FEMALE INVESTORS

ARE THEY TOO CAUTIOUS?

TYING THE KNOT FINANCIALLY TAXES ON CRYPTO

ESG INVESTING GOES MAINSTREAM

ARE THEY TOO CAUTIOUS?

ESG INVESTING GOES MAINSTREAM

Women’s penchant for lower-risk investments may put them at a higher risk of poverty in their old age. 8

13 Head over heart Money issues to consider when making a romantic commitment.

18 Investment analyst’s expertise put to good use at NMG

Raazia Ganie is head of investments at NMG Benefits.

20

38 Is credit life cover weighted against you?

Thousands of people don’t even know they have this cover.

41 The value of a healthcare adviser

Past winning strategies may no longer apply.

42 The F-word

The three main categories of investment fees explained.

44 The cost of focusing only on costs

While costs are important, they “should not override other factors”.

46 Is inheritance tax an answer to inequality? This may be fairer than upping income taxes, finds the OECD.

48 Izibizo: is the tradition becoming extortion?

Customary African marriage practice “is being abused”.

2 Upfront Men, women and risk

4 Book review Books on financial topics

6 Your letters Readers’ queries answered by experts

49 Millennial view Black Tax can be rewarding if planned for

50 Ombud case file

Insurance, advice and retirement fund disputes

52 Fund focus Aylett Balanced Prescient Fund

54 On the contrary

There is no such thing as straight-line investing

55 A list of the adjudicators and the ombuds who can assist you with your complaints, followed by the unit trust quarterly results, tax rates and annuity rates

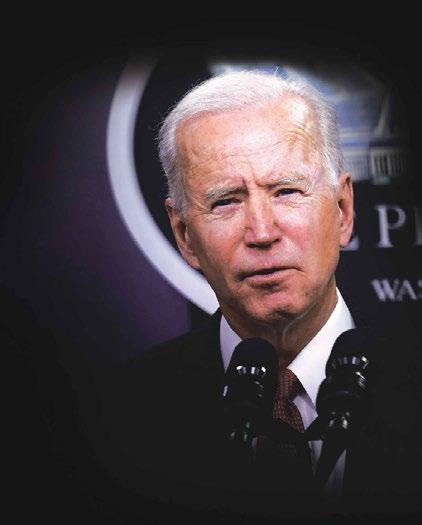

The release of this publication coincides with Women’s Month, and it contains three articles focusing on women: the cover story on women investors; one on how different arrangements between partners, within and outside of marriage, can result in different financial outcomes; and a profile of Raazia Ganie, one of the increasing number of women in senior positions in the financial sector.

It’s a well-established fact that men take more risks than women; hence they pay higher car insurance premiums. However, one area where women could try to behave a little more like their male counterparts is in long-term investing. Here it is beneficial to take on more risk, by investing in growth assets such as equities, instead of “staying safe” in cash. This is because investment risk, in the form of market volatility, while high in the short-term, diminishes over time, in the same way that the numbers of heads and tails you get on flipping a coin even out to 50-50 the more flips you do. Advantageously, this approach produces returns likely to beat inflation by a significant margin, unlike investing in cash, which one adviser recently nominated the “highest-risk” investment owing to its inability to produce a decent real (after-inflation) return.

Women needn’t act completely contrary to their nature and take irresponsible risks, such as short-term bets on crypto or forex, but they can improve their investment outcomes by acting a little less cautiously when it comes to saving for their retirement. Enjoy the feature on page 8.

Many women are still very reliant on their partners for their financial security, a fact taken up in the article “Head over heart” on page 13. But the type of financial arrangement you have with your partner is dependent on whether you are married or not, and, if you are, the type of marital regime you are married under. Unpleasant as it may seem, you need to know where you will stand in the case of the death of your partner or divorce.

Other edifying reads in this edition include a look at taxes on cryptocurrencies, prospects for sub-Saharan Africa as it struggles to emerge from the pandemic, and an update on ESG investing: for those new to the term, it means investing taking environmental, social and governance criteria into consideration.

VOLUME 88

3rd QUARTER 2021

An Independent Media (Pty) Ltd publication

Editor

ANA Publishing CEO

ANA Publishing CFO

Head of Production

Head of Design Designer

Martin Hesse martin.hesse@inl.co.za

Vasantha Angamuthu

Sooren Ramdenee

Mugamad Jacobs

Matthew Naudé

Thabang Boshielo

ADVERTISING

Tony Malek tony.malek@anapublishing.com

Daniel Kgaladi daniel.kgaladi@inl.co.za

SUBSCRIPTIONS subscriptions@anapublishing.com

OFFICE MANAGER

Caryn Wessels caryn.wessels@inl.co.za

IMAGERY Freepik.com and AP

INDEPENDENT MEDIA BOARD OF DIRECTORS

Dr. Mohammed Iqbal Survé, Takudzwa T. Hove, Aziza B. Amod, Ismet Amod, Yuexing Wang, Jinghua Dong

EDITORIAL ENQUIRIES

Tel: 021 488 4187

Physical address: Fourth floor, Newspaper House, 122 St George’s Mall, Cape Town, 8001

Postal address: PO Box 56, Cape Town, 8000

Personal Finance magazine (ISSN 1562-3750) is published by the proprietors, Independent Media (Pty) Ltd, Star Building, 47 Sauer Street, Johannesburg, 2001

All products appearing in Personal Finance are available and all prices are correct at time of print, subject to change.

Author: Nikki Bush

Publisher: Penguin Books

Recommended retail price: R210.00

Nikki Bush is a popular speaker, author and media personality, specialising in parenting and personal empowerment. She has written a number of books, including Future-proof Your Child for the 2020s and Beyond.

The theme of her latest book is disruption, and it couldn’t have come at a better time. The Covid-19 pandemic has given us all a major lesson in disruption. The ways the pandemic has changed our lives, and how best to deal with these changes, form the heart of her book.

Bush herself had to cope with severe disruption in her life back in December 2017, when Simon, her husband of 26 years and father of their two teenage boys, Ryan and Matthew, was shot and killed in an armed robbery at their home in Sandton.

We tend to think of disruption as something temporary and that, in the end, life will “go back to normal”. This is particularly so regarding our thoughts about the pandemic. But Bush says we cannot afford to think that way if we want to move forward.

“When things change dramatically, they rarely, if ever, go back to ‘normal’. Disruption demands that we let go of the past and step into a new way of being,” she says. “Coping with disruption demands flexibility, adaptability and resilience. Resisting change is fruitless and leads to distress, fear and frustration.”

The book looks at ways of dealing with disruption, both from within (harnessing your feelings and developing a positive attitude) and externally in practicalities such as working from home and dealing with children.

Disruption brings changes that we have no control over, but if we’re adaptable and retain a positive mindset, we can focus on what we do have control over to build a fulfilling future.

Author: Nevi Letcher

Publisher: Nevi Letcher

Recommended retail price: R299

Nevi Letcher runs a vibrant marketing and events company in Johannesburg. Her experiences as an entrepreneur after leaving the corporate world are distilled into a valuable handbook for aspiring entrepreneurs and business owners.

The journey of an entrepreneur is not an easy one. It means being a “risk-taker, visionary, leader, pitbull and superhero all rolled into one”. Business school cannot teach you what you can learn only from hard experience or from the wisdom of people who have themselves followed that road.

Letcher’s book is both practical and inspiring. She offers 12 lessons for entrepreneurs which, like Bush’s book above, cover both the internal (your inner feelings, attitudes and drives) and the external (your relationships with others). Also, like Bush, Letcher specifically deals with challenges wrought by the pandemic.

There are no short-cuts: to be a successful business owner takes hard work, resilience and a willingness to learn from your mistakes. “When starting out, many entrepreneurs will come to the realisation that they do not yet have every talent and skill to make their business a roaring success. You will get there simply by putting in the work to acquire the skills you need.”

I’m a small business owner with 10 employees. At what point do I need to get a plan in place for my employees? I’d like to consider offering them benefits such as medical and retirement provisions, but I am not sure where to begin.

Name withheld

John Cranke, principal at PSG Wealth Employee Benefits, Midlands, responds:

There is no legal requirement for businesses to have retirement fund or healthcare cover in place for employees. However, there are many reasons why it is a good idea to have these sooner than later. Offering benefits of this nature through the employer group immediately makes a company an “employer of choice” owing to the financial protection and peace-of-mind offered.

From a retirement fund perspective, there are significant tax benefits to be had – ranging from the contributions made, through to the tax-free investment returns and favourable tax treatment of the benefits ultimately paid to employees leaving the retirement fund. To reap the benefits of the compounding effect, contributions need to start as early as possible. In addition, group risk benefits are often significantly cheaper than buying the same cover on an individual basis. Moreover, modern day administration systems have the flexibility to allow one to offer investments and/or benefits that are attractive to different profiles of employees in the same arrangement.

My recommendation for a small start-up retirement arrangement would be for the fund to be implemented with minimal risk benefits and retirement contributions at the outset, to which annual adjustments can be made over an agreed period until the benefits and contributions reach the predefined levels.

From a healthcare cover perspective, medical schemes may not differentiate the premiums on any basis other than family size, options selected and income of the member. It might be difficult to negotiate for a group of 10, but depending on the age profile of the group, it could be possible to negotiate an underwriting waiver for the group – which means that any waiting periods and late joiner penalties for employees would be waived.

Importantly, the tax credits in respect of medical scheme contributions paid via payroll deductions often almost entirely offset the

portion paid by employees participating in options that base contributions on the income of the member/s (also on the assumption that the employer will subsidise a portion of the required contribution). If medical scheme contributions are unaffordable to lower-income employees, consideration can be given to making a primary healthcare product available, which affords policyholders the opportunity to obtain their healthcare services for day-to-day needs in a private healthcare setting.

I would strongly recommend appointing an experienced and accredited adviser to help you through the quote, selection and implementation process.

I started an online business from my home. As I don’t have a business premises or intend to get one, do I need business insurance?

Name withheld

Bertus Visser, chief executive of distribution at PSG Insure, responds:

Online businesses and those with a physical address face many risks requiring insurance, especially business interruption. Cybercriminals are quick to exploit any opportunities or vulnerabilities making cyber security and insurance critical to the arsenal of any business, or individual interacting online.

Cyber safety must be constant; having virus protection doesn’t mean you should click on something risky. Like you would lock your car every day, you need to lock your data away safely too. Often a secure data back-up and online virus protection are key elements to keep insurance cover in place. A breach could impact your bottom line and stop you from operating, so insurance can be a lifeline.

Do all you can to deter criminals from targeting your business. Just because you are new and perhaps still small, doesn’t mean you aren’t a target; your clients could potentially be of interest to criminals. If you are online, you are exposed, so rather get some advice tailored to your business to properly protect it.

Note: These letters are selected from “Your Questions Answered”, a monthly letters feature in Personal Finance in the Saturday newspapers, sponsored by PSG Wealth.

EXPERIENCE THE BEST OF FAST COMPANY (SA) ON YOUR MOBILE TODAY!

If they’re saving at all, women tend to gravitate towards “safer” financial products, such as savings accounts, rather than investing in the stock market. But in the long run, what seems safe may put them at risk of poverty in old age.

By Anna RichW“omen are less financially literate than men.” That’s the opening statement of Fearless Woman: Financial Literacy and Stock Market Participation, a research

paper released by the Global Financial Literacy Excellence Center earlier this year. The lack of financial literacy means that, to a greater extent than is the case with men, women don’t know what they need to know to make informed financial decisions.

But the researchers noticed another trend when they were assessing the data: women tended to choose the “do not know” option to questions designed to measure financial knowledge far more often than men did.

know, or think you don’t know?

Following from that observation, the researchers wondered whether women really lacked the knowledge, or whether the issue was confidence. They decided to dig deeper, removing the “do not know” option from a subsequent round of research, which meant that the respondents were forced to answer. The result of this experiment? When the “do not know” option was unavailable, women often chose correctly. The researchers determined that a third of the financial literacy gender gap could be explained by “women’s lower confidence levels”. The “fearless woman” of the title of the paper is what the authors hope for, rather than a reality.

Knowing the precise reason for lower levels of financial literacy can help tailor the approach taken to improve the situation: the researchers recommend financial educational programmes that are designed to boost women’s confidence, because a one-size-fits-all approach is not effective enough.

The outcome of women’s lower financial literacy levels, though, is that they don’t invest their money to the same extent as men do. Research has established that financial knowledge and confidence are both important prerequisites for getting involved in the stock market.

Participation in the stock market is important, say the study authors, because it results in a large difference in wealth in the long term, compared to saving in riskfree assets.

“The reason we invest is because we want higher returns than we would get in a money market fund, or a bank deposit, where we’d be getting a set interest rate,” explains Anthea Gardner, founder and managing partner at Cartesian Capital asset management, and author of Make Your Money Work For You: Think Big, Start Small.

An investment pot accumulated over time provides us with an income when we no longer earn a salary. “We need returns that are above inflation to retire comfortably,” says Gardner.

As is the case elsewhere in the world, South African women lag in terms of stock market participation. “Men are twice as likely as women to invest in shares, ETFs, cryptocurrencies and offshore – and 50% more likely to have unit trusts,” says Brandon de Kock, director of storytelling for BrandMapp. This was one of the findings in the annual BrandMapp survey, a large, independent study of economically active South African adults.

These results are mirrored in other surveys, such as the 2020 10X Retirement Reality Report: 44% of women don’t save or invest, and 53% say they don’t have a retirement savings plan. Only 13% of women said they invested their money for growth, compared with 22% of men.

The following commentary from the 10X report paints a bleak picture for all, irrespective of gender: “A frightening number of people have not formally planned how they will fund their

retirement. Of those who have, most don’t know whether or not they are on track to meet their goal to be able to support themselves in retirement, never mind in any comfort.” But as the report also points out, women tend to live longer than men do, which exacerbates the inadequacy of their retirement funding.

EasyEquities online investment platform keeps track of the gender split across their investment products. The pattern of lower levels of investment by women is reflected in their metrics too: of their almost 450 000 investors, 40.18% are female, and 59.82% are male.

Further metrics in the 10X report showed that women are a little more likely than men to be cash savers: 32% of female respondents said they saved money, compared with 28% of male respondents. BrandMapp also saw greater uptake of savings products among women. While this might sound positive, savings do not generate the necessary inflation-beating returns mentioned by Gardner.

On self-perceived attitudes to risk, the survey showed that women are far more risk averse when it comes to finances.

Behavioural research echoes this. “In our research, we found that females were more likely to be part of the ‘avoider’ archetype, which means that they invest in relatively safe assets and show far less engagement with their portfolios,” says Paul Nixon, head of technical marketing and behavioural finance at Momentum Investments. “This was in stark contrast to the ‘assertive’ archetype, which is predominantly younger and male.”

But the tide is turning. “Women are taking up investing and we have moved the needle on this a lot over recent years,” says EasyEquities chief executive Charles Savage.

Gardner has also noticed increased participation in the stock market among women. A high proportion of her clients are female, and she says they are not afraid of taking risk. “My clients want to earn the returns, and to earn the returns, they understand that they need to take

risk. But I suspect that they are among the minority of women who have taken control of their finances.”

As for the rest, Gardner does not mince words: “It’s an absolute must for women to take their heads out of the sand. They need to take control of their own financial situation.”

Returning to the idea of risk, she adds that understanding it is crucial. Risk is a personal issue in that markets go through cycles, and there is the risk that you may need to disinvest your money at a time when the market is down, Gardner explains. “Over the long term, equities have outperformed any other asset class. But if you had a sum of money invested at the beginning of March 2020, then needed to withdraw it on 24 March 2020, you would have crystallised a 30% loss. If you had waited a few months, you would have made back the sharp drop in the

local stock market in those few weeks, and if you’d waited a year from the beginning of March, you would have made a positive return on your investment.”

Age is another facet of risk. Pension funds take age into consideration, says Gardner. “The closer you get to retirement, the less risky assets they put you in, and when they say less risky, they mean less volatile, which often equates to lower returns. When you’re younger, if there is a crisis and the market falls, you can comfortably sit out the volatility, but if you are close to retirement and do not have sufficient funds, you may have to consider staying in the more volatile asset classes to make up for the lack of initial funding of your investment – a decision based on personal risk and return expectations, which requires everyone to educate themselves.”

But there’s another key point: the need to diversify. “Diversification is a risk mitigation strategy; you’re making

sure you don’t have all your eggs in one basket,” says Gardner. “Never have all your money in one asset class or geography.”

The gender pay gap – the average difference in pay between men and women in the workforce – is welldocumented globally. StatsSA’s Inequality Trends report, released in 2020, stated that “Female workers earn approximately 30% less, on average, than male workers.” There are many reasons for this pay gap, including the differences in the types of jobs chosen, hours worked, levels of education, and experience, but the gap often persists even when men and women do work of equal value.

For Gardner, lower earnings cannot be held up as an excuse for not investing.

“I get that we earn 30% less than men, and I know that for households on the breadline it’s hard to put away R100, but the risk of not doing it is too great.

“EasyEquities are game changers here. By designing a product that allows people to invest small amounts, they are making investing accessible,” she points out. In fact, you can invest as little as R10 or less – there are no minimums.

“You must see a financial adviser,” says Gardner. “Go onto the Financial Planning Institute (FPI) website to find a Certified Financial Planner (CFP).” But she adds this rider: “...if you can find one who will talk to you”.

Financial advisers use various remuneration models: some charge a set fee, either for their time at an hourly rate, or for a particular activity; some charge a monthly or annual retainer that covers all tasks done, regardless of the time they take; some work on an assetbased consulting fee, where on-going advice and maintenance is provided on a percentage of a client’s assets; and some work on commission.

“If you can find one who will talk to you”? By this, Gardner is referring to

the assets under advice remuneration model. “Some financial advisers charge a percentage of the client’s investments,” she explains. “If you invest R100 and your adviser charges 1%, they’re getting R1 for their services. It’s a simple commercial calculation: they are more likely to work with the person who is going to invest a million rand because 1% of a million rand generates R10 000 in income for the adviser, whereas with the person who invests R100 000 it is only R1 000.”

Gardner raises the issue of jargon. “People want to invest their money with the smartest person they can find. And how do asset managers prove to you, the retail investor, that they’re the smartest asset manager in town? They speak a language that is above and beyond most people’s comprehension, using terms like ‘price-earnings ratios’, ‘internal rates of return’ and ‘EV to EBITDA valuations’. That just scares half the people away, which is a shame (and partly the reason I wrote a book – to make people more comfortable with the world of investing).”

There’s jargon, and then there’s being patronised. “Women who responded to a US survey said that financial services providers talk down to them, and are full of jargon,” says Nixon, citing a publication by Meir Statman, a professor of finance in the US, for the CFA Institute Research Foundation. “Financial advisers are predominantly male and look to the male in the relationship to make the decision, which leads to disengagement in women,” he adds.

Local anecdotal experience bears this out. “I’ve been told by several women who have gone with their husbands to male financial advisers that the adviser talks mostly to the man and talks down to her, as if she doesn’t know what’s going on,” says Gardner. “When that happens to independent, strong-minded women, they won’t deal with that financial adviser.”

For Janet Hugo, a CFP and director at Sterling Private Clients, the issue of being “talked down to” has personal

resonance. “This is the very reason I chose to complete the postgraduate and advanced postgraduate qualifications in financial planning; my husband’s financial planner couldn’t explain things to me and I felt like my concerns were being dismissed.”

Hugo stresses the importance of finding the right financial adviser for you. “It’s the adviser’s job to interpret the complexity of investments and tax so that you can understand it,” she says. “Interview financial advisers until you find one you connect with, as that person is going to be the financial director in your life. They’re not going to be the CEO – you are – because you make the final decisions, but you need to be fully informed by them.”

Being fully informed comes at a price, Hugo notes. An hourly rate might be the most cost effective, but not everyone can afford this out-of-pocket expense. She charges an hourly rate, but finds that few people are happy with this payment structure – besides professionals such as lawyers and doctors who work on hourly rates themselves.

Though Hugo has never sold products for commission, she says this could be an option if you can’t afford fees, as you still benefit from financial advice this way. “Don’t use fees as an excuse for not making an effort to get a retirement plan,” she adds.

“Rather than measuring the gender divide in investing, the focus should be on the numbers of female versus male financial advisers,” Gardner suggests. “Male domination of the industry is one of the barriers to entry for female investors. I can only hope that there will be more female role models so that women can go, ‘Oh, hang on, the stock market isn’t just for men,’ because that’s the way it looks at the moment.”

As greater numbers of women become involved in financial planning and occupy more leadership roles across the financial services industry, this will make a big difference, says Nixon.

The proportion of female financial advisers registered with the Financial Planning Institute is currently 34%.

But even though the zeitgeist is changing, South Africa is still a very patriarchal society, says Nixon. Having more women in financial planning won’t help if women themselves believe that finances are the domain of males, he notes. Gardner concurs: “There is an ingrained societal norm that men will provide, and until that changes, financial behaviour won’t change either.”

Hugo urges women in relationships to be involved in financial decision-making, rather than risking a hard wake up call down the line.

Gardner says EasyEquities has intermediated the financial services and asset management industry by enabling people to invest directly. The platform provides information about

investing, with the option of opening a demo account to build confidence. Easy Equities pegs their costs at 64 cents per R100 invested.

Another financial institution that provides an accessible solution is Momentum, through its Velocity Club: six-month subscriptions at R99 a month to “Get financially healthy” or at R199 a month to “Get wealthy”. These include interactions with a personal relationship consultant. How often, though? “At the start, the client and relationship consultant agree on the frequency and medium for their check-ins,” explains Andiswa Gqwaru, client success lead at Momentum. “The frequency depends on the client’s money challenges and goals. The minimum is once a month, and the client is able to contact the consultant at any time if they have a specific need.”

The consultants and financial planners are salaried employees and do not earn commission, says Gqwaru. The financial

plans do not necessarily include product recommendations, but if they do, and the client takes up any of them, Velocity Club earns commission.

“Just start,” Savage urges. “And the sooner the better, because time is the investor’s greatest asset, not which shares you buy. The later you leave it, the harder it becomes to win capital back from consumption. The best investors develop investing habits first and what’s left over after investing is for consumption ‘fixes’.”

“Don’t let your fear of making a mistake stop you from taking the first step in the journey,” says Hugo. “Yes, you can optimise by looking tax efficiency, but even if you start with a ‘vanilla’ balanced fund with a long investment horizon, it’s better than doing nothing. The first step is saving something. So is it going to be the new shoes or the savings plan?”

Choosing to share your life with someone could be the most important financial decision of your life – especially if you are a woman. Whether you marry or not, don’t embark on a committed relationship without considering the long-term implications of merging love and money.

By Roz WrottesleyWhatever cocktail of emotions drives a couple to make a lifelong commitment to each other, optimism is an essential ingredient, not least when it comes to money.

Yet, for all the benefits of togetherness, from shared costs to tax breaks, it is indisputable that women tend to be the losers when plans and expectations derail, and are more likely to face a financial crisis after the departure or death of a life partner – whether they are married or not. If there’s anything we have learnt from 18 months of the global pandemic, it is that life can change very suddenly in ways that are inconceivable in the good

times. Women’s Month 2021 has the important theme of gender equality, but it might be even more relevant in this moment to focus on preparing for the unexpected.

Even in the normal scheme of things, there is more at stake financially for women than men in lifelong relationships. For men, the priority is to work and earn well for as long as it takes. The focus is on maximising skills and opportunities and providing options for the family. As long as they succeed financially by the prevailing standards, it’s job done for men.

For women it is rarely that simple. Inequality is still baked into the world of work (see “The gender pay gap”,

well aware from the start that work might be interrupted, limited, or cut short by child-bearing and/or other family responsibilities. We are the compromisers and that can leave us dependent on our partners and on chance in an uncertain world.

So don’t take money for granted in the security of a committed relationship. There are many things to think about, starting with the status of the relationship: marriage or cohabitation?

If marriage, which regime should you go for?

Lianne Lutz, a registered financial planner and founder of Women’s Wealth in Johannesburg (womenswealth.co.za ), outlines the main features of the three options that are open to you:

1. In community of property

• There is no contract; it is the default mode.

• You share all assets and liabilities. This includes debt, so if your spouse-to-be has a lot of debt when you marry, or accumulates debt later, you are equally responsible for it.

• Similarly, the insolvency of one means the insolvency of both. Neither party has protection against the misfortunes of

their spouses.

• On the plus side, it provides equality. The parties are entitled to an equal share of the joint estate throughout the marriage, as well as in the event of divorce, and they have the same powers over the administration of the estate.

2. Out of community of property without accrual

You sign an antenuptial contract (antenuptial contract) before you marry, to ensure that your estates remain entirely separate. It’s a case of each to his/her own, both in marriage and in the event of divorce.

• You declare your assets before marriage and whatever you acquire after that is your own, whatever the source: earnings, investment returns, inheritance, gifts, and so on. There is no obligation on either party to share their assets, or to take responsibility for the debt or insolvency of the other.

• Since the accumulation of wealth by one partner does not affect the estate of the other, the process of getting divorced may be quicker and less costly.

• On the negative side, an antenuptial contract may be used to protect the assets of one spouse from the other from the start. A woman without financial means of her own might sign up because she supports financial independence, without realising that it leaves her without protection if her ability to work and earn is compromised

by circumstances in future.

• Spouses whose contribution to the prosperity of the partnership is unpaid (usually, but not always, women) need to ensure that they are remunerated appropriately during the marriage.

3. Out of community of property with accrual

This regime retains the separation of estates at the time of marriage, but recognises couples as equal partners during the course of the marriage by splitting any growth in assets equally. It is widely accepted as the fairest form of marriage and applies automatically if an antenuptial contract does not specifically exclude accrual.

• The estates of the marriage partners are valued before marriage and again in the event of divorce. Each partner retains his/her original estate, but the assets acquired during the marriage are divided equally. A few assets may be excluded from the accrual calculation: anything inherited, any assets that are specifically excluded in the terms of the antenuptial contract, and any gifts or donations exchanged between the partners.

• It’s important to note that the accrual system does not apply to debt. This protects the parties as intended by the antenuptial contract, but it does mean that it may be more difficult for the spouse with less financial power to obtain credit during the marriage.

Whatever the marital regime, being legally married in South Africa creates what is known as a “reciprocal duty of support”. This means that each spouse has a duty to provide for the other when it comes to accommodation, clothing, food, healthcare and other necessities.

If marriage is not part of your plans, you need to understand fully the long-term implications of living together, more formally known as cohabitation. Sue Torr, a lawyer and managing director of the financial planning firm Crue Invest in Cape Town, says many couples refer to themselves as “common-law spouses”, but this is misleading. “The fact is that no legal status is conferred on couples who choose to live together without getting married,” she says.

One important consequence of this is that unmarried couples have no duty of spousal support, so a partner who becomes unemployed, disabled, ill, or unable to generate an income for any reason, is in a precarious position. In the absence of the most fundamental duty/ right that marriage bestows on couples, it is vital to know where you stand in relation to the following critical financial matters:

The Medical Schemes Act recognises the person you live with as a dependant and you are permitted to add them to your medical aid and gap cover policies as an adult dependant. Similarly, regardless of your marital status, your minor children (from the existing relationship or a previous one) can be added as child dependants on your policies.

It is important to understand your rights fully in this highly regulated area.

• Beneficiaries. Like any married couple, you and your partner are entitled to

nominate each other as beneficiaries of your respective retirement funds, but don’t expect your nominations to be binding on the funds’ trustees. The Pension Fund Act requires trustees to take into account everyone who is financially dependent in any way on the deceased member and distribute the benefits accordingly. Financial dependants can include minor children, a child from a previous relationship, elderly parents … even a sibling who has received support from the deceased before. Dependants always take precedence over non-dependent beneficiaries.

• Claims on pension fund interest on divorce. In respect of pension, provident and preservation funds, the “pension interest” refers to the total benefit the member would have been entitled to if he or she had resigned their membership on the date of the divorce. In respect of retirement annuities, the pension interest is the total amount of the member’s contributions up to the date of divorce plus simple interest at the prescribed rate. The right to claim a share of a member spouse’s pension interest when a relationship comes to an end is strictly limited to couples who are legally married, leaving unmarried partners high and dry. This is particularly unfair if the non-member partner has been a stay-at-home parent, while the working partner has been in a position to invest in his/her employer’s retirement fund.

From a tax perspective, cohabiting couples enjoy the same status as married couples. In terms of the Income Tax Act, a spouse

includes a same-sex or heterosexual union which the South African Revenue Service (SARS) is satisfied is intended to be permanent. In the absence of any proof to the contrary, couples living together in a long-term partnership are deemed to be in a union without community of property. Consequently, the following important tax breaks apply:

• Donations tax: The broader definition of “spouse” in terms of the Income Tax Act means that donations between cohabitants are not subject to donations tax.

• Transfer duty: Anyone who inherits immoveable property is exempt from paying transfer duty on that property, and this includes cohabiting couples. In other words, if your long-term partner bequeaths property to you, you will not need to pay transfer duty and the conveyancing fees will be paid from the deceased estate.

• Estate duty: The estate duty abatement of R3.5 million applies to cohabiting couples who fall within the definition of “spouse” in terms of the Estate Duty Act. This includes people in customary unions and samegender or heterosexual unions that SARS recognises as permanent.

As a cohabiting couple, you are free to nominate each other as beneficiaries on your respective life policies. If you have been nominated on your partner’s policy

and he or she dies, the proceeds of the policy will be paid directly to you. If you fall within the definition of “spouse” for tax purposes, the proceeds of the policy will not be regarded as property in the deceased estate and will not be subject to estate duty.

When it comes to providing maintenance for children, our law does not take into consideration the marital status of the child’s parents. All parents – whether married or not – are responsible in terms of the Children’s Act for the maintenance of their children.

Bear in mind that a cohabiting partner has no legal claim for maintenance from the other partner, should the relationship end. While married couples can rely on the provisions of the Divorce Act when claiming maintenance following a divorce, no such remedy is available to life partners who decide to part ways. If you are a stay-at-home parent in a cohabiting relationship, this could leave you in a financially vulnerable position should your relationship come to an end.

The ownership of property can

be particularly tricky in unmarried partnerships, since everything that is acquired belongs to the partner who acquired it. If you split up and your home is registered in your partner’s name, he or she has the right to evict you from the property. It is not uncommon for partners with no legal claim on a property to contribute to bond payments and the upkeep for years, and then struggle to prove it when the relationship breaks up.

Something that all cohabiting couples need to take into account is that they enjoy no right of inheritance should their life

In 2021, women are still more likely to earn less than men for the same work, according to several surveys undertaken in the last three years. Most recently, an article published in the University of Stellenbosch Business School’s Management Review, based on recent research, described South Africa as having “a stagnant median gender pay gap of between 23% and 35%”, compared to a global average of 20%. Women in the middle and upper wage bands are affected most, according to the research.

Two studies published in 2019 echo these numbers. Stats SA's November 2019 Inequality Trends in SA survey found that salaried women were earning 30% less than their male counterparts – a statistic that is all the more alarming when you consider that salaries account for at least 70% of all household income in this country.

Exactly two years ago, to mark Women’s Month, the online job portal Giraffe, which places medium-skilled workers in various service industries, analysed its database of nearly one million job candidates to make its own contribution to the pay inequality debate. It concluded that women earn, on average, 25% less than men in the same jobs and that the gap is widest between the ages of 36 and 44. It did not cover senior executive and highly skilled jobs, but it found that female managers earned 21% less than males.

The USB research identifies lack of transparency (euphemistically known as privacy) around the exploitation of women as the main obstacle to change, and it’s not too far-fetched to conclude that the same secrecy and silence trickles down to all levels of money management in society, including in the home.

partner die intestate (without a will). At the very least, ensure that you and your partner get professional help to draft and sign a cohabitation agreement addressing the risks that come with cohabitation. But above all, eliminate intestate succession by having valid wills.

Even financial advisers can be unprepared for life’s financial setbacks. Lutz was a pharmacist before her exposure to women’s financial struggles in the healthcare sector prompted her to retrain as a financial planner and start Women’s Wealth. A few years later, after 11 years of marriage, her 48-year-old husband died suddenly of an aneurism while they were on holiday.

“Even though I was so involved with women and their finances, there was so much that was not in place for me at that moment. It made the shock so much worse. I had no idea where to find important documents such as our marriage certificate, title deeds for our home, our birth certificates...

“It’s important to have your own bank account and savings, because bank accounts are frozen when someone dies – even joint accounts. Even if he had been incapacitated, I couldn’t have accessed his accounts because I didn’t have the passwords.

“Fortunately, he had a life policy, which paid out within a couple of weeks. That meant I didn’t have to wait for the estate to be wound up to get access to money. And luckily, his accountant had a copy of his will.

“It could have been even worse, but it made me so much more conscious of the need for independence in financial

matters. For a start, every woman should have a file containing the antenuptial contract (if applicable) and her partner’s legal documents, bank details, policy documents, will (certified copy), credit card details, ID (certified copy) and contact details for any accountant, lawyer and/or financial adviser she doesn’t know personally.”

Oprah Winfrey said: “A man is not a financial plan.” In those few words, she expressed what we all know: that women are too ready to delegate financial management to their partners. In her experience, says Lutz, women who don’t work, or work for relatively little money, often feel they have no right to a say in financial matters.

The truth is that spending and saving needs to reconcile the priorities of both parties. “Establish an open dialogue from the start, and acknowledge your strengths and weaknesses,” says Lutz. “It can be daunting to break through the privacy barrier, but it gets easier.”

Make sure you are included in some – if not all – meetings with financial planners, accountants and tax consultants. A financial planner once told me that it was not uncommon to have a male client for decades, through thick and thin, without meeting the spouse or partner. That meeting would take place at the worst possible time, when the relationship had ended in divorce or death.

“A genuinely caring partner might not want to burden you with money matters, but don’t allow yourself to opt out,” says Lutz. “Insist on knowing the incomings and outgoings on which your household depends.

“They are your finances, like it or not, and there is every chance that you will have to get involved one day.”

aazia Ganie is head of investments at NMG Benefits, a specialist employee benefits firm. NMG Benefits, along with NMG Capital and NMG Consulting, are subsidiaries of the global NMG financial services group.

NMG Benefits provides a full set of solutions to meet the needs of employers, medical schemes, retirement funds, employees and retirees.

Can you provide some background on how you became interested in this area of finance, your qualifications and work experience?

To be honest, I fell into this career accidentally. I completed my BCom at UCT with the intent of becoming a Chartered Accountant. During one of the holidays, I did some vacation work and realised that the CA route was not for me. I started my first job at Old Mutual in what was then known as the Investment Business Unit. This was a dream job for someone fresh out of university. The work structures for graduates were not yet fully in place but a graduate intake was deemed necessary. The programme offered a very gradual introduction to the world of being gainfully employed. I learnt a lot from that first stint at a big corporate – politics, discrimination, and friendships among others. I later joined Fifth Quadrant (now Willis Towers Watson), which effectively launched my career in asset consulting. At the onset, I was very nervous, mainly because I had no idea what an actuarial consulting company does. Asset consulting is not a job you can google and get a firm definition of – information is limited (as was the use of Google back then). I seemed to have found my calling though.

After a few years, I decided to merge my career and social life by travelling abroad to broaden my experience. I was fortunate enough to work at a number of reputable consultancies in London and obtained the Chartered Financial Analyst (CFA) qualification under my belt as well. Eight years later I moved back to South Africa, spending the following 10 years at Alexander Forbes as a principal consultant. After familiarising myself with the local market, the exciting role at NMG became available. And the rest, as they say, is history...

Can you detail your role as head of investments at NMG, explaining the services your team provides within NMG Benefits?

NMG Benefits’ service lines include healthcare consulting, retirement fund consulting, retirement fund administration, actuarial services and retail. I am responsible for investments at NMG Benefits. My team works with pension, provident, and medical aid funds to design portfolios which will produce strong long-term returns with the lowest possible fees. Our clients are medium to large-sized employers and funds across South Africa and Namibia. We also offer the NMG Umbrella Fund for employers who want to outsource some of the governance functions of retirement benefits for their employees. The NMG Umbrella Fund is one of the top-performing umbrella funds over the long term.

Our day-to-day work includes research, portfolio modelling, assessing regulatory change, developing investment strategies, and working with clients to monitor progress. We cover markets to infrastructure and everything in-between. In monitoring global trends, we collaborate with our sister company, NMG Consulting, leveraging off their comprehensive research and insights into many of the world’s largest pension

funds. We come across both exciting opportunities for our clients to invest in, and traps which we help them avoid. It’s an exciting job, which is different every day.

We are a proudly South African and truly independent employee benefits consulting firm, offering our clients unbiased, strategic advice that delivers superior investment performance. This is aligned with our mission to give the best advice to every member.

Can you give readers some insights into leadership: how you motivate your team to outperform?

I joined a very driven team of talented youngsters and not-so-young-stars. I want to lead with integrity and by example. My aim for my team is to work with them to meet not only the company’s goals but also to bring out the best in each one of them. As they say, if we are all doing what we love, we won’t need to work a day in

our lives. My purpose is to create a structured environment that’s also conducive to growth and creativity. I aim to ensure that we are adequately resourced so that the team can have a well-adjusted work/life balance – but also to factor in time to be innovative and just be able to apply our minds well. I have an open door/teams policy and strongly encourage the team to discuss any concerns they have with me. NMG Benefits is highly supportive of employees in terms of personal growth, career development, support for related studies and providing leadership programmes for up and coming talent. Covid-19 has not been kind to team dynamics, but I am pleased to acknowledge that we have managed to maintain a good team spirit despite the difficulties.

Where do you see your company in the next five years, in terms of its provision of financial services and

its geographical footprint in Africa? NMG Benefits has the potential to be a disruptor within our industry and I am expecting that to come to fruition over the next 5 years. The Board are determined to see this coming true and have invested heavily in its success. The NMG Group is already global, but we aim to become a household name within the SADC region, having already made huge in-roads in Botswana

Do you have some advice for women who have an interest in a career in financial services?

Financial services has become a lot more diverse since the start of my career. I remember clearly attending in-person conferences and it was obvious when it was a finance related event because unlike most other large scale events, the gentlemen’s toilets always had a longer queue than the ladies. These days, companies have recognised that diversity adds to the depth and richness of a team, and women are welcomed and strongly encouraged to join the industry. We often also bring a different skillset and way of thinking – which is desirable within investments to add to the diversity in decision making and some may say in bringing a more risk-cognisant style. Companies have started rethinking their policies to accommodate mums and mums-to-be to have successful careers without having to be concerned about the adverse impacts of things like maternity leave. While these changes may be slow in some places, I am confident that they will happen. If you are drawn towards investments or finance, do not be swayed by the fact that the current individuals representing the industry may not look or think like you. Your alternative way of looking at the world may well be exactly what is needed. –Feature sponsored by NMG Benefits.

Tof the coronavirus around the world and low rates of vaccination have darkened the outlook for the world economy. Africa stands out as a sore thumb with a population of more than 1.4 billion people, of which about 1.1 billion live in Sub-Saharan Africa. Of these people about 800 million live in highly indebted poor countries (HIPCs). Most countries in Sub-Saharan Africa are in a desperate need to vaccinate their populations to stave off humanitarian and

At the time of writing, in July 2021, more than 23% of South Africa’s population of about 59 million had been tested, of which about 16% tested positive while more than 63 000 or 3% of those tested had succumbed to the virus. The South African Medical Research Council (SAMRC) estimate of the number of excess natural deaths since May last year was more than 182 000, thereby indicating that, given the known infection and death rates, up to 70% or more of

infected. The situation in the rest of SubSaharan Africa is dire, to say the least.

The total population of Sub-Saharan Africa, excluding South Africa, is about 1.08 billion while the population of countries for which detailed coronavirus statistics are available is about 977 million. As of July, a mere 2.4% of the 977 million had been tested since May last year. Of those, about 7.8% had tested positive and 2% of positive cases had succumbed to the virus.

A grave concern is that countries with the largest populations in this part of the world have some of the lowest testing rates. Nigeria with a population of 206 million has a testing rate of 1.1%, Ethiopia (115 million people) 2.5%, Democratic Republic of Congo (90 million people) 0.1%, and Sudan (44 million people) 0.4%.

The low levels of testing in Sub-Saharan countries ex-South Africa can be ascribed to the individual countries’ medical facilities, as there is a distinct relationship between the number of hospital beds per thousand people and the testing rates: 57% of the all countries and two-thirds of the HIPCs have a bed capacity of less than one per thousand and a testing rate below 5% of the population. The populationweighted average bed capacity for the region is about 0.7 per thousand.

The infection rate in Sub-Saharan Africa ex-South Africa is therefore a lot higher than what the official numbers suggest. But how much worse, you may ask. A rise in mortality rates of people older than one year over a given period is probably an acceptable indication of excess deaths in a country. There are other causes or diseases apart from the coronavirus that contribute to a rise in mortality rates, but it could provide a clue to the actual coronavirus infection numbers.

The latest mortality rates of some of the selected largest countries compared with the rates in 2019 are quite revealing. If the growth in mortality rates is attributed to the coronavirus alone and compared to the official deaths as a result of the coronavirus since the outbreak of the pandemic last year, Nigeria’s death toll as a result of the coronavirus could be 14 times higher than normal and that of the Democratic Republic of Congo (DRC) 11 times higher. In Ethiopia and Uganda, it could be three times higher. In numbers, it means that

in these four countries alone the actual deaths due to the coronavirus could have been more than 60 000 compared to the reported 9 000.

In South Africa’s case, the excess deaths of 46 000 closely matched the official deaths of 64 000 caused by the coronavirus. If the current total deaths to confirmed case ratios are used it appears that the total infections in Sub-Saharan Africa excluding South Africa could be as high as more than 6 million confirmed cases.

In stark contrast to where South Africa managed to flatten the curve of total cases for several months after the first two waves of resurgence, the Sub-Saharan Africa’s curve ex-South Africa has been rising in a straight line. The curve can be attributed to the individual countries experiencing different stages in waves. Some are in a declining trend while others find themselves climbing new waves.

The DRC’s infection rate tends to lead South Africa’s rate while the trend in Nigeria’s rate coincided with South Africa’s trend in the first two waves. Ethiopia’s trend was countercyclical to South Africa’s.

Delta variant

World Health Organisation regional director for Africa, Dr Matshidiso Moeti, on 8 July said that “16 African countries are now in resurgence, with Malawi and Senegal added this week, and the Delta variant has been detected in 10 of these countries”. According to the Africa Centres for Disease Control and Prevention (CDC), Uganda, DRC, Namibia, Rwanda are some of the worst hit.

The outlook for some of the highly populated countries, such as Nigeria, Ethiopia and Sudan is not good, as they have escaped the third wave until now. But it appears that they are about to face it, as the dreaded Delta variant hit the ground in

Nigeria in the second week of July.

With less than one percent of SubSaharan Africa fully vaccinated, it is a race against time. “If we do not vaccinate at speed, our economy will continue to be damaged,” said John Nkengasong, director of the Africa CDC, quoted recently by Bloomberg. “You will see a fourth, fifth and sixth wave and it will be extremely difficult for us to survive as a people.”

The sense of urgency led to President Ramaphosa’s announcement of an agreement that will boost the delivery of Johnson & Johnson (J&J) vaccines to South Africa and the rest of Africa. The J&J vaccine requires only a single dose whereas other vaccines require two jabs to ensure full vaccination.

Of the 250 million doses scheduled for 2021, 30 million will be produced for use in South Africa and the rest for other countries on the continent. Another 250 million doses will be provided through 2022, mostly to other countries in Africa.

I am afraid that Sub-Saharan Africa will face severe economic hardship in coming quarters. Botswana, Equatorial Guinea, Eswatini, Mauritius, Namibia, Rwanda and South Africa are the best prepared to get their populations fully vaccinated in a relatively short time. That is due to their medical facilities based on the number of the populations tested and the number of hospital beds available per one thousand people. Among the said group only Rwanda is classified as a HIPC.

Due to long distances to travel to get vaccinated, the limited medical facilities and apparent shortage of qualified personnel, as witnessed in the lack of coronavirus testing, to administer the jabs leave little prospect of a significant proportion of other Sub-Saharan Africans to be vaccinated in coming quarters.

Hospitals will be overrun and deaths will mount.

Sub-Saharan Africa ex-South Africa is a poor territory. The population-weighted gross domestic product in relation to the number of inhabitants, or GDP per capita, is US$1 290 for the region. In HIPCs it is just over US$900, compared with just over US$5 000 in South Africa. Any delay or deferment of the resumption of economic growth due to a limited or phased-in rollout of the vaccine will severely affect the breadwinners in these countries.

At risk is foreign direct investment – one of the main pillars of current and future economic growth. The biggest prospect for growth in Africa in future is in the East and Central Africa region on the back of China’s One Belt One Road strategy and specifically the Maritime Silk Road, where three economic passages will be knitted together through a chain of sea ports from the South China Sea to Africa that will

direct trade to and from China.

The prevalence of the coronavirus and its variants will undoubtedly stall foreigners from investing in certain projects as they are scared off by internal political strife and the prevalence of the viruses.

The deterioration of household livelihoods is a possible breeding ground for adverse political environments, instability and terrorism. The World Bank’s political stability index (PSI) measures perceptions of the likelihood of political instability and/or politically-motivated violence, including terrorism.

On a scale of 0 to 100, where 100 is the least likelihood and 0 the most likelihood of instability or unrest, Sub-Sahara Africa ex-South Africa has a population-weighted PSI of 17. It means that the region has a significant likelihood of political instability. Any adverse movements in some parts of

the region are likely to push the number lower and have a negative impact on financial markets in that region.

At this stage, South Africa’s PSI score is 40 out of 100. But it is not to say that it will hold, given the current lawlessness and disrespect for the judiciary*.

So as things stand, Sub-Saharan Africa is in trouble. No one knows what the individual countries’ actual debts in relation to the underlying economies are. What we know is that the sub-continent is entering a J-curve. Things will deteriorate before they improve. The virus rules, OK?

Ryk de Klerk is analyst-at-large. Contact rdek@iafrica.com. He is not a registered financial advisor and the views expressed above are his own. *The article was written during the breakout of riots and destruction/ looting of property in KwaZulu-Natal and Gauteng.

Gareth Stokes compares investors’ growing interest in companies that score highly on environmental, social and governance criteria with the ‘irrational exuberance’ of their love affair with technology stocks and their attraction to higherrisk instruments such as cryptocurrencies

Environmental, social and governance (ESG) factors now rank alongside risk and return as key factors when making asset allocation decisions. The fervour with which global asset managers are throwing their weight behind impact and sustainable investment opportunities is not only evidenced by the massive inflows to ESG-focused equities, exchange traded funds and unit trusts in 2020/21, but by its naked display at most investment outlook roadshows over the past year or two. It would seem that ESG is the only emerging investment theme with the legs to keep pace with technology, and whereas ESG is grounded in common sense, the technology boom is showing signs of dizziness in an atmosphere of irrationality.

Growth stocks dominated equity market returns in the immediate recovery following the March 2020 pandemic crisis, driven by investors’ hunger for exposure to firms that could generate revenue in a remote work, stay-at-home environment. The result was that the US-listed FAANGs (Facebook,

Amazon, Apple, Netflix and Google) and Chinese technology darlings such as Alibaba and Tencent rewarded investors with stellar returns last year; despite having been on multi-year highs when Covid-19 first surfaced. There are strong arguments for the record high valuations placed on many of these companies, but some asset managers are concerned that technology-backed growth stocks cannot maintain this level of price exuberance indefinitely.

An Allan Gray and Orbis Investments update held in May this year revealed that US equities have never been dearer. A decade ago, the cheapest US-listed companies were trading at six times earnings and the most expensive at around 25 times; today, the cheapest firms are still stuck at six times, but the most expensive are at nearly 80 times! “We are seeing a disconnect between asset prices, on the one hand, and incomes, on the other … with the ratio of US equity market capitalisation to GDP at an all-

time high,” said Jacques Plaut, a portfolio manager at Allan Gray. He observed that commodity prices and house prices were increasing way faster than incomes in the US and most other developed markets too.

Investors’ trading behaviours in crypto assets, individual shares (think Game Stop) and SPACs (special-purpose acquisition companies) were held up as examples of how uninformed investors with too much cash are driving individual shares (and even entire asset classes) deep into bubble territory. Throughout 2020 and during the first half of this year, Ms and Mr America were throwing their pandemic support cheques at trading platforms like Coinbase and Robinhood in the hope of riding the next penny stock or cryptocurrency “to the moon”.

The cryptocurrency universe expanded to almost US$2 trillion, while GameStop, an obscure and struggling share, surged from less than US$20 to US$350 in a matter of two weeks. SPACs, a US equity market phenomenon described as “blank cheque companies”, raised nearly US$200 billion from investors in 2020 and were close to exceeding this amount by mid-May 2021. “Another danger sign is that, towards the end of last year, there was so much demand from retail investors to buy stocks and options that certain global brokerages could not cope,” said Plaut.

These opening paragraphs paint the irrational return expectations that retail investors are demanding from asset managers, with scant regard for such trivialities as asset allocation strategies or portfolio benchmarks. It also explains why asset managers are under increasing pressure to expand their investable asset universe to include crypto-assets such as cryptocurrencies and non-fungible tokens (NFTs).

Most are taking a cautious approach, constructing portfolios in line with their investment mandates, appropriately matching risk and return objectives. More importantly, asset managers are starting

to assess all investments, regardless of asset class, through an ESG lens. In South Africa, this ESG slant could see longerterm investor capital, most notably that in the retirement fund industry, shift away from listed companies towards opportunities in private markets (more on that later). It is worth noting that the focus on impact and sustainable investing is being driven from the ground up, by consumers.

The mortality shock of the pandemic, the growing realisation that climate change is “happening”, and renewed concerns about the impact of inequality and poverty on the global social construct have refocused ordinary consumers on the need to get maximum impact from their investments. And they in turn are pressuring asset managers, employers, financial advisers, institutional fund managers and retirement fund trustees to use their life savings to make a real difference.

What does this emerging ESG focus mean and how does it play out in the investing and retirement saving environments?

In June this year, Sanlam Investments hosted a panel discussion under the banner: “Critical Conversations: The (South) Africa Investment Opportunity”. The debate centred on the role of the investment community in contributing to impactful and sustainable investing outcomes for South Africa and Africa. Andrew Johnstone, chief executive at Climate Fund Managers, suggested that the aim of investing activity had shifted from maximising dollar returns toward striking a balance between the usage and replenishment of the planet’s resources.

At the same event, Nersan Naidoo, chief executive of Sanlam Investments, noted that asset managers would always interrogate the expected financial returns from investments; the big change is that the impact of these investments is reaching parity in guiding decisions: “We have to start seeing the world through the dual lenses of financial return and positive impact.”

Private and listed equity Investment via private markets is seen as the only way Africa will make up the additional US$150 billion per annum in infrastructure investment needed for the continent to meet the SDGs by 2030.

Johnstone noted that infrastructure was essential for economic growth as it serves as an enabler of trade; offers a safe-haven for investor funding; and remains the best tool to manage and mitigate climate change and adapt to the consequences of it. He added that it would take coordinated efforts from asset allocators, businesses and retail investors – working in concert with government – to channel capital into the right opportunities.

The private sector will play a significant role in expediting these efforts.

“Businesses are influencers and decision makers in the allocation of capital,” said Andile Khumalo, chief executive of Khumalo Co, during the Critical Conversations debate. “What is the point of business if the money we allocate and decisions we make do not serve society?”

The panel agreed that a mass mobilisation of capital, spearheaded by private-public partnerships, was necessary to address the continent’s infrastructure investment shortcomings, with Johnstone chipping in that blended finance was probably the best way to augment small amounts of government capital with trillions in private market funds.

The ESG debate is slightly different in the South African listed company context. Commenting during an “Investing Green” presentation in June, Nigel Green, group personal account chief executive at deVere, observed that the growing focus on ESG factors in investment decision making could see ESG replace “Baby Boomers” as the main trend driving financial market returns. “There is a massive trend towards ESG investing and it is compounding,” said Green, pointing out that fund managers had seen a 20% increase in fund flows to ESG opportunities over the last 12 months.

These fund flows have been driven by consumer choice, government incentives to produce and consume “green” goods and services, and the achievement of

return parity between ESG and non-ESG funds. In the past, ESG investing resulted in a trade-off between conscience and return; nowadays investing with due concern for E, S and G factors is expected to deliver market returns or better. For asset managers, the ESG trend involves ensuring that clients can protect their capital and generate real returns, while simultaneously investing to achieve “net good” environmental and social outcomes.

Is ESG an investment theme and should it be favoured for its investment merits or rather viewed as a form of capital philanthropy?

“The pursuit of delivering a world that can develop in a more sustainable way is a significant investment theme,” said John

Green, chief commercial officer at Ninety One. “And there are plenty of related sub-themes, such as decarbonisation or clean energy.” He was participating in an Asset Management CEO debate on day two of The Investment Forum, held in June this year.

But Magda Wierzycka, ex-joint chief executive of Sygnia Asset Management, cautioned that asset managers should draw a firm distinction between ESG and impact. “ESG is about marketing and presenting yourself as the most investable company … that is not going to be where the returns come from,” she said. Her belief is that a positive screening for ESG factors has little impact in isolation; rather, impact comes from allocating capital to firms that have the potential to change the world in areas such as agriculture, clean energy or healthcare provision.

So, while return remains paramount, it must be considered alongside environmental and social measures, such as reduced carbon emissions, infrastructure improvements and job creation, among others. This shift is seen as crucial for the world to achieve the United Nations’ 17 Sustainable Development Goals (SDGs) by 2030. Most SDGs hinge around impactful infrastructure investment, such as renewable energy to tackle carbon emissions (climate change) or transport projects to encourage economic growth or universities to improve education outcomes.

How can individual investors make sure that the shares in their portfolios live up to the ESG, impact and sustainability hype?

Retail investors’ preference for ESGfriendly investment strategies has prompted a mad rush among asset managers to rank or rate companies listed on the world’s major bourses and to publish ESG ratings on their fund fact sheets. The likes of BlackRock and Schroders are leading the charge by appointing teams of internal analysts to develop and manage internal ESG

screening processes as well as guide portfolio managers on their ongoing interactions with company executives.

“Asset prices and portfolio risks do not yet fully reflect sustainability-related factors, [meaning that] market factors will accelerate the reallocation of capital toward issuers and assets with positive sustainability characteristics, in turn impacting valuations,” said Sophie Thurner, ESG product specialist for BlackRock’s iShares Sustainable Products. Thurner was commenting during a Glacier International investment outlook webinar in May.

Reasons for the industry’s renewed focus on environmental factors include the record damages from extreme weather events recorded in 2020, global regulation moving decisively towards a net-zero carbon emissions economy, and the downward pressure on renewable prices due to technology innovation. Asset managers are thus under pressure to provide investors with a variety of investment approaches that will resonate with the degree of sustainability investors want to achieve in their portfolios. These solutions are unquestionably easier to structure on the global stage.

Siboniso Nxumalo, portfolio manager at Old Mutual Investment Group, reflected on “ESG integration into listed equity analysis” in his presentation to The Investment Forum 2021. He pointed out that ESG ratings were important given the proportion of South Africa’s retirement funding assets that were required, by regulation, to be invested in the JSE. Before focusing on environmental and social factors, he commented that the impact of poor governance on stock market performance was well documented, starting with the Enron and WorldCom scandals in the early 2000s. Locally, we have the Steinhoff debacle, estimated to have destroyed a staggering R219 billion in shareholder value, and African Bank.

Environmental and governance failures often overlap, as evidenced by the emissions-cheating scandal that rocked global vehicle manufacturer Volkswagen in September 2015. Shares in the German company fell more than US$25 billion immediately following the news, with a striking headline lamenting “Volkswagen’s value destruct-o-meter at US$55 billion and counting”.

“You have to pay attention to ESG factors, because when ESG failures happen you actually lose money … share prices go down,” said Nxumalo. And retail investors are cottoning on to this reality.

Paul Traynor, wealth and asset management consulting lead at EY Dublin, writes: “Increasingly investors want to know that the investments and pension contributions they are making will help to sustain and build a better world, while delivering long-term capital gains.” In other words, the asset manager’s responsibility for client’s capital expands from investing purely for return to investing for sustainable wealth generation.

Integrating ESG into stock picking was among the discussion points during the Allan Gray and Orbis Investments event, which briefly considered the pros and cons of investing in British American Tobacco, which is considered to have

less-than-favourable social factors due to the well-documented mortality and morbidity legacy associated with smoking. “ESG is a big part of the process,” said Duncan Artus, a portfolio manager at Allan Gray. “We have always put a lot of work into governance, because it improves underlying companies and portfolio returns, but the environmental and social factors are complex, and it can be difficult to please everyone.”

He commented that domestic asset managers faced a unique challenge due South Africa’s relatively small universe of investable stocks, only numbering around 100. Another issue is that the economy is also heavily exposed to fossil fuels and other environmentally damaging activities, such as mining. It is therefore extremely difficult to operate an exclusionary share selection process in the South African market. “If you start eliminating things, you are left with an extremely narrow pool of assets to invest in,” said Nxumalo.

Of greater concern is what might happen to the domestic economy if the investment and financing communities pull the plug on these firms overnight: the country would be left without electricity and fuel. Avoiding the likes of Eskom (in the bond market) and Sasol on the JSE could prove impossible for SA-based allocators of capital. This reality is commonplace on the African continent. “The continent is dependent on a fossil fuel-based energy system,” said Naidoo. “We cannot switch that off overnight and expect the economies to be unaffected … and still be able to achieve the economic dividend [proposed in the SDGs].” He said the way forward involved a sensible transition towards clean energy (whether that is hydro, solar or wind) and finding an optimal balance between the current energy mix and a renewable energy future.

Local asset managers will therefore have to strive for the so-called ESG trifecta of maximising returns, minimising risk and maximising impact without strictly

excluding opportunities based on carbon emissions and other ESG factors. “An exclusionary strategy does not work domestically, because we still have to maximise returns … what we can do is make sure we think smartly about the risks,” he said.

Nxumalo concluded by saying that ESG was a complicated discussion that created tension between asset managers and their clients. But he also warned that ignoring ESG-related risks would lead to trouble. “Whenever these risks come to bear, not only are they on the front page of the daily news, but they have a direct impact on your investment statements and wealth.”

The reality is that all pockets of capital, including investors’ discretionary funds and retirement funds, will have to come on board for Africa to achieve the UN SDGs by 2030. “Every allocator of capital must realise that money must be deployed in a sustainable way,” said Johnstone. “There is no if/or option; we cannot choose impact or return.”

According to Khumalo, the pressure for impact investing should not be driven by asset managers in attempts to be seen as “benevolent asset allocators”, but by asset owners: the members of retirement funds.

“I am investing in my retirement fund to create a comfortable retirement; but I also want to know what [asset managers] are doing about the environment, infrastructure and addressing poverty,” he said.

On the utilisation of South Africa’s retirement fund assets to achieve impact, the Critical Conversations discussion concluded that asset managers would have to refocus from delivering a financial return on investors’ money to ensuring dignified savings outcomes – which meant delivering return in addition to impact and sustainability. “The asset manager’s role is to match the objective of a dignified retirement while ensuring that the broader community benefits from upliftment,” said Naidoo. “You can invest for impact and deliver return as well.”

If you are buying and selling cryptocurrencies, for long-term investment or as a speculator, you need to be aware of the tax implications, which SARS has not done enough to make public.

Many people are dabbling in cryptocurrencies without being aware of their obligations to the South African Revenue Service (SARS). However, recent interventions by SARS requesting client data from some leading cryptocurrency exchanges underline the fact that the government is serious about getting its share of any profits you make.

On your tax return, you need to be prepared to declare your cryptocurrency transactions to SARS and to pay tax on them where applicable.