LOUISIANAAGENT

JEFF ALBRIGHT

Chief Executive Officer

jalbright@iiabl.com

(225) 236-1366

BENJAMIN ALBRIGHT

Vice-President of Strategic Initiatives balbright@iiabl.com

(225) 236-1357

KAREN KUYLEN

Director of Accounting & Finance

kkuylen@iiabl com

(225) 236-1353

JAMIE NEWCHURCH

Director of Insurance Programs

jnewchurch@iiabl.com

(225) 236-1350

KATHLEEN O'REGAN

Director of Communications & Events

koregan@iiabl.com

(225) 236-1360

BRANDI VAN PELT

Insurance Programs Administrator bvanpelt@iiabl.com

(225) 236-1358

DUSTIN WAMBSGANS

Agency Consultant

dwambsgans@iiabl.com

(225) 236-1361

August

A new leader has emerged to take on the crucial role of Insurance Commissioner. Tim Temple, a business professional with a background in insurance and a passion for public service, will take over as commissioner in January, promising a fresh perspective and innovative ideas to benefit the people of Louisiana.

Before venturing into politics, Tim Temple built a career in the insurance industry. His experience spans over three decades, during which he held various roles that allowed him to gain valuable insights into the complex world of insurance. His expertise in risk management, regulatory compliance, and consumer protection positions him well to navigate the intricacies of the Insurance Commissioner role.

One of Temple's key priorities as Louisiana's Insurance Commissioner is to put consumers first. He is keen on ensuring that insurance policies remain accessible and affordable for all Louisianans. Temple aims to enhance transparency and promote consumer education to empower individuals and businesses to make informed decisions about their insurance coverage.

Given Louisiana's susceptibility to natural disasters, Tim Temple recognizes the importance of disaster preparedness and insurance coverage in mitigating the financial impact of such events. He is committed to working closely with insurers to develop robust disaster response plans and ensuring that insurance policies provide adequate coverage for residents facing the challenges of hurricanes, floods, and other catastrophes.

Temple believes that the insurance industry can benefit from innovation and technology. He intends to encourage insurance companies to adopt cutting-edge technologies that can streamline processes, reduce costs, and improve customer experiences. By embracing innovation, Temple aims to create a more dynamic and competitive insurance market in Louisiana.

While advocating for consumer interests, Tim Temple also understands the importance of maintaining a stable and competitive insurance marketplace. He will work diligently to strike a balance between consumer protection and ensuring that insurance companies can operate efficiently within the state, fostering economic growth.

Jeff Albright

2023

Jeff Albright

2023

Tim Temple's approach to leadership is community oriented. He plans to engage with communities across Louisiana, listening to their concerns and seeking input to inform his decisions. By involving the public, he hopes to create policies that genuinely reflect the needs and aspirations of the state's diverse population.

IIABL has met with Tim Temple numerous times to discuss strategies to resolve inherent problems in the Louisiana insurance market and to attract new insurers to our state. Temple and IIABL have committed to work together to improve Louisiana insurance markets.

One of the most common subject of questions IIABL receives from member agents, brokers and insurers relates to the producer of record statutes. Following is an analysis of those statutes to help IIABL Members & Associate Members properly deal with this law.

Louisiana Revised Statute 22:1564, Subsection B: Producers of Record

1. Recognition of Producers of Record: Subsection B requires insurers to duly acknowledge and honor the designation of a producer of record This recognition is contingent upon the selection made by either the policy owner or the first-named insured Notably, it extends across various categories of insurance policies, encompassing property, casualty, accident, health insurance, and bonds The selected producer of record retains their role and authority for the entire duration of the insurance contract, or until the renewal date, whichever occurs first, unless changed at the request of the policyholder or first named insured

Jeff Albright

August 2023

Insurers are under no obligation to conduct business with producers who lack the requisite appointment or qualification as determined by the insurer's own standards. Nevertheless, it underscores that if a producer satisfies the criteria for appointment or qualification established by the insurer, the insurer is mandated to recognize them as producers of record, subject to the stipulations and conditions within this section.

2. Changing Producers of Record: Insurers are prohibited from unilaterally altering or removing the designated producer of record during the course of

the contract, except when such changes are expressly requested by the policy owner or the first-named insured. In such instances, the policy owner or insured possesses the prerogative to select a new producer of record, which empowers them in directing the management of their insurance affairs. Insurers are also required to make midterm changes in producer of record when requested by the policyholder or first named insured subject to the 10-day notice period outlined below.

3. Producer of Record Letter: Subsection B underscores the significance of the producer of record letter. When an insurer receives such a letter from a producer, the insurer is required to provide quotations or proposals based on the application submitted by that producer. Should the insured accept the quotation or proposal, the insurer is obliged to issue the policy, designating the producer of record as stipulated in the letter.

4. Commission Payments: This subsection

Continued from page 9

delineates the protocol for commission payments to producers of record, depending on the nature of the insurance. Property, casualty, and bond policies result in commissions being disbursed to the producer of record at the inception of the policy. Nevertheless, exceptions are made for policies with extended terms, such as multi-year policies or those that remain continuous until canceled. In such cases, commissions are redirected to the new producer of record on the anniversary rating date when revised rates become effective. On the other hand, commissions for accident, health, or benefits policies are tied to the producer of record currently in place, with changes occurring when a new producer of record is formally designated.

5. Cancellation and Rewrite: The statute incorporates a prohibition that restricts insurers and producers from initiating the cancellation and rewriting of contracts during the tenure of the contract or until the renewal date in a manner that would result in changing the producer of record.

6. Ten-Day Notice Provision: In situations where a change or removal of a producer is requested by an insured during the policy period, the insurer is obligated to provide the existing producer of record with a written notice ten calendar days in advance of the proposed change or removal. This notice period is intended to afford the existing producer an opportunity to respond to or address the request to change the producer of record.

Additionally, if a request to change the producer of record is received by the insurer within the last ten calendar days of the policy period, the insurer is still required to provide the ten-calendar day notice. However, any required change of producer shall be effective on the inception date of the renewal policy.

7. Exceptions: The statute provides exceptions for producers who are in the capacity of employees for an insurer or those who exclusively represent a single insurer or a group of affiliated insurers, as delineated under R.S. 22:691 et seq.

8. Limited Benefit Health Insurance: Subsection C serves to clarify and articulate a specific exemption. It emphasizes that the regulations and provisions delineated within this section do not extend to limited benefit health insurance policies.

9. Applicability to Surplus Lines Insurers: Directive 211, issued by James J. Donelon, Commissioner of Insurance in Louisiana on June 28, 2018, addresses the applicability of the producer of record statute to surplus lines insurers. The directive addresses the issue of changing the "producer of record" on insurance policies and emphasizes that surplus lines insurers must comply with Louisiana law (La. R.S. 22:1564) regarding this matter.

Specifically, the directive underscores that surplus lines insurers, like all insurers, are obligated to accept and recognize a change in the "producer of record" when requested in writing by the policy owner or the first-named insured. This obligation applies to surplus lines insurers just as it does to other types of insurers operating in Louisiana.

Continued from page 10

Surplus lines insurers should be aware that they are not exempt from complying with this requirement. Failing to accept a written request and recognize a change in the "producer of record" from the policy owner or first-named insured may place surplus lines insurers in violation of Louisiana law (La. R.S. 22:1564). Such non-compliance can result in regulatory sanctions.

The producer of record statutes represents a comprehensive framework governing the recognition and role of producers of record. It establishes a set of rules, conditions, and exceptions aimed at fostering transparency, fairness, and consistency in producer recognition, commission payments, policyholder empowerment.

The producer of record statute R.S. 22: 1564 can be found HERE. Louisiana Department of Insurance Directive 211 can be found HERE For further information or questions, please contact Jeff Albright at JAlbright@IIABL com or Ben Albright at Balbright@IIABL.com.

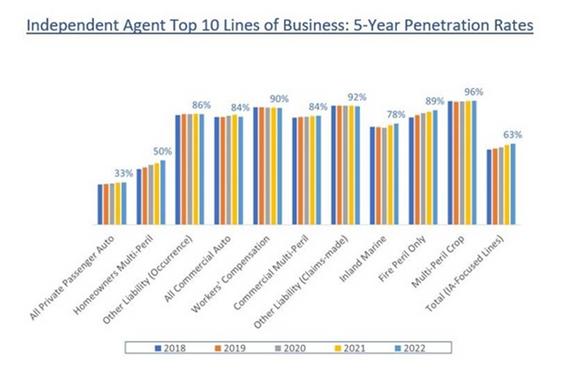

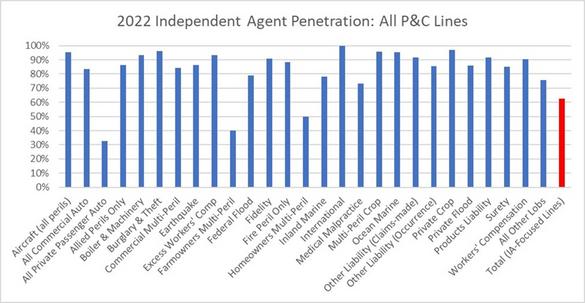

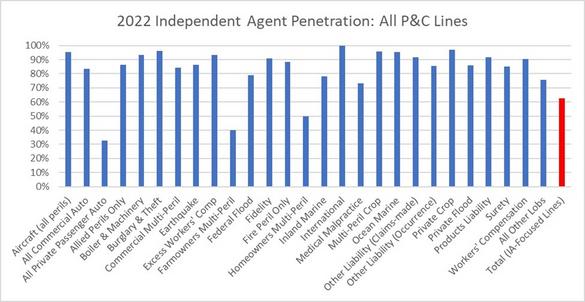

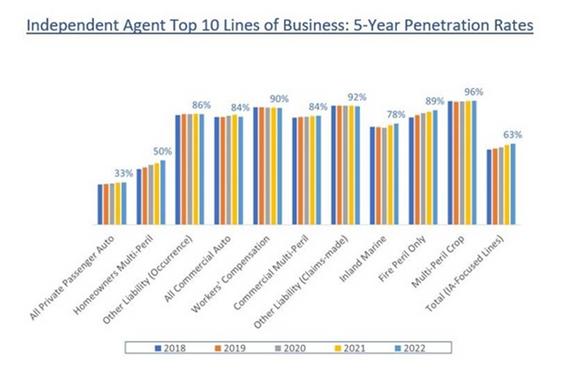

The independent agency channel is holding ground and making slow, steady gains in lines of business penetration, including homeowners, according to the Big “I" 2023 Market Share Report.

The annual Market Share Report compiles and analyzes property & casualty premium data from AM Best and provides insights for agencies and carriers on current market share by distribution types. Based on 2022 data, this year's report points to the growth of the independent agency channel, which places 63% of all property & casualty insurance written in the U.S., an increase of 3% over the past five years' average penetration rate.

Jeff Albright August 2023

Jeff Albright August 2023

While the independent agency channel held steady in commercial lines, placing 87% of all commercial lines written premium, it grew its share of personal lines written premium 38% in 2022, up from 37% in 2021 continuing a trend of growth in personal lines over the past five years. In particular, independent agencies saw gains in the homeowners line of business, up to 50% in 2022 from 46% in 2018. Direct written premiums reached $861 billion in 2022, up from $785 billion in 2021.

Independent agencies have also seen growth in surplus lines, with a 9% utilization rate in the past year compared to an average of 7% over the past five years. In particular, private flood surplus lines has seen a large jump, with a 45% utilization rate in 2022 compared to 36% over the past five years. This correlates to a hardening market and carrier withdrawals.

“Looking at the past five years, the independent agency channel is gaining ground slowly but steadily, with no material losses in any area seen in 2022's data," says Jennifer Becker, Big “I" senior director of agent development, research, and education. “As we begin to see signs of a hardening market, independent agencies are facing the challenges head-on as trusted advisors to their customers."

Market Share Report Summary: The Market Share Report summary emphasizes direct premiums, direct losses, and the associated direct underwriting results before reinsurance. This summary presents the 2022 direct written

premium for all 32 lines of business reported by P&C insurers for all distribution styles. Six of the 32 lines presented are not considered “traditional" independent agent P&C insurance lines and thus are not addressed in the section of this report focused on independent agent distribution. The six lines removed from individual in-depth review and comparison are: accident & health, aggregate write-in, credit insurance, financial guarantee insurance, mortgage guaranty and warranty.

Independent Agent Focused Lines: For the traditional 26 agent-focused lines of business, specific data is provided on loss ratios, growth rates, penetration rates by the various distribution styles and commission rates. In addition and important to independent agents a breakout of surplus lines activity is provided to show trends and utilization rates.

Each of the 26 agent-focused lines of business are detailed individually. Presented within the individual line-of-insurance pages are five-year premiums, loss and combined ratios, penetration rates by distribution style and information on the largest insurers in those lines. The independent agent-focused lines of business are presented in alphabetical order.

Supporting Information: Appendices are provided to: 1) detail the various approaches taken in compiling and presenting the information contained and presented in this report; 2) provide data definitions specific to the insurance industry; and 3) provide additional information that supports the findings of this report.

Continued from page 14

WHAT'S INSIDE? Take a look at the Table of Contents and see what's included in this data rich report.

BIG I MEMBERS: As a member of the Big I the 2023 Market Share Report is available for download at no charge by logging in the Big I web.

COMPANY PARTNERS: All partners that contribute $15,000+ to IIABA national partner programs are eligible to receive a complimentary copy. Request copy.

PURCHASE REPORT: $997 for non-members. to order your e-report with instant delivery.

If you joined the insurance industry in the last 1015 years, this is probably the first hard market you have experienced and its complexities may be challenging to navigate after many years of abundant underwriting capacity and low premiums

Many factors contribute to rising premiums in a hard insurance market, including increased claims costs, inflation, higher reinsurance rates, litigation costs, the severity of losses, supply chain, labor shortages and changes in the regulatory environment. In addition, in certain regions of the country, there is growing exposure to catastrophic claims associated with wildfires, hurricanes and other events.

While working in a hard market presents many challenges, there are a few upsides, such as the opportunity to gain expertise and showcase your

value to your customers Independent agents across the country can highlight their value to their clients by committing to active communication

While premium increases may be unavoidable in some cases, you know how important it is to ensure your clients have the necessary coverage to protect their assets.

Here are eight tips for communicating with your clients in a hard market:

1) Be proactive about renewals. Retention is critical during a hard market. Normally, your agency should have a plan for current business renewals starting at 90 days from expiry, followed by 60 days, and then 30. For more difficult placements, such as commercial property or multi-family housing, begin earlier. Some

In a challenging market environment, here are eight ways you can prove your value to your clients and come out the other side better than ever.Kasey Connors VP Marketing Operations, Trusted Choice

insurance experts now suggest starting your renewal process by gathering renewal information 180 days before expiration.

When you reach out, ask your commercial insureds whether they've ventured into new services, or added buildings, and for personal lines clients, ask if they've experienced life changes such as marriage, death, children, new job, financial changes, or business ventures that could impact coverage. Also, pay close attention to evaluating property values and business income limits.

If any of your insured have experienced claims, it's also a great time to discuss how and what steps they've taken to mitigate incidents from reoccurring.

2) Do your market homework. Don't waste time remarketing every account when rates are rising across the board. Save your energy for accounts that will experience significant disruption at

Continued from page 17

renewal, including much higher premiums, restricted coverage or the need to find a new carrier.

3) Communicate. Start by communicating early and often about the state of the market and its potential impacts, even before clients feel those changes. Clients need a level of awareness of what is happening before they see rising costs.

4) Build strong relationships. Cultivate strong relationships with your clients, underwriters and other industry professionals. Clients are more likely to stay loyal during a hard market if they trust and value your expertise. And, as difficult as this market has been for independent agents, it's often just as tough for underwriters.

Right now, it's more important than ever to invest in strong carrier relationships. “Earning the respect and trust of your carriers is paramount when quoting in a hard market," says Todd Jackson,

partner at McGowan Insurance Group in Indianapolis. “Agents need to paint the most favorable picture possible of their clients so carriers see the merits of staying competitive, and they need to trust the agent when reviewing these."

“Demonstrate to your clients that you have all the carrier relationships needed to ensure they are getting a complete look at what is available," Jackson adds.

5) Focus on risk management. Emphasize the importance of risk management to your clients. Help them identify potential risks specific to their industry or their family and develop strategies to mitigate those risks.

6) Diversify your portfolio. During a hard market, certain industries or coverage types will be more affected than others. Explore new areas of business to diversify your book. This helps offset any significant impact caused by a particular sector or line of business.

To build new relationships, network with trade groups, such as contracting associations, your local Chamber of Commerce, or service organizations such as a Rotary or Kiwanis club. Offer to give a complimentary presentation to local business groups about the impacts of the hard market.

7) Adapt and innovate. Explore new avenues and products to adapt to changing market conditions. Do you have a niche? How is your marketing strategy? When the market is disrupted, it is an ideal time to make sure you are very visible.

8) Seek internal efficiencies. Create a timeline and process for reviewing all accounts. Make sure dedicated, experienced staffers handle your largest clients. Reduce shopping renewals, especially for policies with less than a 15% premium increase. This drains too much energy and, given the hard market, will yield little opportunity for better placement.

Continued from page 18

Offering frequent hard market education or implementing a longer renewal period requires even more energy from servicing staff. Consider creating new capabilities by adopting new technologies or even implementing a small business unit to create more intentional servicing models based on the account size.

Lastly, remember that your clients may get upset and take that out on you as an extension of the insurers. However, don't take things personally. If you handle the hard market with a good attitude and approach it as a learning experience for you and your customers, you'll come out on the other side with more clients and much more industry knowledge.

Kasey Conners is vice president of marketing operations at Trusted Choice.

Download the full Trusted Choice® Hard Market Toolkit for more tips and resources to navigate the current insurance landscape

The Florida Office of Financial Regulation (FOFR) has been in charge of the liquidation of UPC Insurance Company. Because UPC operated in several different states and on several different computer platforms, it has taken time for FOFR to process information and send premium refund computer records to different state guaranty associations.

In Louisiana, the Louisiana Insurance Guaranty Association (LIGA) has been waiting for FOFR to provide the premium refund information to process refunds.

In the past two weeks, LIGA has issued over 20,000 refund checks to UPC policyholders.

LIGA is still waiting to receive approximately 2,0005,000 additional refund computer data files from the FOFR in the next few weeks. LIGA does not have a specific time frame for when FOFR will send the data files, but LIGA is prepared to issue refund checks as soon as they receive the data.

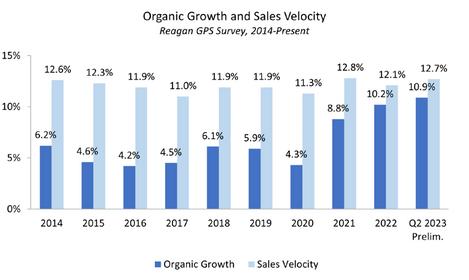

Louisiana Insurance Guaranty AssociationAgents and brokers everywhere are enjoying quite an organic growth run. The industry set an organic growth record in 2021 only to break it again in 2022. This year’s results are on pace to set another record, with median organic growth through the first half coming in at a preliminary estimate of 11.0%.

Organic growth is driven primarily by four factors:

1.

2. 3. 4.

New Business: How many new clients and policies did we add?

Client Retention: How many of our existing clients and policies did we retain?

Rate: How is P&C pricing impacting our book of business?

Exposures: Are the underlying exposures covered by our policies growing or shrinking?

We measure this new business using a statistic called Sales Velocity, a term Reagan coined in

2014 in a research piece on producer recruiting and development. Sales Velocity is defined as new business divided by the base book of commissions and fees. So, for example, if an agency that finished 2022 with $10 million in commissions and fees writes $1 million in new business in 2023, Sales Velocity would be 10% for 2023.

For most of the last ten years, there has been a relatively stable relationship between Sales Velocity and organic growth. From 2014 through 2020, Sales Velocity was approximately 12%, which was slightly more than double the organic growth rate. This means that agents and brokers had to generate Sales Velocity of 12% or more to grow organically at 5% or 6%. The combination of client retention, exposure growth and P&C pricing – the other three elements of the organic growth equation – was a net deduction in the growth equation of 6% or 7%.

BrianDeitz PresidentandPartner,ReaganConsultingContinued from page 22

The market is cyclical and eventually it will turn. Agents and brokers are operating in a moment of almost dizzying financial performance but should be careful to recognize how they are getting there. Are they driving growth through Sales Velocity or simply riding the market wave? When the market turns, only the firms that have built a highperforming new business engine will still be able to deliver strong organic revenue increases.

Brian Deitz President and Partner, Reagan ConsultingClick here to email Brian directly

The last three years have been different as agents and brokers have been able to double their organic growth rates without significant changes in Sales Velocity. The market has changed. Exposure growth and P&C pricing are now a tremendous tailwind for brokers, who are delivering doubledigit organic growth quarter after quarter.

July 17, 2023

Many independent agents have watched with concern as a small number of high-profile banks have faltered during 2023.

Just what does this shock to the banking system mean to independent agents and brokers throughout the country?

The soundness of the banking system, frankly, is not something that most independent agency principals spend time thinking about. But since these issues have arisen, it’s important for agency leaders to navigate the issue. I see four takeaways as relevant to agents in the current environment.

1) The problems leading to the notable bank failures were specific to those few banks. America’s strong bank depositor protections responded to those situations, and healthy banks stepped up to absorb the assets and liabilities of the troubled banks. The protections in place worked. It appears that issues in the banking system have been contained.

2) While the distress has been limited to a few institutions, the rising interest rate environment of 2022-2023 has put many banks under pressure. Banks, which always face competitive pressure to offer favorable interest rates for deposit products and appealing credit terms for loans, now must do so in a market that is challenging to their earnings model.

3) The competitive pressures that all banks face will lead them to narrow their lending activity. For businesses such as independent agencies that present a different business model than other business borrowers, credit availability may be significantly curtailed.

4) Agents should speak to their financial institution and ask questions about deposit insurance protection, bank liquidity and capital ratios.

Many banks today face challenges to earnings and balance sheet strength. I expect there will be a fair

Continued from page 24

number of banks posting lower profits in coming quarters. That’s a long way from saying they might fail, but it does mean they could change the way they operate. This could affect the way banking relationships work for independent agencies.

In this environment, independent agency principals may expect banks to shy away from lending for agency perpetuation, new producer development and acquisitions. New loans, when available, likely will cost more.

For years, I’ve seen many banks avoid independent agencies as borrowers. Bank lenders tend to have little appreciation for the enterprise value of an independent agency and tend to discount the value associated with an agency’s policy renewals, client retention, carrier relationships and loss experience. Faced with recent events and the forecast of higher interest rates, I don’t expect banks to suddenly change their perception of independent agencies.

Even as some banks tighten lending, institutions that truly understand the agency financial model will continue to be active lenders. Banks that exhibit strong earnings, liquidity and available capital will have the financial flexibility to continue providing capital to independent agencies.

Independent agency principals tend to be fiscally conservative. They’ve weathered crises large and small, and they’re used to sleeping well at night. It makes sense for agency owners to ask questions of the banks they’re doing business with. In addition to asking about financial soundness, now is a good time to ask about their current and future appetite for agency lending.

If you are an agency principal, there is one last point to consider about your own financial picture. Any agency owner who has taken out a loan in recent years should carefully review their loan terms and conditions. Numerous agency loans have been made at floating rates based on the prime rate. With interest rates sharply higher over the past two years, loan payments may be significantly higher. You can use the current yield curve to your advantage by thinking about refinancing to a fixed rate loan. In many cases, a medium-term fixed rate may be lower than the floating rate you currently have. A lender that is knowledgeable about the independent insurance agency channel can quickly identify opportunities to save on future interest costs.

WRITTEN BY David W. Tralka

Tralka is the president and CEO of InsurBanc, a division of Connecticut Community Bank, N.A.

WRITTEN BY David W. Tralka

Tralka is the president and CEO of InsurBanc, a division of Connecticut Community Bank, N.A.

The independent agency channel is holding ground and making slow, steady gains in lines of business penetration, including homeowners.

The independent agency channel is holding ground and making slow, steady gains in lines of business penetration, including homeowners, according to the Big “I" 2023 Market Share Report. The annual Market Share Report compiles and analyzes property & casualty premium data from AM Best and provides insights for agencies and carriers on current market share by distribution types. Based on 2022 data, this year's report points to the growth of the independent agency channel, which places 63% of all property & casualty insurance written in the U.S., an increase of 3% over the past five years' average penetration rate.

According to Affinity HR's “2023 Mid-Year Labor Market Study," here are five trends that have emerged so far this year:

While the independent agency channel held steady in commercial lines, placing 87% of all commercial lines written premium, it grew its share of personal lines written premium 38% in 2022, up from 37% in 2021 continuing a trend of growth in personal lines over the past five years. In particular, independent agencies saw gains in the homeowners line of business, up to 50% in 2022 from 46% in 2018. Direct written premiums reached $861 billion in 2022, up from $785 billion in 2021.

IA News Editor

IA News Editor

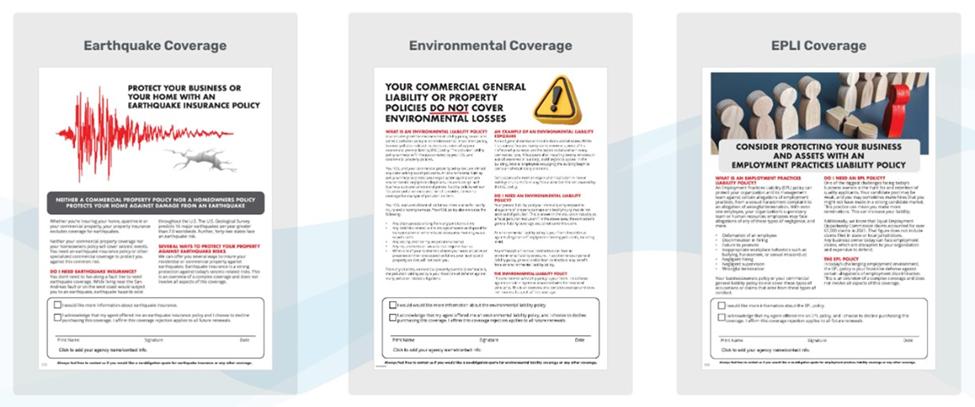

As part of its ongoing effort to arm Big “I" members and Swiss Re Corporate Solutions agency errors & omissions policyholders with tools to improve their practices, the Big “I" Professional Liability risk management team has released a new resource: sample coverage declination forms that Big “I" members may customize and use with their clients.

Sample declination forms are available on the E&O Guardian website for the following coverages:

Commercial umbrella

Contractor professional liability

Cyber

Earthquake Environmental

Employment practices liability insurance

Flood Home business

Personal umbrella

Professional liability

Property Uninsured motorist/underinsured motorist Workers compensation

Coverage declination forms signed by clients are crucial defense tools when defending a “failure to offer" claim. Without a signed declination or proof your agency requested one, your E&O adjuster will have a tougher time defending your agency should a failure to offer coverage claim arise. If the insured does not return the form or wish to sign it, proof that you sent the form in your agency management system or file notes provides the adjuster with a stronger defense against failureto-offer negligence allegations.

Similarly, your agency procedure manual should detail this critical step so that all producers and service reps take advantage of these forms.

Log in with your Big “I" member credentials to access the declination forms.

Additional coverage areas will be added as they are developed. Is there a form you would like to see added? Submit your suggestions to Big “I" Professional Liability staff.

Learn more about the Big “I" Professional Liabili program by connecting with your state association's dedicated Big “I" Professional Liability program manager. For additional information and agency risk management resources, visit E&O Guardian.

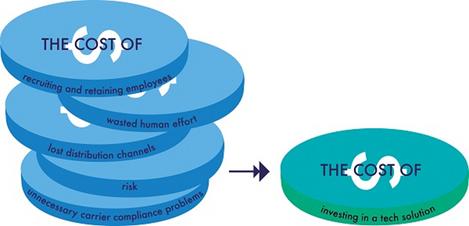

People often think change is expensive. But what about the cost of staying the same? When your business doesn't invest in process improvements, including modern technology and automation, you run the risk of paying the price in the long run.

People often think change is expensive. But what about the cost of staying the same? When your business doesn't invest in process improvements, including modern technology and automation, you run the risk of paying the price in the long run.

We love a good analogy, so let's think for a minute about your car. Let's imagine you own a car that's 20+ years old and has 300,000 miles. Suspend your disbelief for a moment, or at least pretend it's a Toyota.

You've long since paid it off, so there's no monthly car payment. And your auto insurance is dirt cheap because you don't even bother with comprehensive coverage. Wind, hail and fallen trees be damned!

Your cost of ownership may feel like it's small compared to the idea of buying a new car, but the reality is that not making a change is costing you more than you'd like to admit. While you're focused on the large down payment or the higherthan-zero monthly installment, you forget about things like:

New high-tech safety features that can prevent accidents before they happen. Fuel efficiencies that save big money on gas or eliminate gas altogether.

Zero-cost maintenance for your first few years. Lower insurance premiums for cars with antitheft devices and internet-enabled tracking. Warranty coverage for major mechanical failures within the first five or even 10 years of ownership.

When you really think about it, it's often costing you more to stick with something you've had forever than to embrace something new.

This same thing happens in businesses all the time. When people think about upgrading their internal processes replacing manual work with technology, for example all sorts of obstacles get in the way.

Here are a few excuses:

“It'll be too expensive."

“It'll take too much time or effort."

“We'll sacrifice productivity while people get up to speed."

And our personal favorite, “But we've always done it this way!"

Just like that old car, the costs at the forefront of our minds are usually temporary, and much less over time, than the ones we'll pay to keep doing things the old way. It's tempting to think the only

cost you face is the one for adopting a new technology solution, but what seems like a good and cost-effective method now is actually costing you more than you realize.

For example:

Duplicate work because of data and workflow silos.

Lost revenue due to producer downtime between hiring and being ready to sell. Bloated recruiting costs due to a cumbersome employee experience that results in high turnover.

Human error due to manual and repetitive tasks that could easily be automated for greater speed and accuracy.

When an organization considers adding new people, processes, or technology or all of the above the first knee-jerk questions are usually, “How difficult will this change be?" and “How much is this going to cost us?" But what if most organizations are looking at it all wrong?

Continued from page 30

Instead of asking how much it'll cost to make a change or improvement, maybe we should be asking ourselves how much it will cost to stay the same: To do things the way we've always done them.

Money talks. And failure to evolve can definitely hurt your bottom line in a variety of ways. But not all costs are created equal. The ones that weigh more heavily in your decision-making will vary from one organization to another.

Here are some of the most common factors to consider when you're evaluating what it really costs to do things the way you've always done them:

How many humans does your organization need to manage your producer licensing and compliance, just as one example? For each of those administrative employees, you've got to pay for a salary, benefits, taxes, potentially office space, equipment and many other hard costs.

More producers and customer service representatives (CSRs) require fewer administrative or operational heads. We promise you there are better jobs for humans than manually and tediously going through the motions of producer compliance management.

Employees these days have more choice over where and how they work than ever before. If your organization isn't putting systems in place that make your employees' jobs easier, less tedious and more efficient, then you're going to lose out on the best talent to companies that are.

The average cost of a new hire is nearly $4,700, according to new benchmarking data from the Society for Human Resource Management (SHRM), but once “soft costs" like time invested by leadership throughout the hiring process are factored in, the real price may be as high as three to four times the position's salary.

When your company doesn't implement modern technology to make your employee experience truly exceptional, you risk losing everyone, from the producers you rely on to sell, to the compliance managers who oversee producer licensing, to the CSRs who service your clients' policies.

Also, no one likes repetitive tasks with a high probability for errors. But if everyone in your organization is subject to old-fashioned processes that reinforce information silos, multiple and

Continued from page 31

conflicting sources of information and mindnumbing repetition, the odds of attracting and retaining the best talent are slim.

Drastically improving your employee experience by upgrading your tech is also something you really don't want to put off for another day, as the competition for insurance talent is one of the industry's top and ever-growing concerns.

Managing producer licensing and compliance on paper with spreadsheets or by any other manual and human-based method is full of risks.

The more complex your compliance picture, the more risk is involved. What seems reasonable for an insurance agency with 50 producers working in one or two states and with only a few carriers becomes a minefield of risks when it grows to 200 producers working across all 50 states with 15 insurance companies.

When you consider the risks of doing things the way you've always done them, consider each of these elements:

Compliance risks. What are the chances that one of your producers has a license that's expired in one of the states they're currently selling in? Do you know with 100% certainty that every producer in your distribution channel is properly licensed in every state and appointed with every carrier both when they sell and when commissions are paid? Security risk. How secure is your clients' information? Are you storing personal identifiable information? What types of information security protocols are in place? Have you invested in best-in-class information security measures and training for all staff? What are the chances someone has access to information they shouldn't? Or that “secure" information is being kept in unencrypted documents or even on someone's desk? Reputation risk. What would it cost to repair your reputation if your organization made headlines because of a compliance misstep or security breach? Have you considered the financial ramifications of not only immediate legal defense, but public relations work and lost business from customers or investors who decide to leave after a public incident?

Without carrier partners, you've got no products to offer your clients. And if your internal processes make it hard for carriers to get their insurance business in front of consumers, or present risks the carriers aren't willing to take, then you're going to be hard-pressed to sell policies.

Most states allow carriers to take advantage of just-in-time (JIT) appointments, which is the ability for a carrier to postpone paying the appointment fee for a producer until the producer has made their first sale.

This sounds great in theory, but the timing has to be just right. You can't wait weeks or months after the producer writes their first policy to trigger the appointment. So, many carriers refrain from taking advantage of JIT appointments altogether because they don't want to end up with noncompliance issues

Continued from page 32

Would you believe modern technology has a solution that gives carriers the money-saving benefit of JIT appointments and agencies the peace of mind that the appointments will happen when they need to for compliance?

Nothing in life is free, but you get to choose the costs you're willing to pay and those you're not. Are you sure you're willing to pay the price of staying the same?

Ellen Lichtenstein is senior content specialist at AgentSync. Regina Stephenson is a writer and editor at AgentSync. This article is based on AgentSync's guide to the price of business as usual in the insurance industry, “What's the Cost of Doing Nothing?"

Here’s what the perplexing job market, wage growth, the end of the pandemic and more mean for your agency.

Where has 2023 gone? It's a question I keep asking myself, and I'm guessing many of you are asking the same thing. A lot has happened inflation rates are going down, fuel prices are $1 less than this time last year in many places, and grocery prices dipped in March for the first time since 2020. That's all good news, right?

Not so fast. At the same time, tech, media, finance, and, most recently, retail organizations have announced layoffs of thousands of workers. That's bad news, right? But the economy has added an average of 341,000 jobs every month during the last 12-month period. The 2023 labor market has economists, business leaders, and a lot of others scratching their heads.

According to Affinity HR's “2023 Mid-Year Labor Market Study," here are five trends that have emerged so far this year:

1) Recruitment and unemployment. The U.S. added 209,000 new jobs in June 2023, according to the Bureau of Labor Statistics. While this is a more modest number than in the past few months, it remains significantly high. As does the unemployment rate, which remains quite low at 3.6%.

Don't assume that a decreased number of job openings and possible layoffs mean that recruitment will be easier in 2023. This remains a volatile labor market. If you recruit for entry-level positions, anticipate continued high demand for candidates. Regularly review and update your application process, consider mobile-optimized applications, submissions via LinkedIn and other social networks, and one-click job applications if you don't already have them.

2) Wage growth. The Economic Research Institute updated its salary increase projections for 2023 to 3.79% and salary structure increases to 2.91%. These projections are slightly higher than the 3.5% salary increase and 2.7% salary structure projections made back in January.

Susan Pale’ Affinity HR Group, Inc.

Susan Pale’ Affinity HR Group, Inc.

Wage growth will continue to vary significantly by occupation type and geography. Remain aware of the differences in all the markets where you operate. Develop and implement a long-term salary planning process that addresses current and anticipated labor market issues.

Also, conduct a review at least annually of your current pay policies for competitiveness and anticipate the need to increase wages to recruit and retain talent. If raising pay is necessary to hire new talent, review pay levels for current, experienced employees to ensure internal equity and minimize salary compression.

3) Minimum wage. Currently, 19 states index minimum wage changes to cost of living increases. Expect more states to adopt these types of indexed changes in the absence of any federal minimum wage legislation.

However, minimum wage changes may not be state-wide and may not take effect on January 1.

Continued from page 34

Also, you must understand the differences between specified minimum wages and prevailing wages. The U.S. Department of Labor reports that North Dakota and South Carolina were among the states with the highest wage growth in 2022. Both states have a current minimum wage of $7.25.

Keep informed of what's happening at federal, state and local levels in all the locations where they do business via The Economic Policy Institute's Minimum Wage Tracker.

4) Legislative outlook. Paid family leave is not likely to be a federal legislative priority for the remainder of President Joe Biden's term. The debt ceiling deal reached in early June does not provide funding for the creation or expansion of any paid leave programs. There hasn't been much activity at the state level on this issue either. Eleven states and the District of Columbia now offer some type of paid family leave for employees; no states have added paid family leave legislation so far in 2023.

Legislation often happens more quickly at the state and municipal levels than at the federal level. Identify the resources necessary to stay informed of changes and new requirements and consult them regularly. Also, recognize that offering paid family leave may offer a competitive advantage in hiring and retention.

5) COVID-19. May 11 marked the end of the COVID-19 Public Health Emergency, which had been in place for more than three years. However, saying the emergency is over is proving to be quite different. The U.S. Centers for Disease Control and Prevention reports that about 40,000 people have died of COVID-19 so far this year, and the disease was the fourth leading cause of death in the U.S. in 2022.

More significantly, enhanced benefits authorized through the Supplemental Nutrition Assistance Program (SNAP) and funded by the federal government are now being rolled back by individual states. A recent New Yorker article reported that the average SNAP recipient is expected to lose about one-third of their monthly allotment. Approximately 40 million Americans receive SNAP benefits.

During the pandemic, individual states received additional federal funding to expand their Medicaid programs. As a result of this expansion, the uninsured rate in the U.S. fell to 8%. But states are now able to start purging their Medicaid rolls, which was prohibited during the Public Health Emergency, and the CDC estimates that up to 15 million people could lose their health coverage in 2023. Medicaid and the Children's Health Insurance Program (CHIP) currently cover about 93 million people.

Continued from page 35

Susan Palé is vice president for compensation at Affinity HR Group Inc. Affinity HR is the endorsed HR partner of Big “I" Hires, the Independent Insurance Agents of Virginia, Big I New York, Big I New Jersey and Big I Connecticut.

It's always a good time for salary planning. Affinity HR can help you develop a benefits statement to clearly communicate your employees' total compensation. Connect with Affinity HR via email or at 877-6606400 to get your organization on track with a customized strategy.

The global average breach cost reached $4.45 million, with detection and escalation the most expensive component—indicating a shift toward more extended and complex investigations

The cost of the global average data breach in 2023 has set an all-time record high, with the average breach cost reaching $4.45 million, a 2.3% increase from 2022 and a 15.3% from 2020, according to IBM's “Cost of a Data Breach" report, which determines that organizations must invest in cybersecurity to limit damage.

The 2023 research, conducted independently by Ponemon Institute and sponsored, analyzed and published by IBM Security, studied 553 organizations impacted by data breaches that occurred between March 2022 and March 2023.

When cyber breaches were detected by an organization itself, they were able to reduce the impact to the firm, the report found. However, only one-third of companies surveyed discovered the data breach through their own security teams and approximately 67% of breaches were reported to firms by a benign third party or by attackers.

Olivia Overman

IA Content Editor

Olivia Overman

IA Content Editor

Further, when attackers disclosed a breach, it cost organizations nearly $1 million more per incident than when detected internally, the report said.

Identifying and containing a breach disclosed by an attacker required a mean time of 320 days, 80 additional days compared to breaches identified internally and 47 days longer than breaches identified by a benign third party.

The report identified three ways organizations can help mitigate the effects and costs of a cyber breach:

1) Involve law enforcement. Organizations that involved law enforcement in a ransomware attack saved money and shortened the lifecycle of the breach compared to those that didn't. Neglecting to involve law enforcement incurred an additional $470,000 in expenses on average.

Approximately 63% of respondents said they involved law enforcement while the 37% that didn't paid 9.6% more and experienced a 33-day longer breach lifecycle.

Continued from page 38

2) Explore artificial intelligence (AI).

Organizations that extensively used AI and automation security capabilities within their approach experienced, on average, a 108-day shorter time to identify and contain the breach, the report said. These organizations also reported $1.76 million lower data breach costs compared to organizations that didn't.

3) Focus on incident response (IR) planning and testing. Organizations that reported high levels of IR planning and testing saved $1.49 million over the year compared to those reporting low levels. Yet, only 51% of organizations surveyed plan to increase security investments following a breach with others focusing on IR planning and testing, employee training, and threat detection and response technologies, according to the report.

Despite the growing overall expense of cyberattacks, lost business costs hit a five-year

low, the report said. In contrast, detection and escalation costs were the costliest category of data breach expenses, increasing from $1.44 million in 2022 to $1.58 million in 2023. This is indicative of a shift toward more extended and complex breach investigations, including forensic and investigative activities, assessment and audit services, crisis management and communications to executives and boards.

Since 2020, healthcare data breach costs have increased by 53.3% and for the 13th year in a row, the industry reported the most expensive data breaches at an average cost of $10.93 million. Additionally, cloud environments were also frequent targets for cyber attackers in 2023, comprising 82% of reported attacks in public, private or multiple environments, with 39% of breaches spanning multiple environments and incurring a higher-than-average cost of $4.75 million, the report said.

The impact of these costs is felt primarily by customers and consumers with the majority (57%) of respondents indicating that data breaches led to increased pricing of their business offerings.

Continued from page 40

“Looking at the past five years, the independent agency channel is gaining ground slowly but steadily, with no material losses in any area seen in 2022's data," says Jennifer Becker, Big “I" senior director of agent development, research and education. “As we begin to see signs of a hardening market, independent agencies are facing the challenges head-on as trusted advisors to their customers."

Independent agencies have also seen growth in surplus lines, with a 9% utilization rate in the past year compared to an average of 7% over the past five years. In particular, private flood surplus lines has seen a large jump, with a 45% utilization rate in 2022 compared to 36% over the past five years. This correlates to a hardening market and carrier withdrawals.

The Market Share Report is free for Big “I" members and state associations. To order or purchase a copy of the complete 2023 Market Share Report, visit the Big “I" Market Share Report webpage.

Independent Market Solutions (IMS) is a market access solution that helps IIABL members expand their reach and offer clients more choices. With IMS, you can access a wide range of quality insurance company appointments with fair and flexible terms.

IMS works with more than two dozen carriers and 1,100 agencies in 17 states, producing over $100 million in direct written premium. IMS attracts carriers to the program through operational efficiencies that result in improved terms and reduced agent on-boarding costs. IMS agents earn competitive commissions and enjoy 100 percent ownership of policy expirations written through IMS while carriers gain access to high-quality producers at a lower cost.

Over the past five years, most carrier partnerships established with IMS have experienced growth in production and profitability. Last year, the program earned and shared contingencies from four IMS carriers that offer profit-sharing. Additionally, thanks to the relationship IMS has established with select carrier partners, the

program has opened the door for agents to more easily qualify for appointments that can often lead to "graduation" a direct appointment when minimum premium thresholds and performance standards are met.

As IMS continues to grow, the number of carriers available to members will also increase. So, if you're looking for a way to expand your market reach and offer your clients more choices, IMS is the perfect solution for you. To learn more, click here.

IIABL 2023-2024

PRESIDENT, ARMOND K. SCHWING PRESIDENT-ELECT, BRET HUGHES

SECRETARY-TREASURER, ROSS HENRY

NATIONAL DIRECTOR, JOHNNY BECKMANN, III

PAST PRESIDENT, MICHAEL SCRIBER

YOUNG AGENT REP, KRISTIN SWANSON SCOTT

ANN BODKIN-SMITH

MATTHEW DEBLANC

CHRISTY DESOTO

DOMINIQUE DICARLO CROUCH

ROB W. EPPERS

MATT GRAHAM

CHRISTOPHER S. HAIK

STUART HARRIS

BEAU HEAROD

CHARLES H. LEBLANC

CRAIG MARTEL

LYDIA MCMORRIS

A. EUGENE MONTGOMERY, III

JOE KING MONTGOMERY

HARTWIG "ROBBY" MOSS, IV

ROBERT LOUIS PALMER, JR.

RANDY PERISE

ROBERT STONE

Schwing Insurance Agency, Inc - New Iberia

Hughes Insurance Services, Inc - Gonzales

Henry Insurance Service, Inc. - Baton Rouge

Assured Partners - Metairie

Scriber Insurance - Ruston

Swanson & Associates - New Orleans

Thomson Smith & Leach Insurance Group - Lafayette

Continental Insurance Services - Marrero

1st Insurance of Marksville - Marksville

Riverlands Insurance Agency - LaPlace

Risk Services of Louisiana - Alexandria

Lincoln Agency - Ruston

Higginbotham Insurance - Lafayette

McClure, Bomar & Harris, LLC - Shreveport

Jeff Davis Insurance - Jennings

Bourg Insurance Agency, Inc - Donaldsonville

Insurance Unlimited of LA, LLC - Lake Charles

Alliant Insurance Services - Baton Rouge

Community Financial Insurance Center, LLC - Monroe

McGriff Insurance Services - Monroe

Hartwig Moss Insurance - New Orleans

Insurance Underwriters, Ltd - Metairie

Blumberg and Associates - Ponchatoula

Stone Insurance, Inc. - Metairie