NO ONE KNOWS OKLAHOMA BUSINESSES QUITE LIKE OKLAHOMANS DO.

That’s why our communities have trusted CompSource Mutual for 85+ years. We’re proud to be a premier workers’ compensation carrier o ering your customers the best: top-rated financial strength and first-rate service. CompSource Mutual is rated A (Excellent) by AM Best.

EDITORIAL STAFF

Publisher Denise Johnson, CISR, CIC

Managing Editor Jerri Culpepper

Graphic Designer Denise Canon

PROFESSIONAL

President/Chief Executive Officer

Denise Johnson, CISR, CIC

Chief of Staff and Operations

Josh Reasnor, MSSL, CISR, CKC

Senior Vice President of Strategic Initiatives

Sara Bradshaw Ray, CIC, CKC

Workers’ Compensation Account Manager

Jeanette Madrid

Director of Member Services

Shania Slavick

Director of Marketing and Communications

Jerry Rappe’

Specialty Lines Service Account Manager Cindy Munden, CISR

Director of Professional Liability

Cari Senefsky

Education Coordinator Kim Watkins

Denise Johnson, CISR, CIC

Connor Myers,

Bradshaw Ray, CIC, CKC

From the President/CEO

Here’s Some of the Ways YOUR Association Is Helping Your Agency Thrive

We made it to fall! What a fun summer it was… our family was able to take a “once in a lifetime” family vacation, and I feel refreshed and ready to work!

Over the past few months I have attended many conferences and have seen amazing and big changes. There are more Mergers and Acquisitions than ever before. We’re also seeing an increase in small startups. With that, we see the growth of alliance/cluster groups. As “independent” as our agents are, they also understand their needs are changing, and technology is going to be the key to growth and efficiency.

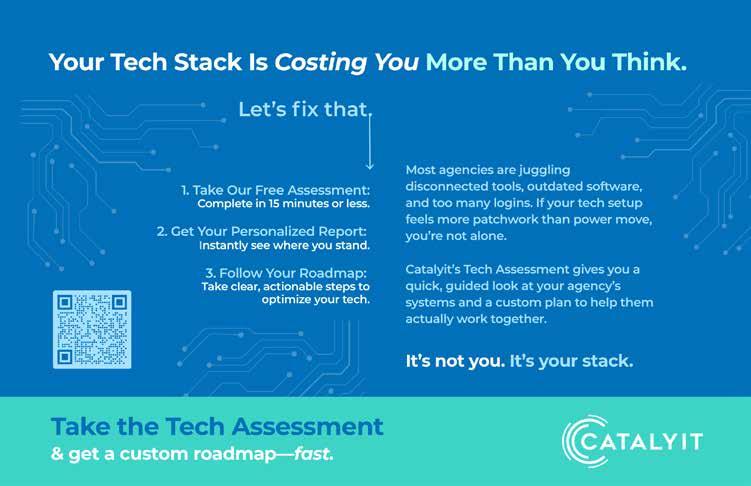

While you’re on the Catalyit website, you should take advantage of the FREE (yes, FREE) Tech Assessment and find out how your agency is doing, with suggestions to assist you in growing a successful agency. Here’s the link: https://catalyit. com/tech-assessment.

The new Tech Assessment now asks you what tools or systems are in your tech stack, as well as how you'd rate it. In addition, we're also collecting overall annual costs for each tool or system and how they integrate with your AMS and CRM.

Membership in BIGiOK will reap you benefits to make your business better, and we can help!

There are so many member benefits when you’re part of BIGiOK. The newest (and perhaps) the most helpful is your free membership to Catalyit. We consider this program similar to Consumer Reports for insurance. Their tag line is “We Make Understanding Insurance Tech Easy.” It is more important than ever that we have a direct connection to technology answers. It makes us more efficient in running our agencies. If you haven’t had a chance to check it out, the website is https://catalyit.com/. As a member of BIGiOK, you can set up your own login and start searching.

Denise Johnson, CISR, CIC BIGiOK President/Chief Executive Officer

With all that data, we can now bring the State of Tech Report findings to you in real time! Once we have enough data to provide a sufficient benchmark, you'll be able to compare your agency's tech stack to your peers who have also completed the Tech Assessment. The new interactive Tech Assessment Analytics Portal will have dashboards to dive deeper into each type of technology and see what others are using, how they rate them, and what the average cost for each system is per user. You'll even be able to filter the data based on agency size, revenue and geographic location!

We are well on our way to building a leading small commercial insurance solution to better serve our agents and brokers and small business customers.

BIGiOK has so many other offerings for members. The value of membership is exponentially more than the “price”. Here is the link to all of our many events to network with fellow agents or guided programs that gives you more information for your agency.

Always remember, we are here to help. Our highly qualified staff is fully accessible to assist! Also remember, we are governed by a Board of Directors that are agents and want the best for this Association and its members. Our board members are volunteers who take time out of their businesses to serve the industry. If you talk to them, thank them. They make my job better. Always feel free to contact me with questions; we’re here to help!

From the Young Agents Committee

Looking Ahead: A Year of Momentum for Oklahoma’s Young Agents

It is with immense excitement and gratitude that I write my first article as chair of the Oklahoma Young Agents Committee. Stepping into this role is not just a professional milestone—it's a privilege. I’m honored to represent and support the young professionals who are shaping the future of our industry across this great state.

As chair, my mission is clear: to help propel this program forward in every way possible, ensuring that young agents in Oklahoma have the resources, education and support they need to thrive. I envision a year filled with opportunities for growth, connection, and impact—and I have no doubt that, with the dedicated team we have on this committee, we’ll rise to meet every challenge and surpass every goal.

We’re kicking things off with a full calendar of events designed to engage and energize. One of our first major initiatives is our SINGO event on Aug. 6, featuring a dunk tank, pie-in-the-face contests and gift basket raffles—all in partnership with the American Cancer Society. Not only will this be a fun and memorable gathering, but it also speaks to our committee’s commitment to giving back and making a difference in our communities.

Shortly after, many of our members will attend the National Young Agents Conference—a chance to collaborate with peers from across the country, share ideas and bring home fresh inspiration

for how we can elevate our efforts here in Oklahoma.

Then, in rapid succession, we’ll host our highly anticipated annual Young Agents Conference Sept. 16-17, themed Back to the Future. This event is designed to reignite passion for the work we do, remind our members of the incredible impact they have on the lives of clients and equip them with tools and motivation to carry forward in their careers with confidence and purpose.

To our committee members: thank you for your energy, ideas, and drive. I am so grateful to walk beside you as we chase ambitious goals together.

To Shania Slavick and the incredible staff at BIGiOklahoma: your tireless support and behind-the-scenes effort make all of this possible. We see you, and we appreciate you.

To Jase Riggs, our immediate past chair: thank you for laying the foundation that makes our continued progress possible. You’ve set the bar high, and I’m honored to follow in your footsteps.

Being a part of this committee means being part of something bigger than any single event or person—it’s about cultivating a space where young agents feel empowered, connected and inspired. This community matters deeply to so many of us, and I’m proud to help carry it forward.

So, get ready. This year is shaping up to be one for the books.

Connor Myers, CCIS Young Agents Committee Chairman

From the State National Director

Chris Floyd, CIC, CRM

State National Director

Building an Iron Dome: Disaster Mitigation in Oklahoma

Oklahoma’s weather is notoriously fierce and unpredictable. From powerful tornadoes and damaging hailstorms to flash floods and crippling winter ice, the state faces a wide range of natural hazards. As climate patterns evolve and extreme weather becomes more frequent and severe, a comprehensive and proactive disaster mitigation strategy is more critical than ever.

and a shift in mindset—prioritizing long-term protection over short-term savings. One promising initiative is the FORTIFIED program, which incentivizes homeowners to use proven, impactresistant materials for repairs and roof replacements. Championed by the Oklahoma Department of Insurance under Commissioner Mulready, and supported by the Independent Insurance

By embracing the “iron dome” mindset, Oklahoma can shift from constant recovery to resilient readiness.

During a recent discussion about the global hard market for property insurance—especially in Oklahoma, which has some of the highest rates in the country—a client asked me, “What can we do about it?” My response, half-joking but rooted in truth, was: “We need to build iron domes around our buildings.”

While not literal, the concept of an “iron dome” represents the urgent need to strengthen and fortify our infrastructure. Without a serious investment in resilience, property owners will continue to face rising insurance costs and increased exposure to catastrophic loss.

It’s time for Oklahomans to start thinking seriously about “building iron domes.”

This begins with stronger building codes, more resilient construction practices,

Agents of Oklahoma (IIAO) and the broader industry, this program targets the state’s most costly perils: wind and hail.

This effort represents a meaningful step toward reducing damage and losses, with the potential to transform Oklahoma from one of the most expensive states for property insurance into a model of resilience. With smarter construction and ongoing maintenance, we can make our communities safer—and invite insurers back with confidence in predictable, manageable risks.

By embracing the “iron dome” mindset, Oklahoma can shift from constant recovery to resilient readiness.

From Strategic Initiatives

The Value of Executive Coaching: A Perspective From Four Decades in Insurance Leadership

After nearly 40 years in the insurance industry—serving as an underwriter, agency owner, manager, consultant, and behavioral profiling “nerd” —I have witnessed firsthand the dramatic shifts in our business landscape. The pace of change, the complexity of client needs, and the demand for agile, empathetic leadership have never been higher. In this environment, one tool has consistently proven its worth for leaders at every stage: executive coaching.

Why Executive Coaching Matters

When I reflect on the most successful leaders I’ve worked with—whether they were guiding agencies through mergers, building high-performing teams, or navigating regulatory upheaval—one common thread emerges: a commitment to continuous growth. Executive coaching is not a remedial measure for struggling leaders; it is a catalyst for high achievers seeking to maximize their impact and lead with clarity, confidence, and resilience.

Coaching provides a confidential and tailored partnership that helps leaders unlock their full potential. Unlike traditional training, which often delivers one-size-fits-all solutions, executive coaching is highly personalized. It focuses on the unique strengths, goals, and challenges of each leader, providing a safe space for honest reflection, feedback, and experimentation.

The Tangible Benefits of Executive Coaching

The data is compelling. Studies show that executive coaching can boost individual performance by up to 70%, with team performance rising by 50% as leaders translate their growth into organizational results. But beyond the numbers, the real value lies in the transformation I’ve seen in both individuals and organizations. Here are just a few of the benefits I’ve observed and experienced:

• Enhanced Self-Awareness: Great leadership begins with knowing oneself. Coaching helps leaders uncover blind spots, recognize their innate strengths, and develop a deeper understanding of how their behaviors impact others.

• Sharper Communication and Interpersonal Skills: In our relationshipdriven business, the ability to communicate clearly, listen actively, and resolve conflicts constructively is invaluable. Coaching provides practical tools and real-time feedback to refine these skills, fostering trust and collaboration across teams.

• Resilience and Emotional Intelligence: Insurance is an industry of risk and uncertainty. Coaching equips leaders to manage stress, adapt to setbacks, and lead with empathy— qualities that are essential for sustaining performance in challenging times.

• Strategic, Visionary Thinking: The best leaders don’t just react to change; they anticipate it. Coaching encourages

Sara Bradshaw Ray, CIC, CKC BIGiOK

Senior Vice President of Strategic Initiatives

From Strategic Initiatives

For insurance professionals, coaching is especially valuable because it addresses both the art and science of leadership. It blends technical knowhow with behavioral insight, helping leaders navigate not just the “what” but the “how” and “why” of effective management.

Now what?

If you are a leader—whether seasoned or emerging—ask yourself: When was the last time you invested in your personal growth? Are you leading with intention, or simply reacting to the demands of the day? Are you leveraging your unique strengths to drive meaningful results for your organization and your clients?

Executive coaching is not a luxury reserved for the C-suite; it is a valuable resource for all leaders. It is a vital resource for anyone committed to excellence, adaptability, and purposeful leadership. In a world where change is the only constant, the willingness to invest in yourself—and by extension, your team and your business—is the ultimate competitive advantage.

leaders to think beyond the immediate, inspiring creativity and long-term strategic planning that drives sustainable growth.

• Goal Setting and Accountability: A coach acts as both a sounding board and an accountability partner, helping leaders set ambitious yet achievable goals and stay focused on what matters most.

My Personal Journey with Coaching

Throughout my career, I have both received and provided executive coaching. As a Certified Kolbe Consultant, I have seen how understanding and leveraging innate strengths can transform not only individual performance but also team dynamics and organizational culture. Coaching has enabled me to help leaders move from “good enough” to truly exceptional—whether that means

navigating a difficult transition, taking on a new role, or simply striving for greater fulfillment in their work.

I’ve watched agency owners rediscover their purpose, managers develop the confidence to make tough decisions, and teams rally around a shared vision. The process is not always comfortable— growth rarely is—but the results are undeniable.

Executive Coaching in the Insurance Industry

Our industry is built on trust, expertise, and the ability to deliver under pressure. Yet, too often, leaders are promoted based solely on technical skills, without the support needed to develop into strategic and empathetic leaders. Executive coaching bridges that gap. It brings an outsider’s perspective—one grounded in experience, objectivity, and a genuine commitment to your success.

I invite you to explore what executive coaching could mean for you and your organization. Reach out, ask questions, and take that first step toward unlocking your full leadership potential. The journey is challenging, but the rewards— for you, your team, and those you serve—are immeasurable.

Let’s lead the way, together. I’ll look forward to hearing from you soon –Sara@BIGiOK.com

Has your agency won any recent industry awards or received recognition for involvement in civic/community affairs? Celebrated an anniversary or milestone, or have one coming up? Launched any initiatives or adopted new technologies that have proved fruitful for your agency? Do you have other news you’d like to share with like-minded professionals throughout the state?

We’d love to share these achievements and milestones with your sister independent insurance agencies in upcoming issues of BIGiOK POLICY magazine!

Also, if you’d like to see a particular topic addressed in a future issue of this quarterly magazine, we’d like to hear those ideas as well!

Please send articles and photos to be considered for inclusion in POLICY, along with any article suggestions you may have, to Jerry Rappe, jerry.rappe@bigiok.com. We Want to Hear Your Good News!

From the State Insurance Commissioner

Reconnecting Families With Lost Life Insurance Benefits

Many families have experienced the loss of a loved one, only to discover later that a life insurance policy existed tucked away in old files, forgotten about, or just unknown to the beneficiaries.

Life insurance provides a financial lifeline during those most difficult times, but beneficiaries can miss out on the support they need when benefits go unclaimed. The Life Insurance Policy Locator can help in these situations.

The

and their financial obligations to help answer those questions. You find more information and tips about life insurance shopping at oid.ok.gov/life.

So, how does the LIPL work? It’s easy, free and secure. First, visit oid.ok.gov/ LIPL and click “Get Started.” Next, you will submit your request, which requires information from the deceased’s death certificate, such as the Social Security number, legal name, date of birth, date

LIPL has significantly impacted the lives of many, and it can do the same for you or someone you know.

The Oklahoma Insurance Department has helped to connect thousands of Oklahomans with millions in unclaimed life insurance policy benefits since we launched this transformative tool in 2016. I want to share more about the LIPL and how it can help you, your loved ones, or the people you serve.

Before we discuss using the tool, I want to stress the importance of life insurance in financial planning. It may seem difficult to address or discuss, but it can help loved ones in case something unforeseen happens. When to purchase, what kind of policy to buy, and how much in benefits will depend on each person and their situation. It’s important for one to consider how many people rely on them financially

of death, and the deceased’s veteran status. You will also need to indicate your relationship to the deceased. Finally, you will click the submit button and receive a confirmation email. If a policy is found and you are the beneficiary, the life insurance or annuity company will contact you directly.

The success of the LIPL speaks for itself. Since the tool’s launch in 2016, OID has helped to connect over 8,000 Oklahomans with over $161 million in unclaimed life insurance policy benefits, with almost 1,500 claiming over $32 million this year alone.

The LIPL has significantly impacted the lives of many, and it can do the same for you or someone you know.

Glen Mulready State Insurance Commissioner

BIGiOK LEADERSHIP

President/CEO

Denise Johnson, CISR, CIC

BIGiOK

Oklahoma City

Secretary

Trent Willis

Cornerstone Insurance Group

Oklahoma City

Director at Large

Helen Kasper

Dillingham Insurance

Oklahoma City

Chairman Elect

Scott Dull

Omega Insurance Agency

Choctaw

Treasurer

Guy Griggs

INSURICA

Tulsa

Immediate Past Chairman

Vicky Courtney

Ricketts Fennell & Assoc.

Tulsa

Director at Large

Tom Perrault

Rich & Cartmill

Tulsa

State Director

Chris S. Floyd, CRM, CIC

Brown & Brown Insurance

Pryor

Director at Large Niki Henley

Extra Mile Insurance

Owasso

YAC Chairman

Connor Myers

Alliant Insurance

Oklahoma City

Company Liaison

Traci Madole

Liberty Mutual

Oklahoma City

BIGiOK MISSION STATEMENT

MGA Liaison

LeAnn Sanderson

One General Agency

Oklahoma City

As the new voice of the independent agents of Oklahoma, BIGiOK promotes and provides education, legislative advocacy, innovative concepts and practical solutions, and community and career opportunities.

ABOUT BIGiOK

Founded in 1906 as the Oklahoma Association of Local Fire Insurance Agents, BIGiOK (Big I Oklahoma, Independent Insurance Agents of Oklahoma) has grown into the largest and most influential insurance trade association in the state. With nearly 450 independent insurance agency members, we proudly represent over 3,000 independent insurance agents and their teams. Our members range from small, one-person operations to some of the largest and most respected agencies in the region.

BIGiOK’s mission and policies are shaped by a dedicated board of directors, elected each year at our annual convention, and implemented by a professional staff based in Oklahoma City. Our work is driven by a commitment to strengthening independent insurance agencies through a variety of

programs and services. From advocacy before legislative, regulatory and judicial bodies in Oklahoma to providing essential resources, BIGiOK is a powerful voice for independent agents at the state level.

We are also proud to be affiliated with the Independent Insurance Agents & Brokers of America (IIABA), a national organization based in Alexandria, Virginia, and Washington, D.C., that amplifies our advocacy efforts on a national stage. Beyond advocacy, BIGiOK serves as the go-to resource for information and updates within the insurance industry. Through our publications—Policy Magazine, the BIGiOK Newsletter and other time-sensitive member communications—we ensure that our members stay informed and equipped to thrive in an ever-evolving industry.

OKPac is BIGiOK’s state political action committee. It provides financial support for state elected officials who will provide support for or have shown support of issues affecting the insurance industry and to those who share our business philosophies. Only individuals or partnerships can make contributions to OKPac. Under Oklahoma law, OKPac can accept no contributions from corporations.

2025 Contributors

John Ankeney

Jeremy Bagley

Aaron Bogie

Mark Carlin

Vicky Courtney

Joan Curtis

Melanie Dinwiddle

Jennifer Dotter

Michael Dull

Warren Dull

Rebecca Easton

Chris Floyd

Vaughn Graham, Jr.

Vaughn Graham, Sr.

Guy Griggs

Niki Henley

Jaycee Hyde

Denise Johnson

Helen Kasper

Traci Madole

Jerry Martinez

Pat Mandeville

Avery Moore

Kathy Reeser

Meghan Pizzalato

Jason Riggs

Margaret Rutherford

LeAnn Sanderson

Stephen Scace

Mike Taylor

Courtney Willis

Trent Willis

InsurPac is BIGiOK’s national political action committee. It pools the voluntary and individual financial contributions of thousands of independent insurance agents to help elect candidates to Congress who share BIGiOK’s business philosophies. InsurPac is the largest property-casualty insurance industry PAC in the country.

2025 Contributors

Wes Becknell*

Travis Brown

Debbie Burton

Mark Carlin

Mike Cole

Vicky Courtney

Jed Dillingham

Jenny Dotter

Tim Driskill

Chris Floyd

Vaughn Graham, Jr.

Vaughn Graham, Sr.

Austin Greenhaw

Guy Griggs

Tony Holmes

Clayton Howell*

Denise Johnson

Mark Long

Bruce Magill

Pat Mandeville

Mark McPherson

Kelly Miller

Jon Moon

Avery Moore*

Mike Mosley

Thomas Perrault*

Kathy Reeser

Jase Riggs*

T.J. Riley

Mike Ross

Belynda Tayar

Brad Warwick

Catalyit: Make Understanding Insurance Tech Easy

“Every agency is different in how they operate and what they need, and choosing the right tech products to grow your agency can be daunting. Catalyit starts from the basics by understanding what you already have and where you are looking to be. The Catalyit team is top-notch and will guide you through your journey of getting the right tech stack in place for your agency.”

— Kelly Gonyo, Founder & President, Blue Line Insurance Agency

In a rapidly evolving digital landscape, one organization is ensuring independent insurance agencies don’t get left behind. Catalyit, a technology platform created by industry insiders, is changing the way agencies understand and adopt technology—with clarity, confidence, and no sales pitches.

And the best part? If you're a member of BIGiOK, you already have full access.

Catalyit

Built by the Industry, for the Industry

Catalyit was founded by seven Big “I” state associations in partnership with agency owners, tech leaders, and insurance innovators. The goal? To solve a growing challenge: while technology raced forward, many agencies struggled to keep up. There wasn’t a centralized, unbiased resource to explore solutions, compare tools, and make strategic decisions—until Catalyit.

What makes Catalyit different is its foundation. It’s not built by outsiders looking to sell software—it’s a support system created by people who understand the unique challenges of running an independent agency. And for BIGiOK members, this powerful resource is already available—at no extra cost.

A Clear Purpose: Smarter Tech Decisions

Catalyit exists to empower independent insurance agencies to make smarter technology decisions. Their approach is all about simplifying the complex and making tech work for the agency. Through their platform, Catalyit helps agencies:

• Understand available technology options in plain language

• Benchmark their current tech setup

• Identify areas for improvement and opportunity

• Make confident, informed decisions

• Use tech to increase efficiency, enhance service, and grow agency value

When technology aligns with agency goals, everything improves—from operations to profitability. BIGiOK members can tap into all of these tools and resources at no cost, simply by activating their Catalyit access.

A Unique, No-Pitch Approach

The insurance tech market is crowded with tools—but light on guidance. Catalyit fills that gap by offering:

• Independent, side-by-side reviews of leading solutions

• A free 15-minute Agency Tech Assessment

• Coaching and workshops tailored to each agency’s needs

• Practical tools like TechTips, guides, and strategy resources

• Access to a collaborative community of fellow agency professionals

Catalyit is committed to evolving alongside its users, continuously updating content, expanding offerings, and incorporating feedback from the field. For BIGiOK members, this means staying ahead of tech trends without paying extra or falling for sales gimmicks.

Free with Your BIGiOK Membership

Thanks to BIGiOK’s partnership with Catalyit, all members receive complimentary full access to the entire platform. That includes every tool, comparison, training, and community benefit. There’s no separate subscription fee—just log in and start using the tools available to you.

If you're already a BIGiOK member, your Catalyit advantage is waiting.

A Trusted Source in a Noisy Space

Whether an agency is just beginning its digital transformation or looking to optimize automation and data tools, Catalyit meets them where they are. The organization aims to be more than a resource—it strives to be the trusted source for agency technology guidance. Catalyit doesn’t just explain what’s out there. It helps agencies put the right tools in place and use them to full advantage. And with BIGiOK’s built-in access, that guidance is always just a few clicks away.

Start Here: Get Started by Taking the Tech Assessment

Catalyit’s free Tech Assessment is a practical first step for any agency. In just 15 minutes, it provides a clear picture of where the agency stands—and how to move forward strategically.

GoTo: Catalyit.com/tech-assessment

Explore at BIGiOK.com/catalyit. Your BIGiOK membership unlocks it all.

Coaching Manager

A Practical, CE-Approved Leadership Series for Today’s Team Leaders

BIGiOK Consulting is proud to introduce a brand-new leadership series this fall: The Coaching Manager, a 3-session virtual program designed to equip current and emerging leaders with realworld coaching tools that build trust, promote accountability, and drive team performance.

Whether you're leading a small department or preparing your next generation of managers, The Coaching Manager offers practical strategies that can be immediately applied to day-today leadership conversations. The series will be facilitated by Amie Haar, a respected instructor with deep experience in leadership development, coaching, and communication. Sessions will be highly interactive, combining brief teaching segments with partner practice, reflection, and action planning.

What You’ll Learn

Each session centers around a key leadership focus:

1. Building Trust Through Coaching

Explore how trust forms the foundation of all meaningful leadership and how to coach with curiosity, empathy, and purpose.

2. Leading With Integrity

Shift from command-and-control to coaching-as-connection. Learn how consistent integrity and personal example drive performance.

3. Inspiring Action + Growth

Identify priorities, build accountability systems, and lead

coaching conversations that result in real progress.

This isn’t about theory—it’s about equipping leaders with tools that work.

Series Schedule

Live virtual sessions:

• Wednesdays: Nov. 5, 12, and 19

• Time: 1-4 p.m. Central

• Format: Zoom

• Approved CE Credit: 9 General Hours (1 additional hour pending for cohort check-in)

• This cohort-style course is intentionally limited in size to allow for personal engagement and group connection.

Don’t Wait—Seats Are Limited

Registration is now open and will close on Oct. 24—or earlier if seats are filled. The program fee is $550 for BIGiOK members.

If you're looking to grow confident, capable leaders who know how to support and develop others—this series is the right next step.

To learn more and register, scan the QR code below

By Sara Bradshaw Ray SVP Strategic Initiatives, BIGiOK

or contact Sara@BIGiOK.com

3-virtual sessions beginning in Fall ‘25 info: sara@BIGiOK.com

You are...

Promote the value you bring to your local community.

Access our new campaign that puts your unique value in the forefront.

Provide your current and prospective clients with a snapshot of the added benefits of working with a Trusted Choice® Independent Insurance agency.

Customize these materials today! cobrand.iiaba.net/made-for-you/i-am

In the evolving energy sector, businesses are confronted with heightened regulatory demands and the initiative to enhance environmental sustainability. We offer customized insurance coverages designed to mitigate risks associated with green and renewable energy initiatives.

Policies are underwritten by Mid-Continent Casualty Company, an authorized insurer in all states except AK and NY; Mid-Continent Assurance Company, an authorized insurer in CA, CT, DE, HI, ID, LA, ME, MA, MO, NE, NV, NH, NJ, ND, OH, OK, PA, RI, TX, VT, VA, WV, WI and the D.C.; and Oklahoma Surety Company, an authorized insurer in AR, KS, LA, OK, TX and OH. © 2022 Mid-Continent Casualty Company, 1437 S. Boulder, Suite 200, Tulsa, OK 74119. All rights reserved. 5676-MCG (11/24)

Education Calendar

SEPTEMBER

• Sept. 17 ~ CIC Agency Management (Hybrid)

• Sept 19 ~ Episode 7: Free Friday Ethics Webinar ~ 11 a.m.-noon

OCTOBER

• Oct. 14 ~ CISR Life & Health Essentials (Hybrid)

• Oct.15 ~ James K. Ruble Graduate Seminar (Hybrid)

• Oct.17 ~ Episode 7: Free Friday Ethics Webinar ~ 11 a.m.-noon

NOVEMBER

• Nov. 5 ~ The Coaching Manager - 3 session (virtual) series ~ 1 - 4p.m.

• Nov. 11 ~ CISR Other Personal Lines Solutions Webinar (Online)

• Nov. 12 ~ CISR Insuring Personal Auto Exposures Webinar (Online)

• Nov. 12 ~ KOLBE Strengths (online) Workshop (2 Hours of CE Approved) ~ 2 - 4 p.m.

• Nov. 13 ~ CISR Insuring Personal Residential Property Webinar (Online

• Nov. 21 ~ Episode 7: Free Friday Ethics Webinar ~ 11 a.m.-noon

DECEMBER

• Dec. 19 ~ Episode 7: Free Friday Ethics Webinar ~ 11 a.m.-noon

MACRH 2026

• March 3 ~ The Manager's Bootcamp Winter 2026 ~ 1 - 4p.m.

On the Road with BIGiOK: Supporting Our Members, Building Our Future

Our director of member services has been hitting the road, connecting face-to-face with incredible BIGiOK members across the state! Whether the conversation centers around marketing resources, cutting-edge technology tools, continuing education opportunities, expert consulting, our dynamic Young Agents program, or our influential role in legislative advocacy—one message rings loud and clear: BIGiOK is here to empower independent agents.

This journey isn’t just about membership—it’s about relationships. It’s about making sure our members feel supported, equipped, and confident to grow, thrive, and lead in an ever-evolving industry. We’re proud to be more than just a resource—we’re your partner in success.

Young Agents

Young Agents of Oklahoma Singo Fundraiser: A Night of Fun, Laughter, and Giving Back

The Young Agents’ Singo Fundraiser proved once again that when our community comes together, great things happen. This year’s event was nothing short of incredible — and the numbers speak for themselves. With a sold-out crowd of over 70 attendees, we raised more than $5,800 for the American Cancer Society.

From the very start, the energy was high. Guests enjoyed mouthwatering birria tacos paired with refreshing frozen margaritas, creating the perfect fuel for an evening of friendly competition and lively socializing. Thanks to the generosity of our partner companies, attendees had the chance to win raffle baskets valued at $100 or more, adding even more excitement to the night.

Of course, the true crowd favorites were the Dunk Tank and Pie in the Face challenges. These hilarious moments kept everyone laughing and cheering — and our brave (and very damp) participants deserve special thanks for making it such a memorable part of the evening.

Beyond the games and prizes, what truly made the night special was the sense of connection and purpose. Every ticket purchased, every donation made, and every laugh shared brought us closer together as a community, united by a common goal: supporting the fight against cancer.

To everyone who attended, donated, or volunteered — thank you. Your support doesn’t just make events like this possible; it changes lives. Together, we proved that giving back can be fun, impactful, and unforgettable. Here’s to another year of making a difference, one Singo card at a time.

Young Agents 2025 FILO Group Volunteers at WINGS' New Facility

The FILO Group recently spent the day volunteering at the new WINGS facility, a nonprofit serving adults with developmental disabilities, in Oklahoma City. From organizing classrooms to landscaping, the team helped prepare the expanded space for upcoming programs and services.

Their efforts came at a key moment as WINGS grows its impact through the new facility. The FILO Group’s time and energy made a meaningful difference, reflecting their commitment to community and servant leadership.