A SPOTLIGHT ON ASIA

S&P Global Commodity Insights has integrated research and solutions to help you navigate the leagues ahead in the natural gas and LNG markets. Our insights span from real-time news, to outlooks out to 2050; from granular pipeline data, to global trade flow fundamentals. Use our data platforms to explore infrastructure developments, compare assets and develop long-term strategy. And, with benchmark price assessments, negotiate with the confidence that only true market value can bring

Dear readers, gas industry colleagues, broader industry partners, and consumers of gas, welcome to the first issue of the 2023 Global Voice of Gas

This year will most likely continue to test the resilience of global energy systems and gas markets. Despite a relative reduction in the European gas price levels, compared to the unprecedented highs of last year, the price of gas remains elevated and global supply is extremely tight.

Luckily, mild winter and several other major global drivers of demand, including a downturn in Asian demand, helped the world get through the first winter in this supply-constrained reality. That could make it easier to forget that our tight supply will remain with us at minimum for the next two years, and the energy crisis is anything but over. It is our duty to continue to manage it and to work on developing new supply and bringing it to market as quickly as possible to ease the pressure of price inflation and volatility, which is hurting businesses and slowing economies. This ability will be greatly impacted by policy; from permitting to finance, policy is a major deciding factor impacting supply development. This was also one of several major conclusions of CERAWeek 2023.

The crisis also alerted the world to the fact that without energy security, there can be no energy transition. Many new coal plants were sanctioned, as an insurance policy for security of supply, and this is despite the fact that coal power emits 50% more CO than natural gas.

Emissions from coal went up significantly last year, while the world set another record in total CO2 emissions. Gas generation was reduced because of the crisis, and even though this was another Li Yalan, IGU President

For more information

Exhibition & Sponsorship Inquiries: exhibition@lng2023.org

Call for Abstracts Inquiries: papers@lng2023.org

About Vancouver: www.destinationvancouver.com

About the Host: www.cga.ca

The 20th International Conference and Exhibition on Liquefied Natural Gas (LNG2023), presented by the International Gas Union (IGU), Gas Technology Institute (GTI) and the International Institute of Refrigeration (IIR), is coming to Vancouver, BC, Canada, between the dates of July 10-13 2023. LNG2023 is hosted by the Canadian Gas Association (CGA).

The largest global LNG conference and exhibition will provide a very unique platform for the global LNG industry and key stakeholders to discuss, debate and showcase the latest industry developments and opportunities.

Vancouver is a vibrant, cosmopolitan city surrounded by incredible nature and is an easily accessible destination with direct flights from many corners of the world. The event will be set at the award winning Vancouver Convention Centre, directly on the city’s harbour, within walking distance of numerous hotels, restaurants and local attractions.

The conference programme will present the industry’s leading issues, and the exhibition will host the ultimate industry marketplace.

Editors’ Note

Welcome to the 11th issue of the Global Voice of Gas magazine, an International Gas Union publication, produced in collaboration with Natural Gas World (NGW).

Unusually mild temperature, together with suppressed demand in recent months, have thankfully led global natural gas prices to ease from record heights last year. Nevertheless, prices are still two to three times higher than what was considered the norm prior to the COVID-19 pandemic, and it is clear that the energy crisis is far from over. The next few winters could prove harsher, and only limited extra LNG supply is expected to arrive on the market until the mid-2020s, while demand from the Asian markets is likely to come back, at least partly, as China’s economy ramps back up.

To avoid future crises, energy policy should seek to become more pragmatic than it has been in the recent decade. There needs to be greater focus on planning for the long-term security of supply, while taking steps now to lower emissions. The energy transition journey needs to be plotted from today all the way to the destination – of achieving a low-emissions system that can provide affordable modern energy to a growing world. Natural gas is an invaluable tool for the world to reach a netzero future, while avoiding volatility and economic hardship. It is an abundant, flexible, and efficient source of cleaner energy that supports resiliency, helps to accommodate greater shares of renewables, and opens a path to decarbonising hard-to-electrify sectors using renewable natural gas, hydrogen, and other low and zero emissions gaseous fuels. At current prices, the value of natural gas is severely limited. But those prices are also a signal that investment in new supply must not only continue, but grow.

Europe has been perceived as the epicentre of the current crisis, given the shock it has sustained from the loss of Russian pipeline gas supply over the last year. But in other parts of the world, especially in Asia, some nations have undergone even greater economic turmoil as a result of high energy costs. In this edition of GVG, we take a look at how China, India and Japan – Asia’s three largest economies –

have coped with the energy crisis, the impact it has had on their climate aspirations, and how it changed their domestic gas consumption plans.

Despite these challenges, momentum continues to build behind the development of carbon capture and storage in Asia, and this edition takes a snapshot of the key projects taking shape in the region.

Africa too has been hit hard, suffering inflation of food, energy, and supply chain costs, but its substantial natural gas reserves can be used not only to support its own economic prosperity and end energy poverty, but also provide the wider world with more reliable and cleaner energy. This issue of GVG explores a new report, produced by the IGU in partnership with Hawilti Ltd, that assesses this potential.

A renewed sense of pragmatism was seen at CERAWeek, one of the most preeminent global energy gatherings that took place in Houston on March 6-10, as GVG reports. The main takeaway from the week was that ideological debates about individual fuels will not get the world any closer to the goal of reduced emissions. The single focus should be on achieving economy-wide emissions reductions with affordable clean solutions that also match the needs of energy users.

We are also very pleased to include in this edition a new section on decarbonising energy through Innovation and Technology, featuring an article by Mark Davis, CEO of Capterio, who describes the work that his young company is doing to support the oil and gas industry in reducing flaring, while creating value and accelerating the energy transition and the bumpy start-up journey it took to get there.

Ahead of LNG2023 in Vancouver this summer, the edition also takes a look at Canada’s cutting-edge LNG projects with innovative partnerships between developers and Canada’s Indigenous communities.

Tatiana Khanberg, Strategic Communications and Membership Director, IGU Joseph Murphy, Editor, Natural Gas WorldThe Numbers Stack up for LNG2023

To paraphrase someone much wiser than me – the two most important times to go to a conference are when the industry has challenges and when it has opportunities. And there is no better example than the upcoming LNG2023, where you can collaborate on the innovations and solutions with your commercial, strategic and technical colleagues from around the world.

LNG2023 also offers the most amazing efficiency dividend which lasts long beyond the knowledge you acquire and relationships you develop while faceto-face. From improved decision making, through

enhanced external communications to the value you bring back to share with your colleagues, the efficiency dividend will last across the following year.

See you in Vancouver for LNG2023, from July 10 to 13.

LNG2023

It’s now time to register to attend LNG2023 Vancouver, which, since 1968, has been the world’s premier conference and exhibition for LNG.

It’s easy to design a programme schedule around your interests. So, which one (or two) of these conference themes most interests you? Select a theme below and explore a tailored schedule.

• LNG Markets, Energy Security and Decarbonisation

• Commercial Stimuli

• Operations and Best Practice

• Upstream/Midstream Gas Production, Processing, Liquefaction

• Shipping, Marine Operations and Terminals

• Downstream Infrastructure and Applications

Or, if you want to check out all the sessions in one place simply go to the Conference Programme. Plus, of course, on-site at LNG2023 you can explore the world’s largest dedicated LNG trade show.

Whether you are focused on the opportunities or the challenges the LNG industry faces, LNG2023 is your most effective way to collaborate, network, learn and do business.

RODNEY COX Director of Events, International Gas Union

IGRC2024

Now this is exciting! IGU, through its International Gas Research Conference, IGRC2024, has collaborated with NGIF Industry Grants’ $10mn Global Cleantech Challenge.

“The IGU’s International Gas Research Conference (IGRC) has been the leading technical RD&I conference for three decades. We are proud to work alongside NGIF and the Canadian Gas Association to help bring technical innovations to life and advance the deployment of new critical, environmentally friendly technologies. We look forward to celebrating at IGRC2024 with the winners and the responsible, cleaner energy sources they will provide for the world,” said IGU Secretary General, Milton Catelin.

If you know any SMEs and start-ups in the following three key investment focus areas – 1. Responsibly Sourced Natural Gas (TRL 6-8) 2. Alternate Gases (TRL 6-8) and 3. Natural Gas Applications (TRL 6-8) – then advise them not to miss this potentially amazing opportunity. More details available at the Global CleantechChallenge Guidelines.

10-13 JULY

Registrations for LNG2023 are now open.

Delegate registrations are now open. Book now to save US$1,180 for an early-bird delegate pass (US$3,600). A conference registration gives you the complete LNG2023

Centre close to the city’s leading hotels; most within walking distance. When you register to attend LNG2023, you will gain access to an exclusive portal for hotel

WGC2025

WGC2025 Beijing is scheduled for May 19-23 and will be hosted in a brand-new conference facility; China National Convention Center Phase II is located in the Beijing Olympic Green Area. This facility was first designed to house the Main Media Centre for the Beijing 2022 Winter Olympics and

Presented By Host Partner:

is being refitted. It is listed as the top 10 most anticipated venues in the world in 2022 and WGC2025 will be the first event that uses the whole venue of CNCC Phase II. The WGC2025 team will be at LNG2023 Vancouver in July, so if you are attending make sure you drop into the WGC2025 booth for the latest details. Or for more details on WGC2025 exhibition and sponsorship, contact Jason Berman.

Africa

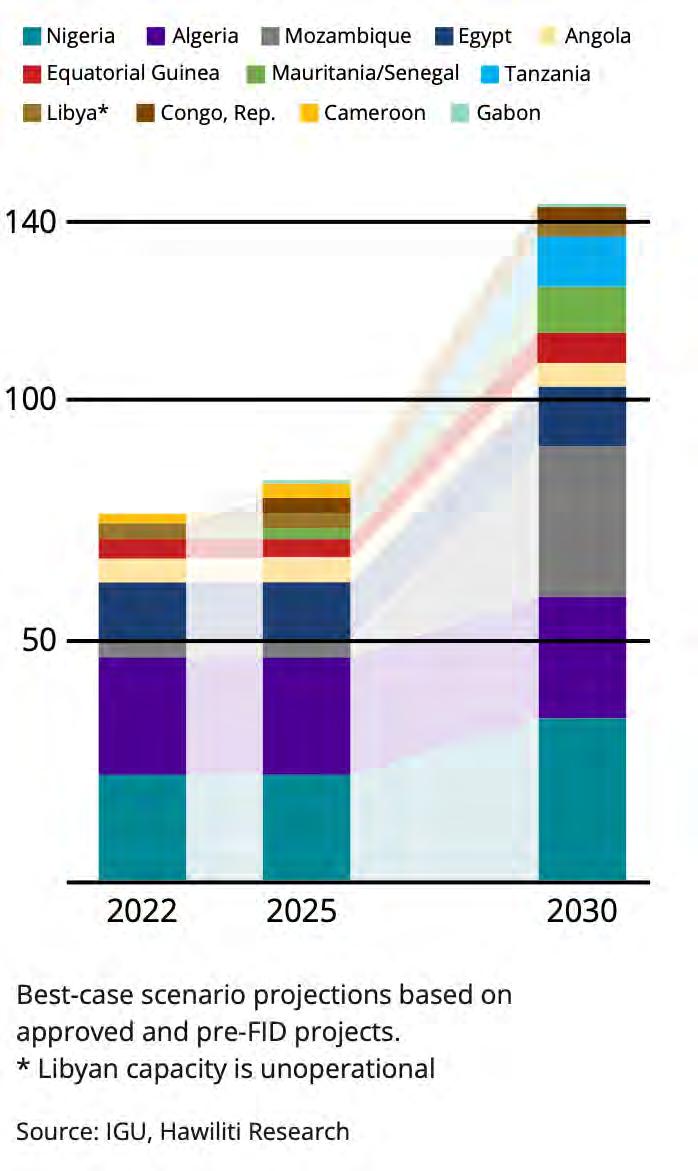

EGYPS 2023 saw the launch of the IGU’s Gas for Africa Report 2023, which assesses the potential for domestic gas resources to energise Africa.

» For the 6th consecutive year, Egypt hosted Egypt Petroleum Show (EGYPS) 2023, under the patronage of His Excellency Abdel Fattah Al Sissi, President of Egypt. Its theme was North Africa and The Mediterranean: Supporting Sustainable Global Energy Supply and Demand. EGYPS is at the heart of the African and Mediterranean oil, gas and energy conversation, and a platform that can convene global industry leaders.

» The International Gas Union (IGU) in collaboration with EGYPS launched the new Gas for Africa Report at the conference, sharing the key findings of a thorough study that produced by the IGU in partnership with Hawilti Ltd. The report assesses the potential for domestic gas resources to energise Africa in a way that supports the global energy transition. The African Energy Commission (AU-AFREC) and the Africa Finance Corporation endorse the report’s findings.

» The report launch session was a great occasion to discuss opportunities of gas development for the African continent, insights into its potential, key drivers, immediate barriers, and solutions of developing natural gas value chains in Africa to address energy poverty and climate change.

in Russian supplies and support the EU’s quest to end dependence on Russian energy. Recent European investments in the gas sector worth billions of dollars in Algeria have reached closure in the first quarter of 2023.

» The future outlook for North African gas is mixed, however, especially regarding its relevance to Europe. With further reforms aimed at spurring investment in the local sector and boosting production and exports while curtailing growth in domestic demand, the region could expand its role as a gas exporter. If that does not materialise, however, the EU will need to look elsewhere for additional supplies to replace sizable Russian gas purchases.

Following a series of massive offshore gas discoveries, there is great attention on East Africa’s untapped potential.

» Home to six of the 10 poorest nations globally, East Africa has long captured the world’s attention for the wrong reasons. But since a series of massive offshore gas discoveries in Mozambique and Tanzania in 2010 and thereafter, the region’s fortunes are being recast.

» Mozambique LNG, one of the main gas projects in the country, saw a $20bn final investment decision (FID) in 2019 – a year in which the country’s gross domestic product (GDP) was only $15.4bn. Several big names in the oil and gas industry are already there, including France’s TotalEnergies, Italy’s Eni, Norway’s Equinor, the US’ ExxonMobil and China’s state-owned China National Petroleum Corporation (CNPC).

» In two pieces of good news for Europe from Mozambique, the first shipment of LNG from the FLNG plant took place in the fourth quarter 2022, while TotalEnergies plans to resume its investment in its LNG train, with the first shipments expected in 2024.

exporters. However, policy reforms in both Mozambique and Tanzania would be necessary to count them as reliable LNG suppliers.

In West Africa, Senegal is set to emerge as a key gas exporter at the end of next year, while Nigeria hopes to better capitalise on its own reserves through the Trans-Sahara Gas Pipeline project.

» Senegal is in third place behind Nigeria and Algeria in terms of the size of its gas reserves in Africa. Senegal and Mauritania’s coastline is estimated to contain about 50 tcf of gas, however, production is not expected to start until the end of next year.

» Nigeria has Africa’s second largest natural gas reserves, though it accounts for only 14% of EU imports of LNG. Projects face the risk of energy thefts and high costs. In Nigeria, ambitious plans have yet to yield

results despite years of planning. The country exported less than 1% of its vast natural gas reserves last year. A proposed 4,400-km-long pipeline that would take Nigerian gas to Algeria through Niger has been stalled since 2009, mainly because of its estimated cost of $13bn. Many fear that even if completed, the TransSahara Gas Pipeline would face security risks like Nigeria’s oil pipelines, which have come under frequent attacks from militants and vandals.

While Africa’s natural gas reserves are vast and North African countries like Algeria have pipelines already linked to Europe, a lack of infrastructure and security challenges have long stymied producers in other parts of the continent from scaling up exports. Alreadyestablished African producers are cutting deals or reducing energy use, so they have more to export to boost their finances, but some leaders warn that hundreds of millions of Africans lack electricity and supplies are needed at home.

» Algeria dedicates 83% of its gas exports to Italy and Spain. Together with Egypt, it is the largest producer of natural gas in Africa. And 20% of Europe’s natural gas imports come from the region. North Africa has stepped up as a supplier of additional gas to alleviate Europe’s exposure to disruptions

» Moreover, Tanzania also has more than 60 tcf in gas reserves, and it is close to finalising a $30bn investment in an LNG export terminal, with construction due to begin in 2027 and first exports by 2030.

» The region’s standing in the growing global LNG market is not insignificant and has received a considerable boost following the war in Ukraine and the EU’s quest for new gas

North Africa’s role in natural gas trade should not be underestimated.

North Asia & Australasia

SATOSHI YOSHIDA Senior Adviser, Japan Gas Association, and IGU Regional Coordinator.

Energy security and climate change remain at the top of the agenda. The natural gas market is easing but prices are still high. E-methane, ammonia and hydrogen projects are advancing to meet low-carbon fuel demand in the region.

China yielded its position as the world’s top LNG importer to Japan last year, but it could reclaim the status in 2023.

» In December, HSBC projected a 5.2% growth in the Chinese economy in 2023, while Morgan Stanley’s forecast is 5.4%.

» Economic growth will trigger more energy demand. Gas consumption in 2023 will rise – potentially by double digits.

» Growth in domestic gas production is likely to remain steady, so much of the increase in gas demand will have to be covered by LNG imports. Late last year, state-owned energy company CNOOC projected that gas imports in 2023 would increase by 7%.

» China’s LNG imports from Australia and the US dropped 30% and 77% respectively from 2021, to 21.9 MT and 2.09 MT.

China is looking to the Middle East to diversify LNG supply.

» Oman LNG has signed a four-year contract with China’s Unipec to deliver 1 MTPA of LNG from 2025.

» China is importing more LNG from Qatar. Qatari shipments increased 75% last year to 15.7 MT, accounting for a quarter of China’s total imports, even as those total imports shrank by nearly 20%.

» It has also been reported that China National Petroleum Corp (CNPC) is near to signing a contract to buy LNG for 30 years or more from QatarEnergy’s North Field expansion project. If signed, this would be the second such deal between Qatar and China.

China’s maritime decarbonisation.

» China’s maritime industry is seeking low-carbon fuel to comply with new IMO standards and ammonia and hydrogen derivative fuel, produced from green hydrogen, are seen as the solutions.

» China Classification Society (CCS), Singapore’s SDTR Marine (SDTR) and Shanghai’s Merchant Ship Design & Research Institute (SDARI) have jointly developed an 85,000-dwt ammonia-fuelled bulk carrier, CCS said on February 22.

Japan is once again the largest LNG market.

» Japan imported 71.99 MT of LNG in 2022, down 3.1% versus the previous year.

» Imports in January came to 6.82 MT, up 0.54% year on year but down 15% compared with the level in January 2021. The average import cost was 128,080 yen ($941.5) per T, which was 156% more than in January 2022 and 282% more than in January 2021. The cost reached a record high of 164,922 yen per T in September 2022.

Japan is progressing plans to substitute city gas with e-methane, with two production projects underway in North America.

» Osaka Gas is conducting feasibility studies on the potential use of Cameron LNG and Freeport LNG to liquefy e-methane produced at locations in the surrounding areas. The partners in the project are Osaka Gas USA, Tallgrass, and Green Plains. This e-methane will be produced from blue hydrogen and biomass-based CO2, captured at bioethanol refineries

operated by Green Plains. It will then be liquefied and transported to Japan to substitute city natural gas. The aim is to produce up to 200,000 TPA of e-methane by 2030. In the future, blue hydrogen could be substituted with green hydrogen.

» The other project is in Texas/Louisiana and involves Osaka Gas, Tokyo Gas, Toho Gas, and Mitsubishi. It is set to produce 130,000 TPA of e-methane beginning in 2030.If these projects proceed as planned, they will supply enough e-methane to replace 1% of Japan’s city natural gas, in line with the city gas industry’s target.

» The real challenge will be supplying enough e-methane to raise this to 90% by 2050.

» Gas utilities are proceeding with multiple e-methane feasibility studies, including site analyses, in a number of countries and regions, such as Australia, Singapore, North America and South America, to secure more sources of e-methane imports for Japan. The ideal conditions for producing e-methane include availability of low-cost hydrogen, abundant CO2 sources, and easy

access to gas transmission pipelines, liquefaction and LNG shipping.

New Zealand’s Southern Green Hydrogen project will produce 500,000 TPA of ammonia for domestic use and export.

» Meridian Energy, New Zealand’s largest power company, said on November 29 that it had selected Australia’s Woodside as the preferred partner of Southern Green Hydrogen.

» Japan’s Mitsui & Co. is also in discussions to join the project as well as develop the potential market for ammonia offtake, with the aim of creating a collaboration that covers the full hydrogen and ammonia supply chain.

» Meridian, Woodside, and Mitsui will work towards starting front-end engineering design (FEED) for the project. A final investment decision will follow the development stage.

Australian LNG export volumes and revenues fell month on month in January.

» According to EnergyQuest, Australia’s LNG export revenue in January was A$7.2bn ($4.93bn), lower than the A$8.6bn in December but up 20% year on year.

» LNG export volumes amounted to 6.57 MT in January, versus 7.2 MT in December. During the first month of the year, 30 cargoes were delivered to China, 37 to Japan and 18 to Korea.

» Western Australian projects earned A$4.5bn in export revenue in January, while Queensland projects earned A$2bn and Northern Territory projects A$0.8bn. West Coast volumes fell to 4.8 MT from 5.3 MT in December, but they were level with shipments in January 2022. West Coast projects operated at 90% of capacity during January.

» East Coast LNG shipments were also slightly down at 1.8 MT in January compared with 1.9 MT in December and 2.1 MT a year earlier. East Coast projects operated at 81% of capacity.

South Korea aims to start importing hydrogen from Malaysia and the UAE by 2027.

» The South Korean government plans to start importing hydrogen produced in Malaysia and the UAE by 2027 for power generation and export after conversion into ammonia, Business Korea reported on January 9. Hydrogen for ammonia production will be produced in Malaysia from hydroelectric power. In the UAE, Korea Electric Power Corp. and Samsung

C&T will produce hydrogen using PV. Supplies from the two countries are expected to amount to 600,000 and 200,000 TPA respectively.

» South Korea is currently testing a hydrogen-LNG fuel mix in combustion. Using a hydrogen-to-LNG ratio of 30:70, CO2 emissions could be reduced by 10%. That reduction rises to 21% using a 50:50 ratio, and 52% using an 80:20 ratio.

» According to Business Korea, there is also a plan to use ammonia produced from hydrogen to cut CO2 emissions from coal-based power generation.

» South Korea’s LNG imports rose to 4.95 MT in January, from 4.50 MT in the previous month.

Chinese Taipei is working to bolster its energy security.

» Chinese Taipei is expanding its natural gas and coal inventories to improve its energy security and make it more resilient to crises, amid growing global geopolitical and economic uncertainty. Chinese Taipei imports 98% of its energy from overseas.

» The economy ministry wants to build new storage facilities to increase natural gas inventories to more than 20 days of demand by 2030, up from 11 days at present. Inventories of coal and other fuels will also be increased in the coming years, under the plan, while crude oil inventories will be maintained at over 100 days of consumption.

» Chinese Taipei’s LNG imports increased to 1.76 MT in January from 1.69 MT in December.

Europe

DIDIER HOLLEAUX President Eurogas, Executive Vice President Engie and IGU Regional Coordinator.

A generally mild winter, very high levels of storage and significant demand reduction, particularly in industry, have caused prices to ease back considerably in Europe.

» European gas prices stabilised at €50-60 per MWh in January and February, and have seen further decline since then.

» This is despite record low Russian pipeline supply – around 25 bcma on an annualised basis since October 2022, or a sixth of the volume in 2021. Russian pipeline gas now only arrives in Europe via Ukraine and the TurkStream.

» The European decision to apply a price cap on TTF gas may have had a psychological impact that caused prices to relax, even if the cap (€180 per MWh) is far higher than market prices since the adoption of the regulation on December 22, 2022, and the conditions for the price cap to apply are quite restrictive.

» Current prices may be far lower than those extreme ones seen during the summer, which regularly exceeded €100 per MWh, and peaked at €350 per MWh. But they are still two times higher than the €20-30 per MWh price range that was considered normal in the years prior to the COVID-19 pandemic.

» As a result of lower prices, and some network congestion, some spot LNG cargoes have been reallocated to other destinations – namely Asia – since the end of last year.

Attention shifts to the summer injection period, as authorities prepare to meet gas storage obligations ahead of next winter.

» In Western Europe, the race to install new regasification capacities is ongoing, and two new floating terminals have been put in operations in Germany in Wilhelmshaven and Lubmin, and a third in Brunsbüttel is undergoing commissioning. A number more terminals are anticipated to start up in France, Estonia, Greece, Italy and Turkey, as well as an additional two or three in Germany. This will allow Europe to import as much LNG as is available on the world spot market for the years to come and to bring this LNG as close to where the demand is as possible.

» In Eastern Europe, countries that were historically very dependent on Russian gas have reached agreements with neighbours to import LNG. Bulgaria has signed a deal to receive LNG from Turkish terminals, and several countries are assisting with alternative supply for Moldova.

» Nevertheless, new long-term supply contracts signed in 2022 and clearly dedicated to Europe amounted only to circa 15 bcma of gas, which is less than a fifth of the missing pipe gas supply from Russia, which amounted to 142 bcm in 2021. This means Europe will rely heavily on the LNG spot market to balance its gas market in 2026-27. It also means that European buyers did not trigger by themselves any new supply investment, with one US liquefaction project as the only exception.

» The European Council and Commission are still working on creating an appropriate framework for European players to jointly purchase the additional gas they need: it is not yet clear if this initiative will have a significant impact either in the short term (gas purchases to fill up the storages in 2023 are already well underway) or in the long term (will the conditions allowing European players to share a long-term contract be met?). The European Commission has announced that the “aggregation tool” designed to facilitate these joint purchases by gathering all quantities which could be bought together will be available in March.

» The domestic production of renewable gas (biomethane, landfill gas, etc.) is now viewed very positively, both for security of supply and for the environment, and its cost is now also considered acceptable (in comparison to the price of natural gas last summer). As a consequence, many countries in Europe are developing more ambitious policies and the output target proposed by the commission (35 bcma in 2030,

in REPowerEU ) is generally seen as achievable.

demand will not return.

» High prices have cut industrial gas demand in Europe as a whole by around 26%, and in some countries the reduction has been as much as 40%. These declines are the result of energy efficiency, fuel switching and demand destruction, as some plants have simply halted production because they or their customers cannot afford the high cost of energy.

» S&P Global estimates that 27% of this demand destruction (i.e. 7% of the European industrial gas demand) will not come back. We know from experience that energy efficiency cannot achieve more than a 3% demand reduction on average per year. This means that 2022 alone has seen the destruction of roughly 4% of the industrial gas demand (plants closed down indefinitely or relocated outside Europe), because of the energy crisis. The rest of the demand is expected to be restored, as there is fuel switching in the opposite direction, and plants temporarily closed are restarted.

» In the residential sector, even if most of the countries have put in place protection measures to avoid households to pay very extreme prices, the combination

of high prices and strong incentives to save energy has led to a significant reduction of gas demand.

» As far as gas-to-power is concerned, the situation has been very different across Europe, as gas-fired power plants have generally been the balancing tool of the power market, and therefore very active when and where hydro, wind and nuclear output has been low.

Unfortunately, the crisis is far from over and the supply security of Europe could be jeopardised by any major incident in the LNG supply chain worldwide.

» The situation will remain critical for at least the next three winters, and re-establishing the security of supply after 2026 will require Europe to make new long-term commitments for gas supply.

» To contribute to its energy security, but also to its external trade position, Europe must also develop its potential for biomethane and renewable H2. In that regard, the 35 bcm of biomethane proposed by the European Commission and now endorsed by the European parliament for 2030 should be considered only as a minimum. As far as renewable and low-carbon hydrogen is concerned, the Delegated Act published by the Commission on February 21 provides a framework that should allow concrete projects to be developed.

Demand destruction in industry has been great, and some of that

European gas prices stabilised at €50-60 per MWh in January and February, and have seen further decline since then.

Gas still key to China’s energy transition despite 2022 demand drop

China’s gas demand is set to rebound in 2023 on the back of moderating gas prices and a long-awaited economic reopening, after consumption dipped slightly due to tight pandemic controls and surging global energy costs.

SHI WEIJUNThe unprecedented expansion of China’s gas market over the past two decades took a pause in 2022, but the faster-than-expected reopening of the world’s secondlargest economy will support a consumption uptick while the energy transition remains a long-term growth driver.

The now-defunct COVID-zero strategy, coupled with high global energy prices, led to substantial weakness in the Chinese gas market last year as economic disruptions sapped industrial and commercial demand for the fuel. The pandemic-related challenges for gas in China peaked in the fourth quarter of 2022 – traditionally the period with the biggest consumption – as COVID-19 swept across the country after policymakers in Beijing loosened tight pandemic controls.

China’s apparent gas consumption in 2022 edged down by 1.7% year on year to 366.3 bcm, according to official figures. The contraction marked a departure from the Chinese gas market’s previous growth trajectory. At

the same time, softer Chinese demand last year offered relief to Europe as governments from Berlin to London scrambled to secure LNG supplies as an alternative to Russian pipeline gas.

Last year’s modest decline was the first in at least a generation and came amid an overall increase in energy demand. This led the share of gas in China’s primary energy mix to decline from 8.9% in 2021 to 8.4% in 2022, according to official data.

Coal meanwhile grew its share from 56% to 56.2% over the same period, but non-fossil sources scored the biggest gain from 16.6% to 17.4%. The Economics and Technology Research Institute of CNPC, China’s biggest national oil company (NOC), expects coal’s share to drop to 44.3% by 2030, while gas’s share will rise to as high as 29% by 2035.

City gas is likely to have been the only segment to have grown in China last year – mainly driven by

residential usage and heating from coal-to-gas conversion – as commercial, industrial and power generation demand weakened in tandem with meagre economic growth. The share of city gas in overall consumption expanded from 35.5% in 2021 to 37.5% in 2022, while the shares of industry, power generation and chemicals all declined.

While last year’s spike in global gas prices depressed Chinese demand overall, it also led paradoxically to recent shortages of the fuel in parts of northern China –making this winter the third out of the past six in which China has suffered an energy crunch.

Europe’s dash for LNG shortly after the start of the ongoing Russia-Ukraine conflict in February 2022 drove up wholesale gas prices in China as city gas distributors were forced to cover the higher cost of imported supply.

But China tightly regulates the residential price that gas distributors can charge – as wholesale prices soared far above retail prices, the distributors stopped reselling wholesale gas to households in December and January.

“This has exposed the failure of some local governments and enterprises in implementing measures to ensure energy supply and stabilise prices for people’s livelihoods,” said Lian Weiliang, vice chairman of the National Development and Reform Commission, China’s top economic planning agency, in mid-January. “No local governments or enterprises should limit the purchase of gas for people’ livelihoods.”

Choppy growth

Last year’s modest decrease in Chinese gas demand looks to be a blip though as the Chinese government is working hard to revive the economy. Analysts expect consumption to rebound in 2023, underpinned by easing prices and economic recovery on the back of the end of the COVID-zero strategy, which will support demand recovery for industrial use and power generation as well as commercial consumption. But demand growth may not pick up speed until spring as the economic recovery remains nascent in China, amid lingering weakness in some key indicators such as crossborder flights and new home sales growth. Reinfections from waning herd immunity over time present a persistent downside risk for China’s reopening this year, potentially weighing on already-subdued consumer consumption. There are other headwinds too. Global gas supply is projected to remain tight this year from a combination of China’s reopening, robust European demand, limited supply additions and a shortage of LNG carriers to ship the fuel. Even if China’s economy bounces back strongly this year, the domestic gas market could be supplyconstrained.

China’s property slump remains a drag. Home sales remain soft despite a policy U-turn by Beijing, in a reflection of persistently weak demand. The reopening will help spur property construction, but the slowdown in completion of new homes means fewer gas connections

completed by domestic utilities like China Gas Holdings and China Resources Gas. Taken altogether, these factors mean Chinese consumption growth could be choppy as the year goes on.

Imports tipped for comeback

Domestic production represented 59.5% of China’s apparent gas consumption last year, the highest share since 2017 when it topped 62%. The five-year high reflected a 9.9% drop in total gas imports that was entirely driven by LNG – shipments plunged by 19.5% to 63.4 MT as surging costs made imported LNG less economically viable. But this decline is also likely to be a one-off as the expected recovery in consumption and fall in international gas prices make LNG attractive to Chinese importers once again.

Piped imports expanded by 7.8% to 45.81 MT, and look set to maintain growth momentum as Gazprom ramps up volumes through the Power of Siberia pipeline to a contracted 22 bcm this year. This would remain less than two-thirds of the pipeline’s capacity of 38 bcma, so there is scope for Gazprom to deliver more than the contractual requirement if there is enough Chinese demand.

Total contracted pipeline imports into China once Power of Siberia ramps up to its contracted capacity will exceed 110 bcma, the majority of which will be contributed by Russia. Following an agreement between Gazprom and CNPC in February 2022, Russian gas deliveries to China could reach 48 bcma in the latter

half of this decade, which would see Russia replace Turkmenistan as the top pipeline supplier to the Chinese market. At the same time, the start of development of the fourth West-East Pipeline from China’s western border to its hinterland provinces in September 2022 could bring renewed impetus for completion of the long-delayed 30 bcma Line D of the Central Asia-China Pipeline network. There will be new long-term LNG offtake contracts of at least 45 MTPA commencing over the next few years based on recently announced deals, which corresponds to 71% of last year’s LNG import volume. The looming increase will coincide with new regasification terminals that will start operations in the next few years.

CNPC and the other two NOCs, Sinopec and CNOOC, have continued to enter into new long-term LNG contracts to safeguard China’s long-term energy security and optimise the national gas import mix. LNG also offers the NOCs greater price flexibility than imported piped gas, as the pool of suppliers are more diversified by region and there are more LNG pricing benchmarks.

In the past three years more non-NOCs in China, such as local energy companies and larger city gas distributors, have been entering into long-term LNG contracts directly with overseas producers to secure supply in anticipation of consumption growth over the long term.

Long-term transition role still assured

The Chinese energy system is continuing to undergo dramatic shifts, with a top-down mandate to transition from a carbon-intensive economy toward a peaking of

emissions by 2030 and carbon neutrality by 2060. While energy security remains at the top of the agenda, China is expected to uphold these ‘dual carbon’ commitments, announced by President Xi Jinping in September 2020. China’s energy regulator issued a key report in January that clarified the timetable for constructing a so-called “new-type power system” and the key tasks step by step. While renewable energy such as wind and solar is expected to be the mainstay of the new-type power system, the implication is that gas will be a fuel source that bridges the gap between more polluting fossil fuels and renewables. The gas industry will be developed alongside renewables, given its important baseload role in the power system. Gas will continue to play a role in China’s energy mix due to a variety of supportive government policies. Unlike coal and oil, whose consumption is projected to peak before the end of this decade, demand for gas is set to continue

expanding with support both at the policymaking level of the Chinese government and the corporate level, with a strong emphasis on gas development at the three NOCs. China approved more coal-fired power generation capacity last year, but the sense is that this was more of a response to anticipated higher demand for peak load shaving as a result of rising imbalances in the power system from increased renewable energy generation. There is a large pipeline of 30 GW of gas-fired power plants under construction or approved by domestic power generation companies alone, which will boost power generation demand for gas once the units are commissioned.

And while a short-term setback for gas prospects like last year’s may occur again, the overall picture for the fuel remains strong in the long term as China doubles down on efforts to transform its coal-dominated economy into a cleaner system.

“[Gas shortages] have exposed the failure of some local governments and enterprises in implementing measures to ensure energy supply and stabilise prices for people’s livelihoods.”

LIAN WEILIANG, VICE CHAIRMAN, NATIONAL DEVELOPMENT AND REFORM COMMISSION

CNPC, Sinopec and CNOOC have continued to enter into new long-term LNG contracts to safeguard China’s long-term energy security and optimise the national gas import mix.

High prices pose challenge to Indian gas ambitions

India embraced LNG as a means of supporting its economy with clean and affordable energy, complementing domestic production and helping to reduce consumption – the country’s main source of power generation. But owing to presently high global LNG prices, India’s progress on expanding gas use to 15% by the end of the decade, from 6-7% at present, is stalling.

India’s LNG imports in 2022 came to 20.8 MT (28.3 bcm of natural gas), down 14% year on year. This is the second year in a row that volumes have dropped – in 2021 they declined by 6%, as climbing prices towards the end of that year began to have an effect.

Meanwhile, domestic gas production grew by only 3% in 2022 to 33.4 bcm, failing to compensate for the drop in LNG shipments, with the country’s overall gas supply dropping 4% last year.

The critical role of gas

High global LNG prices pose a clear challenge to India’s plan of expanding the role of gas in power generation, industry and other sectors, given limited options for pipeline gas imports and slowing growth in domestic output. But its gas targets must be met, if India is to cut coal use and reduce its emissions.

India boasts considerable renewables potential, and the rate at which it is deploying new capacity has been impressive. It now has the fourth largest wind power capacity in the world and the third largest solar PV capacity. But renewables, excluding large-scale hydroelectric capacity, still supply only 5% of the country’s primary energy. And given the intermittent nature of this supply, another source of baseload power capacity is needed to replace coal, and natural gas is the only lower-emission fuel that can play this role in the medium term.

India has been pushing to expand the share of gas in its energy mix for many years, and its slow progress in this area predates the current energy crisis. In fact, the share of gas in the country’s primary energy mix has hardly changed in 15 years. However, high LNG prices now mean that India now finds itself backtracking. The share of gas in its energy mix shrank from 6.8% in 2021 to 6.3% in 2022, and it is likely that a further contraction took place last year.

At the same time coal consumption has continued to grow – by 14% in 2021 and 7% in 2022, according to the International Energy Agency (IEA). The IEA predicts that coal demand will see further growth from just over 1,000

MT in 2022 to 1,220 MT in 2025. New Delhi’s draft national electricity plan anticipates that an additional 26 GW of coal-fired capacity will be developed by 2026-27.

Infrastructure delays

India’s largest LNG importer, Petronet, forecasts that LNG will increasingly dominate the country’s gas market, predicting it will meet 70% of demand by 2030, up from under 50% in 2022. Even though India’s existing LNG import terminals are running at only around half capacity in 2022, substantial new capacity will be needed if India is to meet its gas targets. However, new terminal projects have faced delays. The 6-MTPA Jaigarh LNG terminal was meant to come online last year, but commissioning was postponed

because of COVID-19 disruptions and labour shortages. In August last year, a charter deal for the Hoegh Giant floating storage and regasification unit (FSRU), earmarked for the project, was terminated, and the vessel is due to be deployed elsewhere instead.

Progress at the 5-MTPA Jafrabad LNG project –originally meant for launch in 2019 – has also stalled, because of repeated cyclone damage and pandemicrelated issues. And the Vasant I FSRU which was set to service the terminal is now similarly expected to be used elsewhere.

Meanwhile, the 5-MTPA onshore Dhamra LNG project missed its target for launch in the second half of 2021. Its operator Total Adani told Reuters in February 2023 that it expected to receive 2.2 MTPA of

India risks backtracking on efforts to expand the role of natural gas in its energy mix to 15% by the end of the decade

JOSEPH MURPHY

Another source of baseload power capacity is needed to replace coal, and natural gas is the only lower-emission fuel that can play this role in the medium term.

Gorgon

India’sLNGContractVolumes

The

Madre de Dios basin

is a foreland basin with a prospective area of 43,000 m2 and some 5,000m of sedimentary infill. The basin includes the complex fold thrust belt with outcrops of Paleozoic, Cretaceous and Tertiary age on the south and SW bordered by a foreland basin covered by Quaternary alluvial deposits.

Hydrocarbon exploration in the Madre de Dios basin has been progressively carried out by different companies, which demonstrates the existence of gas potential that has been proven with the discovery of the Candamo Field, which has certified 2C contingent resources of 422.5 BCF and 5.2 MMSTB of NGL (MINEM, 2019). The estimated volume for prospective resources is of 20,401 BCF.

Sabine

Prospect “Salvación”

Reservoirs: Vivian, Lower Chonta and Nia

Avr. Depth: 5,000 m

Fluid type: Gas and Condensate

supply at the facility in the year ending March 2024, but acknowledged that supply arrangements had not been finalised.

A global problem

The good news is that LNG spot prices have now fallen back to the level that they were prior to the conflict starting in Ukraine, and this could spur a recovery in India’s LNG imports. But at $15-20 per mmBtu, these prices are still several times higher than was typical prior to the COVID-19 pandemic. With limited new global supply expected online before the middle of the decade, the market will remain tight in the medium term, further undermining New Delhi’s gas ambitions.

In the longer term, only expanded investment globally can ensure India’s plans get back on track. What Indian companies can do to support this is seek new long-term

supply contracts that can help stimulate investment in extra production. Reports suggest that some are doing just that. In February, local media reported that India’s Indian Oil Corporation Ltd (IOCL) and GAIL are in talks with the UAE’s Abu Dhabi National Oil Company (ADNOC) were at an advanced stage of talks on securing a longterm supply contract with Abu Dhabi-based ADNOC. Indian companies could go a step further and invest in liquefaction projects themselves, supporting their development and securing offtake volumes in the process. Also in February, GAIL was reported by Reuters to be looking to purchase an equity stake in an existing LNG plant or project in the US.

Present market conditions make it difficult, but India will have to continue pursuing a greater role for gas in its economy, if it is to make meaningful progress in curbing its emissions.

AVAILABLE DATA

Basin Area: 7.5 MM Ha.

Source Rocks: Copacabana (Permian), Ambo (Carbonif.), and Cabanillas (Devonian)

Reservoir Rocks: Vivian, Lower Chonta (Cretaceous) and Nia (Permian)

Fluid Type/ °API: Gas and 55 °API Condensate (Candamo-1X) and 50.8°API (Pariamanu-1X)

Wells: 7 Exploratory Wells (Wildcats)

Leads “Mazuko” (MT - 2021)

Reservoirs: Vivian, Lower Chonta and Nia

Avr. Depth: 4,200 m

Fluid type: Gas and Condensate

Acquired 2D Seismic: 8,272 Km (1973-2010)

2D Seismic Reprocessed: 1,800 Km (PSTM), 780 Km (PSDM)

2D Seismic Enhanced by Searcher: 7,923.7 Km

Magnetotelluric: 2 lines with 78 stations (2021)

PROSPECTIVE RESOURCES

Gas to remain critical as Japan tweaks energy mix

The Japanese government is working to reduce the country’s natural gas consumption over the coming years. This is in large part because of the energy transition – Japan is trying to raise the share of renewables and nuclear power in its energy mix, while scaling back consumption of hydrocarbons. Under its sixth strategic energy plan, approved in late 2021, the government set a target of having renewables account for 36-38% of power generation by 2030, which is roughly double the share generated in 2019.

On top of this, in the absence of significant domestic hydrocarbon reserves, Japan is very heavily dependent on imports to meet its energy needs and is seeking to reduce its exposure to volatility in international gas markets. Indeed, the outbreak of war in Ukraine in early 2022 and its impact on natural gas prices and trends may have served to make many countries, including Japan, wary of how much exposure they have to international markets.

On the other hand, Japanese energy targets for 2030 could prove difficult to achieve. Indeed, a February report from Fitch Solutions described the target to reduce gas for power generation from 38% in 2022 to 20% by 2030 as “extremely ambitious”. Fitch’s power team noted the high costs of offshore wind technologies, intermittency challenges with renewables and long-standing opposition to nuclear generation in the country in the wake of the 2011 Fukushima disaster.

Given these challenges, Fitch said natural gas remained “pivotal” to Japan’s energy mix. Given the country’s dependence on energy from overseas, this translates into ongoing imports of LNG, which also represent a cleaner alternative to coal and oil – Japan’s other options for offsetting shortfalls in renewables and nuclear power.

Energy picture

Japan was not among the countries most affected by the gas market shake-up in the wake of the war in Ukraine thanks to its long-term LNG import contracts.

“There are two critical factors we take into consideration when we look at the Japanese gas market: the long-term LNG contracts and nuclear generation,” an Energy Aspects analyst, Min Na, tells Global Voice of Gas. “Japan has been over-contracted, so the weighted average cost of LNG imports are more linked to the oilindexed long-term contracts and Japan’s exposure to spot JKM prices is relatively small,” Na says.

“The average landed cost of Japan’s imported LNG in 2022 is $17 per mmBtu, half of the JKM prices averaging around $34 per mmBtu,” Na continued. “So, it’s relatively easier for Japan to cope with high natural gas if we are just looking at gas. But for Japan, another issue is energy security as the country almost fully relies on imports across different fuels, including gas, coal and oil.”

Indeed, under these circumstances, Japan found itself turning more to oil and coal last year to help offset shortfalls in nuclear generation when it found LNG spot prices to be unfavourably high.

“Given nuclear availability averaged 0.9 GW lower year on year in 2022, Japan increased coal generation as well as oil generation to meet power demand and reduce spot LNG purchases at the same time,” Na said. “Generating with spot LNG last year was even more expensive than oil generation, which is typically the most expensive generation source in Japan.”

This situation resulted in oil and coal use for power generation going up, while LNG imports were down.

“Oil generation was up by 36% year on year and coal generation up by 3% in 2022, which helped to keep the price of import LNG in check,” Na said. “Japanese LNG imports were down by 2.3 MT year on year in 2022.”

A further complication for Japan related to the fact that Japanese companies had interests in – and contracts with –oil and gas projects in Russia, including Sakhalin-2 and the under-construction Arctic LNG 2. In the wake of the war in Ukraine, and international sanctions imposed on Russia, these Japanese companies came under pressure to exit their operations in Russia, as supermajors were doing. However, under the recently approved green transformation (GX) plan, the government granted

Japan is aiming to reduce its natural gas consumption, but even if it succeeds to some degree, LNG imports will continue to play a major role for the country

ANNA KACHKOVA

Natural gas stands to maintain a significant role, especially if Japan wants to avoid falling back on oil and coal again.

official approval for Japanese investors to maintain their interests in Russia, citing the projects’ importance for energy security.

There is no guarantee, though, that Russia will not alter its terms for the participation of foreign players in projects such as Sakhalin-2. Already, Moscow has transferred ownership of the Sakhalin-1 and Sakhalin-2 projects to newly established Russian operators in response to the withdrawal of super-majors. Japanese participation in the projects has been approved by the Russian government, but concern has been expressed that new, unfavourable terms for their continued participation could be introduced in the future, forcing them to rethink.

Looking ahead

An increase in oil and coal use at the expense of natural gas such as the one seen last year has been seen as counterproductive to Japanese energy transition goals. As the country looks ahead it will likely be keen to avoid having this situation repeat. At the same time, the uncertainty over the future of Japan’s participation in Russian energy projects is also likely to drive a push to bolster the country’s energy security.

Indeed, in December 2022 it emerged that Japan was planning to build up a strategic reserve of LNG in a bid to shield the country from gas market volatility. Details of how it will secure supplies have yet to be finalised, but under a proposal from the Japanese Ministry of Economy, Trade and Industry (METI), in the event of an emergency, the government could direct LNG supplies to utilities with the greatest need. The state-owned Japan Organization for Metals and Energy Security (JOGMEC) would cover any losses incurred by the company or companies directed to import the additional LNG volumes required under this plan.

What is expected to change in the wake of recent developments is the nature of LNG supply contracts that Japanese buyers sign. Shorter-term, more flexible contracts could grow in popularity.

“We think Japan would want some flexibility in these contracts, compared with legacy contracts they had, given their long-term energy strategy to reduce thermal generation and the extreme volatility in gas markets,” said Na.

However, given Japan’s push to increase the share of nuclear and renewables in its energy mix, the country’s GX plan includes a levy on LNG and other fossil fuel imports from 2028 based on their carbon content.

At the same time, additional nuclear capacity is due to start up in the coming years, displacing some demand for LNG.

“We expect Japan to restart a few nuclear reactors in the next few years, which will reduce calls on thermal (both gas and coal) in general, so we expect Japanese LNG imports to drop,” said Na. “However, term LNG will be declining at a faster pace than LNG imports, indicating Japan will have a bigger exposure to the spot market and JKM than before. We will not be surprised if Japanese companies sign new term contracts or renew existing contracts and we recently saw a few new deals signed by Japan.”

There is some scepticism over Japan’s ability to meet its new nuclear generation targets. Fitch Solutions anticipates that nuclear power will account for only 9% of the country’s generation by 2030, despite the government aiming for 20-22%. This means that other sources of energy will be required to make up the shortfall, and natural gas stands to maintain a significant role, especially if Japan wants to avoid falling back on oil and coal again.

BRIGHTER FUTURE COOLER BY DESIGN ®

Fitch Solutions described the target to reduce gas for power generation from 38% in 2022 to 20% by 2030 as “extremely ambitious.”

Africa’s energy balance 2020 in millions of tonnes of oil equivalent

Making the case for African gas

Hawilti Ltd, in partnership with the International Gas Union (IGU), launched the Gas for Africa Report on February 14, at the EGYPS 2023 conference in Cairo. The report assesses the key drivers, potential barriers and solutions to developing natural gas value chains in Africa that can tackle energy poverty and enable a just energy transition. In doing so, it demonstrates that gas can play a major role in delivering a secure and sustainable energy future for the continent – economically, socially and environmentally.

Despite having almost 9% of the world’s proven natural gas reserves – some 18 tcm – Africa remains the most energy-poor continent. Its industries continue to rely on expensive, inefficient and polluting sources of energy, and hundreds of millions of households lack modern energy access, the report states. The development of Africa’s gas reserves has remained reserved mostly for the export market, rather than meeting the continent’s own growing domestic energy needs. So, while Africa’s gas has been fuelling economies and supporting decarbonisation and jobs abroad, most of the continent lacks the infrastructure to benefit from the resource itself.

The report analyses the current reality of energy access in Africa and finds that in light of its rapid population growth and the post COVID-19 economic downturn, progress in expanding energy access is slowing. Today, nearly 600mn Africans do not have

access to electricity, and almost 1bn lack access to clean cooking. Energy poverty is preventing Africa’s industrial and commercial development, making it impossible to establish competitive and modern economies. By adopting gas locally, the report finds that Africa can promote industrialisation to create jobs and expand supply chains with the production of fertilisers and petrochemicals, and develop energy-intensive industries such as cement, steel and desalination. Gas can also provide baseload electricity in countries with no alternatives, ultimately supporting the integration of renewable energies. It can also provide households and industries with cleaner and more affordable energy and decarbonise the power mix in the short term by phasing out coal and diesel. Gas systems can later be decarbonised with the use of renewable gas, hydrogen and carbon capture technologies.

The report covers case studies where natural gas development has had clear benefits, both economic and environmental.

In Tanzania the development of the Songo Songo gas field has “resulted in one of the most successful domestic gas monetisation ventures across Africa,” the report notes. Brought into production in 2004, Songo Songo serves the 190-MW Ubungo power plant, and its gas is also used for distribution to the Tanzania Portland Cement Company and for the country’s village

Africa has nearly 9% of the world’s proven natural gas reserves, but much more could be done to capitalise on this wealth.

JOSEPH MURPHY

electrification programme. It is responsible for 45% of Tanzania’s overall electricity supply.

By adopting gas, Tanzania has significantly reduced its emissions, with the World Bank estimating that the country reduces CO2 emissions from power generation and local industry by more than 2.5 MT in 2004-10. The gas replaced diesel and heavy fuel oil as a reliable baseload power source.

As a result of gas development, Tanzanian electricity costs have also dropped significantly. The cost of power generation fuelled by Songo Songo’s gas dropped to $0.13 per kWh by 2010, compared with $0.64 previously, according to the World Bank.

African countries can also reap rewards from more gas export projects. In Nigeria, the NLNG liquefaction hub generated $9bn in taxes and $18bn in dividends to the government between 2019 and 2019. Besides exports, NLNG also supplies LNG to the domestic market, having signed 10-year contracts for the sale of 1.1 MTPA of LNG to three local companies in June 2021. The project also produces high-quality NGLs for the domestic market including LPG, which replaces dirtier fuels for cooking in Nigerian households.

The report also looks at how Africa has much more LNG export potential than the projects currently being proposed. There is a window of opportunity for Africa to position itself as a strategic and reliable global gas supply hub – but it must act fast. To realise this potential, it must demonstrate a pragmatic approach, a sense of urgency and a focus on competitiveness to attract the necessary billions of dollars of investment.

Africa must also overcome barriers to gas development. Firstly there is financing, which has been stifled by growing national debts and global asset managers’ divestment from hydrocarbons. Investments in gas must be future-proofed to demonstrate the fuel’s sustainability and climate value to global investors.

The second barrier is the lack of infrastructure for processing, storing, and distributing natural gas. The report explores how Africa can increase gas penetration by developing industrial clusters, reforming electricity markets, promoting regionalisation and encouraging the adoption of small-scale technologies.

Lastly, policymakers must create a better enabling environment and decrease the risks associated with investing in Africa. Policy certainty and physical security must be prioritised to provide a positive environment for growing gas value chains on the continent.

African LNG export capacity, MTPA (2022-2030)

African LNG export capacity, MTPA (2022-2030)

Despite having almost 9% of the world’s proven natural gas reserves – some 18 tcm –Africa remains the most energy-poor continent.

Expanding Natural Gas Service with Micro LNG

The National Gas Company of Trinidad and Tobago Limited (NGC) has been working to support development of the non-energy sector in Trinidad and Tobago, by fuelling the operations of local commercial, manufacturing, food and transportation industries. Today, in the context of the clean energy transition, NGC’s work includes looking at innovative energy solutions to help power these industries. One solution under active consideration is establishment of a micro–Liquefied Natural Gas (micro-LNG) plant.

Potential benefits of micro-LNG

The target market for gas from NGC’s micro-LNG project would be Light Industrial and Commercial (LIC) customers located more than 5 km away from existing gas pipelines, as well as prospective Compressed Natural Gas (CNG) customers. LNG would be supplied to these customers via a virtual pipeline using Road Tanker Wagons (RTWs). The economic and environmental costs of constructing pipeline infrastructure would be eliminated. If implemented, the micro-LNG project could significantly reduce GHG emissions from onshore oil and gas production, while optimising usage of gas molecules, as stranded gas would be utilised. Stranded gas includes gas that is considered uneconomical to produce, and gas that is currently vented in the production of crude oil. Technology is reducing the cost of micro-LNG solutions. The manpower requirements for micro-LNG plants are relatively low, as the facilities are highly automated. Also, modularisation has been introduced, resulting in relatively straightforward design and construction of plants and regasification terminals.

What are the main challenges?

Developing a micro-LNG project has its challenges. The economics must be favourable on both the supply and demand sides. Factors such as the cost of liquefaction, storage and transportation to remote locations must be considered when determining the commercial feasibility of the project. The returns to be derived from microLNG must be at least comparable to those of traditional pipeline delivery, to warrant further exploration.

Based on the growth of the LIC sector over the past three decades, there may be a potential market for microLNG in Trinidad and Tobago. However, engagement with prospective new clients will be required to ensure that sufficient demand is generated to sustain profitable operations.

While micro-LNG does not require pipeline infrastructure, RTWs require appropriate road infrastructure to ensure access to remote sites. Other potential challenges include distance from the liquefaction facility; traffic intensity on the roadways; road conditions and clearance height from utility lines. A safety assessment would have to be conducted to ascertain and mitigate risks related to the roadways.

Next Steps

NGC’s micro-LNG project is currently in Stage 1 –Initiation – and the business opportunity has been identified. A preliminary schedule has been developed to guide the team and assist with managing deliverables in preparation for the first stage gate review.

Detailed evaluation of technology options is ongoing, and discussions are in progress with producers regarding supply. Project assumptions are being refined while the preliminary economics are analysed. A commercial operating framework is also under development.

Will Asian LNG demand bounce back?

Elevated spot market prices are likely to keep Asian LNG purchasing in check this year, but China’s recovery from its severe COVID-19 restrictions may mean more competition for the sought after fuel than expected. Longer term, Asia still has a significant coal issue to address.

ROSS MCCRACKENAsia accounted for 76% of the growth in LNG imports from 2012-2021. This trajectory has been knocked off course by the conflict in Ukraine and Europe’s sudden thirst for the fuel. Prices rose, leading to an estimated 15 MT drop in LNG imports to Asia in 2022.

In some countries, this has caused a major reevaluation of the role of imported gas in their energy futures and has certainly increased the incentive to invest more in renewables.

However, Asia is short on gas and long on coal, accounting for just under 23% of global consumption of the former, but nearly 80% of the latter. This basic fact is expected to underpin the region’s demand for LNG in the decade to come, and most likely longer, despite even a rapid expansion of renewable energy and/or nuclear power.

Moreover, while domestically-produced gas volumes for Asia-Pacific as a whole continue to rise, almost all of this growth is accounted for by China, which is also the country that has seen the most marked and resilient demand for LNG.

China excepted, Asia produced substantially less gas in 2020 and 2021 than it did in 2019. The developed

Asian economies have no domestic gas production to speak of and many developing Asian economies in south and southeast Asia have structural gas deficits, which are unlikely to be addressed by a rise in domestic gas output in the short to medium term.

As a result, in the medium-term, Asian demand for LNG is expected to bounce back, as more supply comes on stream and Europe reduces its overall need for gas, making spot-traded LNG more affordable.

Japan, South Korea turn back to nuclear power

Both Japan and South Korea have made major u-turns on nuclear policy in the last six months, reflecting a changed perspective on the role LNG will play in their energy mixes.

Their motivations reflect the desire for an energy source less at risk from volatility in international markets and the need to hit environmental goals, which have become more challenging as a lack of affordable gas implies a lengthier dependence on carbon-heavy coal.

In December, Japan approved a draft low-carbon energy policy which is the most pro-nuclear since the

Asia’s role in LNG import growth (bn m3)

Fukushima nuclear disaster of 2011.

Currently, the country has only seven reactors in operation, 26 remain suspended and a further 26 have entered decommissioning. Potentially operable reactors total more than 30 GW, while the capacity of those being decommissioned is just over 17 GW.

The new policy would allow nuclear plants to continue operating beyond 60 years and includes plans to build new reactors to replace those being decommissioned.

Similarly, in South Korea, the recently adopted 10th Basic Plan for Electricity Supply and Demand, under President Yoon Suk Yeol, sees nuclear power’s share of electricity generation rising from 23.4% in 2018 to 32.4% in 2030 and 34.6% in 2036, a sharp turnaround from the 9th plan produced two years earlier under former president Moon Jae-in.

Coal-fired generation will fall sharply and renewables will expand, although the 10th plan projects less renewable energy capacity in the 2030s than the 9th. Despite the greater role for nuclear in the 10th plan, coalto-gas conversions mean the country’s gas fired capacity will rise, even if actual gas burn is forecast to fall. Gasfired electricity generation is expected to account for 22.9% of total generation in 2030, falling to just 9.3% in 2036.

As all of South Korea’s gas use comes from imported

LNG, this implies a large reduction in LNG imports and an equally large amount of idle or rarely-used gas-fired generation capacity.

However, it also means that if the expansion plans for nuclear or renewable energy, or both, fall short of expectations, LNG use will be higher. Consultant Rystad Energy, for example, sees South Korean LNG demand rising to 51 MT in 2030 and 54 MT in 2040 from 47 MT in 2021.

Similar scepticism exists over the impact of Japan’s new nuclear policies, and the country is also investing in new gas-fired generation plants. Most forecasts suggest a gradual decline in LNG demand. The Energy Intelligence’s Research and Advisory Unit sees Japanese LNG demand falling from 73.2 MT last year to 67.5 MT in 2030 and 54.5 MT in 2040.

Public opinion on nuclear power in both countries is volatile and both restart and newbuild programmes can be subject to lengthy delays and cost overruns. Delivering on the nuclear targets will require consistent political backing, which is by no means guaranteed over the next decade and beyond.

Moreover, both countries still rely heavily on coal-fired generation, which generated 302 TWh in Japan and 212 TWh in South Korea in 2021. This must fall sharply, if the two countries are to meet their climate targets. Carbon

Asia’s role in LNG import growth (bcm)

RestoftheWorldAsia-Pacific

Source: BP

neutrality by 2050 means coal-fired generation must be eradicated at the same time that electricity demand growth is met.

As with South Korea, Japan’s future LNG use is dependent on the success and timing of its nuclear and renewable energy expansions. Increasingly, as coal generation capacity is curtailed, LNG will be the only fallback option.

Chinese gas demand is resilient

Chinese gas demand in 2022 appears to have fallen slightly – by 3 bcm (less than 1%), according to Shell’s LNG Outlook 2023, confirming an estimate made by the National Development and Reform Commission in December based on the first ten months of 2022. The reduction marks a significant break from more than two decades of continuous growth.

The primary drivers were the economic impact of zero tolerance policies towards COVID-19, and rising international gas prices, which reduced gas demand in the transport, industrial and power sectors. Pricing also saw a shift in preference for pipeline imports over LNG, and LNG volumes supplied under long-term contract over spot LNG purchases.

However, at the same time, China has been the most active country in terms of signing new long-term contracts for LNG. This reflects the expectation of a demand rebound as economic growth recovers, a return to more

aggressive gas-for-coal substitution and a desire to avoid (and potentially benefit from) spot price volatility.

The lifting of COVID-19 controls suggests the Chinese economy will see higher GDP growth this year than last and this is almost certain to result in higher gas demand. As domestic output is unlikely to rise faster than in previous years, much of the demand rebound will have to be met by imports. Given limitations on Central Asian gas imports to China and despite increased volumes through the Power of Siberia pipeline from Russia, China is expected to need more LNG this year than last. Meanwhile, China continues to expand its renewable energy capacities at a rapid rate. According to government data, China added 37.6 GW of new wind capacity last year, 6 GW offshore, and 87.4 GW of solar PV capacity. China’s National Energy Administration estimates that a further 160 GW of wind and solar capacity will be added this year.

While these are big numbers, China still has a mountain to climb in terms of its massive dependence on coal in the power sector, where gas plays a relatively minor role. Industrial and residential and commercial gas demand both outstrip gas-for-power generation in China. Moreover, even last year, residential and commercial gas demand grew by 6 bcm, according to oil and gas major Shell, which forecasts a 4-9 MT increase in Chinese LNG demand this year in its LNG Outlook 2023.

Change in global LNG trade in 2022, yoy (MT)

and Storage Units to Europe, setting back completion of the Jaigarh and Jafrabad LNG terminals.

With no other import options apart from LNG, a lack of increased gas availability looks certain to mean increased coal use, in line with 2022, which bodes ill both for India’s gas use targets and its greenhouse gas emissions.

Price remains key in Asian markets

Price will be the main determinant of whether Asian LNG demand returns to the growth trajectory seen prior to Russia’s invasion of Ukraine, but it may be some time before LNG spot prices return to more affordable levels. European LNG use was able to rise in 2022 as a result of spare import capacity. This has been boosted further by the rapid deployment of a large number of FSRUs, which notably will bring Germany, the world’s fourth largest economy, directly into the market.

Source: Shell LNG Outlook 2023

South Asia to remain a ‘residual market’

In contrast, the more price-sensitive Indian market saw LNG imports nosedive in 2022. High LNG prices which preceded Russia’s invasion of Ukraine had already had an impact on South Asian LNG imports in 2021. Then, India saw a significant rise in domestic gas production, which offset the decline in gas imports, but last year total Indian gas supply fell by 3.7 bcm.

This means that gas as a share of primary energy consumption decreased, contrary to the government’s medium-term plans. India wants gas to make up 15% of its energy mix by 2025, compared with 6.3% in 2021 and even less last year.

Spot LNG prices have fallen back in the first quarter of this year, but remain at high levels. India and other south Asian LNG importers – Bangladesh and Pakistan – have returned to the market and tenders, ignored in 2022, are finding offers.

However, South Asia is likely to remain a reluctant buyer of LNG, given the likelihood that prices will remain elevated on the back of continued high demand from Europe.

India is expanding its renewable energy capacities far quicker than Bangladesh or Pakistan, but it is also much more dependent on coal. Nonetheless, the country has seen longer-term setbacks in terms of potential LNG demand growth. It has lost two Floating Regasification

On the supply side, investment times for new LNG capacity are long and within Asia, Indonesia continues to consume more gas domestically, limiting gas available for exports.

New supply is expected to come from Qatar and the US, where gas prices have fallen back to very low levels, rather than Asia, further internationalising the latter’s LNG import slate. However, while cheap US gas is positive for LNG exports, it does not speed up the time with which new capacity can be built.

Qatar’s huge expansion of its LNG capacity is not expected to be complete until 2026/27 and it is only around this time that the LNG market is likely to find a balance at a more affordable level.

The prospect of elevated LNG prices for a number of years will limit growth in Asian LNG demand and bolster the prospects of both nuclear and renewable energy. Their more rapid growth is likely to dent pre-Ukraine crisis forecasts of Asian LNG demand. However, post2026/27, when the European LNG demand bubble starts to deflate, latent Asian demand for gas is likely to become more apparent and the problem of massive coal use will remain unresolved.

Shell predicts a growth forecast range for Asia, excluding China, of -4 to +9 MT in 2023. It sees China playing a balancing role in a newly-structured LNG market in which Europe and North Asia have become ‘premium’ markets. However, while South Asia seems certain to retain its role as a residual market, competition from Chinese buyers may prove stronger than expected.

Momentum behind Asian CCS picks up

assesses the feasibility of using greenhouse gas permit G-7-AP for long-term geological storage of CO2. Inpex is the operator for the Bonaparte CCS joint venture and is assessing the project’s potential.

Australia’s DeepC Store, France’s TechnipEnergies and Japan’s Mitsui O.S.K. Lines have teamed up to develop the first floating offshore CCS hub in the AsiaPacific region, off the coast of northwest Australia.

The CStore1 project will inject between 1.5 and 7.5 MTPA of CO2 into storage that has been received from industrial sources in Australia and potentially elsewhere in the Asia-Pacific region. The three companies have signed a letter of intent on engineering, procurement and construction work.