Teachers’ pack

A useful guide for instrumental and vocal teachers, covering the essentials of music teaching

A useful guide for instrumental and vocal teachers, covering the essentials of music teaching

This pack is a useful guide for instrumental and vocal teachers, whether you are employed, working freelance in schools or teaching privately.

It covers issues which all music teachers need to know about, including contracts, fees, safeguarding, employment status, tax, finding work and professional development, as well as looking after your health and wellbeing.

The Teachers’ Pack is a free resource, created by the ISM Trust, the sister charity of the Independent Society of Musicians (ISM). The Trust offers high quality professional development to everyone working in music.

The ISM is the UK’s professional body for music and a subject association for music. ISM members receive unrivalled legal expertise from our in-house legal team, comprehensive insurance and specialist services. Members come from all areas of the music industry, and from a wide variety of genres and backgrounds. If you require further support or information, please get in touch. ismtrust.org / enquiries@ismtrust.org ism.org / membership@ism.org

Music teaching can be a highly rewarding career path.

Decisions to make before you get started:

• Where will you teach? Will you be taking private lessons at home or teaching in a school or college, or a combination of both?

• Do you have a suitable space and the necessary equipment?

• Will you teach adults, children or both?

• Will you teach beginners and more advanced students?

• Will you teach group classes as well as individuals?

• Which instrument or instruments will you teach? And will you teach theory?

• Who is responsible for timetabling: you or someone else?

• Will you offer both in person and online teaching?

Thinking through these questions will help you to focus your teaching practice and promote it more effectively.

Once you have answered these questions, you are ready to consider the practicalities outlined in the rest of this pack.

If you have never taught before or have limited instrumental teaching experience, consider also reading our How to… Begin teaching music guide for ISM members.

The guide looks at how you can develop your music teaching skills and practice, covering useful topics such as lesson planning, motivating your students, dealing with parents and carers, selecting repertoire, and more.

We strongly advise that you have a written contract for every student you bill directly and with every school where you teach. This ensures your rights and obligations (and those of your students or their parents) are clearly set out and reduces the scope for later dispute.

Examples of what to include in a written agreement include:

• the names and addresses of the parties to the contract

• when and where lessons are to take place and their frequency

• your fee

• provision for fee reviews and increases

• payment for missed lessons

• the notice required to terminate lessons on either side and the obligation to give and pay for lessons during the notice period and

• a right for the student or parent to cancel the contract within 14 days of its being agreed.

The ISM provides template contracts for self-employed teachers to use. These can be adapted if necessary to suit individual needs.

Some private teachers use a studio policy which sets out terms and conditions which apply to anyone who undertakes lessons with that teacher. However, if you use such a policy, it is important to obtain active agreement to the terms and conditions and not just leave them on your website and expect them to apply to all students.

It is important to note that schools should not compel their self-employed visiting music teachers and their students’ parents to use a specific form of contract.

We strongly advise that you have a written contract for every student you bill directly and with every school where you teach.

Even if you are self-employed, we strongly recommend that you have a written contract with your school as well as with your students’ parents. Topics the former should cover include:

• the school’s obligation to provide teaching facilities

• the way in which the school will allocate pupils to you

• the school’s commitment to promote your services and introduce you to students

• the extent of your obligation to teach students allocated to you

• what insurances you need

• any room hire charges and

• the notice period for termination

All employees and workers have the right to what is termed a written statement of particulars of employment. Some particulars must be provided by the beginning of employment or engagement and must be contained in a single document. Other particulars may be contained in a reasonably accessible document that is referred to in the statement of particulars. Other information may be given in instalments

but no later than two months after the employment or engagement has begun.

Information that must be given by the start of the employment or engagement in a single document:

• the names of the employer and employee or worker

• the date the employment or engagement began

• for employees, the date on which the period of continuous employment began

• pay or the method that pay is calculated

• the interval at which pay is made (i.e. weekly, monthly or any other method)

• job title

• whether or not the employment or engagement is expected to be permanent and if it is not permanent when it will end

• any probationary period

• normal working hours

• the days of the week on which the employee or worker is required to work

• whether or not hours or days may be variable and how they may vary or how that variation is determined.

• entitlement to paid holiday

• the notice period for either party to terminate the contract

• place of work

• provisions if the employer or worker is required to work outside the UK for more than one month

• any requirements for training and whether it will be paid for by the employer or engager

Information that must be provided in a reasonably accessible document:

• sick leave and pay

• other paid leave in addition to paid holiday

• any pension arrangements

• any training entitlement

Particulars of the following may be given in installments but must be given no later than two months after the employment or engagement has commenced:

• any pension arrangements

• any collective agreements which directly affect the terms and conditions

• any training entitlement

• any disciplinary or grievance rules and procedures applicable to the employee or worker and how decisions can be appealed

Once the contract has commenced and if there is a change to any of these particulars the employer or engager must give the employee or worker a written statement containing particulars of that change.

VMTs are often engaged under contracts which state that their hours of work are variable and that there is no guarantee of any actual work. In such circumstances it is sensible to make sure your working hours are fixed by mutual agreement between you and your employer or engager on a term-by-term basis, so that you have a clear idea of when you will be available for other work.

It is unlawful for an employer employing you on a zero hours contract to restrict your ability to work elsewhere.

ISM members with concerns about any contract should contact the ISM legal team.

Be aware of what other music teachers are charging in your area. You shouldn’t charge either significantly more or significantly less than your competitors. Charging more puts you at risk of losing work to other teachers prepared to charge a lower rate. Charging less means that you are earning less than you could and you risk devaluing music tuition in general.

The results of our annual survey of music teachers’ fees will give you an idea of what the going market rates are. Our surveys cover both private teaching rates and fees paid to self-employed and employed VMTs.

In using the survey results you will want to take into account factors such as:

• where your particular locality sits within the overall fee ranges

• where you fit within the overall range of fees

• general price inflation since the survey date and

• the general economic situation and its impact upon demand for music tuition

Different music teachers charge widely different fees. You yourself will have to take a realistic view of where you personally fit in this marketplace.

You should allow for:

• your skills and qualifications: the greater these are the more you should be able to charge

• the costs involved in running your teaching business: these might include travel costs, studio or room hire, books and other teaching materials

• your teaching experience: our surveys have consistently shown that more experienced teachers tend to charge more than those with less experience

• how much you want/need to attract new students: in other words, if you already have a waiting list you might consider charging a rather higher rate than someone who is just starting out and wanting to expand their teaching practice.

If you are self-employed, remember that you will have to pay tax and National Insurance on your earnings, so keep this in mind when setting your fee.

You should:

• keep things on a business-like footing, starting with a signed teaching contract

• give plenty of notice if you intend to increase your rate: ISM members can download a pro forma written notice of fee increase from our website

• point to our survey results as an indicator of what music teachers are charging

Remember that you do not have to increase your rates every year. Our surveys suggest that most teachers raise their fees only once every two or three years.

Many schools specify a uniform rate to be charged by all their VMTs. In this situation you will probably not want to insist on a higher fee in order not to risk losing students.

However, this should not stop you from being proactive in seeking a higher uniform fee if your school is paying a below-par rate. Review your school’s rates annually, taking into account our survey results for self-employed or employed VMTs. This will help you to check that your school is not falling behind the pack.

If your school’s rates are too low, you could raise this with the school through a group representing the VMTs as a whole. Alternatively, your Head of Music might be prepared to negotiate for you.

Difficulties in recovering fees are, unfortunately, a common problem for music teachers. Here we set out a few dos and don’ts to help ensure you get paid.

Do

• insist on payment in advance

• send a written invoice in good time setting out clearly how much is due and the deadline for payment

• specify which payment methods you will and will not accept, such as cash, cheque, bank transfer, Direct Debit or standing order

• if accepting cheques, make sure they have cleared before acknowledging payment

• send written reminders if you do not receive payment by the due date

• keep copies of all correspondence

• actively look for alternative work to replace lessons which have been cancelled at short notice without being paid for

Don’t

• add a late payment fee: such charges are unlikely to be enforceable even if your contract explicitly provides for them

• think carefully about whether to stop teaching someone because their fees have not been paid: on the one hand, there may be a reasonable explanation for the non-payment, such as absence from home, family problems or even a cheque being forgotten in the pupil’s school bag: you don’t want to lose customers (both the non-payer and others) unnecessarily, but it would be unwise to continue teaching if your fees have been left unpaid for a considerable period

• if your debtor sends you only part of the total sum outstanding: acknowledge the payment, but make it clear that you are accepting it only in partial settlement of what you are owed

Training on child protection and safeguarding issues is absolutely essential for all teachers, whether employed or self-employed, and whether you teach in schools or privately.

If you are working in a school (whether on an employed or self-employed basis) the school should provide regular safeguarding training (and pay self-employed visiting music teachers to attend).

ISM members have access to extensive training, advice and guidance on safeguarding issues, available via our website. Members can also seek advice from our in-house legal team.

We also run free webinars on the subject of safeguarding. These are open to all music teachers and musicians working with children and vulnerable adults.

so qualify for a DBS Enhanced Disclosure with a barred list check.

If you teach vulnerable adults you are likely to qualify for a DBS Disclosure specific to work with vulnerable groups. If you teach both children and vulnerable adults there is a Disclosure option that covers both these ‘workforces’.

Enhanced DBS checks can be obtained only if a specified organisation or employer wants to check an individual.

An individual cannot apply for these higher level disclosures but the ISM can obtain enhanced DBS checks with a barred list check for its members. This can be particularly useful for private teachers who won’t have an employer or are engaged by an organisation.

• attempt to confront the person who owes you money in person: an encounter on their doorstep may only add fuel to an already heated situation: it may even endanger your physical safety or lead to your being accused of bullying and harassment

The ISM’s in-house legal team helps ISM members to recover unpaid fees.

All ISM members must comply with the ISM Safeguarding and Child Protection Policy and Code of Practice. These documents can also be useful to non-members as a good practice guide. You can view and download them from the ISM website

If you teach children for more than three days in any 30-day period you are likely to be engaged in ‘regulated activity’ and

The DBS Update Service is an automatic renewal service which is designed to avoid the need for multiple DBS checks. It allows a DBS certificate to be portable between schools. This means that music teachers no longer have to apply for a new DBS check each time they take on a new job.

The cost of a subscription to the Update Service is only £13 a year. Applicants must opt in to the service either when they apply for the DBS check or within 30 days of their DBS certificate being issued.

You can find out more on the DBS website

If you are teaching under 18s or vulnerable adults in Scotland you will need to apply for a PVG (Protecting Vulnerable Groups) Scheme Membership and Disclosure. As with the DBS Disclosure, if you are an ISM member who is self-employed you can arrange this through the ISM

Managed and delivered by Disclosure

Scotland, the PVG scheme makes the decisions about who should be barred from working with vulnerable groups. When someone applies to join the PVG scheme, Disclosure Scotland carries out criminal record checks and shares the results with individuals and employer organisations.

Regular checks are then undertaken and if they find new information which means someone might have become unsuitable to work with children or protected adults, Disclosure Scotland tell the employer, or the registered body which applied on their behalf.

A PVG scheme member’s paper certificate shows the information available on the day it was created. Membership of the scheme lasts indefinitely though, and scheme members are continuously checked, unless they decide to leave the scheme.

You can find out more on the PVG website: mygov.scot/pvg-scheme

AccessNI operate their own criminal record checking department for employers or professional bodies (such as the ISM) to request an applicant’s criminal record. You are required to get an AccessNI criminal record check if your work involves close or regular contact with

children or vulnerable adults.

Applications must come from a registered body or an umbrella body that is registered with AccessNI. As with DBS and PVG checks this means that an employer or other organisation will apply for the check on an individual. The ISM can apply for an AccessNI check for any ISM members who are self employed.

AccessNI do not have an update service, so the check is valid only on the point of issue and employers can decide how often they would like their employees to obtain a check.

You can find out more on the AccessNI website: nidirect.gov.uk/articles/usingcriminal-record-check

If you are an ISM member who has been teaching privately for six months or more, you can apply for ISM Registered Private Teacher (RPT) status.

Having ISM RPT status is beneficial if you teach under 18s as it demonstrates to current and potential pupils and their parents that you have been reference checked and criminal record checked by your professional body and that you have signed up to the ISM Safeguarding & Child Protection Policy, Code of Practice and procedures.

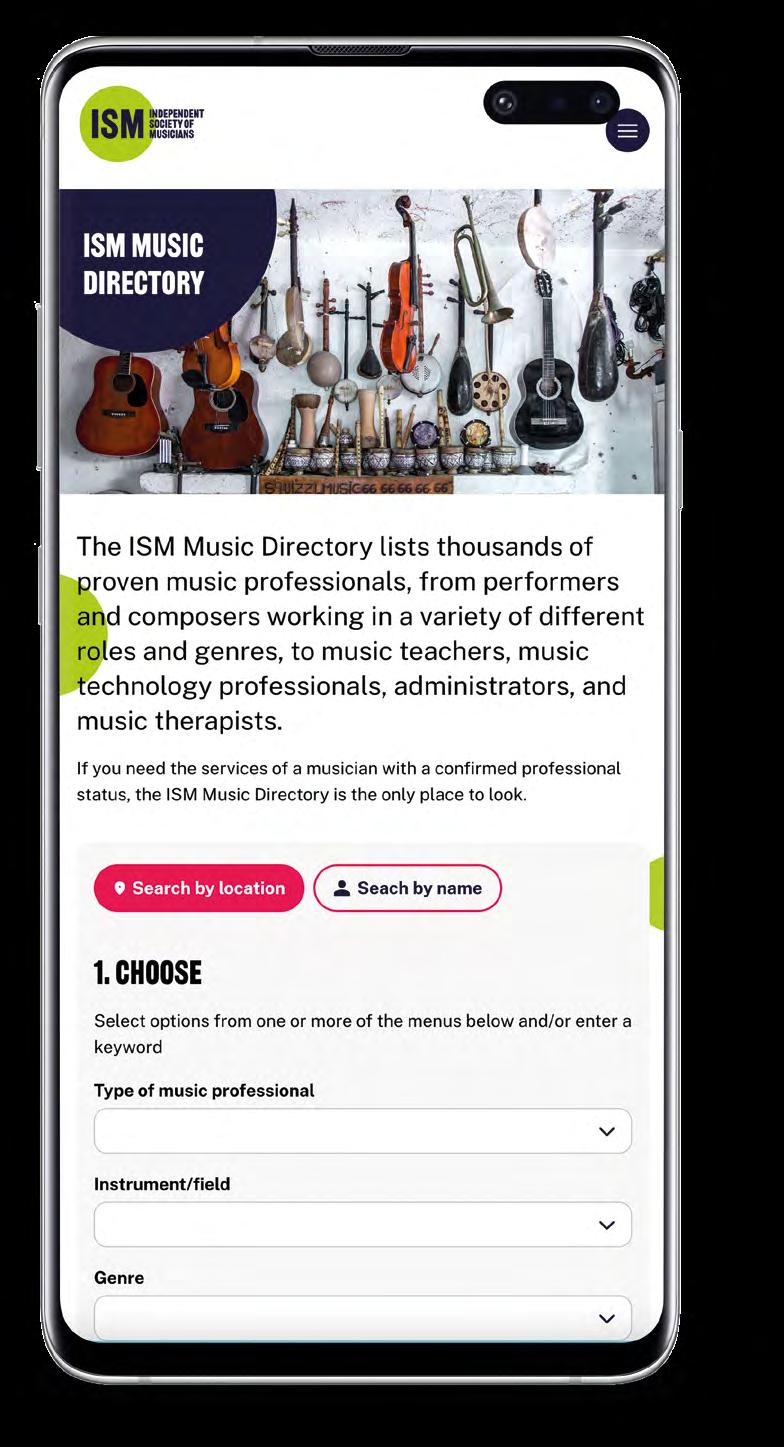

ISM Registered Private Teachers receive a certificate of status and a highlighted listing on the ISM Music Directory, the UK’s only online directory of music professionals with proven credentials.

Find out more here: ism.org/advice/ registered-private-teacher

There are three different employment statuses: employee, worker and self-employed. Employment status matters as it can provide protections and rights for music teachers. Even employees and workers with zero-hours contracts have the rights that follow from their employment status.

An employee is someone with a contract of employment. Typically, an employer is likely to have a high degree of control over what a person does, how it is done and when it has to finish. Employees cannot send someone else to do their work and if an employee breaks the organisation’s rules, they can be disciplined or dismissed. Whether or not you are an employee always depends on the specific facts, but in essence, the more control that an organisation exerts over you, especially during times when you are not working for them, the more likely you are to be an employee.

A worker is someone who is required to personally perform any work or services but who is not doing that work as a genuinely self-employed person. In other words, they are not running

their own business looking after their own customers and clients. Typically, workers are engaged to do work on a casual, freelance or as-required basis. ‘Worker-style’ contracts often state that the organisation is not ‘obliged’ to offer work or the individual to accept it. The main difference between employees and workers is the amount of control asserted by the organisation over the individual’s activities, especially when they are not working.

An individual is considered self-employed if they run their business for themselves and take responsibility for its success or failure. The genuinely self-employed have very few rights at work, except what they have been able to negotiate in the contract with their customer.

Knowing your employment status is important because it is the gateway to key legal rights such as holiday pay or protection from unfair dismissal. However, employment status can be a complex area. An important point to note is that even if you have signed a written contract document that describes you as ‘self-employed’ or ‘freelance’, that is often not the end of the matter. In 2021, in the case of Uber v Aslam, the Supreme Court

said that what matters more than the documentation is the way the relationship really plays out, day to day.

For example, if there is a high degree of control, a teacher cannot send a substitute and cannot negotiate their own fees, then they are more likely to be a worker or employee. If the opposite

is true and a teacher is able to send a substitute, deals directly with parents and sets their own fees, then they are more likely to be self-employed.

If you are in doubt about your employment status you should seek legal advice. ISM members can get advice from the ISM’s legal team.

Being classified as a worker or as an employee brings with it a number of benefits which self-employed musicians generally do not have.

Workers are entitled to certain employment rights, including:

• a written statement of employment particulars outlining job rights and responsibilities

• the National Minimum Wage

• protection against unlawful deductions from wages

• paid holiday

• rest breaks

• payslips

• protection against unlawful discrimination

• protection when reporting wrongdoing in the workplace (“whistleblowing”)

• not to be treated less unfairly if working part-time

• some protections under health and safety legislation

All employees are workers, but an employee has extra employment rights and responsibilities including:

• Statutory Sick Pay (SSP)

• statutory maternity pay and leave

• statutory paternity pay and leave

• statutory adoption pay and leave

• statutory shared parental pay and leave

• minimum notice periods based on length of service if employment will be ending

• protection against unfair dismissal after two years’ continuous service

• the right to request flexible working

• time off for dependants

• time off for public duties

• Statutory Redundancy Pay after two years’ continuous service

• protection from unfair dismissal if taking action over a health and safety issue

Self-employed music teachers may have some employment rights such as protection for health and safety whilst working on a client’s premises and some protection against discrimination.

If you feel that any of these rights are not being implemented then take legal advice. ISM members should speak to the ISM legal team for advice.

The issue of false self-employment arises where visiting music teachers are provided with contracts by schools that make it look as if the teacher is self-employed. Such contracts are often given on a take it or leave it basis rather than as a result of genuine negotiation. However, the reality may be that the teacher is either a worker or sometime even an employee.

The ISM objects in principle to false self-employment because it enables organisations to take all the benefits of an employed workforce, while at the same time, avoiding all the costs, such as employment rights, pension contributions, PAYE tax and employer National Insurance.

It is important that visiting music teachers review their contractual documentation and take advice if they think that they have been inappropriately given a self-employed contract. The ISM legal team regularly advises on this issue and ISM members can obtain advice from them if necessary.

If you are self-employed you are unlikely to have the benefits of paid holiday and sick pay and pension contributions paid on your behalf by an employer. In assessing what is an acceptable teaching rate for you, you may want to make allowance for (i) holiday periods, (ii) possible illness and injury and (iii) retirement planning.

Our surveys of music teachers’ fees have consistently indicated that self-employed VMTs in schools are paid a slightly higher rate than employed VMTs to compensate for the absence of some of the benefits of working as an employee.

Unlike employed teachers, selfemployed teachers do not benefit from any statutory protection against unfair dismissal. This means that the school is entitled to terminate your contract at any time without giving any reason provided they give you notice in accordance with the provisions of your contract.

Genuinely self-employed individuals are unlikely to be protected by antidiscrimination legislation. However, as the definition of employment in discrimination law is very wide, even if

you consider yourself self-employed, you should take legal advice if you think you have been discriminated against on the grounds of age, disability, gender reassignment, marriage or civil partnership status, pregnancy or maternity, race, religion or belief, sex or sexual orientation. Make sure that you take advice within three months as time limits for claims are short.

Most schools do not charge self-employed visiting music teachers (VMTs) for their use of the school’s facilities and others charge a nominal fee (perhaps as little as £1 per term). However, there are some schools that charge substantially more than this. If your school is proposing a more than nominal charge, you may want to draw the school’s attention to the results of our recent survey of room hire charges and, if you are an ISM member, you should contact our legal team for advice.

We disagree with the view sometimes put forward by schools that a room hire charge is necessary to demonstrate the VMT’s self-employed status. Our view is that teachers who bill parents directly are unlikely to be employees.

Some music teachers pass on this room hire charge to parents, listing it as a separate item on their termly invoices.

When a pupil misses a lesson, for example due to sickness or a competing school activity (such as a concert or play, a trip, a sporting fixture), you

should be entitled to charge for this lesson. This should be made clear in your contracts with your pupils’ parents. An exception to this general principle may be made where you are given adequate notice (we recommend two weeks or more) of a competing school activity. Such notice should give you the scope to re-schedule the lesson.

Many schools require their selfemployed VMTs to take out public liability insurance. This covers you against any liability you may have for accidental damage to third parties (for example your pupils) and their property. ISM members automatically have £10m of public liability insurance cover.

Occasionally schools also ask for professional indemnity insurance. Our view is that this is unnecessary. The risk of you being sued because your teaching was professionally negligent is remote. However, if the school insists on it, ISM members can obtain this cover at a discounted rate.

If a portion of your home is used solely for carrying out your work you can claim a proportion of your home insurance, council tax, mortgage interest, rent and home repairs and maintenance against tax (but see below for the implications of sole business use for planning permission

and liability for business rates). You can also claim a reasonable estimate of your heating, light and power costs that relate to your business even if no part of your house is used solely for your work. Alternatively, under the simplified expenses system you can claim a flat expenses rate for each hour you work at home each month. The flat rate varies with the number of hours you work at home.

It is unlikely that you will need planning permission provided that the main use of your home remains residential. For example if you teach in a room which is used at other times for residential living purposes, you do not need planning permission. However, you would need planning permission to use part of your home solely for business use, for example by converting it into a dedicated teaching room or building a music studio in your garden.

As with planning permission, you will not be liable for business rates unless part of your home is primarily used for business rather than residential purposes.

You will need public liability insurance to cover you against damages claimed against you in case of injury to a pupil or damage to their goods which occurred inside your home. The ISM public liability insurance covers ISM members in respect of work they do at home.

When arranging house insurance, if you teach from home, you need to check the small print carefully to make sure that your teaching activities do not invalidate your policy.

You should carry out a suitable risk assessment of your teaching space at home to ensure that it’s as safe as possible for you and your students to work in. The

room should have sufficient lighting and ventilation, and be free from hazards. For safeguarding reasons, there should also be space for parents to sit and watch the lesson if you are teaching children.

It is always best to avoid conflict by trying to address any concerns your neighbours have about noise, eg by not playing instruments at anti-social hours. Your neighbours could complain about noise to the local authority. However, in our experience, it is very rare for a local authority to take formal legal action in relation to the playing of musical instruments. The position is more difficult if you live in leasehold property. Long lease or tenancy agreements often include a clause prohibiting the playing of musical instruments so as to be audible outside the property in question. Such a clause could cause you serious difficulties if you teach at home. You are strongly advised to check the terms of any tenancy or long leasehold agreement very carefully before committing yourself to it. You should also check your lease or tenancy for clauses prohibiting you from carrying on any business activity at home. ISM members can get advice from the ISM legal team in relation to noise disputes.

If a portion of your home is used solely for carrying out your work you can claim a proportion of your bills.

You need to know whether you are employed or self-employed for tax purposes. The rules for determining status for tax purposes are slightly different to those for employment law purposes (see previous pages). HMRC has a guide as to whether or not, from a tax point of view, you are likely to be considered to be employed.

If you do any self-employed work, you must register with HMRC as selfemployed and you are responsible for paying the tax and National Insurance due on your self-employed earnings by the due date. For employed work, however, your employer will deduct the tax and National Insurance due on your employed earnings under PAYE.

This will help to keep your tax liability to a minimum. Take a look on the ISM website for more information on taxallowable expenses which musicians are able to claim.

There are financial penalties for being late. It can often take longer than you had expected to fill in all the details you have to provide. If you are using HMRC’s online self-assessment service for the first time,

even after you have registered for the service it can take up to seven days before you receive your activation code, which you need before you can start using the service to file your return.

As most self-employed taxpayers pay their tax for the year in two six-monthly instalments, these can take a sizeable chunk out of your income in the payment months. It is wise to save ahead for these payments.

ISM members can get advice on tax matters from the ISM’s tax helpline, as well as a range of useful advice pages.

It’s important to assess your income and outgoings, and ensure you know where your money goes each month. If you’re an ISM member, you can access the ISM’s personal budget calculator for music professionals to help you manage your personal and business finances.

Pension planning can be a challenge for music professionals, especially if you are self-employed or have multiple employment statuses.

The ISM offers advice on pensions to help you plan for your future and achievement your retirement goals. You will also find useful pensions information on gov.uk, Which?, The Money Charity and MoneyHelper

Whether you work at a school or teach privately, you need to keep good records and ensure that you comply with data protection rules.

If you work at a school, you need to keep records of your dealings with your employer. If you are a freelance musician, you need to keep records of your dealings with clients and suppliers in order to run your business efficiently. HMRC requires self-employed taxpayers to keep records

Paperwork you should keep carefully includes:

• work contracts

• invoices you send out

• receipts for expenses

• business mileage records and

• bank statements.

to support their tax return. Equally, an organised, comprehensive set of records makes it easier to complete a tax return and to ensure that you have claimed your full entitlement to tax-allowable expenses.

Good record-keeping also makes sound business sense. It helps you to keep track of all fees and other payments due to you. It may also provide helpful evidence should you fall into dispute with a client over what was previously agreed between you.

For tax purposes, if you are self-employed, you must keep your records for roughly six years. For your employed work HMRC requires you to keep your records for 22 months after the end of the tax year to which they relate.

From a legal point of view also, it is advisable to keep paperwork for at least six years. You can make a claim for breach of contract – and, equally, someone else can file a claim against you - for up to six years after the date of the breach. If this should occur, you will need the paperwork to support your case.

The ISM has templates which members can download to help with their record-keeping.

If you are a self-employed teacher then you are likely to be a data controller as you will decide what and how any personal data, such as addresses (including email), telephone numbers, birth dates, academic records, health information, or other material such as photographs or videos, is ‘processed’.

You must have a lawful basis for processing personal data, of which there are six in GDPR:

• Consent

• Contract

• A legal obligation

• Vital interest

• Public task

In respect of employed work, we recommend that you keep all correspondence between you and your employer, in particular:

• your written statement of terms and conditions

• your letter of appointment

• documents concerning any changes toy our terms and conditions, holiday pay, pensions and retirement

• the staff handbook (if there is one)

• your pay slips and

• your annual P60 form setting out your gross pay and the amount of deductions made for tax and National Insurance.

The General Data Protection Regulation (GDPR) came into force in 2018, along with a new Data Protection Act 2018, and created rules about how personal information needs to be handled. The data protection legislation will apply if you store lists of current and prospective clients, hold addresses, payment details, send marketing materials and more. Whether you hold data on your computer, on your mobile phone, in the cloud or manually on paper, you will need to comply with GDPR.

If you work at a school, ensure that you are aware of any data protection procedures that they have in place. You will need to follow these procedures and ensure that your record keeping about students complies with them.

• Legitimate interest

In practice, much of what you are likely to do will arise under the contract basis: you hold the data and process it because it is necessary to fulfil a contract with a student or their parent. You may also rely on consent – this is important where you want to do marketing of your services. If you want to send marketing information by email or other electronic means, you will need to get an express consent from your customers or clients before you send them marketing materials. If you do not already hold an express consent, you must not send marketing emails.

Once you have decided what information you collect and hold then write a data privacy policy which your clients can easily access, for example on your website or as an additional document you issue with

your contracts. This policy will tell them who you are, what data you collect about them, for what purpose, who you share it with and how long you plan to keep it. You must also include a person’s right to ask for a copy of any data you hold on them, and how they can get their records corrected or amended, or deleted.

The Information Commissioner’s Office (ICO) has produced a detailed guide to GDPR, available online. The ISM has produced guidance and a template privacy statement for members to use.

Many teachers use online teaching platforms to expand their teaching business.

Online lessons can be a great alternative method for delivery if it’s not possible to offer a scheduled in-person lesson. They can also be a way of diversifying your income, with the ability to reach students anywhere in the world.

Whatever your reasons for teaching online, there are a number of benefits and things to watch out for.

Teaching online can help a private music teacher to:

• save travel costs

• fit more lessons into a day, as there is no need to allow for travel time

• teach a wider range of students, as you are no longer restricted by location

• juggle other commitments, such as family life or a performing career

• deliver lessons that might otherwise have to be cancelled due to strikes, bad weather or illness

• Choose your online platform carefully – there are a wide range of options available, so take the time to do your research

• Teaching online is not the same as teaching in person – practise using your online platform and adapt your teaching method to ensure you deliver the best quality service

• Understand your safeguarding responsibilities when teaching children remotely

• If offering online lessons as a backup form of delivery, remember that students (or their parents) have a choice about whether to accept this or not – you may wish to specify in your contract with clients that lessons will be delivered online in certain circumstances

• If you are teaching online for an organisation which requires your sessions to be recorded, make sure you have clarity on who owns the copyright to those recordings and how they will be used

• Excessive screen time can be detrimental to health and wellbeing; make sure to schedule breaks and spend time outdoors where possible

There are several steps you can take to improve the way you promote yourself and your teaching practice.

Thinking about the people who may be interested in taking your lessons (your audience), and how and where you’re speaking to them (your messaging), can help you grow your business or expand it in new directions.

You may be wary of the word ‘brand’, but you can just think of it as ‘personality’ – it’s the way you want to present your business to the world. Consistency is key - you want to make sure all the elements of your promotional material, from posters to your website, have a similar look and feel. This will help you come across as professional and authentic, as well as giving an indication of what your approach or style is.

Your website is your ‘shop window’ - it should reflect you and your business in the most professional way possible. Use your website to put potential pupils’ (or their parents/carers) minds at rest, and help them choose you with confidence.

There are many options out there for setting up an affordable website to promote your teaching practice. ISM members can access discounts on website design services.

On your website, use a biography, frequently asked questions (FAQs), and testimonials from current pupils to tell your story for you; this will also allow you to highlight your strengths and unique selling points.

Improve your website’s ranking in Google and other search engines by learning how to write effectively for the web. There is a lot of free advice online to help you. Ensuring that the information on your website is clear, accurate and up-to-date will help optimise your website so that it can be found easily by search engines.

Look into Google’s ‘My Business’ profile –the short information snippets that come up when you search for a service – and make sure yours is up to date. Consider using search engine advertising to draw attention to your website.

Being active on multiple social media platforms isn’t essential for music teachers, but social media can be an effective marketing tool.

Set yourself up on your chosen platforms with a different profile to your personal one. Be careful to make sure that there is

nothing on your public profiles which you would not want a prospective client or pupil to see.

If you can, use the same picture and name, or ‘handle’, on each platform for consistency. Add key information and links, such as your website, to your bio.

Remember to keep your social media pages up to date.

ISM members can contact the ISM membership team for support with marketing and promotion. The ISM Trust also offers free webinars to help musicians improve their business and marketing skills.

If you plan to teach in a school, you should contact local music hubs and schools (particularly independent schools) directly. Make an appointment to see the head of the music hub and perhaps Heads of Music at local schools. Send them your CV, so that they have this on file should they have work for you in the future. Make sure your CV is professionally presented and current.

Websites where music teaching vacancies are advertised include:

• Rhinegold Jobs

• Education Jobs

• Guardian Jobs

• Arts Jobs

• Music Jobs

• Musical Chairs

• Music Mark

• TES

Network as much as possible. Personal recommendation is often a good way to obtain work, especially for private teachers.

The ISM Music Directory is the UK’s only online directory of musicians and music teachers with verified professional credentials. ISM members can use this to promote themselves to the public for free. Remember to keep your profile up to date. musicdirectory.ism.org

Professional development can come in many forms, from formal qualifications and teaching diplomas to webinars and short courses. Music teachers should undertake continuing professional development (CPD) throughout their career, to increase your knowledge and understanding, to give you credibility and to help you gain more income from your work.

It is good practice to keep a record of relevant qualifications you hold and professional development you undertake on your website or LinkedIn.

Postgraduate training in music education is offered by several UK conservatoires. The course you choose will depend on your subject, degree class and location. If you don’t have a degree, you can obtain a degree and qualified teacher status (QTS) on an undergraduate course. There is a list of courses available on the ISM website.

A teaching diploma is a useful demonstration of an appropriate level of knowledge. Several exam boards offer them, including ABRSM, Trinity College London and LCME. It’s worth looking at the different syllabi to find one that suits your area of teaching.

There are also courses such as the Teaching Musician at Trinity Laban, and the Certificate of Music Educators (CME) qualification offered by Trinity College London and ABRSM.

There are many professional development opportunities for music teachers run by the ISM Trust, ISM, and other music sector organisations.

The ISM Trust offers free webinars and resources for music educators covering a range of useful topics, including safeguarding, fees, teaching methods, examinations, SEND/ASN, diversity and inclusion, performance anxiety, and more.

Members of the ISM receive discounts and news on courses and events for music professionals run by ISM partner organisations.

A career in music is hugely rewarding, but it can also be challenging at times. It is important to consider your health and wellbeing, and take steps to ensure you are as mentally and physically resilient as possible.

No music teacher is an island. To avoid becoming isolated, it helps to have a reliable and trustworthy support network in place.

Support can be accessed through a number of channels, including a counsellor, a charity, a professional body or music community like the ISM, or a friend, family member or colleague.

ISM members can access peer support from fellow music professionals in our members’ Facebook group, at our events and via our Member Connect service.

Sometimes, life can be overwhelming. Whether you are struggling with a workrelated or personal issue, a problem shared is usually a problem halved. Talking to a counsellor can be a useful first step.

The ISM Members Fund offers all ISM members access to a 24-hour confidential adviceline staffed by professionally qualified therapists, plus structured counselling and Cognitive Behavioural

Therapy (CBT), and an online wellbeing resource offering information and advice.

Long hours playing instruments or singing and sustained periods of sitting or standing in one position can affect your physical health. ISM members can access a physiotherapy service, provided by the ISM Members Fund, which allows members to seek quick, expert intervention for muscle and joint problems directly from a senior chartered physiotherapist.

Noise-induced hearing loss is another common issue for music teachers. Although it is 100% irreversible, it is also 100% preventable. The Musicians’ Hearing Health Scheme from Help Musicians offers music teachers audiological assessments and custommade hearing protection, and ISM members can access a 25% discount on the scheme.

It is good practice to keep a record of relevant qualifications you hold and professional development you undertake.

• ISM Trust

• ISM

• Contact the ISM legal team

• How to… Begin teaching music

• Contracts

• Setting and negotiating fees

• Safeguarding and criminal record checks

• Insurance

• Tax

• Financial advice

• Record-keeping

• Data protection

• Finding work and promoting yourself

• Postgraduate teacher training courses and funding

• Health and wellbeing

The Independent Society of Musicians (ISM) is the UK’s professional body for musicians and a subject association for music. Founded in 1882, the ISM is dedicated to promoting the importance of music, defending the rights of those working in the music profession and protecting music education.

The ISM supports over 11,000 members across the UK and Ireland with unrivalled legal advice and representation, comprehensive insurance and specialist services.

ISM members come from all areas of the music profession and from a wide variety of genres and musical backgrounds. As well as working musicians, membership also includes part-time and full-time students and retired musicians.

The ISM campaigns tirelessly in support of musicians’ rights, music education and the profession as a whole. The ISM is a financially independent notfor-profit organisation with no political affiliation and this independence allows the freedom to campaign on any issue affecting musicians.

If you would like to find out more about the ISM or join as a member, visit the ISM website

The ISM Trust is the sister charity of the Independent Society of Musicians (ISM). It supports and empowers musicians with high quality professional development. Through events, training and awardwinning resources, the Trust equips music professionals with the tools and knowledge they need to succeed in their career. We cover key topics from legal and business, copyright and royalties, and finance and tax, to music teaching, diversity and inclusion, and musicians’ health. Our projects are regularly delivered in partnership with leading experts, charities and organisations.

Help us to make the future of music by becoming a Friend of the ISM Trust, making a donation or leaving a legacy.

ismtrust.org/support-us

This pack is a useful guide for instrumental and vocal teachers, whether you are employed, working freelance in schools or teaching privately. It covers issues which all music teachers need to know about, including contracts, fees, safeguarding, employment status, tax, finding work and professional development, as well as looking after your health and wellbeing.