In today’s rapidly evolving and complex business landscape, the role of the Chief Financial Officer

(CFO)hassignificantlyexpandedbeyondtraditionalresponsibilitiesinfinanceandaccounting.While historically focused on budgeting, compliance, and financial reporting, modern CFOs now serve as strategic leaders central to organizational decision-making. They play a pivotal role in shaping corporate strategy, driving digital transformation, managing enterprise risk, and enabling long-term value creation. CFOs are increasingly expected to balance financial discipline with innovation, sustainability, and operationalagility KishoreVorastandsoutasaleadingexample,demonstratingtransformativeleadership inarapidlychangingdiamondindustryshapedbytechnology,shiftingconsumertrends,andastrongfocus onsustainability

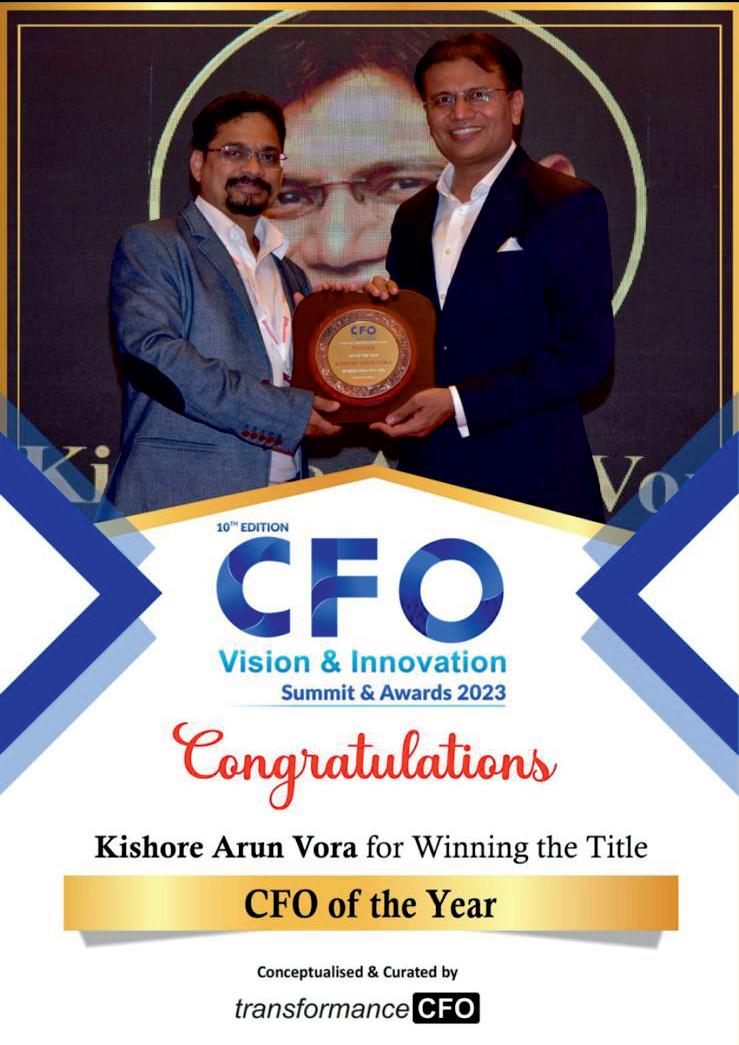

Insights Success in its recent edition titled Best CFO in India to watch in 2025, acknowledges the significant contributions of Kishore Vora, Chief Financial Officer and Board Member at De Beers India. KishorebeganhiscareeratPwC,buildingastrongfoundationinauditandcompliancebeforemovinginto corporatefinancerolesatNovartisandMeadJohnsonNutrition,whereheshapedregionalfinancestrategies. HefurtherstrengthenedhisleadershipskillsthroughexecutiveeducationatHarvardBusinessSchool.AtDe Beers India, he has driven a major transformation,shifting the business from brand licensing to direct-toconsumer retail, integrating digital tools and an omnichannel strategy Under his leadership, finance has becomeastrategic,insight-ledfunctionsupportinglong-termgrowth.

Kishore’s approach focuses on integrating ESG principles, enhancing risk management, and fostering a collaborative, performance-driven culture to support sustainable growth. He views the modern CFO as a hybridleaderwhoistechnologicallyskilled,ethicallygrounded,andstrategicallyfocused.Hisleadership delivers strong financial results while developing future-ready teams and resilient business models, redefiningtheCFO'sroleintoday’sevolvingbusinessenvironment.

Haveagreatreadahead!

Strategic Transformation Architect at De Beers India

A R T I C L E S

Finance Modernization

Naviga�ng Digital Finance Transforma�on for Success

Financial Analysis

Mastering Finance Leadership for Business Success

Managing Editor

Preston Bannister

David King

Senior Sales Managers

Bruno Alves, Jack McDowell

Marketing Manager Technical Head

James M.

Jacob Smile

Technical Specialist

Irvin Wilson

SME-SMO Executive

Steve Rodrigues

Editor-in-Chief

Merry D'Souza

Jenny Fernandes Lusy Jameson

Robert Brown

Rosy Scott

Angela Ruskin

Business Development Manager

Ryan Brown

Max Floyd Simon, Tom

Dominique T.

Frank Adams

Circulation Manager July, 2025

Stella Andrew

sales@insightssuccess.com

David Stokes

Follow us on : www.facebook.com/insightssuccess/ www.twitter.com/insightssuccess We are also available on :

Strategic Transformation Architect at De Beers India

“My journey from a small village to the boardroom has taught me that resilience outperforms brilliance.”

Chief Financial Officer and Board member De Beers India

Thediamondmarket,aworldwidebusinessthatisrich inheritageandluxury,istransformingwithlightning speed powered by technology growth, changing consumertrends,andsustainableneeds.Tomakeamarkand stand tall amidst tough competition in this complicated scenario calls for visionary leadership combining eternal artistry with flexibility in today's world. Characterized by confidence,grit,inquisitiveness,andanever-say-dieattitude, one prominent leader is changing the game with his innovation and dedicated endeavours. He is Kishore Vora, theChiefFinancialOfficerandBoardmemberatDeBeers India.

ThepathofKishorealsostartedinthevillageofOtur,closeto Pune,Maharashtra.Borninapoorfamilycontendingwiththe challenges of life, Kishore initially struggled to receive quality education Having studied in a Marathi-medium schoolforthefirsthalf,Kishoreexperiencedaturningpointto anEnglish-mediumcollegeatPuneafter10thstandard.This marked his initiation of professional and academic excellence.

His determination and resilience were also challenged when he shifted to a bigger city, Mumbai, to take up Chartered Accountancy This was the age of intense learning and mentorship, which shaped his working skills and introduced himtovibrantworkcultures.

ProfessionalBeginnings:GroundingatPwC

Kishore's professional career began in 1997 with PricewaterhouseCoopers (PwC), a global professional services company He gained keen experience in audit and financial reporting during the period, working with multinational clients across various industries. It sharpened his analytical skills and broadened his knowledge on corporategovernanceandregulatorycompliance.

FromPwC,Kishoregainedtheperfectionismandattentionto detailthatwouldcharacterizehisfutureprojects.Hisabilityto navigate intricate financial environments and share strategic observationsturnedhimintoafuturestarintheindustry

Transition to Corporate Finance: Novartis and Mead JohnsonNutrition

Heswitchedfromaudittocorporatefinancein2001,joining an international healthcare organization, Novartis. After a short stint as an Assistant Manager, he took on the role of

Manager,whereheexpandedhislinesofexpertisetobusiness operationsaswellascross-functionalcoordination.Therole exposed him to more financial management as well as strategicplanning.

It was in 2007 that Kishore joined Mead Johnson Nutrition India as its first finance recruit to create the finance function fromgroundzero.Duringhistenure,hehelpedthecompany bring in a new infant nutrition product amidst a competitive market, ride through regulatory hurdles, and lay a strong financialfoundation.

Acrossalmostadecade,herosetotheroleofFinanceDirector for India and subsequently managed finance for the AsiaPacific.Duringthistenure,itfurtherenhancedhisleadership experience, especially in dealing with multicultural, crosscultural teams and coordinating financial strategies with businessgoalsinmultiplemarkets.

Embracing Leadership and Strategic Vision: Harvard BusinessSchool

Looking to surpass conventional finance abilities, Kishore registered for the Senior Executive Leadership Program at HarvardBusinessSchool.Thisleadershipchangegavehima bird's-eyeview,providingstrategicthought,cross-functional leadership, and innovation at the heart of his professional approach.

Theprogramignitedhistransitionfromacompliance-driven CFOtoavalue-drivenleaderdrivingorganizationalstrategy and making enterprise-level difference. The program also exposed him to an international network of leaders, which furtherempoweredhimtoleadindifferentbusinesssettings.

“Technology is only powerful when it frees people to focus on what truly matters—value creation.”

AsapartofbeingapartofDeBeersGroupastheCFOforthe Indian division, Kishore set himself up to take up the formidable task of transforming a company with a legacy spanning more than 135 years into a multi-dimensional change encompassing strategic, structural, cultural, and technologicaltransformation.

KishorewasinstrumentalinreworkingDeBeersIndiafroma fixed royalty rate based traditional model of brand licensing from multi-branded retail outlets to opening its own retail outlets.Thisstrategicshiftfacilitatedonlineandofflinesales channels to converge, providing an assembled omnichannel customerexperience.

Thistransformationentailedacomprehensiveredesignofthe organization's finance function, with team reorganizations and talent infusions from cross-industries, blending the brand'srichheritagewithinnovationandspeed.

In partnership with the Chief People Officer, Kishore led changemanagementeffortsaimedat:

Ÿ Transparentlysharingstrategicchanges.

Ÿ Clarifyingevolvingrolesandexpectations.

Ÿ Buildingcross-functionalalignmentandcollaboration.

In order to restore entrepreneurial passion and agility in a legacy business, Kishore implemented a reward scheme for shares,buildingownershipandresponsibilitywithinteams.

Kishore redefined the finance function's culture from transactingtogeneratingvalueproactively.Empoweringhis teams with leadership, open communication, and strategic thinking, he established finance as a catalyst for long-term growthandinnovationforDeBeers.

Ÿ StrategicandOperationalExcellence

Ÿ MaximizingCFOBandwidthandEmpoweringtheTeam

Grantingbothadditionalstrategicresponsibilitiesandcrucial operating obligations, Kishore established a robust,

“I see change not as a threat, but as an opportunity to innovate and lead.”

empowered financial team with well-defined roles in controllership, FP&A, tax, and risk management Empoweringachievedmaximumeffectivenessandpermitted unencumbered day-to-day execution without the need for continuousmonitoring.

RoutineteamevaluationandprobinginquiryenabledKishore to identify bottlenecks and stay on track, reinforcing strong internalcontrolsandfiscaldiscipline.

Working in the high-end diamond sector amid geopolitical threatsandsupplychaininterruptions,Kishorehasavibrant risk playbook. It allows for real-time observation of market entrants, product development, and changing consumer patterns.

Kishore’s recent achievement includes leading the intricate liquidation of the Hindustan Diamond Company joint venture, surmounting regulatory and litigation issues to repatriateaboutINR93crorestotheparentorganization.

Aferventadvocateofdigitaldisruption,Kishorehassteered De Beers India's finance function towards technologyfacilitated, insight-driven operations. Automated mundane work enables his teams to devote themselves to strategic enablement, and cutting-edge tools like the Oracle suite supportreal-timeforecastingandrapiddecision-making.

He espouses minutely localized analytics for addressing the specific needs of nascent retail businesses, elevating finance as a strategic enabler instead of a backroom numbercrunchingoperation.

Maneuvering Industry Challenges: Market Dynamics andSustainability

Kishore navigates De Beers through changing industry challengessuchas:

Ÿ Emergence of man-made diamonds and consumer awareness.

Ÿ Macro-economic turmoil in the background of geopoliticaluncertainty.

Ÿ AdoptingEnvironmental,Social,andGovernance(ESG) principlesaccordingtoDeBeers'"BuildingForever2030 Goals."

As part of his stewardship, financial KPIs incorporate ESG analytics, carbon-reducing supply chain technologies, and moral procurement processes support community growth, highlightingthecompany'ssustainableluxuryemphasis.

PhilosophyofLeadership:PillarsofStrength

Kishore's leadership philosophy rests on four pillars of strength:

Ÿ Strategic Thinking: Encouraging decisions aligned with long-term vision but remaining receptive to new opportunities.

Ÿ Agile Leadership: Responding quickly to change with composure,solution-orientedintensity

Ÿ Team Empowerment: Fostering trust, autonomy, and responsibilityateverylevel.

Ÿ Collaborative Approach: Integrating finance with other functions to offer whole-picture, fact-driven decisionmaking.

Kishore sees the future CFO as a "hybrid leader" who can balance financial stewardship, strategic vision, digital literacy, and ethical leadership. He cautions emerging CFOs to:

Ÿ Use technology to unlock value and enable timely decision-making.

Ÿ Develop empowered, high-performing, vision-driven teamstotheorganization.

Ÿ Be valued strategic partners to business leaders, driving meaningfuloutcomes.

Inadditiontofinancialresults,Kishorewishestobeknownas a change-bringing leader who built a culture of integrity, collaboration,creativity,andlifelonglearning.Hispathfrom a far-flung village to the C-suite of one of the globe's most legendary companies is as much a testament of individual achievementasitisamodelofleadershipbasedonresilience, humility,andpurpose.

Kishore's legacy in De Beers India is already beginning to takeshapethroughseveralsignatureaccomplishments:

Ÿ Re-positioning the brand from an omnichannel B2B royalties-driven licensing business to a consumer-retail businesswithstandaloneomnichannelstores.

Ÿ Building a robust and agile finance function, able to navigatethecompanythroughmacroeconomicvolatility, supplychaindisruption,andevolvingconsumerbehavior.

Ÿ Purging ESG into financial strategy significantly, demonstratingthatprofitabilityandsustainabilityarenot mutuallyexclusivebutcomplementary

Ÿ Enabling a future generation of finance leaders with competencies, vision, and ownership to drive transformationalchange.

Characterize a TransformationalCFO

“I believe finance is not just about numbers-it's about unlocking strategic value.”

Throughout his illustrious career, Kishore has continously redefined what finance leadership today would be His distinction can be captured through some of the key accomplishments:

1.DevelopingDeBeersIndia'sBusinessModel

StartingDeBeers'ownstoresinIndia—departingfroma

brand-licensing model—was a strategic risk of monumental proportions that involved stakeholder commitment, competitorbenchmarking,andcarefulexecution.Inaddition to creating new channels of revenue, the change better positioned the company to know its customers and serve them.

By upskilling employees, embracing digital technology, and cross-functional collaboration, Kishore transformed finance into a dynamic, decision-making function that could inform livestrategicbusinessdecisions.

From guiding the liquidation of Hindustan Diamond Company to weathering the uncertainty created by the COVID-19crisis,Kishorehasguidedwithclarity,dedication, anddetermination.

4.ESGIntegrationinBusinessStrategy

Not only has he governed with profit in his thoughts, but he has been a force behind implementing ethical sourcing, community involvement, and green responsibility in the company'sfinancialstructure.

FromusingOracleforinstantaneousprojectionstoembracing automation that eliminates drudgery work and augments strategic bandwidth, Kishore's leadership brings digital transformationasthecoreoffinanceinthedigitalage.

TheCFO'sRoleinanUncertainGlobalFuture

Kishore believes that in a less certain and more interdependentworld,theCFOs'roleischanging.Theyareno longer confined to performing finance and compliance function.Infact,today'sCFOmustbe:

Ÿ Strategicpartnertobusinessunits.

Ÿ Technologyenablerembracingdatascienceandartificial intelligence.

Ÿ Riskarchitectwithvisionfornear-andlong-termrisks.

Ÿ Cultural transformer leading values and behavior by exampleandempowerment.

Ÿ ESG integrator combining financial performance with socialandenvironmentalresponsibility.

Kishore embodies this multi-faceted leadership, demonstratingthattheCFOpositioncanbebothstrategically importantandintenselypersonal.

Kishore frequently refers to transformed finance leadership. HiscounseltofutureCFOsisconcise,pragmatic,andfirmly basedonexperience:

Ÿ Master the Fundamentals: Technical competence is essential Compliance, control, and governance knowledgeisthefoundationfortrust.

Ÿ Accept Ongoing Learning: Markets, industries, and technologies are fluid. Learn and ask questions constantly—eitherthroughformalcourseslikeHarvard's SELPorongoingself-learning.

Ÿ Build Cross-Functional Partnerships: Finance is not a silo. Collaborate with sales, operations, technology, and HR.Learntheirissuesandbeagoodbusinesspartner

Ÿ LeadwithPurposeandIntegrity:Valuescount.Peopleare inspiredbyleaderswholeadbyexample,arehonestand fair,andactwithintegrity.

Ÿ Balance Risk and Opportunity:Greatleadersdon'tavoid risk—theytakeitwithinsightandvision,makingboldbut well-informeddecisions.

WhileDeBeersIndiaretainsthemomentumofretailgrowth, digitalization,andESGembedding,Kishore'sleadershipisat the center of the growth story of the company His vision is wide-rangingandambitious:

Ÿ Develop a Customer-Centric Business: Redefine De Beers as a luxury experience business from a diamond businessfoundedonheritageandinnovation.

Ÿ Invest in People: Scaling internal people through mentorship,leadership,andculturalempowerment.

Ÿ Enhance Predictive Performance:Constructingbusiness agility by data-led foresight—foreseeing market, supply chain,andconsumerbehaviorshifts.

Ÿ Support Industry Sustainability: Proactively influencing the future of natural diamonds through guarantee of

“Empowering my team has always been the foundation of sustainable success.”

ethical origins, lowering carbon footprint, and empoweringvaluechaincommunities.

Kishore's odyssey is a reminder that leadership is as much aboutwhereyoustartasitisabouthowyoutransform—and whom you bring along in the journey From a MarathimediumschooltoHarvardexecutiveeducationandtheboard rooms of multinationals, his odyssey is a learning in grit, reinvention,andhigh-impactleadership.

He has proven CFOs can be strategists, culture bearers, innovators, and purpose drivers—transcending the finance past to build a new future not as a cost driver but as a value creator

Kishore does not merely lead numbers; he leads people, possibilities,andpurpose.

In today's business world, digital transformation is an imperativeforbusinessesthatdonotdesiretobeoutof the game but also remain relevant. Digital transformation,inspecific,becomesimperativeinthefinance function where new technologies are rewriting the old rules and the way things are done. Digital finance transformation hasnothingtodowithsystemimprovementorbringingnew tools.It'sachange-driventransformationthatenablesfinance organizations to make the shift away from transactional pursuits and take stewardship of strategic decision-making andbusinessgrowth.Organizationsmustcrossthethreshold of technology adoption at the surface level and make more profoundchangesinordertoenablethistransformation.They mustembraceanend-to-endmodelthroughprocessredesign, cultural transformation, data stewardship, and leadership stewardship. Organizations with the stuff to succeed with

digitalfinancetransformationcanharvesttheirreturnsinreal time by leveraging real-time insights, reducing operating costs, and enhancing decision-making to create enduring value.

Asuccessful digital finance transformation is anticipated by having a clear and actionable plan tightly coupled with the overall business vision. Such an approach should determine specificgoals,criticaltechnologiestotapinto,andtimingand cost of implementation. Leadership sets the tone and the tempo. Finance leaders need to be able to sell a compelling vision, sell it to departmental stakeholders, and establish accountabilityforthetransformationprocess.Intheabsence

of leadership and strategic alignment, even the hippest and mostadvancedtoolswillhavenotangibleoutcomes.

Finance teams are often most comfortable with old systems and multi-step processes, and this deters them from embracing digital solutions. In order to get the teams to transform, organizations must invest in repeated learning, training, and change management programs. Encouraging cross-functional cooperation between finance, IT, and other functions can also de-silo and make co-ownership of digital transformation goals simpler. Empowering and encouraging financeprofessionalscanturnthemintochangeagentsofnew technologyandenabletheorganizationtogrow

Embracing Technologies: Automation to Advanced Analytics

Technology is at the heart of digital finance transformation. ApplicationssuchasRoboticProcessAutomation(RPA)are assisting finance operations in automating mundane manual processes. Instances include data entry, invoice processing, andreconciliations.Roboticcontrolensureserrorsstayaway from the picture by automating routine work and enables financial professionals to focus on more value-added activities such as planning and financial analysis. CloudbasedERPsolutionsalsofindacceptance,offeringintegrated and scalable solutions with the added benefit of real-time access to information and better decision-making power Apartfromautomation,analyticsandAIarealsointroducing profoundchangeinthefinancefunction.

Withtheircapacityforprocessinglargeamountsofstructured and unstructured data, finance operations can leverage AIbased apps for predictive analysis, risk simulation, and scenario planning. These technologies enable firms to react fastertoshocks,takepre-emptivebusinesschoices,andeven predictshiftsinthemarketplace.Forinstance,AIcanforecast futurecashflowneeds,detectanomaliesinexpenses,orwork capitaloptimizationmoreeffectivelythantraditionalmodels. Nonetheless,theeffectivenessofsuchsolutionssignificantly dependsondataquality.Reliabledatagovernanceandproper planning for data architecture are required to achieve reliability,consistency,andsecurityoffinancialinformation.

OvercomingChallengesandMeasuringSuccess

There are various advantages to financial transformation digitally, but organizations mostly end up in spectacular failure when they attempt to do so. Legacy infrastructure, budgets,skillsgaps,andculturesofresistancecanallserveto beinhibitors.Thishastobebrokenbyfirmsusingastep-by-

step change approach starting with projects with quick wins and some concrete benefits. It builds up and demonstrates value for change to the stakeholders. Engaging finance professionals at planning and execution stages also ensures newprocessesandtoolsarebusiness-criticalanddeployable. Talentisthesecondchangedriver Whilethefinancefunction growsmorecentralized,thereisalsoagreaterneedinfinance functionsforexpertswithanalytical,technical,andstrategic expertise.

It entails learning in the data analysis field, understanding automated tools, and strategizing over financial reporting. Theremustbeametricsofdigitalfinanceprogramoutcomes to guarantee future success. Traditional techniques such as cost cutting and process simplification are valid, but others must include qualitative performance as well.These include better predictive accuracy, quicker decision-making, greater regulatory compliance, and improved stakeholder communication.

Financial change is not hype, but a normal evolution of the way the finance function works and helps organisational success.Itisnotmorethanatechnologyupgrade.Itrequires leadership,cultural,capability,andstrategicchange.Withall those drivers combined into one, companies unlock new levels of performance, visions, and speed The finance function is now not compliance reporting. With the proper strategy, it is a compelling driver to accelerate the speed of innovationaswellasriskmanagementanddeliverlong-term valuecreationfortheenterprise.Astechnologycontinuesto growevermoreadvanced,thoseorganizationsthatadoptand utilize digital finance transformation will be in a position to keeponflourishinginthecomingyears.

Effective finance leadership is critical to steering organizations toward sustainable growth and longterm success In an increasingly complex and competitivebusinessenvironment,theroleoffinanceleaders extends beyond managing numbers; it involves strategic decision-making, fostering innovation, and influencing the broader organizational direction Mastering finance leadership requires a blend of technical expertise, visionary insight, and strong interpersonal skills to drive business performance and create lasting value for stakeholders. Finance leaders serve as the linchpin between financial data and business strategy Their ability to interpret financial information,forecastfuturetrends,andcommunicateinsights to key stakeholders enables organizations to navigate risks andcapitalizeonopportunities.Ultimately,masteringfinance leadership is not just about ensuring compliance and

controlling costs—it is about becoming a proactive catalyst forbusinessgrowthandinnovation.

Strategic Financial Management as the Cornerstone of EffectiveLeadership

At the core of finance leadership lies strategic financial management,whichinvolvesaligningfinancialgoalswiththe company’s overall vision and objectives. Finance leaders must develop a deep understanding of the business model, market dynamics, and competitive landscape to craft comprehensive financial strategies that support sustainable growth and long-term profitability This requires moving beyond traditional accounting and budgeting practices to embrace advanced forecasting, scenario planning, and performance measurement tools that enable timely and

informeddecision-making.

Moreover, strategic financial management demands agility, adaptability, and continuous learning. Finance leaders must continuously monitor internal and external factors affecting the business, such as economic shifts, regulatory changes, technological advancements, and evolving customer behaviors.Byintegratingthesediverseinsightsintofinancial plans, they can anticipate challenges and position the organization to respond effectively. This proactive and holisticapproachempowersbusinessestooptimizeresource allocation,managecapitalefficiently,andsustaincompetitive advantage in a rapidly evolving and often unpredictable marketplace.

Finance leaders play a crucial role in enhancing organizational performance by fostering a culture of accountability, transparency, and continuous improvement. They establish robust financial frameworks that support operational efficiency, cost control, and sustainable growth while promoting transparency and strong ethical standards. By setting clear financial targets and key performance indicators (KPIs), finance leaders enable teams across multipledepartmentstounderstandhowtheiractionsdirectly contribute to broader business objectives and overall corporatesuccess.

Beyondnumbers,effectivefinanceleadershipinvolvesactive collaboration, strategic communication, and relationshipbuilding. Finance executives must work closely with other functional leaders to translate complex financial data into actionable insights that drive informed and timely business decisions. Their ability to communicate complex financial concepts in a clear, concise, and compelling manner helps build trust, alignment, and engagement across the entire organization. This collaborative mindset not only improves financialdisciplinebutalsoencouragesinnovation,strategic risk-taking, and agility necessary for sustained long-term success.

To master finance leadership, professionals must cultivate a diverse set of skills that extend well beyond technical financial knowledge Emotional intelligence, strategic thinking,andinfluenceareessentialqualitiesthatdistinguish highly effective finance leaders. Emotional intelligence enables them to manage relationships, resolve conflicts, and

motivate teams, fostering a positive and inclusive organizational culture. Strategic thinking allows them to envision future possibilities and develop robust plans that balanceshort-termresultswithsustainablelong-termgrowth. Inaddition,financeleadersmustcontinuouslyenhancetheir communication, storytelling, and negotiation abilities. The capacity to present financial data in a compelling narrative helps engage stakeholders, secure buy-in for strategic initiatives, and drive meaningful organizational change. Continuous professional development through targeted leadership training, mentorship, coaching, and real-world experience is vital for finance professionals aspiring to leadershiproles.

Mastering finance leadership is essential for businesses aiming to thrive and remain competitive in today’s dynamic economic landscape. By embracing strategic financial management, driving organizational performance, and continuouslydevelopingleadershipskills,financeleaderscan transform their function from a traditional back-office operation to a proactive and strategic business partner This evolution not only significantly enhances overall business outcomesbutalsocreatesaresilientorganizationcapableof sustainedgrowth,innovation,andlong-termvaluecreation.

Mastering finance leadership is a transformative and continuous journey that empowers finance professionals to drive business success well beyond traditional financial stewardship By integrating deep strategic insight with operational excellence and actively cultivating essential leadership qualities, finance leaders become indispensable architectsofsustainableorganizationalgrowthandlong-term resilience. As businesses continue to face increasing uncertainty, rapid technological change, and global market volatility, the ability of finance leaders to anticipate challenges, influence decision-making, and inspire effective collaboration across diverse teams will be absolutely paramount. Investing thoughtfully in the development of finance leadership capabilities ultimately positions organizationstonotonlysurvivebutthrivecompetitivelyin an ever-evolving marketplace, securing lasting long-term valueforallkeystakeholdersinvolved.