A Comprehensive Report

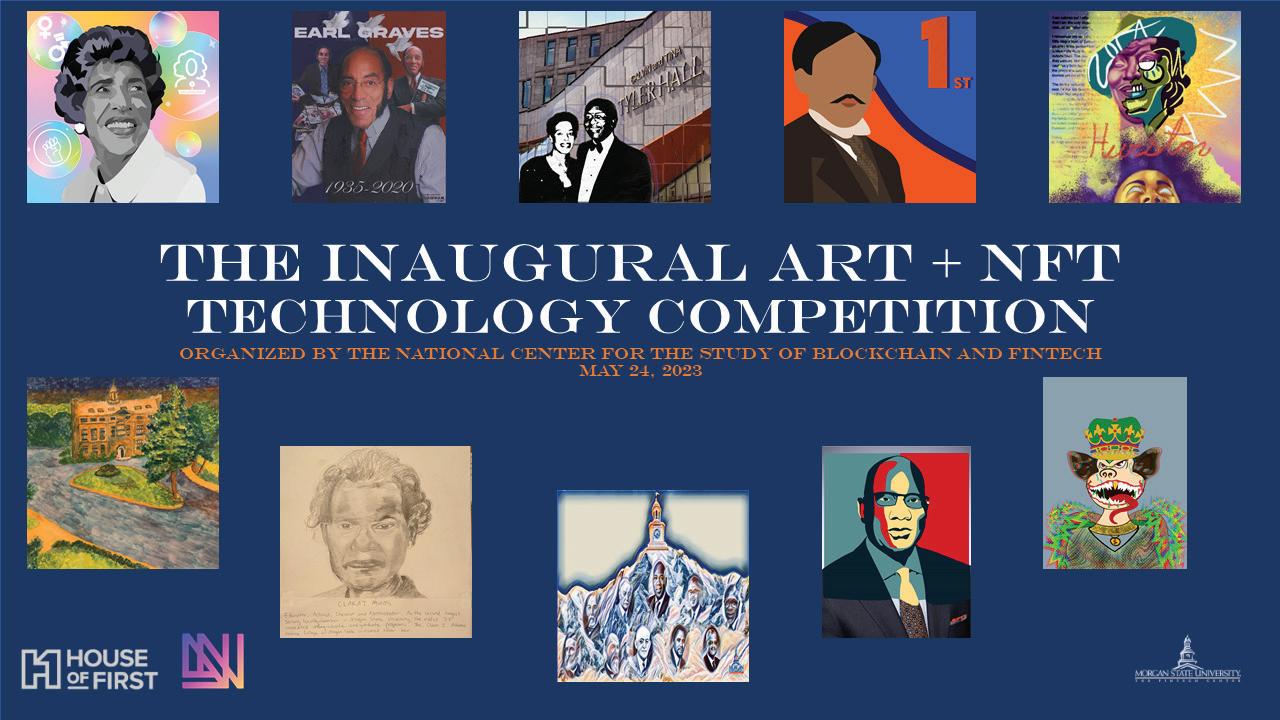

The National Center for the Study of Blockchain and FinTech

Morgan State University has been a revered educational institution since its establishment in 1867. The university has a diverse student population, including individuals from various ethnic, racial, and national backgrounds.

Morgan State University offers more than 100 academic programs, ranging from baccalaureate to doctoral degrees. As the preeminent public urban research university in Maryland, Morgan State University is committed to meeting the challenges and needs of the modern urban environment through comprehensive community-level research and innovative solutions.

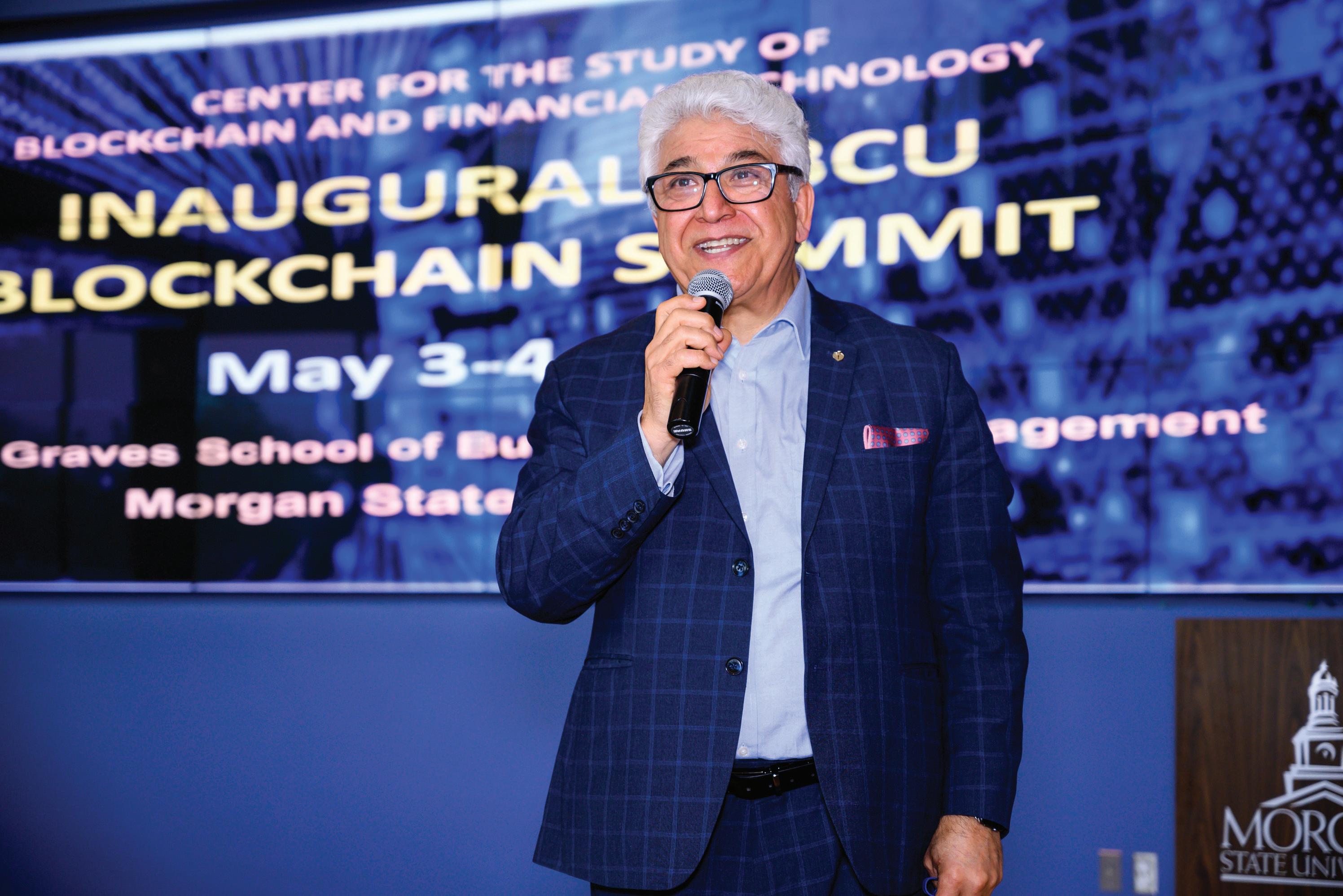

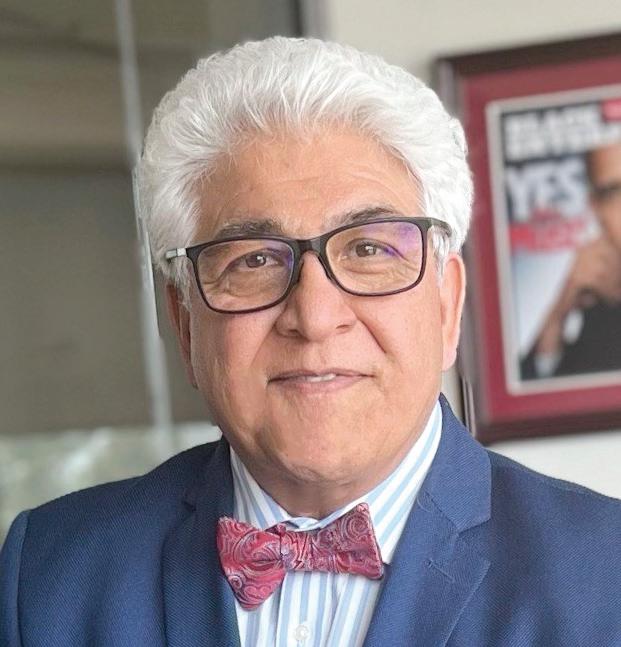

In 2018, Dr. Ali Emdad, Associate Dean of the Graves Business School established the Center for the Study of Blockchain and FinTech (the FinTech Center). In 2019, he received a multiyear, multi-million dollar grant from Ripple, a leading Silicon Valley technology company.

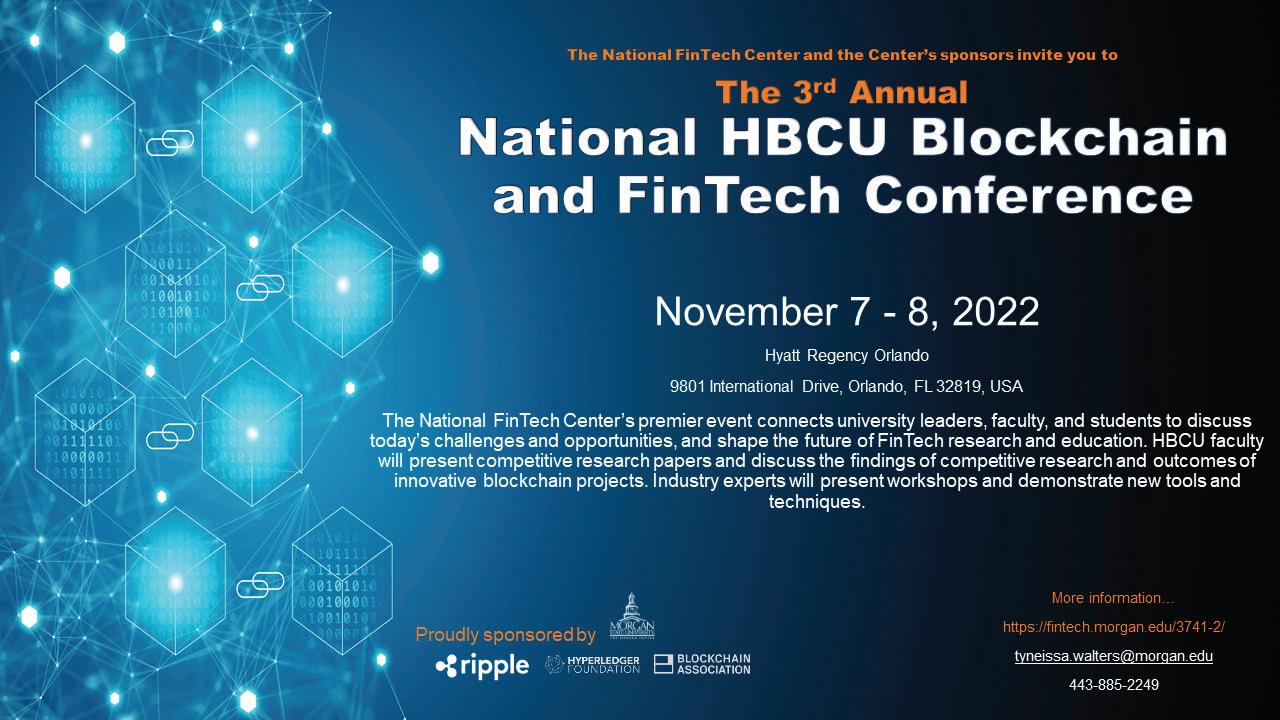

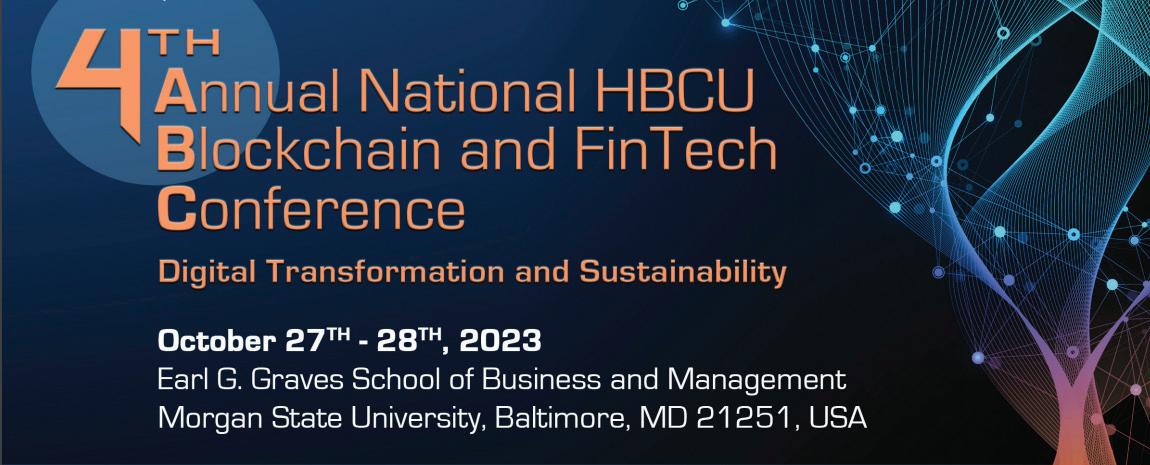

The Center serves as a hub for supporting, facilitating, and enhancing cross-disciplinary collaboration in the areas of blockchain, cryptocurrency, and other FinTech-related technologies across Morgan and other Historically Black Colleges and Universities (HBCUs). One of the Center’s primary objectives is to establish strong industry ties with academia and prioritize the development of innovative courses, academic programs, and cutting-edge research that generate positive impacts on society and business. The FinTech Center is dedicated to increasing a broad audience’s understanding of blockchain and FinTech-related innovative technologies.

The Center supports and fosters the development of state-of-the-art curricula and research in FinTech and other technology innovations. Moreover, the Center creates synergistic collaborative relationships between scholars and practitioners across disciplinary and industry sectors. The Center hosts conferences, sponsors research projects, and engages in community outreach activities to make research both rigorous and accessible.

The FinTech Center supports many vital initiatives dedicated to improving the understanding of new technologies that impact many sectors of the economy and society in general.

Spotlight On Research May 2023 5

The National FinTech Center has received immense support from Ripple as its foundational sponsor which has advanced the Center’s mission. Many other sponsors have continuously supported the Center’s programs. One of the Center’s goals is to create a collaborative environment that fosters innovation, drives tech-

nological advancements, and creates solutions that benefit society. To achieve this goal, the Center is committed to offering numerous opportunities to support not only Morgan but also other HBCUs. By bringing together scholars and practitioners from diverse sectors, the Center aims to create a space

where stakeholders can leverage their collective expertise to develop pioneering solutions in FinTech and blockchain.

Through the Center’s initiatives and profound impact, Morgan State University has been recognized as a global leader in FinTech and related fields.

6 Spotlight On Research May 2023

“The MSU FinTech faculty and staff are committed to fostering awareness about blockchain and financial technology and establishing industry partnerships. They are a dynamic, caring, and knowledgeable group of individuals, and working with them was a sheer delight.”

Dr. Patrice Glenn-Jones Alabama State University

Historically Black Colleges and Universities (HBCU) Network

Spotlight On Research May 2023 7

8 Spotlight On Research May 2023

By providing support to faculty members at Historically Black Colleges and Universities (HBCUs), the Center aims to advance our understanding of these transformative technologies. In this section, we will expand on the research focus areas of the Center, highlighting their significance and potential impact on various aspects of the financial industry.

Consensus:

Consensus mechanisms are the backbone of blockchain technology, enabling agreement among network participants. The

Center’s research in this area explores different consensus algorithms, such as proof-of-work, proof-of-stake, and Byzantine fault tolerance, to enhance the security, scalability, and efficiency of blockchain systems. Understanding and optimizing consensus mechanisms are critical for the successful implementation of blockchain solutions in financial transactions, data management, and various other applications.

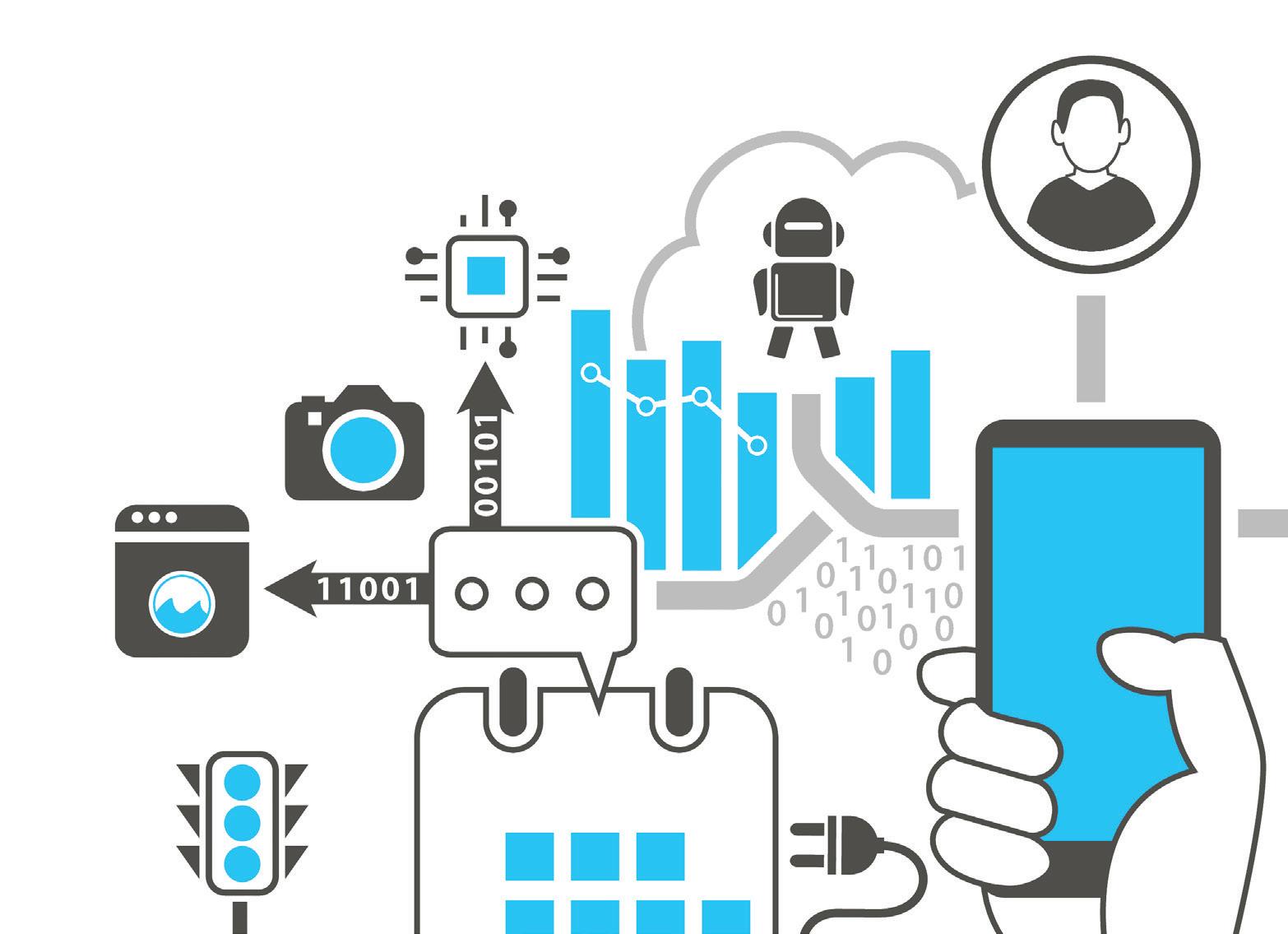

AI-Driven Data Science: Data science, enhanced by AI, plays a pivotal role in unlocking

valuable insights and driving decision-making in FinTech and blockchain. The Center supports research projects that apply advanced data science methodologies, including machine learning, deep learning, natural language processing, and predictive analytics, to analyze vast amounts of financial data, detect complex patterns, and develop innovative solutions for risk assessment, fraud detection, and automated trading strategies. By harnessing the power of AI-driven data science, researchers aim to improve operational efficiency,

Spotlight On Research May 2023 9

The FinTech Center is dedicated to promoting innovative research in the fields of FinTech, Blockchain, Cryptocurrencies, and related areas.

enhance risk management practices, and drive innovation in the financial industry. AI algorithms enable faster and more accurate analysis of large datasets, allowing financial institutions to make data-driven decisions with greater confidence. Additionally, AI-powered predictive analytics can identify emerging trends and potential risks, providing valuable insights that can guide strategic planning and decision-making in the fast-paced world of finance. The combination of data science and AI revolutionizes the way financial data is processed, interpreted, and leveraged, opening up new opportunities for growth and development in the FinTech and blockchain domains.

Decentralization:

Decentralization lies at the heart of blockchain technology, aiming to eliminate the need for intermediaries and enhance transparency and trust in financial transactions. The Center’s research focuses on investigating the opportunities and challenges presented by decentralized systems. This includes studying the implications of decentralization on governance models, exploring the design of decentralized applications (DApps), and analyzing the overall resilience and security of financial ecosystems. Understanding the potential benefits and limitations of decentralization is crucial for shaping the future of financial systems.

Liquidity:

Liquidity is a crucial aspect of financial markets, and the Center’s research aims to ex-

plore liquidity dynamics within the context of blockchain and FinTech. The Center’s research investigates liquidity dynamics in both traditional and blockchain-based markets. This includes analyzing liquidity provision mechanisms, understanding the impact of liquidity on price discovery and market efficiency, and developing models to measure and predict liquidity risk. By enhancing our understanding of market liquidity, researchers aim to foster more vibrant and resilient financial ecosystems.

Digital Asset Derivatives: Digital asset derivatives, such as futures, options, and swaps, derive their value from underlying cryptocurrencies or blockchain-based assets. The Center supports research that delves into the design, pricing, and risk management of digital asset derivatives. Understanding these complex financial instruments is vital for developing effective risk management strategies, facilitating the integration of cryptocurrencies into traditional financial markets, and unlocking new investment opportunities.

Digital Asset Market Structure:

The emergence of cryptocurrencies and blockchain-based assets has disrupted traditional financial market structures. The Center’s research in this area focuses on analyzing the unique characteristics of digital asset markets, including market dynamics, order book analysis, trading behaviors, and price discovery mechanisms. By gaining a deeper under-

standing of digital asset market structure, researchers aim to enhance market efficiency, develop trading strategies, and propose regulatory frameworks that foster a fair and transparent marketplace.

Distributed Systems: Blockchain technology relies on distributed systems to ensure fault-tolerance, resilience, and data integrity. The Center supports research projects that investigate the design and optimization of distributed systems for blockchain applications. This includes exploring consensus protocols, network scalability, interoperability between different blockchain networks, and the development of cross-chain communication mechanisms. By advancing our understanding of distributed systems, researchers aim to improve the performance, scalability, and usability of blockchain technologies.

Game Theory: Game theory provides a powerful framework for analyzing the strategic interactions among participants in blockchain and FinTech ecosystems.

The Center’s research in this area examines game-theoretic models to understand the incentives, behaviors, and equilibrium outcomes in decentralized systems. By applying game theory, researchers can design mechanisms that incentivize honest behavior, deter malicious activities, and improve the overall security and efficiency of blockchain networks.

10 Spotlight On Research May 2023

Incentive Structures:

Incentive structures play a crucial role in motivating network participants to contribute their resources and maintain the integrity of blockchain networks. The Center’s research focuses on designing innovative incentive mechanisms that align the interests of participants and promote desired behaviors, such as network validation, data sharing, and consensus participation. By studying and optimizing incentive structures, researchers aim to enhance the sustainability and robustness of blockchain ecosystems.

Infosec / Opsec:

Information security (Infosec) and operational security (Opsec) are of paramount importance in blockchain and FinTech applications, where the protection of sensitive data and assets is critical. The Center supports research projects that explore novel security solutions to safeguard blockchain and FinTech systems from potential vulnerabilities, threats, and attacks. This includes studying cryptographic techniques, secure key management, privacy-enhancing technologies, secure software engineering practices, and risk assessment methodologies. By addressing Infosec and Opsec challenges, researchers aim to build resilient systems that can withstand malicious activities and protect user data and assets.

Network Analysis:

Non-Technical: Network analysis examines the structure, dynamics, and interactions of participants in blockchain

and FinTech networks from a non-technical perspective. The Center supports research projects that employ social science methodologies, including qualitative and quantitative analysis, to study the behavior of network participants, their decision-making processes, the formation of trust, and the diffusion of innovations. By exploring non-technical aspects of network analysis, researchers gain insights into the socio-economic factors that shape the adoption and impact of blockchain and FinTech technologies.

Network Analysis:

Technical: Network analysis from a technical perspective involves studying the topology, connectivity, and performance of blockchain and FinTech networks. The Center’s research in this area focuses on analyzing the structure of networks, identifying vulnerabilities and attack vectors, developing network measurement tools, and exploring techniques for network optimization and scalability. By advancing our understanding of the technical aspects of network analysis, researchers aim to improve the design, security, and efficiency of blockchain and FinTech systems.

Sustainability:

The National FinTech Center recognizes the significance of sustainability in the context of cryptocurrencies, blockchain, and FinTech, and aims to undertake and support research in this critical area. The Center focuses on investigating innovative solutions that address the environmental impact of cryp-

tocurrency mining, exploring alternative consensus mechanisms that are energy-efficient and environmentally friendly. Researchers collaborate to develop sustainable practices and technologies that promote the adoption of renewable energy sources for blockchain operations. Additionally, the Center explores the potential of blockchain technology to enable transparent and accountable supply chains, facilitating the tracking of sustainable practices in industries such as agriculture, renewable energy, and fair trade. Through interdisciplinary research, the Center aims to advance the understanding of how blockchain and FinTech can contribute to sustainable development goals, promoting responsible and ethical practices within the digital financial ecosystem. By emphasizing sustainability, the Center seeks to foster a more inclusive and environmentally conscious future for cryptocurrencies, blockchain, and FinTech.

Laws and

Regulation

Impact on

Digital

Assets: The regulatory environment plays a crucial role in shaping the adoption and development of digital assets and blockchain technologies. The Center supports research projects that analyze the impact of regulations on digital assets, exploring topics such as legal frameworks, compliance requirements, investor protection, and the implications of regulatory changes on market dynamics. By studying the regulatory landscape, researchers aim to provide insights and recommendations

Spotlight On Research May 2023 11

that promote responsible innovation and regulatory clarity in the digital asset space.

The regulatory landscape surrounding blockchain, FinTech, and digital assets is constantly evolving, and the Center recognizes the importance of conducting research in this area to address the legal and regulatory aspects. By analyzing the legal and regulatory frameworks applicable to these technologies, identifying gaps and challenges, and proposing innovative approaches, the Center aims to create a conducive environment for its development while ensuring consumer protection and market integrity.

Research projects at the Center focus on various topics related to laws and regulations in digital assets and FinTech. This includes examining regulatory sandboxes, data protection, consumer rights, cross-border regulatory harmonization, and intellectual property rights. By exploring these areas, the Center aims to contribute to the establishment of robust frameworks that promote innovation in the field.

In addition to legal and regulatory considerations, software engineering plays a vital role in the development of secure and efficient FinTech and blockchain solutions. The Center’s research in this area is dedicated to software engineering methodologies, best practices, and tools tailored specifically for the unique challenges of blockchain and FinTech applications. Researchers investigate topics such as software architecture,

code quality assurance, smart contract development, testing frameworks, and DevOps practices. By advancing software engineering practices, the Center aims to ensure the reliability and scalability of blockchain and FinTech systems.

Through these research efforts, the Center not only drives innovation but also contributes to policy discussions surrounding digital assets and FinTech. Additionally, the Center empowers faculty members at Historically Black Colleges and Universities (HBCUs) to make significant contributions to the evolving landscape of financial technology. By combining legal and regulatory analysis with software engineering advancements, the Center seeks to shape the future of digital assets and FinTech while fostering a supportive environment for innovation.

12 Spotlight On Research May 2023

“The FinTech Center provided an invaluable opportunity to expose students to FinTech and Blockchain on an advanced level. The students were mentored by FinTech Industry leadership. This opportunity not only provided education but led to career development and enhancement.”

Dr. Millicent Springs-Campbell Spelman College

Spotlight On Research May 2023 13

14 Spotlight On Research May 2023

Katayoon Beshkardana | Morgan State University | Blockchain and the Right to Erasure: Striking a Balance between Technological Innovation and Data Protection

Dr. Beshkardana explored the concept of the “right to be forgotten” in the age of big data. As personal data becomes increasingly valuable, companies have amassed enormous amounts of it to cater to their marketing needs. To securely collect and process encrypted data and mitigate data breach risks, companies have turned to blockchain technology. However, with the era of quantum computing looming, codes are in danger of quantum decryption, and individuals’ rights to data self-determination must be taken into account. The paper compared the right to be forgotten under the European GDPR and two U.S. Senate bills, the American Data Protection and Privacy Act and the Data Protection Act. The paper concluded that a thriving digital market must meet both the legitimate needs of companies and certain rights of individuals to privacy and data protection.

The paper focuses on a comparison of the right to be forgotten under the European GDPR and two senate bills, American Data Protection and Privacy Act (ADPPA) introduced in the House Energy and Commerce Committee and Data Protection Act introduced in the U.S. Senate Committee on Commerce, Science, and Transportation. Today, personal data is considered the economy’s “oil” and a new asset class. The corporate world creates an ever-increasing market value for information by collecting, storing, and processing massive amounts of personal data to tailor its marketing needs. Big tech companies such as Apple, Microsoft, Amazon, Google, and Metaverse already exert enormous control over the personal data of individuals to create wealth and make a profit. One of the technologies that aids companies in securely collecting and processing encrypted data and mitigating data breach risks is blockchain. Given the fast-approaching era of quantum computing, where codes are in danger of quantum decryption shortly, this paper discusses the rights of individuals to data self-determination under the U.S. Privacy Acts and the European General Data Protection Regulation (GDPR). A thriving digital market must meet the legitimate needs of companies and certain rights of individuals to privacy and data protection.

Another paper, authored by Xiaoming Li from Tennessee State University, focused on a blockchain-based health pass system to mitigate the spread of infectious diseases. The paper compared manual, blockchain, and centralized health pass systems and employed the popular susceptible-infectious-recovered (SIR) model to simulate the dynamics of an infectious disease cycle under three travel restrictions between regions. By adjusting the effectiveness parameters of catching infectious, the paper showed the benefits of health checks under three systems: manual, blockchain, and centralized. Health checks were beneficial for reducing the total infected and the infectious peak while bidirectional health checks tended to cause more reductions. Centralized solutions were better than blockchain solutions, which were better than manual systems. Although a blockchain solution cannot mitigate infections the most, its niche lies in its unique capacity for transparency, privacy protection, and immutability.

These two papers illustrate the significant potential of blockchain technology in protecting individuals’ privacy and mitigating the spread of infectious diseases. As the world becomes increasingly digitized, it is crucial to conduct more research in blockchain and FinTech to stay ahead of the curve and ensure that these technologies are used for the benefit of society.

Spotlight On Research May 2023 15

Dr. Katayoon Beshkardana Morgan State University

Xiaoming Li | Tennessee State University | A Blockchain-Based Testing and Vaccination System

The paper focuses on a blockchain-based health pass system for mitigating the spread of infectious diseases. It shows its unique value and compares it with the existing manual and centralized health pass systems. Infectious diseases diffuse through our travel systems. To combat epidemics, we have to implement specific health pass systems from time to time. First, this paper summarizes three methods: manual, blockchain, and centralized. We then employ the popular susceptible-infectious-recovered (SIR) model to simulate the dynamics of an infectious disease cycle under three travel restrictions between regions: no health check, one-directional health check, and bidirectional health checks. By adjusting the effectiveness parameters of catching infectious, we show the benefits of health checks, i.e., the reductions of peaked infectious and total infected/contagious over the whole cycle, under three systems: manual, blockchain, and centralized. Health checks are beneficial for reducing the total infected and the infectious peak while more effective in reducing the contagious height. Bidirectional health checks tend to cause more reductions. Moreover, centralized solutions are better than blockchain solutions, which are better than manual systems. Our numeric examples show that the decrease in peaked infectious ranges from 0.3900% to 17.56%, while the decline of the total infected fields from 0.2184% to 2.056%. Although a blockchain solution cannot mitigate infections most, its niche lies in its unique capacity for transparency, privacy protection, and immutability.

Xiaoming Li Tennessee State University

Xiaoming Li Tennessee State University

“I didn’t know much about crypto prior to starting, I had some exposure to blockchain from classes but that’s about it. Looking forward, I hope to make meaningful contributions at a promising startup or big tech company while developing significantly as a professional.”

16 Spotlight On Research May 2023

Jioke Kamanu Computer Science, Howard University

Juliet Elu |

Miesha Williams | Morehouse College | Cryptocurrency: Implications as Legal Tender

This joint research paper by Elu and Williams examines Latin America and the emergence of cryptocurrency as legal tender. The recent adoption of Bitcoin as a legal tender by El Salvador and the Central African Republic is assessing its validity as a medium of exchange for promoting economic stability. Other countries in Latin America, such as Paraguay, Venezuela, and Anguilla, are contemplating joining the bandwagon as a reflection of an inclusive global financial market. This change presents an opportunity to assess how cryptocurrency satisfies the characteristics of money. The volatility and speculative nature of cryptocurrency may disrupt the economies of these countries. However, the instability of prices and inflation may also allow these countries to use cryptocurrency as their legal tender. This paper considers if Bitcoin, Ethereum, Ripple, and Tether may serve as good legal tender worldwide. Using the Fisher rule model and monthly IMF data from 2010-2022, we present stylized facts to suggest that shifting away from Bitcoin exclusively toward the inclusivity of other coins is advisable. To the extent that cryptocurrency is an acceptable medium of exchange and has a speculative component to its demand, coins such as Bitcoin, Ethereum, Ripple, and Tether may not be good candidates for sale in developed economies. Still, they may be a viable option for developing economies with an excess inflation rate.

Yujian Fu | Alabama A&M University | Specification of Smart Contract Behavior in the Currency Perspective

This paper proposes a formal verification approach based on the Maude model checker to verify that the application implementation in the solidity program complies with the standard specification in temporal logic propositions. A blockchain is a collection of data blocks that are connected by encryption and serve as a decentralized public ledger. Smart-contract flaws can be exploited to cause enormous losses. Before implementation, formal verification is a helpful technique in locating these issues. The DAO attack and Parity multi-signature wallet attacks are just a few examples of subtle mistakes in smart contracts that result in significant financial losses. Numerous studies on static analysis and theorem proving have been conducted to find these faults in smart contracts. However, they do not fully enable automatic operation or thoroughly scan the entire search space; they support inspection for pre-defined error patterns. To model and analyze vulnerabilities of intelligent contracts on the Ethereum platform, this paper proposes a formal verification approach based on the Maude model checker to verify that the application implementation in the solidity program complies with the standard specification in temporal logic propositions. The Maude model checker, rooted in rewriting logic and equation theory, is chosen to support this approach. The proposed model template is defined in a hierarchical structure capturing the behavior of Ethereum, the smart contract, and the execution framework. This approach is implemented and validated in two reentrance and parity multi-signature case studies.

Juliet Elu Morehouse College

Yujian Fu Alabama A&M University

Spotlight On Research May 2023 17

Miesha Williams Morehouse College

Mohammad Mahdi Moeini Gharaghozloo | Morgan State University | Exploring the Role of External Environment Factors in Global Cryptocurrency Adoption

The author investigates the idea that a higher level of democracy in a country enhances the acceptance and adoption of cryptocurrencies. The geopolitical competition between the U.S. and China has become increasingly intense in recent years. One represents Western democracy and free markets, while the other is a symbol of a one-party political system and state-controlled capitalism. Historical data repeatedly suggests that government decisions can substantially impact cryptocurrency markets. While several studies in the literature investigate different macroeconomic factors that could potentially influence the global cryptocurrency markets, Gharaghozloo studies the impact of one of the most important social forces, the state of global democracy, on the expansion of cryptocurrencies in different countries. Analyzing a sample of 109 countries in 2023, The author finds support for his theory. He also tests the building components of democracy and their effect on helping cryptocurrency expansion in a country. This paper contributes to international FinTech literature and helps us understand future trends in global cryptocurrency markets.

Mohammad Mahdi Moeini Gharagozloo | Morgan State University | The Effect of Digitalization of Economies on Global Expansion of Crypto Currencies

Understanding how the digital economy significantly impacts all dimensions of the global economy is a rising priority in the present day. This paper aims to investigate the critical role of the digital readiness of economies worldwide in the effective global expansion of major cryptocurrencies. The authors are also studying the circumstances under which the digital enthusiasm of an economy matters to crypto expansion.

Zeinab Bandpey | Morgan State University | Graph Theoretical Approach to Blockchain Analysis

In this research, the authors study how Graph Theory is helpful in blockchain analysis. We review applications and techniques for performing Bitcoin blockchain data analysis using graph theoretical approaches and techniques such as Oracle’s graph. They perform bitcoin transaction analysis as several case studies by computational graph analysis, pattern matching in graphs, and other graph theoretic techniques.

18 Spotlight On Research May 2023

Mohammad Mahdi Moeini Gharaghozloo Morgan State University

Zeinab Bandpey Morgan State University

Maxim Bushuev | Morgan State University | Delivery Coordination Within a Decentralized Supply Chain Using Blockchain Smart Contracts

This project aims to improve delivery coordination in a decentralized supply chain where each participant makes decisions based on their interests, leading to optimal choices for the whole supply chain. Supply chain coordination can be achieved if a company faces all costs incurred by its decisions. Since a supplier is usually responsible for delivery, the supplier should reimburse the buyer for all the untimely (early or late) delivery expenses. This motivates the supplier to reduce buyer costs associated with untimely delivery and act in the buyer’s best interests.

Hongmei Chi | Florida A&M University | Securing Supply Chain of Autonomous Vehicles with Blockchain Technology

This paper builds upon the motivation of utilizing the potential of two transformative technologies to develop and evaluate a framework for applying Blockchain technology to autonomous vehicle communication to enhance cybersecurity for the A.V. supply chain. Additionally, this framework helps us to address cybersecurity issues on communication and supply chain trust, privacy, and compliance.

Phyllis Keys | Morgan State University | Regulatory Policies, Digital Assets, and Financial Inclusion: An Institutional Perspective

The paper’s primary research question is: Do digital governmental policies in African countries facilitate financial inclusion? The author proposes to use a mixed-method approach to examine how policies on digital assets affect financial inclusion. For the qualitative analysis, she analyzes the African countries’ government policies on digital assets through content analysis. She categorizes country governments into three groups: those with digital policies that indicate financial inclusion as a common goal or outcome of their approach, those with digital policies with no indication of financial inclusion, and those with no digital policies. The author conducts a quantitative analysis by investigating the relationship between the government policy variable and financial inclusion measures using World Bank data.

Spotlight On Research May 2023 19

Maxim Bushuev Morgan State University

Hongmei Chi Florida A&M University

Phyllis Keys Morgan State University

Vasanth Iyer | Grambling State University | POWTracker

In the current context, where networks are vulnerable to data breaches and spoofing attacks, it is crucial to have a reliable source to verify the origin of information. We are exploring the use of Blockchain for location-based point-of-origin proof and re-identification proof of trackable objects. We have named this Blockchain application the POWTracker platform. The POWTracker platform leverages properties like consensus, provenance, immutability, and finality, which are inherent to any Blockchain application, including smart contracts, to enable quick authentication.

Xia Zhang | Alabama A&M University | How Can Privacy and Scalability Issues in Blockchain Networks Be Overcome? –Hyperledger Fabric (HLF) Blockchain Network Framework

The author aims to present a formal framework that solves the scalability issue when confirmed blocks grow over time at different locations in the network and will focus on both the mathematical structure and consensus protocol. To ensure the blockchain system can operate smoothly as demand increases, the author will utilize the Hyperledger Fabric platform in the study.

Abena Primo | Huston-Tillotson University | Detecting Illicit Transactions Based on Fees and Transaction Cluster Properties

Cryptocurrencies aim to enhance the financial conditions of the unbanked population, who usually belong to minority communities and have doubts about financial institutions. To gain trust among the unbanked, cryptocurrencies must be free from any illegal activities. Further investigation into illicit cryptocurrency transactions is necessary to detect them early, which will boost confidence and encourage the adoption of cryptocurrencies.

20 Spotlight On Research May 2023

Vasanth Iyer Grambling State University

Xia Zhang Alabama A&M University

Abena Primo Huston-Tillotson University

Omar Khan | Morgan State University | Blockchain-Driven Global Value Chain: A Conceptual Model for Adaptive, Cost-Efficient, and Agile Management

The paper leverages Transaction Cost Economics (TCE) as the underlying theoretical foundation of governance mechanisms and consolidates it with work done on adaptive learning (in the organizational literature), cross-border distribution (from international marketing literature), and process flow facilitation (from supply chain management literature). The paper is theory-driven and results in a conceptual framework for understanding the integration of blockchain technology within global value chain management. Methodologically, the report utilizes an inductive approach to reviewing practical case examples and an integrative approach to existing theory to construct a conceptual foundation to understand adaptive, blockchain-driven global value chain management comprehensively.

Isabelle Kemajou-Brown | Morgan State University | Estimating Environmental Cost of Cryptocurrency Mining using Statistical Methods

There continues to be a lack of regulation surrounding crypto asset mining activities in the U.S., which has made it difficult to sustain mining businesses while also protecting human health and the environment from pollution. To address this issue, it is crucial to evaluate the monetary value impact of producing cryptocurrencies and assess the magnitude of their environmental and health effects on society. This information can then be used to raise awareness among policymakers about the damages caused by cryptocurrency mining and to encourage them to create sustainable regulatory measures to reduce these costs.

Juliet Elu | Morehouse College | Blockchain Investment in the COVID-19 Pandemic

This paper examines market sentiment and consumer confidence in Blockchain technology during the COVID-19 pandemic in a time series model, using daily trade price data from Bloomberg and data from Blockchain.com. Investors often turn to commodity assets to diversify their portfolios during economic downturns, as shown by Ji, Zang, and Zhao (2020). Gompers and Lerner (2003) examine initial public offerings using a pre-NASDAQ event study to determine “event-time buy-and-hold of abnormal returns.” This paper aims to assess the potential of blockchain initial coin offerings as a haven during the COVID-19 pandemic, contributing to the existing literature. We recommend a rule-of-thumb strategy for prudent day traders to follow and suggest market policies supporting said prudence. The authors state that to their knowledge, no study has yet utilized initial coin offerings as possible portfolio protection in periods of economic downturn.

Spotlight On Research May 2023 21

Omar Khan Morgan State University

Isabelle Kemajou-Brown Morgan State University

Juliet Elu Morehouse College

the Virgin Islands | Introduction

Innovative Contract Technology to Create a Marketplace in the Virgin Islands

This paper investigates the creation of value and monetization in blockchain networks through the supply and demand structure, where the usefulness of the network determines the value. The research is necessary because it impacts multiple critical areas for the Virgin Islands, namely food security, hazard mitigation and resilience, the technology sector, commerce, and intellectual capital. The existing research gap is addressed by collecting baseline data as currently no data exist on the introduction of blockchain into the food supply chain in the Virgin Islands. The research methodology employs a mixed methods approach. A baseline survey of 10% (approximately 22 farmers of the 219; 160 STX, 59 STT) is being conducted based on USDA 2007 Census in the VI USDA 2007 Census1. The farmers are asked to describe their current practices, how decisions are made about specific crops, when to grow the crops, and if and how they determine the demand for certain crops.

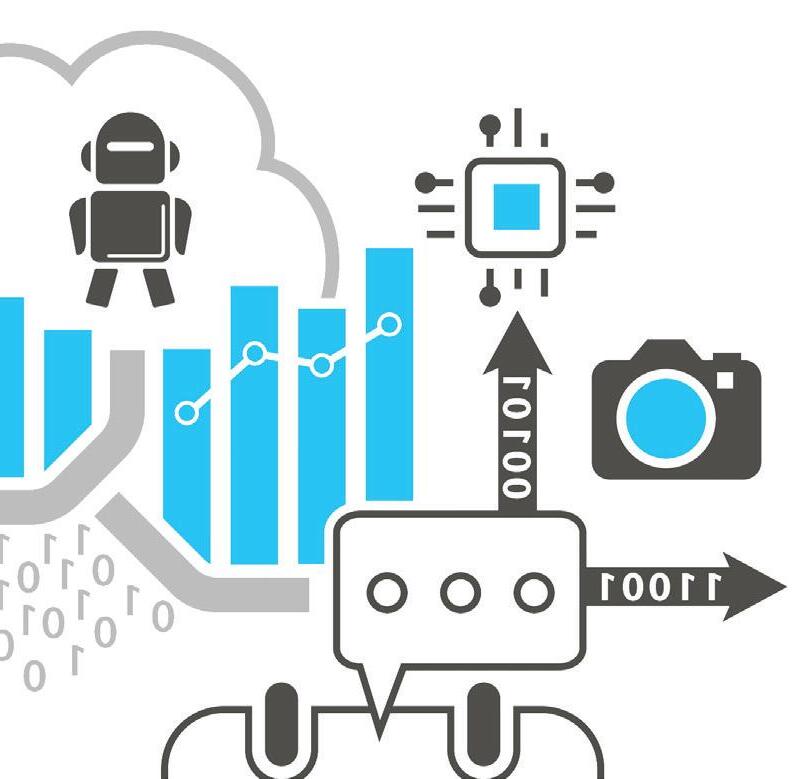

Young Sik Cho | Jackson

State University | A Study on the Convergence of Blockchain Technology and Artificial Intelligence (A.I.) in a Digital

Supply Chain:

Applying Big Data Analytics

Data is the most critical element of machine learning algorithms because poor data quality, regardless of the quality of the A.I. algorithm, leads to inaccurate and distorted business decision-making. In this way, blockchain technology can serve as a powerful data solution for any A.I. system. It enables the creation and operation of decentralized, tamper-resistant, immutable, transparent, and traceable data in supply chain networks. However, there is a lack of understanding of how the convergence of blockchain technology and A.I. can contribute to making optimal operational decisions (e.g., capacity management, forecasting, and inventory management) in supply chain processes. As such, this study aims to understand how the convergence of blockchain technology and A.I. can contribute to creating value and monetization in the digital supply chain.

22 Spotlight On Research May 2023

Joanne Luciano | University of

of

Joanne Luciano University of the Virgin Islands

Young Sik Cho Jackson State University

Arim Park and Huan Li | North Carolina A&T State University | The Effect of Blockchain Technology on Supply Chain Sustainability Performances

This paper focuses on the use of novel blockchain-based supply chain management and its potential sustainability performances in environmental protection, social equity, and governance efficiency. By conducting a systematic literature review and a case study, we aim to evaluate whether the three sustainability indicators can be improved along supply chains based on blockchain technology. Our study shows that blockchain technology has the potential to improve sustainability performance, and we expect a continuing increase in the popularity of blockchain technology applications in supply chain management.

Angelino Viceisza | Spelman College | Understanding Consumer Take-Up of FinTech and its Potential Value

This paper presents preliminary and incomplete evidence on how consumers interact with such platforms using survey and web-clicks data from a sample of 383 Central American migrants. The authors find that FinTech/information seems to impact decision-making. Additionally, the direction of such an effect depends on the nature of additional information, such as delivery speed versus reviews by prior customers. Finally, these effects depend on the amount of money being sent and the MTO in question. More work is needed to understand the robustness, generalizability, and underlying mechanisms of these findings.

Spotlight On Research May 2023 23

Arim Park North Carolina A&T State University

Angelino Viceisza Spelman College

Huan Li North Carolina A&T State University

Young Sik Cho | Jackson State University | A Study on Value Creation through Blockchain-based Supply Chain Networks in Lean Production System

This study explores the impact of blockchain technology on Lean management systems in supply chain networks. In the context of supply chain management, a blockchain-backed Lean system model and measurements for blockchain research are developed. The research model and hypotheses are empirically tested using a survey sample of 219 practitioners and managers in the United States. The results show that blockchain is being adopted in various use cases beyond industrywide payments and transactions. Structural Equation Modeling (SEM) analysis is performed, and the results show that adopting a blockchainbacked supply chain network significantly impacts supplier- and buyerrelated Lean practices. The SEM results also indicate that the blockchainbacked Lean system substantially affects the company’s operational performance, such as cost reduction, quality performance, delivery capacity, and operational flexibility.

Mary Dunaway and Dina El Mahdy | Morgan State University | Expanding Your Accounting / I.S. Classroom with Blockchain Technology: A Case Study Approach

In this research, the authors analyzed the need, impact, feasibility, and challenges of integrating real-world learning content related to Blockchain technology into the accounting/I.S. curricula. Their goal was to match the standards the Association to Advance Collegiate Schools of Business (AACSB) sets. The first draft of this research entitled: “Thinking Technology: Blockchain and the Future of Accounting Curricula” was presented at the 2019 Mid-Atlantic American Accounting Association.

24 Spotlight On Research May 2023

Mary Dunaway Morgan State University

Young Sik Cho Jackson State University

Dina El Mahdy Morgan State University

Farshad Ghodoosi | Morgan State University | Making Smart Contracts Smarter

Ghodoosi explored the two principal problems with the existing smart contracts: first, the legal nature of intelligent contracts remains ambiguous and understudied. Second, smart contracts are very limited in scope and capability, barring more complex arrangements to be executed via Blockchain technology. Drawing from the existing and near-future smart contracts, his articles and presentations showed how smart contracts can be enforceable and smarter. That also showed that legal and societal concerns regarding intelligent contracts could be addressed by designing a dispute resolution network in intelligent contracts. By making so, more complex arrangements can be coded using Blockchain technology which in turn allows the smart contracts to be more innovative. Dr. Ghodoosi has completed a manuscript titled “Digital Solidarity: Contracting in the Age of Smart Contracts.” He presented this work at the 2019 Academy of Legal Studies in Business Annual Conference in Montreal and UBRI Connect at UC Berkeley. This article has been featured in the Machine Learning blog run by the Chinese University of Hong Kong. Moreover, this article is the top download article in the area of contract and commercial law.

Eric Sakk | Morgan State University | The Application and Development of Machine Learning and Deep Learning Methodologies for the Blockchain Paradigm

Professor Sakk discusses the most important cryptocurrencies in the market, the technology behind them, the underlying factors affecting their price fluctuations, and preventive measures for ‘investing in safety.’ It identifies factors that affect their price fluctuations from practitioner / academic literature and conducts a Delphi study involving crypto-analysts to validate and rank order the factors. This research was submitted to the 2020 Conference of the Colloquium on Information Systems Security Education (CISSE), June 14-17, 2020, in Baltimore, MD.

Spotlight On Research May 2023 25

Farshad Ghodoosi Morgan State University

Eric Sakk Morgan State University

Monica M. Sharif | Morgan State University | Blockchain and Human Resources: Advanced Recruitment, Selection, and Compensation

Professor Sharif explored the gig economy, where it is now widespread for employees to change their employment frequently. In most organizations, employee turnover has steadily increased over the years and is now much higher than it used to be in the past. Human resource divisions are, therefore, continually inundated with recruitment and selection. This research explored how blockchain technology can aid human resource divisions by making some of their practices more efficient. In this research, she studied two potential ways blockchain can improve the functioning of human resource divisions in the gig economy: (1) verification in recruitment and selection; (2) intelligent contracts ease of compensation. She also examined two causes for concern that prospective and existing seven employees might raise when organizations use blockchain: (1) trust in the organization; (2) privacy. The findings of this research was submitted to The Leadership Quarterly and Journal of Management in December 2019, and a related article was offered in the Spring of 2020.

Sheela Thiruvadi and Abirami Radhakrishnan | Morgan State University | Cryptocurrency – A Million Dollar Dream or a Reality Check?

This paper discusses the most important cryptocurrencies in the market, the technology behind them, the underlying factors affecting their price fluctuations, and preventive measures for ‘investing in safety.’ It identified factors influencing their price fluctuations from practitioner / academic literature and conducted a Delphi study involving crypto-analysts to validate and rank order the factors.

26 Spotlight On Research May 2023

Monica M. Sharif Morgan State University

Abirami Radhakrishnan Morgan State University

Maxim Bushuev | Morgan State University | Blockchain Technology in Supply Chain Management

His research goal is to improve the supply chain coordination mechanism within decentralized supply chains. In pursuit of this goal, Dr. Bushuev studies the problem of supply chain delivery coordination, where he implements penalties for untimely delivery in Blockchain smart contracts. He proposes a system that will provide hands-on experience with Blockchain technology to students and allow students to manage a company within a supply chain. Dr. Bushuev has recently applied for an NSF grant to create a Blockchain system for education.

Spotlight On Research May 2023 27

Maxim Bushuev Morgan State University

28 Spotlight On Research May 2023

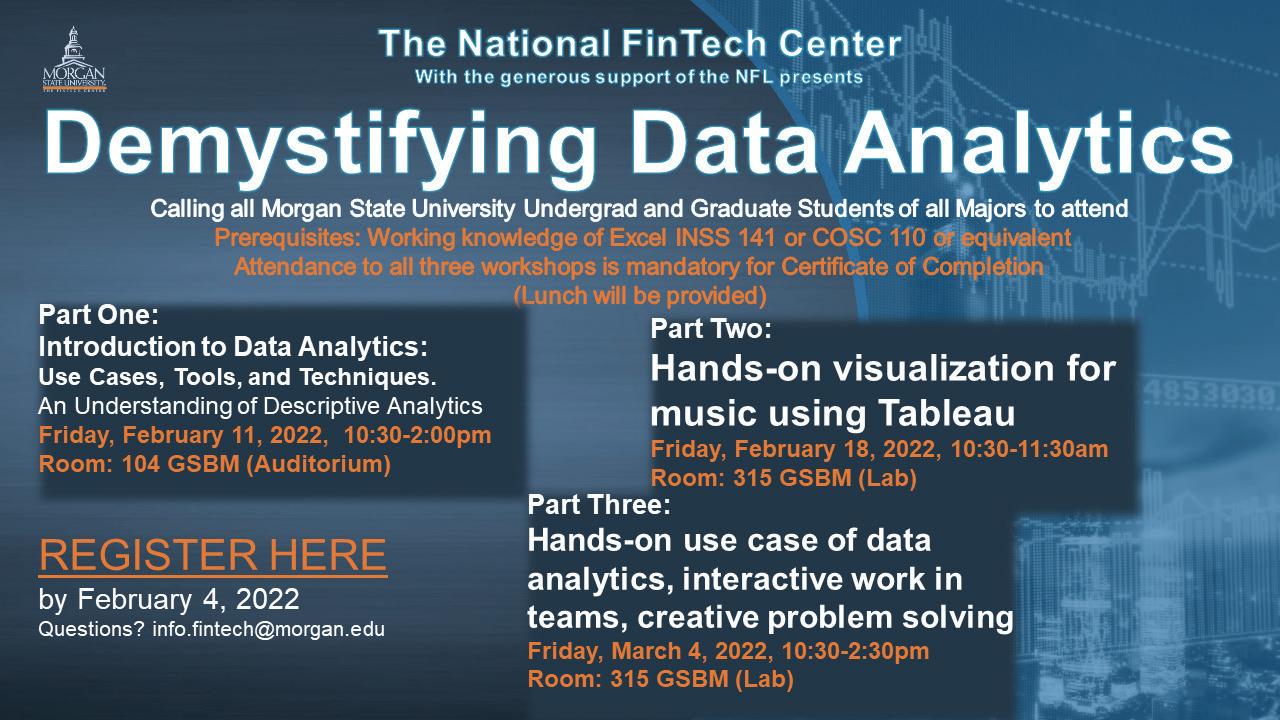

One of the successful and impactful programs that the National FinTech Center launched in 2020 was the grant program to encourage innovations in education in blockchain and FinTech on HBCU campuses. The grants are significant as they provide students with hands-on experience with cutting-edge technologies.

HBCUs are an essential resource for closing the digital divide, promoting economic and social mobility, and building a more diverse workforce in the technology sector. Therefore, supporting the development of innovative educational blockchain, cryptocurrency, and FinTech activities and programs on HBCU campuses is crucial for promoting the growth of the technology industry and its democratization.

Starting in 2020, the National FinTech Center awarded up to ten competitive innovation grants of $10,000 to faculty members from several HBCUs to develop and implement innovative educational activities and programs focusing on blockchain, cryptocurrency, and FinTech on their campuses. These programs aimed to

increase awareness among students and faculty members about blockchain and financial technology through workshops and certifications.

At Southern University and A&M College in Baton Rouge, the PI conducted a series of classroom lectures on blockchain

technologies using IBM online resources. The project aimed to increase awareness of blockchain and FinTech among undergraduate and graduate students from diverse backgrounds. Many students completed IBM blockchain certifications, fulfilling the project’s goal.

Spotlight On Research May 2023 29

Levi “Christian” Pearson and Isaac McCoy Stillman College

Levi “Christian” Pearson and Isaac McCoy of Stillman College developed an accelerated curriculum to prepare non-technical students to operate and manage the Decentralized Autonomous Organization (DAO). The project aimed to educate students on the value proposition of Web3 and crypto by helping them organize a DAO on the Solana blockchain. The project also introduced non-technical students to building on Solana and laid the groundwork for a student-run crypto/ Web3 company at Stillman to raise a seed round.

Robert Tedeschi

Edward Waters University (formerly Edward Waters College)

Robert Tedeschi of Edward Waters University created an asynchronous module on understanding cryptocurrency, financial technology, and blockchain. The workshop, consisting of three asynchronous/online sessions, supported degree completion and allowed participants to understand cryptocurrency issues.

Jack Crumbly of Tuskegee University disseminated fliers about a blockchain project to seniors in finance, accounting, and computer science. Students received training from Matthew Kronick of Kenja Blockchain, replicated the project, and presented their work to IT experts. In-person sessions conducted from September to November 2022 involved experts in Design Thinking. The project’s goal was to expose students at Tuskegee University to blockchain technology through a series of 8-10 sessions in the Fall 2022 Semester.

30 Spotlight On Research May 2023

Jack Crumbly Tuskegee University

Richard Maiti Kentucky State University

Richard Maiti of Kentucky State University developed a blockchain project where participants received a campus token, the Thorocoin. These tokens were transferred to the wallets of the participants to a redeemable gift card for the Bookstore. The project aimed to teach the skills needed to build an autonomous chain for Kentucky State’s campus and academics, utilizing the Solana chain due to its user-friendly interface and low gas fees. The project included blockchain awareness workshops that helped determine the campus’ awareness profile and created a strong foundation for community interest and areas of understanding within the blockchain space. The project’s success paved the way for the next project to build a chain, focusing more on the specific needs of Kentucky State’s campus population.

Shael Wolfson Xavier University of Louisiana

Shael Wolfson of Xavier University of Louisiana created a campus NFT, a landing page, and constructed and deployed three smart contracts for NFT minting and claiming, exposing students to the process of designing and implementing an NFT project. The project achieved its goals of having around 100+ NFTs claimed, creating a landing page, and constructing and deploying three smart contracts for NFT minting and claiming.

The FinTech Center continued the Innovations in Blockchain and FinTech Education Program and awarded grants to faculty members at several HBCUs to introduce innovative educational programs in blockchain and FinTech. These programs aimed to equip students with the knowledge and skills necessary to succeed in the rapidly-evolving financial technology industry. These grants had a significant impact on the participating universities, as they allowed students to develop entrepreneurial skills and gain experience in emerging technologies.

Spotlight On Research May 2023 31

Jifeng Mu Alabama A&M University

Jifeng Mu of Alabama A&M University project focused on turning blockchain ideas into commercially viable products or firms. The project involved a startup pitch competition in which students proposed novel blockchain business ideas. The project held seminars, met with student teams and participants weekly, and coached student teams on their projects such as proposal writing, idea refinement, exchanging ideas between the coach and each student team, and final blockchain idea pitch. This project had a direct impact on students’ career paths by teaching them how to write an idea pitch proposal and how to improve it step by step.

Ashley Thomas Alabama State University

Ashley Thomas of Alabama State University and the Alabama State University Blockchain Think Tank, aimed to build relationships across disciplines, including and beyond cryptocurrencies, to pioneer innovative technologies. The project partnered with domestic and global businesses, start-ups, and investors to promote leadership in blockchain and FinTech innovation. It extended student knowledge and experience with blockchain and FinTech beyond knowledge and use of cryptocurrencies to model creation. The project also helped students use blockchain and FinTech to solve problems and address economic inequities and community issues while encouraging discussions about blockchain and FinTech among students and within their spheres of influence.

32 Spotlight On Research May 2023

Kamal Hingorani of Alabama State University aimed to prepare students, faculty, and staff for the IBM Blockchain Essentials V2 badge. The project conducted a series of workshops both in class and through Zoom to facilitate earning the badge. A total of 140 people, including 107 students, 16 faculty, and 17 staff, completed the Blockchain Essentials course and earned the badge.

Shonda Bernadin of Florida A&M University, Blockchain Workshops-On-TheGo, aimed to create an adaptable and sustainable learning environment for teaching blockchain technologies, stimulate interest and awareness of blockchain and FinTech research to a broad audience at FAMU, and motivate more STEM students to pursue career pathways in blockchain. The project developed six differentiated instructional lesson plans on blockchain technologies and created two mobile labs to deliver lessons and workshops in a variety of learning spaces. The lesson plans included a discussion on career pathways in blockchain. In the workshops, since most of the participants were from engineering, a brief discussion of a blockchain engineer was given.

Abena Primo of Huston-Tillotson University was an educational blockchain newsletter designed to engage students in FinTech. The purpose of this newsletter was to raise awareness of blockchain and FinTech among students. The project involved faculty from multiple disciplines and aimed to provide knowledge about “hot” topics in blockchain/FinTech through articles in the newsletter. Nine newsletter articles were distributed, and students from 15 majors read and took part in post-article surveys.

Spotlight On Research May 2023 33

Kamal Hingorani Alabama State University

Shonda Bernadin Florida A&M University

Abena Primo Huston-Tillotson University

Mohammad Salam Southern University and A&M College

Mohammad Salam of Southern University and A&M College aimed to enhance awareness among the student population about blockchain and financial technology by developing a Blockchain FinTech Club (BFC). The project involved 23 students who completed IBM essential blockchain certification, and among these students, 19 completed IBM blockchain foundation developer certification. The project had four seminars with invited speakers from IBM, Microsoft, and other professionals. The project had a positive impact on the student population by enhancing awareness about blockchain and financial technology.

Millicent Springs-Campbell Spelman College

Millicent Springs-Campbell of Spelman College, designed an educational game development project called “GameOn!!!”. The project involved a hackathon where students could create educational game applications that would help them gain knowledge and understanding of blockchain and financial technology. The project also included a lecture series delivered by academics, researchers, and executives in the blockchain and FinTech community, which provided students with valuable insights into the industry.

The lecture series, which was supported by NYC FinTech Women, covered topics such as blockchain technology, financial technology, game play for learning, how to build technology learning games, and the future of blockchain and FinTech. The hackathon allowed students to explore various aspects of blockchain and FinTech and create sustainable start-ups in the discipline of game learning. The categories for judging were innovation, sustainability, and potential profitability, and stipends were awarded to eight participants.

34 Spotlight On Research May 2023

Jack Crumbly of Tuskegee University designed the “2021 LET US Academy” to expose students to blockchain technology through a series of seminars delivered by speakers from IEEE, IBM, and others. The goal was to provide students with an in-depth understanding of blockchain technology and design thinking. Ten virtual sessions were conducted from September to November 2021, and each session lasted for one hour.

INNOVATION GRANT:

Students: 1,489

Faculty and Administrators: 163

Shael Wolfson of Xavier University of Louisiana created “Xavier University Crypto on Campus (XUCC),” which aimed to create and deliver a token that could be used on campus. The project also sought to engage students in an experiential learning experience by downloading a digital wallet and transacting with a digital token. A survey of the campus community was conducted to gauge general attitudes and knowledge around cryptocurrencies and blockchain.

As a resource hub in blockchain and FinTech, the FinTech Center has granted funds to Historically Black Colleges and Universities (HBCUs) to implement innovative teaching methods such as games and experiential learning in complex subjects like blockchain and FinTech. The Center aims to provide HBCU faculty with the necessary resources to develop new

and effective teaching strategies that can enhance student engagement and learning outcomes. By offering practical experience and expertise in these rapidly growing fields, these grants align with the Center’s mission to bridge the gap between minority communities and the FinTech industry, ultimately building a bridge to future career opportunities.

Spotlight On Research May 2023 35

Jack Crumbly Tuskegee University

Shael Wolfson Xavier University of Louisiana

Shonda Bernadin Florida A&M University

Shonda Bernadin, Florida A&M University (FAMU). The project, titled “A Technical Skill Build Workshop on Blockchain,” involved a two-day blockchain workshop for Engineering and Computer Science Applications. Students were able to engage in an immersive learning environment to earn IBM blockchain digital badges. There were 64 registrants for this workshop, including 3 faculty and 36 active student participants. Out of those, 14 earned the first badge and 2 earned the second badge. This experience provided students with technical skills that will be valuable in their future careers.

Abena Primo Huston-Tillotson University

Abena Primo of Huston-Tillotson University led the project titled “Innovation with Blockchain Competition.” This project involved an Introduction to Blockchain Webinar for students and faculty, which engaged 53 students and 4 faculty members. The blockchain competition involved 10 students and 5 faculty (3 faculty team members and 2 faculty reviewers). At least one student is seeking internship opportunities. This competition allowed students to apply their knowledge in a competitive setting and gave them a chance to network with faculty members and potential employers.

Tiffany Bussey Morehouse College

Tiffany Bussey of Morehouse College led the project titled “5-Week Course on Blockchain Use Cases for Business.” The course covered various topics such as Introduction to Blockchain, Introduction to Hyperledger and Hyperledger Frameworks, Hyperledger Tools, Future of Blockchain in Business, and Prototyping. Five students expressed interest in completing the Linux Foundation Intro to Blockchain Course to obtain the certificate. The students gained the knowledge needed to develop their own business use cases for blockchain technology. This course gave students a comprehensive understanding of blockchain use cases in the business world and provided them with the skills necessary to apply blockchain technology in real-world situations.

36 Spotlight On Research May 2023

Mary Ann Hoppa Norfolk State University

Mary Ann Hoppa of Norfolk State University led the project titled “Establishing a Student-led Blockchain Club.” This project involved monthly meetings of students and a one-day faculty workshop. Students are becoming certified in Python to compete in a Python Code-a-thon for the winter term. This club provides students with a platform to learn and discuss the latest trends and developments in blockchain technology, as well as the opportunity to apply their skills in a competitive setting.

Millicent Springs-Campbell Spelman College

Millicent Springs-Campbell of Spelman College, led the project titled “Increasing Knowledge of Blockchain and Financial Technology for Minority Women Students to Create Job Opportunities and Entrepreneurial Ventures.” This project involved a 6-session virtual lecture series and a start-up idea competition that was held at the end of the lecture series. The lecturers provided career and entrepreneurship mentorship to the students. Research has shown that women and minorities are underrepresented in the blockchain and FinTech industries, so this project is especially significant in providing these students with the knowledge and resources they need to succeed in these fields.

Floran Syler-Woods Stillman College

Floran Syler-Woods of Stillman College led the project titled “Blockchain Learner Podcast.” This project involved an interview-based podcast including 12 podcast discussions/interviews of faculty, practitioners, and experts on various Blockchain and FinTech subjects. As of early December, there have been 133 downloads / plays while the website reported 50 site sessions. This podcast provides students with access to industry experts and valuable insights into the latest trends and developments in blockchain and FinTech.

Spotlight On Research May 2023 37

Joanne Luciano University of the Virgin Islands

The FinTech Center’s grants to faculty at HBCUs have paved the way for a groundbreaking pilot project that showcases the practical applications of blockchain in supply chain management and sustainability. Under this project, scholars like Joanne Luciano of the University of the Virgin Islands collaborated with the National FinTech Center and conducted a proof-of-concept study, titled “The Emerald Archipelago Supply Chain Use Case,” which successfully applied blockchain technology to address local supply chain challenges in the farming industry of the US Virgin Islands. The project utilized blockchain smart contracts to help restaurants and local residents access locally grown foods. The significance of this pilot project goes beyond its potential impact on local communities. It is a practical example of how blockchain can revolutionize supply chain management and foster sustainability across industries. Moreover, it is a testament to the value of introducing educational innovations and hands-on learning experiences in blockchain and FinTech. Students who participated in this project had the opportunity to gain valuable experience in utilizing blockchain technology in real-world scenarios. In addition to the project itself, various educational activities were held to engage students and faculty in the learning process. These included information sessions, networking events, and webinars that provided students with insights into the practical applications of blockchain in the business world. The Hyperledger Foundation supported these initiatives by providing ongoing mentorship and access to the latest blockchain technology developments. Overall, the pilot project and related educational activities demonstrate the FinTech Center’s commitment to equipping students with practical skills and knowledge in blockchain and FinTech. By empowering the next generation of innovators and entrepreneurs, these initiatives are creating a more sustainable and equitable future for all.

Alexander Yap North Carolina A&T State University

Alexander Yap’s project’s goal was to host a one-day Blockchain symposium for faculty and students at North Carolina A&T State University, a Historically Black University in Greensboro, NC. In addition to serving faculty and students at the host institution, faculty and students from the eight additional Historically Black Colleges /Universities were also invited to attend.

38 Spotlight On Research May 2023

“During this program, I learned a lot - from dollar backed stable coins to crypto pairings to crypto’s origin story. The reason I am so excited about crypto is because it was originally created for a greater good, it was built out of the mistrust of banks. I believe that investing in crypto is key to the next generation of entrepreneurs and has the opportunity to make life better for my family and my community. In fact, I started a cleaning company in Baltimore which caters specifically to fellow working mothers and we plan to accept cryptocurrencies at my business in the future.”

Christina Coleman Business Administration, Morgan State University

Christina Coleman Business Administration, Morgan State University

Spotlight On Research May 2023 39

40 Spotlight On Research May 2023

The National FinTech Center has played a profound role in supporting Morgan State University, as well as all HBCUs in the national arena, by leading the efforts to inform and educate students in these emerging fields.

One notable example comes from Edwards Waters University, where Robert Tedeschi, Seong Yoon, Kevin Austin, and Felicia Wider-Lewis utilized their learning management systems to create asynchronous modules on understanding cryptocurrency, financial technology, and blockchain. They successfully provided three hybrid workshops with guest speakers, aiming

to demystify the challenges and opportunities in financial technology for the greater Edwards Waters Community. Through their efforts, a certificate program was developed from the assessment, with prospects of a new course on financial technology that addresses blockchain and cryptocurrency. Pre and post assessment data were gathered to evaluate the

quality and effectiveness of the workshops and modules, showcasing the commitment to measuring and enhancing the educational impact.

At Florida Agricultural and Mechanical University, Shonda Bernadin introduced four blockchain lessons into separate courses in the engineering and computer science curriculum.

Spotlight On Research May 2023 41

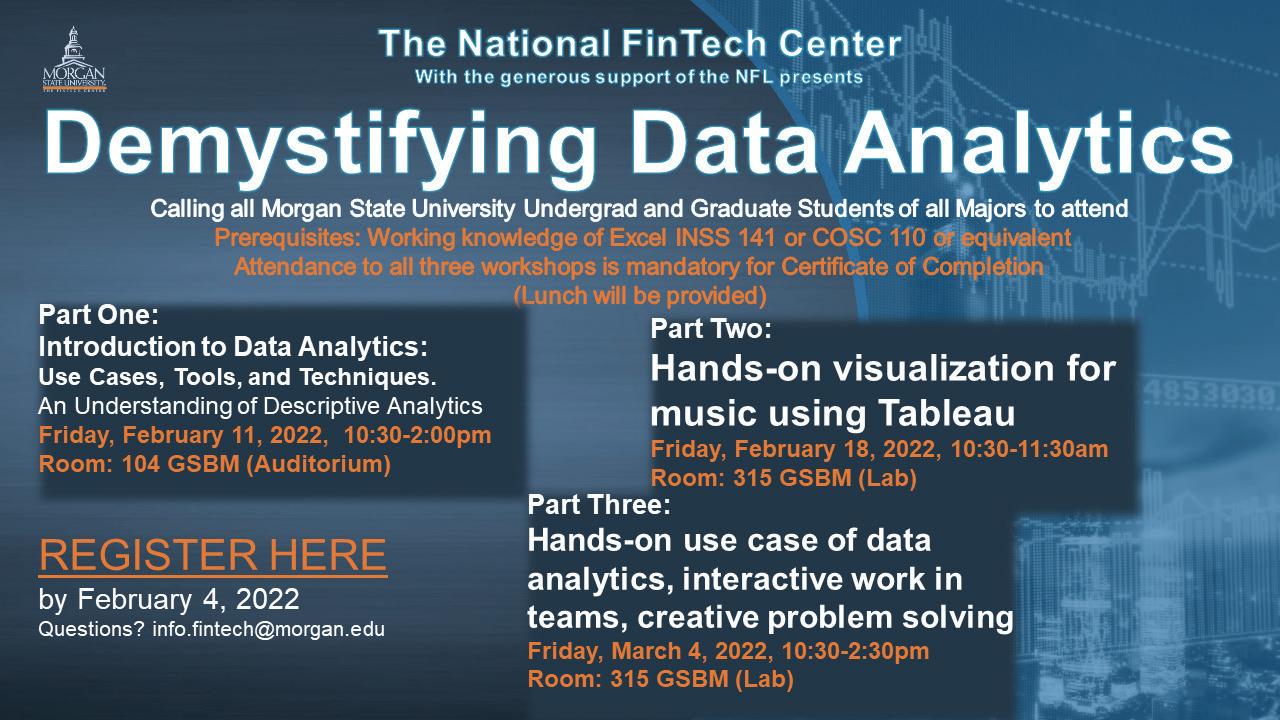

The development of new courses and modification of existing courses with blockchain and related cutting-edge content is of paramount importance in equipping students with the knowledge and skills required to thrive in the evolving landscape of financial technology (FinTech).

These lessons were integrated into EEE 4872 - Introduction to Artificial Intelligence (9 students), CNT 4406 - Cryptography (17 students), CNT 4504 - Data Communications and Org Networks (22 students), and CIS 5396 - Cybersecurity Forensics (10 students). By infusing blockchain content into these courses, Bernadin empowered students with a comprehensive understanding of blockchain technology and its relevance in their respective fields.

Southern University and A&M College’s Department of Computer Science took a significant step by introducing a Blockchain concentration in their undergraduate curriculum, led by Mohammad Salam. This initiative ensures that students receive specialized education and training in blockchain technology, preparing them for future roles in the FinTech industry. By incorporating blockchain into the curriculum, the university enhances

the educational experience and equips students with the skills required to navigate the evolving landscape of digital finance. The Morgan FinTech Center has also made notable contributions to curriculum development through various workshops and institutes.

The Curriculum Development Institute, organized by Morgan State University, attracted faculty from diverse departments who were interested in introducing blockchain concepts into their courses. Faculty members from departments such as Fine and Performing Arts, Business Administration, Multimedia Journalism, Civil Engineering, Teacher Education and Professional Development, and Public Health attended the workshop. The institute showcased the basics of distributed ledger technology and presented resources and educational materials that exemplified the use cases of blockchain across multiple

industries. This initiative not only educated faculty members but also empowered them to incorporate blockchain into their courses, thus disseminating knowledge to a wide range of students.

Additionally, a workshop specifically designed for faculty in the Graves School of Business delved deeper into FinTech and cryptocurrencies, exploring how these concepts could be integrated into upper-level courses. The participation of 38 faculty members in these workshops highlights the commitment of the National FinTech Center and Morgan State University to equip educators with the knowledge and tools necessary to integrate cutting-edge content into their teaching.

The HBCU Blockchain Curriculum Development Institute, held in New Orleans, further demonstrates the commitment of the National FinTech Center to HBCUs. The institute

42 Spotlight On Research May 2023

brought together faculty from 45 HBCUs for three days of intensive training and collaboration. As a result, 37 courses were modified, and eight newly developed courses incorporating blockchain and FinTech-related content were introduced at 30 HBCUs in the spring semester of 2020. This wide-reaching impact ensures that over 1,000 students across these institutions had the opportunity to learn about blockchain and FinTech, preparing them for the future of finance and technology.

Dr. Dessa David, a faculty member at Morgan State University, taught the course “Blockchain Fundamentals” in the Department of Information Science and Systems during the fall semester of 2018. Initially, 15 students enrolled in the course, which provided them with a comprehensive understanding of blockchain technology. In addition to this course, seven MSU faculty members have developed new courses or modified existing courses to incorporate blockchain content, spanning various fields such as artificial intelligence, machine learning, programming

instruction, accounting, auditing, and entrepreneurship. These faculty-led initiatives demonstrate the commitment of Morgan State University to integrating blockchain into the curriculum across disciplines, ensuring students are well-prepared for the emerging job market.

In conclusion, the National FinTech Center has played a pivotal role in driving the development and modification of courses with blockchain and related cutting-edge content at HBCUs. The examples provided from Edwards Waters University, Florida Agricultural and Mechanical University, Southern University and A&M College, and Morgan State University highlight the profound impact of these efforts. By fostering collaboration, providing resources, and organizing workshops and institutes, the National FinTech Center has supported faculty members in incorporating blockchain into their courses, thus equipping students with the knowledge and skills needed to succeed in the rapidly evolving fields of FinTech and digital finance.

Spotlight On Research May 2023 43

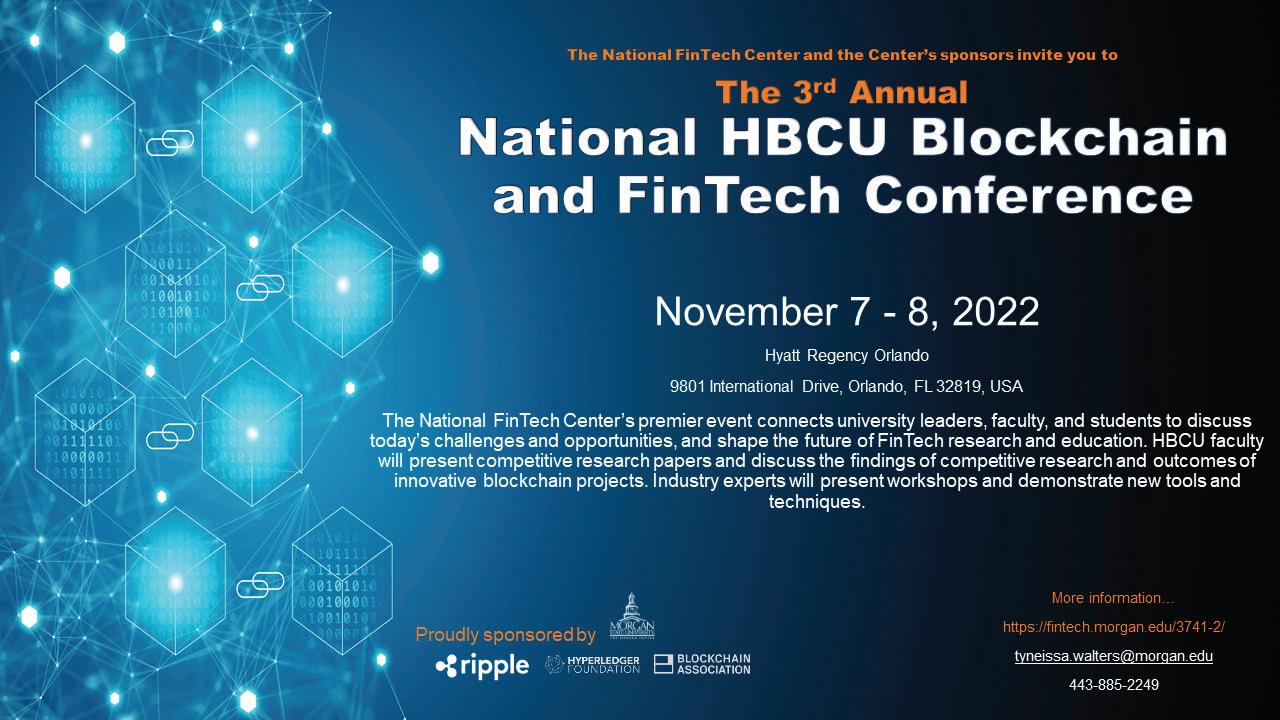

HBCU Blockchain Curriculum Development Institute, New Orleans October 31 - November 2, 2019

The HBCU Blockchain Curriculum Development Institute, held in New Orleans from October 31 to November 2, 2019, was an intensive three-day workshop aimed at assisting faculty from 30 Historically Black Colleges and Universities (HBCUs) in developing blockchain and FinTech-related content for their courses. The institute brought together a diverse group of 45 faculty members who had submitted competitive proposals to receive the Institute fellowship, which covered most of their expenses for the event.

The primary objective of the workshop was to empower faculty members with the knowledge, skills, and resources necessary to incorporate blockchain technology and FinTech concepts into their courses, thereby enhancing the educational experience for their students. The workshop focused on collaborative development, fostering an environment of shared expertise and innovation among participants.

To support the participating faculty in the development of their syllabi, the workshop enlisted the guidance and mentorship of renowned experts from Morgan State University, UC Berkeley, Duke University, and the University of Michigan. These mentors provided valuable insights, best practices, and industry perspectives, serving as a catalyst for the faculty to explore new ideas and approaches.

The learning outcomes of the workshop were extensive and far-reaching. By the end of the three-day institute, the participating faculty had gained a deep understanding of blockchain technology, its applications, and its impact on the finance and technology sectors. They had the opportunity to explore various case

studies and real-world examples, enabling them to contextualize blockchain concepts within their respective disciplines.

Through collaborative sessions and group discussions, the faculty members engaged in the development and enhancement of their courses. They exchanged ideas, shared resources, and worked together to integrate blockchain and FinTech-related content seamlessly into their syllabi. The workshop provided a platform for interdisciplinary collaboration, fostering a dynamic environment where faculty members from diverse fields could leverage their expertise to create comprehensive and engaging course materials.

The results of the HBCU Blockchain Curriculum Development Institute were impressive. As a direct outcome of the workshop, more than 1,000 students across 30 HBCUs had the opportunity to learn about blockchain and FinTech during the spring semester of 2020. A total of 37 existing courses were modified to incorporate blockchain content, ensuring that students received updated and relevant education. Additionally, eight brand-new courses were developed, addressing emerging topics and cuttingedge advancements in the field of blockchain.

The institute not only empowered faculty members with the necessary knowledge and skills but also provided a supportive network of peers and mentors who would continue to collaborate and exchange ideas even after the workshop concluded. This network fostered ongoing professional development and encouraged the sharing of best practices among HBCUs nationwide.

44 Spotlight On Research May 2023

Dr. Dessa David | Morgan State University

Department of Information Science and Systems

Fall semester of 2018 | INSS 410: Blockchain Fundamentals

INSS 410: Blockchain Fundamentals was taught in the Department of Information Science and Systems. Fifteen (15) students were initially enrolled in the course. In addition, seven MSU faculty have developed new courses or modified existing courses with blockchain content, including:

● Introduction to Artificial Intelligence and Machine Learning

● Integration of Blockchain Concepts into Programming Instruction

● Accounting and Auditing

● Entrepreneurship

Spotlight On Research May 2023 45

“I plan on getting my PhD in biotechnology and find a way to combine my biological background with my passion for finance. I am extremely passionate about investments and financial markets. I want to own biotech companies and invest in various assets; also manage other individual’s assets.”

Ismael Busso

Biotechnology, Morgan State University

46 Spotlight On Research May 2023

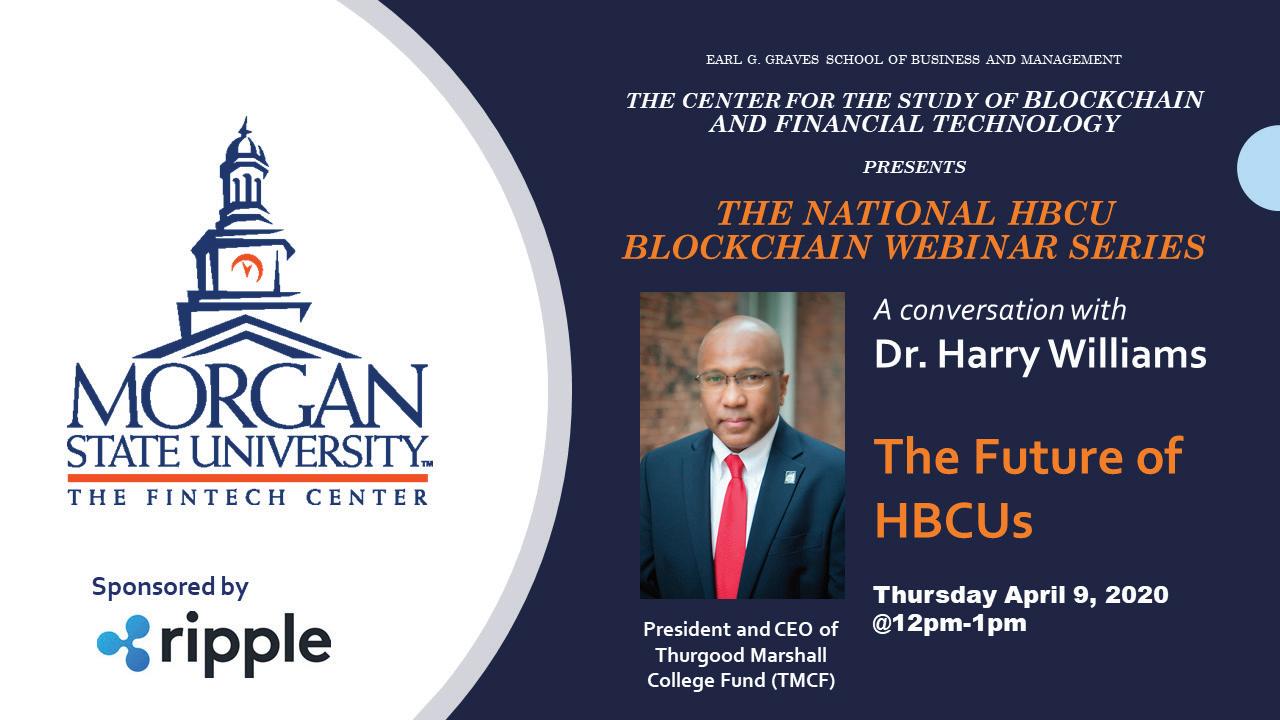

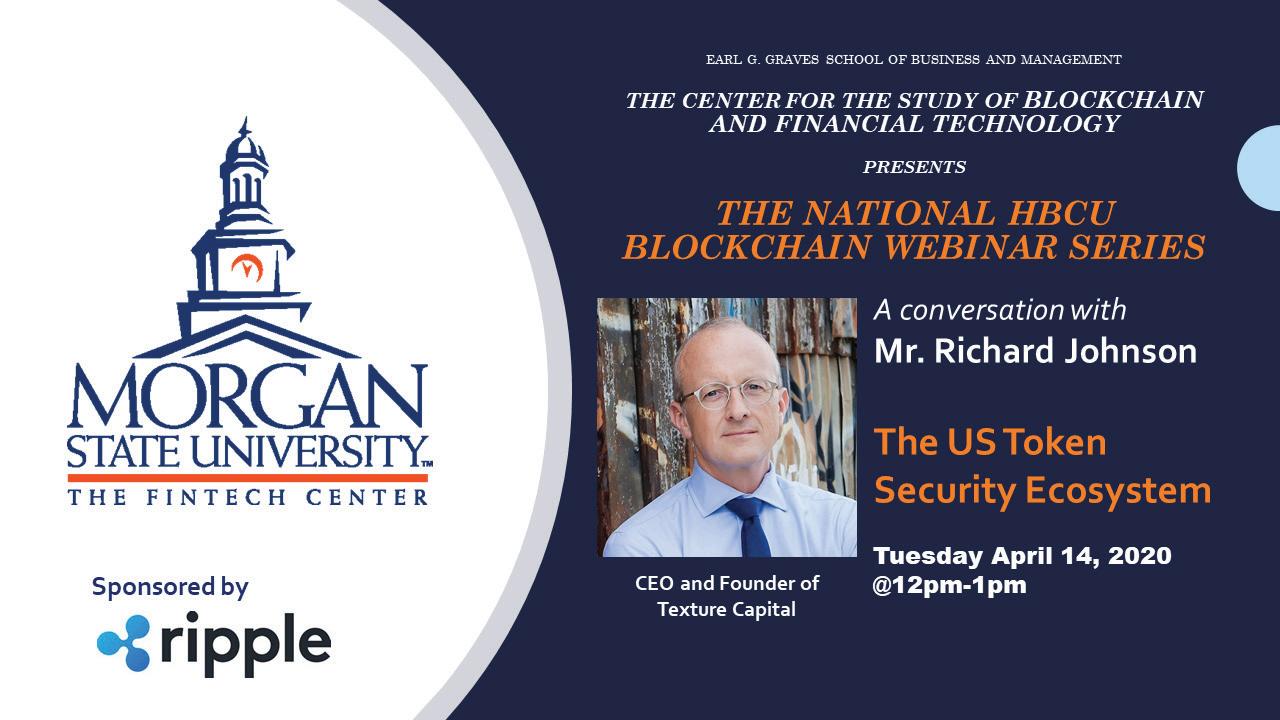

These online events provided a unique platform for lawmakers, regulatory agency commissioners, and directors, as well as industry and academic experts to convene and explore the evolving landscape of these transformative technologies. By bringing together diverse perspectives and expertise, the webinars facilitated in-depth discussions and analysis, enabling participants to gain valuable insights and contribute to the ongoing development of policies and regulations in these domains.

The webinars served as a crucial forum for all stakeholders to deepen their understanding of Blockchain, FinTech, and Cryptocurrencies, and to address the challenges and opportunities they present in today’s rapidly evolving digital economy. Through engaging presentations, interactive panel discussions, and dynamic knowledge sharing, the FinTech Center succeeded in fostering a collaborative environment that promoted meaningful dialogue and exploration of key issues

surrounding these emerging technologies.

This section of the report aims to provide a comprehensive overview of the webinars organized by the FinTech Center. It will delve into the prominent themes discussed, the notable participants who contributed their expertise, and the significant outcomes and recommendations that emerged from these insightful sessions. By examining the collective wisdom and expertise shared during these webinars, we can gain a deeper understanding of the current state and future prospects of Blockchain, FinTech, and Cryptocurrencies, as well as the policy and regulatory implications that arise from their widespread adoption.

The participation of lawmakers, regulatory agency commissioners and directors, and industry and academic experts in these webinars underscores the significance and relevance of the topics discussed. Their

WEBINARS:

1,317 Attendees

engagement demonstrates a shared commitment to staying informed, informed, and actively shaping the future trajectory of these transformative technologies. The insights gained from these esteemed participants serve as invaluable resources for policymakers, regulators, and industry professionals seeking to navigate the complex landscape of Blockchain, FinTech, and Cryptocurrencies.

In the following sections, we will delve into the highlights of the FinTech Center’s webinars, shedding light on the key discussions, presentations, and outcomes. By examining the valuable contributions made by the participants, we aim to provide a comprehensive overview of the knowledge shared and foster a deeper understanding of the implications and opportunities presented by Blockchain, FinTech, and Cryptocurrencies in today’s rapidly evolving digital era.

Spotlight On Research May 2023 47

The FinTech Center’s commitment to fostering knowledge and understanding in the fields of Blockchain, FinTech, and Cryptocurrencies has been realized through a series of insightful and informative webinars.

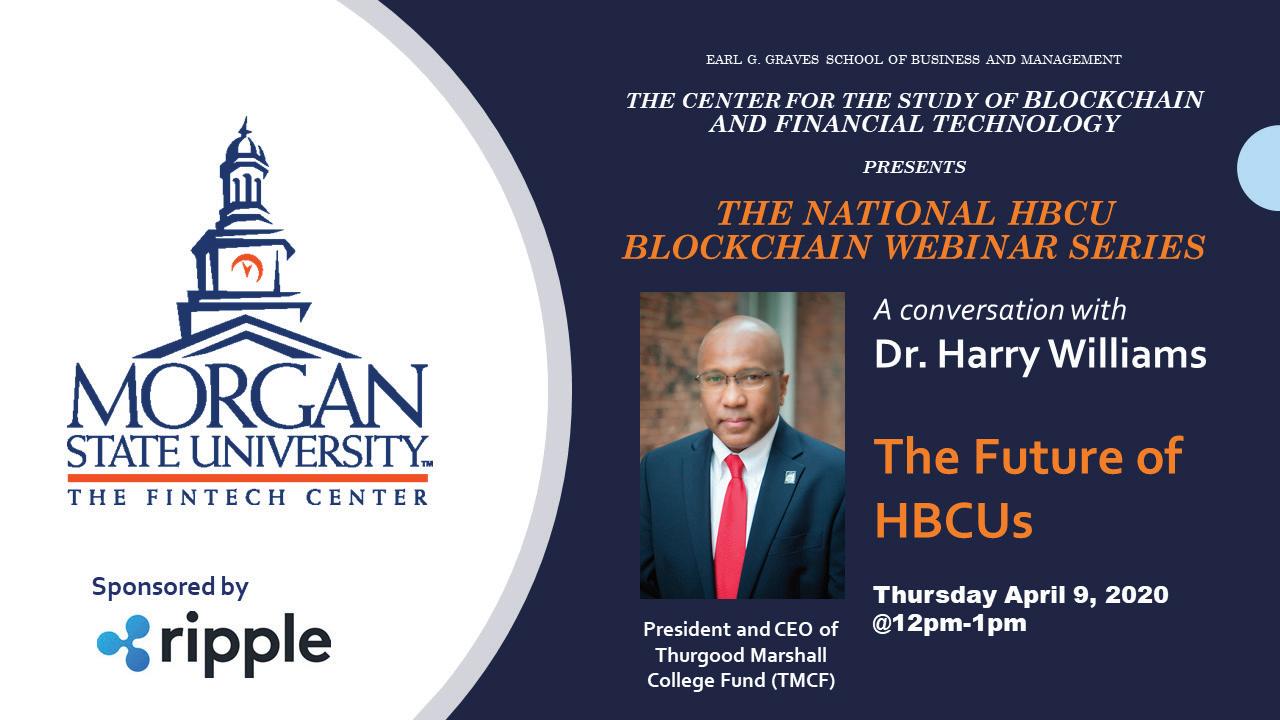

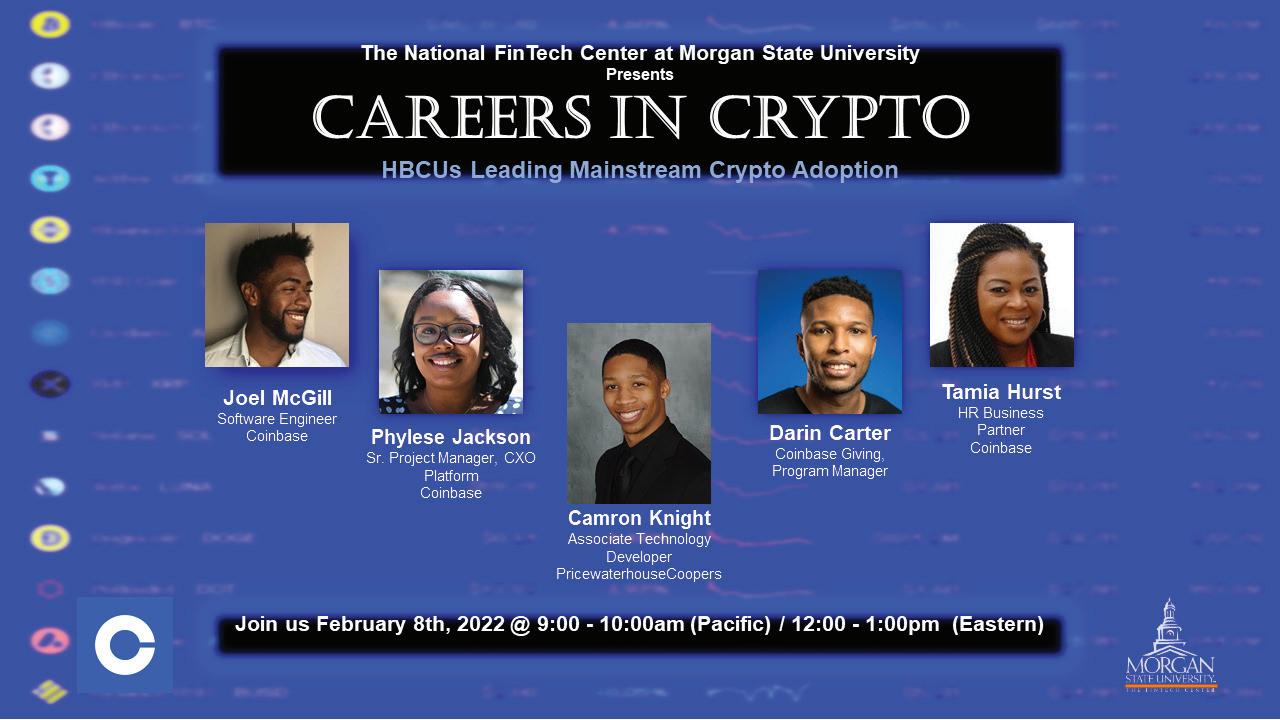

Tuesday, April 7, 2020