MARCH-APRIL 2025

Winners of the Healthcare Design Awards 2025 are revealed

Experts predict healthcare property market trends for 2025

Trailblazing community hospital voted best in England by patients

MARCH-APRIL 2025

Winners of the Healthcare Design Awards 2025 are revealed

Experts predict healthcare property market trends for 2025

Trailblazing community hospital voted best in England by patients

2025 has kicked off with two major announcements impacting the healthcare estate — the results of the review of the New Hospital Programme (NHP), and the publication of the latest Estates Returns Information Collection (ERIC) data.

The NHP — a pledge by the previous government to deliver 40 new or improved hospitals by 2030 — will now take more than a decade to deliver after the Labour-ordered review found the original plan was ‘behind schedule’, ‘unfunded’ and, therefore, ‘undeliverable’.

This admission, and the subsequent reordering of projects as part of a new three-wave, 10-year delivery plan, has led to criticism from trust chiefs who fear that already-dilapidated buildings will continue to deteriorate while they wait their turn.

You can read more about this in our news section ( p6).

We also cover the publication, late last year, of the 2023/24 Estates Returns Information Collection (ERIC) data.

The mandatory data collection is a critical instrument for collecting information related to the costs and operations of the NHS estate.

And it makes grim reading, showing a growing backlog maintenance crisis, with £13.8bn needed just to restore buildings and equipment to ‘acceptable’ levels.

In our report, we speak to Charlotte Wickens, policy adviser at The King’s Fund, about the issues facing healthcare estates managers who are having to balance a lack of funding with tough targets such as achieving net zero carbon ( p10).

About Jo: Jo is the editor of Healthcare Property, having joined Nexus Media in November 2023.

She has been specialising in design and construction best practice for the past 16 years, working on the Building Better Healthcare Awards and editing both

These issues are more evidence, if needed, that the healthcare estate needs capital investment — and quickly.

But that £13.8bn backlog maintenance figure is higher than the entire Department of Health and Social Care capital budget for this financial year.

This means tough questions will have to be asked and healthcare operators will need to work with the private sector moving forward.

But, despite this, innovation is still happening.

In this edition of Healthcare Property, we reveal the winners of the 2025 Healthcare Design Awards ( p44) and speak to the team behind Heatherwood Hospital, which has been named the best elective care centre in England by patients ( p36).

We also look at the impact of colour on healthcare environments ( p40), and explore why the UK is falling behind on the adoption of ‘rightsizing’ when developing senior living facilities.

Throughout 2025, Healthcare Property magazine will continue to bring you all the news and views from the sector, including, in this edition, a special report predicting the likely direction of travel for the property sector over the next 12 months ( p22).

Coming up in the next edition we will be looking more closely at infrastructure procurement and the NHS net zero carbon journey.

To contribute to these features, or to get in touch with us, please email joanne.makosinski@nexusgroup.co.uk

Jo Makosinski Editor, Healthcare Property

Building Better Healthcare and Healthcare Design & Management magazines.

She has a special interest in the design of public buildings, including schools, nurseries, colleges, hospitals, health centres, and libraries.

Chief executive officer

Alex Dampier

Chief operating officer

Sarah Hyman

Chief marketing officer

Julia Payne

Editor

Joanne Makosinski

joanne.makosinski@nexusgroup.co.uk

Reporter and subeditor

Charles Wheeldon

Advertising & event sales director

Caroline Bowern

Business development executive

Kirsty Parks

Head of content

David Farbrother

Head of marketing

Carrie Lee

Publisher Harry Hyman

We round up the latest big stories, including the results of the annual Estates Returns Information Collection (ERIC) data, and the findings of the government review into the New Hospital Programme

News on the latest design and construction projects from across the health and social care sectors

The critical role of ‘rightsizing’ for an ageing population, and how expanding the use of private patient units (PPUs) could help drive NHS efficiencies

34-35

Health think tank, reform, reveals its vision for the Hospital of the Future, plus the Centre for Mental Health calls for a radical reform of psychiatric inpatient care

Investor Publishing Ltd, 3rd Floor, 10 Rose & Crown Yard, King Street, London, SW1Y 6RE

Tel: 020 7104 2000

Website: www.healthcare-property.com

3029-0627 © Investor Publishing Limited 2025

The views expressed in Healthcare Property are not necessarily those of the editor or publishers.

36-42

We speak to the architects behind Heatherwood Hospital, which was recently named the best in the UK by patients; explore the impact of colour in healthcare settings; and look at how modern methods of construction are delivering topquality facilities, faster

22-27

Real estate leaders predict what is in store for the health and care property sector in 2025

Unveiling the winners of the 2025 Healthcare Design Awards

NHS Shared Business Services launches new soft facilities management procurement solutions, and why fire safety should not be overlooked

48-50 Environmental

Exploring Scotland’s approach to net zero carbon in the NHS estate

Health leaders respond to the findings of a government review of the beleaguered New Hospital Programme

Hospital leaders were ‘right to be sceptical’ over funding for 40 new hospitals as the Government describes the original timetable for the New Hospital Programme (NHP) as ‘unrealistic’ and admits it may take more than a decade to deliver the much-needed improvements.

In a statement last month following an urgent review of the NHP ordered after Labour’s victory at the General Election, ministers admitted that delivery of all planned schemes could take far longer than the previous government’s 2030 target.

And this has led to criticism from trust leaders who fear further degradation of buildings and a negative impact on staff and patients.

A new, ‘credible’ timeline for delivery will ensure staff and patients around the country have access to the facilities they desperately need as soon as possible, the

Government said.

It follows a review of the scheme, which found that the previous government’s commitment to deliver 40 new hospitals by 2030 was ‘behind schedule’, ‘unfunded’ and, therefore, ‘undeliverable’.

In its annual report, published last week, the Infrastructure Projects Authority (IPA) also deemed the previous scheme ‘unachievable’, rating the programme as ‘red’ and highlighting major issues including with the schedule and budget.

But an independent IPA review has upgraded the programme from a ‘red’ to an ‘amber’ rating, thanks to the action being taken to improve deliverability.

In May 2023, for example, the previous government announced that the programme was backed by over £20bn of investment.

However, this funding was never delivered. Labour’s new plan will be backed with £15bn of new investment over consecutive five-year waves, averaging £3bn a year.

Wes Streeting, Health and Social Care Secretary, said: “The New Hospital Programme we inherited was unfunded and undeliverable.

“Not a single new hospital was built in the past five years and there was no credible funding plan to build 40 in the next five years.

“When I walked into the Department of Health and Social Care, I was told that the funding for the New Hospital Programme runs out in March.

“We were determined to put the programme on a firm footing, so we can build the new hospitals our NHS needs.

“Today we are setting out an honest, funded, and deliverable programme to rebuild our NHS.”

investment during the 2010s leaving some hospitals with roofs that have fallen in and leaking pipes which freeze over in winter.

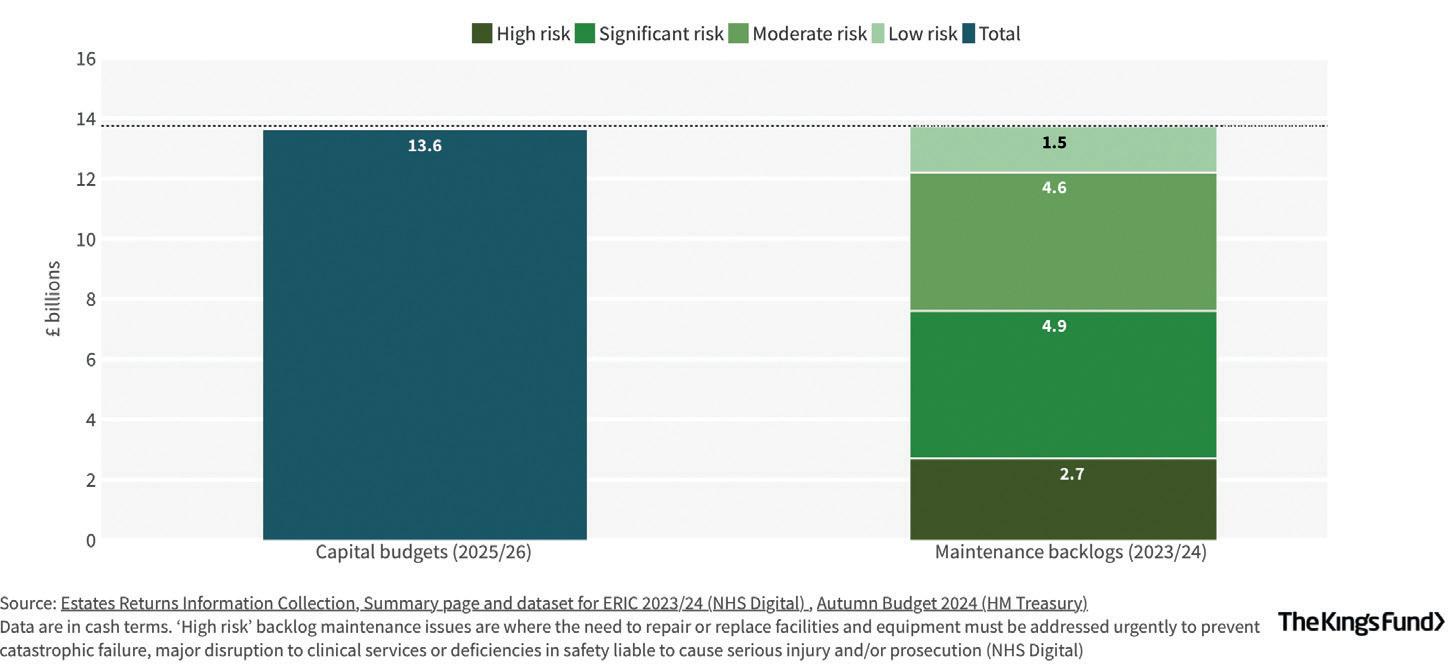

At the Budget in November, the Chancellor, Rachel Reeves, announced that health capital spending in the NHS is set to increase to record levels of £13.6bn in 2025/2026.

For schemes that were out of scope of the review, those already with approved full business cases will continue as planned and are already in construction (wave 0).

The remaining schemes will be allocated to one of three wave groups:

• Schemes in wave 1 are expected to begin construction between 2025-2030. These schemes include hospitals constructed primarily using reinforced autoclaved aerated concrete (RAAC), and have been prioritised as patient and staff safety is paramount

• Shemes in waves 2 are expected to begin construction between 2030-2035

• Schemes in wave 3 are expected to begin construction between 2035-2039 Hospitals in later waves will be supported on their development and early construction work before then to ensure they are ready for main construction.

And the plan for implementation sets out a clear pipeline of schemes to be delivered over the next decade and beyond.

The NHP will continue to work closely with industry to support construction, develop relationships, and secure investment within the supply chain, the Government said.

Morag Stuart, chief programme officer for the New Hospital Programme, added: “This provides certainty on the next steps for the New Hospital Programme.

With one of the largest reported maintenance backlogs in the country (amounting to £439m), the NHP investment is desperately needed, and sooner rather than later, as the current condition of our estate limits our ability to provide the environment that our patients and staff deserve

“We will continue to work with local NHS organisations to deliver improvements to hospitals across England, including making best use of new technology and improving layouts and ensuring future hospitals are designed to meet the needs of patients and staff.”

The New Hospital Programme is just one part of the Government’s wider commitment to transforming the NHS estate.

Over £1bn has been set aside to make inroads into the existing backlog of critical maintenance, repairs, and upgrades; while £102m has been dedicated for upgrades to GP surgeries across England as a first step towards transforming the primary care estate.

Among the hospitals impacted by the review are the Royal Preston Hospital, operated by Lancashire Teaching Hospitals NHS Foundation Trust; and Royal Lancaster Infirmary, run by University Hospitals of Morecambe Bay NHS Foundation Trust.

Following the review, construction work on a replacement Royal Lancaster Infirmary is due to begin between 2035-2038; while

work on the new Royal Preston Hospital is expected to start between 2037-2039.

Aaron Cummins, chief executive of University Hospitals of Morecambe Bay NHS Foundation Trust, said of the announcement: “Any delay to the delivery of a replacement new hospital for the Royal Lancaster Infirmary is disappointing, but we accept the need for a fully-costed and deliverable timeline of investment through the New Hospital Programme.

“While this may not be the news local communities wanted, we hope that the outcome brings some certainty that patients and NHS colleagues will get the new hospital that they deserve.”

Nottingham University Hospitals NHS Trust (NUH) also has two projects within the programme — the National Rehabilitation Centre and ‘Tomorrow’s NUH’.

The National Rehabilitation Centre was not included in the review as it is already under construction and it will continue to go ahead as planned.

But the Government has announced that the Tomorrow’s NUH programme will face considerable further delays and

commencement of the main scheme of work will not be allowed to begin until at least 2037.

The news was met with ‘disappointment’ from trust bosses who fear the impact on staff and patients.

Anthony May, trust chief executive, said: “While we welcome the Government’s ongoing commitment to Tomorrow’s NUH (TNUH), we are very disappointed that the review of the New Hospital Programme means significant delays to the scheme.

“This will not only considerably impact our patients and staff for the coming years, but will also have a huge impact on our wider communities across the region.

“This will mean a significant delay to building a new Centre for Women, Children and Families for Nottingham and our cancer patients will have to wait an additional decade to receive treatment in a bespoke cancer care building.

“Nottingham will also continue to be one of the only acute hospitals in the country without a helipad and we will not be able to build the much-anticipated multi-storey carparks at NUH for many years.

“With one of the largest reported maintenance backlogs in the country (amounting to £439m), the NHP investment is desperately needed, and sooner rather than later, as the current condition of our estate limits our ability to provide the environment that our patients and staff deserve.”

Health think tank, The King’s Fund, also weighed in on the announcement, with its director of policy, partnerships, and events, Siva Anandaciva, telling Healthcare Property:

“This review confirms that hospital leaders were right to be sceptical that there was enough funding to deliver the 40 new hospitals by the 2030 deadline.

“The construction industry has not been immune from rising inflation and labour shortages over recent years, and it is welcome that new plans announced today aim to be more realistic, including a long-term outline for how the programme will be funded.

economy — many hospitals are already spending significant amounts of taxpayers funding trying to maintain sub-standard buildings — and they will have to keep doing so in the years to come.

“Additionally, the scale of the crumbling NHS estate is far wider than the 40 rebuilds on the New Hospital Programme.

“Much of the mental health estate is some of the oldest within the NHS and it is reported that an estimated one in five of England’s GP premises pre-date when the NHS was formed in 1948.

‘However, it will be devasting to staff and patients to hear that plans to rebuild many local hospitals will be kicked so far into the long grass.

“It is clear that the knackered condition of some NHS buildings and equipment in both hospital and out-of-hospital settings is harming patients and staff and hampering attempts to improve NHS productivity.

“Pausing or delaying plans to rebuild hospitals is also very likely to be a false

“And, while £1bn was earmarked in the recent Budget for the most-critical maintenance issues in NHS hospitals, there is a £13.8bn maintenance backlog for buildings and equipment.

“The result is poorer patient care and staff experience because of multiple IT failures, flooded corridors, dangerous roofs, unreliable diagnostic equipment, and substandard layouts that create overcrowding in A&E departments.” n

It is clear that the knackered condition of some NHS buildings and equipment in both hospital and out-of-hospital settings is harming patients and staff and hampering attempts to improve NHS productivity

In this article we look at the findings of the latest Estates Returns Information Collection (ERIC) data, which reveals the true state of NHS buildings

The poor physical state of NHS buildings has become ‘a severe hindrance’ to plans to increase productivity, according to health think tank, The King’s Fund.

Responding to the release, in December, of the Department of Health and Social Care’s latest Estates Returns Information Collection (ERIC) data — a critical instrument for collecting information related to the costs and operations of the NHS estate — Charlotte Wickens, policy adviser at The King’s Fund, said patients and healthcare leaders were ‘in limbo’, with NHS maintenance backlog data showing £13.8bn will need to be invested to restore buildings and equipment to acceptable levels.

This figure is higher than the entire Department of Health and Social Care capital budget for this financial year.

Wickens said: “The scale of the

maintenance backlog means there will have to be some difficult decisions about which buildings and what equipment is prioritised for investment at the upcoming comprehensive spending review.”

The provisional ERIC data for 2023/24 is a mandatory data collection for all NHS

trusts, including ambulance trusts, and comprises information relating to the costs of providing and maintaining the NHS estate, including buildings, maintaining and equipping hospitals, the provision of services such as laundry and food, and the costs and consumption of utilities.

The scale of the maintenance backlog means there will have to be some difficult decisions about which buildings and what equipment is prioritised for investment at the upcoming comprehensive spending review

Key takeaways from this year’s collection include:

• The total cost of running the NHS estate was £13.6bn — up 9.25% on the previous year

• The total cost to eradicate backlog maintenance (BLM) is £13.8bn — up 18% on previous year. The estimated cost to eradicate ‘high risk’ BLM is £2.7bn, ‘significant risk’ BLM is £4.9bn, ‘moderate risk’ is £4.6bn, and ‘low risk’ stands at £1.5bn, all showing an increase on the previous figures

• The number of trusts with an Estate Development Strategy is down from 211 to 209

• Estates and Facilities RIDDOR (The Reporting of Injuries, Diseases and Dangerous Occurrences Regulations 2013) incidents were up by 3.8% to 7,966. Those related to critical infrastructure risk stood at 1,584, down nearly 2% on the previous year. In particular, flood occurrences triggering a risk assessment increased by 28% to 358

• The number of fires recorded was down 19% to 1,102, but false alarms were up by nearly 5% to 23,651. 6,049 of those led to emergency services callout and there was one reported death and 21 injuries, though no patients sustained injuries during evacuation

• Gross internal floor area of NHS buildings stands at 27.5 million sq m — up 1.2%, while occupied floor area is 25.3 million sq m, an increase of 1.1%

• There has been no change in the number of single patient ensuite bedrooms, with 40,012 recorded, but a slight increase in isolation rooms from 1,892 to 1,907

• The cost of water and sewage was £101m — up 9%

• Waste costs were £180.5m — up 9.5%

• On a more-positive note, clinical service incidents due to infrastructure failures decreased by 4.8%

Commenting on the figures, Issy Whitelock, senior consultant at construction and facilities management specialist, Sewell Group, told Healthcare Property: “The newly-released provisional NHS ERIC data gives us a telling snapshot of the NHS estate’s current state. And, as you might expect, managing buildings, infrastructure, and costs is a growing challenge for NHS trusts.

“Total running costs increased, continuing the sizeable upward rising trend seen over the last four years, with these outpacing revenue growth and intensifying the financial strain on the service.

“Despite an increase in capital spending, reaching £11.2bn in 23/24, this only returns capital investment levels to where they were

Despite an increase in capital spending, reaching £11.2bn in 23/24, this only returns capital investment levels to where they were in 2010, after years of underfunding

in 2010, after years of underfunding.

“Compounding these pressures, the IFRS 16 accounting standard now requires leases to be included as capital expenditure, putting restrictions on an already-stretched capital budget, limiting available funds, and impacting NHS trusts’ financial flexibility.”

Wickens adds: “Many patients and staff alike will be familiar with the issues that come with the poor condition of the NHS estate, such as slow scanners, broken lifts, leaking roofs, and the relocating of services to work around dilapidated buildings.

“The neglect of the NHS estate led to 751 dangerous incidents to patients and staff, such as through equipment failures or infection outbreaks.

“The latest NHS maintenance backlog data shows £13.8bn will need to be invested to restore buildings and equipment to acceptable levels. That figure is higher than the entire Department of Health and Social

Care capital budget for this financial year. And this data only covers hospitals, much more would be needed to restore outdated GP practices and other primary and community care buildings.”

The figures reveal that the top 20 trusts with the highest BLM account for 30% of the total BLM across the NHS estate.

However, only nine of the 20 trusts with the most-critical infrastructure risks are included in the New Hospital Programme (NHP), highlighting a significant funding gap for urgent repairs and upgrades.

A welcome sign, according to Wickens, is that ministers have set about changing how NHS capital budgets are planned and set.

She said: “The recent budget earmarked a rise in capital spending, including £1bn for critical maintenance issues with NHS buildings, and a promise to set longer-term capital budgets so that NHS organisations can better plan for future modernisation.”

The neglect of the NHS estate led to 751 dangerous incidents to patients and staff, such as through equipment failures or infection outbreaks

• The total energy usage from all energy sources across the NHS estate was 11.1 billion kWh — down 0.86% on the previous data return

• Total energy costs stand at £1.4bn — up 16%. Total cost of electricity was £769m — up 21%

• The number of CHP units operated on site remains unchanged at 223

• The number of trusts operating a waste reuse scheme increased by 11% to 93. 155 trusts now have a waste manager and 125 have an energy manager Whitelock said: “Energy remains one of the NHS’s largest financial burdens, with costs rising by 13% this year, an additional £185m.

“While the proportion of these energy costs resulting from gas and oil dropped by 2% compared to previous years, these sources still make up a substantial 40% of total energy spending.

“This highlights the NHS’s continued heavy reliance on traditional energy sources, even as it seeks to move toward moresustainable options.”

She added: “Sustainability remains a key goal, with 76% of trusts creating estates development strategies to support some of these ambitions.

“However, many trusts face a tough choice: improve energy efficiency or manage rising costs.

“Progress is visible in some areas, with solar panel investments, EV fleets, and energy upgrades, though budget constraints limit larger-scale green projects.

“Seven Integrated Care Boards (ICBs) saw a reduction in their trust’s gas emissions by over 10%, and there’s been a 38% rise in trust-owned solar power consumption, which is promising.

“LED lighting is also expanding, though 1,778 sites still have less than 50% LED coverage. This could offer substantial benefits, but will need capital investment.”

And she warned that, with the added pressure of backlog maintenance costs, the challenge of achieving net-zero emissions across the healthcare estate could

be in jeopardy.

“This data paints a vivid picture of an NHS estate under growing strain, with rising costs across almost every area,” she said.

“Trusts are making difficult choices: fix urgent issues or invest in long-term transformations like digital upgrades and sustainability.

“It’s a tough call, and the risk is that sustainability projects may be sidelined in the short term and the forthcoming risks associated with the rising BLM and critical infrastructure risk continue to grow.”

• The total cost for cleaning services was £1.5bn — up 10.5%

• The number of cleaning staff rose by 0.4% to stand at 42,000

• The total cost of providing inpatient food was £0.8bn — up 5.6%

• Inpatient food ingredients cost increased by 21% to £291.7m

• The number of inpatient main meals requested increased by 3% to 143 million; meals provided to A&E and urgent care patients increased by 10% to 5.2 million; and staff/visitors meals served stood at 43 million, an increase of 10%

• The number of catering staff rose by 5.8% to stand at 17,900

• Food waste — the first time this had been recorded as part of the ERIC return — was 11,800 tonnes

• Parking costs rose by 6% to £77m.

Income generated from patient and visitor parking was £172m — up 18.5%; while income from staff parking fees was £70.5m — up by 51%

According to Whitelock and Wickens, the data shows a need to look more long-term at the NHS estate and to embrace technology.

Whitelock told Healthcare Property that Sewell Group had devised a tool to support trusts, adding: “One of the key takeaways from the 2023/24 ERIC data is that while estates costs are rising, many trusts struggle to pinpoint exactly where efficiencies can be made.

“This is where data can make a tangible difference in managing the estate and making data-driven decisions.

“We have developed a tool which allows trusts to make sense of their ERIC data to help tackle estate management and cost control challenges — by taking a deep dive into their ERIC data, our estates dashboard can help trusts benchmark performance both between their own sites and nationally, and identify opportunities for cost-saving or operational improvements.

“For instance, we recently worked with an NHS trust in England helping them uncover discrepancies in their data reporting, which were skewing their performance metrics.

“By correcting this, and advising them on how to better utilise their space, we were able to cut down their estates spend while improving the quality of care offered to patients.

“These kinds of insights are vital at a time when NHS funding is tight, and making sure every pound is used effectively can have a direct impact on patient services.”

The King’s Fund has also teamed up with Epsom and St Helier University Hospitals NHS Trust to shine a light on what the capital backlog means for them on a local level.

Every year the trust invests millions in improving its buildings so that staff can provide safe care to patients.

However, its estate is deteriorating faster than the trust can fix it, and the outdated infrastructure causes significant disruption to teams and patients.

In the last year the trust has had to postpone hundreds of operations due to ventilation issues in its theatres.

Even though the trust has now fixed the issue, it anticipates this happening repeatedly due to the deteriorating buildings.

Working with The King’s Fund the trust has devised a plan which will help deliver on the recommendations in Lord Darzi’s review to shift care closer to home and cut surgery waiting times faster. This includes:

• 85% of services staying at Epsom and St Helier hospitals with care closer to home, including urgent treatment, frailty, and ambulatory care services, which will better support the population immediately around St Helier

• Reducing waiting lists faster because Epsom and St Helier theatres will be dedicated to planned surgeries

• The trust’s new specialist emergency care hospital will be located next to The Royal Marsden hospital, helping to improve access to specialist oncology services and reduce the need for local patients to travel n

The Government has announced the biggest capital investment in hospices in a generation.

Over the next two years £100m in funding will help hospices provide the best care to patients and their families in a supportive and dignified physical environment.

Hospices for children and young people will also receive a further £26m revenue funding for 2025/26 through what was, until recently, known as the Children’s Hospice Grant.

Health and Social Care Secretary, Wes Streeting, said: “Hospices provide the care and support for patients and families at the mostdifficult time, so it is only right they are given the financial support to provide these services.

“This package will ensure they will be able to continue to deliver the compassionate care everyone deserves as they come to the end of their life in the best-possible environment.

“This investment will go towards helping hospices to improve their buildings, equipment, and accommodation. That will include refurbishing bedrooms and bathrooms for patients, providing comfortable overnight facilities for families, and improving IT systems to make it easier for GPs and hospitals to share vital data on patients.

“The money will also help towards improving garden and outdoor spaces so patients and their families can spend time outdoors in greener and cleaner spaces.”

Dr Amanda Doyle, NHS national director of primary care, added: “It’s absolutely right

that staff are able to provide high-quality and compassionate care to people at the end of their life in the best-possible environment, and this package will help them to do that.”

As part of the 10 Year Health Plan, the Government wants to shift healthcare out of hospitals into the community to ensure patients and their families receive personalised care in the most-appropriate setting.

And the palliative and end-of-life care sector, including hospices, will have a big role to play in that shift.

The capital funding will also support the Government’s shift from analogue to digital, through digital upgrades.

There are currently around 170 hospices that provide end-of-life care for adults, and around 40 which provide hospice care for children and young people in England, with some hospices providing care to both.

Toby Porter, chief executive of Hospice UK, said: “The announcement will be hugely welcomed by hospices, and those who rely on

their services.

“Hospices not only provide vital care for patients and families, but also relieve pressure on the NHS.

“This funding will allow hospices to continue to reach hundreds of thousands of people every year with high-quality, compassionate care.

“We look forward to working with the Government to make sure everyone approaching the end of life gets the care and support they need, when, and where, they need it.”

Responding to the announcement Ralph Coulbeck, chief executive at Haven House children’s hospice, called for the Government to support local decision-making on where the money should be spent.

He said: “It will be a relief to everybody in the children’s hospice sector to hear that the Children’s Hospice Grant is being maintained next year; this will help to support the vital care we provide to seriously-ill children and their families.

“It is also very positive to hear about the Government’s plans to invest significantly in the wider hospice sector; and we hope there will be as much flexibility as possible to determine locally how this new money is spent.

“This investment shows how government recognises the importance of integrating services to improve the treatment patients receive.”

Dudleys Consulting Engineers has secured four contracts with Torsion Projects to provide structural and civil engineering support for new care home developments in Durham, Chesterfield, Bradford, and Worksop.

The latest instructions follow the successful delivery of new care home and retirement living projects for parent company, Torsion Care, in Shipley, Bingley, Brighouse, Sleaford, Lincoln, and York, for which Dudleys provided full engineering consultancy support.

In Durham, Torsion Care has just completed the purchase of land at Mount Oswald in partnership with Banks Group.

Having supported the project through planning stages, Dudleys is now working onsite to deliver a purpose-designed, three-and-a-half storey care home offering 74 en-suite bedrooms with care facilities.

Torsion Care is also poised to deliver a new 72-bedroom care home in Chesterfield after securing planning consent subject to conditions.

Dudleys is supporting the redevelopment of the former Walton Works, including Grade II-listed mill buildings for the care home alongside new housing.

And, in Bradford, Torsion is redeveloping a brownfield site at Eccleshill to build a new 72-bedroom care home with associated ancillary services. Dudleys is providing engineering solutions to raise the site level by

Works are also due to commence on site next month in Worksop, where Torsion is building a new 70-bed care home within the expanding development at Gatefold Toll Bar in Worksop.

Watson Batty Architects is designing the scheme.

Paul Brownlow, director at Dudleys, said: “We are delighted to secure these further contracts with Torsion Care, cementing our role as a valued advisor for its fast-growing development plans.

“Our team is highly skilled in working with challenging brownfield sites that need varying levels of remediation from historic use or local environmental impact and we admire Torsion’s commitment to rejuvenating often-difficult sites to provide much-needed new community-focused facilities.”

Mercian Group will deliver a 68-bedroom care home development in Somerset for growing not-for-profit provider, Amica Care Trust.

abrdn will fund the development on behalf of a segregated client.

The 1.35-acre site is located within the Orchard Grove masterplan in the expanding town of Taunton in Somerset.

Mercian Developments identified the site’s potential for elderly care and achieved consent for a care home facility which, once built, will comprise 68 bedrooms with ensuite wetrooms.

Designed by KWL Architects, communal amenities will include a selection of lounge and dining spaces, flexible dayrooms for hobbies and activities, a hair salon, café, cinema/bar, sensory room, feature terraces on the first floor, and generous landscaped gardens.

The home will also have exceptional sustainability credentials, being 100% electric powered, and is expected

And it will meet a muchneeded demand for marketstandard wetroom beds in a catchment area which currently has a shortage of modern, quality provision.

Chris Towers, managing director of Mercian Developments, said:

“Mercian has been working with Amica to identify and deliver a flagship scheme for the trust in the Taunton area and is delighted to have completed this acquisition in partnership with abrdn, which will be funding the scheme.

“We can’t wait to get cracking on building what will be a fabulous new home for Amica and the surrounding communities.”

Keren Wilkinson, chief executive

are delighted to get this beautiful state-of-the-art care facility over the line, being so close to our head office, and are looking forward to offering our outstanding care services to the local Taunton community and beyond once completed.

“We are acutely aware of the pressures on the local authority and health services and are excited to be able to offer these modern facilities that will be able to offer excellent services to all.

“By integrating cutting-edge technology, we aim to empower residents to maintain their independence while ensuring they remain safe, comfortable, and well cared for.”

The deal was facilitated by

St George’s University Hospitals NHS Foundation Trust has received planning consent from Wandsworth Council for the development of one of the country’s largest renal units.

The plans will bring together specialist inpatient kidney care from across St Helier Hospital in Sutton and St George’s Hospital in Tooting, while strengthening outpatient services in local hospitals, clinics, and at home, where 95% of patients will continue to receive care and treatment.

Building the new unit, and freeing up space at St Helier, will help pave the way for St George’s, Epsom and St Helier University Hospitals and Health Group (gesh) to deliver on plans to build a new Specialist Emergency Care Hospital in Sutton and modernise Epsom and St Helier Hospitals, part of the government’s New Hospital Programme.

Designed by BDP Architects, the six-storey building will deliver high-quality inpatient, outpatient, and dialysis facilities. This will include inpatient services for people on long-term dialysis, and more-complex care for

individuals needing specialist surgery such as a kidney transplant.

It has been designed following extensive engagement with patients and staff and will feature:

• A building of the highest environmental standards

• 81 beds, including enhanced care and daycare beds

• 72% single rooms with ensuite bathrooms

• 24 acute dialysis stations, including eight single rooms

• Landscaped gardens, including spaces for people with reduced mobility

• Dedicated ambulance parking bays

Closely-located blue badge parking spaces

Jordan Rundle, director of healthcare development and investment at Christie & Co, who said: “We are delighted to have worked with Mercian again on another successful turnkey care home development.

“This scheme has been thoughtfully designed to provide best-in-class accommodation for the growing elderly population in Taunton, with very high energy efficiency and environmental credentials.

“Amica Care Trust is well placed to operate the scheme, having an excellent reputation in the local community and being committed to providing the best care and support through its dedicated and highly skilled team.

“We are looking forward to seeing the scheme come forward for construction and becoming a landmark development in Orchard Grove masterplan.”

Christie & Co acted for Mercian and JLL acted on behalf of abrdn. The property was transacted at an undisclosed price.

and drop-off spaces

New footpaths and a widened pedestrian entrance will also be built, as well as curative spaces for public, patients, and staff.

The purpose-built, modern healthcare facility will be designed to offer better experiences for patients and staff, with improved access to other specialist services.

And the building will enable enhancements to be made to the main entrance and accessibility to St George’s from Blackshaw Road, leading up to the renal unit, ITU, and the Atkinson Morley Wing.

Dr James Marsh, group deputy chief executive and renal consultant at gesh, said: “Reaching this milestone is a huge achievement and means we’re a big step closer to transforming the care we provide to our kidney patients.

“This is a once-in-a-generation opportunity to bring together the best of our two excellent renal services in a state-of-the-art, purpose-built renal hospital at St George’s — and we’re ready to press forward and deliver on our plans.”

Construction has begun on an energyefficient Community Diagnostics Centre (CDC) in Hereford, which will provide a calming and reassuring environment for diagnostic imaging and testing.

Designed by Architype and Medical Architecture for Wye Valley NHS Trust, and being constructed by Speller Metcalfe, the £18m centre is part of a national initiative to boost NHS diagnostic capacity by providing CDCs in local communities across the country. By conveniently locating the new facility close to people’s homes, the service will be more accessible and will reduce the need for hospital visits.

It will also relieve capacity pressures and waiting times at hospital-based diagnostic facilities.

Alongside expertise in healthcare design, the design team members were selected for their knowledge and experience in designing to Passivhaus standards.

Passivhaus design standards combine principles such as high thermal efficiency, airtightness, and mechanical heat recovery to reduce carbon emissions and greatly improve a building’s energy performance.

Rooms are arranged using a set of standard templates, both for improved efficiency and so the building can be easily and cost-effectively adapted to accommodate future changes to service requirements.

This has the benefit of significantly reducing the operational costs of the building, providing long-term savings to the NHS estate.

These principles also provide a robust framework to easily achieve the trust’s other sustainability targets, including exceeding the NHS Net Zero Carbon Building Standard and achieving a BREEAM ‘Excellent’ sustainability rating.

In consultation with a wide range of NHS stakeholders, the building’s internal spaces have been designed to meet the specific technical and safety requirements of a cuttingedge diagnostic facility.

Spaces for MRI, CT, and X-ray imaging, which require protective shielding and heavy, vibration-sensitive items of equipment, are located on the ground floor. This ensures an efficient structural engineering solution can be adopted and enables easy access for patients from the public waiting and reception area.

Spaces for patients to consult with clinicians are provided on the first floor, alongside staff welfare facilities, where generous views and natural daylight create a positive environment for wellbeing.

A double-height atrium directs visitors towards the entrance with its bright, welcoming reception and waiting space.

This area is defined by natural finishes and a large-scale artwork creating an internal landmark which aids orientation on the ground and first floors.

This supports the use of simple and intuitive signage and wayfinding, removing unnecessary visual clutter and enabling the interior to adopt a more-familiar and lessinstitutional character.

The building’s interior has been designed with a calming palette of materials and finishes to support positive patient experiences, subtly comforting those who may otherwise be anxious.

Attention has also been paid to details that create a high-quality workplace to aid the recruitment and retention of NHS staff.

Externally, a black standing-seam metal cladding has been selected as the primary material for the elevations. This provides a contemporary interpretation of the local industrial context, while creating a distinct identity which aids navigation to the site.

As visitors approach the diagnostic centre, softer timber details become apparent within the outside canopy and the window and door reveals, while vertical timber cladding elements beneath the canopy frame the main entrance and provide a clear destination.

And all materials have been selected for their longevity and their ability to age well as part of a holistic sustainability strategy.

Mark Barry, director at Architype, said: “It is very exciting to be constructing another public building and further improving services in our local city, following a three-year period of innovation in the healthcare sector working alongside Medical Architecture.”

Mark Nugent, associate director at Medical Architecture, adds: “This building reflects the collaborative approach of the client, contractor, and the design team members, who have all strived towards the shared ambition of a moresustainable development approach which has the potential to reduce revenue costs, as well as carbon, across the whole NHS estate.”

And Alan Dawson, strategy and planning officer at Wye Valley NHS Trust, said: “Our patients deserve the highest-quality care, and this centre will be instrumental in speeding up the diagnosis of illnesses like cancer and heart disease to ensure they are treated more quickly.

“There’s no doubt that the new centre will lead to improved patient experience and outcomes and will contribute to shorter waits for people from Herefordshire and beyond.”

Westminster think tank, Reform, calls for a more-joined-up, preventative approach to medical services and the delivery of the healthcare estate

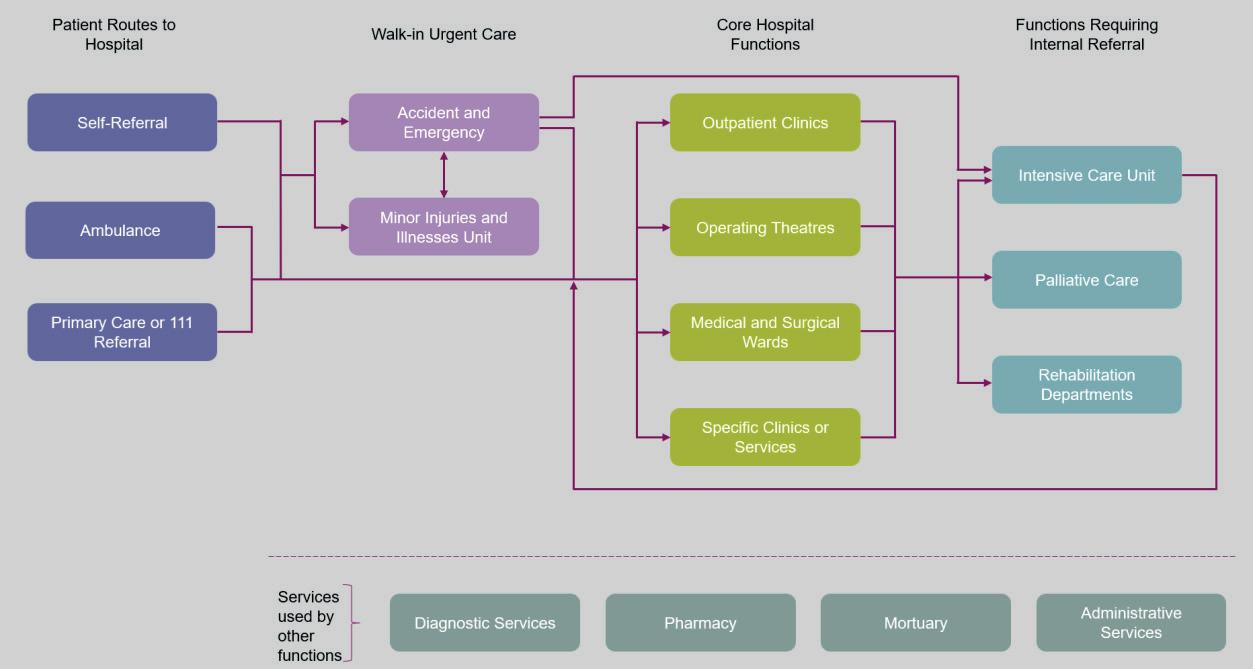

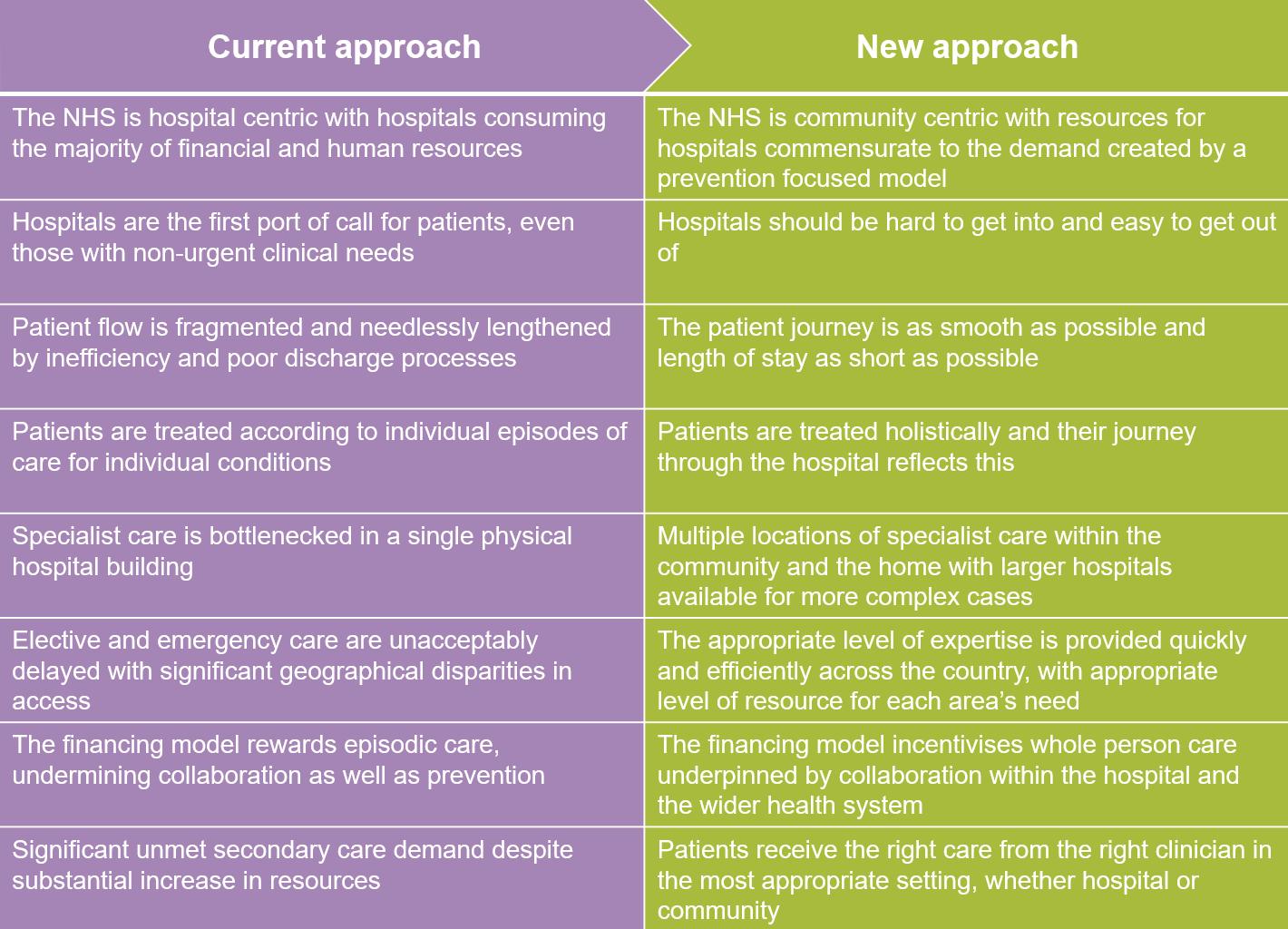

The current approach to delivering hospital infrastructure needs ‘a fundamental reset’, favouring a more-effective model of system-wide integration, according to Westminster think tank, Reform.

As part of its Reimagining Health workstream, Reform has embarked on a new project to outline a vision for hospitals within a health system that is re-orientated towards prevention and early intervention.

The Hospital of the Future proposes a fundamental reset in the approach to secondary care, providing a long-term vision with a new, revitalised model fit for the 21st Century.

And reform has now published the first in a series of papers diagnosing the problems experienced by hospitals today.

This will be followed by a series of papers outlining a detailed programme of reform to reimagine hospitals for the future.

The paper poses the view that a focus on the need for more resource is the wrong approach without consideration of whether the right resources are being deployed to meet the type of demand.

The model of secondary care, it says, is not changing with the nature of demand.

Furthermore, it should be viewed as a service, not just a building.

Reform aims to challenge how the physical hospital building can change and how the same level of care can be provided outside of the traditional hospital.

And it acknowledges that rethinking the division of care in a hospital raises fundamental questions about economies

of scale, as well as logistical concerns about services, facilities, and rotas.

It also points out that patient flow within hospitals needs a ‘fundamental reset’ and promises to explore a more-effective model of system-wide integration, the role of management and flow co-ordination, as well as the technology infrastructure needed to enhance this.

The paper states: “There are severe problems facing hospitals in the immediate

term: financial deficits in NHS trusts, a reliance on locum working, outdated equipment, and a growing maintenance backlog, to name a few.

“But, underlying these shortterm problems, is a profound set of structural questions as to how a hospital fundamentally operates and whether this is the right model.

“This framing paper will diagnose the problems in hospitals today — what they are, why they exist, and the longterm prognosis.”

The paper says that, since the creation of the hospital, the logic of the physical hospital building has always been that it enables substantial economies of scale.

These arise from being able to achieve high levels of utilisation of specialist capacity, both human and technical. For example, health systems have high fixed infrastructure costs, in that they must pay for diagnostic and operating theatre equipment as well as hospital beds and staff. These high costs become substantially more cost efficient the larger the patient base that uses them.

Thus, the core logic of hospitals is that they provide a range of services that draw on economies of scale, providing different forms of care to high volumes of patients using the same underlying infrastructure base.

The paper states: “With this said, it is still not clear what the optimal size and scope of a hospital is if it is to make the most use of its available expertise, infrastructure, and equipment.

“Hospitals that are too large can depart from the optimal level of efficiency and exhibit diseconomies of scale.

“But, at the other end of the scale, small hospitals might be inefficient because the fixed infrastructural and administrative costs are shared across too small a caseload.

“How hospitals achieve economies of scale is also evolving. Many large regional hub hospitals are seeking to increase volumes in specialised services to deliver high-quality care affordably, while smaller hospitals are forming networks to invest in infrastructure, share back office costs, and retain staff who want to undertake a range of clinical work.”

Problems which need addressing, according to the report, include poor understanding of patient flow; hospitals being internally incoherent and fragmented; a bias towards specialism within the workforce; poor integration between primary, secondary,

The different types of hospitals

and social care; insufficient management; complicated funding models; and an absence of communication and technological infrastructure.

Low capital investment is also cited.

The paper states: “Over the past 15 years, levels of capital investment have grown dramatically, but this is partially to compensate for the fact that from 2014-15 to 2019-20, funds from capital budgets were transferred to support dayto-day spending and relieve the growing pressures in the NHS.

“The dire state of NHS England’s hospital estates contributes to poor

secondary care productivity.

“In 2023-24, the cost to resolve the backlog of maintenance for all ‘risky’ NHS England buildings was estimated to be just over £13.75bn.

“Worryingly, over 55% of those costs would be needed just to tackle high-risk and significant-risk building issues.”

It adds: “There are numerous negative consequences, for patients and staff, resulting from poor NHS hospital estates.

“Perhaps, most obviously, shut or disused facilities caused by unsafe buildings or unusable equipment reduces the capacity of secondary care.

…it is still not clear what the optimal size and scope of a hospital is if it is to make the most use of its available expertise, infrastructure, and equipment

Over the past 15 years, levels of capital investment have grown dramatically, but this is partially to compensate for the fact that from 201415 to 2019-20, funds from capital budgets were transferred to support day-today spending and relieve the growing pressures in the NHS

“Broken lifts, unfit-for-use or outdated equipment, and finding workarounds for estate issues causes major inefficiencies, similarly reducing secondary care capacity.”

In its vision for the future, the paper reimagines hospitals as if they were being designed from scratch today, posing four questions:

• How should the patient journey through the hospital change?

• How would hospitals interact with the rest of the healthcare system?

• How would the entire configuration and location of secondary care services look different?

• How would this change the scale, clinical portfolio, workforce, infrastructure, and funding model of secondary care?

It concludes: “Policymakers have paid lip service to prevention for decades, but realising the prevention ambition will always be unachievable if there is not a coherent plan for what the role of the hospital is, and how it can achieve this.

“Otherwise, the modus operandi that has existed for decades — a hospitalcentric health system — will continue, draining resource out of the health

service and forcing costs to increase in perpetuity.

“As the healthcare landscape continues to evolve, the pressure to overhaul hospital systems will only intensify.

“The decisions made today will shape the future of healthcare delivery, and with mounting pressure on the system, the imperative for reform has never been more obvious.” n

Policymakers have paid lip service to prevention for decades, but realising the prevention ambition will always be unachievable if there is not a coherent plan for what the role of the hospital is, and how it can achieve this

EACH EDITION COVERS...

Environmental

Sustainability, carbon reduction, and energy efficiency news, features, insight, and case studies

Projects

The latest building projects in health and social care

Finance

Key drivers behind the health and care property investment markets and procurement insight

Property news

The latest property deals

Market insight

An overview of the key issues impacting the property sector (construction figures, reports, industry comment etc)

Design & Build

Best practice approaches to the design and construction of the health and social care estate

Estates & Facilities

The latest issues impacting estates and facilities management practices in health and care settings

Product

Focus on building products which are helping to boost health and social care environments

People overs and shakers within health and social care

SCAN HERE TO SUBSCRIBE

A‘radical overhaul’ of mental health inpatient care is needed to achieve the Government’s goal of shifting treatment from hospitals to communities, according to a new report from the Centre for Mental Health.

Care beyond beds finds that inpatient care is too often characterised by unsafe levels of bed occupancy, chronic staffing shortages, and dilapidated facilities which risk retraumatising patients.

Patients reported wards with mouse infestations and faeces on floors and walls and many said they did not feel safe.

Black people, neurodivergent people, and children are among the most poorly served.

The report says that the NHS’s 10year Plan must boost investment across the mental health system to drive a ‘safe and sustained shift’ towards community care and to provide inpatient care which

is high quality, close to home, and adequately staffed.

And it finds that limited community support means that people struggling with their mental health are ‘funnelled’ towards the more-acute end of the system. This causes more distress and upheaval and incurs higher costs.

This is especially the case for out-of-area placements, with patients being sent miles from their homes and support networks to get a hospital bed.

The report points out that inpatient services are an important part of the mental health care system, but that comprehensive investment in alternatives to inpatient care, such as crisis cafes and houses, would enable more people to get effective care closer to home.

…too many inpatient services are in outdated buildings that make safe and therapeutic care harder to provide

It also calls for a ‘fair share’ of NHS capital funding to be dedicated to psychiatric services so that outdated facilities can be updated or replaced.

Service users quizzed as part of the report described mental health services in general as ‘fragmented’, ‘difficult to navigate’, and ‘under resourced’.

Strikingly, many wards are not fit for purpose and are ill equipped to deliver good-quality care.

Some participants talked about a pervasive sense of monotony, marked by uninspiring settings and a scant selection of activities which can contribute to a detrimental environment.

Andy Bell, chief executive at the Centre for Mental Health, said: “The NHS spends as much on inpatient services as it does on community mental health care, even though the vast majority of people access their support through community settings.

“As the Darzi report says, too many inpatient services are in outdated buildings that make safe and therapeutic care harder to provide.

“Small-scale and incremental change will be insufficient to deliver the system-wide change that’s needed.

“We need to redesign our mental health system with a wider range of options, including from community and voluntary sector organisations, and a much bigger say for people using services in the kind of treatment and support they can get.

“The new Mental Health Bill promises to modernise mental health care. It must go hand-in-hand with investment in services, staff, and better facilities so that people can receive compassionate and effective support in a mental health crisis close to home, wherever they live.” n

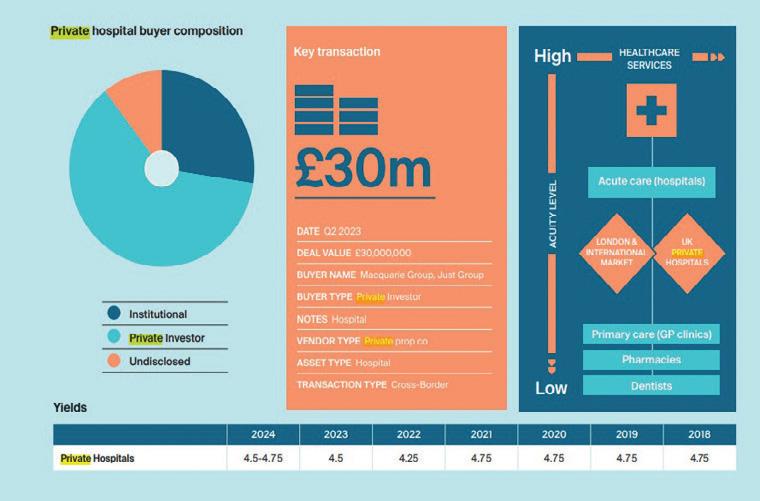

In this special report healthcare property leaders reveal their predictions for the sector in 2025

The healthcare real estate sector experienced significantly more activity in 2024 compared with 2023, with an approximate doubling of transactional volume, according to Richard Harris, head of healthcare at Colliers.

Multi-billion investment from major US healthcare REITS, such as Welltower and Omega, were the highlight of the year, attracted by a generally-higher yield profile when compared with other sub markets and the lack of competition from domestic REITs due to capital restraints.

Colliers estimates that, overall, UK healthcare real estate transaction volumes for 2024 will exceed £2.5bn, which would be comparable to peak pre-COVID.

Harris said: “Add persistent historic underinvestment in real estate to universal human demand and this is a rich recipe for opportunity.”

CBRE’s UK Real Estate Market Outlook 2025 adds: “Healthcare investment

volumes will continue to increase in 2025 following a surge in activity in H2 2024, driven by increasing demand and needs.

“Strong operational performance, attractive lease features, and improving investment market conditions for a growing buyer pool continue to attract investors to the sector.”

Key takeaways from the report include:

• Investment activity will increase as economic conditions continue to improve and buyer and seller pricing expectations align

• Healthcare will be a focus for real estate

Add persistent historic underinvestment in real estate to universal human demand and this is a rich recipe for opportunity

investors due to its resilient inflationary characteristics and robust returns

• The prime healthcare market will be increasingly competitive into H1 2025, while value-add investors are targeting the mid-market to access higher returns through operational performance and active asset management

• New sources of capital focusing on operational real estate have been key to driving healthcare investment activity within a new interest rate environment. At the core returns end of the spectrum, liability-matching insurance capital has enhanced pricing across the capital stack, and this will be a key driver of investment activity in 2025. Global strategic investors including PE, wealth managers, and REITs are focusing on larger-scale operational platforms

And Colliers predicts that technology and sustainability will continue to underpin property market decision-making over the coming months, with hybrid spaces that accommodate both virtual consultations and in-person visits expected to expand significantly, with providers adopting smaller footprints and adaptable layouts.

The market, Harris adds, will also favour smaller, decentralised facilities located closer to residential areas to improve access to care while reducing operational costs.

Here, we look at some of the predictions for each sub sector of the market. n

Growing demand from institutional investors and global private equity firms

CBRE’s UK Real Estate Market Outlook

2025 reveals that primary care property investment activity returned in 2024, with Assura and USS announcing a £250m joint venture in Q2, demonstrating the growing demand from institutional investors for healthcare assets.

And there was new interest from global private equity investors.

The report predicts this increasing demand will continue in 2025, maintaining the current level of investment activity.

It states: “Relatively-slow rental growth and high construction costs have created a barrier to new developments in the primary care market.

“However, we expect upwards pressure on rental levels as third-party investors seek to improve and increase primary care capacity in line with NHS sustainability targets.”

Eddison’s valuer and regional director, David Hayton, adds: “Together with the training and recruitment of more GPs, the need for better-quality GP surgeries and medical centres is seen by many doctors as one of the biggest challenges that the primary healthcare sector faces.

“Where an old GP surgery cannot be adequately modernised or extended, obtaining the land with planning consent on which to build a new medical centre, not to mention the challenges of selecting a contractor and arranging finance, present a considerable obstacle to many GP practices, particularly those with only a small number of partners, some of whom may be approaching retirement.

“As a result, the two largest primary care PLCs — Assura and PHP — have become the main drivers of new medical centre development.

“This trend is likely to continue as the GP sector attempts to address the problem of a decline in the appeal of the traditional partnership structure, resulting in fewer doctors willing to take on the ever-morecostly challenge of improving their surgery premises or developing new facilities.

“2025 will be a challenging year for the primary care sector and is likely to experience ongoing media attention, given the importance to most people of a successful, fully-resourced primary care sector, operating from modern, fit-forpurpose surgeries.”

Primary Health Properties PLC (PHP) is predicting a year of strategic growth and opportunities in 2025.

Mark Davies, chief executive, told

Together with the training and recruitment of more GPs, the need for better-quality GP surgeries and medical centres is seen by many doctors as one of the biggest challenges that the primary healthcare sector faces

Healthcare Property: “As we approach our 30th anniversary we celebrate our marketleading position in primary care in the UK and Ireland.

“It has been a challenging start to the calendar year as UK Gilts have been volatile and it makes investment decisions more challenging when the cost of capital is moving around.

“However, we are confident that our commitment to secure long-term income streams, supported by a high-quality portfolio with increasing demand for space will deliver continued success for PHP.

“Our confidence was demonstrated by a 3% increase in our dividend that we

announced on 2 January 2025 and, looking ahead, PHP sees a range of interesting and accretive opportunities as the market adjusts to the new interest rate environment and we are well set to announce a strong set of results on 28 February.

“Finally, we have the strongest political momentum we’ve seen for primary care for a long time and, combined with the demographic tailwinds we see day in, day out, we are well set to benefit from a 10year plan for healthcare, with more care in the community and we will continue to campaign for reform of the rental system in the UK at a time the Government has committed itself to NHS reform.” n

Increasing investor interest against the backdrop of rising patient demand and improving operational performance

New figures published by LaingBuisson show strong, sustained demand for private health cover as record numbers of individuals and employers continue to turn to private medical insurance (PMI), health cash plans, and dental cover.

This has led to a record high of £7.59bn for the UK health cover market – up £825m year on year.

And this will have an impact on property values and appetite among investors and financiers.

Knight Frank’s 2024 Healthcare Capital Markets report featured insight from Nicholas West, head of UK at Northwest Healthcare Properties REIT.

He revealed the performance in the private medical market was being underpinned by the growing NHS waiting list backlog, growth in the self-pay market, and higher levels of PMI.

The firm is also seeing an emerging trend of operators reinvesting profits into major capital expenditure projects at their hospitals, such as the construction of new operating theatres, upgrading of diagnostic equipment, and other building fabric improvements.

For example, in 2023 Spire undertook £2.8m of capital expenditure to repurpose admin space for a new minor operations theatre at its asset in Sheffield.

And Knight Frank anticipates these improvements will boost operator profitability and energy performance credentials going forward into 2025.

West said: “Location is critical to the operational performance of a hospital.

“Access to top-quality consultants, proximity to NHS feeder sites, and patient affluence profiles are some of the key criteria which are important to hospital operators.

“For this reason, operators in highquality locations seek long-term leases,

typically 20-30 years in duration, with index-linked rent reviews.

“In the short-to-medium term, we forecast that the NHS backlog will remain high, due to the unprecedented levels of doctor and NHS staff strikes, which will continue to drive private hospital revenue streams.

“The high levels of staff and energy cost inflation are anticipated to subside, albeit will remain at elevated levels for some time, and EBITDA should therefore grow inline with the revenue performance of the sector.

“On a longer-term basis, we forecast that the private hospital sector will also outperform the all-sector real estate benchmark, due to the structural

In the short-to-medium term, we forecast that the NHS backlog will remain high, due to the unprecedented levels of doctor and NHS staff strikes, which will continue to drive private hospital revenue streams

prevalence of multi-morbidities and the ageing population.”

And CBRE’s UK Real Estate Market Outlook 2025 states: “There has been considerable investment into the private acute hospital sector in 2024.

“Notable deals include Song Capital’s £631m refinancing of MPT’s UK hospital portfolio in Q2, and Assura’s £500m acquisition of Northwest Healthcare’s portfolio of 14 UK hospitals in Q3.

“We anticipate increased investor demand in 2025 against the backdrop of rising patient demand and improving operational performance.

“The long-term structural trend from inpatient to outpatient care will drive demand for specialist diagnostic and postacute rehabilitation services.

“These require specialist real estate, which may create new investment opportunities in the medium-to-long term.

Eddisons’ research points to a healthy pipeline of projects moving into this year.

Valuer and regional director, David Hayton, said: “It takes a long time to develop a new hospital, from obtaining the land and planning consent to completing the construction of highlycomplex buildings.

“There are currently a series of new private hospital developments in the pipeline, most of which are in the early stages and 2025 is likely to see further schemes confirmed as the private hospital sector attempts to capitalise on both the demand coming from the NHS and the anticipation of further demand for private treatment from individuals who are unwilling to wait months and years for NHS treatment.” n

UK care home market expected to experience a year of growth, with an increase in expansions, first-time buyer activity, and deals funded by REITS

The UK’s over-65s make up around 20% of the population and this proportion is expected to grow year on year, with an additional 1.5 million over-65s in the next five years, fuelling demand for retirement housing and social care facilities.

Similarly, in a recent study commissioned by the UK government, it was found that retirement housing units or ‘supported housing’ will need to grow by nearly 1.3 million over the next 15 years to meet the expected levels of demand.

This imbalance presents significant opportunities for developers and investors.

Christie & Co labelled 2024 as a year of growth in the UK care market, with the majority of operators reporting improved occupancy levels, a reduction in agency usage, and a return in buyer confidence, which resulted in an increase in transactional activity across the market.

Small-to-medium-sized groups (groups of three to 19 care homes) were the most-active buyer group in 2024, thanks largely to the return of occupancy – a notable shift from the most active in 2023, which was first-time buyers and independent purchasers.

However, deal times continued to be delayed as issues with the Care Quality Commission (CQC) persisted, according to Christie & Co’s Business Outlook 2025 report.

The report also notes a reduction in the number of closed, vacant care homes in 2024 — which made up 12% of the company’s healthcare sales in 2024 compared with 16% in 2023.

This is largely due to a material reduction in closed care home instructions and not a reflection in declining investor appetite for repurposing this stock, the firm says.

In addition, the land and development market faced stronger headwinds due to construction cost inflation, ongoing challenges in the planning system, and the availability of debt.

However, the need for futureproofed care beds remains undiminished and the underlying ESG credentials, together with future bed demand, remain compelling for investors.

And Christie & Co expects the combination of improved operational trading performance and stabilisation of construction costs to provide increasing confidence to return to the development

for consented sites and transactional activity forecast for 2025.

In particular, a greater number of developments are coming forward in untapped regions including the South West of England, Wales, and London and it is expected that this will continue into 2025.

In the care market in 2025,

Christie & Co expects:

• Increased activity with interest rates easing

• Increased deals funded by REITS

• Continued first-time buyer activity

• Margins squeezed on those dependent on local authority fees

• ESG credentials will become increasingly important for both owners and funders

• Existing operators will continue to expand with a preference for businesses with upside

• Concern around staffing cost increases versus local authority fees

• Healthcare will continue to be a key target sector for investors

Commenting on the report, Richard Lunn, managing director of care at Christie & Co, said: “2024 was another challenging year and the care sector which, like many, employs a significant workforce is notably impacted by the increase in employers’ National Insurance contributions, with little certainty that local authority fee increases will be sufficient to cover the differential.

“However, strong operators are alive to all the challenges and we are sure that appetite for the whole spectrum of care businesses will continue and, therefore, 2025 will see an increase in activity from a range of buyers and REITS.”

Christie & Co’s director and head of healthcare development and investment, Jordan Rundle, adds: “Following a prolonged period of headwinds in the land and development market, momentum is building in the new-build sector and this has been largely driven by stabilisation of costs and improved underlying trade performance in the private pay arena.

“As confidence returns, we are already seeing a noticeable uptick in demand from operators for good-quality, consented care home sites and anticipate greater land deal volumes over the next 12 months.”

Healthcare real estate investment manager, Elevation, is also predicting momentum in the sector through 2025, with operators looking to address the undersupply of quality care beds.

Elevation’s investment director, James Giles, said: “Over the last 12 months, as construction costs stabilised to a new normal, we started construction on 14 development projects for highquality care homes.

“We see this momentum towards new development continuing in 2025 with an encouraging pipeline of projects.

“Our operator partners have ambitious plans to grow their businesses, delivering social value by addressing the undersupply of quality care beds, and we are very supportive to fund such growth.”

The company’s ESG director, Jacob Hurtley, added that ESG was increasingly key for both operators and investors.

“We are seeing a big push towards integrating energy efficiency and renewable technologies to make property more sustainable,” he said.

“This is driven from both operators looking to make efficiency as well as long-term financial savings, and investors who are looking to boost the long-term resilience of their assets by enhancing their ESG characteristics.

“For example, last year we successfully rolled out solar panels and infra-red heating at participating care homes.”

And Eddison’s valuer and regional director, David Hayton, concludes: “While the private elderly care sector continues to enable many operators to generate good profits, this is almost always highly dependent upon being able to charge higher fees to ‘self-funding’ residents than can be obtained from local authorities.

“That ability to consistently generate profit attracts new care home development in parts of the country where operators can charge premium fees to ‘selffunding’ residents.

“The ‘turnkey’ costs of opening highquality homes regularly exceed £150,000 per bed, affirming residential care as an attractive business choice.” n

Demand for real estate remains strong amid a critical shortfall in places

According to Christie & Co’s recentlyreleased Business Outlook 2025 report, children’s social care settings continue to be sought after as demand for placements increases.

And, following a ‘somewhat-frustrating’ 2024, the next 12 months is likely to see a growth year for the sector, with the emphasis on SEN and complex needs.

The report states that ‘throughout 2024, activity in the sector was moderate, with limited acquisition and business expansion opportunities available to buyers due to many operators holding onto their existing businesses and expanding them, where possible, to keep up with the increase in demand for children’s services’.

care transactions in 2024.

And, despite a shortage of small-tomedium-sized businesses being presented for sale, the sector witnessed a handful of major transactions last year.

fostering, residential, and special education for children with high-acuity and complex needs – from the majority shareholder, Graphite Capital.

Moving through this year, Christie & Co expects:

• Increased merger and acquisition activity

• Continued buyer appetite for quality businesses with proven earnings, especially established businesses with experienced management teams

• Properties with the benefit of permitted C2 or C2a use will continue to command premiums over those sold on a vacant possession basis with C3 use

Amid heightened demand for highquality operational businesses and welllocated vacant properties benefitting from C2 use and CLD, Christie & Co achieved 105% of the asking price on children’s social

In May, for example, Cap10 Partners partnered with the existing Compass management to acquire 100% of Compass Community Children’s Services (Compass) — a leading UK provider of therapeutic

• With local authority funding shortfalls, Christie & Co fears that commissioning into services at lower cost points could result in children’s individual needs not being met

• Continued stagnation of the market in Wales in the short-term n

Independent dental sector dominates the market, with practices appealing to first-time buyers and owner-operators

The independent sector continued to dominate market activity throughout 2024, with first-time buyers, existing owners, and smaller groups driving over 80% of agreed transactions, according to Christie & Co.

This sustained momentum in the volume segment was reflected in pricing, with practices achieving an impressive average of 108% of their asking price.

As borrowing costs stabilised over the year, the market gained more confidence, particularly in practice acquisitions.

Viewings surged by 19%, offers received rose by 17%, and the number of agreed deals soared by 26% compared with 2023.

The aggregate value of all offers increased by 1.5% which, when allowing for the increased volume of offers received, reflects the dominance in independent market activity.

Activity levels were further bolstered by a significant 18% rise in the number of practices brought to market in 2024.

This influx of supply provided prospective buyers with a wider range of opportunities, influencing the average number of offers per practice sale. After climbing from 2.2 in 2022 to 4.4 in 2023, the average rose to 4.8 in 2024, reflecting the evolving market dynamics.

The market has experienced a

is showing signs of renewed optimism on the horizon.

While the transactional market in 2024 saw fewer major deals to corporate operators, this shift has opened up exciting opportunities for independent and first-time buyers.

Predictions for 2025 include:

• A continued appetite from independent groups and owner-operator first-time buyers for all practice types

• Increased numbers of sellers wanting to exit before future changes to Business Asset Disposal Relief (BADR)

• Higher National Living Wage (NLW) rates affecting practice profitability along

• Private Equity-backed corporate buyers returning to the market in light of stabilised interest rates and successful periods of integration and divestment

• Continued issues with recruitment, alleviated somewhat by the streamlining of the PVLE & ORE processes

• Due to the financial restrictions placed on NHS-focused practices, such as the ineligibility for the increased employment allowance, acquisitions focused on NHSheavy portfolios might have less appeal to buyers. Buyers may, instead, target practices with a larger private patient base, which are less constrained by the 2024 Autumn Budget’s public sector stipulations n

Bouyant market after a record year for transactions

2024 was a record-breaking year for pharmacy property transactions, with a third of real estate deals involving new market entrants, reveals Christie & Co’s Business Outlook 2025 report.

In the 12 months to the end of November 2024, Christie & Co completed 222 pharmacy sales, more than double the amount for the preceding year. And 36% of these were corporate disposals, which the broker expects to subside in 2025 and be replaced with an increasing volume of independent sales.

First-time buyers were the most-active buyer type in 2024, acquiring 33% of pharmacy businesses on the market with Christie & Co, down from 45% in 2023.

In contrast, large groups and corporate operators made up just 8% of acquisitions last year.