Managing Director

Shankar Shivaprasad

Co-founder & CEO

Shashank M

Chief Editor

Ujal Nair

Head of Operation

James Smith

Head of Production

Tom Hanks

Head of Research

Catherine D’Souza

Head of Media Sales

John Smith

Advertising Contact Info@wboutlook.com

Content Managers

Kevin Thomas

Laura Edwards

Sathyanarayana B

Amith Raj S

Business Developers

Daisy Cooper, Mark Cooper, Justin Wong, Elena Davis, Eric Thomson

Graphic Designer

Charles Smith

Chandan R

Video Editor

C Gidieon Sam Issac

Accounts Manager

Steve Smith

Office Address

32 Pekin St #05-01

Singapore 048762

Phone: +65 86159608

As we venture deeper into 2025, the business landscape is experiencing a seismic shift characterised by technology, sustainability, and innovative leadership. The Asia Pacific region stands at the forefront of this transformation, with robust GDP growth in nations like Japan, China, and Australia creating fertile ground for investment, particularly in sectors such as hospitality and real estate. However, the true driving force behind this renaissance is the rapid advancement of artificial intelligence (AI), which is reshaping industries and demanding that organisations embrace digital transformation.

Companies that leverage AI are not merely enhancing their operational efficiency but are also cultivating a more agile and interconnected business ecosystem. In today’s fast-paced economy, adaptability is no longer an option; it is a necessity. This urgency to innovate is coupled with a growing emphasis on sustainability. As environmental concerns become increasingly pressing, businesses are responding by prioritising eco-friendly practices, particularly in construction and waste management. LEED-certified buildings are just one example of how organisations are aligning their strategies with the values of a more eco-conscious consumer base. Beyond compliance, adopting Environmental, Social, and Governance (ESG) principles is proving to be a significant competitive advantage, appealing to consumers who prioritise ethical business practices.

In this shifting environment, the qualities of effective leadership are evolving. Emotional intelligence, resilience, and a passion for lifelong learning are emerging as essential traits for navigating the complexities of a world driven by rapid technological advancements and uncertain market dynamics. Leaders must not only champion innovation but also balance the pursuit of financial success with the imperative of creating a sustainable and equitable global community. This requires a collective commitment to adapting leadership styles that promote inclusivity and responsiveness in the face of change.

The agriculture sector exemplifies these transformative trends, as smart farming technologies are revolutionising traditional farming methods. Innovations such as AI-driven weather predictions and robotic harvesters are enhancing productivity while addressing labour shortages. Moreover, vertical and indoor farming practices are gaining traction, enabling year-round crop production and contributing to sustainable urban agriculture.

At the same time, the digital landscape calls for innovative identity verification solutions, particularly in the fintech and Web3 sectors. Traditional verification methods are yielding to the concept of “proof of personhood,” which upholds privacy while confirming an individual’s identity. This advancement not only mitigates operational costs for financial institutions but also paves the way for Web3 platforms to build trust with users.

As we navigate the complexities of this evolving landscape, it is clear that the future of business will hinge on the ability to adapt to technological advancements and sustainability imperatives. Companies that embrace these changes with strategic foresight will not only thrive but also play a vital role in shaping a more responsible and prosperous future for all. The call to action is clear: innovate, sustain, and lead the change.

Be sure to check out our website at www.worldbusinessoutlook.com

Connect with us on Facebook: www.facebook.com/WBOutook

Twitter : https://twitter.com/wboutlook

Instagram: https://instagram.com/wboutlook

LinkedIn: https://www.linkedin.com/company/world-business-outlook

YouTube: https://www.youtube.com/@worldbusinessoutlook908

Commercial Real Estate in the Future: Datadriven Insights are Transforming Investments

Top 3 Best AI Essay Generators in 2025 for Students From Static to Cinematic: What FPV Drones Bring to Visual Storytelling

10 How AI, Big Data and Location Intelligence Are Transforming Commercial Real Estate

What is Smart Farming? It’s The Future of Agricultural Industry

Advanced Crypto Trading Strategies for Singapore Investors

10 Small Businesses to Start Up with a Shipping Container in Santa Maria Greener Indiana – How Clean Tech Is Changing Lives Across the State 20 40 46 50 54

Automation in the Energy Sector: Opportunities and Obstacles

Representational image

Investors look to its composition, movement, and statistical markers to inform strategic decisions. This analysis provides a clear, data-driven story of market movers and key trends. It offers historical context, current dynamics, and future projections, helping stakeholders make informed, resilient investment decisions.

The index is built from a carefully chosen group of leading companies, providing an overview of market health over the decades. Phases of expansion and contraction have been captured in historical records which can help us understand past market cycles. This context is used by analysts to analyze stability and growth potential, combining modern data with longterm patterns. An analysis of the evolution of economic sectors and shifting market forces over time provides a thorough Dow Jones Index overview. This contextual framework enables investors to make informed decisions based on the history of the market rather than just what is happening right now. These dynamics are carefully documented to improve predictive accuracy, the key to strategies based on empirically grounded, measured risk assessment. In shaping resilient investment frameworks

and deeper market insight, the historical perspective remains indispensable.

Domestic and global economic events have driven significant shifts in recent trading sessions. Leading market movers are analyzed to unveil how the sector and geopolitical factors affect trading patterns. Corporate earnings, policy adjustments, and macroeconomic shifts are what guide volatility and momentum, according to observers. To understand real-time market conditions, investors use Dow Jones Index performance metrics to discern the subtle nuances within the rapid fluctuations. This analysis illustrates how both immediate data and larger economic narratives affect market sentiment. Portfolios that are robust in uncertain periods must strike a balance between short-term disruptions and enduring trends. Overall, the current landscape calls for close attention to performance indicators to inform tactical and strategic investment decisions.

Macroeconomic forces remain central to market

trajectories. Interest rates, inflation, and employment data are assessed in detail to provide critical insight into underlying economic stability. Analysts marry disparate data sources to show how fiscal policy changes affect markets. Experts correlate broad economic indicators with sector-specific trends by checking Dow Jones Index stats, allowing them to identify emerging patterns and forecast potential market shifts.

The analytical framework combines numerical data with subjective evaluations to create a unified comprehension of market behaviour patterns. Investors who track economic signals can predict market shifts and modify their investment approaches. Long-term investment success and market resilience in today’s evolving landscape depend on a comprehensive understanding of economic influences. These macroeconomic forces remain susceptible to changes from global trade patterns, technological progress, and demographic shifts, which demand ongoing monitoring and

adaptability. The broad perspective enables investors to take proactive measures when market conditions transform.

More and more investors rely on precise technical analysis to decode market trends and make decisions. Advanced statistical models are applied to create a clear picture of market strength and potential turning points. Moving averages, support resistance levels, and momentum oscillators are reviewed in detail to gauge short-term fluctuations. The addition of a Dow Jones Index quote to these analyses clarifies the narrative, as real-time data provides an immediate understanding of market sentiment. Rigorous quantitative assessments combine with this technical framework to support investment decisions with both historical data and current performance indicators.

Integrating technical tools with robust statistical

measures achieves a balanced approach to risk assessment and portfolio optimization. The methodical study of market patterns helps form strategies that incorporate immediate market conditions as well as long-term financial objectives, resulting in an informed and disciplined investment process. Secondly, the technical approach is adaptable and resilient as market conditions change, and investors can constantly refine their strategy to anticipate any potential disruptions. By using this proactive, data-driven methodology, the probability of successfully navigating the unpredictable market increases.

However, to forecast market trends, it’s important to understand both the current and the potential risk factors. By integrating advanced predictive models with emerging economic signals, analysts project future market conditions. An overview of evolving policy changes, global events, and market dynamics allows for a nuanced Dow Jones Index outlook, highlighting possible scenarios. These projections look at the optimistic growth trends, as well as the chance for volatility, highlighting the need for risk management. Investors can then proactively adjust portfolios by identifying vulnerabilities and assessing probable market shifts. By taking a forward-looking approach, it advocates balanced risk-taking and strategic flexibility, making investment strategies adaptable.

Future projections, robustly analysed, highlight the importance of the interplay between market dynamics

and economic realities, while a disciplined approach to uncertainty is fostered. In a complex financial environment, such evaluations are critical to minimizing risk while capitalizing on opportunities. Furthermore, market participants must stay vigilant of real-time data and adapt their strategies to sudden changes because market performance can be steered off course quickly by unforeseen events. The capacity to stay responsive and adjust forecasts as new data becomes available means that investments are resilient and able to weather potential economic turbulence.

With the changing market landscape, investors need to constantly review and upgrade their strategies. Asset allocation, as well as risk mitigation practices, are informed by comprehensive evaluations of market trends. With detailed insights, investors balance growth and defensive positions and stay nimble in the face of uncertainty. Periodic Dow Jones index performance reviews are used as a framework for the rebalancing process and serve to illustrate strategic repositioning opportunities. These assessments highlight the importance of continued monitoring and adaptive management. Robust portfolio construction and long-term wealth preservation require strategic adjustments based on current market data. Investors align the investment strategies with the latest analytical insights, creating a dynamic, resilient, and responsive framework. With this disciplined approach, proactive decision-making is encouraged, which leads to sustained financial growth and effective control of market risks.

An analysis of the Dow Jones Index demonstrates the power of a single tool to analyze a market dynamic. Collectively, historical context, current performance, economic indicators, technical analysis, and forwardlooking projections provide a robust framework for informed decision-making. A balanced view of market trends and risk factors provides investors with adaptive strategies for long-term success. In the long run, this systematic approach ultimately reinforces resilient investment practices and strategic portfolio management.

AI, big data, and location intelligence advancements are driving a revolution in commercial real estate. These technologies are giving brokers, renters, and investors datadriven insights that improve decision-making and lower risks. As the industry gets increasingly complicated, platforms like Realmo take use of these advancements. Better investment decisions are made by stakeholders as a result.

AI

When it comes to valuation, AI is already changing the way CRE professionals assess market trends and property value. This is because predictive analytics tools use historical data to predict future outcomes, making it easier for brokers and investors to identify promising opportunities and avoid threats. These solutions also help to improve accuracy, which is critical in CRE where small inaccuracies can lead to major losses.

Another area where AI is improving the CRE landscape is risk management. By automating the calculation of key financial metrics such as debt-to-income ratio, loanto-value ratio and debt service coverage ratio, AI helps to streamline the underwriting process and mitigate various risk factors in investment transactions. In addition, it can monitor portfolio conditions in real time and alert CRE professionals of any changes so that they can take prompt action to minimize risks and optimize their investments.

As a result, the potential for AI to transform the CRE industry is significant. However, the full benefits of the technology are not yet realized due to several barriers.

To overcome these challenges, CRE professionals must demonstrate the value of AI to their functional leaders and organizational stakeholders. This requires demonstrating how AI can deliver new insights, enhance decision-making, streamline data collection and analysis, provide better workplace experiences and drive operational efficiency.

Big data analytics and artificial intelligence work together like a powerful duo to drive innovation and efficiency across industries. The former provides the nutrition for the latter, providing massive datasets that fuel Machine Learning algorithms and enhance their utility to enterprises.

AI enables businesses to process big data quickly and accurately, enabling them to take proactive action. It also helps them to spot trends and patterns in real-time. Examples include: detecting fraudulent transactions in banking, monitoring patient vitals in healthcare, and optimizing the performance of equipment in energy.

In retail, AI enables companies to predict product demand, forecast sales, and automate pricing strategies. It also enables retailers to optimize inventory levels, and avoid overstocking or stockouts. For example, British fashion brand Burberry uses AI-powered predictive analytics to offer personalized shopping experiences to its customers.

AI technologies like natural language processing and image recognition extract meaning from unstructured

data, enabling companies to analyze social media sentiment and customer feedback or improve their products with chatbots and voice assistants.

Moreover, big data platforms with AI capabilities enable users to explore and visualize their data with ease by removing the barrier between humans and machines. ThoughtSpot is an enterprise-grade AI solution that empowers users to tell a powerful data story with automated insights and drill-anywhere visualizations.

Geographic data is a crucial asset to business applications such as site selection, supply chain management and risk assessment. It is also a powerful tool to optimize operations, gain a competitive advantage and deliver a personalized experience.

LI allows businesses to understand customer behavior patterns, improve marketing campaigns and offer targeted promotions. This leads to higher sales and

improved ROI.

For instance, Quick service restaurants (QSRs) can use LI to identify consumer purchase behavior trends and map them across their outlets for better market penetration and a superior customer experience.

LI is also used by industrial companies to streamline production processes, optimize supply chain operations and identify new investment opportunities. Energy companies rely on location intelligence to assess environmental risks, visualize assets and optimize networks.

In addition, retail brands use location intelligence to identify customer footfall patterns and determine optimal store placements that drive revenue. Similarly, financial services firms utilize location intelligence to find high-demand markets for opening branches and ATMs, as well as assess credit risk using regional economic trends and real estate values.

Big Data and AI are powerful tools for transforming commercial real estate. Together, they enable companies to forge smarter strategies, drive desired results, and gain a competitive edge. To make the most of these technologies, however, businesses must ensure that they have the necessary infrastructure in place. This includes investing in robust, scalable technology platforms that can handle massive datasets and complex AI algorithms.

In addition, businesses should implement policies that ensure data quality and security. This will help to build trust with customers and ensure compliance with

regulations. Additionally, businesses should invest in training programs to hire and retain skilled analysts and data scientists. This will allow them to develop and maintain robust, cutting-edge AI models and algorithms.

Making decisions based on data is becoming more and more essential as artificial intelligence, big data, and location intelligence continue to transform the commercial real estate industry. By providing investors with actionable data, platforms like as Realmo help them remain ahead of the curve in a sector that is becoming more and more dynamic. CRE professionals may make quicker, more informed, and more lucrative decisions by utilizing these tools.

Commercial real estate in the United States is going through a major transformation. Digital tools and data analysis are driving a rapid evolution of market dynamics, tenants’ preferences and investment strategies. Realtime data is increasingly used by investors, brokers and tenants to inform their decisions.

Analysts at realmo believe that location intelligence and analytics will improve decision making in commercial real estate. They help assess risk, forecast market trends and optimize asset performances with unparalleled precision.

Traditional methods of CRE investing relied heavily upon manual research, historical trends, and intuition. The technology revolutionized the industry by providing powerful tools based on data that improve accuracy and efficiency.

AI-based models analyze real-time and historical data to help investors predict market trends. Commercial landlords, for example, can predict rental demand while developers identify the most suitable locations for their new projects. Realmo, for example, aggregates vast quantities of data from the market to provide investors with these insights.

Geospatial and demographic data are combined with economic indicators in order to calculate property values. Investors can use foot traffic, consumer behaviour, and new infrastructure to determine potential appreciation of property instead of solely relying on previous sales data.

AI-driven tools can help investors evaluate risks related to specific markets, types of properties, and locations. AI predicts how property markets will respond to economic downturns by analyzing patterns. This allows investors adjust their portfolios in accordance. Realmo’s data-driven strategy helps minimize potential risks while maximizing returns.

Commercial real estate is constantly adapting new trends to shape the investment strategy and lease dynamics. Commercial real estate is shaped by a number of key trends.

As hybrid models of work have become more popular, the demand for office space has decreased. However, the requirement for flexible spaces is increasing. Landlords and investors must reconsider their leasing strategy, with a focus on co-working spaces and adaptive office space. Demand for commercial spaces that offer flexible leasing terms is on the rise.

The explosive growth in e-commerce has had a negative impact on brick-and-mortar retailers. While many traditional retailers downsize, logistics and fulfillment centres are growing. Industrial real estate such as distribution and warehouse centers are becoming more attractive to investors as a profitable alternative.

Commercial real estate is now required to be sustainable. Eco-friendly buildings, green designs and energyefficient operations have become critical factors in investment. Property with LEED or intelligent energy management systems attracts higher values and strong tenant demand.

Commercial real estate investment is shaped by federal and state policy. Investment in certain markets is encouraged by tax incentives and initiatives to promote sustainability. Investors need to stay up-to-date on the latest regulatory changes in order to take advantage of government incentives.

Investors must use technology to their advantage in order to stay competitive on a market that is increasingly datacentric. These are some of the best practices.

Technology-Enabled decision-Making: Embrace it!

Investors need to integrate AI, location intelligence, and big data into their investment strategy. Realmo, for example, offers tools to analyze large datasets and make smarter decisions. These tools allow investors to identify areas with high growth, forecast property performance and optimize asset allocation.

Investors should diversify their portfolios rather than depend on one asset class. In today’s investment

market, mixed-use development, logistics hubs and office space with a tech focus are all promising categories.

Investors must be aware of the changing demands and preferences. Flexible spaces, environments that promote wellness, and technologies for smart buildings are top priorities. Investors that align their property with tenants’ needs can expect higher occupancy rates as well as better returns over the long term.

4. Keep up to date with market data and trends

Investors can stay on top of the industry’s changes by regularly monitoring trends in industry reports and research. Market reports and property valuations tools are updated regularly, as is location intelligence. This allows for better risk management and decision making.

Conclusion

Commercial real estate is changing at a rapid pace. Data-driven insights have been at the forefront of this

change. Technology is changing the way investors evaluate opportunities, manage risk, and maximize returns.

CRE professionals who use data-driven insights can make better investment decisions, remain ahead of the market, and stay on top of trends by leveraging platforms such as Realmo. Data-driven approaches will help those in the CRE industry succeed as they embrace digital transformation.

The investment world is experiencing a seismic shift as artificial intelligence transforms traditional strategies into data-driven powerhouses.

image

Gone are the days when successful investing relied solely on human intuition and basic market analysis. Today’s investment landscape demands sophisticated tools that can process vast amounts of information at unprecedented speeds and identify patterns invisible to the human eye.

AI’s growing presence in finance isn’t merely a technological novelty; it represents a paradigm shift in how wealth is managed, risks are assessed, and opportunities are discovered across investor categories, from novices to seasoned professionals.

The journey toward AI-powered investing didn’t happen overnight. What began decades ago with simple rule-based algorithms has evolved into sophisticated cognitive systems capable of learning and adapting. Early algorithmic

trading merely followed predetermined instructions, executing trades when specific conditions were met.

Machine learning algorithms now process millions of data points to identify profitable patterns and market anomalies. Leading hedge fund recently reported its ai for stock trading platform detected a correlation between weather patterns and commodity futures that human analysts had overlooked for years.

Deep learning networks continuously improve through experience, becoming more effective at recognizing complex market patterns with each transaction they process. These systems can simultaneously analyze thousands of stocks across multiple markets, identifying opportunities that would require an army of human analysts.

AI has transformed portfolio construction by enabling real-time optimization based on market conditions. Unlike traditional rebalancing methods, AI-powered systems continuously adjust asset allocations to maintain an ideal risk-reward balance.

In risk management, advanced AI models predict market downturns with high accuracy, monitoring portfolios around the clock and proactively implementing hedging strategies when needed. This proactive approach helps mitigate losses before they escalate.

As the financial landscape grows increasingly complex, AIdriven technologies are transforming how investments are analyzed, executed, and optimized.

Today’s advanced trading platforms leverage reinforced

learning, where AI continuously improves through trial and error. These systems detect profitable patterns across various timeframes, from microsecond price shifts to long-term market cycles.

• AI-driven trading algorithms adapt dynamically to market fluctuations.

• Proprietary AI models developed by leading firms consistently outperform traditional strategies.

• AI trading strategies now dominate daily trading activity on major exchanges.

Forward-thinking investors use alternative data sources like satellite imagery, social media sentiment, and locationbased foot traffic to gain deeper market insights. AI synthesizes these diverse inputs for a comprehensive market outlook.

• AI systems process unstructured data to uncover hidden market trends.

• Real-time sentiment analysis enhances predictive accuracy.

• Alternative data-driven funds have demonstrated superior performance over traditional models.

Modern AI investment platforms tailor strategies to individual goals, risk tolerance, and investment timelines. These systems evolve with changing client needs and market conditions.

• AI-driven recommendations enhance portfolio performance and client engagement.

• Adaptive strategies ensure investments align with shifting financial objectives.

• Personalized AI platforms improve decision-making efficiency for investors.

• AI identifies hidden market relationships and acts without emotional bias, improving decision-making.

• Provides a structural advantage in increasingly efficient markets.

• AI-powered research tools reduce securities analysis time by over 80% (Goldman Sachs).

• Analysts can cover more assets with greater depth and accuracy.

How is AI changing stock trading strategies?

AI-driven trading platforms use Machine Learning and reinforced learning to detect profitable patterns, adapt to market fluctuations, and execute trades at high speeds, significantly improving efficiency and returns.

Can AI-powered investment tools replace human financial advisors?

While AI enhances investment strategies with datadriven insights, human advisors remain valuable for personalized guidance, complex financial planning, and emotional decision-making support, creating a balanced AI-human approach.

What are the main advantages of AI in portfolio management?

AI optimizes asset allocations in real-time, enhances risk management through predictive analytics, and democratizes investment intelligence by making advanced financial tools accessible to retail investors at lower costs.

the

As AI transforms investment strategies, success depends on the extent to which these tools are integrated into investment processes. As AI enhances data analysis and decision-making, human judgment is still needed to define goals, manage risk, and address market volatility. Merging AI with prudent oversight leads to stronger, forward-looking portfolios.

• AI-driven portfolios outperform traditional strategies by an average of 3.7% annually over five years (Stanford, 2023).

Smart farming is a modern agricultural practice that employs advanced technologies to enhance productivity, efficiency, and sustainability. Farmers use sensors, drones, artificial intelligence (AI), and automated machinery to grow crops and manage livestock with greater efficacy rather than depending on traditional methods.

This technology helps farmers save time, save money, and make more informed decisions about their land and resources. With the global population continuing to rise, farmers need new and innovative ways to increase food production with lower environmental impact.

Smart farming refers to the use of digital tools and automation for daily farm activities. Farmers are no

longer depending solely on intuition or hearsay to decide when to plant, water, or harvest their crops. Technology, instead, offers real-time data and analytics that assist them in making informed decisions.

Precision agriculture is one of the main components of smart farming. This method ensures that resources, such as water, fertilizers, and pesticides, are applied only where and when they are needed rather than evenly spread throughout a whole field. Through the use of smart sensors and satellite imaging, farmers can monitor soil conditions, trace field variables of plant health, and guide pest detection in its early stages.

Groundbreaking technology is automated machinery. Tractors, harvesters, and irrigation systems can be programmed to work autonomously or controlled

remotely. Some of these machines are powered with AI-enabled software, helping them learn and adapt to farming conditions to increase effectiveness over time.

Farm equipment providers play an important role in smart farming as they heavily rely on advanced equipment and machinery. Texas and other states have dealers that provide high-tech farming tools built to help farmers work smarter, not harder.

One of the biggest makers of agricultural machines has created driverless tractors, GPS controlled harvesters, and precision planters. The John Deere dealers texas enable farmers to manage their farms conveniently, minimize human error, and improve crop yields. Many of these machines also come equipped with sensors and can connect to the cloud, enabling farmers to monitor their fields in real-time from a smartphone or computer.

John Deere dealers don’t just sell equipment; they sell support. To teach farmers how to use smart farming tools properly, they also provide training and technical assistance. These dealers usher in the future of agriculture by giving farmers access to cutting-edge technology.

One of the most important advantages of smart farming is efficiency. Automating tasks and utilizing data-driven insights help farmers produce more food with fewer resources. This increases profits while reducing costs and waste.

Another advantage is better decision-making. Today, farmers have access to real-time data on soil moisture, temperature, and crop health, allowing them to make informed decisions about irrigation, fertilization, and pest control. Not only does this increase productivity, but it also decreases crop failure.

Smart farming is also beneficial for environmental sustainability. The application of precision agriculture allows farmers to limit water consumption, decrease chemical leaching, and reduce soil degradation. This

preserves ecosystems and keeps farmland productive for the future.

Additionally, smart farming helps reduce the laborintensive nature of agriculture. Automated machines make it easier to complete farm work in less time and with higher accuracy than before. This is particularly crucial given the labor shortages in the agriculture industry.

Advancements in smart farming technologies are reshaping agriculture with significant innovations on the horizon. Artificial intelligence (AI) and Machine Learning are enhancing weather predictions, enabling early detection of plant diseases, and automating tasks more efficiently.

Additionally, the adoption of robotic farming is gaining momentum. Farmers are increasingly turning to robotic harvesters that efficiently pick fruits and vegetables, outpacing human labor.

Moreover, the rise of vertical and indoor farming through techniques like hydroponics and advanced climate controls allows for year-round crop cultivation indoors. These methods are space-efficient, consume less water, and offer sustainable urban agriculture solutions.

Smart farming is revolutionizing the farming industry. Technology, automation, and data-driven decisionmaking enable farmers to be more efficient, reduce waste, and produce more food to feed the world’s growing population. While smart farming faces challenges such as high costs and limited internet access, its expansion and growth show bright prospects.

Farm equipment manufacturers and dealers play a crucial role in providing farmers with the tools and support needed to adopt smart farming practices. As the industry continues to evolve, agriculture will become more productive, sustainable, and prepared to embrace future challenges.

In today’s digital economy, our identities serve as gateways to nearly everything we do online. Yet, for all our technological progress, the way we prove who we are remains startlingly outdated. Financial institutions are saddled with bloated verification systems, users struggle with endless logins, and platforms battle waves of bots and fake accounts.

As both the fintech and Web3 sectors continue their explosive growth, a critical challenge has emerged – creating trustworthy digital relationships without sacrificing privacy or efficiency.

For consumers, it means repetitive verification processes

across different platforms. For financial institutions, it translates to increased operational costs and regulatory scrutiny. For Web3 platforms, it represents perhaps their most significant barrier to mainstream adoption.

The solution emerging at this intersection is proof of personhood – verification systems that confirm a user is indeed human without necessarily revealing exactly who they are. These innovative systems are quickly becoming essential infrastructure for both traditional finance and decentralized technologies.

Traditional identity verification typically requires users to submit extensive personal documentation such as

passports, driver’s licenses, and utility bills – creating centralized databases of sensitive information that become prime targets for hackers.

In contrast, proof of personhood systems take a fundamentally different approach. They focus on verifying humanity and uniqueness rather than establishing comprehensive identity profiles. This shift represents a significant evolution in our understanding of digital verification.

The financial sector has always faced a fundamental tension: the need to verify customers while providing seamless experiences thoroughly. Balancing these priorities has become increasingly difficult as consumer expectations rise and digital threats multiply.

Consider cross-border payments and remittances, where identity verification has long been a significant bottleneck. For digital banking platforms, the advantages extend beyond cost savings. Verified digital identities enable banks to:

• Create more personalized experiences based on verified attributes

• Reduce compliance costs while maintaining regulatory standards

• Minimize fraud losses through more reliable authentication

• Streamline account opening and transaction processes

While financial institutions have been exploring decentralized identity solutions, the Web3 ecosystem faces an even more existential need. According to Chainalysis, 60% of DeFi project leaders cite identity verification as a major barrier to market growth.

The challenge is particularly acute for decentralized finance platforms, which aim to create open financial systems without traditional intermediaries. Without robust identity solutions, these platforms struggle with

• Prevent market manipulation and Sybil attacks

• Complying with evolving regulatory requirements

• Building trust with mainstream users and institutions

• Enabling real-world asset tokenization at scale

This explains the recent surge in interest around proof of personhood protocols. These systems provide the critical infrastructure needed to bridge traditional finance with its decentralized counterparts.

One of the most remarkable aspects of modern proof of personhood systems is how they resolve what previously seemed an insurmountable trade-off between verification and privacy.

Zero-knowledge proofs stand at the heart of this solution. This cryptographic technique allows users to prove specific facts about themselves (age, residency, creditworthiness) without revealing the underlying data. The technology essentially creates a win-win scenario –financial institutions receive higher-quality verification with less liability, while users gain both convenience and enhanced privacy. This breakthrough not only boosts user trust but also enables scalable, fraudresistant digital identity systems across finance and social platforms.

How does proof of personhood differ from traditional identity verification?

Traditional verification identifies exactly who you are using government IDs and personal documents stored in centralized databases. Proof of personhood primarily verifies that you’re a unique human without necessarily collecting or storing your details.

Are decentralized identity solutions compatible with existing banking systems?

Yes, most decentralized identity solutions are designed for interoperability with existing systems.

How might proof of personhood impact financial inclusion in emerging markets?

Proof of personhood could dramatically increase financial access in emerging markets by providing identity verification for the estimated 1 billion people worldwide without formal documentation.

Conclusion

As we navigate an increasingly digital financial landscape, proof of personhood systems aren’t merely helpful additions; they’re becoming essential

infrastructure. By solving the fundamental challenge of verifying unique humans without compromising privacy, these technologies unlock new possibilities across both traditional finance and Web3.

The financial institutions that embrace these solutions early will likely gain significant advantages in customer experience, operational efficiency, and market positioning. For an industry built on trust, reimagining how that trust is established may prove to be its most important innovation yet.

The process of reviewing contracts is vital in business activity. Traditionally, this involves painstaking manual labor and sharp observation of the eyes. Nonetheless, the field of analyzing contracts became a great deal more effective with the advent of artificial intelligence. AI contract review software is just the solution to the manual assessment problem. In this post, we will explain a few reasons why AI software is taking over when it comes to contract review matters.

Going through an entire contract manually takes considerable time. It is common for professionals to waste hours or even days reading long documents. While it all might take a good bit of time for a human to do, it is a job an AI software can do in a matter of minutes. AI document review solutions use advanced algorithms to scan and analyze contracts at lightning speed, flagging any key components and potential red flags.

Manual contract reviews face an ever-present risk of human error. We can miss details or misunderstand them because of fatigue. We tend to get distracted or do not see everything. As a result, AI-powered solutions have a higher level of accuracy. These systems can read contracts meticulously so that no important point is missed. In addition, AI software ensures uniformity in the review process. AI tools will apply uniform standards and criteria to all documents, unlike human reviewers who may interpret results differently.

Onboarding people to judge contracts is costly. They are expensive and must be paid salaries and offered benefits training. This is why AI contract review software is a much more inexpensive solution. Although AI tools require a significant initial investment, they will save even more over time. It cuts down the extensive manpower needed by businesses, reducing their overheads. In addition, rapid and accurate AI reviews can help avoid expensive drift or contract disputes, resulting in additional monetary gains.

Contracts are filled with off-putting language and complex clauses. It takes a keen eye to identify potential risks. AI software does this brilliantly, processing advanced natural language to understand complex language. They can alert businesses to vague or problematic clauses and help manage risk ahead of time. By detecting problems early, it helps the companies make the right decision, negotiate better terms, or make appropriate corrections ahead of the finalization of agreements.

Businesses change, and so do the number of contracts they may require. Such changes can be overwhelming for manual reviews. AI software is scalable and can process huge volumes of contracts without any compromise in quality or time. AI tools can also be adjusted to changing

legal standards or business requirements. AI systems, on the other hand, can easily be updated, reprogrammed, etc. in order to comply with new regulations or industry practices which is very difficult with human reviewers because that would mean extensive retraining of the reviewers.

One of the most important factors in the contract review process is confidentiality. Such manual reviews can leak confidential data to unauthorized users. AI software helps to secure data as humans do not interact with sensitive documents. It utilizes techniques like encrypted storage of confidential data, etc., and enhances the security of all contracts being reviewed, providing organizations with peace of mind.

Machine Learning Algorithms: An AI Contract Review

Software Continues to learn the more contracts these systems process, the better they get at pattern recognition and their predictive power. Constant selfimprovement helps these AI tools stay current with industry trends and changing legal nomenclature. Industry gains access to next-generation tech, which becomes increasingly reliable over time, thereby providing lasting benefits over trying to review manually.

The shift from manual to AI-driven contract review marks a significant business advancement. AI software offers numerous benefits, including enhanced efficiency, accuracy, cost-effectiveness, and security. As technology evolves, AI contract review tools will likely become even more sophisticated, further widening the gap between manual and automated processes. Adopting AI contract review software is a wise choice for companies aiming to streamline operations and minimize risk. This approach modernises contract analysis and sets the stage for greater success in an ever-competitive business landscape.

We all know that having a writing assistant can be a lifesaver, especially when burdened with multiple writing assignments. In 2025, we now have two different types of writing assistance available: professional writers and AI writing tools.

While hiring professionals can be pricey, AI writers offer a cost-effective solution. Factually speaking, AI essay generators have become go-to aids for many students. These tools use advanced tech to create well-structured essays and assist with brainstorming and organization. However, finding the top performer is the key.

Let’s explore the top AI essay generators transforming the writing game this year.

2025’s Leading AI Essay Writers

2025 sees the rise of various AI essay generators, making essay writing much easier. Now, as we step into 2025 with the same momentum, these tools continue to redefine and simplify the writing process.

They promise even greater convenience and efficiency for users. So pick the one that delivers the best results for you.

Let’s break down the list of our top 3 best AI essay generators:

1. PerfectEssayWriter.ai – Exemplary Essay Crafting Excellence

2. MyEssayWriter.ai – Tailored Essays, Your Way

3. FreeEssayWriter.ai – Cost-Free Essay Excellence

PerfectEssayWriter.ai

So, in the quest for the perfect essay-writing tool, the one platform that has truly stood the test of time is PerfectEssayWriter.ai. As active participants in the academic discourse, we explored this AI essay generator, and what we found left us genuinely impressed.

Having been around for quite a while, this AI writing tool has garnered attention not just for its longevity but for its efficient, cost-effective, and user-friendly features.

What caught our attention are the outstanding features that set PerfectEssayWriter.ai apart from the rest:

• Generate Unique Essays with Ease: The platform generates unique essays according to your instructions, delivering content that is both original and engaging.

• Essay Structures for Guided Writing: The platform provides logical essay structures. This feature acts as a guiding light, assisting students in organizing their thoughts effectively.

• Plagiarism-Free Essays: This tool ensures that the content it produces is not just unique but also free from any traces of plagiarism.

• Efficient Referencing Tool: PerfectEssayWriter.ai simplifies the citation process by offering an efficient citation machine.

The buzz surrounding PerfectEssayWriter.ai on notable platforms like Quora speaks volumes about its efficacy. Students, in particular, have been quick to embrace its efficiency, cost-effectiveness, and user-friendly interface.

One noteworthy aspect we’d like to highlight is the platform’s pricing. PerfectEssayWriter.ai manages to strike a balance between affordability and quality, making it an accessible resource for students on varied budgets.

MyEssayWriter.ai

MyEssayWriter.ai blends advanced algorithms with practical functionalities. Our recent exploration into this platform left us not just impressed but genuinely excited to share our findings with the academic community.

Sophisticated algorithms, a user-friendly interface, and active customer support made the experience with this essay writer extraordinary.

Let’s look into the features that make MyEssayWriter.ai a go-to resource for writers of all levels:

• Unique and Original Content: The tool delivers content that is not just unique but also original, ensuring that your voice shines through in every piece.

• Essay Outliner: The platform offers a dynamic essay outliner, a valuable tool for those seeking a structured approach to their writing.

• Summarizer Tool: Condensing complex information has never been easier. MyEssayWriter.ai’s summarizer tool provides concise summaries that keep the essence of the content.

• Citation Generator: The citation generator offers a hassle-free solution for accurate referencing.

• Grammar Checker: The grammar checker ensures that your content is not just compelling but also impeccably written.

• Content Humanizer: MyEssayWriter.ai injects a human touch into your AI-flagged content, which is a great feature for academic writing.

• Plagiarism Checker: MyEssayWriter.ai’s plagiarism checker maintains academic integrity by accurately checking the content for potential duplicate material.

MyEssayWriter.ai distinguishes itself by offering an impressive collection of 16 templates, each for different

writing tasks. This diversity ensures that writers have the right tools at their disposal, regardless of the nature of their assignment.

FreeEssayWriter.ai

True to its name, this tool offers considerable features without putting a dent in your budget. It is an attractive option for students seeking cost-free essay excellence.

FreeEssayWriter.ai uses advanced natural language processing, providing high-quality content for all types of academic writing. This free AI essay writer tool’s prowess extends beyond mere automation, providing students with a comprehensive set of features that go hand in hand with their academic pursuits.

Students across platforms, including Quora and Reddit, have recognized the platform for its affordable features.

Here are some of the standout features that garnered our attention

Plagiarism-Free Content: FreeEssayWriter.ai ensures that the content it generates is not only unique but also free from any traces of plagiarism.

AI Essay Outliner: The tool assists users with a structured essay outline, laying the foundation for a well-organized and coherent paper.

AI Essay Writer: With advanced AI algorithms, this feature generates essays with remarkable efficiency, saving students valuable time and effort.

Content Summarizer: FreeEssayWriter.ai’s content summarizer simplifies complex ideas without compromising on clarity.

Citation Machine: Navigating the nuances of citations is made easier with the tool’s built-in citation machine, ensuring adherence to academic standards.

Easy to Navigate: A user-friendly interface ensures that

students, regardless of their technical proficiency, can easily navigate and utilize the tool’s features.

This AI essay generator tool is making waves in the academic community with its commitment to providing cost-free essay excellence. The tool’s features, coupled with its advanced natural language processing, position it as a valuable ally for students.

These top AI essay writing tools have made writing essays easier. Just provide instructions, and you’ll get a well-written piece. While these tools might not excel at analyzing data, they’re changing the game in education.

Students can find more success if they learn how to use them effectively. These AI tools can be a key to making academic tasks easier and helpful in achieving better results.

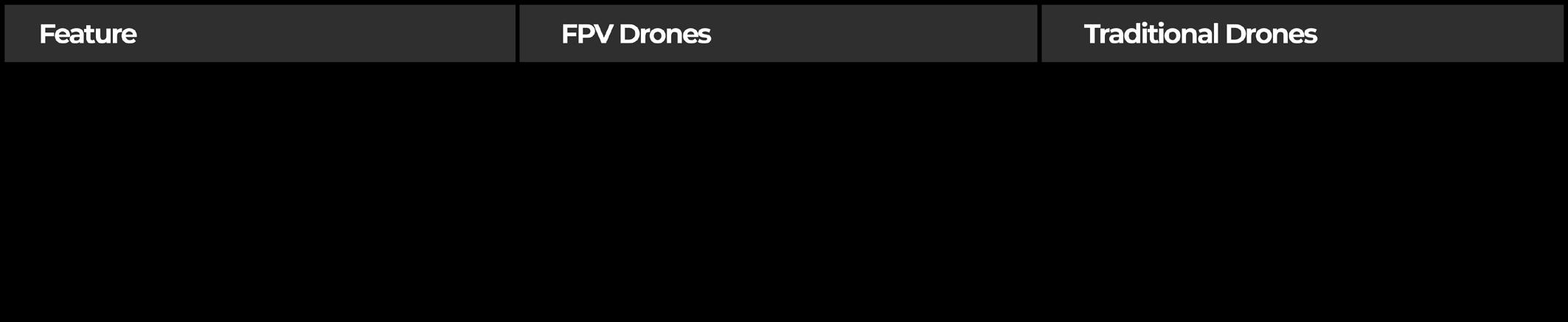

Filmmaking has always relied on creative tools to tell captivating stories, and now, FPV (First-Person View) drones are taking visual storytelling to new heights. In 2025, the revenue in the drone market worldwide amounted to US$4.4 billion, a testament to the rapid growth and impact of drone technology in various industries, including filmmaking.

image

From capturing high-speed action shots to weaving intricate sequences, FPV drones provide a level of control and agility that traditional drones simply cannot match. Whether for cinematic movies, music videos, or documentaries, FPV drones are revolutionising the art of visual storytelling.

FPV drones have become a game-changer for filmmakers, enabling the capture of stunning visuals from a unique, first-person perspective. Unlike traditional drones, which typically capture standard aerial shots, FPV drones

allow for precise, agile flight through tight and dynamic environments.

This ability has transformed visual storytelling by making it possible to create immersive scenes that draw audiences into the action. Drone-powered solutions, including those seen with FEDS Drone-Powered Solutions, improve FPV drone capabilities, enhancing stability and performance in challenging environments. These systems help filmmakers capture smoother, more cinematic shots, elevating the potential of filmmaking.

This level of control is essential for creating visually stunning action shots, especially in high-speed sequences where the FPS will be very high. Unlike traditional drone systems, FPV drones allow for much more flexible and agile movement.

As filmmakers travel around the world, capturing dynamic footage in various countries, these drones have become a preferred tool for filming in diverse locations. In cities like Dubai, which is known for its futuristic architecture and vast landscapes, FPV drones are particularly effective in capturing stunning aerial views.

This makes them a popular tool for drone filming in Dubai, where filmmakers can capture dynamic shots of the city’s striking architecture and landscapes with unparalleled agility and precision.

FPV drones are particularly useful for filming highspeed action sequences. Their ability to move through tight spaces and follow fast-moving objects makes them ideal for capturing the intensity of stunts and chase scenes. The drone’s rapid movement adds an extra layer of excitement and realism to the action, making viewers feel like they are part of the chase.

In music videos, where creativity is key, FPV drones offer unique visual styles. With their agility and ability to zoom through confined spaces, these drones can provide breathtaking visuals that enhance the energy and rhythm of a music video.

Documentary filmmakers have also embraced FPV drones. These drones allow them to capture expansive landscapes or follow subjects in remote, rugged locations in a natural flow.

While FPV drones offer great creative advantages, they also present unique challenges. Piloting FPV drones requires skill and practice, as they offer a higher degree of control but also a steeper learning curve. Most FPV drone pilots start with simulators before flying in realworld environments to get comfortable with controls.

FPV drones have brought a fresh, dynamic perspective

to filmmaking, allowing creators to capture scenes in ways that were previously unachievable. Their ability to provide immersive, precise shots for action-packed sequences and creative videos makes them an essential tool for modern filmmakers.

As technology continues to evolve, we can expect FPV drones to grow even more powerful and versatile, further enhancing their role in visual storytelling.

1. What is the primary advantage of using FPV drones in filmmaking?

FPV drones offer precise control and immersive perspectives, enabling filmmakers to create dynamic, high-speed shots and smooth transitions that are difficult to achieve with traditional drones.

FPV drones have a steeper learning curve compared to traditional drones. Beginners should start with simulators and undergo training before flying in real-world conditions. With practise, they can safely operate FPV drones.

FPV drones can range in price from moderate to high, depending on the quality of the drone, camera, and features. Filmmakers should consider their specific needs and budget when selecting an FPV drone for their projects.

Phone cases aren’t just for protection anymore, they’re part of your everyday style. In 2025, aesthetic phone cases are all about blending personality with design. Whether you’re into soft pastels, bold patterns, or playful 3D elements, there’s a trend that fits your vibe. These small accessories now say a lot about who you are and what you love.

If you’re looking to switch things up or just want to stay ahead of what’s popular, this blog covers the cutest and most talked-about phone case trends right now. Let’s explore the designs that are making phones way more fun this year.

Before we jump into what’s trending now, let’s take a look at how phone case fashion got here, because it’s come a long way from just being about protection.

Remember when phone cases were just about keeping your phone safe from drops and scratches? Not anymore. These days, they’re more like a part of your outfit, showing off your vibe, your mood, and even your favorite colors or designs. From bold prints to cute iphone cases, it’s all about turning your phone into something that feels a little more you.

The Rise of Maximalism

Minimalism had its moment, but 2025 is all about going big. Think bold prints, mixed textures, charms, and designs that pop. Phone cases aren’t trying to blend in anymore, they’re here to stand out and start conversations.

Color Trends Dominating 2025

Now that we’ve talked about style and design, let’s get into the colors everyone’s loving this year, because the right shade can totally change the vibe of your phone case.

Neo-Pastel Revolution

This isn’t your ordinary pastel palette. The neo-pastel trend features slightly muted versions of traditional pastels with unexpected color combinations that feel both nostalgic and fresh.

Dopamine Brights

In response to challenging times, phone cases with mood-enhancing, vibrant colors have gained massive popularity. Think electric yellows, hot pinks, and cobalt blues that instantly boost spirits when you glance at your device.

Chromatic Gradients 2.0

The gradient trend has evolved beyond simple color fades. The newest versions incorporate dimensional effects that create an illusion of depth and movement as you tilt your phone in different lights.

Material Innovations in Custom Phone Cases

Looks and colors aside, what your phone case is made

of matters too. Let’s check out the cool new materials showing up in custom cases this year.

Biodegradable Luxury

Eco-conscious consumers are driving demand for sustainable materials that don’t sacrifice style. Many phone cases now feature plant-based polymers and biodegradable elements without compromising aesthetic appeal.

Texture Revolution

In 2025, phone cases aren’t just about looks, they’re about how they feel. Soft-touch finishes, raised textures, and embossed patterns make cases more interactive, turning them into a full-on sensory experience.

Thermal-Reactive Surfaces

Perhaps the most innovative trend of 2025, these smart materials change color in response to body heat, creating dynamic, ever-changing patterns throughout your day.

What’s Trending Right Now

The trendiest phone cases in 2025 are doing it all, smart design with serious style. Aura-inspired patterns full of color and motion are catching eyes everywhere, while lifelike botanical prints are a hit with nature lovers.

Personalization is huge too, with AI-generated art letting people design cases that feel one-of-a-kind. And for those who like a cleaner look? Sleek, architectural styles with sharp lines and modern vibes are stealing the spotlight.

As we progress through 2025, phone case aesthetics will continue to evolve at the intersection of technology, art, and personal expression. Choosing designs that speak to you, your most-used device becomes not just a tool but a canvas for self-expression.

What materials offer the best protection while still looking stylish?

Dual-layer cases combining polycarbonate with TPU offer excellent protection while allowing for creative designs and finishes on the exterior.

How can I match my phone case to my style?

Consider your wardrobe color palette, favorite art styles, and whether you prefer subtle aesthetics or statement pieces that stand out.

What’s the most popular phone case trend for Gen Z in 2025?

Neo-nostalgia designs that reimagine Y2K aesthetics with contemporary twists are dominating the Gen Z market, especially with interactive elements.

No asset class is as volatile and dynamic as cryptocurrency. The price swings associated with even the most renowned cryptocurrencies can experience sharp dips and euphoric rises without warning, causing the stomachs of conservative traders used to traditional strategies to churn.

In a place like Singapore, where innovation and regulation go hand in hand, crypto traders have a unique edge as well as unique risks. Trading cryptocurrency requires a careful and methodical comprehensive strategy to reap profits and stay ahead.

While growing your investment under these conditions can be achieved, it’s also likely to make crypto trading mistakes and enter a pitfall where your capital plummets into oblivion.

If you’re familiar with easy and automatic crypto trading strategies like dollar-cost averaging and longterm HODLing but feel like you can step up your tactical

game, then you’re in the right place. We’ll break down strategies you can apply in your next crypto trade to ensure that you stay ahead as a Singapore-based investor.

Let’s jump right into it.

Disclaimer: This article is for educational purposes and should not be taken as financial advice.

One advanced crypto strategy you can adopt is swing trading. This strategy is a speculative trading strategy wherein the trader buys or sells an asset before making a substantial price movement upwards or downwards.

The strategy utilises multiple indicators to anticipate the closing value of the crypto token.

Common tools that traders leverage in crypto exchange platforms like Independent Reserve Singapore include moving averages, which spot trend direction and

strength of support or resistance; RSI, or relative strength index, which determines whether the asset is overbought or oversold; and MACD, or moving average convergence divergence, to gauge price momentum shifts.

Unlike day trading, which targets small and quick price changes within the same day, swing trading spans several days to weeks and aims to profit from broader market moves. Traders typically hold positions across multiple sessions, focusing on sustained trends rather than reacting to daily fluctuations.

When the signals look optimal for the buyer’s overarching financial goals and align with their entry and exit zone, that’s when they execute a buy or sell order to reap the profit. A good swing trader also has a specified cutloss limit to ensure that the value of their investment doesn’t dip farther than they’d like if trading conditions plummet suddenly.

This reduced time commitment is optimal for Singaporeans who often live a busy lifestyle, balancing their career, personal lives, and other commitments. It’s still a fairly involved process if your goal is to make profits, but it won’t take up a large chunk of your time, making it ideal for experienced traders who want to ride the momentum of a token and time their entry and exit optimally.

Day trading is often the go-to strategy for beginners looking to move beyond passive investing. It’s risky, but can be incredibly fulfilling and profitable if you know how it works.

This trading strategy focuses on making small and frequent gains in the market. Unlike traditional day trading in the stock market, which operates in market hours, crypto users can day trade 24/7, as the market is open all day in Singapore and the rest of the world.

Day trading requires constant attention to the market and charts. Traders use short timeframes of about 15 minutes or less to gauge entry and exit points. They

also use a combination of different technical strategies to predict potential price jumps or dips in the market.

For instance, it’s common for many traders to use tools like Bollinger bands to identify price reversals and breakouts when day trading. Day traders also look at the volume of each price movement in a certain timeframe to gauge the strength of the move, a term known as volume analysis.

In any case, day trading is an effective method of reaping profits in crypto. If done right, traders can easily beat the average market growth rate. However, the chance of getting a bad call is also high, especially for beginners, so it’s ultimately up to the individual’s risk tolerance if they see day trading as a potential strategy to implement in their crypto trading journey.

While relying solely on user sentiment is not the most foolproof strategy in established markets like stock markets, it’s actually a viable gauge of a token’s shortterm and long-term value in the crypto space.

Emotions and social media chatter are big drivers of price trends in the crypto space, particularly for smaller, liquid crypto tokens. Advanced crypto traders can get a comprehensive picture of a crypto token’s current worth by reviewing how it’s perceived and viewed in social media platforms like X and Reddit.

The reason why sentiment analysis is useful is because of its ability to detect shifts in market psychology before they’re reflected in price charts. Crypto market prices aren’t always driven by token fundamentals; many investors are in the space in the hope of riding a quick profit. Lots of investors pick tokens to invest in based on emotions like fear, greed, and hype.

Typically, the primary drivers of price changes are none other than a few influential characters in the space itself. It’s a good idea to follow crypto influencers, especially the ones with a large following, to get notified of any potential shifts in user sentiment as early as possible.

Knowing how the market views a token is a key part in predicting a crypto’s price movements. It’s not something to solely take into account, but it should be reviewed as part of a larger process to ensure that you’re getting a complete picture of the coin’s value.

Margin trading is a high-risk trading strategy that involves leveraging funds from a broker or lender to increase your position size. It allows traders to control an exponentially larger amount of crypto than their own. This is a high-risk venture, as while the highs can be high, the losses can also be devastating.

Many platforms offer adjustable leverages from 2x to 100x to give traders a personalised leverage scheme that fits their trading preference. Most traders stick with lower ratios and implement a stop loss to ensure that they don’t completely wipe out their position.

This trading strategy involves plenty of risk, as even just a small 5% dip can be enough to wipe your trading capital dry. Furthermore, you’ll also have to pay for interest on the borrowed amount at a later agreed-upon date. Given all this, it’s crucial to approach margin trading with caution, strategy, and clear thinking to avoid exposing yourself to unnecessary risk when opening a position.

Another trading strategy that crypto traders can use is arbitrage. This strategy is relatively low-risk and involves the trader being aware of the price of the same crypto asset across two or more exchanges.

An arbitrage trading strategy goes like this: First, the trader identifies an under-the-radar and low liquidity alternative token. Then, the trader checks multiple exchanges to see if there are any price gaps for that token. If there’s a difference, the trader quickly buys from the cheaper exchange and sells it at the more expensive exchange for profit.

To profit from this trading method, acting fast is key. Expert traders typically use bots to execute this action before them, and they do this in less than a minute. That said, you’ll still have to factor in real-world frictions like transaction fees and withdrawal delays that may erase any initial advantage you may have.

We hope these strategies will serve you well in your crypto journey. Besides picking the optimal strategy, it’s also important to choose the right crypto exchange platforms and tokens to ensure that you’re making the most out of each transaction.

For years, Bitcoin held the spotlight as the poster child for crypto. Institutional investors and average users, though, are seeking the next crypto giant now, so the attention is gradually shifting. There’s one currency that has quietly lingered in the shadows with a consistent presence: Litecoin. While it’s also sometimes called the “digital silver” to Bitcoin’s gold, litecoin news suggests that this investment may be overdue for a revival and Wall Street is starting to notice.

While investors are looking for the best coin to invest in an expanding crypto market, one of the most intelligent first moves is to keep your money safe.

Litecoin’s Legacy: More Than a Fork Litecoin was developed in 2011 by former Google engineer Charlie Lee as a faster and more scalable alternative to Bitcoin. It is based on Bitcoin’s code but with some significant changes, including smaller block times (2.5 minutes versus 10) and a different hashing algorithm (Scrypt versus SHA-256).

This means Litecoin transactions confirm faster, and its network is secure but energy-efficient. Litecoin has always performed as a reliable transactional currency throughout the years. It has been the coin where new updates are tested prior to being rolled out to Bitcoin most frequently.

Even its look has become emblematic – litecoin’s logo has become household in the parlance of cryptomaniacs, representing convenience, speed, and decentralization. Upgrades to litecoin’s logo recently revived its marketing without changing its message of consistency and dependability. The updated litecoin logo now appears across most major wallets, exchanges, and payment integrations — signaling its continued relevance in

the crypto world. If you’re interested in expanding your crypto holdings beyond Litecoin, you can also buy Solana for a solid investment alternative.

So why is Litecoin again making headlines? For several reasons:

• Low charges and faster affirmation times make it attractive for institutional transactions.

• Litecoin is one of the handful of altcoins traded on major exchanges, even institutionally preferred ones.

• New enhancements like MimbleWimble Extension Blocks (MWEB) added optional privacy features to make Litecoin even more appealing.

A CoinDesk report in 2024 referenced how old-school cryptos such as Litecoin are beating out newer tokens during times of intense stress in the markets because they’re well-tested with regard to security and because they continue to see active development.

Additionally, money and large holders are beginning to see Litecoin as a long-term store of value. It’s less volatile than the majority of the newer coins, has a capped supply of 84 million, and has a network uptime of over ten years.

With each crypto cycle, there are new stars born. But Litecoin has demonstrated it’s not one of them. Here’s why it should be shined under the limelight again:

• Proven track record: More than ten years with no significant security issues.

• Liquidity: Traded on virtually all exchanges with reasonable daily volume.

• Adoption: Increasing application for micropayments, tipping, and international payments.

• Community: One of the most passionate developer and user communities in crypto.

If you’re searching for the most stable coin to invest in that balances innovation with reliability, Litecoin is a good middle ground.

Every bull cycle has a wave of speculation, and many coins ride that wave on hype alone. Litecoin never finds itself at the center of salacious headlines, but it’s always in the mix. That stability could be its biggest strength.

Relative to overhyped coins, Litecoin still performs. In a report by Cointelegraph, analysts suggest that Litecoin’s focus on utility rather than style might cause it to overshadow newer tokens in the future.

Litecoin news cycle might not be as glamorous as that of its competitors, but it has solid fundamentals. This combined with its age and market acceptance is

why some call it the most “underestimated asset” in crypto. Analysts who have been tracking litecoin news have noted that the coin’s resilience and incremental progress are impressive considering that the market is volatility-driven.

Last Word: Fundamentals-backed Litecoin isn’t a meme coin. It isn’t a speculative bet. It’s a decade-old network that still runs smoothly, remains decentralized, and continuously improves. As Wall Street evaluates which crypto assets to embrace next, Litecoin checks many of the right boxes.

Whether you’re an institutional investor or an individual planning your first steps in crypto, Litecoin offers clarity in a market that’s often clouded by hype. So if you’re in the process of creating your portfolio and wondering what could be the next big crypto, Litecoin is worth a serious consideration. Sometimes the best investments are not the most flashy. They’re the ones that quietly endure the test of time.

Keeping energy production and distribution running smoothly is no easy task. Without automation, everything relies on manual labor. What it does is slow down operations, waste resources, and, if anything, make it harder to respond to disruptions.

Automation mixed with predictive analytics changes that. It detects issues before they cause failures. How does it help? It allows engineers to step in early. So, what opportunities are there in the energy industry that you can use to automate your systems? Read on.

Robotic Process Automation (RPA)

Robotic Process Automation takes repetitive tasks off the table. It handles things like data entry, document processing, and system updates by mimicking human actions on a computer. Clicking buttons, copying data, filling out forms—RPA does it all.

In the energy industry, RPA is used for billing, meter data processing, and compliance reporting. It helps energy demand forecasting by collecting and analyzing realtime energy data. RPA also enhances control room operations by automating routine monitoring tasks. RPA has software scripts that act as bots to pull and check equipment performance data. If a failure happens, they can trigger maintenance alerts.

How RPA is used in energy?

• Smart Meter Data Processing – Extracts and verifies data from smart meters, automatically flagging irregular readings.

• Automated Grid Management – Bots monitor energy distribution and adjust supply in real time to prevent overloads and blackouts.

• Oil & Gas Supply Chain Automation – Simplifies vendor management and automates purchase order processing.

A smart grid is not just an electricity network. It’s an intelligent system that optimizes power distribution. Sensors, automation, and AI track electricity use and adjust supply instantly. If a failure happens, the grid reroutes power to prevent blackouts. It also balances solar, wind, and traditional energy to keep everything running smoothly.

Why do smart grids matter?

• Dynamic Pricing – Adjusts electricity costs based on demand.

• EV Charging Management – Prevents system overloads by controlling when cars charge.

• Optimized Energy Storage – Saves extra power and releases it when needed. Without smart grids, energy stays inefficient and unstable.

Imagine having a virtual replica of a power plant or wind turbine that updates in real time. That’s a digital twin. It takes sensor data, feeds it into AI, and predicts failures before they happen. Digital twins can also simulate different situations to improve energy production. Digital twins also run simulations to improve energy production and help balance supply and demand –especially for renewables like solar and wind. They even boost security by testing cyber defenses through cyberattack simulations.

Who’s using digital twins?

• Siemens – Runs Virtual Power Plants (VPPs) using digital twins.

• Tesla’s Autobidder – Predicts energy demand and optimizes battery storage in real time.

• EDF Energy – Tests nuclear reactor performance and optimizes fuel use.

• General Electric – Automates smart grid operations.

Capturing CO₂ isn’t new. But automating the process? That’s a game-changer. Automated CCS pulls carbon emissions from power plants and industrial sites, and then stores them underground. AI and IoT sensors monitor CO₂ levels, while Machine Learning adjusts the capture process based on energy demand. Some systems use blockchain to track CO₂ and stay compliant.

Who’s leading the way?

• Chevron’s Gorgon CCS Project in Australia

• Occidental Petroleum & Carbon Engineering in the USA

• Sleipner CO₂ Storage Project in Norway

• Shell’s Quest CCS Facility in Canada

Automated drones for inspection and monitoring

Energy infrastructure is massive, remote, and, honestly, dangerous to inspect manually. That’s where drones come in. They fly over power lines, oil rigs, and wind turbines all while taking high-res images, thermal scans, and LiDAR data. AI analyzes everything, detecting leaks, corrosion, and equipment failures before they become major problems.

Drones with infrared and gas sensors also monitor oil and gas pipelines. If there’s a pressure drop or weak spot, the system sends an alert before disaster strikes.

Who’s using drones for automation?

• BP uses drones to check oil pipelines and find leaks in remote locations.

• Shell uses drones to monitor offshore oil platforms in the North Sea.

• Xcel Energy uses drones to inspect high-voltage power lines without human workers.

• Equinor uses drones to inspect offshore wind farms. Automation can boost energy, but challenges slow it down. What’s in the way?

Balancing supply and demand is the biggest challenge

in energy especially with renewables like wind and solar. Their output isn’t constant. One minute you’ve got strong winds, the next—nothing. This unpredictability leads to voltage swings and grid instability. The fix? Smarter grid management and better energy storage. Without it, we’re stuck with an unreliable power supply.

Automation isn’t cheap. Companies have to invest in new tech and upgrade aging systems. And let’s be real. switching from traditional methods to automated systems means some jobs will disappear. That’s a tough economic shift, and not everyone is ready for it.