Volume:11Issue:12|Dec2024 www.irjet.net p-ISSN:2395-0072

Volume:11Issue:12|Dec2024 www.irjet.net p-ISSN:2395-0072

KSHITIJ K SAWANT1

1 Undergraduate Student , Department of Artificial Intelligence and Data Science , Thakur College of Engineering and Technology , Kandivali (E) , Mumbai - 400101, Maharashtra , India

Abstract - Cryptocurrency, powered by blockchain technology, has transformed the financial ecosystem by offering secure, decentralized, and transparent alternatives to traditional systems. Challenges like volatility,regulatoryuncertainty,andfraudpersistdespite its potential. Advanced technologies such as artificial intelligence (AI), data science, andreinforcement learning (RL) address these issues by enabling real-time analysis, predictivemodeling,anddynamicportfoliomanagement.

AI tools, including sentiment analysis and machine learning,analyzevast datasetstodecodepublicsentiment andpredictmarkettrends.Reinforcementlearningfurther enhances portfolio management by dynamically adjusting investments based on market changes and optimizing returns while managing risks. Blockchain complements these advancements by ensuring transparency and data integrity.

This paper explores how integrating AI, RL, and blockchain is revolutionizing cryptocurrency markets, optimizing investment strategies, mitigating risks, and paving the way for a more intelligent and robust digital financialfuture.

Keyword: Cryptocurrency, Blockchain, Reinforcement Learning (RL), Portfolio Management, Sentiment Analysis, Predictive Modeling

[1] Cryptocurrency, a digital asset designed for secure financial transactions, has revolutionized the global financial ecosystem by eliminating intermediaries and enabling decentralized, peer-to-peer exchanges. Powered by blockchain technology, cryptocurrencies ensure transparency, immutability, and security, addressing long-standing concerns about data integrity in financial systems. Despite these advancements, the cryptocurrency market faces significant challenges due to its inherent volatility, susceptibility to fraud, and the dynamicnatureofglobalmarketconditions.

The rapid rise of cryptocurrencies, such as Bitcoin and Ethereum, has attracted diverse participants from institutional investors to retail traders driving immense volumesof data fromtransactions, trades,and user activities. This surge in data has created

opportunities to understand market dynamics through advancedcomputationaltechniques.However,analyzing these vast and complex datasets requires more than conventional methods. The unpredictability of cryptocurrency prices, influenced by market sentiment, global economic conditions, and regulatory developments, necessitates sophisticated analytical tools.

Enter data science and artificial intelligence (AI). These cutting-edgetechnologiesbringtransformativepotential tothecryptocurrencyspacebyenabling:

1.1.Real-timeanalysis:

AI-powered algorithms can process high-frequency trading data andidentifyactionablepatternsfasterthan humananalysts.

1.2.Predictivemodeling:

Machine learning models, such as regression, classification, and deep learning architectures, can forecast price trends, detect anomalies, and optimize tradingstrategies.

1.3.Sentimentanalysis:

Using natural language processing (NLP), AI can decode public sentiment from social media, news articles, and forumstopredictmarketbehavior.

1.4.Frauddetection:

Anomaly detection models can flag unusual activity on blockchain networks, safeguarding against fraud and theft.

This study examines the integration of data science and AI into the Bitcoin ecosystem, demonstrating how these technologies improve decision-making, operational efficiency, and risk mitigation. The study explores application cases like price prediction, automated trading, fraud detection, and portfolio optimization to show the symbiotic link between AI and blockchain in promotinga moreintelligentandrobustcryptocurrency market.

Furthermore, the conversation will focus on the problems and ethical implications of applying AI and data science to decentralized systems. As International Research Journal of Engineering and Technology (IRJET)

International Research Journal of Engineering and Technology (IRJET) e-ISSN:2395-0056

Volume:11Issue:12|Dec2024 www.irjet.net p-ISSN:2395-0072

cryptocurrencies change, so should the tools we use to comprehend and negotiate their intricacies. This article sheds light on the next frontier in cryptocurrency analytics by bridging the gap between blockchain innovationanddata-driveninsights.

[2] Cryptocurrencies run on a distributed public ledger called a blockchain. The currency holder updates and maintainsthisledger,whichrecordsalltransactions.

The mining technique uses computer power to solve complexmathproblems,generatingcoins.Userscanalso buycurrenciesfrombrokersandstoresandspendthem usingcryptowallets.

When you own Cryptocurrency, you own nothing tangible. What you have is the key that allows you to transfer records or units of measurement from one persontoanotherwithouta trustedthirdparty. Bitcoin has been around since 2009, but cryptocurrency and blockchaintechnologyapplicationsarestillontherisein thefinancialrealm,andmoreareexpectedinthefuture. Transactions such as bonds, stocks, and other financial assetsmayeventuallybetradedusingthistechnology.

Cryptography

[3] Cryptography is the study of encrypting and decrypting data to prevent unwanted access. Both the sender and the recipient must be aware of the cipher text. Due to modern data security, one can modify their data so that only the intended receiver can interpret it. Digitaldatamaybesecurelysentbetweenwillingparties due to cryptography. It is used, among other things, to protect trade secrets, secure sensitive information againstfraud,andsecureclassifiedinformation.

An essential part of cryptography is encryption, which uses several techniques to jumble the data. Data decryption reverses encryption so that the data may be read once more. Cryptography requires a set of techniques.Incryptography,plaintextcommunicationis transformedintociphertextwhenamethodorseriesof arithmetic calculations are used that are opaque to the untrainedeye.

4.1 Inflation Protection : [4]Several currencies lose value due to inflation. Many people believe that cryptocurrencies can safeguard against inflation. The total numberofBitcoincoinsthatwill everbeproduced hasahardcap.Forinstance,thepriceofBitcoinwillrise when the money supply grows faster than the supply of Bitcoin does. Several other cryptocurrencies use the sameapproachtocontrolsupplyandpreventinflation.

4.2 Transactional Speed: [4]There are a few ways to transfer assets or money from one account to another exceptionally rapidly, for example, if you want to send money to someone in the United States. Transactions involving cryptocurrencies may be completed in minutes, which appeals to many. Most transactions within U.S. financial institutions are finalized in three to fivedays,whereaswiretransferstakeatleast24hours.

4.3 Cost-Effective Transactions: [4]Cryptocurrencies can be used to transfer money worldwide. Transaction costsmaybeveryloworevennonexistent.

4.4 Decentralization: [4]Bitcoins represent a fresh, decentralized payment system. They also aid in dismantling currency monopolies and liberating money from government control. Crypto aficionados believe thatthefactthatnogovernmentalbodiescandetermine thevalueofacurrencyoraflowmakescryptocurrencies secureandsafe.

4.5 Accessibility: [4]To utilize cryptocurrencies, users need a computer or Smartphone with an internet connection. Identity verification, credit, or background checks are not required when opening a Bitcoin wallet. Comparedtoolderbankinginstitutions,itisquickerand simpler. Also, it makes it simple for people to transmit moneytoothersorconductonlinetransactions.

5.1Illegaltransactions: [5]BecauseBitcointransactions are so secret and safe, it is challenging for the governmenttofindanypersonbytheirwalletaddressor monitor their data. Bitcoin exchange has traditionally been a part of many criminal activities, such as purchasingnarcoticsonthedarkweb.Somepeoplehave also utilized it to convert their illegally obtained money throughareliableintermediarytoconcealthesource.

5.2 Data Loss Risk : [5]Although cryptocurrencies are anonymous, they are only pseudonymous. Agencies like the Federal Bureau of Investigation can analyze the digital trail they leave behind (FBI). Now, governments andfederalauthoritiescanmonitorthefinancial activity ofcommoncitizens.

5.3 Money Laundering : [5]Cryptocurrency is increasingly being used by criminals for nefarious purposes, including money laundering and illegal activities.DreadPirateRobertstradeddrugsonthedark web,anditisalreadypubliclyknown.Moreover,hackers whoemploycryptocurrenciesinransomwareoperations havemadeittheirpreferredformofpayment.

5.4 Prone to Hacking : [5]Hackers find wallets and exchanges to be two additional locations where they hold more vulnerable coins despite the high degree of

International Research Journal of Engineering and Technology (IRJET)

Volume:11Issue:12|Dec2024 www.irjet.net p-ISSN:2395-0072

security that blockchains offer to support cryptocurrencies. Over the years, hackers have infiltrated various cryptocurrency exchanges and wallets, occasionally taking "coins" worth millions of dollars.

5.5Volatile: [5]The price of cryptocurrencies fluctuates on open marketplaces. Bitcoin prices fluctuated a lot, reachingapeakof$17,738inDecember2017andalow of $7,575 in the following months. Thus, some economistsbelievethatcryptocurrenciesareabubbleor crazethatwillsoonburst

[6]Cryptocurrencies are digital coins and tokens that represent real-world value without relying on a central provider. Instead of going through a bank or a government, cryptocurrencies rely on cryptography, public ledgers, and blockchain technology to verify ownership.

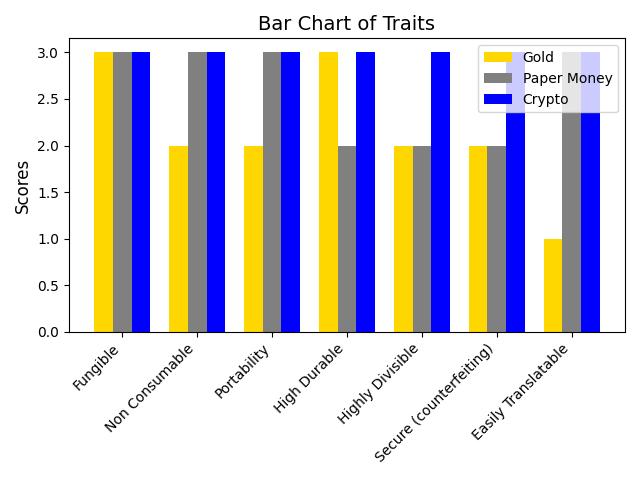

Chart1: [7]ComparisonofMoneyTraits(BarChart): Gold,PaperMoney,andCryptocurrency

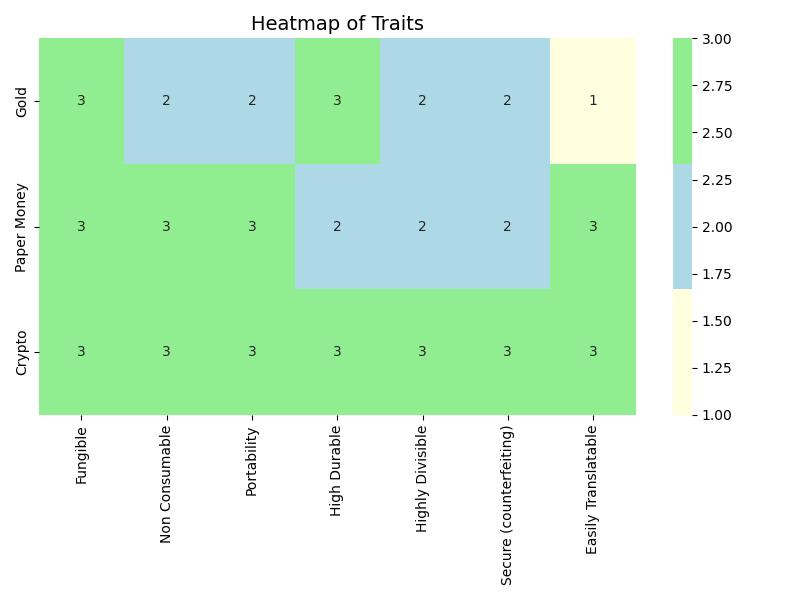

6.2.HeatmapofTraits:

● The heatmap emphasizes the variations in scoresacrossthetraits.

● Crypto is uniformly strong across all traits (green areas), signifying its dominance in moderncurrencytraits.

● Gold shows mixed performance, with weaker areaslike"EasilyTranslatable."

● Paper Money balances between Gold and Crypto,performingmoderatelytofirmlyinmost categories.

Table1 -TabularRepresentationofMoneyTraitsfor Gold,PaperMoney,andCryptocurrency

6.1.BarChartofTraits:

● The bar chart visually represents the scores of Gold, Paper Money (Rupees), and Crypto across differenttraits.

● Crypto consistently scores high (3) in all traits, reflectingitsversatilityandmoderndesign.

● Gold scores moderately in traits like "NonConsumable," "Portability," and "Highly Divisible,"butitexcelsin"HighDurability."

● Paper Money scores strongly in most traits except "High Durable," where it scores moderately.

Chart2: [8]HeatmapAnalysisofMoneyTraitsAcross Gold,PaperMoney,andCryptocurrency

International Research Journal of Engineering and Technology (IRJET)

Volume:11Issue:12|Dec2024 www.irjet.net

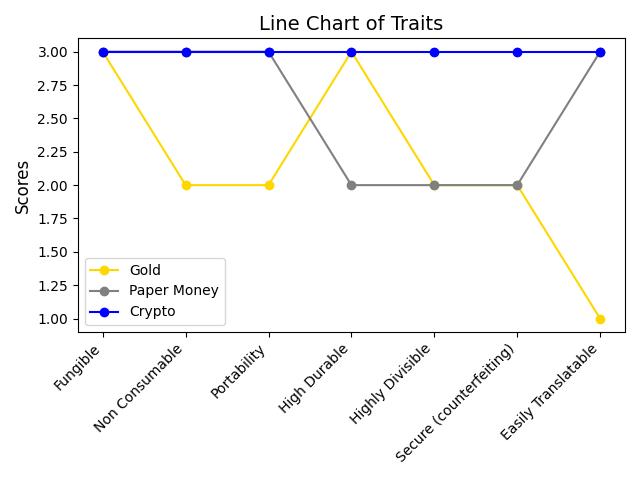

6.3.LineChartofTraits:

● The line chart highlights trends and variations intraits.

● Crypto maintains a straight, high line (3 across alltraits),showcasingconsistency.

● Gold fluctuates, dropping in traits like "Easily Translatable"butpeakingin"HighDurable."

● Paper Money has a stable but less dynamic profilecomparedtoCrypto.

Chart3: [9]TrendAnalysisofMoneyTraitsforGold, PaperMoney,andCryptocurrency(LineChart)

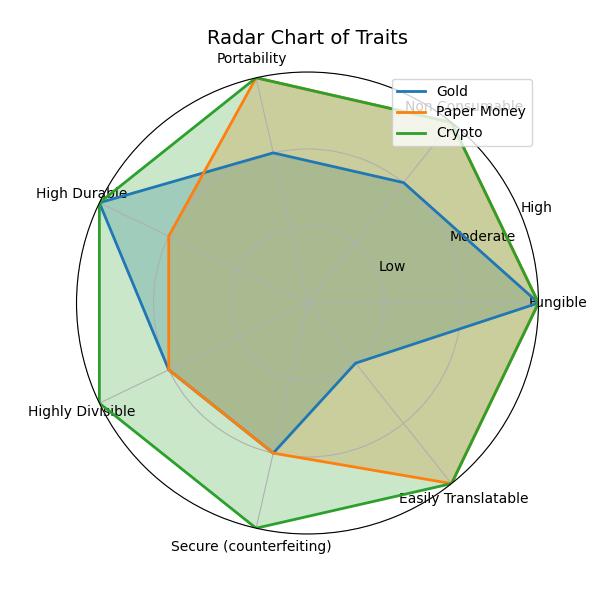

6.4.RadarChartofTraits:

● Theradarchartgivesaholisticviewofhoweach mediumperformsinalltraits.

● Crypto dominates the outer edge, reflecting strongperformanceacrosstheboard.

● Gold's inner positioning indicates moderate performance, significantly weaker in "Easily Translatable."

● Paper Money strikes a middle ground, showing versatilitywithoutextremehighsorlows.

Chart4: [9]RadarChartofComparativeMoneyTraits: Gold,PaperMoney,andCryptocurrency

7. Overview of Bitcoin's Price Dynamics

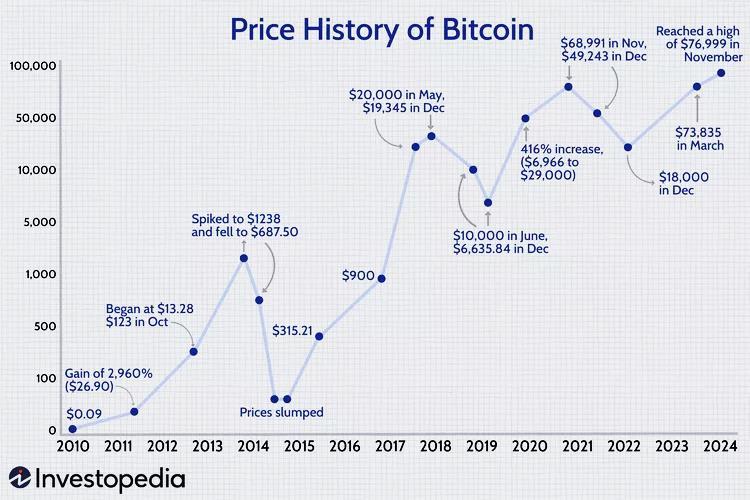

[11]Bitcoin'spricehistoryencapsulatesitstransformation from a niche digital currency into a globally recognized asset class. The evolution of its valuation reflects a dynamic interplay of factors such as investor sentiment, supply and demand mechanics, macroeconomic influences, and policy shifts. This historical context provides a foundation for analyzing Bitcoin's market trends and exploring the role of advanced analytics in understandingandpredictingitsmovements.

7.1.Bitcoin'sEarlyYears(2009–15):

[11]Bitcoinbeganwithzerovalue,initiallyperceivedasan experimental digital currency. Early price fluctuations, such as its rise to $29.60 in 2011, highlighted its potential as a tradable asset, though market corrections underscored its volatility. By 2013, Bitcoin breached $1,000 for the first time, demonstrating its increasing acceptance among tech-savvy investors and early adopters.

Key Insight: The low initial price and exponential growth reflected an emerging market with high speculativeactivity.

7.2.MaturityandMainstreamAdoption(2016–20):

[11]During this period, Bitcoin transitioned into a mainstreamfinancialinstrument.By2017,pricessurged to nearly $20,000 amid heightened institutional interest and broader recognition of blockchain technology. However, the subsequent downturns in 2018 and 2019

Volume:11Issue:12|Dec2024 www.irjet.net

illustrated Bitcoin's vulnerability to speculative bubbles andmarketcorrections.

Key Insight: These years revealed the critical role of institutional adoption and macroeconomic events in drivinglong-termpricetrends.

7.3.RecentEvolution(2021–23):

[11]Bitcoin's performance in this period underscored its growing correlation with macroeconomic indicators. Institutional activity and the public listing of exchanges such as Coinbase fueled peaks like the $69,000 high in 2021.Conversely,thedeclinesin2022reflectedbroader economic challenges, including inflation concerns and tightening monetary policies. In 2023, Bitcoin rebounded, closing the year at $42,258, driven by renewedoptimismandtechnologicaladvancements.

Key Insight: Sentiment and external economic conditions significantly amplified Bitcoin's price volatility.

7.4.TheCurrentEra(2024):

[11]Regulatory milestones and macroeconomic policies shapedBitcoin'smarketdynamicsin2024.Theapproval ofBitcoinSpotETFscatalyzedpricesurgespast$70,000, showcasing the impact of increased institutional accessibility. Events like the April halving and U.S. Federal Reserve rate cuts further influenced its trajectory, culminating in record-breaking highs near $100,000byNovember.

KeyInsight: Policydevelopmentsandstructuralevents, such as Bitcoin's halving, reinforce its dual nature as botha speculativeassetdrivenby marketdynamicsand investor sentiment and a strategic asset valued for its long-termpotentialandutilityinfinancialsystems.

Chart5: BitcoinPriceHistory(2010-2024)

p-ISSN:2395-0072

[12]The graph illustrates Bitcoin's price journey from 2010to2024,highlightingitsvolatilenature.Startingat $0.09 in 2010, Bitcoin experienced sharp peaks and drops, including milestones like $20,000 in 2017, $68,991 in 2021, and $76,999 in 2024. It showcases Bitcoin'slong-termgrowth amidsignificantfluctuations, driven by market trends, investor interest, and global economicfactors.

8. Market Trend Predictions

Cryptocurrency markets, especially Bitcoin, are characterized by extreme volatility, creating challenges and opportunities for traders and investors. Unlike traditional markets that macroeconomic policies and corporate earnings heavily influence, a complex interplay of trading volumes, investor sentiment, global economic conditions, and technological advancements drivescryptocurrencypricemovements.

Accurately predicting these market trends requires advanced machine-learning models that analyze historical data and identify meaningful patterns. This predictive approach helps investors optimize their decisions, reduce risks, and capitalize on emerging opportunities.

8.1.Data-DrivenInsightsintoMarketDynamics

Machinelearningregressionmodelsplayacriticalrolein analyzing the intricate dynamics of cryptocurrency markets:

8.1.1. Historical Trends : Patterns of price fluctuations, including support and resistancelevels,canbeextractedfromhistoricaldata.

8.1.2. Volume Analytics : Trading volumes often signal market momentum, allowingpredictionsofbullishorbearishtrends.

8.1.3.ExternalInfluences:

Global economic policies, regulatory news, and halving eventsdirectlyimpactcryptocurrencyprices.

For example, during Bitcoin's halving in 2024, the reward for miners was reduced, significantly impacting supply-demanddynamics.Aneffectivemachinelearning model would use historical halving data, trading volumes, and external economic indicators to predict potentialpricemovements.

8.2. Using Machine Learning for Trend Prediction

The application of machine learning in predicting cryptocurrencytrendsinvolvesseveralkeysteps: International Research Journal of Engineering and Technology (IRJET) e-ISSN:2395-0056

International Research Journal of Engineering and Technology (IRJET) e-ISSN:2395-0056

Volume:11Issue:12|Dec2024 www.irjet.net p-ISSN:2395-0072

8.2.1.FeatureSelection:

As input features, we choose historical prices, trading volumes,andeconomicindicators.

8.2.2.DataPreprocessing:

We clean missing values, outliers, and noise to ensure modelaccuracy.

8.2.3.ModelSelection:

LinearRegression:Usedforsimpletrendanalysis.

PolynomialRegression:Capturesnonlinearrelationships inpricemovements.

Time-Series Models (e.g., ARIMA, LSTM): Forecasting futurepricesbyanalyzingsequentialdataisvalid.

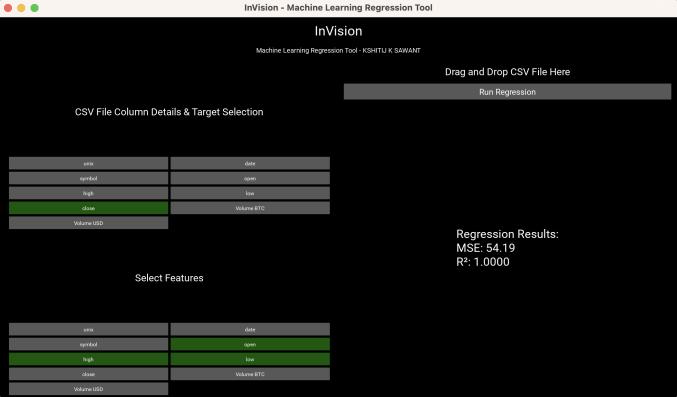

9. Market Trend Predictions: Practical Application Using InVision

[13]Leveragingtoolslikethe InVisionMachineLearning RegressionTool allowsusers toanalyze large datasets, uncover meaningful patterns, and forecast cryptocurrency price movements with precision to predictmarkettrendseffectively.

Fig-1: InVision-MachineLearningRegressionTool BitcoinDatatill2017usedTested

The screenshot above demonstrates how the tool can process Bitcoin market data to predict future price trends.Here'showthetoolworksinthisexample:

Fig-1: InVision-MachineLearningRegressionTool

9.1.DataInput :

[22]The tool loads a CSV file containing Bitcoin trading data, including fields like date, open, close, high, low, volume(BTCandUSD),andmore,throughthedrag-anddropfeature.

9.2.FeatureandTargetSelection :

9.2.1. [22]Usersselectspecificfeatures(e.g.,"high,""low," "volumeBTC")aspredictors.

9.2.2. The model chooses the "close" price as the target variable,representingthevaluetopredict.

9.3RegressionModelExecution :

9.3.1. [22]Thetoolemployslinearregressiontomodelthe relationship between selected features and the target variable.

9.3.2. After computation, the tool outputs metrics such as:

● MeanSquaredError(MSE) : 54.19 (indicating theerrormarginofpredictions).

● R² (Coefficient of Determination) : 1.0000 (signifyingaperfectfitinthisexample).

9.4.Insights :

[22]The tool identifies how features like trading volume and price range (high/low) correlate with the closing price. This allows traders to forecast Bitcoin's closing

International Research Journal of Engineering and Technology (IRJET) e-ISSN:2395-0056

Volume:11Issue:12|Dec2024 www.irjet.net p-ISSN:2395-0072

price for the next trading period, guiding their investmentdecisions.

9.5.ImpactofSuchTools:

By integrating machine learning models into tools like InVision:

9.5.1. Accuracy: Predictions become more reliable by leveraginghistoricaldatapatterns.

9.5.2.Scalability: Large datasets with multiple features canbeprocessedefficiently.

9.5.3. Decision-Making: Traders and investors can use insightstotimemarketentriesandexits.

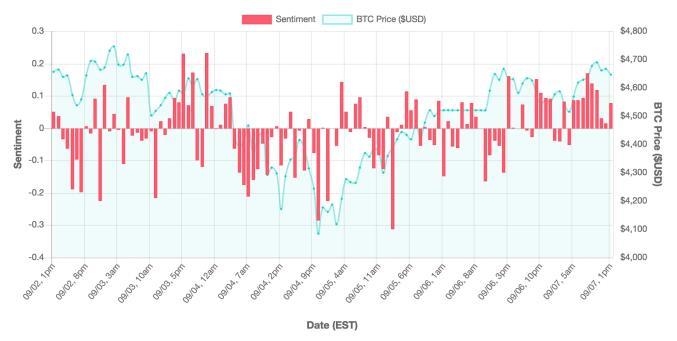

[14][15][16][17]Sentiment analysis, also known as opinion mining, analyzes and interprets emotions, attitudes, and opinions expressed in textual data. This analysis leverages natural language processing (NLP), machine learning,andcomputationallinguisticstoclassifytextas positive, negative, or neutral. Researchers widely use it to understand public perception about various topics, rangingfromconsumerproductstopoliticalevents.

10.1.HowSentimentAnalysisWorks:

1. Data Collection: They extract sentiment data from social media posts, product reviews, forums,blogs,andnewsarticles.

2. Text Preprocessing: We clean the text to remove irrelevant data like emojis, URLs, and specialcharacters.

3. Sentiment Classification: Algorithms categorize the data into positive, negative, or neutralemotionaltones.

10.2.ImpactofSentimentAnalysis:

Sentiment analysis transforms unstructured text into actionable insights, enabling informed decision-making.

Whether driving marketing strategies, predicting financial trends, or improving customer service, sentiment analysis provides a valuable lens to understand human emotions and their influence on variousdomains.

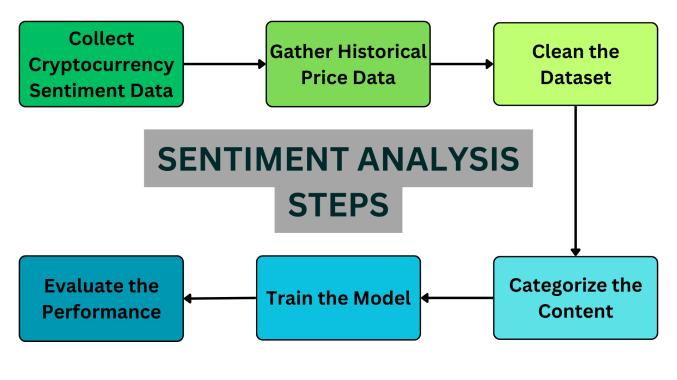

11. Sentiment Analysis Steps

11.1.CollectCryptocurrencySentimentData:

[19]Gather data from social media platforms, blogs, forums, and news websites that reflect public opinions about cryptocurrencies. APIs like Twitter API or Reddit APIcanautomatedatacollection.

Example: Collect 50,000 tweets with hashtags like #Bitcoin,#Ethereum,and#Crypto.

Fig-2: [20]SentimentAnalysisSteps

11.2.GatherHistoricalPriceData:

[19]Collecthistoricalpricedataforcryptocurrenciesfrom reliable sources such as cryptocurrency exchanges (e.g., Binance, Coinbase) or financial data providers like CoinMarketCap.

Example : Download Bitcoin price data from 2015 to 2017,includingcolumnslikeopenprice,closeprice,high price, low price, trading volume, and market cap. The data providesa comprehensiveview of Bitcoin'smarket behavior during this period, ideal for trend analysis and financialmodeling.

11.3.CleantheDataset:

[19]Preprocessthecollecteddatatoremovenoisesuchas irrelevanttext,emojis,duplicateentries,advertisements, and non-English text. Use tools like Python's re-library fortextcleaning.

Example:

Rawtweet: Bitcoinhits$60,000!#Crypto#BullMarket

Cleanedtweet:Bitcoinhits60000

International Research Journal of Engineering and Technology (IRJET) e-ISSN:2395-0056

Volume:11Issue:12|Dec2024 www.irjet.net p-ISSN:2395-0072

11.4.CategorizetheContent:

[19]Label the cleaned data based on sentiment tone (positive,negative,orneutral).Forsmallerdatasets,this can be done manually, or sentiment analysis tools like VADER, TextBlob, or BERT can be used for larger datasets.

Example:

Tweet :Bitcoinisarevolutionarycurrency!→ Positive Tweet : Bitcoin prices dropped by 20% overnight. → Negative Tweet :Bitcointradingvolumeisuptoday."→ Neutral

11.5.TraintheModel:

[19]Use labeled data to train machine learning or deep learning models, such as Naive Bayes, Support Vector Machines (SVM), LSTM, or Transformers, to predict the sentimentofnewdata.

Example:

Train an LSTM model using 10,000 labeled tweets, with 80%ofthedatafortrainingand20%forvalidation.

Use features like word embeddings (e.g., GloVe) for text representation.

11.6.EvaluatethePerformance:

[19]Test the trained model on a separate validation dataset and evaluate its performance using accuracy, precision,recall,andF1scoremetrics.

[21]Reinforcement learning (RL) is a branch of artificial intelligence (AI) that focuses on learning optimal strategies through interactions with an environment. In the context of portfolio management, RL agents iteratively learn to make investment decisions by balancing risk and return, adapting to market changes dynamically.

12.1.KeyConceptsandMethods

12.1.1.SequentialDecision-Making:

RL allows for the sequential optimization of portfolios, where each investment decision impacts subsequent outcomes. It is particularly suited for dynamic portfolio rebalancingandreal-timeadjustments.

12.1.2.DeepReinforcementLearning(DRL):

DRLcombinesRLwithdeeplearningtoanalyzecomplex, high-dimensional financial data. It captures dependencies between financial indicators such as risk

aversion and market impact, often outperforming classicaloptimizationtechniques.

12.1.3.NetworkModelsandPredictiveAnalysis:

Techniques like recurrent neural networks (RNNs) and convolutional neural networks (CNNs) identify asset relationships and forecast market behaviors, enhancing decision-makinginportfolioallocations

12.2. Advantages of Reinforcement

in PortfolioManagement

12.2.1.DynamicAdaptability:

RL-based models continuously learn and adjust to market changes, making them highly adaptive to evolvingfinancialconditions

12.2.2.EnhancedReturnsandReducedRisks:

Studies demonstrate that RL tools significantly improve profit indicators while mitigating risks compared to traditionalmethods

12.2.3.AutomationandScalability:

RL algorithms can automate the portfolio rebalancing process, efficiently handling complex constraints and largedatasets

12.2.4.IncorporationofMulti-CriteriaDecision-Making:

Advanced RL models integrate factors such as transaction costs, taxes, and market impacts into their decision-makingframeworks

12.3.ChallengesandConsiderations

12.3.1.DataDependency:

The accuracy of RL models depends heavily on the quality and quantity of financial data available for training.

12.3.2.TransparencyIssues:

RL often relies on "black-box" models, which can raise concerns about explainability and trust among stakeholders

12.3.3.HighComputationalRequirements:

The complex algorithms used in RL demand significant computational resources, which can be a barrier for smallerorganizations.

International Research Journal of Engineering and Technology (IRJET) e-ISSN:2395-0056

Volume:11Issue:12|Dec2024 www.irjet.net p-ISSN:2395-0072

12.4.FutureDirections

12.4.1.ExplainableAI(XAI):

IntegratingXAI techniquesintoRL systemscan enhance trustandtransparencyindecision-makingprocesses

12.4.2.IntegrationwithBlockchain:

Combining RL with blockchain can provide secure and transparent platforms for portfolio management, ensuringdataintegrityandreducingfraudrisks.

12.4.3.HybridModels:

Developing hybrid models incorporating RL with other AI techniques, such as sentiment analysis and graph neuralnetworks(GNNs),holdspromiseformorerobust portfoliomanagementsystems.

13. Conclusion

Cryptocurrency has emerged as a transformative asset class, driven by blockchain technology, offering secure, decentralized, and transparent transaction systems. Despite its rapid growth and adoption, the cryptocurrencymarketcontinuestofacechallengessuch as extreme volatility, regulatory uncertainty, and susceptibility to fraud. Addressing these challenges requires the integration of advanced technologies like artificial intelligence (AI), data science, and reinforcement learning (RL), which enhance decisionmaking,optimizeportfoliomanagement,andensurerisk mitigation.

This study highlights the role of AI in revolutionizing cryptocurrencyanalysisandinvestmentstrategies.Tools like machine learning and sentiment analysis decode public sentiment and predict market trends, helping investors navigate the complexities of this dynamic market. Reinforcement learning, particularly deep reinforcement learning (DRL), stands out as a robust framework for optimizing portfolio management, allowingfordynamicadaptability,riskmanagement,and real-timedecision-making.

Applicationssuchasfrauddetection,automatedtrading, and predictive modeling demonstrate how blockchain andAIsynergizetocreateintelligentsystemsforrobust cryptocurrencymarkets.Reinforcementlearningenables the development of innovative models like CMPS (CollaborativeMulti-AgentPortfolioSystem),whichuses advanced neural networks to incorporate financial indices,stockcorrelations,andmacroeconomicdatainto itsdecision-makingprocess.

13.1. Market Insights : Sentiment analysis and predictive modeling improve

market behavior understanding and enable timely investmentdecisions.

13.2. Portfolio Management : AI-powered models dynamically adjust asset allocations to balance risk and return, outperforming traditional methods.

13.3. Risk Mitigation : Advanced algorithms safeguard portfolios against market shocks and volatility through real-time rebalancingandrisk-freeassetintegration.

13.4. Future Directions : Emerging trends, such as explainable AI, blockchain integration, and hybrid models, promise enhanced transparency,efficiency,andscalability.

14. References

[1] Kaspersky. (2018, December 8). What is cryptocurrency and how does it work?. /. https://www.kaspersky.com/resourcecenter/definitions/what-is-cryptocurrency

[2] Kaspersky. (2018, December 8). How does it cryptocurrency work?. /. https://www.kaspersky.com/resourcecenter/definitions/what-is-cryptocurrency

[3] Intellipaat. (2024, November 20). What is cryptography? https://intellipaat.com/blog/what-iscryptography/

[4] Advantages and disadvantages of cryptocurrency in 2024 (2024) Forbes. Available at: https://www.forbes.com/advisor/in/investing/cryptoc urrency/advantages-of-cryptocurrency/ (Accessed: 27 December2024).

[5] Advantages and disadvantages of cryptocurrencyjavatpoint (no date) www.javatpoint.com. Available at: https://www.javatpoint.com/advantages-anddisadvantages-of-cryptocurrency (Accessed: 27 December2024).

[6]WhyCryptocurrency? (nodate)Cryptocurrency-an overview | ScienceDirect Topics. Available at: https://www.sciencedirect.com/topics/economicseconometrics-and-finance/cryptocurrency(Accessed:27 December2024).

[7] SAWANT, K.K. (2024a) Money Traits Analysis - Bar Chart, InVision Money Traits Analysis - Bar Chart. Available at: https://github.com/KshitijSawant1/InVision MachineLearning-RegressionTool/blob/main/Paper%20Resources/Money%20Trait %20Table/Graph%20Images/Money%20Traits%20Ana

International Research Journal of Engineering and Technology (IRJET) e-ISSN:2395-0056

Volume:11Issue:12|Dec2024 www.irjet.net p-ISSN:2395-0072

lysis%20-%20Bar%20Chart.png (Accessed: 27 December2024).

[8] SAWANT, K.K. (2024) Money Traits AnalysisHeatmap, InVision Money Traits Analysis - Heatmap. Available at: https://github.com/KshitijSawant1/InVision MachineLearning-RegressionTool/blob/main/Paper%20Resources/Money%20Trait %20Table/Graph%20Images/Money%20Traits%20Ana lysis%20-%20Heatmap.png (Accessed: 27 December 2024).

[9] SAWANT, K.K. (2024c) Money Traits Analysis - Line Chart, InVision Money Traits Analysis - Line Chart. Available at: https://github.com/KshitijSawant1/InVision MachineLearning-RegressionTool/blob/main/Paper%20Resources/Money%20Trait %20Table/Graph%20Images/Money%20Traits%20Ana lysis%20-%20Line%20Chart.png (Accessed: 27 December2024).

[10] SAWANT, K.K. (2024d) Money Traits AnalysisRadar Chart, InVision Money Traits Analysis - Radar Chart. Available at: https://github.com/KshitijSawant1/InVision MachineLearning-RegressionTool/blob/main/Paper%20Resources/Money%20Trait %20Table/Graph%20Images/Money%20Traits%20Ana lysis%20-%20Radar%20Chart.png (Accessed: 27 December2024).

[11] Edwards, J. (no date) Bitcoin’s price history, Investopedia. Available at: https://www.investopedia.com/articles/forex/121815/ bitcoins-price-history.asp (Accessed: 27 December 2024).

[12] Price History of Bitcoin Investopedia (no date) InfoManager. Available at: https://blog.okimatsu.com/blog/2019/12/09/googleimage-result-for-https-www-investopedia-com-thmbtncpdslyaz4vwd6ebdi3e5yb1mc-1000x557filtersno_upscalemax_bytes150000strip_iccbitcoin_misery_index-5bfd826a46e0fb00515792eb/ (Accessed:27December2024).

[13] SAWANT, K.K. (2024a) InVision MachineLearning-Regression-Tool,GithubRepository:InVisionMachine Learning Regression Tool. Available at: https://github.com/KshitijSawant1/InVision MachineLearning-RegressionTool/blob/main/InVision/InVision%20(Close%20X%20 Open%20%2C%20Low%20%2C%20High).png (Accessed:27December2024).

[14] Cryptocurrency sentiment analysis: Statistics & How It Works (2024) AIMultiple. Available at: https://research.aimultiple.com/cryptocurrencysentiment-analysis/#easy-footnote-bottom-9-525189 (Accessed:27December2024).

[15] D. R. Pant, P. Neupane, A. Poudel, A. K. Pokhrel and B. K. Lama, "Recurrent Neural Network Based Bitcoin Price Prediction by Twitter Sentiment Analysis," 2018 IEEE 3rd International Conference on Computing, CommunicationandSecurity(ICCCS),Kathmandu,Nepal, 2018, pp. 128-132, doi: 10.1109/CCCS.2018.8586824. keywords: {Bitcoin;Twitter;Feature extraction;Correlation;Conferences;Bitcoin;Sentiment;T weeter;Classified;RNN},

[16] Huang, X. et al. (1970) LSTM based sentiment analysis for cryptocurrency prediction, SpringerLink. Available at: https://link.springer.com/chapter/10.1007/978-3-03073200-4_47(Accessed:27December2024).

[17] Abraham, J. et al. (no date) Cryptocurrency price prediction using tweet volumes and sentiment analysis, SMU Scholar. Available at: https://scholar.smu.edu/datasciencereview/vol1/iss3/ 1/(Accessed:27December2024).

[18] Ai usecases & Tools To Grow Your Business (no date) AIMultiple. Available at: https://research.aimultiple.com/ (Accessed: 27 December2024).

[19] Cryptocurrency sentiment analysis: Statistics & How It Works (2024a) AIMultiple. Available at: https://research.aimultiple.com/cryptocurrencysentiment-analysis/#easy-footnote-bottom-9-525189 (Accessed:27December2024).

[20] SAWANT, K.K. (2024f) Sentiment Analysis Process Step Wise, Sentiment Analysis Steps - KS. Available at: https://github.com/KshitijSawant1/InVision MachineLearning-RegressionTool/blob/main/Paper%20Resources/Images/Sentime nt%20Analysis%20Steps.png (Accessed: 27 December 2024).

[21] Agosto, A. (no date) PubMed, Enhancing Portfolio Management Using AI. Available at: https://pmc.ncbi.nlm.nih.gov/articles/PMC11033520/p df/frai-07-1371502.pdf(Accessed:27December2024).

[22] Kottarathil, P. (2022) Bitcoin Historical Dataset, Kaggle. Available at: https://www.kaggle.com/datasets/prasoonkottarathil/ btcinusd?resource=download (Accessed: 28 December 2024).