BECAUSEYOUR STORY DESERVES THE SPOTLIGHT

P e r s p e c t i v e

Theworldoffinancehaslongbeenshapedbyindividualswho

pairtechnicalexpertisewithclarityofjudgmentandanability tounderstandwhattrulydrivesoutcomes.Whilenumbersoffer structureandmodelsofferpredictability,thedeepestinsightsoften emergefromreal-worldlessonsgatheredoveryearsoffacingcomplex situations.Theseexperiencesformafoundationthatcannotbetaught withinthepagesofanyacademictext.Instead,theyarelearnedthrough observation,introspection,andthewillingnesstoquestionnotjustdata, buthumanbehavior.

Today,thedemandforleaderswhocancombinestrategicreasoning withperceptivedecision-makingishigherthanever.Stakeholderslook forprofessionalswhocanmaintainstability,inspireconfidence,and respondtochallengeswithabalancedandthoughtfulapproach.Such individualsdonotrelyontheoryalone;theydrawfromcountless encountersthatrevealhowmotives,expectations,andinterpersonal dynamicsinfluenceoutcomesfarmorethanmetricssuggest.These insightsbuildresilience,sharpeninstincts,andcultivateclaritythat standsstrongeveninuncertainenvironments.

Itisinthisspiritthatwepresent The Financial Icon –Celebrating a Journey of Mastery,anedition dedicatedtorecognizingaleaderwhosejourney reflectsdepth,maturity,andanunwavering commitmenttocontinualgrowth.Thiseditionhonors thosewhoremindusthatfinanceisnotmerelya function—itisarealmshapedbypeople,intentions, andthecouragetointerpretbothwithprecisionand fairness.

Thefeaturedexecutiveinthiseditionhasbuilta distinguishedjourneythatreflectsdecadesof commitmenttounderstandingfinancebeyondits mathematicalstructure.Withextensiveexperience acrossseniorroles,thisleaderbelievesthatsuccessat thehighestlevelsdependsontheabilitytounderstand peoplemoreaccuratelythantheyunderstandyou. Theirperspectivehighlightshowunseenmotivesand unspokenconcernsoftenshapedecisionsfarmorethan spreadsheetsandmodels.Throughtheirreflections, theysharearareblendofwisdom,clarity,andpractical insightthatcontinuestoguideprofessionalsseekingto risewithpurposeandintegrity

Wehopethiseditioninspiresreaderstopursuegrowth notonlythroughknowledge,butthroughthedeeper awarenessthatdefinestruemasteryinfinance.

Let the pages fill you with not just insights, but ideas in motion!

-Bill Limbert

Managing Editor: Bill Limbert

Assisting Editor : Joe Lee

Visualizer : Stewart Jonas

Art & Design Director : Robin Clarck

Sr. Graphic Designer : Authur Watson

Vice President : Jil Kendal

Asst. Vice President : Kevin Johnson

BDE : Daniel Smith

BDE : Jennifer Peters

Technical Head : Andrea Jackson

Technical Specialist: Mike Anderson

Technical Consultant : Oliver Sutton

Research Analyst : Wendy J.

SEO Lead : Tasha L.

www.twitter.com/enterprisereview.com/ www.facebook.com/enterprisereview.com/

WE ARE ALSO AVAILABLE ON

Email sales@enterprisereview.com For Subscription www.enterprisereviewmedia.com

Copyright © 2025 www.enterprisereviewmedia.com, All rights reserved. The content and images used in this magazine should not be reproduced or transmitted in any form or by any means, electronic, mechanical, photocopying, recording or otherwise, without prior permission from Enterprise Review. Reprint rights remain solely with enterprisereview.

December, 2025

The Financial Icon - Celebra�ng a Journey of Mastery

The Signature Story

Guiding You to Navigate the Intricate Number Game of the Present and the Future

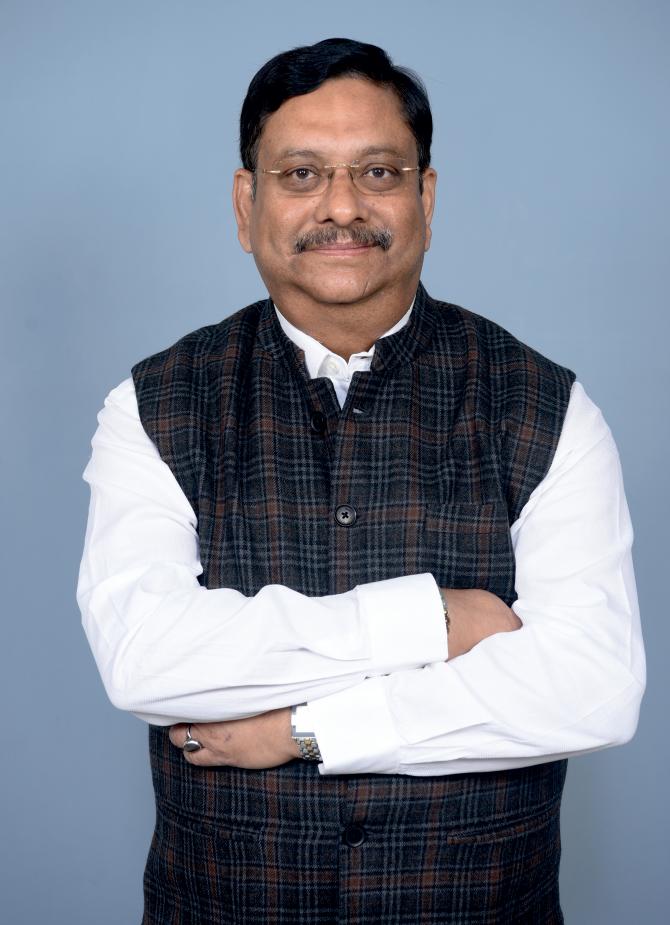

Dr Bhaskar Roy

Former Execu�ve Director and Chief Opera�ng Officer (COO) Globus Spirits Ltd

It'sbeenalongtimesincethefieldoffinancemoved beyondnumbersandtextbooks.Aftergainingavast repertoireofexperienceinit,DrBhaskarRoy—the formerExecutiveDirectorandChiefOperatingOfficer akaCOOatGlobusSpiritsLtd—describeshishardearnedwisdom–thekindthatneverappearsinnumbersor textbooksbutbecomesthedecisivefactoratseniorlevels as:

“Theabilitytoreadpeopleandintentions—fasterandmore accuratelythantheycanreadyou.”

Thisgoesfarbeyondemotionalintelligence,believesDr Roy.Headds,“Veteranfinanceleaderswilltellyouthat onceyouclimbhighenough,thehardestproblemsarenot numbers,notmodels,notmarkets—theyarepeople's incentives,hiddenagendas,andunspokenfears.”

1.Dealsdon'tfallapartbecauseofvaluation—theyfall apartbecauseofpeople.

M&Anegotiations,bankcovenants,JVpartnerships,board approvals—thestatednumbersmatterlessthan:

• whoactuallyhasvetopower,

• whatsomeoneisafraidtoreveal,

• whosecareerdependsonwhatoutcome.

2.Marketmovementsarepredictablecomparedto internalpolitics.

Financeleadersspendenormousenergyon:

• readingboarddynamics,

• sensingshiftingpowercenters,

• knowingwhena“yes”isactuallya“noinslow motion.”

3.Earlydetectionoftroublesavesmorevaluethan forecastingeverdoes.

Asuddensilencefromalender,asubtlechangeina regulator'stone,abusinessunitheadavoidingdetail— thesemicro-signalstellyoueverythingbeforetheP&L does.

DrRoybelievesthatseniorfinanceleaderslikehim typicallyacquirethisskill

✔ Bybeingblindsidedearlyintheircareer.

Adealheandhisteamthoughtwassolidcollapsedfora reasonnospreadsheetcaptured.

Thisteaches:“Numbers don't move people — people move numbers.”

✔ Bysittinginenoughboardroomstorecognize patterns.

Youstarttoseewhoinfluenceswhom,whofreezes underpressure,andwhonegotiatesindirectly.

✔ Bymanagingcrises.

Cashcrunches,hostilelenders,regulatory scrutiny—thesemomentssharpenyourability toreadintentbecausesurvivaldependsonit.

✔ Bywatchingwhatpeopledo,notwhatthey say

ACEOwhopostponesameetingtwiceistelling youmorethantheirstrategydeck.

✔ Bylosingwhentheytrustedwordsinsteadof incentives

Everyonelearnsthisonethehardway

TheDistilledWisdom

“Infinance,yourrealedgeisn'tnumericalaccuracy—it's theaccuracyofyourjudgmentaboutpeople,”insistsDr Roy

DrRoyputsitthisway:“Aspreadsheettellsyouwhat shouldhappen.Aperson'sincentivestellyouwhatwill happen.”

ReflectingontheCrisesCrucible

DrRoysaysthatsincehedidn'tpersonallylivethrough crises,he'sgainedthewisdomofhowotherveterans managedcapitalthroughtheDot-comBust,2008GFC,the TaperTantrum,andthePandemicCrashconsistently.He describesitasthesinglestrategiclessonthatpermanently reshapedthemarketphilosophy.

MostProfoundStrategicLesson:

“Liquidityisnotametric—itisyouroxygen,andyou mustalreadyhaveitbeforeyouneedit.”

Acrosseverymajorcrisis,theprofessionalswhosurvived (andoftenemergedstronger)creditoneinsight:

Returnoncapitalmattersfarlessthanreturnofcapital— andliquidityistheonlythingthatprotectsboth.

1.Crisesarenotaboutlosses—theyareaboutthetiming oflosses.

Youcanholdgoodassetsthroughdrawdowns. Butyoucannotholdanythingifyou'reforcedtosellto meet:

• redemptions

• margincalls

• workingcapitaldeficits

• loancovenants

• vendororpayrollobligations

Veteransrealized:

Themarketdoesn'tkillyou.Forcedsellingdoes.

2.Liquidityevaporatesexactlywhenyouneeditmost.

Thisistherecurringpatternin2000,2008,and2020:

• Buyersdisappear.

• Bid–askspreadsexplode.

• Fundingwindowsshut.

• Bankstightenevenfortheirbestclients.

• EvenAAAcollateralisdiscounted.

Thelesson:

Ifyourplandependsonsellingintoacrisis,youdon'thave aplan—youhaveahope.

3.Crisesrewardthosewhocanplayoffensewhileothers playdefense.

In finance, your real edge isn't numerical accuracy — it's the accuracy of your judgment about people.” “

Thosewithliquidityin2008boughtdistressedcreditat 20–40cents.

Thosewithliquidityin2020boughtblue-chipequitiesat 30–50%discounts.

Thosewithoutliquiditysoldthesameassetsatfire-sale prices.

Thus,thephilosophicalshift:

Liquidityisn'tjustprotection—itisthecapacitytobe greedywhentheworldisfearful.

Howdoesthisinsightchangecapitalallocationstrategy?

Beforecrises

Mostportfolioschaseoptimization—“efficientfrontier”, maximumIRR,lowestidlecash.

Afterlivingthroughcrises

Veteransadoptadifferentruleset:

✔ Maintainredundantliquidity,not“optimal”liquidity

Twolayers:

• Operatingliquidity

• Strategic“crisisliquidity.”

✔ Durationmismatchkillsfasterthanbadassets

Matchfundingtoassetlives.

Short-termleverageonlong-termassets=catastrophein slowmotion.

✔ Positionsizingisasurvivaldecision,notanoptimization one

“Youcan'tblowupifyousizepositionssmallenough.”

✔ Alwayspriceinthecostofforcedexits

Thetheoreticalmodelofprice≠crisisexecutionprice.

✔ Riskiswhat'sleftoverwhenyouthinkyou'vemeasured everything

Truetailrisksarebehavioralandsystemic,notstatistical.

TheRealLearning

ThereisonesentenceDrRoyengravesintohisinvestment philosophy:

“Youdon'tcontrolreturns;youonlycontrolyourabilityto stayinthegame.”

Liquidity,conservativeleverage,anddisciplinedsizing— thesebecomethepillarsofastrategybuilttosurvive decades,notcycles.

Forward-lookingCapital–TheCorePhilosophy:

Today,DrRoyisactuallyadvisingfirmsandclients—not justtostayprofitable,buttopositioncapitaltocapture asymmetricupsideinthenextdisruptivecycle(AI,climate tech,bio-manufacturing,robotics,energysystems,etc.).

“Don'tbetontechnologies.Betonthe enablers andthe bottlenecks thateverydisruptivewavemustpass through.”

Thebiggestwealthgeneratorsindisruptiveerasarerarely thefront-lineinnovators.

Theyaretheinfrastructurelayers,toolinglayers, distributionlayers,andregulatorychokepointsthat becomeunavoidableasthenewindustryscales.

Thisreflectshisguidanceseeninforward-lookingcorporate finance,PE,andstrategiccapitalallocation—nottheory DrRoy'sCurrentAdvicetoFirms/Clients(Strategic CapitalAllocation)

1.Overweight“PicksandShovels,”NotPure Innovators

Avoidtheearly-stagehypenames.

Focusonthecompaniesthatmakedisruptivetech possible

ForAI:

• Computeinfrastructureproviders

• High-yieldpowerproducers

• Datacenterbuilders

• Semiconductorequipmentsuppliers

• Advancedcoolingtechnologies

ForClimateTech:

• Gridupgradecontractors

• Batterymaterials&recycling

• Industrialheatpumps

• Greenhydrogeninfrastructure

ForBio-manufacturing:

• Labautomation

• Fermentationcapacity

• Precisionreagents

• Regulatorytech(GMP+QAplatforms)

Rationale:

Innovatorschangeevery12–24months. Enablersbecomemonopolies.

The ability to read people and inten�ons—f more accurately than the can read y

2.BuildCapitalAroundthe“3I's”: Infrastructure→Interoperability→Integration

Thisisaconsistentpatternacrossalldisruptivesectors:

*Infrastructure:

Physicalordigitalbackbonewithlong-durationreturns (e.g.,powersystems,datacenters,bioreactors)

*Interoperability:

Companiesprovidingstandards,APIs,regulatory compliance,andsafetylayers (e.g.,modelalignmenttools,carbonaccountingsystems, bio-safetyplatforms)

*Integration:

Horizontalplatformsthatbecomethe default operating system foranentiresector

Thisiswherethe massive multiplesemerge.

3.AllocatetoAssetswithLong-DurationOptionality Notspeculativeoptionality—structuraloptionality. Examples:

• Landnearfutureindustrialpowerclusters

• Long-lifeIPthatcompoundswitheverynewproduct

• Regulatorylicensesinconstrainedmarkets

• Powercontracts(PPAs)inregionsfacingAI-driven electricitydemandgaps

• Contractmanufacturinginbio(ascapacitygetsscarce)

Theseassetsbehavelikelong-datedcalloptions without the decay

4.PrepareFirmstoMonetizeDisruption,NotJust SurviveIt

Mostcompanies react todisruption.

Thewinners pre-invest in capability gaps thatcompetitors willfacelater

Examplesofforwardinvestments,DrRoyadvises:

• InternaldatainfrastructureforAI-readiness

• Transitioningfromcapex-heavytocapex-lightmodels

• Workforcereskillingaheadoftheneed

• Earlypartnershipswithregulatory-forwardplayers

• Establishingprocurementlock-insforscarce commodities(chips,power,rarematerials)

5.Keep10–20%ofcapitalina“strategicbetsbucket.”

ThisisnotVC-stylerisk-taking.

It'sasmall,structuredexposuretotechnologiesthatwill bemainstreamin10yearsbutnotinvestabletoday Typicalinstruments:

• Jointdevelopmentagreements

• Convertiblefacilities

• Revenue-sharingmodels

• Minoritystrategicstakes

• Pilotprojectswithoptionrights

Thisgivesafirm first rights ondisruptiveopportunities withoutriskingthebalancesheet.

WhatDrRoyTellsLeadersAbouttheTimingofthe NextCycle

Thenext10–15yearswillbedominatedbythree constraints:

~Compute

AIdemandisgrowingfasterthanchipsorpowersupply.

~Energy

AI,manufacturing,andelectrificationwillcreatemultidecadepowershortages.

~Biology

Bio-manufacturingcapacitywillbefullybookedlike semiconductorfabs.

“SothequestionIpushfirmstoask:Areyoupositioned onthesideofthebottleneckorthesidecrushedbyit?”

You don't control returns; you only control your ability to stay in the game.”

TheCoreAdvice

"Ownthebottlenecks.Leasetheinnovation.Compound theinfrastructure.”

That'sthestrategyusedby:

• sovereignfunds

• topPEfirms

• corporatestrategists

• generationalfamilyoffices

Becauseit'stheonlyrepeatablewaytocaptureupside across multiple disruptivecycles.

DrRoy'sLeadershipPhilosophy:

“Clarity,Trust,andOwnership—engineeredthrough systems,notslogans.”

Ahigh-performingfinanceteamdoesn'temergefrom motivationallanguage;itemergesfromdeliberatedesign ofincentives,communicationnorms,talentpathways,and decisionrights.

Heanchorshisphilosophyonthreepillars:

1.BuildTrustbyMakingExpectationsFrictionlessand Transparent

Hightrustisnotaboutbeing“nice”;it'saboutremoving ambiguity.

✔ Radicalclarityofroles

Everypersonmustknow:

• Whatdecisionsdotheyown

• Whatdecisionsdotheyinfluence

• Whatdecisionsaretheysimplyaccountablefor executing

• Whatsuccesslookslikeinobjectiveterms

Ambiguitydestroystrustfasterthanunderperformance.

✔ Informationsymmetry

Financebecomespoliticalwheninformationishoarded.

“Myrule: Everyone gets the same context I have unless restricted by governance.”

Whentheteamseesthatdataanddecisionsaren't manipulated,trustcompounds.

✔ “Nosurprises”culture

“Webuildtrustbyensuringissuessurfaceearly—before theymetastasizeintocrises.”

“Irewardearlyescalation,neverpunishit.”

2.DriveAccountabilityThroughEmpowerment,Not Surveillance

Accountabilityonlythriveswhenpeopleactually own something.

✔ Decisionssitwiththepersonclosesttothe information

• Controllersowncontrols.

• FP&Aownsforecastingassumptions.

• Treasuryownscashdecisions.

• Businessfinanceownsperformancenarratives.

• Leadersinterveneonlywhenrisksexceedthresholds.

✔ Scorecards,notsupervision

Everyrolehasa3–5metricscorecard:

• measurable

• quarterly

• tiedtobusinessoutcomes,notactivities

Accountabilitybecomesobjective—notemotional.

✔ Post-mortemswithoutblame

Failuresareanalyzedsystemically:

“Whatbrokeinprocess,training,orassumptions?”

—not“Whocanwefault?”

Thisencouragesownershipinsteadofdefensiveness.

3.DevelopNext-GenFinancialLeadersforaDigitally TransformedIndustry

Thefinanceleadersofthenextdecadewillneedthree capabilities:

Capability A: Digital Fluency (not coding, but comprehension)

DrRoyrequiresemergingleaderstounderstand: dataarchitecture

• automationworkflows

• AI-augmentedanalytics

• digitalcontrols

• cloudERPlogic

• real-timedashboards

Theydon'tneedtowritePython—theymustknowwhat's possible.

Howhedevelopsthis:

• Rotationsthroughdata&analyticsteams

• Shadowingsystem-implementationsprints(ERP,RPA, AIprojects)

• Monthlydeep-divesononenewtechcapability (“chatbotsforcontrols”,etc.)

• MandatoryliteracyinSQL-liteand PowerBI/Looker/Tableau

Thiscreatestech-awarefinanceleaders,notback-office accountants.

Capability B: Strategic Framing & Storytelling

Thebestfuturefinanceleadersarethosewhocanexplain:

• “Whatthenumbers mean.”

• “Whyitmattersnow.”

• “Whatwemustchangenext.”

Howhedevelopsthis:

• Weekly“narrativereviews”ofrollingforecasts

• Rewritingbusinessreviewsas1-pagestrategymemos

• Exposinghigh-potentialtalenttoboard-prepand investor-relationsprojects

• Coachingoncommunicationmodels(pyramid principle,structuredinsights)

Numbersmatter.

Narrativesmoveorganizations.

Capability C: Judgment Under Ambiguity

Digitaltransformationincreasesuncertainty,notreducesit.

Howhedevelopsthis:

• Simulatedcrisisscenarios(liquidityshock,system outage,pricingcollapse)

• Delegatingsmallbutcriticaldecisionsearly

• Rotationsbetweencontrollership→FP&A→treasury →businessfinance

• Teaching“decisionprinciples”ratherthan“rules.”

“Iwantleaderswhocanmakethecallwhenthereisno data,notjustwhendataisperfect.”

TheOperatingSystemBehindthePhilosophy

DrRoy'sapproachreliesonbuildingsystems,notheroic leadership:

✔ Weekly“decisionforums”whereanalystspresent options,notfindings.

✔ Atalentaccelerationmapforhigh-potentialfinance staff(18–24monthcycles).

✔ Automationoflow-valueworksoanalystsdonot spendnightscleaningspreadsheets.

✔ AItoolsbuiltintoforecasting,reconciliations,and reportingpipelines.

✔ Aculturewherefinanceisastrategicpartner,nota historicalrecordkeeper.

Thegoal:

Turnfinanceintoadigitallyempowered,strategicnerve centreoftheorganization.

“

Trust comes from clarity. Accountability comes from ownership. Leadership comes from judgment. Digital readiness comes from design, not luck.”

TheCrucialPoint

“Trust comes from clarity Accountability comes from ownership. Leadership comes from judgment. Digital readiness comes from design, not luck.”

Overthenextfiveyears,DrRoybelieves trust, transparency, and liquidity inglobalfinancialmarketswill bere-architectedaroundthreeconvergingthemes: programmabletrust,institutional-gradeinfrastructure,and thetokenizationofreal-worldassets.

Historically,trusthasbeenconferredthrough institutions—exchanges,custodians,clearinghouses,and auditors.Whatblockchainsintroduceis embedded trust: guaranteesenforcedbycode,notintermediaries.

• On-chainsettlementfinalitywillreducecounterparty riskinwaystraditionalT+1/T+2systemscannot.

• Programmablecompliance(KYC/AMLbakedinto smartcontracts)willallowregulatorsvisibilitywithout compromisingmarketintegrity.

• Verifiableaudittrailswillshifttrustfrom“believeus” to“verifyyourself.”

Asaresult,thetrustpremiumassociatedwithlarge incumbentinstitutionswillcompress.Thecompetitive differentiatorwillmovefromtrustto execution quality, scale, and interoperability.

2.TransparencyWillBecomeSelective,NotAbsolute

Blockchainisoftenframedas“radicallytransparent,”but institutionsrequire controlled transparency.“Wewillsee.”

• Permissionedandhybridchainsenablinggranular accesstotransactiondata.

• Zero-knowledgeproofsallowingverificationwithout disclosure—criticalfortradesecrets,positions,and clientidentities.

• Standardizedon-chainreportingframeworksthat regulatorswillincreasinglymandate.

Transparencybecomes programmable, tiered, and dataminimized—alargeshiftfromtoday'sbinarypublic-private model.

Intheearlyphase,liquidityacrossdigitalassetvenueswill remainfragmentedduetoregulatorysilosandinconsistent standards.Butbytheendofthefive-yearhorizon:

• Tokenizedreal-worldassets(RWAs)—bonds,funds, tradefinance,carboncredits—willreachmeaningful scale.

• 24/7marketswillbecomethenewliquiditynorm.

• Interoperabilityprotocolswillallowliquiditytopool acrosschainsthewayitcurrentlypoolsacross exchanges.

• Automatedmarket-making(AMM)principleswill bleedintotraditionalfinanceforilliquidassets.

Liquiditybecomesmorecontinuous,moreglobal,andless constrainedbyjurisdictionalfrictions.

Therealinflectionpointispsychological:Inthenextcycle, marketparticipantswon'ttrust institutions that use blockchain—theywilltrust the infrastructure itself.

• Clearingandsettlementfunctionswillcompressinto near-instantworkflows.

• Custodyriskwilldiminishasprivatekeymanagement becomesabstracted.

• Marketintegritywillbeenforcedalgorithmicallyrather thanprocedurally.

Thisdoesnoteliminateinstitutions—itelevatesthosethat canoffer governance, compliance, risk frameworks, and ecosystem orchestration abovetheprotocollayer

Theleadingplayersinthisfuturewillbethosewho: Bridgeregulatedandpermissionedsystemswithopen blockchainnetworks.

Integratedigitalidentityandcompliancedirectlyinto marketrails.

Offerblockchain-agnosticliquidityvenues. Builddataandriskanalyticsforprogrammableassets. Inmanyways,thisisnotacryptostory—it'sacapital marketsmodernizationstory

DrRoy'smostpivotalcareershifthappenedwhenhe realizedthathisworkintraditionalfinance—while intellectuallyrigorous—hadhimoperatingprimarilyasa stewardofcapitalratherthanacreatorofvalue.The inflectionpointcamewhenhebeganpartneringclosely withearly-stagecompaniesandPE-backedbusinesses.He foundhimselfincreasinglymotivatednotjustbyoptimizing returnsbutbyshapingstrategy,buildingteams,and influencingthelong-termtrajectoryofbusinesses. “Whatultimatelypushedmetotransitionintoan entrepreneurial,investment-focusedrolewasthedesirefor directownershipofoutcomes.”Inlargefinancial institutions,impactisoftendistributedacrosslayersof governance.Inprivateequityorventureenvironments,the connectionbetweendecision,risk,andconsequenceis immediateanddeeplypersonal—andthatintensity appealedtoDrRoy.Hewantedtoputhisownconviction, reputation,andcapitalontheline.

Thisshiftalsobroadened—andrecalibrated—hisdefinition ofsuccess:

Clarity, Trust, and Ownership — engineered through systems, not slogans.” “

• Successwasnolongermeasuredsolelyinfinancial performance,butinthedurability,scalability,and integrityofthebusinesseshehelpedbuild.

• Impactmovedfromreportingmetricstoshaping them,fromanalyzinggrowthtoarchitectingit.

• Leadershipchangedfrommanaginginstitutionsto empoweringfounders,operators,andteamstomake decisionsthatcompoundlongaftertheirinvolvement.

Inshort,themovewasn'tjustacareerchange—itwasa mindsetpivot:

from protecting value to creating value, from optimizing systems to building them, from success as performance to success as legacy

Operatingasapublicfigureinfinancemeanslivinginan environmentwhereeverydecisionisdissected—often fasterthanitcanbeexplained.Overtime,DrRoylearned thatmanagingscrutinyisn'taboutavoidingpressure;it's aboutcreatingaleadershiparchitecturethatkeepspressure fromdistortinglong-termthinking.

First,hebuiltadisciplinedcommunicationframework. Withregulators,shareholders,andthemedia,consistencyis currency.Hemadeitapointtoarticulatethesamestrategic narrative,withthesamerationaleandthesamedata foundation,regardlessoftheaudience.Thatdiscipline reducednoiseandreinforcedcredibilityevenduring periodsofvolatility

Second,heseparatedsignalfromsentiment.Notevery headlinewarrantsaresponse,andnoteveryregulatory questionindicatesastructuralissue.Hedevelopedahabit ofstress-testingconcernsthroughobjective dashboards—riskmetrics,capitalbuffers,conduct indicators—sohisdecisionswereanchoredinfacts,not reactions.

Third,DrRoyinvestedheavilyininternaltransparency. Ateamthatunderstandsthestrategichorizonisfarless likelytobeswayedbyexternalturbulence.“Byensuring alignmentacrossleadershipandempoweringmid-level managerswithcontext,weturnedscrutinyintoaunifying forceratherthanadestabilizingone.”

Finally,hesetclearboundariesbetweenleadership visibilityandleadershipvolatility.Beingaccessibleand proactivewithstakeholdersisessential,butallowing externalpressurestodictateprioritiesisnot.Thelong-term strategyremainedthenorthstar—everypublicinteraction wasmeasuredagainstwhetherithelpedreinforceordetract fromthatvision.

Inessence,scrutinydidn'tchangehowDrRoyled;it sharpenedit.Itforcedhimtocommunicatewithprecision, governwithdiscipline,andthinkwith conviction—ensuringthatshort-termnoiseneverdiluted long-termvaluecreation.

“Ifmyprofessionalobituarycouldhighlightonlyone achievementbeyondfinancialmetrics,Iwouldwantitto saythat I built leaders who built institutions Themost enduringvalueanyexecutivecancreateisn'tbalance-sheet strengthormarketshare—it'sthenextgenerationof thinkers,operators,andstewardswhocontinuethemission longafterwe'regone.”

DrRoyalwaysbelievedthatinfluencecompoundsfarmore powerfullythroughpeoplethanthroughperformance statistics.Hislegacy,therefore,wouldbecultivatinga culturewhereintegrity,curiosity,andaccountabilityare non-negotiable;whereindividualsareencouragedto challengeassumptions;andwhereleadershipisdefinednot byauthority,butbytheabilitytoelevateothers.

Heworkstowardthisinthreedeliberateways:

Hetreatstalentdevelopmentwiththesamerigorascapital allocation—structured,data-driven,andintentional.He maintainsarotatingcohortofhigh-potentialindividuals whomhementorsnotjustonskills,butonjudgment, ethicalgrounding,andstrategicthinking.

Insteadofbeingthefinalanswer,DrRoyfocuseson designingprinciples-basedmodelsthathelpteamsmake complexdecisionsindependently.“MygoalisthatwhenI stepoutoftheroom,thequalityofdecisionsstaysthe same—orimproves.”

DrRoyhasworkedhardtonormalizequestioning,debate, andupwardfeedback.Infinance,courageoftentakesthe formofajunioranalystflaggingariskothershave overlooked.Aculturethatempowerssuchvoicescan outlastanysingleleader.

“Ultimately,iftheonlyenduringlinewrittenaboutmy careeristhatIleftbehindleaderswhobuiltresilient, ethical,high-performanceorganisations,thatwouldbe moremeaningfultomethananyP&Lachievement.”

TheMessage

“Honestly,thepieceofadviceIheardallthetimeearly on—'Keep your head down, do great work, and the right people will notice'—feelscompletelyoutdatednow.”

Backthen,itsoundednoble.Todayit'sborderline dangerous.

Inmodernfinance,keepingyourheaddownisexactlyhow yougetinvisible.Theindustrymovestoofast,talent marketsaretoofluid,anddecisioncyclesaretoo compressed.Ifyou'renotactivelyshapingyournarrative, buildingrelationships,andmakingyourthinkingvisible, you'rebasicallyleavingyourtrajectorytochance. “WhatI'velearnedinsteadisthis:”

• Visibilityisn'tvanity;it'sstrategy.

• Upwardcommunicationmattersasmuchas upwardperformance.

• Opportunitiesflowtopeoplewhosignal readiness—notjustcompetence.

“SonowItellyoungerprofessionalstheopposite: Keep your head up. Speak up. Show your work. Make people understand how you think.”

~Greatperformanceisthebaseline.

~Greatvisibilityisthemultiplier

That'sthepartnobodysaidoutloudwhenhewas starting—butit'sabsolutelyhowthegameworkstoday.

Overthenextdecade,hebelievestheprimarybenchmark forjudgingafinancialinstitution'shealthwillshiftfrom traditionalperformancemetricstowhathecalls:

“TrustVelocity.”

TrustVelocityistheinstitution'sabilityto maintain, regain, and compound trust atapacefasterthanthe environmenterodesit.

Itisnotasinglemetric—it'sacompositeof:

• Dataintegrityandcyberresilience(theprobabilityof remaininguncompromisedinadigital-firstworld),

• Regulatoryalignmentandtransparencyspeed(how quicklytheinstitutioncanexplain,disclose,and remediateissues),

• Customersignalstability(churn,engagement,digital behaviorpatternsthatreflectreal-timetrust),

• Ethicalmodelgovernance(AI/MLfairness, explainability,andcontrolframeworks),

• Leadershipcredibility(stakeholderconfidenceduring stressevents).

Whydoesthisbecomethebenchmark:

• Digitalassets,AI-drivenfinance,andglobalregulatory fragmentationwillmaketraditionalbalance-sheet metricstooslowandtoonarrow

• Institutionswillwinorlosenotonyieldspreadsor AUMgrowthalone,butonhowreliablytheypreserve trustamidconstanttechnologicalandsocialvolatility.

• Trustwillbecomequantified,monitored,andstresstestedthesamewayliquidityandcapitalbuffersare today

Tenyearsfromnow,astronginstitutionwon'tjustbe capital-adequate—itwillbe trust-adequate

MessagetotheNextGenerationofFinance Professionals

Ifhecouldleaveyouwithonemessage—partinspiration, partcaution—itwouldbethis:

Don'tconfusespeedwithwisdom.

You'reenteringafinancialworldthatmovesfasterthanany generationbeforeyou:marketsreactinmilliseconds, narrativesshiftovernight,andyourreputationcanbe shaped—ordamaged—inasinglescreenshot.Butthe careersthatendurearebuilton judgment,notvelocity

Thegreatestedgeyoucancultivateisn'ttechnicalbrilliance orperfecttiming;it'stheabilitytostaygroundedwhen everythingaroundyouaccelerates.Learntopause.Learnto thinkindecades,notquarters.

Afewtruthsworthcarryingwithyou:

Curiositycompoundsfasterthancapital.

Toolswillchange,industrieswilltransform,butpeoplewho keepaskingbetterquestionswillalwaysoutpacethosewho don't.

Yourethicswillbetestedquietly,notloudly.

Rarelywillyoufaceobvious“rightvswrong”dilemmas. Instead,you'llfacesmallshortcutsthatseemharmless. That'swherereputationsaretrulymade—orlost.

Data Integrity Risk — the risk of making strategic decisions on corrupted, manipulated, or incomplete informa�on.” “

Masteryisnotbuiltonvisibility,butondiscipline.

Inaworldobsessedwithhyper-communicationandinstant recognition,themostsuccessfulprofessionalsarestillthe oneswhoshowupprepared,readdeeply,andexecute consistently

Relationshipsareyourrealcurrency.

AI,automation,andanalyticswilldominate workflows—buttrust,empathy,andcredibilitywill dominateoutcomes.

Chooseenvironmentsthatstretchyou,notonesthat validateyou.

High-growthcareersrarelyhappenincomfort;theyhappen whereyouarechallengedintellectually,ethically,and emotionally.

Finally, remember this:

Financerewardsintelligence,butitfollowscharacter.

Buildthelatterwiththesameambitionyouapplytothe former,andyouwillnotjustsucceed—youwillendure.

Forfurtherassistanceorconsultation, callDrBhaskarRoyat+919818286455 emailhimatbroyglobus@gmail.com

BenjaminGrahamhasfewnamesinthemoneyand

investmentworldthatcancarrytheweightofhis name.Grahamisregardedasthefatherofvalue investinganddevelopedaclearanddisciplinedapproachto thinkingaboutstocksandwealthbuilding.Histhoughtwas basedonactualexperienceinWallStreet,anditendured themostseriousmarketcrashes.Bookslike The Intelligent Investor stillteacheverydaypeoplehowtogrowmoney withouttakingcrazyrisks.Evenintoday'sworldofmeme stocks,crypto,andhigh-speedtrading,Graham'ssimple ruleskeepmillionsofinvestorsonsolidground.

BenjaminGrahamwasborninLondonin1894and relocatedtoNewYorkasaninfant.Hisfatherdiedearly, leavingthefamilystruggling.YoungGrahamworkedodd jobswhilestudyingandgraduatedfromColumbia Universityatjust20yearsold.Heturneddownteaching offersandwentstraighttoWallStreet.

Hestartedasamessengerandquicklymovedupto analyzingcompanies.Inthe1920s,heranhisown investmentfirmandmadegoodmoneyuntilthe1929crash wipedoutmostofit.Insteadofgivingup,Grahamstudied whatwentwrong.Thosepainfullessonsbecamethe foundationofeverythinghelatertaught.

andbuiltBerkshireHathawayintooneofthemost successfulcompaniesinhistory.

OtherstudentslikeWalterSchlossandIrvingKahnalso becamemillionaireinvestorsusingthesameideas.Graham didn'tjustwritebooks;hecreatedanentireschoolof disciplined,long-termthinkers.

Walkintoanyinvestmentfirm,andyou'llseeGraham's fingerprints.Stock-screeningsoftwareusesthesamefilters heinvented.GiantfirmslikeVanguardandBlackRockowe partoftheirsuccesstoideasthattracebacktohim.

Grahamdeclaredthatastockwasnotalotteryticket,buta partofarealbusiness.Hisbreakthroughwasteaching peoplehowtofigureoutwhatacompanyistrulyworth.In 1934,heandDavidDoddwrote Security Analysis,thefirst textbookthatshowedstep-by-stephowtovaluecompanies usingbalancesheets,earnings,anddividends.

Hisfavoriterulewasthe“marginofsafety.”Onlybuy somethingifit'ssellingformuchlessthanit'sreallyworth, likegettingadollarforfiftycents.Thatextracushion protectsyouifyoumakeamistakeorthemarketfalls.

Valueinvestingreferstosearchingforgoodcompaniesthat havebeenforgottenbythemarket.Grahamhuntedfor stockstradingbelowtheir“bookvalue”(whatthecompany wouldbeworthifitsoldeverythingandpaiditsdebts).He usedbasicratioslikelowprice-to-earningsandignoredhot tipsorexcitingstories.

Thisstylewasboringonpurpose.Otherinvestorswere busyfollowingthenewtrend,butGrahaminvestorsquietly bargainedandwaited.Theresultsspokeforthemselves:his fundearnedabout20%ayearoverdecades,beatingthe marketbyawidemargin.

GrahamtaughtfinanceatColumbiaUniversityformany years.Onestudentin1949wasayoungmannamedWarren Buffett.Buffettsayseverythingheknowsaboutinvesting startedinGraham'sclassroom.Buffetttookthoselessons

Laterinlife,Grahamrealizedmostpeopledon'thavetime tostudycompaniesdeeply.Herecommendedtheysimply buylow-costindexfundsthatownthewholemarket,an ideathathelpedlaunchthemassivepassive-investing revolutionweseetoday

Evennewrulesthatforcecompaniestoreporthonest numberscamepartlyfromthemessGrahamsawinthe 1920sand1930s.

SomepeoplecallGraham'sstyleold-fashioned.Theysayit missesfast-growingtechcompanies.Andyes,value investorslaggedduringthelate1990sdot-combubble.But whenthatbubbleburst,Graham-styleinvestorslostfarless. Thesamethinghappenedin2008andagainwhenmeme stockscrashed.

Timeandagain,marketsproveGrahamright:prices eventuallyreturntorealbusinessvalue.

BenjaminGrahamdiedin1976,buthisbooksstillsell thousandsofcopieseveryyear.Neweditionscomewith updatesfrompeoplelikeWarrenBuffett,yetthecore messagestaysthesame:buygoodbusinessesatfairprices, leaveamarginofsafety,andlettimedothework.

Inanoisyworldfullofget-rich-quickpromises,Graham's calm,clearblueprintremainsoneofthesafestpathstoreal wealth.Followit,andthemarketwillusuallyrewardyou slowly,steadily,andforalifetime.

Theworldofwealthmanagementusedtofeellikean exclusiveclub.Privatebanks,wood-paneled offices,andmillion-dollarminimumskeptmost peopleout.Today,thatclubhasbeentorndown,andsome ofthebiggestchangesarecomingfromnamesyoualready know:celebrities,athletes,andinfluencerswhobuilthuge followingsonlineandarenowchanginghoweveryday peoplehandlemoney

WhenTheRockTalksMoney,MillionsListen

Dwayne“TheRock”Johnson,KevinHart,CardiB,and LeBronJamesaren'tcertifiedfinancialadvisors,buttheir reachisunmatched.WhenTheRockpostsaboutdiscipline andsmartchoices,orCardiBsharesreal-talkmoney lessonswithher160millionfollowers,peoplepay attention.Thesemoderniconshaveturnedfinancial educationintomainstreamentertainment.

$5toMillions:AppsThatOpenedtheDoor

AppslikeAcorns,Wealthfront,Robinhood,andCashApp madeinvestingpossiblewithjustafewdollars.Celebrities helpedspeedthisup.RapperNasinvestedearlyin Robinhood.SerenaWilliamsbacksCoinbase.LeBron supportsGoalsetter,asavingsappforkids.Whenfanssee theirheroesusingorowningtheseplatforms,trustfollows, andmillionsofnewinvestorsjoin.

Socialmediachangedeverything.TikTokandInstagramare nowfullofquick,simplemoneylessons.Creatorslike GrahamStephan,ToriDunlap(“HerFirst$100K”), HumphreyYang,andevenMrBeastbreakdowncompound interest,RothIRAs,andsidehustleswithmemesandplain language.ForGenZandmillennials,thesecreatorshave becomethenewfaceofwealthmanagement.

Traditionalbanksnoticed.MorganStanleyadvisorsmake TikTokvideos.UBSandGoldmanSachsrunInstagram pagesthatfeelmorelikelifestylebrandsthanbanks.A 2024studyfound68%ofpeopleunder40wouldrathertake moneyadvicefromatrustedinfluencerthanasuitinan office.

Loveitorhateit,cryptobroughtmillionsofyoungpeople intoinvesting.WhenElonMusktweetedaboutDogecoin, SnoopDoggdroppedNFTs,andParisHiltonandSteph Currybackedblockchainprojects,pricesjumpedandnew walletsopened.Manyofthosefirst-timecryptobuyerslater movedintostocks,ETFs,andretirementaccounts.

Womenandminoritycommunitiesareseeingthebiggest shift.InfluencerslikeDelyanneTheMoneyCoach,Bola Sokunbi(CleverGirlFinance),andYanelyEspinalfocuson peoplewhowereneverinvitedtotheoldclub.When Rihanna,Serena,orIssaRaesucceedfinancially,itshows theiraudience:“Iftheycandoit,socanI.”

Therehavebeenmistakes.Somecelebritiespromotedrisky coinsoroutrightscams,andthe2022cryptocrashhurt manybeginners.Thelesson?Famedoesn'tequalexpertise. Smartfollowersnowlookforeducators,notjusthype machines.

Wealthmanagementisnowmoreopenanddemocraticthan ever Youdon'tneedamilliondollarsorafinancedegree, justaphone,afewdollars,andsomeoneyoutrusttolearn from.

Today'siconsaren'tjustentertainingus.They'vetakena once-stuffyindustryandmadeitsimple,visual,andfullof personality.Becauseofthem,morepeoplethaneverare saving,investing,andbuildingrealwealth.

Theprivateclubstillexists,butnowthere'samuchbigger table,andeveryone'sinvited.