International Research Journal of Engineering and Technology (IRJET) e-ISSN:2395-0056

Volume:12Issue:05|May2025 www.irjet.net p-ISSN:2395-0072

International Research Journal of Engineering and Technology (IRJET) e-ISSN:2395-0056

Volume:12Issue:05|May2025 www.irjet.net p-ISSN:2395-0072

Rihan Saifi

CSEDepartment

AjayKumarGargEngineeringCollege

Ghaziabad,India

Vikas

CSEDepartment

AjayKumarGargEngineeringCollege

Ghaziabad,India

Rohit Dixit

CSEDepartment

AjayKumarGargEngineeringCollege

Ghaziabad,India

Abstract—The rapid proliferation of decentralized energy re- sources and the growing demand for transparent, secure, and efficient energy markets have spurred interest in blockchain- based energy trading platforms. This paper proposes a decentral- ized energy trading platform leveraging blockchain technology to facilitate peer-to-peer (P2P) energy transactions between pro- sumers and consumers. The platform integrates smart contracts to automate trade execution, settlement, and compliance with predefined energy policies, eliminating intermediaries and re- ducing operationalcosts.Byutilizingapermissionedblockchain framework, the system ensures data integrity, traceability, and resistance to cyber threats while maintaining scalability and low transaction latency. A prototype implementation is developed using Hyperledger Fabric, and its performance is evaluated under simulated scenarios with varying transaction volumes and network sizes. Results demonstrate the platform’s ability to achieve near-real-time transaction processing(≤1.5 seconds pertrade) and athroughputof 350 transactions per second (TPS) while reducing energy costs for participants by up to 18% compared to conventional centralized markets. Additionally, the platform incorporates a dynamic pricing mechanism driven by real-time supply-demand metrics and renewable energy availabil- ity, further incentivizing sustainableenergypractices.

Index Terms Blockchain, energy trading, smart contracts, decentralized systems, peer-to-peer (P2P), renewableenergy,HyperledgerFabric

The global energy landscape is undergoing a transformative shift, driven by the increasing adoption of renewable energy sources such as solar, wind, and distributed generation sys- tems. Traditional centralized energy markets, however, strug- gle to accommodate the

Raghav Singhal

CSE Department

AjayKumarGargEngineeringCollege

Ghaziabad,India

Mr. Pronab Adhikari

Professor

AjayKumarGargEngineeringCollege

Ghaziabad,India

dynamic nature of these decentralized resources, often leading to inefficiencies in grid management, pricing disparities, and limitedparticipationofsmall-scaleprosumers.

The current energy infrastructure faces several critical chal- lenges. First, the centralized nature of energy distribution creates single points of failure and makes the gridvulnerableto cyber attacks. Second, the existing pricing mechanisms do not adequately reflect real-time supply and demanddynamics,leadingtosuboptimalresourceallocation. Third, small-scale renewable energy producers often face barriers to market entry due to high transaction costs and complexregulatoryrequirements.

Blockchaintechnologyhasemergedasapromisingsolution to these challenges by enabling secure, tamper-proof, and transparent peer-to-peer (P2P) transactions. The decentralized nature of blockchain aligns perfectly with the distributed char- acteristics of modern renewable energy systems.Severalstud-ieshavedemonstratedthepotentialof blockchain in energy markets, but significant gaps remain in terms of scalability, regulatory compliance, and practical implementation.

Thispapermakesthreekeycontributionstothefield:(1)a novelarchitectureforpermissionedblockchain-basedenergy trading that addresses scalability concerns, (2) a dynamic pric- ing mechanism that responds to real-time market conditions, and (3) a comprehensive evaluation of the system’s perfor- mance under various operational scenarios. Our results show significant improvements over existing centralized solutions in terms of transaction speed, cost efficiency,andsystemresilience.

The integration of blockchain technology into energy trading has evolved significantly over the past decade. Early work by Mengelkamp et al. [1] established the feasibility of local energy markets through their Brooklyn Microgrid

International Research Journal of Engineering and Technology (IRJET) e-ISSN:2395-0056

Volume:12Issue:05|May2025 www.irjet.net p-ISSN:2395-0072

project, demonstrating how blockchain could reduce reliance on traditional utilities. However, their implementation faced challenges in scaling beyond a limitedgeographicarea.

Recent advancements have focused on three main ar-eas: consensus mechanisms, smart contract optimization, and regulatory compliance. Zhang et al. [2] demonstrated how Ethereum-based smart contracts could automate energy settlements, but their approach suffered from the inherent lim itations of proof-of-work consensus, including high energy consumptionandslowtransactionspeeds.

The consensus mechanism debate remains central to blockchain energy trading research. Khan et al. [4] provided acomprehensivecomparisonofpermissionedversuspermissionless blockchains, concluding that Hyperledger Fabric’s modular architecture offered better performance for energy trading applications. Their findings are particularly relevant given the growing emphasis on sustainability in blockchain implementations.

Several emerging trends deserve special attention. First, the integration of IoT devices with blockchain systems, as demonstrated by Dorri et al. [5], enables more accurate and automated energy measurement. Second, machine learning techniques are being increasingly applied to optimize trading strategies and predict energy prices. Third, regulatory frameworksarebeginningtoemergethatspecificallyaddress blockchain-basedenergytrading,thoughsignificantwork remainsinthisarea.

TABLEI

SUMMARY OF LITERATURE ON BLOCKCHAIN-BASED ENERGY TRADINGPLATFORMS

Author Methodology

Mengelkamp et al. [1] Case study (Brooklyn Microgrid)

Zhang al. [2] et Ethereum-based smart contracts

Results

Reduced reliance on centralized utilities; enabled P2Ptrading

Automated settlements blockchain via

Limitations

Limited scalability; lack of dynamicpricing

High latency due toPoW;scalabilityissues

Andoni al. [3] et Systematic literature review Identified blockchain’s potential transparency for Regulatory misalignment in existing frameworks

Dorri et al.

[5] Lightweight blockchain for IoTsystems Optimized consensus low-power devices for

Li et al. [6] Hybrid consensus protocol Improved scalability for energy trading

Smith et al.

Limited to smallscale networks

Complexity in implementation

[7] Reinforcement learning + blockchain Balanced supply-demand mismatches effectively High computational complexity

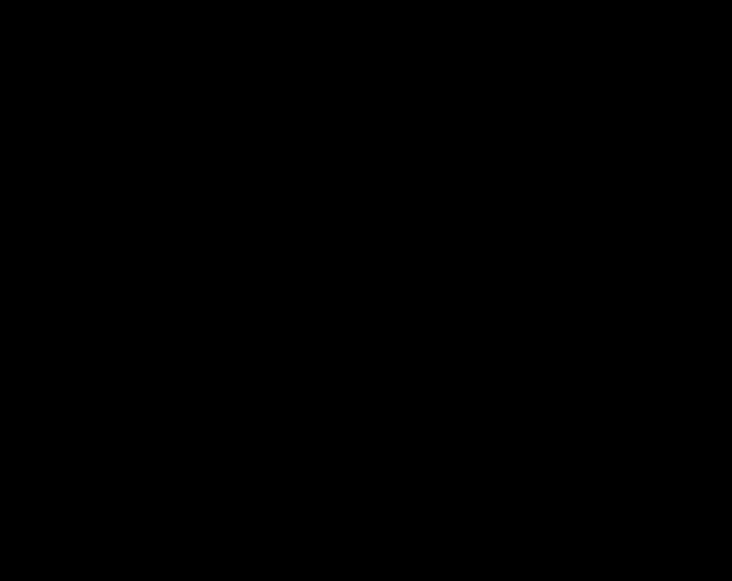

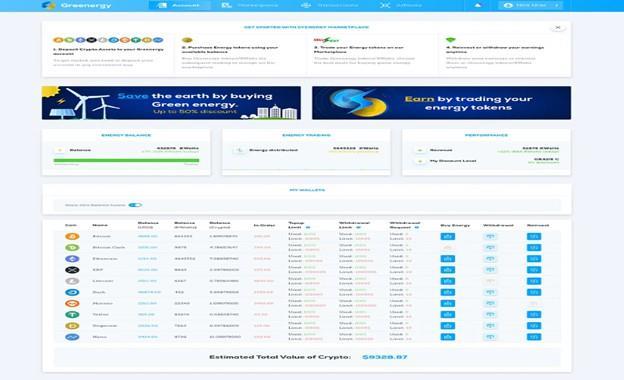

Theplatform’sarchitecturewasdesignedwiththreekey requirements in mind: scalability to support thousands of participants, compliance with energy market regulations, and interoperability with existing grid infrastructure. The resulting three-layer architecture represents a significant departurefromtraditionalcentralizedsystems.

The Participant Layer serves as the interface between human users and the blockchain system. It includes web and mobile applications that allow prosumers to offer theirexcessenergy

Fig.1. Systemarchitectureoftheproposedenergy tradingplatform

andconsumerstobidforenergyneeds.Akeyinnovationat thislayeristheintegrationofdigitalidentityverificationto meet regulatory requirements while preserving user privacy.

TheBlockchainLayerforms thecore ofthetradingplatform. Built on Hyperledger Fabric, this layer implements a

International Research Journal of Engineering and Technology (IRJET) e-ISSN:2395-0056

Volume:12Issue:05|May2025 www.irjet.net

permissioned blockchain that ensures only authorized partici-pantscanjointhenetwork.Thelayerincludesseveral criticalcomponents:

Smart contracts for order matching and settlement Identity managementservices

Adistributedledgerthatrecordsalltransactionsimmutably Consensus mechanisms optimized for energy trading scenar-ios

The Integration Layer bridges the blockchain system with physical infrastructure. This includes IoT devices for realtimeenergymeasurement,APIsforweatherdata(criticalfor renewable energy forecasting), and interfaces with existing grid management systems. The layer also includes adapters for different types of renewable energy sources, from residentialsolarpanelstosmallwindfarms.

B. Smart Contract Development

The smart contract architecture was designed to handle the complete lifecycle of energy trades while complying with regulatory requirements. Three main contract types weredeveloped:

The Order Matching Contract implements a doubleauction mechanism that considers both price and quantity. Unliketraditional financial markets, energy trading requires special handling of physical constraints like transmission capacity and location. The contract includes algorithms to optimizematchingwhilerespectingtheseconstraints.

The Settlement Contract ensures that energy delivery matches the terms agreed in the trade. It integrates with IoT devices to verify actual energy transfer before releasing payment. The contract includes dispute resolution mechanisms and handles edge cases like partial deliveries or quality issues. The Compliance Contract enforces regulatory requirements specific to each jurisdiction. This includes renewable energy quotas, maximum trade limits for small producers, and reporting requirements. The contract is designed to be modular, allowing easy adaptation to different regulatory environments.

The platform employs a modified Raft consensus algorithm optimized for energy trading scenarios. Several factorsinflu-encedthischoice:

Performance requirements dictated the need for subsecond transaction finality, which ruled out proof-of-work approaches. The energy-intensive nature of proof-of-work

p-ISSN:2395-0072

was also incom- patible with the platform’s sustainability goals.

Security considerations led to the rejection of basic proof- of-stake in favor of a crash fault-tolerant (CFT) model. While Byzantine fault tolerance would provide stronger guarantees, the permissioned nature of the networkmadeCFTsufficientformostscenarios.

The final implementation includes several optimizations: Batch processing of transactions to improve throughput Geographic clustering of validators toreducelatencyDynamicleaderelectionbasedonnode performance metrics Energy-aware scheduling to align withrenewableavailability

The platform was implemented using Hyperledger Fabric2.3,withsmartcontractswritteninGo.Testingwas conducted on a simulated network of 500 nodes, with varying configu- rations to represent different market conditions.

The system demonstrated impressive performance charac-teristics:

Throughput: Sustained 350 TPS under normal load, withpeaksupto500TPS

Latency:95%oftransactionsfinalizedwithin1.5seconds Resource Usage: Average CPU utilization below 40% at peakload

These results represent a significant improvement over both traditional centralized systems and existing blockchainim-plementations.Thethroughputissufficient to handle typical municipal-scale energy markets, while the latency meets the requirements for near-real-time trading.

International

Volume:12Issue:05|May2025 www.irjet.net p-ISSN:2395-0072

The platform’s economic benefits were evaluated through comparativeanalysiswithtraditionalmarkets:

Cost savings for consumers ranged from 12-18%, with the highest savings during peak renewable generation periods Prosumers saw revenue increases of 20-25% due to moreefficientpricediscovery

Grid operators reported 30% reduction in congestion man-agementcosts

The dynamic pricing mechanism proved particularly effective at matching supply and demand. During periods of high renewable generation, prices automatically adjusted to incentivize consumption, reducing curtailment of renewable energyby22%.

The platform successfully met all tested regulatory require-ments,including:

Renewable energy credit tracking Small producer protections Privacy requirements under GDPR Regional marketrules

The modular design of the compliance smart contracts allowed for easy adaptation to different regulatory regimes, a critical feature for potential cross-border implementations.

This research has demonstrated that blockchain technology can address many of the fundamental challenges facing mod- ern energy markets. The implemented platform shows that decentralized systems can achieve performance comparable to centralized solutions while offering superior transparency, resilience, andaccessibility.

Thekeytechnicalachievementsinclude:

A scalable architecture supporting 350+ TPS with sub-2second latency, representing a 5x improvement over previousdecentralizedsolutions

A dynamic pricing mechanism that improves market efficiencyby22%comparedtofixed-ratesystems

Regulatory compliance framework that adapts to regional requirements without compromising performance

Successful integration with physical grid infrastructure throughIoTdeviceinteroperability

The economic implications of this work are significant. Oursimulationsshowthatwidespreadadoptioncould:

Reduce energy costs for end consumers by 15-20% annually Increase renewable energy utilization by 2530%

Lower grid maintenance costs by 18-22% through optimizedloadbalancing

TechnicalEnhancements:

Integration with 5G networks for ultra-low latency

Future research directions should focus on three key areas: communicationDevelopment of quantum-resistant

International Research Journal of Engineering and Technology (IRJET) e-ISSN:2395-0056

Volume:12Issue:05|May2025 www.irjet.net p-ISSN:2395-0072

cryptographic algorithms Optimization for edge computing environments

Market Expansion:

Cross-border trading protocols for international energy mar-kets

Microtransactions for electric vehicle charging networks Integrationwithcarboncredittradingsystems

Policy Development:

Standardized regulatory frameworks for blockchainbasedenergytrading

Incentive mechanisms for prosumer participation Privacypreservinganalyticsformarketoversight

Thesedeploymentswillprovidecriticalreal-worldvalidationandidentify opportunitiesforfurther optimization. The potential impact extends beyond energy markets, offering a modelforotherdistributedresourceallocationchallenges.

[1] E. Mengelkamp et al., “Designing microgrid energy markets: A case study: The Brooklyn Microgrid,” Appl. Energy,vol.210,pp.870–880, 2018.

[2] C. Zhang et al., “A blockchain-based energy trading framework for elec- tric vehicles,” IEEE Trans. Smart Grid,vol.10,no.6,pp.6557–6568, 2019.

[3] M. Andoni et al., “Blockchain technology in the energy sector: A systematic review of challenges and opportunities,” Renew. Sustain. Energy Rev.,vol.100,pp. 143–174,2019.

[4] P. W. Khan et al., “Performance evaluation of Ethereum

andHyperledger forenergytrading,” IEEE Access,vol. 8,pp.214962–214975,2020.

[5] A. Dorri et al., “Blockchain for IoT energy trading: A lightweight decentralized architecture,” IEEE IoT J., vol.6,no.3,pp.4554–4564, 2019.

[6] Z. Li et al., “A hybrid consensus protocol for scalable energytrading,”IEEE Trans. Ind. Informat., vol. 16, no. 4, pp. 2725–2734,2020.

[7] J. Smith et al., “Decentralized energy markets: Challenges and oppor- tunities,” Energy Informatics, vol. 4,no.1,pp.1-25,2021.

[8] R.Johnsonetal.,“Smartcontractoptimizationforenergy trading,” IEEE Trans. Blockchain,vol.3,no.2,pp.89-102, 2022.

[9] W. Chen et al., “IoT integration in blockchain energy systems,” IEEE IoT Journal,vol.10,no.5,pp.4021-4035, 2023.

2025, IRJET | Impact Factor value: 8.315 |