The Home News Automotive

Photo by Gregory Morgan Photography

Vehicle Owners Reminded to Prepare for Fall

Submitted

by

THERESA PODGUSKI

In 2024, AAA received over 27 million emergency roadside service calls across the United States. Of those calls, most vehicles required towing (roughly 13 million) or were experiencing battery issues (approximately 7 million). Combined, these two types of incidents accounted for roughly 74% of total calls and eclipsed flat tires and lockouts. October is Car Care Month and the perfect opportunity for vehicle owners to make sure they are prepared for changes in the weather.

To help ensure a vehicle’s safety and reliability during this season, AAA recommends the following maintenance steps:

● Tire Inspection: Assess the condition and tread depth of tires and ensure they are properly inflated. If living in an area subject to significant snow and ice, consider transitioning to winter tires to enhance traction.

● Battery Examination: Cold weather can decrease battery performance. Check for corrosion, secure mounting and battery charge. If a battery is older than three years, have it tested to avoid potential issues.

● Fluid Level Review: Confirm that all essential fluids—oil, brake fluid, coolant and windshield washer fluid—are at appropriate levels. Topping off or replacing fluids as needed can protect your vehicle’s performance.

● Wiper Blade and Light Functionality: Inspect windshield wipers to ensure they effectively clear rain and snow. Replace any blades that are worn or damaged. Test all lights—head-

ON THE COVER

Pictured on the cover is a Chevrolet Bel Air, photographed by Gregory Morgan Photography at the Upper Nazareth Township’s Inaugural Car Show this past August.

lights, brake lights and turn signals—to ensure they are functioning properly.

● Oil Change Consideration: If a scheduled oil change is approaching, now is an opportune time to have this service completed. Fresh oil is vital for optimal engine performance, particularly as temperatures begin to drop.

● Emergency Roadside Kit: Assemble a vehicle emergency kit with things like blankets, a flashlight, snacks, water and basic tools. Having these items readily available can significantly enhance everyone’s safety should an unexpected situation arise.

New Study Finds Almost All Motorists Experience Road Rage

Submitted by THERESA

PODGUSKI

If it feels like everyone has road rage these days, that’s because they probably do. A staggering 96% of motorists admit to engaging in aggressive driving behaviors over the past year, according to a new study from the AAA Foundation for Traffic Safety. From speeding and tailgating to cutting off other vehicles, aggressive driving has become a near universal experience – and it's not just frustrating; it appears to be contagious.

Other key findings:

● Ninety-two percent of motorists reported aggressive behaviors that put others at risk, like speeding or cutting off other vehicles. Their top motivators were to get to their destination faster and avoid perceived danger.

● Eleven percent admitted to violent actions such as intentionally bumping another car or confronting another driver.

● Aggressive driving is contagious: Motorists who experienced higher levels of aggressive

Fax: 610-923-0383

E-mail: AskUs@HomeNewsPA.com

Paul & Lisa Prass - Publishers Catherine StrohAssociate Publisher & Editor

Anthony Pisco - Art Director

Danielle Tagliavia - Delivery Driver

Road Rage

Continued from Page 3

driving also had higher levels of engagement in aggressive driving.

● The vehicle plays a role: The kind of car driven could predict how motorists act – and how others perceive them. People in sports cars, big trucks and motorcycles are often seen as more aggressive. Some motorists say they felt more powerful and dominant behind the wheel of these vehicles.

This latest study updates research originally conducted by the AAA Foundation for Traffic Safety in 2016, offering a look at how aggressive driving behaviors have shifted over time. While some behaviors have become more common, others have declined:

Since 2016:

● Cutting off other vehicles is up 67%.

● Honking out of anger is up 47%.

● On the positive side, tailgating is down 24% and yelling at other drivers is down 17%.

AAA encourages motorists to prioritize courtesy and safety to help curb aggressive driving. In fact, the study found that encouraging good road etiquette may be the most effective way to reduce aggressive driving and road rage. Simple actions—like using turn signals, letting others

merge and offering a friendly wave—can help de-escalate tensions.

AAA’s Top Tips When Encountering an Aggressive Driver:

1. Stay Calm – Don't Engage

No eye contact, no gestures, no response.

2. Give Space

Let them pass and keep your distance.

3. Protect Yourself

Call 911 or go to a public place — never drive home.

AAA’s Top 3 Tips to Control Road Rage:

1. Breathe Before Reacting

One deep breath can help reset the drive.

2. Don’t Take the Bait

Ignore and avoid aggressive drivers.

3. Choose Time Over Tension

Leave early, give space, arrive safe.

Bill Targeting

Catalytic Converter

Thefts Passes Senate

Submitted by NICOLE McGERRY

The Senate has unanimously approved legislation sponsored by Sen. Frank Farry (R-6) to help address the surge in catalytic converter

Continued on Page 5

Catalytic Converter

Continued from Page 4

thefts across Pennsylvania.

Senate Bill 914 repeals the Scrap Metal Theft Prevention Act and moves the requirements to Title 18, the Crimes Code. Title 18 requires scrap processors and recycling facilities to collect buyer information, set commercial-account rules, restrict purchases of certain materials and create penalties – giving law enforcement and prosecutors stronger tools to investigate, track and prosecute catalytic converter thefts.

“Catalytic converter thefts have become a major problem in communities across the state,” Farry said. “One of my top priorities is keeping our communities safe, and this bill gives law enforcement and prosecutors stronger tools to charge and convict those responsible for these crimes.”

The bill now heads to the House of Represen tatives for consideration.

A Classic Car Owner's Guide to Insurance

caranddriver.com

You probably wouldn't treat your classic car like just any other set of wheels. You don't use your antique showpiece or muscle car for your

commute in the morning or to take the kids to soccer practice. It takes you for a trip down memory lane. You've put hours of work or thousands of dollars, usually both, into your beloved vintage or antique car. Whether it's a '77 Volkswagen Beetle or a '65 Shelby Cobra, classic car insurance protects all your hard work.

A big difference between classic car insurance and everyday car insurance is how the vehicle is used. While classic car coverages have unique characteristics, the basic idea of coverage is simple. Classic car insurance coverage includes:

● Bodily injury liability

● Property damage liability

Continued on Page 6

Guide to Insurance

Continued from Page 5

● Comprehensive

●

●

●

●

What Makes a Car Classic?

Per Plymouth Rock, most insurance companies will define a classic, antique or vintage car as a collectible vehicle, considered to have a limited production, exceptional quality, or has a

particular historical quality. Owning a vintage car doesn't guarantee you'll qualify for classic car insurance. Each insurance provider will have different requirements.

These are the most common requirements to get classic car insurance:

Your car is at least 25 years of age or 20 years old with collectible value.

You drive another car that is used for your commute or regular travel.

You have and have maintained a clean driving record for the previous 5-10 years.

Continued on Page 7

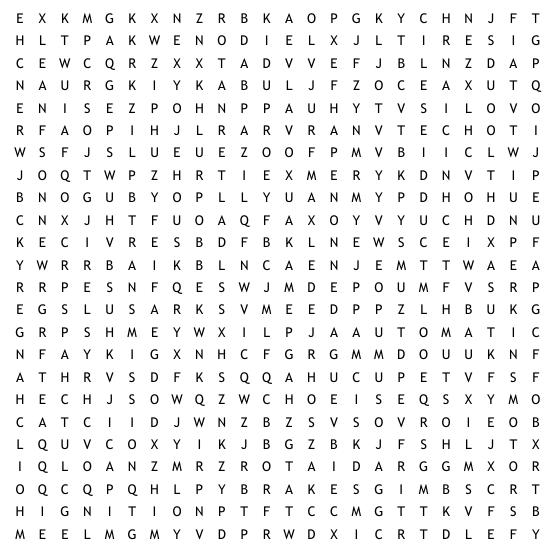

Automotive Word SeArch

Guide to Insurance

Continued from Page 6

You have no more than a single at-fault accident or moving violation in the previous three years.

You do not use the vehicle for racing.

You limit the number of on-the-road miles.

You store your vehicle in a climate-controlled or fully closed garage.

New cars like Corvettes or Ferraris may be considered for classic car insurance based on eligibility, says The Zebra.

Types of Classic Car Coverage

Classic car insurance is similar to regular car insurance except for several additional coverage options, including agreed value coverage, tiered mileage plans and spare parts coverage. Automobile memorabilia, such as hood ornaments, collector license plates and other historical items, can also be added to your policy, per Geico.

These are the most common coverages added to classic car insurance policies, according to ValuePenguin:

Agreed value: Agreed value insurance means that if your collectible car is totaled, you will be paid out the amount the vehicle was worth when you first took out the policy.

Tiered mileage plans: You may be able to forgo a deductible and pay lower overall rates if you agree to limit the number of miles you put on your car every year.

Spare parts coverage: This coverage provides you any backup parts when parts of your vehicle are stolen or damaged.

Worldwide coverage: If you plan on traveling abroad for car shows or events, you will still be covered with this option.

Multiline discounts: You can qualify for multiline discounts if you have more than one type of insurance with the same insurance provider.

Auto show medical: This insurance covers you if someone injures themselves at an exhibit, car show, or event your car is featured at.

The Cost of Classic Car Insurance

Classic car insurance is usually much cheaper than regular car insurance. According to Baily Insurance Agency, a classic car policy costs around $200 to $600 annually. If you own an abnormally expensive vehicle, your rates may be higher. In contrast, regular car insurance usually costs over $1,000 per year. Insurance providers expect you to drive your classic car infrequently, keep it well maintained, and keep a clean driving record. Because of this, companies believe classic car owners are less likely to file a claim than regular drivers.