersystemportfolio,includingquantitiesofvariousassets,their usefullife,replacementcosts,andthevaluationmethodbywhichthereplacementcostswerederived.Intotal,themunicipality’s wastewatersystemassetsarevaluedat$279millionbasedon2016replacementcosts.Theusefullifeindicatedforeachassettypebelow wasassignedbythemunicipality.

Figure27showsthemunicipality’shistoricalinvestmentsinitswastewatersystemsince1950.Whileobservedconditiondatawill providesuperioraccuracyinestimatingreplacementneedsandshouldbeincorporatedintostrategicplans,intheabsenceofsuch information,understandingpastexpenditurepatternsandcurrentusefullifeconsumptionlevels(Section4.3)caninformtheforecasting andplanningofinfrastructureneedsandinthedevelopmentofacapitalprogram.Notethatthisgraphonlyincludestheactiveasset inventoryasofDecember31,2016.

Majorinvestmentsintothemunicipality’swastewaterassetsbeganinthelate1950s.Investmentsthenfluctuatedandpeakedinthelate 1990sat$47million.Duringthistime$32.8millionwasputintosanitarysewergravitymains.

Inconjunctionwithhistoricalspendingpatternsandobservedconditiondata,understandingthe consumptionrateofassetsbasedonindustryestablishedusefullifestandardsprovidesamore completeprofileofthestateofacommunity’sinfrastructure.Figure28illustratestheusefullife consumptionlevelsasof2016forthemunicipality’swastewatersystem

Virtually100%ofassetshaveover10yearsofusefulliferemaining.

Usingreplacementcost,inthissectionwesummarizetheconditionofthemunicipality’ssanitary servicesasof2016.Bydefault,werelyonobservedfielddataasprovidedbythemunicipality.In theabsenceofsuchinformation,age-baseddataisusedasaproxy.Themunicipalityhasprovided conditiondataforallwastewatersystemassets.

Assesseddataindicatesthat71%oftheassetsareingoodtoverygoodcondition,while13%,with avaluationof$35million,areinpoorcondition.

Inthissection,weillustratetheshort-,medium-andlong-terminfrastructurespendingrequirements(replacementonly)forthe municipality’swastewatersystemassets.Thebacklogistheaggregateinvestmentininfrastructurethatwasdeferredoverpreviousyears ordecades.Intheabsenceofobserveddata,thebacklogrepresentsthevalueofassetsthatremaininoperationbeyondtheirusefullife.

Conditiondataindicatesnobacklogor10-yearreplacementneeds.Themunicipality’sannualrequirements(indicatedbytheblackline) foritswastewaterassetstotal$3,516,000.Atthislevel,fundingwouldbesustainableandreplacementneedscouldbemetastheyarise withouttheneedfordeferringprojects.

Conditiondatashowsnobacklogandminimal10-yearreplacementneeds.Themunicipality shouldcontinueitsconditionassessmentprogramofitswastewaterassetstoprecisely estimateitsfinancialrequirementsandfieldneeds.SeeSection2,‘ConditionAssessment Programs’inthe‘AssetManagementStrategies’chapter.

Thedatacollectedthroughconditionassessmentprogramsshouldbeintegratedintoarisk managementframeworkwhichwillguideprioritizationofshort,medium,andlongterm replacementneeds.SeeSection4,‘Risk’inthe‘AssetManagementStrategies’chapterformore information.

Inadditiontotheabove,atailoredlifecycleactivityframeworkshouldbedevelopedtopromote standardlifecyclemanagementofthewastewatersystemasoutlinedfurtherwithinthe“Asset ManagementStrategy”sectionofthisAMP

Wastewatercollectionsystemkeyperformanceindicatorsshouldbeestablishedandtracked annuallyaspartofanoveralllevelofservicemodel.SeeSectionVII‘LevelsofService’.

Themunicipalityshouldassessitsshort-,medium-andlong-termoperationsandmaintenance needs.Anappropriatepercentageofthereplacementcostsshouldthenbeallocatedforthe municipality’sO&Mrequirements.

Table10illustrateskeyassetattributesforthemunicipality’sstormnetwork,includingquantitiesofvariousassets,theirusefullife,their replacementcost,andthevaluationmethodbywhichthereplacementcostswerederived.Intotal,themunicipality’sstormnetwork assetsarevaluedat$80millionbasedon2016replacementcosts.Theusefullifeindicatedforeachassettypebelowwasassignedbythe municipality.AsindicatedinAppendix2,stormassetsareaddressedthroughtheUrban/RuralReconstructionProgram.

Figure32showsthemunicipality’shistoricalinvestmentsinitsstormnetworksince2000.Whileobservedconditiondatawillprovide superioraccuracyinestimatingreplacementneedsandshouldbeincorporatedintostrategicplans,intheabsenceofsuchinformation, understandingpastexpenditurepatternsandcurrentusefullifeconsumptionlevels(Section5.3)caninformtheforecastingandplanning ofinfrastructureneedsandinthedevelopmentofacapitalprogram.Notethatthisgraphonlyincludestheactiveassetinventoryasof December31,2016.

Thestormwaternetworkwasinstalledbefore1985withthelargestinvestmenttakingplaceintheearly1960swithavaluationof$49.6 millionwithafocusonstormmains.

Inconjunctionwithhistoricalspendingpatternsandobservedconditiondata,understandingthe consumptionrateofassetsbasedonindustryestablishedusefullifestandardsprovidesamore completeprofileofthestateofacommunity’sinfrastructure.Figure33illustratestheusefullife consumptionlevelsasof2016forthemunicipality’sstormassets

70%oftheassetshaveatleast10yearsofusefulliferemainingwhile9%,withavaluationof$7.1 million,remaininoperationbeyondtheirusefullife.Anadditional16%willreachtheendoftheir usefullifewithinthenextfiveyears.

Usingreplacementcost,inthissectionwesummarizetheconditionofthemunicipality’sstorm services.Bydefault,werelyonobservedfielddataasprovidedbythemunicipality.Intheabsence ofsuchinformation,age-baseddataisusedasaproxy.Themunicipalityhasnotprovidedcondition dataforitsstormnetworkassets

Basedonagedata,virtuallyallthestormnetworkassetsareinpoortoverypoorcondition

Inthissection,weillustratetheshort-,medium-andlong-terminfrastructurespendingrequirements(replacementonly)forthe municipality’sstormassets.Thebacklogistheaggregateinvestmentininfrastructurethatwasdeferredoverpreviousyearsordecades. Intheabsenceofobserveddata,thebacklogrepresentsthevalueofassetsthatremaininoperationbeyondtheirusefullife.

Age-baseddatashowsabacklogof$3.6millionandfive-yearreplacementneedsof$15.7million.Anadditional$4.2millionwillbe requiredbetween2021-2025.Themunicipality’sannualrequirements(indicatedbytheblackline)forstormassetstotal$1,088,000.At thisfundinglevel,themunicipalitywouldbeallocatingsufficientfundsonanannualbasistomeetreplacementneedsastheyarise withouttheneedfordeferringprojectsandaccruingannualinfrastructuredeficits.

Themunicipalityshouldimplementaconditionassessmentprogramofitsstormmainsto furtherdefinefieldneedsandtoassisttheprioritizationoftheshortandlongtermcapital budget.SeeSection2,‘ConditionAssessmentPrograms’inthe‘AssetManagementStrategies’ chapter.

Usingtheaboveinformation,themunicipalityshouldassessitsshort-,medium-andlong-term capital,andoperationsandmaintenanceneeds.

Anappropriatepercentageofthereplacementvalueoftheassetsshouldthenbeallocatedfor themunicipality’sO&Mrequirements.

Stormnetworkkeyperformanceindicatorsshouldbeestablishedandtrackedannuallyaspart ofanoveralllevelofservicemodel.SeeSectionVII‘LevelsofService’.

Table11illustrateskeyassetattributesforthemunicipality’sbuildings&facilities,includingquantitiesofvariousassets,theirusefullife, theirreplacementcost,andthevaluationmethodbywhichthereplacementcostswerederived.Intotal,themunicipality’sbuildings assetsarevaluedat$282millionbasedon2016replacementcosts.Theusefullifeindicatedforeachassettypebelowwasassignedbythe municipality.

$282,170,583

NotethattheAssetswithUnknownDataareshowninthetableaboveandFigure36tohighlightthetotalvaluationofownedassets. Theseassetsarenotincludedwithintheremainingfiguresinthissectionastheydonothavesufficientdata.However,theseassetsare accountedforwithintheannualrequirementsandfinancialstrategy

Figure37showsthemunicipality’shistoricalinvestmentsinitsbuildings&facilitiessince1950.Whileobservedconditiondatawill providesuperioraccuracyinestimatingreplacementneedsandshouldbeincorporatedintostrategicplans,intheabsenceofsuch information,understandingpastexpenditurepatternsandcurrentusefullifeconsumptionlevels(Section6.3)caninformtheforecasting andplanningofinfrastructureneedsandinthedevelopmentofacapitalprogram.Notethatthisgraphonlyincludestheactiveasset inventoryasofDecember31,2016.

Themunicipality’sinvestmentsintoitsbuildingassetsgrewconsistentlystartingin1960until1979.Between1985and1989,theperiod oflargestinvestment,$41.2millionwasinvestedintothebuildingassetswithafocusonstructures.

Inconjunctionwithhistoricalspendingpatternsandobservedconditiondata,understandingthe consumptionrateofassetsbasedonindustryestablishedusefullifestandardsprovidesamore completeprofileofthestateofacommunity’sinfrastructure.Figure38illustratestheusefullife consumptionlevelsasof2016forthemunicipality’sbuildingsassets.

97%ofbuildingsassetshaveatleast10yearsofusefulliferemaining;2%,withavaluationof$6.6 millionremaininoperationbeyondtheirestablishedusefullife.

Usingreplacementcost,inthissectionwesummarizetheconditionofthemunicipality’sbuildings assets.Bydefault,werelyonobservedfielddataasprovidedbythemunicipality.Intheabsenceof suchinformation,age-baseddataisusedasaproxy.Themunicipalityhasprovidedconditiondata for96%ofitsstructures.

86%ofbuildingsassets,withavaluationof$237million,areingoodtoverygoodcondition;5% areinpoortoverypoorcondition.

Inthissection,weillustratetheshort-,medium-andlong-terminfrastructurespendingrequirements(replacementonly)forthe municipality’sbuildingsassets.Thebacklogistheaggregateinvestmentininfrastructurethatwasdeferredoverpreviousyearsor decades.Intheabsenceofobserveddata,thebacklogrepresentsthevalueofassetsthatremaininoperationbeyondtheirusefullife.

Primarilyconditiondataindicatesabacklogof$7millionandminimalfive-yearreplacementneedsof$2.3million.Themunicipality’s annualrequirements(indicatedbytheblackline)foritsbuildingstotal$5million.Atthisfundinglevel,themunicipalitywouldbe allocatingsufficientfundsonanannualbasistomeetreplacementneedsastheyarisewithouttheneedfordeferringprojectsand accruingannualinfrastructuredeficits.

Themunicipalityshouldcontinueitsconditioninspectionprogramforitsbuildings&facilities topreciselyestimatefuturefinancialneeds.SeeSection2,‘ConditionAssessmentPrograms’in the‘AssetManagementStrategies’chapter.

Thedatacollectedthroughconditionassessmentprogramsshouldbeintegratedintoarisk managementframeworkwhichwillguideprioritizationofshort,medium,andlongterm replacementneeds.SeeSection4,‘Risk’inthe‘AssetManagementStrategies’chapterformore information.

Inadditiontotheabove,atailoredlifecycleactivityframeworkshouldbedevelopedtopromote standardlifecyclemanagementofbuildings&facilitiesasoutlinedfurtherwithinthe“Asset ManagementStrategy”sectionofthisAMP.

Usingtheaboveinformation,themunicipalityshouldassessitsshort-,medium-andlong-term capital,andoperationsandmaintenanceneeds.

Anappropriatepercentageofthereplacementcostsshouldthenbeallocatedforthe municipality’sO&Mrequirements.

Facilitykeyperformanceindicatorsshouldbeestablishedandtrackedannuallyaspartofan overalllevelofservicemodel.SeeChapterVII,‘LevelsofService’.

Table12illustrateskeyassetattributesforthemunicipality’smachinery&equipment,includingquantitiesofvariousassets,theiruseful life,theirreplacementcost,andthevaluationmethodbywhichthereplacementcostswerederived.Intotal,themunicipality’smachinery &equipmentassetsarevaluedat$13millionbasedon2016replacementcosts.Theusefullifeindicatedforeachassettypebelowwas assignedbythemunicipality.

$13,390,935

NotethattheAssetswithUnknownDataareshowninthetableaboveandFigure41tohighlightthetotalvaluationofownedassets. Theseassetsarenotincludedwithintheremainingfiguresinthissectionastheydonothavesufficientdata.However,theseassetsare accountedforwithintheannualrequirementsandfinancialstrategy

Figure42showsthemunicipality’shistoricalinvestmentsinitsmachinery&equipmentsince1950.Whileobservedconditiondatawill providesuperioraccuracyinestimatingreplacementneedsandshouldbeincorporatedintostrategicplans,intheabsenceofsuch information,understandingpastexpenditurepatternsandcurrentusefullifeconsumptionlevels(Section7.3)caninformtheforecasting andplanningofinfrastructureneedsandinthedevelopmentofacapitalprogram.Notethatthisgraphonlyincludestheactiveasset inventoryasofDecember31,2016.

Themunicipalityrapidlyexpandeditsmachinery&equipmentportfoliobeginningintheearly2000s.Between2010and2014,theperiod oflargestinvestment,$4.8millionwasinvestedinthemachineryandequipmentcategory.

Inconjunctionwithhistoricalspendingpatternsandobservedconditiondata,understandingthe consumptionrateofassetsbasedonindustryestablishedusefullifestandardsprovidesamore completeprofileofthestateofacommunity’sinfrastructure.Figure43illustratestheusefullife consumptionlevelsasof2016forthemunicipality’smachinery&equipmentassets.

While23%ofassetshaveatleast10yearsofusefulliferemaining,12%,withavaluationof $835,000,remaininoperationbeyondtheirusefullife.Anadditional41%willreachtheendof theirusefullifewithinthenextfiveyears.

Usingreplacementcost,inthissectionwesummarizetheconditionofthemunicipality’smachinery &equipmentassetsasof2016.Bydefault,werelyonobservedfielddataasprovidedbythe municipality.Intheabsenceofsuchinformation,age-baseddataisusedasaproxy.The municipalityhasprovidedconditiondataforitsfurnitureandgear&deviceswhileITsystemsrely onage-basedata

Basedonamixofassessedandagedata,30%ofassets,withavaluationof$2.1million,areinpoor toverypoorcondition;61%areingoodtoverygoodcondition.

Inthissection,weillustratetheshort-,medium-andlong-terminfrastructurespendingrequirements(replacementonly)forthe municipality’smachinery&equipmentassets.Thebacklogistheaggregateinvestmentininfrastructurethatwasdeferredoverprevious yearsordecades.Intheabsenceofobserveddata,thebacklogrepresentsthevalueofassetsthatremaininoperationbeyondtheiruseful life.

Inadditiontoabacklogof$564,000,themunicipality’sreplacementneedstotal$2.3millioninthenextfiveyears.Anadditional$4.1 millionwillberequiredbetween2021-2025.Themunicipality’sannualrequirements(indicatedbytheblackline)foritsmachinery& equipmenttotal$1,401,000.Atthisfundinglevel,themunicipalitywouldbeallocatingsufficientfundsonanannualbasistomeet replacementneedsastheyarisewithouttheneedfordeferringprojectsandaccruingannualinfrastructuredeficits.

Themunicipalityshouldimplementacomponentbasedconditioninspectionprogramforall machinery&equipmentassetstobetterdefinefinancialrequirementsforitsmachineryand equipment.SeeSection2,‘ConditionAssessmentPrograms’inthe‘AssetManagement Strategies’chapter.

Usingtheaboveinformation,themunicipalityshouldassessitsshort-,medium-andlong-term capital,andoperationsandmaintenanceneeds.

Anappropriatepercentageofthereplacementcostsshouldthenbeallocatedforthe municipality’sO&Mrequirements.

Table13illustrateskeyassetattributesforthemunicipality’slandimprovements,includingquantitiesofvariousassets,theirusefullife, theirreplacementcost,andthevaluationmethodbywhichthereplacementcostswerederived.Intotal,themunicipality’sland improvementsassetsarevaluedat$72.3millionbasedon2016replacementcosts.Theusefullifeindicatedforeachassettypebelowwas assignedbythemunicipality.

NotethattheAssetswithUnknownDataareshowninthetableaboveandFigure46tohighlightthetotalvaluationofownedassets. Theseassetsarenotincludedwithintheremainingfiguresinthissectionastheydonothavesufficientdata.However,theseassetsare accountedforwithintheannualrequirementsandfinancialstrategy

Figure47showsthemunicipality’shistoricalinvestmentsinitslandimprovementssince1950.Whileobservedconditiondatawill providesuperioraccuracyinestimatingreplacementneedsandshouldbeincorporatedintostrategicplans,intheabsenceofsuch information,understandingpastexpenditurepatternsandcurrentusefullifeconsumptionlevels(Section8.3)caninformtheforecasting andplanningofinfrastructureneedsandinthedevelopmentofacapitalprogram.Notethatthisgraphonlyincludestheactiveasset inventoryasofDecember31,2016.

Expendituresinlandimprovementshavefluctuatedacrossthedecades.Between2005and2009,theperiodoflargestinvestment,$30 millionwasinvestedwithafocusongeneralsiteworks.

Inconjunctionwithhistoricalspendingpatternsandobservedconditiondata,understandingthe consumptionrateofassetsbasedonindustryestablishedusefullifestandardsprovidesamore completeprofileofthestateofacommunity’sinfrastructure.Figure48illustratestheusefullife consumptionlevelsasof2016forthemunicipality’slandimprovementassets.

94%ofthemunicipality’slandimprovementassets,withavaluationof$67.9million,haveatleast 10yearsofusefulliferemaining Anadditional2%willreachtheendoftheirusefullifewithinthe nextfiveyears.

Usingreplacementcost,inthissectionwesummarizetheconditionofthemunicipality’sland improvementassets.Bydefault,werelyonobservedfielddataasprovidedbythemunicipality.In theabsenceofsuchinformation,age-baseddataisusedasaproxy.Themunicipalityhasprovided conditiondatafornearlyalllandimprovementassets

Basedprimarilyassesseddata,89%ofthemunicipality’slandimprovementassets,withavaluation of$64million,areingoodtoverygoodcondition;1%areinpoortoverypoorcondition.

Inthissection,weillustratetheshort-,medium-andlong-terminfrastructurespendingrequirements(replacementonly)forthe municipality’slandimprovementsassets.Thebacklogistheaggregateinvestmentininfrastructurethatwasdeferredoverpreviousyears ordecades.Intheabsenceofobserveddata,thebacklogrepresentsthevalueofassetsthatremaininoperationbeyondtheirusefullife.

Primarilyassessedbaseddatashowsnobacklogorfive-yearreplacementneeds.However,replacementneedswilltotal$3.7million between2021-2025.Themunicipality’sannualrequirements(indicatedbytheblackline)foritslandimprovementstotal$2,394,000.At thisfundinglevel,themunicipalitywouldbeallocatingsufficientfundsonanannualbasistomeetreplacementneedsastheyarise withouttheneedfordeferringprojectsandaccruingannualinfrastructuredeficits.

Themunicipalityshouldcontinueitsconditionassessmentprogramforitslandimprovement assetstopreciselyestimatefinancialneeds.SeeSection2,‘ConditionAssessmentPrograms’in the‘AssetManagementStrategies’chapter.

Thedatacollectedthroughconditionassessmentprogramsshouldbeintegratedintoarisk managementframeworkwhichwillguideprioritizationofshort,medium,andlongterm replacementneeds.SeeSection4,‘Risk’inthe‘AssetManagementStrategies’chapterformore information.

Usingtheaboveinformation,themunicipalityshouldassessitsshort-,medium-andlong-term capitalandoperationsandmaintenanceneeds.

Anappropriatepercentageofthereplacementcostsshouldthenbeallocatedforthe municipality’sO&Mrequirements.

Table14illustrateskeyassetattributesforthemunicipality’svehiclesportfolio,includingquantitiesofvariousassets,theirusefullife, theirreplacementcost,andthevaluationmethodbywhichthereplacementcostswerederived.Intotal,themunicipality’svehiclesassets arevaluedat$78.8millionbasedon2016replacementcosts.Theusefullifeindicatedforeachassettypebelowwasassignedbythe municipality.

NotethattheAssetswithUnknownDataareshowninthetableaboveandFigure51tohighlightthetotalvaluationofownedassets. Theseassetsarenotincludedwithintheremainingfiguresinthissectionastheydonothavesufficientdata.However,theseassetsare accountedforwithintheannualrequirementsandfinancialstrategy.

Figure52showsthemunicipality’shistoricalinvestmentsinitsvehiclesportfoliosince1950.Whileobservedconditiondatawillprovide superioraccuracyinestimatingreplacementneedsandshouldbeincorporatedintostrategicplans,intheabsenceofsuchinformation, understandingpastexpenditurepatternsandcurrentusefullifeconsumptionlevels(Section9.3)caninformtheforecastingandplanning ofinfrastructureneedsandinthedevelopmentofacapitalprogram.Notethatthisgraphonlyincludestheactiveassetinventoryasof December31,2016.

Investmentsinvehiclesquicklyincreasedstartinginthe1990s.In2010-2014,theperiodoflargestinvestment,$27millionwasinvested with$17millionputintofleetandtransit.

Inconjunctionwithhistoricalspendingpatternsandobservedconditiondata,understandingthe consumptionrateofassetsbasedonindustryestablishedusefullifestandardsprovidesamore completeprofileofthestateofacommunity’sinfrastructure.Figure53illustratestheusefullife consumptionlevelsasof2016forthemunicipality’svehicles

40%ofassetshaveatleast10yearsofusefulliferemaining;14%,withavaluationof$11million remaininoperationbeyondtheirusefullife.Anadditional28%willreachtheendoftheirusefullife withinthenextfiveyears.

Usingreplacementcost,inthissection,wesummarizetheconditionofthemunicipality’svehicles assetsasof2015.Bydefault,werelyonobservedfielddataasprovidedbythemunicipality.Inthe absenceofsuchinformation,age-baseddataisusedasaproxy.Themunicipalityhasprovided conditiondataforitsfirevehicleswhiletheremainingassetsrelyonage-baseddata

Age-basedandassesseddatashowsthat34%ofthemunicipality’svehicleassetsareinpoortovery poorcondition;51%,withavaluationof$40millionareingoodtoverygoodcondition.

Inthissection,weillustratetheshort-,medium-andlong-terminfrastructurespendingrequirements(replacementonly)forthe municipality’svehiclesassets.Thebacklogistheaggregateinvestmentininfrastructurethatwasdeferredoverpreviousyearsordecades. Intheabsenceofobserveddata,thebacklogrepresentsthevalueofassetsthatremaininoperationbeyondtheirusefullife.

Inadditiontoabacklogof$8.9million,replacementneedswilltotalover$16millionoverthenextfiveyears;anadditional$27million willberequiredbetween2021-2025.Themunicipality’sannualrequirements(indicatedbytheblackline)foritsvehiclestotal $6,260,000.Atthisfundinglevel,themunicipalitywouldbeallocatingsufficientfundsonanannualbasistomeetreplacementneedsas theyarisewithouttheneedfordeferringprojectsandaccruingannualinfrastructuredeficits.

Apreventivemaintenanceandlifecycleassessmentprogramshouldbeestablishedforall vehicleassetstogainabetterunderstandingofcurrentconditionandperformanceaswellas theshort-andmedium-termreplacementneeds.SeeSection2,‘ConditionAssessment Programs’inthe‘AssetManagementStrategies’chapter.

Usingtheaboveinformation,themunicipalityshouldassessitsshort-,medium-andlong-term capitalandoperationsandmaintenanceneeds.

Anappropriatepercentageofthereplacementcostsshouldthenbeallocatedforthe municipality’sO&Mrequirements.

Table15illustrateskeyassetattributesforthemunicipality’snaturalresources,includingquantitiesofvariousassets,theirusefullife, theirreplacementcost,andthevaluationmethodbywhichthereplacementcostswerederived.Intotal,themunicipality’snatural resourcesarevaluedat$412.7millionbasedon2016replacementcosts.Theusefullifeindicatedforeachassettypebelowwasassigned bythemunicipality.

Notethattheseassetsareincludedtohighlightalloftheassetsthatareownedbythemunicipality.Acompleteanalysisontheseassetsis notprovidedsincenaturalresourcesdonotfollowstandardassetmanagementtechniquesbasedonreplacement.

Thetwoprimaryriskstoamunicipality’sfinancialsustainabilityarethetotallifecyclecostsof infrastructure,andestablishinglevelsofservice(LOS)thatexceeditsfinancialcapacity.Inthis regard,municipalitiesfaceachoice:overpromiseandunderdeliver;underpromiseandoverdeliver; orpromiseonlythatwhichcanbedeliveredefficientlywithoutplacinganinequitableburdenon taxpayers.Ingeneral,thereisoftenatrade-offbetweenpoliticalexpedienceandjudicious,longtermfiscalstewardship.

DevelopingrealisticLOSusingmeaningfulkeyperformanceindicators(KPIs)canbeinstrumental inmanagingcitizenexpectations,identifyingareasrequiringhigherinvestments,driving organizationalperformanceandsecuringthehighestvalueformoneyfrompublicassets.However, municipalitiesfacediminishingreturnswithgreatergranularityintheirLOSandKPIframework. Thatis,theobjectiveshouldbetotrackonlythoseKPIsthatarerelevantandinsightfulandreflect theprioritiesofthemunicipality.

Beyondmeetingregulatoryrequirements,levelsofserviceestablishedshouldsupporttheintended purposeoftheassetanditsanticipatedimpactonthecommunityandthemunicipality.LOS generallyhaveanoverarchingcorporatedescription,acustomerorienteddescription,anda technicalmeasurement.ManytypesofLOS,e.g.,availability,reliability,safety,responsivenessand costeffectiveness,areapplicableacrossallserviceareasinamunicipality.ThefollowingLOS categoriesareestablishedasguidingprinciplesfortheLOSthateachserviceareainthe municipalityshouldstrivetoprovideinternallytothemunicipalityandtoresidents/customers. ThesearederivedfromtheTownofWhitby’s Guide to Developing Service Area Asset Management Plans

Reliable Servicesarepredictableandcontinuous;servicesofsufficientcapacityareconvenientand accessibletotheentirecommunity

CostEffective Servicesareprovidedatthelowestpossiblecostforbothcurrentandfuturecustomers,fora requiredlevelofservice,andareaffordable

Responsive

Opportunitiesforcommunityinvolvementindecisionmakingareprovided;andcustomersare treatedfairlyandconsistently,withinacceptabletimeframes,demonstratingrespect,empathyand integrity

Safe Servicesaredeliveredsuchthattheyminimizehealth,safetyandsecurityrisks

Suitable Servicesaresuitablefortheintendedfunction(fitforpurpose).

Sustainable Servicespreserveandprotectthenaturalandheritageenvironment.

Inthissection,weidentifyindustrystandardKPIsformajorinfrastructureclassesthatthe municipalitycanincorporateintoitsperformancemeasurementandfortrackingitsprogressover futureiterationsofitsAMP.Themunicipalityshoulddevelopappropriateandachievabletargets thatreflectevolvingdemandoninfrastructure,itsfiscalcapacityandtheoverallcorporate objectives.

Strategic

Financial Indicators

Tactical

Operational Indicators

Percentageoftotalreinvestmentcomparedtoassetreplacementvalue

Completionofstrategicplanobjectives(relatedtoroads,andbridges&culverts)

Annualrevenuescomparedtoannualexpenditures

Annualreplacementvaluedepreciationcomparedtoannualexpenditures

Costpercapitaforroads,andbridges&culverts

Maintenancecostpersquaremetre

Revenuerequiredtomaintainannualnetworkgrowth

Totalcostofborrowingvs.totalcostofservice

OverallBridgeConditionIndex(BCI)asapercentageofdesiredBCI

Percentageofroadnetworkrehabilitated/reconstructed

Percentageofpavedroadlanekilometresratedaspoortoverypoor

Percentageofbridgesandlargeculvertsratedaspoortoverypoor

PercentageofassetclassvaluespentonO&M

Percentageofroadsinspectedwithinthelastfiveyears

Percentageofbridgesandlargeculvertsinspectedwithinthelasttwoyears

Operatingcostsforpavedlaneperkilometres

Operatingcostsforbridgeandlargeculvertspersquaremetre

Percentageofcustomerrequestswitha24-hourresponserate

Table 18 Key Performance Indicators – Buildings & Facilities

Level KPI (Reported Annually)

Strategic

Financial Indicators

Tactical

Operational Indicators

Percentage of total reinvestment compared to asset replacement value

Completion of strategic plan objectives (related to buildings & facilities)

Annual revenues compared to annual expenditures

Annual replacement value depreciation compared to annual expenditures

Revenue required to meet growth related demand

Repair and maintenance costs per square metre

Energy, utility and water cost per square metre

Percentage of component value replaced

Percent of facilities rated poor or critical

Percentage of facilities replacement value spent on O&M

Facility utilization rate

Percentage of facilities inspected within the last five years

Number/type of service requests

Percentage of customer requests addressed within 24 hours

Table 19 Key Performance Indicators – Vehicles Level KPI(ReportedAnnually)

Strategic

Financial Indicators

Tactical

Operational Indicators

Percentageoftotalreinvestmentcomparedtoassetreplacementvalue

Completionofstrategicplanobjectives(relatedtovehicles)

Annualrevenuescomparedtoannualexpenditures

Annualreplacementvaluedepreciationcomparedtoannualexpenditures

Costpercapitaforvehicles

Revenuerequiredtomaintainannualfleetportfoliogrowth

Totalcostofborrowingvs.totalcostofservice

Percentageofallvehiclesreplaced

Averageageofvehicles

Percentofvehiclesratedpoororcritical

PercentageofvehiclesreplacementvaluespentonO&M

Averagedowntimepervehiclescategory

Averageutilizationpervehiclescategoryand/oreachvehicle

Ratioofpreventivemaintenancerepairsvs.reactiverepairs

Percentofvehiclesthatreceivedpreventivemaintenance

Number/typeofservicerequests

Percentageofcustomerrequestsaddressedwithin24hours

Table 20 Key Performance Indicators – Water, Sanitary and Storm Networks Level KPI(ReportedAnnually)

Strategic

Financial Indicators

Tactical

Operational Indicators

Percentageoftotalreinvestmentcomparedtoassetreplacementvalue

Completionofstrategicplanobjectives(relatedtowater,sanitaryandstorm)

Annualrevenuescomparedtoannualexpenditures

Annualreplacementvaluedepreciationcomparedtoannualexpenditures

Totalcostofborrowingcomparedtototalcostofservice

Revenuerequiredtomaintainannualnetworkgrowth

Percentageofwater,sanitaryandstormnetworkrehabilitated/reconstructed

Annualpercentageofgrowthinwater,sanitaryandstormnetwork

Percentageofmainswheretheconditionisratedpoororcriticalforeachnetwork

Percentageofwater,sanitaryandstormnetworkreplacementvaluespentonO&M

Percentageofwater,sanitaryandstormnetworkinspected

Operatingcostsforthecollectionofwastewaterperkilometreofmain

Numberofwastewatermainbackupsper100kilometresofmain

Operatingcostsforstormwatermanagement(collection,treatment,anddisposal)per kilometreofdrainagesystem.

Operatingcostsforthedistribution/transmissionofdrinkingwaterperkilometreofwater distributionpipe

Numberofdayswhenaboilwateradvisoryissuedbythemedicalofficerofhealth,applicable toamunicipalwatersupply,wasineffect

Numberofwatermainbreaksper100kilometresofwaterdistributionpipeinayear

Numberofcustomerrequestsreceivedannuallyperwater,sanitaryandstorm

Percentageofcustomerrequestsaddressedwithin24hoursperwater,sanitaryandstorm network

Table 21 Key Performance Indicators – Machinery & Equipment

KPI (Reported Annually)

Percentage of total reinvestment compared to asset replacement value

Strategic

Completion of strategic plan objectives (related to machinery & equipment)

Annual revenues compared to annual expenditures

Annual replacement value depreciation compared to annual expenditures

Cost per capita for machinery & equipment

Indicators

Tactical

Operational Indicators

Revenue required to maintain annual portfolio growth

Total cost of borrowing vs. total cost of service

Percentage of all machinery & equipment replaced

Average age of machinery & equipment assets

Percent of machinery & equipment rated poor or critical

Percentage of vehicles replacement value spent on O&M

Average downtime per machinery & equipment asset

Ratio of preventive maintenance repairs vs. reactive repairs

Percent of machinery & equipment that received preventive maintenance

Number/type of service requests

Table 22 Key Performance Indicators – Land Improvements Level KPI(ReportedAnnually)

Strategic

Financial Indicators

Tactical

Operational Indicators

Percentageoftotalreinvestmentcomparedtoassetreplacementvalue

Completionofstrategicplanobjectives(relatedtolandimprovements)

Annualrevenuescomparedtoannualexpenditures

Annualreplacementvaluedepreciationcomparedtoannualexpenditures

Costpercapitaforsupplyingparks,playgrounds,etc.

Repairandmaintenancecostspersquaremetre

Percentoflandimprovementsratedpoororcritical

PercentageofreplacementvaluespentonO&M

Parklandpercapita

Percentageoflandimprovementsinspectedwithinthelastfiveyears

Number/typeofservicerequests

Percentageofcustomerrequestsaddressedwithin24hours

Inadditiontoamunicipality’sfinancialcapacityandlegislativerequirements,manyfactors, internalandexternal,caninfluencetheestablishmentofLOSandtheirassociatedKPIs Thesecan includethemunicipality’soverarchingmissionasanorganization,thecurrentstateofits infrastructureandthewidersocial,politicalandmacroeconomiccontext.Thefollowingfactors shouldinformthedevelopmentofmostLOStargetsandtheirassociatedKPIs:

Themunicipality’slong-termdirectionisoutlinedinitscorporateandstrategicplans.This directionwilldictatethetypesofservicesitaimstodelivertoitsresidentsandthequalityofthose services.Thesehigh-levelgoalsarevitalinidentifyingstrategic(long-term)infrastructure prioritiesandasaresult,theinvestmentsneededtoproducedesiredLOS.

Thecurrentstateofcapitalassetswilldeterminethequalityofservicesthemunicipalitycandeliver toitsresidents.Assuch,LOSshouldreflecttheexistingcapacityofassetstodeliverthoseservices, andmayvary(increase)withplannedmaintenance,rehabilitationorreplacementactivitiesand timelines.

ThegeneralpublicwilloftenhavequalitativeandquantitativeinsightsregardingtheLOSa particularassetoranetworkofassetsshoulddeliver,e.g.,whataroadin‘good’conditionshould looklikeorthetraveltimebetweendestinations.Thepublicshouldbeconsultedinestablishing LOS;however,thediscussionsshouldbecenteredonclearlyoutliningthelifecyclecostsassociated withdeliveringanyimprovementsinLOS.

MacroeconomictrendswillhaveadirectimpactontheLOSformostinfrastructureservices.Fuel costs,fluctuationsininterestratesandthepurchasingpoweroftheCanadiandollarcanimpedeor accelerateanyplannedgrowthininfrastructureservices.

Thecompositionofresidentsinamunicipalitycanalsoserveasaninfrastructuredemanddriver, andasaresult,canchangehowamunicipalityallocatesitsresources(e.g.,anagingpopulationmay requirediversionofresourcesfromparksandsportsfacilitiestoadditionalwellnesscenters). Populationgrowthisalsoasignificantdemanddriverforexistingassets(loweringLOS),andmay requirethemunicipalitytoconstructnewinfrastructuretoparallelcommunityexpectations.

Environmental Change

Forecastingforinfrastructureneedsbasedonclimatechangeremainsanimprecisescience. However,broaderenvironmentalandweatherpatternshaveadirectimpactonthereliabilityof criticalinfrastructureservices.

ThemunicipalityshouldcollectdataonitscurrentperformanceagainsttheKPIslistedand establishtargetsthatreflectthecurrentfiscalcapacityofthemunicipality,itscorporateand strategicgoals,andasfeasible,changesindemographicsthatmayplaceadditionaldemandonits variousassetclasses.Forsomeassetclasses,e.g.,minorequipment,furniture,etc.,cursorylevelsof serviceandtheirrespectiveKPIswillsuffice.Formajorinfrastructureclasses,detailedtechnical andcustomer-orientedKPIscanbecritical.Oncethisdataiscollectedandtargetsareestablished, theprogressofthemunicipalityshouldbetrackedannually.

Theassetmanagementstrategysectionwilloutlineanimplementationprocessthatcanbeusedto identifyandprioritizerenewal,rehabilitationandmaintenanceactivities.Thiswillassistinthe developmentofa10-yearcapitalplan,includinggrowthprojections,toensurethebestoverall healthandperformanceofthemunicipality’sinfrastructure.Thissectionincludesanoverviewof conditionassessment,thelifecycleinterventionsrequired,andprioritizationtechniques,including risk,todeterminewhichcapitalprojectsshouldmoveforwardintothebudgetfirst.

Themunicipalityshouldexplore,asrequestedthroughtheprovincialrequirements,whichnoninfrastructuresolutionsshouldbeincorporatedintothebudgetsforitsinfrastructureservices. Non-infrastructuresolutionsaresuchitemsasstudies,policies,conditionassessments, consultationexercises,etc.,thatcouldpotentiallyextendthelifeofassetsorlowertotalasset programcostsinthefuturewithoutadirectinvestmentintotheinfrastructure.

Typicalsolutionsforamunicipalityincludelinkingtheassetmanagementplantothestrategicplan, growthanddemandmanagementstudies,infrastructuremasterplans,betterintegrated infrastructureandlanduseplanning,publicconsultationonlevelsofserviceandcondition assessmentprograms.Aspartoffutureassetmanagementplans,areviewoftheserequirements shouldtakeplace,andresourcesshouldbededicatedtotheseitems.

Itisrecommended,underthiscategoryofsolutions,thatthemunicipalitydevelopandimplement holisticconditionassessmentprogramsforallassetclasses.Thiswilladvancetheunderstandingof infrastructureneeds,improvebudgetprioritizationmethodologiesandprovideaclearerpathof whatisrequiredtoachievesustainableinfrastructureprograms.

Thefoundationofanintelligentassetmanagementpracticeisbasedoncomprehensiveandreliable informationonthecurrentconditionoftheinfrastructure.Municipalitiesneedtohaveaclear understandingregardingtheperformanceandconditionoftheirassets,asallmanagement decisionsregardingfutureexpendituresandfieldactivitiesshouldbebasedonthisknowledge.An incompleteunderstandingofanassetmayleadtoitsuntimelyfailureorprematurereplacement.

Somebenefitsofholisticconditionassessmentprogramswithintheoverallassetmanagement processarelistedbelow:

understandingofoverallnetworkconditionleadstobettermanagementpractices allowsfortheestablishmentofrehabilitationprograms preventsfuturefailuresandprovidesliabilityprotection potentialreductioninoperation/maintenancecosts accuratecurrentassetvaluation allowsfortheestablishmentofriskassessmentprograms establishesproactiverepairschedulesandpreventivemaintenanceprograms avoidsunnecessaryexpenditures extendsassetservicelifethereforeimprovinglevelofservice improvesfinancialtransparencyandaccountability enablesaccurateassetreportingwhich,inturn,enablesbetterdecisionmaking

Conditionassessmentcaninvolvedifferentformsofanalysissuchassubjectiveopinion, mathematicalmodels,orvariationsthereof,andcanbecompletedthroughadetailedorcursory approach.Whenestablishingtheconditionassessmentforanentireassetclass,acursoryapproach (metricssuchasgood,fair,poor,verypoor)isused.Thisisaneconomicalstrategythatwillstill provideup-to-dateinformation,andwillallowfordetailedassessmentorfollow-upinspectionson thoseassetscapturedaspoororcriticalcondition.

In2015,PSDpublishedastudyinpartnershipwiththeAssociationofMunicipalitiesofOntario (AMO).Thereport, The State of Ontario’s Roads and Bridges: An Analysis of 93 Municipalities, enumeratedtheinfrastructuredeficits,annualinvestmentgaps,andthephysicalstateofroads, bridgesandculvertswitha2013replacementvalueof$28billion.

Acriticalfindingofthereportwasthedramaticdifferenceintheconditionprofileoftheassets whencomparingage-basedestimatesandactualfieldinspectionobservations.Foreachasset group,fielddatabasedconditionratingsweresignificantlyhigherthanage-basedconditionratings, withpavedroads,culverts,andbridgesshowinganincreaseinscore(0-100)of+29,+30,and+23 pointsrespectively.Inotherwords,age-basedmeasurementsmaybeunderestimatingthecondition ofassetsbyasmuchas30%.

Typicalindustrypavementinspectionsareperformedbyconsultingfirmsusingspecialized assessmentvehiclesequippedwithvariouselectronicsensorsanddatacaptureequipment.The vehicleswilldrivetheentireroadnetworkandtypicallycollecttwodifferenttypesofinspection data:surfacedistressdataandroughnessdata.

Surfacedistressdatainvolvesthecollectionofmultipleindustrystandardsurfacedistresses,which arecapturedeitherelectronicallyusingsensingdetectionequipmentmountedonthevan,or visuallybythevan'sinspectioncrew.Roughnessdatacaptureinvolvesthemeasurementofthe roughnessoftheroad,measuredbylasersthataremountedontheinspectionvan'sbumper, calibratedtoaninternationalroughnessindex.

Anotheroptionforacursorylevelofconditionassessmentisformunicipalroadcrewstoperform simplewindshieldsurveysaspartoftheirregularpatrol.Manymunicipalitieshavecreateddata collectioninspectionformstoassistthisprocessandtostandardizewhatpresenceofdefectswould constituteagood,fair,poor,orcriticalscore.Lackinganyotherdataforthecompleteroadnetwork, thiscanstillbeseenasagoodmethodandwillassistgreatlywiththeoverallmanagementofthe roadnetwork.

Itisrecommendedthatthemunicipalitycontinueitspavementconditionassessmentprogramand thataportionofcapitalfundingisdedicatedtothis.Wealsorecommendexpansionofthisprogram toincorporateadditionalcomponents.

OntariomunicipalitiesaremandatedbytheMinistryofTransportationtoinspectallstructuresthat haveaspanof3metresormore,accordingtotheOSIM(OntarioStructureInspectionManual).

Structureinspectionsmustbeperformedby,orundertheguidanceof,astructuralengineer,must beperformedonabiennialbasis(onceeverytwoyears),andincludesuchinformationasstructure type,numberofspans,spanlengths,otherkeyattributedata,detailedphotoimages,andstructure elementbyelementinspection,ratingandrecommendationsforrepair,rehabilitation,and replacement.

Thebestapproachtodevelopa10-yearneedslistforthemunicipality’sstructureportfoliorelieson thestructuralengineerwhoperformstheinspectionstoalsoproduceamaintenancerequirements report,andrehabilitation&replacementrequirementsreportaspartoftheoverallassignment.In additiontodefiningtheoverallneedsrequirements,thestructuralengineershouldidentifythose structuresthatwillrequiremoredetailedinvestigationsandnon-destructivetestingtechniques. Examplesoftheseinvestigationsare:

Detaileddeckconditionsurvey

Non-destructivedelaminationsurveyofasphaltcovereddecks

Substructureconditionsurvey

Detailedcoatingconditionsurvey

Underwaterinvestigation

Fatigueinvestigation

Structureevaluation

ThroughtheOSIMrecommendationsandadditionaldetailedinvestigations,a10-yearneedslistcan bedevelopedforthemunicipality’sbridges.

Themostpopularandpracticaltypeofbuildings&facilitiesassessmentinvolvesqualifiedgroupsof trainedindustryprofessionals(engineersorarchitects)performingananalysisoftheconditionofa groupoffacilitiesandtheircomponents,thatmayvaryintermsofage,design,construction methodsandmaterials.Thisanalysiscanbedonebywalk-throughinspection(themostaccurate approach),mathematicalmodelingoracombinationofboth.Thefollowingassetclassificationsare typicallyinspected:

Site Components –propertyaroundthefacilityandoutdoorcomponentssuchasutilities, signs,stairways,walkways,parkinglots,fencing,courtyardsandlandscaping

Structural Components –physicalcomponentssuchasthefoundations,walls,doors, windows,roofs

Electrical Components –allcomponentsthatuseorconductelectricitysuchaswiring, lighting,electricheaters,andfirealarmsystems

Mechanical Components –componentsthatconveyandutilizeallnon-electricalutilities withinafacilitysuchasgaspipes,furnaces,boilers,plumbing,ventilation,andfireextinguishing systems

Vertical Movement –componentsusedformovingpeoplebetweenfloorsofbuildingssuchas elevators,escalatorsandstairlifts

Oncecollected,thisinformationcanbeuploadedintotheCityWide®,themunicipality’sasset managementandassetregistrysoftwaredatabaseinorderforshort-andlong-termrepair, rehabilitationandreplacementreportstobegeneratedtoassistwithprogrammingtheshort-and long-termmaintenanceandcapitalbudgets.

Itisrecommendedthatthemunicipalitycontinueitsinspectionofstructuresandexpandits conditionassessmentprogramforothersegments.Itisalsorecommendedthataportionofcapital oroperatingfundingisdedicatedtothis.

Thetypicalapproachtooptimizingthemaintenanceexpendituresofvehiclesandmachinery& equipment,isthroughroutinevehicleandcomponentinspections,routineservicing,andaroutine preventivemaintenanceprogram.Mostmakesandmodelsofvehiclesandmachineryassetsare suppliedwithmaintenancemanualsthatdefinetheappropriateschedulesandroutinesfortypical maintenanceandservicing,andalsomoredetailedrestorationorrehabilitationprotocols.

Theprimarygoalofsoundmaintenanceistoavoidormitigatetheconsequenceoffailureof equipmentorparts.Anestablishedpreventivemaintenanceprogramservestoensurethis,asitwill consistofscheduledinspectionsandfollowuprepairsofvehiclesandmachinery&equipmentin ordertodecreasebreakdownsandexcessivedowntimes.

Agoodpreventivemaintenanceprogramwillincludepartialorcompleteoverhaulsofequipmentat specificperiods,includingoilchanges,lubrications,fluidchangesandsoon.Inaddition,workers canrecordequipmentorpartdeteriorationsotheycanscheduletoreplaceorrepairwornparts beforetheyfail.

Theidealpreventivemaintenanceprogramwouldmoveprogressivelyfurtherawayfromreactive repairsandinsteadtowardsthepreventionofallequipmentfailurebeforeitoccurs.

Itisrecommendedthatapreventivemaintenanceroutineisdefinedandestablishedforallvehicles andmachinery&equipmentassets,andthatasoftwareapplicationisutilizedfortheoverall managementoftheprogram.

Unlikesewermains,itisoftenprohibitivelydifficulttoinspectwatermainsfromtheinsidedueto theconstantandhigh-pressureflowofwater.Aphysicalinspectionrequiresadisruptionofservice toresidents,canbeanexpensiveexerciseandistimeconsumingtosetup.Itisrecommended practicethatphysicalinspectionofwatermainstypicallyoccursonlyforhigh-risk,large transmissionmainswithinthesystem,andonlywhenthereisarequirement.Thereareanumber ofhightechinspectiontechniquesintheindustryforlargediameterpipesbuttheseshouldbe researchedfirstforapplicabilityastheyarequiteexpensive.Examplesincluderemoteeddyfield current(RFEC),ultrasonicandacoustictechniques,impactecho(IE),andGeoradar.

Forthemajorityofpipeswithinthedistributionnetwork,gatheringkeyinformationinregardsto themainanditsenvironmentcansupplythebestmethodtodetermineageneralcondition.Key datathatmaybeused,alongwithweightingfactors,todetermineanoverallconditionscoreinclude age,materialtype,breaks,hydrantflowinspectionsandsoilcondition.

Itisrecommendedthatthemunicipalitycontinueitswatermainassessmentprogram,andthat fundsarebudgetedforthis.

ThemostpopularandpracticaltypeofsanitaryandstormsewerassessmentistheuseofClosed CircuitTelevisionVideo(CCTV).TheprocessinvolvesasmallroboticcrawlervehiclewithaCCTV cameraattachedthatislowereddownamaintenanceholeintothesewermaintobeinspected.

Thevehicleandcamerathentravelthelengthofthepipe,providingalivevideofeedtoatruckon theroadabovewhereatechnician/inspectorrecordsdefectsandinformationregardingthepipe.A widerangeofconstructionordeteriorationproblemscanbecaptured,includingopen/displaced joints,presenceofroots,infiltration&inflow,cracking,fracturing,exfiltration,collapse, deformationofpipeandmore.Therefore,sewerCCTVinspectionisaneffectivetoolforlocating andevaluatingstructuraldefectsandgeneralconditionofundergroundpipes.

EventhoughCCTVisanexcellentoptionforinspectionofsewers,itisafairlycostlyprocessand doestakesignificanttimetoinspectalargevolumeofpipes.