LOUISIANAAGENT

Benjamin Albright

Chief Executive Officer, President balbright@iiabl.com (225) 236-1357

Jeff Albright

Consultant

jalbright@iiabl.com (225) 236-1366

Karen Kuylen

Director of Accounting & Finance kkuylen@iiabl.com (225) 236-1353

Jamie Newchurch

Director of Insurance Programs jnewchurch@iiabl.com (225) 236-1350

Kathleen O'Regan

Director of Communications & Events koregan@iiabl.com (225) 236-1360

Karson Roberts

Communications & Events Administrator kroberts@iiabl.com (225) 236-1351

Lyra Roberts

E&O Administrator lyra.roberts@iiaba.net (225) 236-1352

This article discusses Louisiana's Regulation 131, allowing insurers to cancel certain homeowners' policies.

JEFFALBRIGHT IIABLCONSULTANT

The Louisiana Department of Insurance (LDI) issued a Notice of Intent to Promulgate Regulation 131, entitled "Plan for Nonrenewal or Cancellation of Homeowners Policies in Effect and Renewed for More Than Three Years."

The purpose of Regulation 131 is to implement the provisions of Act 2024, No. 9 of the Regular Session of the Louisiana Legislature, which authorizes an insurer to notify the Commissioner of a plan to nonrenew or cancel up to 5% of its insureds’ homeowners policies in a calendar year that have been in effect for at least three years on or before August 1, 2024, for any reason and to request the Commissioner’s approval of a plan to nonrenew or cancel more than 5% of its insureds’ homeowners policies in a calendar year that have been in effect for three years or more on or before August 1, 2024.

Regulation 131 requires insurers providing property, casualty, or liability insurance to submit a plan for nonrenewal or cancellation of certain homeowners policies pursuant to R.S. 22:1265(L) to the Louisiana Department of Insurance.

Any insurer that makes a filing pursuant to R.S. 22:1265(L) for the nonrenewal or cancellation of up to five percent or for more than five percent of its insureds’ homeowners policies in Louisiana in a calendar year shall file with the commissioner a Plan for Nonrenewal or Cancellation setting forth the insurer's plan in the state of Louisiana. A Plan for Nonrenewal or Cancellation shall not include a nonrenewal or cancellation of more than 5% of the insurer’s homeowners policies in force in any one parish that is subject to the “3 year rule”, unless authorized by the commissioner. The commissioner shall have the discretion to disapprove any Plan for Nonrenewal or Cancellation up to five percent if deemed to not be in the public interest.

Approval by the commissioner is required for a Plan for Nonrenewal or Cancellation requesting more than 5% of its insureds’ homeowners policies in any one parish in Louisiana in a calendar year. Subject to the review and approval of the commissioner, an insurer may submit a request to non-renew more than 5% in any parish. In determining whether to grant the request, the commissioner will consider the impact of the request on the insurer’s risk and financial profile, the ability of the insurer to maintain or expand its operations, the cost of reinsurance and such other factors as the insurer shall submit or the commissioner shall deem necessary for the evaluation of the request to determine its overall impact on the insurance market. The commissioner will approve or reject any request within thirty (30) days of submission.

An insurer shall only send a notice of nonrenewal or cancellation to an insured on or after January 1, 2025.

The Plan for Nonrenewal or Cancellation shall include, but not be limited to the following:

1. a listing of the physical addresses, types of policies, zip code and parishes for the properties that will be the subject of the requested nonrenewal or cancellation process;

2. a statewide graphic map by parish representing each proposed parish and zip code affected by the nonrenewal or cancellation, along with the deductible amount. The map shall pinpoint all proposed homeowners policies to be nonrenewed or cancelled and demonstrate compliance with the requirement that no more than 5% of the insurer’s homeowners policies in force in any one parish that is subject to the “3 year rule” and a listing of those homeowners policies that may be nonrenewed or cancelled;

Ben Albright

December 2023

3. a policy count of all active homeowners policies meeting the eligibility criteria under the current “3year rule” concept, including policy inception date and nonrenewal or cancellation date. The policy count and a percentage of the amount of homeowners policies being nonrenewed or cancelled shall be presented on a statewide basis, as well as a per parish basis and zip code basis;

4. the coverage A limits or residential coverage limit for each property risk that will be the subject of the requested nonrenewal or cancellation;

5. a listing of homeowners policies inception date, nonrenewal or cancellation dates for all homeowners policies, premium amount, that will be subject to the non-renewal or cancellation;

6. a mathematical breakdown that illustrates compliance with the requirement that no more than 5% of the insurer’s homeowners policies in force in any one parish that is subject to the “3 year rule” and a listing of homeowners’ policies that may be nonrenewed or cancelled;

7. the insurer's total homeowners policies in force in the particular zip code and parish;

8

. the insurer's total homeowners policies in force in the state;

9

. the insurer's premium by state and by parish as a percentage of the insurer’s total written premium in the state; and

10. any other factors that the commissioner determines are applicable, relevant, and appropriate.

The commissioner may rescind his approval of any Plan for Nonrenewal or Cancellation filing made pursuant to this Regulation if it is subsequently determined that the insurer made any material misrepresentation in its submission, or if the insurer violates the statutory prohibitions against discrimination contained in provisions of R.S. 22:34, R.S. 22:35(A), R.S. 22:1964, or if the insurer violates any provision of Title 22 through the implementation of its approved plan.

View Regulation 131 here.

If you have any questions, please submit them to regulations@ldi.la.gov.

Some companies complicate workers’ compensation with fancy gimmicks and unclear incentives. Stonetrust offers accurate, up-front pricing to get you from point A to point B with no drops or delays. Experience exceptional and personalized service with Stonetrust every time.

RATED AEXCELLENT

EVERY STEP OF THE WAY.

This article discusses Louisiana Legislature committees addressing the state's automobile insurance crisis.

JEFFALBRIGHT IIABLCONSULTANT

It is highly unusual for committees of the Louisiana Legislature to hold regular monthly meetings between legislative sessions.

It is therefore significant that four different committees are holding regular meetings to discuss the automobile insurance crisis during the off season. House & Senate Insurance committees, House Civil Law, and Senate Judiciary A committees are all conducting hearings to evaluate the underlying causes of the high cost of automobile insurance in Louisiana, and the lack of markets for commercial automobile insurance.

Their initial meetings have taken a very broad approach to looking at all the possible causes. They have researched road conditions, distracted driving, DUI, uninsured motorists, lawyer, and insurer advertising, and of course our tort laws.

Legislators are hearing loud and clear from their constituents that the availability and affordability of home and auto insurance is a major problem for citizens and businesses. People want the Louisiana Legislature to address the issue to bring Louisiana in line with surrounding states.

The Legislature made some significant property reforms during the 2024 Legislative Session. But very little was done on tort reform in the face of opposition and a veto of collateral source by Governor Jeff Landry. A majority of legislators believe that tort reform is essential to bringing Louisiana automobile insurance loss costs and premiums in line with other states.

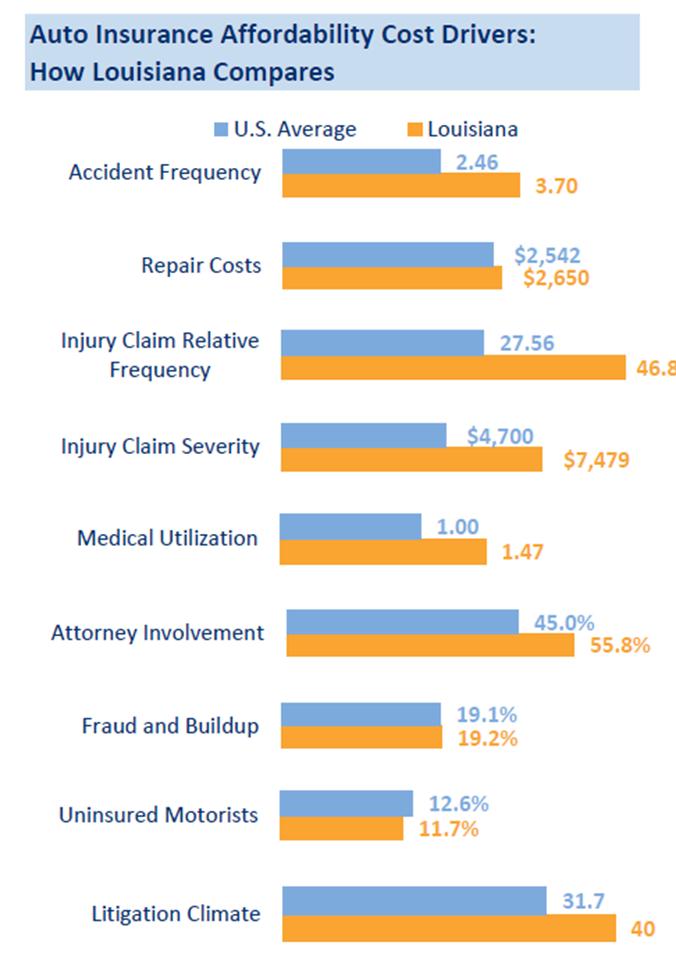

The statistics are very clear. As outlined in the cart on page 11, Louisiana accident frequency is only slightly higher than the national average. Our repair costs are right in line with the national average. But our *Injury Claim Relative Frequency* is almost twice the national average. Injury Claim Severity, Medical Utilization, and Attorney Involvement are all much higher than the national average.

It doesn’t take a rocket scientist to figure out if our bodily injury claims are much higher, our premiums must also be much higher. The Louisiana Legislature knows they must do something to solve the automobile insurance crisis. There seems to be some appetite to bring legislation next year to reduce lawsuit abuse. The big question is whether Governor Jeff Landry will continue to side with the plaintiff attorneys and oppose tort reforms.

KATHLEENO’REGAN

IIABLDIRECTOROF

COMMUNICATIONS &EVENTS

Are you ready for a day of delicious food, fun competition, and great company? The first annual IIABL Insure & Sizzle Cook-Off is just around the corner, and we’re inviting everyone to be part of this exciting event. Whether you’re ready to showcase your cooking skills or simply want to enjoy a fun afternoon of food and entertainment, this event has something for everyone.

With cook-off teams competing for top prizes and attendees getting the chance to sample all the dishes while enjoying drinks and live music, this is the perfect opportunity to come together for a day of unforgettable fun. Let’s take a look at how you can get involved whether as a competitor or an attendee!

Calling All Cooks—Compete in the Insure & Sizzle Cook-Off!

Are you a grill master? A culinary enthusiast with a passion for creating amazing dishes? Now’s your chance to show off your cooking skills at the Insure & Sizzle Cook-Off!

1.No Entry Fee for Teams

Continued from page 13

That’s right it’s free to enter! Whether you’re a seasoned chef or just love cooking for fun, this is your chance to compete without any cost. Simply gather up to five people to form a team and get ready to cook up something special. With no restrictions on what you can cook, you can prepare anything from BBQ and smoked meats to vegetarian masterpieces.

Teams will be competing for the coveted Best Dish Award as well as the People’s Choice Award, voted on by the attendees. The competition is all about showcasing your best dish, creativity, and cooking techniques. So bring your A-game, impress the judges, and you could walk away with top honors and bragging rights!

3.Cook in a Fun, Outdoor Setting

The cook-off will take place outdoors at the West Line Event Center in Scott, LA. Picture this: grills sizzling, the smell of delicious food in the air, and the camaraderie of your fellow insurance professionals all gathered for a day of fun.

Event Date: November 7, 2024

Continued from page 14

**Arrive any time between 6am and 12 pm; all teams must be set up by 12 pm

Location: West Line Event Center, Scott, LA

Team Size: Up to 5 people

No Restrictions on What You Can Cook

No Electricity Available—so bring a generator if needed.

Once you’ve signed up, we’ll send you all the details to make sure you’re prepped and ready to compete. So what are you waiting for? Register your team today and let’s see who has what it takes to take home the top prize!

Not interested in cooking? No problem! You can still be part of the fun by joining us for the Insure & Sizzle Cook-Off Party at the end of the day. This event is perfect for anyone who loves food, drinks, and a lively atmosphere. Here’s why you should attend:

For just $40 per person, you’ll get access to all the food samples from our cook-off teams. From savory BBQ to creative dishes you won’t find anywhere else, this is a foodie’s dream come true. You’ll be able to taste a variety of dishes and enjoy unlimited samples throughout the event.

Your registration also covers beer, wine, soda, and water so whether you’re sipping a cold drink or savoring the flavors from each team’s creations, you’ll be well taken care of. It’s the perfect way to enjoy the event and spend time with your friends, colleagues, and family.

As an attendee, you won’t just be there to eat you’ll also get a say in the competition! You’ll have the opportunity to vote for your favorite dish and help decide the winner of the People’s Choice Award. It’s a fun way to get involved and ensure your favorite team gets the recognition they deserve.

The cook-off isn’t just about the food! We’ll have live entertainment throughout the party, so you can enjoy music, mingle with fellow attendees, and soak in the atmosphere. You can expect great tunes to keep the party going.

Date: November 7, 2024

Location: West Line Event Center, Scott, LA

Party Time: 5 PM – 9 PM

Cost: $40 per person (includes food samples, drinks, and entertainment)

This is more than just an event it’s a party you won’t want to miss! So grab your ticket, bring your appetite, and get ready for a day full of food, fun, and festivities. Register now to reserve your spot at the Insure & Sizzle Cook-Off Party.

Whether you’re competing for the top prize or just coming to enjoy the fun, the Insure & Sizzle CookOff is set to be an unforgettable day. We can’t wait to see you there so be sure to register as a team or an attendee today!

This article discusses breaking traditional workplace rules to embrace employees' unique skills and leadership potential.

SEPTEMBER,2024

I was perusing news articles online recently when the headline of a piece by Korn Ferry caught my eye. “5 Workplace ‘Rules’ to Consider Breaking Now,” it read.

The article was about how, post-pandemic, the traditional concept of the workplace has changed, and how leaders are or should be open to rethinking the standards that went along with that now-outdated status quo.

As I was reading through the article, I noticed that most of the suggestions revolved around some version of the idea of “bringing your whole self to work.” That is, approaching each employee as a well-rounded person with a unique set of skills and experiences that can be applied in new, useful, and niche ways for success in their companies.

For example, the article noted, if your company is trying to reach a younger demographic, you might solicit advice from employees who are recent college graduates to understand the motivations and setbacks their peers face helping you to better target this demographic. These employees may find that offering this insight provides them with better visibility among their colleagues and even leads to additional opportunities within the company. “While this might not be considered a traditional skill, it is a unique aptitude,” Korn Ferry says.

Another paragraph noted that employees “don’t need a formal title to be a leader” and anyone can step forward with ideas and suggestions, while another section argued networking isn’t just for after-hours and should be encouraged throughout the workday not only among team members, but also across departments.

I began thinking about how, in our post-pandemic world, the lines between our work lives and our personal lives have been blurred more than ever. Aided by technology, your typical Wednesday could start with an 8 a.m. meeting on Zoom, followed by working out at the gym near your home, followed by six hours in your company’s office, followed by taking the kids to their weekly soccer game, followed by dinner at home and a few more hours of work and Zoom meetings from your home office.

It’s no surprise, then, that Korn Ferry has picked up on the need for organizations to treat their employees as whole people, with unique skills and insights to offer. Because the value people bring to a company isn’t limited to the departments, teams, or other siloes they work within. Nor is it limited to what’s on their resumes. Their value may come from unexpected places, or in unexpected ways. Worklife balance isn’t just about freeing people from the confines of their jobs; it’s also about fostering a mutually beneficial relationship among the different aspects of an individual’s existence. If you’re fulfilled in your personal life, you bring better, more creative, more successful ideas to work; and if you’re fulfilled in your work life, you bring that energy to your personal life. It’s a win-win.

We talk so much about flexibility when it comes to schedules and remote work, but companies really need to be flexible in how they approach their people making sure they see them for the well-rounded individuals they are. That’s why at WAHVE we’ve always shunned the idea of recruiting and hiring based solely on resumes. Rather, our extensive qualifying process looks beyond skills and experience to assess a candidate’s true potential value for an organization, as well as their fit within an organization’s culture. It’s one of the reasons WAHVE has a 90% success rate.

This article discusses the LDI issues in the 2024 Agency Universe Study on independent agencies.

ANNEMARIE MCPHERSONSPEARS

IIABANEWS EDITOR

Despite the hard market, business conditions for property & casualty independent insurance agencies continue to be favorable with the number of agencies experiencing revenue gains up significantly, according to the 2024 Agency Universe Study. However, the number of independent p&c agencies in the U.S. has dropped slightly from the previous study in 2022.

Future One, a collaboration of the Big “I" and leading independent agency companies, has released key findings from the recently completed Agency Universe Study, hailed as the most comprehensive look at the independent agency system.

“The 2024 Agency Universe Study once again shows the independent agency channel's capability to adapt and overcome challenges, as agents across the U.S. continue to improve operations and client communications during the hard market, even with the difficult headwinds they have confronted," says Charles Symington, Big “I" president & CEO.

The study also identifies key areas in which agencies need support, including market and product access, client communication and technology underscoring the importance of maintaining strong agency-carrier relationships, especially in the current market.

“Independent agencies are essential partners in the insurance distribution ecosystem and the Big 'I' is proud to support them with the resources and guidance they need to serve their communities," Symington says.

The study looks at statistics about independent agencies operating in the U.S., including their numbers, revenue base and sources, number of employees, ownership, mix of business, diversification of products, technology uses, non-insurance income sources and marketing methods.

“This year's study provides a valuable look at the independent agency ecosystem as it gains distance from the coronavirus pandemic and navigates the obstacles presented by the hard market," says Jennifer Becker, Big “I" senior director of agent development, research and education. “Technology adoption continues to prove itself as a key strategy for success."

“This year's study saw significant increases in adoption of digital communication tools, with many changes in service and operations prompted by the hard market and its impact," Becker says.

Key findings from the 2024 Agency Universe Study include:

1) The number of independent agencies dropped slightly. In 2024, the estimated total number of independent p&c agents and brokers in the U.S. stands at 39,000, a decrease from 40,000 in 2022. Mergers & acquisitions activity and perpetuation challenges continue to impact the agency channel with 1 in 3 agencies expecting an ownership change in the next five years.

2) Most agencies make revenue gains despite business conditions. Three in 4 agencies (75%) saw revenue gains in the 2024 study significantly higher than the 2022 study, in which 62% saw gains. Meanwhile, 12% of agencies saw decreases in revenue, with an average decrease of 24%. Personal lines revenue has grown significantly more in the 2024 study than in 2022, with 72% of agencies reporting an increase compared to 60% in 2022. Commercial lines revenue grew as well, with 68% of agencies reporting an increase compared to 57% in 2022.

3) The hard market is top of mind for agencies. More than half (56%) of agents say that developing talking points for customers about the hard market and coverages is the most important factor to succeed, surpassed only by identifying operating efficiencies (63%). More than 1 in 4 agencies have made digital service and digital interaction operating changes due to the hard market.

4) Agencies outline market challenges. Agencies are appointed with an average of 17 carriers. As many as 21% of agencies say carriers are meeting the market challenges extremely poorly, while 68% believe carriers are meeting the market challenges moderately well. However, 11% percent of agencies believe carriers are meeting the challenges of the hard market extremely well. When asked what their No. 1 challenge is, 56% of agencies said it was finding carriers that will maintain their commitment to their market, up from 31% in 2022. The second most pressing challenge was “having carriers that are addressing new personal lines risks by adding new products, services or coverages," at 49%. Finding and screening job candidates with strong potential was the third most challenging issue at 46%.

5) Agencies continue to adopt technology. The use of electronic communication tools has increased significantly, with the use of agency e-signature tools increasing to 70% in 2024 from 61% in 2022. The use of direct bill commission statements has also risen since 2022, at 52% in 2024 versus 45%. More than half of agents are likely to agree that insureds are just as likely to accept e-documents as paper. Nearly half 46% agree they have seen significant cost savings by using carriers' paperless communication options.

However, challenges with technology continue. Dealing with multiple carrier interfaces was the No. 1 technology issue for agents, followed by marketing their agency effectively on the internet.

6) Social media continues to be an important marketing activity. More than half of agencies (56%) say social media is a top marketing activity, a slight decrease from 62% in 2022. Agencies most often rely on Facebook, LinkedIn and Instagram. Social media is primarily used to build the agency's brand (87%) and attract prospects (79%).

7) Emerging purchase channels remain a concern. Agencies continue to express concern about emerging purchase channels and their impact on their business. One-third believe their agency will be impacted by personal lines and small commercial lines products purchased directly through insurance companies, noninsurance websites and emerging online channels. However, nearly half of agencies believe the independent agency channel is extremely resilient to marketplace changes.

The Agency Universe Study was first conducted in 1983. Since 2002, the study has been completed biennially. Since 2004, the Agency Universe Study has relied on internet data collection. In total, 1,269 respondents were included in the 2024 study, conducted by Zeldis Research in cooperation with Future One.

In addition to the Big “I," the Future One coalition includes the following company partners: Amerisure; Central Insurance Companies; Chubb; CNA; Foremost, A Farmers Insurance Company; The Hanover Insurance Group; Hartford Steam Boiler (HSB); Liberty Mutual Insurance/Safeco/State Auto Insurance; National General, an Allstate Company; Nationwide; Progressive Insurance; Selective Insurance; Travelers; and Westfield Insurance. To order a copy of the 2024 Agency Universe Study Management Summary, which provides an overview of the highlights from the complete study, visit the Big “I" Agency Universe Study webpage.

Commercial

IIABL 2024-2025

CHAIRMAN, BRET HUGHES

CHAIRMAN-ELECT, ROSS HENRY

SECRETARY-TREASURER, JOE KING MONTGOMERY

NATIONAL DIRECTOR, JOHNNY BECKMANN, III

PAST CHAIRMAN, ARMOND K. SCHWING

YOUNG AGENT REP, MAGGIE LANDRY

Hughes Insurance Services, Inc - Gonzales

Henry Insurance Service, Inc. - Baton Rouge

McGriff Insurance Services - Monroe

Assured Partners - Metairie

Schwing Insurance Agency, Inc. - New Iberia

Perkins-McKenzie Insurance Agency - Baton Rouge

ANN BODKIN-SMITH

MATTHEW DEBLANC

CHRISTY DESOTO

DOMINIQUE DICARLO CROUCH

ROB W. EPPERS

MATT GRAHAM

CHRISTOPHER S. HAIK

STUART HARRIS

BEAU HEAROD

CHARLES H. LEBLANC

CRAIG MARTEL

LYDIA MCMORRIS

A. EUGENE MONTGOMERY, III

HARTWIG "ROBBY" MOSS, IV

SETH OSTENDORFF

ROBERT LOUIS PALMER, JR.

RANDY PERISE

ROBERT STONE

Thomson Smith & Leach Insurance Group - Lafayette

Continental Insurance Services - Marrero

1st Insurance of Marksville - Marksville

Riverlands Insurance Agency - LaPlace

Risk Services of Louisiana - Alexandria

Lincoln Agency - Ruston

Higginbotham Insurance - Lafayette

McClure, Bomar & Harris, LLC - Shreveport

Jeff Davis Insurance - Jennings

Bourg Insurance Agency, Inc. - Donaldsonville

Insurance Unlimited of LA, LLC - Lake Charles

Alliant Insurance Services - Baton Rouge

Community Financial Insurance Center, LLC - Monroe

Hartwig Moss Insurance - New Orleans

Dethloff & Associates - Shreveport

Insurance Underwriters, Ltd. - Metairie

Blumberg and Associates - Ponchatoula

Stone Insurance, Inc. - Metairie