Chairman of the Board - Allyson Padilla allyson@blanksinsurance.com

President - Patrick Taphorn, CIC, CSRM ptaphorn@unland.com

President-Elect - Thomas Evans, Jr. tom.evans@assuredpartners.com

Vice President - Chris Leming cleming@troxellins.com

Secretary/Treasurer - Cindy Jackman, CIC, CISR cjackman@arlingtonroe.com

IIABA National Director - George Daly george.daly@thehortongroup.com

Mohammed Ali - mali@aliminsurance.com

Charles Hruska, IV - chas@hruskains.com

David Jenk, Esq. - djenk@nwibrokers.com

Rebecca Kohn - rkohn@worthyinsurance.com

Lindsey Polzin - lpolzin@presidiogrp.com

Ray Roentz - ray.roentz@hwcrins.com

Noele Tatlock - ntatlock@unland.com

Luis Tayahua - lt@goldenowlinsurance.com

Sharon Waldvogel - sharon@infinitybrokersinc.com

Andrea Wallace - andrea@aadins.com

Amiri Curry - acurry@assuranceagency.com

Kevin Lesch - klesch09@gmail.com

Jeff McMillan - jeff@mcmillanins.com

James Sager - james@sagerins.com

Luke Sandrock, CIC - lsandrock@2cornerstone.com

Budget & Finance | Cindy Jackman, CIC, CISR cjackman@arlingtonroe.com

Education | Lisa Lukens salibainsurance@gmail.com

Farm Agents Council | Steve Foster s.foster@ciagonline.com

Government Relations | Dustin Peterson dustin@peterson.insurance

Planning & Coordination | Nick Gunn, CIC ngunn@envisionins.com

Technology | Brian Ogden brian@ogdeninsurance.com

Young Agents | Cody Imming cody@imminginsurance.com

Follow us on socials.

Member Support

Director of Information and Technology

Director of Education and Agency Resources

Accounting & Admin Services

Director of Human Resources, Board Admin

Sr. Vice President/Chief Financial Officer

Chief Executive

Director

Director

Office

Rebecca Buchanan (217) 321-3010 - rbuchanan@ilbigi.org

Shannon Churchill (217) 321-3004 - schurchill@ilbigi.org

Brett Gerger, CIC (217) 321-3006 - bgerger@ilbigi.org

Tami Hubbell, CIC (217) 321-3016 - thubbell@ilbigi.org

Jennifer Jacobs, SHRM-CP (217) 321-3013 - jjacobs@ilbigi.org

Mark Kuchar (217) 321-3015 - mkuchar@ilbigi.org

Phil Lackman, IOM (217) 321-3005 - plackman@ilbigi.org

Lori Mahorney, CISR Elite (217) 415-7550 - lmahorney@ilbigi.org

Evan Manning (217) 321-3002 - emanning@ilbigi.org

Kristi Osmond, CISR Elite (217) 321-3007 - kosmond@ilbigi.org

Rachel Romines (217) 321-3024 - rromines@ilbigi.org

Tom Ross, CRIS, CPIA (217) 321-3003 - tross@ilbigi.org

Carol Wilson, CPIA (217) 321-3011 - cwilson@ilbigi.org

The one thing I have learned over the years is that there are 24 hours in a day, no more, no less. You may sleep less, spend less time with friends and family, or give up hobbies such as binge-watching Breaking Bad or Ted Lasso in order to get more out of those 24 hours. All the stuff you give up, such as sleep, will cause you to be less happy and effective over time. You have a finite amount of time with your kids over their formative years, as much of their time will be spent at school, work, and with friends. In order to find that work-life balance, you need to have someone or something take tasks away from your plate, so to speak, so that you can enjoy downtime from your work or business. Many times, money is the driver as to what you give up or not give up. You must ask questions such as:

•What can I give up without affecting the value of my business?

•What am I willing to give up?

•How important is my family? (10 out of 10 is my answer )

•How important are my various hobbies?

•What are my options for solutions?

•Can it be done legally?

•How do I balance all of the things that are important to me?

Some people appear to have 40 hours in their 24 day, and we call them unicorns (Nicole Broch, she is amazing), so this article is for 98% of us non-unicorns. The biggest thing we need to define, or answer is: What does success look like to me?

Let’s answer the questions.

What can I give up without affecting the value of my business? This will be different for all of us, depending on what stage of life we are in and our unique circumstances. Significant other is number one in my book (love you, Wendy ) Kids, to me, from 0-18 years old, are the next most important thing, followed by growth and success in my career then, followed by hobbies. My kids are both 18+ now, so my list has changed to significant other first (still love you Wendy) followed by what pickleball court times that I can get this week, then when can I binge watch the show of the week, then my kids (depending on the day) and lastly, the perpetuation of my business. This goes to show you that our priorities are ever changing depending on your personal preferences and all of the other factors depending on your stage of life. By spending less time in your business, you may potentially negatively affect the value of your business but that may be okay, and you may be able to supplement your business with other resources so that the effect is negligible.

What am I willing to give up? What you can and what you are willing to give up can be two different lists. For example, I can give up McDonald’s fries, but I am not willing to give up McDonald’s fries . I ate two large fries while I was writing this article. These lists will be different for everyone, as I know that someone else in the education department would gladly give up McDonald’s fries.

How important are my various hobbies? This is more important to me than others as it provides a mental break that can allow me to re-center and re-focus to be more present in the moments that are really important to me. Sometimes, these little reality breaks are the most important priority.

What are my options for solutions? I can do everything, and every area will suffer the consequences. I can hire a nanny for my children and those relationships will suffer. I can neglect everything, but my business and it may thrive at the cost of everything else. I can neglect my business and everything else may negatively affect every other aspect of my life as I won’t be able to afford things such as a nice home, vacations or pickleball paddles and gear. I could hire more employees to pick up some slack so that I could focus on the other priorities on my list. I could employ virtual assistants in the place of employees at a lesser cost in order to focus on other priorities. I could also employ third party vendors to take away agency operation tasks such as accounting or HR services.

Can it be done legally? The virtual options that you may look into may not be okay with your E&O policy nor may it be okay with your various carrier contracts. You will need to read your E&O policy very carefully to determine coverage and you will need to examine every carrier contract to ensure that they are okay with your various solutions. For example, they may not allow offshore or foreign Virtual Assistants so you may have to find firms with employees located in the States (this typically raises costs over foreign assistants).

How do I balance all of the things that are important to me? This is a fine line that will be different for everyone due to circumstances and location. It is tough to find good employees in rural areas due to the size of the potential employee pool so a virtual option may better suit those employers. Big cities may be more appropriate for hiring employees as there is a larger pool of employees to choose from. However, big city rent may be cost prohibitive due to size of space needed for hiring new employees and then again remote is always an option these days. On the other side of the coin, you may happen to get lucky and have a great pool of employees in a rural area and space can be cheaper in a rural area. The best piece of advice is to analyze all options and not automatically make assumptions based on where your agency is located. When you find the sweet spot, you will know it as everything will be balanced and thriving. The process is like baking, as you will need to do a little adjusting here and there among all of your priorities to find the perfect mix. Enjoy and embrace the process like I do when my daughter is trying out a new cupcake recipe. I may not be totally honest with her as I want more testing and definitely more tasting. It is great to have all of the new options that this new virtual world and technology provide us in our endeavors.

Lastly, what does success look like to me? A finished article delivered to Rachel on time (Huge success to me). Success will look different to all of us. I set my watch workout goal so low that I can sit and teach all day while only getting up a couple of times, then driving home and as I sit down on the couch for my nightly binge-watching , the watch tells me that I met my goal. While my wife walks a couple of miles every day and at 10 o’clock at night she is furiously going up and down the stairs to meet her goal while I am watching her and enjoying a nice bowl of ice cream. If I were you, I would be my wife and not myself

As always, this is just Brett’s 2 ½ Sense (it dropped to 2 ½ as eggs are down 60% but not all the way to 2 yet due to the tariff uncertainty ) and I hope it was helpful. You can contact me through my CONNECT and if it is urgent, do not hesitate to reach me through CONNECT. I may be pushing you to CONNECT. If you need any clarification or have any suggestions for future articles please email me at bgerger@ ilbigi.org

Nearly 6 in 10 agents say customers are unaware of how legal system abuse affects their insurance costs. Yet the numbers are staggering:

$366.8 billion

$162.1 billion

abuse leads to:

$5,135 per year

By David Carothers

Commercial insurance producers face a major challenge in sales: getting in front of decision-makers and converting prospects into long-term clients.

Many business owners already have agents they’ve been with for years, making it tough to break through their existing relationships. But the key isn’t just about persistence - it’s about using the right approach.

The most successful producers don’t just ask better questions; they reframe the entire conversation to keep the prospect engaged. Instead of pushing for a quick “yes,” top salespeople know that getting to “no” first can actually increase their chances of closing the deal.

This article will teach you:

• How to use sales psychology to influence prospects

• How to frame questions that get the right responses

• How to set more appointments and overcome objections

• How to leverage content marketing for better lead generation

If you’re tired of getting ignored, dismissed, or stuck in conversations that go nowhere, this article will show you a new way to sell.

Why Getting to “No” Works in Sales

Most sales training programs teach you that your goal is to get prospects to say “yes” as quickly as possible. But what if that’s the wrong approach?

Chris Voss, former FBI hostage negotiator and author of Never Split the Difference, discovered that people actually feel more in control when they say “no” instead of “yes.”

Why?

Because saying “yes” feels like a commitment, while saying “no” feels like protection.

Rewording Questions to Get a “No” First

Most producers ask questions that push for a “yes”—but that immediately puts the prospect on guard. Instead, reverse the question so that “no” is the natural response.

Here’s how:

BAD: “Would you like to set up a time to talk?” (Prospect sees this as pressure.)

BETTER: “Would you be opposed to a 15-minute call next week to discuss ways to reduce your total cost of risk?” (Prospect feels in control and more likely to engage.)

Another example:

BAD: “Do you have time to meet this week?”

BETTER: “Would it be a bad idea to schedule a quick call to see if I can save you money on insurance?”

This simple change makes it easier for the prospect to say “no” in a way that actually opens the door to further discussion.

Once you have them engaged, your next goal is to get them to keep talking.

Mirroring Technique – Repeat the last few words of their sentence in a questioning tone. This encourages them to elaborate.

Labeling Technique – Instead of saying “I understand,” say, “It sounds like you’re frustrated with your current coverage.” This makes them feel heard.

The Silent Pause – When they answer a question, pause for a few seconds before responding. Silence creates discomfort, prompting them to keep talking.

The more they talk, the more you learn about their pain points - which makes it easier to position yourself as the solution.

Getting a business owner’s attention isn’t easy, but the key is using data to spark curiosity.

Instead of leading with a generic sales pitch, try benchmarking data to grab their interest:

• “Are you aware that your competitors are paying 30% less for their workers’ compensation insurance than you?”

• “Would it be crazy to say that your cyber risk score puts you at a high risk for data breaches?”

• “Are you comfortable knowing that your business is overpaying for general liability coverage compared to similar companies?”

By presenting real numbers, you make the conversation about facts instead of opinions - and prospects respond better to data-driven insights.

Gatekeepers exist to block salespeople, so you need to sound different from the typical insurance producer.

Instead of introducing yourself as an insurance agent, try this:

“I’m not calling to sell you a policy—I’m calling because I found something in your experience mod that I think you should know about.”

This creates curiosity, making them more likely to let you through.

Instead of arguing, reframe the question:

BAD: “Would you be willing to consider a second opinion?”

BETTER: “Are you 100% certain that your current agent is reducing your total cost of risk as much as possible?”

By adding “100% certain,” you force them to consider whether they actually know the answer.

the “My

Many business owners feel emotionally tied to their agent, which makes it difficult to convince them to switch. The best way to break through this is to reframe it as a financial decision.

“Would you ever pay a friend $50,000 a year just to keep them around?”

“Would your friend be willing to write you a check for the extra money you’re spending?”

This forces them to think logically instead of emotionally.

Power of Webinars in

Instead of making 100 cold calls, host one webinar and get in front of 50-100 engaged prospects.

Example Topics:

• How Business Owners Can Reduce Workers’ Compensation Costs

• Why Most Companies Overpay for Cyber Insurance (and How to Fix It)

• The Hidden Costs of General Liability Insurance That No One Talks About

Once recorded, turn the webinar into multiple pieces of content:

• A long-form blog post

• Short video clips for LinkedIn & YouTube

• Social media posts

• Email drip campaigns

Creating Evergreen Content That Works for You 24/7

A single well-written blog post can generate leads for years.

Example: A producer wrote a long-form blog post on Workers’ Compensation Experience Mods. A business owner found it via Google, called him, and ended up signing a $500,000 policy.

By optimizing your content for search engine traffic, you create a constant source of inbound leads - without having to cold call every day.

Using Technology to Increase Efficiency

Instead of manually prospecting, automate key tasks:

• Track MOD score changes so you can call at the right time.

• Use email drip campaigns to nurture leads automatically.

• Leverage AI-powered chatbots to pre-qualify leads before a call.

One-Degree Separation Marketing: Selling Without Selling

Instead of selling home and auto insurance, try marketing umbrella policies to solar panel owners (who are required to carry higher liability coverage). Instead of pitching general contractors, offer them drone insurance (which gets them in your CRM).

By taking this indirect approach, you avoid competing with other agents while still capturing high-value clients.

• Reframe your questions to get to “no” first - this increases engagement.

• Use benchmarking data to position yourself as a trusted advisor.

• Leverage content marketing and automation to generate leads effortlessly.

David Carothers CIC, CRM is the Principal at Florida Risk Partners and founder of Killing Commercial, and host of the Power Producers Podcast.

People often struggle to define momentum because it seems intangible and, yet we’re all familiar with it. Physics defines it as “the quantity of motion of a moving body, measured as a product of its mass and velocity.” In practical terms, momentum simply refers to movement.

You know it when you see it or, more typically, when you feel it.

For example, if you’re a fan watching a football game and your team is having trouble scoring or gaining yardage, you probably feel frustrated and discouraged. But then there’s a big play and the entire momentum of the game changes, along with your mood. Suddenly, you feel energized.

With momentum on your side, you entertain the idea that your team could win the game. As they score a touchdown, you feel euphoric - until you see the yellow flag on the field. Just like that, you’re deflated. The momentum has shifted again.

Whether seismic or subtle, for better or for worse, shifts in momentum also can occur in an insurance agency. These shifts are either positive or negative. Depending on what you do, you’re either gaining momentum or losing it. For example, one day things at your agency seem great. You’re getting lots of referrals and writing new business. You’re gaining momentum.

Then, inexplicably you’re struggling to make your numbers. No matter how hard you work, your performance falters and nothing seems to go your way. You’re losing momentum. You wonder what went wrong and how you will recoup your forward movement.

Like other organizations, your agency comprises Momentum Makers and Momentum Takers. Momentum Makers propel your agency forward, while Momentum Takers push it back. Although it’s possible to regain lost momentum, the most successful agencies keep from losing it in the first place by continually adding Momentum Makers and avoiding Momentum Takers.

Whether seismic or subtle, for better or for worse, shifts in momentum also can occur in an insurance agency. These shifts are either positive or negative.

Momentum Makers move their agency ahead by improving its culture (language and behaviors), productivity, relationships, and results. Momentum Takers have the opposite effect, hindering an agency’s overall productivity and growth. In your agency, can you distinguish the Makers from the Takers?

Whether your agency experiences positive or negative momentum often depends on the following key areas.

Momentum Takers have no clarity. They’re confused about what they need to do, and so they hope that nothing bad happens. What’s more, they communicate reactively, both internally (with their teams) and externally (with clients). Typically, they take the easy way out. Takers would rather fix a problem than prevent it. They wait for clients to contact them about an issue or problem, which by then may be too late to resolve.

By not communicating with clients until the clients contact them, Takers cost the agency valuable time as well as money. Beyond losing accounts, they also lose credibility and, ultimately, momentum.

Momentum Makers have clarity about their mission, their roles and their responsibilities. They communicate proactively through intentional and consistent weekly High-Performance Team meetings. These meetings enable sales and service staff to discuss key clients, red flags, commitments to clients, schedules and more.

Because they anticipate and address issues before they become a problem, their agency gains momentum, which in turn creates abundance.

Momentum Takers do the things they perceive as most urgent, which is usually whatever is right in front of them. They’re always busy but never productive. Their first order of business is to take care of the minor, mindless tasks that require the least effort. After all, it’s much easier to scroll through endless emails than to tackle what’s truly important.

Takers figure it’s better than doing nothing at all, plus it gives them a sense of accomplishment. Sadly, activity does not equal accomplishment, as I’ve discussed many times.

While I’m not suggesting you ignore things like email, it’s important to recognize that you lose momentum when you prioritize answering text messages and email over the things

By Brent Kelly

you should be doing to generate income. Do you really need to scour your inbox during the time you work at your highest level or can it wait until later? Remember, emails are someone else’s priority - not yours.

Momentum Takers also perceive that every issue is an emergency and, therefore, are constantly interrupting their service team. This is counterproductive. If everything is an emergency, nothing is an emergency. Until your agency spells out what constitutes an emergency that warrants help from another department, disruptions will continue to erode your momentum.

Momentum Makers know how to prioritize. Business and self-help author Steven Covey writes about this in his bestselling book, The 7 Habits of Highly Effective People: “Good performers prioritize their schedule and great performers schedule their priorities.” That’s so true. You create momentum when you identify, prioritize and execute the nonnegotiables. These are the thing(s) that absolutely, positively must get done ASAP.

Makers are very intentional with their calendar. In addition to a list of impact items for the week, their calendar specifies what needs to be done first. A producer’s calendar should contain a “to-do” list of their primary revenue-generating items, in order of importance. The list might include:

• Sales and sales conversations

• Proactive relationship management

• Pipeline development

Although it depends on your role and responsibilities, your weekly calendar should be set the Friday before the week begins. That way, if you see holes in your schedule, you can plan how to use the time most effectively. When Monday rolls around, you’ll be focused and ready for the week.

Would you rather invest an hour to change the oil in your car or spend the time and money to get it fixed when it breaks down? That’s the difference between preparing and repairing. Certainly, preparing requires forethought and effort, but repairing typically takes much longer, costs a lot more and requires more energy and patience.

Momentum Takers don’t like to practice and rehearse; they like to wing it. In lieu of preparation, they simply show up, throw up and blow up. They’re known to “techno-barf” on prospects before realizing - after the fact - what happened. By then it’s too late to do anything about it.

Is it possible to show up unprepared and still get some wins? Certainly. But how many times has your lack of preparation caused you to lose momentum? How many times have you left an appointment and kicked yourself for not asking a couple of specific questions you’d thought about but forgotten because you weren’t well rehearsed?

As a participant in one of our producer training programs lamented, “I’ve got to stop rehearsing my presentation during the actual presentation!”

Relying on on-the-job practice is extremely risky because the penalties for failing are significant. And it’s not just money and momentum that you stand to lose. You also lose credibility by looking unprofessional. This can have a ripple effect on future referrals and income-generating opportunities. You only have one chance to make a first impression. Make it a good one.

Momentum Makers are meticulous about preparing and practicing. They believe preparation is the ultimate competitive advantage. Even if they lack extensive resources, the best market access or the most experience, they succeed because they always out-prepare their competition. Preparation makes people confident, and confidence is a huge momentum maker. What’s more, it’s something that every producer can control 100%.

Momentum Makers firmly believe that every opportunity deserves their very best. That’s why they consistently engage in low-risk practice in front of their peers. They polish their presentations by rehearsing repeatedly. Their mantra: “I will never lose to someone who is more prepared.” If you’re taking the time to visit a prospect or client and they’re taking the time to meet with you, don’t you want to be at peak performance?

Is your agency gaining or losing momentum? What are you doing about it? The good news is that you can totally control it by thinking and acting like a Momentum Maker.

While there’s no guarantee that you’ll win every time, positive momentum puts you in a better position to succeed. Getting there may not be easy, but the opportunities it brings promise to make it well worth the effort.

Brent Kelly, is president of Sitkins Group, Inc., and a motivating influencer, coach and speaker who has a passion for helping insurance agencies maximize their performance. Find out more at sitkins.com or contact him at brent@sitkins.com.

The commercial insurance renewal process consumes significant time and resources for most commercial insurance departments. Managing automatic renewals, commercial downloads, and non-standard renewals while trying to maximize efficiency can be a struggle, especially as carriers continue to push more work onto our team.

In today’s fast-paced world, efficiency is key to staying competitive and meeting client needs, but how? You are in the right place, this blog explores strategies to streamline the commercial insurance renewal process, ultimately enhancing your team’s productivity and client satisfaction.

The commercial insurance renewal process involves several steps, from gathering client information to reviewing policies and negotiating terms. However, agencies often face challenges such as manual data entry, lack of centralized information, and communication gaps.

Teams must manage multiple projects at different stages while acting as the link between the carrier and the client. This complexity highlights the need for a consistent process to ensure important steps aren’t missed, which is why we created our process packs to help maintain consistency in your agency.

There are many options for commercial teams to transform their commercial processes. Digital transformation offers solutions by providing benefits like improved data accuracy, faster processing times, and enhanced security.

Some items to consider:

• How to automate collection of new, renewal, and remarketing applications

• Getting assistance with collecting loss runs and following up on submissions and trailing documents

By Kelly Donahue-Piro

• Tools that can assist with population of supplemental applications

• Having a strong repeatable process to track new and renewal business and ensure items are not missed

Utilizing tools already built into your agency management system and adoption of automation tools can assist with streamlining workflows, ensuring timely renewals and reducing errors.

Communication is key to ensure a seamless renewal process. Utilizing collaboration tools fosters teamwork and transparency, while keeping clients informed and engaged throughout their journey.

It’s imperative that team understand:

• Expectations on turn around times for new, renewal, and remarketing

• How to effectively communicate with carriers and underwriters – Who to contact, how to contact them, and carrier logins.

• How to effectively communicate with clients – When to call, text, or email – There is a right time for all!

• How to effectively communicate as a team, especially when there are multiple parties involved: producers, account managers, internal and virtual assistants, managers

Having clear guidelines around communication will help your team stay on track and enable your agency to ensure consistency and accountability.

Policy reviews are essential for ensuring clients have adequate coverage and that your agency has updated information before sending submission to the market. Involving clients in the review process promotes transparency and allows for a tailored insurance solution that meets their evolving needs while maximizing efficiency to ensure it’s done right the first time.

If we aren’t engaging our clients and ensuring that we have accurate information, we are spinning our wheels and wasting precious time!

Continuous learning and skill development are vital for teams to adapt to industry changes and technological advancements. Investing in training enhances staff efficiency and ensures a high standard of service delivery.

Teams want to do a good job, but it is leadership’s responsibility to ensure that teams know what that means. Having a repeatable process is key to success so that everyone is on the same page.

Agencies should also provide tools to help make teams lives easier, including:

• Quote Sheets that allow for consistency in obtaining information

• Remarketing Guidelines that set the stage for what and when to remarket

• Agency Standards that allow teams permission and clarity around what is acceptable to say yes and no to

• Carrier Cheat Sheets that can provide a centralized place for carrier selling features, credits available, and go to markets

• Scripts to help teams to overcome objections and answer questions easily

• Templates with approved agency communications that help to ensure consistency and mitigate errors

Providing your team with training shows that you care about their knowledge and career growth. It also ensures your clients receive consistent interaction from all team members, reinforcing why they choose to do business with your agency.

By implementing these strategies, insurance agencies can transform their commercial insurance renewal process, achieving maximum efficiency, client satisfaction, and increasing agency retention.Key steps include:

• Embrace change

• Leverage technology

• Prioritize communication

• Provide continuous learning opportunities, tools and resources

Efficiency in the commercial insurance renewal process is not just about saving time and resources - it’s about delivering exceptional service and building lasting client relationships. Start your transformation journey today and unlock the potential for growth and success.

Kelly Donahue-Piro, founder and president of Agency Performance Partners, is a no-nonsense effectiveness expert who has helped hundreds of insurance agencies identify and capitalize on sustainable improvement opportunities. Go to agencyperformancepartners.com for more information.

By Mary Boyd

Small business owners are the acrobats of the business world. Running a small business requires flexibility and precision to perform multiple tricks, all while balancing ambition with caution.

Entrepreneurs constantly make critical decisions with limited budgets. Yet, the one key risk that many entrepreneurs overlook is the need for a safety net to catch themselves should they fall: adequate insurance coverage.

Surprisingly, 75% of small businesses in the U.S. are underinsured, according to the 2023 Hiscox USA Underinsurance Report. For businesses with narrow profit margins, insurance is essential in preventing an error or accident from snowballing into financial setbacks and legal entanglements.

Insurance agents play a critical role in educating business owners about the risks they face and the size of safety net they truly need to absorb the impact of a fall.

Understanding why small businesses tend to be underinsured helps insurance agents support their clients more effectively. These reasons include:

Cost-cutting missteps. Facing limited budgets, some owners may reduce or not purchase coverage to save money, unaware that this can lead to long-term financial strain.

Set-it-and-forget-it coverage. Many entrepreneurs treat insurance as a one-time purchase, renewed each year without review. What they don’t realize is that as a business evolves, so do its coverage needs.

Policy confusion. A substantial number of small business owners misunderstand coverage details, leading to unexpected gaps. For example, 71% of small business owners don’t fully understand what a business owners policy (BOP) covers, and 83% are unclear on general liability insurance, according to the Hiscox study.

Overlooked specialized coverage. Entrepreneurs, especially those in consulting or professional services, do not realize that general liability will not cover all their needs. Advisors can point out when additional policies, like professional liability, are necessary.

Small business owners are required to be masters of many talents, simultaneously managing finances, marketing and operations. Insurance often takes a back seat. That’s why agents play a vital role as educators and advisors, helping clients navigate the complexity of adequate protection.

In fact, 56% of small business owners view brokers and agents as key resources to guide them through their insurance journey. By following these five best practices, agents and brokers can help small business owners avoid underinsurance:

1) Use plain language. Advisors can explain insurance in terms that small business owners can understand. For example, include how much a lawsuit could cost their business, noting that attorney fees for just two hours could exceed an entire year’s insurance premium. Educating clients about the hidden costs of underinsurance and the potential consequences of perceived “savings” can shift their perspective.

2) Personalize advice. Every business requires a tailored approach to address its unique risks. The benefit of seeing an insurance professional is that they take the time to understand all aspects of a client’s business to ensure they are appropriately insured and fully understand their coverage. Using real-world examples helps clients see the need for tailored coverage, such as what could happen to a consultant if they give bad advice.

Additionally, offering personalized solutions that balance affordability with comprehensive protection reinforces insurance as an essential investment for a business’s long-term stability.

3) Require honesty. An agent can help to foster an open environment where a client feels comfortable being transparent about their business operations. When a client divulges all the information about a business, whether positive or negative, an agent can recommend the best possible coverage for full protection.

4) Provide a biannual check-up. Insurance is not a one-anddone concept. Agents and brokers help small business owners avoid underinsurance by highlighting how insurance must evolve with a growing business. Encourage clients to assess their needs biannually or after significant changes, such as acquiring new equipment, expanding services or increasing revenue. Regular policy check-ups ensure their coverage keeps pace with their operations, protecting them from unforeseen risks.

Independent agents and brokers play a critical role in not only encouraging small business owners to prioritize insurance, but also closing the underinsurance gap and helping to build a more resilient small business community.

Mary Boyd is CEO of Hiscox USA.

This article was originally published in IA Magazine and is reprinted with permission.

Understanding why small businesses tend to be underinsured helps insurance agents support their clients more effectively.

Released July 2025

Premium Growth Rates

Loss Ratios

Commission Data

Premium Taxes

Line of Business Details

Surplus Lines Utilization

Penetration Rates © A.M. Best Company - Used with Permission

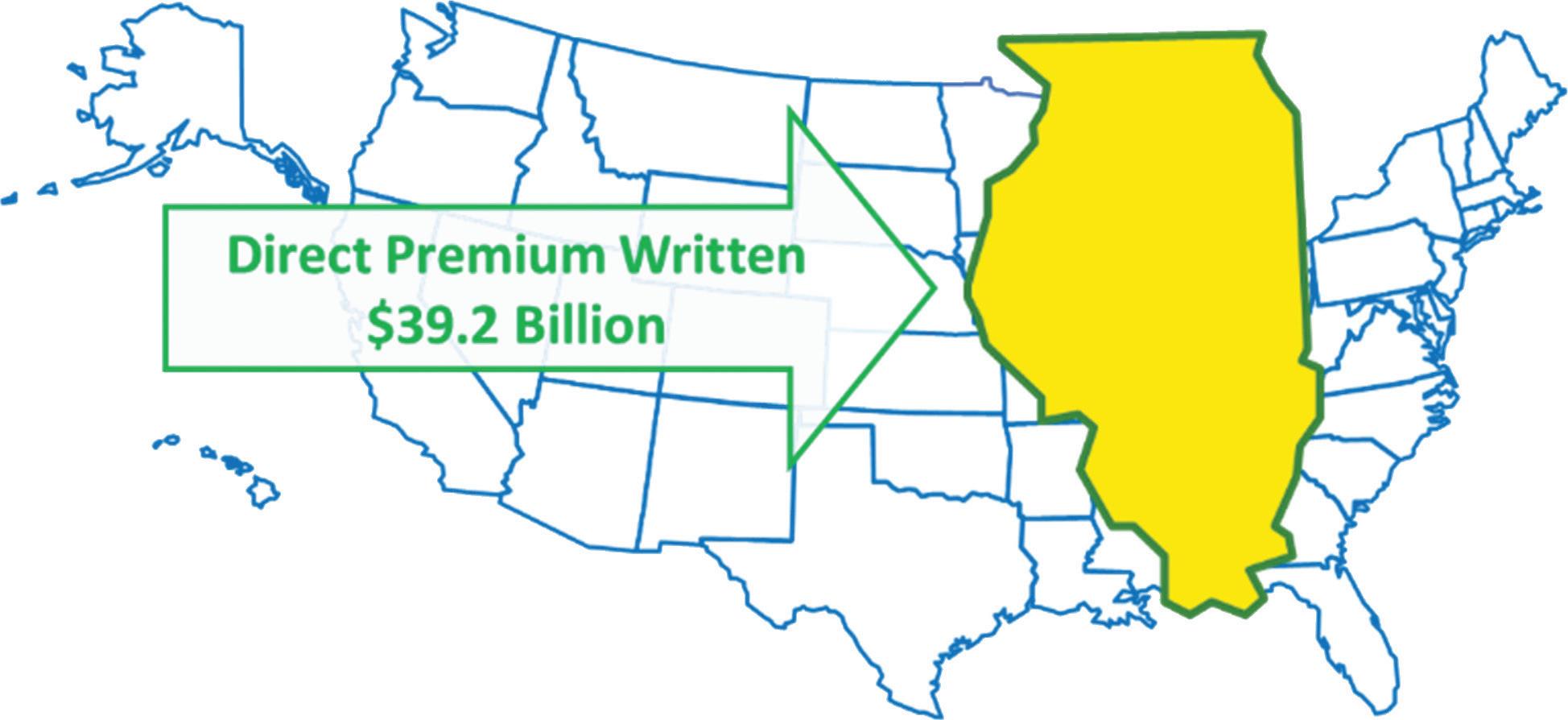

The 2024 Illinois Annual P&C Marketplace Summary provides you with data and insights on important aspects of the Illinois P&C marketplace. INCLUDED IS A SUMMARY OF SOME OF THE KEY INFORMATION. As a Big I Illinois member benefit, agency members receive complimentary access to the full 80+ page report.

This Summary focuses on direct premiums, direct losses, and associated underwriting results before reinsurance. It includes Direct data from nearly 3,000 U.S.-domiciled insurers, highlighting those that have written premiums in Illinois. Direct data is the insurer data that most closely demonstrates what is happening in the P&C marketplace. As independent agents, we operate within this marketplace - competing for, explaining, and placing P&C insurance across the state.

What follows is a graphic and numeric presentation of the Illinois P&C industry data from an independent insurance agent’s perspective. The 2024 data used is the most recent available from A.M. Best Company (June 1, 2025) and includes all 50 states and the District of Columbia (equaling the 51 entities referred to in the data in this report).

The full report includes the following and more:

• Premiums for all 32 P&C Lines of Business

• The Top 10 Lines of Business for Independent Agents

• Loss and Combined Ratios

• Premium Change Rates

• Penetration Rate of Independent Agents

• Commission Rates

• Surplus Lines

• Premium Taxes

• Largest/Highest and Smallest/Lowest states, and U.S. Average

• Line of Business In-Depth Details on the Lines of Business focused on by Independent Agents

In 2024, Illinois property and casualty (P&C) Direct Premium Written reached $39.2 billion, ranking Illinois 5 of 51 states for total premiums in the United States. That is 3.8% out of $1.04 trillion in premiums nationwide. On a per capita basis, Illinois ranks 22 of 51 for all P&C premiums combined, 34 of 51 for Personal Lines, 7 of 51 for Commercial Lines, and 16 of 51 for Agricultural Lines.

In Illinois in 2024, the largest Line of Business for independent agents was Other Liability (Occurrence), as determined by Direct Premium Written (DPW). The second largest Line of Business in Illinois was All Private Passenger Auto, and the third was Homeowners Multi-Peril. For comparison, nationwide in 2024 those Top 3 Lines of Business were: All Private Passenger Auto, Homeowners Multi-Peril, and Other Liability (Occurrence).

Other LOBs, 14%

Premium Change Rates

From 2023 to 2024 premiums changed in Illinois by +9.1% for all P&C Lines of Business combined, placing it 28 of 51 in the United States and District of Columbia. The fastestgrowing Lines of Business in Illinois were Homeowners MultiPeril (+14.7%), Other Liability (Occurrence) (+13.8%), and Farmowners Multi-Peril (+13.1%). Nationally, P&C premium change averaged +9.6%, with the fastest growing percentage being + 15.2% (Washington), and the slowest being + 0.2% (North Dakota). The fastest-growing Lines of Business across the U.S. were Homeowners Multi-Peril (+13.4%), Farmowners MultiPeril (+13.0%), and All Private Passenger Auto (+12.9%). To see all 26 lines, access the full report.

2024 Illinois 1-Year and 5-Year Direct Premium Written Changes

In 2024 the Illinois average Loss Ratio across all P&C Lines of Business was 63.1%, with the highest Loss Ratios occurring in Private Crop (100.5%), Other Liability (Occurrence) (78.8%), and All Commercial Auto (71.1%). Nationwide in 2024 the average Loss Ratio was 62.3%, with the highest state-wide average Loss Ratio being 82.2% (Nebraska), and the lowest being 47.5% (Hawaii). Across the United States, the Lines of Business with the highest Loss Ratios are Federal Flood (237.8%), Private Crop (93.0%), and Multi-Peril Crop (85.9%).

To see all 26 lines, access the full report.

2024 Illinois 1-Year and 5-Year Loss Ratios by Line of Business

During 2024, independent agents controlled 60.5% of the Illinois P&C marketplace. This compares to the United States average of 61.5%, with the highest Penetration Rate being 78.8% (Massachusetts), and the lowest being 51.4% (Alaska). In Illinois, the top Penetration Rates by Lines of Business were: International (100.0%), Aircraft (all perils) (98.8%), and Ocean Marine (98.5%). In the United States, top penetration rates by Lines of Business were: International (100.0%), Multi-Peril Crop (96.9%), and Private Crop (96.4%). To see the comparison back to 2020, access the full report.

Other Liability (Occurrence)

All Private Passenger Auto

Homeowners

All Commercial Auto Workers' Compensation

Commercial

(Claims-Made)

The average Commission Rate in Illinois in 2024 was 11.3% for all P&C Lines of Business combined. By contrast, the average Commission Rate in the United States was 11.5%. The highest average Commission Rate was 13.6% (Massachusetts), and the lowest was 10.1% (Delaware). To see the full list of rates, and average commission comparisons by line, access the full report.

The percentage of P&C insurance premiums going to Surplus Lines is on the rise across all states. In Illinois in 2024, the percentage of premiums going to Surplus Lines Domestic insurers was 8.5%. That percentage was 7.9% in 2023, and 5.8% in 2020. In the United States the corresponding figures were 9.7%, 9.4%, and 7.0%, respectively. In Illinois, the top 3 Lines of Business with premiums going to Surplus Lines insurers were: Other Liability (Occurrence), Other Liability (Claims-made), and Fire Peril Only. In United States, the top 3 Lines of Business with premiums going to Surplus Lines insurers were: Other Liability (Occurrence), Other Liability (Claims-made), and Fire Peril Only. To see a breakdown by line of business, access the full report.

Illinois 5-Years of Surplus Lines Premiums (Domestic Premiums Only)

Dollars represented in millions.

Illinois: Domestic Surplus Lines Premiums

Illinois: Domestic Surplus Lines as Percent of All Domestic Premiums

All U.S. states levy a tax on property and casualty (P&C) insurance premiums, commonly referred to as a premium tax. In Illinois in 2024, the average tax rate for Admitted premiums was 1.5%, while the Surplus Lines predominant tax rate was 3.5%. Together these taxes generated $692 million for Illinois in 2024, accounting for approximately 1.3% of Illinois' total tax and fee revenue, or about $54.4 per capita. Nationally, the average premium tax rates are 2.1% for Admitted premiums, and 3.9% for Surplus Lines premiums. In 2024 that equates to $25 billion in premium taxes nationwide, or about 2.0% of all state tax and fee revenue.

Big I Illinois members can download the full 2024 Illinois Annual P&C Marketplace Report at no cost. This in-depth report provides a comprehensive look at the Illinois P&C insurance market from 2020 through 2024. It offers valuable visual and numeric insights to help you:

• Understand current marketplace trends and opportunities

• Analyze historical shifts and data-driven assumptions

• Explore evolving market segments and insurer activity

Associate Partners at the Silver level and above are eligible for free access. Contact Shannon Churchill at schurchill@ilbigi.org

This summary and analysis were prepared by Paul Buse, Real Insurance Solutions Consulting (R.I.S.C.), which provides additional data resources for Big I Illinois members, including:

• Quarterly Marketplace Summaries as new insurer data becomes available

• Individual P&C Insurer Snapshots upon request, offering detailed state and national views

• Annual Storm Event Summaries using NOAA/NCEI data, available by request

To view source information, download the full report. If you have

By Shannon Churchill

The Farm Agents Council (FAC) hosted their 95th Annual Golf Outing & Summer Meeting on June 12-13 in Bloomington, IL. This event is a wonderful representation of the Farm Agents Council, with lots of great people coming together for good conversations, fun, networking and friendship.

The event kicked off with the sold-out golf outing where over 112 golfers put up some awesome scores well below par. Following a day of fun in the sun, the group headed back to the hotel for the niche tradeshow and social hour. 19 vendors and 140 people gathered over food, drinks and conversation. On Friday, Flint Walton of MEM shared his expertise on “Managing Risk & Safety in Agricultural Workers’ Compensation.” The session was very informative, and attendees left better prepared to handle conversations with their agricultural clients around risk management, safety practices and the importance of coverage in this unique sector.

During the event the Farm Agents Council Board recognized this year’s recipient of the Will Cook Memorial Scholarship, Josh Athmer of Highland, IL. The FAC Board created the Will Cook Memorial Scholarship in 2023, in honor of late FAC member and employee of Frontier-Mt. Carroll Mutual Insurance Co. The scholarship is being awarded for the third time to one Illinois high school senior interested in pursuing

an agricultural area of study including, but not limited to, farm labor, grower, farm/ranch management, biology, horticulture, farm science, agriculture sales or insurance. The recipient will receive $1000 towards their first semester of college. Josh has participated in many clubs and organizations at the high school level including the FFA, Student Council, National Honor Society, Varsity Bowling & Shooting Sports team, Fellowship of Christian Athletes, Student Ambassadors program, and Environmental Club. Josh will be studying large animal veterinary medicine at the University of Illinois at Urbana-Champaign. Upon graduation he will use his degree to pursue his passion for the future of agriculture. His ambition, drive & determination are a winning combination and we can’t wait to see him live out his dreams.

One of the main goals of the event was to raise awareness and funds for the Big I Illinois State Political Action Committee (State PAC). Through events during the Golf Outing, and the new VIP Bourbon Tasting event, the Farm Agents Council was able to raise over $2,900. To learn more about State PAC and the advocacy efforts of the Association, go to ilbigi.org/advocacy.

Overall, the event was a great success and the FAC Board is looking forward to welcoming everyone back to Bloomington, IL on June 11-12, 2026. Mark your calendars now!

The FAC Board is looking for volunteers to serve on the Board and helping direct events and information related to industry. If you would like to learn more, reach out to farmagents@ilbigi.org.

to

with the Farm Agents Council on our website atilfarmagents.com or through Facebook at www.facebook. com/FarmAgentsCouncil.

agency deals in crop, agriculture or farm, you should consider becoming a part of the Farm Agents Council, if you are not already. Send an email to farmagents@ilbigi.org to discuss!

Mike Bulow Tinley Park, IL

Why did you choose to pursue a career in insurance?

I was drawn to insurance because it offers a unique opportunity to engage with a wide range of industries and business owners. I find it genuinely exciting to learn the story behind each company - their history, their challenges, and what makes them go. Being able to provide peace of mind by protecting everything they’ve worked so hard to build is both meaningful and rewarding. It's not just about policies - it's about people, trust, and impact.

What obstacles did you face when you first started, and how did you overcome them?

When I first got started, one of the biggest challenges was relating to different generations of business owners - especially when I didn’t yet have the personal experience to match theirs. Building trust took time and consistency. Another early obstacle was learning how to be disciplined with my time. In a fast-paced, relationship-driven business, staying structured was critical - and luckily, that clicked quickly for me. Overcoming those early hurdles shaped the way I approach clients today: with focus, curiosity, and respect.

What’s something people should know about your generation in the workplace?

My generation experienced both pre-digital and digital eras - so we’re comfortable with both face-to-face conversations and fast-paced tech. We value hard work, but we also value flexibility and purpose. We’re not afraid to challenge old systems if they don’t make sense, but we still respect the experience and wisdom that came before us. In short, we’re adaptable, relationship-driven, and focused on getting results without losing the human element while utilizing technology for a better experience.

How has this industry impacted your life?

I never expected insurance to impact my life the way it has. What started as a career quickly became something much bigger. It’s introduced me to people I never would’ve crossed paths with - business owners, families, and mentors - all with different stories, challenges, and goals. It’s taught me how to listen, how to lead, and how to earn trust. Most of all, it’s given me a sense of purpose: knowing that I play a part in protecting what people have worked their whole lives to build.

Beyond that, this industry has opened doors I didn’t even know existedpersonally and professionally. The opportunities are truly endless if you’re willing to show up, work hard, and stay curious. Insurance has shaped who I am, and I’m grateful every day that I found my way into it.

The newly designed Big I Illinois website at ilbigi. org has received an Azbee Award of Excellence! This award, given by the American Society of Business Publication Editors (ASBPE), recognizes outstanding work by business, trade, association and professional publications.

We consider the website a work in progress - always evolving to better serve our members. We regularly review analytics and user feedback to make informed updates that improve functionality, navigation, and design. Whether it’s simplifying access to resources, enhancing mobile responsiveness, or refining content organization, our goal is to ensure the site remains user-friendly, modern, and aligned with the needs of independent insurance professionals across Illinois.

The Southern Illinois Golf Outing was held June 5 in Carbondale. The weather wasn't perfect, but it was still a great event full of networking and camaraderie.

Allen Stueck (“Big Al”) passed away peacefully on May 4 in Lake Zurich, IL at the age of 78. Allen was born on November 25, 1946 in Manitowoc, WI to Elroy and Doris (Heberer) Stueck. He graduated from Reedsville High School in 1954 where he enjoyed playing sports and was selected All State for the football team. He then attended UW Stevens Point graduating in 1972 with a Bachelor’s degree in History. While at Steven’s Point he met the love of his life, Linda Roberts. They married in 1972 and began their 53 loving years together. The couple eventually set roots in Mundelein, IL where they raised two children, Sarah and Jonathan.

Allen’s life-long career was in the insurance industry. In 1982 he started his own insurance agency, Fairfield Tuttle Stueck Insurance, with his wife, Linda, working beside him. Over the next 45 years they grew the business into a very successful and reputable insurance agency receiving several industry awards until his retirement in 2021. Allen prided himself on honest and thorough service and made some of his closest and life-long friends over his tenure. You could often find him in Chicago enjoying a meal at one of the restaurants he insured.

Allen is survived by his wife of 53 years, Linda Lee (Roberts) his “Silver Star”; Two children: Sarah (Brian) Gusanders, Downers Grove, IL, Jonathan Stueck, Antioch, IL; and four Grandchildren.

Freiburg Insurance Agency Honored by Bicentennial Commission

Freiburg Insurance Agency in Quincy, IL has been recognized and celebrated as a legacy business that has served their county for 150 years or more!

The agency has received a certificate of recognition and an official bicentennial commemorative sign symbolizing their enduring contributions to the community.

The German Insurance Company was founded in 1859 to serve the German speaking community in Quincy who did not read or write English. As the large stockholder moved west, the German Company policyholders had their policies rewritten into the larger and stronger capitalized stock companies. Max Freiburg, Sr. bought into the insurance agency of Miller, Castle and Bastert in 1921. Miller, Castle and Freiburg was dissolved in 1989 and the Freiburg Insurance Agency was formed.

Congratulations to the team at Freiburg on this welldeserved recognition!

Thank you to our Associate Members.

Progressive

Surplus Line Association of Illinois

Arlington/Roe

Blue Cross/Blue Shield of IL CRC Group

Pekin Insurance

Bliss-McKnight IMT Insurance

Keystone Insurance Group, Inc.

MEM

Bronze Level

A. J. Wayne & Associates

AAA, The Auto Club Group

AMERISAFE

AmTrust Insurance

Apollo Brokers dba Limit

Auto-Owners Insurance Co.

Berkley Small Business Solutions

Berkshire Hathaway GUARD Insurance Companies

BlueSky Restoration Contractors, LLC

Boundless Rider

BriteCo

Central Illinois Mutual Insurance Company

Chubb

Columbia Insurance Group

Cowbell Cyber

Donald Gaddis Company, Inc.

Donegal Insurance Group

EMC Insurance

Encova Insurance

Erie Insurance Group

Forreston Mutual Insurance Company

Graham-Rogers

Grinnell Mutual Reinsurance Company

IA Valuations

Illinois Mine Subsidence Ins Fund

Illinois Public Risk Fund

Imperial PFS

Independent Mutual Fire Insurance Company

Indiana Farmers Insurance

Insurance Program Managers Group (IPMG)

J M Wilson

Liberty Mutual/Safeco Insurance

Madison Mutual Insurance Company

Main Street America Insurance

Mercury Insurance Group

Midwest Insurance Company

Nationwide

Paychex HR and Payroll Solutions

Rockford Mutual Ins. Co.

SECURA Insurance

ServiceMaster DSI

Society Insurance

SPRISKA - Specialty Risk of America

Steadily

Summit Insurance

Travelers

W. A. Schickedanz Agency, Inc./Interstate Risk Placement

West Bend Insurance Company

Western National Insurance

Westfield

XPT Specialty

This Ruble Seminar is a practical, fast-paced session exploring common commercial lines coverage pitfalls and how to resolve them. We’ll examine ISO forms, emerging exposures like cryptocurrency and autonomous vehicles, and clarify confusing concepts like business income claims and the differences between insureds. Walk away with sharper insight and actionable strategies to better serve your clients in today’s changing risk environment.

Trausch

23. Are you looking for an exit strategy while still continuing to produce for a few years or are you ready to sell now? Paczolt Insurance would like to talk with you! We are an independent agency dating back to the 1970s that is located in the western suburbs. Our focus is on mid-to-small commercial accounts and personal lines. Our companies include EMC, Badger Mutual, Safeco, Progressive, and Travelers. We have the flexibility and capital to get a deal done. Contact:

Susan Troppito

Paczolt Insurance susan@piaigroup.com (708) 215-5202

20. Since 2004, Central Illinois Agents Group LLC has been providing independent agents with a variety of markets with contingency opportunities. Agents have availability to several markets that they may not be able to sustain or maintain on their own. We have markets for personal, commercial, agricultural and crop insurance lines. Let us help you get to the next level.

Visit www.ciagonline.com for contact information.

02. Forest Park/Oak Park agency for over 60 years, will meet your needs by providing space, markets, marketing & sales support, automation, merging with or purchasing your agency. Perpetuation/ Succession Plans, Buy-Sell Agreements also available. We have experienced, educated and dedicated staff for you and your clients. Have access to our numerous companies, office services and many other resources. Please look closely at us- we are an agency you want to do business with! We’ve done it before, we know how- we make it easy! Visit our website at forestagency.com/agents.html, or call for a confidential discussion and a list of Agency benefits.

Dan Browne will provide an agency evaluation/appraisal at little cost to you. Please call:

Dan Browne or Cathy Hall Forest Insurance/Relation Insurance Services (708) 383-9000

www.forestinsured.com/mergers-acquisitions