SERVING AG, CONSTRUCTION AND OUTDOOR POWER EQUIPMENT DEALERS ACROSS IOWA AND NEBRASKA

SERVING AG, CONSTRUCTION AND OUTDOOR POWER EQUIPMENT DEALERS ACROSS IOWA AND NEBRASKA

From AI-powered machinery to service-based business models, Mark Hennessey, CEO, shares how dealers can harness emerging trends to drive growth and meet evolving customer expectations. Discover how INEDA is helping members stay ahead by spotlighting the future of ag tech and creating new revenue opportunities through innovation.

Discover how INEDA is scouting top ag tech from coast to coast and bringing groundbreaking innovations—like autonomous tractors, solar-powered robots, and precision sprayers—to the Midwest. Tom Junge highlights the global companies now participating in our expos, offering members early access to technologies reshaping the future of farming. 14 10

Phil Erdman recaps the 2025 Nebraska Legislative Breakfast and outlines key policy issues impacting ag equipment dealers, including UTV titling, ag data protection, and proposed tax changes. Learn how INEDA is actively engaging with lawmakers to advocate for your interests throughout the session.

Read as Jamie Mertz shares a recap of the second annual Iowa Ag Expo Innovation After Hours that brought over 100 entrepreneurs, investors, and ag leaders to spotlight cuttingedge start-ups and strengthen connections across the ag tech ecosystem.

Explore expert predictions on the agricultural robotics market in 2025, where labor shortages, sustainability goals, and cost pressures are fueling adoption despite differing views on growth potential. Leaders across the industry highlight key technologies, promising global regions, and how AI-powered automation is reshaping both largescale and small-farm operations. 16

Kunau Implement’s DeWitt dealership underwent a major expansion to improve workflow, enhance employee facilities, and better serve customers with upgraded shop space, parts storage, and a modernized showroom. Completed in 2021, the remodel reflects a strategic investment in customer relationships and workforce satisfaction, positioning the business as a top-tier employer and service provider in the region.

Read along as Director of Marketing, Cindy Feldman, shares why streaming TV and podcasts are essential for reaching farmers.

Kevin Clark Chairman, Lincoln, NE

Dave McCarthy Vice Chairman, Waterloo, NE

Jay Funke Past Chairman, Edgewood, IA

Bruce Bowman Ankeny, IA

Kent Grosshans Central City, NE

Clay Haley Carroll, IA

Keith Kreps Scottsbluff, NE

Mark Placek Alliance, NE

David Adelman IA Legislative Director

Phil Erdman Dir. of Dealer & Gov’t Rel.

Cindy Feldman Marketing Director

Laurie Haeder Ag Expo Coordinator

Mark Hennessey President/CEO

Tom Junge Expo Director

Tim Keigher NE Legislative Director

Cara Jicinsky Administrative Assistant

Jamie Mertz Dir. of Dealer & Gov’t Rel.

Gwen Parks Finance Director

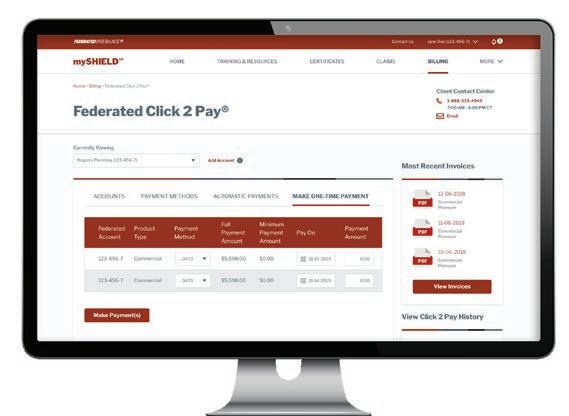

In addition to receiving this Retailer magazine in print, INEDA will begin sending you more information in print––yes, you heard that right!

Currently, you can stay informed about events through the RoundUp eNewsletter, Retailer magazine, social media, email invites and on INEDA.com. Starting January 1st, however, we’ll also be promoting all events through print mailings.

We want to make sure you get information the way you prefer, and the choice is yours!

Individual subscriptions are available without charge to Association members. One-year subscriptions are available to all others for $30.00 (4 issues). Contact INEDA for additional information. This publication is designed to provide accurate and authoritative information in regard to the subject matter covered. It is furnished with the understanding that the Iowa-Nebraska Equipment Dealers Association, the publisher, is not engaged in rendering legal, accounting, or other professional services. Changes in the law may render the information contained in this publication invalid. Legal advice or other expert assistance should be obtained from a competent professional.

In this issue of the Retailer, you will learn how innovation and technology is rapidly playing an increasing role in our industry. The future of innovation and technology for agricultural equipment dealers is rapidly evolving, driven by advancements in precision agriculture, automation, AI, and sustainability. Dealers who will be adapting to the changing farmer needs, new business models, and emerging digital solutions will find opportunities that are shaping our industry.

At the Iowa Ag Expo, and the Nebraska Ag Expo, INEDA has been actively showcasing innovative and technology driven products for our equipment dealers. This dealer driven objective is to understand the impact and future potential that innovation may offer to our members. Here are five highlights:

Autonomous Machinery – Self-driving tractors, drone technology, robotic harvesters, and automated sprayers reduce labor dependency and increase efficiency.

AI & Machine Learning – Advanced data analytics for crop health, soil conditions, and yield predictions help optimize farm operations. We unveiled a drone company that has embedded AI as its differentiator in it’s see-n-spray applications.

IoT & Telematics – Equipment will be increasingly connected, providing real-time performance data, predictive maintenance, and remote troubleshooting.

For dealers: Selling and servicing these high-tech machines will require advanced training, software integration, and more data-driven support models. Disintermediation is a risk where equipment can be troubleshooted by a team of technicians located anywhere in the world.

Equipment-as-a-Service (EaaS) – Farmers may lease machinery with pay-per-use models instead of outright purchases, reducing upfront costs.

Predictive Maintenance – AI-powered diagnostics will allow dealers to offer proactive service and reduce downtime for farmers.

For dealers: Shifting from one-time sales to ongoing service contracts and subscriptions could create new revenue streams.

Electric & Hydrogen-Powered Equipment – Sustainable alternatives to diesel-powered machines will gain traction. Tesla has successfully introduced electric engines to the automotive market. While

Chief Executive Officer

(continued)

electric engines may not replace the high horsepower tractors pulling a 32-row planter, advancements in battery technology coupled with the immense power generated from these machines will be foretelling of its future.

For dealers: Expanding into alternative energy solutions and eco-friendly equipment will introduce new tractors, and products for agriculture that are likely to align with government incentives and sustainability trends.

Online Equipment Sales – Farmers increasingly expect digital purchasing options, including virtual showrooms and AI-driven recommendations.

Parts & Accessories E-Commerce – Faster parts delivery and automated inventory management will be crucial. Shared warehousing using coop subscription models for parts inventory across equipment dealers may become financially attractive

Block chain for Transparency – Equipment history, service records, and warranties may be securely stored on block chain networks. At our shows, there were vendors whose solutions consumed OEM manuals, service repair history records and embedded AI for consumers and technicians to use in equipment repairs.

For dealers: A strong online presence, easy-to-use e-commerce platforms, and digital customer engagement will be essential. AI will play a role.

5. Workforce & Dealer Network Evolution

Training on Advanced Tech – To be successful in the future, dealers will need to up-skill employees to handle AI-driven diagnostics, robotics, and data analytics.

Remote Support & Augmented Reality (AR – Avatars) – AR-Avatar based repair guidance and virtual technician support could become standard and may handle routine customer inquiries, freeing up staff for high-value tasks. AI Tools allow you to create an avatar of your service manager, replicate their voice and mirror interactions with consumers where it’s becoming increasingly difficult to determine whether you’re speaking to a person or an Avatar.

For dealers: Investing in continuous training and tech-enabled service models will be critical for staying competitive.

Ag equipment dealers will need to adapt, innovate, and embrace digital transformation to stay ahead. The shift from traditional machinery sales to data-driven, tech-integrated, and service-based models will have a place in our future. At INEDA, one of our strategic objectives is to create revenue opportunities for members by introducing innovative companies to you. Each year, we plan to facilitate at least three opportunities for innovation companies to share new products and services with our members. Stay tuned for opportunities that may be of interest to you!

At Tax Favored Benefits, we serve as a partner in helping individuals, families and business owners achieve financial success. Our experienced professionals are supported by world-class resources in providing a full suite of wealth, investment and retirement planning services to clients across the country. We focus, first and foremost, on helping you achieve your personal financial goals. As financial professionals, we put your best interests first, at all times and in all situations. We succeed when you succeed.

David B. Wentz, J.D., LUTCF | CEO

4801 W. 110th Street, Suite 200, Overland Park, KS 66211 Phone: 913.648.5526 | Fax: 913.648.6798

dbw@tfbusa.com

PHIL ERDMAN Director of Dealer and Government Affairs [phile@ineda.com]

The scene from the movie “Groundhog Day” is a classic. Bill Murray’s character finds himself repeating the same day over and over. On one of those “days”, he steals the groundhog in a pickup and then allows the groundhog to drive the red pickup truck, but with the reminder, “Don’t drive angry. Don’t drive angry!”

As comical as that scene is, it is a good reminder of how many legislative sessions feel to those involved. Similar issues are introduced, discussed, and even voted on every year, only to have those items raised again the next year and the next year. The message of “Don’t drive angry” seems silly when spoken to a groundhog but are very appropriate when talking to public officials steering the policy that affects their constituents.

Setting good public policy depends on input and perspective. Sometimes you don’t like what you are hearing, but understanding the moment accurately will help avoid careening over a cliff ending in a fiery policy inferno.

That’s where you come in!

The Nebraska Legislative Breakfast was held on Thursday, January 16, 2025, at the Cornhusker Hotel in Lincoln, NE. All State Senators were invited to attend and visit with members. 29 registered and 17 attended, including Speaker of the Legislature John Arch. Nebraska Director of Agriculture Sherry Vinton and Attorney

Dave McCarthy (Titan Machinery) discusses issues facing dealreships with members and elected officials.

State Senator Myron Dorn and Karsten Thurmond (Hamilton Equipment)

The 2025 Nebraska Legislative session is underway. With the help of our advocacy partner at Keigher and Associates, we are in regular conversation with State Senators, the Governor’s office, and other Nebraskans in our efforts to protect and promote your interests. Here are just a few of those issues:

• LB 98 – Titling of UTVs (Side by Sides). Working with Chairman Moser, he introduced legislation to address the issue with the inability to title UTVs that are 2000 pounds or more. The bill was passed by the Legislature on March 6, unanimously. Since the bill had the emergency clause, it became law when it was signed into law by Governor Pillen on March 11, 2025.

• LB 525 – Protection of Ag Data. As written, it prevents any data (sales, location, financial, etc.) that was generated in the production of livestock or crops from being shared, stored, or used by anyone without the express written consent of the farmer. Staff and members have been working to understand the intent as well as the impact of the bill as written. Manufacturers and other ag groups have also been consulted. We have visited with Senators and the Governor’s staff about it. Staff testified at the hearing on the bill our availability, as well as that of manufacturers, for the interim study that will happen on this matter during the summer and fall.

• LB 650 – Taxing RTK/GPS Towers and Net Wrap/Twine along with repealing a number of other agricultural programs have been offered as one of the ways to close the projected $432 million shortfall. Senator von Gillern introduced the bill on behalf of Governor Pillen. The hearing on this bill was on March 19, 2025 and staff testified in opposition. We are grateful for the amendment offered by Senator von Gillern to remove the provisions that affect equipment dealers and customers.”

For a complete list of legislative bills we are following in Nebraska, please check out the weekly Legislative Updates emailed each Monday to members in Nebraska by Keigher and Associates. If you are not receiving those emails, please contact Phil Erdman.

Don’t miss the 2025 Legislative Meetings and Golf Outings!

June 17 – York Country Club (York, NE)

June 19 – Copper Creek Golf Club (Pleasant Hill, IA)

PHIL ERDMAN Director of Dealer and Government Affairs [phile@ineda.com]

The Iowa Nebraska Equipment Dealers Association (INEDA) and its members and staff participated in our annual Washington D.C. on March 25-27.

On behalf of Iowa Nebraska Equipment Dealers Association (INEDA) members, thank you for the opportunity to visit with you about issues impacting equipment dealer businesses and industry.

The Washington D.C. Fly-In plays a critical role in the success of INEDA’s legislative agenda and gives INEDA members the opportunity to discuss important topics with their elected representatives and industry officials.

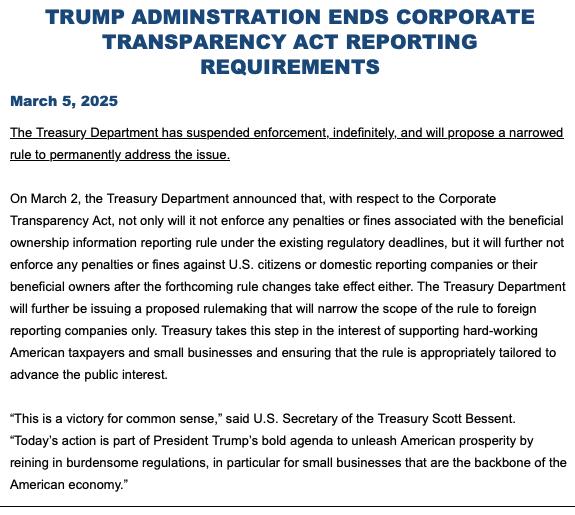

The intent of this visit is to find common sense, resultsoriented solutions. To the right are five issues INEDA asks you to consider today:

During the Fly-In, we met with Congressmen Mike Flood, Don Bacon, Adrian Smith and US Senators Deb Fischer and Pete Ricketts from Nebraska as well as Representatives Mariannette Miller-Meeks, Ashley Hinson, Zach Nunn, Randy Feenstra and US Senators Charles “Chuck” Grassley and Joni Ernst from Iowa. INEDA partnered with Associated Equipment Dealers (AED) as well as Pioneer Equipment Dealers Association (PEDA) for the Fly-In. (Both INEDA and PEDA have a Memorandum of Understanding with AED to partner on Federal Advocacy.)

The goal of the Fly-in is to find common sense, results-oriented solutions to equipment dealer industry issues. INEDA presented six main issues to legislators during the fly-in:

Facts about the Iowa Nebraska Equipment Dealers Association (INEDA)

• INEDA is a trade association dedicated to promoting the general well-being of agriculture, construction, and outdoor power equipment dealers in Iowa and Nebraska.

We urge lawmakers to strengthen the safety net for farmers, continue voluntary, incentive-based conservation programs that allow for producer flexibility, expand the use of agriculture- based biofuels, encourage adoption of the most precise, high- tech equipment, and invest in promoting U.S. commodities around the world.

• Established in 1893, INEDA is one of the oldest retail trade associations in North America.

• INEDA supports its members with legislative advocacy, manufacturer relations, education and scholarships, workforce development, and more.

• Equipment dealers employ over 9,000 personnel in sales, management, parts, service, accounting, and technical positions.

We strongly support making provisions from the Tax Cuts and Jobs Act (TCJA) permanent to protect $4.6 trillion tax cuts critical to families and businesses including reinstating immediate expensing for capital investments and measures that aim to boost innovation and economic growth (reinstating 100 percent bonus depreciation and business interest deduction cap at 30 percent of EBITDA).

• Over 90 percent of dealership jobs are in communities with fewer than 10,000 population.

• Iowa and Nebraska equipment dealers’ combined gross annual sales of equipment and services is in excess of $4.5 billion.

• There are over 430 dealer member locations in Iowa and Nebraska.

Equipment dealers and manufacturers rely on trade agreements and other accords that permit accessible and efficient international trade. Tariffs, particularly on our key trading partners, increase the cost of imports, invite retaliation and create market uncertainty, there by detrimentally impacting equipment dealers, manufacturers, contractors, farmers, and U.S. consumers.

We urge lawmakers to strengthen the safety net for farmers, continue voluntary, incentive-based conservation programs that allow for producer flexibility, expand the use of agriculturebased biofuels, encourage adoption of the most precise, hightech equipment, and invest in promoting U.S. commodities around the world.

The Biden administration’s regulatory onslaught is in full swing, INEDA is working together with AED and the broader business community to push back against costly and burdensome mandates targeting America’s job creators.

2025 Washington DC Fly-In Participating Members (L to R): Mat Habrock, AKRS Equipment; Misty Wells, Titan Machinery; Mark Hennessey, INEDA; Dave McCarthy, Titan Machinery; Elliot Grosshans, Grosshans, Inc.; Kevin Clark, AKRS Equipment; Garon Borkowski, AKRS Equipment; Jay Funke, Del-Clay Farm Equipment; and Clay Haley, Haley Equipment. (Not pictured Phil Erdman and Jamie Mertz, INEDA)

The American Farm Bureau Federation and most major agriculture equipment manufacturers have signed Memorandums of Understanding to allow farmers access to technical information, parts, tools, and diagnostic equipment to repair their own equipment. We oppose government intervention in equipment markets including right to repair legislation and regulations. INEDA asks Congress to allow the private sector process to continue to develop the solutions to better serve customers.

The greatest challenge facing INEDA members and their customers is the workforce shortage. While our members are leading the charge through incentives and recruitment programs, we are asking for policies that will provide resources to employers and workers to pursue in-demand careers and educate students to fill skilled positions at dealerships.

We strongly support making expiring (and expired) provisions from the Tax Cuts and Jobs Act (TCJA) permanent. Aside from the corporate tax rate, which doesn’t sunset, most other pro-growth provisions from TCJA have either expired, are currently phasing out or will end after 2025.

INEDA asks Congress to allow the private sector process to continue to develop solutions to better serve customers.

We are grateful for the Trump administration’s regulatory approach after the onslaught of costly and burdensome mandates targeting America’s job creators from the previous administration.

The greatest challenge facing INEDA members and their customers is the workforce shortage. While our members are leading the charge through incentives and recruitment programs, we are asking for policies that will provide resources to employers and workers to pursue in-demand careers and educate students to fill skilled positions at dealerships.

If you are interested in attending the 2026 Washington DC Fly-In, please contact us!

JAMIE MERTZ Director of Dealer and Government Affairs [jamiem@ineda.com]

On Tuesday, February 4th, 2025, marked the second annual Iowa Ag Expo Innovation After Hours Event held in the Junior Ballroom at the EMC Insurance Expo Center (formerly the Iowa Events Center). More than 100 start-ups, investors, and executives from across the state and beyond gathered for an evening dedicated to fostering connections and collaboration. Designed to strengthen relationships between start-ups and investors, the event provided a platform for entrepreneurs, potential investors, association members, and key stakeholders to network and exchange ideas. Among the distinguished guests in attendance was Iowa Secretary of Agriculture, Mike Naig.

The evening began with a lively cocktail hour, follow by Kaylee Williams of InnoVenture Iowa setting the tone with the engaging start-up pitch session.

The following innovative companies showcased their ideas:

• Gripp (WI) – Founder and CEO Tracey Wiedmeyer. Gripp provides “dead simple” broad based operational record keeping and communication tools for Agriculture allowing them to centralize tribal knowledge, critical equipment & asset information and their related conversations.

• Persistent BioControl (IA) – Founder and CEO Keegan Shields. Offers farmers a new tool to combat soil insects, persistent biocontrol (Entomopathogenic) nematodes.

• Midland Co (IA) – Founder and CEO Jackson Kimle. Our beachhead market includes a turn-key contract grower system for shrimp production using proprietary, innovative technology, the Algae-Based RAS® (Recirculating Aquaculture Systems).

• Agriwater (TN) – Founder and CEO Dr. Bianca Bailer. Focused on implementing onsite wastewater treatment systems for livestock farmers to help ease the burden of waste management.

• Skysense AI (WA) – Founder and CEO Justin Clune. AI-powered drone technology company that addresses labor shortages and rising input costs in agriculture. By delivering precise maps of stand counts, weed pressure, and irrigation issues, we help farm managers make faster, in-season corrective actions to reduce wasted water, pesticides, and labor.

• Sentinel Fertigation (NE) – Founder and CEO Jackson Stansell. Sentinel Fertigation uses software that leverages satellite imagery, weather, and other data to provide nitrogen management recommendations optimized for profitability.

This year, unlike last year, we introduced a $10,000 showcase award for the top start-up, along with a $1,000 “People’s Choice” award for the start-up that the crowd voted as the best of the evening. All participating companies delivered outstanding presentations, making it a tough decision for the judges. The judging panel for the $10,000 showcase award were Myron Stine (Stine Seed), Billi Hunt (America’s Cultivation Corridor), and Josh Demers (The Combine).

The success of this event is made possible through the strong partnership we have with our sponsors. Below is our list of sponsors for 2025:

• Farm Credit Services of America

• Iowa State University

• Ag Startup Engine

• BioConnect Iowa

• InnoVenture Iowa

• Catch Des Moines

A special thanks goes out to the committee members who played a vital role in planning the event and ensuring its continued success. Committee members represented INEDA, Iowa State University, InnoVenture Iowa, and Plug & Play. Kevin Kimle (ISU) gave a heartfelt tribute to the late Bill Northey, former Iowa Secretary of Agriculture, who served on the planning committee for the 2024 event and passed away just days after its conclusion. He was a great mentor,leader, and friend to many and will be remembered for years to come.

A new addition to this year’s event was an opportunity for a company that applied to the pitch competition but was not selected for the showcase to still present their product and innovation to the guests during the dessert portion of the dinner. This year that company was Amos Power out of Cedar Falls, Iowa.

• AMOS Power (IA) – Founder and CEO, Tom Boe. AMOS Power manufactures fully electric autonomous tractors. They utilize an innovative tri-motor design unlike any tractor on the market and maintain the largest horsepower of any electric tractor sold. Their vehicle architecture allows them to significantly reduce the components required to build a functional tractor. No clutch, no transmission and no differential. AMOS Power begins full production in the summer of 2025.

The 2nd Innovation After Hours was a tremendous success, strengthening Iowa’s position as a hub for agricultural innovation. With growing momentum, we look forward to an even bigger event next year!

Following a year of decreasing commodity prices and projected farm income, the agricultural equipment market is entering 2025 with a mix of opportunity and uncertainty.

“In 2024, we saw a slowdown in machinery purchases compared to the previous few years, however, equipment continued to move at a pace that frankly surprised many throughout the industry,” says Lucas Scheibe, an AgDirect territory manager in North Dakota.

“The most obvious trend in 2024 was the vast numbers of machines being sold at auction. Many dealers placed high priority on moving late-model, high-dollar used machines and aged inventory to the auction channel to free up working capital.”

In response, AgDirect saw the largest year-over-year growth in auction and private party financing in its 26-year history. Leasing activity began increasing in the second half of 2024 as producers began exploring methods to reduce equipment costs.

Scheibe anticipates leasing will continue to be a tool producers will utilize moving into 2025. For equipment dealers, adjusting to these evolving purchase behaviors and financing strategies will be critical to staying ahead in an increasingly competitive landscape.

Looking ahead, several key factors will shape equipment buying trends and behavior:

• Inventory Management: The need for dealers and OEMs to strike a careful balance of new and used equipment on lots will be crucial to moving forward through the year. Many major OEMs are forecasting flat to slightly declining new machine sales for 2025.

“Inventory management continues to be a high priority with many dealers still concerned about the number of aged units, or 1- to 2-year-old high dollar units, that may not be in a demand cycle for selling at a premium price – such as combines,” says Scheibe. “They may be forced to decide: ‘Should we carry the inventory into the next demand cycle or dispose of the unit at auction?’”

• Economic & Policy Uncertainty: Producer sentiment remains positive with the new administration signaling deregulation and a more favorable tax climate. On the other hand, lower projected farm incomes, trade tariffs, and potential immigration reform introduce some uncertainty.

• Interest Rate Environment: The Federal Reserve’s anticipated 150-basis-point rate cut for 2025 has since been revised down to just 50 basis points, dampening expectations for significant relief. This will continue to be a headwind in the current rate environment. With lenders competing for business more than ever, producers are likely to shop around to find a rate and product that fits their needs, making it important for dealers to stay informed on competitive financing options.

Concerns over the high cost of new equipment have led many producers to shift their replacement strategies. Some are opting to extend the lifespan of their current machines, while others are investing in late-model, low-hour used equipment through auction or dealer channels.

“We have seen used equipment demand increase as higher prices on new units continue to plague producers when attempting to find a balance of cost per acre and profitability,” Scheibe shares. “With lower farm incomes projected into 2025, we will likely see continued demand for good, used iron in the marketplace.”

While auctions have become a routine avenue for equipment acquisitions – with many producers now willing to take on the risk of purchasing units sight unseen – Scheibe notes the surge in auction activity in 2024 may have helped dealers ‘right-size’ used equipment inventory levels.

As a result, the steep discounts seen at auction a year ago may diminish as supply stabilizes. Additionally, there may be a continued emphasis from dealers on ensuring that highly specialized inventory – such as combines, forage harvesters, sprayers, and planting/seeding equipment – is kept in check.

“There may not be a widespread slowing by product categories, however you may see dealers attempt to clean-up aged inventory on an individual basis by sending units to wholesalers or auctions, especially as they attempt to strike a balance of keeping a good supply of inventory on hand while measuring the cost to carry this inventory throughout the calendar year,” Scheibe says.

“Typically, shortline products, such as tillage implements or grain carts, are the first to be cut from dealer inventories as they tie up working capital and are difficult to forecast for sales in certain areas,” he adds. “Sales of planters and drills may slow as well as producers find ways to extend their lifespan through increased maintenance or installing new wear parts.”

Looking at the year ahead, Scheibe predicts producers may take a wait-and-see approach in the first half of 2025, potentially delaying equipment upgrades as the spring planting season approaches. However, if policy and tax conditions remain favorable, improved commodity prices could bolster farm income and influence buying decisions.

One bright spot in the market is strong livestock prices, which are providing some financial stability for producers. Still, challenges remain, particularly regarding trade policies, immigration reform, and ongoing inflationary pressures, all of which could impact farm profitability. While producers will continue reinvesting in their operations, overall spending on equipment may be slightly lower than in 2024.

“In 2025, producers will be looking for smarter ways to deploy capital. A larger down payment on a loan can sometimes be a barrier to acquisition, and there are many lease structures that may assist in conserving working capital while keeping costs comparable or even lower than a loan,” Scheibe explains.

“As the year progresses, some operations may find themselves needing additional cash. For those who purchased equipment the past 12 months, AgDirect offers options such as a purchase leaseback or refinance reimbursement to help replenish working capital.”

AgDirect offers competitive rates and terms for both new and used equipment purchases at the dealership, at auction (both in person and online) and via private party.

Apply online, check rates, quote payments and compare options at agdirect.com or using the free AgDirect Mobile app available for download from the App Store and Google Play*. Or learn more about AgDirect equipment financing by locating the nearest AgDirect territory manager or contact the AgDirect financing team at 888-525-9805.

*Your mobile carrier’s messaging data rates apply. The App Store is a service mark of Apple, Inc. Google Play is a trademark of Google, Inc. AgDirect is an equipment financing program offered by Farm Credit Services of America and other lenders, including participating Farm Credit System Institutions.

TOM

JUNGE, Expo Director [tomj@ineda.com]

A key goal of our farm shows is to introduce members to the latest high-tech products shaping agriculture. These events help bring cutting-edge companies to the Midwest.

For three years, we’ve scouted and recruited top innovators at FIRA USA and the World Ag Expo in California. Now, many are making their way to our region.

This year, three companies attended our expos, with two more set to join next season. Their advanced technologies—precision spraying, autonomous farming, and sustainable weed control—are poised to transform Midwest agriculture.

Ecorobotix, a Swiss company, attended the Nebraska Ag Expo in December. Their product called ARA is an ultra-high precision sprayer which enables the ultra-targeted application of herbicides, fungicides, insecticides or fertilizers. For now, it is targeted to vegetable and organic growers. One dealer in Nebraska has signed on and one precision ag/drone dealer in Iowa is exploring it. Ecorobotix presented at the Innovation After Hours event, Tuesday night of the Expo. For more information see: https://ecorobotix.com/en

Aigen, a Washington based company, displayed their Element robot which eliminates herbicide-resistant weeds mechanically, reducing the reliance on chemicals and improving yield. Again, this product is most likely targeted for organic growers. The robots

run 100% on renewable energy. Powered by the sun, robots run for up to 12 hours per day. All four-wheel motors are regenerative, capturing and reusing energy. This product might be viewed similar to drone spraying application services and provided by a service contractor. For more information see: https:// www.aigen.io/

AMOS is being designed in Cedar Falls, Iowa with the first production units hitting the ground this year. It is 75-85 HP fully electric, fully autonomous tractor. It features 34-40PTO HP and 8-hour battery life. Beginning designed initially for vineyards, it could have applications anywhere in farming. AMOS presented at the Innovation After Hours event, Tuesday night of the Iowa Ag Expo. For more information see: https://www.amospower.com/

AMOS at the 2025 Iowa Ag Expo.

After years of working with specialty crops, Carbon Robotics has introduced their G1200 (40’) and G1800 (60’) lazer weeders for organic corn and soybeans. In the summer of 2022, Carbon Robotics demoed their lazer weeder in a West Bend, Iowa soybean field and learned what it would take to modify their machine for Midwest Farmers. The “G” weeders are lighter and can travel twice the speed of previ-

ous models. The new Self-contained, fully sealed weeding modulesinclude 3 high-resolution cameras with enhanced optics, 2 NVIDIA GPUs for advanced image processing and 20 LED lights for day or night operation. We are currently in talks of having Carbon Robotics at both events this upcoming winter. For more information see: https://carbonrobotics.com

We first saw Burro at FIRA 2022 in Fresno, California. Since then, the company has increased the size, capabilities, and applications of their autonomous “carrier”. They now offer the original Burro, Burro Verde, Burro Grande “Donkey”, Burro Cortador “Mower” and Sprayito “Autonomous Spot Sprayer”. As the Burro gains customer exposure, many more applications will be discovered.

We are in the process of sending them a proposal to attend both Expos this upcoming winter. For more information see: https://burro.ai/

Also on the show staff’s radar are Solinftec (solar powered sprayer) from Brazil and Swarm Farm (most advanced autonomous sprayer) from Australia.

For personal contacts of these companies, contact Tom or Cindy at the Association Office.

The general consensus among leaders in the world of agricultural robots is a positive outlook for the agricultural robotics market in 2025, with varying levels of optimism.

The market for agricultural field robots seems set for growth, driven by labor shortages, rising production costs, and the need for greater sustainability. However, opinions on the outlook for 2025 differ. Industry leaders from a range of companies featured in our field robots catalogue share their insights on market potential, regional growth opportunities, and key challenges.

Future Farming analyses their predictions, examining factors driving the adoption of ag-robots and highlighting key regions with the greatest sales potential. The general consensus among leaders in the world of agricultural robots is a positive outlook for the agricultural robotics market in 2025, with varying levels of optimism.

Several factors are contributing to the expansion of the ag-robot market. The most notable is the ongoing shortage of agricultural labor. As the global workforce ages and fewer young people enter farming, automation offers a vital solution. Ag-robots can perform routine tasks, alleviating the pressure on farmers to find sufficient labor.

Key Points

• Agricultural robotics market growth: The market for agricultural robotics is expected to grow due to factors like labor shortages, increasing production costs, and the need for sustainable farming solutions.

• Diverse outlooks for 2025: Opinions on the agricultural robotics market’s potential in 2025 vary, with mainly differing levels of optimism from industry experts.

• Factors affecting market dynamics: Market growth is influenced by external factors such as immigration policies and tariffs, which may impact the adoption of agricultural robots.

• AI and autonomy driving growth: Improvements in AI and autonomous technologies, along with rising labor costs and the shift toward electric alternatives, are expected to propel the agricultural robotics market further forward.

• Technology adoption among small farms: Smaller farms are increasingly adopting automation, thanks to affordable solutions that provide a quick return on investment.

• Regional growth opportunities: The U.S., Europe, and parts of Asia are emerging as key markets for agricultural robots, each with specific drivers for adoption

• Precision farming demand in the U.S.: Regions like California, Florida, and the Pacific Northwest are seeing high demand for precision farming tools, especially for high-value specialty crops.

• Sustainability as a key adoption driver: Sustainability is a major driver for adopting agricultural robots, with farmers seeking solutions that reduce environmental impact, such as organic farming and pesticide reduction.

Dan Abramson, co-founder and COO of Directed Machines, is cautiously optimistic about the market. He highlights the rapid growth of the company’s operations, but he also notes that factors such as immigration policies and tariffs are likely to affect market dynamics in the coming years.

Dan Wiechec, Strategic Sales & Marketing Manager at Burro, is confident, citing rapid improvements in AI and autonomy, as well as rising labor costs and the push towards electric alternatives, which will drive the autonomous ag-robot market forward. He foresees continued market growth, bolstered by these technological and economic trends.

For Bryan Sanders, President of HSE (U.S. dealer of the XAG R150), the outlook for 2025 is decidedly positive. He notes the convergence of rising labor costs, input costs, and increased competition as key drivers for growth. Autonomous technologies, such as spray drones and field robots, offer increased precision, efficiency, and yield potential, making them essential for farmers looking to stay competitive. Sanders also points to the opportunity for attracting the next generation of tech-savvy farmers, which is vital for revitalizing the agricultural workforce.

Burro is confident, citing rapid improvements in AI and autonomy, as well as rising labor costs and the push towards electric alternatives, which will drive the autonomous robot market forward. Photo: BurroBurro is confident, citing rapid improvements in AI and autonomy, as well as rising labor costs and the push towards electric alternatives, which will drive the autonomous robot market forward.

Richard Beaumont, founder of Agovor, which features the compact, autonomous robotic tractor GOVOR in our buyers’ guide, remains optimistic, emphasising the increasing adoption of technology, especially among smaller farms. Affordable solutions, designed to provide a quick return on investment, make automation accessible to more growers, Beaumont says.

Thibault Boutonnet, Founder of Siza Robotics, presents a nuanced view, indicating that the market for agricultural robotics in 2025 will likely experience tempered yet resilient growth. He points out that the convergence of labor shortages, sustainability imperatives, and productivity demands will continue to drive interest, though the market’s trajectory will depend on geopolitical and macroeconomic factors.

However, not all voices are as optimistic. FarmDroid, the maker of the FD 20 field robot, presents a more cautious outlook. According to the company, farmers are currently hesitant to make investments due to economic uncertainties, and distributors are holding large stock volumes.

When it comes to regional growth, the picture becomes clearer. The United States, Europe, and parts of Asia are emerging as key markets, each with specific drivers for adoption. Bryan Sanders (HSE) sees the greatest sales potential in regions like California, Florida, and the Pacific Northwest, where specialty crops dominate and where the demand for precision farming tools is high. These areas face unique challenges that ag-robots can address.

Sanders also points to the Midwest Corn Belt and the Southeast of the U.S., where row crops continue to be a significant focus, with increased interest in automation solutions. Dan Wiechec (Burro) echoes this sentiment, identifying North America and Australia as key markets for ag-robots in outdoor crops. Both regions, Wiechec points out, have high labor costs.

For Andrew Bate, CEO of Australian company SwarmFarm Robotics, the opportunity is strongest in both North and South America, especially in regions like California, which, despite challenges with outdated OSHA legislation, still holds immense potential due to its diverse agricultural sector. The demand for ag-robots in orchards, horticulture, row crops, and broadacre farming is significant, and Bate believes that the market is barely scratching the surface of its potential.

Similarly, David Haynes, Founder of DPH Industries, maker of the The FarmHand Tractor, identifies California and Washington as prime regions for small, affordable robotic tractors, particularly in areas that focus on high-value specialty crops. Haynes is also aware of potential opportunities in other markets globally, such as Europe and parts of Asia.

Thibault Boutonnet of Siza Robotics mentions California, but also highlights regions in Southern Europe such as France, Italy, and Spain, where agriculture is undergoing a technological revolution, making them attractive markets for ag-robots.

For FarmDroid, the company’s focus remains on Europe, with the United States following closely behind as a secondary market. Farmdroid has an emphasis on robotics for smaller farms. HSE focuses primarily on the U.S. market, while the Dutch company Andela, known for its robot weeder, highlights Europe as a key region of interest, citing strong demand across various markets.

Sustainability is another key driver of ag-robot adoption. The shift towards organic farming and the need for energy-efficient solutions are prompting farmers to seek out technologies that reduce environmental impact.

As Bryan Sanders (HSE) notes, growers are increasingly looking for ways to boost efficiency and reduce operational costs, but robotics also offer a way to optimise processes and ensure healthier crops through precision applications of resources like water and pesticides.

Silvano Tasso, Technical Manager at ECO Process & Solutions, maker of the Moondino, mentions the demand for organic cultivation as a major factor behind the increasing interest in automation. Tasso, sees significant potential in organic crops like rice, beetroot, and tomatoes.

Similarly, Ekobot, the creator of a robot that eliminates weeds in and between rows, views robotic solutions as essential for reducing reliance on chemical pesticides, especially in organic farming.

Source: FutureFarming.com

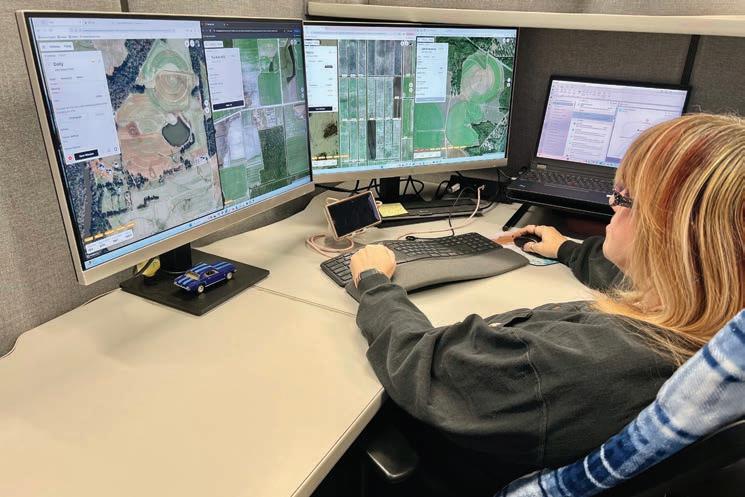

Shown is Sabanto’s full-time virtual Field Operator, Angie Cook. She works with farm managers daily and has controlled more than 15 systems simultaneously.

The American company Sabanto is seeking operators for one of the world’s first positions dedicated to remotely managing a fleet of autonomous tractors. This marks a pivotal shift from traditional tractor driving to virtual tractor operation, akin to playing an online game, where new skills—such as experience with Farming Simulator—are becoming increasingly essential.

Sabanto, a leader in autonomous farming technology, is hiring an Autonomy System Operator in Ames, Iowa. This entry-level position, based on an hourly contract, involves remotely operating, monitoring, and providing light technical support for Sabanto’s fleet of autonomous tractors.

“At Sabanto, we’re delivering agricultural services that will transform the farming world. Our team is building a fleet of autonomous farming machines to enable faster, cheaper, and more efficient farming—24/7 and worldwide,” said Craig Rupp, CEO of Sabanto. “That’s why we’re looking for new team members to help realize the future of agriculture.”

The new generation of tractor operators will no longer spend their days in a remote field, sitting in the luxury cab of a tractor, guiding it with attached implements. Instead, they will use computer applications to configure, deploy, and monitor autonomous missions for

Sabanto’s clients. This role emphasizes remote management from a computer screen, allowing operators to manage multiple tractors from a central location.

Key qualifications Sabanto is looking for include a high school diploma, GED, or associate degree, and experience with Farm Simulator 19 or 22. When asked whether traditional tractor-driving skills are still relevant for this role, Rupp firmly stated, “I’ve never flown a plane, but I’ve piloted a drone.”

According to Rupp, agricultural education programs are adapting well to these changes: “We’re working with local ag-tech community colleges. They have a group of students who understand farming and are obsessed with Farming Simulator. We’re adapting them and taking their skills to the next level as quickly as we can.”

Describing a typical workday for a virtual tractor operator, Craig Rupp explained: “At the break of dawn, our so-called virtual Field Operator (vFO) receives instructions from the farm manager on the day’s required field operations. Local personnel place the autonomous system in the first field. The vFO then deploys a mission and remotely monitors it. The vFO is responsible for notifying the local farm manager when refueling is needed.”

Rupp emphasized that a virtual field operator need not worry about taking a break during the workday: “We have redundancy in place to monitor the system even when the operator is on a break. For example, if a tractor gets stuck in a wet spot, our system is designed to pause automatically as soon as it detects wheel slip. Moreover, our operators monitor local weather conditions and maintain direct communication with the farm manager. We can dynamically enable or disable non-navigable obstacles, such as wet spots.”

The position requires working from Monday to Friday, 8:00 AM to 6:00 PM, with occasional weekend shifts. Operators will divide their time between Sabanto’s office in Ames, Iowa, and working from home, offering flexibility in their work environment. When asked whether a virtual tractor operator earns more than a traditional tractor driver, Rupp indirectly confirmed: “The vFO monitors more systems and covers more acres than today’s traditional tractor driver.”

As for the future of tractor drivers, Rupp was clear: “I see a future where all fieldwork is outsourced and carried out autonomously. Farming will eventually require low capital investment from landowners. You better start preparing.”

Source: https://www.futurefarming.com/tech-in-focus/ job-opening-marks-new-era-in-agriculture-operators-for-autonomous-tractors-fleets/

Kunau Implement’s DeWitt dealership underwent a major expansion to improve workflow, enhance employee facilities, and better serve customers with upgraded shop space, parts storage, and a modernized showroom. Completed in 2021, the remodel reflects a strategic investment in customer relationships and workforce satisfaction, positioning the business as a top-tier employer and service provider in the region.

Read on as Julie Myers of Kunau Implement, shares how the whole process played out.

Our original building was built in 1994, and we added onto the shop around 2000. With the size of equipment growing, we were running out of shop space as well as parts storage and decided that if we wanted to keep up with the industry, we needed to remodel and add on.

After years of adding on, we needed to address problems with:

• Inefficiency of workflow

• Insufficient employee areas including locker room facilities, lunchroom accommodations, training areas, hard surface parking, and clean/safe/well-lit workspaces

• Lack of proper wash bay and detailing facilities

• Insufficient parts storage, both in layout and capacity

• Insufficient customer-facing spaces, including poor showroom spaces for our retail goals, clear directional signage, room for our sales team, needs for a reception area, lack of a comfortable customer waiting area, hard surfaced parking,

• Lack of shipping and receiving areas to accommodate parts, machinery and service business

Our main challenge that we faced was working with our existing structure. We were not starting on a brand-new property, so we had to be cognizant of reusing our building while adding on in a way that made sense. There is not one area of the old building that wasn’t changed in some shape or form.

We began working on the expansion with our architect in 2017 and worked with our general contractor to order the steel building in December of 2019. We put the balance of the work bids out in early 2020 and officially finished in the Summer of 2021.

Our original building was built in 1994 and had 6 sales offices, 3 admin/service manager offices, as well as separate parts counters for customers and technicians. With the remodel we now have 12 sales/admin offices, separate service and parts manager’s offices, as well as a “service bullpen” where we have an assistant service manager, service writer, and the shop parts counter.

Our showroom is over double in size and directly off the showroom is a meeting room that gets utilized almost weekly. We also have a receptionist immediately inside the front door of our showroom.

The new shop is 100’x180’ with a crane running the entire span. We also have a consumer/lawn and garden shop area that is about 35’x70’. We turned part of our old, detached parts warehouse into an 80’x50’ wash bay and continue to use the remainder for large parts and lawn mower storage. Our parts storage area is about 70’x100’ with about a third of that being a double layer mezzanine with shelving.

Our customers understand that our investment in the remodel was a direct investment in our relationship with them. Our ability to provide more key parts for them and efficiently be able to service their various equipment types/sizes was a key driver in the remodel. The ultimate goal of this project was to establish Kunau Implement as The Employer of Choice in our market by providing a state-of-the-art facility for our employees to spend a good percentage of their lives in a safe and welcoming environment.

Source: Julie Myers – Communications Manager, Kunau Implement

It was another successful Career Exploration Event this year at the Iowa Ag Expo. Below are the key highlights for the Iowa Ag Expo Career Exploration Event:

• Nearly 600 students registered to attend

• 28 Participating Schools

• 8 Equipment dealers served as tour guides for the schools

• 8 Exhibitors participated as stops for the tours to talk about careers (AGCO, Bobcat, CaseIH, John Deere, Sukup, Vermeer, Unverferth, Ziegler)

• Career presentations by Rueter’s, AgriVision, Vetter’s, DMACC, and Jamie Mertz (INEDA)

Overall, we received great feedback from exhibitors, dealers, and most importantly the students and the teachers that attended. Iowa Ag Expo Career Exploration Event is a chance for our members and exhibitors to get in front of middle school to high school students to educate them about all the opportunities in the Agriculture and Construction dealer career fields.

Working collaboratively, Iowa and Nebraska career exploration events used an online registration form which made the process much easier for the schools to register. We are collecting survey information and any student interested in a career with one of our dealers or the exhibitors will be contacted. With our new CRM, schools can sign up next year, select the tour time and date for when they want to come to the event.

$3.1B Combined Gross Annual Revenue of Iowa Equipment Dealerships

250 Dealers in Iowa Sell Ag, Construction, and Outdoor Power Equipment

5,000

People Employed by Iowa Dealers

Sales/Acquisitions

Succession

Strategic

Financial

Tim Kayton of Kayton International, former Past Chairman, was recently honored with a plaque in recognition of his dedicated years of service to the Iowa-Nebraska Equipment Dealers Association. The award was presented during the Association’s recent Spring Board Meeting.

This is an incredible opportunity to connect with dealers, hear the latest legislative developments in your state, and have fun golfing all in the same day! Members are able to attend just the meeting and are not required to participate in the golf outing.

We are often asked about how long tax and business records should be kept. Discarding records that should be kept poses a wide range of potential tax and legal problems. Keeping reports too long wastes precious space and resources.

But how long should these files be kept? Generally, the files should be kept as long as they serve a useful purpose or until all legal and regulatory requirements are met.

Below is a record retention guideline to assist you in keeping your records up to date and organized. Please note this table should only be used as a guide. You should consult your business attorney or insurance carrier, as applicable, when establishing a record retention policy.

It is your responsibility to keep and protect your original documents and records for any possible future use, including potential examination by government agencies.

Construction records Permanent

Lease payment records Life + 4 years

Leasehold improvements Permanent

Real estate purchases Permanent

Board minutes Permanent

Business licenses Permanent

Bylaws Permanent

Contracts - major Permanent

Contracts - minor

Insurance policies

Leases Permanent

Mortgages Permanent

Patents Permanent

BUSINESS – BANK RECORDS

– EMPLOYEE RECORDS

Shareholder records Permanent

Stock registers Permanent

Stock Transactions Permanent

Trademarks Permanent

Divorce documents Permanent

Estate planning documents Permanent

Home improvement receipts Ownership period + 7 years

Home purchase documents Ownership period + 7 years

Insurance policies

Loan documents

Retirement plan annual reports Permanent

Tax

Legislation has been introduced in the Nebraska Legislature to amend the Nebraska Healthy Families and Workplaces Act (“Act”). LB698 amends the Act to remove temporary or seasonal agricultural workers and youth under 16 years of age from the definition of employee, exempts employers with ten or fewer employees from the Act, and provides that the Nebraska Department of Labor is the sole enforcer of the Act, rather than through private actions. It was heard by the Business and Labor Committee on February 3.

LB415 amends the Act to remove individual owner/operators and independent contractors from the definition of employee, expands the definition of paid sick time, starts the accrual of paid sick time after 80 hours of consecutive employment, allows for paid time provided to an employee this year before October 1, 2025, to be counted towards the employer’s obligations under the Act, and clarifies that employers are not required to pay an employee for unused sick time upon the employee’s separation from employment. The hearing on LB415 was February 24 before the Business and Labor Committee.

While the Act does not go into effect until October 1, 2025, the Act defines several important terms, including:

• Employee: Any individual employed by an employer, excluding those working fewer than eighty hours in a calendar year in Nebraska or those covered by the federal Railroad Unemployment Insurance Act. (Note that the initiative does not specify that those hours be worked for the employer from which or whom sick time is claimed.)

• Employer: Any entity employing one or more employees, excluding the United States, the State of Nebraska, and its political subdivisions.

• Family Member:

a. Any of the following, regardless of age: A biological, adopted, or foster child, a stepchild, a legal ward, or a child to whom the employee stands in loco parentis;

b. A biological, foster, step, or adoptive parent or a legal guardian of an employee or an employee’s spouse;

c. A person who stood in loco parentis to the employee or the employee’s spouse when the employee or employee’s spouse was a minor child;

d. A person to whom the employee is legally married under the laws of any state;

e. A grandparent, grandchild, or sibling, whether of a biological, foster, adoptive, or step relationship, of the employee or the employee’s spouse; or

f. Any other individual related by blood to the employee or whose close association with the employee is the equivalent of a family relationship.

• Paid Sick Time: Time compensated at the same hourly rate and with the same benefits as the employee typically earns during hours worked.

• Small Business: An employer with fewer than 20 employees (whether full time, part time, or temporary) on its payroll in each of twenty or more calendar weeks in the current or preceding calendar year

Paid sick time begins to accrue at the commencement of employment or October 1, 2025, whichever is later, and can be used as it is accrued. Employees accrue a minimum of one hour of paid sick time for every thirty hours worked. For exempt employees, accrual is based on a presumed forty hour workweek unless their typical workweek is less.

The Act sets annual caps on paid sick time:

• Small Businesses (19 or fewer employees): 40 hours

• All other Employers (20 or more employees): 56 hours

Accrued but unused paid sick time must be carried over to the next year. Alternatively, employers may provide a lump sum at the beginning of the year and pay out any remaining leave at the end of the year.

Paid sick time can be used for:

• The employee’s own mental or physical illness, injury, or health condition (or their need for medical diagnosis, care, or treatment of the same) and for preventative medical care.

• Care for a family member includes the same opportunities as permitted for the employee and adds expanded coverage related to children, allowing the employee to attend meetings necessitated by the child’s health at a school or place where the child is receiving care.

• Closure of the employee’s place of business or a child’s school due to a public health emergency.

• Self-isolation or care for a family member due to exposure to a communicable disease.

Paid sick time must be provided upon an oral request. Employers may require reasonable documentation for absences exceeding three consecutive workdays. Note that reasonable documentation does not necessarily mean that the employer can require a doctor’s note under the language of the initiative – the documentation that can be required will vary depending on circumstances. Employers who require notice of the need to use sick leave must provide the employee with a written policy containing the procedures to provide notice. The employer cannot require the employee to find replacement coverage as a condition of taking leave.

Employers are prohibited from requiring disclosure of detailed health information as a condition for providing paid sick time. Any health information obtained must be treated as confidential and maintained separately from other personnel records.

The Act protects employees from retaliatory actions for exercising their rights. Employers must provide written notice to employees about their rights and the terms of paid sick time. This information must be displayed in conspicuous places and provided in English and other languages spoken by at least five percent of their workforce if a poster approved by the Department of Labor is available.

The Nebraska Department of Labor is responsible for enforcing the Act. Among other penalties stated in the Act, employers found in violation face citations and administrative penalties, ranging from up to $500 for a first violation and $5,000 for a second or subsequent violation. Employers have only 15 days to challenge the citation. Employees have the right to file suits for violations and seek legal and equitable relief, including reasonable attorney’s fees.

Iowa does not have a state-mandated paid family leave program for private sector employees. However, the Iowa

Civil Rights Act of 1965 requires employers with four or more employees to provide a pregnant employee with a leave of absence for the period the employee is disabled because of the employee’s pregnancy, childbirth, or related medical conditions, or for eight weeks, whichever is less. When paid leave is not available, the employee is to be provided unpaid leave. The employee is to provide timely notice of the period of leave requested and the employer must approve any change in the period requested before the change is effective. Before granting the leave, the employer may require that the employee’s disability resulting from pregnancy be verified by medical certification stating that the employee is not able to reasonably perform the duties of employment.

Editor’s Note: This article is not intended to provide legal advice to our readers. Rather, this article is intended to alert our readers to new and developing issues and to provide some common sense answers to complex legal questions. Readers are urged to consult their own legal counsel or the author of this article if the reader wishes to obtain a specific legal opinion regarding how these legal standards may apply to their particular circumstances. The author of this article, Jerry L. Pigsley, can be contacted at (402) 4378500, jpigsley@woodsaitken.com, or at Woods Aitken LLP, 301 S. 13th Street, Suite 500, Lincoln, NE 68508-2578.

This is the most recent “Regulatory ALERT,” however, others can be found under the Dealer Resources tab on the INEDA website at https://ineda.com/ regulatory-compliance-2/.

CINDY FELDMAN, Marketing Director [cindyf@ineda.com]

The agriculture industry is changing, and so is the way farmers consume information. The next generation of producers is embracing digital content, streaming TV and podcasts to stay informed, entertained and connected. For agriculture brands and marketers the message is clear: If you’re not on streaming platforms and podcasts, you’re missing out.

According to Farm Journal Research, producer use of social media and streaming was projected to reach 70% in 2024.

Source: Farm Journal Research

For generations, print publications, radio and television have been trusted sources of information for farmers. These mediums remain essential in the industry today. However, with the rise of on-demand digital content, many farmers are adding streaming TV and podcasts to their media mix, giving them more flexibility to consume information when and where they need it.

Whether it’s listening to a podcast while checking crops or streaming market updates before heading to an auction, digital content is becoming an integral part of daily farm life — not as a replacement, but as a complement to traditional ag media.

With the rise of on-demand digital content, many farmers are adding streaming TV and podcasts to their media mix, giving them more flexibility to consume information when and where they need it.

Farm Journal uses their podcast network to inform listeners about agriculture, and on Unscripted Tyne Morgan and Clinton Griffiths put down the teleprompters. Each week, they bring in fellow Farm Journal hosts and editors and friends to share behind-the-scenes insights on the stories we’ve covered, giving you a chance to meet the personalities behind the personalities.

This trend is backed by compelling data:

• More than 1 in 4 podcast listeners (28%) have made a purchase based on a podcast advertisement or mention. (Marketing Charts Why Do People Listen to Podcasts?)

• Podcast advertising revenue is projected to surpass $3 billion in 2024.

(IAB US Podcast Advertising Revenue Study)

• 100+ million people in the U.S. will be active podcast listeners this year, marking a 5.3% increase from last year.

(Oberlo US Podcast Revenue (2015–2026)

So why are farmers incorporating streaming and podcasts into their routines?

Unlike scheduled broadcasts, streaming TV and podcasts allow farmers to access content on their own terms — whether they are in a tractor or winding down in their chair at night. These platforms make it easier than ever to stay informed. Trusted podcast hosts and streaming networks also foster strong relationships with their audiences. Farmers are looking for more than just news—they are seeking insights from voices they trust. Digital platforms provide more ways to engage with the industry’s most credible experts, complementing the information they already receive through print, radio and traditional TV.

Farm Journal owned AgDay reaches out to every household with the story of U.S. agriculture, featuring the people and places unique to the industry and small-town America. Within this trusted content, marketers can break through the noise and gain immediate credibility with their message.

Streaming TV and podcasts aren’t just a trend, they’re a powerful opportunity to connect with farmers where they’re already engaged. Whether through audio or video podcasts, streaming news, or entertainment, agriculture brands can build trust, create meaningful connections, and keep their audience informed to stay on top of mind

Source: Sydnee Summers, Farm Journal

Iowa-Nebraska Equipment Dealers Association

8330 NW 54th Ave.

Johnston, IA 50131-2841

– Mark R. , KanEquip Sales Representative, NE

Easy applications and fast credit decisions get the deal done.

AgDirect understands what you need and what your customers want. Along with our easy applications and fast responses, you’ll find a robust mobile app for anytime quotes, plus e-sign for anywhere deals. And our dedicated service is second to none.

Here’s what else we offer:

Flexible terms from 2-7 years on most equipment – up to 10-year term on pivots * As low as $0 down * No prepayment penalties ** Delayed payments up to 15 months *

Learn more by calling 888-525-9805 or visiting agdirect.com.