INDEPENDENT DEALER

Editorial & Contents

I am writing this column during a short break in my travels between the Office Partners Gathering in Tampa and the start of ISG’s Industry Week in Denver. It was great to meet up again with dealers and vendors in Florida and, as you’ll see from the news story on page 14, enjoy the fantastic Southern hospitality that Matthew Hebert and his family always provide.

It was also interesting to be part of one of the first major trade events after Essendant dropped its bombshell in September.

Some high emotions were in evidence, almost entirely negative toward the wholesaler. They ranged from outright hostility to resigned disappointment that such a long and fruitful relationship had to end so abruptly. These reactions came from all sides of the channel. If anything, it was the vendors that were most vocal and caustic in their criticism.

There was an unhappy consensus that the fallout would see some independents either selling up or going out of business, particularly those that had chosen not to diversify their product portfolios; but there was also the strong belief in

Rowan McIntyre, editor and publisher rowan@idealercentral.com

the resilience of the IDC and in the opportunity that turmoil and adversity always bring.

There was also a general feeling that while S.P. Richards might struggle with its new-found volume initially, it will rise to this new challenge; and there was a strong showing from other wholesale partners which are angling to step in to fill any gaps that may appear.

In addition, there were a lot of calls from dealers for vendors to raise prepaid freight and lower minimum order levels—a request that some were responding to and that no doubt will be echoed in Denver.

What was agreed by all is that it will be some time before we understand the full consequences of Essendant’s move; but, for those who can adapt and continue to diversify, there will be opportunity for growth.

Porter’s Office Products, Rexburg, Idaho 14 INDUSTRY NEWS 30 WSA FOCUS

38 COVER STORY

Enable the sustainable: Lisa Veeck talks to dealers who are adopting new and varied strategies to help reduce both their own carbon footprints and those of their customers.

44 COLUMNS

44 West McDonald: On AI and sustainability

48 Jennifer Vitanzo: On sustainable marketing

52 Tom Buxton: Change now or die!

54 Marisa Pensa: On which prospects are playing ball

56 Troy Harrison: On sales versus service

INDEPENDENT DEALER

Editor and publisher

Rowan McIntyre

Associate editor

Lisa Veeck

Head of media sales

Chris Turness

Finance and operations

Kelly Hilleard

Head of creative

Joel Mitchell

Digital manager

Aurora Enghis

BRIGHT IDEAS DESERVE A PAPER THAT CARES

Need a versatile paper? Want your documents to stand out with vivid quality? Looking for a sustainable yet high-performing solution? Whatever your printing goals, there’s always a Navigator for you.

Navigator Premium Multipurpose

Trusted performance that always delivers!

• 99.99% paper jam-free

• Improved surface for optimal color contrast

• Multifunctional for every use

• 97 Bright

Ideal for: Letters, Invoices, Receipts, Memos, Statements, Agreements and other daily printed materials

20lb | 24lb

Navigator Platinum Digital

• Excellent print contrast

It’s time to print in high definition!

• Microporous surface for fast ink drying

• Extra thick and opaque for duplex printing

• 99 Bright

• Now with UHD Formula

Ideal for: Presentations, Color Graphics, Sales & Marketing Collateral, Reports and other color-intensive printed materials

20lb | 24lb | 28lb | 32lb

Ask us about product availability and our extensive support sizes range: ricardo.ferreira@thenavigatorcompany.com

Winner’s Circle

Office Service turns 100

Office supply centenarians are an elite group—it’s not easy to remain an independent dealer for 100 years. Even more unique is a third and fourth-generation family business hitting this milestone. But Office Service Company, Reading, Pennsylvania, has achieved both distinguished designations.

In 1925, two men opened a stationery store half a block away from the Reading County courthouse. In the late 1950s, Earl Mohn, a rep for Pitney Bowes, decided to go into business for himself. He purchased the store and added print to the company’s product mix. Some years later, Earl’s son-in-law, Jeff Barbour, and a partner founded a plastic injection molding company. However, when this partnership soured, he asked his father if he could work for him. His father welcomed him with one stipulation: that he work in sales.

As it turned out, sales suited Jeff—so much so that the company soon expanded its geographical reach and its offering to include transactional furniture. In 1987, Jeff bought Office Service from his father-in-law and shortly thereafter, having outgrown its approximately 1,800-square-foot downtown location, the company built

a dedicated 10,000-square-foot facility. Around this time, Office Service also developed a relationship with HON to further expand its furniture product line.

Today, Office Service is 100 percent B2B, with a product mix comprising 30 percent print, 30 percent office products and 40 percent furniture. It has 37 employees and its largest customer segments include state and local government, banking and education, with sales in healthcare and hospitality also on the rise.

Jeff’s sons, Matthew and Mark, grew up in the business, working summers

and weekends doing whatever was needed. The brothers bought the company in 2015 and Matthew now serves as CEO, with Mark as COO. Mark’s daughter, Paige (Barbour) McConachie, started working at Office Service part-time during school breaks and then moved full-time after graduating from college. She has served in a variety of capacities, which she now bundles under the catch-all title of “business operations director.” Her husband, Ben McConachie, joined the company in 2023 as facilities manager.

So, what accounts for Office Service’s impressive centenary status? “To quote Mark Cuban, ‘Make your product easier to buy from you than your competition’ is one main reason,” says Matthew. “We live by the edict that the customer may not always be right, but they are always the customer. And every customer is different. ‘Meet people where they are’ is the new buzz phrase, but that is what we do. If they want to be invoiced monthly, we invoice them monthly. If they prefer to order online, they can order online. We have customers that fax us orders. Whatever works for them, we do.”

Merry and bright— from label to delivery.

Labels, cards, and tags for shipping orders, gifting, and wrapping up the season.

The year-end rush comes fast—and even small moments feel big. Avery waterproof shipping labels help you stay polished through it all. Finish strong with personal touches that wrap up the year with care and gratitude.

• Waterproof address & shipping labels stay intact and smudge-free— even through rain, sleet, or snow.

• Specialty labels in unique shapes add a premium feel to packaging and gifts.

• Holiday cards & thank you notes help wrap up the year and show appreciation.

• Personalized gift tags tie it all together for gifting, selling, or mailing.

Paige elaborates: “Service is our middle name—it really is the core of our business. We are very nimble: if a customer wants XYZ and we don’t offer it, we’ll find it. Our model is people first.”

And people first is also what customers get when they call. “The recordings of ‘Press 1, then press 2’ are irritating and annoy people,” says Matthew. “When you call us, you get a human. Earlier today, I overheard a call where our customer service rep picked up and immediately called the customer by name because our rep recognized their voice. People want technology, but most people don’t want a 100 percent AI experience. They want to buy from people they like and trust. We offer technology for customers when they want technology and people when they want people.”

That means having the right people is vital. “Our team is so important,”

Paige confirms. “We have employees who have been with us 25-plus years. In January, one of our employees retired after 47 years with us. During difficult times, you must adapt. Like during the COVID-19 pandemic, our team banded together and pushed through. This kind of team support is crucial to longevity.”

They also believe their local connections have proved beneficial. “Being a resource for the community and giving back where we can is part of who we are—and our customers know that,” says Paige.

Matthew agrees: “It’s part of our ethos to buy local ourselves and keep the dollars in the community, and I think our customers recognize the importance of this as well. Not everyone wants to buy from Amazon. We stay connected to the community and support the people who support us.”

Eakes helps military families

In October, the Cheyenne, Wyoming team of Eakes Office Solutions, Grand Island, Nebraska, collected and stuffed food bags as part of the area’s Military Family Food Drive. The bags were stuffed full of canned soup, vegetables, oatmeal, applesauce, peanut butter and jelly sandwiches, assorted snacks and many other tasty and nutritious items. They were then dropped off at the designated distribution facility.

“At Eakes Office Solutions, service to the communities we serve has been a cornerstone of our business since 1945,” explains COO and CFO Paul McKinney. “This is just one example of what our teams across our market area do every day. While we support our communities in many ways and are involved with many causes, this food drive was especially close to our hearts because it supports military families,

“I think the best piece of advice I can give is: no matter what, do the hard thing—the thing the competition shies away from doing,” he continues. “It doesn’t always feel good, but when adversity pops up—and it will, because we are human and humans make mistakes sometimes—pick up the phone right away. Connect with the customer when it’s hardest to do so. Don’t be a fair-weather friend. You need to be a foul-weather friend—to be there when things are at their worst.”

Matthew predicts a bright future: “Mark and I are third-generation, and Paige and Ben are fourth. They have two little ones, the fifth generation, who may want to work in the business. We’ll see; but as long as family wants to be part of the business, they can. In the meantime, we will continue to innovate, to look for growth opportunities and ways to support our clientele and the industry.”

which make up a large part of the Cheyenne community. This is a great example of what sets independent dealers apart from big box and e-tail competitors. When was the last time you saw one of their names on the back of a Little League t-shirt? The human factor is something technology simply can’t replace. They look to please shareholders; we look to please our customers and serve our communities.”

AHI Enterprises awarded PACE contract

Texas dealer AHI Enterprises has secured a new Purchasing Association of Cooperative Entities (PACE) Cooperative Contract and is inviting other independent dealers to sell on it.

The new contract started on November 1 and has an initial seven-year term.

AHI had previously been awarded a PACE contract in 2014, which was taken over by Essendant in January 2023. The wholesaler’s recent sudden exit from the office products channel and abandonment of its Vertical Markets Group has left the dealers who sold on the contract without access to its customers in local government agencies, school districts, cities, counties, colleges, universities and nonprofits throughout the United States.

AHI is now offering dealers the chance to access those contracts once again. It has already signed around a dozen dealers, but is open to more joining with no limits on the numbers that can sell on the contract. There is also no restriction on buying group or any other dealer association affiliations.

“We are pleased to announce that AHI Enterprises has

recently secured a PACE Cooperative Contract from ESC 20 in San Antonio,” said CEO Mark Nolan. “The contract covers office products, jan/san, furniture, IT, school and medical supplies, ad specialty, apparel, and flooring. I invite [others] to join us and see the real difference of selling under PACE versus the other guys. Please contact me or our office if interested in selling the contract.”

Mark can be reached at mark@ahitexas.com; or the AHI team at pace@ahitexas.com

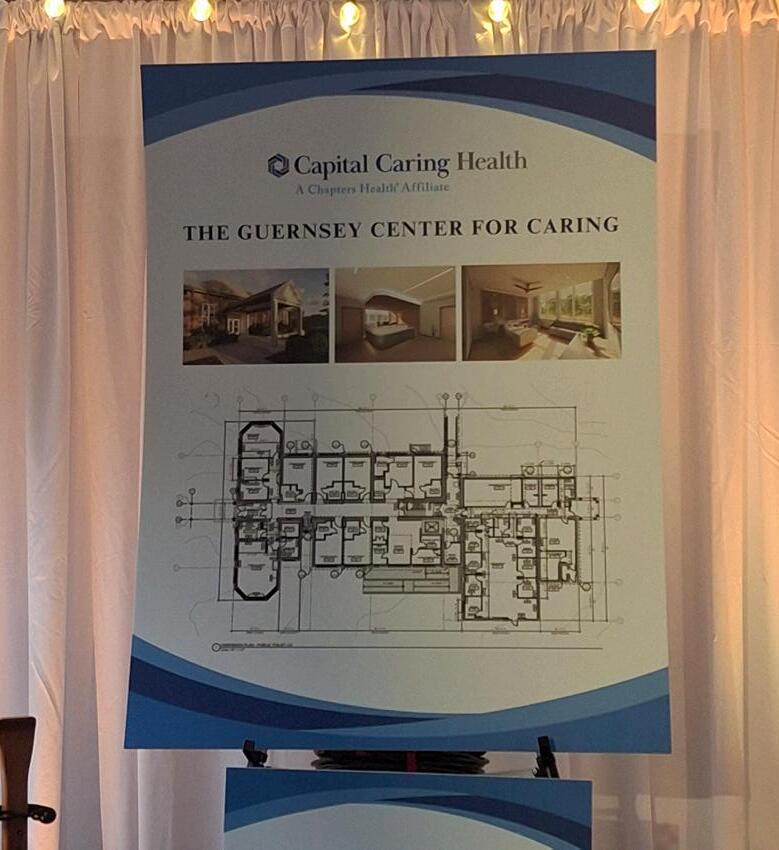

Guernseys take the lead on the Center for Caring

David Guernsey, founder and executive chairman of Guernsey, Inc., Sterling, Virginia, and his wife, Diane, recently attended the groundbreaking ceremony for the future Guernsey Center for Caring in Arlington, Virginia. The Guernseys are the lead sponsor, having provided the seed funding to get the project started.

The approximately 15,000-square-foot facility is being managed by Capital Caring Health. It will offer inpatient/ outpatient hospice care, palliative medical services, bereavement care and a training center for nurses and volunteers, providing essential services to hundreds of patients and their families annually. The facility is expected to be completed in November 2026.

“The Capital Caring program has personally touched our family, the families of Guernsey staff and thousands of other families living in the broad Washington, D.C. community. Diane and I, like most people, have given to many worthy causes over many years. However, we felt there would come a time when we could make a truly significant gift, meaning a large dollar gift, to a cause we feel needs attention. We considered cancer, heart disease, diabetes and

other worthy causes; but ultimately, we realized that hospice organizations are largely underfunded and need to scrape together every small dollar contribution to provide their services. We believe contributors initially consider research where any existing trauma might be mitigated, even eliminated; but we rarely consider the inevitable challenges that all people will face. Hence our decision to provide a significant contribution to Capital Caring and the effort to stand up a new Center for Caring.”

In separate news, Guernsey recently sponsored and participated in the Northwest Federal Credit Union

Foundation’s (NWFCU) Drive for the Driven golf tournament at Stonewall Golf Course in Gainesville, Virginia. Guernsey sponsored a hole and account manager Wade Weber sponsored a foursome. The NWFCU Foundation empowers youth to help them achieve their goals by supporting their health, wellbeing and education. Guernsey’s team of four was one of 36 teams that competed in the event.

“Guernsey participated in the event to support the community and NWFCU’s worthy goals,” says COO Jake Mages. “It also provided a chance to strengthen our relationship with a key customer, NWFCU.”

Z-Grip Just Got Better!

Zebra Pen’s #1 Retractable Ballpoint, Z-Grip, is now made with 68% recycled content.

Keeping the same comfortable grip, durable metal clip, and smooth ink flow, Z-Grip is perfect for work, school, and everyday writing. These ballpoint pens are available in black ink, assorted pack sizes, and medium point size.

Scan QR code to learn more about Zebra Pen.

GBP Direct Acquires Mulé-Durel

GBP Direct, New Orleans, Louisiana, has acquired New Orleans-based independent dealer Mulé-Durel, Inc. The deal—GBP Direct’s 13th since 2014—took effect on October 8, 2025 and the business is already operating under the GBP Direct name.

Founded more than 60 years ago, Mulé-Durel had annual sales of approximately $2 million in 2024. GBP Direct operates out of five locations, has 44 employees and, with this latest acquisition, expects to end 2025 with an estimated $22 million in annual sales.

“Since our founding in 1999, GBP Direct has grown steadily through strategic investments, expanded service offerings and a commitment to excellence in customer support,” says president and co-owner Randy Durbin. “GBP continues to lead the consolidation of Louisiana’s remaining independent office products dealerships, combining the strength of a growing organization with the personalized service of a locally owned company.”

The acquisition further expands GBP Direct’s local coverage and enhances its offerings in office furniture design and installation, custom printing, promotional products and logistical support.

“This acquisition reflects our dedication to growth and to serving Louisiana businesses with greater resources, broader expertise and the same personal attention they’ve always valued,” says co-owner Cody Durbin. “Mulé-Durel has built an incredible legacy and we’re honored to carry that forward while continuing to strengthen GBP’s local presence … Together, we remain focused on delivering quality, reliability and innovation across every category we serve.”

FriendsOffice partners with Irwin’s Office Supplies and Equipment in Ohio

Findlay, Ohio-based FriendsOffice has taken on the customers of Irwin’s Office Supplies and Equipment of Ashland, Ohio.

Founded in 1960, Irwin’s was family owned and operated throughout its history and was a trusted source for office supplies and furniture in Ashland and the surrounding area. It has closed its downtown store and transferred its customer base to FriendsOffice. Former owner Marti Irwin—who worked at the dealership for the past 50 years—is to retire, alongside five employees, most of whom have worked with her for many years.

“It has been my privilege to serve our community and customers for the past five decades,” said Marti. “We are grateful for the loyalty and friendships we’ve built over the years. While it’s bittersweet to close this chapter, I’m confident our customers will continue to be well cared for through FriendsOffice.”

“We are honored to welcome Irwin’s customers and look forward to continuing the high level of service they’ve come to expect,” said Ken Schroeder, president and CEO of FriendsOffice. “FriendsOffice shares the same Ohio roots and commitment to supporting local businesses.”

BOS named a Best Place to Work and raises $45,000 for Make-A-Wish

BOS (Business Office Systems), based in Chicago, Illinois, has made the Crain’s Chicago Business 2025 Best Places to Work. It is the seventh time they have appeared on the list.

To secure inclusion, companies must apply and provide all necessary information. Company employees are then surveyed and at least 70–80 percent must respond for the business to be considered for contention.

“To have a great culture and be regarded as a great place to work is important to us and an honor,” says BOS president George Lucas Pfeiffer. “It is important for our team and our culture and reflects the promise we make to our customers to help them create a great work environment.”

Meanwhile, BOS helped raise more than $45,000 for the Make-A-Wish Foundation by hosting an indoor Charity Golf Classic, transforming its showroom into an eight-hole miniature golf course designed and built by the BOS team. The event more than doubled the donation and attendance of the Make-A-Wish fundraiser held by BOS last year.

“The team is truly the best in the industry—their dedication, commitment and passion are an inspiration,” enthuses Pfeiffer. The company has already set a 2026 goal of $50,000. Make-A-Wish is a nonprofit organization that grants life-changing wishes to children with critical illnesses, helping them build hope and strength.

Secrets of Success

Porter’s Office Products

As a fourth-generation Porter, Mark grew up in Porter’s Office Products, Rexburg, Idaho—a company founded in 1915 by his great-grandfather. Mark left to pursue other interests but returned to the company in 1998. In 2001, he bought out his father and grandfather.

A family business that has thrived for 110 years can’t rest on its laurels and no one understands this more than Mark, as his job title of “visionary” would suggest.

“One reason I believe Porter’s has remained successful is we don’t take our eye off the marketplace or take things for granted,” he says. “In fact, I am less involved in the day-to-day operations now; in addition to maintaining key customer and vendor relationships, my role is to look ahead for the next big idea to present to my management team. Together, we decide if it’s a go or not.”

“We are also involved in our community and are at the forefront of technology,” he continues. “For example, I believe we are in the 1–2 percent of independent dealers that use all the features DDMS offers. We talk to people at ECI and they tell us they wish more dealers would use all the platform’s features. Many dealers struggle with issues that DDMS could solve, but they don’t want to take the time to learn the capabilities or try new methods, so they are still doing a lot of things manually. We use all the system’s features, which has really helped us streamline our operations.”

The Blue Cow brand we developed has also helped the company. “We brand everything we do as our ‘Blue Cow Service,’” the visionary explains. “These services are no different from what other dealers offer but branding them in this way makes them seem unique.”

Another strategy that has helped keep the business running smoothly is the adoption of an entrepreneurial operating system (EOS). “There are books that explain how to this,” says Mark. “But we implemented EOS on our own about three years ago and it’s been a huge success. A lot of dealers, myself included, fly by the seat of their pants. Having a system in place has helped us grow faster and utilize our staff’s talents.”

Company info

Headquarters: Rexburg, Idaho

Top management: Mark Porter, visionary; Kristy Benson, integrator; Shawn Call, vice president—sales; Kyndra Valentine, finance director; Jeremy Bryan, project manager

Number of employees: 25

Product mix: 50% office products, 40% furniture, 10% breakroom

For Porter’s, its EOS has involved setting three goals for each department and each employee, all aimed at achieving the company’s three overarching quarterly targets. To hold people accountable and remove the risk of personal bias, the company keeps track of how well these goals and targets are being achieved using scorecards. When there is an issue or a low score, the team can identify the challenge and find solutions to get back on track. Management also holds a weekly meeting to help ensure operations are running smoothly.

Mark has felt the benefits of EOS at a very personal level: “In 2021, I was really sick and out of the office for 18 months. Because we had used EOS to allocate duties, the business didn’t depend on me. The fact that the business can run without them might be hard for some owners’ egos, but not mine. Implementing EOS allowed me to prioritize my health, take the time I needed to recover and not worry that my absence was hurting the business. I think it also helps my people feel freer, knowing they can make decisions without being second-guessed.”

Industry News

Another great Gathering for Office Partners

Dealer and vendor members of family-run buying group Office Partners came together once again in Tampa, Florida last month for another successful and enjoyable annual meeting.

Naturally, much of the discussion at this year’s The Gathering focused on the impending end of Essendant’s 60-day notice period and how the IDC will function with only one of its traditional major national wholesalers in operation. It would be fair to say there was an air of despondency, disappointment and displeasure about Essendant’s decision to exit the office products channel and the manner in which it was announced; but this was more than tempered by the congenial atmosphere for which the meeting is known and the staunch belief of those present that the IDC has, as it has shown in the past, the ability to overcome all manner of adversity.

As always, the event offered its trademark relaxed and entertaining atmosphere, while still offering invaluable learning and networking opportunities for members through a combination of formal meetings, one-on-one “speed-dating” dealer/ vendor match-ups and, of course, a dizzying array of social events—

featuring the excellent food offering that attendees have come to expect at this event. (The melt-in-the-mouth short rib and mashed potato at dinner on the Monday evening demanded special mention this year!)

The show began on Sunday afternoon with a meeting highlighting the opportunities available to members through the group’s GSA contracts. Mike Flaherty of Great Falls Paper Company, in Montana, explained that one of the main aims of the Department of Government Efficiency’s efforts is to push more government purchases through the GSA Advantage platform, rather than the open market options being used by some agencies. He spoke of the success his company has enjoyed selling to the US government and offered fellow Office Partners members the opportunity to sell on his GSA contract. He was followed by Bob Broderick and Patrick Carr of North American Marketing, who talked about how to access Office Partners’ own Service-disabled, veteran-owned, small business contract for furniture.

On Sunday evening, the welcome reception in the Marriott’s penthouse restaurant The View at CK’s gave

attendees a first opportunity to sample the fantastic social side of Office Partners’ gatherings—a situation that continued for some in the hotel bar after the reception officially ended.

In order to accommodate his members’ desire to discuss the recent industry upheaval, Office Partners president Matthew Hebert made some changes to the previously advertised Monday morning meeting schedule. In place of the intended presentation on AI applications, Eddie Baird, senior vice president of furniture and national accounts at S.P. Richards (SPR), addressed both dealer and vendor attendees.

He used the time to emphasize the financial stability that now underpins SPR since its purchase by CNG. He also asked for understanding as the wholesaler attempts to scale up its operations to cope with the additional workload thrust upon it by Essendant’s demise. He explained that in recent weeks, the company has onboarded over 300 new dealers (those that had no contract at all with SPR previously); added six new distribution centers to its network, creating 1 million square feet of new facility space; employed 40 additional drivers delivering to over 150 new locations; and added around 2,600 new SKUs to its inventory. He closed by asking how well any of the businesses in the room might cope with a 65 percent increase in business overnight—a point that was well taken by his audience.

Baird was followed by a presentation from Mike Tucker, executive director of IDC trade association the Workplace Solutions Association, who spoke about the benefits available to members, including its health insurance program, government advocacy efforts, scholarship program, AI advisory group and jan/san committee.

Matthew Hebert

h ps://l.ead.me/signandlit

When you’ve got something to say, say it with De ecto® Sign and Literature Holders. Sign and literature holders are an e ective method to communicate, protect and display information in a way that’s a ractive, a ordable and easy to use.

Attention then moved to the opportunities offered by the national accounts programs operated by AOPD, as national healthcare sales director Betsy Hughes took the floor. She ran through the different GPO contracts the organization offers access to, highlighting the fact that it is no longer necessary to be a full member of AOPD to access individual contracts.

We then heard from Mark Prosser, VP of sales at The United Group, who spoke about the benefits that Office Partners’ members received due to their automatic membership of the jan/ san buying group.

Next up were a series of marketing presentations from Office Partners vendors who preferred to address the dealers as a group rather than

individually at the one-on-ones. Tom Edgeworth of Baumgartens was followed in turn by Paul Ventimiglia and Dorian Douglass of Bi-Silque/ Mastervision and John Gartner and Bryan Gould from 3M.

Matthew Hebert then took center stage he updated dealer members about the new categories that were now available to them, including hunting clothes and electric vehicle chargers; and Office Partners’ ongoing collabortion with software companies ECI, Logicblock, Prima, SSI and GOPD to improve access to product pricing information for its members.

Following requests from dealer members, the morning session closed with a dealer panel-led discussion, chaired by industry veteran Keith Powell and featuring Jennifer Spencer

of Dawkins Office Supply in Mississippi, Marty Beck of Business Essentials in Texas and Jay Olensky of Olensky Brothers Office Products in Alabama. Topics discussed ranged from the current wholesaler situation to staff recruitment and training, AI, pricing, financial reporting, and the importance of hiring good truck drivers.

A delicious lunch attracted all present back to the top floor of the hotel before making their way to the Hillsborough Ballroom for the traditional dealer-vendor one-on-one meetings. This traditional fixture of the Office Partners event sees each dealer spend 10 minutes with each vendor before moving on to the next, prompted by the dulcet tones of a cowbell—an excellent way of ensuring everyone sees everyone and has the chance to

do important business or catch up on the latest industry gossip.

Monday evening saw the traditional cocktail reception and gala dinner (including the memorable short rib and mash combo), which saw speeches from Matthew and his mother Diane, who welcomed new members and thanked all those assembled for their attendance.

The final morning of this year’s Gathering on the Gulf on Tuesday saw members and vendors reconvene in the Hillsborough Ballroom for the completion of the one-to-one sessions before gradually slipping away to the adjacent Tampa Airport terminal building to catch their flights home, having enjoyed a worthwhile few days of networking.

“What makes this group so special,” wrote Hebert in his introductory letter to attendees, “[is that] we are more than just a network. We’re a family. We’ve all taken our hits and have the bruises to prove it, but we keep showing up. We help each other. We push each other. And that’s what keeps this industry alive.” INDEPENDENT DEALER couldn’t agree more.

»

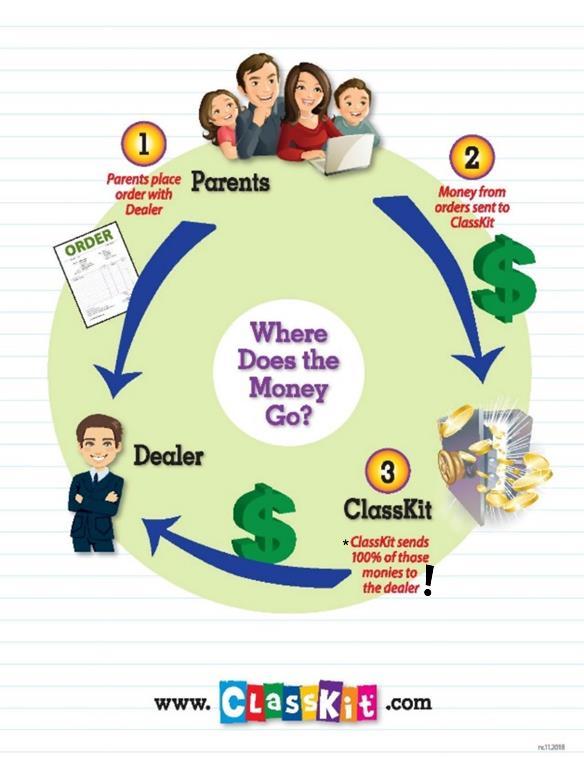

Did you miss out on Back -To-School supply list business in your area?

NOW is the time to get your local schools signed up! Contact us to learn how.

Friends Office (OH), Kennedy(NC), Forms and Supply(NC) , The Office Shop(MN) and Complete(IN) all took part in getting their share of the BTS sales!

A turnkey software program allowing Independent Dealers to create, price, build and ship BTS Supply Kits for Elementary School Students!

* Less processing fees

Keith Powell

Eddie Craig

The Hebert and Olensky families

Barry Lane to succeed Michael Rowsey at Harbinger National

Manufacturers’ representative organization Harbinger National has announced the appointment of Barry Lane as its new president and CEO. Lane succeeds Michael Rowsey, a widely respected figure in the office products industry, who is stepping down having helped found the company in 2011.

Lane began his career in the commercial office products industry in 1978 and joined Avery in 1982, where he remained until September of this year. He has held various sales leadership roles in the commercial, superstore and retail channels throughout North America and was most recently vice president of commercial sales.

Lane has devoted time and energy to building strong customer relationships, promoting manufacturer peer group exchanges and supporting the industry’s charitable efforts. He has always been actively involved in the industry and has

participated in many trade associations and groups, particularly BSA and AOPD.

From 2016-2019, Lane was president of BSA, having previously been VP and a board member. He also served on the AOPD advisory board from 2013-2019 and is a member of a variety of different customer supplier councils. In 2015, he was the recipient of the prestigious City of Hope Hall of Fame Award and AOPD’s President’s Award. In 2022, he received the BSA Leadership Award and was named Professional of the Year at the North American Office Product Awards.

“Barry Lane is the right leader at the right time,” said Michael Rowsey, outgoing CEO of Harbinger National. “His unwavering commitment to reseller partners and his unmatched experience in this industry will ensure Harbinger National continues to thrive. I couldn’t be more confident about the future of the company under his leadership.”

Lane emphasized continuity and partnership as central to his new role.

“Harbinger National was built on a foundation of strong reseller relationships and a relentless focus on bringing best-in-class manufacturers into new channels,” he said. “I am honored to follow in Michael’s footsteps and look forward to working closely with our partners to strengthen our position across the office, jan/san, MRO and industrial spaces.”

This leadership transition is part of a strategic succession plan designed to maintain Harbinger National’s momentum while reinforcing its long-term commitment to partners and manufacturers alike.

Another huge total raised for City of Hope

The National Business Products Industry (NBPI) presented a check for almost $14 million to the City of Hope during the gala evening in honor of 2025 Spirit of Life Honoree John Fellowes at the end of September

The 2025 Expanding Hope campaign raised $13.9 million for the California-based cancer and diabetes research organization, with events taking place throughout the year all over the US.

These included a sterling effort from workplace furnishings vendor HNI, which raised a record-breaking $1 million during its annual Presidents’ Roundtable dinner and golf outing which took place on September 18. Read more about this and HNI’s fundraising initiatives for the NBPI at: HNI Golf Outing PR Sept 2025

Next year’s Spirit of Life Honoree is Greg Welchans, president and CMO of Distribution Management.

THE NATIONAL BUSINESS PRODUCTS INDUSTRY PRESENTS

TOGETHER, WE EXPANDED HOPE

City of Hope extends heartfelt gratitude to John Fellowes, President and CEO of Fellowes Brands, and the National Business Products Industry for their extraordinary leadership and generosity during the 2025 Spirit of Life® campaign. Your commitment helped raise an incredible $13.9 million to advance lifesaving cancer research and compassionate care.

As we celebrate this milestone, we look ahead with excitement: Greg Welchans, President, Distribution Management, will lead his own 2026 Spirit of Life® campaign. With Greg’s vision and the continued support of this remarkable industry, we will build on our success and drive even greater impact for patients and families everywhere.

Thank you for making hope a reality — and for joining us as we take the next bold step forward.

Highlands announces leadership transition

Sales and marketing agency Highlands has announced a leadership transition as Bob O’Gara steps into the role of non-executive chairman.

O’Gara—who has been gradually reducing his day-to-day involvement in operations over the past several years—will continue as a partner alongside Gordon Christiansen and Seth Raley, serving in an advisory capacity.

Effective October 15, 2025, Raley has assumed the role of CEO. He joined Highlands as a partner more than three years ago, with the long-term vision of leading the company’s next chapter.

“Known for his strategic insight, collaborative leadership and deep understanding of the evolving B2B

landscape, Raley is well positioned to guide Highlands into the future,” the company stated.

“This transition comes at an auspicious time as seismic changes continue to shape the digital and B2B environments,” said O’Gara.

“Navigating change has always been a cornerstone of Highlands’ culture and Seth is the right leader to carry that tradition forward.”

Raley commented: “Our success has always been built on collaboration with our incredible staff, clients and customers, and I look forward to working together to drive meaningful and profitable growth in the years ahead. I’d like to thank Bob and Gordon for their trust and partnership

as we continue to build on the strong foundation they’ve created.”

“Our future is bright,” added O’Gara. “Highlands’ success has always been rooted in the strength of its people and their shared commitment to collaboration, creativity and progress.”

Connexions 2025 celebrates collaboration in Chicago Industry News

The US contract furnishings community gathered in Chicago at the end of September for Connexions 2025, the Independent Suppliers Group (ISG)-powered event—via the IS Contract program—that has become a regular fixture in the North American dealer calendar.

Now in its seventh year, the three-day meeting took place at the city’s Merchandise Mart and brought together more than 70 Connexions members and 30 leading furniture vendors. The program combined supplier meetings, design showcases and networking sessions with a keynote from ThinkLab founder and president Amanda Schneider, who spoke about navigating change in the evolving contract interiors sector.

Participants explored new developments in seating, tables, acoustic solutions and storage, with functionality, aesthetics and sustainability emerging as recurring themes. Social highlights included the Grand Gala featuring live entertainment and an architectural boat tour offering delegates a fresh perspective on the city’s design heritage.

Connexions also presented its annual member and vendor awards, with founder Don Lipscomb receiving a Lifetime Achievement Award on the occasion of his retirement. Other honorees included Groupe Lacasse (Tradition of Excellence), Lesro and RightAngle Products (Vendor of the Year), Ghent (Vendor Innovation), OFDC Commercial Interiors (Member of the

Year), Broadway Business Interiors and Complete Office Supply (Sales Growth of the Year) and WJ Office (Rising Star).

ISG said the Connexions platform continues to grow as a collaborative hub for contract furniture dealers and manufacturers, with next year’s edition already confirmed to return to The Mart.

WE’RE HERE FOR YOU

With so many of our dealer family, customers, and friends adapting to vastly different daily routines, one thing remains the same. We’re here for you.

Office Partners can help you find the products you need for your customers as they continue to provide essential services, adapt to a home office setup, and keep things rolling along. We have over 300 vendors in the Jan/San, Chemical, Office Products, Office Furniture, School Supplies, and School Furniture spaces.

All Office Partners members have access to the same services, including GSA and state and local government contracts, wholesaler programs, networking opportunities, and marketing support with low membership fees and no cost to join

Want to know more?

Contact Matthew Hebert at 205.640.4270 or matthew@officepartners.com

Industry News

ISSA names new executive director

Worldwide cleaning association ISSA has confirmed Kim Althoff as its next executive director.

Althoff will succeed John Barrett, who has served in the role since 2015 and will transition to chairman emeritus, continuing to advise the association for the next three years. The leadership change will be formally announced to members at the ISSA North America Show in Las Vegas this month

Althoff has almost 30 years of experience at the organization. Most recently, she was EVP, leading membership, events, media, sales, international operations and ISSA charities.

“Kim has been instrumental in advancing strategic partnerships, overseeing flagship events like ISSA Show North America and championing member engagement initiatives such as the ISSA Hygieia Network and ISSA Emerging Leaders program,” the association stated.

Barrett is credited with leading ISSA through “a period of unprecedented growth and modernization.” This has included overseeing more than 25 mergers and acquisitions—among them the Independent Office Products & Dealer Furniture Association (now renamed the Workplace Solutions

Association)—and expanding international partnerships.

Meanwhile, ISSA has announced its 2026 board members, with new additions including execs from Essity, Rubbermaid Commercial Products and Staples.

Laurie Sewell of Servicon will continue to lead the board as president, supported by the following newly elected members:

• Vice president/president-elect: John Swigart, Spartan Chemical

• Executive officer: Matthew Urmanski, Essity Professional Hygiene

• Manufacturer director: Rob Posthauer, Rubbermaid Commercial Products

• Distributor director: Mike Cusick, Staples Inc

• Canada director (BSC): Michael Kroupa, United Services Group

Returning from the 2025 board are:

• Secretary: Rachel Sanchez, Prestige Maintenance USA

• Treasurer: Adam Camhi, Sunbelt Rentals

• Manufacturer representative director: Mark Presho, Access Partners

• BSC Director: Ricardo Regalado, Rozalado Services

EPIC Business Essentials

seals furniture partnership

National accounts organization EPIC Business Essentials (EBE) has announced a strategic partnership with furniture category consulting firm Catalyst. EBE—a subsidiary of Independent Suppliers Group— said the collaboration was aimed at driving increased market share and profitable revenue growth within the furniture category across its portfolio of public and private sector contracts.

• Distributor director: Nick Lomax, S.P. Richards

• Distributor director: Debbie Sardone, Speed Cleaning

• Manufacturer director: Fabio Vitali, Sofidel

• Manufacturer director: Bill Simpson, Ecolab

Outgoing executive director John Barrett said the 2026 board “reflects the diversity of roles and experience” across the industry, enabling the association to “champion member success across all segments while advancing cleaning as a critical investment in health and performance.” The new board will officially take office on November 13 during the ISSA Show North America 2025 in Las Vegas.

A primary focus will be driving sales of the 10,000+ newly added furniture items on EBE’s OMNIA Partners contracts while also prioritizing alignment with leading manufacturers to expand reach, enhance members’ capabilities and deliver greater value to customers.

“Furniture continues to be a high-potential growth category. Through Catalyst’s industry expertise and targeted engagement strategies, we will maximize the value of our contracts, increase customer adoption and drive profitable revenue expansion for the network,” promised EBE managing director Dante Ercoli. »

Essendant update

Following its recent exit from the office products dealer channel, Essendant is apparently repositioning itself as an e-commerce wholesale organization focused on the jan/san and foodservice categories, as well as customer channels that include e-tail, enterprise and tech.

In an update on its website with the headline “The new way forward,” Essendant published an open letter to customers explaining how it is “transforming.”

Here is the letter in full:

Dear Valued Customer, Your success drives everything we do and we are excited to introduce a stronger, more focused Sales Team built to deliver exactly what your business needs. Here’s what is new and why it matters.

Expanded Sales Team: Since our announcement we have added over 20% additional Account Executives dedicated exclusively to JanSan & Foodservice channels. That means faster answers, deeper expertise and service that is tailored to your world.

Account Executive Coverage: Every JanSan and Foodservice account now has a dedicated outside Sales Account Executive. This means that you will have a true partner who knows your market, is available locally, and is laser-focused on helping you uncover growth opportunities.

Etail / Enterprise / Tech / Specialized Resellers Expertise: Our strategy in these channels remains strong and unchanged, which means you can count on the same dedicated focus, expertise and growth support you’ve always had. These specialized teams continue to bring tailored solutions

designed to accelerate your business in fast-evolving markets.

Tenure & Experience: You’ll be working with a team that not only understands your business but has been serving it for years. More than half of our Sales Team has over a decade of experience at Essendant, ensuring you benefit from proven expertise, industry insight, and a partner who knows how to deliver results.

Dedicated JanSan & Foodservice Category Support Team: These Subject Matter Experts serve as specialized partners for customers, offering deep expertise and personalized guidance. We have built dedicated support teams around each product category to ensure you have direct access to the experts who know your business best. Whether it’s troubleshooting, optimization or strategic planning, your commercial strategy team is here to help you succeed.

Essendant also provided a link to its updated sales organization under the leadership of new chief revenue officer Brian Schreiber. You can read that chart here

Essendant has also shared more information about its distribution network. The company confirmed it will be operating from six distribution centers: Dallas, Texas; Atlanta, Georgia; Chicago, Illinois; Oaks, Pennsylvania; Phoenix, Arizona; and Sacramento, California.

Meanwhile, orders from a further eight facilities Essendant is exiting will be accepted until November 6. Accounts for OP dealers assigned to these DCs will remain open for an unspecified period so they can take advantage of promotions and close-out sales.

Most of the wholesaler’s locations will end wrap-and-label orders on the same date, with three exceptions: Cranbury, New Jersey until December 4; and Orlando, Florida and Perris, California, both until December 30.

A go-forward assortment document showed the extent to which traditional office supplies and print products have been dropped by Essendant. Almost 13,800 items have been discontinued, impacting 367 vendors. In addition, Essendant is carrying zero stock of several well-known OP, print and furniture manufacturers.

More details can be found here

The International Organization for Standardization (ISO) and the Greenhouse Gas Protocol (GHG Protocol) have announced a strategic partnership designed to streamline sustainability reporting by aligning existing GHG standards and jointly developing new ones.

The agreement, revealed on September 9, will see ISO’s 1406X standards and the GHG Protocol’s Corporate Accounting and Reporting, Scope 2 and Scope 3 Standards integrated into a unified set of co-branded international standards. The partnership also includes work on a

joint product carbon footprint standard to support companies seeking more detailed emissions data across their value chain.

Both organizations said the collaboration aims to reduce complexity, improve consistency and provide a common global framework for emissions accounting. The move follows calls from policymakers, investors and business groups— including the B7 community and the International Sustainability Standards Board—for more alignment in climate-related standards.

ISO and GHG Protocol standards

have been widely adopted across the world, underpinning regulatory frameworks and sustainability reporting initiatives. The new joint approach is expected to simplify processes for companies and support broader decarbonization efforts.

EVERYBODY'S CURIOUS

Logitech for Business leader makes HP switch

Logitech’s B2B president has been lured to HP Inc in a new role at the PC and printing giant.

Prakash Arunkundrum was confirmed as president of the Logitech for Business unit only a few months ago, after serving as the tech products firm’s COO for two years. The former management consultant joined Logitech in 2015.

In a LinkedIn post, HP CEO Enrique Lores confirmed Arunkundrum had moved to Palo Alto to take on the newly created role of chief strategy and transformation officer—a position that “brings together our long-term strategy and M&A with enterprise-wide

transformation efforts, with a strong focus on AI-driven initiatives.”

HP and Logitech compete closely in the workspace solutions and video conferencing markets following HP’s acquisition of Plantronics brand owner Poly in 2022.

Arunkundrum’s arrival is not the only senior change announced by HP this week.

Alex Cho, who leads the company’s Personal Systems business, will exit the company on December 31 after nearly 30 years. Stepping into Cho’s role will be Ketan Patel, a 20-year HP veteran who currently serves as COO of the Global Personal Systems division. He officially

Kimberly-Clark launches dispenser recycling scheme

Kimberly-Clark Professional (KCP) has introduced Thrive, a sustainability service designed to help businesses divert waste from landfills and track progress toward environmental goals. Through the Thrive Dispenser Service, KCP collects qualifying used plastic dispensers directly at customer sites and prepares them for shipment. Old dispensers, as well as leftover dry paper products, are then

sent to a sustainability partner to be processed into an alternative fuel for use in cement and building material production.

The program is available to commercial customers in the US and Canada which replace 100 or more eligible dispensers. As part of the service, KCP installs new Scott, Kleenex or ICON units to replace the old ones.

Customers also receive traceable reporting and an environmental impact achievement certificate, helping them to measure and demonstrate their landfill diversion results.

“Our customers are looking for practical, measurable ways to meet their sustainability goals,” said Susan Gambardella, president of KCP. “Thrive offers a solution that’s easy to implement and makes a tangible, positive impact toward waste reduction.”

started his new job on November 1.

Meanwhile, HP also announced that George Brasher has been named managing director of its North American operations. Brasher began his HP career in 1990 and has held multiple financial and commercial roles in the US and Europe since then.

Bolt-on acquisition for Avery

CCL Industries has announced an acquisition for Avery in the ID badges segment.

The labelling specialist has acquired IDESCO Holding and IDSecurityonline. com, privately owned providers of secure badging and identification solutions headquartered in Manhattan, New York. Sales of the acquired businesses in 2024 were around $15.6 million. CCL said the debt-free, all-cash purchase price is approximately $13.8 million, subject to standard closing conditions.

CCL CEO Geoff Martin commented: “This acquisition continues to build on Avery’s growing portfolio of badging and credentials technologies, products and brands using software and related supplies.”

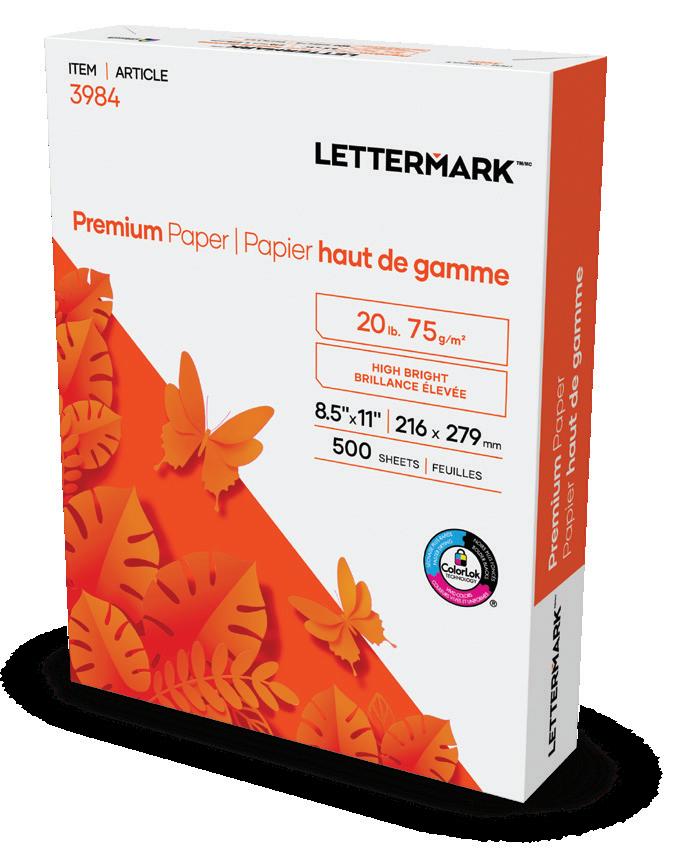

Ready When You Need It!

Lettermark Copy and Lettermark Premium are conveniently stocked across Domtar’s vast North American manufacturing and distribution network. Simplify your office paper inventory needs with the reliability of Lettermark.

Depot parent to be taken private

The ODP Corporation (ODP) has announced it has entered into a definitive agreement to be acquired by an affiliate of private equity firm Atlas Holdings.

Atlas will pay $28 per share in cash for ODP. This represents a premium of 34 percent versus its closing price on September 19 and values the reseller at around $1 billion. When the deal closes—most likely before the end of the year—ODP will become a privately held company and be delisted from the NASDAQ stock exchange.

“This transaction, fully supported by our board, provides a substantial premium for The ODP Corporation’s shareholders and will improve the company’s position for the next phase of growth,” said CEO Gerry Smith in a press release.

He added: “Atlas brings an understanding of our industry, along with the operational expertise, resources and track record of supporting its companies that will fast forward our B2B growth initiatives and strengthen our position as a trusted partner to our customers.”

Atlas Managing Partner Michael Sher commented: “Atlas has a long history of transitioning public companies into successful private enterprises and we are uniquely positioned to do just that with The ODP Corporation – an iconic American company.”

He continued: “The ODP Corporation’s leadership has already taken several steps to mitigate the challenging retail environment and we are the right partners to support The ODP Corporation’s continued evolution in its next chapter.”

It was then revealed that a significant number of parties were interested in acquiring the company before it finally agreed last month to be bought by private equity firm Atlas Holdings.

In a regulatory filing, ODP said expressions of interest regarding a transaction dated back to October 2024, with Atlas entering the picture in early December. Interestingly, in February 2025, Atlas indicated it would be willing to pay $30 a share for ODP, which is higher than the final price of $28.

However, that was before a) the onset of the well-documented tariff issues and b) Atlas had seen ODP’s management’s financial projections until FY29. On April 7, the private equity firm indicated a lower valuation of $21.25 per share.

Atlas, though, was by no means the only one eyeing ODP: a total of 14 parties executed confidentiality agreements after financial advisor JP Morgan began to seek potential acquirors toward the end of April.

Already in the frame by this time was an organization described in the SEC filing as “Party D,” which had

“expressed interest in an all-cash acquisition of ODP to combine ODP with one of Party D’s portfolio companies, a direct competitor of ODP.” It can be safely assumed that Party D is Staples Inc owner Sycamore Partners.

The majority of the other interested parties were financial investors. One of these was Party C, which was revealed to own a retail business. In June 2025, Party C submitted an expression of interest to merge ODP with this retailer—an all-stock transaction that would not have seen ODP’s shareholders receive any cash. This proposal was apparently not taken any further.

Talks with Party D went on for some time, but the stumbling block was the antitrust risk. Ultimately, ODP’s board felt this risk was too great and it informed Party D on August 12 it no longer wanted to purse a transaction.

Meanwhile, ODP indicated to those still in the race— including Atlas—it would consider $28 a share in cash to be an appropriate valuation. There appears to be a sense of urgency on the part of ODP to get a deal over the line; it requested final bids by September 10—with Atlas submitting its proposal on that date.

No other offers matched the Atlas bid of $28 per ODP share and, after a few points had been ironed out, the acquisition was finally announced on September 22.

While the final offer price was below the $30 Atlas had indicated in February, it still represented a premium of more than 130% on ODP’s closing price on April 8, the day after President Trump made his tariff announcement. ODP’s board concluded $28 was unlikely to be achieved “for the foreseeable future” had the reseller continued on its current course.

The future of ODP CEO Gerry Smith has not been publicly discussed. According to the SEC filing, he will receive a golden parachute of almost $29 million when the transaction closes.

Premium, Green & Refillable.

Over 70% of Pilot’s premium quality writing instruments are refillable and over 70% of our packaging contains recycled material. Choosing to refill instead of throwing away is a simple, eco-friendly way to help create a greener future and unlock the value already built into your favorite writing instruments. Re-Think & Re-Ink® with Pilot.

What a government shutdown actually does—and who it hurts (yes, even you)

Paul A. Miller, legislative counsel, Workplace Solutions Association

When Congress fails to pass appropriation bills or a continuing resolution before the fiscal year deadline, the federal government enters a lapse in appropriations— commonly called a “government shutdown.” That sounds dramatic, and it is; but a shutdown is not the same as all government operations suddenly grinding to a halt. It is rather a legally driven pause in activities that rely on annual appropriations. Some programs keep running; others stop or slow down—and private companies that depend on federal work feel the shockwaves fast. Here I explore the facts, common myths, who really loses (and who doesn’t) and the practical damage caused—especially to small businesses and the office products supply chain.

In brief: what really shuts down and what keeps running

• What shuts down: Activities and employees funded through annual discretionary appropriations that an agency’s contingency plan designates as non-excepted. These include many agency programs, routine regulatory activity, grant processing and many contractor interactions when agencies don’t have appropriated funds to keep paying for new work. Agencies must identify essential (“excepted”) versus non-essential staff and services in contingency plans.

• What keeps running: Mandatory spending programs (Social Security, Medicare, many benefit payments) and some user-fee funded operations generally continue—although associated customer service functions and administrative processing can be delayed. Essential national security, public safety and emergency operations also continue, often with employees working without pay until the lapse ends.

Facts and myths

Fact: federal employees generally receive retroactive pay once a shutdown ends

Under the Government Employee Fair Treatment Act (part of the 2019 appropriations changes), federal employees who are furloughed—and those who are “excepted” but had to work without pay—are entitled to retroactive pay after the shutdown ends. This protects workers from permanent lost wages for the furlough period, but it doesn’t eliminate the short-term cash-flow pain. The Office of Personnel Management and agency guidance reiterate this retroactive pay policy and explain how premium pay, leave accrual and similar rules work during a lapse.

Myth: no one at the government gets paid during a shutdown

Not true. Mandatory programs and

agencies funded outside annual appropriations (e.g., U.S. Postal Service operations) continue to pay; essential employees (e.g., military, air-traffic controllers, certain law enforcement and medical staff) continue to work, although many do so without immediate pay and wait for retroactive pay after funding is restored.

Fact: federal contractors do not get the same guaranteed backpay

Unlike federal employees, private contractors are not guaranteed retroactive pay by that 2019 law. Whether a contractor continues to be paid or can perform depends on contract funding, the type of contract, whether the work can be done off-site and agency decisions. Agencies’ procurement pauses and lack of access to facilities or to non-excepted government staff (who normally approve deliverables or invoices) are common reasons why contractors lose revenue during shutdowns. That makes contractors—and especially small businesses that rely heavily on federal contracts—vulnerable.

Myth: a shutdown is harmless once it’s over

Not exactly. The economic damage often persists. Workers who miss paychecks may accumulate debt, miss bills or cut spending; some small businesses lose contracts, lines of credit or customers; and agencies’ backlog and lost regulatory activity can take months to unwind. The Congressional Budget Office and other analysts have found that the net economic effect does not fully reverse after a shutdown ends.

How shutdowns hurt the economy: the macro story

• Direct lost output and spending: CBO and other analysts have estimated

large, measurable short-term hits from shutdowns. For example, the economic disruption from the 2018–19 shutdown was estimated in the billions of dollars (CBO and subsequent analyses put the cost to the economy in the order of magnitude of ~$8–11 billion), with effects on consumer spending in regions with many federal workers. More recent CBO estimates highlight large daily costs tied to furloughed payrolls and interruptions in agency services.

• Confidence and investment: Political stalemates that lead to shutdowns increase uncertainty. Businesses delay hiring, investment and procurement; financial markets and credit conditions can be rattled. Surveys of small businesses show shutdown risk reduces confidence and is cited as a direct constraint on growth plans.

• Sectoral spillovers: Tourism (parks, museums), travel (airport operations that suffer staffing disruptions) and regional retail/restaurants near federal workplaces take immediate hits when employees miss paychecks or national landmarks close.

How shutdowns harm small businesses: the micro story

Small businesses are disproportionately exposed, for several reasons:

• Loss or delay of federal contracts and invoices: Agencies may stop issuing new awards or delay approvals and payment processing. If a small firm depends on one or a few federal customers, a pause in contracting or invoice processing can quickly cause cash-flow crises. The Small Business Committee and Small Business Administration (SBA) briefings from previous shutdowns documented halted 7(a)/504 lending activity and paused contracting opportunities.

• Loans and SBA programs pause: SBA lending and guarantee approvals, »

disaster assistance decisions and other programs can be curtailed during a shutdown, delaying capital for small firms. The 2018–19 shutdown saw billions in delayed loans.

• Subcontractor chain effects: Larger prime contractors may ration limited paid staff and prioritize core deliverables; small subcontractors waiting on approvals or sub-invoices may be left unpaid or unable to operate. Legal and administrative uncertainty can arise for small firms with employees that support government contracts.

• Cash flow and credit pressure: Banks and suppliers may be less willing to roll short-term financing when a customer’s largest buyer (the government) is temporarily paused. This matters more for small firms that operate month to month.

Office products industry: why shutdowns sting

The office products sector— manufacturers, wholesalers and resellers that supply paper, toner, furniture, janitorial and office essentials—is an instructive case because it often works on General Services Administration (GSA) schedules and agency supply contracts, and it relies on predictable, recurring procurement volumes.

• GSA schedules and federal contracts matter: A lot of office products dealers hold GSA or agency contracts to supply government customers. During a funding lapse, agencies may pause new purchase orders, delay approvals or restrict access to purchase portals. If an agency can’t accept deliveries at a government facility because of a shutdown or has furloughed the staff who sign off on receipts/invoices, vendors can’t get paid even for shipped goods. That creates inventory, billing and accounts receivable headaches.

• SMB resellers are especially exposed: Large national players may sustain a short delay more easily; small regional dealers with a high share of federal business can face immediate liquidity stress (no new orders, delayed payments, suppliers expecting payment). During prior shutdowns, smaller suppliers reported order cancellations, delayed invoices and difficulty getting credit from wholesalers.

• Operational logjams: Some office products are stocked through inventory consignment or depot arrangements with agency facilities. If agencies restrict facility access (for cleaning, deliveries or receiving docks), supply chain flows break, leaving vendors with returned shipments or storage costs.

Who doesn’t lose pay or benefits— and important exceptions

• Social Security and most mandatory benefits continue: Monthly Social Security payments, Medicare benefits and similar mandatory payments are generally paid because they’re funded through separate mechanisms. However, administrative services (replacement cards, customer service lines, benefit verifications) may slow or stop.

• Federal employees are protected for retroactive pay: However, that protection does not extend to contractors or most grantees. Contractors must rely on contract terms, agency guidance and commercial remedies.

Concrete examples from prior shutdowns (why these patterns matter)

• 2018–2019 shutdown: CBO and other analyses estimated roughly $11 billion in lost economic output, with lingering effects even after pay was restored; national parks, regulatory inspections and many US Department of Agriculture and Food and Drug Administration routine functions were paused or slowed. Small business loan approvals and government contract activity were delayed, creating real hardships for

firms dependent on federal spending.

• Agency-specific effects: In previous shutdowns, the Federal Aviation Administration, the Transportation Security Administration and other agencies saw large numbers of staff working unpaid or furloughed; the resulting operational stress produces flight delays, inspection backlogs and increased overtime costs after the shutdown ends. That unpredictability increases costs for travel-dependent businesses and suppliers.

What small businesses can (and should) do to prepare or reduce risk

• Diversify customers: If a large share of revenue comes from a small set of federal customers, accelerate efforts to win private-sector or state/local business to smooth cash flow.

• Know contract funding type: Identify which contracts are fully funded (carryover funds, multi-year appropriations) versus incrementally funded or pending—the latter are

more at risk during a lapse. Legal advisors and contracting officers can clarify status.

• Prepare short-term liquidity plans: Talk with banks about emergency lines, negotiate payment terms with suppliers and map how many payroll cycles you can survive without government receipts.

• Document work and invoices carefully: If a contract is later paid, clear documentation speeds invoicing and reduces disputes; if a contract ends for convenience, proper documentation may help recover costs.

• Stay informed of agency contingency guidance: Agencies publish contingency plans and procurement notices that will tell you whether they’ll accept deliveries, approve invoices or continue contract performance.

Bottom line

A government shutdown is not merely a political spectacle—it’s an economically disruptive event with one

group protected (federal employees, who receive retroactive pay after the fact), while many others (contractors, small businesses, frontline vendors in sectors like office products) face real and immediate financial pain. Shutdowns slow lending, pause contracting and regulatory work, depress local spending where federal employees live and shop and create uncertainty that damages investment and hiring decisions.

If you run a small business that sells to the federal government—especially in predictable/recurring categories like office supplies—treat shutdown risk as real. Identify how much of your revenue depends on federal buyer flow; confirm funding and invoicing mechanics for each contract; and develop short-term liquidity and diversification plans now. The government will likely pay employees retroactively when a shutdown ends, but that doesn’t automatically fix the cash-flow, credit and contractual disorder a shutdown creates for private vendors.

Essendant is gone … What are we going to do?

Mike Tucker, executive director, Workplace Solutions Association

A few astute dealers sensed a problem months ago and are well on their way to answering this question. If they were first call Essendant, they started transitioning orders to S.P. Richards (SPR) and determining SPR’s ability to handle the unique needs of their customers and accounts. If they were stocking dealers, they began analyzing their inventory and direct buy strategy for ways to minimize the impact.

But many, if not most, dealers were caught completely off guard by

Essendant’s announcement and the very short timeline they were given to adjust. If you are in this group, the next several months to a year will be challenging. Don’t panic—and don’t try to eat the whole elephant all at once.

I discussed these challenges with Scott Hart, president and COO of Greenville Office Supply and a Workplace Solutions Association board member. Following are some insights and strategies which Scott shared. I hope they will help you.

Essendant’s exit is not just a bad surprise: it’s a structural signal. The playing field is shifting. Your response must be more than reactive—they’ve given you a reason to change your model.

The goal for the IDC now is not just to survive; it’s to use this disruption to reposition for long-term strength. On the next page, I have provided a table of some observations, ideas, pitfalls and tactical next steps you may want to consider.

Your business isn’t one-size-fits-all and your ecommerce platform shouldn’t be either. Logicblock delivers the customization, support, and scalability you need to grow, without locking you into overpriced plans or cookie-cutter templates.

Take a 30-day test drive with real data, real support, no surprises.

What this means operationally (and what you must do)

Below are key levers you must examine, fast.

AREA

Supplier relationships

RISK/CHANGE

You lose a major primary wholesaler, with systems, terms, programs (wrap and label, drop-ship) built into your operations.

ACTION

Review all Essendant-dependent programs (wrap and label, drop ship, special private brands). Determine if you will move these to SPR or other sources.

Inventory/ warehousing

You may have gaps where you relied on Essendant’s availability

Logistics/ fulfilment

Systems/ software/ERP

Your delivery, pick/pack, wrap and label and drop-ship.

Orders, pricing feeds, drop-ship links and vendor integrations will break once Essendant shuts them down

Customer/ account impact

Margin/pricing

Capital/ cash flow

Some customers may notice slower fill, higher cost, fewer SKUs.

Removing a major vendor from your mix may cause your costs to creep upward.

Working capital stress: you may need to carry more inventory, prepay vendors or spend upfront on warehousing or tech.

You’re undertaking what’s effectively a “system conversion” with all the associated risks: data migration errors, service interruptions, scope creep, hidden dependencies.

Wholesale/distribution alternatives

You need a blended, multi-supplier approach. Don’t put all your eggs in one new basket.

• SPR: Many dealers are moving here. But beware: it will be absorbing a surge. Its capacity, systems and fulfilment models may stretch. You

Conduct an inventory “stress test,” item by item: which SKUs you absolutely need to stock, which you can drop, which you can special-order. Try to reduce reliance on the just-in-time model until your new flows stabilize.

Audit your internal logistics: material handling, sorting, packaging, labor needed, labor safety. Consider whether you should “white-box” your own wrap and label from direct buy inventory.

Figure out what you’ll lose (EDI feeds, content, automated ordering, pricing files, rebates) and replace them. Contact your ERP vendor to assess what changes are required (new supplier integrations, reprogramming, cost).

Each dealer must decide whether to communicate these changes with customers or adopt a tone of “Nothing to see here—everything’s fine.”

Redo your margin models. Account for higher cost of goods sold, lower rebates, higher freight costs and possible added handling costs. Don’t give away margin to hold share unless it’s strategic for key accounts.

Run cash-stress simulations under worst-case scenarios (some accounts leave, vendor terms shift). Don’t overextend. Prioritize high return on invested capital moves.

should vet its performance in your region.

• R.J. Schinner: Good choice, especially for jan/san, facility supplies and non-core SKUs.

• Global Industrial/Grainger: Strong in industrial/MRO; might fill gaps, especially on non-office products SKUs (tools, safety).

• TD Synnex/Ingram Micro: Strong in technology and electronics. These make sense for your tech lines.

• Arlington/Educators Resource/

Veritiv: Niche or regionally strong;

might supply specialty or school channels.

• ISG/other independent group wholesalers: Often used in office/ industrial supply space for mid-tier volume.

• Direct manufacturer relationships: Particularly for your top 100–200 SKUs you move fast. Rather than routing through wholesalers, negotiate direct supply (with appropriate breakpoints) for higher security.

Transition phases and tactical roadmap (next 12–18 months)

Below is a rough phased roadmap you can adapt.

Phase 0: Emergency stabilization (next one to three months)

• Freeze noncritical capital outlays unless they directly support transition.

• Run a full impact audit: departments, customers, SKUs, vendor exposure.

• Appoint a transition team (cross-functional—operations, sales, IT, finance).

• Begin immediate outreach to alternate suppliers/vendors. Sign memoranda of understanding, pilots, test orders.

• Communicate early and transparently with your largest customers—tell them you are on top of this.

• Begin reprogramming your systems (ERP, pricing, EDI) to support new supplier inputs.

• Begin scaling or reconfiguring your logistics/warehouse strategy (more flexibility, buffer capacity).

Phase 1: Load balancing/dual sourcing (months 3–9)

• Run a “dual sourcing” model for critical SKUs (Essendant and alternate) to reduce risk.

• Begin shifting volume gradually—don’t try to reassign all at once.

• Track vendor performance rigorously (fill, lead time, cost, quality).

• Begin adjusting pricing and margin structures on a per-account basis to reflect the new cost basis.

• Use this phase to “shake out” issues (errors, returns, system bugs, fulfillment gaps).

Phase 2: Complete cutover/exit (months 9–15)

• As your new supply chain processes stabilize, fully exit Essendant dependency.

• Retire or reassign internal workflows built around Essendant (folder structures, account codes, SKUs).

• Offer “grandfathered deals” or loyalty incentives to customers that stay through the transition.

• Review and optimize inventory (clear slow SKUs, invest in fast movers).

• Reassess team structure; remove or retrain roles no longer needed (e.g., Essendant wrap/label specialization).

Phase

3: Growth and repositioning (after ~15 months)

• Lean into new growth categories (e.g., jan/san, industrial, tech).

• Introduce value-added services: managed supplies programs, vendor-managed inventory, subscription models, service contracts.

• Invest in analytics, customer segmentation, vertical specialization.

• Increase your ability to be sticky (e.g., integrated procurement platforms for customers, dashboards, replenishment automation).

Resources, frameworks and tools you should leverage

• WSA/trade groups (OPI, IDC, ISG, OPA): Keep close; use their research and peer benchmarking.

• ERP/systems consultants with

wholesale/distribution experience: Especially those that have done supplier cutovers.

• Benchmark dashboards/analytics: Set up scorecards on every new vendor (fill, lead time, defect, cost).

• Peer networks: Connect with dealers that are ahead in the transition (some saw it coming).

• Case studies of companies shifting supply chains: Both in your vertical and in analogous industries (e.g., distributors in industrial, MRO).

• Working capital models/cash scenarios: Stress test your cash flow under worst/likely/best cases.

• Legal/contract review: vendor contracts, change of terms, exit liabilities.

The bad news is that every time our industry comes up for air, we get hit by another wave. The good news is we keep coming up for air. Things will eventually settle down and usually the disruption will present opportunities. Stay the course. Call on your experience, your team, your fortitude and your faith and once again, you will weather the storm.

Enable the sustainable

by Lisa Veeck

While “sustainability” has become something of a buzzword in the IDC— as in other sectors—in recent years, the term means different things to different people. Reflecting this diversity, independent dealers have been rising to the challenge in different ways, adopting new and varied strategies to help reduce both their own carbon footprints and those of their customers.

Sourcing choices at 1st Source Sustainable products account for 30 percent of Minneapolis, Minnesota-based 1st Source’s $8 million annual sales. The dealer’s largest customers in the category are casinos, movie theaters and food service establishments; while top-selling products include food service disposables and chemicals.