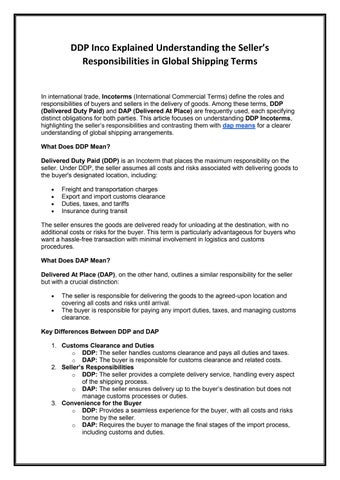

DDP Inco Explained Understanding the Seller’s Responsibilities in Global Shipping Terms

In international trade, Incoterms (International Commercial Terms) define the roles and responsibilities of buyers and sellers in the delivery of goods. Among these terms, DDP (Delivered Duty Paid) and DAP (Delivered At Place) are frequently used, each specifying distinct obligations for both parties. This article focuses on understanding DDP Incoterms, highlighting the seller’s responsibilities and contrasting them with dap means for a clearer understanding of global shipping arrangements.

What Does DDP Mean?

Delivered Duty Paid (DDP) is an Incoterm that places the maximum responsibility on the seller. Under DDP, the seller assumes all costs and risks associated with delivering goods to the buyer's designated location, including:

Freight and transportation charges

Export and import customs clearance

Duties, taxes, and tariffs

Insurance during transit

The seller ensures the goods are delivered ready for unloading at the destination, with no additional costs or risks for the buyer. This term is particularly advantageous for buyers who want a hassle-free transaction with minimal involvement in logistics and customs procedures.

What Does DAP Mean?

Delivered At Place (DAP), on the other hand, outlines a similar responsibility for the seller but with a crucial distinction:

The seller is responsible for delivering the goods to the agreed-upon location and covering all costs and risks until arrival.

The buyer is responsible for paying any import duties, taxes, and managing customs clearance.

Key Differences Between DDP and DAP

1. Customs Clearance and Duties

o DDP: The seller handles customs clearance and pays all duties and taxes.

o DAP: The buyer is responsible for customs clearance and related costs.

2. Seller’s Responsibilities

o DDP: The seller provides a complete delivery service, handling every aspect of the shipping process.

o DAP: The seller ensures delivery up to the buyer’s destination but does not manage customs processes or duties.

3. Convenience for the Buyer

o DDP: Provides a seamless experience for the buyer, with all costs and risks borne by the seller.

o DAP: Requires the buyer to manage the final stages of the import process, including customs and duties.

When to Use DDP

DDP is ideal for transactions where the buyer prefers minimal involvement in logistics and customs procedures. It’s commonly used in cases where:

The buyer lacks expertise in navigating customs regulations.

The seller has a robust understanding of import requirements in the destination country.

Both parties seek a straightforward, transparent transaction with no hidden costs for the buyer.

When to Use DAP

DAP is better suited when:

The buyer has the resources and knowledge to handle customs clearance.

The seller prefers to avoid the complexities of managing duties and taxes in the buyer’s country.

Conclusion

Understanding the differences between DDP (Delivered Duty Paid) and DAP (Delivered At Place) is crucial for selecting the right shipping terms in international trade. While DDP simplifies transactions for buyers by transferring maximum responsibility to the seller, dap means flexibility for sellers while giving buyers control over customs processes.

Choosing the appropriate Incoterm ensures smoother transactions, transparency, and alignment of responsibilities, ultimately facilitating successful global trade.