www.thecioworldmedia.com

www.thecioworldmedia.com

Showcasing Advisory Impact

Gaining Unmatched Exposure

Establishing as Industry Authority

Featuring on International platform

Taxseasonhasalwaysbeenaperiodthatdemandsprecision,foresight,and

expertise.Forindividualsandbusinessesalike,itisatimeofcriticaldecisionmaking—wheretherightguidancecanmeanthedifferencebetweencompliance andcostlyoversight,betweenoptimizedreturnsandmissedopportunities.Asfinancial regulationsevolveandeconomiclandscapesshift,theroleofatrustedtaxadvisorhas neverbeenmoreessential.

Trusted Advisors for Tax Season 2025 celebratestheprofessionalsandfirmswhostand outasbeaconsofreliabilityduringthiscrucialtime.Thesearetheexpertswhogobeyond numbercrunching.Theynavigateintricatetaxcodes,anticipateregulatorychanges,and craftstrategiesthatsafeguardfinancialhealthwhileunlockinglong-termvalue.Their workisnotseasonal—itisyear-roundcommitmentthatculminatesintheprecisionand confidencerequiredwhenfilingdeadlinesdrawnear

Whatdefinesa“trusted”taxadvisor?It’snotjusttechnicalcompetence—thoughthatisa given.It’stheabilitytolisten,tounderstandeachclient’suniquecircumstances,andto tailorsolutionsthatbalancecompliancewithstrategicadvantage.It’sthecommitmentto accuracy,thededicationtostayingaheadoflegislativeupdates,andthewillingnesstoact asapartnerintheclient’sbroaderfinancialjourney

Thisyear’strustedadvisorsbringtogetherdiverseexpertise—coveringcorporatetaxation, personalincometax,internationaltaxcompliance,estateplanning,andmore.Theyserve abroadspectrumofclients,fromsmallbusinessownersandentrepreneurstolarge corporationsandhigh-net-worthindividuals.Eachhasdemonstratedtherareblendof diligence,discretion,andadaptabilitythatsetsthemapartinacompetitiveindustry.

Taxseasonismorethananobligation—it’sanopportunitytomakeinformedfinancial decisionsthatshapethefuture.Theprofessionalsfeaturedhereunderstandthat,andthey approacheveryengagementwiththehigheststandardsofintegrityandprofessionalism.In doingso,theyensurenotonlycompliancewiththelaw,butalsotheconfidencethat comesfromknowingone’sfinancialaffairsareincapablehands.

Trusted Advisors for Tax Season 2025 isatributetothosewhotransformcomplexityinto clarity,pressureintoperformance,anddeadlinesintoopportunitiesforgrowth.

08 T H E F R O N T P A G E

E X C L U S I V E

I N D U S T R Y I N S I G H T S

Editor-in-Chief

Deputy Editor

Managing Editor

Assistant Editor

Visualizer

Art & Design Head

Art & Design Assitant

Business Development Manager

Business Development Executives

Technical Head

Assitant Technical Head

Digital Marketing Manager

Research Analyst

Circulation Manager

David

Mia

Eric

Richard

Dr. Tani Zahavi Partner

Khalid Maniar Founder and Managing Partner

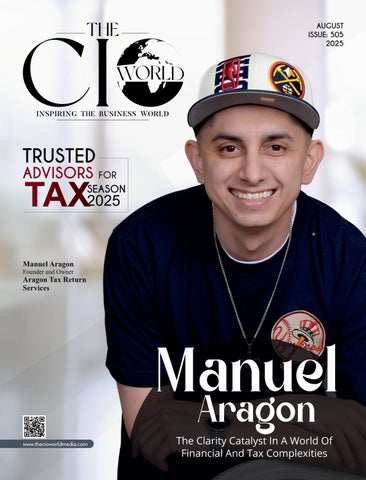

Manuel Aragon Founder and Owner

René Torres Fragoso CEO Stan Samole CEO/Founder

Meitar meitar.com/en/ Company Name

Crowe UAE crowe.com/ae

Aragon Tax Return Services aragontaxreturn services.com

CONTPAQi contpaqi.com

Family Tax Recovery Inc. familytaxrecovery.ca/

Dr. Tani Zahavi is a highly esteemed partner in Meitar’s Project Finance Group, consistently ranked among Israel’s top legal professionals in the field of infrastructure and energy finance.

Khalid has been instrumental in providing guidance to global organiza�ons, helping them make informed decisions and achieve las�ng value.

Manuel has built his reputa�on on simplifying complex tax ma�ers, ensuring compliance, and maximizing returns for his clients.

With a strong vision for innova�on and digital transforma�on, René spearheads the company’s mission to empower small and medium-sized enterprises with intui�ve, reliable, and efficient tools that drive business growth

With a passion for financial advocacy, Stan built the company on the belief that every individual deserves access to the refunds and savings they are en�tled to—o�en overlooked due to the complexity of tax regula�ons.

FRONT PAGE EXCLUSIVE

Whether it's personal or professional finance, this can be complex for most people, including both common and professional individuals who are notfromthesector Addtaxationtoit,andpeoplefeeltenseat justthementionofit.

Eveninthepresenceoffinancialconsultantsandtaxadvisors, they often feel confused, at best, or worried, at worst. It is whereManuelAragoncomestotherescue.“I’m committed to simplifying your finances and helping you achieve success,”heassures.

Widelytrustedasoneofthesimplesttaxadvisors,whomakes finance and tax so easy for his clients, that they understand everything clearly, Manuel is a recognized leader in tax preparation,accounting,finance,cashflowplanning,andtax strategy.“Whether it’s tax preparation, bookkeeping, payroll, or personalized tax strategies, my team and I are here to provide expert, stress-free support tailored to your needs,”he ensures.

Being the Founder and Owner of Aragon Tax Return Services, Manuel has always delivered innovative, clientfocused financial solutions that drive growth and efficiency for businesses and individuals across Colorado and beyond. “Withafocusonaccuracy,efficiency,andcare,we’rereadyto handlethedetailssoyoucanfocusonwhatmattersmost.Let’s worktogether— ”heappeals. contactmetodaytogetstarted!

The Unifying Purpose: Financial Clarity and Confident Futures

Manuel'sextensivecareer,spanningtaxpreparation,finance strategy,CFOroles,andconsulting,mightappeardiverseon thesurface.Yet,forhim,asingular,powerfulpurposethreads through every function: “ a commitment to getting better personally and helping individuals and businesses with financial clarity and confidence.” He views his work not merelyasaservice,butasapartnershipaimedatempowering hisclients.

Whetherheismeticulouslypreparingtaxesorofferinghighlevel strategic advice, Manuel’s core objective remains consistent. “My purpose is to learn the end goal, then the numbers, and help clients make informed, strategic decisions, ” he explains This client-centric approach, prioritizing understanding their aspirations before delving intothedata,iswhattrulydifferentiateshispractice.

Manuel firmly believes that “financial literacy is a powerful tool for growth and resilience.”Hisultimateambitionistobe morethanjustanadvisor;heaims“to be a trusted partner in each client’s future—helping them navigate complexity, seize opportunities, and achieve lasting success ” This deep commitmenttolong-termclientempowermentisthedriving forcebehindhismultifacetedcareer

Manuel Aragon’s journey into the world of finance and accounting was sparked by a profound observation: the transformative power of financial knowledge “My inspiration came from seeing how financial knowledge can transform lives—both personally and for businesses,” he recounts.Earlyinhiscareer,hequicklyidentifiedapervasive issueamongindividualsandbusinessesalike:“Many people felt overwhelmed by taxes and accounting.” It was this widespread confusion and anxiety that ignited his desire to make a difference. “I wanted to bridge that gap,” he states, aimingtodemystifycomplexfinancialconcepts.

Over the years, Manuel’s perspective has undergone a significantevolution.Whatbeganasafocusonthetechnical intricacies of finance has broadened into a more holistic vision.“Over time, my perspective has evolved from viewing finance as a technical discipline to seeing it as a means of growthandeducation,”heelaborates.

Today, his practice extends far beyond mere compliance. “I focus not just on compliance, but on proactive planning, education, and long-term partnership with my clients,” he affirms.Thisshiftunderscoreshisdedicationtoempowering clientswiththeunderstandingandtoolstheyneedtoachieve enduring financial well-being, solidifying his role as a true financialeducatorandtrustedally

Many businesses and individuals grapple with the inherent complexities of financial and tax matters. Manuel Aragon's approachtosimplifyingtheseintricatesubjects,withoutever compromising on depth or accuracy, begins with a fundamental principle: “Clarity starts with listening.” He dedicates significant time to truly comprehending “each client’s unique situation and goals.”Thisdeepunderstanding forms the basis for his communication strategy, where he masterfully “breaks down complex concepts into straightforwardlanguageandactionablesteps.”

Tofurtherenhancecomprehension,Manuelemploysarange ofeffectivetools.“Iusevisualaids,real-worldexamples,and transparent reporting to make the numbers relatable,” he explains. This multi-pronged approach ensures that clients not only receive accurate information but also genuinely graspitsimplications.Crucially,hemaintainsanunwavering commitment to precision. “At the same time, I never cut corners on accuracy or depth,” he asserts, emphasizing that whilethedeliveryissimplified,theunderlyingrigorremains. Hisultimateaimistoensureclients“have all the information they need, but in a format that’s accessible, actionable and easy to understand,” empowering them to make informed decisionswithconfidence.

Manuel Aragon has cultivated a strong reputation for seamless client onboarding and exceptional satisfaction, a testamenttohisdeliberatepracticeofbuildingtrust.Forhim, “Trust begins with transparency and communication.” This commitmentisimmediatelyevidentinhisinitialinteractions with new clients “I set clear expectations from the start upfront pricing, timelines, and deliverables so clients know exactly what to expect, ” he clarifies This proactive approach eliminates ambiguity and lays a foundationofhonesty.

Manuel also highlights the crucial, often overlooked, aspect of client engagement: “This also requires a two-way

interaction, I can't do my part if the client does not engage, and that’s something we are adapting to.” This emphasizes the collaborative nature of successful financial partnerships. He prioritizes “ one-on-one consultations, where I listen to their needs and provide tailored solutions,” ensuring that every piece of advice is personalized. Furthermore, “Consistent follow-up and responsiveness are key; clients know I’m accessible and invested in their success.” This unwavering dedication is encapsulated in his guiding principle:“My commitment is to treat every client’s business as if it were my own.”Thisethosofpartnership,transparency, and genuine investment in client outcomes is what truly cementshisstrongreputation.

Seamless Transitions: Strategy and Service as Guiding Lights

Manuel's career trajectory, from Tax Preparer to Operations Manager and Finance Director, showcases a remarkable ability to transition seamlessly between diverse roles while maintaining strategic consistency. His secret lies in a fundamentalperspective:“I approach every role through the lens of strategy and service.” This overarching philosophy allows him to adapt and excel, a capability he attributes to a relentlesspursuitoflearning.“I wasn’t always the person-togot to for this, so I think that shows my capability to keep learningandadapt,”hehumblystates.

Whetherheismeticulously“deepinthedetailsofataxreturn or overseeing operations,” Manuel consistently keeps “the broaderbusinessobjectivesinmind.”

This strategic alignment ensures that every daily task contributes to the larger vision. “This means aligning daily tasks with long-term goals and ensuring every decision supports the client’s vision.” He credits his agility to a combination of personal attributes and collaborative practices: “Flexibility, ongoing learning, and open communicationwithmyteamallowmetoadaptquicklywhile maintaining a consistent, client-centered approach.” This integrated perspective ensures that no matter the role, his focus remains firmly on delivering value and supporting clientsuccess.

Colorado'sbusinessenvironmentisknownforitsdynamism, and Manuel Aragon has observed distinct trends among businesses in the region. He notes an increasing focus on “innovation, sustainability, and adapting to regulatory changes.” A significant shift he has witnessed is “toward digital transformation and remote operations,”which,while offeringnewopportunities,alsointroduces“ new compliance challenges.”

Manuel’sroleistoactasaproactiveguide,helpinghisclients navigate these evolving currents and build financial resilience. “I help clients stay resilient by offering proactive tax planning, cash flow management, and guidance on leveraging technology for efficiency, ” he explains His expertise lies in anticipating future shifts and equipping his clients to meet them head-on. “My role is to anticipate changes, educate clients, and implement strategies that keep them agile and competitive.” By combining foresight with practical, actionable financial strategies, Manuel Aragon ensures that businesses in Colorado not only survive but thriveamidsttheregion'sdynamiceconomiclandscape.

In the ever-shifting landscape of financial regulations, Manuel's commitment to proactive compliance is a cornerstone of his service He understands that simply reacting to changes is insufficient for his clients' long-term success. “Staying ahead requires continuous education and monitoring of regulatory updates at the federal and state levels, ” he emphasizes. To achieve this, Manuel makes significantpersonalandprofessionalinvestments.

“I invest in ongoing training, software, attend industry seminars,andleveragetechnologytotrackchanges,”

he explains, highlighting his dedication to remaining at the forefrontofregulatoryknowledge.

Forhisclients,thisproactiveapproachtranslatesintotangible benefits.“Iprovideregularupdates,conductannualplanning sessions, and recommend adjustments before new rules take effect, ” he states This foresight allows businesses and individualstoadaptstrategically,ratherthanbeingcaughtoff guard. Manuel's ultimate objective is transformative: “My goal is to turn compliance into a strategic advantage, so clients are always prepared rather than playing catch-up.” This philosophy ensures that his clients are not only compliantbutalsopositionedtoleverageregulatorychanges fortheirfinancialbenefit.

Cashflowplanningisundeniablyacriticalfoundationforany sustainable business, yet it's an area where many companies makecommon,oftencostly,mistakes.Manuel,drawingfrom

bothhisprofessionalexperienceandhisownentrepreneurial journey, pinpoints the primary error: “The most common mistake is focusing solely on revenue without forecasting expenses or planning for seasonality.” He openly shares his personallearningcurve,noting,“I have over planned and am adjustingasmyownbusinessgrows.”

Another significant oversight, he observes, is the timing mismatch between money coming in and going out. “Many businesses also overlook the timing of receivables and payables,whichcancreatecashcrunches,alsoanexperience I am navigating,” he admits, underscoring his practical, empathetic understanding. To course-correct these issues, Manuel provides invaluable guidance. “I help clients build detailed cash flow projections, identify gaps, and implement processes for timely invoice and expense management.” His approach is not a one-time fix but an ongoing partnership. “Regular reviews and scenario planning ensure they’re prepared for both opportunities and challenges, ” he concludes,ensuringhisclientsbuildrobustfinancialstability

Throughout his multifaceted journey, Manuel has distilled profound leadership lessons, particularly while mentoring teams and guiding businesses through challenging financial turnarounds.

For him, “The most valuable lesson is the importance of empathy and clear communication.” He understands that effectiveleadership,especiallyintimesofcrisisorsignificant change,demandsadeephumanconnection.“Leading a team or guiding a business through a turnaround requires listening, understanding diverse perspectives, and building trust ” This emphasis on active listening and genuine comprehensionallowshimtoforgestrongbondsandgainthe confidenceofthoseheleads.

Manuelhaslearnedthattransparencyisnotjustavirtuebuta strategicimperative.“I’ve learned that transparency—about both challenges and solutions—fosters resilience and buyin,”heexplains.Byopenlycommunicatingtherealitiesofa situation,heempowershisteamsandclientstobecomeactive participants in finding solutions. Beyond transparency, his leadership is characterized by a focus on growth and recognition: “Educating others, setting clear goals, and celebrating progress are essential to driving sustainable results.”Thesepracticesensurethatteamsremainmotivated, aligned, and continuously moving forward, building a foundationforenduringsuccess.

Looking ahead, Manuel offers a compelling vision for the future of tax strategy and accounting, particularly with the accelerating rise of AI, automation, and fintech tools. He firmly believes that “The future is about combining technologywithhumaninsight.”

While acknowledging the transformative power of these advancements,hemaintainsaclearperspectiveontheirrole. “AI and automation will continue to streamline routine tasks, improve accuracy, and provide real-time data,” he predicts, recognizingtheirimmensepotentialforefficiency

However, Manuel is quick to emphasize the irreplaceable human element. “However, the human element—strategic thinking, personalized advice, and ethical judgment—will remain irreplaceable.” He highlights a crucial aspect that technology cannot replicate: “Also, the emotional aspect, AI can't give a client a hug or sense when someone is in need of simplelifeadvice.”

This profound understanding of the human dimension of finance shapes his evolving role. “I see my role evolving towardhigher-levelconsulting,helpingclientsinterpretdata, optimize strategies, and navigate an increasingly complex financiallandscape.”

Manuel is not just preparing for the future of finance; he is actively shaping it, ensuring that technology serves to amplify, rather than diminish, the invaluable human connection and strategic guidance that define true financial partnership.

Foraspiringprofessionalslookingtoforgeasuccessfulcareer in the dynamic finance and tax field today, Manuel offers invaluable advice rooted in his own journey of continuous growth and adaptation. His counsel centers on a dual focus: mastering foundational skills while cultivating adaptability “Focus on mastering the fundamentals first—technical skills, regulatory knowledge, and attention to detail are nonnegotiable,” he asserts, emphasizing the critical bedrock of theprofession.

However,inaneraofrapidtechnologicalchange,hestresses the equally vital need for flexibility. “At the same time, cultivate adaptability and a willingness to learn new technologies.”Beyondtechnicalprowess,Manueladvocates forstrategiccareerdevelopment.“Seek out mentors, invest in ongoing education, and don’t be afraid to take on diverse roles, ” he advises, encouraging varied experiences that broaden one's perspective and skill set. His ultimate insight for success in this evolving landscape is clear: “The most successful professionals are those who can bridge technical expertise with strategic thinking and strong relationships.” This holistic approach ensures both depth in one's craft and theversatilitytonavigatefuturechallenges.

What keeps Manuel grounded and continuously inspired, bothprofessionallyandpersonally,asheexpandshisimpact, is a profound sense of purpose rooted in service. “What grounds me is my commitment to service—knowing that my workmakesatangibledifferenceinpeople’slives,”heshares. This deep connection to the real-world impact of his efforts provides a powerful anchor amidst the complexities of financialmanagement.

Professionally, the validation comes from witnessing his clients' successes. “Seeing clients achieve their goals and overcome challenges is deeply rewarding, ” he reflects

Personally, his family serves as a constant source of inspiration.“Myfamily,especiallymyson,inspiresmetokeep growing and striving for balance.”Thisblendofprofessional fulfillment and personal motivation fuels his drive. “I’m motivated by the opportunity to keep learning, adapt to change, and help others build a secure financial future,” he states.

Manuel Aragon's vision extends beyond the realm of business; it is a testament to a broader philosophy of selfimprovement and positive influence. “I see more than just a tax business; it is truly about being a better person and inspiring others to do the same,”heconcludes,encapsulating his enduring legacy as a leader who empowers not just financialclaritybutalsopersonalgrowthandwell-being.

Becauseforoverthreedecades,lendinghasbeen characterizedbydelayedapprovals,bothersome paperwork,stringenteligibilityrequirements,and over-relianceonlegacycreditscoringmodels.Asbanks havebeenthemaingatekeepersofcapital,they'vefartoo oftenfallenshortoftoday'sconsumers'andbusinesses' demands—particularlyinaworldwherespeed, personalization,andopennessarethegame.Thisgapin servicethereforeopeneduptheopportunityforfintech innovatorstomoveinandfillthespacewithquicker, information-based,andmoreseamlesssolutions.

Fin-techdisruptionoflendingisbaseduponthecapacityto leveragetechnologythroughouttheentireprocess.Bigdata, AI,andcloudtechnologyhaveallowedplatformsto approveloanapplicationsinminutes,notweeks.MobilefirstapproachesandAPIintegrationsallowborrowersto applyforcredit,monitorapprovals,andrepayviathe

convenienceoftheirmobile.Processdigitizationand automationbyfin-techplatformsloweroperating expenditures,allowingcredittobecomemorescalableand affordable.

Oneofthemostpotentfintechtechnologiesinlendingisthe useofalternativedatapointstomakecreditdecisions. RatherthanonlyusingvintagedeterminantssuchasFICO scores,fintechlendersconsiderpaymenthistory,utility bills,onlinepurchases,andsocialmediaactivityto determinecreditworthiness.Thatopensuplendingtothinfileindividualsandsmallbusinessnichesthathavebeen underservedbytraditionalmainstreambanksfordecades. Expandingtheriskuniversebeyondthephysicalrealm, web-basedplatformsextendcoveragewithoutnecessarily expandingtheriskofdefaults.

Peer-to-peer(P2P)lendingandmarketplacewebsiteshave transformedthelendingindustrybymatchingborrowers withindividualorinstitutionallendersdirectly.By bypassingintermediaries,banks,thewebsitesprovide competitiveinterestratestoborrowersandgenerousreturns tolenders.PlatformslikeLendingClub,FundingCircle,and Prosperhavegoneglobal,providingswiftapprovals,clear terms,andflexibleloanproducts.Themodelhasespecially beenbeneficialforsmallbusinessesseekingtoaccessquick cashtotakeadvantageofgrowthopportunities.

Thefintechlendingdisruption'ssecondwaveisoccurring viaembeddedfinance—lendingembeddedfunctionality withinnon-financialplatforms.Retailplatforms,ridehailingplatforms,andSaaSapplicationsareintroducing instantcreditfunctionalityasafeatureoftheiruser

interface.Forinstance,"BuyNow,PayLater"likeKlarna, Afterpay,andAffirmhavemademicro-lendingomnipresent atthecheckout.Thesemodelsrenderborrowingvirtually invisibletothecustomer,turningfundingintoanextension ofnormaltransactions.

Fintechhasrevolutionizedlendingtosmallbusinesses, historicallyanindustryweigheddownbytime-consuming approvalandheavyrejection.FirmslikeBlueVineand Kabbageunderwriteinminutesbasedonreal-timedataof businessoperation—receiptsofsales,inventorylevels, insteadofthetraditionalhistoricalfinancialstatements. Suchspeedenablesfirmstoseeworkingcapitalinaday,so thattheycanpayforcashflowdeficiencies,financegrowth opportunities,orrideoutseasonality.

Notonlyaredigitallendingplatformscompetingagainst eachotheronvelocity—theirscopeisgeographiesat unparalleledreach.Cloudinfrastructureanddigital identificationtechnologyenableplatformstocovermultiple geographieswithseamlessexperienceirrespectiveof geography.Inthedevelopingworld,withthinbanking infrastructure,mobilelendingplatformssuchasTalaand Branchareextendingcredittotensofmillions,releasing entrepreneurshipandeconomicactivityontheground.

Regulatorsarerunningtocatchupasfintechlendinggrows. Amongtheissuesfuelingincreasedsupervisionare algorithmicbias,dataprivacy,andpredatorylendingrisk. Onlineplatformsaremademoreaccessiblebutwillneedto walkatightropebetweengoodlendingpracticesand innovationiftrustistobesustained.Opendisclosure,moral interestrates,andopentermswillbethepacebreakersto sustaininggrowthwithoutsacrificingreputations.Thereare somemarketswherefintechoperatorsandregulatedbanks arecomingtogetherinpartnershipstobreakthroughasa meansofmarryingregulationtoinnovation.

Artificialintelligencemakesfintechlendingpossible, allowingforpredictivemodelingthatcanlearnandadapt fromsuccessivedatasets.AIalgorithmscanspotearly defaults,optimizeinterestrateoffers,andputborrowersin abest-fitloanproductinrealtime.Suchcomplexity, however,raisesthechallengeofexplainability—giving borrowersandregulatorsvisibilityintohowdecisionsare beingmade,particularlywherealgorithmicdecisionsabout accesstoneededcreditareinvolved.

Earlyreportshadfintechasaneasyvillaintoblamefor banks,butnowadaysrealityisallaboutcooperation.Banks thesedaysincreasinglycooperatewithfintechplatformsto increasetheirweb-basedlendingcapabilities,addhigh-end analytics,andaccesscustomersegmentsthatwereonceout ofreach.Thepartnershipsleveragetheregulatorycapital andcredibilityofbankswiththeagilityandinnovationof fintechtoprovidehybridmodelsoflendingthatbenefit bothsides.

Thefutureoflendingwillbeubiquitous,personal,and predictive.Blockchaincanmakeloantermsandrepayments evenmoretransparent,reducingfraudandsimplifying enforcementthroughsmartcontracts.Cross-borderlending isassimpleasanemailusingglobaldigitalidentity systems.Withincreasinglymaturedataenvironments, lenderswilldepartfromreactivecreditanalysistowards proactivefinancialsolutionsanticipatingneedand providingsolutionsbeforeaborrowerevenasksforthem. ReimaginingtheBorrowerExperience

Themostsignificanteffectoffintechdisruptionisnot necessarilythespeedorcostoflending,buttheborrower experienceitself.Whereasinthepastborrowingmoneywas paperwork,risk,andpostponeddecisioning,todayitnow usuallyamountstoseveralclicks,real-timejudgments,and openterms.Theaggregateeffectisoneoflendingwhere technologymakesiteasiertoexecutebothsidesofthe transaction—openingdoorsforborrowersaswellas introducinglenderstonew,information-stuffed opportunities.

Fordecades,banksandinstitutionallenderscontrolled

capitalaccessforindividuals,smallbusinessowners, andentrepreneurs.Approvalsmeantjumpingover highhurdles—strictcreditstandards,lengthyprocesses,and littleflexibility Timeshavechanged.Alternativefinancehas disruptedthemarket,makingcapitalaccessiblewithout gatekeepersofthepast.Crowdfunding,peer-to-peerlending, revenue-basedinvesting,andothermodelsare revolutionizingthesourceofideasthatarebeingfundedand howinvestorsfindthem.

Platformshaverevolutionizedthefinancingofcreators, entrepreneurs,andinnovators.Ratherthangoingoutand findingasinglelargeinvestor,campaignsraisemoneyfrom lotsofpeople—eachattractedtoacompellingconceptor futureworth.Kickstarter,Indiegogo,GoFundMe,andequity crowdfundingplatformssuchasSeedInvesthaveopened investingtoeveryone,makingitconvenientandaccessible, sothatsupporterscouldfundindependentfilms,new technologies,andmore.Itisamodelthatsurvivesonstory, socialcapital,andthespreadofnetworks,andthusthe marketingiseverybitasnecessaryasthegoodorservice itself.

Peer-to-peer(P2P)lendingwebsitessuchasLendingCluband Prosperavoidedthebankingmiddlemanbyenablinglenders todirectlyinteractwithindividualorinstitutionalborrowers. Borrowershaveaccesstocompetitiveratesandstreamlined applicationprocesses,whilelendershaveaccesstodiversified consumerorsmallbusinessloanportfolios.P2Plending createdpossibilitiesforindividualswhowouldotherwisebe ineligiblefortraditionalcreditbutwiththeneedoftightly holdingriskandhavingfaithinplatforms.

Revenue-BasedFinancing:ExpansionWithoutSacrificing Equity

Forstart-upsrequiringcapitalatzerocostofownership, revenue-basedfinancing(RBF)isanadaptablesolution. Insteadoffixedmonthlypayments,firmspayapercentageof theirrevenueseachmonthuntiltheyhaverepaidaset amount.Thissynchronizesinvestorreturnswithbusiness performance,withadaptabilitywhenmonthsarelow-growth andpeakcontributionwhenmonthsarehigh-growth.Itis especiallyattractiveforsubscription-basedorhigh-margin businesseswheresteadyrevenuestreamsmakeforpayback.

Theproliferationofalternativefinanceisnotisolatedofthe fintechphenomenon.Onlineplatformshavefacilitatedriskcalculated,streamlinedonboardingandofferedsecure,userfriendlyexperiencestoborrowersandinvestors.Data analytics,AI-poweredcreditscoring,andblockchainpoweredsmartcontractsareraisingtransparency,fighting fraud,andfacilitatingcross-bordertransactions.The technologyplatformhasallowedalternativefinancetogo globalwithoutsacrificingspeedandefficiency

HazardsandResponsibilitiesintheNewWorldof Funding

Alternativefinanceismarkedbyflexibilityandopenness, buttherearehazards.Crowdfundingdoesnotnecessarily introducetheanticipatedproducts,andcontributorsrisk losing.P2Plendersfacepaymentfailurewheretheylack theaccoutrementsoftraditionalbanks.Revenue-based financetendstoover-financecompaniesduringslow growth.Borrowersandinvestorsshouldpaycloseheed throughthoroughduediligence,notingplatform reputations,contractterms,andrepaymentarrangements. Regulatorsincreasinglyintervenetooffsetinnovationand protecttheconsumer

Alternativefinancehasbeenarescuerforbusinesses outsidethemainstreamfundinginstitutions.Newventures inthenewmarkets,creativeindustry,orsociallyresponsiblebusinessareguaranteedtobeturneddownby banksbuthigh-fivedbyspecialistinvestorsonline.Seed fundingavailabilityhasthepowertoturbo-chargeproduct launches,fundstaffing,andfuelhyper-growth. Furthermore,thepublicexposureofmostfunding campaignsalsoprovidesmarketvalidation—prioritizing demandpriortocommittingdeepresources.

TheDemocratizationofInvestmentChoices

Borrowersnolongerhavefewermeansofborrowing. Likewise,individualinvestorsalsonowhavemoremeans toinvestinearly-stagecompanies,loanbooks,andmission investments.Equitycrowdfunding,forinstance,provides commoninvestors—notonlyaccreditedinvestors—means toholdequityinstartups.Democratizationisrechanneling investmentawayfromthesolepossessionofhigh-net-

worthindividualstowardamorecommunity-based, democraticsystem.Theoutcomeisnotnecessarily diversifiedfinancingbutanimprovedemotionalconnection betweeninvestorsandfirmsinwhichtheyinvest.

Webplatformshaveallbuteliminatedthegeographyrestrictedlimitationofthemobilityofcapital.Small businessindividualsfromthedevelopingnationsareableto standinfrontoffinanciershalfwayacrosstheglobe. Borrowersfromonepartoftheglobecanlendtolenders fromanother,bringingneweconomicempowerment options.Cross-bordertrade,though,offersissuesin currencyconversion,lawstobefollowed,andregulation compliance,andplatformshavetonavigateapatchworkof globalregulations.

Inthenextfewyears,alternativefinancemightbemoreand moreintegratedintotheoverallfinancialsystem.Withthe integrationofelementsfromcrowdfundingandtraditional investment,AI-drivenloanmarketplaces,andtokenized assetsunderblockchainplatforms,thereisperhapseven greaterscopetobeharnessed.Withmoretrustinsuch networksandsophisticatedregulation,alternativefinance willceasetobereferredtoas"alternative"inanyway—it couldbecomeastandardsourceoffundingforindividuals andorganizations.

Fundamentally,alternativelendingisinclusion—making doorsaccessibletothoseexcludedfromtraditionalcapital sources.Whetherthesidehustleentrepreneur,small businessventuringintonewmarkets,orconsumer refinancingviaP2Plending,thesemodelsdemocratize financeonalargescale.Withfurtheradvancesin technologyandexpandinginvestorcommunities, alternativefinancewilloverturnmoreconventionalnorms andconstructamoreinclusive,innovativefinancialfuture.