That’s why our communities have trusted CompSource Mutual for 85+ years. We’re proud to be a premier workers’ compensation carrier o ering your customers the best: top-rated financial strength and first-rate service. CompSource Mutual is rated A (Excellent) by AM Best.

Publisher Denise Johnson, CISR, CIC

Managing Editor Jerri Culpepper

Graphic Designer Denise Canon

PROFESSIONAL

President/Chief Executive Officer

Denise Johnson, CISR, CIC

Chief of Staff and Operations

Josh Reasnor, MSSL, CISR, CKC

Senior Vice President of Strategic Initiatives

Sara Bradshaw Ray, CIC, CKC

Workers’ Compensation Account Manager

Jeanette Madrid

Director of Member Services

Shania Slavick

Director of Marketing and Communications

Jerry Rappe’

Specialty Lines Service Account Manager Cindy Munden, CISR

Director of Professional Liability

Cari Senefsky

Education Coordinator Kim Watkins

CIC, CRM

Bradshaw Ray, CIC, CKC

May is a busy month! Not only did we have the IIABA (Big I) Legislative Conference in D.C., which I was excited to attend with 16 other Oklahoma agents, but our state conference, INSURCON, followed the next week in Oklahoma City at the new OKANA Resort & Waterpark. Hopefully, as you read this article, you had positive experiences attending these events. Incoming IIABA Chair Angela Ripley was a scheduled speaker at INSURCON. She has an incredible passion for our industry, and I look forward to her leadership.

Did you know IIABA (Big I) has 25,000 agency member locations and is the oldest and largest national association for insurance? Did you know IIABA has a solid presence in D.C. and is valued by Congress as a dependable resource on insurance issues? Contributing to InsurPac allows national funding of legislators favorable to our industry and protection of our clients.

Major donors are invited to an InsurPac reception in D.C., mingling with members of Congress. Attending this event gives you one-on-one time to get know these members personally and express your views on pending actions or needs of our citizens. Involvement by contributing to OKPac allows local support to our legislators. At the time of writing this article, we have five insurance professionals in Oklahoma’s Congress. BIGiOK Day at our state capitol resulted in very positive visits. If you haven’t experienced either event, DO IT—you

won’t regret it and will gain valuable insights to the inner workings of our government.

DC 2025 was again a fantastic experience. While busy with Big I meetings, spending two days at the capitol visiting our state representatives and senators was a unique experience as few are privy to such meetings with our lawmakers. Oklahoma is gifted with legislators willing to listen to and be supportive of the issues the Big I focused upon.

In D.C., a couple were unfamiliar with the Litigation Transparency Act of 2025 (HR1109), and after hearing the Big I stance, promised to investigate. The LTA would make it mandatory to disclose TPLF agreements (Third Party Litigation Funds via domestic and foreign investors with nearly $20 billion in assets) wherein the plaintiff accepts an immediate payout from the TPLF in exchange for rights to future settlements gained by expensive litigation funded by the TPLF.

The problem is two-fold. Plaintiffs receive a much lower amount subject to income tax, while the TPLF may receive millions at a more favorable domestic tax or zero tax rate if foreign. Second, these nuclear awards drive up premiums by draining reinsurance funds and can result in carriers pulling out of markets. We asked for fairness to adjudicate legitimate claims while closing the tax loopholes.

Watching the uncontrollable wildfire damage in California was horrific, but when it hit our state, it brought home the helplessness felt by not being able to

control the situation. The Big I encourage passing the Fix Our Forests Act (HR471) to increase our resilience to such wildfires by improved land use planning and forest management as well as adoption of fireresistive building standards. The Disaster Mitigation & Tax Parity Act of 2025 and Disaster Resiliency & Coverage Act of 2025 exclude funds provided under state-based mitigation programs (such as the one instituted by Commissioner Mulready) as federal taxable income.

A huge bill beneficial for our members is the Main Street Tax Certainty Act of 2025. Over 85% of independent agents nationwide are pass-through tax entities. This Act will make the 20% small business deduction (aka 199A) permanent. All were in favor of this bill.

Big I urged Congress to protect the Federal Crop Insurance Program (FCIP) from funding cuts and oppose amendments to the Farm Bill or legislation which could weaken the

private sector of crop insurance as well as have devastating effects on farmers, the true backbone of our country. Imagine empty store shelves or pricing if local farmers ceased to exist. A very important agenda item as Congress develops its budget for FY2026.

Finally, my time as your chairman come to an end after INSURCON, when I pass the gavel to Kathy Reesor of VIP Insurance, Edmond. It has been an honor to serve our members and represent our state at various conferences across the country.

I have met very dedicated individuals giving their time to better our industry. If you have an interest in serving, or know of a qualified candidate to recommend, please reach out to a board member. I cannot express the value of every minute of my involvement, but can assure you –it will always be a joyful memory. Giving back just a tiny bit of what insurance has given me and my family will always be a cherished time in my life.

Thank you to the BIGiOK staffers who’ve always been there when I had questions or needed help with a task. And special thanks to our president and CEO, Denise Johnson, for her ceaseless encouragement and counsel since I first joined the board as a director.

Wishing all our readers success and prosperity as we serve insureds across the state!

Denise Johnson, CISR, CIC BIGiOK President/Chief Executive Officer

What a spring we’ve had at BIGiOK! Already this year, we’ve started a new FILO class, a successful Day at the Capitol, IIABA Legislative Conference, EmpowerHER Conference and an incredible INSURCON at the fabulous OKANA!

All have exceeded our expectations. I’m amazed at our member engagement in our many events – and this could not happen without our company Partners. Now we’re looking forward to what’s next!

Membership in BIGiOK will reap you benefits to make your business better, and we can help!

valuable Designation, we also offer many opportunities for free CE. Be sure to check out our Education calendar often!

• NEW this year: we’ll be offering a License Prep class to those new in the industry who are wanting to get their insurance license.

• Our Young Agent program offers many opportunities to those new to the industry. We look for ways to engage new agents in their endeavors into the industry by offering programs like FILO (Future Insurance Leaders of Oklahoma), Lunch & Learns, the YA Conference and

Membership in BIGiOK will reap you benefits to make your business better, and we can help!

Did you know??

• By being a member of BIGiOK, you are also a member of our national association, IIABA! They are working on our behalf on federal legislative issues.

• The Trusted Choice Marketing Reimbursement Program helps agencies offset the cost of various marketing activities that help grow your agency. Members can access funds for DIY digital marketing, working with one of our preferred vendors, or marketing education.

• We offer the BEST Education classes in the industry. Not only can you get a

community fundraisers. We’re doing our best to secure our new hires a place in our industry.

• Our E&O program is the BEST in the Industry! We offer many products and services to our members to help them make agencies better. If you haven’t looked at our products for agents, I would encourage you to do so.

• If you don’t have a contract with CompSource to write business for your agents, we can do that! Take advantage of this program that can benefit your clients.

continued on page 9

As I write this final article as chair of the Young Agents Committee, I’m filled with gratitude, pride and a deep appreciation for what this committee has accomplished over the past year. Serving alongside this passionate and driven group of professionals has been one of the great honors of my career.

The momentum behind Young Agents continues to build—and our recent events prove it. We just wrapped up two incredible Lunch & Learn sessions in Tulsa and Oklahoma City, both focused on delivering valuable, CE-approved content to agents at every stage of their careers.

The Oklahoma City event, led by Accident Fund, drew over 50 attendees—a strong showing that speaks to the hunger for education and engagement in our community. The session, titled The Total Cost of a Workers' Compensation Claim, went beyond policy to explore the long-term financial and human impact of workplace injuries. The feedback was overwhelmingly positive, and we’re already working on what’s next.

And speaking of what’s next … on June 5, we hosted a special fundraising event to benefit the American Cancer Society. This was not your average industry gathering. We brought out Singo, a dunk tank, pies in the face and gift basket raffles—all designed to raise money for a cause that touches so many of us.

We were also excited to connect with agents and industry leaders at INSURCON, hosted at the brand-new OKANA Resort in Oklahoma City. The Young Agents had a booth set up at the conference, and we brought our signature energy with friendly competition to raise money for OKPac These funds support advocacy efforts for the legislation that impacts both our industry and our clients across Oklahoma and beyond.

Throughout the year, our goal as a committee has been to create meaningful opportunities for young agents across Oklahoma—to learn, to lead and to connect. We know that investing in young talent today builds a stronger, more resilient industry for tomorrow. From continuing education to leadership development, networking events to community service, everything we do is with that mission in mind.

To my fellow Young Agent Committee members: thank you. Thank you for your time, your ideas, your energy and your heart. You’ve shown up, leaned in and made a difference. Every success we’ve shared this year is a direct result of your dedication and your belief in what this group can accomplish.

To Shania and the Big I Oklahoma staff, thank you for your unwavering support and partnership. Your behind-the-scenes work makes everything we do possible. And to the young agents across our state: it has been the privilege of a lifetime to serve you. I believe deeply in

continued from page 8

continued from page 7

the future of this industry because I see it in each of you – your ambition, your professionalism and your commitment to doing things the right way. Oklahoma is blessed to have you.

Though my time as chair is ending, I’ll always be a proud supporter of this committee and its mission. I look forward to watching the next group of leaders step up, push boundaries and continue to bring value to young agents throughout our state.

Thank you for the opportunity to serve!

• We offer amazing Consulting Services for your agency: everything from Kolbe training, agency valuation, strategic planning and more. Take advantage of this important service.

• Don’t forget about our many conferences, geared to make your agencies better. In the fall, we have our Young Agent Conference, in the early spring, we hold our EmpowerHER conference, and then in the late spring, we bring in INSURCON! You’ll hear some of the finest most important speakers here that connect us with the issues and products of the time.

Last but not least, we always have to thank our Partners for their support of our programs. We could not do what we do without them. ... If you see them in your offices, be sure to thank them for their support.

We are always looking for ways to make your agencies better. If you have thoughts, feel free to contact me at denise.johnson@BIGiOK.com

• CISR Agency Operations (Hybrid)

• CIC Insuring Company Operations (Hybrid)

• Episode 7: Free Friday Ethics Webinar ~ 11 a.m.-noon

• Episode 7: Free Friday Ethics Webinar ~ 11 a.m.-noon

• KOLBE Strengths (Online) Workshop (2 Hours of CE Approved) ~ 2-4 p.m.

• CISR Insuring Commercial Property (Hybrid)

• CIC Commercial Multiline (Hybrid) ~ Noon

• Episode 7: Free Friday Ethics Webinar ~ 11 a.m.-noon

• CIC Agency Management (Hybrid)

• Episode 7: Free Friday Ethics Webinar ~ 11 a.m.-noon

We have provided service-oriented, solution-driven, and specialty-focused products for the Inland Marine industry for more than 75 years. Our expertise and relationship-based approach help us offer solutions that address specific needs, even during economic instability.

Chris Floyd, CIC, CRM

State National Director

I have just attended two of the most important conferences of the year for me and many other insurance professionals: the Big I Legislative Conference and the Oklahoma Big I “INSURCON”. During these conferences, I am reminded how vital and important community is to everyone but especially those in our industry.

In an industry built on trust and relationships, community is not just a benefit—it’s a necessity. Independent insurance agents and brokers, though often working autonomously, thrive when they connect, collaborate and support one another.

Community also fuels innovation. As agents face emerging risks—like cyber threats or climate-driven insurance gaps—collaborative problem-solving leads to smarter solutions. Shared success stories inspire others to try new approaches, whether it's adopting new tech or refining customer service practices.

Moreover, a strong community enhances resilience. In times of crisis—be it natural disasters or economic shifts—having a network of peers to lean on can make all the difference.

At its core, the insurance business is about protecting people.

Unlike captive agents, independents must navigate complex markets, shifting regulations and diverse client needs without the backing of a single carrier. This independence brings freedom, but also challenges. That’s where community steps in—offering a shared space for knowledge exchange, mentorship and mutual support.

Through our Big I associations, agents and brokers can tap into collective experience. Veteran agents provide guidance to newcomers, while peers share market insights, product updates and sales strategies. This collaboration strengthens professionalism across the board, helping agents better serve their clients.

Are you missing that community and support? You can easily be part of a professional network that supports your potential and help fuel your growth by being actively engaged in the Big I Events. Get engaged and find your community in Big I. From the State

At its core, the insurance business is about protecting people. When agents support each other, they elevate the entire industry, creating a culture of excellence and care. Community isn’t just good for business—it’s the heart of it.

As a third-generation insurance agency owner turned agency management consultant, I’ve seen firsthand the struggles of planning within the fastpaced world of insurance. Growing up, I watched my parents tirelessly work “in” their business, often leaving little time, energy or expertise to work “on” their business. This challenge isn’t unique to my family’s agency; it’s a common scenario I encounter with so many of my clients across the country and right here at home!

Throughout my nearly four decades in the industry, I’ve observed a troubling trend: many agency owners know they need to plan, but they get so caught up in daily operations that strategic planning takes a back seat. Yet, in the challenging market cycle we are currently navigating, planning is more crucial now than ever.

“Hope is not a plan,” and indeed, an idea without a plan remains just a dream. These sayings, though cliché, capture the essence of the precarious position many find themselves in—hoping for the best without laying down the strategic groundwork to ensure success. In the insurance industry, where unpredictability is the only guarantee, relying on hope rather than strategy can lead to missed opportunities and stunted growth. The truth is, proactive planning is the key to growth. It allows you to anticipate

changes, prepare for challenges, and seize opportunities with agility and confidence. Without it, agencies often find themselves in a reactive mode, struggling to adapt to market fluctuations and client demands.

Reflecting on my parents’ experiences, I recognize the signs of an agency caught in the whirlwind of daily demands. They were incredible at their jobs, dedicated to their clients, and deeply knowledgeable about the industry. However, the constant pressure of immediate needs left them little time to consider longterm strategies. This reactive approach can create a cycle that’s hard to break without intentional effort and external support.

The first step to breaking out of this cycle is recognizing the need for change. It’s about understanding that while working “in” the business is what keeps the lights on today, working “on” the business is what ensures the lights stay on in the future.

At BIGiOK Consulting, we specialize in helping agencies like yours transition from reactive operations to proactive strategic planning. Our suite of services, from 1:1 Executive Coaching to comprehensive workshops like the Agency Plan in a Box, are designed to equip you with the tools and insights necessary to craft a forward-looking strategy.

Senior Vice President of Strategic Initiatives

Strategic Planning: The BIGiOK Way evolves with your business, supported by regular follow-ups and adjustments. This

Don’t let another year pass hoping things will improve on their own. It’s time to take control of your agency’s future with strategic planning. Whether you’re interested in a group setting like our workshops or prefer the personalized touch of executive coaching, BIGiOK Consulting has the expertise and the relationships to help you move from dreaming to doing.

Knowing what your future holds doesn’t require a crystal ball—it requires a plan. As someone who has not only witnessed but lived the transformative power of effective planning, I can confidently say that the time invested in planning today is the key to unlocking a prosperous tomorrow.

Reach out to us at BIGiOK Consulting. Let’s plan today for your success tomorrow. Because in our industry, the best way to predict the future is to create it. Sara@BIGiOK.com

Promote the value you bring to your local community.

Access our new campaign that puts your unique value in the forefront.

Provide your current and prospective clients with a snapshot of the added benefits of working with a Trusted Choice® Independent Insurance agency.

Customize these materials today! cobrand.iiaba.net/made-for-you/i-am

It’s been a very active year in Oklahoma, with the state experiencing fires, tornadoes and hailstorms. Disasters can strike anytime, so it’s crucial that we share with consumers what to do in case they are impacted. Here are some tips you can share with your clients if they’re affected by disasters.

For those who’ve experienced significant loss:

• Contact your insurance agent or company as soon as possible. Ask about your ALE (additional living expense) coverage. Your insurer should be able to quickly get you a check to help you get temporary living quarters and other necessities (clothes, food, etc.) in this early stage.

• Ask your insurer what information is needed to process your claim. Provide that information, including your contact information, if you cannot live in your home.

• Once safe to do so, take photos to document the damage. Your insurance company has a right to inspect the property, so clean-up will have to wait.

• Keep track of your expenses and save all your receipts because your insurance company may reimburse you.

For those who’ve experienced minor damage:

• If the damage is minimal, get repair estimates BEFORE filing a claim. Compare this figure with your deductible level. If it’s lower than or slightly higher, consider

not filing a claim so it won’t appear on your insurance record.

• When safe to do so, make the necessary repairs to prevent further damage. Do not have permanent repairs made until your insurance company has inspected the property and you have reached an agreement with them on the cost of appropriate repairs. Move undamaged items to a safe location when necessary to avoid theft or additional loss.

• Take numerous photos or videos of the damage, and don’t throw anything away.

Remember these tips when you’re dealing with contractors to avoid fraud:

• Always get more than one bid.

• Check references and phone numbers. The Better Business Bureau collects contractor complaint information. You can also contact the Construction Industries Board to make sure the contractor has a valid license to do business in the state and that they carry liability insurance.

• Don’t pay upfront or make your final payment until the job is finished.

• Avoid contractors who offer to waive your deductible or promise a rebate (It’s against the law!).

• Never sign a contract with blank spaces; always keep a copy for your records.

• Contact the Office of the Oklahoma Attorney General Consumer Protection

Unit at 833-681-1895 if you suspect contractor fraud.

Anyone needing assistance can contact OID’s Consumer Assistance division at 800-522-0071 or visit oid.ok.gov. It’s also important to report damage at damage. ok.gov because these reports help with local recovery efforts and access to disaster relief aid.

Consumers can find more information about preparing for disasters and reviewing insurance coverage at oid.ok.gov/GetReady

call 1-800-798-2294 or visit nationalsecuritygroup.com.

Chairman

Vicky Courtney Ricketts Fennell & Assoc.

Tulsa

Chairman Elect

Kathy Reeser VIP Insurance Edmond

Treasurer Scott Dull Omega Insurance Agency Choctaw

Secretary Guy Griggs INSURICA

Tulsa

Director at Large

Rob Piearcy Arnett Insurance Agency

Durant

State Director

Chris S. Floyd, CRM, CIC

Brown & Brown Insurance Pryor

Director at Large

Trent Willis

Cornerstone Insurance Group Oklahoma City

Immediate Past Chairman

Vaughn Graham Jr., CIC

Rich & Cartmill Inc. Oklahoma City

Director at Large

Helen Kasper Dillingham Insurance Oklahoma City

Company Liaison

Traci Madole

Liberty Mutual

Oklahoma City

MGA Liaison

Rebecca Easton CompRisk Management Inc.

Oklahoma City

YAC Chairman Jase Riggs Riggs & Associates Ardmore

As the new voice of the independent agents of Oklahoma, BIGiOK promotes and provides education, legislative advocacy, innovative concepts and practical solutions, and community and career opportunities.

Founded in 1906 as the Oklahoma Association of Local Fire Insurance Agents, BIGiOK (Big I Oklahoma, Independent Insurance Agents of Oklahoma) has grown into the largest and most influential insurance trade association in the state. With nearly 450 independent insurance agency members, we proudly represent over 3,000 independent insurance agents and their teams. Our members range from small, one-person operations to some of the largest and most respected agencies in the region.

BIGiOK’s mission and policies are shaped by a dedicated board of directors, elected each year at our annual convention, and implemented by a professional staff based in Oklahoma City. Our work is driven by a commitment to strengthening independent insurance agencies through a variety of

programs and services. From advocacy before legislative, regulatory and judicial bodies in Oklahoma to providing essential resources, BIGiOK is a powerful voice for independent agents at the state level.

We are also proud to be affiliated with the Independent Insurance Agents & Brokers of America (IIABA), a national organization based in Alexandria, Virginia, and Washington, D.C., that amplifies our advocacy efforts on a national stage. Beyond advocacy, BIGiOK serves as the go-to resource for information and updates within the insurance industry. Through our publications—Policy Magazine, the BIGiOK Newsletter and other time-sensitive member communications—we ensure that our members stay informed and equipped to thrive in an ever-evolving industry.

OKPac is BIGiOK’s state political action committee. It provides financial support for state elected officials who will provide support for or have shown support of issues affecting the insurance industry and to those who share our business philosophies. Only individuals or partnerships can make contributions to OKPac. Under Oklahoma law, OKPac can accept no contributions from corporations.

Kristi Abdo

Aeriel Akers

John Ankeney

Jeremy Bagley

Fred Barker

Nicole Barnhill

Ashlea Bearden

Stewart Berrong

Amanda Brendel

John Brogan

Eric Callaham

Mark Carlin

Kent Casteel

Hunter Clark

Justin Collet

Cassidy Cooper

Vicky Courtney

Cara Covault

Carson Curtis

Joan Curtis

Steve DeSpain

Melanie Dinwiddie

Jenny Dotter

Gina Douglas

Michael Scott Dull

Warren Dean Dull

Rebecca Easton

Chris Floyd

Alison Garahan

Vaughn Graham, Sr.

Vaughn Graham, Jr.

Claudia Haltom

Julie Hamill

Julie Handrich

Taylor Horton

Sherry Hutman

Jaycee Hyde

Stefanie James

Denise Johnson

Jamie Larson

Traci Madole

Pat Mandeville

Betsy Martin

Bob Martin

Jerry Martinez

Ian McCormick

Cristal Melendez

Avery Moore

Dayna Morton

Sar Nigam

Brandon Oliveira

Brad Owens

Kathy Reeser

Eric Reynolds

Jase Riggs

Terry Rinner

Sloan Roller

Savannah Parker

Thomas Perrault

Abby Perez

Rob Piearcy

George Prideaux

Meghan Pizzalato

Jennie Reed

Tianna Rogers

LeAnn Sanderson

Jennifer Soder

Michael Sourie

Deidre Stone

Jody Styles

Noah Styles

Mike Taylor

Roger Thompson

Zoe Torrey

Braedan Warwick

Courtney Willis

Trent Willis

Haley Wilcox

Justin Zwaschka

InsurPac is BIGiOK’s national political action committee. It pools the voluntary and individual financial contributions of thousands of independent insurance agents to help elect candidates to Congress who share BIGiOK’s business philosophies. InsurPac is the largest property-casualty insurance industry PAC in the country.

Wes Becknell

Travis Brown

Mark Carlin

Vicky Courtney

Timothy Driskill

Chris Floyd

Vaughn Graham

Austin Greenhaw

Guy Griggs

Tony Holmes

Denise Johnson

Mark Long

Bruce Magill

Patrick Mandeville

Mark McPherson

John Moon

Avery Moore

Michael Mosley

Thomas Perrault

Kathy Reeser

Jase Riggs

T.J. Riley

Michael Ross

Belynda Tayar

Brad Warwick

See more information and quantifiable examples of contributions by going to: OKPac

Tom Perrault

Rich & Cartmill

Tom is honored to be considered for Agent of the Year. As a commercial insurance producer at Rich & Cartmill, he is dedicated to helping clients strategically manage business risk while actively contributing to the community through civic and philanthropic involvement. Tom holds CIC, AFSB and CPCU designations and was named Young Agent of the Year in 2022. Outside of work, he enjoys life with a supportive spouse and three children, ages 10, 9 and 7. The family stays busy with youth activities and sports—especially when cheering on the Golden Hurricanes.

Jose Orquiz

Aarvin Insurance

Jose is an agent with Aarvin Insurance who entered the insurance industry just one year ago and quickly discovered a strong passion for serving clients. With a background in sales beginning at age 18, Jose developed a deep appreciation for understanding and meeting people’s needs—skills that now translate into helping individuals and businesses protect what matters most. At Aarvin Insurance, he works alongside a supportive team to deliver customized coverage solutions with a focus on client care and peace of mind. Jose finds great reward in making a meaningful difference in the lives of those he serves.

Stephanie Cherry

ECI Insurance Agency

Fifteen years ago, a career in insurance wasn’t the plan—but today, Stephanie can’t imagine doing anything else. As the Commercial Lines Team Manager at ECI Insurance, she focuses on more than managing accounts: She solves problems, builds lasting relationships, and supports team development. Known for being coachable, hardworking and always willing to go beyond the job description, Stephanie believes that success is a team effort and shows up with that mindset every day. Passionate about continuous growth and leading with heart, she is honored to win Agency Staff Member of the Year.

Mid-Continent Group (MCG)

Ashlea brings 13 years of insurance experience across claims, underwriting and marketing. She currently underwrites for Kansas and several non-state specific programs at MCG, where she is committed to supporting agents and promoting the MCG brand. Ashlea believes the foundation of business success lies in “winning on relationships.” A strong advocate for continuing education, she holds 10 designations from The Institutes and encourages the next generation to explore insurance as a rewarding career. Outside of work, she enjoys spending time with her husband and preschooler, golfing, hiking, attending country music concerts and traveling.

CompSource Mutual

Brad is a seasoned insurance professional with more than 28 years of industry experience. As director of business development at CompSource Mutual, he is known for his commitment to excellence and talent for turning opposition into opportunity. Brad approaches every challenge with a competitive drive and a focus on achieving the best outcomes for both clients and company. His forward-thinking mindset and ability to spot potential where others see obstacles have been key to his long-standing success. Respected for his leadership and influence, he continues to play a pivotal role in driving growth and building strong relationships throughout the industry.

Founded in 1930, Johnson & Johnson is a family-owned insurance wholesaler built on strong, lasting relationships. The company offers innovative solutions across Commercial Lines—including property and casualty, marine, professional liabilities, workers’ compensation, transportation and flood— and Personal Lines such as homeowners, high-value, marine and recreation, and flood. Johnson & Johnson Preferred Financing is also available. With offices in Oklahoma City and Dallas, the company’s local marketing representatives provide personalized service and tailored coverage solutions. A technology-driven, service-focused organization, Johnson & Johnson combines decades of industry expertise with a forward-thinking approach to support its partners and drive long-term growth.

For more than 200 years, The Hartford has built a legacy of trust by showing up for people—customers, agents, communities and employees alike. As a leader in property and casualty insurance, group benefits and mutual funds, The Hartford is committed to innovation and personalized service. The company works daily to earn the confidence placed in them, offering tailored solutions that support small businesses and strengthen local partnerships. Proud to be part of the Oklahoma insurance community, The Hartford remains dedicated to delivering value through collaboration, innovation and long-standing relationships.

Founded by Joy Haltom in 2005, Haltom Insurance Agency serves clients across Oklahoma and Kansas with offices in Alva and Cherokee. The agency provides a full range of insurance products, including auto, home, farm, commercial, life and health. Following Joy’s passing in August 2024, her daughter, Hannah Haltom, who rejoined the agency in 2017, now leads the business. Haltom Insurance Agency is committed to serving clients with honesty and integrity, focusing on education and delivering comprehensive coverage at the best value. The agency continues to grow through strong relationships and client referrals, taking pride in understanding the unique needs of each customer. The team is honored to have won the BIGiOK Small Agency of the Year Award.

Cornerstone Insurance Group is honored to have been nominated after 19 years of dedicated service. The agency is committed to delivering reliable insurance solutions while building strong, lasting relationships with clients. With a focus on personalized service, Cornerstone proudly supports the local business community and strives to make a meaningful impact. This recognition reflects the agency’s ongoing commitment to excellence and client care. Outside the office, the team enjoys participating in community events, supporting youth sports and spending time with family. Cornerstone looks forward to connecting with fellow BIGiOK members and sharing in the collective experience of the independent insurance community.

Headquartered in Oklahoma City since 1959, INSURICA is one of the 50 largest insurance brokers in the United States, placing more than $2 billion in annual premiums. Ranked as the 28th largest privately held independent agency in the country, INSURICA employs over 800 team members across more than 35 offices in Oklahoma, Arizona, Arkansas, California, Colorado, Georgia, Kansas and Texas. The company is committed to delivering exceptional service and expertise to its clients while continually expanding its network through strategic partnerships that add value to the enterprise.

Service and philanthropy are core values at Rich & Cartmill, driving the agency’s commitment to strengthening communities. In the past year, Rich & Cartmill donated $50,000 to employee-nominated nonprofits, packaged 20,000 meals during United Way’s Day of Caring, and supported local elementary schools with food, coat and school supply drives. The agency also hosted Christmas programs for Happy Hands and the Bethel Foundation. Through its R&C Cares sponsorships and volunteer initiatives, the team engages in hands-on service to make a meaningful, lasting impact. Rich & Cartmill remains dedicated to giving back and supporting the communities it proudly serves.

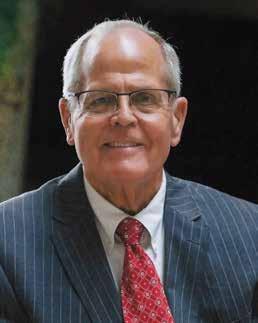

The Legacy of Service Impact Individual Award honors a person who has made a meaningful and lasting impact on BIGiOK and the insurance industry. This year’s recipient exemplifies leadership, dedication and the core values that define our association.

Based in Oklahoma City, Jeff currently serves as president of INSURICA of Central Oklahoma. His impressive career includes roles at INSURICA, the INSURICA Insurance Management Network, and USF&G/St. Paul. Across these positions, he has played a key role in the growth and success of each organization.

A graduate of the University of Oklahoma with a B.B.A. in finance, Jeff brings a wide range of expertise, including disability insurance, customer service, umbrella insurance, employee benefits and overall industry knowledge. His insight and professionalism have earned him the respect of colleagues and peers alike.

Beyond his professional achievements, Jeff has been a dedicated leader within BIGiOK, serving as a past chairman of the board and continuously offering guidance and vision to advance the association. His contributions have left a lasting impact, and BIGiOK is proud to recognize his legacy of service.

CISR Designation Certificates

CPRM Designation Certificate

Ashley McSpadden Berrong Insurance

Aloha Award for Swag-tacular Excellence Amwins Specialty Auto

Most Aloha Booth Liberty Mutual/SAFECO

Congratulation to our Agency and Company prize drawings

Jessica Anthony: National GeneralCompany Prize

Amy Buoy: INSURICA - Agent Prize

Taelyr Smith: INSURICA - Agent Prize

This year’s INSURCON was nothing short of epic—and the numbers prove it! With a record-breaking 540 total attendees, including 301 rock star agents, it officially became the biggest INSURCON to date. Hosted at an all-new resort destination— the OKANA Resort & Indoor Waterpark in Oklahoma City—the tropical vibes and upgraded venue gave the entire event a fresh energy.

From the moment guests checked in, it was clear we were in for something special. The luau-themed Partner Showcase was a true island escape—complete with leis, tiki huts and swag that would make any beachgoer jealous. Networking never looked so festive!

The golf tournament brought 101 players to the greens for a day of fun, friendly competition and plenty of prizes.

Meanwhile, the Empowered Women’s Happy Hour gathered over 100 inspiring women for an evening of connection, leadership and collaboration—cheers to that!

Education took center stage with CE sessions that delivered big. From ChatGPT and AI to Cybersecurity, E&O, and beyond, attendees left with real-world tools to level up their work.

On the advocacy front, attendees raised over $17,000 for OKPac, reinforcing our commitment to protecting the independent agency channel. And let’s not forget the big winners—congrats to all of our award recipients and our lucky agents who walked away with $1,000 and $2,000 prizes during the Partner Showcase!

INSURCON 2025 had it all: sunshine, innovation and a whole lot of aloha spirit. We’re already counting down to next year!

The latest FILO (Future Insurance Leaders of Oklahoma) session brought young insurance professionals together for an indepth look at underwriting & claims, thanks to the support and expertise of CompSource Mutual. Their generous partnership made this continuing education opportunity possible, and BIGiOK is grateful for their continued investment in future leaders.

FILO is a BIGiOK program designed to grow the knowledge, confidence and network of rising insurance professionals. Each module is crafted to provide CE credit while diving into key areas of the industry. Past sessions have explored sales & marketing, BIGiOK basics, government affairs, and community service, and even included a behind-the-scenes tour of the Oklahoma Insurance Department. Every module ends with a class review to help reinforce the material.

Ready to take the next step in your insurance leadership journey? Visit BIGiOK.com/FILO or email Shania Slavick at shania.slavick@BIGiOK.com to get involved.

In the nonstop juggle of meeting continuing education (CE) requirements, the Young Agents of BIGiOK are stepping up to make things easier—and more engaging—for insurance professionals across the state.

Recently, the Young Agents hosted a pair of Lunch & Learn events, offering attendees a chance to earn CE credit, connect with peers and walk away with practical insights. While organized by the Young Agents committee, the events are open to all industry professionals.

A big thank-you goes to IPFS for sponsoring and presenting the Tulsa session, and to AF Group for doing the same in Oklahoma City. Their support made these educational events possible, creating a relaxed environment where learning and networking go hand in hand. Be sure to check BIGiOK.com/education for upcoming Lunch & Learn dates—you won’t want to miss the next one!

Thank you to CompSource Mutual for hosting the Young Agents Committee at the Thunder game in your suite! We truly appreciate your generous hospitality and continued partnership.

Jeffrey Jack Burton, 67, passed away May 17. Jeff grew up in Poteau. He earned his business degree from the University of Oklahoma, where he began a lifelong love affair with Sooner football. To Jeff, Sooner Magic was not just about game day, it was a way of life.

In 1982, a job fair match led Jeff to USF&G Insurance, where he launched a distinguished career in the insurance industry. From field supervisor to trusted leader, he dedicated his professional life to serving clients and colleagues with care, intelligence and integrity. He joined INSURICA in 2000 and rose to become president of INSURICA of Central Oklahoma.

Jeff was a true student of the industry, earning the CPCU, CIC and CRM

designations. He was a pillar in the insurance community, serving on the board of directors and as chairman for the Independent Insurance Agents of Oklahoma. He was recently honored with the prestigious Big I Oklahoma “Legacy of Service Award.”

Jeff was known as a man who knew the value of relationships. He was not just respected by his clients, they loved him. A strong leader and passionate mentor, he invested deeply in the personal well-being of his team.

A devoted husband, father, grandfather, brother, uncle and friend, he leaves behind his beloved wife of 32 years, Debbie, a son and daughter-in-law, and many others, including his vast INSURICA family.

James Alexander Keitz, known to many as Jim, Jimbo, Keitzee, passed away peacefully April 22 following a brief illness, just days after celebrating his 80th birthday.

Jim lived a life marked by undying love for his beautiful wife, Sharon, who preceded him in death, dedication to his family, his faith and his community. A business graduate and active alum of Oklahoma State University, he was also a die-hard fan of the OSU Cowboys.

After college, Jim served as a captain in the U.S. Army, stationed in Panama. Upon completing his tour of duty, he and Sharon returned to Oklahoma City, where he began his career in insurance

by founding Keitz and Associates Inc., officing with his father. He later joined Messer Bowers Co., where he worked until the end of his life.

Jim was a former president of the Independent Insurance Agents Association of Oklahoma City and proudly served the insurance community since 1969.