SERVING AG, CONSTRUCTION AND OUTDOOR POWER EQUIPMENT DEALERS ACROSS IOWA AND NEBRASKA

SERVING AG, CONSTRUCTION AND OUTDOOR POWER EQUIPMENT DEALERS ACROSS IOWA AND NEBRASKA

+5% PRO and PUT Standard Residual

Effective June 1 - September 30, 2024

AgDirect® is increasing its standard PRO and PUT residuals by plus [+] 5% on John Deere, Case IH, Fendt, Kubota, Massey Ferguson, McCormick and New Holland tractors. New and used 140 HP and higher row crop, 4WD and track tractors may qualify*. Utility tractors are excluded.

How it works:

1 Visit agdirect.com to view the residual matrix.

2 Review the current standard tractor residuals in the residual matrix.

3 Add 5% to the standard PRO or PUT residuals listed in the residual matrix.

Rates and terms:

Visit agdirect.com to see current standard lease rates. For more information or a customized lease quote, contact AgDirect. FPO residuals are not eligible for this program.

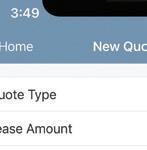

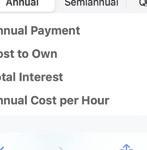

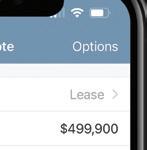

Compare payment options with AgDirect ® Mobile

Check current AgDirect interest rates, calculate individual payment quotes or compare payment options side by side and apply for financing from your smartphone or tablet with our free mobile app. Scan the QR code to download from AgDirect Mobile from the App Store SM or the Google Play TM store. ** 7:30 a.m. to 5:30 p.m. CT Call 888-525-9805 or visit agdirect.com

Read what Mark Hennessey, CEO, has to say about the common challenges agriculture and construction equipment dealers share and how they address mutual challenges, despite having unique industry nuances.

3 6 4

Explore with Phil Erdman as he discusses what he has been up to in Nebraska so far this year, including Crucial legislative advocacy efforts, connections made at district meetings, and ongoing education initiatives.

Learn more with Jamie Mertz as he shares information on the common issue he has discovered while traveling and meeting with dealers accross the state of Iowa, a surplus of inventory

Join Tom Junge, Expo Director, as he explains the Employee Compensation Survey, and everything he has learned about the current climate of construction dealers.

Discover the 2025 outlook for construction equipment sales, the growth opportunities and the potential challenges that may be faced.

Jay Funke Chairman, Edgewood, IA

Kevin Clark Vice Chairman, Lincoln, NE

FEATURE INNOVATIONS AND CHALLENGES IN CONSTRUCTION

Read more about the ever-evolving landscape of construction, how innovation drives progress, and how to navigate through the complexities of the rapidly changing world of construction.

FEATURE: LABOR SHORTAGE IN CONSTRUCTION

Dive in to learn the key reasons there has been a shortage of labor workers in the industry and tools to help correct the problems!

FEATURE: 6 STEPS TO AI ADOPTION IN CONSTRUCTION

Read more about 6 ways that can help you integrate AI in construction into you buisness and push the development of innovation. 18

Tim Kayton Past Chairman, Alliance, NE

Bruce Bowman Ankeny, IA

Kent Grosshans Central City, NE

Clay Haley Carroll, IA

Dave McCarthy Waterloo, NE

Mark Placek Alliance, NE

David Adelman IA Legislative Director

Phil Erdman Dir. of Dealer & Gov’t Rel.

Cindy Feldman Marketing Director

Laurie Haeder Ag Expo Coordinator

Mark Hennessey President/CEO

Tom Junge Expo Director

Tim Keigher NE Legislative Director

Jamie Mertz Dir. of Dealer & Gov’t Rel.

Donna Miller Operations Manager

Gwen Parks Controller

Jordan Reynolds Marketing Comm. Designer

MARKETING VIEW

Read along as Director of Marketing, Cindy Feldman, explains the power of radio in 2024 and the opportunities AM/FM has to offer when advertising your dealership.

CONTACT INEDA: 8330 NW 54th Ave. Johnston, IA | 50131-2841 E: info@ineda.com | W: www.ineda.com P: 515.223.5119 | F: 515.223.7832 TF: 800.622.0016.

Individual subscriptions are available without charge to Association members. One-year subscriptions are available to all others for $30.00 (4 issues). Contact INEDA for additional information. This publication is designed to provide accurate and authoritative information in regard to the subject matter covered. It is furnished with the understanding that the Iowa-Nebraska Equipment Dealers Association, the publisher, is not engaged in rendering legal, accounting, or other professional services. Changes in the law may render the information contained in this publication invalid. Legal advice or other expert assistance should be obtained from a competent professional.

With this issue of the Retailer, we are focusing our content on the construction equipment industry. INEDA’s membership is comprised of primarily construction and ag dealers. Whether it’s skid loaders, or an in-depth rental fleet, there are many similarities that our members share across the agriculture and construction industry. Here are some commonalities:

1. Seasonal Demand: Both industries experience seasonal fluctuations in demand. Agriculture equipment dealers may see increased demand during planting and harvesting seasons, while construction equipment dealers may experience peaks during periods of high construction activity. Managing inventory, staffing, and cash flow to accommodate these fluctuations can be a shared challenge. Today, inventory management is the strongest commonality that both industries are facing with these uncertain economic times.

2. Technology Integration: Like construction equipment, agriculture equipment is also becoming increasingly advanced with technology integration, including GPS guidance, precision farming, and automation. Both types of dealerships need to stay up-to-date with the latest technological advancements, provide training to their staff, and support customers in adopting and utilizing new technologies.

3. Equipment Financing: Both industries rely heavily on equipment financing options to facilitate sales. Dealerships often work closely with financial institutions to provide financing solutions such as loans, leases, and equipment rental programs. Economic conditions, interest rates, and access to financing can impact sales and profitability for both construction and agriculture equipment dealers.

4. Regulatory Compliance: Both industries are subject to regulatory requirements related to safety, emissions standards, and environmental regulations. Dealerships need to ensure that the equipment they sell meets regulatory standards and provide support to customers in complying with applicable regulations. Keeping abreast of changing regulations and ensuring compliance can be a shared challenge.

5. Service and Maintenance: Providing timely and effective service and maintenance is crucial for both construction and agriculture equipment dealerships. Downtime can be costly for customers, so dealers need to have skilled technicians, adequate parts inventory, and efficient service processes to minimize equipment downtime and keep customers satisfied.

6. Market Competition: Both industries are competitive, with multiple dealerships vying for customers in their respective markets. Differentiating their offerings, providing exceptional customer service, and building strong relationships with customers are essential for both construction and agriculture equipment dealerships to remain competitive and retain market share. OEM’s in both industries continue to impose more contractual obligations, and qualifications to be an equipment dealer.

While there are certainly unique aspects to each industry, construction equipment dealers and agriculture equipment dealers face many similar challenges and opportunities. Collaboration and knowledge-sharing between the two sectors can be beneficial in addressing common issues and driving innovation in both industries.

Chief Executive Officer

Thank you for all of your efforts this year with the 2024 session!

LB 1308 would have reinstated the tax on ag repair and replacement parts in Nebraska. However, due to the work of members and staff and the support of key Senators, that bill was not included in the final version that was debated on the floor of the Legislature. The omnibus tax bill that was debated was ultimately pulled from the agenda due to lack of support. While the Legislature adjourned without passage of Governor Jim Pillen’s Property Tax Shift Plan, there is more work to do.

Governor Pillen has notified members of the Legislature that he will be calling them back for a special session on July 25 to “finish the work” on property tax reform. While we don’t have any legislation to review or specific details of what they may be voting on, here is what we are hearing from conversations with State Senators and reports from Governor Pillen’s town hall meetings.

Governor Pillen has been advocating for:

• Broadening the sales tax base to not only include taxing ag inputs (seed, fertilizer, parts, etc.), but other business inputs as well.

• Eliminating the common levy for schools and the state would pick up that cost – similar to what was done for community colleges last year Bonds and other special assessments would still continue to be funded by property taxes.

• Front-loading already approved property tax credits for income taxes paid, placing hard caps on local government spending.

PHIL ERDMAN Director of Dealer and Government Affairs [phile@ineda.com]

Regardless of what is introduced, we will be prepared and present to represent your interests and will likely be calling on you to assist. If you are not currently receiving the Legislative updates – when the Legislature is in session – from Tim Keigher with Keigher and Associates, please let me know.

We had nearly 70 attendees across our 4 meetings. It is an honor to not only serve you and your business, but to host you for dinner and discussion on issues of concern to dealers. In addition to our conversations, staff provided updates from the Washington DC Fly-In and federal issues, previewed upcoming events including regional and legislative meetings and golf outings, and the opportunity to partner with us on the Andrew Goodman Scholarship. Plans are underway for district meetings for 2025.

When the Legislative session didn’t require my attention, I have been traveling the state and visiting with dealers. I have had over 440 member contacts in the past three months including 59 dealer visits. Many dealers have expressed a renewed focus on inventory management – whether that be on used equipment that is accumulating or on the pressure being brought to bear by manufacturers to order and carry additional new goods.

Higher interest rates continue to impact the carrying cost for dealers and the willingness of customers to purchase new or additional equipment, so many of you have been evaluating your current product lines. I want to make sure that you are aware that there are processes and protections for dealers and requirements for manufacturers to follow under

Nebraska law. The statute not only deals with your current contracts, but also what happens should you choose to cancel a contract.

The Andrew Goodman Scholarship program helps dealers financially support and train those aspiring toward management, technical, sales or administrative positions within the dealership. INEDA provided matching scholarships up to $1,500 for the upcoming 2024-2025 academic year. This year dealers are matching the INEDA scholarship funds of $90,000 for 82 students. (If a student fails to complete their course work a refund is provided to INEDA and the dealership.)

While many of you consider this program to be for service technicians, the scholarship is open to any student who may be pursuing a degree that would be of value to them as an employee of your dealership. The annual deadline to apply is April 15.

We also have been working to position dealers before educators to build strong relationships as you recruit future team members. This year, INEDA members joined together to present on the type of careers dealerships offer to ag teachers in Nebraska.

To further enhance the employee pipeline, we are supporting educators and the development of curriculum taught in our schools. We have partnered with the Curriculum for Agricultural Science Education (CASE) which develops comprehensive curriculum materials that teachers who are certified in a CASE course may implement in their classroom.

Four teachers from Nebraska and Iowa have received this curriculum to teach and raise the interest and aptitude of students in high school for careers in Agricultural Equipment Maintenance & Technology (AEMT). We will continue to work on this effort and expand interest and awareness in the coming year.

I look forward to meeting with you in the coming months!

• Legislative efforts in Nebraska for 2024 saw successful advocacy against LB 1308, avoiding reinstatement of tax on agricultural repair and replacement parts. A special session on July 25 is planned by Governor Jim Pillen to address property tax reform.

• INEDA focused on dealer engagement through district meetings and legislative updates, emphasizing community involvement, federal issues, and educational initiatives such as the Andrew Goodman Scholarship.

• Educational initiatives included expanding the Andrew Goodman Scholarship to support students pursuing careers in dealership management and technical roles, alongside efforts to enhance curriculum and partnerships with educators to promote careers in Agricultural Equipment Maintenance & Technology.

JAMIE MERTZ Director of Dealer and Government Affairs [jamiem@ineda.com]

In my travels over the past few months there is a common theme among dealers—they have too much inventory. Over the past three plus years, dealers have gone from inventory shortages to a surplus of inventory. Dealers have had orders placed with manufacturers for two years that have not been fulfilled until now. That means that the orders placed for equipment two years ago, a year ago, and the current years worth of orders have all been arriving on dealers lots all at once. It seems that the manufacturers were finally able to get the components they have been waiting on for so long to complete whole goods orders and this has created a surplus of equipment.

There are still a few manufacturers out there that are having supply chain issues, but the majority have worked through this issue. The dealers that carry a line of equipment that are still struggling with completing the manufacturing process have said they are light on inventory. This has affected their sales numbers and market share in their area because other manufacturers have been able to shore up production shortages and get machines out to their dealers.

Customers get tired of waiting for new machines, so they switch brands because of availability. This makes it very difficult for the dealer that is waiting on machines, because once a customer leaves for another brand, it is very tough to nearly impossible to get them back.

The continual push from manufacturers on their dealers to fulfill the market share quotas is not

helping the situation either. Dealers are faced with much higher interest rates (around 8% currently) on floor plan equipment which makes the carrying cost that much more expensive. Most dealers on the agricultural side of the business are stating farmers have a lot of grain in their bins, but they are holding tight on selling that grain and trading equipment until there is more stability in the grain markets.

The construction dealers have said that business has remained steady. The only drop off they have seen is with the smaller construction companies or the businesses that have smaller jobs such as sidewalks, driveways, etc. The larger construction companies have sizable contracts that will keep them busy for the next 3 to 5 years. There is still a lot of building going on, especially in the urban areas.

Worldwide sales for AGCO, CNH, and John Deere for the 2nd quarter were all down double-digit percentages. Agriculture and turf are down, but the construction markets continue to be strong.

Over the past few months, we have seen some of the larger multi-store dealers in the US put equipment on auction, trying to reduce their inventory by tens of millions of dollars. Yes, that is correct, tens of millions of dollars.

Some of the losses that I have been hearing from those auctions are in the millions. For example, take a one-year-old X9 1100 combine with 350 engine hours that retailed on a dealer’s lot a year ago for $850,000 is now selling on an auction this year for $450,000.

When dealers sell equipment on an auction and the equipment is bringing significantly less money, it sets a new value for that equipment and devalues the equipment on their lot they are retailing along with other dealers’ equipment.

Source: machinerypete.com

The idea is that if a dealer sells now, they avoid a bigger loss later down the road. It is not fun being in the position of owning or running a business and losing money. Right now it is about mitigating risk and minimizing the loss that the business is going to take because dealers are in the cycle of having too much inventory and need the cash flow to keep the doors open.

Dealers are still optimistic about the rest of this year, but not as optimistic about 2025. They are buckling up for a bumpy year next year and trying to get their house in order by reducing inventory.

• Dealers are facing a surplus of inventory due to delayed orders from manufacturers, causing market share challenges as customers switching brands for quicker availability.

• High interest rates (around 8%) on floor plan equipment are increasing carrying costs for dealers, impacting profitability.

• Agricultural dealers note farmers holding onto grain amid market instability, delaying equipment purchases despite surplus inventory.

• Construction sector remains strong overall, with larger companies securing long-term contracts, though smaller firms and projects show reduced activity.

NEBRASKA — On June 17, members from across Nebraska met in York at the York Country Club. Tim Keigher with Keigher and Associates gave a recap of the 2024 Legislative Session and previewed the rumored Special Session on tax reform.

The INEDA Legislative Committee for Nebraska with the assistance and insights of Keigher and myself reviewed the 25 Legislative races in this election. Members allocated NEDPAC contributions to qualified candidates and identified dealers in each district who would host a visit with candidates. 10 State Senators are running for reelection. The current Legislative has 250 years (5.10/years average) of legislative experience. For those who would serve in the 2025 session, legislative experience range would range from 155 (3.16 avg.) to 113 (2.31 avg.) years depending on the results of the races. Our goal was to raise $30,000 for the NED-PAC this election cycle. (That would be the highest contribution amounts from members in any election cycle so far.) Your support has surpassed that goal and will help us ensure we have the resources we need to be effective in the 2024 elections. (NED-PAC is a state political action committee fund, which can receive both personal and corporate contributions.)

On the Federal level, both U.S. Senators Fischer and Ricketts are up for re/election as are the three members of the House of Representatives. Congressman Bacon is likely to have another very close reelection. (We do NOT have a Federal PAC to contribute to Federal races. Members are encouraged to support candidates personally.)

Members also offered their insights on state and federal legislation and issues and discussed opportunities like the Nebraska Legislative Breakfast and the Washington DC Fly-In as ways to get involved in shaping public policy.

Advocacy Strategy for 2024:

• Support NED-PAC

• Host candidates at your dealership

• Support candidates in your communities

Finally, the importance of candidate engagement for the 2024 election was discussed. Specifically, how important it is to get to know and educate candidates in your area for the well-being of your business. Dealers have hosted 48 State Senator visits to their dealerships in Nebraska in the last two years. Make it a point to invite your State Senator or member of the Federal Delegation to visit your dealership and let me know how I can help!

PHIL ERDMAN Director of Dealer and Government Affairs [phile@ineda.com]

IOWA — On June 20, members from across Iowa met at Copper Creek in Pleasant Hill, IA. Cornerstone gave a recap of the 2024 Iowa session and relevant legislation that was passed. They also previewed possible 2025 legislation. The INEDA Legislative Committee in Iowa lead the discussion on a strategy of the representatives that we are planning to support for their campaign this year. We have seen contributions to the PAID-PAC this year in the amount of $8,350 with another $10k that has been verbally committed from dealers to the PAC. Our current balance is $15,726.46.

I will be visiting dealers throughout the summer to continue to add to the PAC in preparation for the 2024 elections and campaign contributions. When the verbal commitments from members become PAC donation checks, our PAC account will surpass $25,000!

TOM JUNGE, Expo Director [tomj@ineda.com]

For the first time in 15 years, construction equipment dealerships were included in the Employee Compensation Survey. The three main reasons for their inclusion were the increase in dual ownership of agricultural and construction equipment dealerships, a larger geographic base so more construction equipment dealers could report, and the change in the number of larger multi-store agricultural equipment dealerships which now operate like multi-store construction equipment dealerships.

When we conducted the last Iowa-Nebraska Equipment Distributors (construction equipment dealers) Employee Compensation Survey, there were noticeable differences in wages paid by construction and agricultural equipment dealers. That is not true today. More now than ever, construction and agricultural equipment dealerships compete for the same skilled employees.

This survey was conducted in cooperation with the Iowa-Nebraska Equipment Dealers Association and Pioneer Equipment Dealers Association. The 5-state area includes Iowa, Nebraska, Minnesota, South Dakota and North Dakota. 55 firms completed the survey representing 376 locations. Nearly 16% were exclusively construction equipment dealerships or dual-purpose dealerships. The last Iowa-Nebraska Equipment Dealers Association survey was conducted in 2021.

I’ve been analyzing the data for at least 25 years for the Association, and it is always interesting to see where the largest change in compensation occurs.

Sales personnel compensation is the most variable due to the economic conditions at the time of the survey since a large percentage of their wage is based on commission. In the last survey, location/store managers made the biggest jump at 19% over two years.

This year, the winner was Entry Level Service Technicians. Their total compensation leaped 45% over 3 years (13% annually). This is no surprise as it seems everyone is looking for technicians. Naturally there was a trickle up effect so Top Technician compensation increased nearly at a 7.4% annual pace. The hourly rate for entry level technicians increased 9% annually, whereas for top technicians it was 10%.

These past years, dealers also report the difficulty of hiring parts personnel. What was interesting in the results was that their hourly rate jumped 20%, but their total compensation only changed 10% from 2021. Commission and bonuses dropped by 66%, so it appears that dealers are offering more up front to lure employees.

This compensation survey also looked at the benefits that equipment dealers offer their employees. Tuition reimbursement, tool allowances, maternity/ paternity leave, and HSAs are only a few of them. In many cases, there are a number of members that don’t offer any benefits across all types of employee benefits. Since members are competing for talent in localized areas, it’s valuable to keep in mind that local employers may be attracting labor by offering these benefits to their workforce.

The survey also showed the continued downward trend of employers requiring employees to work Saturdays year-round. In 2021, 60% of the employers required employees to work Saturdays year-round compared to 43% now.

Participants received complimentary survey results as a thank you for completing the survey. Nonparticipants can order the survey from the Association. The survey is $500 and will be received electronically. Should you have any questions about the survey contents, feel free to contact me at tomj@ineda.com or Mark Hennessey at markh@ineda.com. The next survey will be conducted in 2026.

“Since members are competing for talent in localized areas, it’s valuable to keep in mind that local employers may be attracting labor by offering these benefits to their workforce.

—TOM JUNGE

MARK HENNESSEY CHIEF EXECUTIVE OFFICER [markh@ineda.com]

Last year, INEDA signed a Memorandum of Understanding (MOU) with AED, a national association of equipment dealers whose roots began in the construction industry and have successfully expanded into the agriculture industry as well. For our members, we believe all members of our association have benefited from this MOU.

At the federal level, AED ’s expertise on national policy issues, key relationships with federal regulatory agency leaders, members of Congress and the Executive Branch are vital in steering legislative decisions or proposed bills in the right direction. Our Washington DC Fly-In is an excellent chance to experience this in action. Consider joining us in 2025.

One of their education-based opportunities for INEDA’s AED members is their annual summit. Whether you’re interested in inventory management best practices, future economic forecasts or succession planning, there are a variety of sessions hosted by subject matter experts that will give attendees answers to questions or provide resources that you can turn to for more information.

Keynote speakers such as George Bush, Jr, Mike Pompeo, or General James Mattis share their experiences at this event that leaves you inspired to be an American.

Today, Right to Repair continues to surface at a national level by regulatory agencies and congressional delegates. AED and INEDA are closely monitoring prospective bills where proposed amendments with language detrimental to our equipment dealers are being initiated. Keeping a close eye on R2R, or other proposed policy changes requires us to stay vigilant and prepared on your behalf.

With this issue of the Retailer, we are highlighting the construction industry. Yet, we view ourselves as one association supporting the needs of all members at all levels. Our relationship with AED is an example of this commitment to action.

Infrastructure Investments: The federal and state investments in infrastructure are significant factors driving demand. The Infrastructure Investment and Jobs Act (IIJA) allocates $1.2 trillion for a wide range of projects, boosting the need for construction equipment. For example, Illinois has a $21.3 billion budget for the 2021-2026 period for major highway and bridge improvements, and Michigan is set to receive $7.3 billion in federal funds for road repairs and upgrades.

Urbanization: Continued urbanization and the development of smart cities in the Midwest create demand for both heavy and compact construction equipment. According to the U.S. Census Bureau, the Midwest’s urban population is projected to grow by 4% from 2020 to 2025. Cities like Chicago, Minneapolis, and Indianapolis are undergoing significant development driven by population growth and the need for modern infrastructure.

Technological Advancements: Innovation in equipment technology, such as electric and autonomous machinery, is appealing to contractors looking to enhance productivity and meet environmental standards.

According to a report by the Association of Equipment Manufacturers (AEM), sales of electric construction equipment are expected to grow by 10% annually through 2025.

Supply Chain Disruptions: Ongoing supply chain issues can impact the availability of construction equipment and raw materials, potentially delaying projects and equipment purchases. The National Association of Home Builders (NAHB) reported that material costs increased by 26% in 2021, affecting equipment production and pricing.

Economic Factors: Economic uncertainties, including inflation and interest rates, could affect construction budgets and financing options for purchasing new equipment. Fluctuations in economic conditions can lead to variations in construction activity and equipment demand.

Regulatory Environment: Stricter emissions regulations may pose challenges for equipment manufacturers and contractors, requiring investment in new, compliant technologies. Compliance with these regulations can increase operational costs and affect equipment pricing.

Upward Trend: The overall outlook for the U.S. construction equipment market, including the Midwest, is positive. Reports from sources like Grand View Research and Market Research Future suggest a steady growth trajectory through 2025.

Grand View Research projects the U.S. construction equipment market to reach $65.1 billion by 2025, growing at a compound annual growth rate (CAGR) of 3.5% from 2021 to 2025. The projected growth rates and increased investments in infrastructure projects support this optimistic outlook.

Downward Pressures: While the long-term trend appears upward, there are short-term pressures such as supply chain issues and economic uncertainties that could affect the pace of growth. These factors might lead to fluctuations in equipment sales year over year.

To provide a more nuanced view, the market is generally expected to grow, but there are risks and challenges that could temper this growth. The industry must navigate these challenges effectively to maintain the positive trend.

The construction equipment market in the Midwest is expected to experience growth in 2025, driven by significant infrastructure investments, urbanization, and technological advancements. However, potential challenges such as supply chain disruptions, economic factors, and regulatory pressures could impact the pace of growth. Overall, while the outlook is optimistic, it is essential to monitor these variables closely to understand their impact on the market.

Source: ChatGPT, OpenAI, July 2024

Source: marknteladvisors.com

At Tax Favored Benefits, we serve as a partner in helping individuals, families and business owners achieve financial success. Our experienced professionals are supported by world-class resources in providing a full suite of wealth, investment and retirement planning services to clients across the country. We focus, first and foremost, on helping you achieve your personal financial goals. As financial professionals, we put your best interests first, at all times and in all situations. We succeed when you succeed.

The construction equipment dealership industry has always been synonymous with adaptability. In recent years, however, it has faced unprecedented challenges. From supply chain disruptions to labor shortages, these obstacles have tested the industry’s resilience. Yet, amidst these challenges, there has been remarkable progress. “We’ve seen a significant shift towards more sustainable construction practices,” notes Jessica Hayes, a construction industry analyst at Build Insights. “Companies are increasingly adopting eco-friendly machinery and implementing energyefficient technologies.” Indeed, sustainability has become a cornerstone of modern construction.

The heartbeat of construction equipment dealership innovation lies in its technological advancements. From autonomous machinery to Building Information Modeling (BIM), technology is revolutionizing every aspect of the construction process. “Automation and robotics are transforming construction sites,” remarks Thomas Wu, CEO of MechTech Innovations, a leader in construction robotics. “Our autonomous machinery not only accelerates project timelines but also improves safety by reducing human error.” Furthermore, the integration of BIM software allows for precise project planning and management.

This digital twin technology enables real-time collaboration among architects, engineers, and construction teams, streamlining workflows and minimizing delays.

Amidst these advancements, the machinery sector has seen a surge in demand. Equipment manufacturers are innovating at an unprecedented pace, developing smarter, more efficient machinery to meet the evolving

needs of the industry. “We’re witnessing a shift towards electric and hybrid machinery,” states Andrew Park, Sales Director at EcoTech Machinery. “These innovations not only reduce emissions but also lower operating costs, making them a preferred choice for environmentally conscious contractors.” Furthermore, the adoption of telematics and IoT (Internet of Things) in machinery has enabled predictive maintenance and data-driven decision-making. This proactive approach ensures minimal downtime and maximizes equipment efficiency, translating into tangible cost savings for construction companies.

In the ever-evolving landscape of construction equipment, where steel meets innovation and machinery drives progress, the industry finds itself at a pivotal juncture.

As we navigate through the complexities of a rapidly changing world, construction equipment dealers stand resilient, adapting to new challenges while embracing cutting-edge technologies that promise a brighter future.

Despite challenges like supply chain disruptions and labor shortages, construction equipment dealers are advancing with optimism for 2025.

Dealers are embracing sustainable practices, offering eco-friendly machinery and energy-efficient technologies to improve efficiency and lower costs. Technology continues to play a crucial role, with autonomous machinery and digital planning tools like BIM enhancing safety and speeding up projects. The machinery sector is thriving, with new electric and hybrid equipment reducing emissions and boosting productivity. Overall, 2025 promises to be a year of growth and opportunity for construction equipment dealers.

Source: ChatGPT, OpenAI, July 2024

Tactical Talent Management: Bridging the Knowledge Gap

The first step in AI adoption is cultivating a workforce that is ready for change. (Yes, we are talking about culture now). Look to initiate tailored training and employee engagement programs that cater to different learning preferences within your multigenerational workforce. This step not only bridges the knowledge gap but also instills confidence in employees by showcasing AI as an enhancement to their skills and productivity rather than a threat to job security. Encourage mentorship programs to facilitate knowledge sharing between experienced and newer employees. The younger generation will most likely adopt and adapt more quickly with AI, so the knowledge sharing moves in multiple directions (not just top down).

Diversity & Inclusion: AI for Unbiased Recruitment

Talent gaps continue to be a challenge and attracting people with the right skills is critical. While accomplishing this, promoting diversity, equity and inclusion (DEI) with AI doesn’t require an extensive data infrastructure. Use AI tools for unbiased recruitment processes, mitigating biases in hiring decisions.

This tactical approach aligns with ethical standards and enhances DEI without necessitating a fully developed data strategy. AI tools can be deployed to support learning and career development programs as well. We want to keep the good talent we hire and see them take on more responsibilities to contribute to the overall success of the organization.

Foundations of Electrification: Implementing Predictive Maintenance

For businesses considering the electrification of their equipment, the initial focus could be on predictive maintenance. Introduce AI-powered tools that analyze equipment data to predict maintenance needs, especially with batteries and powering stations as new assets are added to their fleets. This not only extends the lifespan of the machinery but also minimizes downtime, making the transition to electric fleets smoother. Such a tactical step ensures a sustainable approach to equipment management without overwhelming the organization with a full-scale electrification strategy.

Implementing AI in risk management doesn’t require an extensive data strategy from the outset.

Start with predictive analytics to foresee potential project delays. By analyzing historical project data, AI can identify patterns and trends, offering early insight into potential risks. This tactical approach allows construction businesses to build a more risk-aware culture without needing a complex data infrastructure.

AI can play a pivotal role in optimizing supply chain processes even without a fully developed data strategy. Implement AI to analyze existing supply chain and/or inventory data, providing insights to streamline procurement processes and restructure inventory levels to better address slow moving items. This tactical step ensures efficient material sourcing, minimizes disruptions and delivers cash along the way as it sets the stage for more comprehensive data strategies as the supply chain organization progresses in its AI adoption journey.

At the tactical level, implementing AI doesn’t have to be an overwhelming process for the workforce in the field or office. Introduce AI-enhanced collaboration tools for project management. These tools facilitate communication, task tracking and collaboration among project stakeholders. By enhancing communication channels, businesses can foster a collaborative environment that lays the groundwork for more sophisticated AI applications in the future whether in the manufacturing facility or field.

In the early stages of AI adoption, the emphasis should be on one or two tactical measures that align with the organization’s strategic vision yet address a significant challenge or pain point where a focused response can be deployed that delivers improvements easy to measure in the operation and financial metrics. While a comprehensive data strategy is essential for long-term success, any of these tactical steps pave the way for gradual integration and allows the organizational culture to begin to adopt a new way of thinking and operating in the business. By focusing on one or two critical areas such as talent management, electrification of equipment with predictive maintenance, risk analytics or supply chain optimization, construction businesses can embark on their AI journey with tangible, immediate benefits in 2024 and also give the culture time to adopt and embrace the tools and adapt and learn over time.

In conclusion, the key to successful AI adoption lies in taking practical, tactical steps that align with the organization’s strategic vision. By implementing AI in areas that don’t require extensive data infrastructure, businesses can lay the foundation for a more innovative and resilient future. Early adoption is about building momentum, and any of these tactical measures pave the way for broader, strategic AI integration in the evolving construction landscape.

Source: Bill Tipton, ChasmBridge Business Management Firm

The construction equipment industry is increasingly moving online, thanks to advancements in technology and changing consumer habits. E-commerce and online marketplaces have made it easier for companies to buy and rent equipment quickly and conveniently. Here are some key strategies driving this trend.

Online Marketplaces

E-commerce sites like MachineryTrader, IronPlanet, and Equipment Trader offer vast selections of new and used construction equipment. These platforms allow buyers to compare prices and features from multiple sellers easily.

Example: Equipment Trader’s easy-to-use website lets customers search for equipment based on different criteria like category and price, making online shopping more appealing than traditional methods.

Better Online Experience

Companies are improving their websites with features like 3D views and virtual tours to help customers understand the equipment better without seeing it in person.

Example: Caterpillar uses augmented reality (AR) on its website to show customers how equipment would look and work on their job sites, making buying decisions easier.

Online platforms now offer various financing and leasing options, including monthly payments and short-term rentals, making it easier for businesses to get the equipment they need.

Example: United Rentals offers an online platform where customers can rent equipment and choose from different financing options to fit their budgets.

Online platforms use data to understand customer preferences and recommend products that suit their needs, making the shopping experience more personalized and satisfying.

Example: Komatsu analyzes customer interactions on its website to offer personalized product recommendations, leading to higher sales.

Good customer support is crucial for online sales and rentals. Companies are adding live chat, virtual assistants, and detailed FAQ sections to their websites to help customers quickly.

Example: John Deere provides excellent online support with live chat, a virtual assistant, and downloadable product manuals, making customers feel informed and confident.

Source: ChatGPT, OpenAI, July 2024

Reasons Behind the Skilled Labor Shortage

Aging Workforce: Many skilled technicians and dealership staff are reaching retirement age, creating a significant gap in experienced labor.

Educational Emphasis: There has been a shift away from vocational training in favor of academic pursuits, resulting in fewer young people entering trade professions like equipment technicians.

Economic Cycles: The construction equipment industry experiences cyclicality, which affects workforce stability. During economic downturns, skilled workers may leave the industry or retire early, and when the economy rebounds, there is often a struggle to attract new talent.

Perception and Recruitment: There is a persistent perception that technicians jobs are lowpaying and physically demanding, deterring potential workers from pursuing careers in the field.

Challenges Posed by the Shortage

Service Delays: Shortages can lead to delays in equipment maintenance and repair, affecting overall project timelines and client satisfaction.

Increased Costs: Higher demand for a limited pool of skilled technicians can drive up labor costs, impacting project budgets and equipment maintenance expenses.

Quality Concerns: Inexperienced labor may compromise the quality of workmanship, leading to safety issues and potential rework costs.

Innovation and Technology Adoption:

The industry’s ability to adopt new technologies and innovate may be hindered by the lack of skilled workers capable of operating and maintaining advanced equipment.

Looking ahead to 2025, several potential outlooks and strategies could mitigate the skilled labor shortage in construction equipment dealerships and mechanics:

Workforce Development Programs:

Increasing investment in vocational training and apprenticeship programs to attract and retain young talent. Collaborations between educational institutions and industry stakeholders can help bridge the skills gap.

Technological Integration: Embracing advanced technologies such as telematics, IoT (Internet of Things), and automation can offset the shortage by increasing productivity and reducing reliance on manual labor.

Diversity and Inclusion: Promoting diversity and inclusion within the construction equipment workforce can broaden the talent pool and bring new perspectives to the industry.

Industry Collaboration:

Strengthening partnerships between government, industry associations, and private sector employers to develop comprehensive workforce development strategies and policies.

Competitive Compensation and Benefits:

Offering competitive wages, benefits, and career advancement opportunities to attract and retain skilled workers.

The skilled labor shortage in construction is a multifaceted challenge with far-reaching implications for project delivery, costs, and industry innovation. While the outlook presents challenges, proactive measures such as workforce development, technological integration, and industry collaboration offer promising solutions leading up to 2025. By addressing these issues strategically, the construction industry can navigate the labor shortage and sustain growth in a competitive market environment.

Source: ChatGPT, OpenAI, July 2024

JAMIE MERTZ Director of Dealer and Government Affairs [jamiem@ineda.com]

There was not a lot of legislation that happened this session that affected equipment dealers, which is usually a good thing. Most of the time for the house and senate was spent on the governor’s agenda that she unveiled at her condition of the state address in January. The focus was on higher salaries for teachers, restructuring the AEA, and reducing state income tax for Iowans. The session this year ended the earliest it has since 2010.

Even though 2024 and the past few years have been quiet in Iowa for equipment dealers, that doesn’t mean there isn’t legislation around the corner that could possibly be proposed that would affect Iowa dealers. In Nebraska our members faced the governor trying to pass a bill that would eliminate property taxes for landowners and to pay for it they would eliminate tax exemption status for farmers on all ag parts purchased in the state.

This would negatively affect not only farmers, but severely impact dealers in the state, especially where farmers are close to the borders of the state where they can travel across state lines and purchase parts using tax exemption in the surrounding states.

Take it a step further and some service business will be lost due to this proposal also. With the work of our association and members in Nebraska, this effort to eliminate tax exemption status for farmers on all ag parts was defeated That does not mean that it will not come up again in 2025.

For 2025, we feel that there will be a push in IA from some representatives to look at tax exemption status on ag parts and equipment. Especially with the push to lower and get to the goal of 0% state income tax. Right to repair is also another push in states and nationally that seems to not be going away.

It is important to support the PAC and also have a relationship with your local representative to educate them on the impact both of these issues would have on your dealership, farmers, and the local communities that you serve.

CINDY FELDMAN, Marketing Director [cindyf@ineda.com]

There are many advertising choices to choose from the marketing mix, however, radio still ranks as one of the best ways to reach ag producers.

And while it is easy to dismiss AM/FM radio when Spotify, Apple Music and Pandora exist, it’s easy to underestimate the powerful reach and ad effectiveness that AM/FM radio advertising has to offer.

Recently, Aimpoint Research came out with findings for a study they did for the National Farm Broadcasters Association (NFBA) when doing research on the Farmer of the Future 2.0. Their aim was to enable deeper understanding of the U.S. farmers and ranchers. This research builds upon the 2018 Farmer of the Future analysis, and unlocking powerful insights that will help advertisers better understand, engage and service their existing ag customers.

Key findings include:

• The average listener’s farm contains nearly 11 radios.

• Younger listeners are more likely to visit a website after hearing about it on the radio.

• On-air ag radio is a major part of listeners’ weekday routine.

“Studies like this prove how much farmers pay attention to what is on their radio dial,” reports the Executive Director for the National Farm Broadcasters Association (NAFB).

NAFB has been a key player in the fight to keep AM radio in cars and trucks. “We’ve asked our members to be engaged in that process – to talk about it on the radio, post on social media, and encourage lawmakers to vote in favor of moving that bill forward–sharing the message that AM radio is reaching a rural audience that is largely underserved,” NAFB says. “We know when it comes to emergency information, it doesn’t matter what your zip code is. Listeners in rural areas don’t necessarily have consistent access to cellular or broadband, or it may not be reliable enough. We know that AM has continued to deliver.”

The survey also found, perhaps surprisingly, that younger listeners edged out older listeners for time spent tuned to agricultural broadcasts. “The perception is older Americans would listen the most, but what we found was that the grandson is listening four minutes per day more than grandpa, and two minutes more than dad,” reports NFBA. “It helps us tell the story that agricultural radio is as pertinent, if maybe not a bit more important, to younger generations than what advertisers may perceive. The relationship that they’ve got by listening to a farm broadcaster and to that radio station means a whole lot more to them than just reading what the market price is on a computer screen.”

Other advantages of using radio advertising in your marketing mix include:

1. Affordability

• The average cost of a :60 second radio advertisement ranges from $5-$750 when measured by cost per point (CPP).

• Usually, the more listeners the radio station has, the more customers it can reach, therefore making the cost higher.

• The cost of entry for radio advertising is less than other broadcast mediums.

2. Ability to reach a broad audience

• The audience share of AM/FM radio is 18X larger than ad-supported Spotify and 15X larger than ad-supported Pandora.

• 84% of those age 55+ are reached each weak by radio; 83% of those aged 25-54 are also tuning in weekly.

3. High Return on Investment (ROI) with stats to back it up

• Four waves of surveys in 2021 and 2022, conducted by Aimpoint Research for the National Association of Farm Broadcasting among 800 respondents in all U.S. regions, in the farming or ranching business – defined as primary or shared-decision makers on a farm with income of $100,000 or more –show that 74% listen to ag radio five or more days a week. Average time spent listening is just over an hour, with listenership highest in early morning hours.

Check out INEDA’s Facebook page for more great information on choosing radio advertising as part of YOUR marketing media mix.

Source: National Ag Broudcasters Association and Aimpoint Research

On May 23 and 30, INEDA hosted Regional Workshops on Workforce and Trucking Regulations in Grand Island, NE and Ankeny, IA.

Nebraska Carrier Enforcement and Iowa Department of Transportation conducted the trucking regulation workshops. Members benefited from an overview of the current trucking regulations including state and federal rules as well as a “walk around” of loaded equipment provided by AKRS Equipment and Logan Contractors Supply.

During the workforce workshop, speakers discussed workplace best practices, visa programs, and pathways programs followed by a tour of the Career Pathways Program at Grand Island (Nebraska) High School and Des Moines Area Community College (Iowa). Jerry Pigsley of Woods Aitken Law Firm presented workplace best practices and new legal mandates. He highlighted the changing landscape in workplace rules and regulations.

[phile@ineda.com]

Community outreach specialists from the United States Customs and Immigration Services (USCIS) provided an overview of the visa programs including the eligibility requirements and process for seeking visas for employees. While this program has been utilized by some members, the process is quite involved and requires representatives of schools focusing on trades discussed their efforts to equip the next generation of workforce ready employees and the programs and facilities they utilize. For this strategy to succeed, it has to be a partnership between these programs and employers. We would encourage you to reach out to these programs in each state and learn more about how you can partner with them.

If you are interested in learning more about any of these topics or have questions on opportunities that are available to your dealership, please let us know!

AN ASSOCIATION MEMBER BENEFIT FOR 119 YEARS

DIRECT, LOCAL MARKETING REPRESENTATIVES AUTO PROPERTY AND CASUALTY SELF-INSURED RETENTION

POLICYHOLDER SURPLUS LIVE VOICE CUSTOMER SERVICE

MYSHIELD® TAILORED, INDUSTRY-SPECIFIC COVERAGE

BUSINESS SUCCESSION AND ESTATE PLANNING STABLE

FACE-TO-FACE RELATIONSHIPS FINANCIAL STRENGTH

MUTUAL COMPANY DIRECT CLAIMS REPRESENTATIVES

500+ EXCLUSIVE ASSOCIATION RECOMMENDATIONS ESTATE PLANNING ATTORNEY NETWORK ANNUITIES

WE’RE BETTER TOGETHER LIFE AND DISABILITY INCOME

PRIVATE BONUS PLANS KEY PERSON COVERAGE

WORKERS COMPENSATION HIRING PRACTICES FEDERATED DRIVESAFESM TELEMATICS SOLUTION

RISK MANAGEMENT RESOURCE CENTER

EMPLOYMENT RELATED PRACTICES LIABILITY

EMPLOYMENT LAW ATTORNEY NETWORK

BONDING EMPLOYEE SAFETY TRAINING

RISK MANAGEMENT ACADEMY

CLIENT CONTACT CENTER

FIELD RISK CONSULTANTS

CERTIFICATE CENTER

SURETY SPECIALISTS MANAGED CARE CYBER IT’S OUR BUSINESS TO PROTECT INEDA MEMBERS

Scan to learn more about BUSINESS SUCCESSION AND ESTATE PLANNING support.

8330 NW 54th Ave.

Johnston, IA 50131-2841

+5% PRO and PUT Standard Residual

Effective June 1 - September 30, 2024

AgDirect® is increasing its standard PRO and PUT residuals by plus [+] 5% on John Deere, Case IH, Fendt, Kubota, Massey Ferguson, McCormick and New Holland tractors. New and used 140 HP and higher row crop, 4WD and track tractors may qualify*. Utility tractors are excluded.

How it works:

1 Visit agdirect.com to view the residual matrix.

2 Review the current standard tractor residuals in the residual matrix.

3 Add 5% to the standard PRO or PUT residuals listed in the residual matrix.

Rates and terms:

Visit agdirect.com to see current standard lease rates. For more information or a customized lease quote, contact AgDirect. FPO residuals are not eligible for this program.

Compare payment options with AgDirect ® Mobile

Check current AgDirect interest rates, calculate individual payment quotes or compare payment options side by side and apply for financing from your smartphone or tablet with our free mobile app. Scan the QR code to download from AgDirect Mobile from the App Store SM or the Google Play TM store. ** 7:30 a.m. to 5:30 p.m. CT Call 888-525-9805 or visit agdirect.com