Experiential AI for Finance Leaders

April 5, 2023

Usama Fayyad, Executive Director, Institute for Experiential AI

Usama Fayyad, Executive Director, Institute for Experiential AI

(EAI) at Northeastern University

Professor of the Practice, Khoury College for Computer Sciences, Northeastern University

Large Orgs

Goal: Make AI and Data usable, useful, manageable - democratize the responsible use of AI across fields

Education

Startups

● Ph.D. Computer Science & Engineering (CSE) in AI/Machine Learning

● MSE (CSE), M.Sc. (Mathematics)

● BSE (EE), BSE (Computer Engin)

● Fellow: Association for the Advancement of Artificial Intelligence (AAAI) and Association for Computing Machinery (ACM)

● Over 100 technical articles on data mining, data science, AI/ML, and databases.

● Over 20 patents, 2 technical books.

● Chaired major conference in Data Science, KDD, AI.

● Founding Editor-in-Chief on two key journals in Data Science.

|

3

Major Themes in this Talk

Making AI work correctly is one of the grand challenges facing us today.

Digitization has taken hold and has been greatly accelerated with the pandemic

AI is believed to be the next frontier in accelerating knowledge worker productivity – Yet it has been a great and difficult challenge for most companies

• Machine learning is the dominant part of any working AI (including Generative AI)

• ML has a huge dependency on Data

|

4

The Lost Themes: Data and the Human-in-the-Loop

being so essential, most organizations struggle with the basics of making

The “AI-haves” understand this and they have systems to: Capture every bit of data + context

Capitalize on and capture every human intervention to guide AI

○ The ability to leverage this data through Machine Learning (ML) to automate the determination of the right action in the proper context

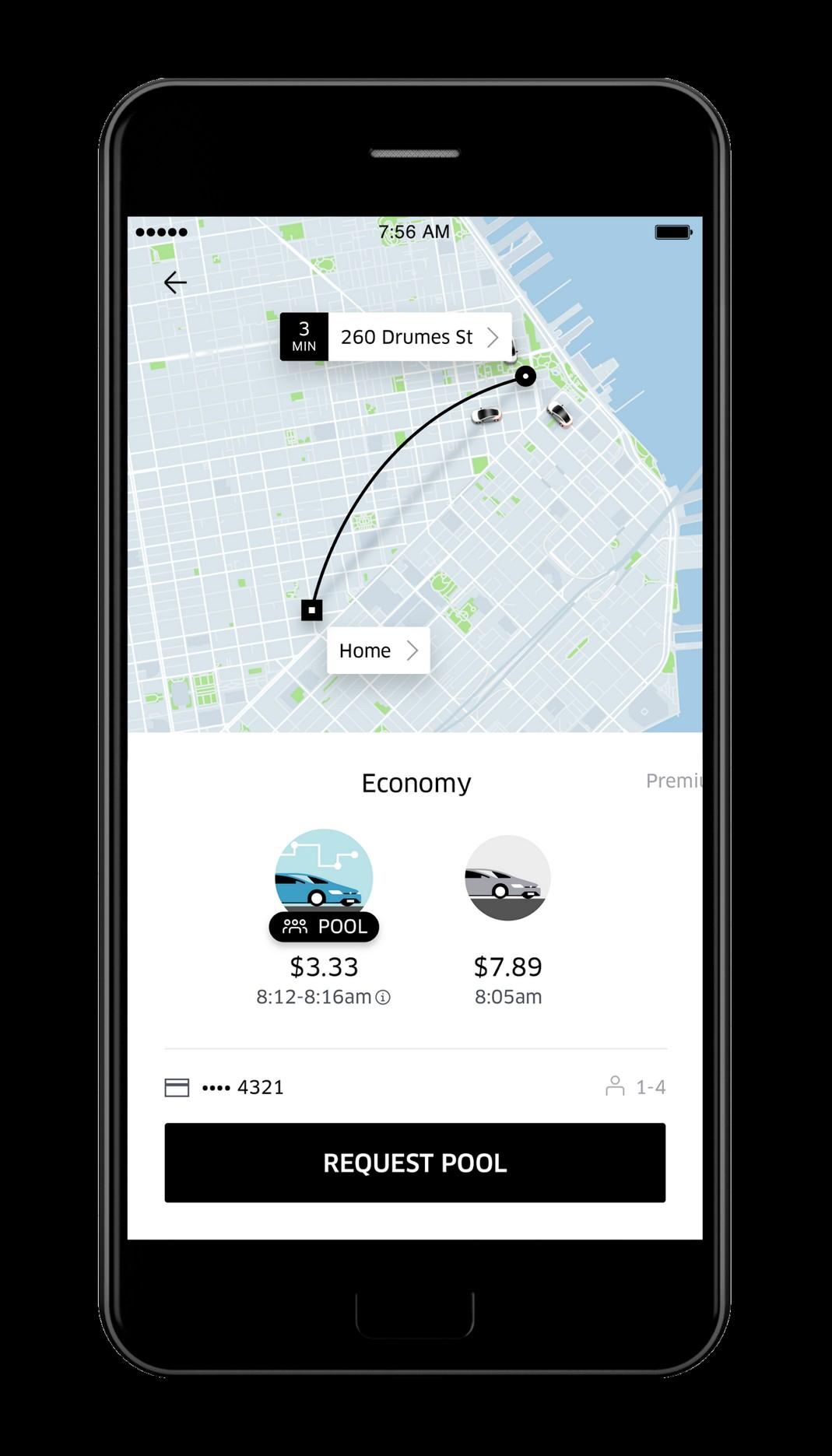

Human intervention is the most valuable asset for Google, Open AI, Amazon, Tesla, and all companies that make AI work

What about the human-in-the-loop?

|

5

What is Experiential AI?

Human-centric approaches to solve real problems in real contexts with a human in the loop emphasis to determine how AI can work with humans most

Human intervention is a must

Human intervention is a great opportunity for knowledge capture & ML

We believe taking an applied approach is the best way to solve problems both scientifically and in practice. By doing so, we can leverage data in a way that amplifies the values and benefits of machine learning. We create mechanisms for machines and humans to learn together, creating actions and decision that neither can achieve alone .

|

Is There a Human in the Loop (HITL) in ChatGPT?

Much speculation about pure AI (AGI) or much human intervention?

• Strong evidence that human editorial review is applied

• Some questions are answered by humans

• Generally, this is a good sign in our opinion

• Does raise issues about “intelligence” and “reasoning”

• This is a best practice – we call it

Experiential AI – many do it:

• Google MLR

• Amazon recommendations

• Many intervention-based relevance feedback

https://mindmatters.ai/2023/01/found-chatgpts-humans-in-the-loop/

|

7

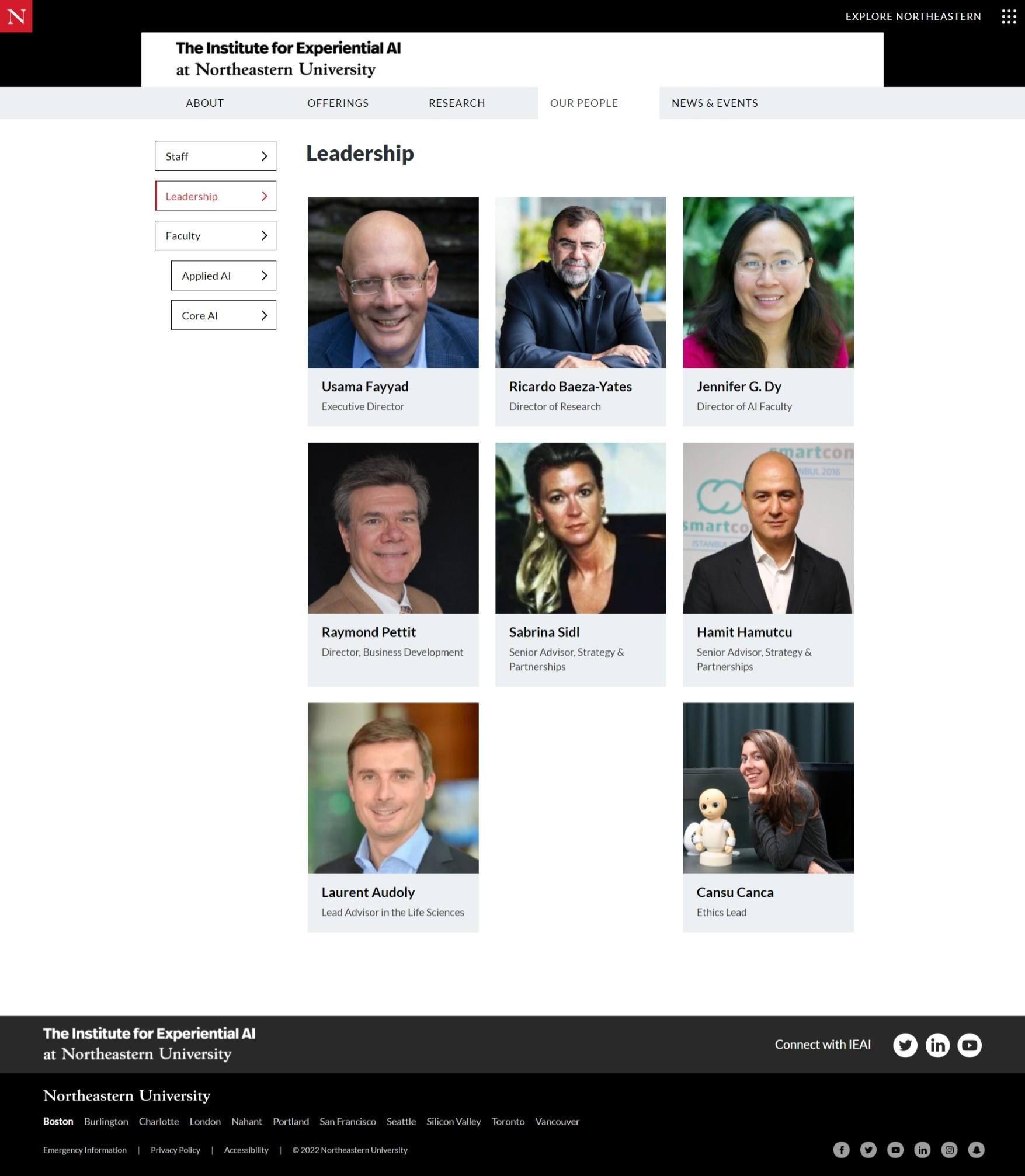

A Few Words on the Institute for EAI @ Northeastern

Academic Tenure Track:

64 Core Faculty members

31+ Affiliate Members

Covering all 9 colleges at Northeastern, and at least 4 of the 11 campuses

Research Faculty & Scientists:

12 Research Scientists/Faculty (growing to 80+ target)

30+ Postdocs

Advancing the state-of-theart in EAI in context of solving real-world problems

AI Solutions Hub: Staff of professionals for projects delivery

Responsible AI Practice: Staff of professionals and faculty/researchers

ACADEMIC LEADERSHIP TEAM

|

Dr. Sam Scarpino Director, AI + Life

Dr. Eugene Tunik Director, AI +

8

Dr. Cansu Canca Ethics Lead

Digital Transformation - Financial Services Example

● Financial Services has been undergoing major digital transformations for the last 7 decades

● FinTech is a term that represents the super-accelerated tech transformation of the last 2 decades

● AI has gotten a lot of attention in recent FinTech efforts

Simple Example of dramatic transformation in traditional finance: Accounting

○ Think about Accounting of 60 years ago vs today

○ Excel completely replaced many old jobs and “technologies” (like Index cards) but created many more higher value jobs

○ Production chain, supply chain, and inventory management has been completely changed

|

9

Digital Transformation - Data & AI Are Core for Success

Failure to Survive Excelling with Data

Incentive-based solution lead to:

● Kodak had a business built on intimate customer relationships

○ Customer goes to store to purchase film

○ Returns to drop off film

○ Returns again for prints

The shift to digital technology eliminated this ecosystem

Kodak invented the digital camera - but was too late to release their own

2012 Bankruptcy

@ 124 years old

Losses double as digital transformation remains at the "thoughtful" stage 2015-2019

competitors embraced on-line and invested in it

2019: revenues drop 5.6%

COVID-19 forced the resolution

2020 Bankruptcy

@ 118 years old

40% reduced cost in hospital admissions

14% cost reduction per patient

25% reduction in hospital stays

Vitality integrates with over 100 wearable technologies

Discovery launched its car insurance product (Similar to Drive Safe and Save) in 2011

$4.7M medical cost savings

Customer interactions data allowed increase its customer retention by 87%

> 80,000 big data experiments a year

> 70% prediction accuracy

83% cost reduction of customer acquisition in 2 years

By 2012 - DBS was considered a failing bank. Start Digital Transformation in 2013

By 2017, application costs reduced by over 80%

Record net profit of SGD $4.39B income up > 4% over last year

9% CAGR in income and 13 % in net profit

> 10,000 training sessions by DBS Academy yearly

-

AI Enablement top priority now

|

“I think it’s a bit of a fool’s errand… to chase digital for the sake of cost reduction”

Richard Fairbank, CEO

10

Example - From Traditional Banks to Digital Banks

Data is the key to restoring the lost customer intimacy in the digital interactions era

100 years ago

Front office was intimate

● Direct interactions

● Personal knowledge - Staff knows all that is happening with client and family

● Personalized service automatic

Back office was simple

● Easy to understand risk

● Easy to score and set limits by intuition

● KYC trivially easy and natural

● Controls straightforward

Now

Front office has no knowledge or intimacy

● More complex product line

● Data silos and high latencies

● No unified view and understanding of the customer

● Personalization a challenge

Back office is overly complex/manual

● Difficult to scale because tech did not evolve

● Risk and Finance expensive hard to manage because the data is a mess and hard to access

● Controls a challenge

|

11

JPMorgan Chase in Today’s Headlines

Jamie Dimon's annual Shareholder Letter for 2023

"Artificial intelligence (AI) is an extraordinary and groundbreaking technology. AI and the raw material that feeds it, data, will be critical to our company’s future success — the importance of implementing new technologies simply cannot be overstated. We already have more than 300 AI use cases in production today for risk, prospecting, marketing, customer experience and fraud prevention, and AI runs throughout our payments processing and money movement systems across the globe. "

|

12

—Jamie Dimon, CEO of JPMorgan Chase

"Data" was the #1 most used word in the letter27 times. JPMorgan has identified 300 use cases for AI that are already in practice at Chase.

Examples of AI in Financial Services

Credit & Risk

● Underwriting & pricing model optimization

● Dynamic credit limits

● Use of 3rd-party and unstructured data

● Risk modeling and scenario analysis

Customer Service & Personalization

● Dynamic customer profiling, segmentation

● Personalized content, product/service recommendations

● Intelligent call routing and service intervention

● Agent support, Chatbot service augmentation

Fraud Detection & Prevention

● Credit Card Fraud

● Insurance claims fraud

● Money laundering

AI & Trading

● Data analysis and trading support

● Portfolio optimization

● Modeling and scenario analysis

Back office & Process

Automation

● Data extraction

● Document capture

● Document review

Responsible AI

● Ethics governance & training

● Bias audit

| ai.northeastern.edu 13

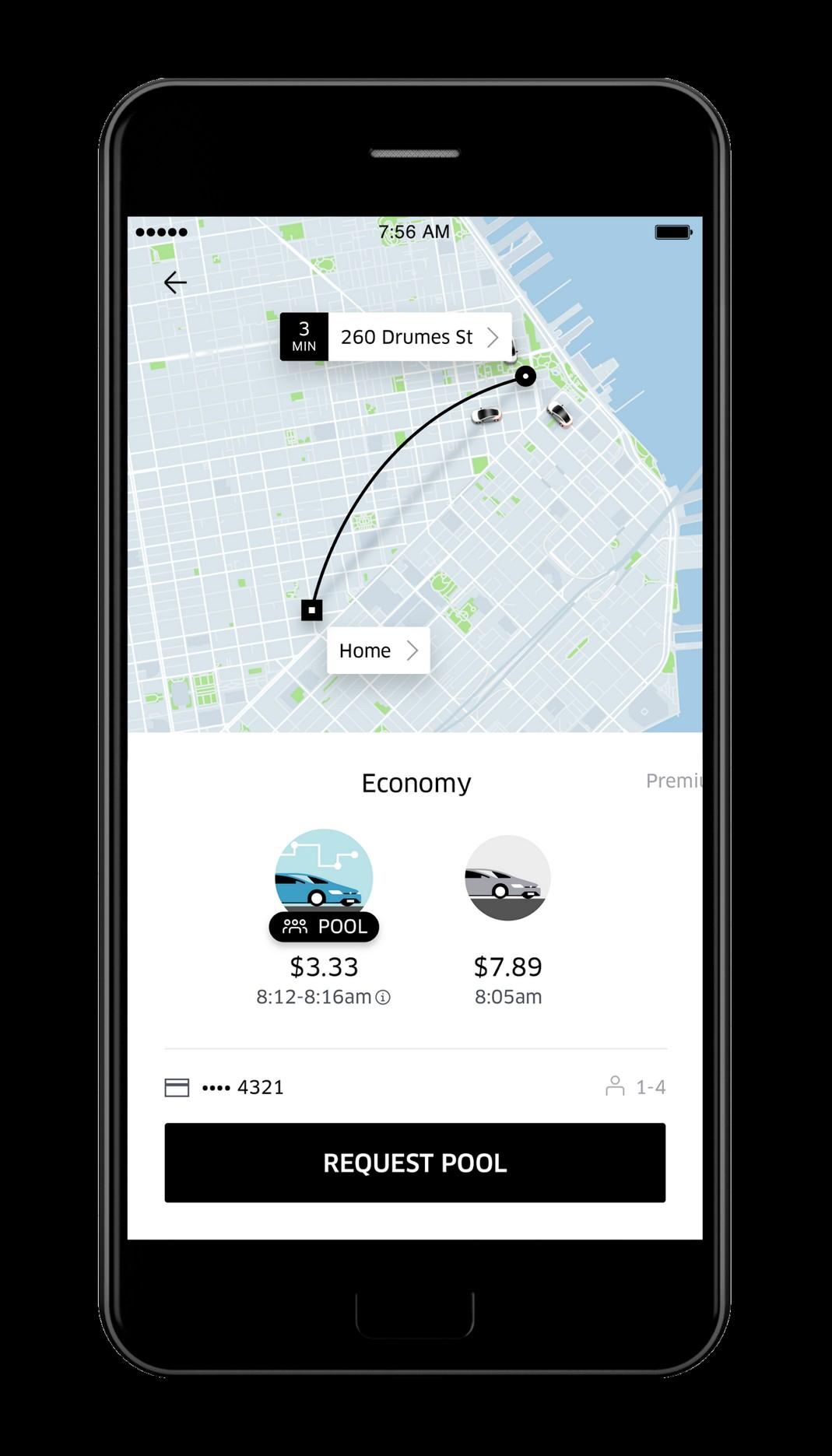

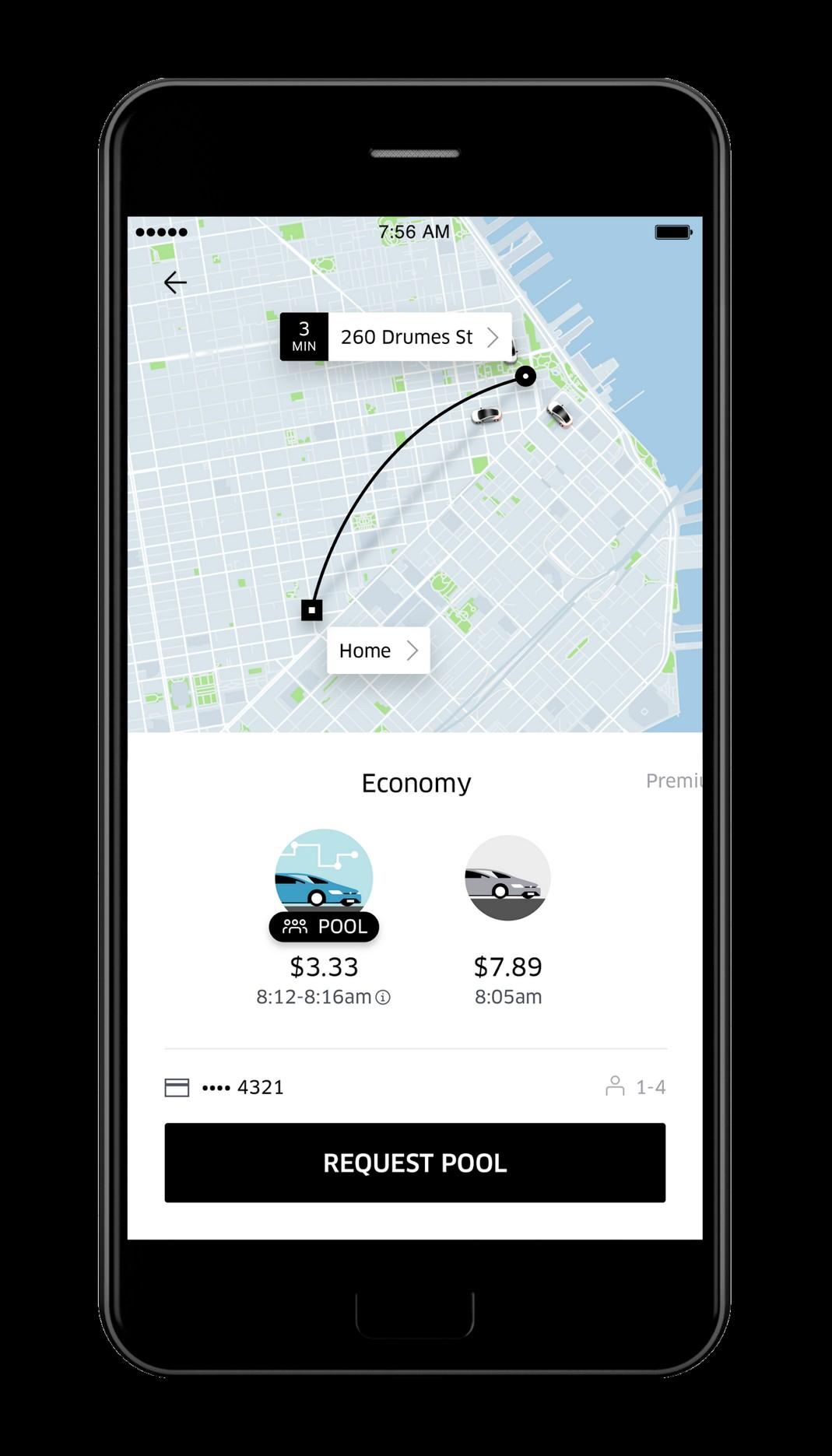

Much of finance digitization has focused on workflows, but little advance on customer experience and interactions

Need to inject some of the human intelligence/ understanding in customer interactions to achieve the right customer experience

● Understanding customer context

● Understanding intent, challenges, and issues

● Reduce costs of customer service operations (chatbots, problem understanding, problem resolution)

● Next-best-action, X-sell, up-sell, reactivation, etc… at scale

Still expensive and complex and needs intelligent automation

● Compliance

● Financial Crime

● “Operations” – e.g. forms into actions

• Market data operations

• Modelling micro and macro trends based on document injection - news, reports, analysts

• Market research and report generation and updates

|

AI and FinTech: Why?

“Front Office” “Back Office” “Investment Banking”

14

Fintech will Create Many Novel Use Cases

This is a redefinition of how we think about financial services

digital money – eCash, wallets, cryptocurrency redefining how FS fits into the new digital economy – a huge opportunities to redefine

contracting, tracking, and settlements

Accounting/bookkeeping: totally redefined and friction removed via integration with interactions

● Insurance re-invented: micro-transactions, risk reduction via IoT, buy-by-the-cup, etc…

● Instant everywhere: latency will disappear, instant becomes the standard

o Exactly what happened with email versus post (snail mail), chat versus calls, etc…

o New era for micro-contracts and transactions

● Refactoring of banking: micro-services, banking-as-a-service, micro-payments, smart subledgers, etc.

Most use cases will be ones we have not yet imagined

|

15

A refactoring of how we think of financial services “actions”

Refactoring of Banking/FS as we have known it traditionally: Break down traditional services into micro-services, and enabling injecting them into transactions

New payment mechanisms, especially micro-payments

● Financial Advisory: Democratizing access and engagement to all consumers

o Complexity of products and options bewildering consumers and overwhelming advisors

o Much of advisory is about collecting template for context - self-serve is more efficient and more convenient for consumers

● Modeling risk and future scenarios better-suited for algorithms – as long as algos are fair/responsible AI

o New ways of scoring risk, credit, and needs

o Leveraging all the information available publicly – e.g. LinkedIn and many other networks

o Better understanding of behavioral data

|

AI and FinTech: Why

16

FinTech: Why is AI necessary?

Scale is a must – human processing is not scalable or feasible

● AI algorithms for “understanding” – of context and customer

o Leverage human judgement in delivery to build the right training data sets and KB

o Need to make sure AI algos are subject to Responsible AI criteria (often overlooked)

● Complexity of products requires “reasoning”: Still a big challenge in AI

New capabilities tech/network require automation

● Novel risk and credit scoring opportunities

● Integration into microservices

● Leverage networks (e.g. social, economic, commerce networks) and other viral services

|

17

FinTech: Some of the Big Challenges for AI

Fairness and bias in algorithms can have big consequences

Financial decisions are much more consequential than e.g. targeting ads

Algorithms have little commonsense reasoning (or any reasoning) – typically all they know is data (with

Modeling complex decisions and consequences is still a hard problem

Advances in tech and data enable potentially deep intrusion on privacy and civil rights

Successful AI is heavily dependent on ML/Data Science, hence need good training data: Data remains a huge challenge for most organizations

● Good training data is extremely expensive to get, reliable labelling even more expensive

● Just collecting and managing raw data is a challenge for most, growing exponentially with digitization, cloud, and IOT

● Data manipulation is very difficult, few understand unstructured data

|

18

Sample Case Studies in Finance

At 3 Financial Services Institutions

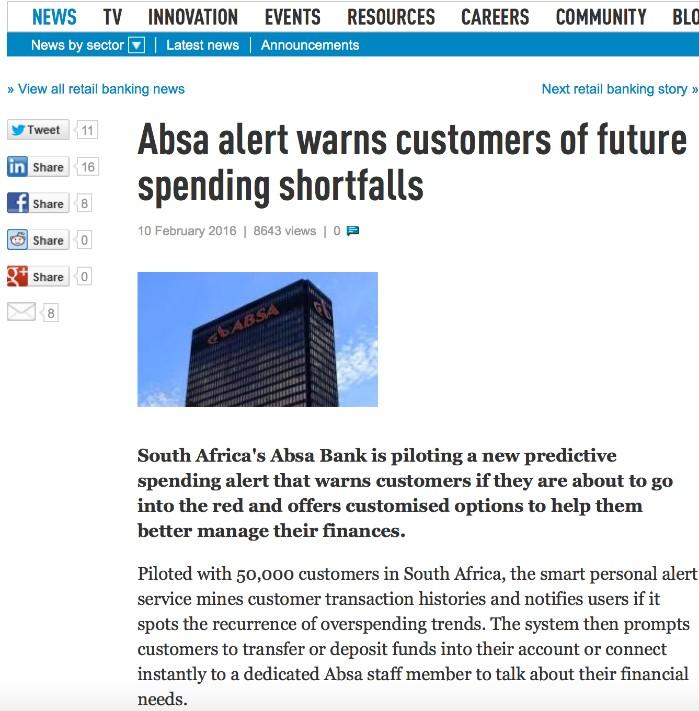

Real time Decisioning Helping Customers Avoid Overdraft Fees

Barclays Africa Retail Banking

• Help customers avoid overdraft charges

• Allow customers to react in time to prevent overdraft

• Based on historical interactions, we PREDICT likelihood of overdraft

•

Real-time SMS sent to customer to notify of impending event

Results?

• 60% response rate

• 80% favorability rating by customers as part of initial 50K user pilot

• Launched at mass end Feb 2016

• 60% revenue uplift

See: http://bit.ly/1VbpaZD for press coverage

|

20

Digital Adoption and Personalization

Influencing Customers to Move to Digital Channel

10X increase in Mobile App Usage

10% increase in # Transactions on Digital

Engagement: 1 in 2 more likely to use digital

Credit Limit Increase Personalization

● Uptake: 2X increase

● Connection: 30% increase via voice

● Value: 10% average increase in CLI offered

|

21

Customer Experience and Operational Efficiency through 24*7 Conversational AI

1. Onboarding

• Monitor each step of the online journey

• Bot assist if user is unable to move forward

2. Coverage selection

• Bots provide dynamic questions to assist the customer with appropriate coverage selection

3. Activation

• Bot personalizes the premium based on the declared details with add on rider suggestion

4. Claim Processing

• Bots guides customer through claims journey for faster processing

5. Renewal Set-up

• Bots sets up direct debit

6. Reminder

• Bots optimizes reminder service and prompts

7. Advice

• Bots advices customers on products and customize based on needs communicated

Benefits Delivered

8. Prompts for additional needs

• Bots prompts customers additional products they may need based on product holding and behaviour changes

|

Reduction in call volume by 5% 22

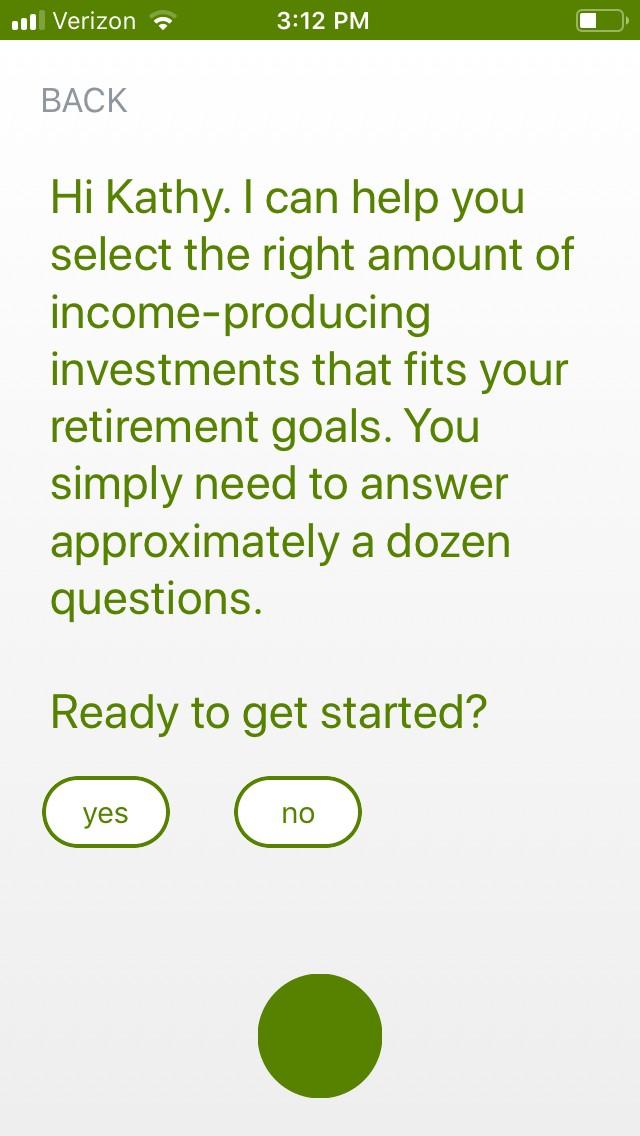

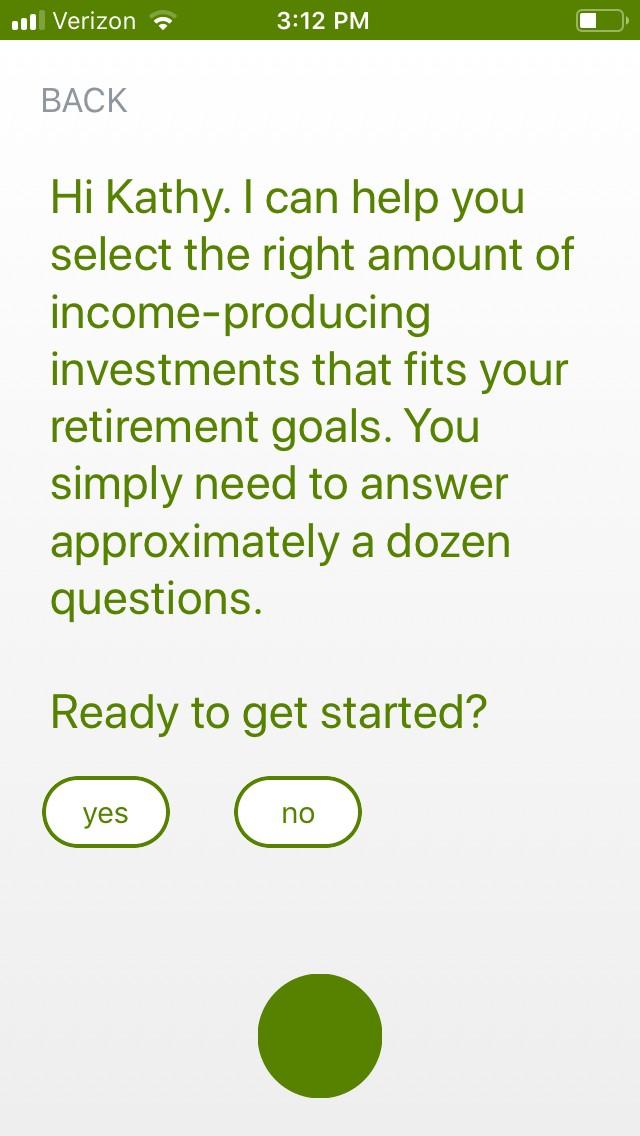

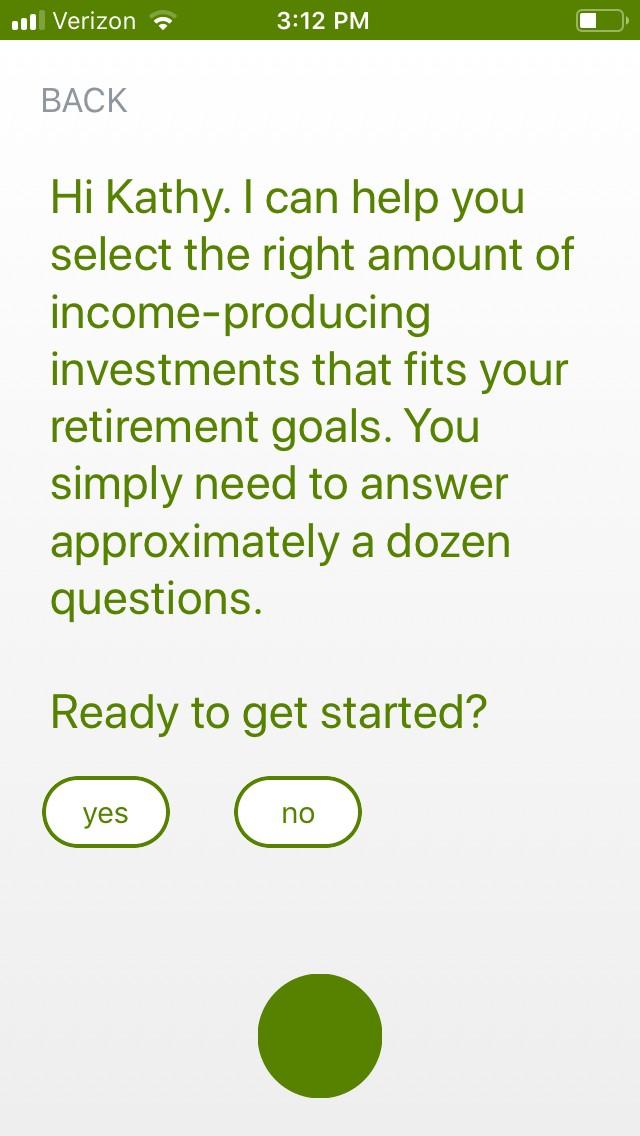

Annuities Proof of Concept

Problem Statement: Advisors are spending 20+ minutes collecting information from clients interested in an annuity and manually inputting that information into a web-based tool to generate a single recommendation.

Can we leverage conversational AI platform to create a conversational experience that

● reduces the time advisors were spending manually collecting and inputting the fields

● annuity match recommendation.

|

Project work done with Abe.AI technical

23

team

Annuities Proof of Concept

Solution: Create a conversational experience that empowered clients to self-serve by providing the information necessary to generate an annuity recommendation. The solution let the user to choose between voice, chat, and buttons.

• Duration: 5 weeks

• Cost: <$200K

• Reduced the time it took for an advisor to generate a recommendation with clients from 20+ minutes to 5 minutes.

• Estimated $5M of productivity gains of advisor workforce annually.

|

24

Project work done with Abe.AI technical team

Why is this Chatbot Different?

PERSONALIZED UNDERSTANDING

Utilize personal data to make better predictions in real-time.

STATES & MODES TO COLLECT

Allow the AI to enter into gather mode to collect data from customers.

NON-LINEAR CONVERSATIONS

Easily handle requests that are seemingly out of the current context.

Use contextual references like “that” to create a natural conversation.

SHORTMEMORY & CONTEXT

Project work done

technical

25

with Abe.AI

team

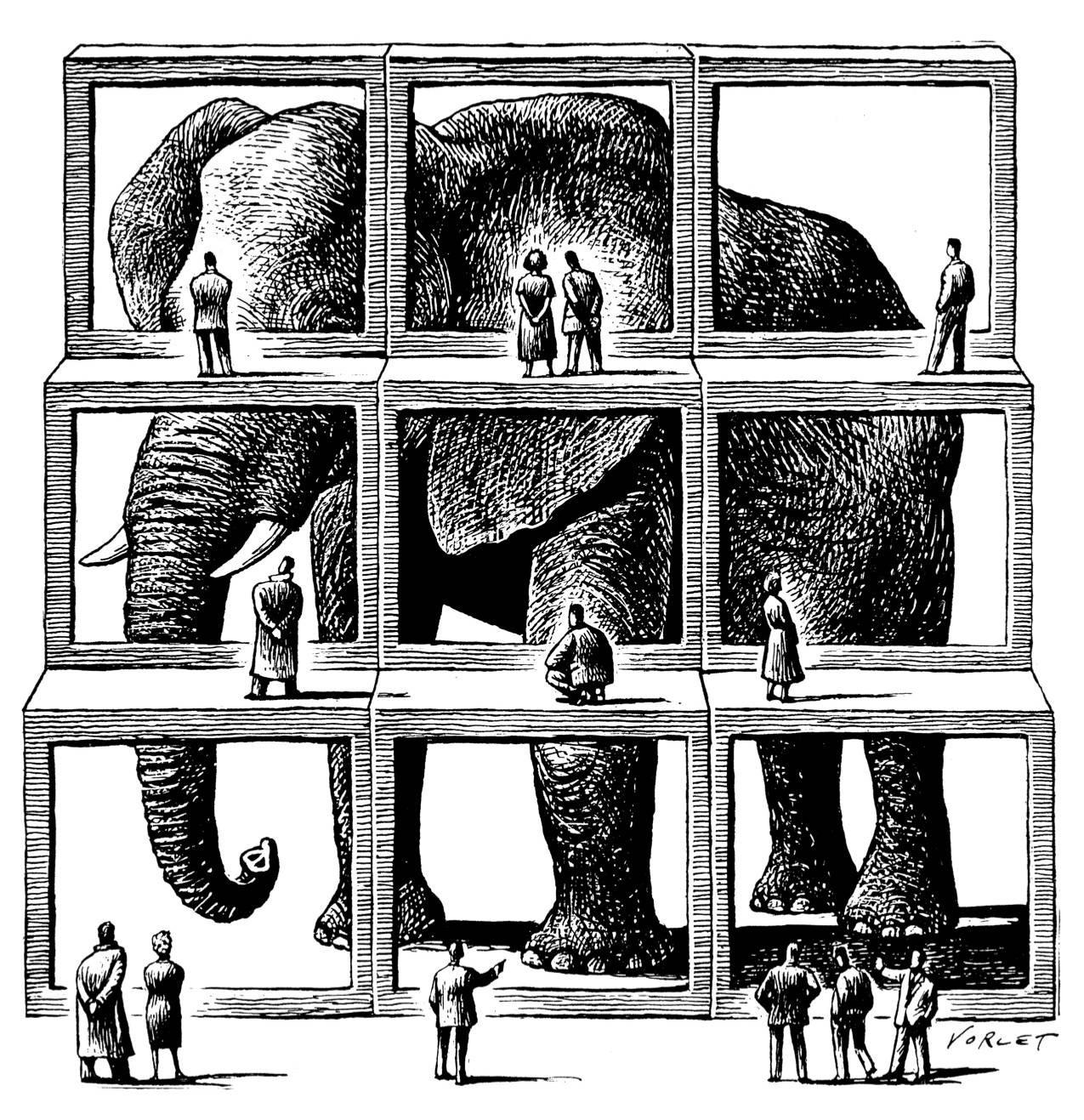

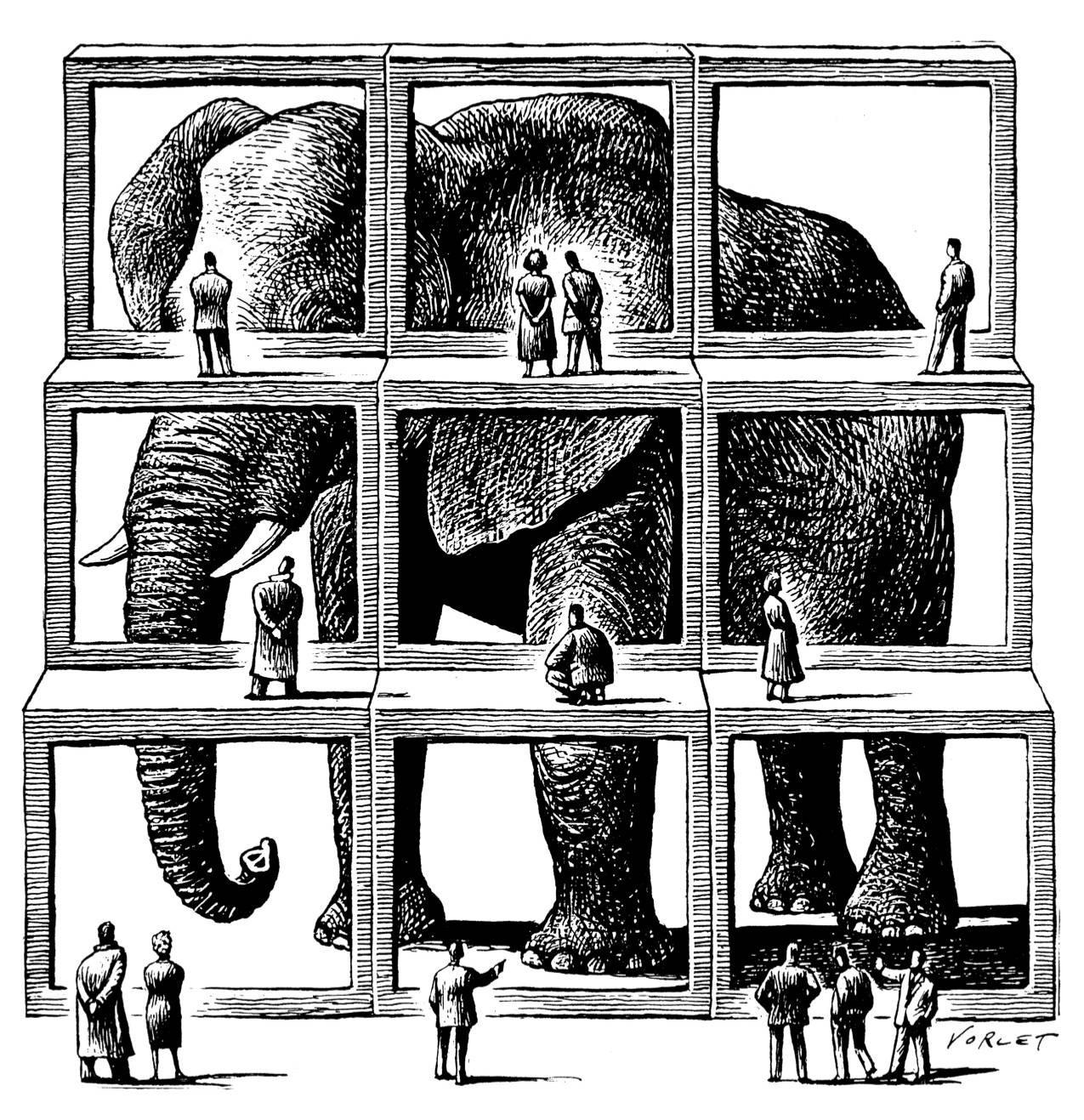

Final Thoughts - Can You See the Big Picture?

Do you have a unified view of your customers? (customer360, product360, etc…)

Do you have the context of your customer interactions?

Can you provide data-driven personalized offers/content?

Is data access democratized, secure, enabling easy analytics?

Can your data enable intelligence in your digital channels?

|

26

Improving the Customer Experience with AI

D’Amore-McKim School of Business Northeastern University

Professor Yakov Bart

Professor Yakov Bart

Yakov Bart

Core Faculty Member, Institute for Experiential AI (EAI)

Associate Professor of Marketing and Thomas E. Moore Faculty Fellow, D’Amore-McKim School of Business

Co-Founder and Faculty Director of DATA Initiative at Northeastern

Teaching and Research:

Education:

|

28

Improving the Customer Experience with AI

By leveraging AI technologies, financial institutions can create more engaging, customized experiences for their customers, leading to increased satisfaction and loyalty

|

29

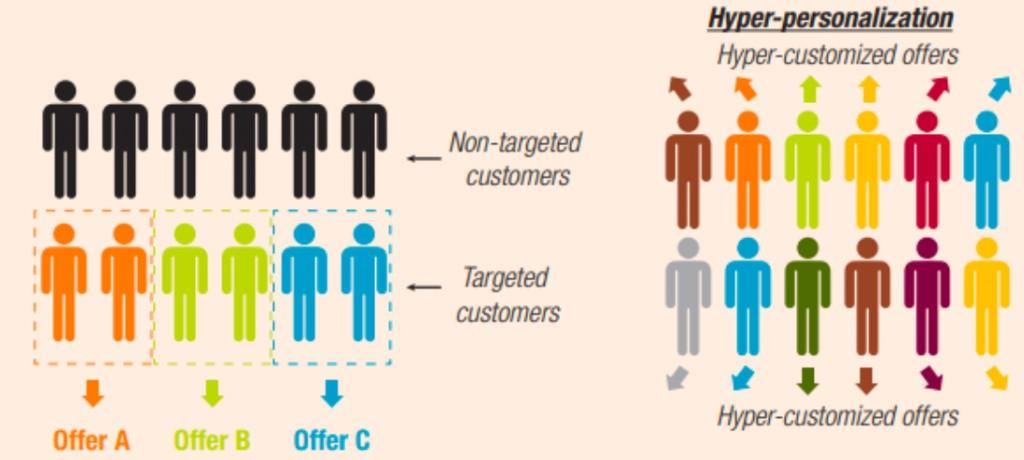

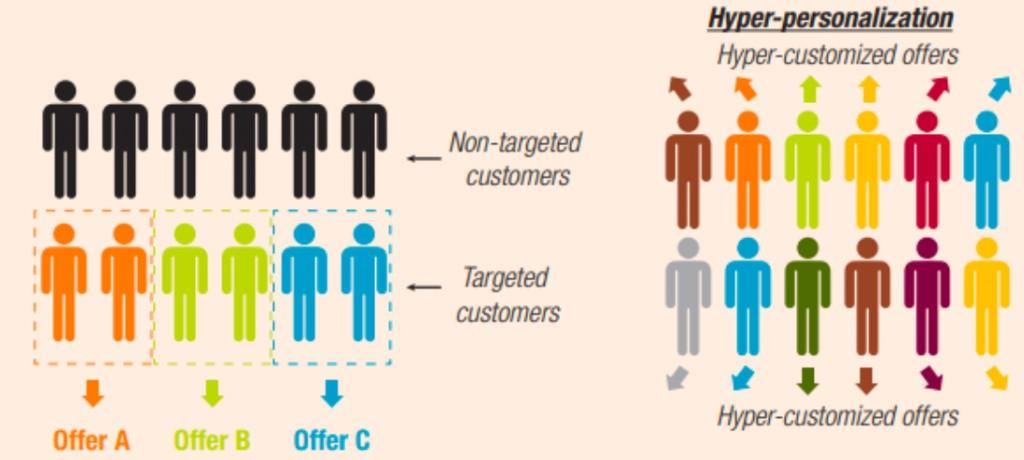

Personalized Customer Experiences and Communications

Companies can gain a competitive edge by harnessing extensive customer data to revolutionize and customize user experiences

From the early days of one-to-one marketing before the internet to the contemporary digitalera customer journey, personalized customer experiences have emerged as the source of sustainable competitive advantage

● Personalization has evolved beyond simply addressing customers correctly in marketing communications, having comprehensive information available during customer service calls, or customizing web landing pages with relevant offers for each customer

● Today, it serves as the design objective for every physical and virtual interaction point, with AI playing an increasingly vital role in powering these personalized experiences

|

30

Hyper Personalization

|

31

Wells Fargo: Predictive Banking for a Personalized Experience

● Wells Fargo offers an AI-powered predictive analytics tool in its mobile banking app

● The bank claims its customers can use this tool to see an analysis of their spending habits and receive recommendations on how to save money based on those habits

● It could flag higher-than-normal automatic monthly payments or remind customers to transfer money between accounts to avoid an overdraft fee, for example.

● There are over 50 different prompts a consumer can receive based on past and expected future account activity

| 32

Customized Offers: JPMorgan and Persado

. is adopting artificial intelligence that’s meant to improve what the financial-services firm says in its marketing messages, such as email pitches to prospective borrowers

In tests, JPMorgan Chase found that Persado’s machine-learning tool crafted better ad copy than its own writers could muster, as measured by the higher click rates—more than double in some case—on digital ads for Chase cards and mortgages.

In one such matchup, an ad written by a human read, “Access cash from the equity in your home.” The more successful version, from Persado, read, “It’s true—You can unlock cash from the equity in your home.”

|

33

Agent Support and Service Augmentations

By leveraging AI technologies, financial service providers can enhance the capabilities of their customer service agents, improve overall operational efficiency, and deliver a more personalized and satisfying experience for their customers, for example:

Sentiment Analysis

By analyzing customer interactions and detecting emotions, AI can help agents understand the customer's mood and attitude. This allows agents to tailor their responses, improve communication, and ultimately enhance the customer experience.

Intelligent Call Routing

AI can analyze customer inquiries and route them to the most suitable agents based on their skills, expertise, and availability. This ensures that customers are connected with the right agents to address their specific concerns, resulting in faster resolution times and increased customer satisfaction

Real Time Transcription & Analysis

AI can transcribe and analyze ongoing customer interactions, providing agents with relevant information, potential solutions, and possible upselling opportunities. This can improve the efficiency of agents and lead to a more personalized customer experience.

AI Powered Chatbots

AI-powered chatbots: AI-driven chatbots can handle routine inquiries, freeing up human agents to focus on more complex issues that require human empathy and judgment. Chatbots can also be used as virtual assistants for agents, providing real-time information and guidance to help them better serve customers.

|

34

Wells Fargo’s Virtual Assistant, “Fargo”

|

35

Customized Investment Advice

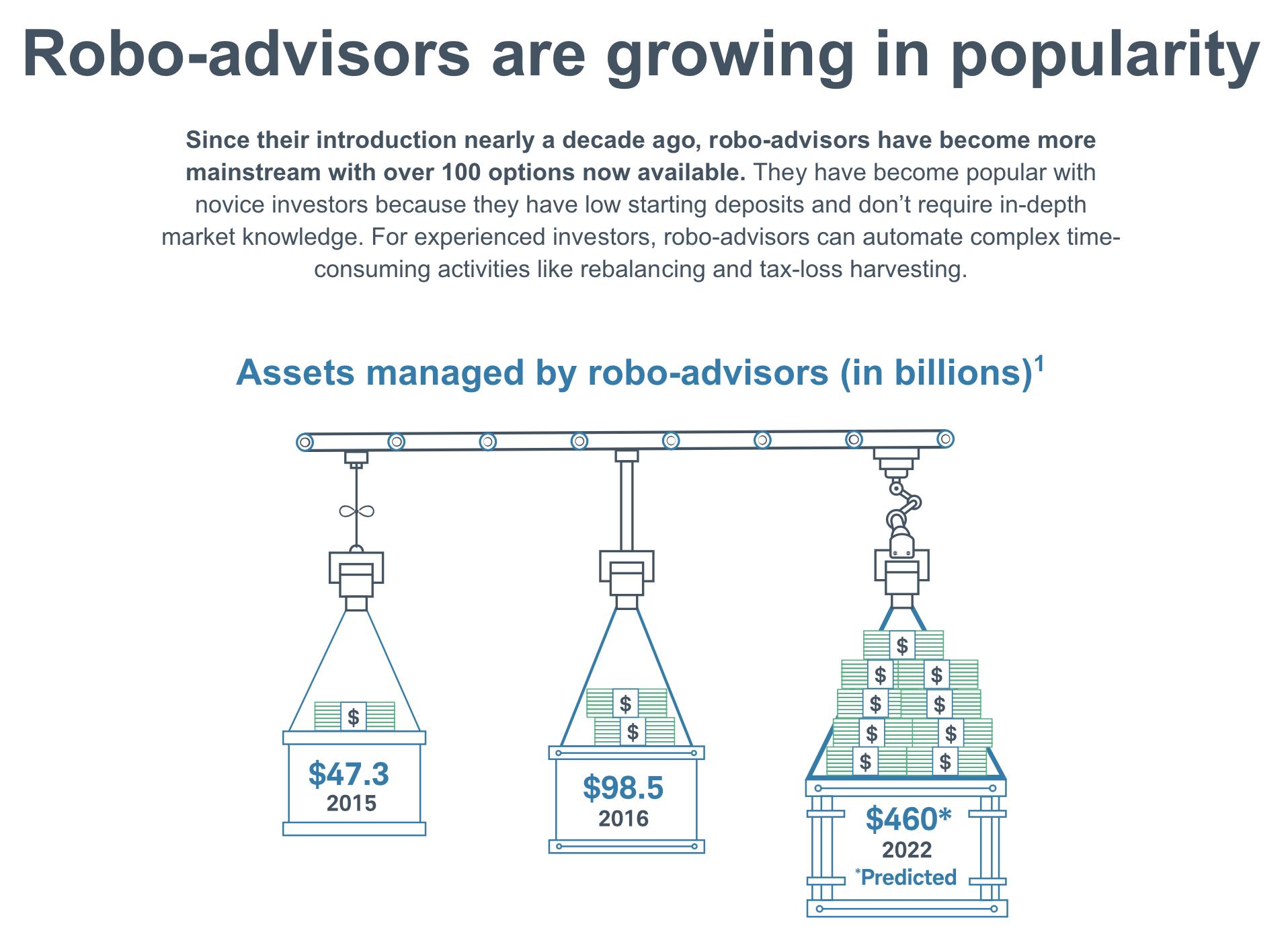

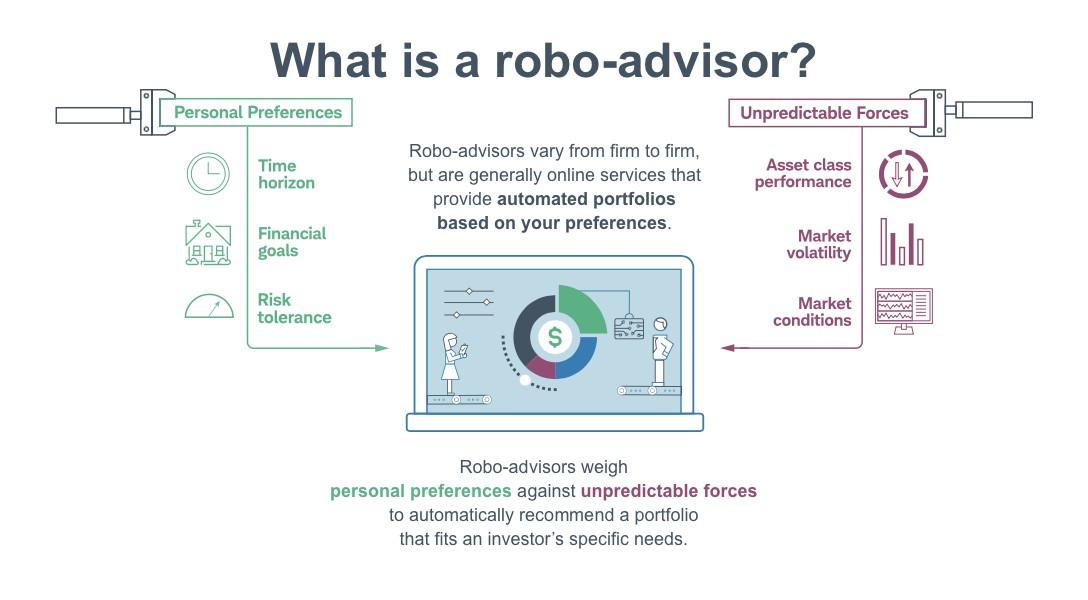

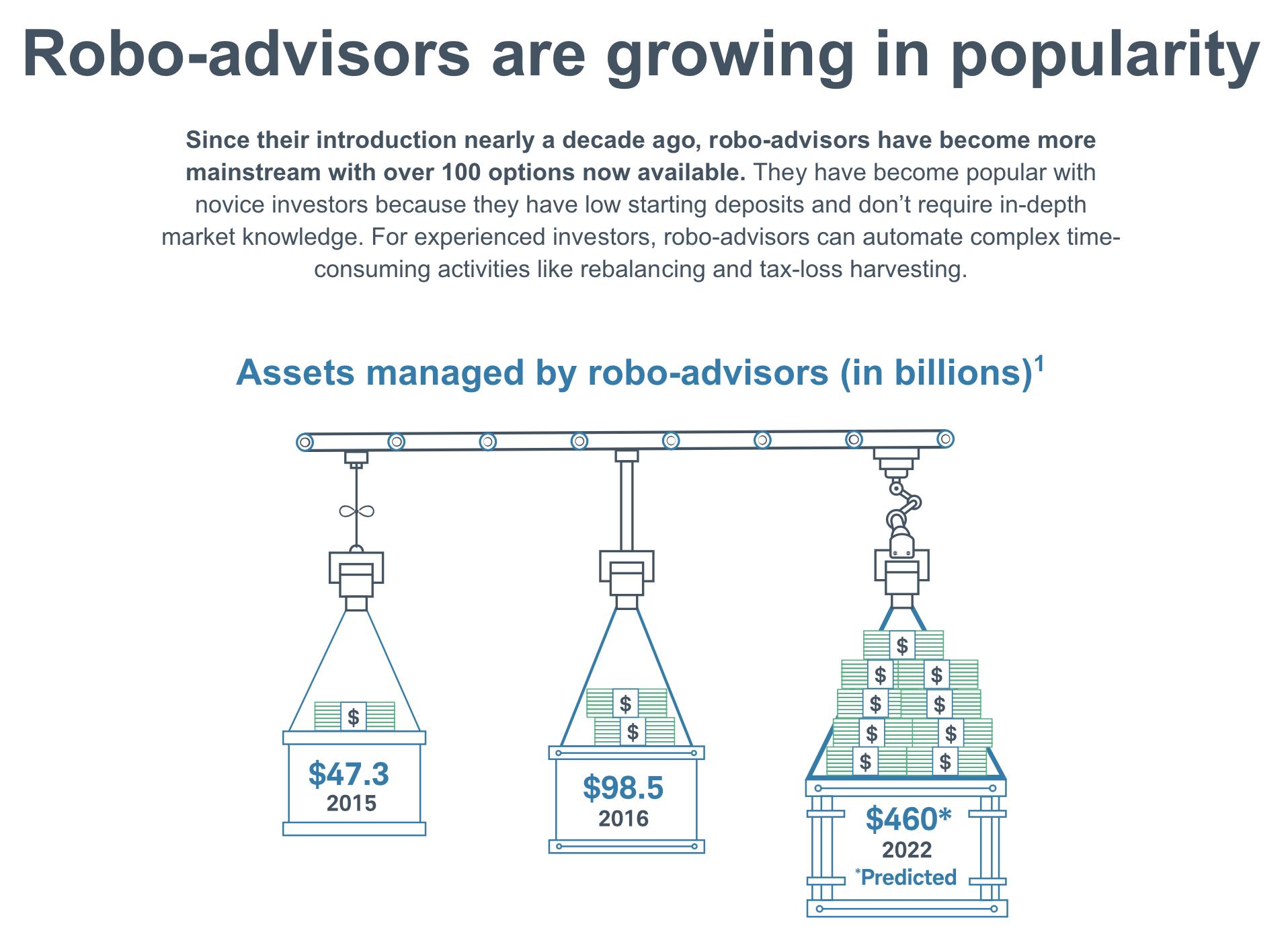

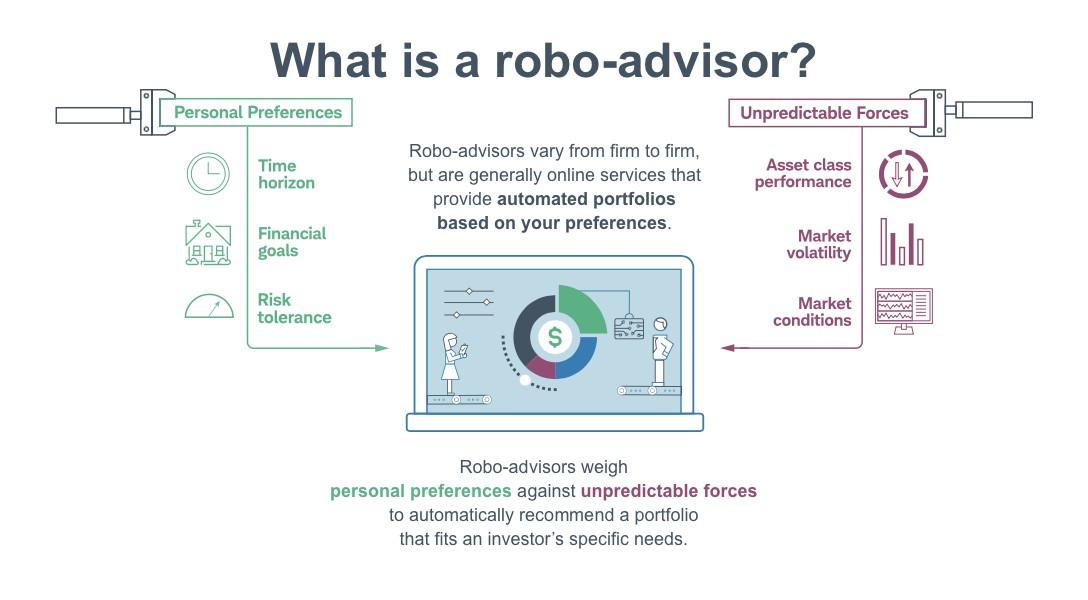

AI-driven robo-advisors offer personalized investment advice by analyzing customers' financial goals, risk tolerance, and investment horizons They can create customized portfolios and provide ongoing portfolio management to optimize investment returns based on individual preferences

|

36

Robo-Advisors are Growing in Popularity

https://www.schwab.com/automated-investing/what-is-a-robo-advisor

| 37

What is a Robo-Advisor?

| 38

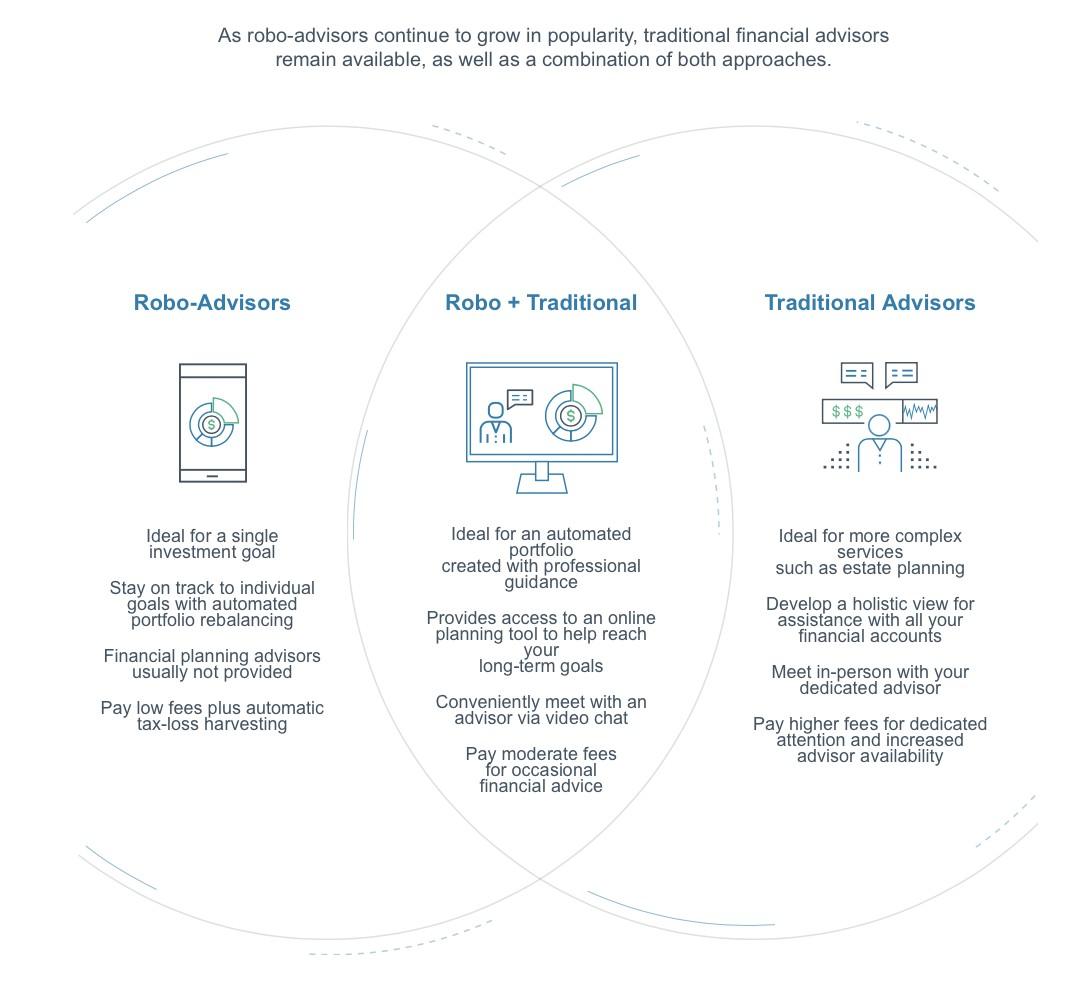

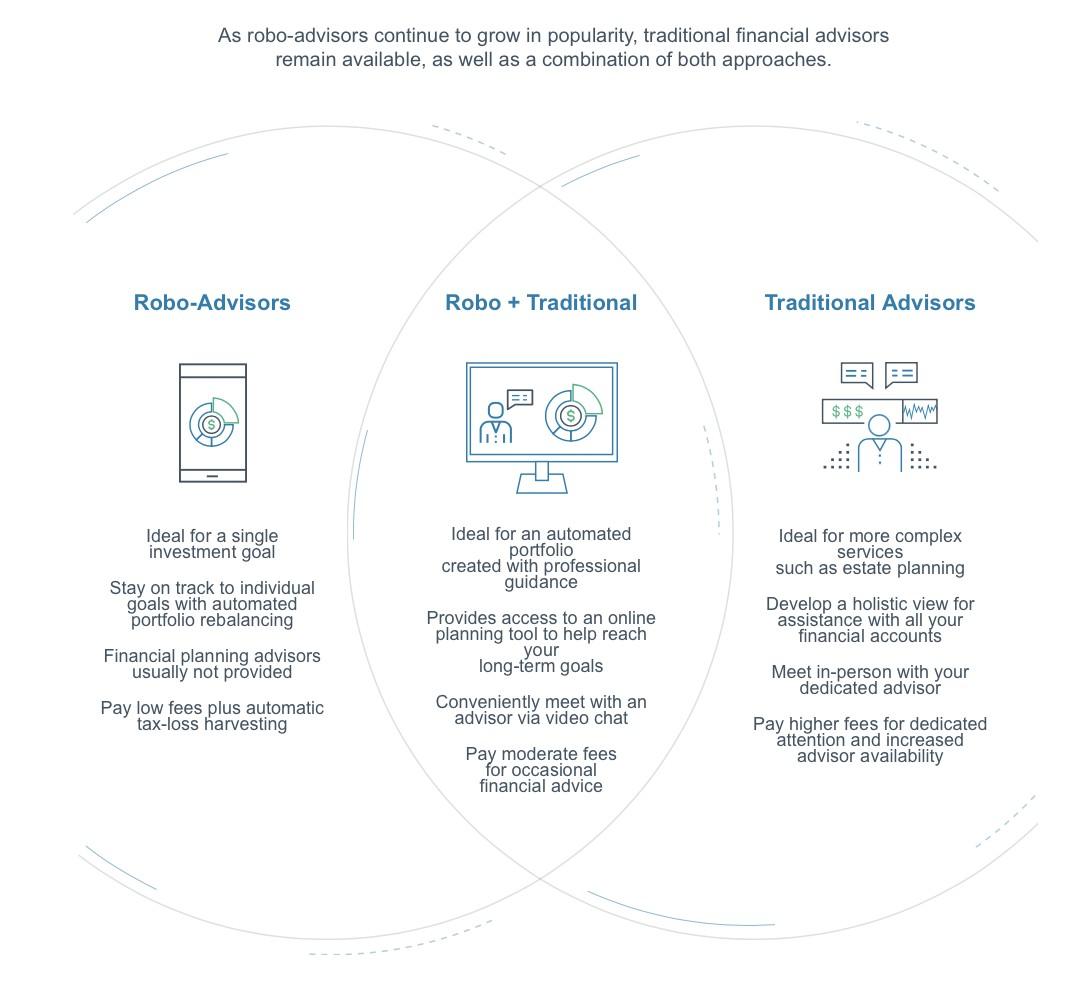

Robo-Advisors vs. Traditional

Robo-advisors continue to grow in popularity, but traditional financial advisors remain available, as well as a combination of both approaches

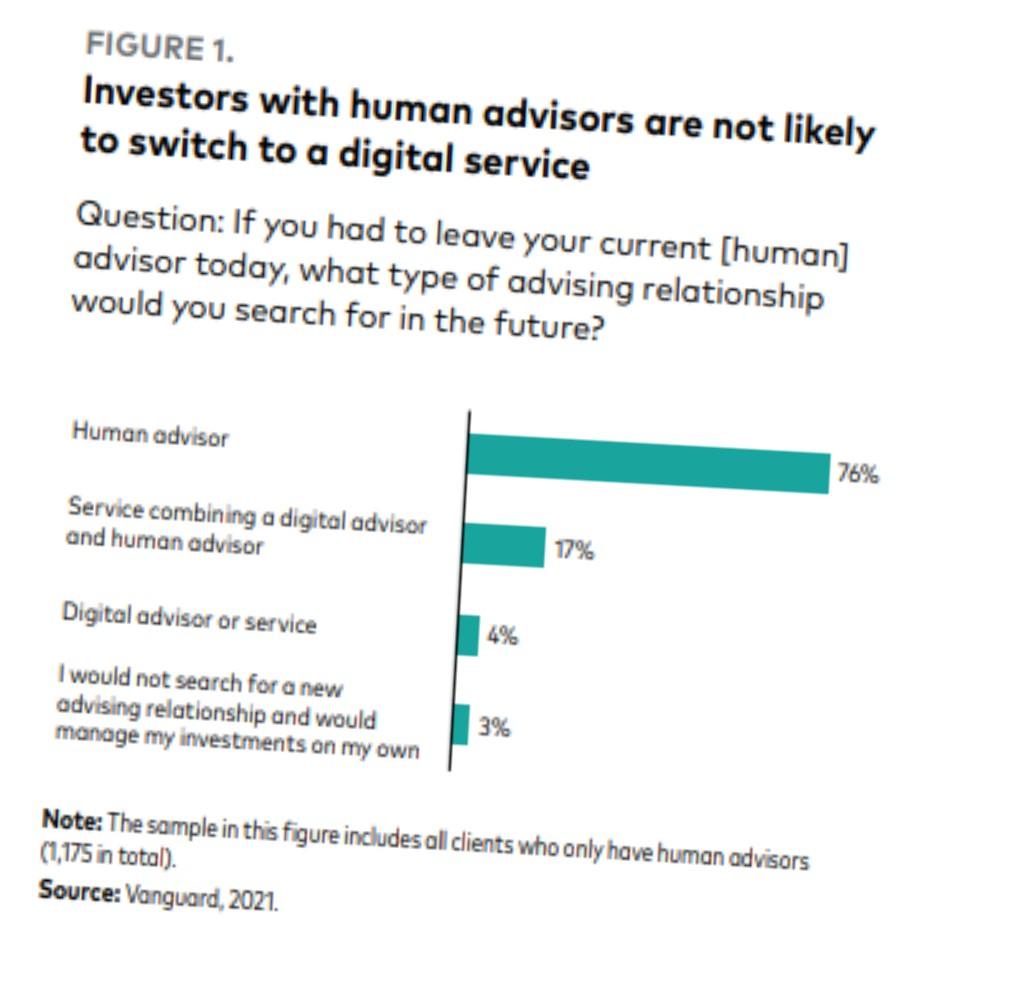

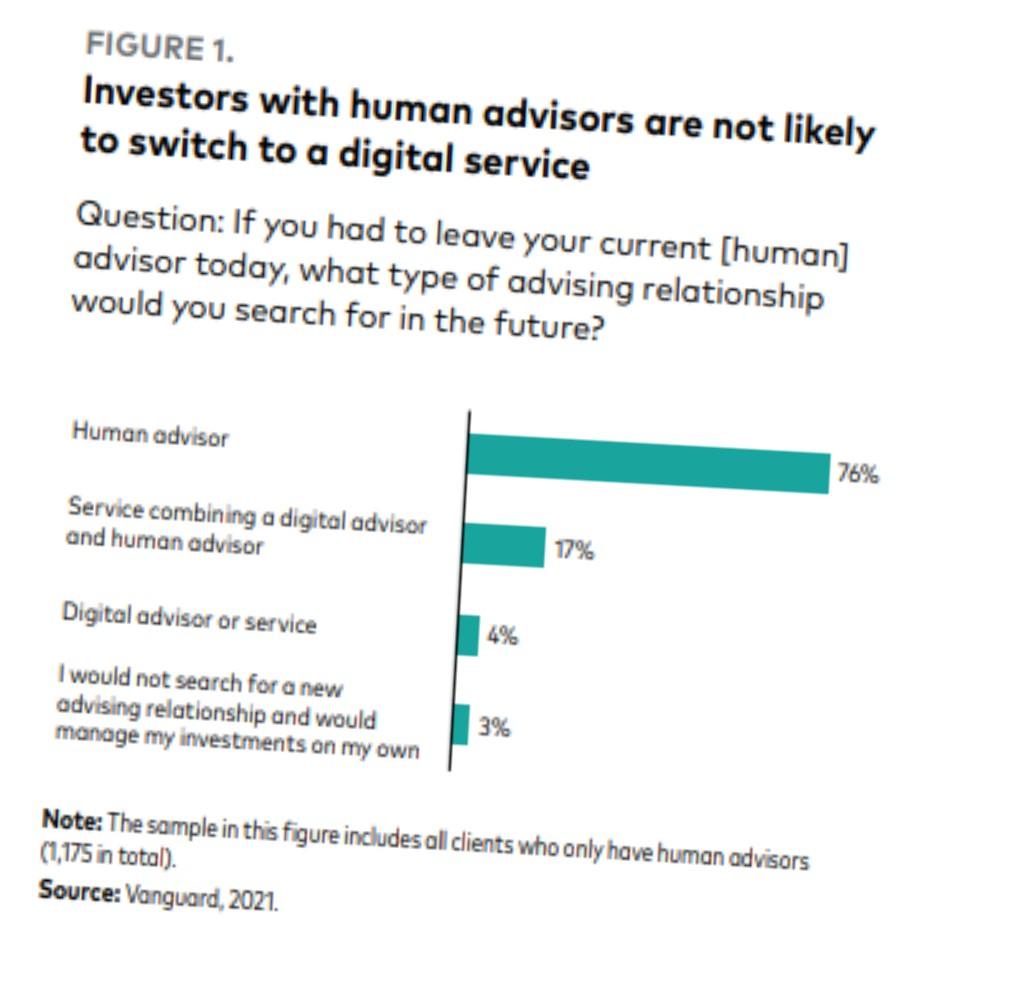

But What About Consumer Adoption?

Why do investors predominately choose to engage (do business) with traditional human investors over robo-advisors, despite some inherent and strong advantages offered by robo-advisors?

|

40

Adoption of Robo-advisors: Role of Agentic Mind Perception and Attribution of Responsibility on the Preference of Advisors (work in progress, presented at Winter AMA conference 2023)

Agency and Responsibility Attribution

● Agency has traditionally been defined as the capability of an entity to act….intentional act

● Robo-advisors are perceived to be agents with low agency (vs. human)

● Higher the agency of agents, higher is the attribution of responsibility

| 41

Adoption of Robo-advisors:

of Agentic Mind Perception and Attribution of Responsibility on the Preference of Advisors (work in progress, presented at Winter AMA conference 2023)

Role

Adoption (Rejection) of Robo-Advisors

Robo-advisors are perceived to have lower agentic mind

Lower agentic mind perception results in lower attribution of responsibility

Investors are less willing to engage with robo-advisory services

|

42

Adoption of Robo-advisors: Role of Agentic Mind Perception and Attribution of Responsibility on the Preference of Advisors (work in progress, presented at Winter AMA conference 2023)

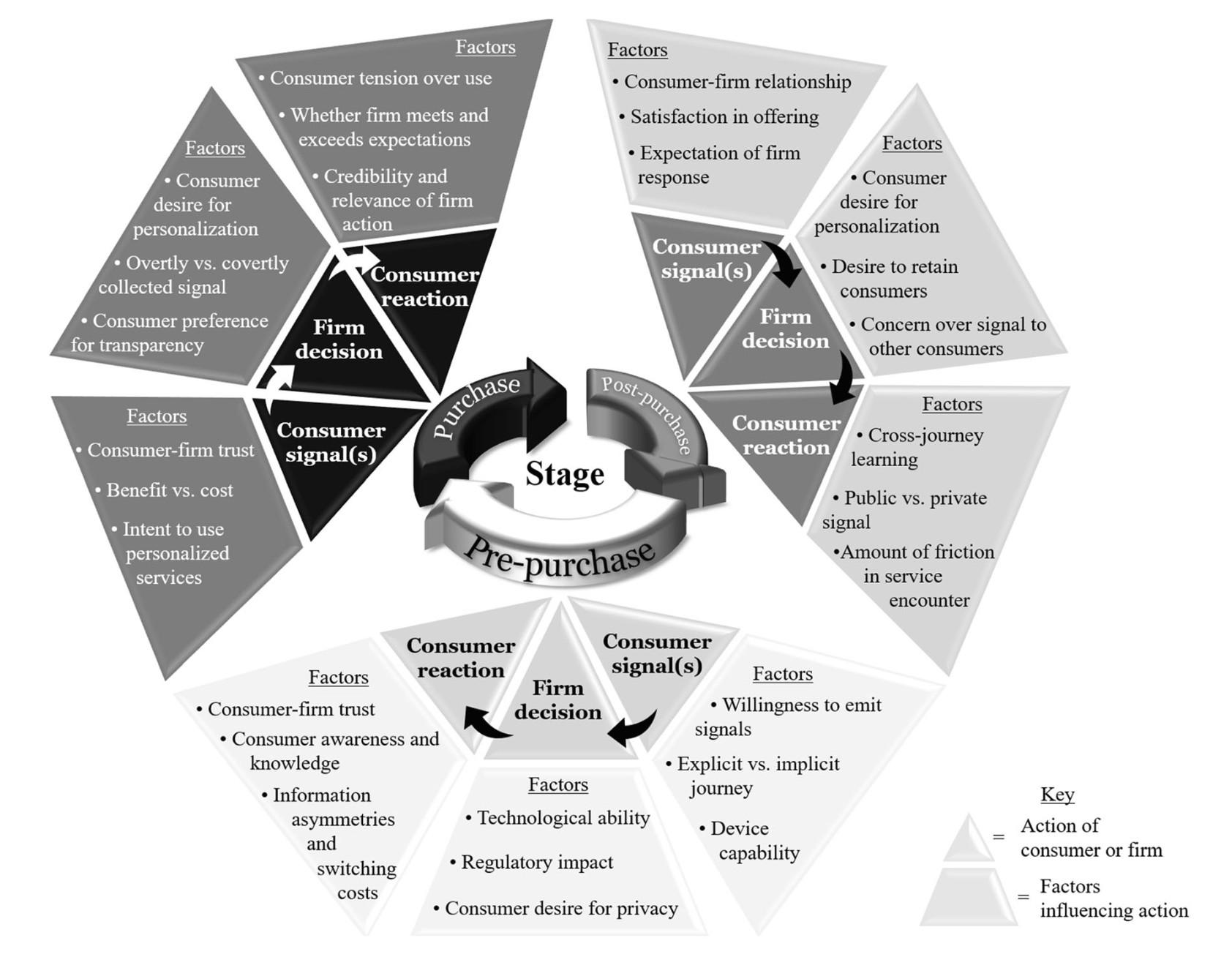

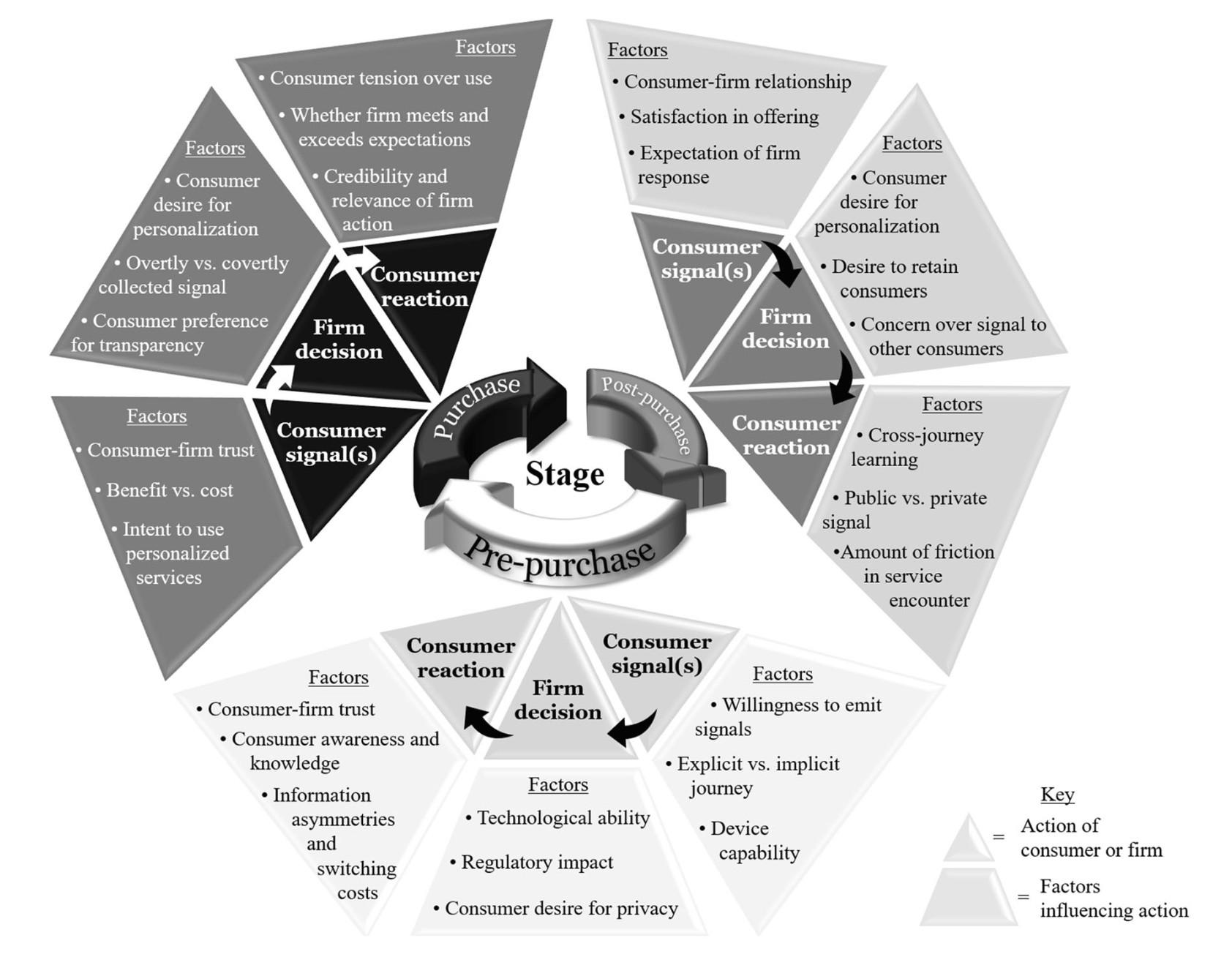

Consumer Digital Signals

Growth in the popularity of consumer-facing technologies

From digital assistants and smart thermostats to wearables and connected devices, consumers continually interact with devices capable of collecting and transmitting information pertaining to their actions and intentions

The firm’s ability to leverage consumer digital signals depends on its capability to gather, analyze, and act on such data

The technology-enabled customer journey, rooted in the idea of consumer digital signals, manifests from the interplay of the firm’s capabilities and consumers’ knowledge and preferences

Schweidel, David A., Yakov Bart, et al.

"How consumer digital signals are reshaping the customer journey." Journal of the Academy of Marketing Science (2022): 1-20.

| 43

Consumer Digital Signals

Schweidel, David A., Yakov Bart, et al. "How consumer digital signals are reshaping the customer journey." Journal of the Academy of Marketing Science (2022): 1-20.

| 44

The Intersection of Blockchain and Artificial Intelligence

Prof. Felipe Cortes

D’Amore-McKim School of Business

Northeastern University

Felipe Cortes, Professor of Finance, D’Amore-McKim School of Business at Northeastern University

Teaching and Research:

Education:

| 46

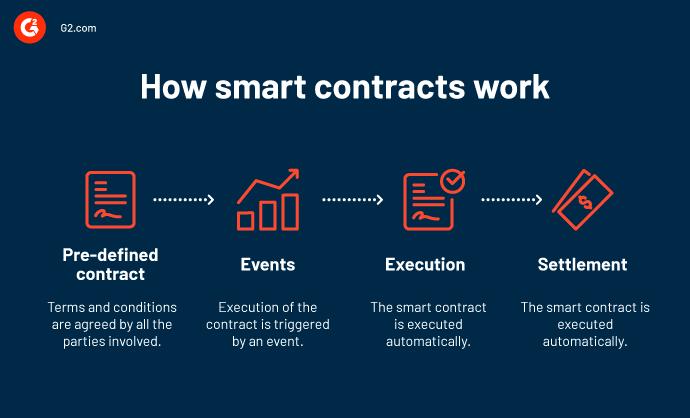

What is Blockchain?

Blockchain is a data management solution: Ledger (private, shared, or universal)

Timestamped and secured through

Decentralized Ledger Technologies allow efficiency in:

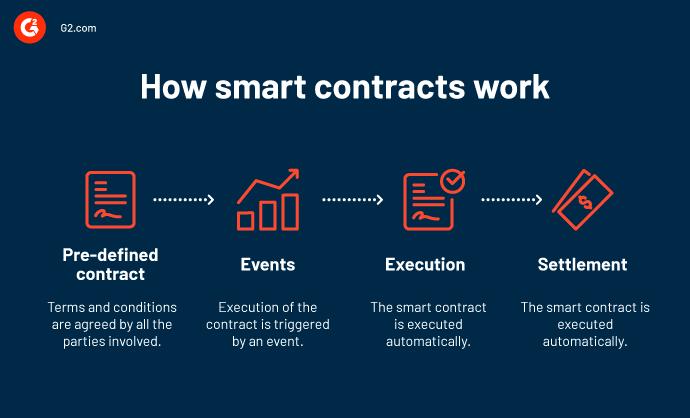

• Transfer, recording and reconciliation of information

• Programmable money (i.e., Smart Contracts)

|

Prof. Felipe Cortes 47

A Natural Synergy between Technologies

Blockchain Technologies and Artificial Intelligence are independent technologies with Blockchain: efficient storage and tamper-proof transfer of data

Artificial Intelligence: the efficient execution of (very) complex tasks that are otherwise done

The combination of Blockchain and AI:

• Allows the transfer and recording of data in a programmatic way (blockchain and smart contracts)

• Contingent on the execution of complex operations (AI).

Integrating AI and blockchain technology can transform various industries by enhancing their security, transparency, and efficiency.

|

Prof. Felipe Cortes 48

Industries where AI and Blockchain are Gaining Momentum

Blockchain: Ensure the integrity of the data

AI: Detect and Respond to threats

Both: More secure and efficient cybersecurity systems for individuals, businesses, and

Blockchain: Create a transparent and secure supply chain

AI: Analyze data and optimize the supply chain.

• Both: Reduce costs, improve efficiency, and ensure that products are delivered on time and in high quality

Financial Services:

• Blockchain: Ensure the security and integrity of transactions

• AI: Ensure the security and, integrity of transactions AND improve underwriting/screening

• Both: Reduce the cost and time required for cross-border transactions and make the financial system more accessible to those that are unbanked by reducing operating costs.

|

Prof. Felipe Cortes

49

The Integration between Blockchain and AI in Financial Services

Deposit Token

Automatic Underwriting of Loans

● Banks create deposit tokens:

User A has $100 in deposits

821E1DF9A…

● Deposit Tokens are transferred to a liquidity pool:

Deposit Token

Blockchain –Liquidity Pool

Blockchain-Friendly Format

Smart Contract

|

Prof. Felipe Cortes

50

The Integration between Blockchain and AI in Financial Services

• Loan Underwriting:

Smart Contract is Triggered

• Loan Issuance:

Applicant Information

Artificial Intelligence (Verification of Conditions)

Smart Contract

Smart Contract Deposit Token

User B has $100 in deposits

|

Prof. Felipe Cortes

51

The Integration between Blockchain and AI in Financial Services

The addition of AI to blockchain can improve programmable money by:

• Enhancing Security (Fraud prevention, AML)

• Risk Assessment (Credit Scoring, Screening)

• Increase speed of execution (faster algorithms, less noisy)

• Minimize Fee Structures (Faster closing)

Prof. Felipe Cortes 52

The Integration between Blockchain and AI in Financial Services

• Loan Underwriting <5 Days

• Reduction in Closing Fees

• Lower Delinquency Rate

|

Prof. Felipe Cortes 53

Smart Contracts:

• Allow the automation of claims (payment)

• Processing and computation of liabilities

Artificial Intelligence:

• Lowers risk of fraud

• Fast claim verification

• Enhanced underwriting

54

Conclusion

AI is becoming an imperative in the digital age - yet challenging to make workHuman intervention a must for continuous correction of the algorithmic issues

Customer experience is a key business driver

No Data no working AI

Digitization 10x to 100x more data - good news for AI?

5. Blockchain adds more data & flow logs: digitizing smart contracts and transactions

6. Getting the data/context story right is the key enabler - for business insights and for AI

7. There is a rational approach to getting to data assets - and capturing valuable human interactions

Experiential AI ⇒

| Vital Themes Recap 56

The Dynamics of AI Applications

AI is highly dependent on ML

ML highly dependent on Data

AI applications are subject to bias, unreliable data, and serious brittleness (lack of robustness) in the face of changes

What is the most expensive part of building a working AI application?

What is the most critical dependency on keeping the AI application working?

|

57

Q&A

EAI: We are Here to Co-work the AI Journey with You

• We understand the technologies deeply - from LLM’s to Generative AI, to ML/DS, to Data and humanin-the-loop

• Part of our co-working model is to build solutions and train/upskill your employees

• We bring access to delivery team, faculty, researchers, and students/co-ops to help accelerate your successful project

|

59

Want More on Experiential AI for Finance Leaders? email ke.sanborn@northeastern.edu visit ai.northeastern.edu

AI for Finance Leaders

Usama Fayyad

Executive Director, Institute for Experiential AI

Yakov Bart

Research Professor, D’AMore-McKim School of Business

Felipe Cortes

Professor of Finance

D’AMore-McKim School of Business

Usama Fayyad, Executive Director, Institute for Experiential AI

Usama Fayyad, Executive Director, Institute for Experiential AI