86 7$; 67$786 '(&/$5$7,21

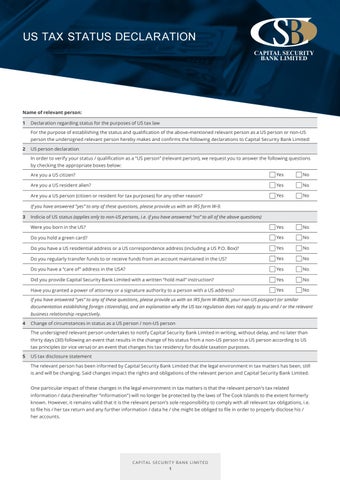

Name of relevant person: 1 Declaration regarding status for the purposes of US tax law

For the purpose of establishing the status and qualification of the above-mentioned relevant person as a US person or non-US person the undersigned relevant person hereby makes and confirms the following declarations to Capital Security Bank Limited:

2 US person declaration

In order to verify your status / qualification as a “US person” (relevant person), we request you to answer the following questions by checking the appropriate boxes below:

Are you a US citizen?

Yes

No

Are you a US resident alien?

Yes

No

Are you a US person (citizen or resident for tax purposes) for any other reason?

Yes

No

If you have answered “yes” to any of these questions, please provide us with an IRS form W-9.

3 Indicia of US status (applies only to non-US persons, i.e. if you have answered “no” to all of the above questions)

Were you born in the US?

Yes

No

Do you hold a green card?

Yes

No

Do you have a US residential address or a US correspondence address (including a US P.O. Box)?

Yes

No

Do you regularly transfer funds to or receive funds from an account maintained in the US?

Yes

No

Do you have a “care of” address in the USA?

Yes

No

Did you provide Capital Security Bank Limited with a written “hold mail” instruction?

Yes

No

Have you granted a power of attorney or a signature authority to a person with a US address?

Yes

No

If you have answered “yes” to any of these questions, please provide us with an IRS form W-8BEN, your non-US passport (or similar documentation establishing foreign citizenship), and an explanation why the US tax regulation does not apply to you and / or the relevant business relationship respectively.

4 Change of circumstances in status as a US person / non-US person

The undersigned relevant person undertakes to notify Capital Security Bank Limited in writing, without delay, and no later than thirty days (30) following an event that results in the change of his status from a non-US person to a US person according to US tax principles (or vice versa) or an event that changes his tax residency for double taxation purposes.

5 US tax disclosure statement

The relevant person has been informed by Capital Security Bank Limited that the legal environment in tax matters has been, still is and will be changing. Said changes impact the rights and obligations of the relevant person and Capital Security Bank Limited.

One particular impact of these changes in the legal environment in tax matters is that the relevant person’s tax related information / data (hereinafter “information”) will no longer be protected by the laws of The Cook Islands to the extent formerly known. However, it remains valid that it is the relevant person’s sole responsibility to comply with all relevant tax obligations, i.e. to file his / her tax return and any further information / data he / she might be obliged to file in order to properly disclose his / her accounts.

Forms - Tax Declaration September 2016

CAPITAL SECURITY BANK LIMITED 1