THE TENNESSEE INSUROR September/October 2022 Volume 33 | Number 5 4 6 Insurors 129th Annual Convention 10 Special Bulletin: Annual Business Meeting October 18, 2022 Meet Your 2022 Convention Speakers

not dollars. not line items.DREAMS PEOPLE not relationships.FRIENDSHIPS Because we’re a different kind of local bank. One that’s been proudly helping Tennessee businesses –people we consider friends –for more than 16 years. THAT’S WHAT WE’RE AIMING FOR. 5614 Franklin Pike Circle, Brentwood, TN 37027 I 2106 Crestmoor Road, Nashville, TN 37215 615.515.2265 I 866.866.2265 I www.insbanktn.com I Open Mon. - Fri., from 8:30 AM – 4 PM.

Phone 615.385.1898

Toll Free: 1.800.264.1898 marketing@insurors.org

Editor: Ron Travis Publisher: MarketWise, Inc

INSURORS

President Norfleet Anthony III

IIABA National Director Cindi Gresham, CIC

VP Region I Bobby Sain

VP Region II, President-elect Matt Swallows, CIC, CRM Region III Kym Clevenger, CPCU, CACW John McInturff III, ARM Richard Whitley, CIC Director, Region I Eric Collison, CIC, CRM Director, Region I Jamie Williams, CIC, ARM Director, Region I Cy Young Director, Region II Reno Benson Director, Region II Chip Piper Director, Region II Paul Steele, CIC, CRM Director, Region III Tim Goss, CIC Director, Region III Bill Oldham III, CIC Director, Region III Cindy Widener Winn, CPA, CIC, CBIA Director, Young Agents Matt Felgendreher Immediate President Bob McIntire advertising rates, deadlines and specifi cations may be obtained by writing to Insurors of Tennessee, 2500 21st Avenue South, Suite 200, Nashville, TN 37212, calling 615.385.1898, e-mailing marketing@insurors.org or online at www.insurors.org all Insurors Tennessee associate

INSURORS OF TENNESSEE 2500 21st Avenue South, Suite 200 Nashville, TN 37212-0539

www.insurors.org THE TENNESSEE INSUROR

Email:

OFFICERS

.........................................................

..............................

...................................................................

............

VP

...................................

Treasurer ....................................................

Secretary ........................................................

......................................

................................

.............................................................

....................................................

...........................................................

......................................

....................................................

..........................................

........

.................................

Past

......................................

ADVERTISING Display

The Tennessee Insuror is provided to

of

members and

members as a member service. contents 3The Tennessee Insuror 6 Special Bulletin: Annual Business Meeting - October 18 8 Thank You! Convention Sponsors 10 Meet Your 2022 Convention Speakers 13 Visit These Convention Exhibitors 18 Convention Throwback 1893-2022 departments 21 From Your President 129 Years of Gathering and Fellowship 23 From Your IIABA National Director How to Get the Most From Your Convention 25 From Your CEO It's Convention Time in Tennessee 26 Tennessee Young Agents '22 Future Leaders Spotlight - Clark Powers Young Agents Update 28 Partners for Tennessee - Thank you for your support! 31 Government & Legal Update Certificates of Insurance: A Protracted Battle 35 Association Update 39 Company Briefs 44 Insurors Officers and Staff Head North to Learn and Lead - Sept. 14-18 48 Education Calendar 50 Meetings - Mark Your Calendars 53 Your Big "I" What Inflation Means for Your Insurance & Business 54 Directory of Advertisers 4 Insurors 129th Annual Convention: Welcome to Insurefest 2022 Vol. XXXIII, Number 5 September/October 2022

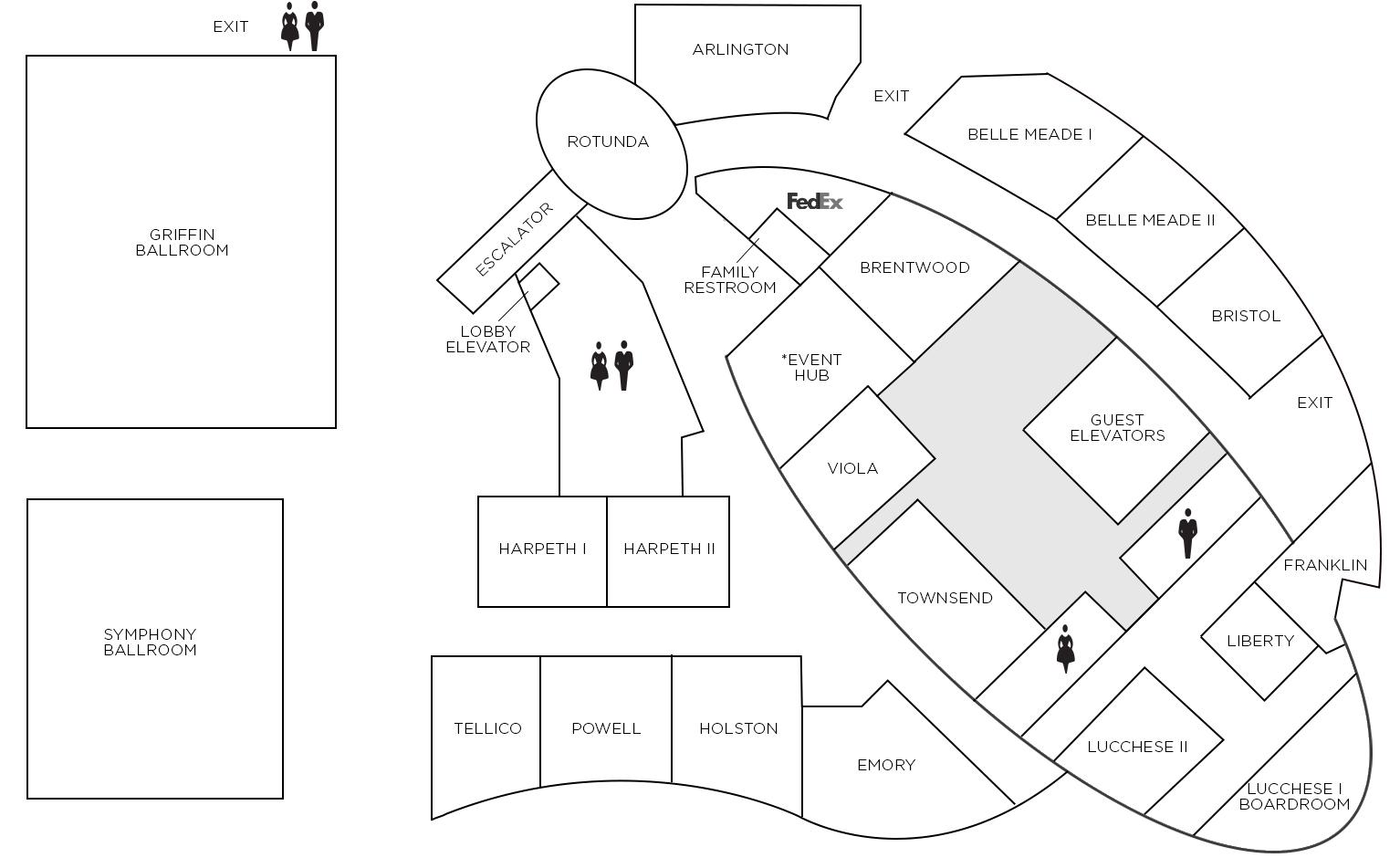

Welcome to...

Welcome to the Insurors of Tennessee 129th Annual Convention. We are excited to meet in the state capitol and host city, Nashville, at the spectacular JW Marriott hotel. We have a great lineup of events planned and hope you take advantage of the many opportunities to learn and network. Of course, there will be plenty of time to relax and socialize as well. The schedule of events follows. If you have any questions after you arrive please visit us at the on-site registration desk. Find a map of the JW Marriott event spaces on page 6.

Schedule of Events • All times Central • Meeting rooms in italics

Saturday, October 15, 2022 • Football Watch Party • Kick-off the Convention Featuring College Football

6:00 pm - 8:00 pm Join us for a welcoming night of football and fellowship as we kickoff our Annual Convention! Wear your schools colors to show your support! Belle Meade 1 & 2

Sunday, October 16, 2022 • Day One • Registration • Trade Show Opens • Keynote Speaker • Top Golf • More

8:30 am - 11:00 am Board of Directors Meeting (by invitation only)

Bristol

11:00 am - 5:00 pm Registration Open Griffin Ballroom Hallway

11:30 am - 12:30 pm Past Presidents Luncheon (by invitation only) Brentwood

12:00 pm - 1:00 pm Partner Recognition Lunch (by invitation only) Arlington

1:00 pm - 5:00 pm Trade Show Day 1 Griffin Ballroom 2:00 pm - 3:00 pm Agent General Session with keynote speaker Ginny Pierson, CPCU, ARM, AU Belle Meade 1 & 2

3:00 pm - 4:00 pm

WINS: Women in Insurance Networking Session Emory

YA4:00 pm - 5:00 pm Young Agents Networking Session Arlington

6:00 pm - 9:00 pm

Opening Night Party at TopGolf with dinner and transportation provided

Monday, October 17, 2022 • Trade Show • Clay Shoot • Golf Tournament • CE & Tennessee State Museum Tour

8:00 am - 12:0 0 pm Trade Show Day 2 breakfast provided Griffin Ballroom

•You chose your afternoon activity when you registered. Option are to Clay Shoot at the Nashville Gun Club, play golf at the Tennessee Grasslands championship quality golf courses in Gallatin or attend Continuing Education courses at the new Tennessee State Museum.

•A free guided tour of the new museum is offered for spouses and guests..

12:00 pm - 4:00 pm Clay Shoot at Nashville Gun Club with lunch provided onsite

12:00 pm - 5:00 pm Golf Tournament at Tennessee Grasslands Foxland Course with lunch provided onsite Sponsored by Travelers

1:00 pm - 4:00 pm CE (1HR) - "Fine Art: The Market and Protection" by Michelle Impey, Chubb Personal Risk Services Spouses/Guests Event with Tennessee State Museum Tour, lunch provided onsite

Presented by Martin & Zerfoss and Chubb

6:00 pm

9:00 pm - 11:00 pm

Company Night (dinner on your own)

Exclusive party with live music at The Valentine on lower Broadway

Tuesday, October 18, 2022 • Association Day Breakfast & Business Meeting

8:00 am - 10:00 am

Breakfast and Annual Business Meeting featuring guest speaker Bob Fee Griffin Ballroom (Please the Special Bulletin on page 6 for business matters to be voted on during the meeting.

10:00 am - 10:30 am 2023 Board of Directors Portraits (by invitation only)

10:30 am End of Convention u

The following association changes are to be voted on by our agency members at the Annual Business Meeting being held at the JW Marriott on Tuesday, October 18th at 8 o’clock in the morning in conjunction with our 2022 Annual Convention in Nashville. Agency Members must be present at the Business Meeting to vote.

2023 Board Elections & Nominees

Immediate Past President – Norfleet Anthony, III (Region I)

President – Matt Swallows (Region II)

President Elect – Kym Clevenger (Region III)

Vice Presidents – Elected Annually

Region I Bobby Sain has served 1 year

Region II Matt Swallows (moving to president)

NOMINEE Battle Bagley

Region III Kym Clevenger has served 3 years (moving to president-elect)

Treasurer - Elected Annually John McInturff, III has served his term NOMINEE Richard Whitley

Secretary - Elected Annually Richard Whitley has served his term NOMINEE Kevin Ownby

Directors – Elected for 3 Year Term

Region I Jamie Williams has served 3 years NOMINEE Pam Wells

Region I Eric Collison has served 2 years

Region I Cy Young has served 1 year

Special Annual Business Meeting JW 201 8th Nashville, Tennessee 37203 615-291-8600

Region II Reno Benson has served 3 years

NOMINEE Cam Winterburn

Region II Paul Steele has served 2 years

Region II Chip Piper has served 1 year

Region III Cindy Widener Winn has served 3 years NOMINEE Josh Gibbons

Region III Bill Oldham, III has served 2 years

Region III Tim Goss has served 1 year

Young Agent Director – Elected Annually Matt Felgendreher has served his term NOMINEE John Brock

State National Director – Elected for 3 Year Term Cindi Gresham has served her term NOMINEE John McInturff, III

Proposed Bylaw Change

The Government Affairs committee has requested a bylaw change regarding Article XIII, Section 5: Leadership Com mittee, that reduces the number of nominees the leader ship committee is required to have to present the nominat ing committee.

The proposed change states: “The Leadership Committee shall submit a list of no less than two (2) candidates per open officer or director position to the Nominating Committee. The Nominating Committee shall select nominations from this list or make other recommenda tion for proposing persons for election as Directors and Offi cers at the next annual meeting of the Association.”

Music City’s first true luxury hotel located in the heart of downtown, just two blocks to Broadway and the Gulch and adjacent to Music City Center.

Discover breathtaking skyline views from every room and suite in the hotel plus Nashville's only Bourbon Steak by Michelin-star chef Michael Mina. Visit the web site for many more thoughtful amenities.

6 The Tennessee Insuror

Bulletin:

- October 18, 2022 GRIFFIN BALLROOM HALLWAY The

Marriott Nashville

Avenue South

www.marriott.com

MAP

7The Tennessee Insuror HANK KNIGHT | Sales Executive | 502.561.9991 | hank.knight@ipfs.com Premium financing made easy with the Imperial PFS® suite of industry-leading technology to start your digital transformation 1. Imperial PFS is a trade name affiliated with IPFS Corporation® (IPFS®), a premium finance company. Access to products and services described herein may be subject to change and are subject to IPFS’ standard terms and conditions in all respects, including those specifically applicable to use of IPFS’ website, mobile application, and IPFS’ eForms Disclosure and Consent Agreement. 2. Our electronic payment processing provider charges a technology fee where permitted by law. Copyright © 2022 IPFS Corporation. All rights reserved.

8 The Tennessee Insuror FLOOD INSURANCE THANK YOU Convention Sponsors ! ACCIDENT FUND INSURANCE COMPANY OF AMERICA • AMTRUST • ASSOCIATED INSURANCE ADMINISTRATORS, INC BERKSHIRE HATHAWAY GUARD INS. • BURNS & WILCOX • CELINA INSURANCE GROUP CINCINNATI INSURANCEEMC INSURANCE • GRAHAM-ROGERS INSURANCE • HIPPO INSURANCE • J.M. WILSON KEY RISK | A BERKLEY COMPANY • METHOD INSURANCE • MIDWEST INSURANCE • OPENLY PREVISOR INURANCES • SAFEWAY INSURANCE COMPANY • SOUTHERN INSURANCE UNDERWRITERS • UTICA NATIONAL DiamonD PL aTInUm GoLD SiLver Bronze evenT SPonSorS CHUBB - Tennessee State Museum Tour with lunch MARTIN & ZERFOSS - Tennessee State Museum Tour with lunch TRAVELERS - Golf Tournament at Tennessee Grasslands Foxland Course with lunch provided

9 Talk to your territory manager or find one at LibertyMutualGroup.com/Business and Safeco.com/agent-resources © 2021 Liberty Mutual Insurance, 175 Berkeley Street, Boston, MA 02116 We do more. So you can grow more. The right products and programs to help you compete. 9

Meet Your 2022 Convention Speakers

Ginny Pierson, CPCU, ARM, AU; Assistant Vice President of Market ing with Big “I”

Our keynote speaker is Ginny Pier son, CPCU, ARM, AU. Ginny is Assis tant Vice President of Marketing with Big “I” at the national office in Alexan dria, Virginia. She works with Big "I" state associations across the country to assist with their efforts to promote programs available to their member ship through the national office.

Ginny joined the association in 2006 after a career on the carrier side in management, marketing and field underwrit ing. A native of Chicago, Ginny is a graduate of Western Il linois University.

Ginny will be speaking about the wealth of resources the Big I national office makes available to Insurors of Tennes see members. Ginny’s presentation can help your agency further capitalize on the benefits of your membership in the Insurors of Tennessee.

Bob Fee, AAI, CPCU

Bob started his career as an Indepen dent Insurance Agent in 1987 upon grad uating from the University of Kansas. He joined his Dad and brother in a small fam ily owned agency in Hutchinson starting out mostly selling life insurance products to their clients. As the agency grew, he tool on more of a role in property & casu alty lines of business while still selling life and health products.

Bob’s father Jim Fee, had been a past President of the Kan sas Association as well as the national director from Kansas, so very early on in his career Bob also got involved in the as sociation. First as a young agent, and then getting on vari ous committees of the state association. Eventually he went on the Board of the KAIA and served as President 2007–2008. Between 2010 and 2012, Bob served as Chairman of the National Trusted Choice Board of Directors. From 2012 –2015 he served as the National Director for Kansas and was elected to the National Executive Committee in 2015. He served as Chairman of the National Association from Sep tember 2021 – September 2022.

10 The Tennessee Insuror

Retirement Services Staffing Services With BBSI, you’ll have a dedicated Business Unit team who knows you and your business. In addition to payroll support and our full suite of consulting services, you’ll have access to our unique pay-as-you-go workers’ compensation program. BBSI will help you look at your business holistically in order to improve your efficiency, mitigate risk, and reduce administrative burdens. Full PEO Support To Take Your Business To The Next Level Call today or visit www.bbsi.com/nashville to learn more. Dion Matos - Area Manager 760.445.5909 Dion.Matos@bbsi.com

11The Tennessee Insuror ONE SIZE FITS ONE. Selective is committed to working with independent agents in Tennessee just like you. Together, we can provide Commercial, Personal, and Flood coverage for each unique customer. Contact Dan Schilling, Territory Manager, at dan.schilling@selective.com and help your customers Be Uniquely Insured. © 2021 Selective Ins. Group, Inc., Branchville, NJ. Products vary by jurisdiction, terms, and conditions and are provided by Selective Ins. Co. of America and its insurer affiliates. Details at selective.com/about/ affiliated-insurers.aspx. SI-21-037

Top-class protection around the world and out. of that’s

= Your insights Our strengths and expertise

+ Your attorney clients know their firm inside

You know your markets and your competitors. At Swiss Re Corporate Solutions, we have the capabilities and the financial strength to meet the risk needs

insureds for Lawyer’s Professional Liability. Whether the risk is basic or complex, we believe there’s only one way to arrive at the right solution. And

to work together and combine your experience with our expertise and your strengths with our skills. Long-term relationships bring long-term benefits. We’re smarter together. Swiss Re Corporate Solutions is proud to be the exclusively endorsed Lawyer’s Professional Liability provider for the Insurors of Tennessee. For more information or to access the program, please contact administrator Jeff Severino of Lockton Affinity at JSeverino@locktonaffinity.com or 913.652.7520. Insurors of Tennessee Ph 1 800 264 1898 E info@insurors.org Insurance products underwritten by Westport Insurance Corporation, Overland Park, Kansas, United States, a member of Swiss Re Corporate Solutions.

Visit These Convention Exhibitors

Accident Fund Insurance Company of America and United

Heartland

Aegis General Insurance Agency

AMERISAFE

AmTrust North America

AmWins Group, Inc.

Appalachian Underwriters

Applied Systems, Inc.

Applied Underwriters

Arcus Restoration

Arlington/Roe

Associated Insurance Administrators

Bailey Special Risks, Inc.

BBSi

Berkley Southeast Insurance Group

Berkshire Hathaway GUARD Insurance Companies

Berkshire Hathaway Homestate Company

Builders Insurance

Ck Specialty Insurance Associates, Inc.

ClearPath Mutual

CNA Commercial Insurance

Columbia Insurance Group

Commercial Sector Insurance Brokers

Doulos Financial Consultants

Encova Insurance

ePayPolicy

Equipment Insurance International

Falls Lake Insurance Companies

First Connect Insurance

FrankCrum, Inc.

Grange Insurance Companies

Harford Mutual Insurance Group

Imperial PFS Insurance Program Managers Group

Insurate

J.M. Wilson

Jencap Insurance Services Inc.

KNK Compliance Services, LLC

Liberty Mutual Insurance

LUBA Workers' Comp

Markel Specialty

Martin & Zerfoss, Inc.

McGowan Companies

Method Insurance

MidSouth Mutual Insurance Company

Mountain Empire Agency Alliance Mountain Life Insurance Company

National General, an Allstate company National Security Fire & Casualty Company

National Summit Normandy Insurance Company

North Point Underwriters, Inc.

Oak Tree Brokerage

Openly Orion180

Palomar Specialty Penn National Insurance Pie Insurance

Previsor Insurance

ProCare Property Restoration, an ATI Company

Right Choice Agency

Risk Placement Services

RT Specialty Safeco Insurance Company

Safeway Insurance Company

SCOTTISH AMERICAN

Selective Insurance Company of America Service Guarantee and Surety Company

Skyward Specialty Insurance Group Small & Rural Services, Inc.

Society Insurance South & Western Southern Pioneer P & C Ins. Co.

Southern Trust & Southern Specialty Underwriters State Auto Insurance Companies Strategic Insurance Software/Zywave Synergy Select

TAPCO Underwriters, Inc.

Titan Digital Travelers

United Home Insurance US Assure

V3 Insurance Partners

Westfield

XS Brokers Insurance Agency, Inc.

Zenith Insurance Company

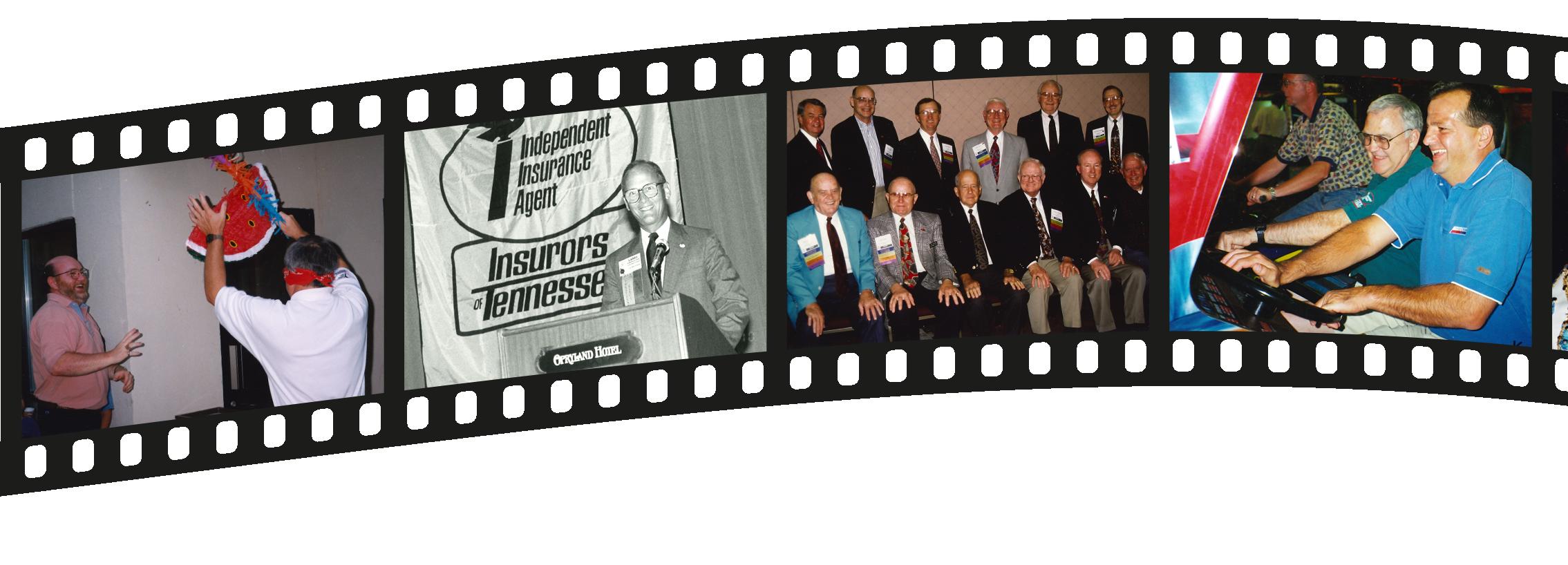

Convention Throwback... Cherish the Memories 1893-2022 14 The Tennessee Insuror

Trusted Choice MARKETING REIMBURSEMENT PROGRAM

Trusted Choice has funds available to help Big “I” member agencies offset the cost of marketing expenses when leveraging the Trusted Choice brand. Members have multiple ways to access funds:

Co-brand with the Trusted Choice logo*

General Co-branded Marketing: Up to $750 in reimbursement when co-branding with the Trusted Choice logo on any consumer facing items. This could include business cards, brochures, advertising costs, event sponsorship, branded giveaway items and more. (This program has a lifetime max value of $750 per agency location)

*Co-branding funds and additional 2021 digital marketing funds are reimbursed at 50% of cost to agency with a max of $750 for each option.

Digital Marketing Incentive: Additional $750 in Funds Available for 2021 Only!

Open to all members. Must be used towards digital marketing efforts (video, social or web ads) and must include the Trusted Choice logo. Members can use any of the Trusted Choice customizable campaigns or can create their own ad.

Endorsed Partner of

If you need print, advertising or digital marketing services and would like to take advantage of your co-branding funds, contact Titan Digital at 615.890.3600 or visit TitanInsWebsites.com

15

16 The Tennessee Insuror RLI is a proud member of the Big “I”. Contact us to gain access to comprehensive insurance solutions and protect your commercial and personal lines customers from the unique risks they face. From our specialized solutions to our focus on building strong relationships with the agents we work with, we’re different. And at RLI, DIFFERENT WORKS . PRODUCTS AVAILABLE THROUGH BIG “I” MARKETS: Home Business • Personal Umbrella Learn more about our specialty insurance solutions at RLICORP.COM . INNOVATIVE INSURANCE SOLUTIONS. PARTNERSHIP FOCUSED.

Convention Throwback... Build on the Past 1893-2022 17The Tennessee Insuror

18 The Tennessee Insuror EMC is a leader in providing workers’ compensation insurance. And with more than 110 years of experience, you know you can count on us to take care of your clients. Medical bills, lost wages, return to work assistance? We cover that. Proven injury management programs that control costs and provide the best possible outcome? Yup, we provide those too. Count on EMC ® to take care of your clients so they can get back to business. ©Copyright Employers Mutual Casualty Company 2022. All rights reserved EMC Insurance Companies | Des Moines, IA | 800-447-2295 Check us out: emcins.com/workerscomp/ Workers’ Compensation Expertise? Check!

Open instant revenue streams.

Capture more customer wallet share with Revenue Booster©

Bridging the gap to more sales, Revenue Booster© allows your customer service representatives to capture $100,000 in additional income annually without extra work.

• Get a custom online platform to add coverage to new sales

• Empower CSRs to expand coverage with one simple question

• Eliminate barriers to growth immediately it sounds.

19The Tennessee Insuror

It’s as easy as

Scan the code to learn more or call us today: 1-800-842-9124 ext. 508

We answer to main street, not Wall Street.

As a mutual company, we are owned by our policyholders. We focus our time, attention, and resources on delivering superior financial strength and stability, a comprehensive product portfolio, and most of all, on doing what’s right for policyholders. To us, policyholders are much more than insurance consumers. And because of that, all of our business decisions are made with a policyholder-first focus.

For more information about our products, please contact one of our territory managers at 615-889-2740.

Brent Potts 7514 Kinard 7518 Wilder 7545

20 The Tennessee Insuror www.PennNationalInsurance.com

ext

Jane

ext

Andy

ext

From Your President

Norfleet Anthony, III

presented by

129 Years of Gathering and Fellowship

The September/October edition of the Tennessee Insuror magazine is histori cally focused on the annual convention, and it also serves as your guide to the convention. We hope you find this is sue of the magazine both useful and in formative. For those of you who are at tending the 129th Insurors of Tennessee Annual Convention, we welcome you and look forward to seeing you during the convention. If you have questions, observations, or comments during the event, please reach out to Insurors of Tennessee staff members. They will be happy to assist you.

It was thirty-three years ago this year when my father, S. Norfleet Anthony, Jr., had the honor of standing before the members of the In surors of Tennes see as President of this association at the 96th conven tion. By that time, I had returned from college, was work ing in the family agency and had been attending Insurors of Tennessee events for several years. In 1989 the con vention was held at the Opryland Hotel in Nashville and our entertainment was Tanya Tucker. At that time, the Opryland Hotel was the premier place to hold a convention in Nashville and the Opry land Theme Park was still in operation. I recall having a great time.

It is interesting to note that there have been several of my contemporaries who followed in the footsteps of their fathers to also serve as Presidents of this associ ation over the past 129 years. I think this speaks to the commitment of Insurors of Tennessee members across generations to the organization. It also underscores the ongoing importance of our Young Agent initiatives in developing the fu ture membership and leadership of our association. I encourage agency prin cipals across the state to make sure the future leadership of your agency is in volved in Young Agents, WINs and other activities of the association.

Be sure to take advantage of all this year’s convention has to offer. There are oppor tunities to learn from guest speakers, ed ucation sessions, vendors at the trade show, and the wealth of experience your colleagues have to offer. Perhaps even more importantly, the convention pres ents opportunities to renew old friend ships and create new ones. Many of my most important personal and business relationships to this day were formed during Insurors of Tennessee conven tions and other events. As I look back over my career, it is those relationships with my colleagues that I value most.

Each year associate members, partners, sponsors and others, participate in a tradeshow to share with you the prod ucts and services they offer to help pow er the success of insurance agencies and

brokers. One or more of these organiza tions could offer the products or servic es that could prove transformational for your agency. Many of the participants are on the leading edge of our industry and are thought leaders. In short, they are good people to get to know. Be sure to explore the trade show to keep up with the ever-changing insurance marketplace.

We are also offering recreational activi ties throughout the course of the con ference to give you an enjoyable break from the daily challenges of running an independent insurance agency, insur ance company or other related organi zation. Be sure to get involved in one or more of the events; you will be glad you did at the end of the day.

Thank you to our partners and sponsors who helped support the convention this year. We simply cannot plan, stage, and present the convention without you. To all our members, I ask that you take note of the sponsors and the company’s who serve as our partners throughout the year. Please be sure to thank them for their support. I also want to express my appreciation to the Insurors of Tennes see staff for the many hours of work that goes into making the convention possi ble. I hope you all enjoy the 129th Insur ors of Tennessee Annual Conference also known as InsurFest this year! u

22 The Tennessee Insuror Connect Communicate Agency App Client Portal Website Marketing Automation Drip Campaigns Content Library Mass Text Messaging AMS + CRM Clients, Policies, Claims Financial Management Sales Data Analytics Allies Integrations Industry Partners Downloads More than just so ware, Partner is who we are Platform Platform Partner Partner t Partne P r Contact the Partner Team, sales@sisware.com or call 614.334.9698 Endorsed by Insurors of Tennessee AMS & CRM provider to leading Tennessee agencies Grow your agency and support your client relationships in a single unified system More than just so ware, Partner is who we are Platform Partner t Partne P r “The Partner Platform and the team that supports the program are high quality. They made the transition to Partner easy, provided a great conversion and training experience and the system has everything we wanted in a modern agency management system. For any agency looking for an intuitive system with plenty of capabilities that are simple to use, I’d recommend they give the Partner Platform a look.” -Bob McIntire, President McIntire & Associates Insurance, Former President of Insurors of Tennessee

From Your IIABA National Director

Cindi Gresham, CIC

How to Get the Most From Your Convention

Welcome to the Insurors of Tennessee 129th Annual Convention. We are back in Nashville for Insurefest 2022 October 15-18 at the new and beautiful J.W. Mar riott Downtown Hotel.

Saturday, October 15 we kick off the events from 6:00-8:00 with our Football Watching Party in the Belle Meade 1&2 rooms. Plan on wearing your favorite teams colors and cheer on your team.

Sunday, our Board of Directors start ear ly at 8:30 for their Board meeting while the rest of our attendees can sleep late and relax until the trade show opens at 1:00 in the Griffin Ballroom. Be sure to bring your business card and introduce yourself to all of our vendors at the trade show. You never know what you might learn from our vendor Partners that will provide you with a market or service that will help you in your agency. Be sure to attend the Agents General Session at 2:00 in the Belle Meade 1&2 Room. At 3:00 Our WINS (Women In Insurance) will

have a networking session and Young Agents have a 4:00 networking session. Be ready at 6:00 for our Opening Night Party at TopGolf. Dinner and transporta tion will be provided. You do not need to be a golfer to enjoy this event. It will be a fun time for all so please plan on at tending.

Monday morning the trade show is open from 8:00-12:00. Grab breakfast and fin ish up visiting any of our vendors booths that you did not get to see on Sunday. The door prizes from our Partners will be given away right after the trade show closes. Monday afternoon offers some thing for everyone whether you are par ticipating in clay shooting at the Nash ville Gun Club, golf at the Tennessee Grassland Course, a tour of the Tennes see State Museum or just hanging out and relaxing. 1 hour of CE will be given to those who participate in "Fine Art: The Market and Protection" presented by Mi chelle Impey of Chubb in conjunction with the Tennessee State Museum tour.

Monday night you are on your own. Head out with friends or a company rep or head down to Broadway for music, fun and entertainment. You may want to join the Insurors exclusive party with live mu sic at The Valentine on lower Broadway from 9:00- 11:00. Make sure your register early so we have enough space.

Tuesday morning finishes our conven tion with our Association Day Breakfast and Business Meeting starting at 8:00. After breakfast the meeting will start and the new Board of Directors election will be held. Don’t forget and leave early. You must be present if your name is drawn for a door prize. The convention closes at 10:00 giving you time to head home until our convention next year.

I look forward to seeing each of you at the Convention. It will be a fun time to catch up with old friends and meet new ones. Talk to your carrier and discov er new products and services. This con vention offers something for everyone. Learn about the inner working of your National Association, how they oper ate and how the National Director rep resents our membership and the great State of Tennessee. u

24 The Tennessee Insuror It shouldn’t take walls collapsed by 140-mile-per-hour winds to find out who your customers can trust. BUT SOMETIMES IT DOES. And that’s the Silver Lining®.

From Your CEO

Ron Travis presented by

It's Convention Time in Tennessee

After a long hot summer, the promise of cooler weather and the vibrant col ors of Fall across our beautiful state are just around the corner. It is also plan ning season for many businesses and organizations. Jake Smith and I just re turned from the Big "I” Fall Leadership Conference held in Niagara Falls, New York from September 14-18, where three principle components of the conference included the Big “I“ Fall Board meeting, Education Convocation, and the Young Agents Leadership Institute. The focus of these sessions was either directly or indirectly focused on planning and po sitioning the Big “I” and our state asso ciations for future success. The confer ence was of real benefit to the Insurors of Tennessee as we grow and move for ward. Jake Smith has written a short re view of the conference with more detail on page 44 of this magazine.

While it is “football time in Tennessee”, it is also convention time for our associa tion with the start of InsureFest 2022 on the evening of Saturday, October 15. Ap propriately, the convention kicks off with a Football Watch Party at the J.W. Marri ott Hotel on Saturday evening for early arrivals. InsureFest meetings and events begin on Sunday, October 16, and con tinue through Tuesday, October 18.

We have an exceptional conference planned for you this year that will deliver real value to you and your agency as you conclude 2022 and make plans for 2023. We also have great recreational events planned throughout the conference to help you relax and enjoy the conference with your insurance industry colleagues from across Tennessee. Please refer to the agenda provided in this magazine and on the Insurors of Tennessee web site for more details.

One of the most important elements of the Annual Conference is the annu al member business meeting where we deliver on the requirements of our char ter, comply with standards set forth by the national Big “I” organization and meet regulatory requirements of the state. The business meeting is the or ganizational mechanism that perpetu ates the association forward from year to year and has done so for the past 129 years. While to some it may not be the most exciting element of the con vention, it is one of the most impor tant and necessary parts of the confer ence enabling the confirmation of new board members, various office holders within the board, the installation of the new president each year and a myriad

of other business items. It is the culmi nation of much work done by the In surors of Tennessee Board of Directors throughout the year to ensure the suc cess of the organization going forward. I want to thank the Board of Directors this year for their work, wisdom, and com mitment to securing the future of the In surors of Tennessee as we celebrate our 129th year as an association serving the independent insurance agents and bro kers of Tennessee.

I hope you all take the time to enjoy In sureFest 2022! We have much to be grateful for and to celebrate as an orga nization. If you are unable to attend this year, I hope you will make plans to at tend in 2023 as we mark the 130th year of this historic association.

On a final note, since being given the op portunity and the honor to serve as the Chief Executive Officer of the Insurors of Tennessee, I have been consistently im pressed by the leadership talent, experi ence, expertise, and vision of our mem bers. Perhaps more importantly, the integrity and professionalism exhibited by our members each day is something we can all be proud of as an association. Forward we go! u

Tennessee Young Agents '22

Future Leaders Spotlight

presented by

Clark Powers • Boyle Insurance Agency, Memphis

Clark Powers is an insurance producer with Boyle Insurance Agency. Clark has been with Boyle for a little over two years. Boyle Insurance is based out of Memphis with an office also located in Nashville.

Clark, a Memphis native, is a proud 2016 graduate of Mississippi State University. While there he earned his Bachelor of Business Administration degree in Accounting and Business Management.

Clark’s career as a whole has been about protecting one’s assets. It began right out of college as a financial advisor at a firm just outside of Starkville. Inevitably, he decided to move back home to Memphis. He then got a job at a local industrial safety equipment company and worked as a sourcing manager. There he purchased leather gloves and eyewear from multiple factories across the globe. Yet again his job was about protecting another asset, your body. After 3 years with that company, Clark came to the conclusion that it was time for a change and this began his career in insurance.

He started out at a captive agency that predominately wrote personal lines accounts. While at the captive company he developed a passion for the industry, but he realized it also limited him. Clark began targeting medium to large multifamily properties that the captive agency was not equipped to handle. He then made the switch to an independent agency joining Boyle Insurance.

When asked what Clark likes about the business he states, “Every day is a new day with new challenges. I enjoy the unique, hard to place risks; it makes me

think outside the box. I want my clients to sleep peacefully at night knowing they are protected if the unexpected happens.”

Though they didn’t know it at the time, Mississippi State would be where Clark meets his future wife. Clark married his wife, Emily, in June of 2019. He and Emily just had their first child, Eleanor “Ellie” Rose, in June of 2022 and they couldn’t be happier. They also have 4 dogs including three labs (Bear, Cadie and Mini), and a rescue, Rosie. Mini is the puppy from Bear and Cadie’s litter.

When not at the office you can find them at The Junction cheering on the Bulldogs, working with his dogs, or in the woods chasing wild game.

Insurors of Tennessee thanks Clark for sharing his story with other members by participating in our Future Leader's Spotlight. u

26 The Tennessee Insuror

From Matt Felgendreher, President of Young Agents and Insurors of Tennessee Board Member...

From the beginning of my career, my mentors emphasized the importance of getting involved with IOT. Whether it was a CE course, Young Agents social, Growth Conference, or Annual Convention, the objective was the same- Gain as much knowledge as possible by being present and by engaging your peers.

No forum presents more opportunity for this than the convention. The annual convention is the highlight of the IOT calendar, each year hosting hundreds of agents and company representatives from across the state. It wasn’t until my first convention experience that I truly understood the value and purpose of these gatherings. Not only does it bring like minded people together, but it also provides opportunities for education, strengthening carrier relationships, and uncovering the full potential of an IOT membership. I believe that these benefits are particularity useful to the Young Agent looking to advance their career and maximize their potential.

I’m excited for the convention to be held in my home city this year. Nashville will play a great host with amazing entertainment, food, and accommodations. I encourage all Young Agents to make the trip for this important event. We’ll have an opportunity to meet as a group to discuss the issues that are most pressing for us. There will also be time for socializing and networking of course!

I look forward to seeing you in Music City!

Matt

27The Tennessee Insuror

Below: Young Agents event at the Railgarten in Memphis berkleysig.com Berkley Southeast Insurance Group is a member company of W. R. Berkley Corporation, whose insurance company subsidiaries are rated A+ (Superior) by A.M.Best. Products and services are provided by one or more insurance company subsidiaries of W. R. Berkley Corporation. Not all products and services are available in every jurisdiction, and the precise coverage afforded by any insurer is subject to the actual terms and conditions of the policies as issued. ©2019 Berkley Southeast Insurance Group. All rights reserved. Bill Vanderslice, Regional Vice-President 615-932-5508 | bvanderslice@berkleysig.com or your Middle Market Underwriter Your Back-in-Business Insurance Company® Follow us on Our Claim Commitment • 24/7/365 loss reporting-including online • • Accelerated auto and property estimating and repair options • • “Fast Track” medical only claims handling program • • Tele-emergent medicine program-connects injured workers to medical care, not “triage” • Below is just a broad listing. If you don’t see what you’re looking for, please contact us. 0719-38 A M BEST Are you making the Right Choice for their Business? Middle Market Choice Classes* * All classes may not be available in all states. BSIG Makes It Easy With Choice Classes For Middle Market Risks • General Contractors • Building Trade Contractors • Utility Contractors • Land Improvement Contractors • Pavement Maintenance-Non DOT • Services Contractors • Building Cleaning & Maintenance Contractors • Construction Material Suppliers • Manufacturing • Wholesale and Distributing Want to know more? YA REGISTER

ACCIDENT FUND INSURANCE COMPANY OF AMERICA • AMTRUST • ASSOCIATED INSURANCE CINCINNATI INSURANCE • EMC INSURANCE • GRAHAM-ROGERS INSURANCE • HIPPO INSURANCE PREVISOR INURANCES • SAFEWAY INSURANCE COMPANY • SOUTHERN INSURANCE UNDERWRITERS PARTNERS F O R T E NN E S S E E 28 certified DiamonD 2022 certified Bronze 2022 certified GoLD 2022 certified SiLver 2022 certified PL aTinUm 2022 The Tennessee Insuror Thank you for your supporT of Tennessee IndependenT agenTs The generous support of Insurors of Tennessee partners is a key component of our ability to deliver a wide range of services and support to members and to ensure we maintain a healthy and vibrant insurance industry in Tennessee.

INSURANCE ADMINISTRATORS, INC • BERKSHIRE HATHAWAY GUARD INS. • BURNS & WILCOX • CELINA INSURANCE GROUP INSURANCE • J.M. WILSON • KEY RISK | A BERKLEY COMPANY • METHOD INSURANCE • MIDWEST INSURANCE • OPENLY UNDERWRITERS • UTICA NATIONAL 29 FLOOD INSURANCE The Tennessee Insuror

30 The Tennessee Insuror ® we give you peace of mind, which gives us peace of mind. simple human sense We are dedicated to the independent agency system and proudly stand behind the agents who represent us. auto-owners.com

Certificates of Insurance: A Protracted Battle Government & Legal Update

Insurors’ Work on Certificates in Tennessee

Over a decade ago, Insurors sought help from the Tennessee Department of Commerce and Insurance (TDCI) in the form of an official “Bulletin,” issued by then-Commissioner Julie Mix McPeak, to formally declare that the issuance of inaccurate certificates of insurance (COI) was a violation of Tennessee’s Unfair Trade Practices and Unfair Claims Settlement Act of 2009. Tenn. Code Ann. §56-8-101 et. seq. The bulletin was issued by Commissioner McPeak on March 21, 2012 and stated, in part, “[a]ny attempt to amend, expand, or alter the terms of an underlying insurance policy through the use of [a] certificate of insurance will be considered a violation of the unfair trade practices act and could subject a producer’s license to disciplinary action by the Division.”

While a good first step, the 2012 bulletin is silent on third parties (e.g. corporate risk managers, attorneys, etc.) and the ever increasing pressure and demands inappropriately placed on agents in Tennessee. Thus, in 2020, Insurors worked with the General Assembly and TDCI to pass legislation to further address these issues. Tennessee’s law is fashioned after a model bill promoted by the National Conference of Insurance Legislators (NCOIL), itself which was based on a template developed by the Big “I”. The bill passed unanimously and was signed into law by Governor Bill Lee on March 20, 2020.

Although more than 30 states have adopted similar legislation, the dreaded COI issue continues to be a pain for agents in Tennessee and across the country. We wanted to use this space to recap the current state of the law and assure you that Insurors continues to look for ways to improve the agency experience with COIs.

A Refresher on Tennessee’s Certificate of Insurance Law Tenn. Code Ann. §56-7-114 defines what a certificate of insurance (COI) is and outlines in state law that a COI does not amend, extend, or alter the coverage of the underlying insurance policy. The current law prohibits a person from

preparing, issuing, requesting, or requiring the issuance of a COI that contains any false or misleading information concerning the underlying policy, or that purports to alter, amend, or extend the coverage provided by the underlying policy. It also prohibits altering or modifying a COI after its issuance. Furthermore, the law states that a COI cannot warrant that an insurance policy complies with the insurance or indemnification requirements of a contract.

The law applies to all COIs issued in connection with property or casualty insurance risks located in this state, regardless of where the policyholder, insurer, insurance producer, or person requesting or requiring the issuance of a certificate of insurance is located.

The law states that any notice of cancellation, nonrenewal, material change, or other notice requirements is governed by the terms of the underlying insurance policy, an endorsement to the policy, or state law, rather than a COI. i.e. Operative coverage and notice provisions are governed by the policy, not a COI.

Violations may result in any of the following actions by the Tennessee Department of Commerce and Insurance (TDCI):

• TDCI may examine and investigate the activities of any person that it reasonably believes engaged in, or is currently engaging in, an act or practice that is prohibited under this law. (This is where evidence of violations, as reported by producers to TDCI, can assist the department in enforcement matters.)

• An order to cease and desist actions that constitute a violation of the law.

• A civil penalty of up to $1,000 per violation.

Looking Ahead

Insurors continues to look for ways to improve the climate for agents with respect to COIs. Throughout this process, we’ve heard from many of you that the law is not having the impact we hoped, especially with regard to certificate

31The Tennessee Insuror

clearinghouses. We are currently surveying the laws in other states for meaningful ways Tennessee’s statute may be improved.

Additionally, we continue to have dialogue with the TDCI on ways Insurors and our members can help the department’s enforcement efforts and elevate the statute’s impact in dissuading illegal COI demands on agents. To that end, some recent feedback we have received from TDCI is that few, if any, formal and actionable complaints have been filed with the department. This is a critical and necessary step in the process and one within agents’ control. And although it may seem time consuming initially, think about the amount of time and resources you spend fighting over COIs with third parties and insureds over improper (or illegal) requests.

To that end, we are here to help you navigate that process.

Illegal COI demand? Document and report it to TDCI.

For questions about enforcement efforts related to certificates, or to file a complaint against a third party, reach out to the Fraud Section of the Tennessee Department of Commerce and Insurance by visiting their webpage (https:// www.tn.gov/commerce/insurance/consumer-resources/

fraud-investigation.html), call the complaint hotline at (615) 253-8841, or the toll-free number at (800) 792-7573, or send written complaints to:

Tennessee Department of Commerce and Insurance Insurance Division – Fraud Investigations 500 James Robertson Parkway, 6th Floor Nashville, Tennessee 37243-0575

As always, please keep us updated on any complaints or let us know if we can be helpful in your communications with TDCI, as we continue to work with the department on effective enforcement of (and ways we may improve) Tennessee’s COI law.

About the Author—Trey Moore is the government and legal consultant for Insurors. He operates Trey Moore Consulting in Nashville and formerly served as senior public policy counsel for one of Nashville’s largest law firms. Trey has over a decade of experi ence in representing clients before the Tennessee General Assembly and state government. u

Workers’ Compensation

We distinguish our Workers’ Compensation coverage by providing value-added services before, during, and after a claim.

Upfront loss control

Responsive claims handling

We’ve been successfully protecting our and since 1983. all of our www.guard.com

32 The Tennessee Insuror

APPLY TO BE AN AGENT: WWW.GUARD.COM/APPLY/

measures

Facilitation of quality medical care (when an accident does occur)

policyholders

their employees

Browse

products at

Our Workers’ Compensation policy is available nationwide except in monopolistic states: ND, OH, WA, and WY.

33The Tennessee Insuror You expect a company to have your back. We do. Our commercial lines products, tools and resources can help provide value to your commercial clients and support your business growth. Expect more. Expect Nationwide. solutions COMMERCIAL INSURANCE Nationwide, the Nationwide N and Eagle, Nationwide is on your side and other marks displayed are service marks of Nationwide Mutual Insurance Company, unless otherwise disclosed. © 2020 Nationwide CMR-0576AO.1 (12/20) EXPECT MORE Visit Nationwide.com/ExpectMore PROUD PARTNER of INDEPENDENTS

More a community.

than a network We’re

There are many reasons why independent agencies turn to Keystone, but you might ask what makes them stay? Keystone is more than just a network, we’re a community. Our goal is to strengthen independent agencies by bringing them together for peer-to-peer collaboration, industry expertise and access to national resources. Together, we’re making each other stronger and keeping clients better protected. That’s how independence works better together! ©2022 Keystone Insurers Group ®. All rights reserved. This does not constitute an offer to sell a franchise in any state in which the Keystone Insurers Group franchise is not registered. FOR MORE INFORMATION: Carolyn Nalley 570.473.2147 | cnalley@keystoneinsgrp.com keystoneinsgrp.com

Association Update

Martin & Zerfoss Makes Cover of Rough Notes

The Rough Notes Company, Inc. selected Martin Zerfoss, Nash ville, as their September Agency of the Month. The title they se lected for the article, “Nashville Agency Focuses on Helping Peo ple” is truly part of their mission! Appearing in the cover photo are Paul Steele, Mickey Martin, Taylor Ragan, and Amanda Hardin, CPA. Read the full article at https://roughnotes.com/custom er_is_the_mission/.

Boyle Investment Company Is Pleased to Announce Matt Hayden as President & CEO

Boyle Investment Co. has named both a new president and CEO and a new chairman, effective immediately. Matt Hayden has been appointed president and CEO. He succeeds Paul Boyle, who has been promoted to chairman.

Henry Morgan Jr. and Bayard Morgan have been named vice chairmen, and Bayard Boyle Jr. and Henry Morgan Sr. have been named co-chairmen emeritus.

Hayden’s promotion comes after rising in the ranks at Boyle. He joined the real estate company in 2014 as deputy treasur er and became its treasurer and CFO in 2016. Prior to joining Boyle, Hayden had prominent roles with Memphis companies Wunderlich Securities Inc., as a senior vice president, and at Morgan Keegan & Co., as a first vice president. As Boyle’s CFO, Hayden oversaw the financial accounting and reporting on a large portfolio of investment properties, which included 150 real estate entities comprised of different investors.

“I never envisioned [being CEO] when I joined Boyle,” Hayden told Memphis Business Journal, a sister publication to the NBJ. “Working with the Boyle and Morgan families and the key ex ecutives here, one thing led to another. It was never in my mind that I’d be in this position, but I’m very grateful to be.”

Memphis-based Boyle has 135 total employees, including more than 30 at its Nashville office. The company collective ly manages 8 million square feet of commercial space in the Memphis and Nashville metros. u

Along with offering workers’ compensation and employers’ Stonetrust works help companies Stonetrust an entire system of in-house processes our core, we are a relationship-driven company and are always working hard to be the “first choice” workers’ compensation in all of our markets.

35The Tennessee Insuror

liability insurance,

to

prevent accidents and remain

Safe

and services designed to achieve safety goals and keep premiums and claim costs down. At

carrier

800.311.0997 STONETRUSTINSURANCE .COM

Company Spotlight

West Bend Mutual Insurance Company

Headquarters: 1900 South 18th Avenue, West Bend, WI 53095

Founded: April 1894

Website: thesilerlining.com

A.M. Best Rating: "A" Excellent

West Bend strives to be the company of choice for agents and policyholders. We're proud to be recognized as one of the very best P&C insurance companies in the United States. Since 1971, West Bend has been rated A (Excellent) or better by A.M. Best Company, known worldwide as the benchmark for assessing insurers' financial strength.

We develop and nurture strong relationships between our network of independent insurance agents and associates through personal contact, responsible actions, and a genuine concern for our valued partners. We use performance programs, continuing education, and advisory boards to strengthen bonds and ensure mutual success. Within senior management, underwriting, billing, and claims, in fact, with our entire company, you’ll not find a more dedicated, personal, community-oriented, and caring group of people.

The Silver Lining®

The foundation of West Bend's strategy is to create a robust property and casualty product and service portfolio that provides our independent agency partners with a market for a large percentage of the business they write. Around this foundation, we wrap out standing service – The Silver Lining® - and deep agency relationships that enable us to win in the marketplace. Finally, we recognize that our associates are our greatest asset, and the perpetuation of our outstanding culture is critical to our success.

When it comes to understanding commercial risks, we're proud of the broad base of knowledge shared by the underwriters in West Bend's Commercial division. Add to that a team of loss prevention professionals who use a hands-on approach to develop programs tailored to the individual business and property/casualty and workers' compensation claim reps with the expertise and technology to process claims quickly and efficiently - you have a quality commercial insurance product.

West Bend's specialty division offers insurance programs for market segments or situations that don't meet standard insurers' underwriting guidelines. We're a leader in providing innovative programs for specialty lines, such as personal care, childcare, YMCAs, and health clubs. Our experienced claim and legal professionals will do all they can to help protect a customers' valuable businesses.

West Bend also offers mono-line workers' compensation through our Argent level of service. Our professionals collaborate with agents and their customers to improve workers' compensation performance through innovative and customer-focused loss pre vention, medical cost containment, education, and communication. This high-touch, results-oriented strategy is custom-built to fit each culture and designed to help customers control the cost of insurance.

Our associates drive our culture of service and family at West Bend. Because of them, we've been honored as a Best Place to Work in Insurance for 12 consecutive years by Business Insurance and as a Top Workplace by the Milwaukee Journal Sentinel for 11 years. We're also proud of the many awards acknowledging our community service, financial stability, and support of healthy lifestyles for our associates. All of these make West Bend a better company for our trusted agent partners.

Kevin Steiner President and CEO

36 The Tennessee Insuror

Vendor Spotlight

Revenue Booster for P&C Agencies

Powered by Oak Tree Brokerage

Companies grow wallet share by introducing multiple products and services to generate as much revenue as possible from each customer. Examples that we can easily relate to are when we order a Big Mac at McDonald's; they ask if we would like french fries or an apple pie. Or when you order from Amazon, other items are immediately suggested that other people or dered when they bought the same product as you did.

Getting new customers is 5 – 25 times more expensive than maintaining existing ones, so increasing your wallet share with each customer is essential. A proven process must be adopted that is simple, fast, and easy to be successful.

Increasing wallet share is the part of the business that most P&C agencies struggle with but understand that they need to embrace if they want to increase revenue and retention.

Historically, the majority of P&C agencies do not make their customers aware that they can provide life insurance for several reasons;

• They have no process to stimulate interest and don't know how to create one.

• If there is interest, the agency does not have an effective strategy for the next steps and obtaining coverage.

• Life insurance is complicated to explain, and the application process is cumbersome.

• The agency has no personnel to handle additional work, especially for life insurance.

According to LIMRA, 52% of the population intends to buy life insurance in the next twelve months. That means 52% of your customers intend to do the same.

Revenue Booster consists of specifically designed life insurance products combined with a process that creates interest and technology that delivers efficiency and a great customer experience.

Overview of Revenue Booster for P&C Agencies;

• Easily create interest for life insurance from your customers.

• Provides a simple, fast, and easy way to obtain coverage.

• You nor your staff are involved in the application process; your customers do it themselves online.

• NO additional staff and NO significant investment of resources are required.

• You can be up and going within three weeks!

You are probably asking yourself….will this work for me? The answer is YES!

Stop by our booth at Insurefest 2022 or give us a call to learn more.

GIVE US A CALL!

TREVOR MORRING 800-842-9124 X508 Tmorring@otfc.com pcrevenuebooster.com

37The Tennessee Insuror

Maintaining of the

38 The Tennessee Insuror

a safe workplace shouldn’t be a daunting task. Protecting the workforce is what we do at Summit, and we’re here to help every step

way. Policies are underwritten by Bridgefield Casualty Insurance Company and Bridgefield Employers Insurance Company, authorized insurers in AL, AR, FL, GA, IN, KY, LA, MS, NC, OK, SC, TN, TX and VA; BusinessFirst Insurance Company, authorized in FL, GA, IN, KY, NC, SC, TN and VA; ©2022 Summit Consulting LLC (DBA Summit, the people who know workers’ comp LLC), PO Box 988, Lakeland, FL 33802. All rights reserved. summitholdings.com

Company Briefs

Acuity Earns Gold Technology Awards

Acuity earned Gold Spark Awards in both Commercial Lines and Personal Lines from Ivans for the insurer’s agency connectivity successes. Ivans Spark Awards recognize companies that are sparking digital connectivity by using technology to support the growth of their agency partners across the policy lifecycle. Acuity is one of only nine companies worldwide to achieve Gold status for both Commercial Lines and Personal Lines.

“Acuity is committed to remaining on the leading edge of agency connectivity and extending digital capabilities that help agents do business with us in both Personal and Commercial Lines,” said Ben Salzmann, Acuity President and CEO. “We are honored to be recognized by Ivans for our leadership in supporting agents’ digital strategies that increase their operational efficiency.”

“This year’s Spark Award class has a great group of companies that are really pushing the industry forward, and I am stoked to recognize them,” said Reid Holzworth, Ivans CEO. “So many outstanding organizations are paving the way in using technology to support independent agents’ needs for digital connectivity. We are proud to be at the center of this intersection of insurance and technology to be drivers in this movement.”

The Gold Spark Awards honor Acuity for offering independent agencies a comprehensive range of automated servicing and digital distribution products. Gold Awards are earned by companies that are in the top percentile of digital technology adoption when compared to their peers.

Arlington Roe's Indianapolis Headquarters Relocating

Arlington/Roe’s Indianapolis headquarters are relocating to a new office. After 22 years in the 8900 building, we are moving just across the street to the 8888 Keystone at the Crossing building over Labor Day weekend. Our headquarters are moving, but our service to you is staying put. Our business, including website, email and telephones will be fully operational during the moving process, and you will experience no changes or delays in service during that time. The new office comes with a new, modern look and will be more welcoming to our visiting guests and aesthetically pleasing for our associates. The office will also have more amenities that are appropriate to our needs and is technologically more up-to-date.

Please update your records with our new address: 8888 Keystone Crossing, Suite 900 Indianapolis, IN 46240

We’re right here to do more.

To help support both your physical and mental health while giving back to our communities is to go beyond what is expected from a health insurance company. And that’s exactly why we do it.

39

© 2022 BlueCross BlueShield of Tennessee, Inc., an Independent Licensee of the Blue Cross Blue Shield Association

Company Briefs continued

Harford Mutual Insurance Group Named a Finalist in U.S. Insurance Awards

Bel Air, Md. – Harford Mutual Insurance Group has been selected as a finalist in Business Insurance’s 2022 U.S. Insurance Awards for the category of Community Outreach Project of the Year. The Business Insurance U.S. Insurance Awards honor teams of professionals working on specific projects in the commercial insurance and risk management industry. This is the fifth year for the awards program and the first time Harford Mutual has been named a finalist.

Harford Mutual was nominated for its HMIG Gives Back Program. In 2021, the company partnered with more than 70 local and national charitable organizations, providing volunteer hours and financial assistance. Harford Mutual ended the year with more than $625,000 in community support, including $17,000 in scholarship donations.

In 2021, the company also created the Harford Mutual Insurance Group (HMIG) Community Fund at the Community Foundation of Harford County. With $300,000 invested, the goal is to build upon the company’s culture of philanthropy and watch it grow to support and uplift many more charitable organizations for years to come.

A panel of risk managers will assess the finalists and the winners in each category will be announced at an awards event in New York on September 14, 2022.

J.M. Wilson Announcements

PORTAGE, MI, AUGUST 2022 - J.M. Wilson is pleased to announce the addition of Heidi Wheeler as Finance and Reporting Accountant in their Portage, Michigan office. Heidi is responsible for a variety of accounting duties, such as cash management, collections, month-end closing, financial reporting, audit preparation, and process/system automation for all JM Wilson offices. Prior to joining JM Wilson, Heidi served as accountant, internal auditor, and office manager for 16 years at Kalamazoo College. A Western Michigan University graduate, Heidi earned a bachelor’s degree in Social Science, and minored in Business Management and Japanese.

J.M. Wilson is pleased to announce the addition of Jessica Allers as Agency Information Coordinator in their Portage, Michigan office. Jessica is responsible for assisting independent insurance agents in becoming appointed with JM Wilson, as well as managing and updating the contact

information and agency records for all currently appointed agents. Prior to joining JM Wilson, Jessica owned a garden wholesale and lawncare business for 10 years. She was also an account specialist and an employment recruiter. A Western Michigan University graduate, Jessica earned a bachelor’s degree in Social Work with a minor in Psychology.

JM Wilson is pleased to announce the promotion of Jamie Yohn to Transportation Underwriter in their Charleston, South Carolina office. Jamie is responsible for underwriting a wide variety of new and renewal transportation risks, corresponding with carrier underwriters, and assisting independent agents in Florida, Georgia, North Carolina, South Carolina, and Tennessee. Jamie joined JM Wilson in 2020 where she began as an Assistant Transportation Underwriter. She was promoted to a Renewal Transportation Underwriter in 2021. A Clemson University graduate, Jamie earned a bachelor's degree in History and a minor in Chemistry.

J.M. Wilson is pleased to announce the promotion of Jilary Tamarit to Transportation Renewal Underwriter in their North Charleston, South Carolina office. Jilary is responsible for underwriting renewal commercial transportation accounts, corresponding with carrier underwriters, and maintaining relationships with independent agents in Florida, Georgia, North Carolina, South Carolina, and Tennessee.

Jilary has ten years of experience in the trucking industry where she worked as a Commercial Department Manager at an insurance agency. She is fluent in English and Spanish, is licensed as a South Carolina and North Carolina Insurance Producer, and holds a Surplus Lines Broker License.

J.M. Wilson is pleased to announce the promotion of Ryan Bartolacci to Senior Personal Lines Underwriter in their Portage, Michigan office. Ryan is responsible for underwriting personal lines risks and strengthening relationships. Ryan joined JM Wilson in 2017 as an Assistant Transportation Fleet Underwriter and was promoted to Personal Lines Underwriter in 2019. Ryan is an Olivet College graduate with a degree in Insurance & Risk Management. During his time at Olivet College he also earned a UACRM designation.

40 The Tennessee Insuror

Reach new heights.

You have invested time and energy into your firm, and you’re still passionate about the insurance business, your clients and your employees. If you’re interested in taking your business to the next level, while enjoying the fruits of your labor, let’s explore a possible partnership. Why insurance firms choose to partner with Higginbotham: • Ten-year average return of 30% IRR • Ten-year average annual shareholder distribution of 25% • Insurance Business America, 2022 Top Insurance Employer • Privately-held and run by insurance professionals • Majority ownership held by employee shareholders • Leverage Higginbotham’s consistent 20% compound annual growth rate • Broad risk management and benefit plan services add client value to support your growth • Maintain your leadership role • $5 million donated to nonprofits through the Higginbotham Community Fund Are you ready to soar? Contact David Fishel | (817) 349-2260 | dfishel@higginbotham.com higginbotham.com See what our agency partners are saying Our Tennessee-based Partners

START YOUR OWN INDEPENDENT AGENCY WITH THE FOUNDATION PROGRAM MEAA IS PROUDLY A MASTER AGENCY OF Reduce your risk while starting your own agency with MEAA’s proprietary program. With MEAA’s staff and resources, this step-by-step program is designed with transitioning exclusive agents in mind. We will teach you the independent business with support from our professional team and direct carrier access. Anderson, Bedford, Bledsoe, Blount, Bradley, Campbell, Cannon, Carter, Chester, Claiborne, Clay, Cocke, Coffee, Crockett, Cumberland, Davidson, Decatur, Dekalb, Dickson, Fayette, Fentress, Franklin, Giles, Grainger, Greene, Grundy, Hamblen, Hamilton, Hancock, Hardeman, Hardin, Hawkins, Haywood, Henderson, Hickman, Jackson, Jefferson, Johnson, Knox, Lauderdale, Lawrence, Lewis, Lincoln, Loudon, Macon, Marion, Marshall, Maury, McMinn, McNairy, Meigs, Monroe, Moore, Morgan, Overton, Perry, Pickett, Polk, Putnam, Rhea, Roane, Rutherford, Scott, Sequatchie, Sevier, Shelby, Smith, Sullivan, Tipton, Trousdale, Unicoi, Union, Van Buren, Warren, Washington, Wayne, White, Williamson, and Wilson MEAA SERVES THE FOLLOWING TN COUNTIES. VISIT OUR WEBSITE FOR A FULL TERRITORY LIST. MOUNTAIN EMPIRE AGENCY ALLIANCE meaa4u.com/insurors 423-560-6077

Company Briefs continued

Stonetrust Workers' Compensation is Rated A-Excellent by AM Best

Stonetrust Workers’ Compensation, a regional monoline workers’ compensation insurance company headquartered in Baton Rouge, is now rated A- Excellent by AM Best. The new financial strength rating reflects Stonetrust Insurance Group’s overall balance sheet strength, which is assessed as very strong, and its risk-adjusted capitalization is listed at the strongest level as measured by AM Best’s Capital Adequacy Ratio (BCAR).

“Stonetrust continues to perform exceptionally well, and we are looking forward to the opportunities created by our new rating.” said President and CEO Mike Dileo. “Our vision is to be the premier or ‘First Choice’ workers’ compensation carrier for all our agents and policyholders and the A- rating will help us reach that goal. This is a tremendously satisfying achievement for our great team.”

With the addition of Alabama and Kansas in 2021, the company is now operating in ten states and is planning to move into Iowa and Georgia in October 2022. Stonetrust credits its growth and new rating to the talented staff they

have assembled and the strong personal relationships that they have built with their agency partners.

Marisue Elias-Newman, Esq.

Marisue Elias-Newman, Esq. was recently elected Chairperson for the National Workers’ Compensation Reinsurance Association (NWCRA) Board of Directors at its 2022 annual meeting. She was elected to the NWCRA board in 2019, is the Assistant Vice President of Regulatory Affairs at Berkshire Hathaway GUARD Insurance Companies, where she oversees the company’s residual market activities, licensing, and governmental relations. She is the past chair and current member of the New Jersey Compensation Rating and Inspection Bureau (NJCRIB), the past chair and current member of the Delaware Compensation Rating Bureau (DCRB), and a member of the North Carolina Workers’ Compensation Bureau (NCRB) Workers’ Compensation Committee. u

43The Tennessee Insuror

2022 JM Wilson TNInsur OUTLINES.indd 1 12/6/21 2:37 PM

The Big "I" held its annual Fall Leadership Conference in Niagara Falls, New York from September 14-18. Insurors of Tennes see traveled several officers and staff to attend another event filled with insightful and beneficial programming from our na tional counterparts.

Insurance and Education Specialist Teresa Durham attended the ‘Education Convo cation’ portion of the Leadership Confer ence and enjoyed learning more about how The National Alliance can be an asset to our associations education offerings. “This conference has really set the bar for the future of education for our associations. The nuance of hybrid classes in this new era allows for endless possibili ties on the education front for our industry,” said Teresa. The Education Convocation attendees were also treated to the famous Made of the Mist boat tour.

Director of Operations, Jake Smith, and Young Agent Direc tor, Matt Felgendreher, joined later in the week to attend the ‘Young Agents Leadership Institute’ where they networked with many of the future leaders of the insurance industry.

The Young Agents Leadership Institute began with an evening

National Security has provided competitive, affordable insurance to policyholders for 75 years. We also provide our agents with competitive commissions, excellent customer service and experienced company adjusters.

As a Southeastern based regional company, National Security prides itself on fast, efficient service from a friendly small town company. Our agent website provides fast quotes, online policy issuance, and real-time policy information. Find out more about our products by calling 1-800798-2294 or visiting nationalsecuritygroup.com

social hour to break the ice before a full day of programming on Fri day. Attendees heard from keynote speaker Lance Allred, the first deaf NBA player, before an afternoon comprised of topics such as agency automation and agency succession and perpetuation. The session fin ished by highlighting the 2022 calen dar of Young Agents programming across the various states that were represented at the conference.

The Young Agents Leadership Insti tute concluded with a breakfast on Saturday where Young Agent state representatives shared their stories of program success within the areas of: Member ship Development, Meetings/Conferences, InVest initiatives, Community Service, and InsurPAC effort.

“Gathering together with other Young Agents provided valuable insight into what our key focus needs to be for our Young Agents program,” said Matt Felgendreher. “We are al ways looking into new and creative ways to boost intent and engagement with our Young Agents across Tennessee, and I feel as though we received some valuable takeaways from our fellow Young Agents across the country.” u

44 The Tennessee Insuror

Insurors Officers and Staff Head North to Learn and Lead - September 14-18 Dwelling Fire • Limited Homeowners • Comprehensive Mobile Homeowners • Vacant Property • Life & Health Elba, Alabama

Celebrating 75 Years Of Providing Competitive, Affordable Insurance. Elba, Alabama

45 Harford Mutual Insurance Group is a Ward’s 50® top-performing property-casualty insurance company for the second consecutive year. 2022 & 2021 We partner with independent agents to insure restaurants, contractors, mercantile, and other commercial entities.

HELP RECRUIT THE NEXT GENERATION

You understand that there are great opportunities in the insurance industry for young people. Help recruit the next generation to MTSU’s nationally ranked Risk Management and Insurance program, the only one of its kind in Tennessee.

Refer students to our degree program in insurance, where they may obtain internships, study abroad, and even work toward professional licensure while in school. MTSU offers a dedicated risk management lab with specialized technology to give every student a head start in their new career. You can make a difference for these students and for your industry as a whole.

Learn more at mtsu.edu/insurance

46 The Tennessee Insuror

0622-0590 / Middle Tennessee State University does not discriminate on the basis of race, color, national origin, sex, or disability. See our full policy at mtsu.edu/iec.

THE BEST-PROTECTED JOB-SITES HAVE HARDHATS, GUARDRAILS, AND BUILDERS MUTUAL.

Dedicated exclusively to construction since 1984, we understand this industry better than anyone else. We will be here for years to come to protect you, your employees, and your business.

47The Tennessee Insuror

Education Calendar

The Insurors of Tennessee offers education opportunities to member agents across a wide range of insurance specialties that satisfy individuals at many different experience levels. If you are looking to further your career, seeking a professional designation, or need to satisfy continuing education requirements, check out the variety of courses available. Additional course options and details of each class can be found online or by contacting Teresa Durham at tdurham@insurors.org or 615.515.2607.

Register for CISR & CIC at www.insurors.org under education. The following is a list of "in person" courses available in Tennessee this year.

CISR

Fee: $186 CE: 7

12/6 CISR Commercial Property Nashville

12/7 CISR Commercial Property Memphis

2/01 CISR Elements of Risk Management Nashville

2/02 CISR Elements of Risk Management Memphis

CIC

Fee: $440 CE: 16

11/9-10 CIC Company Operations Nashville

3/1-2 CIC Agency Management Nashville

4/19-20 CIC Ruble Nashville

Additional courses for designation programs are offered on-demand at your own pace and as live webinars.

The National Alliance for Insurance Education & Research is registered with the National Association of State Boards of Accountancy (NASBA) as a sponsor of continuing professional education on the National Registry of CPE Sponsors. State boards of accountancy have final authority on the acceptance of individual courses for CPE credit. Complaints regarding registered sponsors may be addressed to the National Registry of CPE Sponsors, 150 Fourth Avenue North, Suite 700, Nashville, TN, 37219-2417. Website: www.nasba.org. Advanced Curriculum Rating = 20 CPE Credits. For more information regarding administrative policies such as complaint and refund, please contact our offices at 800-633-2165.

Additional Courses

Additional courses are available On-Demand and as Live webinars at the IIABA Virtual University *check the VU site for course offerings, CE and pricing (independentagent.com/vu)

From The National Alliance (www.scic.com)

Choose from the following programs CIC, CRM, CISR, CPRM, CSRM, Dynamics, RGS, MEGA, PROFOCUS, WTH, Intro, Producer School, Ethics, Flood and other. Choose by topic, location, delivery method and/or date.

From The Institutes (ceu.com/customer/insurors-tn )

Insurors of Tennessee has partnered with CEU, powered by The Institutes, to provide you with relevant and conve nient online insurance continuing education (CE) courses. Through our partnership with CEU, you will enjoy a 35% dis count on any of CEU’s relevant, practical courses when you log in. More than 150 course topics

ABEN Webcasts (insurors.aben.tv)

To the right is a partial listing of upcoming webcasts.

ABEN Webcasts (insurors.aben.tv)

Active Shooter/Workplace Violence Ins. CE: 2 $48

11/1 11/28 12/6 12/22

Contracts Agents Should Read CE :2 $48 11/1 11/28 12/6 12/22

Flood Program Overview - NFIP Then/Now CE: 3 $72 11/1 11/28 12/6 12/22

E&O - Roadmap to Pers. Auto & Umbrella Ins. - #1 CE: 3 $72 11/2 11/14 12/7 12/12

E&O - Roadmap to Pers. Auto & Umbrella Ins. - #2 CE: 3 $72 11/2 11/14 12/7 12/12

E&O - Commercial Property Coverage Gaps - #1 CE: 3 $72 11/3 11/18 12/1 12/16

E&O - Commercial Property Coverage Gaps - #2 CE: 3 $72 11/3 11/18 12/1 12/16

E&O - Roadmap to Homeowners Ins. - #1 CE: 3 $72 11/4 11/21 12/2 12/19

E&O - Roadmap to Homeowners Ins. - #2 CE: 3 $72 11/4 11/21 12/2 12/19

E&O - Homeowners Endors. & Personal IM - #1 CE: 3 $72 11/7 11/17 12/5 12/15