International HR Adviser

The Leading Magazine For International HR Professionals Worldwide

The Leading Magazine For International HR Professionals Worldwide

You are cordially invited to our on Monday 16th June, 2025 from 12pm - 4.30pm at The Royal Automobile Club, Pall Mall, London

This event is for Senior Global HR Professionals only and is Free to Attend

Please join us for an afternoon of advice and information from professionals in their field, all based on issues that Global Mobility professionals face whilst managing their company or organisation's global mobility programmes.

To register for this annual event please email the name/s and job titles of those who would like to attend, to helen@internationalhradviser.com

We look forward to seeing you there

FEATURES INCLUDE:

Global Engagement Models: Non-Traditional Mobility For The Modern Workforce Hybrid Working: Navigating Permanent Establishment Risks In International Remote Working Preparing For The New Normal: Why You Should Re-Think Your Expatriate Management Model Avoiding Inconsistent Mobile Employee Experience • Global Tax Update Breaking Silos Down Isn't Just An Operational Challenge Keeping Business Travellers Safe: What HR Professionals Need To Know AI Authentic Leadership for HR: Why AI Is Every Authentic Leader's Responsibility

ADVISORY PANEL FOR THIS ISSUE:

Global Engagement Models: Non-Traditional Mobility For The Modern Workforce

Clare Fazal & Iain Martin, Deloitte LLP

Hybrid Working: Navigating Permanent Establishment Risks In International Remote Working

Karen McGrory, BDO LLP

Global Tax Update

Karen McGrory, BDO LLP

Preparing For The New Normal: Why You Should Re-Think Your Expatriate Management Model

Simon Davies, ITX

Avoiding Inconsistent Mobile Employee Experience

Olivier Meier, Mercer

Breaking Silos Down Isn't Just An Operational Challenge

Kristin White, Sterling Lexicon

Jonathan Carter-Chapman, Business Travel Show Europe

Michael J. Provitera & Mostafa Sayyadi

The working landscape is constantly evolving. Driven by advances in technology, there is increasing opportunity for work to be performed anywhere. Cultural attitudes to remote work are also shifting, with workers valuing flexibility and organisations focusing on the need for business agility. These factors are fuelling the desire to remove geographical barriers to both work and talent agility. This can however, result in an increase in crossborder challenges and increased complexity for organisations.

A more distributed global workforce will give rise to time and resource pressures for subject matter experts (SMEs), who must assess regulatory and compliance risks, implement guardrails to protect the business and increase tracking and oversight to maintain their employer duty of care.

In this article, we will introduce examples of non-traditional mobility and explore the considerations for organisations who are being challenged to utilise a broader suite of talent engagement models to meet the demands of the modern workforce.

Traditional mobility - assigning individuals to work in another country for a temporary period or relocating personnel on a permanent basis - has long been used to facilitate business objectives. However, some organisations are finding there is a need to re-evaluate their global talent strategies and revisit perspectives on cross-border movement, both physically and virtually, casting the net wider in the search for global talent and incorporating new engagement options.

The modern work evolution is being shaped by several key factors including:

• An increased ability for work to be performed anywhere (rather than tied to a particular location)

• Employer imperatives to attract and retain key talent by enabling increased flexibility

• A quest for increased organisational agility to enable rapid response to geopolitical or market factors

• A desire to tap into a broader talent pool by filling opportunities based on skills without geographic barriers; and

• Business responses to overseas expansion objectives.

Whilst business challenges vary significantly across organisations and sectors, several questions arise in relation to this evolution and challenge whether non-traditional engagement models may be the answer:

• How can an organisation enable individuals to work remotely on a longterm or permanent basis where there is no entity locally?

• How can the business tap into a broader talent pool by filling opportunities based on skills without regard to geographic barriers?

• How can the business expand swiftly into new territories by getting people on the ground there?

There is certainly no ‘silver bullet’ to these questions and many organisations will use a suite of engagement options to respond to different business challenges and scenarios. Practical considerations such as employee experience, cultural fit, scalability, cost and return on investment need to be considered alongside tax and legal risk, reward, regulatory and finance matters.

Some of the most common nontraditional engagement options currently are:

• Long-term/permanent international remote work

• Engaging independent contractors

• Employer of Record (EoR) – a third-party service provider which acts as the legal employer of an individual in the work location

• Commuter arrangements

• Global Employment Company (GEC) - an incorporated entity within the group structure used as a centralised employment vehicle

• Establishing a new local entity (in the work location)

• Virtual assignments

Deloitte EMEA Dbrief, June 2024 Poll question: Which areas will your organisation explore further to aid a truly global workforce?

Note: Participants were able to select more than one response.

In the June 2024 Deloitte EMEA Dbrief “Your global workforce footprint – optimal structures and approaches”, we polled participants on the areas in which their organisations will further explore alternative engagement options:

‘Long-term or permanent remote work’ to address talent needs and the ‘Use of independent contractors’ were the top two responses. ‘Use of an Employer of Record (EoR)’ and ‘Global Employment Company (GEC)’ were also high, with more organisations expecting to explore these compared with the same survey question in 2023.

A key differentiator in the quest for increased agility is being ready to respond to often urgent business needs when assessing global engagement models. Often businesses need to react swiftly to engage talent before it is lured away by a competitor, or to get ‘boots on the ground’ so as not to lose a business opportunity in a new location. We see preparedness typically falling into three scenarios:

• Proactive – “I’m ready when needed”

• Reactive – “I’ll work it out when needed”

• Retrospective – “I’ll work it out after the event”.

The optimum scenario is of course to be proactive, ultimately reducing overall time, effort, cost and the risk of tax and legal compliance failures, as the requirement to ‘unwind’ or ‘retrofit’ cases is greatly reduced. There should be fewer cases where structures have been put in place to provide a quick-fix solution, without having fully considered the strategic needs of the business or longer-term implications. Sometimes a short-term solution is required and there are certainly engagement options which may be more suited to this, for example, using an Employer of Record or independent contractors. However, there should be clear stakeholder alignment to proceed with these and awareness of the costs (internal and third-party) in moving to a new structure in the future.

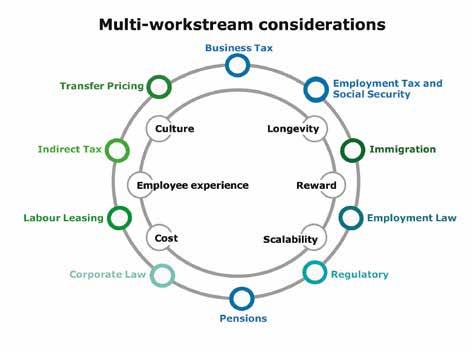

Each of the engagement options mentioned have relative benefits and limitations, meaning early interaction across the business is key before choosing the appropriate engagement model for your organisation. Below is a nonexhaustive list of areas that should be assessed when exploring engagement model feasibility:

The various stakeholders across these business functions need to align, to identify priority actions and shared goals to deliver a successful, future-focused, engagement model strategy

• Business Alignment – The engagement model(s) selected must be tailored to the organisation’s specific strategic objectives, workforce planning approach and risk tolerances. A cross-functional stakeholder group (including tax, legal, finance, HR, talent acquisition etc.) is required to ensure that the

relative pros and cons of each engagement model can be weighed up against each other. As an example, an EoR arrangement may assist with reducing employer compliance obligations from the employment tax and social security perspective; however, the legal function may have concerns in mitigating risk associated with the individual being employed by a third-party. The various stakeholders across these business functions need to align, to identify priority actions and shared goals to deliver a successful, futurefocused, engagement model strategy

• Cost-Benefit Analysis – Often the views of the organisation will be formed early, focusing on either a) only the benefits (e.g. access to talent, speed and flexibility), or b) only the costs (implementation costs, management costs and potential risks). A full cost benefit analysis should be performed at the feasibility stage, including consideration of the return on investment of the engagement model(s). As an example, whilst the implementation of a GEC is likely to be a material cost, would the long-term benefit provide the desired return on investment?

• Corporate Tax and Permanent Establishment (PE) position – Under traditional mobility, PE and corporate tax responsibilities would generally be managed as part of the assignment or relocation processes and would often be managed by an arrangement with the entity in the work location. Where independent contractors or Employers of Record are used, it is key for the organisation which oversees the worker to continue to assess the PE position and any corporate tax exposure in the work location

• Income tax, social security and payroll –Workers may become subject to income tax or social security in more than one jurisdiction, and organisations may be responsible for payroll compliance in multiple jurisdictions, depending on local laws and tax treaty provisions. Where an EoR is engaged, typically payroll compliance obligations are a core service that the EoR will meet in the working location, which can mitigate employment taxes risks, but there are wider factors regarding the use of the EoR model that require careful consideration, such as permanent establishment risk and employment law requirements

• Immigration law - It’s vital to review the work visa or permits required to work legally in a country and if the organisation would be able to sponsor a visa where required. For example, in some locations only the employing entity can sponsor a visa and the law may not allow a non-resident company (e.g., a GEC) or an EoR to be a sponsor

• Employment law - Where the hiring country and working country are different, you may need to navigate the employment law rules of both countries, including minimum

wage requirements, working hours, leave entitlements, termination procedures and data protection. A GEC may, over time, build up knowledge of these requirements across a range of countries which can then assist with quicker deployment and compliance for workers in the future

• Labour leasing restrictions – Some jurisdictions will regulate the practice of “leasing” employees from one entity to another (i.e. both intra-group and on an arms-length basis), to protect employee rights, prevent tax evasion and maintain fair competition in the labour market. As an example, some countries will only allow this practice for specific industries or job functions (e.g. only for seasonal work or for specialised skills) and this could limit which of the engagement model options you can consider for such a location. Companies that violate labour leasing restrictions may face significant fines, legal penalties and reputational damage

• Company culture/strategy – Under EoR or contractor arrangements, the workers will not be employees of the business and so this may limit the organisation’s ability to provide elements of reward or benefits that may normally help to connect the worker to the aims of the business. It is also important to consider the potential impact on retention as the flexibility afforded by such arrangements can work both ways, e.g., it is easier for a contractor to decline your organisation’s work and provide services to other organisations, including competitors

• Current employees – If considering changing the engagement model for current employees then it is important to review whether end of contract provisions could be triggered if re-engaging individuals. When moving employees into a GEC, which is an intra-group company move, you may be able to make provisions for continuity of service, but this becomes much less practical for contractors and when using EoRs and could mean, for example, that end of contract payments would be due to be settled, despite an ongoing working relationship with the individual.

As with traditional mobility, using global engagement models comes with complexities when engaging workers across borders. It is important for organisations to recognise that engagement models can support risk mitigation but not risk elimination. Therefore, once the engagement models have been chosen, it is important that robust risk management frameworks across the key business functions and due diligence processes are implemented, with ongoing monitoring of compliance continuing to be key. Additionally, it is essential for an organisation to have the right technology and vendor ecosystem to manage a distributed workforce, track compliance and maintain a positive employee experience.

The use of global engagement models which supplement traditional mobility is expected to continue to grow, as organisations tap-in to the more flexible solutions that they offer, as organisations seek to remain competitive, agile and attract and retain top talent in an interconnected world, or where swift global expansion is often a key objective.

Although there are benefits in engaging with these options, there is also a need for any undertaking to be balanced with an appropriate cross-functional feasibility assessment, an understanding of the cost/benefit and a clear map of responsibility for ongoing management processes, all of which help to ensure that any model deployed meets the needs of the business now and in the future.

Given the complexities involved, collaboration across SMEs is crucial in navigating the tax, legal and regulatory landscapes effectively. We would advise that organisations pro-actively explore and assess potential models and develop a roadmap to leverage them to their best advantage for their organisation, as this will be key to their ultimate success.

CLARE FAZAL Director

E: cfazal@deloitte.co.uk

T: +44 (0)207 007 0284

Given the complexities involved, collaboration across SMEs is crucial in navigating the tax, legal and regulatory landscapes effectively

IAIN MARTIN

Associate Director

E: imartin@deloitte.co.uk

T: +44 (0)1224 847 311

To address the most challenging business demands, multi-national organisations need to define and understand their global workforce footprint and deliver global talent deployment efficiently and compliantly. Deloitte’s dedicated Global Talent Mobility practice is a multi- disciplinary consulting group of tax, immigration, talent, HR and digital professionals who support clients as they navigate these complex global workforce challenges, developing focused strategies and delivering practical enablement.

This communication contains general information only, and none of Deloitte Touche Tohmatsu Limited (DTTL), its global network of member firms or their related entities (collectively, the “Deloitte organization”) is, by means of this communication, rendering professional advice or services. Before making any decision or taking any action that may affect your finances or your business, you should consult a qualified professional adviser. No representations, warranties or undertakings (express or implied) are given as to the accuracy or completeness of the information in this communication, and none of DTTL, its member firms, related entities, employees or agents shall be liable or responsible for any loss or damage whatsoever arising directly or indirectly in connection with any person relying on this communication. DTTL and each of its member firms, and their related entities, are legally separate and independent entities. ©2025. For information, contact Deloitte Global.

Monday 16th June, 2025

at The Royal Automobile Club, Pall Mall, London. 12pm - 4.30pm

Our annual event for Senior Global HR Professionals only will cover the following topics:

New Global Mobility LandscapeTax, Talent, And Compliance For A Hybrid Workforce:

· How hybrid working is reshaping global mobility and tax obligations.

· Legal and tax structuring solutions for international remote workforces.

· Tax-efficient policies for attracting and retaining global talent.

· Leveraging technology for compliance and risk management in hybrid work.

Presented by BDO LLP

· It's no longer business as usual.

You Can Do About It

· How are businesses adapting to a new world order?

· What does this mean for talent?

· How can you adapt?

Presented by Nick Hedges, ECA

Is it time you should re-think your expatriate management model?

Hosted by Simon Davies, ITX

An updated time line and progress report for the roll-out of new digital travel systems in the UK and EU, including the ETA, the EES and the ETIAS

The high-level requirements of these systems including eligibility, costs and application processes

· How to avoid potential pitfalls when navigating these new systems, from both a business and an individual perspective

· Key actions that can be undertaken now to prepare for these changes to international travel.

Presented by Alastair Mason, Smith Stone Walters

The World is changing at a faster pace than ever before and Global Mobility is no exception to this with more assignment types, an increasing pressure on costs, a pressure on talent combined with differing generational expectations and a desire for improved technology in an industry that is required to constantly provide a quality experience. Peter will explore the challenges facing all Mobility functions to ensure that they are future fit and able to respond to business needs.

Presented by Peter Sewell, Sterling Lexicon

To register for this free event, please email helen@internationalhradviser.com with the name and job titles of those who would like to attend.

We look forward to seeing you there!

SPONSORED BY:

Following on from my last article, "Hybrid working and global mobility to attract and retain talent", I am now focusing on the importance of having a suitable policy in place for "working anywhere". In particular, looking at the risk of creating a permanent establishment in another country if this area is not properly managed and monitored.

Firstly, it is helpful to distinguish between different types of global mobility. Particularly for your c-suite level employees, who may fall into both categories.

Short-Term Business Visitors (STBV) is an umbrella term to describe individuals that move at short notice and for much shorter periods of time than traditional expatriate assignees. They will not change residency or move home. This is often driven by specific projects or tasks. These staff are sent to a location by their employer.

In addition to STBV, the emergence of new ways of working has led to many organisations offering hybrid working arrangements, which can include allowing their workforce to work flexibly overseas known as international remote working (IRW). These staff are choosing themselves where to work.

For both STBV and IRW you may be required to report on business visitors and travellers by Base Erosion and Profit Shifting (BEPS) legislation and local tax authorities. Tracking your workforce and handling any related compliance issues can quickly become complicated. Robust tracking is essential, and you should consider both BEPS legislation and Country by Country reporting requirements to align transfer pricing practices with value creation.

However, help is at hand, as there are now multiple technology solutions available to assist with tracking your workforce. This can include processing IRW requests, tracking and monitoring of STBV and IRW to meet the needs of filings required, as well as producing summaries to provide high level oversight to key stakeholders.

If you want to grant flexibility to your staff, it’s important you understand the various areas which need to be managed, including corporate taxes (e.g. permanent establishment considerations, see below for more detail), immigration, data protection, recording employee data, income tax, social security and employment law. There is a lot of risk to be managed, and it needs constant tracking and monitoring. It is likely that the OECD will publish new guidelines on International Remote Working (IRW) soon, but in the meantime, this is still something that needs your attention.

At our 2024 Workplace Evolution event we ran a poll; 60% of attendees said they had a working from anywhere policy, but over 85% of employers said they had a long way to go in being comfortable, with tax/social security

The starting point for creating your IRW policy is to consider your strategy, employee roles, company culture, risk appetite, data sensitivity amongst other factors

being a main concern. You are likely to be keen to benchmark yourself as this is a key part of talent attraction and retention but there is a lot of risk to be managed at the same time.

The starting point for creating your IRW policy is to consider your strategy, employee roles, company culture, risk appetite and data sensitivity amongst other factors. For example, will you let employees work anywhere or only where there is an automatic right to work, will the policy apply in different ways to senior employees? Where you do want to put a IRW policy in place, you should aim to create one which allows your employees to work across various locations for several days per year, whilst reducing the risk and commercial obligations involved. The final policy you end up adopting will likely depend on your appetite to risk on this subject.

Although IRW does raise various issues and complexities it cannot simply be ignored, as that can lead to difficulties as a result of not responding to employee needs in flexibility, such as talent attraction and retention or employee feedback.

In many countries that operate under general international tax principles, often established by tax treaties, one of the conditions for a nonresident company to create a corporate taxable presence, or permanent establishment (PE), is where there is a fixed place of business in another territory through which the business is operated.

You could find yourself with an unexpected corporate taxable presence in territories where your employees are working remotely if you do not manage this.

You therefore need to consider whether your employees working from a home office in another territory could create a taxable presence with associated compliance requirements and potential tax costs.

There is considerable debate as to whether, how and when a home office might give rise to a taxable presence with no definitive

UK (or international) test. Some of this debate focuses on whether a private home is “at the disposal” of an employer, one of the generally held tests for a fixed place of business. OECD guidance notes that while part of a business may be carried on at a home office this should not lead to the automatic finding of a fixed place of business. However, equally, the OECD notes there are circumstances where a home office could give rise to a taxable presence. In other words, the specific facts and circumstances of each case will be important.

Key Considerations:

• An understanding of the activities of your employees in the context of your business is important – there is generally an exemption where activities are preparatory or auxiliary. This applies where the services performed are remote from the actual realisation of profit by the company. Although some recently introduced anti-fragmentation rules may also need to be considered

• It is also possible that the level of activity performed in the UK, while productive, does not rise to the level of carrying on a business in the UK which is also required for a PE to exist

• Is the employee required to work from home (perhaps, for commercial reasons like data security), or does the business benefit from having an individual situated in the UK – or can their work be done elsewhere/anywhere?

• The UK tax authorities have provided examples of employees of foreign businesses working in the UK –determining whether each scenario would create a ‘fixed place of business’ permanent establishment. The guidance is limited in scope, but highlights that where employees are only working occasionally in the UK you may still need to consider their position on a case-by-case basis. Even where a 'fixed place of business' is not established, the position regarding dependent agents and permanent establishments should be considered. If it is determined you have a presence in the UK, you must then calculate how much of the profit of the non-resident company is attributable to the PE. If there is no significant presence this may be very limited, but this will also be fact dependent. Importantly, you should be aware that even a minor presence in the UK would not remove the need for appropriate compliance.

If you are a UK company with employees working outside the UK, you will need to consider the local rules, treaties and local tax authority approach in each territory because these often differ.

If you are a UK company with employees working outside the UK, you will need to consider the local rules, treaties and local tax authority approach in each territory because these often differ

You should also remember that there are other triggers of corporate taxable presence - the habitual conclusion of contracts outside the territory of corporate residence could also create a taxable presence irrespective of the existence of a fixed place of business.

As you can see from the above, it is the work that is carried out that needs to be considered. With your c-suite making business decisions, this leads to an increased risk of a PE being created. Therefore, you may need to balance this risk in your IRW policy with more strict conditions for the c-suite. Does a member of your c-suite have a holiday home abroad? In the event that the individual works from that holiday home regularly, say, a few weeks each year, the repetitive nature may be considered habitual or permanent by some tax authorities. Though this doesn’t just apply to the c-suite, it is likely the risk is elevated as a result of the tasks they undertake whilst abroad.

As always, managing and monitoring the arrangements of employees is essential. This is another reason that having a wellconsidered IRW policy is essential. To specifically address the PE risk when

designing your IRW policy you should:

• Ensure corporate tax issues are considered when developing your IRW policy so that the risk of creating a UK and/or other offshore PE is managed

• Put in place a process to monitor PE risk by understanding where your employees may be working in a different country, to allow the corporate tax risk in this area to be properly assessed and managed.

The key considerations to be aware of for PE risk are what are the employee activities being carried out and the relevant local laws. From this the keys steps to take to mitigate risk are to assess your workforce, including reviewing their contracts.

Making sure you are on top of your compliance obligations and minimising potential risks of IRW are key. A well designed IRW policy and systems to keep track of your employees need to be put in place as soon as possible. This is an evolving area, so once you have established your best practice it is advisable to keep reviewing how it is working for you. New global developments that impact you should also be monitored and adapted to.

KAREN MCGRORY

Karen McGrory is head of expatriate Tax Services at BDO LLP. She has over 30 years’ experience in the field of expatriate taxation. Karen is indebted to Joel Kara for his contributions to this article.

BDO is able to provide global assistance for all tax issues arising from an internationally mobile workforce. If you would like to discuss any of the issues raised in this article, please do not hesitate to contact Karen McGrory on +44 (0)20 7893 2460, email karen.mcgrory@bdo.co.uk.

Tax exemptions to attract talent on one hand alongside increasing costs and uncertainty for employers on the other.

With many countries now offering beneficial tax regimes to attract talent, does this help you and your employees? Are you up to date with what tax exemptions are being introduced as well as increasing employer costs and uncertainty in other countries.

As ever, care needs to be taken with an internationally mobile workforce, especially keeping on top of any rule changes in all jurisdictions you have people.

With continued changes to current rules across the globe, make sure that you are up to date with what’s new. Check you have read and understood the small print - a recent case from Switzerland on accident insurance shows how important it can be.

Inpatriate Tax Regimes – Attracting Talent

With a new regime in Spain, an improved offering in Luxembourg, a reversal of changes in the Netherlands and tightened rules in Italy; here is a breakdown of what you need to know.

In Spain: a new tax benefit is available for individuals relocating to the Madrid region. This is known as the Mbappé law, taking its name from a French football player. Since 1 January, 2025, foreigners arriving in the Madrid region will be able to take a deduction of up to 20% of the value of certain investments against the regional portion of their personal income tax. This includes company shares, fixed income

securities, or bonds. In the case of shares, the investor can´t hold more than 40% of the investment and no management and/or labour relationship may be carried out. The goal is to attract high-net-worth individuals to increase the region’s gross domestic product, so may be interesting to your C-Suite executives who have personal investments beyond their employment related shareholdings.

In Luxembourg: from 1 January, 2025, the existing inpatriate tax regime has been updated to make enhancements. Now 50% of your employee’s annual compensation (excluding benefits in kind and certain partly tax-exempt cash items) is tax exempt. The maximum annual amount that can benefit from the 50% tax exemption is EUR 400,000; i.e. the maximum exemption is EUR 200,000. The regime applies for up to eight years after the year of arrival, with existing users being able to opt in to the new regime.

The profit-sharing bonus regime has also been enhanced. Now the maximum amount that you can pay as a profitsharing bonus is 7.5% of the employer’s net profits in the preceding year with the maximum amount for each employee increased to 30% of the employee’s annual salary (benefits are excluded).

As in the past, no application is required to be submitted, but annual reporting to the tax authorities is mandatory. For companies established in Luxembourg for 10 years or more, a maximum of 30% of all employees can benefit from this regime.

There are also specific tax exemptions for young professionals covering a rent allowance and bonuses.

In the Netherlands: the scaling back of the “30-20-10” regime will be reversed, and a maximum tax-free reimbursement of 27% will apply as of 1 January 2027. For years 2025 and 2026, a 30% rate will apply to all incoming employees. In the event of a change of employer, the transitional law will remain applicable with the new employer, provided that a new employment contract is concluded within three months after the end of the employment with the previous employer.

The Dutch government also proposes to increase the salary requirement for the 30% scheme from EUR 46,107 to EUR 50,436 (2024) as of January 1, 2027. The salary requirement for incoming employees under the age of 30 with a master's degree will increase from EUR 35,048 to EUR 38,338 (2024).

In Italy: a year ago, steps were taken to tighten their inpatriate tax regime. The revised rules narrowed the criteria for accessing the regime, making it more difficult for employees to benefit from this tax advantage. However, as the latest data on the number of employees who have benefitted from the inpatriate tax regime in the last few years is yet to be published, we don’t yet know the impact this rule change has had.

Spain, Luxembourg and the Netherlands tax exemptions are providing better tax reliefs to attract talent. However, the changes made in Italy and the change of tack by the Netherlands show that keeping on top of your global workforce’s current and future tax exposure is an ever moving target.

In Spain, employees who take advantage of the Mbappé law need to be aware if they do not maintain their residence in Madrid, and the investment, for the required six years they will not be able to benefit and would have to reimburse the rebate. For example, if a taxpayer applies the deduction in their 2024 personal income tax return (which is filed in spring 2025), but leaves Madrid the following year, the taxpayer would have to file a supplementary income tax return and pay the difference represented by the deduction, late payment interest, and a surcharge.

Separately, on 13 January, 2025, the Spanish Prime Minister announced proposals aimed at tackling the issue of housing accessibility in Spain. These may include increased taxes for non-EU residents buying Spanish property. While this may not affect your business directly, it could have impact for your C-Suite. Depending on how the proposals are implemented, it is useful to be aware of local matters that could impact your team.

2025 Quotas for Third-Country Nationals

Outside of the tax implications for your employees working in various jurisdictions, there are always immigration aspects to consider.

The Swiss Federal Council has determined the 2025 quotas for third-country nationals and service providers from the EU/EFTA. In 2025, 8,500 specialists from non-EU/EFTA countries may be recruited in Switzerland. Of those, 4,000 may be granted L short-term residence permits (good for one year, with the possibility of renewal for another year) and 4,500 may be granted B residence permits (usually for five years, with the possibility of renewal).

The maximum number of service providers allowed in Switzerland from EU/ EFTA countries will be 3,000 quotas for L short-term residence permits and 500 quotas for B residence permits.

BDO Comment

The total number of quotas for 2025 are remaining at the same level as for 2024. If you are planning on sending your employees to Switzerland, make sure you are mindful of the quota requirements.

Increases to employer costs and reporting benefits

There are three areas of change you and your employees need to be aware of in the UK.

From April 2025, there is a 1.2% increase in employers Classes 1, 1A, and 1B National Insurance Contributions (NIC), raising the rates to 15%. At the same time the Class 1 NIC secondary threshold will be reduce from GBP 9,100 to GBP 5,000 annually. These changes sit alongside an increase to the National Minimum Wage (NMW) rates at the same time.

For your employees, there was an increase in the capitals gains tax (CGT) rates to 18% for standard rate taxpayers and 24% for higher rate taxpayers, which took effect on 30 October, 2024. In addition, some C-suite executives may qualify for the business asset disposal relief (BADR) on their shareholdings, but the special BADR CGT rate of 10% will increase to 14% from 6 April, 2025 and then to 18% from 6 April, 2026. Lastly, mandatory payrolling of benefits in kind (BiK) will take effect from April 2026. To comply with this, you will need to report more data than is currently required to provide a breakdown of the BiKs being reported through payroll, and to reflect the introduction of Class 1A NIC being payrolled. Payrolling employmentrelated loans and accommodation will be voluntary for 2026/27, with a timetable for transitioning to mandatory payrolling of these benefits slated to be published “in due course.” Until then, Forms P11D and P11D(b) can be used to report loans and accommodation but cannot be used for any other BiK. With the official rate of interest no longer fixed for a tax

year (it may change on a quarterly basis from 6 April, 2025 onwards), you may find it easier to continue to use P11Ds for loan benefits while this is permitted.

However, longstanding proposals to require employers to report more extensive details of hours worked by individual employees on Real Time Information payroll submissions from April 2025 have been dropped.

If you are a large employer in the UK, the increase in staff costs is likely a significant concern for you. In the run up to April, you may wish to consider salary sacrifice for pension contributions and electric vehicles. However, the potential impact of the National Minimum Wage rules will need to be considered to ensure your organisation remains compliant.

The increase in CGT rates will impact your employees who have share awards or the owners/management team on a sale of the business, unless the owners make a sale to an employee ownership trust. Given the increase in NIC, it is important to remember that no NIC charge arises on share awards when your employees receive shares that are not “readily convertible assets”. Even with the CGT increases, employee share plans remain an attractive incentive arrangement.

Although there is still another year before the mandatory payrolling of BiK has effect, there is work that you can be doing now. There are many areas where the impact of the change in terms of communication to employees, payroll processes and other administrative changes will need to be managed carefully. For example, your employees could have two years’ worth of benefits on which tax must be collected in one tax year. While it represents a timing difference rather than an additional cost, this could be a significant amount for some of your employees. This is particularly the case where employees may be lower paid in cash terms but have a reasonable level of benefits and expenses.

The increased number of calculations and the quantum of tax being collected through the payroll increase the possibility of errors. Therefore, it is important for you to test your payroll systems thoroughly and be aware of the potential risks. HMRC will adopt a “soft touch” for the 2025/26 tax year only. If you want to have a trial run of payrolling your BiK in 2025/26, you will need to register with HMRC before April 2025.

While good news that there will be no new administrative burden on working hours, employers would still be wise to retain detailed working hours records in case of an NMW challenge by HMRC.

Pushing for greener company cars

Expect higher costs for company cars for your employees in Belgium. To address

environmental concerns and incentivise cleaner transportation options, the Belgian tax authorities published the CO2 emission reference values for company cars that will be applicable in 2025 to calculate the BIK. This development signals a continued trend towards stricter emissions standards, with lower CO2 emission thresholds set for both petrol and diesel vehicles compared to previous years.

The updated BiK charges reflect a clear legislative push to steer corporate behaviour towards sustainable mobility solutions. When planning ahead, keep in mind that this trend is expected to accelerate as technology advances and the market increasingly shifts towards greener transportation options.

Proposed Stock Option changes delayed to 2026

Canada has not yet signed into law the tabled legislation that would reduce the employee stock option deduction for stock option benefits that exceed the annual limit. However, the Canadian tax authorities have now confirmed that the rules will come into force from 1 January, 2026 (rather than 26 June, 2024 as originally planned). Until that time, the capital gains inclusion rate for gains exceeding a combined annual limit of CAD 250,000 for both employee stock option income and capital gains will remain 50%.

BDO Comment

The delay in implementing the new 66% rate of tax on stock option gains gives some affected stockholders a window of opportunity to realise gains that will be taxable at the current 50%. The announcement also provides much needed certainty for employers in processing their final year-end payroll obligations for 2024 and 2025.

Karen McGrory is head of expatriate Tax Services at BDO LLP. She has over 30 years’ experience in the field of expatriate taxation. BDO is able to provide global assistance for all tax issues arising from an internationally mobile workforce. If you would like to discuss any of the issues raised in this article, please do not hesitate to contact Karen McGrory on +44 (0)20 7893 2460, email karen.mcgrory@bdo.co.uk.

Despite the recent emergence of nationalistic and protectionist trends, the business environment remains, unquestionably, globally connected. Organisations are increasingly venturing beyond their domestic shores to set-up operations and find new customers. Today’s global competition is not only for customers, but also for the best talent, which is increasingly recognised as the key to competitive advantage, as many manual tasks are automated and value is created through knowledge-based roles.

Being able to hire and deploy talent across borders quickly and efficiently becomes therefore a critical element of the competitive strategy and operating model of today’s most successful organisations.

However, such a hyper-connected business environment comes with many challenges: events in one corner of the world can send shockwaves around the globe, impacting people and markets almost instantly. Geo-political changes, such as Brexit and ongoing trade tensions between US and China, can happen quickly and disrupt global supply chains, creating uncertainty and confusion. Increased regulations in immigration, tax and data privacy laws create a complex compliance minefield. And we now know the full extent of how COVID19 pandemic caught many organisations unprepared for many difficult decisions regarding their international assignees. Fast forward to today and, the new normal. We can safely assume that “Volatility, Uncertainty, Complexity and Ambiguity” (VUCA) are all features that will characterise the world for the foreseeable future. The question is then, how can organisations compete and succeed in such a VUCA environment?

A constantly changing environment does not only imply challenges, but also many possibilities. Today’s most successful businesses constantly find ways to overcome hurdles and capitalise on opportunities by continuously fine-tuning their strategies and implementing leaner and more agile operating models across the organisation. And since international assignments are

instrumental to the execution of those strategies and operations, creating an agile, flexible and resilient mobility programme becomes business-critical.

There are many ways to bring agility into mobility programmes, but it is also essential to understand that there is no single solution that would address all organisational priorities at once. Therefore, before making any changes to a Global Mobility framework, it is essential to specify the key objectives for the change. These objectives are referred to as “design principles”, since the re-design of the framework will be done bearing in mind these ultimate objectives. If the goal is to “future-proof” your mobility programme by making them more agile, resilient and flexible, there are some general principles that have already helped many leading companies.

Even within the same organisation, international assignments could be very different in terms of duration, purpose, strategic impact or geography. Whilst it may be tempting to have a single policy and process for all these different assignment types, this simplistic approach will almost certainly result in increased costs and numerous requests for policy exceptions. Segmentation is a way of recognising compelling reasons for doing things differently, depending on the situation. The outcome of the segmentation exercise is a set of policies and procedures that are officially recognised by the organisation. The importance of a careful segmentation exercise cannot be overemphasised, as the segmentation criteria will determine which policy will apply to each assignment and each assignee.

Most organisations have at least a very simple segmentation based on “assignment length”, which involves having distinct policies depending on the assignment’s duration, for example, Short-Term assignments, Long-Term Assignments, Permanent Transfers, etc. Some organisations further differentiate assignments based on the “strategic intent”, which enables them to differentiate between “business-critical”, “technical”, “developmental” and “employeeinitiated” assignments. Other common segmentation criteria include geographic proximity, seniority, nationality, and several others.

If done properly, a smart segmentation of international assignments will create perfect alignment between the mobility policies, business needs and talent needs. Segmentation also gives the business the flexibility to allocate a different amount of budget and effort to each type of assignment.

Segmentation should be done in the right amount: insufficient segmentation will lead to a policy framework that is not fit for purpose, but over-segmentation will result in too many policies, leading to confusion, inconsistencies and increased administration.

Having the right set of policies is only the starting point. Once the relevant assignment types have been identified, it is essential to optimise policies and processes to achieve the maximum efficiency, from both a cost and operational perspective. Maximum agility will be achieved through a fine balance between affordability and ability to motivate employees to move. Excessive cost-cutting may make assignments more affordable in principle, but it may result in lower acceptance rates, longer negotiations, increased exception requests and delayed deployment timelines. Market competitiveness is also essential to reduce the risk of assignment failure due to resignation or premature repatriation.

Optimisation should not be limited to cost considerations, but it should also aim to streamline administration, enabling HR resources to focus on value-adding activities, rather than transactional tasks. Organisational agility is greatly enhanced if the HR function is able to monitor, control and continuously improve mobility programmes without being bogged down by administration. HR service delivery can be greatly enhanced by having some level of centralised coordination, technology infrastructure, and the right support from 3rd party vendors.

The management of international assignments involves a significant level of specialist knowledge and complex administration related to immigration, tax,

payroll, relocation, insurances, cost of living adjustments, and many others. Mistakes can be risky and costly, and it is not feasible to have the appropriate level of HR experience in every location that either sends or receives an international assignee. Centralising this specialist expertise and administrative setup is a great way of achieving economies of scale, delivering consistent standards of service and providing support and specialist expertise to the entire organisation.

A global centralised structure also allows much clearer visibility of the cost of the mobility programmes. Consolidated reports make it easier to track the “assignment spend” and track key performance metrics. This would be very hard to achieve with a decentralised model, where each country or region only has partial visibility of the whole picture.

Furthermore, centralisation makes it more financially feasible to justify investments such as technology infrastructure, 3rd party vendor agreements and international benefit schemes, retirement and insurance plans to cover globally mobile employees.

Many of the world’s leading organisations are choosing to centralise at least part of these processes and infrastructure into Shared Service Centres, focusing on transactional tasks, as well as Centres of Expertise (CEOs) looking at governance and strategic alignment of the mobility programmes.

A special type of centralised structure is a Global Employment Company (GEC also know as a Single Employment Entities SEEs), which is a fully-owned subsidiary of the group. This subsidiary becomes the legal employer of mobile employees prior to their deployment. In addition to bringing all the benefits of centralisation mentioned above, a GEC can also help to mitigate corporate tax exposure and provide adequate social coverage to such assignees making it a more than attractive operating model for corporate organisations.

Centralisation through a Shared Service Centre or a GEC delivers many advantages to the business, but it still represents a fixed cost, in terms of headcount, real estate and IT infrastructure. Furthermore, service quality is highly dependent on keeping staff turnover low and ensuring that the team remains constantly up to date with changes in immigration, tax, social security and employment laws in all applicable jurisdictions. Business continuity depends on this team having access to the premises, tools and information required to perform their job. Based on these considerations, many organisations decided to take centralisation one step further, and outsource most, if not all, of the transactional processes. By combining centralisation with outsourcing, these organisations are leading the way in achieving the ultimate organisational agility. Internal

resources are able to focus on governance and strategic alignment, whilst a reliable outsourcing vendor keeps the mobility programmes running smoothly, based on pre-agreed policies, processes and workflows. Service Level Agreements provide service quality and business continuity, with little or no investment in infrastructure required.

Most importantly, this type of administrative model provides scalability and replaces fixed costs with flexible costs. This means that in the event of a sudden decrease in the volume of international assignments, as seen during the recent pandemic, the company would not continue to be burdened with the fixed cost of a large Mobility team and internal infrastructure, nor would it need to worry about having excess headcount in the Mobility team. Conversely, in the event of a sudden surge in the number of assignments, the organisation would not need to commit more internal resources and infrastructure.

Interesting over 90% of Global Mobility heads say that both compliance and governance had improved with a GEC. This is even more remarkable given a staggering 62% of GM focused processionals claim to have little of no clear knowledge of the GEC model. The common misconceptions are. The GEC is like a EOR, the GEC is only for large int populations, The GEC is only for Oil & Gas companies, The GEC avoids tax. All of the above are entirely incorrect and this causes confusion in the GM community.

In summary, having a GEC will enable you to thrive in today's business environment where agility is a critical success factor. Some options require internal transformation, investments and ongoing maintenance of HR teams, whereas others are more sharply focused on delivering results by outsourcing the investments and administrative processes to specialist vendors. Somewhere along this continuum there is an optimal solution for every organisation. To get started, it is often useful to conduct an internal Business Needs Analysis, surveying the current and future priorities of Line Managers, assignees and other HR stakeholders. This internal discussion would also benefit from the input of external experts, who can provide ideas, insights and emerging trends that can help you in your objective of future-proofing your mobility programmes.

In the year 2000, the concept of the Global Employment Company (GEC™) was “packaged” and met with quick adoption by several large corporations that were looking for effective alternative operating solutions to meet the many challenges of international mobility.

This narrative still applies today. With Global Mobility being challenged to deliver better costs control, in full compliance and in line with all applicable international regulations. For over

a quarter of a century ITX has established itself as the World’s leading Global Employment Company (GEC) specialist.

ITX assists those with a GEC to fine tune and improve efficiency. And for those companies potentially looking at setting one up. ITX will provide a consultation that conducts and delivers, a free initial preanalysis and feasibility, implementation and ongoing management support of the GEC. If the findings generate a business case, a full fee paid feasibility is conducted. This can be achieved for both in-house and the outsourced Global Employment Company requirements. In its capacity as an outsourced specialist, ITX manages assignees in more than 130 countries across the globe and advises international organisations on a variety of Global Mobility matters, achieving the simplification for HR, better internal integration, financial savings and real time bespoke technology support.

ITX is immensely proud of the role it plays in helping to educate the Global Mobility community on this often-misunderstood topic and alternative operating model across all industries.

SIMON DAVIES Director, of Client Strategy, Global Mobility,

EMEA USA

Simon has been supporting Global Mobility for 25 years. He has worked with some of the World’s biggest brands and travelled extensively. Simon has relocated himself and enjoyed time in Singapore and the USA. A customer first approach to quality building solid partnerships vendor alliances continue to play a key role in his ongoing career successes. Simon helps his clients to turn thought leadership and change management ideas into practical operational advantages. Simon has published many articles and spoken at numerous industry events across the Globe.

Email: sdavies@itx-ge.com Website: www.itx-ge.com

SIMON WILL BE HOSTING A SEMINAR AT

on Monday 16th June at The Royal Automobile Club, Pall Mall.

To register for this conference that is for Global HR Professionals only, please email helen@internationalhradviser.com

Employee experience has emerged as a key focus for organisations, particularly in a time of talent scarcity and multiple challenges. Significant efforts have been made to understand the diverse needs of employee groups, although some have arguably oversimplified some key issues (e.g., the alleged preferences of younger workers, a degree of corporate wishful thinking about the role of base pay compared to other more abstract motivators and the ease of moving employees where the organisation really needs them). That said, policies and processes are being developed to enhance the overall mobile employee experience.

While the intentions behind these initiatives are commendable, the execution often falls short. The issue at hand extends beyond writing policies and unconnected ad hoc initiatives. The lack of effective implementation, characterised by a series of inconsistencies, lies at the heart of the problem. These inconsistencies encompass a misalignment between objectives and corporate reality, as well as misunderstandings between stakeholders.

Risks: When faced with a challenge, it’s all too easy to hastily jump to conclusions and solely address its symptoms rather than thoroughly analyse its underlying sources. One common example pertains to employee well-being: Companies are increasingly introducing support programmes. While these are commendable endeavours and can help in some circumstances, they will be of little use to employees burdened with excessive workloads, unrealistic objectives or subjected to toxic management practices.

Unspoken issues, such as family constraints limiting employee mobility or broader problems, are concealed beneath discussions about costs which often remain unaddressed.

Mitigation: To effectively tackle these challenges, it is crucial to combine opinions with factual data to get to the root causes.

Creating an environment that encourages employees to express their concerns without fear of repercussions is essential. Many employees may hesitate to voice their concerns due to apprehension about missing career opportunities, while others may feel unsupported and consequently dismiss themselves from mobility opportunities.

Consider the broader employee experience over the entire assignment lifecycle rather than focusing on isolated incidents and individual items in the mobility package. Frustration about an issue might be a symptom of a broader problem that started earlier in the assignment process.

Offering a “workation” and allowing employees to work for a short period remotely from abroad may seem like a nice benefit but for many employees, taking up a position in a new location is about having a better lifestyle for their families and not just a superficial attempt to increase vacation time. This should trigger a broader reflection from management instead of a quick fix.

This should trigger a broader reflection from management instead of a quick fix

Risks: One perennial management challenge is effectively managing expectations. Making grand announcements, particularly in the context of new work arrangements like “working from anywhere,” carries inherent risks. The repercussions of promising more than can be delivered can come back to haunt the company. The

gap leads to challenges to policies and could produce a counter-narrative that would threaten the whole approach: “I did not receive the support I was promised” (assignees); “We spent a lot of money on the assignments and employees resigned shortly after” (management).

Mitigation: Consistency over time is essential when it comes to improving employee experience. The say-do gap can be the result of several things:

• Often, narratives are not adapted to the realities of talent mobility in the companies: For example, officially, mobility is good for employees, but if there is no talent management process in place, that international experience will not be translated into a career boost

• Too much novelty and complex choices can kill flexibility: The organisation claims to provide extensive support to the assignees and their families. However, it is difficult for them to find and understand the options offered or have a clear point of contact.

Resources can also limit HR teams' capacity to deliver the promised experience. Assessing the increased direct workload and indirect burden over the long-term for HR teams is crucial.

Be mindful of conflicting changing priorities - new business changes can impact mobility practices and force management to discard some of their original promises. For instance, a sweeping cost-cutting exercise or reorganisation might mean that some of the mobility provisions are not fully implemented.

Risks: Top management’s communications and intentions may not be fully understood at all levels of the organisation. Line management and local HR are not experts in assignment management and might misrepresent new initiatives. Similarly, external providers who are in contact with assignees might not accurately convey the messages set by the company.

Mitigation: Organisations need to ensure that line managers and local HR personnel have a clear understanding of the objectives and rationale behind the initiatives by providing comprehensive training programmes. This empowers them to effectively convey the message to their teams and address any concerns or questions that may arise.

Words matter and trigger expectations. All stakeholders should communicate terminology and principles consistently. Communication materials and delivery at all levels should emerge with a clear narrative and logic. Approved language around important concepts (in short, which words to use and which to avoid) is invaluable here.

Regular updates and clear messaging from top management help to ensure that intended improvements are effectively communicated and understood throughout the organisation. Watch out for outsourcing pitfalls associated with limiting mobility teams’ control over communication channels.

Know the influencers within the organisation: Engaging these people, understanding their perspectives and aligning their interests with the intended changes can help secure their buy-in and support, making it easier to gain traction and overcome resistance among the wider workforce.

Watch out for outsourcing pitfalls associated with limiting mobility teams’ control over communication channels

Risks: Issues often arise from misunderstandings and conflicting priorities between different stakeholders in different business units. Cost issues, competing objectives and a lack of incentive to share talent can all contribute to these problems.

Mitigation: Reconciling the business objectives of different stakeholders and, when possible, addressing their concerns early in the process can help avoid risk and overcome resistance.

The allocation of costs is often a point of friction for talent mobility. If only the largest business units can afford top talent, it could lead to a skillset imbalance within the organisation. Central or regional budgets can sometimes be used to avoid inequities between business units.

Overcome reluctance to share talent: Business unit managers should be viewed less as “talent owners” and more as “talent brokers” who encourage the rotation of talent

Overcome reluctance to share talent: Business unit managers should be viewed less as “talent owners” and more as “talent brokers” who encourage the rotation of talent. This will work only if managers are rewarded for participating in the global sourcing efforts of the company and the development of talent. Organisations could provide incentives to line management to foster a good experience for assignees.

Avoid pitching assignees versus locals: Make sure that the assignments benefit all parties involved and that the receiving business units can voice their concerns and expectations. The real test of the success of assignees is their long-term impact on the receiving business’ performance and the skills of the local talent pool.

Risks: HR managers trying to launch new initiatives to improve employee experience are not starting from scratch. They operate in a complex environment shaped by their organisation’s culture. This culture is the sum of the perceptions and attitudes of all the stakeholders over time - and not just what management wants it to be. This does not mean that the culture cannot evolve but rather that change requires time and effort. Misreading the starting point could be fatal to new approaches.

Mitigation: Pragmatically analyse your organisation’s culture and measure it against different dimensions - for example:

• Paternalistic versus laissez-faire

• Centralised versus decentralised

• Pioneer versus risk-averse

• Hierarchical versus egalitarian

• Traditional setup versus flexible work model. The history of the company and understanding previous HR initiatives can also shed light on what could work or, on the contrary, should be avoided.

These elements do not constitute barriers as such, but inform how different initiatives might be implemented. Your company’s culture is not just an abstract idea: it is reflected in processes and work practices. Benchmarking is a good first step to sourcing ideas for new initiatives, but ultimately, organisations need solutions that fit their unique cultures.

HR professionals must move beyond the realm of buzzwords, generic benchmarking and formal policies. They must proactively identify and address the potential inconsistencies within their organisations if the implementation of new employee experience initiatives is to stand any chance of success.

OLIVIER MEIER

Mercer

Olivier.meier@mercer.com

Find out more:

Talent Mobility Trend Surveys: www. mobilityexchange.mercer.com/surveys Join us at the 2025 Talent Mobility Conference in Copenhagen to learn how to successfully manage a global talent workforce, international assignees and remote workers, business travelers and, ultimately, all employees crossing international borders. https://www.mercer.com/insights/ events/global-hr-conferences/talentmobility-conference-2025/ During the conference, we will explore strategic talent mobility management trends as well as detailed practical issues related to compensation, benefits, employee experience, equity and cost-effectiveness. The presentations will comprise a keynotes session from experts and practical case studies. This is a must-attend event for international HR managers, global mobility managers, global compensation and benefits managers, international talent management and talent acquisition professionals.

It’s The Key To Driving Innovation, Improving Efficiency, And Retaining Top Talent In The Modern Business Landscape

Global mobility’s true integration with other functions is an important priority.

The global mobility function has made great progress in becoming a truly strategic and highly valued contributor to an organisation’s growth. And yet, there’s an important element of that trajectory that remains stubbornly elusive: achieving stronger integration and alignment with other areas of the business. In a recent survey conducted by Sterling Lexicon and Deloitte, in fact, respondents named that objective as one of their top three priorities for 2025.

Cross-Silo Leadership, an article published in the Harvard Business Review, explains that functional silos are common and natural, as people tend to prioritise the work that gets done with their immediate colleagues, or what it called vertical relationships. But it also points out that it’s the horizontal collaboration - or the interfaces between functions, offices, organisations and geographies - that tend to drive the greatest innovation and value.

Nobody wants any of those things, and yet, breaking silos down seems to be a pretty universal challenge

On the flip side, silos create nothing but problems for businesses - like blocking innovation, risking missed opportunities, hampering efficiencies and growth, driving up costs, or negatively impacting the customer and employee experiences. Nobody wants any of those things, and yet, breaking silos down seems to be a pretty universal challenge.

Greater integration between global mobility and other business functions, especially talent acquisition and development, has long been a goal. But there are two key things that may be ramping up the urgency to get it done:

1. 2025 is expected to see a peak in the number of employees reaching traditional retirement age in several parts of the world - with insufficient numbers to replace them. 2. The pace of technological advancements continues to grow exponentially, quickly and substantially reshaping work and necessitating the development of entirely new skillsets.

Business leaders will need to evaluate their risk of losing top expertise and talent, while also ensuring that there is a sufficient pipeline to support critical knowledge transfer, and career development and growth opportunities for the emerging workforce. Mobility teams can help get the right people into the right roles to achieve these goals - through both internal and external candidate sourcing. Their early and ongoing involvement in these talent decisions is essential.

Some actionable steps that can go a long way toward helping achieve business-wide alignment include:

Directly tie global mobility goals and measurable performance indicators to the business’ overall objectives, and in particular, the talent strategies that will help meet them.

Fostering Greater Cross-Department Communication And Collaboration

Bring teams together from talent acquisition, compensation, legal, training and development and mobility on a regular

basis to discuss shared goals and priorities. The earlier mobility is involved in global talent decision making, the more likely they are to be able to help streamline the processes and timelines for acquiring and building the right skills.

Better alignment between recruitment and relocation policies also helps all candidates considering cross-border roles know what to expect, setting them up for greater likelihood of success.

Their early and ongoing involvement in these talent decisions is essential

Access to a centralised system that integrates key employee data creates a single source of truth for all teams. The right level of shared data also facilitates better predictions on talent trends, cost management and visibility into process inefficiencies or bottlenecks, as well as identifying needed skill opportunities and gaps.

When all business units are truly working together with a common goal, with the employees’ needs as their core focus, it’s a win-win. Better understanding helps companies arrive at more personalised support. Communication is naturally more consistent. The risk of duplicate information requests is significantly lowered. And employees have greater trust and confidence in the process – all helping to reduce anxiety and result in positive journeys.

Particularly for those moves that are employees’ first introductions to the company culture, a positive experience can help secure future brand champions and foster greater retention.

A clear understanding – and regular reminders – of the impact mobility teams have on the overall success of the business will help cement internal buy-in for greater collaboration. Successes like speed to fill critical roles, improved retention rates or strengthened leadership pipelines though the mobility process, for example, speak volumes.

Business environments are constantly changing - whether due to new regulations, market shifts, or global crises. An agile global mobility strategy, with strong connections across departments and regions, ensures that the organisation can rapidly adapt to fluctuating conditions.

For mobility teams, achieving deeper alignment with talent acquisition, compensation and benefits, legal, and other areas of the business isn’t just a nice-to-have, it’s a must. The organisations that get this right will not only operate more efficiently, but will also retain top talent, better manage their risks and gain a critical edge in the global marketplace.

For mobility teams, achieving deeper alignment with talent acquisition, compensation and benefits, legal, and other areas of the business isn’t just a nice-tohave, it’s a must

at E: kristin.white@sterlinglexicon.com

The International Air Transport Association (IATA) predicts that air traveller numbers will surpass 5 billion this year, with around 20% of those being business travellers. That’s a significant number of people to keep safe, stay in touch with, and have a duty of care for.

Whether an organisation has a global travel manager, works with a travel management company, or relies on EAs to book travel, HR professionals undoubtedly play a crucial role in ensuring the safety of business travellers. In some cases, they are even responsible for managing the entire travel category.

For dedicated travel managers, business travel is already a complex category to oversee. But when it falls under the broader HR umbrella where it is just one of many responsibilities, it can present even more challenges. So, what should HR professionals be aware of when it comes to traveller safety and wellbeing?

Suzanne Sangiovese, Travel and Technology

Director at Riskline - a leading global travel risk intelligence company explains:

“In organisations without a dedicated global travel manager, HR often finds itself

responsible for travel, either alone or as part of a broader group managing the function. That means they need to stay on top of traveller risk and duty of care, ensuring employees have the right support before, during and after a trip. Whether travelling domestically or internationally, employees can face unfamiliar risks and even routine but unexpected disruptions”.

The ever-changing global landscape doesn’t make this any easier. Natural disasters, geopolitical unrest, government policy changes and new travel regulations - such as Brexit-related policies and the introduction of Electronic Travel Authorisation (ETA) requirements - add further complexity. HR teams must stay informed about these developments while also managing internal organisational changes.

“Key considerations in an effective travel risk management programme include understanding destination risks, knowing company policies on emergency response and ensuring employees have access to 24/7 assistance”, adds Sangiovese. “It’s also critical that HR professionals responsible for travel can locate travellers in real-time, communicate safety protocols clearly and align with legal and compliance requirements”.

This would be tricky enough if all travellers were the same with identical needs. But, of course, they’re not.

Carolyn Pearson, CEO of Maiden Voyage, a specialist business travel safety training provider, highlights the importance of considering individual traveller risks:

“When it comes to protecting our business travellers, a one-size fits all approach definitely won’t cut it. The world is a complex place, and individuals face different risks related to their unique characteristics. These risks can be heightened depending on the destination. Cultural laws and nuances create additional challenges, from attitudes towards women and gender interactions to dress codes and local customs”.

Pearson cites the following examples:

• Women travellers may face risks related to pregnancy, breastfeeding, and menopause. The Zika virus prevalent in numerous countries can pose a risk to unborn babies, airline fit-to-fly protocols may vary and some herbal menopause supplements such as ashwagandha are illegal in certain countries

• Male travellers face heightened risk of physical and violent attacks, robbery and targeting by sex workers, sometimes leading to blackmail or sextortion

• LGBTQ+ employees Over 60 countries criminalise same-sex relationships, with some carrying the death penalty. LGBTQ+ employees may be reticent to travel to these locations and if they do, they risk persecution, arrest, violent attacks and entrapment. The trans community regularly experience mis-gendering, inappropriate airport pat-downs and transphobic abuse as they travel

• Travellers from ethnic minorities frequently experience explicit bias, including prolonged questioning at airports, accusations of criminal activity at hotels and are generally provided with a poorer passenger and guest experience. American Airlines famously settled a lawsuit after offloading eight male black passengers from a flight due to a complaint about unidentified body odour

• Passengers with disabilities - both physical and hidden - have differing needs and risks. Again, there have been numerous high-profile cases where wheelchair passengers have had to crawl off a plane due to breakdowns in passenger assistance programmes.

Pearson isn’t aiming to be alarmist, she says, merely realistic, adding, “These things can and do happen. There are many high-profile cases where things have gone horribly wrong. This includes reports of sexual assaults in hotels and even on international flights. Sadly, in February this year, we heard of the disappearance of businessman Campbell Scott who was found murdered in a Kenyan forest”.

Business Travel Show Europe’s annual survey on inclusive corporate travel policies reveals that while there is growing awareness of accessibility needs (43%) and solo women travellers (36%), fewer than a quarter of businesses consider other vulnerable groups, including marginalised communities, neurodivergent travellers, and religious groups.

So, what practical steps can HR teams take to improve travel safety?

“As a minimum, companies need to provide regular training for employees managing travel programmes, as well as for the travellers themselves on trip preparation and safety. This is both a legal and moral obligation. In the event of an incident, the depth and effectiveness of training will be assessed”, says Pearson.

Riskline’s Sangiovese adds: “HR can reduce risk by establishing strong pre-trip approval processes, ensuring employees are briefed on potential risks and providing comprehensive travel insurance. Partnering with a trusted travel risk management provider can help streamline emergency response, while maintaining an open line of communication with travellers ensures they feel supported. Regularly reviewing and updating travel policies to reflect evolving risks, whether geopolitical, healthrelated, or logistical, will help keep employees safe and confident on the road”.

Travel technology plays an essential role in risk mitigation. CTM, one of the world’s leading global travel management companies, develops technology designed to integrate travel risk management into everyday operations.

These tools:

• Provide real-time updates on emerging risks, including conflicts, crime, and environmental disruptions