Successful CEOs are those who have the ability to inspire and motivate others, to build strong teams, and to lead by example.

- Cyril Ramaphosa

Living Paycheck to Paycheck: A Reality for Many

Moneyisacrucialpartofourdailylives.Itisthemeansthroughwhich

weacquirebasicnecessitieslikefood,shelter,andclothing.Infact,a recentsurveyrevealedthatabout78%ofAmericanslivepaycheck-topaycheck,underscoringtheimportanceoffinancialstability Withoutmoney, fulfillingeventhesimplestneedsbecomesachallenge.

Moreover,moneyplaysasignificantroleinachievingourlong-termgoals. Whetherit'ssavingforahouse,fundingeducation,orplanningforretirement, financialresourcesareessential.Statisticsshowthatnearly60%ofAmericansdo nothaveenoughsavingstocovera$1,000emergency,whichhighlightstheneed forbetterfinancialplanningandsavingshabits.

However,therealityisthatmoneydoesn'tjustappear;itrequireseffortand strategytoearnandsave.TheaverageAmericanhouseholdcarriesabout$7,000 increditcarddebt,whichcanhinderfinancialgrowth.Thisdebtcanaccumulate quickly,makingithardertosaveandinvestforthefuture.

Intoday'sworld,wherepricesareconstantlyrising,understandinghowto managemoneyeffectivelyismoreimportantthanever.Itisnotjustaboutearning moneybutalsoaboutmakinginformeddecisionsonspendingandsaving.By prioritizingfinancialliteracy,individualscantakecontroloftheirfinancesand worktowardsamoresecurefuture.Ultimately,whilemoneymaynotbuy happiness,itcertainlyprovidesthefoundationforastableandfulfillinglife.

Herecomeleaderswhoareincreasinglyrecognizingtheimportanceoffinancial literacyandstabilityinfosteringahealthysociety.Theseleadersadvocatefor policiesandinitiativesaimedatimprovingfinancialeducation,reducingdebt burdens,andpromotingsavingsamongindividualsandfamilies.

LeaderslikeMichaelAdamsonareincreasinglyacknowledgingthecriticalrole offinancialliteracyandstabilityinbuildingahealthiersociety.Inthelatest editionofInsightsSuccesstitled "Top Impactful CEO Transforming Financial Services in Africa," Adamsonishighlightedforhiseffortsinpromotingfinancial educationandreducingdebtburdensamongindividualsandfamilies.His initiativesaimtoempowerpeoplewiththeknowledgeandtoolsnecessaryto managetheirfinanceseffectively,therebynurturingacultureofsavingsand responsiblefinancialplanning.

Have a great read ahead!

C O V E R

S T O R Y

5 Strategies to Improve Customer Experience in Financial Services

What are the Common Mistakes to Avoid When Using a Line of Credit?

22.

Robo-Advisors: Exploring the Impact on Traditional Financial Advice

26. The Impact of Quantum Computing on Financial Services

Andre Nortje CEO

Jus�nus Van Der Westhuyzen CEO

Michael Adamson CEO

Ndaedzo Madume CEO

Neerejh Ramlakhan CEO

Olaotse Leepile CEO Regan Adams CEO

Safiera Mall CEO

Tobie van Zyl

CEO & Founder

Tony Reddy

CEO

Strate (Pty) Ltd strate.co.za Company

King Price Insurance kingprice.co.za

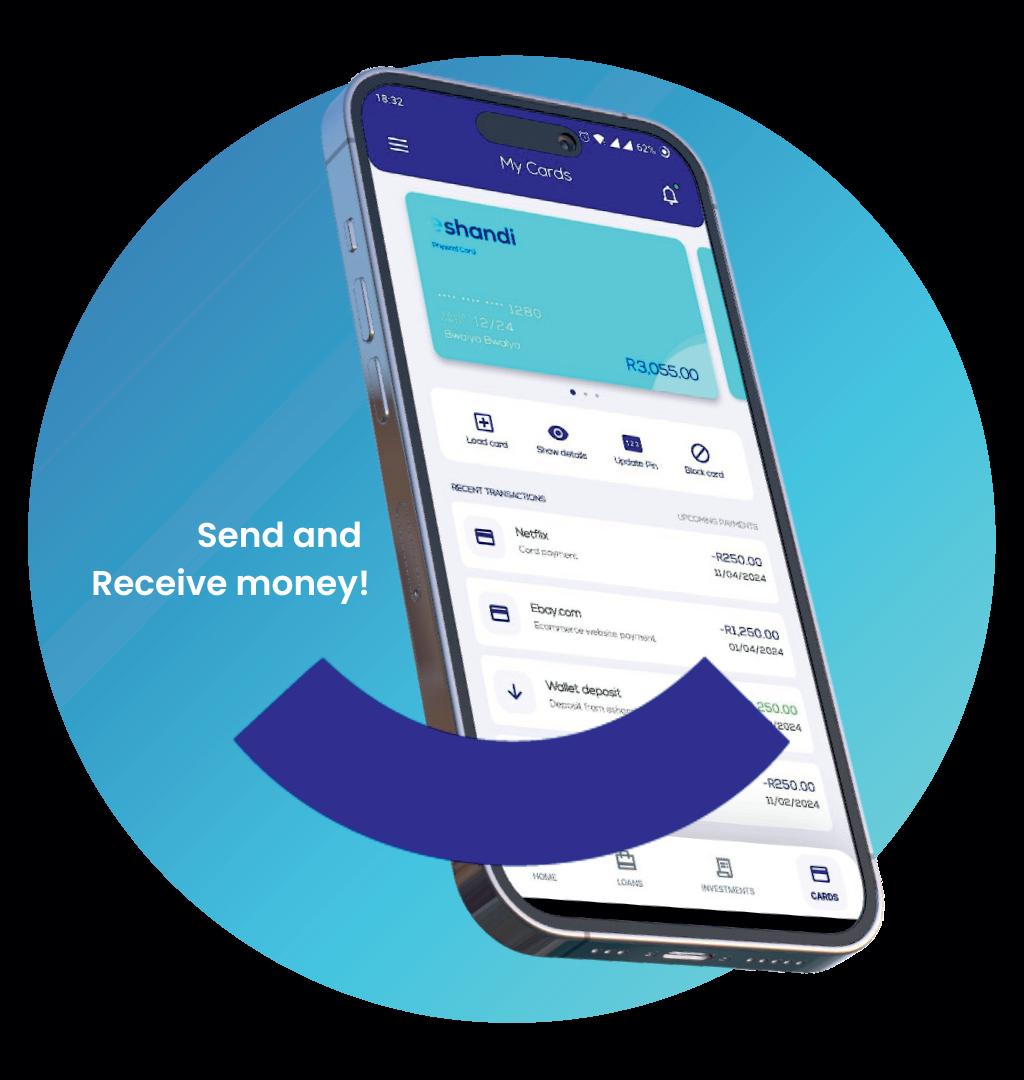

eShandi eshandi.com

GraceNineteen gracenineteen.com

Forex Mul�-Trader Management fxmtm.com

A thought leader in the financial infrastructure space, dedicated to building robust and efficient systems that support the growth of the African economy

A risk management expert, leading a team dedicated to providing comprehensive insurance solu�ons that protect individuals and businesses in Africa.

Michael Adamson, the CEO of Eshandi, is on a mission to modify financial services for Africa’s underserved popula�on.

A social entrepreneur driven to create posi�ve change through innova�ve financial products and community empowerment ini�a�ves.

An expert in the field of foreign exchange, commi�ed to empowering traders and investors with cu�ng-edge tools and strategies.

Novare Holdings novare.com

A seasoned execu�ve with a passion for driving sustainable growth and fostering financial stability in the African market.

RCS rcs.co.za

Glasfit Group glasfit.com

A visionary who has transformed the consumer credit landscape, offering accessible and responsible financial solu�ons to individuals across Africa.

A trailblazer in the glass and glazing industry, commi�ed to delivering high-quality products and excep�onal customer service.

Be�r.App be�r.app CliqueFin cliquefin.com

A fintech innovator, developing user-friendly mobile applica�ons that simplify financial management and promote financial inclusion in Africa.

A fintech pioneer, spearheading the development of userfriendly pla�orms that simplify financial transac�ons and enhance customer experiences.

“

The key to success is not to reinvent the wheel unnecessarily but to leverage existing technologies to complement our product.

“

AcrosstheAfricancontinent,millionsfind

themselvestrappedinacycleofpoverty,unableto accessbasicfinancialservicesthatmanytakefor granted.Traditionalbankshavelongoverlookedlowincomeconsumers,leavingthemvulnerabletopredatory lendersandinformalfinancialsystems.Thisexclusionhas perpetuatedeconomicinequalityandhinderedprogressfor countlessindividualsandcommunities.

Inresponsetothispressingissue,MichaelAdamson,the CEOofEshandi,isonamissiontomodifyfinancial servicesforAfrica'sunderservedpopulation.Drivenby personalexperiencesduringhistravelsacrossthecontinent, hewitnessedfirsthandthedevastatingimpactoffinancial exclusiononeverydaylives.Underhisleadership,Eshandi aimstobridgethegapinfinancialservicesbyproviding innovative,accessiblesolutionstailoredtotheneedsof thosewhohavebeenhistoricallymarginalized,thereby cultivatingfinancialinclusionandempowermentacrossthe continent.

Eshandifirmlybelievesthathavingaccesstodependable andaffordablefinancialservicesisnotmerelyaluxury;itis abasichumanright.Thisbeliefdrivesthecompany’s missiontoconnecttraditionalbankingsystemswith individualswhourgentlyrequirefinancialinclusion.

Withhisinfluence,Eshandiisharnessingprogressive technologytocreateinnovativesolutionstailoredtothe uniqueneedsoflow-incomeconsumers.Bycombining mobilebanking,microfinance,andfinancialeducation,the companyisempoweringindividualstotakecontroloftheir financialfutures.

Eshandi'sapproachgoesbeyondmereaccesstobanking services.Thecompany'scustomer-centricmodelfocuseson understandingthespecificchallengesfacedbyitstarget audience,ensuringthatitsproductsandservicesareboth accessibleandbeneficial.

AsEshandicontinuestoexpanditsreachacrossAfrica,his visionisinspiringanewgenerationoffintechentrepreneurs andsocialinnovators.Hisjourneyservesasanexampleof thetransformativepowerofinclusivefinancialpractices andthepotentialfortechnologytodrivemeaningful change.

Let us explore his journey!

Michaelisspearheadingatransformativeinitiativeaimedat enhancingfinancialinclusionforlower-income communitiesacrossAfrica.Hiscareerischaracterizedbya uniquecombinationofpersonalinsightsandprofessional milestones,whichincludesignificantrolesintopfinancial institutionsandfintechcompanies.

Hisfirsthandexperienceswithfinancialexclusionduring histravelsacrossvariousAfricannationsfueledhis convictioninthepotentialoftechnologytofosterfinancial access.AstheleaderofEshandiSA,heisdedicatedto reformingthefinancialserviceslandscape,strivingto connecttraditionalfinancialsystemswiththeneedsof underservedpopulations.

ThestoryofEshandibeganwithaprofoundrealization: millionsofpeopleinAfricalackaccesstobasicfinancial services.Traditionalbankingsystemsoftenexcludelowerincomepopulations,leavingthemvulnerableandwithout meansforfinancialstability.

Thisgapinspiredthevisiontocreateaplatformthatnot onlyprovidesimportantfinancialservicesbutalsoallows individualstotakecontroloftheirfinancialfutures.

Eshandi'smarketentrystrategystressesleveragingexisting technologiesratherthanreinventingthewheel.AsMichael states, “The key to success is not to reinvent the wheel unnecessarily but to leverage existing technologies to complement our product.”

Thisapproachacceleratestimetomarketandreducesstartupcosts,allowingEshanditofocusonitscoreproductand disruptthemarketwithinnovativefinancialsolutions.

AcrucialaspectofEshandi’sstrategyisitsdeep understandingoflocalcontexts,particularlythecostof livinginvariousregions.Michaelhighlightstheimportance ofrecognizingthefinancialpressuresfacedbylow-income individuals,stating, “In many African countries, the cost of living is rising rapidly. Our products must provide real, immediate value to our users.”

Simply launching a product that is cheaper or quicker to access but still excludes the same market as all other products is not genuine inclusion.

Eshandi’sMyPayproductexemplifiesthisstrategyby allowingclientstoaccessearnedwagesbeforepayday, helpingthemmanageimportantexpenseswithoutresorting tohigh-interestloans.Thisinnovativesolutionaddresses thepressingneedsofusers,demonstratingEshandi's commitmenttocreatingimpactfulfinancialproducts.

Eshandiisdedicatedtopromotingfinancialinclusionfor everyone.Manyconventionalfinancialsystemstendto overlookindividualswholackaregularpaycheckordon’t fitthetypicalmoldofabankcustomer.Michaelquestions thisapproach,asking,“Whyaretheseindividuals automaticallyturnedaway?Theyhavespendinghistoriesat variousstores,andweunderstandtheirfinancial capabilities.”

Eshandiisagroundbreakingalternativemethodtoaward credittothosetypicallyrejectedbyautomatedprocesses. ByusingadvancedAItoolsanddigitalprofiling,the companycreatesnewaffordabilityprofilesthatprovidea moreaccuratepictureofanindividual’sfinancial capabilities.Thisapproachconfirmsthatfinancialproducts genuinelycatertothosewhoneedthemmost.

Understandingtheeconomicrealitiesofitstargetmarket informsEshandi’spricingstrategy Thecompanyis dedicatedtokeepingservicechargeslow,makingits productsaccessible,andbuildingtrustandloyaltyamong clients.Eshandi’sdigitalwalletplatformexemplifiesthis focusonaffordability,offeringlow-costtransactionfeesand nohiddencharges,whichiscrucialforuserswhohavebeen underservedbytraditionalfinancialinstitutions.

Michaelasserts, “Simply launching a product that is cheaper or quicker to access but still excludes the same market as all other products is not genuine inclusion.” Eshandi’sapproachfundamentallydiffersbydeveloping productsthatspecificallycatertotheneedsofthe financiallyexcluded,settingnewindustrystandards.

AprimeexampleisEshandi'searnedwageaccessproduct, "MyPay,"whichallowsclientstoaccessmoneythey've alreadyearnedduringthemonthforasmallservicecharge. Thisinnovativesolutionprovidesimmediatefinancialrelief andstabilitytothosewhoneeditmost.

Additionally,Eshandiisexploringgroundbreakingfinancial products,includingamicrocreditplatformthatusesAIand machinelearningtoassesscreditworthinessbasedon unconventionaldatapoints.Byconsideringfactorslike utilitybillpaymentsandmobilephoneusagepatterns, Eshandicanextendcredittoindividualsoverlookedby traditionalfinancialinstitutions.

Eshandi'sinnovativespiritextendstoitspartnerships, collaboratingwithfintechstartups,NGOsandcommunity groupstopilotnewideasandscalesuccessfulinitiatives quickly ThisagilityguaranteesthatEshandi'ssolutions remainrelevantandeffectiveinaddressingthechanging needsofthemarket.

Byaligningitsfinancialproductswithsocialand environmentalgoals,Eshandicreatesaholisticmodelof financialinclusionthatconsidersthebroaderwell-beingof thecommunitiesitserves.Groundingitsmarketentry strategyinathoroughunderstandingofthecostofliving andeconomicchallengesfacedbyitstargetaudience, Eshandidesignsproductsthatoffertangiblebenefitsand

addressrealfinancialpainpoints,makingthiscustomercentricapproachacornerstoneofitssuccess.

ConvertingfinancialservicesinAfricapresentsseveral challengesforEshandi,includingregulatoryhurdles, technologicalbarriers,andmarketresistance.Michael viewstheseobstaclesasopportunitiesforgrowthand innovation.

Directingcomplexregulatoryenvironmentsisapriorityfor Michaelandhisteam.Theyengagewithregulatorsand policymakerstoadvocateforamoreinclusivefinancial frameworkthatbenefitsunderservedpopulations. Technologicalbarriers,suchaslimitedinternetconnectivity anddigitalliteracy,alsoposesignificantchallenges. Eshandiaddressestheseissuesthroughinitiativesaimedat improvingdigitalliteracyandexpandingaccessto technology,partneringwithlocalorganizationstobridge thedigitaldivide.

gathersfeedbackfromusers,andcontinuouslyiterateson itsproducts.

Elasticity, user-centric design, and a commitment to innovation are key components.

Marketresistancetonewfinancialproductsisanother hurdle.Manyindividualsandbusinessesarehesitantto adoptunfamiliarsolutionsformanagingtheirfinances. Eshandibuildstrustthroughtransparencyandexceptional customerservice,signifyingthevalueandreliabilityofits offeringstograduallyovercomeskepticismandgainthe trustofitstargetmarket.

SuccessforEshandimeanscreatinganecosystemwhere technologyseamlesslyintegratesintothelivesof businessesandindividuals,drivingfinancialinclusionand economicempowerment.Thecompanymeasuressuccess bythenumberofpeopleitcanupliftthroughitsservices, thepartnershipsitforges,andthepositiveimpactithason thecommunitiesitserves.

Eshandi'smissionistodemocratizeaccesstofinancialtools andcertifythateventhemostunderservedpopulationscan benefitfromtechnologicaladvancements.

Publicandmediarelationsarecentraltobuildingbrand awareness,creatingcredibility,andcommunicating Eshandi'smissiontoabroaderaudience.These relationshipshelpthecompanyshowcaseitsinnovations, sharesuccessstories,andengagewithstakeholders.

EffectivepublicandmediarelationscanincreaseEshandi's message,attractpotentialpartners,anddrivecustomertrust, allofwhicharecentraltosustainablegrowth.

Eshandi'slineofproductmanagementiscenteredaround understandingtheuniqueneedsofitsdiversecustomer base.Thecompanyconductsthoroughmarketresearch,

Bymaintainingcloserelationshipswithclients,Eshandican tailoritsofferingstoaddressspecificpainpointsandscale solutionstofitbusinessesofallsizes.Elasticity,usercentricdesign,andacommitmenttoinnovationarekey componentsofEshandi'sproductmanagementstrategy

UnderMichael'sleadership,EshandiSAstandsoutinthe financialservicesmarketasabeaconofhopeforthe financiallyexcludedandaleaderininnovativesolutions. Thecompany’svisiongoesbeyondprovidingfinancial services;itseekstoallowindividuals,througheducation, accesstocreditandconvenientfinancialtools.

AsEshandigrows,itscommitmenttotransforming financialservicesinAfricaremainsstrong.Withapresence inZambia,Zimbabwe,andKenya,thecompanyaimsto createinclusivesolutionsthatredefinetheindustryand confirmeveryonehasaccesstoqualityfinancialservices.

Eshandiisinvestinginresearchanddevelopment,exploring technologieslikeblockchainandadvanceddataanalyticsto increaseitsofferings.Byleadingintechnological advancements,Eshandisetsnewstandardsinthefinancial servicessector.

MichaelenvisagesEshandiplayingakeyroleinglobal financialinclusion.Bycollaboratingwithinternational organizations,Eshandiaimstoinfluencepoliciesthat promotefinancialinclusionworldwide,highlightingthat thisissueextendsbeyondlocalboundaries.

Inaworldwheremanyareexcludedbytraditionalfinancial systems,Eshandiisagame-changer,focusingontrue inclusionandtransforminglivesacrossAfrica.

Success consists of going from failure to failure without loss of enthusiasm.

- Winston Churchill

Improvingcustomerexperiencein

financialservicesisessentialfor fosteringloyalty,enhancing satisfaction,anddrivingprofitability

Inacompetitivelandscape,financial institutionsmustadopteffective strategiestomeetandexceedcustomer expectations.

Here are five key strategies to enhance customer experience in this sector:

PromoteFinancialLiteracyThrough CustomerEducation

Financialliteracyisacrucial componentofcustomerempowerment. Manycustomersoverestimatetheir understandingoffinancialproducts, whichcanleadtopoordecisionmaking.Accordingtoresearchfrom theRaddonResearchInstitute, financiallyliteratecustomersaremore profitableforbanks,astheytendtouse morebankingproducts.

Byofferingeducational resources—suchasonlinecourses, workshops,andin-branch consultations—financialinstitutions canhelpcustomersmakeinformed decisions.Thisnotonlyenhances customersatisfactionbutalsobuilds trustandloyalty.Forinstance, communitybankshavesuccessfully

engagedwithlocalschoolstopromote financialeducation,potentiallycultivating futurecustomerswhilebenefitingthe community

Theonboardingexperienceisoftenthefirst significantinteractionacustomerhaswitha financialinstitution.Researchindicatesthat nearly68%ofbankapplicantsabandonthe accountopeningprocessduetolengthyand complicatedprocedures.

Tocombatthis,banksshouldsimplifytheir onboardingprocessesbyreducingthe numberofstepsrequiredandutilizing technologylikebiometricauthenticationfor identityverification.Bymakingiteasierfor customerstoopenaccounts,bankscan significantlyincreaseconversionratesand customersatisfaction.Astreamlined onboardingprocessnotonlyreducesdropoffratesbutalsosetsapositivetoneforthe customerrelationship.

Intoday'sdigitalage,customersexpect personalizedexperiences.Financial institutionscanharnesstechnologyto delivertailoredservicesthatmeet individualneeds.Forexample,using customerrelationshipmanagement(CRM) systemscanprovidea360-degreeviewof customerinteractions,enablingstafftooffer personalizedrecommendationsand solutions.

Moreover,adoptingconversational banking—wherecustomerscanengage throughnaturallanguageinteractions—can enhancethecustomerjourney Astudy foundthat79%offinancialcustomers wouldpaymoreforconvenientservices, highlightingthedemandforpersonalized, responsivesupport.

Self-serviceoptionsareincreasingly popularamongcustomerswhopreferto managetheirfinancesindependently. AccordingtoZendesk,therehasbeena 5.4xgrowthinself-serviceadoptionin financialservices.Byprovidingrobustselfservicetools—suchasFAQs,chatbots,and

mobileapps—bankscanempower customerstoresolveissuesquicklyand efficiently.

Forinstance,Nubank,aBrazilian fintech,allowscustomerstomanage variousservicesthroughitsself-service model,achievingover80%customer satisfaction.Thisnotonlyreduces operationalcostsbutalsoenhancesthe overallcustomerexperienceby providingimmediateassistance.

Regularlysolicitingcustomerfeedback isvitalforunderstandingtheirneedsand expectations.Financialinstitutionscan usesurveys,focusgroups,anddirect interviewstogatherinsightsabout customerexperiences.Accordingtoa study,companiesthatactivelyseek customerfeedbackcanseeasignificant increaseinsatisfactionandloyalty

It'sessentialtoaskopen-endedquestions togaindeeperinsightsratherthan relyingsolelyonquantitativedata.By actingonthisfeedback,bankscanmake informeddecisionsaboutproduct offeringsandserviceimprovements, ensuringtheyremainalignedwith customerpreferences.

Conclusion

Inconclusion,enhancingcustomer experienceinfinancialservicesisnot justaboutmeetingbasicneeds;it'sabout creatingmeaningfulinteractionsthat fosterloyaltyandtrust.Bypromoting financialliteracy,streamlining onboardingprocesses,leveraging technologyforpersonalizedservice, implementingself-serviceoptions,and activelyseekingcustomerfeedback, financialinstitutionscansignificantly improvetheircustomerexperience.

Thesestrategiesnotonlyleadtohigher customersatisfactionbutalsocontribute toincreasedprofitabilityandlong-term successinacompetitivemarket. Investingincustomerexperienceisnot merelyanoption;itisanecessityfor thrivinginthefinancialservices industry

Haveyoueverwonderedhow

tomakethemostofalineof creditwithoutfallinginto commonpitfalls?Usingalineofcredit wiselycanprovidesignificantfinancial flexibility,especiallyforbusinesses. However,impropermanagementcan leadtoseriousfinancialissues.Let's explorethecommonmistakestoavoid whenusingaworkingcapitallineof creditandhowtomanageiteffectively

MisunderstandingthePurpose

Whenutilizingaworkingcapitalline ofcredit,it'scrucialtounderstandits intendedpurpose.Thistypeofcreditis designedtocovershort-term operationalneeds,suchaspayroll, inventorypurchases,orunexpected expenses.Usingitforlong-term investmentsornon-essential expenditurescanstrainyourfinances. Sticktoshort-termneedstomaintain financialhealthandavoidunnecessary debt.Byaligningcreditusagewithits purpose,businessescanensuretheyare notoverextendingthemselves.

Oneofthemostcommonmistakesis notpayingcloseattentiontothe interestratesandfeesassociatedwitha lineofcredit.Thesecostscanaddup quickly,makingthelineofcreditmore expensivethaninitiallyanticipated.It's essentialtounderstandthetermsof

yourcreditagreementfully.Compare differentoptionsandchoosetheone withthemostfavorablerates. Regularlyreviewtheinterestratesand feestoavoidunpleasantsurprisesand keepcostsundercontrol.

Overborrowingisasignificantrisk whenusingalineofcredit.Whileitis temptingtousetheavailablefundsfor variousneeds,thiscanleadto excessivedebt.Borrowonlywhatyou needandcancomfortablyrepay Excessiveborrowingcanstrainyour cashflowandmakeitdifficulttomeet repaymentobligations.Establisha clearborrowingplanandsticktoit. Thisdisciplinedapproachhelps maintainfinancialstabilityandavoid debttraps.

AccordingtoLanternbySoFi,"How muchyourbusinesscanborrowwill dependonavarietyoffactors, includingyourcreditscore,revenue, andexistingdebt.Keepinmindthat yourcreditlineisthemaximumyou canborrowbeforeyouneedtopayoff yourbalance."

Anothercommonmistakeisneedinga solidrepaymentplan.It'scrucialto haveaclearstrategyforrepayingthe borrowedamount.Withouta repaymentplan,youriskfallingbehind onpayments,incurringadditionalfees, anddamagingyourcreditscore. Developarealisticrepaymentschedule thatalignswithyourcashflow Prioritizetimelypaymentstoavoid penaltiesandinterestaccumulation. Thisproactiveapproachensuresyou maintaingoodfinancialstanding.

Usingalineofcreditfornon-essential expensescanquicklyleadtofinancial trouble.It'sessentialtodistinguish betweennecessaryandunnecessary expenditures.Reservethelineofcredit forvitalbusinessneeds,suchas coveringoperationalcostsormanaging short-termcashflowgaps.Avoidusing itforluxuryitemsornon-essential purchases.Thisprudentapproach ensuresthatthecreditisavailable whenyouneeditmostandhelps maintainfinancialdiscipline.

Monitoringyourcreditusageregularly canresultinoverspendingand financialmismanagement.Keepa closeeyeonhowmuchyouborrow andtheremainingcreditlimit.Regular monitoringhelpsidentifypotential issuesearlyandallowsfortimely correctiveactions.Usefinancialtools andsoftwaretotrackyourcreditusage andrepayments.Thisvigilanceensures youstaywithinyourcreditlimitsand manageyourfinanceseffectively

Inconclusion,avoidingcommon mistakeswhenusingaworkinglineof creditiscrucialformaintaining financialhealth.Byunderstanding thesecommonerrorsandmanagingthe creditwisely,businessescanbenefit fromthefinancialflexibilityitoffers withoutfallingintodebttraps.Proper usageensuresthatthelineofcreditisa valuablefinancialtool,supportingthe businessintimesofneed.

Success is not how high you have climbed, but how you make a positive difference to the world.

- Roy T. Bennett

Robo-advisorshaveemerged

asasignificantforceinthe financialadvisorylandscape, revolutionizinghowindividuals managetheirinvestments.By leveragingtechnologyand algorithms,theseplatformsprovide automatedinvestmentmanagement servicesthatareaccessibletoa broaderaudience,particularlythose whomayhavepreviouslyfelt excludedfromtraditionalfinancial advising.

Attheircore,robo-advisorsare digitalplatformsthatautomatethe investmentprocess.Userstypically beginbyansweringaseriesof questionsabouttheirfinancialgoals, risktolerance,andinvestment horizon.Basedonthisinformation, therobo-advisorcreatesa personalizedinvestmentportfolio. Thisapproachsimplifiesthe investingprocess,makingiteasier forindividualswithlittletono financialexpertisetostartinvesting.

Oneofthemostappealingaspectsof robo-advisorsistheircosteffectiveness.Traditionalfinancial advisorsoftenchargearound1%of assetsundermanagement,while manyrobo-advisorschargelessthan 0.4%annually Thislowerfee structurecanleadtosignificant savingsovertime,especiallyfor thosejuststartingtheirinvestment

journey.Forinstance,a$15,000 investmentmanagedata1%feewould cost$150annually,whilethesame investmentwitharobo-advisor charging0.4%wouldcostonly$60.

Thepopularityofrobo-advisorshas surged,particularlyamongyounger investors.Accordingtoareport, around40%ofmillennialsandGenZ investorsarecomfortableusing technologyforfinancialmanagement. Thisdemographicismorelikelyto embracedigitalsolutions,seeking convenienceandlowercosts.

Robo-advisorshavealsomade investingmoreaccessiblebylowering minimuminvestmentrequirements. Someplatforms,likeBetterment,have nominimumbalance,allowingusersto startinvestingwithevenmodest amounts.Thisdemocratizationof investmentmanagementisasignificant shiftfromtraditionalfirmsthatoften requiresubstantialinitialinvestments.

Robo-advisors offer several advantages:

• Accessibility:Theyprovideauserfriendlyinterfacethatallows anyonetostartinvestingwith minimaleffort.

• CostEfficiency:Lowerfeesmake investingmoreaffordablefora widerrangeofpeople.

• AutomatedManagement:Roboadvisorscontinuouslymonitorand rebalanceportfolios,ensuringthey remainalignedwiththeinvestor's goals.

• Transparency:Mostplatforms offerclearinsightsintofeesand investmentstrategies,helping usersunderstandwheretheir moneyisgoing.

Despitetheirbenefits,robo-advisors arenotwithoutlimitations.One significantdrawbackisthelackof personalizedadvicethatconsidersan individual'sentirefinancialpicture. Whiletheycancreateadiversified portfolio,theyoftendonotaccountfor complexfinancialsituations,suchas taximplicationsorestateplanning.

Moreover,robo-advisorsprimarily investinexchange-tradedfunds(ETFs) andmutualfunds,whichmaynotsuit everyinvestor'sneeds.Thoselooking formoresophisticatedstrategies,such asoptionstradingorindividualstock picking,mayfindrobo-advisors lacking.

Anotherconcernistherelianceon algorithms.Whilethesesystemscan analyzevastamountsofdata,theymay struggletoadapttosuddenmarket changesoruniquepersonal circumstances.Forexample,during significantmarketdownturns,ahuman advisorcanprovidereassuranceand adjuststrategiesbasedonreal-time insights,somethingarobo-advisormay noteffectivelyreplicate.

Asrobo-advisorscontinuetogrow, theyarelikelytocoexistwith traditionalfinancialadvisorsrather thancompletelyreplacethem.Many individualsmayfindvalueinahybrid approach,utilizingrobo-advisorsfor straightforwardinvestment managementwhileconsultinghuman advisorsformorecomplexfinancial planning.

Infact,asurveyfoundthat60%of investorsbelievethatacombinationof humanandrobo-advisoryservices wouldbeidealfortheirfinancial needs.Thissuggestsashifttowarda moreintegratedfinancialadvisory

landscape,wheretechnologyenhances traditionalservicesratherthan replacingthementirely

Robo-advisorsrepresentasignificant advancementintheworldofinvesting, makingfinancialmanagementmore accessibleandaffordable.Theyhave transformedhowmanyindividuals approachinvesting,particularly youngergenerationswhoprioritize convenienceandcost.However,their limitationshighlighttheimportanceof humanoversightinfinancialplanning. Astechnologycontinuestoevolve,the financialadvisorylandscapewilllikely adapt,blendingthestrengthsofboth robo-advisorsandtraditionaladvisors tomeetthediverseneedsofinvestors.

Leadership is not about being in charge, Its about taking care of those in your charge.

- Simon Sinek

Astheworldoffinancegrapples

withever-increasing complexities,theemergence ofquantumcomputinghassparkeda neweraofpossibilities.This revolutionarytechnology,withits abilitytoharnesstheuniqueproperties ofquantummechanics,ispoisedto redefinethelandscapeofbanking, investment,andriskmanagement.

Inthiscomprehensivearticle,wewill explorethemultifacetedimpactof quantumcomputingonthefinancial servicesindustry,uncoveringtheuse cases,challenges,andstrategic implicationsthatwillshapethefuture ofthisdynamicsector.

Atthecoreofquantumcomputinglies theconceptofqubits,whichdiffer significantlyfromthetraditionalbinary bitsusedinclassicalcomputers.Qubits canexistinstatesofsuperposition, allowingthemtoperformmultiple calculationssimultaneously This inherentparallelismendowsquantum computerswiththeabilitytoprocess dataatstaggeringspeeds,far exceedingthecapabilitiesofeventhe mostpowerfulsupercomputers.

Oneofthemostsignificant applicationsofquantumcomputingin financelieswithintherealmof corporatebanking.Thehighmonetary valueatstakeandthesheercomplexity

ofusecases,suchastradefinanceand collateraloptimization,makethis domainaprimetargetforthe transformativepowerofquantum technologies.

Similarly,inbettingandgambling,the potentialforquantumcomputingto revolutionizethiswebsiteisimmense, offeringadvancedalgorithmsanddata analysistooptimizebettingstrategies andenhancedecision-making processes.

Quantumcomputingcanrevolutionize thewayfinancialinstitutionsmanage collateralforusecaseslikesecurities lending.Byleveragingthe technology'sabilitytohandlean exponentiallylargersetofvariables andconstraints,bankscanachieve greateraccuracyinoptimizing collateralacrossmultipleportfolios. Thisenhancedoptimizationcanleadto improveddecision-making,reduced risk,andincreasedprofitability

Theinherentcapabilitiesofquantum computing,suchasitscapacityto handleavastarrayofboundary conditions,canfacilitateholistic simulationsofliquidity.This,inturn, cansupportreal-timedecision-making andevenenableautomateddecisionmakingprocesses,ultimately enhancingtheefficiencyand responsivenessofcorporatebanking operations.

Thefinancialsector'srelianceon accurateriskmanagementandrobust cybersecuritymeasuresmakesita primebeneficiaryofquantum computing'stransformativepotential.

Quantummachinelearningcanenable decision-makerstoconsiderabroader setofvariablesandassetswhen simulatingrisks,reducingthecostof riskmanagementandfacilitatinglarger dealswithhighermargins. Additionally,quantumcomputingcan enhancetheaccuracyoffraud detectionalgorithmsbyincorporatinga morecomprehensivesetoffactors.

Theadventoffault-tolerantquantum computersposesasignificantthreatto thecurrentcryptographicprotocols usedtosecurefinancialdataand transactions.Tomitigatethisrisk,the financialindustryisactivelyexploring twoleadingapproaches:post-quantum cryptography(PQC)andquantumkey distribution(QKD).

Whiletheusecasesofquantum computinginretailbankingmayshare similaritieswithcorporatebanking,the challenges,andcomplexitiestendtobe morestraightforwardduetothe inherentstructureofretailbanking operations.

Quantumcomputingcanenhancethe accuracyofcreditdecisionalgorithms byconsideringabroaderrangeof

relevantfactors,leadingtomore informedanddata-drivenlending decisions.Thiscantranslateinto improvedriskmanagement,reduced defaults,andincreasedprofitabilityfor retailbankinginstitutions.

Theuniquepropertiesofquantum statesofferthepotentialto revolutionizethepaymentslandscape, addressinglong-standingissuessuchas moneylaunderingandtransaction security

Quantumpayments,enabledby quantumkeydistribution(QKD) protocols,canprovideamoresecure andefficientalternativetotraditional paymentmethods.Byleveragingthe inherentpropertiesofquantumstates, quantumpaymentscaneliminatethe possibilityofcounterfeiting,aswellas significantlyenhancethespeedand overallsecurityoffinancial transactions.

Thedevelopmentofquantummoney, whichisbasedonQKDprotocols,can furthertransformthebanking ecosystem.Quantummoney,withits non-falsifiablenatureandenhanced securityfeatures,hasthepotentialto redefinethewayfinancialinstitutions andtheircustomersengageinintraandinter-banktrades,offeringamore robustandtamper-resistantsolution.

Theapplicationsofquantum computinginwealthmanagement sharesimilaritieswiththosein investmentbanking,asbothdomains

involvethemanagementofcomplex financialassetsandtheoptimizationof investmentportfolios.

Quantumtechnologiescanfacilitate themanagementofnon-physicalassets byencodingcontractsinquantum states.Thisapproachcanprovidea faster,moresecure,andmore sustainablealternativetocurrent blockchain-basedsolutions,which oftenrelyonenergy-intensivemining processes.

Quantumcomputingcanenablewealth managerstocreatedigitaltwinsof theirclients'portfolios,allowingfor moregranularsimulationsand optimizations.Thiscanleadto enhancedcapitalallocation,improved riskmanagement,andbetter-informed investmentdecisions.

Investmentbankingisoneoftheareas wherequantumcomputingcanhave themostimmediateandsignificant impact,particularlyinportfolio optimizationandderivativespricing.

Quantumcomputingcanempower investmentbankingteamstocreate comprehensivedigitaltwinsoftheir banks'positions,enablingthemto simulatevariousmacroeconomic scenariosandpathways.Thiscanlead tooptimizedcapitalallocation, improvedcollateralmanagement,anda deeperunderstandingoftheunderlying assetsandtheirinterdependencies.

Intheshortterm,quantumcomputing canenhancetheaccuracyandspeedof classicalMonteCarlosimulations, whicharewidelyusedininvestment banking.Inthelongterm,the

implementationofquantumMonte Carloalgorithmscanprovidequadratic speedupsovertheirclassical counterparts,furtherimprovingthe efficiencyofinvestmentbanking operations.

Thetransformativepotentialof quantumcomputingextendsbeyond traditionalbankingfunctionsand impactstheoperationsandfinance domainswithinfinancialinstitutions.

Inthefinanceandaccounting functions,quantumcomputingcanbe usedtooptimizefinancialprocesses andaugmenttheinsightsprovidedby humanexperts.Byconsideringa broaderrangeofvariablesandfactors, quantum-enabledalgorithmscan supportmoreaccurateandinformed decision-makinginareassuchastax planningandfinancialreporting.

Asthefinancialservicesindustry grappleswiththetransformative potentialofquantumcomputing, financialinstitutionsmusttake proactivestepstocapitalizeonthis emergingtechnologyandsecurea competitiveadvantage.

Financialinstitutionsthathavenotyet startedbuildingquantumcapabilities shoulddosoimmediately This involvesidentifyingrelevantusecases, garneringexecutivesponsorship,and securingsustainedfundingtosupport thedevelopmentofquantum-related skillsandinfrastructure.

Organizationscanstartexperimenting withquantumusecases,evenifthey donothavedirectaccesstoquantum hardware.Byleveraginginsightsfrom quantumtechnologiestoimprove classicalsolutions,financial

institutionscancapturenear-term economicadvantagesandposition themselvesasearlymoversinthe quantumcomputinglandscape.

Asthefinancialservicesindustry grappleswithincreasingcomplexities, theemergenceofquantumcomputing hasopenedupaworldofpossibilities. Fromoptimizingcorporatebanking operationstoenhancingcybersecurity andrevolutionizingpayments,this transformativetechnologyholdsthe powertoredefinethelandscapeofthe financialsector.

Byunderstandingtheuniqueproperties ofquantumcomputing,financial institutionscanharnessitspotentialto driveinnovation,improvedecisionmaking,andgainacompetitiveedgein anever-evolvingmarket.Thetimeto actisnow,asearlymoversinthe quantumcomputingspacestandto secureasignificantadvantageinthe yearstocome.