PRE-OWNED PILATUS MARKET: IS YOUR PERCEPTION REALITY?

THIS MONTH’S BACK PAGE FEATURE: AIRCRAFT INSURED VALUE AS IT RELATES TO AVIATION INSURANCE COVERAGES

PRE-OWNED PILATUS MARKET: IS YOUR PERCEPTION REALITY?

THIS MONTH’S BACK PAGE FEATURE: AIRCRAFT INSURED VALUE AS IT RELATES TO AVIATION INSURANCE COVERAGES

We deal with this age-old topic all the time. Sellers look at Controller.com, desperately seeking data and clarity on pricing for aircraft. Buyers do the same thing. And, once they’ve filled up the bucket between their ears with enough “perception” of what values are, they establish their “reality.” This is a natural human thing, and it’s going to happen at some level, regardless of the players involved. At JetSwiss we talk about how “Brokerville” stretches the truth on values of aircraft to get a listing or uses the “perception” of pricing to finagle offers, etc… we see this every day, it’s a technique often referred to as ‘Offer Coaching’.

As of writing this for the September publication, we’ve been engaging several different buyers on the aircraft we currently have for sale. Interesting to note, what I spoke about above actually comes true! We talk to buyers and ask them about what they’ve encountered in the marketplace, what they feel is their Pilatus buying power, and just their general feedback. Every time, it is blatantly obvious to see how their perception(and commensurate interactions) is now their reality. It only takes them three or four phone calls into Brokerville to get a false sense of what someone will sell an airplane for (or at least what they’re told). It’s the classic spiel: “Yes sir, thank you for the call today, the price of our aircraft is $4 million, but I really think that somewhere around the $3.75 million mark will buy it.” What do you think that buyer’s reality is now? After all the hot air has been exchanged, he thinks that the market for that particular model year and total time is $3,750,000. Wrong. Buyers naturally want to do their homework I get it. Garnering any data that will enable them to negotiate a better price on an aircraft only makes sense. As Lee Corso says, “Not so fast, my friend.” Can you say, “Garbage in—garbage out,” with me?

Take my $4 million ask price and the $3,750,000 take price example of above. Let’s say that buyer did go through with the purchase of that aircraft at $3,750,000.They have no idea what land mines or expenses will hit that aircraft over the next 1 to 5 years. It hasn’t gone through a prebuy inspection, in fact, he hasn’t seen it with his own eyes. Essentially, he is operating blind. Unfortunately, by the time Brokerville has him contractually locked up it’s too late. He will likely put it into an inspection, where reality will hit. Folks, I’m here to tell you, perception is not reality in our world. If anybody spends a lot of energy and hot air, convincing you and talking to you about the perception, rather than the reality, turn and run in the other direction.

Back to my example. The buyer is feeling good about the fact that he bought the aircraft for $250,000 less than asking price. He later finds out, during some assemblance of a diligence process, that the aircraft is staring in the face of almost $100,000 worth of required maintenance in the coming 12 to 24 months. It has hail damage on the tail that no one could see, and the pictures from the internet look like glamour shots taken at the mall. It is worn out. Now his $250,000 negotiation doesn’t look so good and he will spend over half of that to bring the aircraft up to a minimum market standard.

Sidebar here: there is no better feedback to receive from our buyers then when they come to our facility to see an aircraft and they say, “this aircraft is exactly as represented!” Perception was reality. The problem with the preowned aircraft market is that this is not always true. So, as we always stress, seek out clarity, seek out advice and expertise by taking the time to perform your diligence. That $3,750,000 purchase price may not seem like a great deal after all.

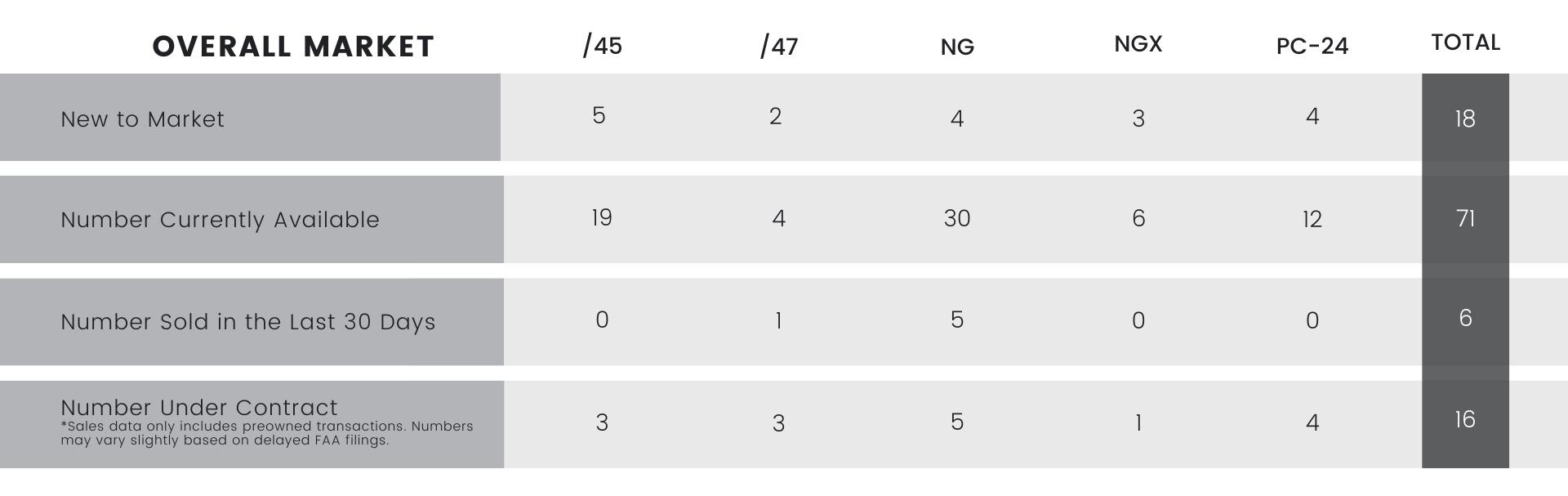

Folks, here is your reality for the current market (and for those who know me well, this is no BS):

• Terms are becoming more flexible – Sellers are allowing more inspections, etc.

• Pricing/market is virtually stagnant, aircraft are coming on to the market and leaving the market at somewhat the same pace. Brokerville is still hanging tough on their pricing… ugh.

• Buyers are finally getting a chance to negotiate. Buyers will naturally gravitate towards price initially, however, terms/ conditions from seller (and of course the condition of the aircraft) will weed out the good deals from the bad.

JetSwiss has 6 planes for sale. It is an exciting time for us. We know that we are going to deliver a great product and process to the next owner as good stewards of the brand. The important thing for buyers to keep in mind is going through your diligence and understanding what you’re going to spend on maintenance over the next one to five years. At JetSwiss we advise our buyers and sellers on this with our proprietary MPR (Maintenance Projection Report). This is ‘reality’ shaping ‘perception’ with cold hard fact, which dramatically impacts the purchase price and negotiations at the core.

Fly safe, Bub

Similar to the Asking Price vs Model Year chart, this information helps our clients determine “the mileage on the car” for their specific budget. “Want to own a low time aircraft?” This chart will give you an indication on what you will spend. Note: aircraft under 1,000 hours total time historically yield much higher prices.

JETSWISS SEES MORE PRE-OWNED PC-12 TRANSACTIONS THAN ANYONE IN THE WORLD.

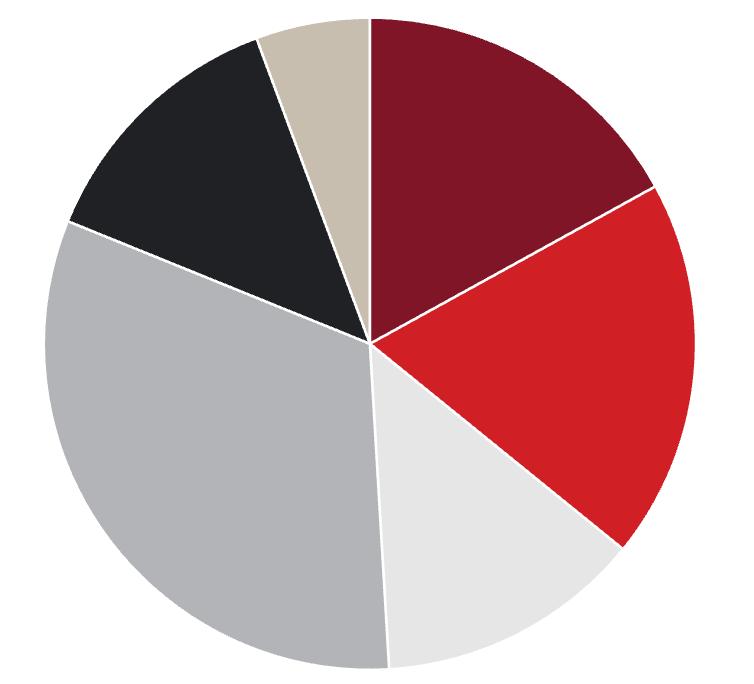

This chart reflects the current market for Pilatus PC-12 aircraft that are on the retail market. Want to know how much your Pilatus dollars will buy? This is a great place to start. As you can see, the aircraft model year plays a key factor in pricing of the aircraft, and thus generates a commensurate trend curve. This data provides a baseline for our aircraft evaluations.

$3.314M PC-12/45 $3.766M PC-12/47

$4.838M PC-12NG

$7.108M PC-12NGX $12.889M PC-24

HAS REMAINED ESSENTIALLY THE SAME SINCE LAST MONTH

One of the hot topics in the aircraft insurance world over the last couple of years and certainly post COVID are the inventory levels of pre-owned aircraft and how that has impacted the asset value of an owned aircraft. Supply/demand logic dictates that when OEM’s have multi-year order backlog for new aircraft deliveries and pre-owned aircraft inventory levels are very low it can drive “artificially” higher valuations for owned assets. The premium for the insured value of any aircraft (physical damage coverage) drives 6080 percent of that aircraft’s total annual insurance premium in most cases. So it is a topic you as a current or future aircraft owner will want to keep a close eye on in terms of properly valuing your aircraft on the insurance policy. Aviation insurance differs from automobile insurance for instance as it’s a ‘stated value’ policy. Stated value means you as the policy holder and insured party set the value of the asset and that value is what claims are adjusted off of and also what you pay premiums on – very dissimilar to auto insurance whereby the asset value is determined by an insurance adjuster at the time of loss and an initial valuation is determined by the insurer at the time coverages are placed. The stated value of the aircraft on an aviation policy is typically defined when the aircraft is purchased/first insured and usually reflects the purchase price. Stated values on aircraft policies can be amended anytime by the policy holder but it is

a good idea to assess the valuation of your aircraft at it’s annual insurance renewal. Values can fluctuate during the policy period namely due to pre-owned inventory levels or perhaps you have completed upgrades, engine overhauls or other enhancements to elevate the asset value of your aircraft.

Over or underinsuring? - Insurers generally won’t allow you to deviate more than 10-20 percent from Blue Book or what Vref is showing – so if you are seeking higher insured value than those aforementioned resources which suggests what your aircraft be valued at – be prepared to substantiate the requested value either with an appraisal or build scope/work order showing the upgrades contributing to the deviation from ‘bluebook’. If you overinsure your aircraft you run the risk of an insurer having grounds to repair and an aircraft that otherwise should have been totaled as insurers adjust losses on the stated insured value rather than a market value (as an auto loss would be adjusted). You also will pay a higher annual premium to have your aircraft ‘overinsured’. On the flip side of that equation is underinsuring your aircraft can result in an insurer totaling an aircraft (and taking possession of the salvage) for a loss that should otherwise have been repairable. The bottom line is have the insured value discussion with your aviation insurance broker at policy renewal each year and gain a trusted opinion of what your Pilatus might be worth from a reputable Pilatus re-seller in the space (JetSwiss for instance for the Pilatus class of aircraft).

Tom Hauge and Wings Insurance, broker aviation insurance for thousands of turbine pilots and owners worldwide. Wings Insurance has 6 USA offices locations and 45 employees and is approaching it’s 40th anniversary year since being founded in 1984. A foremost expert in the placement of owner/flown turbine aviation policies. Wings maintains reach to all aviation underwriting markets here in the USA and also globally via our brokerage partnership in the EU with SAAM Verspieren.