Members’ Newsletter

October 2025

October 2025

Dear member,

As we go to press with this monthly update, we have no idea if the Seanad will accept amendments we have made to the Defamation Amendment Bill at Committee Stage on 1st October. The legal lobby have played a blinder in confining the debate to whether we have juries in defamation trials, despite the fact that jury trials make up less than 1% of the 300 defamation cases each year. The vast majority of cases are taken in a retail setting. We have made it clear to both the Department of Justice and to Commissioner Michael McGrath who oversees the Justice portfolio in Brussels that we will not rest until we see this defective legislation properly amended

Tuesday 7th October is budget day. Our pre-budget submission covers five essential themes for small businesses:

• The need to control business Costs

• The need to reform Indigenous Enterprise Policy

• The need for Skills and Training among our enterprise base

• The need to control public finances

• The need for adequate levels of affordable housing

We have seen very little indication of what any movement on the main areas that require action in this budget- there has been very little leaking. However, it does seem there may be some measures to reduce the price of apartments, and there may be something to encourage citizen uptake of exchange-traded funds.

We attended a Department of Social Protection information launch on Auto-Enrolment on 24th September. You can view the recording of the briefing HERE. The good news for employers is that admin will be very simple: AE requires only that employers (and/or their payroll provider) registers for AE, and sets up a variable direct debit. What happens then is that anyone who is eligible for the AE deduction, Revenue will process that deduction automatically. It will be similar to but separate from the automatic deduction of PAYE/PRSI/USC.

A key point that emerged from the AE briefing is that the qualification hurdle, which is €20,000 in income per annum, is analysed QUARTERLY. Therefore, if you have any workers who exceed €5,000 in income between the second week of October and the end of the year, they will qualify for an AE deduction in January. There are many workers in retail and hospitality for whom this will be the case. You should talk to your payroll provider and your accountant NOW.

Lastly, remember you’re in Q4, and if you’re considering granting staff a tax-free benefit under the Revenue Small Benefit Exemption scheme, you need to plan for it now and order your Me2You gift cards from ISME. Remember- you can now gift up to €1,500 annually, which is the equivalent of €3,480.68 in total remuneration cost to you the employer. Don’t forget to let employees know in good time ahead of Christmas what they qualify for- they can budget a voucher into their Christmas shopping.

ISME say Budget 2026 must stimulate expansion of domestic businesses

ISME, the Irish SME Association, has warned that Budget 2026 must deliver an ambitious new direction for Ireland’s indigenous enterprise base, saying the Government is “sleepwalking into economic peril” by continuing to rely so heavily on multinational corporation tax receipts.

With the US economy under self-inflicted severe strain, and bond markets signalling fiscal stress in both France and the UK, ISME says Ireland cannot continue with “incremental change” when our nearest trading partners are in difficulty.

ISME highlights that Ireland already spends heavily on enterprise supports, but much of it is captured by large foreign companies. Among the issues ISME are highlighting include that R&D tax credits are concentrated in multinationals, with limited impact on SMEs. It also says the KEEP (Key Employee Engagement Programme) is overregulated and failing, leaving domestic firms unable to retain skilled staff against multinational employers. €1.5 billion sits idle in bank deposits that ISME say could be channelled into SME capitalisation via an Irish version of the UK’s ISA

Meanwhile, the association warns that SME credit continues to fall in retail, hospitality and construction due to cost pressures and excessive risk.

Read more here

SEAI is hosting a FREE & ONLINE Energy Management Training Session in October

Introduction to Energy Management Training will take place on Thursday October 9th from 2-4pm. This is a free 2 hour workshop which supports SMEs in creating an Energy Action Plan. Further details on the training, as well as relevant workbooks and guides are available on our website here: Energy Efficiency Training for SMEs | Business | SEAI. Businesses can register for the training through our Ticket Tailor site here: Buy tickets – Introduction to Energy Management Training

For any business unable to attend, this training course is run frequently so there will be other sessions available throughout the year.

For any business looking to get started on their Energy Efficiency journey immediately, our Energy Academy is also available which provides free, on-demand training on energy management. SEAI Energy Academy | SEAI

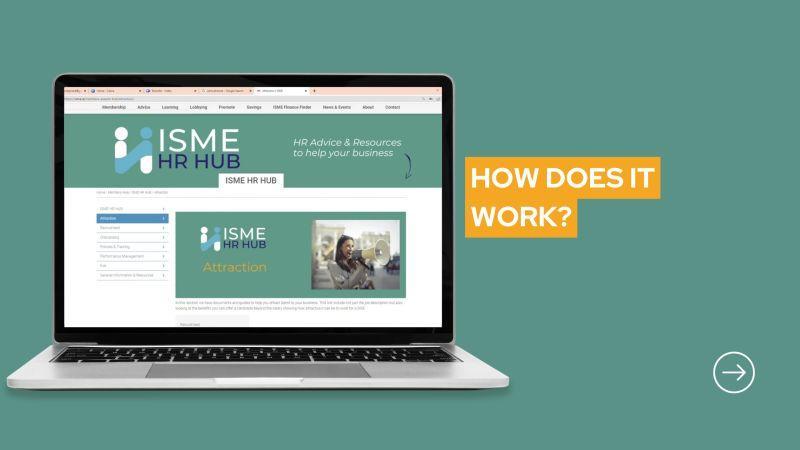

ISME HR Hub – your HR support

To support Members to deal with the everchanging world of HR and employment law, we have created a portal to give you access to guides, templates, contracts, policies and more to support you in managing HR in your business. We have curated the information based on the HR Life Cycle: Attraction, Recruitment, Onboarding, Policies & Training, Performance Management and Exit

You can also find information from government agencies and other third parties in our General Information & Resources page, links to the top downloads and view our selection of blogs including Statutory Sick Pay FAQs and EU Directive on Transparent and Predictable Working Conditions.

To find out how it works and looks, click on the video about the portal here. To use the ISME HR Hub log into the Members Area, click on the top left button.

Register Now for the 2025 Employment Law

There have been several important employment law changes arising from the courts and new legislation this year. This webinar will provide important updates to Irish SMEs.

The important topics that Barrister of Law Katherine McVeigh will be covering are:

• A review of the WRC Annual Report – what are the most common types of cases for an employer to be aware of?

• New law relating to settlement agreements under the Employment Equality Act 1998

• How to effectively manage long term absences of an employee and what are the risks?

• Key Principles for Investigations prior to a Disciplinary Procedure

• Probationary employees: What are the risks if there is a failure to manage employees on probationary period properly and how to effectively manage them?

• Recent important employment law case law and key legal principles arising from the case law that every employer should know

Time & Date: Thursday, 10th October, 08.00 am – 09:15 am

The ISME Finance Finder, developed in partnership with Swoop Funding, is an online platform designed to streamline access to finance for Irish SMEs. It offers a centralized solution for businesses seeking funding options to start, expand, improve cash flow, refinance debt, acquire assets, or invest in new markets. Key features include:

• Comprehensive Funding Options: Access to loans, equity, grants, and asset finance tailored to various business needs.

• Expert Guidance: Support from a team of funding specialists to assist with queries and application processes.

• Application Tools: Provision of templates and resources to facilitate funding applications.

• Dedicated Support: Availability of a hotline and email support five days a week for funding-related inquiries.

• Regular Updates: Finance updates and alerts to keep businesses informed of new opportunities

Additionally, businesses can avail of a complimentary 30-minute oneon-one consultation with Swoop's funding experts, offering confidential and obligation-free advice.

For more information or to begin your funding journey, visit the ISME Finance Finder.

ISME Skillnet Training Needs Analysis Survey

With 2026 fast approaching, we would like to understand your business challenges and skills gaps so we can address them through the ISME Skillnet training program next year and beyond.

Please take 1 min to answer this short survey so that we can bring more valuable courses to you in the coming years.

We greatly appreciate your valuable feedback!

Click here to access the survey

❑ Workplace Occupational Safety and Health Training (HSA Resources): Employees require Occupational Safety and Health (OSH) training at different points in time. Providing comprehensive occupational health and safety training for staff is essential to fostering a safe and healthy workplace environment. The provision of training helps reduce the risk of work-related injuries and ill health. This page provides links to information including the employee OSH learner journey, workplace OSH training requirements and approach, tips for procuring training, training providers, hsalearning.ie and more.

❑ Code of Practice: Safe Use of Industrial Trucks: This Code of Practice provides practical guidance on compliance with legislation related to the use of rider operated industrial trucks in all workplaces.

❑ Driving for Work: Risk Management Guidance for Employers: This guidance document has been jointly developed by An Garda Síochána, the Health and Safety Authority and the Road Safety Authority to help employers understand and manage the main risks that working drivers face and create when driving for work.

❑ Annual Review of Workplace Injuries, Illnesses and Fatalities 2022–2023 report presents the Annual Review of Workplace Injuries, Illnesses, and Fatalities for 2022- 2023. In preparing this report, we recognise the importance of providing reliable and up-to-date statistical information as an evidence base for decision-making.

❑ A Short Guide to Health Surveillance in the Workplace aims to assist employers and health professionals working on their behalf in understanding their legal requirements regarding health surveillance in the workplace. It also highlights the key elements to consider when implementing a health surveillance programme.

❑ Employing Apprentices: Safety On the Job information sheet is written for people who employ apprentices. It provides a summary overview of how employers should fulfil their duties as an employer and protect apprentices, who may be more at risk of injury and ill health.

❑ Safety On the Job for Apprentices- This information sheet is written for Apprentices. It provides some essential tips to help Apprentices stay safe and healthy as they start their career.

Key events that influenced foreign exchange markets in September

• The US Federal Reserve cut interest rates at its meeting in September by 25 basis points – this is the first interest rate cut of 2025

• The European Central Bank kept interest rates unchanged noting at its press conference that “headwinds on growth should fade next year" and “Indicators of underlying inflation (are) consistent with our 2% target”.

• The Bank of England kept interest rates on hold at 4% although two of the nine-member Monetary Policy Committee voted to bring the rate down to 3.75%.

• The US Labour Department revised employment data for the year prior to March 2025, with a drop of 911,000 from the initial estimate showing that the US Labour market created far fewer jobs than previously thought

• Euro zone Inflation increased to 2.1% for August up from 2.0% in July

What data and factors could impact the major currencies in October?

• October 3rd – US Non-Farm Payrolls (employment data)

• October 6th – European retail sales year on year

• October 17th - European core Inflation year on year

• October 29th – US Fed interest rate decision

• October 30th – European Central Bank monetary policy meeting

As an ISME member, you have exclusive access to Fexco’s dedicated account manager John Barry, who will help you with all your foreign exchange requirements.

• Reduce your cross-border payments costs

• Protect your business from currency volatility

Discover the benefits to your business without an obligation to trade!

>>Tell Me More>>

[ISME 2025 WEBINAR SERIES] Steps & Supports to Becoming a Low Carbon Business

Thursday 23rd October | 10:00 – 10:45am

ISME are delighted to introduce this new webinar as part of the ISME 2025 Webinar Series, featuring keynote speaker Kathleen Moore, Executive on SME Business Decarbonisation Supports team at SEAI

According to a 2024 survey by the Strategic Banking Corporation of Ireland (SBCI), 48% of Irish SMEs cite transport and energy costs as a risk to their business. This webinar will outline how your business can mitigate this risk, through SEAI SME-focused tools and grants to decarbonise.

During this webinar, Kathleen will talk you through the SEAI supports which enable businesses to:

• Understand their energy use

• Identify significant energy users (equipment and processes)

• suitability for deployment of renewable heat solutions

• Identify opportunities for reducing energy use and carbon emissions at their site

• Become aware of SEAI grants and supports that will help businesses to implement energy saving opportunities

Register Now for this ISME X SEAI Webinar

Watch back ISME X Unio Wealth Management Webinar on Retirement Planning and Beyond: A Guide for Business Owners

On Thursday 25th September, ISME held this essential business advisory webinar on Retirement Planning and Beyond: A Guide for Business Owners with Unio Wealth Management.

The 30-minute webinar was tailored for business owners who want to take control of their retirement planning. During the webinar, Unio’s expert advisers – Gary Cullen and Elizabeth Byrne – shared practical insights on:

• How to make the most of your pension options as a business owner

• What recent changes mean for your retirement strategy

• How to plan with confidence — and tax efficiency

If you missed it or would like to revisit key takeaways you can now watch the full recording at your convenience here. You can also download the presentation slides here.

The Minister of State for Employment, Small Business and Retail, Alan Dillon, has confirmed that he intends to sign a new Employment Regulation Order for the Contract Cleaning Industry.

Effective 17th October 2025, a revision to 2024 ERO for the sector SI No 255 of 2024 will come into effect and sets out revised minimum pay and allowances for over 30,000 workers in the industry.

Under the new terms, the minimum hourly rate for adult contract cleaning workers will rise to €14.10 per hour with a further increase will take effect on 1 January 2026, raising the hourly minimum to €14.80.

The ERO also introduces a new unsocial hours premium. From 17 October 2025, cleaners working between midnight and 6:00 a.m. must receive an additional €1.00 per hour. This allowance applies for a minimum of three hours.

For employers, the ERO creates both obligations and challenges. Payroll systems must be updated to reflect the new rates, and companies will need to budget for the January 2026 rise.

Legally, the new pay framework is set out in SI No. 430 of 2025, ensuring compliance is enforceable.

Any breaches of an Employment Regulation Order may be referred to the Workplace Relations Commission for appropriate action.

For further information or support on this or any HR matter, ISME Members can contact the HR Advice Line via HR@ISME.ie or 01 6622755

The Gender Pay Gap Information Act, signed into Irish law in 2021, marked a crucial step towards greater workplace equality and transparency. As its reach expanded to include more businesses in 2025, employers must understand its implications and take the necessary steps to ensure compliance.

This article explores the core aspects of the Act, who it applies to, and how businesses can prepare effectively.

The gender pay gap refers to the difference in average earnings between men and women within an organisation. Expressed as a percentage of men’s earnings, this measure sheds light on systemic disparities in pay structures, career progression opportunities, and representation in leadership roles. While it does not necessarily indicate direct pay discrimination, it serves as a crucial metric for assessing broader gender-based inequities in the workplace

The Gender Pay Gap Information Act was introduced to address these inequities by mandating transparency in pay-related data. Under this legislation, employers in Ireland must publicly disclose detailed information about their gender pay gap, including:

• Mean and Median Hourly Remuneration – The difference in

average (mean) and middle-point (median) hourly earnings of male and female employees.

• Mean and Median Bonus Payments – The average and median differences in bonus payments between genders.

• Percentage Receiving Bonuses or Benefits in Kind – The proportion of male and female employees receiving bonuses or non-monetary benefits, such as company cars or health insurance.

• Explanatory Notes – A narrative that explains the factors contributing to the pay gap and the measures being implemented to address them.

By promoting accountability, the Act encourages employers to take meaningful steps to close the gender pay gap.

The implementation of the Act has been phased in gradually to allow businesses time to prepare. As of 2025, the reporting requirement now extends to all organisations with more than 50 employees, making it essential for employers of this size to be fully prepared.

Ensuring compliance with the Gender Pay Gap Information Act requires a structured and proactive approach Below are the essential steps businesses should take:

Employers must familiarise themselves with the Act’s requirements by:

• Identifying the reporting metrics mandated by legislation.

• Staying informed about deadlines and updates from the government.

• Understanding the penalties for non-compliance, which could include reputational damage and potential legal consequences.

Businesses must confirm whether they meet the employee threshold for compliance. As mentioned previously, as of this year, the Act applies to organisations with over 50 employees.

A comprehensive pay audit is the foundation of compliance. Employers should:

• Collect and analyse payroll data for all employees, based on a snap shot date of their choosing in June.

• Calculate the mean and median hourly pay for male and female employees

• Assess bonus payments and benefits in kind.

Employers must also ensure that data collection methods align with GDPR and data protection regulations

4. Identify Contributing Factors

Once the data is compiled, it’s important to analyse it for root causes of any gender pay gaps. Contributing factors may include:

• Underrepresentation of women in senior leadership roles

• Unequal access to training and development opportunities.

• A higher prevalence of part-time work among female employees

A key aspect of compliance is the narrative accompanying the data. Employers must:

• Provide a clear explanation of the identified pay gap.

• Outline specific measures to address these disparities, such as mentorship programs, flexible working arrangements, and diversity initiatives.

• Set measurable goals and timelines to track progress

Employers must ensure their reports are publicly accessible on their website or another easily reachable platform by November each year. Reports should:

• Be clearly visible and easy to understand.

• Present data transparently, avoiding misleading interpretations.

A government-operated central portal for report submissions is also expected to increase accessibility.

7.

Transparent communication is essential for demonstrating a commitment to gender equality. Employers should consider:

• Informing employees about findings and planned actions

• Showcasing gender equity efforts in external communications to enhance employer branding.

Addressing the gender pay gap is an ongoing effort that requires continuous assessment and adaptation. As employers, you should regularly review pay data to evaluate the effectiveness of implemented measures and identify areas for improvement.

Action plans should be adjusted based on insights gained from data analysis and employee feedback Additionally, staying updated on legislative changes and best practices in gender pay equity ensures organisations remain compliant and proactive in fostering workplace equality.

But while the Act goes a long way to promote workplace fairness, some challenges may arise during implementation. Ensuring precise and comprehensive data collection can be complex, making data accuracy a significant concern. Smaller businesses may also face resource constraints, struggling to allocate sufficient time and expertise for compliance efforts. Additionally, overcoming ingrained biases and systemic barriers requires long-term cultural change, which can be difficult to implement effectively. Addressing these challenges proactively will be key to achieving meaningful progress in closing the gender pay gap.

Despite these challenges however, compliance with the Gender Pay Gap Information Act offers numerous advantages. Transparent pay practices will enhance your organisation’s reputation, improve public perception and strengthen your brand image. Demonstrating a commitment to workplace equity can also be a powerful tool for talent attraction, drawing jobseekers who prioritise fairness and inclusivity. Internally, addressing pay disparities fosters trust and loyalty among employees, leading to improved retention rates. Furthermore, research indicates that diverse and equitable workplaces achieve stronger financial performance and drive greater innovation, making gender pay gap compliance a strategic advantage for businesses.

The Gender Pay Gap Information Act represents a pivotal moment in advancing workplace equality. By understanding the legislation and taking proactive measures, employers can not only meet their legal obligations but also contribute to a more equitable society.

Rather than treating compliance as a mere legal requirement, you should see this as an opportunity to assess internal practices, cultivate inclusivity, and foster an environment where all employees can thrive.

At MSS, The HR People, we have the expertise to guide you through this legislation and reporting requirement with confidence. We can even assist you with completing it. Contact us today to ensure your organisation remains fully compliant and prepared for the future of workplace equality.

Info@mssthehrpeople ie │ www.mssthehrpeople.ie

October is Menopause Awareness Month. It’s an initiative by the International Menopause Society (IMS) and the World Health Organisation (WHO) to raise awareness about menopause and improve support for women. October 18th is World Menopause Day.

In the past menopause has been secret and taboo. However, over the past few years, it has become more mainstream. 50% of the population will experience menopause (with 80% of those experiencing symptoms). And the other 50% may be impacted, directly or indirectly. Menopause affects women personally and professionally, with 45 being the average age of perimenopause (the lead up to menopause) and 51 being the average age of menopause (when menstruation stops). According to the most recent Census in 2022 there are 652,000 menopausal women in Ireland and 420, 000 of these are in paid employment. This is a very large part of the workforce in Ireland.

Discussing an intimate health condition in the workplace can be very daunting for employers, and managing a sensitive conversation around health can be difficult. A good start is to approach with empathy and understanding. While there are lots of issues for employers already to manage in todays’ workplace, there are some straightforward things that employers can do to support employees, which can result in a happier and more effective workforce.

Some of the common symptoms that can impact women at work are: Cognitive (76%) like poor concentration or memory, fatigue (63%), anxiety (52%), feeling overwhelmed (48%) and loss of confidence (48%). Physically woman can experience hot flushes/flashes or heavy menstruation/periods. However there are many other varied symptoms reported.

Some examples of what employers might be able to do to support are:

• Regular team engagement, one to ones, feedback and a buddy system where suitable

• EAP Programme if costs allow

• Flexible working arrangements where possible

• Provision of a fan or a workstation close to a window

• Short breaks to step out for fresh air

• Easy access to toilet/hygiene facilities with flexibility to use these facilities as and when needed, for example when working in a customer facing role or a production line

Research carried out by The Menopause Hub in September 2023, with 3044 peri/menopausal women in Ireland found that:

• 84% of respondents were negatively impacted by symptoms at work;

• 38% took time off work due to symptoms;

• 18% took 3+ days off;

• 34% were considering giving up work;

• Up to 10% will leave work due to symptoms.

When these women were asked what they would like from their employers:

• 90% wanted training for HR and managers

• 94% wanted a menopause policy

There are a number of training modules available free from the HSE on www.hseland.ie that are just 20 minutes long. In order to access these you’ll need to set up a HSEland account at https://www.hseland.ie/dash/Account/Login

Other helpful resources are:

• Menopause and the Workplace –considerations for managers

• HSE Menopause Policy

• How to create menopause inclusive workplace

ISME’s Employee Assistance Programme (EAP)

We offer an Employee Assistance Programme (EAP) to support our members and their employees. We are committed to delivering the best and most appropriate, and accessible solutions along with our partners, Laya healthcare and their health and wellbeing provider, Spectrum Life. All of their services continue to be delivered to the highest clinical standards by fully accredited, experienced professionals.

This programme offers unlimited access for your employees & their families to a 365 freephone EAP service also accessible via website, app, or live chat.

Members up to 30 employees €950 (fixed cost per year)

Each subsequent employee €8 per employee per year

This is a discounted rate for ISME Members

For further information visit https://isme.ie/isme-wellness-programme/

The ISME Skillnet service is here to help both the business owner and their employees.

ISME Members can receive up to 40% discount on ISME Skillnet training, view courses below.

MS Excel Advanced

Wednesday 8th October View Course

Business Writing & Email Etiquette

Tuesday 14th October View Course

Introduction to Canva

Thursday 16th October View Course

Jason Cooper B2B Sales Workshop for SMEs

Tuesday 21st October & Thursday 23rd October View Course

Confident Conversations

Tuesday 21st October View Course

Excel: Dashboards and Data Visualisation

Wednesday 29th October View Course

SCAN

THE QR CODE TO FIND THE FULL LISTING