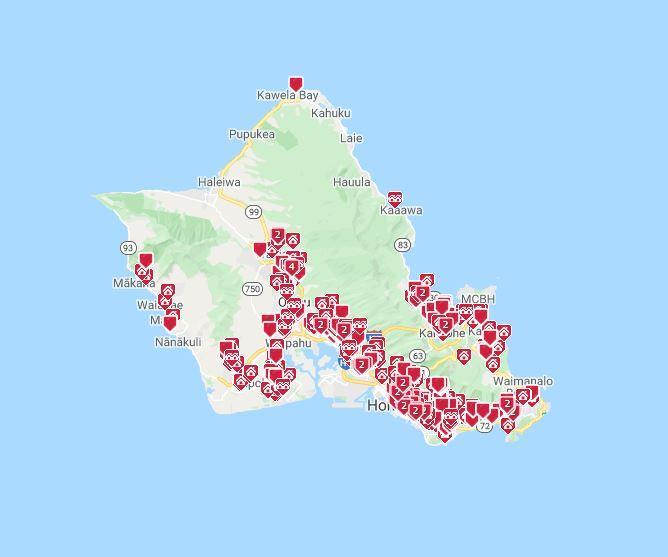

• Sold over 1,500 properties

• Over $1 Billion in sales

• Closed $113 million in 2022

• Top 5 on Oahu out of 7,500+ agents

1,602+ families served $1,126,800,504+ of transactions

© 2023 The Ihara Team. Duplication or dissemination of all or parts of this presentation is not authorized without the written consent of The Ihara Team. Figures used in this presentation is for illustrative purposes only. Each person’s legal and tax situation is unique; please consult a legal and tax professional for you specific situation. For your real estate needs, please contact The Ihara Team of Keller Williams Honolulu RB-21303, 1347 Kapiolani Blvd, 3rd Floor, Honolulu, HI 96813. Every Keller Williams office is independently owned & operated.

● 2007 – 2024 (Top 1% on Oahu)

Who’s Who in Hawaii Real Estate Top 100 Realtors in the state of Hawaii and Hall of Fame 12 consecutive years

● KW Honolulu #1 in 2019

● KW Northern CA/Hawaii Region #1 in Unit Sales in 2019

● 2017 & 2018 Hawaii’s 50 Fastest Growing Companies (PBN)

● Aloha Aina Award Nominee 2014-2016

● National Association of Realtors Outstanding Senior Real Estate Service Award Recipient 2014 (out of 1.3M realtors in the US)

© 2023 The Ihara Team. Duplication or dissemination of all or parts of this presentation is not authorized without the written consent of The Ihara Team. Figures used in this presentation is for illustrative purposes only. Each person’s legal and tax situation is unique; please consult a legal and tax professional for you specific situation. For your real estate needs, please contact The Ihara Team of Keller Williams Honolulu RB-21303, 1347 Kapiolani Blvd, 3rd Floor, Honolulu, HI 96813. Every Keller Williams office is independently owned & operated.

1. What prices will do over the next few years 2. Benefits of owning real estate

3. Is it a good time to buy now? 4. How to buy a home in today’s market

A. What are the steps

B. What do I need to look out for

C. Who can help me during the process

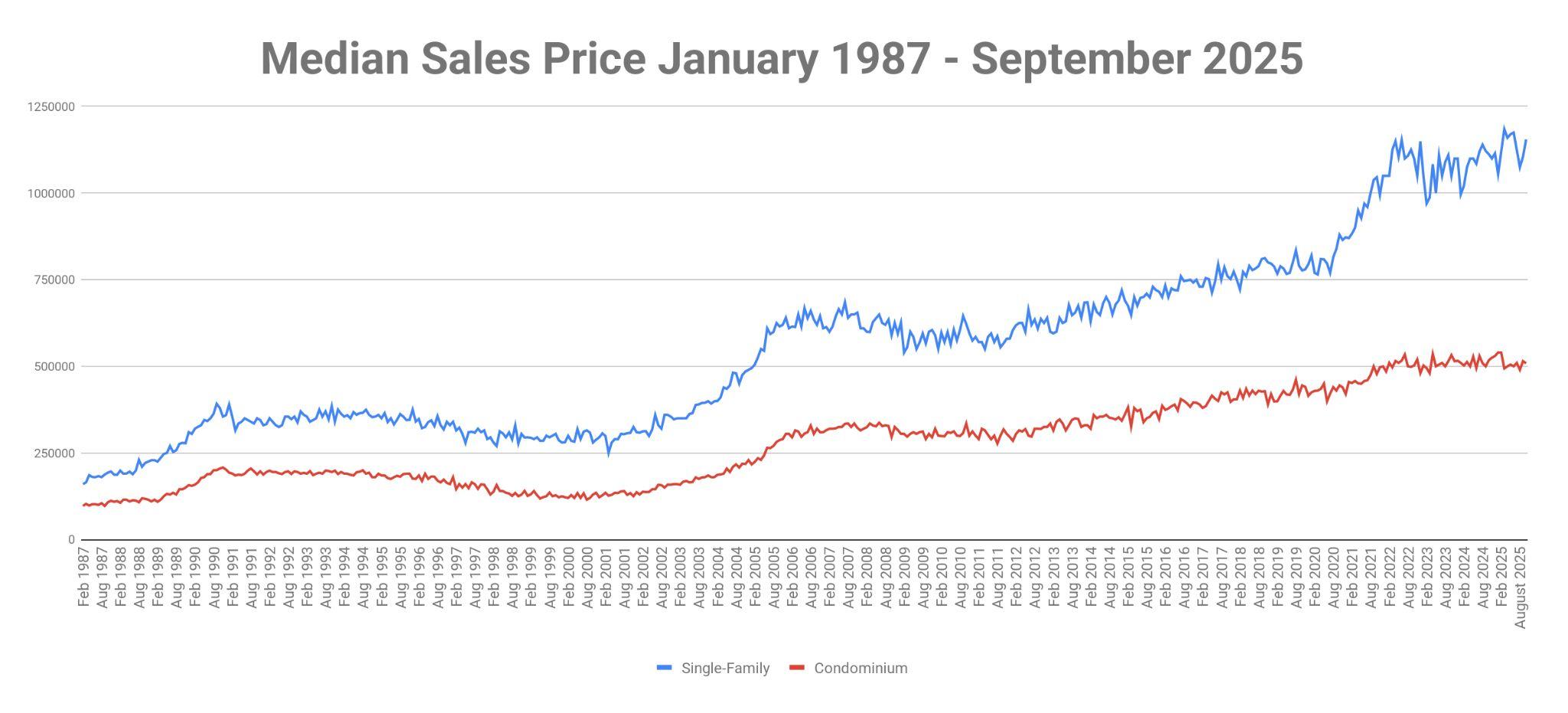

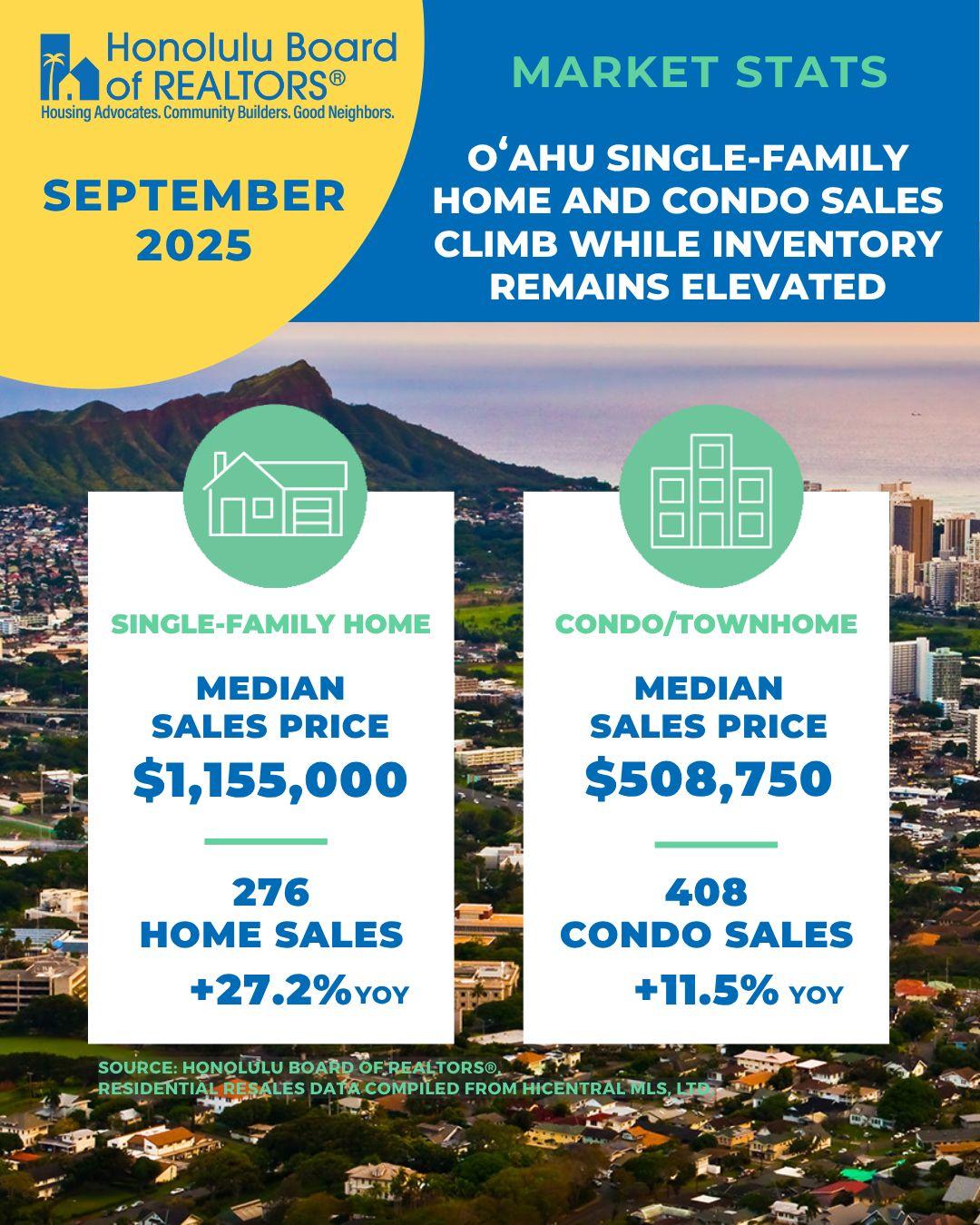

Source:https://www.hicentral.com/market-press-releases.php

© 2023 The Ihara Team. Duplication or dissemination of all or parts of this presentation is not authorized without the written consent of The Ihara Team. Figures used in this presentation is for illustrative purposes only. Each person’s legal and tax situation is unique; please consult a legal and tax professional for you specific situation. For your real estate needs, please contact The Ihara Team of Keller Williams Honolulu RB-21303, 1347 Kapiolani Blvd, 3rd Floor, Honolulu, HI 96813. Every Keller Williams office is independently owned & operated.

Updated Date 08/15/23

Source: https://fred.stlouisfed.org/series/MORTGAGE30US#

© 2025 The Ihara Team. Duplication or dissemination of all or parts of this presentation is not authorized without the written consent of The Ihara Team. Figures used in this presentation is for illustrative purposes only. Each person’s legal and tax situation is unique; please consult a legal and tax professional for you specific situation. For your real estate needs, please contact The Ihara Team of Keller Williams Honolulu RB-21303, 1347 Kapiolani Blvd, 3rd Floor, Honolulu, HI 96813. Every Keller Williams office is independently owned & operated.

❖ Interest rates have adjusted back to normal

❖ Limited amount of new supply

❖ Expect multiple offers on desirable properties

❖ Real estate forecasters predict long-term rising values

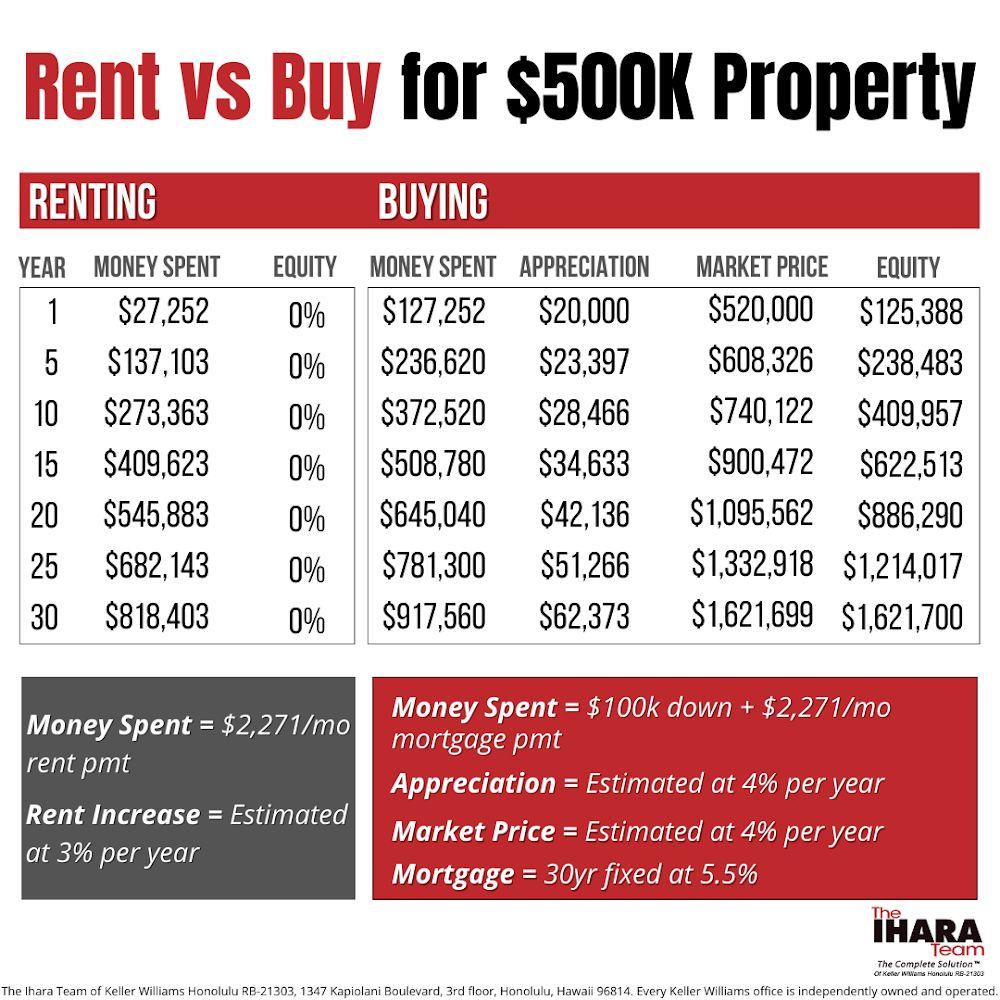

❖ Real Estate is the largest creator of wealth in the U.S.

❖ Appreciation increases your equity in the long run

❖ Home Equity Loans create other sources of finances

❖ Mortgage interest tax deductions (consult your tax advisor)

❖ Capital Gains Tax Exemption when selling

❖ If you’re renting, why pay someone else’s mortgage?

❖ Understand your needs, wants and future goals

❖ Location (proximity to schools, work & activities)

❖ Size/floor plan

❖ Number of Bedrooms/Baths

❖ Views, topography

❖ Condition of property (Excellent – tear down)

❖ Amount of time & investment for improvements

❖ Take care of paperwork to get the ball rolling

❖ Select a local, reputable, and experienced lender

❖ Determine financing options

❖ Determine what you can qualify for, and what’s comfortable

❖ Have a lender pre-approve you

❖ Enter parameters into the MLS system & jointly identify properties to see

❖ Coordinated showing schedule to efficiently find your home

❖ Visit homes on schedule – spreadsheet and MLS information

❖ Look past the stuff (imagine it cleared out)

❖ If Sellers agent there, write down and hold your thoughts.

❖ Identify the key likes & dislikes

❖ After each property, review, share thoughts & rate property (1-10)

1 = low, 10 = high. For ratings of 8, 9 or 10 we should write an offer

❖ At the end of day, we’ll have a good idea of what you’re looking for

❖ Starts with initial showing and ends at closing

❖ Proper questions can place you in a position of strength

❖ Negotiate price and terms

❖ Effectively work with cooperating agent

❖ Negotiate through each contingency

❖ Offer before other offers

❖ Learn about the Seller - needs/motivation

❖ Study the market in depth

❖ Write the offer with attractive terms to Seller

❖ Write a personalized cover letter to touch emotions

❖ Use special provisions to give you the advantage

❖ Ask lender to make strong buyer call

❖ Recommend strategy & initial offer price

❖ Get the offer accepted and successfully close the transaction

❖ A legally binding 14 page contract w/ 91 provisions

❖ Standard Hawaii Association of Realtors document

❖ Discuss important terms and contract provisions

❖ Review the Purchase contract with you and answer all your questions

❖ Cover Letter- Touch the emotion of the Seller

❖ Pre-Approval Letter – proof of ability to purchase

❖ Comparables – validate fair market value (if not competing)

❖ Work with the Seller’s Agent – cooperative tone

❖ Open escrow (we send all documents and initial deposit)

❖ Determine financing

❖ We coordinate all inspections

❖ Conduct due diligence

Typically 45-60 days until you get the keys

❖ Seller’s Disclosure Statement

❖ J1 – Inspection Period

❖ CC&Rs, Condo Docs

❖ Survey & Staking

❖ Termite Inspection Report (TIR)

❖ Preliminary Title Report

❖ Financing Contingencies

❖ Document prepared by Seller telling you/us what they know about the property

❖ 4 page document with 101 questions

We Will:

➢ Explain Seller’s disclosure & answer your questions

➢ Assist in identifying & clarifying potential issues

➢ Typical Timeline: Seller has 7 days to deliver to you

You have 7 days to accept or reject

➢ Amended disclosure: 7 more days to accept or reject

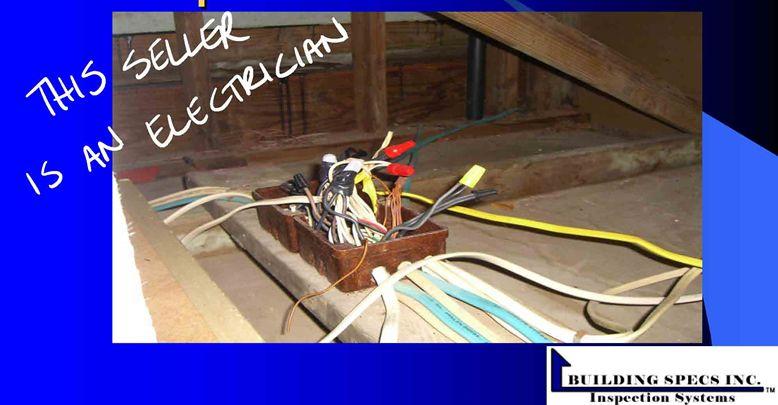

It is typical for a Buyer to have a professional home inspection completed (paid for by Buyer)

We Will:

➢ Be present to understand magnitude of findings

➢ Recommend strategy & course of action based on findings

➢ Negotiate significant findings and submit request

➢ Timeline typically 10-15 days to accept J-1

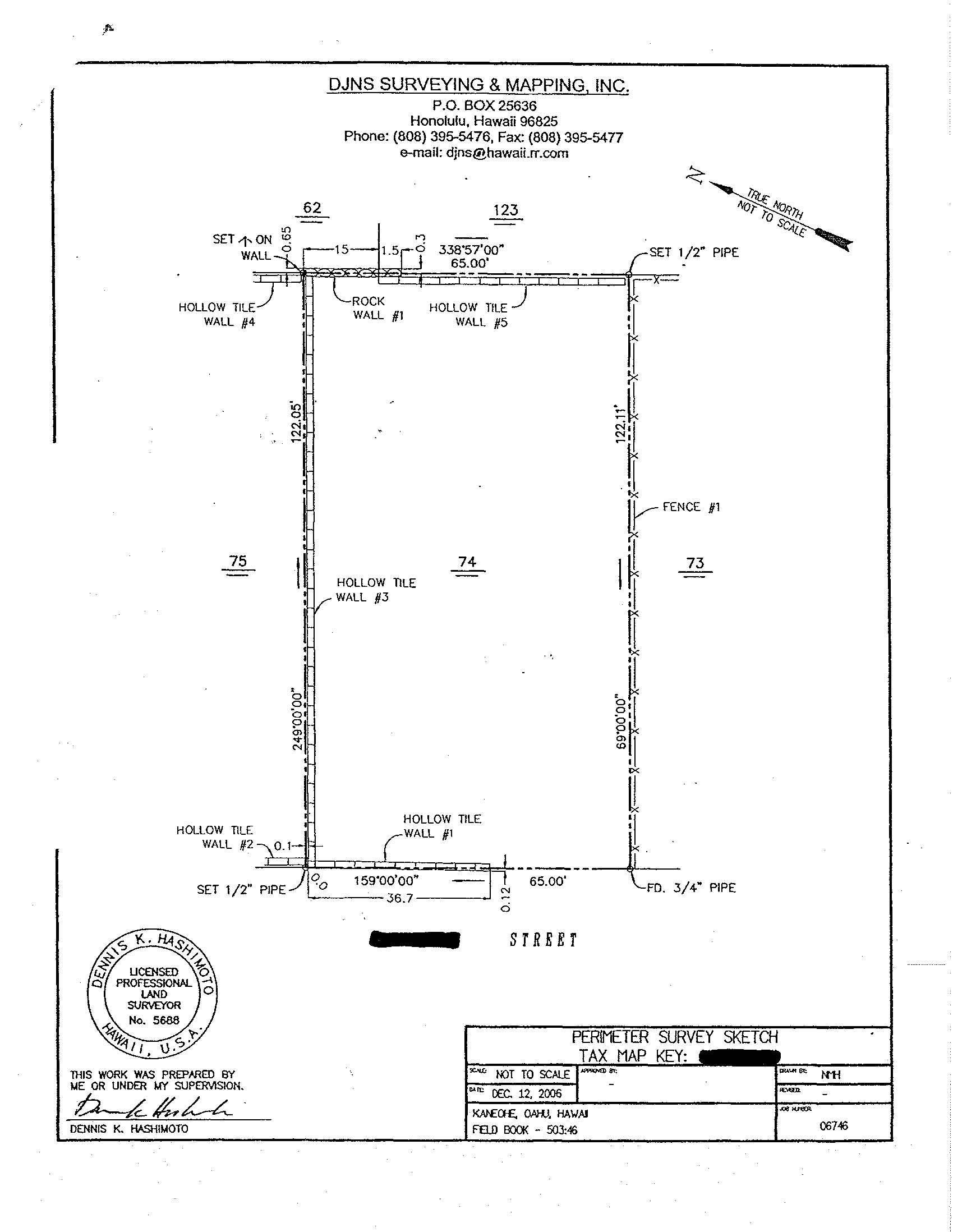

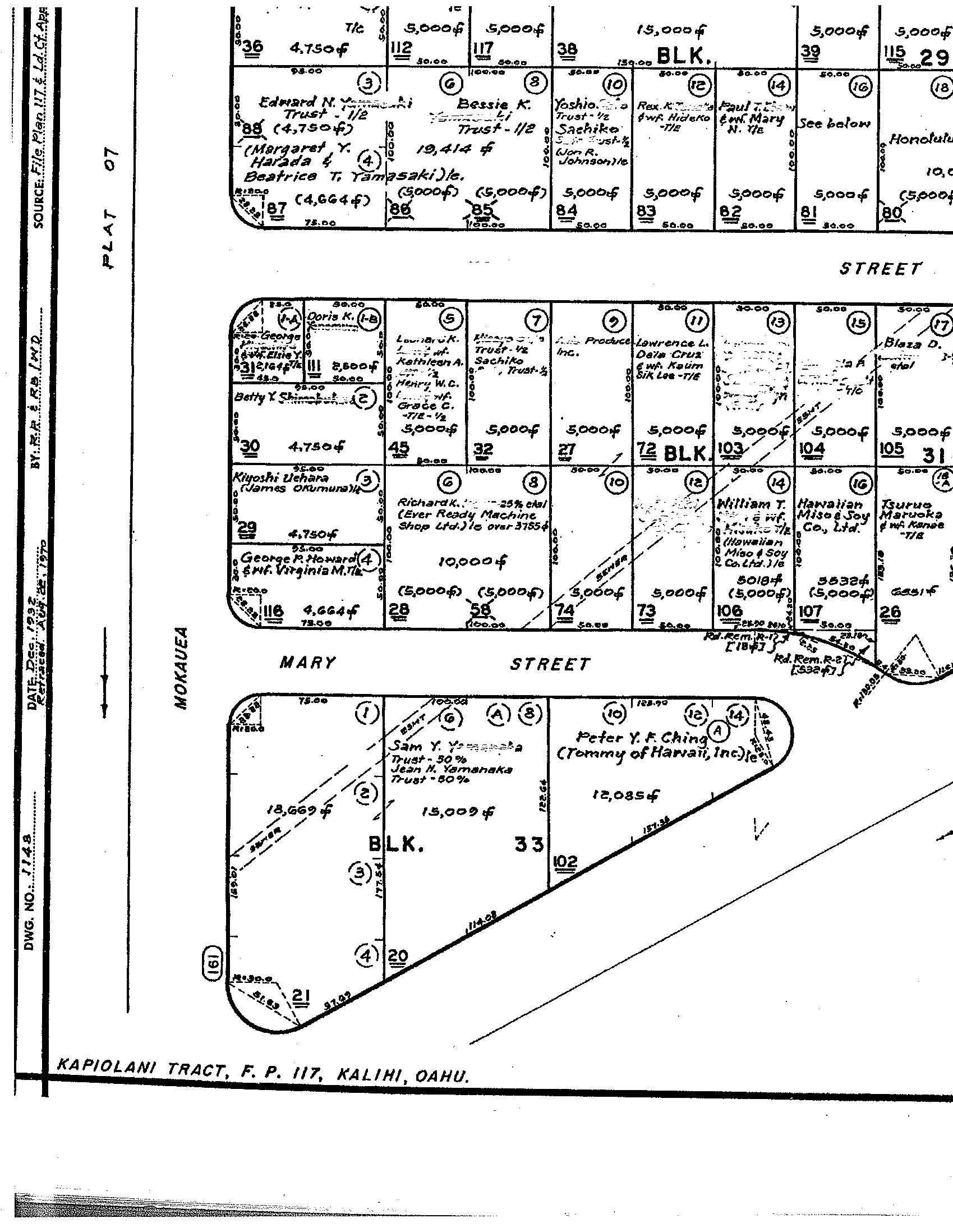

❖ Staking: marks the corner points

❖ Survey: corner points and the boundary map

❖ The survey will tell you if there are any encroachments

➢ Walk the property with you

➢ Ensure you understand the details of the survey

➢ Obtain in writing who owns all perimeter improvements

➢ Negotiate to obtain proper encroachment agreements

P.O.

Phone: (808)

(808)

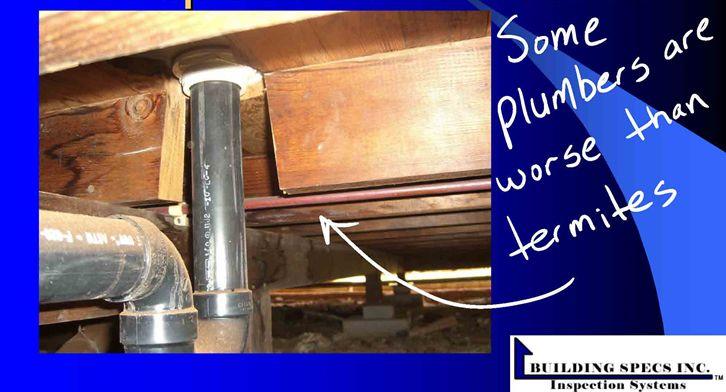

❖ Buyer selects termite inspector (Seller or buyer pays for inspection)

❖ Termite company will inspect improvements for termite damage or live infestation

❖ If the report recommends treatment, the contract requires the Seller to complete and pay for treatment

We Will:

➢ Be present to understand magnitude of findings

➢ Recommend strategy & course of action based on findings

➢ Negotiate significant findings

➢ Typical timeline: TIR is 10-15 days prior to closing

❖ CC&R documents (Condo Docs)

❖ Read thoroughly

❖ Understand the property’s restrictions

❖ Learn the history and possible issues

❖ Timeline typically 7, 7 days

Title report will:

❖ Tell you who the owner is

❖ Include the property description

❖ Include matters that affect the property – easements, setbacks, encumbrances (liens, mortgages), etc.

We will want to purchase the property with a “clear” title. Make sure there are no “clouds” on title.

You/lender will have to complete the following:

❖ Fill out loan application (5 days from acceptance)

❖ Pre-approval letter (5 days from acceptance)

❖ Conditional loan commitment letter (10 days prior to close)

❖ Final loan commitment letter ( 5 days prior to close)

We Will:

➢ Facilitate communication with lender (if necessary)

➢ Follow up with lender to ensure deadlines are met

❖ Clearly understand your needs and goals

❖ Aggressively search for properties within your parameters

❖ Negotiate the best terms & lowest price on your behalf

❖ Clearly communicate terms/provisions of contract and disclosures

❖ Schedule, coordinate, attend & explain all inspections

❖ Be there for you at escrow signing

Make sure the transition into your new home is as smooth as possible

❖ Be your advocate at ALL times – answer your questions, negotiate, resolve issues, work hard, be proactive and transparent with you

The final approval hearing is scheduled for November 26, 2024.

❖ Buyer and Seller commissions were always negotiated

❖ MLS no longer allows commissions to be posted on listings

❖ Seller’s listing might not provide commission to Buyer’s Agent

❖ However, most Seller’s Agents understand the value of having an agent representing the buyer

❖ Buyer may have to pay commission to their Agent if listing does not provide Buyer’s Agent commission - 2.5%

To honor God by serving others with the highest level of competency, care and compassion with uncompromising integrity

❖ Review and explain the process, so you can make educated and informed decisions

❖ Be there every step of the way

❖ Be your advocate

❖ Work hard to earn your referrals

❖ Sign paperwork to activate the next steps

❖ Create a customized plan & strategy for you

Once the price range is determined, we will schedule a shopping day