At Macquarie Capital, we combine over 30 years of experience in infrastructure with ideas and unique capital solutions to help unlock long-term growth, drive innovation and create a real-world impact in our communities.

Our deep sector expertise

Macquarie

1 Elizabeth Street

Sydney NSW 2000

Transurban

Tower 5, Collins Square

727 Collins Street

Docklands VIC 3008

Herbert Smith Freehills Kramer

ANZ Tower, 161 Castlereagh Street

Sydney NSW 2000

Schneider Electric

2 Banfield Road

Macquarie Park NSW 2113

The APP Group

Level 14, 10 Spring Street

Sydney NSW 2000

Mizuho | Greenhill

Level 43, Governor Phillip Tower

1 Farrer Place

Sydney NSW 2000

Transgrid

180 Thomas Street

Sydney NSW 2000

Department of Treasury and Finance

1 Treasury Place

Melbourne VIC 3002

Infrastructure Partnerships Australia

Level 12, 92 Pitt Street

Sydney NSW 2000

P: +61 2 8232 3333

W: macquarie.com

P: +61 3 8656 8900

W: transurban.com

P: +61 2 9225 5000

W: hsfkramer.com

P: 13 73 28

W: se.com/au/en/

P: +61 2 9957 6211

W: app.com.au

P: +61 2 9229 1410

W: greenhill.com/en

P: +61 2 9284 3000

W: transgrid.com.au

P: +61 3 9651 5111

W: dtf.vic.gov.au

P: +61 2 9152 6000

E: contact@infrastructure.org.au

W: infrastructure.org.au

I am delighted to welcome you to one of our signature annual events Partnerships 2025 – thank you for joining us.

Over the years, Partnerships has provided our members with a valuable opportunity to step away from the office or worksite and take a broader view – reflecting on the year past, anticipating what lies ahead, and considering how we as a sector are responding.

While it often feels as though each year is more significant than the last, 2025 and the period since we last gathered has brought a whole host of new challenges, opportunities, and areas of focus.

Earlier this year, the Australia and New Zealand Infrastructure Pipeline reached a major milestone – surpassing the one trilliondollar mark, driven by a strong, albeit increasingly uncertain, energy pipeline. Beyond the sheer numbers, the reconfiguration of the pipeline from metropolitan transport projects to energy projects in rural and regional Australia brings uncharted geographic, social and economic challenges for the sector.

Following a decisive election victory, the Federal Government has put economic reform and productivity back on the national agenda. We are meeting a month on from the economic reform roundtable and, no doubt, will reflect on some of the learnings that came from that.

Many of the existing and emerging forces currently at play in our sector will guide the conversations we have today. Today’s agenda features sessions with leaders from across industry and the public sector on a breadth of relevant topics including the state of play in geopolitics, the role of private capital in infrastructure delivery, the energy transition rollout, and the accelerating demand for digital infrastructure, namely, data centres.

As we are all aware, these dynamics will demand more than business as usual but sharper thinking, more deliberate investment and deeper collaboration. This is what events like today are about – working to bridge the gap between aspiration and action.

Macquarie Capital, our Platinum Sponsor, will return this year with another engaging keynote interview between Macquarie Group Managing Director and Chief Executive Officer, Shemara Wikramanayake, and Infrastructure Partnerships Australia Chief Executive, Adrian Dwyer as well as their highly anticipated Economic Update. We are also pleased to be joined by The Honourable Gabrielle Williams MP, Victorian Minister for Transport Infrastructure and Minister for Public and Active Transport, who will provide the sector with an update on her portfolio.

Amid growing demand for digital infrastructure, we will convene our first dedicated session on data centres, featuring Greg Boorer, Founder and Chief Executive Officer of CDC. Mr Boorer will share his insights into the investment, policy and regulatory frameworks required to position Australia to capitalise on the unprecedented opportunity in data centres.

This year’s event is being held at a particularly significant time for Infrastructure Partnerships Australia as we mark two decades of shaping public debate, connecting the sector, and driving reform towards good infrastructure policy. In recognition of this milestone, today’s agenda also features a panel covering the last two decades of policy reform with some of our founding patrons and members.

I cannot mention this extraordinary milestone without thanking our longstanding supporters – many of whom join us for this year’s event. I would like to give special recognition to the sponsors of Partnerships 2025, in particular Platinum Sponsor, Macquarie Capital, and Gold Sponsors, Transurban, Herbert Smith Freehills Kramer and Schneider Electric. We also extend our thanks to all the speakers and contributors for ensuring this event remains at the forefront of thought leadership for the sector.

Once again, a warm welcome to Partnerships 2025 – I hope today presents many opportunities to engage with your fellow colleagues, and I look forward to catching up with many of you throughout the day.

Yours sincerely,

Sir Rod Eddington AO

Infrastructure projects are increasingly complex, involving ever-greater levels of engagement with growing numbers of stakeholders – from communities and regulators to investors and strategic operators. While in the case of public spending, projects face scrutiny as governments come under pressure to demonstrate measurable productivity gains from their capital outlays.1

A consequence of all of this is that advisers need to be better at knowing where the optimal opportunities lie, says Tom Butcher, Executive Director and Head of Infrastructure, Asia Pacific, at Macquarie Capital. And a prime example of this is in the renewables space.

As a vast country with an abundance of sunshine and wind – together with its stable government, growing economy and strong rule of law – Australia’s opportunity has always been clear. Even with greater pragmatism now part of the energy transition story, the direction of travel remains towards renewable energy, and Australia remains an attractive opportunity for investors.

“There’s plenty of demand from private and listed markets to pursue transactions and investment in the renewables space. There is also plenty of opportunity, be it grid, electrons, pipelines and molecules. Our infrastructure team’s scale, deep expertise and activity in the sector means we understand both sides and

can find and connect the right opportunities in this new era,” Butcher says.

Global investors in infrastructure and the energy transition are increasingly taking a more nuanced approach to the way they invest their capital. Investors are moving from a ‘divest/invest’ approach, which saw selling carbon-exposed assets to reinvest in renewables, to a more holistic approach of supporting an orderly transition, through continued investment in assets related to natural gas and an increasing focus on energy storage assets.

“Investment to support energy security and the infrastructure required to enable the transition to renewable energy is about more than meeting net zero commitments,” says Joanne Spillane, Executive Director and Global Head of Private Capital Markets at Macquarie Capital. “It’s about opportunities to deliver

risk-adjusted returns to these investors based on practical and rational business plans with timetables for delivery that are achievable.”

A better understanding of the physical challenges in achieving net zero – such as integrating and upgrading transmission networks with effective firming to support intermittent renewable generation – has driven a much more pragmatic view of what the energy transition means and requires.

“While developers are building out new wind and solar generation and coal-fired generators are ageing and becoming increasingly unreliable, the demand for electricity is growing, spurred by growing energy loads of data centres in particular. This has led to a focus on ‘energy pragmatism’ – the view, for example, that natural gas needs to be part of our energy mix and support an orderly transition – and that provides an opportunity for investors and users,” Spillane says.

This is not just an Australian story. It is a global story, with a focus on the trillions of dollars2 required to establish and upgrade transmission grids to enable new sustainable generation to be plugged in.

“Given the long-dated nature of renewable assets and sheer scale of the build-out required, decisions made in the next five years will be felt across the next four decades,” says Danish Aleemullah, Division Director and Head of Energy and Renewables, Australia, at Macquarie Capital.

The Australian energy sector has never had to tackle a task of this magnitude. The considerations at play include what the appropriate mix is for the creation of energy, the forms of storage and capacity that need to be deployed in support of that, an efficient buildout of the electricity and natural gas networks, and the maintenance of system strength throughout this journey.

This process isn’t limited to large-scale projects; what happens in homes and businesses is just as critical. The continued installation of rooftop solar and rapid uptake of battery systems is impacting energy consumption patterns and there’s an

expectation that these ‘small assets’ will be orchestrated to play a growing role in managing system wide issues.

“How policies are set and where capital is deployed will drive the costs to energy users for many years to come. A strategic approach to investment and drawing upon industry expertise will make a substantial difference to return outcomes,” says Aleemullah.

Businesses and deployers of capital now need bespoke advice and tailored business models, he adds.

“The draw on capital is huge and the make-up of projects is very diverse. It’s why you need to hear from people that have spent time in the sector, matching technical and financial requirements.”

The deeper understanding of the energy transition, and therefore the assets that provide higher returns and lower volatility, has resulted in a change in the volume of investment and identity of investors.

A new cohort of investors and developers are entering the Australian market as others recycle capital or exit, says Jessica Edwards, Division Director at Macquarie Capital specialising in renewables and transport.

Financial investors continue to target higher returning opportunities in the energy sector such as development activities, she says.

Also, many of the large renewables platforms, having come to market over the past three years, are now focused on achieving scale, delivering new assets, optimising operations and funding and attacking the various market opportunities their model presents.

“Now you need to knit together a transaction, and that takes a lot of skill and advisory bench strength,” Edwards says. “There might be someone looking for a capital partner, someone looking to exit assets and a fund investor looking for a particular type of asset. That takes a lot of conversations, knowing what’s going on in markets and deep expertise.”

The resources industry is a case-in-point, says David Wickstrom, Division Director at Macquarie Capital specialising in resources infrastructure and renewables. Mines are using more electricity as ore bodies are extracted at greater depths, de-watering increases, and diesel and natural gas is swapped out for electrified equipment.

“Electrification is where we see the next big step-change in the resources industry. Many remote mines are not connected to traditional grids, so they are reliant on building and operating their own power plants,” Wickstrom says.

KKR’s acquisition of Zenith Energy is a prime example of the intersection of resources and infrastructure.

Zenith builds large-scale, hybrid, renewable plants that combine wind, solar, battery and back-up diesel and gas. These hybrid plants can enable sites to operate using up to 100% renewable energy.3

Macquarie Capital advised KKR on the acquisition of Zenith, leveraging our understanding of the WA resources sector and Zenith’s customers.

Macquarie Capital also advised Transgrid, Australia’s largest electricity network operator, on funding its $A5 billion HumeLink project in southern NSW, which includes 365 kilometres of new transmission lines.4 The project will receive up to $A1.9 billion of funding from the Clean Energy Finance Corporations’ (CEFC) Rewiring the Nation Fund.5

“We brought to Transgrid an innovative CEFC financing structure that leverages its existing business and access to capital, which works for all parties, and ultimately facilitated five individual securityholders committing to fund the $A5 billion project,” says Xavier Eid, Division Director at Macquarie Capital specialising in utilities and transport.

“We achieved that by combining our knowledge of regulated infrastructure with financial expertise, and having strong relationships with the CEFC, Transgrid and its securityholders –knowing what was, and wasn’t, going to work for them,” adds Eid.

The project was not financeable without Rewiring the Nation funding, and ultimately a hybrid and concessional loan arrangement was negotiated with the CEFC. Transgrid securityholders could make the decision to invest because the return they were getting was commensurate with the risk of the project, Eid says.

As businesses and investors refine their strategies, the focus has shifted to actionable opportunities. What began as a momentum-building journey has now evolved into a defining moment for the nation’s infrastructure landscape, setting the stage for a future where progress isn’t just imagined – it’s built.

1. ‘Growth mindset: how to boost Australia’s productivity’, Australian Government Productivity Commission, 24 July 2025, www.pc.gov.au

2. ‘The cost of inaction: Grid flexibility for a resilient, equitable energy future’, World Economic Forum, 20 January 2025, www.weforum.org

3. Zenith Energy, Accessed: August 2025, www.zenithenergy.com.au

4. ‘HumeLink Project’, Transgrid, Accessed: August 2025, www.transgrid.com.au

5. ‘RTN Fund backs clean energy superhighway’, CEFC, December 2024, www.cefc.com.au

By Amanda Princi | Head of Data and AI Enablement, Transurban

In traffic control rooms monitoring some of Australia’s busiest motorways, Artificial Intelligence (AI) is going about its business scanning thousands of roadside CCTV camera feeds 24/7 to make sure traffic – and cities keep moving.

The AI systems are searching for changes in pixel lighting levels on the cameras. If there’s no change for 10 seconds the system alerts the traffic control room operators to check for any incidents and, if necessary, dispatch a response crew.

With around 2.3 million trips a day on Transurban’s roads in Sydney, Melbourne and Brisbane, any incident has the potential to create major traffic delays.

Every week, Transurban’s Automated Incident Detection (AID) systems identify more than 1,000 on-road anomalies including stopped vehicles, debris and even sudden weather changes. These systems feed into a purpose-built platform that recommends the best way to respond based on historical data and real-time conditions. This could be speed reductions, lane or tunnel closures or sending out the incident responders.

With the support of AID, our response teams are now clearing incidents in under 10 minutes on average to keep traffic flowing.

And, in Melbourne alone, AI scanning - along with optical sensors - has helped our traffic control team prevent more than 500 over-height vehicles from entering the Burnley and Domain tunnels last year, avoiding potentially costly damage and major traffic impacts.

When CityLink opened 25 years ago, it introduced high-tech electronic tolling to Australia. Today it continues to be one of the world’s most sophisticated roads with thousands of pieces of technology - from CCTV cameras and sensors embedded in the road, to electronic speed and lane-control signage and dynamic tunnel lighting - monitoring and controlling traffic flow.

But as cities grow, mobility demands evolve and technology advances, AI is increasingly playing a key role both on and off CityLink and Transurban’s other toll roads to help our teams create more efficient, safer and seamless experiences for users.

On-road, AI is helping maintain road pavements to the safest condition by detecting even the smallest defects.

Using AI-driven video analytics and dashcam telematics, we can detect pavement defects as small as a coin — often beyond the capabilities of manual inspections. AI-powered video processing capability is used across all our roads, providing a consistent assessment of pavement conditions. Most importantly, it keeps our people safe, with employees no longer needing to be exposed to any risks during on-road inspections.

We are also planning to use AI models to analyse sensor data to predict when infrastructure components — such as cameras, fans, or road surfaces — are likely to fail. This will allow for proactive maintenance, reducing downtime and extending asset life.

It is also being used to reduce energy consumption of the 1,500 industrial fans, which account for up to 70 per cent of energy use in our tunnels. Digital models track the impact of traffic volume, vehicle mix and emissions to allow us to determine the optimal ventilation needed. The result - approximately 10 per cent in power savings, improved tunnel air quality and increased life of ventilation fans.

Data and AI are also powerful tools in helping create safer roads by identifying incident hotspots. Transurban has developed a platform to capture crash data across states and by integrating data from internal sources (such as traffic data), and external sources (such as connected vehicle data and weather conditions), we can gain insights into vehicle dynamics, road conditions, weather patterns, and crash types and locations, across all times of day. Using this data, our Road Safety team can implement targeted action plans to reduce crashes across our roads. Off-road, AI is also being used to keep our customer base safer.

We have developed a generative AI-enhanced fraud detection solution, designed to proactively identify fraudulent retail customer accounts.

Known as FRANK (Fraud Risk Analysis Network Kit), the solution uses sophisticated machine learning techniques to analyse account features and make connections with known fraudulent accounts.

This approach is more dynamic than existing fraud reporting, widening the net and enabling earlier detection. In addition, the model can explain why an account is flagged, helping our fraud team make quicker and more informed decisions.

With a 99 per cent accuracy rate in detecting fraud, FRANK not only boosts operational efficiency but also keeps Transurban ahead of fraudsters.

This year, we also introduced our newest customer service team member, ‘Lex’ - a Generative AI chatbot and messaging platform. Lex helps customers within the Linkt app and website through natural conversations. Since launching, it has handled more than 400,000 chats, resolving 56 per cent without agent support.

These systems provide fast, accurate responses and free up our people to focus on complex issues, enhancing the overall customer experience.

Looking to the future, the rise of autonomous vehicles combined with AI offers further ways to improve safety and efficiency on roads.

In 2024, Transurban conducted an on-road trial of two trucks with automated driving systems (ADS) to explore how their systems interacted with smart road infrastructure.

The trial found that AI capability within the trucks interacting with roadside technology provided advanced awareness of road and traffic conditions ahead.

For example, on-road cameras and sensors can share data with an autonomous truck’s ADS, helping the system ‘see’ what’s happening beyond the range of its own sensors, including when sensors are blocked and when the truck cannot access a full picture of the road ahead (for example, around corners).

This allowed trucks to make earlier decisions which can benefit safety, efficiency and performance.

As AI continues to evolve, its integration into road infrastructure and customer interactions has the potential to make travel not only smarter and safer, but it will help meet the transport challenges of our growing cities.

How Australia’s Infrastructure Transformation is Powering a Competitive, Climate-Ready Future

Australia is entering a transformative era in infrastructure

- one defined by the urgent need to decarbonise and the growing momentum behind electrification. These are not just environmental imperatives; they are strategic levers for national resilience, economic competitiveness, and long-term liveability. As global pressures mount to reduce emissions and transition to clean energy, Australia has a unique opportunity to lead. By investing in infrastructure that is clean, connected, and climatealigned, we can build a future that supports growth while safeguarding the environment.

Decarbonisation is transforming infrastructure from the ground up. By reducing emissions and embracing sustainable materials and technologies, we are creating systems that are not only environmentally responsible but also cost-effective and resilient in the long term.

• Lower emissions through renewable energy integration,

• Healthier communities with cleaner air and reduced noise pollution,

• Smarter design that anticipates future climate challenges.

Electrification is the engine behind Australia’s clean energy transition. From electric buses and trains to smart grids and EV charging hubs, electrification is enabling a seamless, sustainable mobility ecosystem

• Electric public transport is reducing urban congestion and emissions,

• Smart energy networks are improving reliability and efficiency,

• Integrated transport systems are enhancing connectivity across regions.

Electrification is the engine of Australia’s clean energy future. It is enabling the shift from fossil fuels to renewable power across transport, buildings, and industry. In cities and regions alike, electrification is redefining how people and goods move - making systems smarter, cleaner, and more efficient.

Electric buses, trains, and vehicles are becoming more common, supported by a growing network of charging infrastructure. Smart grids and battery storage are enhancing energy reliability and enabling real-time energy management. Electrification is also unlocking new economic opportunities, from advanced manufacturing to green jobs, while reducing dependence on imported fuels.

Transport is one of the largest sources of emissions in Australia. But it’s also one of the sectors with the greatest potential for transformation. Urban mobility is being reimagined through electric buses, light rail, and active transport infrastructure. These systems not only reduce emissions but improve accessibility, reduce congestion, and enhance urban liveability. Freight transport is also evolving. Electrified rail corridors, smart logistics hubs, and low-emission delivery fleets are helping to decarbonise supply chains while boosting efficiency and reliability.

Key outcomes and benefits include:

1. Electric bus fleets in major cities

Electric buses are transforming public transport in Australia’s cities, offering faster, more reliable service that reduce commute times and improves access to jobs and services. For businesses, cleaner air and less congestion mean more productive employees and more attractive urban precincts.

2. EV charging hubs along freight corridors

New EV charging hubs are supporting the shift to electric vehicles, cutting fuel costs for individuals and small businesses. For freight operators, they enable efficient long-haul logistics with less downtime and greater supply chain reliability.

3. Rail Revitalisation to shift freight from road to rail

Upgraded rail infrastructure is moving more freight off of roads, easing congestion and improving safety for commuters. Businesses benefit from faster, more cost-effective deliveries and freed-up road capacity that supports local economies.

As infrastructure becomes more electrified and decentralised, digital connectivity is essential. Smart infrastructure - enabled by sensors, data analytics, and AI - can monitor performance, predict maintenance needs, and optimise energy use in real time.

Digital tools also support better planning and decisionmaking. Digital twins, for example, allow planners to simulate

infrastructure performance under different scenarios, improving resilience and reducing risk. By embedding digital intelligence into physical infrastructure, Australia can create systems that are not only efficient but adaptive and future-proof.

The scale and complexity of Australia’s infrastructure transformation require unprecedented collaboration. Governments, industry, investors, and communities must work together to align goals, share risks, and accelerate delivery. Public-private partnerships are proving vital in mobilising capital and expertise. These partnerships can unlock innovation, improve project outcomes, and ensure infrastructure is delivered on time and on budget.

Australia’s infrastructure transformation depends not only on investment and innovation but on strong policy alignment to support clean energy and transport goals. Enabling policy frameworks are essential for removing barriers, unlocking productivity, and ensuring infrastructure operates at its full potential. This is particularly critical in the freight and logistics sector, where productivity is often constrained by land availability and operating time restrictions. As new commercial models reshape how projects are delivered, coordinated and forwardlooking policy reform is vital - not just to accelerate progress, but to address systemic limitations and maximise the impact of sustainable infrastructure initiatives across both urban and freight networks.

The economic case: Infrastructure that drives growth

Clean, electrified infrastructure is not just good for the planet, it’s good for the economy. It creates jobs, attracts investment, and enhances productivity. According to recent studies, every dollar invested in sustainable infrastructure generates multiple dollars in economic return. It also reduces long-term costs by avoiding the impacts of climate change, such as extreme weather damage and health-related expenses. By leading in clean infrastructure, Australia can position itself as a global hub for green innovation and export its expertise to the world.

Australia’s infrastructure transformation is already underway, but the pace must accelerate. With the right policies, partnerships, and investments, we can build systems that are not only fit for purpose today but ready for the challenges of tomorrow. This is a once-in-a-generation opportunity to reshape our cities, regions, and economy. By embracing electrification and decarbonisation, we can create infrastructure that:

• drives inclusive economic growth,

• supports national climate goals, and

• improves quality of life for all Australians.

The future is not something we wait for – it’s something we build. And the time to build is now.

By Dr Jonathan Spear | Chief Executive Officer – Infrastructure Victoria

With productivity lagging and tight government budgets, digital technologies can help deliver infrastructure smarter, faster and cheaper.

But choosing which technologies to use and where can be a challenge.

Government procurement can play a role in enabling wider use of digital technologies in infrastructure and give businesses the confidence to invest in the capabilities they need to grow.

Infrastructure Victoria has commissioned research to assess which digital technologies, available now and already proven, are most likely to boost productivity in infrastructure.

The Digital technology and infrastructure productivity report assessed 25 existing digital technologies and their potential to boost productivity across government infrastructure in the near term.

This filter found five of the most promising technologies if widely used:

• machine learning and artificial intelligence (AI)

• robotics

• advanced imaging

• advanced data analytics, and

• geospatial technologies.

These technologies were then analysed using a test case to show their real life potential, possible broader applications across the sector, and an estimate of the cost savings of each.

The test cases (below) highlight the report’s main finding - that adopting digital technologies more widely in the infrastructure sector can boost productivity, save money and help deliver projects faster and more safely.

Infrastructure Victoria is recommending the Victorian Government pilot digital technologies on its infrastructure projects, use building information modelling on major projects, and promote greater use of digital technologies in projects through procurement.

Applying machine learning and artificial intelligence to the design and delivery of Victorian schools and kindergartens could reduce cost overruns by an average of 2.5 per cent, the study finds. This amounts to avoided costs of around $20 million every year.

Machine learning and AI means computers learn from data without direct human programming. Large and complex data can be managed and analysed. These technologies can be used across projects, from generating and assessing design and project management options, automating decision-making in areas such as procurement, and managing assets. The technologies allow designers and project managers to quickly assess different scenarios and better manage on-site project challenges.

Applying machine learning and AI on all government infrastructure could deliver $375 million of benefits per year or $9.4 billion by 2055, the report finds.

Widescale adoption will depend on effective governance and regulation which also enables innovation and investment. Standards and regulations must be updated to encourage the responsible use of AI, data analytics and digital tools in infrastructure development and maintenance.

Robotics have a variety of applications across the infrastructure sector including maintaining utilities assets, bridges, jetties, roads, and buildings. They are currently being used to undertake repetitive and low value tasks, but more advanced applications can use robotics for tasks that are fully autonomous and more intricate.

Our report finds robotics for underground water maintenance could extend the life of assets and reduce water leakage in underground pipelines by 10 per cent. This can save money and ensures every drop of water is saved as the climate changes. More frequent inspections can improve performance and extend the life of water infrastructure. The analysis finds the use of robotic monitoring in the water sector can also reduce maintenance costs by 20 per cent.

Researchers from the University of Technology in Sydney, working in collaboration with Transport NSW, have developed a robot designed to inspect and clean bridge piles. The submersible pile inspection robots have claw arms that allow them to grasp a pile, conduct surface cleaning using highpressure water jets, and use cameras and sensors with advanced algorithms to allow the robot to work autonomously.

The robots collect high-definition images of the cleaned pile and produce a 3D map of the structure to inform a human-led condition assessment. They perform underwater tasks which are usually done by divers who face a range of safety risks, including low visibility, strong water currents and using high pressure water systems.

The high capital costs of robotics remain one of the main barriers to entry. These are compounded by a lack of understanding of the benefits of the technology and how it can be sourced and applied. The potential impact on jobs will need to be manageddisplacing some, but creating demand for new skilled jobs.

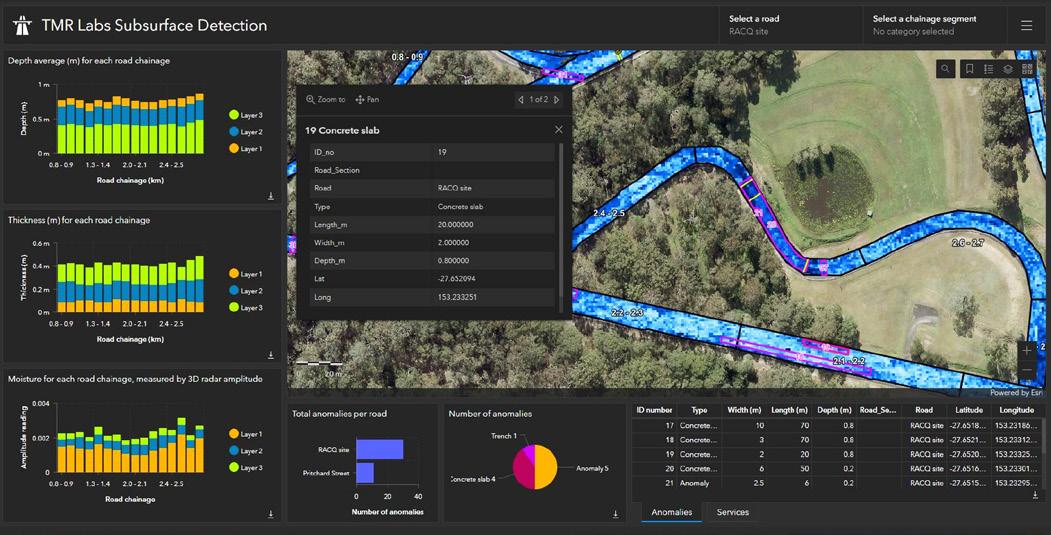

Advanced imaging for subsurface inspections in road construction.

Advanced imaging combined with ground-penetrating radar can be used to map infrastructure below the surface quickly and accurately. This helps reduce the potential for costly clashes with underground infrastructure. It can also find potential defects or maintenance needs earlier.

Our report finds advanced imaging with ground-penetrating radar could save around $42 million every year if applied across the Victorian infrastructure sector.

Ground-penetrating radar is a non-intrusive method of seeing below the ground’s surface to find underground utilities and other layers, such as pipes and cables, concrete, metals. The units are becoming smaller and easier to use. Compact units can now be towed behind cars and even smaller units mounted on, or underneath, vehicles.

Advanced imaging can be employed across engineering, medical imaging, astronomy, biology and physics to improve diagnostics and decision-making. It still at the early stages of deployment in Australia. As such, costs are still high and the equipment highly technical. But is has the potential to deliver substantial productivity gains across the sector. These gains are amplified when combined with other technologies.

Building information modelling, which is also known as a form of digital engineering, can reduce project delivery times and costs and improve resource efficiency. It uses advanced data analytics to create 3D digital models and is widely available.

The technology has many potential applications across the infrastructure sector. For example, experience from Norway has found that drawingless construction of roads using building information modelling can reduce average cost overruns by around 15 per cent.

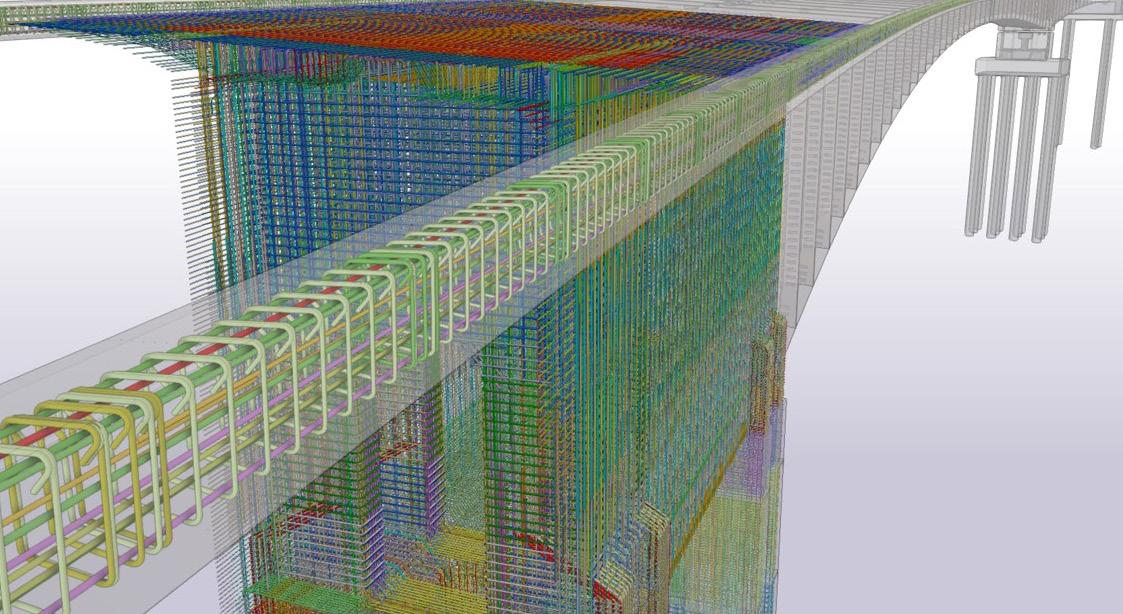

The Randselva Bridge, also in Norway, is the world’s longest bridge designed and built without drawings. Five teams across five countries collaborated on the

project. The detailed design was done through a single model, with all foundations, four pier piles, 200,000 rebars and 250 post-tensioning cables. Adjustments were made directly through the model, ending the need for manual drafting and allowing more efficient testing.

Our report finds use of building information modelling technology could save more than $76 million every year on the cost of building public housing. This figure is based on an estimate that full adoption of building information modelling can save around 7 per cent project costs on residential housing.

Geospatial technologies, combined with AI-enabled predictive analytics and earth observation monitoring, has many potential uses including land use management, emergency management, construction, and transport.

For example, an Australian company based in Queensland has developed an AI-powered geospatial intelligence platform that quickly finds and maps wildfires. It can trigger an emergency response when fires are small and easier to extinguish.

It combines real-time satellite imagery with on-ground camera sensors for near immediate threat identification. Pixels showing heat are used to confirm smoke.

Access to earth observation technology and satellite infrastructure, combined with advanced data analytics, is increasing the precision, timeliness and processing power of geospatial technologies. Continuing the development of geospatial technologies and information can help manage Victoria’s vulnerability to climate change and better protect infrastructure and communities.

Geospatial information systems, positioning technology and satellite imagery are evolving to incorporate 3D, 4D and GeoAI. Each of these components allows for faster and more accessible spatial analysis.

To read the full report visit infrastructurevictoria.com.au/ resources/digital

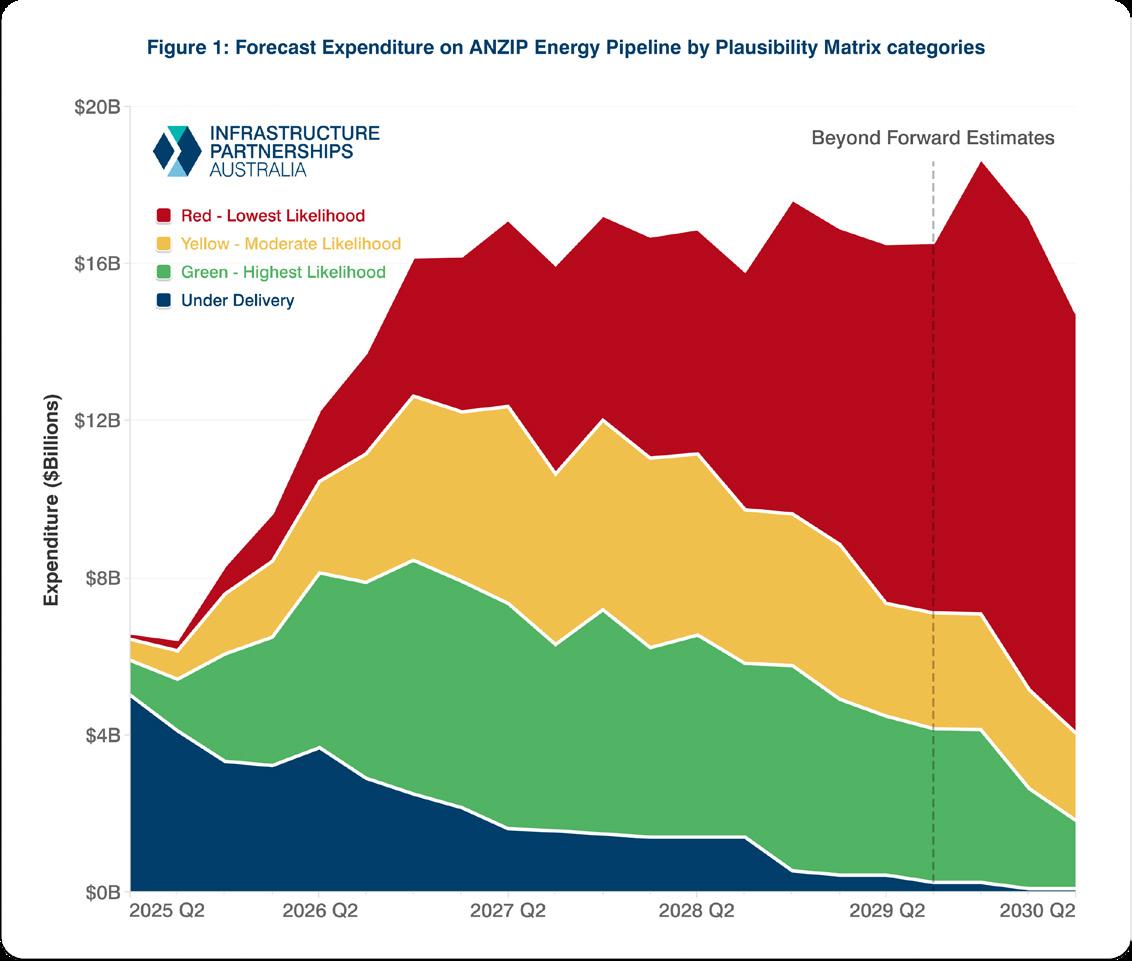

The scale of the Australia and New Zealand Infrastructure Pipeline (ANZIP) has rapidly expanded over recent years, surpassing the $1 trillion mark in April. As the pipeline has grown – driven primarily by growth in energy projects - the dynamics affecting it have changed.

To analyse these changing dynamics, Infrastructure Partnerships Australia developed three metrics of pipeline plausibility: Visibility, Consistency and Magnitude. In short, what proportion of projects on ANZIP have publicly available construction schedules? How many of those projects stick to their schedules? And if they miss them, by how much?

The results of this analysis were clear, primarily publicly procured road, rail and social projects are much more likely to stick to their plans than energy projects, which are delivered in less mature, developer-led markets that respond to a very different set of market signals and nascent regulatory processes.

To deal with the plausibility challenges of the energy pipeline, we have dug further into the data to establish predictive capability in our pipeline analysis. This has resulted in the establishment of the Energy Infrastructure Plausibility Matrix, a multi-criteria model

that assesses energy projects on ANZIP for their likelihood to meet future construction schedules.

The Plausibility Matrix assesses projects not yet under delivery against their achievement of lead indicators for on-time delivery. Criteria include big-ticket gateways like signing main works contracts, final investment decision status, planning approvals and the presence of credible equity; as well as smaller, but no less important milestones including power purchase agreements, government funding or financing assistance, major project designation, and participation in priority planning programs. This model does not pass a value judgement on the merits of these projects but is instead a probabilistic model of their

likelihood to be delivered as currently scheduled. Projects are categorised in a sliding scale, Green - most likely, through to Red - least likely. Figure 1 breaks down Infrastructure Partnerships Australia’s forecast expenditure model of the energy pipeline using the Plausibility Matrix.

Applying the Matrix to the energy pipeline on ANZIP finds 18 per cent of projects are under delivery, 24 per cent of not-yetdelivered projects are Green, 25 per cent are Yellow, and 33 per cent are Red. It is expected that as time passes some projects will progress towards delivery, moving through the colour scale, while others will not progress and eventually exit the pipeline.

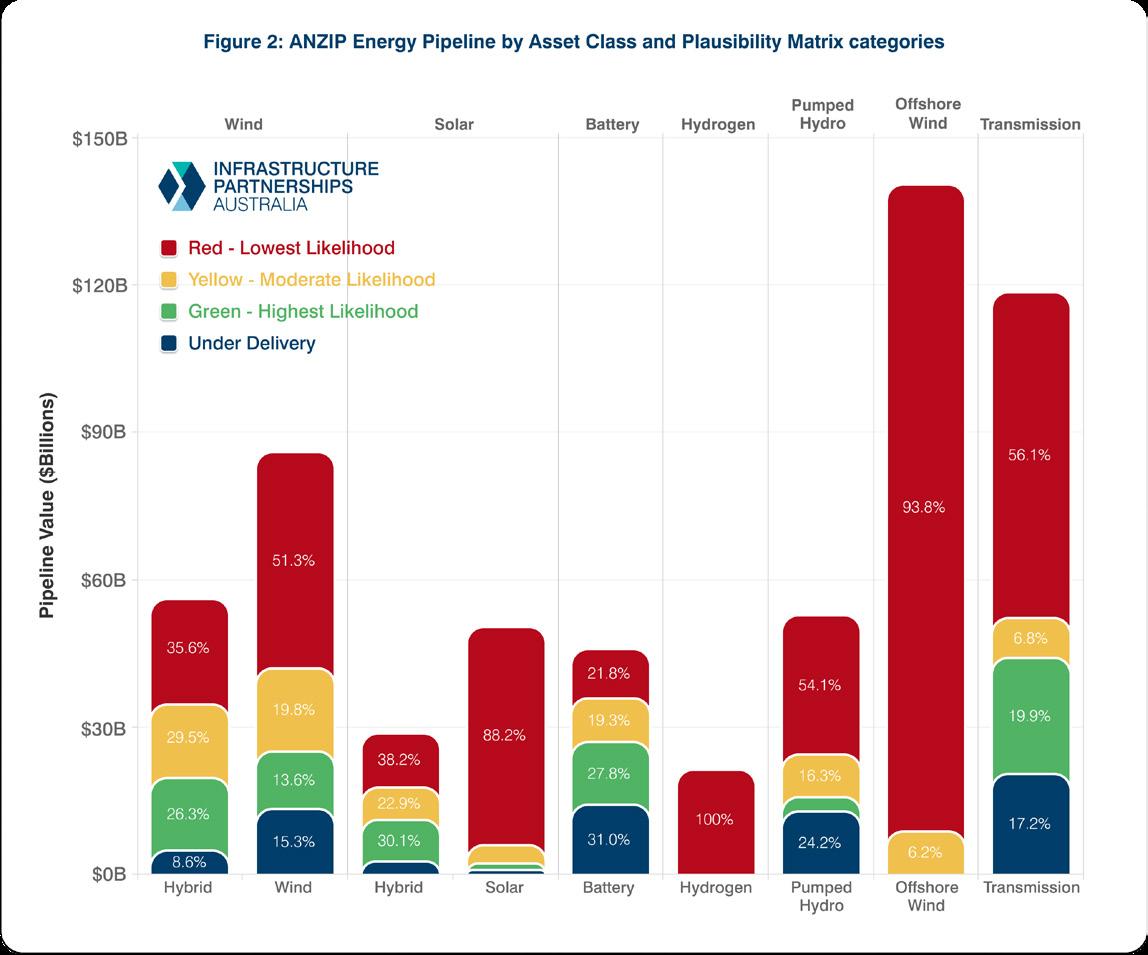

The energy pipeline currently totals 298 projects worth $599 billion. The bulk of the pipeline by value is made up of onshore wind, offshore wind, transmission and solar projects, with pumped hydro and chemical battery projects the next largest asset classes. The forces at play governing this market are far

from uniform, with different asset classes being impacted in distinct ways. Figure 2 shows the energy pipeline by asset class and Plausibility Matrix categorisation.

Of the asset classes assessed for plausibility, chemical batteries have the greatest proportion of projects Under Delivery and the second highest proportion of projects categorised as Green. The Plausibility profiles of standalone solar and hybrid solar projects tell a markedly different story, with standalone projects far less likely to meet their construction schedules than those projects that also include the flexibility of a battery. Plausibility challenges are also observed in standalone wind projects with over 70 per cent of the pipeline assessed as Yellow or Red.

The results of this matrix should come as no surprise. Unlike the transport boom of the last 15 years which saw the delivery of singular projects solving singular problems – there can only be one road linking Point A to Point B, the energy pipeline often involves multiple proposals, of varying qualities, attempting to solve variants of a singular problem – there are many possible options for generating power in a wide geographic region. Consequently, something akin to an artificial oversupply of notional projects is created in the pipeline as multiple solutions jockey to solve a finite problem. During this process a wide range of potential projects must be considered while their merits are assessed, which leads to turnover in the pipeline, as projects which don’t pass the test are removed.

This turnover is represented by the 22 energy projects removed from ANZIP so far this year. Some of these projects were deemed non-financially viable in the case of hydrogen, some offshore wind projects ran into unforeseen challenges, while other projects were simply left to wither on the planning vine as it became apparent to the proponent that their project may not be the winning solution to a particular problem.

The energy transition was never going to be a seamless journey, with plenty of bumps expected along the way. Fortunately, Australia possesses the necessary skills, expertise and capital required to navigate these issues. Infrastructure Partnerships Australia will continue to keep our members updated across these challenges by providing analysis of the pipeline and hopefully reporting green shoots of improved conditions as we develop solutions at scale to solve the transition.

Shemara Wikramanayake, Macquarie Group Managing Director and Chief Executive Officer, sat down with Ed Burley, Head of Digital Networks & Data, Australia and New Zealand, Macquarie Capital, to discuss key global trends driving the evolution of digital infrastructure.

Shemara: Ed, we’re told that this era of machine learning is the Fourth Industrial Revolution and is going to need significant new digital infrastructure. What do you think this means for the sector?

Ed: We think this is going to be transformative for the digital infrastructure sector and more significant than the arrival of the cloud about ten years ago. We’re going to need a lot more data centres, we’re going to need a lot more high-capacity submarine networks to connect nations and regional economies, we’re going to need a lot more dense fibre so the data centres can support their customers, and we’re going to need a lot more power to stand up those data centres.

Of course, all of this is going to require a lot of capital to build. And, to put that into perspective, in the last five years there was about 7,000 digital infrastructure transactions, with a combined

value of $A3.3 trillion.1 So, AI will likely require multiples of that, which is great news for investors.

Ed: When you travel the world talking to our stakeholders, what are the key thematics you see driving the demand for digital infrastructure?

Shemara: It’s generally impacting everything, but there are four themes I would point to. One is demographics and population growth. As populations are growing, the demand for digital infrastructure is growing a lot, because consumption is stepping up, but also due to the demographics of the population with young digital natives coming through who are using technology for learning, for communication and for social interaction. The second theme is smart cities and urbanisation, with these smart cities using digital solutions for everything, from transport to energy and public services. The third one is in terms of what’s

going on with sovereignty and the geopolitical background, where everyone is wanting sovereign resilience so they’re domesticating their digital infrastructure. And the last theme we’re seeing is digital transformation across every industry, so for things like managing risk and customer experience industries are going digital to deliver solutions. These are four themes I think apply the world over.

Shemara: This increasing scale and also the complexity of the modern digital environment means that we’re seeing a need for AI data centres. What are some of the key characteristics and drivers there?

Ed: AI data centres are a completely new generation of data centres, and investors are seeing it that way too. They’ve got some very distinctive attributes. The first is scale: they need to be in the gigawatts not megawatts. They need access to cheap, reliable power; we’re talking again gigawatts of power supply for them. They need ultra-efficient cooling systems, which brings up the issue of water cooling and access to sustainable water. And they need connectivity to fibre. Investors see them as very distinctive attributes of these data centres and are looking to find ways to get exposure.

They can either do that directly, by investing directly in AI data centres, as we’ve seen investors invest in the Stargate Project,2 for example, in America. Or they can do it indirectly, by investing in the chip aggregators that sell AI data capacity to customers.

A really good example of that is Macquarie Capital’s participation in CoreWeave’s pre-IPO financing.3 CoreWeave sells chip capacity to AI developers, and they rent space and power at AI data centres, so it’s a very good way of getting synthetic exposure to this new generation of data centres.

Ed: As we see continued investment in digital infrastructure, how are you seeing that impacting demand for energy, and funding solutions and renewables in particular?

Shemara: As you’ve been saying, energy demand is growing massively and is being driven by a number of things. It’s general economic growth, and it’s also the energy transition, with the rise of EVs and electrification, but data centres are also a contributor. We’re finding this mostly in the US, which is where the bulk of the data centres are being built, but we’re also seeing it around the world. A couple of big portfolios we have include Aligned Data Centres and Applied Digital, which are both in the US. We also have a platform called VIRTUS Data Centres, that we’re developing to support the UK and European build out. These data centres used to be built close to demand, but now a lot of factors on the supply side are driving where they’re located. This includes factors like access to energy, but also as you mentioned, water for cooling and also access to land, which are all driving where they’re located. This industry has a history of driving efficiency, so it’s unclear how fast energy demand will grow, but it’s going to increase significantly. Renewables are going to play an important part in that because it’s the quickest form of new build energy and also because a lot of the hyperscalers have their own climate and emissions goals, so they’re favouring renewable energy sources.

Shemara: We’ve talked about data centres, but I’m interested to hear more about fibre. What is it doing in terms of supporting things like AI, edge computing and smart cities?

Ed: To use a physical analogy, we see fibre as the skeleton of the digital infrastructure sector. It’s the means by which all the components of a digital ecosystem are connected. Fibre has high capacity; it can transmit a lot of data at low latency. It can move that data really quickly. It’s reliable and doesn’t tend to drop or get cut and, most importantly, it’s infinitely scalable, so it doesn’t cost much to scale up the network if you need to do that. So, we’re seeing a lot of fibre operators globally significantly reinvesting in their fibre networks as they anticipate dramatically increased demand from the AI developers and the data centres. A really good example of that, was where we advised Vocus

Group, which is a Macquarie Asset Management portfolio company, in acquiring TPG’s fibre assets. That was all about completing their national coverage for Australia so they could service their customers, but also to ensure they can service TPG’s own needs as a mobile operator. We’ll probably see a lot more investment in fibre as the digital ecosystem builds.

Shemara: Lots of exciting opportunities there. What role is Macquarie Capital playing in this?

Ed: Macquarie Capital and my team focus on trying to match the right capital with the right asset. We spend a lot of time with the assets and the management teams understanding the scale and level of funding they need, and then we try to match them to the right investor, who has an investment mandate and risk appetite that’s a good fit for their needs.

In the last ten years we’ve worked on 28 digital infrastructure transactions with a combined value of $A58 billion,4 so it’s been very busy and there’s a lot more of it to come. We aim to match marquee assets with astute investors, and to have a bit of fun along the way! As you know, the assets themselves are quite static and industrial, but the people behind them are vibrant, so we enjoy that.

Shemara: That’s fantastic. I’m very glad to hear that, both on behalf of Macquarie but also on behalf of the broader community you’re supporting in this hugely growing area.

Ed: Thank you, Shemara.

Watch the full conversation at macquarie.com/insights

1. Mergermarket global transactions, run 15 August 2025.

2. Announcing The Stargate Project, 21 January 2025, https://openai.com/index/ announcing-the-stargate-project/

3. CoreWeave Expands Investor Base with $650 Million Secondary Sale, 13 November 2024, https://investors.coreweave.com/news/newsdetails/2024/CoreWeave-Expands-Investor-Base-with-650-MillionSecondary-Sale/default.aspx

4. Macquarie internal database. Asia Pacific digital infrastructure transactions.

By Melanie Kurzydlo | Chief Executive, Property & Social Infrastructure

With the Federal Government securing a convincing second term and reaffirming its commitment to the National Housing Accord and the Housing Australia Future Fund, the window for policy development has definitively closed.

Voters sent a clear message that Australia’s housing crisis demands more meaningful action.

This term must be characterised by delivery, where policy maturity, infrastructure readiness, and construction innovation converge to address affordability and supply challenges at speed and scale.

The re-elected government enters this term not only with renewed legitimacy but with the policy architecture needed to deliver results. The $10 billion Housing Australia Future Fund (HAFF), paired with the ambitious National Housing Accord target to build 1.2 million homes over five years, creates both a financial and legislative foundation. The HAFF is set to enable the construction of 30,000 new social and affordable homes in the next five years.

These efforts will be focused on vulnerable cohorts, including the elderly, women and children at risk of domestic violence, and people experiencing homelessness, with additional funding earmarked for remote Indigenous housing repair and homelessness support services. Critically, this represents a shift from ambition to execution.

NSW has emerged as a pioneer in housing reform, offering a policy framework that could be scaled nationally. The Low and Mid-Rise Housing Policy is accelerating approvals for infill developments and enabling a broader spectrum of residential typologies between detached homes and high-rise towers. The Pre-Sale Finance Guarantee is further facilitating financing for developments previously considered high risk due to pre-sale constraints.

The Housing Delivery Authority (HDA) is a welcome change to fast-track major housing projects across the State. The HDA will assess and approve major housing projects, potentially bypassing traditional council processes, especially for developments meeting certain criteria (eg, cost thresholds for Greater Sydney and regional NSW). The HDA aims to expedite the approval process, cutting through red tape and delays. Scaling these reforms nationally would address gaps in diversity and location of housing stock, aligning supply more closely with community needs.

Housing delivery is intrinsically linked to infrastructure delivery, as homes cannot be built faster than the infrastructure that supports them. The Federal Housing Support Program must be leveraged to coordinate and accelerate investment in water, transport, electricity, and digital connectivity. Timely and targeted infrastructure development ensures new housing integrates seamlessly into communities, avoiding the pitfalls of isolated, underserviced developments.

Failure to synchronise infrastructure with housing construction risks perpetuating poor urban outcomes and contributes to increasing holding costs for asset owners and developers. Communities are increasingly burdened by developments that lack public transport access, community facilities or essential services – conditions that exacerbate social isolation and infrastructure stress. Coordination across all levels of government, including key infrastructure agencies, must be elevated as a strategic imperative.

A proactive approach to urban land utilisation is essential. Mixeduse sites near existing transit corridors and social infrastructure represent untapped opportunities. Prioritising these areas allows for higher-density development without overwhelming existing infrastructure. These sites can accommodate multi-functional

buildings that combine residential, commercial, and civic uses, enhancing liveability and economic vitality while curbing sprawl.

Modern Methods of Construction (MMC) are no longer experimental. Prefabrication, modular housing, and Design for Manufacture and Assembly techniques have proven their efficacy globally. In Australia, $54 million has already been committed to MMC initiatives, signalling intent, but scaling is now imperative. The construction sector must integrate these technologies as standard practice, not fringe innovation.

MMC offers a pathway to reduce build times, improve site safety, and enhance environmental sustainability. As housing targets become more ambitious, MMC adoption can deliver high-quality housing at reduced cost, while alleviating pressure on labourintensive traditional methods.

Australia’s construction productivity continues to lag behind global standards. Addressing this constraint is pivotal to successful housing delivery. Digitisation, from Building Information Modelling to supply chain analytics, can streamline processes and mitigate delays. Workforce development programs must upskill labour to meet emerging technical demands, while procurement reform can improve collaboration and reduce timeframes.

Increasing productivity across the housing pipeline not only improves delivery speed but also enables cost savings and quality enhancements. This is the frontier where industry, government, and academia must converge to shift the productivity curve and lay the foundation for enduring reform.

Why long-term transmission planning is essential to unlock opportunity in our urban economic powerhouses

Australia’s energy transition has the potential to unlock significant economic benefits: driving investment in new industries, creating tens of thousands of jobs, lowering long-term energy costs and strengthening our global competitiveness in clean energy exports and advanced manufacturing. Nowhere are the stakes higher than in the Sydney-Newcastle-Wollongong corridor - home to 70 per cent of the NSW population and responsible for more than a third of its economic output.

The Sydney-Newcastle-Wollongong area is a useful case study for all of Australia. It is not only the economic engine of Australia, but also its most complex energy environment. Population growth, widespread electrification and the emergence of highload sectors - like data centres driven by artificial intelligence (AI), transport electrification and low-carbon manufacturing - are forecast to drive dramatic increases in demand. Over the next four decades, this region will be a bellwether for how we electrify urban Australia.

Because this is not just a Sydney story. It is a national infrastructure challenge. As Renewable Energy Zones (REZs) are activated and long-distance backbone transmission lines come online, we’ll need to ramp up supply corridors to get energy to where people live, work and innovate.

As the transition from coal to renewables reconfigures the grid, new strategic corridors must be created to bring renewable energy into our load centres– efficiently and reliably. Mid-20th century generation was concentrated at coal fields close to demand centres. But future supply will come from diverse locations further afield:

• In NSW, from the Central-West Orana, New England and South West REZs.

• In Victoria, from REZs in the Southwest, Central Highlands, Grampians Wimmera, Wimmera Southern Mallee, Northwest, Central North and Gippsland.

Given the timelines for new transmission builds, our planning must look well beyond the 10-year horizon of our traditional transmission planning. This is why Transgrid is modelling energy demand out to 2065 - and looking at how to match future supply.

We are working now to understand what infrastructure we need, where and when, to be future-ready and keep the economy growing for our children and grandchildren.

In 2025, for the first time, we are sharing a multi-decade perspective on the shape of Sydney’s future grid. We are presenting our long-term strategy to strengthen supply corridors, build resilience into the network and deliver the clean energy needed to power homes, industries and jobs across a growing, electrifying economy.

We now have probable, possible and indicative strategic network developments for the NSW main system in the Newcastle, Sydney and Illawarra supply corridors to enable scalable, longterm augmentation of capacity into the greater Sydney region. These developments are based on:

• Scenario planning that explores multiple demand futures, including electrified industry clusters and the rise of emerging energy loads

• Modelling alternative pathways to unlock future transmission capacity at the lowest cost and with minimal community impact. This includes uplifting existing 330 kilovolt (kV) lines to 500 kV operation, converting single-circuit lines to double-circuits and establishing new bulk supply points, switching points and substations.

We are also acting now to ensure our future plans can become reality. This includes making strategic land and easement acquisitions to preserve future corridor options before they are built out by urban development. Such early acquisitions are essential to secure future energy supply in our cities as data centres, electric vehicles and electrification push energy demand higher than ever before.

To date, data centre energy use has been kept under control by more efficient hardware, smarter cooling systems and better use of computing resources. But this is changing. AI workloads require larger, more power-hungry computer chips, with cooling requirements beyond the capacity of traditional systems. Current estimates suggest that by 2035, large data centre load increases could be 20 times what we’re predicting for large industrial and mining loads - even after electrification.

Long-term transmission planning is not just about keeping pace - it is about creating confidence. By signalling the likely shape of energy supply over 30 to 40 years, we can help industry, regional councils and infrastructure investors to align their own planning and investment. This is about:

• Enabling a faster, lower-cost transition by avoiding late-stage infrastructure bottlenecks.

• Encouraging supply chain readiness in transmission manufacturing, logistics and skilled labour.

• Supporting local governments and precinct planners with certainty to drive low-carbon development.

• Giving data centre operators and manufacturers a clear picture of where clean, reliable power will be available.

Over the next 40 years, the Sydney-Newcastle-Wollongong corridor will become a living example of what it means to power a modern, electrified economy. But success will depend on the choices made today - about where we invest and how we coordinate at both the state and national levels.

The same forces reshaping Sydney – urbanisation, electrification, digitalisation - are at work in cities across Australia. The approach we are taking in greater Sydney offers lessons for all. Start planning early, protect future corridors and collaborate across the sector to avoid delays and maintain capacity buffers to power a decarbonised economy.

By Nicholas Carney | Partner and Global Co-head of Infrastructure & Erin Wakelin | Partner

Australia is facing intensifying climate volatility and, as this continues, the resilience of our infrastructure is no longer a theoretical concern – it is a national imperative. From heatwaves that buckle rail lines to floods that devastate regional roads, the climate adaptation challenge is reshaping how governments, investors and operators think about infrastructure longevity, risk and accountability.

The concept of resilience isn’t new. Infrastructure has always been built for the long term – what is new are the stressors introduced by climate change that legacy assets were never designed to handle. The evidence is all around us – we have an ageing coal-fired fleet showing signs of strain under rising temperatures, and urban centres - like Sydney and Melbourneface mounting pressure to upgrade flood defences and cooling infrastructure.

Australia is not alone. Globally, events like the Genoa Bridge collapse and the Panama Canal drought disruption highlight the consequences of underestimating modern climate risk.

In New South Wales, the State government has spent over $6 billion in the past three years rebuilding roads washed away by floods. As Josh Muray, Secretary of Transport for NSW, puts it, “When it comes to resilience and readiness we need to keep investing. We can’t afford to just be reactive when it comes to weather events.”

Flooding, drought and cyclones have cost the Australian economy $2.2 billion in the first half of this year alone (Climate Change Authority, Home Safe Report 2025). Natural disasters are estimated to cost our economy around $38 billion each year, and this cost will rise to at least $73 billion by 2060. If our

emissions are still high at that time then this could reach up to $94 billion. (Deloitte Access Economics Report, 2021)

The question is no longer whether we need resilient infrastructure, but the scale and nature of the stressors it should be designed to withstand, and who will fund it.

Resilient infrastructure is not just about engineering – it is about trust. Failures disrupt lives, economies and public confidence. Whether it is a data centre outage that cripples banking systems or a power outage during a heatwave, the social licence to operate is fragile.

Governments must lead with clear regulation that embeds resilience into planning approvals, procurement standards and asset management. This includes mandating climate risk audits, setting enforceable KPIs, and ensuring transparency in publicprivate partnerships.

Australia is beginning to respond. Infrastructure Australia has introduced Resilience Principles to provide a national framework for embedding resilience into asset design and delivery.

State Governments have released climate adaptation strategies and plans, though many initiatives remain in early stages and updated plans are expected in the coming years.

Many companies are now subject to the new mandatory Australian Accounting Standard Board (AASB) S2 Climaterelated Disclosures and will have to decide whether to adopt the voluntary AASB S1 General Requirements for Disclosure of Sustainability-related Financial Information. If they don’t, investors may question why.

Infrastructure owners and operators are alive to this risk, as are investors and insurers. Asset owners and operators are developing their own adaptation plans with the goal of ensuring their assets continue to produce revenue.

Of course, the answer to that question will depend on the asset in question and the legal and commercial arrangements which underpin it. For legacy assets owned by government, the cost will sit with government. For other assets, the answer may depend on the contractual arrangements in place (if any).

What we have seen from the UK water sector failures is that risk in relation to critical infrastructure often sheets home to government.

In that context, we expect to see the development of a range of models to finance the cost of adapting existing infrastructure and building new infrastructure.

With governments as the counterparty, there will be opportunities for availability payment models; however, the funding landscape is complex.

Insurance markets are tightening, and uninsurable risks are rising. In addition, the due diligence for these upgrades and new assets will be more complex.

Legal, technical, and insurance assessments both at the outset and in a sale context must now consider forward-looking climate scenarios, not just historical compliance. As ESG frameworks have evolved to anticipate future risks, infrastructure planning and assessment must also continue to evolve.

The benefits of resilient infrastructure are often invisible - until they’re not. When systems work as intended trains run on time, water is safe to drink, and electricity flows uninterrupted. Investors benefit from stable returns, governments avoid costly bailouts, and communities enjoy predictable services.

Resilience builds public trust, reduces litigation risk, enhances economic productivity and ultimately expands social licence. In a climate-challenged future, these outcomes are not luxuries, they are necessities.

As Australia prepares for the next century of infrastructure challenges, the stakes are high - but so too is the opportunity.

Victoria is committed to delivering a pipeline of infrastructure projects that meets the growing needs of Victorians, provides certainty to industry and maintains a steady flow of investment to ensure a sustainable program. As several Big Build projects reach completion, Victoria’s infrastructure investment spending will still be a significant $17.9 billion on average from 2025-26 to 2028-29.

Project finance presents an opportunity to meet Victoria’s demands for housing, energy, health infrastructure and other key services, supported by infrastructure investment. Project finance plays a crucial role in many sectors of Victoria’s infrastructure delivery, with the specialised knowledge and experience of the private sector driving innovation and efficiencies in project execution. Another benefit to the State is the ability to manage risks in partnership with the private sector. Financial uncertainties are reduced, infrastructure and service delivery outcomes are improved, and financial gains can be shared between both parties.

By fostering effective partnerships and leveraging private sector strengths, Victoria aims to deliver infrastructure that meets the needs of its growing population and supports sustainable economic development. As Victoria continues to evolve, the collaboration between public and private sectors will be pivotal in navigating the complexities of infrastructure delivery, ensuring that Victoria remains a vibrant and connected place to live and work.

The Partnerships Victoria policy provides a framework for contractual relationships between the State and private sector through its procurement requirements, standard deeds, guidance and tender templates. Since its inception, Partnerships Victoria has facilitated over $50 billion in capital investment across various sectors, including transport, utilities, precincts, health, and education. Across all projects, there is an emphasis on value for money, appropriate risk allocation and long-term service delivery, ensuring that both public and private sectors share responsibilities and rewards.

The Partnerships Victoria policy forms part of the Whole of Government Infrastructure Procurement Framework, which was released in 2023 to provide a simplified and consistent approach to infrastructure procurement in Victoria. A second tranche of complementary policy reforms and new standard contracts is expected to be released later in 2025.

The new Melton Hospital, which is being delivered as an availability PPP, leverages private sector finance to deliver crucial social infrastructure. In October 2024, the Exemplar Health consortium was awarded the contract to design, construct, finance, operate and maintain the hospital for 25 years.

The new Melton Hospital will be the first fully electric hospital in Victoria and provides much needed health services to one of the State’s key growth areas. The demand for services in the area is expected to more than double over the next 20 years. The new hospital will service the communities of Caroline Springs, Rockbank, Melton, Bacchus Marsh and Gisborne. Once completed, Melton Hospital will have the capacity to treat 130,000 patients each year and its 24-hour emergency department will be able to see almost 60,000 patients each year. The hospital will also include at least 274 beds, an intensive care unit, maternity and neonatal services, mental health services, radiology services and ambulatory care.

The new hospital will ease the pressure and reduce waiting times at other busy Melbourne hospitals. It will provide an essential link with services at the public hospitals in the western regionincluding Sunshine Hospital and the new Footscray Hospital.

The PPP model is expected to deliver the best possible outcome for Melton and the people of Melbourne’s west. This model allows for innovation, best practice design and long-term asset management. It provides the necessary resources to enable the building of a world-class hospital for the local community that is maintained to high standards.

The PPP model has continued to evolve, with the Melton Hospital contracts responding to market conditions and projectspecific characteristics, ensuring the model remains fit for purpose, attracts private sector investment and delivers positive outcomes for Victorians.

Project finance will continue to play an important role in supporting Victoria to deliver on the infrastructure pipeline, with live procurements currently underway in the energy and housing sectors. Partnering with investors brings developer expertise to complement existing State capability, unlocks supply chains and introduces new players and more competition to the Victorian infrastructure market.

Macquarie Capital is a leading financial adviser in infrastructure, delivering unmatched expertise for our clients.

Infrastructure

Level 12, 92 Pitt Street

Sydney NSW 2000 PO Box R 1771 Royal Exchange NSW 1225 infrastructure.org.au