Chicago native John Greene moved to Naperville in 1969 He came here because he was inspired by the unique opportunities that were surrounding him More than four decades and 145,000 residents later, Naperville and the surrounding areas are admired as great places to live, raise families, and retire

Initially, John worked with a large Chicagoland brokerage. While the brokerage experienced successful growth, the quality of service and their ability to make real-time, locally-based decisions began to decline John saw an opportunity to add value to the local market through a new model that focused on personal relationships, hand-picked agents and local expertise The vision for the company was captured in the tagline “A Better Way”

Since that day, we have been committed to helping its communities grow, not just growing its business. As a result, john greene Realtor is revered as a family-owned boutique brokerage that brings the reach of an expansive global network of independent real estate companies to each and every one of its clients

As the next generation of family leadership guides john greene Realtor into the future, we remain committed to the people and values that built this company

"I don't think anyone should wake up in a home that they don't love."

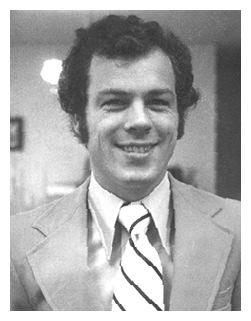

John Greene, 1976. Grand Opening of john greene Realtor.

We are john greene Realtor®, a family-owned and operated company founded in 1976 by John Greene

Our company is a full-service residential brokerage firm that is filled with hand-picked agents who share the same vision, sensibilities, respect and dedication as our founder.

We proudly maintain our reputation for excellence, innovation, and delivering a five-star client experience

Quite simply,we believe that real estate is a peo ple business first. We believ e in investin g in our tea m, providing top-quality ser vice to our lcients, and contributingin a positiv e way to thecommunities we serve.

We have a carefully-selec ted team of f ull-time & highly traine d agents. We seek to hirethe best an d most dedicate d agents in the industry,and we inve st heavily in their success. Our talentedteam prides itself in providing excep tional clientcare and consistentlyexceeding ex pectations.

Our local agents and comm unity cultureplay a majo r role in providing you the best local market knowle dge, and making sure your home is priced right from the start. We pride ourselves on our personal market expertise andour ability to provide v aluable information t o better ser ve our client s on buyers, competition,and the mark etplace.

Our team consistently ran ks at the topof the indu stry and consistently outperfo rms the competition. We a re committed toproviding th e highest level of servic e and getting h omes sold.

Buying a home is a complex process. Our job is to make this journey as stress free as possible and get you across that finish line. Your john greene agent will assist you all through the search, comparable homes sold, making an offer, inspection, repair, and appraisal processes, as well as help you find the best value, neighborhood, and quality for your budget and requirements. We will guide you through every step of your search to help you find the perfect home, and will work to make the process of purchasing your home seamless, providing guidance and resources throughout the transaction to closing and beyond.

Buyer

consult ationand

agreement Get pre-qualified. Make your wish li st.

P R E P A R E

Before starting your home search process, it is important to evaluate your financial situation, confirm your budget, and familiarize yourself with mortgage options.

Your monthly payments should be comfortable for you to handle, in relationship to your total obligations, about 28% of gross monthly income Your house payment and your debts should not exceed 36% of your income, including revolving credit, student loans, and child support You should also pick the correct loan for your needs. A fixed rate is more expensive, but offers more protection than an adjustable rate mortgage that can reset to a higher amount, making your monthly payments higher.

An integral part of the financial process is getting pre-approved by your lender. When making an offer on a home, the pre-approval letter shows sellers and their agents that you are a serious, qualified, and committed buyer.

Working with your Realtor™ and your lender, you will evaluate: will

In addition to the mortgage payment, additional costs to take into account when determining your budget include:

• How muchnfiancing you can qualifyofr

• Your credithistory and credit score

• How much yo u will need for a down payment

• Items included in your mortgage payment

• Possible nfiancing choi ces

• Current interest rates

• Monthly HOAPayments (i f applicable)

• Property taxes

• Insurance

• Utilities

• Commutingocsts

Bank Statements (all pages even if blank)

Last two months from all accounts

Retirement

Last two months of retire ment/pension,401K and so cial security 1099statements

Pay Stubs

Last 30 days

Tax Returns

Last two year s of 1040 fe deral tax return, last tw o years of federal corporate and/or partnershipatx returns ( if self-employed ), last two years of W-2forms

Valid I.D. copy

Driver’s license, social security card , passport

Earnest Money

Copy of earnest money che ck deposit

Award letters (if applicable)

For retirement/pension in come, socialsecurity, di sability income

Divorce (if applicable)

Decree and separation agr eement

Mortgage Statements (if applicable)

Property taxbills and ho meowners insurance statements fo r all real e state owned

Bankruptcy (if applicable)

Petition andDischarge

10 do’s and dont’s 1. 2. 3. 4. 5. 6. 7. 8. 9. 10.

Don’t applyofr new credit of anykind.

Don’t max outor overcharge existing credit cards.

Don’t consolidate debt to onerotwo credit cards.

Don’t make major purchases.

Don’t make uncharacteristically large payment s into your accounts.

Do keep allxeisting credit cardcacounts open

Do be prepare d to pay off collections i f required b y underwritingor the loan program guidelines.

Do provide documentation for satisfiedjudgments o r paid tax lien s.

Do stay current on payments forall existing monthly obligations.

Do call yourRealtor™ bef ore making anynfiancial decisions orchanges to your normal f inancial routine. Werae here to h elp you throughhte process.

Make a list of must-have features so you can narrow your home search A front porch, a two-car garage, hardwood floors, and eat-in kitchen can all add to the enjoyment of your home Just as important is how your home is designed The number of bedrooms and baths should suit your household members, and the layout should suit your lifestyle If you like to entertain, you should have plenty of dining space and storage for dishes and cookware. If you frequently work at home, you’ll need a home office or at least a quiet designated workspace Just make sure the home you choose allows room for your family to grow

After you talk to your lender to see what you can qualify to buy, talk with your john greene agent about the home you have in mind With professional guidance, you should be able to find and buy the home of your dreams, where you ll be happy for a long time to come We recommend that all decision makers on the purchase of the home rank or circle your top needs independently and compare notes to ensure alignment in your home search

Price of home

Style of home

Neighborhood

Views

Near work

Near schools

Near shopping

Freeway acces s

Near recreation areas

Neighborhoodcovenants/re strictions

Overall look/feel of hous e

Number of stories

Garage size

Upgrades

Number of bedrooms

Number of bathrooms

Closet/storag e space

Type of heat

Fireplace

Eat-in kitche n

Master bedroom

Office

Finished basement

Large backyar d

Landscaping

Guest quarter s

Other:

• How long doyou plan on living in this home?

• Will you need a home th at will accommodat e different life stages?

• Do you haveor plan to have children ?

• Are you approaching ret irement?

With the dramatic rise and fall of housing prices over the last decade, consumers have new respect for homes as investments But the flip side is that your investment is still a home, one you’re likely to occupy for several years or more.

According tothe annual P rofile of Hom e Buyers and Sellers, compiled by the National Association of REALTORS®, th e primary re ason buyers icte for purc hasing a homeis simply t he desire toown, followe d closely by th e desire for more space,and a change in the famil y situation.

For most people, buying a home is abou t giving hou sehold member s more comfo rtable living arrangementsand putting them closerot jobs, favo rite activities, other fa mily and friends. What ar e your goals for buying a home? You might wan t a better h ome and neighborhood. You might want adifferent kind of livin g experience , such as moving from an apartment toa single-fam ily home witha private garage and yard. Your fam ily may be growing, so yo u have to think about sch ool districtsand proximi ty to parks andother recrea tion. If you’re not certa in, you mightthink about what would hcange about your situation ove r the years if you becamea homeowner . If you’re l ike most hom ebuyers, youexpect to st ay in your new ohme about 10 years.

You’ll also ubild equity for yourself,instead of for someone lese. Every p ayment you make, plus the rules of inflationwill eventua lly allow youto recoup m ost if not al l of your in vestment, ormake a profi t when you sell. Affordability m ay also be animportant f actor for you . The combin ation of lowinterest rat es and low prices allows you to buy more homefor the mon ey. Rents arerising, mak ing ownershipmore affordable than renting i n many areas,especially when you factor in tax in centives suchas mortgage interest deductions and p roperty taxesallowable a s deductionsagainst your income.

When you buy,make your g oals long-term. Choose th e home you think will ser ve your household’s needs the best forthe longest period of time, as it’s b een proven that the longe r you own a ohme, the mor e equity you’llbuild. Toda y’s market conditions and affordabilit y make it mo re likely tha t you will r each your home buying goals, n o matter whatthey are.

U R S U E

There’s no perfect home. You may want all thelatest ameni ties of a new home, but eve n new homes may not be perfect, perhaps coming w ith longer commutes andbigger price tags.

Many sellersdon’t repain t or re-carpe t prior to selling, so if y ou’re shoppin g for an olderhome, expect to do some cosmetic work

Homes that need updating are priced below homes t hat are up t o the minute and move-in erady. That c ould be to your financia l advantage, so try to look beyond outdated fixtures and focus instead on th e floorplan and dimensions. I gnore the seller’s tastes and imagi ne each room clean and clear of clutte r with your own things inthem.

Most cosmeticchanges are relatively inexpensive,and you can even pay for them with you r mortgage l oan, in some cases. Talk t o your lende r.

Buying a homecan be a wi se financial investment,fi you buy we ll and hold your home forlong-term g ain. Because of closing an d moving cos ts, it’s nearly impossible tobuy a home and sell it immediately for a large gain,but it is possibl e to sell af ter a coupleof years with nocapital gai ns tax, shoul d you make a profit.

According tothe National Association of REALTORS®,home equity growth beats inflation by about one to two percent annually, not to mention government subsidies for home ownership inthe form of tax relief an d other incentives.

However, if y ou look at o wning a home strictly as a n investment , you’ll miss many pleasures.

P U R C H A S E

In a neighborhood of simi lar homes, wh y is one wor th more thananother? Tha t’s the question that’s t eased buyers and sellers for ag es, but thenaswer is sim ple.

Every home isdifferent.

When a homesisold, a wi lling sellerand a willin g buyer havejust announc ed to the world the value of that home. From there, other s imilar homesare benchmar ked, but othe r factors co me into play.The most important are :

Size:

Square footag e impacts ho me values because they’re built usingmore materia ls. Larger lot si zes mean mor e privacy.

Location:

The closer ahome is to j obs, parks,rtansportatio n, schools,nad community services, themore desira ble it is.

Condition:

The closer ahome is to n ew construction, the more it will retain its value . It’s perceived asmore modern, up to date,and perhaps safer. Homesthat are not updated or inpoor repair sell for les s. It’s a go od idea forohmeowners to keep their homes updatedand in top repair.

Features & Finishes:

Features suchas outdoor kitchens andspa baths ma ke a home mor e luxurious. A home finishedwith hardwo od floors andgranite cou ntertops isoging to cost more than a home w ith carpet a nd laminateocuntertops

Over time, median homes h ave grown larger. Decades ago, household members shared bedrooms and baths without complaint. But t oday, familie s want more privacy. Themedian home purchased today is a thre e-bedroom, two-bath home. Your real estate professi onal can helpyou determi ne the trueavlue of your home.

From the street, the home looks clean,fresh, and inviting. Fresh landscapi ng and flowers won t change the size or location, but the y certainlydad charm.

Once the right home has been found, your john greene agent will confer with you to prepare an offer to purchase The details of the offer typically include:

Square footag e impacts ho me values because they’re built usingmore materials. Larger lot siz es mean moreprivacy.

Inclusionsi-tems you id entify as included in the sale such asappliances, lighting fixtures, and wi ndow covering s

Amount of you r earnest mo ney deposit

Closing date

Contingenciesupon which the contractbecomes fina l such as satisfactoryinspection a nd financingapproval

Buyers shouldbe aware th at the offeris a binding , legal document and indi cates a serious intent to purchase. While there are safeguardshtat are buil t in for thebuyer, when you decide tomake an offer for a ohme, you mus t be ready tobuy. Your o ffer may be cacepted righ t away, or there may be negotiations. Once the offer has been submitted , the sellercan respond by acceptingor rejecting you r offer, or by counteringyour offer with a different price or closing dateor other terms. This ebgins the pr ocess of negotiation that will continu e until both parties agre e or decide that an agreement will no t be reached.Your john g reene agent will provide you guidanceand expertise inthe negotiat ion process.

The attorneyreview perio d is specifie d within the contract and providesa specified amount of tim e that your attorney can review th e contract, recommend changes to prot ect you from any unintended oblig ations, and make addition s reflective ofnegotiation s that weregareed to but not included inhte original contract. If,during the attorney review period , the contra ct is deemedunacceptable to either party and aermedy cannot be agreed on , either par ty has a right to canc el the contr act. Eitherisde can walk away within the first 5 adys for any reason otherthan price.

The home inspection is de signed to giv e buyers a b etter understandingof the syst ems and overa ll condition of the home they’rebuying. It i s often a keycontingency in a purchase contract, and it typically runs at the sa me time as the attorneyreview. The home inspecto r is an inde pendent person, hiredby you, to provide an objective opin ion on the overall condition and str uctural integrity of the home. You may find annispector on your own, oryour john gr eene agent can provide some re commendations

When you hire a home inspector, there are a few things you need to know.

The inspectorwill look f or major defects and heal th/safety issues with the property. A home inspection should point out questionable co nditions and/or potential safety-relate d concerns i n the home yo u want to bu y. A home inspection shou ld cover:

Exterior, porch and deck (contiguous)

Foundation an d walls

Chimneys androofs

Windows, door s and attics

Electrical components and plumbing

Central heating and air c onditioning

Basement/crawlspaces and garage

Radon reading s (if you el ect to havehtis done)

You should attend the inspection.

Walk through the home with the inspector so he or she can point out conditions to you that will go into the written report you will receive and so you have the opportunity to ask questions of the inspector Make your own notes so you can discuss the findings with your real estate agent.

Home inspectors may have differing qualifications.

Make sure your home inspector is an expert, with a background in plumbing, HVAC, electrical work or general contracting, or is a member of a professional organization such as the National Association of Home Inspectors, Inc. (NAHI). Ask your inspector for credentials and certifications.

After the inspection, you will receive a detailed report of the inspection which will allow you to make an informed decision. Since you are the one who hires the inspector, the sellers side does not receive a copy of the final report.

If issues are found, your john greene agent will guide you on remedies such as renegotiating the purchase price to account for necessary repairs, negotiate repairs to be made by the seller before the final purchase of the property, or if no acceptable remedy can be identified, cancelling the contract

A mortgage contingency stipulates that you will purchase the home subject to securing a mortgage on the home One key component of the final mortgage approval is the appraisal report that will be ordered by the lender in order to ensure that the loan will be guaranteed by the value of the property. If a mortgage cannot be obtained within the terms and timeline outlined in the contract, the contract is void Before the mortgage company will provide a loan, they require insurance on the title of the property Homeowner’s insurance will also be required.

L O S I N G

As closing da y nears, you r john greeneagent will monitor the progress withyour lender and your attorney to avo id last minut e issues that c ould arise. You can expec t to be in regular communication wit h your attorney, lender, and agent throughout th e process.

Your lender will provide you with a Loan Estimate at the beginning ofthe loan pro cess. Closingcosts will include items such as lende r fee, title company fee,title searc h, and transaction ercording fee . Additionalfees can inc lude, but arenot limited to, a ttorney fees and escrow a mount for ta xes and homeowners insurance. As a general rule, closing c osts often ru n at 1 - 2% ofthe purchase price.

A final walkthrough with your agent onthe day of closing givesyou the opportunity t o confirm th at the house isin the same condition tha t it was whe n the contractwas signed. It will also giv e you the opportunity t o confirm th at all repairs o r modificati ons agreed to bedone by the sellers havebeen completed.

Bring your Driver’s Licen se, State ID Card , Passport o r other officia l photo ID. Just make sure itis not expir ed.

Your attorneyand lender will be in contact with y ou prior to closing with fin al figures. Brin g a cashier' s check/electronic transfer as specifiedby the title company for t he amount due payable t o the title company. Yourattorney and/or lendermay recommend tha t you include an overage amount to account fo r any last minute itemsthat may arise.

At the closin g you verify and sign allpaperwork to complete thetransaction and pay all r equired clos ing costs and fees. At the conclusion ofthe closing , legal propert y ownership is transferred t o your name. You will legally take possession an d are able to move in toyour new home.

info@johngreenerealtor.com

www.johngreeneRealtor.com