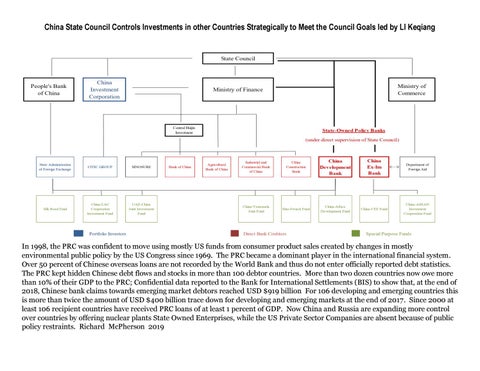

China State Council Controls Investments in other Countries Strategically to Meet the Council Goals led by LI Keqiang

In 1998, the PRC was confident to move using mostly US funds from consumer product sales created by changes in mostly environmental public policy by the US Congress since 1969. The PRC became a dominant player in the international financial system. Over 50 percent of Chinese overseas loans are not recorded by the World Bank and thus do not enter officially reported debt statistics. The PRC kept hidden Chinese debt flows and stocks in more than 100 debtor countries. More than two dozen countries now owe more than 10% of their GDP to the PRC; Confidential data reported to the Bank for International Settlements (BIS) to show that, at the end of 2018, Chinese bank claims towards emerging market debtors reached USD $919 billion For 106 developing and emerging countries this is more than twice the amount of USD $400 billion trace down for developing and emerging markets at the end of 2017. Since 2000 at least 106 recipient countries have received PRC loans of at least 1 percent of GDP. Now China and Russia are expanding more control over countries by offering nuclear plants State Owned Enterprises, while the US Private Sector Companies are absent because of public policy restraints. Richard McPherson 2019