“There’s something one should expect not only of a watch but also of oneself: to never stand still.” Company founder Walter Lange’s aspirational guiding principle still characterises the craftsmanship of A. Lange & Söhne across all areas of the manufacture. In their state-of-the-art workshops in Glashütte, the highly skilled watchmakers and finishers strive passionately to perfect every watch down to the very last detail. In doing so, they pursue a single goal: to build timepieces that belong to the pinnacle of international watchmaking artistry.

During the division of Germany, there was one man who never gave up his dream of making the finest timepieces under the name A. Lange & Söhne again: Walter Lange, the great-grandson of Ferdinand Adolph Lange, who brought fine watchmaking to the former mining town Glashütte in 1845. Immediately after German reunification, Walter Lange resumed the family tradition with a clear vision, that each new Lange watch must set new standards while matching the craftsmanship of the prestigious pocket watches the brand had once been famous for. The breakthrough came with the first collection and the LANGE 1, a successful combination of tradition and innovation that to this day epitomises Lange’s art of watchmaking.

At A. Lange & Söhne, product developers and watchmakers work hand in hand to harmonise precision and aesthetics in the best possible way. Each of the 73 different watch movements created since 1990 is developed in-house, whilst every component is decorated with its own specific type of finissage, whether or not it is visible through the sapphire-crystal caseback. A special type of finish is reserved for the balance cock, which is engraved with the Lange-style floral pattern that makes each Lange watch unique. Each movement is assembled twice by hand to ensure highest precision.

A. Lange & Söhne is creating extraordinary mechanical masterpieces, encouraging the passion from every single employee, and making their working environment the very best it can be. Perfection, simplicity, community spirit and combining innovative spirit with the preservation of tradition are highly valued in the company.

So far, 2025 has been another year of innovation and in this issue, we cover it all. We explore the vibrant and dynamic Spanish real estate market, examining the trends and opportunities that are shaping its future. Simultaneously, we venture into the cosmos, investigating the exciting realm of investment in space exploration, a field that is rapidly expanding and redefining our understanding of potential frontiers. Meanwhile, artificial intelligence is changing the way we design cities and digital transformation is coming for finance and treasury teams.

Find out more about what policymakers and key stakeholders are planning for the rest of the year around the world and across sectors. We feature an in-depth interview with Kamel Ghribi, exploring the intricacies and importance of global health diplomacy. Additionally, we present insights from Yevhen Krazhan on the burgeoning future of the iGaming industry, a sector experiencing remarkable growth and innovation. We also feature our latest batch of winners who are shaping the world of investment and finance.

Happy reading, Sophie

12

10

Investing in space exploration

Global space exploration investment is set to reach $31 billion by 2034, according to a new report from Novaspace.

18 Summer Atlantic Capital: Pioneering global investment & market access solutions

Enabling businesses to thrive in an increasingly complex financial landscape.

32

Reshaping today’s cities with AI

More than a third of engineers and architects are relying on AI every day.

12 Meet Kamel Ghribi: The power broker shaping global healthcare diplomacy

An interview with one of the most influential figures canvassing for universal healthcare.

20 Beyond Capital: Driving sustainable growth in the DACH region

Transforming regional heroes into national champions.

52

16

Fortis Market: The global journey to success for investors

Fortis Market doesn’t just offer a trading platform; it provides a comprehensive service experience.

24 It’s all about sensations

Aston Martin Aramco F1 and GirardPerregaux are now pleased to unveil their latest model.

36 Redefining Private Equity: Beyond financial engineering to sustainable value Creation

Sebright Chen, CEO of Summer Atlantic Capital, on the future of private equity.

41 iGaming’s Billion-Dollar Growth: key trends, regions & winnings strategies

Yevhen Krazhan, CBDO at GR8 Tech on the iGaming industry’s explosive growth.

44

The world’s most expensive perfume is a tribute to the spirit of Dubai

SHUMUKH, the world’s most expensive and luxurious unisex perfume, is valued at $1.295 million.

48 Anticipating future energy demand

The private sector can significantly influence the direction and pace of the electricity grid’s evolution.

52

Airtasker’s Tim Fung: Driving growth at full throttle with the unsung heroes of Formula One

An interview to mark Airtasker becoming an official team partner of Visa Cash App Racing Bulls F1 Team (VCARB) in 2025.

54 The Risk and Rewards of Emerging Markets

How to navigate these emerging markets with Delphos.

62

Active Re’s strong position in international reinsurance

With a multicultural team across 12 countries, the company reflects the diversity and global reach of its operations.

68

Navigating the Spanish real estate market

David Amores Brun, a Spanish real estate manager on the current state of the Spanish real estate sector.

56 UBlac: Redefining Branding & Marketing with Innovation

UBlac is a renowned regional creative agency known for delivering bold, impactful branding and marketing solutions.

64

Gulf Insurance Group: Driving economic stability and societal progress in the MENA region

With its steadfast commitment to sustainability, Gulf Insurance Group continues to lead the way in innovation.

72 The Digital Transformation Imperative

James Bowler, CEO & Co-Founder at NUMARQE, argues why finance and treasury teams must escape the manual payments workflow trap.

58

Revitalising Greece’s Elefsina Shipyard: A Strategic financial undertaking

Elefsina is set to become a contemporary beacon of innovation and sustainability.

66

Every wave lifts you higher

With its unique financial services, Fortis Market helps investors reach new heights with every wave.

76 International Investor Awards Winners

Amongst our award winners there are some exceptional banks, businesses and leaders and we want to recognise their roles and achievements.

Global space exploration investment is set to reach $31 billion by 2034, according to a new report, Prospects for Space Exploration, from the space consulting and market intelligence firm Novaspace. Over the past 20 years, the number of countries involved in space exploration has expanded considerably; also attracting growing interest from the private sector. New public-private contractual schemes are emerging, as space agencies are prepared to act as strategic partners and future customers of commercial services if it results in a cost-effective sustainable model for space exploration.

Over 850 space exploration missions are expected in the coming decade, more than doubling the number of the 300 missions in the past ten years. Lunar exploration (robotic and human spaceflight) will account for the largest proportion of missions - over a third. This continued focus on the moon is partly driven by the fact that establishing a sustainable presence on the Moon is considered a central piece to enabling future human Mars missions and is highly driven by strategic and geopolitical motivations.

Although it was the least funded application in 2024, Mars exploration is anticipated to experience the greatest growth in the next decade, with an 11% 10Y CAGR, until reaching close to $6B by 2034. This momentum will be primarily fueled by upcoming sample return missions.

Meanwhile, other deep space exploration funding is anticipated to continue increasing until reaching an average of around $2B by 2030.

Traditionally, space exploration missions have followed a more conventional procurement scheme, where the programmes are managed, owned, and operated by governments who procure technology from industry. However, as the Novaspace report explains, new contractual models between government and the private sector are emerging in which commercial organisations build, own, and operate the assets directly, while governments position themselves as customers or strategic partners. This change has been led by the US, and is now being followed by other countries/agencies including the European Space Agency, Canada, and India.

Only a few individuals operate with the strategic effectiveness with which Kamel Ghribi works in the highstakes realm of global healthcare. Over the years, he has emerged as one of the most influential figures canvassing for universal healthcare. Whether attending the Rome MED Dialogues or behind closed doors at several key bilateral forums, he is always focused on steering the agenda of cross-border healthcare collaboration, especially between Europe and the Middle East.

One of the interesting things about this visionary is that he isn’t merely interested in responding to health crises. Instead, he anticipates them, putting measures in place to address the challenges. This is one of the things that sets him apart in the increasingly urgent space of global healthcare diplomacy.

Kamel Ghribi’s growing influence is driven by his vision to see people healthy. Over the past decade, he has consistently framed healthcare not as a standalone humanitarian cause but as a central pillar of economic stability and geopolitical security.

At several international conferences, such as the World Economic Forum and high-level policy gatherings in Rome and Riyadh, Ghribi has advanced a compelling argument that healthcare must be treated as a foundational element of diplomacy, on par with energy and defence. This strategic framing has found resonance among both public and private stakeholders, many of whom now recognise that healthcare is no longer a soft power concern but a hard-edged matter of national interest.

Ghribi’s foresight became particularly evident during the COVID-19 pandemic, where he was among the earliest voices calling for a coordinated transcontinental approach to vaccine access, hospital investment, and health security infrastructure, particularly in the Global South.

Where Ghribi truly excels is in his ability to bridge worlds. From Geneva to Abu Dhabi, he maintains a vast network of decision-makers, including presidents, ministers of health, private equity leaders, and heads of international organisations.

Ghribi’s signature move is convening power brokers in neutral, forward-looking settings where real cooperation can emerge. These aren’t just symbolic roundtables; they are spaces where investment deals are seeded, regulatory barriers are broken, and crossborder partnerships take shape. His role in facilitating public-private healthcare investments (including in fragile or underserved markets) demonstrates his unique capability to align commercial incentives with public health goals.

A recent example includes his behind-the-scenes role at the Rome MED Dialogues, where he was instrumental in brokering health cooperation talks among European and MENA-region officials, helping reframe Mediterranean health collaboration not as charity, but as mutual resilience planning.

Ghribi’s identity is naturally bicontinental, thanks to his Tunisian heritage and deep business ties to Italy. This interconnectedness allows him to function as a diplomatic bridge between Europe and the Middle East. He has nurtured enduring relationships with key stakeholders in several Middle Eastern countries, including the UAE and Saudi Arabia, with a focus on strengthening local health infrastructure through both private investment and policy support. He has also championed hospital modernisation efforts, advocated for knowledge transfer, and pushed for localised solutions to regional health burdens, including digital health systems.

In Europe, particularly Italy and the wider Mediterranean basin, Ghribi has worked to elevate health diplomacy as a cornerstone of EU external action. Through his support of regional health forums and policy symposia, he has created pathways for closer EU-MENA healthcare alignment, an effort that has gained momentum in light of rising migration, demographic pressures, and post-pandemic recovery needs.

He has also made contributions to healthcare access in Eastern Europe, including Poland, though his primary focus remains the Euro-Mediterranean corridor.

While some people like to operate in the theory and rhetoric of international diplomacy, Ghribi’s work is measurable. He has played a key role in funding cross-border hospital ventures, facilitating health tech accelerators, and convening stakeholders for direct action during health emergencies. His partnerships have helped fast-track mobile clinics, improve training for healthcare workers, and promote equitable access to diagnostics and vaccines in regions where such support often arrives too late.

Notably, his approach reflects a growing consensus in global health, which is that public-private partnerships are not just useful, but essential. The World Bank and organisations like Global Health 50/50 have echoed the need for financing models that blend innovation with inclusion. This is a model that Ghribi has long championed.

Moreover, his work supports the argument that diplomacy shouldn’t be confined to government channels. Instead, strategic philanthropy and private influence, when leveraged responsibly, can unlock stalled negotiations and accelerate lifesaving progress.

Speaking of philanthropy, Ghribi has demonstrated his deep commitment. In his home country of Tunisia, he was instrumental in establishing a specialised children’s heart catheterisation laboratory at La Rabta Hospital, located in Tunis. This facility, equipped with advanced diagnostic imaging technology, enables cardiologists to effectively treat heart conditions in children. The lab stands as a testament to his dedication to enhancing medical infrastructure across the region.

Ghribi’s philanthropic reach extends beyond Tunisia to disaster-stricken regions. Following the devastating earthquake in Syria in February 2023, he coordinated the delivery of humanitarian aid through the ECAM Council. This included four ambulances, medical equipment, medicines, and clothing, among other items, transported via Italian Air Force planes to support the Syrian Red Crescent’s relief efforts.

Similarly, in the aftermath of the earthquakes that struck Morocco and Turkey, Ghribi mobilised resources to provide essential aid, demonstrating his unwavering commitment to humanitarian assistance across borders. His actions underscore a philosophy that transcends business, focusing on tangible support for communities in crisis.

As the world continues to grapple with cascading health challenges exacerbated by climate-driven disease outbreaks and ageing populations, the need to find urgent solutions has become even more pressing. To this end, Kamel Ghribi’s expertise will continue to be relevant. His blend of foresight, convening power, and grounded pragmatism offers a glimpse into the future of healthcare diplomacy: agile, multistakeholder, and relentlessly strategic.

If global healthcare cooperation is to keep pace with the scale of need, it will require exactly the kind of behind-thescenes leadership Ghribi embodies. While others seek the spotlight, he moves policy forward quietly, consistently, and with remarkable effect.

The complex and dynamic nature of financial markets makes having the right information and a strong platform more crucial than ever for investors. However, the key to success in the investment world lies in having a solid strategy and a reliable brokerage. Established in 2017 and rapidly growing, Fortis Market offers investors the opportunity to make solid strides in global financial markets through its advanced platform and customer-centric approach. With solutions designed for both experienced investors and newcomers, Fortis Market provides a powerful success potential for every level of investor.

Fortis Market doesn’t just offer a trading platform; it provides a comprehensive service experience. Behind this experience is a dedicated team continuously working to ensure investor security and success. So, what makes Fortis Market so special? To answer this question, we share insights from our exclusive interview with Fortis Market executives.

Victoria Roberts, Head of Investor Relations at Fortis Market provides valuable insights into the company’s goals and investor-focused approach. Roberts explains the company’s mission:

“Our goal is not just to provide a platform where investors make financial gains, but also to build an infrastructure that guides them correctly and enables them to trade in a secure environment. We aim to offer the most advanced technology to help our investors make informed and safe investment decisions.”

Fortis Market continues to be a preferred choice for many investors thanks to the opportunities and services it provides. According to Victoria Roberts, trust in the company is based on more than just a user-friendly platform:

“Every investor has different needs and goals. That’s why we offer a wide range of account types. From Classic, Silver, Gold, and Platinum accounts to Islamic accounts designed for Sharia-compliant investing, we cater to investors of all levels.”

When discussing Fortis Market’s competitive swap and spread rates, Roberts emphasised how these features are fundamental to the company’s investor-friendly approach:

“Our goal is to provide investors with the most favorable trading conditions. Our low spread rates minimise transaction costs, enabling investors to take more profitable positions. Additionally, our swap rates are optimised in line with market conditions, which is particularly advantageous for long-term investors. Whether for short-term trades or long-term strategies, we ensure that our rates remain at the most competitive levels to maximise our investors’ returns.”

Roberts highlights that these financial advantages help investors make better decisions and develop more effective trading strategies.

Having a powerful trading platform alone is not enough for investment success. Investors must also analyze markets correctly and develop the right strategies. Fortis Market supports investors with comprehensive education and consultancy services.

Roberts states:

“We don’t just provide a platform; we also offer investors the knowledge and support needed to make informed decisions. Through educational materials, mentorship, and one-on-one consulting, we help our investors continuously improve their skills.”

Fortis Market’s consultancy and educational services are not just for experienced traders—beginners also benefit from tailored guidance and training programmes. This ensures that new investors overcome early challenges more quickly and confidently.

Fortis Market presents investors with a new career opportunity through its Introducing Broker (IB) Programme. This programmes allows investors to expand their financial knowledge while earning additional income.

According to Roberts, “the IB programme does more than offer a business opportunity—it also paves the way for a career in the financial sector. IB brokers can earn attractive commissions based on the investors they refer.”

With competitive commission rates, educational materials, and continuous support, Fortis Market’s IB programme creates a profitable opportunity for brokers and their referred investors alike.

Another innovative feature Fortis Market offers is Copy Trading, which provides a major advantage for new investors. Copy Trading allows investors to mirror the strategies of experienced traders, helping beginners achieve success faster.

Roberts explains, “one of the biggest challenges for new investors is creating the right strategy. Copy Trading is an excellent solution to this problem. By following the trades of seasoned investors, beginners can save time, minimise risk, and invest more confidently.”

Copy Trading also offers a learning opportunity for new investors, allowing them to grasp market dynamics more quickly while increasing their potential for profit.

With its powerful platform, extensive educational resources, IB program, and innovative features like Copy Trading, Fortis Market offers exceptional opportunities for financial success.

Roberts shares her vision for the company’s future:

“The success of our investors is our top priority. We continuously enhance our services to help each investor reach higher goals. With Fortis Market’s offerings, investors are not only shaping their present success but also building a prosperous financial future.”

In conclusion, Fortis Market provides not just a trading platform but a comprehensive support system. With its secure infrastructure, continuous educational opportunities, and investor-focused services, Fortis Market is the ultimate partner on the journey to financial success.

Every Wave Lifts You Higher: Shape Your Investments with Fortis Market!

Unlock the potential of international markets with Summer Atlantic Capital, your trusted partner in strategic investment, market expansion, and cutting-edge investment solutions. Under the leadership of CEO Sebright Chen, an award-winning investment visionary, we are committed to driving global innovation, fostering sustainable growth, and enabling businesses to thrive in an increasingly complex financial landscape.

Navigating global markets requires deep expertise, strategic vision, and strong partnerships. Summer Atlantic Capital specializes in providing comprehensive market access strategies, tailored investment solutions, and operational scalability. Whether you're a high-growth startup, an institutional investor, or an established enterprise looking to expand internationally, we offer the expertise and network to accelerate your success.

SUSTAINABLE, AND IMPACTDRIVEN STRATEGIES

We believe in innovation, sustainability, and strategic collaboration as core pillars of long-term success. Our datadriven investment approach, extensive industry insights, and focus on ESG-driven initiatives ensure maximum value creation while prioritizing responsible and sustainable growth.

From joint ventures and licensing partnerships to private equity and strategic capital allocation, Summer Atlantic Capital is at the forefront of shaping the future of crossborder investments, technology commercialization, and healthcare advancements.

LEADERSHIP WITH PROVEN EXCELLENCE

Led by Mr. Sebright Chen, a recognized leader in global investment strategies, Summer Atlantic Capital has received numerous accolades, including multiple awards for corporate sustainability, ESG innovation, and leadership in market integration. Our success is built on a foundation of trust, strategic foresight, and commitment to excellence in everything we do.

JOIN US IN DEFINING THE FUTURE OF GLOBAL INVESTMENT AND EXPANSION

Whether you're seeking high-impact investment opportunities or expanding into international markets, Summer Atlantic Capital provides the strategic edge needed to navigate today’s evolving global economy.

Partner with us and experience the future of investment. Contact us at info@summeratlantic.com to explore opportunities.

SUMMER ATLANTIC CAPITAL: WHERE VISION, INNOVATION, AND GLOBAL OPPORTUNITY CONVERGE.

Driving Sustainable Growth in the

Region – Transforming Regional Heroes into National Champions

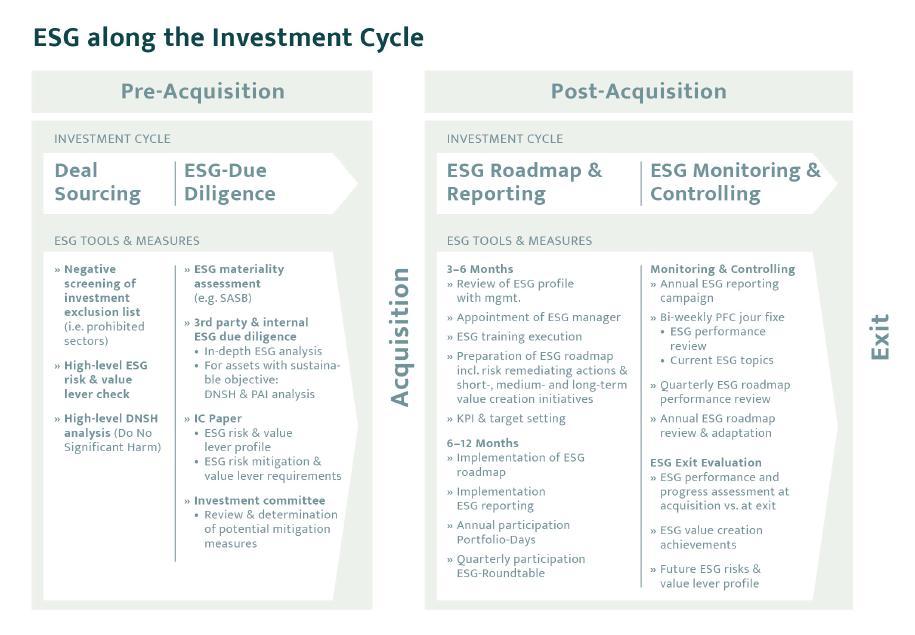

Beyond Capital Partners (BCP) is an owner-managed investment company based in Frankfurt am Main that was established in 2015 by three entrepreneurial founders. BCP has crafted a distinct identity rooted in its commitment to responsible investment and sustainable growth. By leveraging its entrepreneurial DNA and ESG-oriented investment strategies, Beyond Capital Partners has established itself as a trusted partner for founders navigating succession and expansion. BCP has become a leading private equity participant in the small-to-medium enterprise market and is one of the most active lower-mid-market General Partners in the DACH region.

BCP’s investment strategy is the acquisition of majority shareholdings in well-performing small-to-medium sized companies with revenues at entry between EUR 10m and EUR 50m and EBITDA ranging from EUR 1.5m to EUR 7.5m. The focus lies on asset-light business models in the sectors of B2B services, IT services, software, healthcare & well-being, lifestyle and entertainment and ESG-oriented companies in the German speaking countries. The team, comprising 14 professionals with entrepreneurial and private equity expertise, collaborates closely with the portfolio companies providing strategic guidance, a strong value framework and capital to accelerate growth, and hence, delivering longterm value creation and sustainable outcomes.

The investment philosophy centres on good entrepreneurship, with sustainability criteria being embedded into every stage of the value creation process of the portfolio companies. BCP ensures that its portfolio companies align with global standards while fostering innovation, sustainable growth and long-term success. Therefore, as part of its responsible investment strategy, BCP specifically invests in business models and supports measures and initiatives in its portfolio companies that make a positive contribution to the UN Sustainable Development Goals (SDGs).

“Good entrepreneurship is the foundation of every successful business and ever since has been a core pillar of Beyond Capital Partners’ investment strategy.”

Christoph D Kauter

Since its founding in 2015, Beyond Capital Partners has executed 27 acquisitions consisting of 13 platform investments and 14 add-ons plus more than 100 smaller acquisitions in the course of a roll-up strategy. Additionally, over the three funds raised, BCP could exit three companies and establish furthermore a portfolio of high-performing sustainable businesses. BCP closed the most recent Beyond Capital Partners Fund III as a SFDR Art. 8+ fund at the hard cap in April 2024, despite a very challenging fundraising climate, underscoring its established position in the private equity market landscape and the attractiveness to existing and new investors. To support climate change adaptation as well as social and societal necessities, the investment firm allocates a percentage of the committed capital into companies that pursue a sustainable environmental or social business objective.

Over the years, Beyond Capital Partners has successfully launched three funds, each achieving significant milestones: Beyond Capital Partners Fund I (2017): With an initial closing of EUR 25.5m from a family office investor in May 2017, Fund I delivered already eighteen month later 1.5x multiple on invested capital (MOIC). The final asset held will be sold in the coming year.

Beyond Capital Partners Fund II (2021): Closed at the hard cap of EUR 115.2m in March 2021, Fund II currently holds a 1.96x MOIC with a DPI of 0.23x, reflecting its steady growth trajectory but conservative valuation approach.

Beyond Capital Partners Fund III (2024): Marking a significant milestone, Fund III closed at EUR 180.7m at the hard cap in April 2024, making it one of the few successfully raised funds in our segment in the DACH region in a challenging fundraising environment. Institutional investors, including the European Investment Fund (EIF) and other leading fund-of-funds, reupped their commitments, further solidifying BCP’s status as an established General Partner.

Beyond Capital Partners embeds ESG principles as an integral part of its investment lifecycle process, from sourcing, due diligence and value-creation planning to postacquisition and exit strategies. BCP invests in and works with its portfolio companies in accordance with the UN Principles for Responsible Investment (PRI) and the UN Global Compact. Good governance creates resilient companies and lays the foundation for long-term value creation processes.

Looking to the future, Beyond Capital Partners further contributes to continuing the success story of German SMEs while positively impacting the environmental, social, and governance challenges. BCP firmly believes that economic success beyond the capital invested depends first and foremost on the trust, passion and integrity of the actors involved. All these efforts demonstrate BCP’s commitment to driving good entrepreneurship, sustainable growth and value creation in relation to its own, but at least as importantly, its portfolio companies.

With history dating back to 1913 and its founders Lionel Martin and Robert Bamford, Aston Martin has a storied history rooted in racing. Early success at the Aston Hill Climb inspired a legacy of crafting high-performance luxury vehicles, which today includes the DB12, Vantage, Vanquish, DBX707, and the F1-inspired Aston Martin Valkyrie. The brand debuted in Grand Prix racing in 1922, claimed outright victory at Le Mans in 1959 and returned to Formula One in 2021 under Lawrence Stroll’s leadership.

The team has since made significant investments, notably opening the AMR Technology Campus in Silverstone in 2023, featuring sustainable design and a cutting-edge wind tunnel set to be operational in 2025.

On-track, the driver line-up features the experienced Canadian Lance Stroll and double World Champion Fernando Alonso, supported by Test and Reserve Drivers Felipe Drugovich and Stoffel Vandoorne, along with Team Ambassador Pedro de la Rosa and Young Development Driver Jak Crawford. Aston Martin Aramco also races in the all-female F1® Academy series, with Swiss driver Tina Hausmann competing under the mentorship of the team’s F1® Academy Head of Racing and Driver Ambassador, Jessica Hawkins.

Off-track, Aston Martin Aramco continues to drive progress through its I / AM fan engagement platform, and Make A Mark ESG programme, driving sustainability, inclusion and community engagement. Partnerships with Racing Pride, Spinal Track, and the Aleto Foundation support inclusivity, accessibility, and leadership development. The team’s commitment to energy efficiency is certified by ISO 50001 compliance.

Aston Martin Aramco Formula One™ Team Press Contact:

Ella Seager

Senior Communications & Media Officer

ella.seager@astonmartinf1.com

The Laureato Absolute Aston Martin F1® Edition is housed in a 44 mm case formed of Grade 5 titanium.

The Laureato Absolute Aston Martin F1 ® Edition is housed in a 44 mm case formed of Grade 5 titanium. Familiar to both the British Formula One brand and Swiss Manufacture, this material is often selected for its low mass and notable strength. It is also corrosion

Executed in Aston Martin Racing Green, the dial hue reinforces the automotive theme. The Aston Martin hour and minute hands are partially openworked and were inspired by the front grille widely found adorning the car marque’s road cars, such as the iconic DB12. They are also lined with luminescent material,

resistant, non-magnetic and hypoallergenic; attributes that are particularly beneficial for watchmaking. In this instance, the titanium has been sandblasted, imbuing the alloy with a subtle texture that confers a sublime tactility.

aiding readability in restricted light conditions. Each hour is denoted with an applied index, again incorporating luminescent treatment. The centre seconds hand and date display, executed in lime green, a hue that graces the Aston Martin Formula One car, complete the inventory of functions.

To complement the case, the Laureato Absolute Aston Martin F1® Edition is presented on a green FKM rubber fabric-effect strap that has been optimally designed to deliver a superb feel. Both companies chose FKM rubber as it is more flexible, less prone to fading and offers superior wearresistance when contrasted with conventional

Consistent with all Laureato models, the case design masterfully unites contrasting shapes to glorious effect. Executed in Aston Martin Racing Green, the dial incorporates lime and white accents, while the caseback is engraved with the British marque’s iconic emblem. Suitable for adventure, the Laureato Absolute Aston Martin F1® Edition looks eminently stylish wherever it goes. With its simple to read dial and 300 metre water resistance, the watch also proves notably practical.

Consistent with all Laureato models, the case design masterfully unites contrasting shapes to glorious effect.

Ticking beneath the solid caseback is an in-house Manufacture movement, the GP03300 calibre. Crafted at the company’s production facility in La Chaux-de-Fonds, the self-winding movement is optimally shaped for the Laureato model. It features an oscillating weight adorned with circular Côtes de Genève motif. Additional movement refinements include straight Côtes de Genève on the bridges, bevelling, mirror-polished screws, circular graining on the main plate and engraved gilded text, all executed to the company’s no-compromise standards.

rubber. The strap is fitted with a titanium folding clasp with a micro-adjustment system, allowing the wearer to finely adjust the strap to achieve the perfect fit. Indeed, it is the soft and supple nature of the strap, together with the ergonomic clasp, that make this watch a comfortable companion, ideally suited to daily wear.

Reference: GP03300-1060

Self-winding mechanical movement

Diameter: 25.95 mm (111/2’’’)

Height: 3.36 mm

Frequency: 28,800 Vib/h – (4 Hz)

Number of components: 218

Number of jewels: 27

Power reserve: min. 46 hours

Functions: Hours, minutes, central second, date

In the 70s, a number of companies synonymous with Haute Horlogerie released elegant steel watches fitted with integrated steel bracelets. However, Girard-Perregaux was the only Manufacture to design and develop its elegant steel watch fully in-house.

From the outset, the Laureato has always been equipped with an in-house movement, affording the Manufacture the creative freedom to design a watch devoid of compromise. Indeed, Girard-Perregaux differentiates itself from most watch companies by adopting a holistic approach to the design of the dial, case and movement, a rare approach that it has followed since 1867 when Constant Girard conceived the legendary Tourbillon with Three Bridges.

Over the years, the Laureato has evolved, embracing an array of dial colours, case materials and complications. Now, the Manufacture, working in close cooperation with Aston Martin, has crafted a neoteric expression of the Laureato that’s made to perform and born to race.

The Laureato Absolute Aston Martin F1® Edition is limited to 88 pieces. It will go on sale 20 March 2025 and will be available worldwide.

!Overthe years, the Laureato has evolved, embracing an array of dial colours, case materials and complications.!

With history dating back to 1913 and its founders Lionel Martin and Robert Bamford, Aston Martin has a storied history rooted in racing. Early success at the Aston Hill Climb inspired a legacy of crafting high-performance luxury vehicles, which today includes the DB12, Vantage, Vanquish, DBX707, and the F1-inspired Aston Martin Valkyrie. The brand debuted in Grand Prix racing in 1922, claimed outright victory at Le Mans in 1959 and returned to Formula One in 2021 under Lawrence Stroll’s leadership.

The team has since made significant investments, notably opening the AMR Technology Campus in Silverstone in 2023, featuring sustainable design and a cutting-edge wind tunnel set to be operational in 2025.

On-track, the driver line-up features the experienced Canadian Lance Stroll and double World Champion Fernando Alonso, supported by Test and Reserve Drivers Felipe Drugovich and Stoffel Vandoorne, along with Team Ambassador Pedro de la Rosa and Young Development Driver Jak Crawford. Aston Martin Aramco also races in the all-female F1® Academy series, with Swiss driver Tina Hausmann competing under the mentorship of the team’s F1® Academy Head of Racing and Driver Ambassador, Jessica Hawkins.

Off-track, Aston Martin Aramco continues to drive progress through its I / AM fan engagement platform, and Make A Mark ESG programme, driving sustainability, inclusion and community engagement. Partnerships with Racing Pride, Spinal Track, and the Aleto Foundation support inclusivity, accessibility, and leadership development. The team’s commitment to energy efficiency is certified by ISO 50001 compliance.

With history dating back to 1913 and its founders

On-track, the driver line-up features the experienced Canadian Lance Stroll and double World Champion Fernando Alonso,

Since 1791, Girard-Perregaux has been embracing the rhythm of ever-elusive time. Cradled in the Jura mountains in the heart of La Chaux-de-Fonds, it is a pioneer in the world of Haute Horlogerie: an independent Manufacture which has retained this status for over two centuries, successfully keeping all production in-house and passing down exceptional horological skills throughout the generations. The preservation of this savoir-faire, along with a sincere passion for beauty and for the art itself, has remained the key to Girard-Perregaux’s ability to continuously innovate.

Always seeking the perfect balance of beauty and functionality, fans of fine watchmaking will instantly recognise the house signatures, such as the iconic octagonal bezel of the Laureato and the legendary Tourbillon with ‘Three Gold Bridges’. From seeking to create industry references in timepieces to making the invisible visible through the art of precision engineering, Girard-Perregaux never ceases to change the course of time via pieces that are the first of their kind. This place at the vanguard of horological innovation is solidified by over one hundred recorded patents for original designs, like the movement of three arrow-shaped bridges, registered in 1884, as well as prizes like the ’Aiguille d’Or’ in 2013 and distinctions like the Gold Medal at the Paris Universal Exhibition in 1889.

Rooted in its heritage, Girard-Perregaux is driven by the instinct to always look ahead, embracing new technologies, utilising state-of-the-art materials, and finding inventive ways to bring joy by reimagining iconic shapes. To this end, Girard-Perregaux has remained a human-sized Manufacture, and in 2022 became part of an independent collective of Haute Horlogerie Manufactures alongside sister Maison Ulysse Nardin.

Reference 81070-21-3405-1CX

Limited edition of 88 pieces, engraved “One of 88”

Material: titanium

Diameter: 44.00 mm

Height: 14.65 mm

Glass: anti-reflective sapphire crystal

Case-back: secured by 6 screws, engraved

Aston Martin logo

Dial: Aston Martin Green color, applied indexes with luminescent material (green emission)

Hands: skeletonized, grey PVD-treated with lime green lacquered tip ‘baton’ type hours and minutes hands with luminescent material (green emission), lime green central second hand

Water resistance: 300 meters (30 ATM)

Material: green rubber with a fabric effect, green stitches

Buckle: titanium, folding with micro adjustment system

More than a third of engineers and architects are relying on AI every day, according to a new global survey by global sustainable development consultancy, Arup. The survey, Embracing AI: Reshaping Today’s Cities and Built Environment, examines attitudes and adoption of AI by those shaping our cities across 10 countries – Australia, Brazil, China, Germany, India, Indonesia, Nigeria, Singapore, the UK and the US.

The survey asked 5,000 engineers, architects, city planners, and digital leaders in the built environment how they are using AI. According to their answers, AI-powered solutions like large scale simulations, evolutionary algorithms are being used across work including project design, advanced modelling, urban planning, creating digital twins, and enhancing sustainability and energy efficiency.

The industry seems to be embracing the potential of AI to help projects be delivered on time and on budget, while also helping to tackle the climate and nature crises – citing solutions such as waste reduction, developing sustainable materials, and optimising renewable energy. Nearly twothirds of respondents see it as an opportunity while only 11%

consider it a risk to their jobs.

However, over 90% of professionals believe it is important to have ethical guidelines for AI in the built environment, with roughly half reporting apprehension about the dominance of global tech companies in AI development.

According to Stanford’s 2025 AI Index report, in 2024, US private AI investment grew to $109.1 billion—nearly 12 times China’s $9.3 billion and 24 times the UK’s $4.5 billion. It’s a growing market and Arup’s AI experts argue that if just 10% of this investment was used to design AI for major challenges in the built environment, it could help radically transform cities and infrastructure to improve people’s lives.

There are many reasons to choose Eccelsa Aviation for your trips to Sardinia

· State-of-the-art dedicated Business Executive Terminal

· Gateway to Costa Smeralda and Sardinia since 1963 *

· 3 km from the Marina of Olbia and 25 km from Porto Cervo

· Complete under the wing services for aircraft up to A340 and B747

· Tailored passenger services

· Full plannig for crew stay(s) at preferential rates

· Hangarage recovery

· Maintenance service in cooperation with Meridiana Maintenance

· Slot- and PPR-free landing and take-off **

· Great value-for-money services and easy payment methods

· Award-winning professional and experienced multi-language staff

However, you can forget about all of them.

In fact, what you’ll really appreciate is how you will feel And that’s all the difference between simply landing and truly arriving.

So whatever your reason for visiting Sardinia, keep in mind you are always welcome to

By Mr. Sebright Chen, CEO, Summer Atlantic Capital

Private equity is undergoing a profound shift. The era of leveraged buyouts and financial engineering is fading, replaced by a new paradigm—one defined by operational engagement, strategic partnerships, and sector expertise. Macroeconomic pressures, technological disruptions, and geopolitical realignments are reshaping investment strategies, forcing firms to adapt or be left behind.

The days of cheap capital are over. Inflation, economic slowdowns, and aggressive monetary policies have disrupted traditional value-creation models. Market volatility, deglobalisation, and regulatory tightening present new challenges, while sector-specific transformations— especially in AI, healthcare, and deep tech—demand a more sophisticated investment approach.

Meanwhile, within private equity itself, specialised fund managers are outpacing generalists. Capital alone is no longer the differentiator—deep industry expertise, governance excellence, and technological adaptability separate leaders from laggards. The winners of the next decade will be those who embrace this shift.

The investment climate in 2025 is defined by complexity. Global GDP growth is expected to remain sluggish at 2.7%, with geopolitical tensions—particularly between the US and China—complicating cross-border deals. In Europe, economic fragmentation and regulatory tightening further challenge foreign direct investment and M&A activity.

Yet, disruption creates opportunity. AI, deep tech, and

healthcare continue to present high-growth avenues, with the AI market alone projected to surpass $1.5 trillion by 2030. Supply chain restructuring and localised manufacturing offer additional investment openings. Disciplined investors will find opportunities in undervalued assets, leveraging the market correction to build resilient portfolios.

For PE firms, 2025 is a year of recalibration—balancing risk mitigation with opportunity capture through refined deal structuring, strategic capital deployment, and deeper operational involvement. The traditional playbook of leveraged buyouts and cost-cutting is no longer sufficient. Innovation, governance, and ecosystem-driven growth are the new imperatives.

The US and China remain the two largest private equity markets, yet their trajectories diverge.

In the US, technological innovation drives investment. AI, biotech, and automation are reshaping industries, yet increased regulatory scrutiny—particularly in semiconductors and cybersecurity—complicates foreign investment. The CHIPS Act and other policies demand a localised, strategic approach.

China, meanwhile, is witnessing a domestic innovation boom. AI, renewable energy, and healthcare are at the forefront, supported by government initiatives to enhance self-sufficiency. Yet, foreign investors face barriers—capital controls, regulatory shifts, and geopolitical tensions. Outbound foreign direct investment declined 15% in 2024, reflecting an increasingly restrictive investment climate.

Successful navigation of these markets requires more than capital—it demands local expertise, strategic structuring, and strong governance. Firms that integrate transparency and compliance into their investment models will be best positioned to succeed.

Private equity is no longer just about deploying capital; it’s about building ecosystems. The most successful firms invest not just in companies but in strategic partnerships, coinvestments, and localised market integration. This ensures long-term sustainability and value creation beyond financial returns.

Corporate governance is a critical differentiator in this new era. Strong governance frameworks enhance transparency, regulatory compliance, and risk management—essential for navigating complex cross-border investments. Institutional investors are increasingly prioritising firms with rigorous governance structures, recognising their role in mitigating risk and enhancing long-term performance.

At Summer Atlantic Capital, we have firsthand experience in how responsible investing and governance drive superior outcomes. Our approach—fostering trusted teams, facilitating technology localisation, and aligning stakeholder incentives—has enabled us to create sustainable value across diverse investment landscapes.

Private equity must evolve beyond financial engineering. The next decade belongs to firms that combine capital with deep sector expertise, operational engagement, and strong governance.

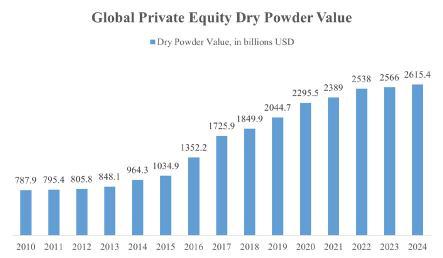

A common misconception in the industry is that dry powder guarantees superior returns. The reality tells a different story.

Despite record-high dry powder exceeding $2.5 trillion in 2024, returns have not kept pace. The real challenge is a capital-expertise mismatch—large funds are often managed by managers lacking the technical depth to generate sustainable value, while highly capable sector specialists struggle to access institutional capital.

Institutional investors must rethink their approach. Instead of prioritising past financial performance, they should focus on fund managers with deep industry knowledge, strong governance, and the ability to navigate technological disruption. Capital-first strategies are being replaced by capability-first models.

Success in private equity will no longer be dictated by financial leverage alone. The firms that thrive will be those that align sector expertise with execution—leveraging technology, reinforcing governance structures, and fostering strategic partnerships.

One of the greatest challenges in private equity today is the paradox of short-term profit arbitrage. Pressure from LPs for quick returns often leads to financial maneuvers that prioritise immediate gains over sustainable business growth. This short-termism is flawed. The failures of leveraged buyouts that relied on excessive debt and cost-cutting—like Toys “R” Us and Payless Shoes—illustrate the dangers of prioritising financial engineering over business fundamentals.

Conversely, firms taking a long-term view—investing in innovation, operational efficiency, and strategic growth— are outperforming. KKR’s digital transformation initiatives and Warburg Pincus’ investment in Reorg are examples of how private equity success is shifting toward sustainable, technology-driven value creation.

Bad actors in private equity and the broader entrepreneurial ecosystem pose systemic risks. Predatory investment practices, excessive leverage, and governance failures threaten not only individual firms but the broader economy. The collapse of poorly managed funds erodes public trust in private markets, inviting regulatory scrutiny and undermining the industry’s legitimacy.

Responsible competition, by contrast, fosters innovation and

economic growth. Firms must take an active role in enforcing stricter governance standards, ensuring transparency, and aligning incentives with sustainable value creation rather than short-term profit extraction.

Responsible investing must go beyond superficial ESG metrics. True responsible investing means aligning financial success with broader economic and social stability.

Private equity must redefine its role—not just as capital allocators but as stewards of long-term value creation. Success should not be measured solely by IRRs and exit multiples but by the real impact investments have on industries, economies, and societies. The key questions for investors are no longer just about returns—they are about impact.

• Are we funding technologies that enhance productivity and sustainability?

• Are we building businesses that contribute to economic resilience?

• Are we ensuring governance structures that align stakeholder interests?

These considerations will define the next generation of successful private equity investors. Private equity’s future

belongs to those who embrace this evolution. The industry must move beyond financial engineering toward a model driven by innovation, governance, and long-term value creation. Investors who fail to adapt will be outmaneuvered by those who do.

The private equity industry stands at a defining moment. The macroeconomic and geopolitical landscape of 2025 presents both risks and opportunities. Those who cling to outdated financial engineering models will struggle, while firms that embrace innovation, governance, and ecosystemdriven growth will lead.

Investors must challenge traditional assumptions, rethink valuation models, and prioritise long-term sustainability over short-term gains. The firms that will define the future of private equity are those that move beyond capital deployment to active value creation—leveraging technology, reinforcing governance, and building resilient businesses.

Private equity has the power to drive technological breakthroughs, reshape industries, and fuel economic transformation. It is time for the industry to embrace that responsibility—creating not just profitable portfolios, but a more sustainable, innovative, and resilient global economy.

By Yevhen Krazhan, CBDO at GR8 Tech

Having closely followed the iGaming industry’s explosive growth over the past years, I have seen how it has become one of the most lucrative digital industries. Fueled by digital innovation and changing player behaviors, the market hit $85.6 billion in 2023 and is on track to exceed $125.6 billion by 2027 – potentially reaching $195 billion by 2031. But with massive opportunities come fierce competition and complex challenges.

The success of the iGaming business varies significantly across different countries, depending on factors like regulation, market demand, and player preferences. Understanding regional differences is key to successful business expansion in the industry.

Europe dominated the iGaming market with over 41% global share in 2022, driven by gambling legalization in various countries. From my experience, Europe remains a powerhouse due to its well-established regulations, but the market is also getting increasingly competitive. Navigating licensing requirements while keeping up with evolving player expectations is no small task.

Africa is emerging as one of the most dynamic regions for iGaming growth, with several countries experiencing significant market expansion last year. Leading the charge are Rwanda, Malawi, the Democratic Republic of the Congo, and Togo, all of which have seen remarkable growth rates, some surpassing 100%. One thing stands out when I look at Africa’s growth: mobile-first, feature-light experiences are key, and I have seen platforms thrive when they prioritize accessibility over flashy features.

Southeast Asia is quickly becoming a major hotspot for iGaming growth, driven by a young tech-savvy and mobilefirst population. However, the market’s diversity is what truly sets it apart – each country has very unique player preferences and gaming habits. I think it’s also worth noting that Asia Pacific is the fastest-growing region in online casino revenue, with a CAGR of 13%.

Also, Latin America remains a prime iGaming investment opportunity fueled by an unmatched passion for sports betting. While Brazil dominates headlines with its strict regulatory rollout, more stable markets like Chile and Peru offer clearer pathways for growth. Success in the region goes beyond licensing and requires local expertise, strong payment solutions, and innovative content to meet players’ high expectations. With local providers often lagging in product diversity, there’s room for international entrants to bring new offerings.

To succeed in the iGaming industry, businesses must localize: in terms of content, payments, regional user behavior, and so on. This goes beyond regional understanding; it lies in country-by-country diversification. Offering access to over 50 sports, 25,000 daily events, and more than 2,000 betting markets overall, we at GR8 Tech created geo-specific presets designed to gather the best for specific markets, enabling quick launches and predictable growth based on catering to specific interests and demands of the local audiences.

iGaming has benefited tremendously from technological advancements that have helped businesses grow immensely. Innovations like personalized experiences and effective CRM have made platforms easier to use and more engaging, attracting players and keeping them invested.

Sportsbooks have become a must-have for any iGaming platform, growing at an impressive 10.7% annually. However, the industry’s default mindset still leans toward casinos as the

top earner when discussing profitability. For a good reason – casinos operate on a predictable margin model, offering operators a clear, mathematical expectation of returns. Does this mean sportsbooks aren’t viable? Absolutely not – if you know how to unlock their full potential.

For instance, GR8 Tech’s margin management tools allow real-time odds and margin adjustments, helping operators strike the perfect balance between player appeal and profitability. On average, our clients see a 15% profit increase, with some exceeding 30% growth without extra investment. But maximizing sportsbook earnings goes beyond margins.

AI-driven personalization and advanced CRM tools take engagement to the next level. By analyzing player behavior in real-time, the platform delivers tailored recommendations and betting opportunities, increasing interaction by 30% with a 99% accuracy rate. The tools transform occasional bettors into loyal, high-value players.

The competition in iGaming extends beyond betting platforms – to streaming services, social networks, and other digital entertainment that demand constant engagement. Players expect seamless, real-time experiences with zero friction. If a platform doesn’t match the speed, personalization, and reliability of its entertainment competitors, engagement drops and players leave. A slow-loading bet slip, a lagging transaction, or an interruption during peak events can cause them to lose trust and move on. Performance is the foundation of player retention, and every millisecond matters. GR8 Tech prioritizes speed, stability, and real-time personalization to ensure operators keep their audiences engaged. Our platform delivers 99.96% uptime, handles

20,000 bets per second, and maintains latency as low as 6070 milliseconds. During high-traffic events like the IPL 2024, which saw 21.5 million bets placed, players enjoyed a smooth and uninterrupted experience. These capabilities ensure that whether traffic surges or betting volumes peak, the system remains stable and responsive. Operators who rely on this level of performance retain players more effectively and create an experience that feels effortless and reliable.

Performance also depends on adaptability. Player expectations shift rapidly, and platforms need to evolve without costly downtime or technical bottlenecks. Configurability allows operators to fine-tune experiences in real time, while a modular system makes it easy to expand and integrate new features. A platform must support growth, adjust to emerging markets, and introduce innovations without disruptions. With the right foundation, operators stay ahead of industry changes and deliver engaging experiences that meet the demands of digital-first players.

What stands out to me is the adaptability required to thrive in this industry. I believe that those who can authentically engage with unique markets by prioritizing accessibility and user experience will set themselves apart in the iGaming sector. For investors, the key lies in aligning with visionaries like GR8 Tech, who are unafraid to embrace change and innovate. Leveraging technology, driving user engagement, and adjusting to local trends will undoubtedly pave the way for sustainable growth. The future is bright for iGaming, and I am eager to explore where this journey will lead us next.

Nabeel, an ultra-luxury fragrance brand from the United Arab Emirates (UAE), has unveiled SHUMUKH, the world’s most expensive and luxurious unisex perfume, valued at US $1.295 million. Paying tribute to the spirit of Dubai, SHUMUKH, which in Arabic translates to ‘deserving the highest’, unites the art of jewellery and perfumery to create a one-of-a kind masterpiece that tells the tale of the great Emirate through seven core design elements. Set with 3,571 sparkling diamonds (totalling 38.55 carats), topaz, pearls, nearly 2500 grammes of 18 karat gold and nearly 6000 grammes of pure silver, SHUMUKH is the epitome of luxury.

Standing 1.97 metres tall and taking over three years and 494 perfume trials to formulate, SHUMUKH is comprised of the finest natural ingredients sourced from the furthest corners of the globe, culminating in a scent that is as unforgettable as it is mesmerising with notes of amber, sandalwood, musk, rare pure Indian agarwood, pure Turkish rose, patchouli ylang-ylang and frankincense. SHUMUKH takes its lasting power from the superior quality and rarity of its ingredients, and is estimated to last on the skin for more than 12 hours and up to 30 days on fabric.

SHUMUKH’s hand-blown Italian Murano glass bottle has the capacity to hold three litres of perfume that is dispensed via a revolutionary remote-controlled spray mechanism that adjusts to the user’s ideal height.

SHUMUKH was created by Mr. Asghar Adam Ali, Chairman and Master perfumer at Nabeel Perfumes Group of Companies, and executed by renowned artisans and master craftsmen from Switzerland, Italy and France - including the recipients of the designation of Meilleurs Ouvriers de France (“Best Craftsman of France”). SHUMUKH is the only perfume to hold two Guinness World Record titles, including ‘Most diamonds set on a perfume bottle’, and ‘Tallest remote controlled (RC) fragrance spray product’. It is also customisable and offers the opportunity to have bespoke and personalised modification incorporated. Additionally, all diamonds and precious stones are accompanied by individual certificates of authenticity.

Mr. Asghar Adam Ali, Founder & Chairman of Nabeel Perfumes Group of Companies, Master Perfumer and Designer of SHUMUKH said,

“with a history of passion for perfumery that has spanned 47 years and a keen eye for jewellery design, my dream

was to bring to life a “history in the making” concept with innovation at its core. My vision was not only to capture Dubai’s persona in one monumental piece of art, but to also create a fragrance that embodied the pinnacle of luxury in the world of perfumery. Today, I am very proud of SHUMUKH, an evocatively stunning and bespoke creation which combines the disciplines of art, jewellery design and perfumery and, is concurrently also the holder of the highest number of Guinness World Records in the world of perfume industries”.

The Spirit of Dubai Parfums series is inspired by the rich and diverse cultural heritage of Dubai – an awe-inspiring city of vivid scenery and captivating contrasts of ancient tradition and all the luxuries of a thriving, cosmopolitan society. The awardwinning brand launched its ‘First generation’ Luxury collection in 2015 followed by ‘Second Generation’ Ultra-luxury Collection in 2016. All products are conceptualised from the seven core elements. SHUMUKH – an unrivalled tribute to Dubai in the world of fragrance, beautifully showcases the seven key elements of pearl diving (Durra), falconry (Baz), Arabian horses (Abjar), roses (Narjesi), luxury (Haibah), Arabian hospitality (Diwan), and Dubai’s stature as a ‘city of the future’ (Aamal), all of which have been intricately modelled in gold and silver, and ornamented with the highest quality VVS diamonds and precious stones.

Paying tribute to ‘The Spirit of Dubai’, the seven elements SHUMUKH represents are as follows: Durra – the greatest pearl ever found, Baz – the imperial falcon, Aamal – the city of Future, Abjar – the noble steed, Narjesi – the rose in eternal bloom, Haibah – the most precious diamond, and Diwan – the home of heroes.

The sports car re-imagined with sustainability in mind

Around the world, retrofitting and electrification efforts are gathering pace to meet ambitious sustainability targets but the strain on the power grid is emerging as a critical bottleneck. The issue of grid capacity during the energy transition is not just theoretical; take the example of the recent power cut across both Spain and Portugal, the largest power cut in recent European history. Investigations are still ongoing into what went wrong with the electricity system, which impacted some 60 million people, but experts say infrastructure investment is essential.

The European Union’s power grid mostly dates back to the last century, with half of the lines being over 40 years old. The increase in green energy production and booming demand from both data centres and electric vehicles require an immediate overhaul of the grids that also need digital protection to withstand cyber attacks.

This is where the private sector has a fundamentally pivotal role to play, going beyond simply conducting business; it involves a proactive, strategic approach that encompasses advocacy, collaboration, and long-term planning.

Specifically, the private sector can significantly influence the direction and pace of necessary infrastructural changes by actively advocating for comprehensive grid upgrades. This advocacy is most effective when conducted in a robust and transparent partnership with the public sector, ensuring that

regulatory frameworks and investment decisions are aligned with the urgent need for grid modernisation. Furthermore, direct and consistent collaboration with Distribution Network Operators (DNOs) is essential. By sharing detailed and accurate energy demand forecasts, the private sector enables DNOs to synchronise their infrastructure planning and upgrades with anticipated increases in electricity consumption.

This level of collaboration ensures that the industry’s energy needs are not only understood but actively incorporated into the long-term strategy for grid development. Consequently, the private sector’s involvement in these areas is not just beneficial, it is crucial for driving meaningful and sustainable change in the energy landscape, ensuring a reliable and robust power grid capable of supporting future electrification efforts and sustainability goals.

Stanbic Bank Botswana operates under key pillars that shape its community-building efforts:

• Corporate Social Investment (CSI): Focusing on employability and entrepreneurship, health, and education.

• Sponsorships: Emphasising thought leadership, team sports, and the performing arts. Key assets include such properties as the Stanbic Bank Gaborone Golf Club.

Stanbic Bank Botswana, a member of the Standard Bank Group, commenced operations in Broadhurst in March 1992 and has been serving the nation for 33 years. It stands as the third-largest commercial bank by profitability and leads the Corporate and Investment Banking sector. The Bank is also committed to reclaiming its position in the Business and Commercial Banking space and expanding its footprint in Personal and Private Banking.

The Bank caters to three main client segments:

• Personal and Private Banking (PPB): Servicing retail clients.

• Business and Commercial Banking (BCB): Serving Enterprise/SME and Commercial clients.

• Corporate and Investment Banking (CIB): Managing large corporates and multinationals.

These segments are supported by various Corporate Function Units to deliver comprehensive solutions and drive the Bank’s growth.

• Social Economic and Environmental (SEE) Initiatives: Executed through programmes like the Accelerate Incubator and Citizen Economic Empowerment Programme (CEEP), these initiatives aim to support underserved youth and entrepreneurs, combat youth unemployment, and scale small to medium enterprises through coaching, mentoring, market access, accelerated growth programmes, and funding opportunities.

The Bank employs over 645 staff members and maintains a national presence with 13 branches:

• Gaborone: Six branches.

• Other Locations: Francistown, Letlhakane (digital branch), Maun, Mogoditshane, Palapye, Selebi Phikwe, and Kazungula.

To enhance customer convenience, Stanbic Bank Botswana offers a comprehensive Card Acquiring solution with standalone Point of Sale (POS) devices nationwide, eCommerce merchant solutions, and integrated POS tills in key retail outlets. The Bank also services customers through a network of 79 ATMs across the country.

The Bank has introduced world-class digital platforms to enhance customer experience. This includes but is not limited to Shyft, a mobile forex app allowing users to trade in four leading

currencies: US Dollar, British Pound Sterling, Euro, and Australian Dollar. This aligns to the overarching desire to grow financial inclusion and accessibility in line with the national Vision 2036.

In 2024, Stanbic Bank Botswana received several accolades, including:

• Visa Payments Excellence Award 2024: Recognising the Bank's efforts in enhancing customer experience and strengthening its connection with clients through trusted financial services.

• Visa Brand Awareness Award 2024: Acknowledging the Bank's commitment to improving brand visibility and solidifying its position in the market.

• Botswana's Best Bank for Environmental, Social, and Governance (ESG) by Euromoney 2024: Highlighting the Bank's dedication to sustainability and its positive impact within the community.

• Best Bank for SMEs at EMEA Finance African Banking Awards 2025.

• Best Trade Finance Provider in Botswana for 2025 by Global Finance.

Stanbic Bank Botswana is committed to creating value for clients and communities by providing access to digital financial solutions that support sustainable growth. The Letsema 2025 Strategy serves as a clear roadmap towards achieving growth and performance measures, both financial and Social, Economic, and Environmental (SEE), embodying the belief that “Botswana is our home, and we drive her growth.”

For further information, visit www.stanbicbank.co.bw

Airtasker, Australia’s leading online marketplace for local services, has become an official team partner of Visa Cash App Racing Bulls Formula One™ Team (VCARB) in 2025. By entering the world of motorsport like no brand before it, the aim is to celebrate the unsung heroes behind the scenes of the VCARB team. International Investor sat down with Airtasker’s CEO, Tim Fung, to discuss the partnership.

AIRTASKER’S ENTRY INTO FORMULA ONE™ IS UNIQUE BY FOCUSING ON THE BEHINDTHE-SCENES TEAM. WHAT INSPIRED THIS APPROACH, AND WHAT MESSAGE DO YOU HOPE TO CONVEY?

As a consumer platform, we connect people with everyday jobs, and Formula One is the ultimate showcase of skilled professionals working at an elite level. From mechanics finetuning engines to logistics teams moving equipment around the world, these are tasks that everyday people can relate to—just executed at the highest standard.

By entering Formula One through our partnership with Visa Cash App Racing Bulls (VCARB), we want to spark conversations about the skill, dedication, and teamwork behind the sport and highlight the unsung heroes who make it happen— like Taskers in our community who bring expertise and passion to their work every day.

In true Airtasker nature, we also saw some odd jobs like queue line-up posted on the platform for the AUS GP recently, with a customer wanting to someone to line up for her at the Grand Prix gates this weekend so she can get a good spot at the Melbourne walk.

AIRTASKER HAS A GLOBAL PRESENCE. HOW DOES THIS PARTNERSHIP FIT INTO YOUR INTERNATIONAL EXPANSION STRATEGY, AND WHAT ARE YOUR TARGET MARKETS?

Formula One is one of the fastest-growing global sports, and it offers an incredible platform for brand visibility and networking on an international scale. As Airtasker continues to expand globally, we’re harnessing the power of this sport to stand alongside the world’s biggest brands, and Formula 1 provides that unique mix of cutting-edge technology and global audiences.

HOW DOES AIRTASKER PLAN TO ENGAGE WITH THE BROADER FORMULA ONE™ AUDIENCE?

Formula One is becoming increasingly popular amongst the masses and not just hardcore racing fans, allowing brands to leverage this moment and connect with different audiences no matter what life stage they are at or what their goal is. At Airtasker, we’re shining a light on the team behind the scenes. From pit crews to garage technicians and engineers, the Visa Cash App Racing Bulls (VCARB) Formula One team works their magic behind the scenes to make sure the race runs

smoothly. We’ll be engaging with broader audiences to share these behind the scenes stories through out of home advertising, PR, social and creating content and conversation that brings these stories to the surface.

WHAT DO YOU THINK THE FUTURE HOLDS FOR COLLABORATIONS BETWEEN TECH COMPANIES AND SPORTS ORGANISATIONS, PARTICULARLY IN FORMULA ONE™?

I think we’re just at the beginning of something much bigger when it comes to global tech brands getting involved in major events and moments like this. As technology continues to evolve, the opportunities for innovation in motorsport are endless. We’re already seeing tech companies playing a huge role in improving performance, whether it’s through data analytics, AI or even enhancing the fan experience.

It’s likely we’ll see deeper partnerships where sports organisations and tech companies work together to create better performance, more immersive fan experiences, and even smarter, safer racing. It’s a space that’s only going to get more sophisticated as technology continues to grow and evolve.

Emerging Markets have accounted for almost two-thirds of the world’s GDP growth and more than half of new consumption over the past 15 years, boasting growth rates surpassing those of developed nations. Rapid urbanization, expanding industries, and increasing infrastructure demands make these regions key drivers of global economic expansion.

However, an annual infrastructure investment gap exceeding $1.5 trillion—equivalent to 4.5% of GDP—highlights the pressing need for capital to capitalize on these opportunities and support long-term sustainable development. To tap into these opportunities successfully, institutions require expert financial structuring, risk management, and intricate relationships to make it all come together.

That’s why Delphos exists. We are pioneers in the world of investing in emerging markets. For over thirty years, our people have triggered the rise of these economies’ growth stories, bringing in a steady flow of capital (over USD 20 billion) when investor confidence was low or non-existent.

Our success track in structured and secured financing for transformative projects drives economic progress and

industrial modernization. Our expertise spans multiple industries, delivering strategic financial solutions that enhance growth and stability.

• Aviation & Transportation Infrastructure

• to accommodate increasing passenger and cargo demand.

• Renewable Energy Expansion

• Facilitating investments in solar, hydro, and wind projects to expand sustainable energy access.

• Maritime & Industrial Development

• Supporting the modernization of ports and shipyards

• to enhance global trade and connectivity.

• Decentralized Energy Solutions

• Financing off-grid power systems to improve energy security in underserved regions.

• Strategic Mineral Resources

• Structuring investments in critical minerals crucial for clean energy and advanced technologies.

• Cross-Border Energy Connectivity

• Advising on interconnector projects that strengthen regional energy security and trade.

The global economy is shifting. While developed markets face stagnation, emerging economies in Latin America, Africa, and Asia are advancing rapidly, driven by urbanization, industrialization, and demand for sustainable infrastructure. The opportunities to invest in critical sectors, from transformative infrastructure to strategic minerals for clean energy, are vast. Now is the time to act.

Bart Turtelboom CEO & Chairman of Delphos

Governments and businesses seek international capital to fund infrastructure, energy, and industrial projects. The high demand for critical minerals essential for green technology development and major infrastructure investments highlight the urgency and profitability of these sectors.

But well-known challenges such as regulatory complexities and currency fluctuations often cause hesitation. That’s where Delphos comes in: well-structured investments can generate high returns. Delphos helps investors navigate these risks by ensuring capital is deployed efficiently while safeguarding long-term profitability. Through blended finance models, structured lending, and equity investments, we enable access to high-growth sectors with minimized exposure to volatility.

The 10 Big Emerging Markets (BEM) economies are (alphabetically ordered): Argentina, Brazil, China, India, Indonesia, Mexico, Poland, South Africa, South Korea, and Turkey. Emerging markets like Chile, Indonesia, Mongolia, Romania, Sierra Leone, Vietnam, Egypt, Iran, Nigeria, Pakistan, Russia, Saudi Arabia, Taiwan, and Thailand are other major emerging markets transforming rapidly, offering investors new avenues for growth.

Whether your focus is on infrastructure, renewable energy, or industrial expansion, Delphos’s team and experience will help you achieve a successful landing in the emerging world. Our techniques in balancing foreign exchange rate risk, nonnormal distributions, lax insider trading, restrictions, and lack of liquidity will surprise you. High-impact investments are achievable.

The global economy could receive an $11 trillion boost if all emerging economies emulate outperformers.

Navigate Emerging Markets with Delphos Reach out to us today to shape tomorrow: delphos.co/contact.

UBlac is an exceptional regional creative agency that has consistently demonstrated its ability to deliver bold and impactful branding and marketing solutions. With extensive expertise in executing numerous international and regional projects, UBlac specialises in crafting influential brand identities, engaging campaigns, and captivating digital experiences that effectively connect with target audiences.

What sets UBlac apart is their commitment to innovation—they don’t simply follow trends; they create them. By integrating creativity with cutting-edge technology, particularly through sophisticated AI-driven marketing strategies, UBlac develops dynamic, data-driven campaigns designed to maximise audience engagement and deliver tangible results.

Recognizing their creative approach and outstanding success in using AI technology, UBlac was recently honored with the prestigious “Pioneer in Advertising & Marketing Branding” award by International Investor. This accolade highlights their remarkable capability to harness artificial intelligence in crafting highly personalised and successful marketing campaigns.

With an ongoing focus on strategy, creativity, and technological advancement, UBlac consistently pushes marketing boundaries. Their groundbreaking guerrilla marketing tactics, immersive digital storytelling, and AI-enhanced content ensure that their clients don’t merely compete—they confidently lead in their industries.

Discover more about their transformative work at ublac.com.

In a monumental stride towards fortifying Europe’s maritime infrastructure and energy security, Greece’s Elefsina shipyard is undergoing a significant transformation. Once perceived as a relic of the nation’s industrial past, Elefsina is set to become a contemporary beacon of innovation and sustainability, thanks to a pivotal $125 million financial injection orchestrated by the United States via global finance advisory firm, Delphos.