WHAT’S INSIDE

2024 trends:

5 trends to adopt to stay relevant

Where to invest program funds for maximum impact

Be easier to do business with: A more personalized partner experience is possible

Program segmentation: Are you targeting the right partners?

Communications best practices for to-partner marketing CHANNEL PARTNER ENGAGEMENT | VOLUME 24

from the desk of KRISTIN BRANDENBURGH

Vice President, Channel Partner Solutions

As we embark on a new year, I find inspiration in the words, “A challenge is nothing more than a seed of opportunity.” In the dynamic landscape of channel incentive programs, today’s challenges are tomorrow’s opportunities. Take a look at key trends that will redefine the channel landscape—and impact opportunity—in the coming year.

Partner enablement evolution

Providing channel partners with the resources they need to sell and support products and services is a longstanding practice. But evolving business conditions demand a more strategic approach. Successful programs go beyond traditional enablement, morphing into comprehensive enablement strategies that include training, program messaging, content, demand generation, to-partner marketing and funding. The key lies in a forward-looking, detailed approach to ensure the best shortand long-term returns.

Personalized partner experience

Imagine tailoring program elements to the needs of a contractor specializing in new-build residential projects, or alternately to a commercial renovations contractor.

Getting this technical is a top priority for global B2B marketing decision-makers. To stay ahead in a rapidly changing industry, channel programs must be scalable, segmented and carefully managed to provide the personalized experience that resonates with diverse business.

Increase in behavior-based incentives

While traditional sales incentives and rebates are reactive (e.g., generated by lagging indicators), leading channel programs incorporate behaviorbased incentives. The approach creates proactive impact on key performance metrics. It also adds depth by encouraging partners to take big-picture actions that align with broader incentive objectives.

Even more actionable insights

Today’s demand for performance data is non-negotiable. When properly refined, visualized and operationalized, data drives tangible benefits. Channel programs that embrace and provide access to performance data stand out, offering partners a competitive edge through informed decision-making.

As we navigate the challenges and opportunities ahead, our commitment is to support you in optimizing your channel incentive programs. Together, let's make the coming year a testament to growth, collaboration and success.

contents

02 2024 trends: 5 trends to adopt to stay relevant

08 Where to invest program funds for maximum impact

1 4

Be easier to do business with: A more personalized partner experience is possible

18 Communications best practices for to-partner marketing

24 Program segmentation: Are you targeting the right partners?

insights magazine | 1

2024 TRENDS 5 trends to adopt to stay relevant

By: Ellen Linkenhoker, Channel Solutions Manager

By: Ellen Linkenhoker, Channel Solutions Manager

2 | insights magazine

To get a clear vision of what’s ahead for channel partner programs in 2024, I recommend leaders first look at the conditions currently influencing our markets. Many organizations are still reeling from years of headwinds:

> Market conditions are still fluctuating

> Inflation is still present but improving

> Global program consolidation efforts to improve efficiencies suffer from misalignment between regional and enterprise teams

> Political discord continues

> Partner expectations remain on the rise

> Growth is stagnant or slow, and channel leaders are being pushed to do more with less

That might paint a pessimistic picture to some. But it’s not all doom and gloom.

These kinds of years offer us a chance to reflect. Take time to think about what we’ve put in place for our partners so far, consider where we want to go with our programs, and truly evaluate what’s at our fingertips to make it happen.

I encourage channel leaders to embrace three “Rs” that will help reveal strategic opportunities.

> Reassess channel program efforts

> Refine the partner experience

> Realize returns through measurement

I’ll cover how the “reassess, refine and realize” framework can help you evolve your program to meet future needs shortly. But first, there are a few trends you need to be aware of and consider during the evaluation process.

WHAT YOU NEED TO KNOW

Current business conditions necessitate channel partner leaders do more with less.

Embracing enablement and other key trends will require refining programs and making changes. Successful programs focus on elements that will yield the best return on investment for the short- and long-term.

insights magazine | 3

5 CHANNEL PARTNER PROGRAM TRENDS FOR 2024

As channel partner solution experts, we hold many insights, but we don’t have a crystal ball. Our outlook for 2024 channel partner program trends is informed by current research, conversations with channel leaders and decades of designing research-based channel incentive programs. Here are five trending areas that will continue to gain traction in 2024.

Enablement emerges as the channel’s hottest strategic initiative—regardless of industry.

Providing channel partners with the resources they need to sell and support products and services isn’t anything new—but it’s hard to do well. Forward-looking partner programs are getting serious about their enablement strategy. Inclusive of training, program messaging, content, demand generation, to-partner marketing and funding, it will take a much more strategic approach to get it right.

Take action : Explore creating training built specifically for the channel and focused on responsibilities of each role, instead of repurposing internal content. Regularly assess the impact of enablement initiatives through partner feedback and performance metrics.

Behavior-based incentives

will drive key performance indicators.

Prioritizing behavior-based incentives gives you the power to proactively impact the key performance metrics that matter most. Sales, SPIFs and rebates are reactive tactics inspired by lagging indicators. They’re necessary, but sometimes lacking in big-picture actions you need partners to take. Leading channel programs have already started adding behavior-based incentives to their mix.

Take action : Focus on where your partners need to improve and track the behaviors that drive those outcomes. Consider adding points-based incentives that prompt actions tied to those KPIs. This approach, especially when coupled with increased touchpoints, has the potential to increase engagement and offer another opportunity to reinforce your relationship with your partners.

Partner experience and engagement will become even more personalized.

Imagine separate program elements for a contractor specializing in new-build residential projects versus one focused on commercial renovations. Or, a dealership focused on repair and maintenance versus a retailer selling new products. This level of granularity is no longer a futuristic vision. It’s becoming a top priority for global B2B marketing decision-makers. To keep pace with evolving industry demands, programs need to be meticulously managed, segmented and scalable.

Take action: Homepages, goals, rewards, incentives, and enablement must be tailored to individual roles and routes to market—even specific competencies within those routes. By embracing personalization, businesses can unlock enhanced partner engagement, loyalty, and ultimately, sales growth. Demand

for performance data and actionable insights becomes non-negotiable.

Organizations are hungrier than ever for advanced analytics and useful insights—especially around performance. When properly refined, visualized and operationalized, a wealth of data becomes a value-producing resource.

Take action : Channel leaders should pursue access to new data sources and consolidate current data into actionable dashboards that can empower your department, field teams and partners.

Artificial intelligence (AI) will improve channel program customizations.

Seventy-five percent of global business and technology professionals indicated they were adopting or planning to adopt AI infrastructure technology within the next 12 months, according to Forrester’s Priorities Survey.

Take action : Most AI adoption is happening inside product and service offerings, or to augment internal organizational knowledge and efficiency. However, we’re also seeing AI make improvements in channel programs through data analysis and marketing material customization.

Adopting trends often requires convincing stakeholders to change up an existing approach. Go into those conversations after evaluating your program, so you’re ready to act on very

ASSESS YOUR PARTNER PROGRAM

Take our assessment to reveal that state of your current program. Learn if you’re headed in the right direction and receive tailored recommendations for improvement to help maximize your strategy.

info.itagroup.com/program-quiz

Program leaders must reassess, refine and realize returns

We work with brands to continually evolve their channel programs. In my tenure at ITA Group, I’ve seen how the most successful brands can integrate new ideas because they’ve adopted a framework that encourages learning from past performance and welcoming a culture that tries new things based on market feedback.

That’s where my “Three Rs” come in. This year, take time to:

1. Reassess many of the existing program elements. Evaluate each element for overlapping capabilities, performance effectiveness, consolidation opportunities and innovation. Conserve your limited resources while maximizing partner experience and channel growth impact.

2. Refine the experience partners have with your program, the messages used to attract and retain partners, as well as the benefits and awards used to reward them. These updates help capture mindshare and increase engagement within the channel.

3. Realize returns by measuring the impact of investments on key performance metrics, beyond sales. Collect and consolidate the data alongside a meaningful analysis that can make the case for continued support. Present success stories to executive leadership teams to maintain channel investments.

6 | insights magazine

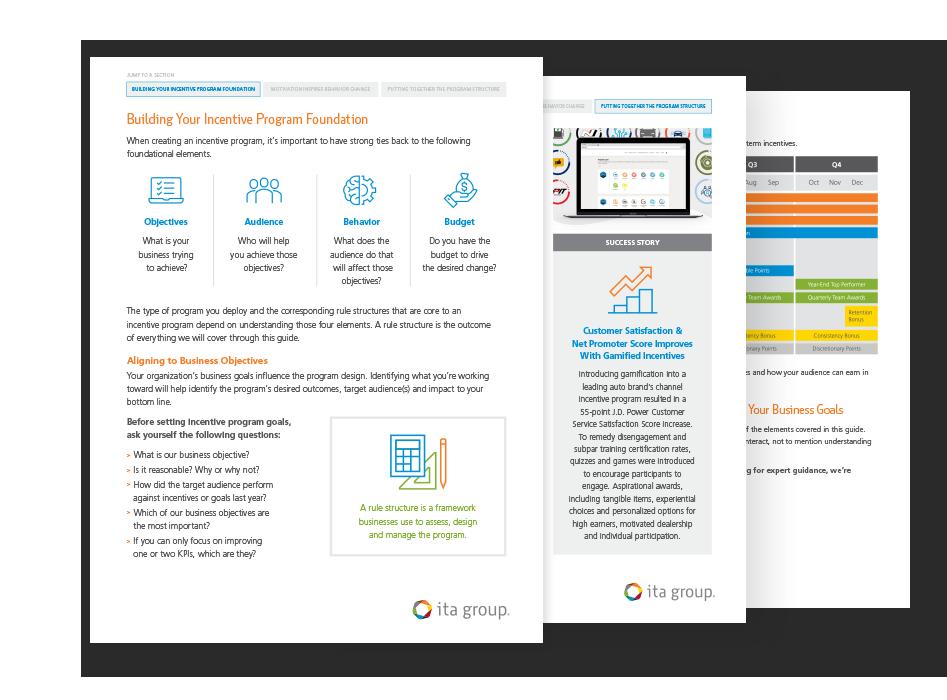

The ultimate guide for ultimate returns

insights magazine | 7

Successful incentive programs drive performance like sales, training and other specific KPIs. However you measure their success, incentives are a valuable tool in achieving any metric. Download our white paper to learn more. info.itagroup.com/high-return-whitepaper

WHERE TO INVEST PROGRAM FUNDS FOR MAXIMUM IMPACT

In a challenging economic climate, many brands envision major changes to partner programs in the near future. Those brands increasing budgets for channel ecosystems have high expectations for return on investment. If you’re experiencing a do-more-withless mandate from your organization, slashing an incentive program is a short-sighted solution that will ultimately set your brand back. Instead, leaders should get strategic and optimize their channel partner program spend. By investing in areas that have the strongest return, you can get the most out of your incentive program budget.

The trick is figuring out: where to focus any new funds and how to maximize your existing spend.

insights magazine | 9

Where to focus new channel program investments

Understanding your partner experience and business goals is key to making informed channel program investments. Consider your business goals through the following lenses.

Partner journey

Start by mapping the partner journey. When do specific interactions and milestones happen?

From there, identify which parts and pieces create pain points. Think about your business goals, where gaps exist or where existing partner support is weak. That will guide what program improvements you need to tackle.

Discoveries could include:

> Enablement: Partners need to sell different products or service types to meet goals

> Onboard: New partner onboarding is too slow

> Support and grow: Sold accounts are stagnating

Mapping pain points to the customer journey could look like:

Partner feedback

Asking your partners for program feedback is another strategy to target your investment. Tools such as pulse surveys, focus groups and other research methods let you know which elements are succeeding and how your program might be falling short. Diagnose common frustrations noted on the right:

Mapping partner feedback

> Implement and support: Partners are struggling to implement and then service your products and solutions

> Enablement: Resources needed to make sales are inaccessible

> Transaction: Existing incentives and rewards aren’t valuable to them

customer journey could look like:

10 | insights magazine

to the

Putting it together

After mapping the partner journey through the lens of your business goals and soliciting partner feedback, was there overlap in what you learned? If so, investments in those areas can have the strongest returns for your partners and your program.

In this example, there is overlap between partner enablement and support. It would make sense to prioritize investments in product training and education and marketing automation tools.

How to maximize existing channel program investments

To optimize your current spend, focus on short-term impact by improving your incentive bucket. Re-allocations in these areas can demonstrate results quickly:

> Market Development Funds (MDF): Often earn through revenue levels and help partners leverage vendor content, messaging, branding and demand generation activities in their local markets

> Co-op funds: Reward channel partners as they sell more products (from the sales and marketing budget)

> Rebates: Encourage purchases across a specified group of products or services and are often paid out after a purchase or set period

> Launch funds: Launch new partnerships with an incremental fund to accelerate awareness and generate demand; separate from MDF and Co-Op funds

> Sales Performance Incentive Fund (SPIF): Pay a bounty to increase sales and meet growth goals; often used in short time frames to stimulate activity

> Points-based awards: Collect and redeem points for behaviors, sales and other KPIs (e.g., loyalty programs)

But to be effective, reallocations must be built on business goals and communicated with a partner-centric approach to gain adoption and mindshare.

insights magazine | 11

Evaluate what portion of your budget is going to key audiences through the different types of incentives listed above. Return to the partner journey mapping and feedback loop strategies to understand what will be most compelling to reach your goals and appeal to your partner base.

No matter what type of partner roles you’re working with:

> Owners

> Sales

> Support

Implementation and program participation are directly tied. Unfortunately, many channel incentives are underutilized because a one-sizefits-all approach doesn’t align with the goals of the partner type they are designed to support, and they’re rarely communicated well.

Investing in program awareness through communications is a critical but often overlooked component of program design. Successful incentive programs hinge on more than a one-time email blast. They must attract attention and generate excitement.

Prioritize investments based on your business goals and partner needs

Whether upping an investment or optimizing existing spend, getting the most from your channel partner program budget requires understanding your audience, aligning incentives with your organization’s goals and getting the word out efficiently and effectively. Investments in these areas will serve you well, regardless of which specific enhancements you make.

NAVIGATING BUDGET CUTS?

Check out our white paper to learn how to measure the success of your incentive program— and make the data matter to stakeholders.

info.itagroup.com/budget-cuts

12 | insights magazine

insights magazine | 13 Are you making the right program investments? ndividual Contributors Indiv d Contribu P Many organizations limit their channel partner program budgets, making leaders justify every dollar and do more with less. But, it's possible to maximize the impact of every dollar invested or reallocated. info.itagroup.com/channel-spend-webinar

Be easier to do business with A more personalized partner experience is possible

By: Ellen Linkenhoker, Channel Solutions Manager

By: Ellen Linkenhoker, Channel Solutions Manager

Being easier to do business with takes many forms, but the most consistent way is to personalize your program using the research-backed tips shared in our webinar (see more on the next page). Partners told us exactly what they needed to increase performance—personalization, relevance and communication.

14 | insights magazine

Feeling like you're hard to do business with?

Here’s how to improve the partner experience

It's common to have dashboards for admins, executives, field teams and occasionally partners. The real improvements in partner experience come when the right people have access to dashboards that track eligibility, progress towards goals and next-best actions.

> Dashboards: Make dashboards available for people who can impact change in numbers—partner owners, partner reps or support teams.

1> Partner experience portals: Depending on your access to data, embed goal tracking, progress, KPIs, and AI and machine learning techniques to suggest next-best actions based on profiles, historical data, program and business rules, and your program goals.

How will your programs survive in the future?

Employ personalization and relevance

If you’re not offering personalized and relevant programs, someone else will be. And they will steal your market share. Their program capabilities make them infinitely easier to do business with.

The following five steps highlight a program personalization framework to implement where it makes sense for your business. You don’t have to follow every step, and you don’t have to move sequentially.

PROGRAM

Not everyone can be in the same program. How you tier or segment your program can be based on industry, specialization, go-to-market strategies, customers served or enrollments in competency tracks vs. different programs.

Tiering on volume and revenue is important to you, but not necessarily to your partners. It should be part of the program and how you make decisions because you’re investing money but make it a secondary driver.

For example, let everyone join the same program and then self-select areas of focus. One partner might choose a focus of creating joint IP or integrating with their products. Another might select reselling, and yet another reselling and service or repair. This helps tailor your core messaging to how partners can grow their business with you and allows you to meet their needs first while still layering in tiers or thresholds based on revenue.

insights magazine | 15

PROMOTIONS

Tailor incentives and rule structures to the way your partners sell, who they sell to or their specialties. Customization requires you to have intel on what type of partner they are, who they sell to and how they sell.

Adding personalization skips the broad roll out of new SPIFs, rebates or promotions to every partner and instead rolls out to the ones most likely to sell based on historic performance, partner type or who they sell to.

Personalization should help optimize your spend and significantly cut down on the noise your partners receive.

2 3 4 5

ENABLEMENT

Focus on segmentation to scale enablement efforts. Your partners should see role-based and sellingstyle information when they enter the portal. After a business owner logs in, show them the social-selling training you made for reps. Then push owners to encourage their reps to take it (such as incenting a % completion). Or when a marketer logs in, show them how or where to access new campaign materials (and consider incenting a roll out).

PORTALS

Portals should aggregate the necessary tools, goals, next actions and enablement to give partners one place to go.

ENGAGEMENT

Your communications can be pre-set based on segments and relevancy. They should celebrate, nudge and push partners to the next action.

For example, if partners sell to mid-size clients, don’t ship them promotions geared toward enterprise products. If a product like a display or a piece of large equipment often needs to be serviced or maintained, consider a roll out to partners who sell and service. View the full-length webinar featuring Forrester’s premier channel analyst sharing new research—directly from the channel itself—on how to increase channel program performance. info.itagroup.com/channel-partner-webinar

Communications best practices for to-partner marketing

At their core, channel incentive programs are all about behavior modification. The programs reward partners for pre-determined efforts or desired behaviors aligned with achieving specific business goals, such as highlighting new products, liquidating old inventory, identifying new market opportunities and increasing sales. However, there’s a catch.

Even the best designed channel programs fall flat if there isn’t an engagement strategy to reinforce program benefits and drive behaviors that impact partner success. To-partner marketing helps shape that engagement strategy.

To ensure successful program engagement, channel leaders must develop a strategy for each of three to-partner marketing stages: attraction, activation and acceleration. Each phase should build upon the last to drive behaviors, create habits and develop advocates. Effectively communicating throughout the partner journey is the key to building engagement.

PARTNER ENGAGEMENT JOURNEY

ATTRACT

Recruit Decision Onboard Enable Transact Implement Support Grow

Attract channel partners with clear program purpose and benefits

In the attraction stage, the most important message is the program’s value proposition. Partners need to be able to easily answer:

> “What is this program?”

> “What am I supposed to do with it?”

> “What’s in it for me?”

You need to take the time to understand the ideal participant and reach them where they are. Marketers frequently state it takes multiple interactions with a brand before a person acts.

Digital marketing experts estimate the average American is exposed to about 6,000–10,000 marketing messages a day, based on past years’ statistics and current trends. So how do we reach partners and create meaningful interactions that drive action?

The key to capturing channel partners’ attention is understanding your audience—their work environment, how they engage with technology, how they’re motivated, etc.

20 | insights magazine

ACTIVATE ACCELERATE

Tailor the communications campaign to specific demographics of your target audience to drive results. Gone are the days of exclusive programs that are only available to a select few. Most programs now try to generate interest in key demographics to expand their participation and enrollment efforts, encouraging new partnerships throughout the channel.

Be sure to keep program names and communications simple. Don’t overlook the importance of an informative name that isn’t overly clever or cute. In general, you don’t want participants to guess what you’re offering them.

While publicly showcasing your program benefits without requiring participants to register might feel risky, keeping benefits secret can be detrimental to growth and success.

We understand that the fear of competition can be paralyzing.

You might worry:

> “What if my competitor finds out what I’m doing?”

> “What if they try to undercut the benefits I offer?”

> “What if they take all of my ideas?”

If you’re confident in your product, partners and program, there’s nothing to fear about your competition knowing the benefits you provide.

Those not effectively and transparently promoting their channel partner programs are the ones who should be afraid.

Activate channel partners with frequent and consistent communication

In the activation stage, consistent communication is critical. Participants need to understand what behaviors drive awards and results. Take time to train them on how to be successful in your program and reinforce those desired behaviors at every step. By providing regular updates and resources, you help partners achieve their goals and grow their business with your products or services.

Frequency is as important as consistency when communicating your channel program’s message. Brand and program messaging should be threaded through every touchpoint in a relevant, succinct, cohesive and timely way—especially early in the program. Every touchpoint, no matter how simple or standard, should be intentional, tied to the brand’s tone and integrated with a comprehensive strategy.

insights magazine | 21

Accelerate channel partner engagement with awards and recognition

In the acceleration stage, channel partners build habits and establish long-term program effects. During this stage, ongoing communications should not only define the benefits channel partners receive, but also demonstrate the overall value.

It’s easy to become complacent as desired behaviors become habits, but continued program communications are still important for long-term growth.

At this point, participants likely already understand the benefits and have experienced the value of your channel program, so communications should change accordingly. Focus on elements such as progress-to-goal emails, program notifications and promotional announcements to reinforce audience engagement and performance.

You should also never assume participants are hooked and will never leave the program. Find ways to surprise and delight existing participants with tactics like branded thank-you kits.

Acknowledge their continual growth through marketing tools and resources that allow them to share their success with peers. Make sure they continue to see exceptional levels of support and service. Ideally, partners will experience so much long-lasting growth, and they’ll be so entwined in the program, that it will feel too great a barrier to leave the program. This will take them from just program participants to engaged brand advocates.

Partner marketing best practices

It’s critically important that your partners know from the beginning what you want them to do and how they can most easily succeed with your products and services. Clear, segmented communications throughout the journey will help you do just that. It allows your brand to break through the noise to reach partners with the right message at the right time. Looking for even more actionable partner marketing best practices to implement? Read our article.

info.itagroup.com/partner-marketing

22 | insights magazine

insights magazine | 23 ITA Group transforms how business feels. EVENTS | INCENTIVES | RECOGNITION | LOYALTY | RESEARCH | LEARNING

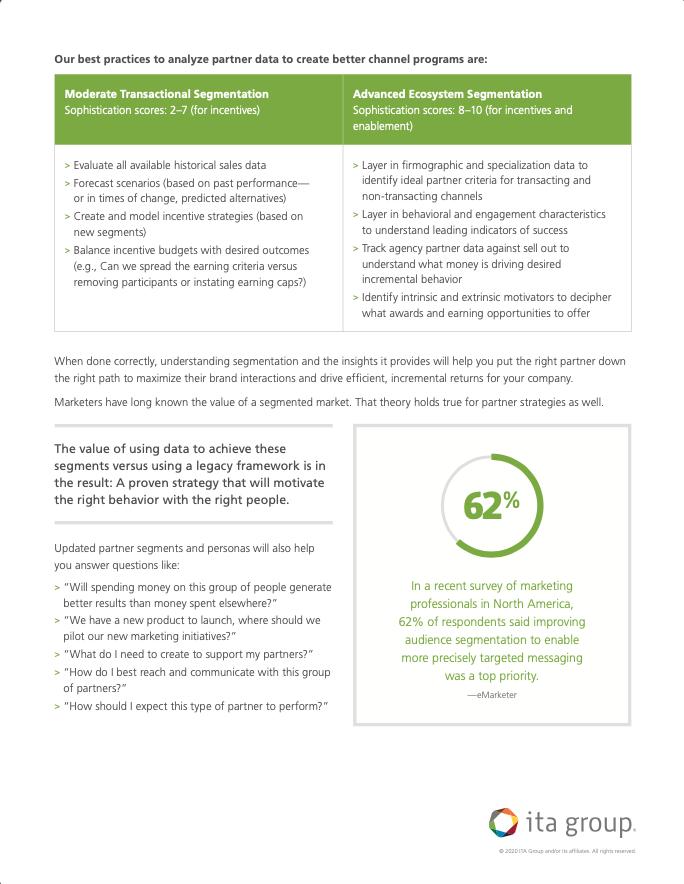

Are you targeting the right partners?

When you think about identifying your best partners—the ones with an ideal set of characteristics—those selling the most probably come to mind first. While dollars being brought in will always be a big factor in identification, it’s far from the only way to look at who your best partners are. Focusing solely on this could even encourage flawed thinking.

So let’s tackle finding your best transactional partners first: Who is driving the most sales? How do you find them? How can you get more of them?

24 | insights magazine PROGRAM SEGMENTATION

Start with the data you have on hand

First, look at the sales history for (at least) the last two years—preferably longer. Get as much context as you have available to you. Information helpful to know includes:

> Who sold it?

> To whom did they sell it? (or at least type of customer)

> How much was sold?

> What was sold exactly?

> Did they offer discounts or concessions?

> How much profit is attributed to your products and services?

> Are there repeat purchases?

Cross-selling or up-selling?

> Total number of customers

Getting ahold of as much of the transactional information listed to the left as you can will help you piece together a picture of who your best partners are. You can see who is at the top and then identify what type of partner that is.

For example, imagine a technology company who analyzes only sales data with the general partner types and has some product/ service information as well. They could find out that VARs sell the most of their products and it’s usually to mid-sized clients. So they might go out to find more of these types of VARS selling to mid-sized clients.

insights magazine | 25

Or, if you have a manufacturing company whose best partners, based on their analysis of sales data, turns out to be resellers that sell to both business and consumers. So they’d go out to find more of these resellers who target both business and consumer.

CAUTION: This is where the logic can become flawed.

If you base your segmentation solely on sales and partner type or customer type, you’re missing valuable correlations between behavior and activity. Better understanding that you can apply to other partners to push them in that direction of greater success.

You may also be missing key factors that would help you know other specializations or competencies to make their success viable.

Using only sales data will lead to drawbacks

There are some pitfalls you can run across by crafting an ideal partner profile based purely on sales data. It can give you a false sense of who is performing unless it’s been consistent over the years.

Even with that information, you could be missing key details that paint a picture of where partners are heading in our increasingly digital selling environment. Do you have partners who aren’t keeping up with new products and digital selling techniques? Arguments can be made that partners who historically have been excellent at selling products and services may not be adapting to new products coming onto the market. Or worse, they’re not getting their message out to prospective buyers through digital means and virtual selling.

Possible pitfalls of building ideal partner profiles focusing only on sales:

> It’s a picture of right now. Today. What about tomorrow?

> Sales can be a lagging indicator of success, especially if you have a long sales cycle

> Lead generation and MDF usage could indicate repeatable characteristics to boost other partner’s performance

> Digital presence of partners and their sales team

> Competency with products and services

This also doubles as a list of additional data you should collect to really flesh out an ideal partner scorecard. Understanding beyond sales what characteristics make a partner high performing will help you better adjust performance expectations with existing partners.

Firmographic and specialization information can help you craft a partner profile to go out to the market and find others like your best.

It’s an important distinction to make— the difference between an ideal partner scorecard and an ideal partner profile. Learn more to the right.

IDEAL PARTNER PROFILE

A set of firmographic and demographic information on a partner that you could take to the market and use to find others like them. These are the characteristics that are repeatable without knowing sales and engagement history within your own program. It’s a best guess— like judging a book by its cover.

IDEAL PARTNER SCORECARD

A set of characteristics based on the behaviors your top partners exhibit inside your partner program. These scorecards could vary by product line or ideal buyer type. The key here is identifying things you can replicate with other partners in your program. A little like building a “Choose Your Own Adventure” where you’re using program incentives to push partners down the path most lucrative.

insights magazine | 27

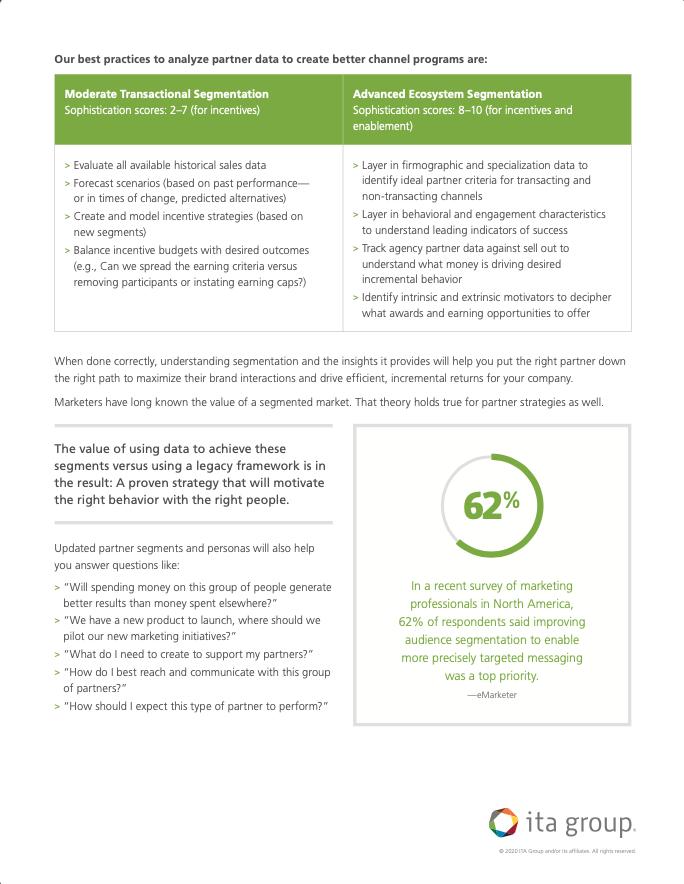

Better data leads to better segmentation, which leads to better budget decisions

We recommend having a broader view than just partner names and sales data to craft an ideal partner profile.

Want to understand which partners are the best at selling your different product and service mixes? Of course you do—this could help make smarter budget choices by narrowing down who to target to sell a specific type of new or enhanced offering. However, to get this level of detail, you need to capture additional data points about the sales being made. Layer in demographic and firmographic information about your partners. This will allow you to apply characteristics like company size, geography, specialization with products, vertical expertise, different routes to market, ideal client profiles, etc.

If you apply the following types of partner data to your analysis, you could uncover sub-segments of ideal partners:

> Partner demographic information (location, size, type, etc.)

> Partner customer types (who do they sell to?)

> Partner selling style (how do they sell?)

> Partner sales data

> Specialization and expertise

For example, you may have VARs targeting mid-sized clients as your best partners when it comes to your hardware and maintenance products, but MSPs targeting mid-sized clients have the most success with your security software. Layering in this information can also tell you that you need to find or grow capabilities around certain competencies and specialization to attract or make better partners.

But wait, there’s more

By focusing only on sales (even with layered in data to define better profiles and scorecards) you’re leaving other ideal partners out of the picture. What about the partners who are the very best at referring you in? What is it about them that you could find and replicate with others?

What about the partners who are the very best at retaining business? What behaviors and characteristics do they exhibit? You could also take a complete step back and ask, who are the best partners to drive sales for my products that I may or may not already know about?

This can be solved by understanding the path to purchase for your brand’s products and services. In fact, this is a critical part of incentive design. If you know who is making brand choice at the point of sale, you’ve identified the place you can have the most impact with an incentive program. Without understanding who is making brand choice, you could be in the wrong audience.

When done correctly, understanding segmentation and the insights it provides will allow you to put the right persona down the right path to maximize their brand interactions and drive efficient, incremental returns for your company.

28 | insights magazine

Apply segmentation for channel partner ecosystem success

One of the most accurate ways to see improved outcomes is with advanced segmentation. This can be applied to any number of partner initiatives with optimal results. Download our white paper to learn more.

info.itagroup.com/segmentation-white-paper

insights magazine | 29

Craving more content? Get the latest tips and trends on the topics you care about right to your inbox. Event Marketing Incentive Travel Employee Experience Channel Partner Engagement Customer Engagement Incentives Subscribe to Insights info.itagroup.com/insights ITA Group® and the ITA Group logo are registered trademarks of ITA Group, Inc. All rights reserved.

By: Ellen Linkenhoker, Channel Solutions Manager

By: Ellen Linkenhoker, Channel Solutions Manager