Editor’s Editor’s Note Note

Thestateoftheinsuranceindustryhascomeunder deepscrutiny,particularlyastherecentCOVID-19 pandemicrevealednewrisksandweaknesses againstabackdropofmarketvolatility.Thefutureofthe industrydependsuponmoderninsuranceleaderswhohave thevisionarytraitstodisruptandinnovatewithintheir organizations.

Theinsuranceindustryhasuniquechallengesand opportunities.Navigatingthesewellisthekeytosuccessin theinsuranceworld.Yourteamneedsgreatleadershipto helpthemmanagethesechallengesandopportunities.One importantaspectofbeingagoodleaderistonurtureyour team.Astheirleader,yourteamlookstoyouforguidance, strength,motivation,andsupport.

Youessentiallytakeontheparentroleforyourteam,andit isyourresponsibilitytomakesurethatyourteamishealthy andhappy.Agoodleaderrecognizeswhatmakeseachteam membergreat.Byrealizingeachmember’sstrengths, leaderscanbetterorganizetheirteamandprojectsbasedon eachperson’sability.

Innovationisessentialtothesurvivalofyourinsurance business.Ifyourcompanydoesn’tinnovatewell,your businesswillplateau.What’smore,competitorswhoare innovatingwillpassyouby.Innovationstartsattheteam level.Themoreyouempoweryourteamtoinnovate,the moreinnovativeyouwillbecomeasacompany. Fortunately,innovationcanbecultivated.

Keepingthecompany’soverallmissioninmindisan essentialskillofagoodleader Withoutthisvision,teams canquicklylosetheirdirectionandgetoffcourse.

Seeingthebigpictureandimplementingitintoprojects helpsyourteamstayinalignmentwithcompanygoals.

Embracingthejourneyoftheleaderswhoareenabling noveltiesinthemoderninsuranceindustrywithaunique approachwhileshowcasingsignificanttraits,Insights Successfeaturesthe“TheMostInfluentialWomenin InsuranceIndustry-2023,”whoareenablingbetterments intheniche.

Flipthroughthepagesandcomprehendtheleadershiptraits thatareenablingnewadvancementsintoday’sinsurance industry.

HaveaDelightfulRead!

AbhishekJoshi

Joshi Ankita Pandharpure

Marketing

sales@insightssuccess.com

August, 2023

Development Executives Simon, Shweta Jacob Smile Prachi Mokashi Dominique T. SME-SMO Executive Sagar Lahigade Frank Adams Circulation Manager Robert Brown Stella Andrew David Stokes Revati Badkas Abhishek Follow us on : www.facebook.com/insightssuccess/ www.twitter.com/insightssuccess We are also available on :

BrendaAustenfeld CEO&President

BrookeRunnion ExecutiveVicePresident

CatrinaGilbert VicePresident (RiskManagement)

EleniCarras VicePresident

LenikaMilne ChiefMarketingOfficer

BrendaisanInsuranceExecutivespecializingintheleadership ofanexceptionalcommercialpropertyteamofhigh-achieving salesandserviceprofessionals. RTSpecialty rtspecialty.com

LocktonCompanies global.lockton.com

DallasFort WorthInternational Airportdfwairport.com

Brookeworkswithclientstomanageoperationalrisksand developimpactfulhealthandbenefitsprogramsandholdsa goaltohelpherclientsachievetheirbusinessobjectives–both financialandhumancapital.

AlliantInsuranceServices alliant.com

One80Intermediaries one80intermediaries.com

Catrinaispassionateaboutprovidingasafeworkenvironment foremployeesandstakeholderswhileprotectingkeyassets.

Eleniassistsemployersinprovidingcomprehensiveand suitablehealthinsuranceplansfortheiremployees.

LenikaservesOne80astheChiefMarketingOfficer,andis responsibleforarticulatingthecompany’sstrategicvision, missionstatementandvalue.

One80Intermediaries,aleadinginsurance intermediaryfirm,appointedLenikaMilneafew monthsagoasChiefMarketingOfficerto spearheadthecompany'sbrandandstrategicvision.With overtwodecadesofexperienceinsalesandmarketing, LenikaisresponsibleforupholdingtheOne80brand, sustainingOne80’scustomercentricculture,leveraging dataanalytics,andanticipatingmarketchangeand disruption.

LenikajoinedOne80Intermediariesin2019astheNational DirectorofSalesandMarketing,wheresheplayedakey roleinboostingthecompany'srevenueandbrand awarenessthroughherleadershipofsalesandgrowth initiatives.Shealsooversawmediarelations,sponsorship activity,andsocialresponsibilityefforts,allofwhich contributedtothecompany'ssuccess.

AsaCMO,LenikaissettotakeOne80Intermediariesto newheightsbyleveragingherexpertiseinbrandingand storytellingtostrengthenthecompany'smarketposition. Herstrategicapproachandvisionwillbeinstrumentalin shapingthefutureofthefirmanddrivinggrowthina highlycompetitivemarket.

TheinterviewhighlightshowOne80Intermediaries,ledby Lenika,iswell-positionedtoleadtheindustryinproviding highlyspecializedandcomprehensiveinsurancesolutions.

PriortojoiningOne80Intermediaries,Lenikaenjoyeda10yearcareerwithCitigroupwithpostsinNewYork, HongKong,ShanghaiandLondon.

ShebeganherbankingcareerworkingalongsideCiti’s CEO,VikramPandit,intheofficeofGlobalCorporate AffairsinNewYork.Shewasthenaskedtorelocatetothe Asia-PacificregiontoserveontheRegionalGovernment andPublicAffairsteam.Here,LenikasupportedCiti’s publicrelationsstrategyasthebankexpandeditsconsumer presencethroughouttheChinesemarket.

Lenikawasthenappointedtoregionaltrademarketinghead forEurope,MiddleEast,andAfricafortwoyears,untilshe waspromotedtoglobaltrademarketinghead,basedin London.Inthisrole,sheledglobaltrademarketingefforts todriveproductandclientsegmentstrategies,workedwith leadersthroughouttheglobetoexecutemarketingstrategies thatdifferentiatedCiti,de-commoditizedCiti'sproductset, anddrove20%year-over-yeargrowthforCiti’s$1.6Btrade business.

ShebeganhercareeratAmericanInternationalGroup wheresheheldavarietyofunderwriting,salesand marketingrolesthroughouttheUS.Sheservedasamedia relationsinternfortheWhiteHousein1999,graduated withhonoursfromtheUniversityofCaliforniain2000,and receivedanMBAinInternationalMarketingfrom GeorgetownUniversityin2008.

Lenikaisactiveinherlocalcommunity Withthree daughtersundertheageofnine,sheispassionateabout empoweringwomenanddevelopingthenextgenerationof leaders.Sheservesonherlocalschoolboardandleadsa committeededicatedtonurturingfather-daughter relationships.SheisalsoinvolvedwithUSAWomen’s WaterPoloandisavolunteerwiththeNationalBrain TumourSociety.

One80Intermediaries:InnovatingatthePaceof Change

TheculminationofLenika'sexperienceshasledhertoher dreamjobastheChiefMarketingOfficerforOne80 Intermediaries.AstheCMO,sheleadsallmarketing, advertising,media,andpublicrelationseffortsforthe $500Morganization.Lenika'steamandagencypartnersare responsiblefordrivingtheOne80brandthroughdigitaland performancemarketing,SEM,SEO,conversionrate optimization,andcontentstrategy

Lenikajoinedthecompanyin2019,whenitwasstillinits earlystagesasthesecondemployee.Sheservedasthe NationalDirectorofSalesandMarketing,responsiblefor definingthecompany'sstrategicvision,missionstatement, andvalues.

One80's success is a�ributed to its culture built on trust, unparalleled industry exper�se, and entrepreneurial spirit.

LenikacraftedtheOne80Intermediariesbrandand narrative,whilealsodefiningitsculture.

Injustthreeyears,One80hasgrowntobecomeoneofthe largestintermediariesintheUnitedStates,employingover 1,800employeeswithofficesin55locationsthroughoutthe USandCanada.In2022,BusinessInsurancerankedOne80 asthe5thLargestMGA/UnderwritingManager/Lloyd's Coverholderand5thLargestUnderwritingManagerinthe country.

One80'ssuccessisattributedtoitsculturebuiltontrust, unparalleledindustryexpertise,andentrepreneurialspirit. ThesevalueswereatthecoreofOne80'sbusinessplan priortolaunch,andthecompanyhasremainedcommitted tothemsinceitsinception.

Tenyearsintohercareer,Lenikawasservingasa MarketingAssociateforCiti'sOfficeofGlobalCorporate AffairswhenshewitnessedthecollapseofLehman Brothers,thefourth-largestinvestmentbankintheUnited Statesandtheclimaxofthesubprimemortgagecrisis,on themorningnews.Lenikaworkedtirelesslyinthe followingmonths,oftensleepingunderherdeskinthe officeatnight,tocontributetoCiti'sresponsetothe volatilityofthemarkets.Sheexperiencedconfusion,fear, andexcitementduringthistime.

LenikaworkedcloselywithCiti'sCEO,VikramPandit,and thepublicrelationsteamtocrafttalkingpointsforthe CongressionalOversightCommittee.Sheplayedapartin aneffortthatinstilledtrustinlawmakersandbeyond. Althoughshedidnotrealizeitatthetime,thelessonsshe learnedduringthistimecontinuedtoinformher

professionaldecisionswellintothefuture.Theselessons includedtheimportanceofdedication,teamwork,strategy, remainingcalminthefaceofcrisis,mentalandphysical endurance,clearcommunication,andtransparency

One80launchedinJanuary2020,justtwomonthsbefore theCovid-19outbreakthatwouldchangetheworld.The pandemicforcedthecompanytoquicklyadaptanddevelop aninclusiveculturethroughnewwaysofworkingand advancedtechnologies.Atthetime,itwaschallengingto quantifytheeconomicimplicationsofthepandemic. SimilartoLenika'sexperienceatCitiduringthefinancial crisis,itwascrucialtobuildtrustwithemployeesasthey faceduncertaintimes.

Toalleviateemployeeconcernsandsignalthattheirjobs wereprotected,One80'stop200employeesvolunteeredto takea20%salaryreduction.Thisactionremovedfinancial insecuritiesandconveyedthemessagethatanyfiscal burdenwouldbecontainedwithinthemanagementteam.

One80focusesonhighlyspecializedareasinthemarket, maintainingdeepunderstandingoftheclientsandindustries theyweserve;andrespondingwithtailoredsolutionsthat arenotofferedbyourcompetitors. Theseattributesare underscoredbyOne80’sabilitytorespondtomarket changeswithspeedanddecisiveness. One80continuesto prioritizethedevelopmentofnewprogramsinresponseto ever-changingmarketneeds.In2022,Lenikaspearheaded aninitiativetoestablishtheNextGenInnovationForum. Thisforumbroughttogetherthenextgenerationofleaders atOne80forathree-dayoffsiteevent.Aspartoftheforum, One80invitedindustryinfluencerstohostanInnovation Workshop.

Followingtheworkshop,forumdelegatesweredividedinto teamsandtaskedwithcreatingaproduct,service,or solutiontomeettheneedsofOne80'sclients.Thesegroups willpresenttheirideastotheexecutivecommitteeinMay, withthegoaloflaunchingviableproductsinthecoming year

ThisinitiativeservesasanexampleofhowOne80'sculture iscenteredaroundbringingnewprograms/MGAsto market,deliveringconsistentproductsandcapacityto distributionpartners,andprovidingahomefor entrepreneurialunderwritingtalent.

Lenika played a part in an effort that ins�lled trust in lawmakers and beyond.

Theinsuranceindustry,asectorthatwasonceheavilydominatedby

maleleadership,isnowwitnessingmiraculouschangesinits processofleadership.Turningoveranewleaf,theindustryisnow underthedirectionofleaderswithanovelanduniqueapproach.Anew broomintheinsuranceindustryisitsstrongandbrilliantwomenleaders.In recentyears,therehasbeenanoticeableshiftaswomenleadershavebeen makingsignificantstridesandtransformationswithinthesector.These womenarenotonlybreakingdownbarriersbutalsobringinguniquetraits andqualitiesthatarereshapingthelandscapeoftheinsuranceworld.Inthis article,wewillexploresomeofthekeytraitsexhibitedbywomenleaders thataredrivingchangeandinnovationintheinsuranceindustry

Oneofthestandouttraitsofwomenleadersintheinsuranceindustryis theirinnateabilitytounderstandandconnectwiththeneedsofcustomers. Empathy,astrongpointoftenassociatedwithwomen,helpsthemidentify thepainpointsandconcernsofpolicyholders.Womenleadersareplacinga strongemphasisoncreatingcustomer-centricstrategies,tailoringproducts tomeetspecificneedsandfosteringasenseoftrustthatisessentialinan industrybuiltonprovidingfinancialsecurityduringuncertaintimes.

Womenleadersembracecollaborationandinclusivity,qualitiesthatmakea significantimpactontheinsuranceindustry Theyarechampioningdiverse teams,notonlyintermsofgenderbutalsointermsofdifferent backgrounds,experiencesandperspectives.Thisdiversityofthoughtand experienceisdrivinginnovationwithininsurancecompanies,leadingtothe developmentofmorecomprehensiveandinclusiveproductsandservices.

Inanindustrythatconstantlyfacesnewchallengesand disruptions,adaptiveproblem-solvingisatraitthatwomen leadersbringtotheforefront.Theseleadersareadeptat navigatingcomplexsituations,findingsolutionsand makingquickdecisionsinrapidlychangingenvironments. Theirabilitytothinkontheirfeetandremaincomposed underpressurereshapestheindustry’sresponsetoemerging risksanduncertainties.

Resilienceisatraitthatgoeshandinhandwithleadership intheinsurancesector Womenleadersaredemonstrating remarkableresilienceinthefaceofadversity They understandthenatureofrisksanduncertaintiesbetterthan most,andtheircapacitytomanageriskseffectively contributestothestabilityandgrowthoftheir organizations.Theirresilienceservesasaninspirationfor theirteamsandtheindustryasawhole.

Theinsuranceindustryhasbeentransformedby technologicaladvancements.Womenleadersareprovingto beadeptatembracinginnovationandincorporatingnew technologiesintotheirstrategies.Theirfuture-focused visionallowsthemtoseebeyondthepresentandanticipate industrytrends,leadingtothecreationofinnovative productsandservicesthatmeettheevolvingneedsof policyholders.

Effectivecommunicationisacornerstoneofsuccessful leadership.Womenleadersareexcellinginthisareaby fosteringopenlinesofcommunicationwithintheir organizationsandwithclients.Theirabilitytolisten, articulateideasandinspireothersishelpingtobuild strongerrelationshipsanddrivepositivechangeinthe insurancesector.

Womenleadersareactivelycommittedtotheirown professionaldevelopmentaswellasthegrowthoftheir teams.Theyunderstandthevalueofcontinuouslearningin anindustrythatisconstantlyevolving.

Byencouragingongoingeducationandskilldevelopment, theyareequippingtheirorganizationstostayaheadina competitivelandscape.

Ethicalleadershipisbecomingincreasinglyimportantinthe insuranceindustry,andwomenleadersaresettingahigh standardinthisregard.Theyprioritizeethicalbehavior, transparencyandaccountability,creatingacultureoftrust bothinternallyandexternally.Thiscommitmenttoethical practicesisenhancingtheindustry’sreputationand fosteringlong-termrelationshipswithclients.

Womenleadersintheinsuranceindustryarenotonly transformingthesectorthroughtheirtraitsandqualitiesbut theyarealsobreakinglong-standingstereotypesand inspiringotherstofollowintheirfootsteps.Asmore womentakeonleadershiproles,theindustryisbecoming morediverseandinclusive,whichinturnisfostering innovationandfreshperspectives.

Manywomenleadersareactivelyinvolvedinempowering andmentoringthenextgenerationofleaders.Through mentorshipprogramsandnetworkingopportunities,they arecreatingavenuesforyoungprofessionalstolearn,grow andexcelintheinsuranceindustry Thiscommitmentto nurturingtalentensuresthecontinuedtransformationofthe sector

Inconclusion,womenleadersaremakingremarkable contributionstotheinsuranceindustrybyembodyinga diversearrayoftransformativetraits.Ahorseofadifferent color,womenleadersininsurancepossessdistinctqualities fromempathyandcustomer-centricfocustoresilience, innovationandethicalleadership.Withthese,theyreshape thesectoranddriveittowardamoreinclusive,customerdrivenandtechnologicallyadvancedfuture.Aswomenrise inleadershippositions,theirimpactontheinsurance industrywillonlybecomemorepronounced,settinganew standardforexcellenceanddrivingpositivechange.

Vice President Alliant Insurance Services

Vice President Alliant Insurance Services

Asapassionateindividualcommittedtohelping people,EleniCarrasstartedworkinginthe insuranceindustryatanearlyage.Sheassists employersinprovidingcomprehensiveandsuitablehealth insuranceplansfortheiremployees.

TodayastheVicePresidentatAlliantInsurance Services,Eleniunderstandsthatdeliveringcompetitive benefitssolutionscanbechallengingforeachemployer, whetheritbeacrossindustriesoryear-over-yearwithinthe samecompany.Sheconsidersthemarketforcesandother factorsthatimpactemployees'livelihoodtoprovidethebest solution.

Eleni'suniqueperspectiveonherworkhashelpedher becomeatrailblazerintheinsuranceindustry.Herapproach toherworkisrootedinherbeliefthatinsuranceisabout beinghumanandhumane.Shestrivestobringenthusiasm, vulnerability,andhonestytoeverythingshedoes.Witha focusoninnovation,analytics,anddevelopingnewleaders, Eleniiscommittedtopushingtheboundariesofwhatis possibleintheinsuranceindustryandhelpingherclients thriveinanever-changinglandscape.

Eleniknowsit'sacomplicatedgame,giventheshifting legislativerequirements,varyingpointsolutions,and fluctuatinghiringmarketsthatcoalesceintoaGordianknot ofcomplicationsforeachclientannually.However,sheis motivatedtocutthatknotassmoothlyandefficientlyas possibleeverytime,ensuringherclientsreceivethebest potentialbenefitsandsolutions.

Afterrespondingtoanewspaperad,EleniCarrasstartedin theinsurancebusiness27yearsagoasanassistanttoa broker.Sheinitiallyneededtounderstandthesignificance oftheupcomingHIPAAlegislation.However,withher mentor'sguidance,shedevelopedatechnicalapproachthat hasprovedbeneficialasthebenefitsparadigmhaschanged overtime.

OneofEleni'sgreatestpleasuresasaninsurance professionalisconductingemployeemeetings,whereshe canhelpfamiliesgraspthevalueoftheirinsurance program.Shebelievesinkeepingthebenefitssimple

enoughforeveryonetounderstand,especiallythosefor whomEnglishisasecondlanguage.Elenihasreceivedfive internalawardsinherfirstsevenyearswithAlliant, includingthreeLeadershipawards,oneInnovationaward, andEmployeeoftheYear.Sheishonoredtorepresent Alliant'sPacificNorthwestofficeinthenationalinnovation lab,whereshecanbetterexplorenewideastoserveclients intoday'sever-changingenvironment.

Eleniisfortunatetoworkwithemployerswithaforwardthinkingapproachtotheirbusinesses.Herfundamental strategyisensuringthattheleadershipteamsharesthesame goals.Astheexecutives'trustedthoughtpartner,Elenihelps themseethebigpictureandhowtheirdecisionsimpact theirstakeholders.Onceadirectionisdecidedupon,her clientsknowthatEleniwillbealongsidethemthroughout theprocess,monitoringprogressandensuringtheyreach milestones.Beyondhermanagerialposition,Eleni genuinelytriestounderstandandanticipateemployees' demands,furtherstrengtheningherabilitytoprovide valuableinsightsandsolutionstoherclients.

Alliantisahighlyentrepreneurialorganizationthatenables itsemployeestosucceed.Inanever-changingandevolving industry,Alliantpromotesadynamic,collaborativeculture whereteammembersaregiventhefreedomtothink creativelyanddeliverthebestpossibleresultsforclients andpartners.

Eleni's unique perspec�ve on her work has helped her become a trailblazer in the insurance industry. Her approach to her work is rooted in her belief that insurance is about being human and humane.

The Most Influen�al Women in Insurance Industry- 2023

Alliantempowerspeopletoachieveexceptionalresultsand livehealthily.Itprizesacollaborativeworkculturewhere ideasareshared.Elenisays, "Leadership has an open-door policy where everyone's voice is heard, and our team members are given the resources and flexibility to perform at the highest level day in, day out."

Eleni'sfirstbossimpartedavaluablelessonthatshehas heldclosetoherheartthroughouthercareer.Shefirmly believesthatbusinessisallaboutbuildingrelationshipsand connectingwithpeopleonapersonallevel.Whileshe understandstheimportanceofstructureandefficiency,she alwaysremembersthatthere'sahumanbeingontheother sideoftheconversation.Toher,bringingpassionand excitementtoherworkisjustasimportantasbeinghonest andopen.

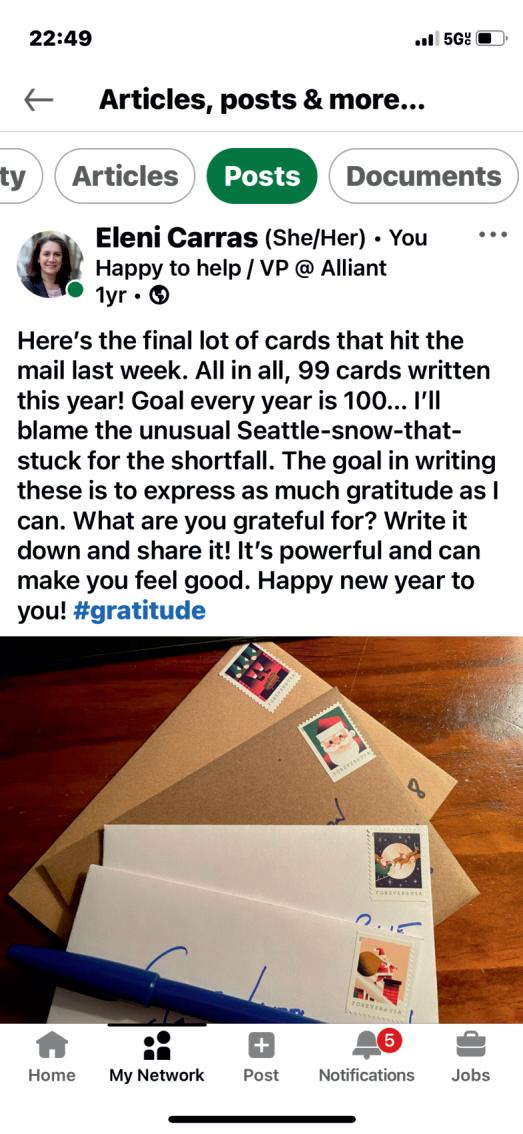

Elenibelievesthatinsuranceisallaboutbeinghumaneand empatheticatitscore.Inherpersonallife,Elenisetsagoal towrite100handwrittencardseveryyear,whichbringsher immensejoy.Sheenjoysexpressinggratitudeand appreciationtoothersandfindsitincrediblyfulfilling.

Withthehelpoftechnology,EleniandherteamatAlliant havesignificantlyenhancedtheiranalyticscapabilitiesover thepastdecade.Theamountofdataavailablenowwas unimaginablejusttenyearsago,andtheteamleveragesthis datatogaininsightsintomarkettrendsandmember behaviorpatterns.Eleniandherteamcanbetterpredictand recommendspecificsolutionsfortheirclientsbyanalyzing theavailabledata.Theyconnectthedots,examinethe informationclosely,andpresentactionableinsightstotheir clients.ThisthoroughapproachenablesAllianttoprovide tailoredsolutionsthataddresstheirclients’unique circumstances.

Intheinsuranceindustry,asignificantshiftishappening thatbringspositivechange-theemergenceofwomenand peopleofcolorinleadershiproles.Traditionallydominated bywhitemen,theindustryisnowexperiencingamore focusedeffortondevelopingleaderswithdiverse backgroundsandlifeexperiences.Eleni,forinstance,isa first-generationAmericanandawoman,andherunique perspectivebringsavaluablecontributiontothetable.This evolutionisbeneficialforthenextgenerationofleadersand theindustryasawhole.

Eleni'sfirstbosstaughtheranimportantlessonthatshestill appliestoday:don'tbeafraidtomakemistakes.Eleni believesthatmakingnewmistakesiscrucialforpersonal growth.Theinsuranceindustryoffersmanyopportunitiesto takerisksandtrynewthings.Eleniencouragesotherstobe willingtofailandtohaveamindsetthatwelcomes challenges.

Sheadvisesfindinginternalandexternalpartnerswhoshare similarvaluesbutcanofferdifferentperspectives.Withthe rightmindsetandsupportsystem,takingriskscanleadto meaningfulgrowthandsuccessbothpersonallyand professionally.

Intoday’scomplexanduncertainworld,theinsurance

industryplaysapivotalroleinprovidingindividuals, businessesandcommunitieswithfinancialprotection andpeaceofmind.Theinsurancenicheencompassesa widerangeofservicesandproducts,fromlifeandhealth insurancetopropertyandcasualtycoverage.Thisarticle delvesintothedynamicsoftheinsuranceniche,examining itskeycomponents,challenges,innovations,anditseverevolvingroleinmodernsociety.

Theinsurancenicherevolvesaroundthetransferofrisk fromindividualsorbusinessestoinsurancecompanies.By payingpremiums,policyholderssecurecoverageagainst potentiallosses,whichcanincludedamagetoproperty, illness,accidents,orevendeath.Inreturn,insurance companiespoolthesepremiumsandusethemto compensatepolicyholderswhoexperiencecoveredlosses.

Theinsurancenicheismultifaceted,comprisingvarious componentsthatcontributetoitsoverallfunctioning:

TypesofInsurance:Theinsurancelandscapespansdiverse categories,includinglifeinsurance,healthinsurance,auto insurance,propertyinsurance,liabilityinsurance,andmore. Eachtypecaterstospecificrisksandneeds.

ActuarialScience:Actuaries,professionalswithexpertise inmathematicsandstatistics,playapivotalroleinthe

insuranceindustry.Theyanalyzedata,assessrisksand determineappropriatepremiumratestoensurethat insurancecompaniesremainfinanciallystablewhile meetingtheirobligations.

Underwriting:Underwritersevaluateapplicationsfor insurancecoveragetodeterminethelevelofriskinvolved. Theydecidewhethertoapproveordenycoverageandset premiumratesbasedontheirassessment.

ClaimsManagement:Theclaimsprocessinvolves policyholderssubmittingclaimsforcoveredlosses,which arethenreviewedbyclaimsadjusters.Theseprofessionals assessthevalidityofclaimsanddeterminetheappropriate compensation.

DistributionChannels:Insuranceproductsaredistributed throughvariouschannels,includinginsuranceagents, brokers,onlineplatforms,anddirectsales.Thesechannels playacrucialroleineducatingcustomersandhelpingthem choosetherightcoverage.

Theinsurancenichefacesseveralchallengesthatinfluence itsdynamicsandshapeindustrypractices:

RiskAssessment:Accurateriskassessmentisessentialfor maintainingthefinancialstabilityofinsurancecompanies. Asnewrisksemerge,suchasthoserelatedtocybersecurity orclimatechange,insurersmustadapttheirunderwriting andpricingmodels.

RegulatoryLandscape:Insuranceisheavilyregulatedto protectconsumersandensureindustrystability.Navigating complexregulatoryframeworkscanbechallenging, particularlyaslawsandregulationsevolve.

TechnologyDisruption:Technologicaladvancementsare transformingtheinsuranceindustry.Insurtechstartupsare leveragingdataanalytics,ArtificialIntelligenceand blockchaintostreamlineprocesses,enhancecustomer experiencesandofferinnovativeinsurancesolutions.

DataPrivacyandCybersecurity:Asinsurerscollectand storevastamountsofsensitivecustomerdata,protecting thisinformationfromcyberthreatsandensuring compliancewithdataprivacyregulationsisasignificant concern.

CustomerExpectations:Today’sconsumersdemand personalizedexperiencesandseamlessinteractions. Insurancecompaniesmustadapttomeettheseexpectations, providinguser-friendlydigitalplatformsandtailored coverageoptions.

Theinsuranceindustryisundergoingadigital transformation,drivenbyinnovativetechnologiesand changingconsumerpreferences:

DigitalPlatforms:Insurersareinvestinginuser-friendly digitalplatformsthatenablecustomerstomanagepolicies, fileclaimsandobtaininformationonline.Thisenhances convenienceandimprovescustomerengagement.

TelematicsandIoT:TelematicsandtheInternetofThings (IoT)haverevolutionizedautoinsurance.Devicesand sensorscollectdataondrivingbehavior,enablinginsurers toofferusage-basedpoliciesandrewardsafedrivinghabits.

ArtificialIntelligence:AI-poweredchatbotsandvirtual assistantsareimprovingcustomerinteractionsbyproviding instantsupport,answeringqueriesandguidingcustomers throughtheclaimsprocess.

BlockchainTechnology:Blockchainenhances transparencyandsecurityintheinsuranceindustry.Itcan streamlineprocesseslikeclaimsmanagement,reducing fraudandadministrativecosts.

DataAnalytics:Advanceddataanalyticsenableinsurersto gaininsightsintocustomerbehavior,risktrendsandmarket dynamics.Thisinformationinformspricingstrategiesand productdevelopment.

Beyondfinancialprotection,insuranceplaysabroaderrole insociety:

RiskMitigation:Insuranceencouragesriskmitigationand safetymeasures.Forinstance,homeownersmaytakesteps topreventpropertydamagetoreducetheirinsurance premiums.

EconomicStability:Insuranceprovidesasafetynetinthe faceofunexpectedevents,helpingindividualsand businessesrecoverandmaintainfinancialstability.

SocialResponsibility:Certaintypesofinsurance,like healthandlifeinsurance,contributetosocialwelfareby ensuringaccesstomedicalcareandfinancialsupportfor familiesintimesofcrisis.

SupportingEntrepreneurship:Businessinsuranceallows entrepreneurstotakecalculatedrisksandinnovate, knowingthattheirinvestmentsareprotected.

Theinsurancenicheisamultifacetedandevolvingsector thatrevolvesaroundriskmanagementandfinancial protection.Itencompassesavarietyofinsurancetypes, eachtailoredtospecificneedsandrisks.Despitechallenges suchaschangingconsumerexpectations,emergingrisks andregulatorycomplexities,theindustryisadapting throughtechnologicalinnovationsanddata-driven strategies.Astechnologycontinuestoshapethelandscape, insuranceremainsavitalcomponentofmodernsociety, providingindividualsandbusinesseswiththesecurityand confidencetonavigateanunpredictableworld.