Lake Norman | Q1 2025

Q1 Market Report | April 2025

PODCAST & VIDEOS

Lake Norman posts mixed Q1 results in luxury real estate market

COMMUNITY UPDATES

Cornelius

Davidson

Mooresville

West Shore

North Shore

Concord & Cabarrus

Lake Hickory & Lake Rhodiss

FORECAST

The spring and summer markets should deliver solid sell through, albeit with a little more buyer choice on the inventory side in some areas and ranges

LAKE NORMAN POSTS MIXED Q1 RESULTS

IN

LUXURY REAL ESTATE MARKET

After 10 years of quarter-over-quarter expansion, some segments of the Lake Norman area’s luxury real estate market began to show the first signs of a cooling environment. The regional luxury markets, which have been tied more closely to the performance of the financial markets than to that of mortgage rates, continued to see mostly solid sales activity in the first quarter. In contrast, April’s early financial market instability has seemingly trimmed some of the previously existing frothiness from the market, at least temporarily.

Davidson continued its surge, with its luxury segment over $1 million in list price, sporting 26 pending contracts heading into the second quarter, coming on the heels of 25 closings in that range in the first quarter. Overall sell-through at Lake Norman remained solid, with most areas and price ranges showing less than 4 months of inventory, something that should allow the area’s real estate markets to maintain solid fundamentals, provided recent tariff-related market gyrations begin to work themselves out this quarter. The ultra high-end over $ 3 million in list price typically slows over the winter, and subsequently is just starting to enter into its more typically active phase, something that will be worth monitoring in the coming weeks.

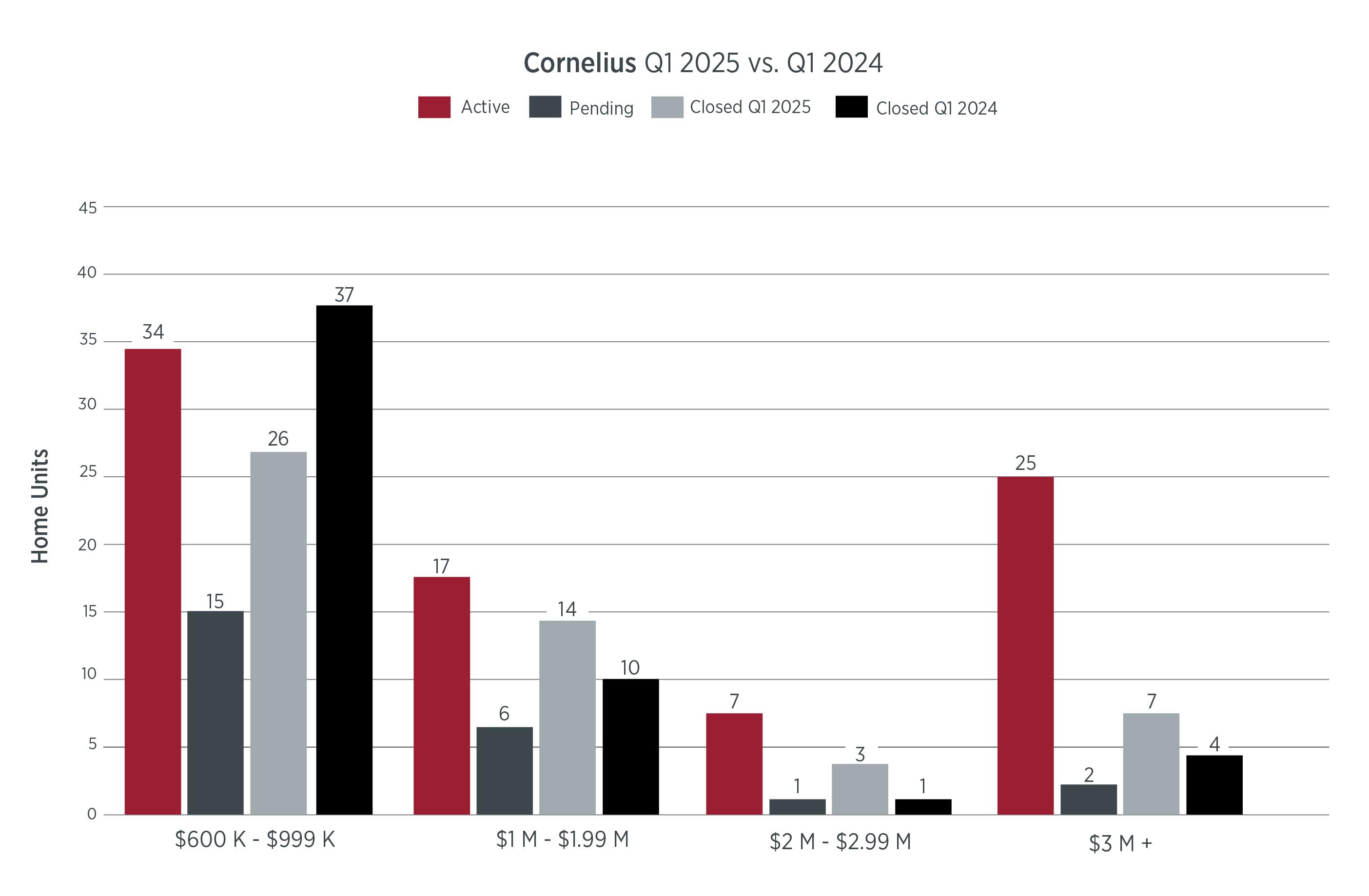

Cornelius

The Cornelius market, which rode the Covid wave to record-setting prices and low inventory, continued to see solid activity, albeit at not quite the robust levels seen in the 2022-2024 period. Inventory continues to remain fairly scarce, except for the ultra luxury $3 million range, which did see 7 closings in the first quarter, yet enters the spring with 25 homes on the market in that range. The popular range between $1 million and $2 million showed very solid activity, with 14 closings for the quarter, leaving an active inventory of 17 homes.

Cornelius Home Sales

Davidson

New construction and infill projects propelled Davidson to yet another strong quarter, with 25 closings taking place over $1 million in list price, and another 26 homes showed to be under contract. This number includes a robust 8 homes listed at over $2 million, including 5 new construction offerings. Overall, closings in the mid-market and luxury segments in Davidson rocketed upward from 37 closings in last year ’ s Q1 to 56 closings in the just completed first quarter.

Davidson Home Sales

Mooresville

With its larger land mass, Mooresville has seen unit Sell-through has expanded significantly over the past 5 years. Its million-dollar segment posted 32 closings between $1 and $2 million in Q1, and rolls into the spring quarter with 55 homes under pending contract over a million dollars in value. The first quarter also saw 15 closings over $2 million in list price, leading the Lake area in sell through in the ultra-luxury range.

Mooresville Home Sales

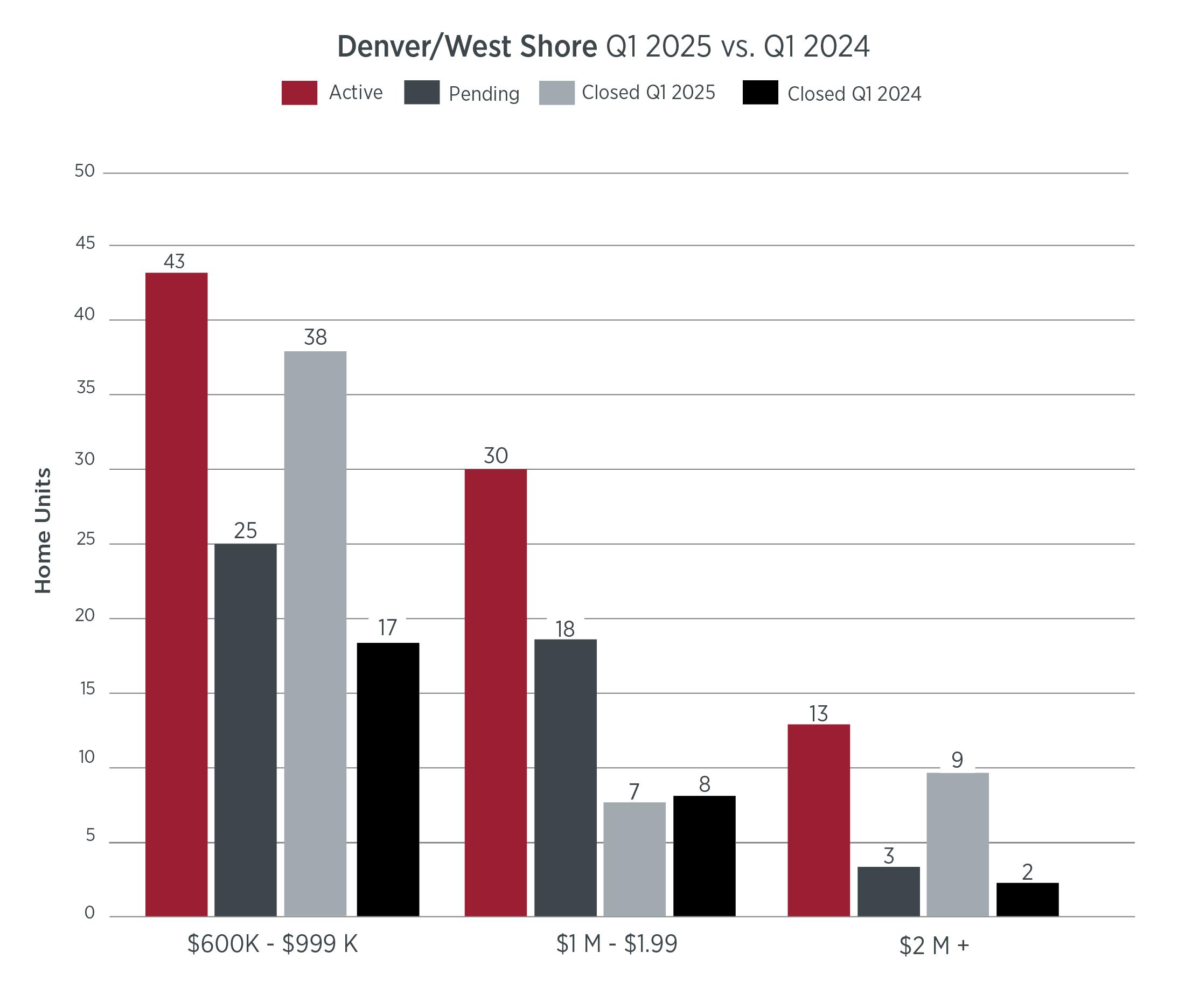

Denver | West Shore

As predicted in our year-end forecast from 2024, surging values on the east side of the lake and in Davidson, have accelerated activity in the luxury ranges on the West Shore area, in Denver, Stanley, and moving up in Terrell. The mid-market segment just under $1 million had a blow out quarter, with 38 homes closing vs 17 in the same quarter last year.

The West Shore also posted an impressive 9 transactions over $2 million in value in the just-completed first quarter, compared to just 2 in last year ’ s same period. Inventory levels on the West Shore side of the lake remain fairly low, something that should help absorption as several new luxury construction projects near launch.

Denver/West Shore Home Sales

North Shore

Troutman/Sherrills Ford

The North Shore area up the lake on both the east and west sides showed solid activity, with 17 homes closing above $1 million in list price in the first quarter, compared to 15 in last year ’ s same period. The impact of improving amenities, and better highway access to the airport and Charlotte, have both impacted the desirability of the north end of the lake, as have relative price value,s which still allow for attractive waterfront settings under $2 million.

North Shore Home Sales

Concord & Cabarrus

Cabarrus County continued its post-Covid upward trend relative to luxury real estate sell-through. The market, just under $1 million, has expanded greatly in recent years, with spillover from Charlotte, Davidson, and Cornelius driving activity while the million-dollar range continues to emerge. The just-completed quarter saw 9 closings over $1 million and enters the spring quarter with a robust 9 additional homes under pending contracts. With inventory in this range at 19 active properties, conditions are stable and trending upward in both price and activity.

Concord & Cabarrus Home Sales

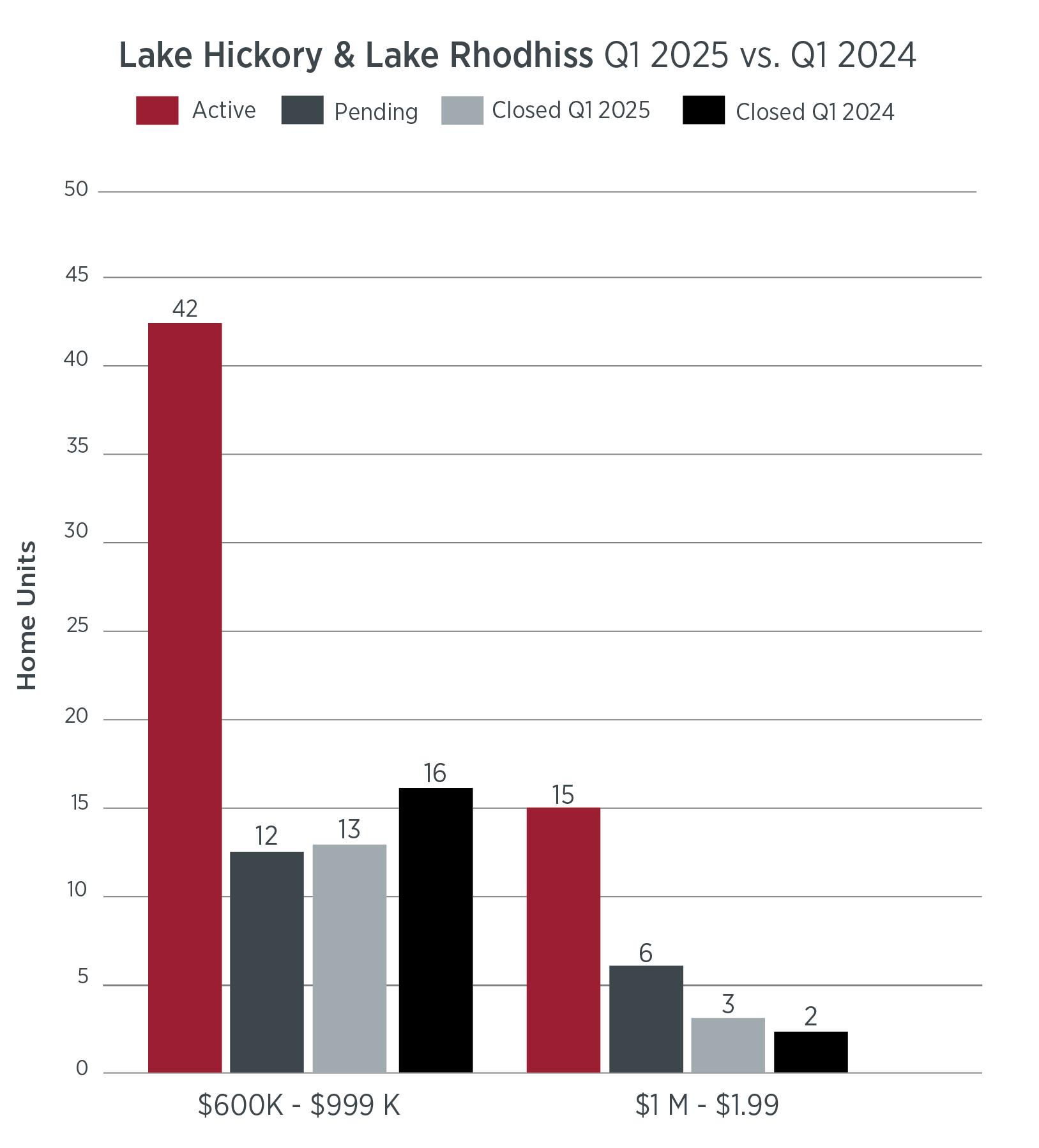

Lake Hickory & Lake Rhodhiss

New to Ivester Jackson Christie’s market report is our coverage for the emerging Lake Hickory and Lake Rhodhiss areas. Northern neighbors in the Catawba River chain of lakes, both lakes have begun to see the “halo effect” of being close to Lake Norman, with its upward push in home values now starting to domino over to neighboring waterfront options. While Lake Hickory only saw 3 closings in the first quarter over $1 million in list price, the area enters the spring quarter with 6 pending contracts in that luxury price segment, on an overall inventory of 15 listed homes, a solid upward trend that indicates these two areas are starting to be discovered.

Lake Hickory & Lake Rhodhiss

Home Sales

Spring Forecast

After steamrolling to record property prices over $10 million in 2024, to go with total closings over $2 million in list price, the Lake Norman area came into 2025 poised to see more of the same. The area has been on a 10-12 year roll, and has emerged to become one of the most desirable destinations in the southeast. That said, the region’s luxury market may not be immune to any sustained volatility in the financial markets.

The keyword being “sustained”. It is our observation that in this day and age, American consumers have accumulated significantly healthy balance sheets since 2012, and along with that dynamic, have become accustomed to using that asset base to purchase luxury real estate. Early indications over the past 2-3 weeks of early April point to continued activity in the luxury ranges, albeit with one cautious eye looking over one ’ s shoulder at the financial markets for any indication that volatility may begin to subside. Absent further material deterioration of personal balance sheets, the spring and summer markets should deliver solid sell-through, albeit with a little more buyer choice on the inventory side in some areas and ranges.

Listen To Our Podcast And Visit Our Video Page For Market Forecasts, Interviews, and Marketing Ideas, Join the Team at Ivester Jackson | Christie's for the Latest in the Carolinas Luxury Real Estate Content.