2025 Legislative Update

Practical Impacts: New Laws

• THE BIG THREE REUNITE

Ø Governor Greg Abbott

Ø Lt. Governor Dan Patrick

Ø Speaker of the House Dustin Burrows

Statistics for the 89th Legislative Session

• 8,940 Bills Filed (+651)

ü 5,608 House Bills

ü 208 House Joint Resolutions (Const. Amendments)

ü 3,041 Senate Bills

ü 83 Senate Joint Resolutions

• 13.8% Passed (20% prior avg.)

• 28 Vetos

• 2 Special Sessions

• Effective Dates

ü Immediately (2/3 vote)

ü September 1, 2025 otherwise (unless noted)

Ad Valorem Tax Relief

• Amendment to Texas Constitution required – vote November 4, 2025

• Proration challenges until decided – Some from past closings when and if adopted

• If passes – effective for 2025

• Residential Homestead exemption increases to $140,000

• Over 65 and Disability exemptions increase to $60,000

• These are for school taxes

§ Other taxing units may adopt

• Propositions 13 and 11, respectively, are on the ballot

Business Ad Valorem Tax Relief

• And another Constitutional Amendment required – Proposition 9

• But this time not limited to just school taxes

• And effective January 1, 2026

• A business taxpayer may exempt up to $125,000 value in personal property used to produce business income.

• Confusion already

• HJR 1 suggests an exemption up to $125,000 total

• HB 9 states the exemption applies to each location

Alien Ownership

SB 17 (Kolkhorst)

• Designated Countries - China/N. Korea/Russia/Iran

§ Nat’l “Bad Country” list w/in 3 yrs

§ Governor may also designate!

• Prohibited Owners

§ Citizens of designated countries

§ Resident of designated countries

§ Gov’t Agent/Official/Governing Pol. Party Member of designated countries

§ Entity “controlled” by designated countries or prohibited owner

§ Entity w/ over 50% ownership by designated countries or prohibited owner

Alien Ownership

• Effective 9/1/25

§ Prior law applies to RE owned by 8/31/25

• Not Prohibited

§ US Citizen

§ Permanent Residents (Green Card)

§ Entities with “passive” investment up to 50%

• NO “CONTROL”

§ Homestead Purchase while a legal resident (Student/Work)

§ Real Estate Loan

• Not Real Estate “interest”

§ Leases LESS than 1 yr

§ Sales and leases after 9/1/25

Alien Ownership

• Enforcement - Attorney General

• Rules/Regulations

• AG to investigate and sue

• Broad discovery rights

• Penalties (for prohibited owners of "voidable" transaction)

• Jail Felony

• Up to $250,000 fine*

• Receivership

• Dist. Court application

• Traditional Receiver Power

• Sell RE

• Pay lienholders, reimburse AG, remainder to Owner*

Alien Ownership - Impacts

• Before Effective Date

• Run on Texas RE!?

• Convey title by 8/31/25

After Effective Date

• Operate/develop owned RE under Prior Law

• Sell owned RE

• Indirect investment

• Passive (no control), minority interest in Entity

• Lender

Brokers/Lawyers/Title Companies

• Disclose the prohibition to potential clients?

• Beware of discrimination – Fair Housing laws control

• Beware of Entities

• Parties may require representation & waivers – contract issues

• Investigate Title Co. requirements on sales (mostly there will be none)

• Be a Receiver

• Defend RE Owners from AG prosecution

Condominiums Catch Up to HOA’s

• Management Certificates (for 60 units or more) must be recorded and include amendments, contact info, and transfer fees.

ØTPC 82.1142, 82.116

• Resale Certificates are capped at $375

ØTPC 82.157(f)

• Electronic communications are permitted

ØTPC 82.108, 82.110

Deed Fraud

• Clerk authority to ask questions, request information, and potentially decline to record

• SB 647, Tex. Gov’t Code 52.901, District or County attorney must agree

• SB 648 vetoed – but passed in second Special Session List as SB 16 Requires ID to record in person –

Adds many criminal provisions – new specific crimes of Real Property Theft and Real Property Fraud to assist law enforcement – can be a first degree felony and enhancement based on nature of victim and/or homestead

• Expedited Process to Remove a Recorded Fraudulent Document

• SB 1734 – Tex. Gov’t Code 51.9035

• Court may enter Order after Affidavit, Certificate of Mailing, and no contradicting affidavit within 120 days

More Dirt

• Expedited Process to Remove a Squatter

• SB 1333, TPC Chpt 24B

• Allows for immediate removal after filing complaint, unless

• Property was open to the public, possession is in litigation,

• or “squatter” is an immediate family member or a current or former tenant

• Expedited Process to Release a Memorandum of Contract

• HB 4063, TPC 12.020

• Person filing MOC must also send notice to the owner

• owner may contest within 45 days

• Online Records May be Redacted

• Peace officer – but only online records – not actual county deed records

• HB 4350 – TPC 11.008(j)

More Ways To Own Real Estate

• Business Entity-Owned Residential Arrangements

• TPC 223

• Note religious exemption

• Texas Fair Housing Act 301.042(a-1)

• Limited to less than 25 acres

State Pre-emptions Of Local Land Use Reg.

Encouraging Higher Density Housing

S . B . 15 & 2477 (Bettencourt ) & S . B . 840 (Hughes )

• All Bracketed the SAME

• Cities 150K+ pop.

• in Counties 300K+

• 19 of 21 largest TX cities

• Brackets can be expanded in the future!

• Private Enforcement

• Mandatory Legal fees/costs recovery

• Access to Business Appeals Court

Applicable Cities

Houston

San Antonio

Dallas

Austin

Fort Worth

El Paso

Arlington

Corpus Christi

Plano

Lubbock

Irving Garland

Frisco

Grand

McKinney

Brownsville

Killeen

Pasadena

Mesquite

Density – Lot Size

S . B . 15 (Bettencourt )

• Zoning pre-emption for 3,000 SF lot min.

• Restricts indirect density limits

• Applies to new 5 ac + developments to be platted and zoned SFR

Opportunity in Larger Cities :

Affordable, dense SFR housing, including BTR

Density – Lot Size

PROHIBITS:

• Res. lot size min. = 3000 SF area /30’ width/75’ depth

• Density caps resulting in > 3,000 SF lots

• Small lot (4,000 SF. or less) regs

• Setbacks < 15’ front, 10’ rear or 5’ side

• Covered or offsite parking, < 1 space per unit

• < 30% open/permeable surface

• > 3 stories

• Bulk

• Wall articulation.

• “other zoning restriction…inconsistent with this subsection….”

PERMITS:

• Setbacks to protect “environmental features, erosion, or waterways” IF authorized by federal or other state law.

• Shared drives

• “Aquifer recharge zone” regs.

• Stormwater regs.

Density – Mixed-Use and Multifamily

S.B. 840 (Hughes) –

• Permits mixed-use, multifamily & residential conversions in most zoning districts w/o rezoning!

• Permits high density – 36 units/AC

• Restricts indirect density regulation

• Limits regs on RESI Conversions

Opportunities in Larger Cities -

• Dense Apartments/Town Houses without rezonings

• Residential Conversions

Density – Mixed-Use and Multifamily

PERMITS WITHOUT REZONING :

• Multi-Family (3+) [minor exceptions] units) & Mixed Use (65%+ SF. RESI) in most non-residential zoning districts (not heavy industrial

PROHIBITS:

• Density cap > 36 unit/ac or max. density in the City

• Height cap > 45’ or highest height in the City (ex. industrial)

• Setback/Buffer < 25’ or otherwise applicable

• Parking < 1 per unit

• Requiring structured parking

• Floor to Area Ratios (FAR)

• Requiring Mixed Use (unless Mixed Use District)

Density – Mixed-Use and Multifamily

“MUST APPROVE” STANDARD FOR PERMITS:

• “meets municipal land development regulations”

• PROHIBITS governing body approval

• MANDATES administrative approvals

• Mimics “ministerial” approvals in platting

For conversions of office, retail and warehouse buildings

PROHIBITS:

• TIAs or traffic mitigation

• Add. parking

• Oversizing utilities

• Design requirements over Com. Bldg. Code

• Impact fees (unless applicable for non-resi development of the building)

Density

– Office Conversions to Mixed - Use

& Multifamily

SB 2477

• Virtual duplicate of SB 840

• Office Conversions only

• Multi-Family (3+ units) & Mixed Use (65%+ SF. RESI each fl. & total) in all zoning districts (not heavy industrial)

• Similar Prohibitions and Remedies

Zoning - Protests

H.B. 24 (Orr)

• Protest threshold from 20% to 60% increased residential density or new citywide code/map

• No supermajority – Simple Majority Commissioners

• Notice on Website

• Presumed valid after 60 days if a rezoning increases residential density

• IMPACT – Fewer successful protests/harder to challenge residential density increases

Platting – Taxes Paid?

• One must be current with ad valorem taxes in order to file a plat, replat, or amended plat.

• On occasion, taxes are not assessed until after the plat is filed but before it is approved

• Non-payment of taxes in this scenario is no longer a basis for rejection

• HB 2025 - TPC 12.002 and 82.051(f)

Notary Public

• More educational requirements – SB 693

• Failure to keep records may be “good cause” for license revocation.

• If the signer does not appear before the notary, it is a misdemeanor offense for the notary, unless

• It is a state jail felony if the document being notarized involves the transfer of real property or any interest in real property.

Notices

• SB 2349 – TPC 92.0135: Short- Term Leases and Flooding

• Floodplain and flooding notices are not required for leases less than 30 days in length or TREC Contract Temporary Leases pre- and post-closing 90-day leases.

• SB 2468, TPC 5.0141(b): Public Improvement Districts

• Purchaser may terminate the contract 7 days after notice is provided if after contract signed

More Required Notices

• HB 2037 – TPC sections 92.112 and 94.110: Forwarding Address

• Tenant may provide notice to managing agent, leasing agent, or to satisfy security deposit requirements

• E-mail may be used if that has been a form of communication

• HB 2067 - Tex. Ins. Code 551.001(a), .002(a), .0521, .055,.109: Can’t Get No Insurance?

• Insurer must provide written notice of denial or if an existing policy is cancelled or non-renewed, with an explanation

Notice No Longer Required

• SB 2550(HB 3901): If a transaction only involves groundwater and/or surface water, it is exempt from certain disclosures applicable to typical real estate transactions:

• Coastal Area Property (Tex. Natural Resources Code 33.135)

• Property located seaward of the Gulf Intracoastal Waterway (TNRC 61.025)

• Public Improvement District (TPC 5.014)

• Certified service area of a utility service provider (Tex. Water Code 13.257)

Real Estate Agency

• Currently, a licensed real estate agent cannot simply show a property without entering into a representation agreement.

• SB 1968 creates that possibility – a written agreement is still required, and no advice may be given – Texas Occupations Code 1101.558. Effective January 1

• The old practice of sub-agency is also repealed. Tex. Occupations Code 1101.002(8) and .805(f). IABS form has been modified.

When Does One Need a License?

• SB 1172 also clarifies a number of transactions and situations that do not require real estate license:

• Transactions involving solely minerals, other energy sources, and water do not

• Tex. Occupations Code 1101.002 (4-a), (4-b), 9

• LP’s, LLC’s, and commercial signage entities do not require a licensed agent for dealing in their own property sale, leasing and acquisition – includes employees

• Tex. Occupations Code 1101(10),(11), (12)

Changes for Marketing Outreach

SB 140

• Expanded definition of solicitation:

• Now includes not just voice calls, but also SMS, MMS, photos, videos, or any electronic messages that encourage property transactions.

• Significant legal risk under DTPA:

• Consumers can directly sue for violations.

• Potential outcomes include actual damages, attorney’s fees, treble (triple) damages, and mental anguish

• No limitation on repeat claims each violation may lead to new lawsuits

• Registration required for cold outreach:

• Register with Texas Secretary of State if contacting cold leads by phone/text.

• Requirements: $200 fee, $10,000 bond or letter of credit, annual renewal, and quarterly new staff reporting

More on Mass Marketing

There are exemptions – realtors should ask their broker or an attorney

Be particularly careful with past clients – you likely need written consent for promotional content.

Written consents and opt-outs are required. You must respect "quiet hours" and the Texas DNC (do not call) list.

Keys to success -

Be intentional

Get consent

Document your agreements and understandings

SIGNS – You Need Permission

• HB 3611 amends Transportation Code Section 393.001 and 393.007 to expand responsible persons and increase penalties.

• This law prohibits placing commercial advertisements in a public rightof-way without authorization.

• “Every dog gets one bite,” so if a sign is removed after a first warning, there is not a fine.

• After that, persons subject to fines include employees, agents, independent contractors, assignees, business alter egos, and successors in interest.

• Fines range from $1,000 to $5,000.

TBOC and Business Courts

• SB 29 – Business Judgment Rule – need to draft for it

• SB 1057

• Waive jury trial – need to draft for it

• Exclusive jurisdiction – draft for it

• Different voting rights by ownership group – draft for it

• HB 40 – Business Court jurisdiction lowered to $5 million

• Can also hear arbitration enforcement and intellectual property matters

• May want to consider transferring a pending matter

Geothermal Energy

• SB 1762 – Geothermal energy is "dispatchable energy" eligible under the Texas Energy Fund

• HB 1878 -Geothermal water conveyance facilities may be treated as a PID

• SB 879 - Closed loop geothermal wells are exempt from regulation by the Railroad Commission in most regards

Water, Water – Everywhere?

• SB7 and HJR 7 are on the November ballot – specific budget funding 1 Billion $/year through 2047 for improved water measures and water infrastructure development.

• Includes flood mitigation

Who Owns Produced Water?

• News Flash ! – Cactus Water Service v. COG Operating was decided by the Texas Supreme Court June 27, 2025. – Produced water belongs to the mineral estate owner, unless a reservation or exception from the mineral conveyance is specifically expressed.

• A concurring opinion filed by 3 justices refined the question to essentially focus on the language of the grant and that a grant of the “oil, gas, and other hydrocarbons” only provided a right to use the produced water, not claim ownership to any other minerals

Brine – How About It?

• Of course, a current question will be the right to lithium or other rare minerals found in the produced water. Would SB 1763 would have decided this question differently? Brine minerals were defined to include lithium and many other “interstitial particles and solutes suspended, dissolved, or otherwise contained in brine.”

• The term would not include groundwater or “fluid oil and gas waste.”

• Drafting may become determinative, especially when the possibility of leasing brine recovery is in play or a possibility. Landowners and mineral lessees should each be careful and specific with grants, reservations, and exceptions to conveyance.

Produced Water

• HB 49 limited liability for those that treat and use, possess, or transport produced water for a beneficial use

• HB 2246 makes permits longer terms and easier to renew

• HB 1238 allows TCEQ to use inspection reports of licensed engineers and geoscientists

More Water

• The Governor vetoed SB 1253, but it passed with minor changes in the second special session as SB 14. SB 14 provides for credits against impact fees for developers, for including water conservation features or reduced use or reuse of wastewater. This new law is effective January 1, 2026.

FINCEN – March 1, 2026

• The Rule has already been adopted, and final comments regarding the form were due July 7. ON September 30, FinCEN published a form and delayed implementation from December 1

• Non-financed residential property sales involving an entity or trust as the grantee will require extensive new reporting on both the seller and the buyer(s), including Beneficial Ownership Information (BOI).

• If a title company is involved, it will be the responsible reporting entity, but a lawyer could easily find itself the responsible reporting party if no title company is closing the transaction.

• Next step is predicted to include commercial property transactions. Lawyers may include language regarding reporting in their retention agreements and closing instructions.

The FinCEN Rule

• Open Question – the form requires each blank to be filled.

• FinCEN has also stated the form must be complete or fines will be imposed on the reporting entity.

• A title company or attorney may choose not to close until all information is available.

• Can they do that?

• Can FinCEN create a new legal principle via a rule form?

• Counsel and TREC may want to include language in the contract to require that the necessary information be provided. Or even in a retention agreement? A listing agreement?

• Counsel may also include a closing instruction making it clear who is the reporting entity.

Just In Case

• HB 149 – may run into Federal legislation – but it creates an AI state agency, testing mechanisms, and a complaint process . The Texas Responsible Artificial Intelligence Governance Act!

• Parents beware HB 27. Your high school student will be taking “financial literacy instruction.” Are ready to answer tough questions?

• But your student cannot call you from the classroom – no "personal communication devices" allowed – HB 1481

MORE TO KNOW

• Gold and Silver will legal tender in Texas beginning in September 2026– to be fully functioning May 1, 2027 using debit cards and mobile apps. HB 1056.

• SB 21 adopts the Texas Strategic Bitcoin Reserve and Investment Act, establishing a State Bitcoin Reserve. Texas may purchase, hold, and oversee cryptocurrency assets using public funds. The fund will be managed by the Texas Comptroller separately from the Treasury to hedge against inflation, enhance financial resilience, and position itself as a national leader in digital assets. Effective immediately.

Many Failed…

86% fail…but could return

Special Sessions are over?

Next Reg. Session Jan. 2027

• If interested in proposing legislation, start NOW.

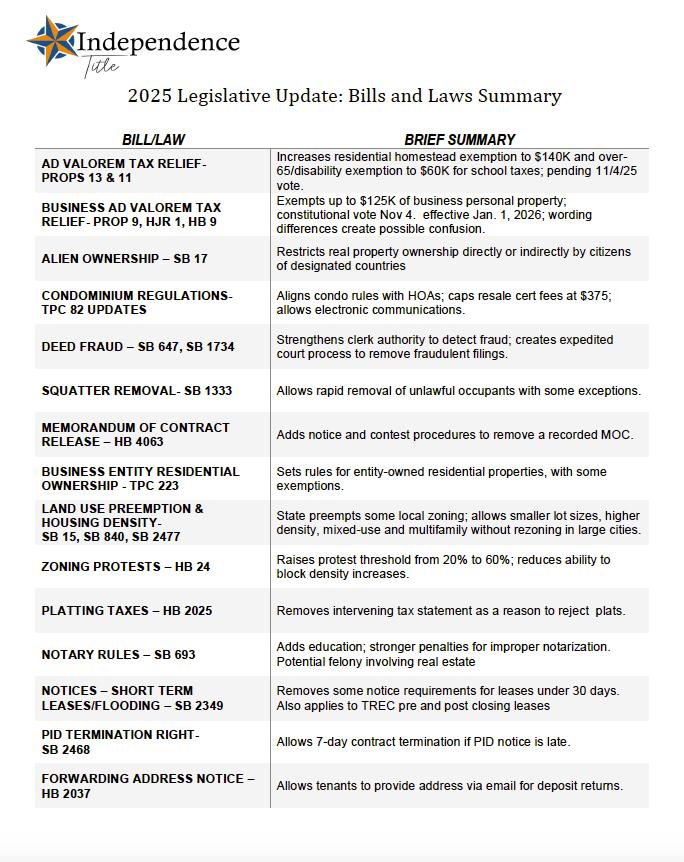

2025 Legislative Update: Bills and Laws Summary

What Real Estate Agents Need to Know

BILL/LAW

AD VALOREM TAX RELIEFPROPS 13 & 11

BUSINESS AD VALOREM TAX RELIEF- PROP 9, HJR 1, HB 9

ALIEN OWNERSHIP – SB 17

CONDOMINIUM REGULATIONSTPC 82 UPDATES

DEED FRAUD – SB 647, SB 1734

SQUATTER REMOVAL- SB 1333

MEMORANDUM OF CONTRACT RELEASE – HB 4063

BUSINESS ENTITY RESIDENTIAL OWNERSHIP - TPC 223

LAND USE PREEMPTION & HOUSING DENSITYSB 15, SB 840, SB 2477

ZONING PROTESTS – HB 24

PLATTING TAXES – HB 2025

NOTARY RULES – SB 693

NOTICES – SHORT TERM LEASES/FLOODING – SB 2349

PID TERMINATION RIGHTSB 2468

FORWARDING ADDRESS NOTICE –HB 2037

BRIEF SUMMARY

Increases residential homestead exemption to $140K and over65/disability exemption to $60K for school taxes; pending 11/4/25 vote.

Exempts up to $125K of business personal property; constitutional vote Nov 4. effective Jan. 1, 2026; wording differences create possible confusion.

Restricts real property ownership directly or indirectly by citizens of designated countries

Aligns condo rules with HOAs; caps resale cert fees at $375; allows electronic communications.

Strengthens clerk authority to detect fraud; creates expedited court process to remove fraudulent filings.

Allows rapid removal of unlawful occupants with some exceptions.

Adds notice and contest procedures to remove a recorded MOC.

Sets rules for entity-owned residential properties, with some exemptions.

State preempts some local zoning; allows smaller lot sizes, higher density, mixed-use and multifamily without rezoning in large cities.

Raises protest threshold from 20% to 60%; reduces ability to block density increases.

Removes intervening tax statement as a reason to reject plats.

Adds education; stronger penalties for improper notarization. Potential felony involving real estate

Removes some notice requirements for leases under 30 days. Also applies to TREC pre and post closing leases

Allows 7-day contract termination if PID notice is late.

Allows tenants to provide address via email for deposit returns.

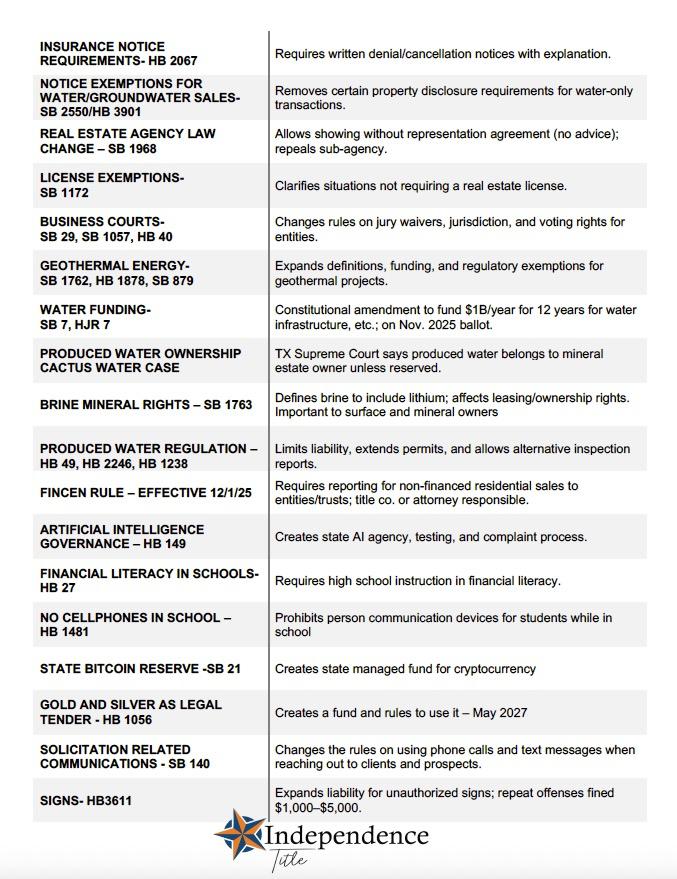

INSURANCE NOTICE REQUIREMENTS- HB 2067

NOTICE EXEMPTIONS FOR WATER/GROUNDWATER SALESSB 2550/HB 3901

REAL ESTATE AGENCY LAW CHANGE – SB 1968

LICENSE EXEMPTIONSSB 1172

BUSINESS COURTSSB 29, SB 1057, HB 40

GEOTHERMAL ENERGYSB 1762, HB 1878, SB 879

WATER FUNDINGSB 7, HJR 7

PRODUCED WATER OWNERSHIP CACTUS WATER CASE

BRINE MINERAL RIGHTS – SB 1763

PRODUCED WATER REGULATION –HB 49, HB 2246, HB 1238

FINCEN RULE – EFFECTIVE 12/1/25

ARTIFICIAL INTELLIGENCE GOVERNANCE – HB 149

FINANCIAL LITERACY IN SCHOOLSHB 27

NO CELLPHONES IN SCHOOL –HB 1481

Requires written denial/cancellation notices with explanation.

Removes certain property disclosure requirements for water-only transactions.

Allows showing without representation agreement (no advice); repeals sub-agency.

Clarifies situations not requiring a real estate license.

Changes rules on jury waivers, jurisdiction, and voting rights for entities.

Expands definitions, funding, and regulatory exemptions for geothermal projects.

Constitutional amendment to fund $1B/year for 12 years for water infrastructure, etc.; on Nov. 2025 ballot.

TX Supreme Court says produced water belongs to mineral estate owner unless reserved.

Defines brine to include lithium; affects leasing/ownership rights. Important to surface and mineral owners

Limits liability, extends permits, and allows alternative inspection reports.

Requires reporting for non-financed residential sales to entities/trusts; title co. or attorney responsible.

Creates state AI agency, testing, and complaint process.

Requires high school instruction in financial literacy.

Prohibits person communication devices for students while in school

STATE BITCOIN RESERVE -SB 21 Creates state managed fund for cryptocurrency

GOLD AND SILVER AS LEGAL TENDER - HB 1056

SOLICITATION RELATED COMMUNICATIONS - SB 140

SIGNS- HB3611

Creates a fund and rules to use it – May 2027

Changes the rules on using phone calls and text messages when reaching out to clients and prospects.

Expands liability for unauthorized signs; repeat offenses fined