At john greene Real Estate, our unwavering commitment to exceptional service, integrity, creativity, and collaboration sets us apart. We take immense pride in delivering the highest caliber of brokerage services while also serving as a strategic partner, aligning our expertise with your unique business objectives.

Our team possesses the invaluable experience, capabilities, and in-depth market knowledge required to navigate the complexities of commercial, industrial, land, and investment real estate transactions seamlessly. With us as your trusted advisors, you can effectively achieve your real estate goals and drive your business strategy forward with confidence. The respect we've garnered from our clients is a testament to our impeccable service and proven track record of delivering successful outcomes.

From initial consultation to the closing table, the john greene Real Estate team is poised to guide you through every step of the process. Our brokers work in tandem with a dedicated support staff comprised of seasoned real estate professionals with extensive industry experience and knowledge Our forwardthinking leadership team has extensive experience in land entitlement, development and operational systems and processes and have provided invaluable insights, empowering us to navigate the ever-evolving landscape of today’s dynamic market with unwavering resilience.

We invite you to experience the john greene Real Estate difference – where professionalism, expertise, and a client-centric approach converge to deliver exceptional results.

We’vegotyoucovered.

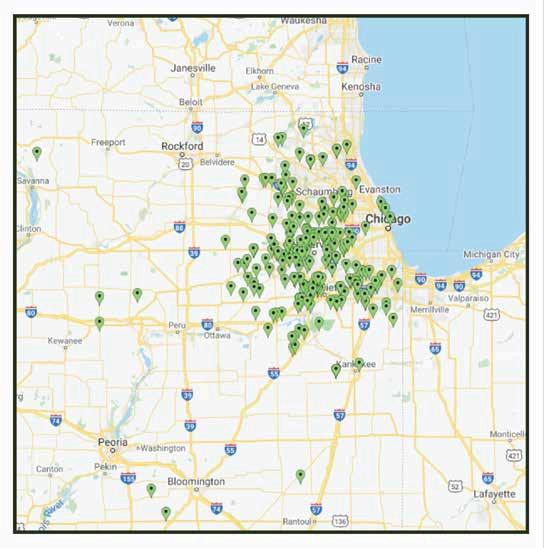

As a market leader, john greene Real Estate has transacted $1 billion worth of commercial, land, and industrial assets, including over $915 million since 2010 alone Our transactions span across over 90 communities from the Indiana border to the Wisconsin border and across the entire Chicagoland market.

We are dedicated to providing the highest quality services to our clients and getting assets sold. We understand our clients require partners with experience, capabilities, and knowledge to successively navigate an extremely complex and unique array of issues. We are well equipped to assist you with all of your real estate needs.

Our seasoned industrial specialists possess an in-depth understanding of the Chicagoland market, backed by a proven track record of success We proudly represent a diverse clientele, including local and national manufacturing, distribution, and service companies, as well as institutional investors and private owners. Whether representing sellers, buyers, landlords or tenants, our dedicated team tailors their top-notch services to meet each client’s unique needs Our comprehensive approach ensures that our clients receive unparalleled support and guidance every step of the way.

Our team represented a national investor in the acquisition of this property The Class B industrial building was 88% leased to five tenants at the time of closing After closing, our team marketed the vacancy and secured strong tenants with long term leases for each available unit.

PROPERTY SIZE

SALE PRICE

LOCATION

49,048± SF

$2,695,000

Plainfield, Will County

Ownership engaged john greene Real Estate to market their property for sale The property is a new, Class A, multi-tenant industrial building fully leased with quality tenants at the time of sale With an aggressive, investortargeted marketing strategy, the client received multiple offers, and successfully completed a 1031 exchange transaction

PROPERTY SIZE

SALE PRICE

Our team originally represented the purchaser in the acquisition of the property Several years later, the client engaged our team to privately market the fully leased property for sale Our team utilized our broad network and successfully sold the property This off market transaction stands out as one of the highest prices per square foot in the area for like-kind properties

PROPERTY SIZE

SALE PRICE

LOCATION 12,000± SF and .5± AC outdoor storage

$1,350,000

Plainfield, Unincorporated Will County

john greene Real Estate represented the purchaser in the acquisition of the property and was then exclusively engaged to market the vacancies postclose. Our team successfully negotiated two long term leases, resulting in a fully leased building and outdoor storage space

$2,575,000

LOCATION 25,500± SF

Shorewood, Will County

PROPERTY SIZE

LEASE TERMS

LOCATION

Joliet, Will County

Our team has had the privilege of serving Prologis, a global leader in logistics real estate, for many years For this project, we sourced the land assemblage for the developer to fulfill their infill development site requirement in a highly sought after submarket After the land acquisition, our team was exclusively engaged to market the vacancies, and we secured long term leases with strong tenants on all three of the units The building is a multi-tenant industrial building totaling 115,460± square feet, with easy access to I-355 and I-55 via two interchanges

Over the last several years, our team has been engaged by Prologis to market vacant units for lease at their multi-tenant facility located at 470 Crossroads Parkway We have secured strong, longterm leases for each unit in this building

LEASE TERMS

LOCATION

john greene Land Company represented the seller for a portfolio of eleven tracts of agricultural land across six Illinois counties The team marketed the properties to a single buyer for a successful sale of the entire portfolio

LOCATION

We identified this off market property as a desirable investment for our client Our team negotiated the terms of the sale and successfully closed the transaction

The property features excellent Class A soils with an average PI of 138 8 Our team developed a targeted marketing campaign to farmers looking to expand and agricultural investors, and successfully closed on t

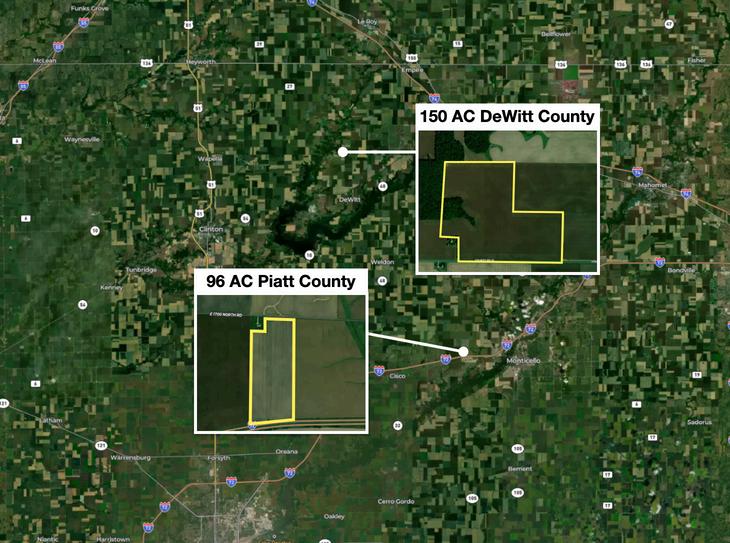

acres across two Illinois counties. Following the client's request for an off-market deal, our team leveraged our agricultural network to identify a buyer and complete a successful transaction.

PROPERTY SIZE

SALE PRICE

LOCATION

$1,003,310

SALE PRICE

LOCATION

Drawing from years of experience and deeprooted connections within the agricultural community, our land specialists at john greene Real Estate are uniquely positioned to serve the needs of farm families and agricultural investors alike. Leveraging our comprehensive understanding of the industry and our unwavering commitment to excellence, we ensure that every land transaction is handled with utmost professionalism, delivering exceptional results that exceed expectations

Sycamore, Dekalb County 379±

$4,050,000

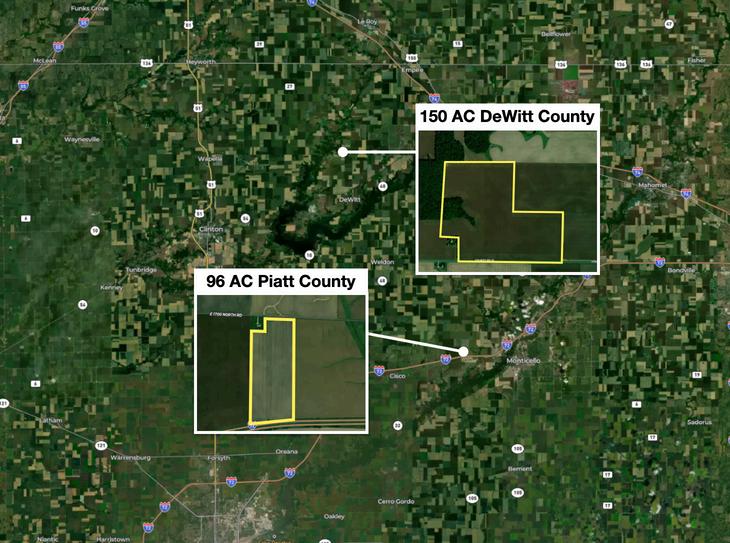

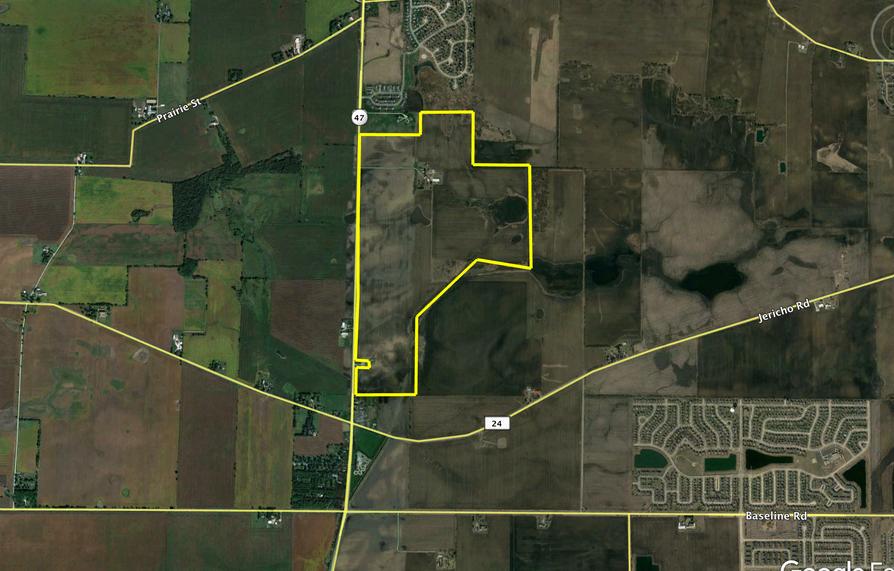

Dewitt & Piatt Counties

The farmland boasts top-tier Class A soils (average PI: 136) and is near residential and agricultural areas Utilizing our expansive network, our team was able to secure a purchaser and successfully closed on the sale of the property

PROPERTY SIZE

SALE PRICE

LOCATION

$4,350,000

Sugar Grove, Kane County

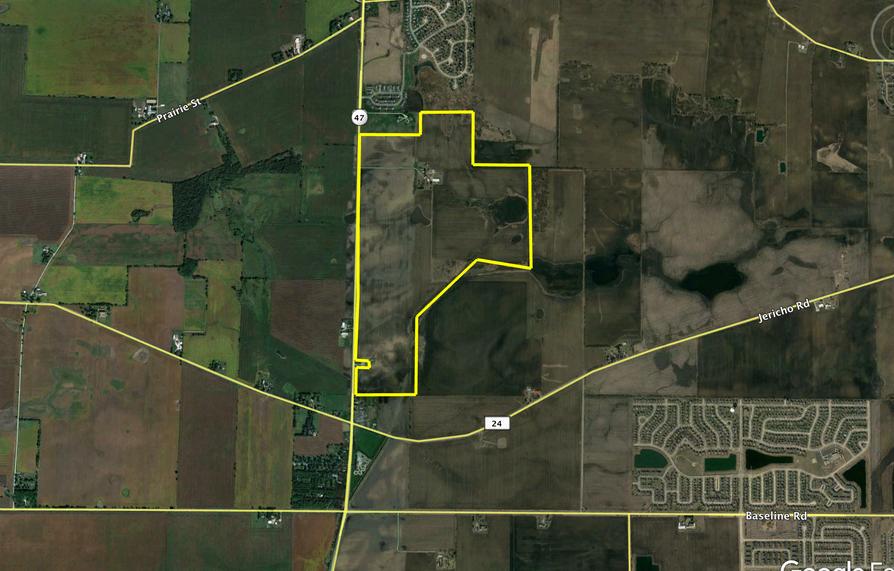

john greene Real Estate privately marketed 86.97± acres for the seller, closing with Pulte Homes This first phase will feature 1,700-3,300 SF single-family homes, with access to Naperville amenities and Plainfield School District 202

PROPERTY SIZE

SALE PRICE

LOCATION

Will County

We represented Pulte Homes in acquiring 77.3± acres for Sawgrass of Bolingbrook, a new community of twostory homes in the sought-after Indian Prairie 204 School District

SALE

LOCATION

Our team was engaged by a consultant representing the court of an estate dispute to bring to market this 64 81± acre site and facilitated a successful sale to M/I Homes The site is approved to be developed into a 130-unit single family residential development

$11,750,000 Bolingbrook, Will County

jgRE represented Continental Properties in acquiring 24+ acres for Springs at Lily Cache Creek This 320-unit development offers 1-3 bedroom townhome-style apartments with resort amenities, including a clubhouse and fitness center

PROPERTY SIZE

SALE PRICE

LOCATION

64 81± AC

$1,100,000

Will County

At john greene Real Estate, we specialize in serving residential developers at the local, regional, and national levels. Our expertise lies in crafting customized solutions to suit their diverse needs Our deep understanding of local markets, zoning regulations, and development trends enables us to identify prime opportunities aligned with our clients' objectives With our industry knowledge and negotiation skills, we empower residential developers across all levels to optimize their portfolios and achieve sustainable growth with confidence

PROPERTY SIZE

SALE PRICE

LOCATION

24 04± AC

$4,300,000

Bolingbrook, Will County

M/IHomes

3170WolfRoad

john greene Real Estate marketed 126+ acres, sold to M/I Homes for their Piper Glen community. The development will offer 300+ single-family homes (twostory and ranch options), a walking trail, and park Residents will attend Oswego Community Unit School District

PROPERTY SIZE

SALE PRICE

LOCATION

$4,915,174

Oswego, Kendall County

Drawing from extensive experience in collaborating with industrial developers, our team is adept at addressing the unique challenges inherent to industrial projects. From navigating complex zoning regulations to facilitating the acquisition of necessary entitlements through coordination with attorneys and municipalities, our team possesses the expertise and experience to guide industrial developers through every stage of development. We actively utilize our extensive network of clients, often resulting in fully pre-leased buildings and build-to-suit projects

Scannell Properties, an international commercial real estate development firm, has been a longstanding valued client of ours Our team was engaged to source land for their two-phase development project Our team identified a forty acre site, and Phase One, a 250,000± SF warehouse distribution facility, was completed in 2020 During construction, our team marketed the vacancy for lease and secured a long-term national tenant, resulting in a fully pre-leased building Phase Two, also a 250,000± SF facility, was completed in 2023.

ScannellProperties MoundRoad&Brush CollegeRoad

Our team sourced the land for Scannell Properties and represented them in the acquisition of the 37.6± acre site for a build-to-suit facility for FedEx.

$4,414,461

$15,341,902

Plainfield, Will County

Our team was engaged by the seller to market their land for industrial development The area is undergoing significant industrial development, and we successfully sold the property to two buyers. Throughout the transaction, our team consulted on entitlements, assisted with relationships at a municipal level and managed complex due diligence requirements. Approximately 26 acres of the land was sold to cold storage developer and a 300,000 square foot cold storage facility is currently under construction The remaining 91 acres was purchased by an industrial developer who is constructing a 1.5 million square foot industrial building

Our team represented the purchaser in the acquisition of three contiguous parcels totaling over 38 acres of land The site will be developed into Batavia Logistics Center, a

Our team of multifamily and mixed-use specialists are well-versed in the unique challenges and opportunities facing multi-family and mixed use investors We take a collaborative approach, diving deep to understand our clients' specific business goals and financial objectives within their real estate investments Whether navigating market fluctuations, optimizing property performance, or maximizing ROI, we tailor our strategies to align with their specific needs Through our dedication and commitment to delivering tangible results, we've built a strong foundation of trust with our clients This trust empowers them to confidently pursue and expand their real estate portfolios with our support.

Our team facilitated the acquisition of an off-market sixunit, low-rise building close to downtown Plainfield on behalf of the purchaser A few years later, our client enlisted our services to discreetly market the fully leased property for sale, wanting to avoid the open market Through our efforts, we successfully identified a buyer and closed the transaction, resulting in a strong return on investment for our client

Our client turned to john greene Real Estate to bring to market their fully leased mixed-use building The property is located in the heart of downtown LaGrange, offering a true “walk to train” advantage. The mixed-use building development includes fourteen residential apartments as well as seven retail/office spaces Our team launched a multi-faceted marketing campaign and our efforts culminated in the successful sale of the property to well-qualified buyer who recognized the value of this mixed-use asset.

Will County

LaGrange, Cook County

Our investor client engaged our team to assist them with expanding their multifamily portfolio in the Plainfield area Our team identified the subject property as an off-market opportunity, successfully negotiated the contract terms, and closed on the acquisition of this six-unit multifamily building near downtown Plainfield

Our team was exclusively engaged to bring to market Bellevue Place, a rare 15-unit luxury apartment building, is one of Batavia’s treasured historical buildings and has been on the National register of Historical Places since 1976 The building totals 18,908± square feet and features one- and two-bedroom units

Our team represented our investor client in the marketing and sale of their multifamily building in Chicago’s Bridgeport neighborhood The seven-unit building, fully leased at the time of sale, presented an attractive investment opportunity. We implemented a custom, wide-reaching marketing plan to reach buyers actively seeking a multi-family investment. With our expert guidance and negotiation support, we successfully guided our client through the sales process, resulting in a successful transaction

Our team offers unparalleled expertise in both leasing and selling of commercial, office, and retail properties With a keen understanding of market dynamics and a strategic approach tailored to each client's goals, we maximize value for every transaction. From crafting compelling leasing strategies to executing successful sales transactions, our d end i li

Our client engaged the team to assist them with identifying an available space to lease for their veterinary practice Our team identified a suitable opportunity – an old bank building that could be converted to meet their needs We secured a longterm lease with desirable terms that allowed for tenant improvements, enabling our client to establish their veterinary practice in the repurposed space

PROPERTY SIZE

LEASE TERMS

LOCATION 3,300± SF 10-Year Term

Hinsdale, DuPage County

Our team was engaged by the seller to bring to market their 34,396± SF building The building was previously used as a medical facility, with seven fully built out suites and approximately 20,000± SF of remaining space in raw condition Despite the challenges that a high vacancy property presents, our team launched a custom, comprehensive marketing plan and successfully closed the transaction

PROPERTY SIZE

SALE PRICE

LOCATION 34,396± SF $1,100,000 Joliet, Will County

13600SRoute59

Our team represented a long-term investor client in the acquisition of this property The building is located on heavily traveled Route 59 in Plainfield, and was previously used as a bank. Our client converted the building to suit medical or dental uses, and engaged our team to market the vacancy for lease as space became available

PROPERTY SIZE

SALE PRICE

LOCATION 5,000± SF $750,000

Plainfield, Will County

Our client, a nonprofit organization, engaged our team to represent them in their search for a new facility Our team identified an educational and/or training facility that would meet our client’s needs and successfully closed the transaction The building is situated on additional land for expansion, allowing for future growth

Our team was engaged to bring a unique opportunity to market: a fully renovated, high end office space situated in the heart of downtown Naperville’s vibrant central district We recognized the unique selling points of this premier property and tailored a comprehensive, customized marketing strategy This strategic approach, combined with our team’s local market expertise and negotiation skills, enabled us to secure a highly favorable transaction for our client.

Leveraging intimate local market knowledge about approved usage changes and the opportunities they presented, our broker proactively cold-called the seller After several conversations, we brought the property to market. Our team successfully negotiated a lease buyout for the existing tenant and received multiple offers We assisted the buyer with securing necessary local zoning changes, ultimately selling the property at a premium in a cash transaction with a quick close.

Tim is the President and CEO of john greene Real Estate, a family-owned and operated brokerage established by his father, John Greene, in 1976. Under Tim’s leadership, it has grown from a boutique residential brokerage to one of Chicagoland’s largest privately held brokerages, and has expanded to serve all major asset classes Tim’s commitment to prioritizing clients’ needs drives both his personal representation of investor clients and his leadership of the company, instilling this value in every team member every day His knowledge and service to his own clients, and all clients of john greene Real Estate, are of the highest standards to be found in the real estate industry

Shamus brings over 25 years of real estate experience and has played a pivotal role in guiding investors in their real estate endeavors, including acquisitions, asset repositions, and dispositions. As the leader of the john greene Real Estate team, Shamus plays a key role in driving strategic growth initiatives Leveraging his experience as a business owner, he upholds high standards and effective processes to ensure continued success and client satisfaction

n is to serve small business owners in his community to do his part to row the area and the local economy Chris uses a collaborative understand his client's business and financial objectives as they ir real estate needs and his ability to deliver results has earned him ust Chris understands that each client requires individual care to ecific investment goals and real estate needs.

A seasoned professional with over 15 years in industrial and commercial real estate, Cory specializes in acquisitions, dispositions, leasing, and development. His expertise spans owner/landlord and buyer/tenant representations, site selection, build-to-suit transactions, and sale/leasebacks for clients ranging from local firms to national institutions Cory takes a collaborative approach, leveraging his comprehensive market understanding to guide clients effectively and negotiate favorable terms on their behalf.

With a background in commercial credit and lending, Jon’s experience equip with valuable insights to effectively evaluate investment opportunities and a clients in constructing their portfolios Living locally, Jon’s deep ties t community give him valuable market insights into the greater Will County are serves a diverse range of clients, from large portfolio owners to individual bus owners looking to enter the real estate market. Jon’s priority is always the clien believes in being honest, loyal and direct in order to service their ne

As an experienced entrepreneur herself, Bhavini understands the risks and challenges small business owners face when navigating the commercial real estate market She has a deep appreciation for the impact that the right representation can have on protecting her clients’ interests Specializing in tenant and landlord representation, Bhavini utilizes her expertise to provide tailored real estate solutions that enable small businesses to achieve their goals and thrive.

As an industry veteran, Mike specializes in representing clients in land, office, retail, and multi-family transactions and understands the complexities and nuances involved in each asset class Mike developed his skills through businessto-business sales and management while also venturing into entrepreneurship, founding his own small successful businesses. His personal experience as a business owner profoundly shaped his approach to client relations, emphasizing that exceptional customer service will always be the foundation of his success

With a career spanning nearly five decades, Denny is a true veteran of the real estate industry His unwavering dedication and professionalism have been the cornerstones of his success. In an industry where relationships are paramount, Denny’s reputation precedes him His integrity, work ethic and ability to navigate complex transactions have made him a respected figure in the agricultural real estate community