Do you know how much money is lost to fraud in insurance?

According to National Health Care Anti-Fraud Association (NHCAA), healthcare insurance fraud costs more than $68 billion annually. Evidently, the industry is plagued by rising insurance fraud incidences.

Regulators like California's SIU regulations contemplate million-dollar fines on insurers failing to implement anti-fraud measures. The Department of Health and Human Services expects to collect a whopping $4.7 billion from insurers post the related audits.

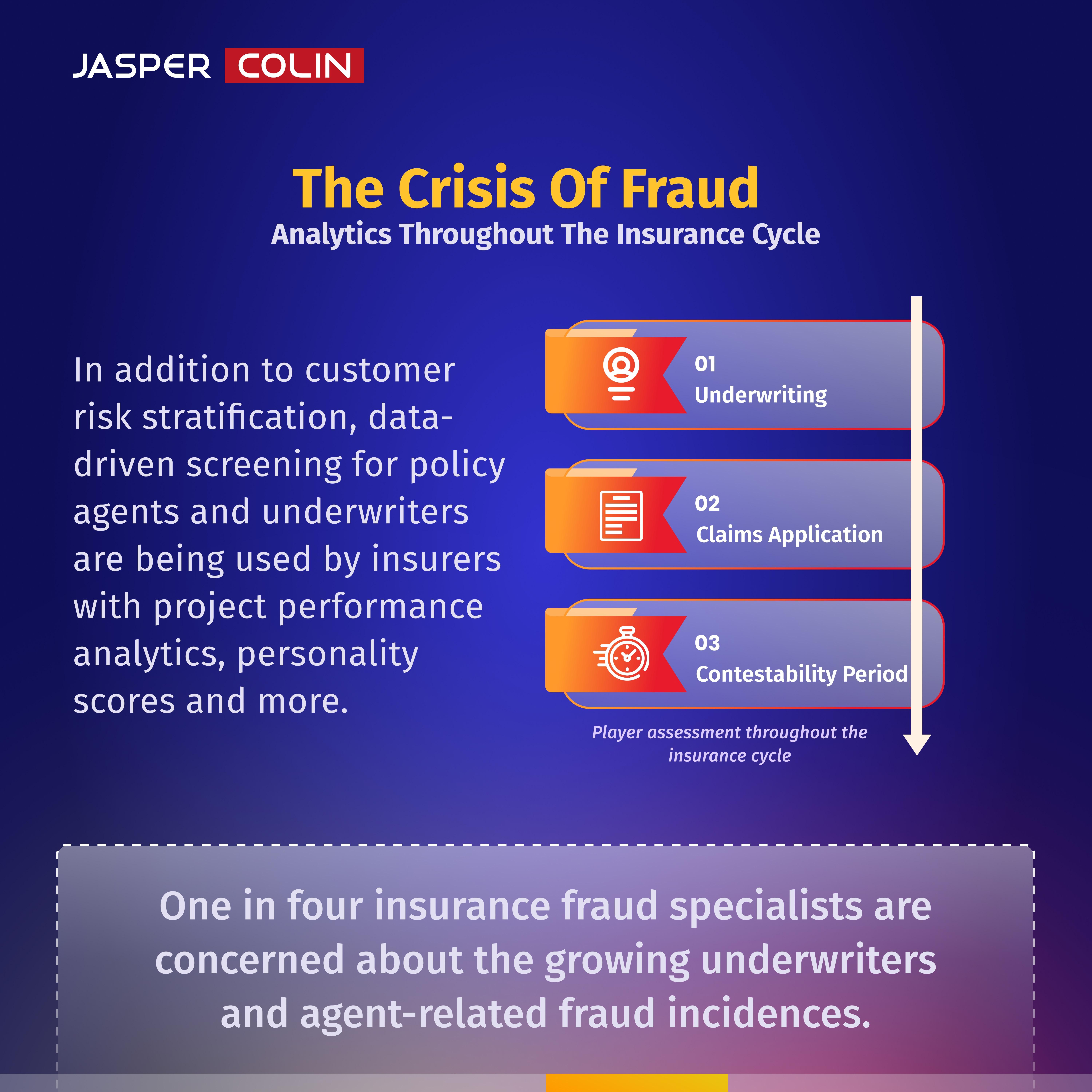

Consequently, the payer ecosystem is bracing itself up to use data-driven technology to mitigate these incidences with the growing domain of "Fraud analytics". A few people are calling this "the uberization moment" of the insurance industry, while others hail it as just another fad in the industry's evolution. However, no one is denying this new vision of predictive reality in insurance analytics is here to stay.

Here's a sneak peak into Jasper Colin's latest dive into the deployment of predictive analytics in insurance, where our research reveals that predicting bogus claims will save at least 20% of claim losses for insurers.