Dwindling risk dynamics & the alarmed bankers!

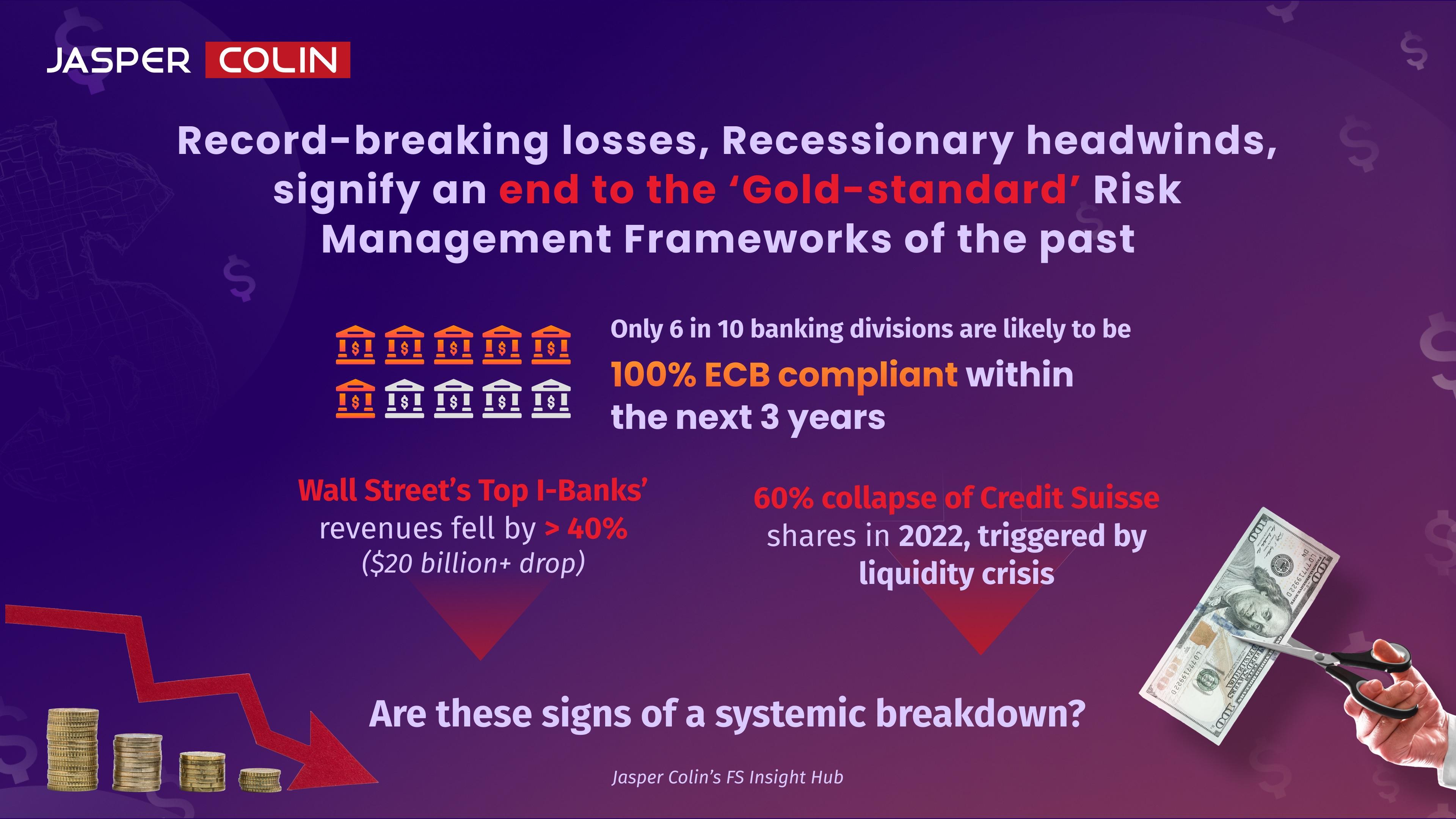

Record-breaking losses, plummeting liquidity, recessionary headwinds, and unprecedented volatility post-covid seem to be signifying a redundancy for the "Gold Standard" risk management frameworks of the past.

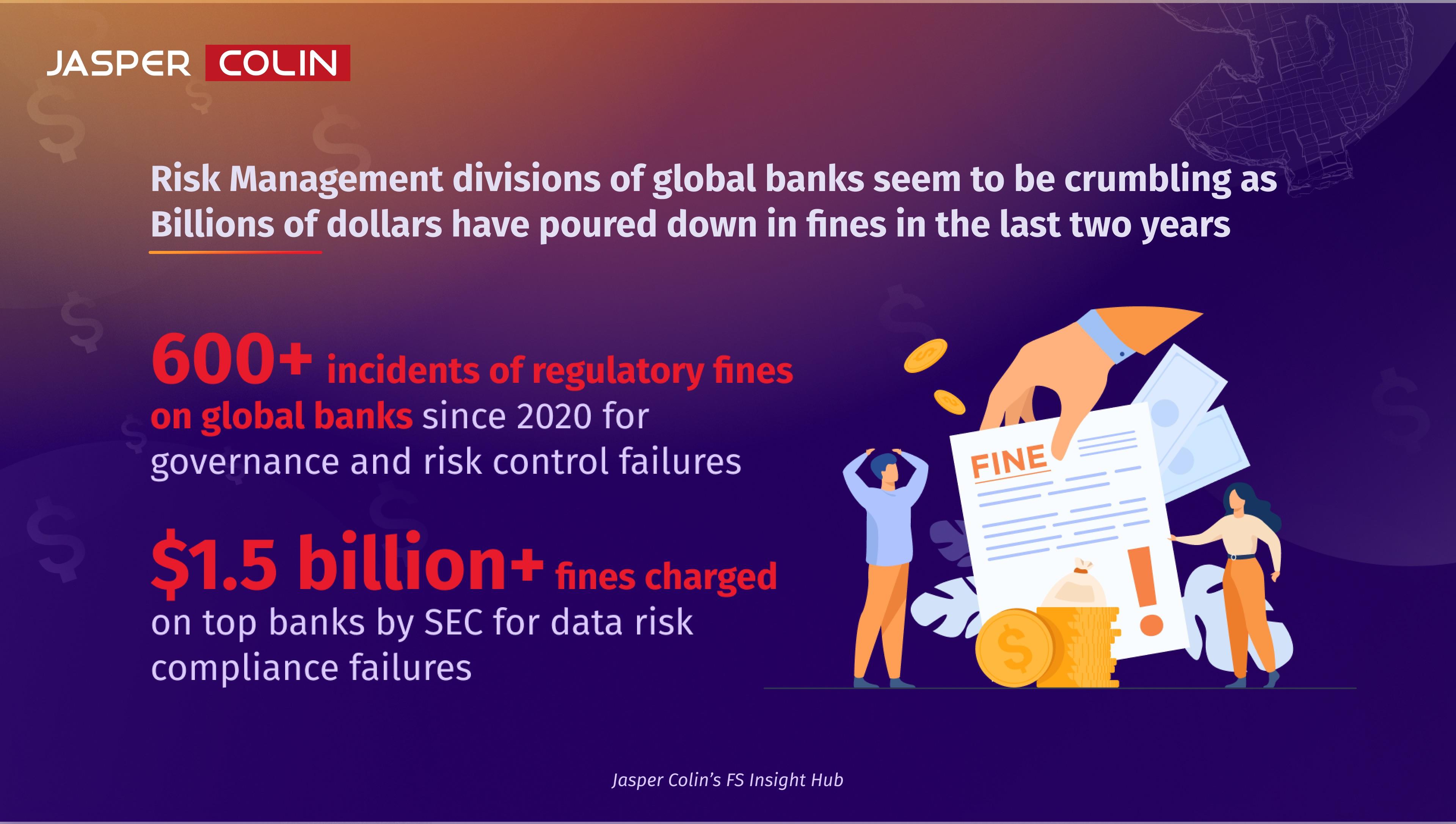

A whopping 600+ regulatory fines have been charged to banks since 2020 for their noncompliant governance and risk systems. In addition, Wall street's recent plunge in banking revenue for the top players amounting to about $20 billion only added to the sector's woes.

With the post-covid era's volatility, underpinned by unprecedented market swings, geopolitical crises, data security, and crypto crashes, the risk bubbles have popped up in markets across the globe, and banks are struggling to address them.

Here's a sneak peek into Jasper Colin's coverage of the dwindling risk systems in the top banks of the developed markets.