He mihi

Ko Te Awa Kairangi he pou herenga iwi, he pou herenga waka.

Here mai ko te kei o tō waka ki te tumu herenga waka o ngā pae mounga kua whakatūtūria nei e te hikuroa o Ngake Mai i Tararua ki Remutaka ki Pūrehurehu, ki Pōkai Mangumangu, ki Pareraho, ki Tirohanga, ki Tukutuku, ki Puke Tirotiro, ki Pukeariki, e whakamarumarutia nei

Te Tatau o Te Pō a Ngāti Te Whiti, a Ngāti Tāwhirikura, ki Pukeatua, te tuahu tapu o Te Kāhui Mounga i te wā i a Māui ki te whakapuare i te wahanui o Te Ika Whakarau a Kutikuti Pekapeka.

I ahu mai i Te Wai Mānga, i a Rua Tupua, i a Rua Tawhito, Ko Ngake, ko Whātaitai. Ka timu ngā tai o Te Wai Mānga, ka pari mai ko Te Whanganui a Tara e pōkarekare mai ana.

Ka tū a Pukeatua ki runga i ngā wai e kato ana, i a Awamutu, i a Waiwhetū, kei reira a Arohanui ki te Tangata a Ngāti Puketapu, a Te Matehou, a Ngāti Hāmua e tū ana, tae noa atu rā ki ngā wai tuku kiri o te pūaha o te awa o Te Awa Kairangi.

Koia hoki te puna i heke mai ai he tangata. E kore e mimiti tēnei puna, ka koropupū, ka koropupū. Ko Te Awa Kairangi e rere iho mai ana i hōna pūtakenga i Pukemoumou i te paemounga o Tararua ki runga i hēnei whenua, ki runga i tēnei kāinga, hei āhuru mōwai ngā iwi.

Te Awa Kairangi is a rallying point for the many people and the many tribal affiliations that have made it their home.

Bind yourself to the many mountains of this place that were born from the lashing tail of Ngake. From Tararua to Remutaka, to Pūrehurehu, to Pōkai Mangumangu, to Pareraho, to Tirohanga, to Tukutuku, to Puke Tirotiro, to Pukeariki, to Te Korokoro o Te Mana which stands atop Te Tatau o Te Pō of Ngāti Te Whiti and Ngāti Tāwhirikura, to Pukeatua, the sacred altar of the Mountain Clan in the time of Māui.

It was here that the two ancient tūpuna, Ngake and Whātaitai, were summoned from the depths of the fresh water lake, tasked with prising open the mouth of the great fish.

It is Pukeatua that stands above the waters of Awamutu and Waiwhetū, the home of Arohanui ki te Tangata of Ngāti Puketapu, Te Matehou, and Ngāti Hāmua, flowing out to the life-giving waters at the mouth of Te Awa Kairangi.

This is the spring that gives life to the people. This spring which will never be diminished, it will continue to flow, it will continue to flourish. Te Awa Kairangi that flows down from its source at Pukemoumou in the Tararua ranges and over these lands as a sheltering haven for the people.

He karere nā te Koromatua/ Tumu Whakarae Message from the Mayor and Chief Executive

Kia ora,

Hutt City Council’s Annual Plan 2025-2026 sets out the services we will be providing and the projects we will be delivering as per year two of the 10 Year Plan 2024-2034.

We want to ensure our city is a place where everyone thrives. Providing future-fit infrastructure, enabling a liveable city and vibrant neighbourhoods, and supporting and enhancing the natural environment continue to be key priorities. We are investing in significant resilience projects, including Te Wai Takamori o Te Awa Kairangi (formerly RiverLink), and prioritising investment in the Seaview Wastewater Treatment Plant which is a critical asset for our city.

We are very aware that any rates increase, especially at this time, will be hard to manage given people are continuing to face financial pressures. Significant cost pressures also affect Council and we need to carefully manage these. Some of these are due to a drop in government funding in areas like transport, less revenue from regulatory services due to economic conditions, price increases for things like Greater Wellington Regional Council bulk water charges, and the need to continue to meet people’s expectations of our services.

A detailed budget review process has been undertaken, and new savings targets have been baked in. Increases to fees and charges have also

been made which will help offset some of the cost pressures. We have reprioritised transport activities in light of reduced government funding and will be continuing to drive improvements to ensure value for money for ratepayers across all our services, including water. A new model for the delivery of water services was separately consulted on with you as per Local Water Done Well, and the councils involved are currently considering next steps.

Through Council’s work, the rates revenue increase in the 10 Year Plan has reduced from 13.4% to 12.6% (after growth) for 2025-26. This means an additional $8.90 a week for a home in Lower Hutt (based on average house value).

Overall, our plans are very similar to those set out in the 10 Year Plan which was consulted on widely last year. Thank you for taking the time to read this plan.

Ngā mihi,

Campbell Barry Te Koromatua o Te Awa Kairangi ki Tai Mayor of Lower Hutt

Jo Miller

Tumu Whakarae Chief Executive, Hutt City Council

Tākai Here – Mana Whenua

Partnership with Mana Whenua

Manaaki whenua, manaaki tangata, haere whakamua. If we take care of the land and take care of the people, we will take care of the future.

Kia ora koutou katoa, Hutt City Council, Mana Whenua, and hapori Māori (Māori communities) have strong and trusting relationships, working collectively to support and enhance the wellbeing of everyone living and working in Te Awa Kairangi ki Tai Lower Hutt. This 10 Year Plan outlines many of the ways we seek to do this.

Central to Council’s work with Mana Whenua are the Tākai Here. Through these partnership agreements we work together to create a more inclusive and sustainable future for all our people. We all acknowledge there is much work to do to address the inequities across our tāone so that all people living and working in Te Awa Kairangi ki Tai Lower Hutt thrive.

The community consultation-derived priorities for the 10 Year Plan are: fit-for-future infrastructure, financial sustainability, enhanced environment, liveable city, and vibrant communities, promoting wellbeing of all people, climate change, and working in partnership with stakeholders and communities. These focus areas speak to what Council should prioritise, how we do this and with whom we should work alongside.

Mana Whenua support these priorities, and especially the call to enhance both the wellbeing of whānau and te taiao. This aligns with the values and beliefs of Mana Whenua in Te Awa Kairangi ki Tai Lower Hutt.

The ambition to thrive outlined in the 10 Year Plan holds the interest of Mana Whenua and Māori at heart. The expression of kaitiakitanga, kotahitanga, and manaakitanga throughout this document is supported by Mana Whenua and demonstrates the various ways Council is committed to keeping Te Tiriti o Waitangi and its legislative obligations at the heart of its work programme.

When all parts of our community are thriving, we are much better off as a city and community. This plan along with other strategies ensures the aspirations and outcomes for Māori to be a priority.

Ngā mihi nui,

Taranaki Whānui ki Te Upoko o Te Ika Trust Chair

Te Whatanui Winiata

Te Rūnanga o Toa Rangatira Chair

Callum Katene

Te Rūnanganui

o Te Āti Awa Chair

Kura Moeahu

Palmerston North Māori Reserve Trust Chair

Liz Mellish

Wellington Tenths Trust Chair

Anaru Smiler

More information about Mana Whenua partnerships can be at: hutt.city/mana-whenua

Tīmatanga kōrero Introduction 1

Nau mai ki tā tātou Mahere ā-Tau Welcome to our Annual Plan

Here’s our plan for the year ahead

Last year, Hutt City Council updated its 10 Year Plan, outlining the services and projects it will fund over the next decade.

The planning for the future of our city is shaped by our growing population, a challenging economic environment, a changing climate, ageing assets, and the need to address past underinvestment in our water infrastructure.

We are managing significant cost pressuresincluding a reduction in our transport funding from government, market-driven revenue reductions, and cost increases to our bulk water supply - by reprioritising spending, increasing fees, and targeting $0.5 million in annual savings.

In the 10 Year Plan, Council proposed a rates increase of 13.4% (after growth) for 2025-26. This has been reduced to 12.6% (after growth), due to elected member decisions and operational changes.

Following engagement on the draft Annual Plan 2025-26, we heard that cost of living pressures continue to impact our ratepayers and parking fee increases in Petone were not welcome. As a result of this feedback, Council agreed to maintain the current hourly parking rate across the city and delay increases to development contributions for the Valley Floor.

Our purpose is to contribute to Te Awa Kairangi ki Tai Lower Hutt being a place where everyone thrives. To achieve this, we have a plan that’s centred on three key priority areas and ways to support how we deliver them.

Te pānui i tēnei mahere How to read this plan

This Annual Plan outlines our performance goals and budgets for the upcoming year, and highlights key projects and milestones that will shape the city in the months ahead.

Here is a quick overview of Council’s planning and reporting cycle:

• The Long-Term Plan (also known as the 10 Year Plan) and the Annual Plan work together as part of an ongoing process. The 10 Year Plan establishes the vision for the city over the next decade and identifies major projects and budgets for that period. The first year of the 10 Year Plan also serves as the Annual Plan for that year.

• For the two years following the adoption of a 10 Year Plan, we produce an Annual Plan each year. You can think of these as the next chapters of the 10 Year Plan, building upon the foundation it sets.

• Both the 10 Year Plan and Annual Plan include specific goals across various work areas to ensure Council is continually improving and effectively serving our community. These goals are then reviewed and assessed in our Annual Report, which includes an audit by the Office of the AuditorGeneral.

In 2024, we adopted a 10 Year Plan outlining our strategic direction for 2024–2034. This Annual Plan covers the second year of that period, 2025–26. The first section of this Annual Plan provides an overview of the challenges we anticipate as we move into the new financial year. It outlines key milestones and projects that will be visible in the community.

The second section details the performance goals for each area of our work, and the associated budgets.

The final section presents comprehensive financial information for the 2025–34 period.

Ngā wero Challenges we are facing

Understanding the challenges we are facing this year is important as this is one of our most demanding periods. We have a growing and increasingly diverse population, a tough economic environment, climate change, and the need to manage our assets effectively and address past underinvestment in our water infrastructure. All these factors will shape how we move forward and make decisions for the future of our city.

Managing our infrastructure

Since 2020, we have been investing heavily in water infrastructure, which remains an area of high investment in the Annual Plan 2025-2026. We have a large and growing backlog of investment to catch up on but there are affordability limits to what we can realistically do. In the meantime, we are prioritising works on critical assets such as the Seaview Wastewater Treatment plant.

This Annual Plan continues to include initiatives and funding to improve water services, transport, and resilience to meet growing demand and higher investment needs. We are taking steps to ensure sustainable infrastructure that supports the resilience of our places and people, building strong foundations for future generations.

In this plan, we have carefully reviewed our transport projects and adjusted spending priorities due to reduced government transport funding of $22 million over the next three years compared to the 10 Year Plan.

Water services

There are ongoing legislative changes and uncertainty. The most significant change is water services reform. Local Water Done Well is progressing and councils in the Wellington region are working together in support of this. A Water Service Delivery Plan (WSDP) is due to Government in September 2025.

Wellington Water Ltd commissioned reports in early March 2025 to identify better value for money through the investment made by its shareholding councils, including Hutt City Council. At this stage, we do not know the implications of these reports on our financial modelling. We will share updates on this through our usual channels as soon as we can.

Public consultation on water services took place from 20 March to 20 April. Find out more at hutt.city/futurewater

Challenging economic environment

When we set our 10 Year Plan in 2024, we recognised several challenges on the horizon that are changing the economic landscape. We know many people in our community are feeling the pinch from rising everyday costs. Because of these challenges, we have prioritised reducing costs and making savings in order to lower the rates revenue increase for 2025-26 compared to the 10 Year Plan.

Managing our assets

Past underinvestment in many of our facilities, parks, and reserves means we now need to make significant upgrades. A key challenge is ensuring the future affordability of maintaining these assets, while addressing increasing demand from our growing population. To balance these needs without overburdening ratepayers, Council is continuing to evaluate how buildings and spaces can better serve the community alongside current users.

Our revenue has decreased in several areas because of lower activity, mainly due to economic conditions (eg, regulatory services). We are reviewing our operating expenses to ensure we get the best value for money. Additionally, we are proposing to increase fees and charges where necessary to reduce the impact on ratepayers and ensure users pay for the services they receive.

Check out the full list of fees and charges included in the Fees and Charges section of this plan.

Our growing and increasingly diverse population

The current population of Te Awa Kairangi ki Tai Lower Hutt is around 113,000, and it’s expected to grow to 125,000 by 2033, reaching 137,000 by 2043. Census 2023 data shows that alongside this growth, our city is becoming more ethnically diverse.

Our Māori population has increased, and one in five people in Te Awa Kairangi ki Tai Lower Hutt (21,000) now identify as Māori. Lower Hutt’s Asian population is the fastest-growing ethnic group, nearly doubling in 10 years to around 20,000 residents. As our city becomes more ethnically diverse, it will be important to ensure that Te Awa Kairangi ki Tai Lower Hutt is an inclusive and socially cohesive city. This will need to flow through schools, businesses, and communities. To address the way our city is changing, we’re working with the Government, community groups, and developers to ensure the city thrives.

Weathering the change in climate

Communities across the country are experiencing the effects of increasingly frequent and severe weather events driven by climate change. With a significant portion of our population residing on a large floodplain, Te Awa Kairangi ki Tai Lower Hutt is particularly vulnerable to flooding and landslides. This is why we are investing in key projects that will improve the resilience of our city. This includes Te Wai Takamori o Te Awa Kairangi (formerly RiverLink), Tupua Horo Nuku, and Eastern Hutt Road.

Our strategy

Our purpose is to make Te Awa Kairangi ki Tai Lower Hutt city a place where everyone thrives. To do this, we need a plan on how to get there. Our plan centres around three key priority areas and four ways to support how we deliver them.

We’re working towards

Providing future-fit infrastructure

Enabling a liveable city and vibrant neighbourhoods Supporting and enhancing the environment

1 In partnership with our communities

3 Taking climate change into account We’re taking the next steps

2 In a way that is financially sustainable

This is how we plan to spend every $100 of rates on average over the next nine years.

We expect to receive $5.58 of credit from the landfill. This will help to offset costs and is reflected in the figures for all these other services shown on this page.

*Sustainability engagement represents spending on community

along with facilitation of projects across council activities, including investment in decarbonisation of council facilities, healthy urban waterways, etc.

He tironga whāiti o ngā take pūtea Our finances at a glance

A summary of our Financial Strategy

As part of our 10 Year Plan we reviewed our Financial Strategy and ensured that it enabled long-term sustainability. The strategy is based on important principles that provide the foundation for prudent sustainable financial management:

• Affordability of rates

• Achieving intergenerational equity by spreading the costs between both present and future ratepayers

• Maintaining prudent borrowing levels

• Achieving a balanced operating budget in the long term and ensuring that everyday costs are paid for by everyday income

• Delivering services effectively and efficiently

• Strengthening Council’s financial positio.

Our Financial Strategy helps us manage our finances and guides spending decisions. The Annual Plan 2025-2026 has been developed to deliver investment in key infrastructure in a challenging economic climate. We are dealing with cost pressures across some areas in the form of:

• Revenue decreases largely due to lower than expected users for services

• Government subsidy reductions

• Increased costs for key infrastructure projects

• Increased depreciation costs resulting from significant increases in our asset values

• Higher borrowings compared to the 10 Year Plan

We have worked to fund these cost pressures by offsetting savings or reprioritising of expenditure within existing budgets where possible. In our 10 Year Plan, we set the direction of returning to a balanced operating budget by 2028–29. This Annual Plan delays the targeted time frame to 2031-32. This approach has helped us keep the rates revenue increase for 2025-26 lower than what was planned in the 10 Year

Plan. This approach does mean that debt is higher than what was planned in the 10 Year Plan. We are proposing adjustments to rates revenue increases in future years to help ease the pressure on our borrowing capacity and reduce interest costs.

Council revenue and operating spend

Councils are limited in how they can generate revenue to cover their costs. Rates are our main source of revenue. Water services (48%) and transport (13%) make up more than half of our operating spend. Fixing our pipes and other water infrastructure remains our top priority and is driving much of the rates increases.

Our revenue has decreased in several areas because of lower volume/activity, mainly due to current economic conditions (eg, regulatory services). We are focused on mitigating the financial impact on our ratepayers. We are reviewing our operating expenses to ensure we get the best value for money. Additionally, we have increased fees and charges where necessary to reduce the impact on ratepayers and ensure users pay for the services they receive.

We have needed to manage reduced transport funding from government of $22 million over the next three years (compared to the 10 Year Plan), which will impact our ability to deliver transport projects and services. We have reviewed our projects and further adjusted our spending priorities.

When we created our 10 Year Plan, we looked for ways to save money and reduce the financial pressure on our community. We chose to increase spending on important things like water services and dial down less urgent activities. Even though we made some savings in the last plan, unexpected cost increases and lower income in some areas have started to outweigh those savings. To help manage this, we’ve included $17.5 million in savings in the new plan.

As we haven’t been able to fully cover all the rising costs, borrowings have increased together with related interest costs. We will continue to implement efficiencies and look for different ways to increase our income which can reduce the rates burden.

Capital Investment and funding

We plan to spend around $2.8 billion (an increase of $43 million) over the period of the 10 Year Plan. Of this spend, around 61% is on water services and 20% on transport. This significant capital investment will be funded largely by borrowings.

Graph 1 on the next page shows the planned capital investment, which is higher than the spending planned through the 10 Year Plan. This is due to changes in timing, as well as increased investment for the landfill and water services, a reduction in transport, and updates related to revised inflation adjustors. Some projects that were originally planned for the first three years have been slowed or pushed back to later years. These changes have helped reduce the impact on rates for 2025–26.

A balanced operating budget – everyday costs are paid for from everyday income

A guiding principle of our Financial Strategy is the importance of having a balanced operating budget. This means that ratepayers are contributing an appropriate amount towards the cost of the services they receive or can access, ie, everyday costs are paid for from everyday income. The 10 Year Plan originally projected that we would reach a balanced budget in 2028-29, but we are now projecting to meet this target in 2031-32, three years later, largely due to higher depreciation costs (See Graph 2). Higher asset values in the 2024 revaluation have led to increased depreciation costs, which impact our budget and long-term financial planning. We are not proposing to cover the additional depreciation costs immediately. The funding set out in the 10 Year Plan will ensure essential renewals are covered in the short term, helping to ease the financial burden on ratepayers.

The delay in reaching a balanced operating budget effectively means we are borrowing money to offset any funding shortfall until 2031-32. This provides a balance between managing the cost pressures on ratepayers and ensuring we remain financially sustainable into the future.

Borrowings

The change in the capital programme results in a corresponding adjustment in the level of borrowings we’ll require. Borrowing levels have increased further towards the limits set in our financial strategy, although they do not breach these limits. Careful management of our debt and borrowing limit will be needed over the coming years.

(See Graph 3)

Rates

The table below outlines the rates revenue increases included in the plan over the next nine years. The rates in out years have been adjusted to reflect updates through the Annual Plan. These proposed increases are also the equivalent Council limit on rates as required by the Local Government Act.

What does this mean for you and your rates?

The rates you pay make up most of the revenue we use to invest in our city. To ensure adequate investment in key areas, while taking affordability into account, we have reduced the 2025-26 rates revenue increase to 12.6% (after growth) compared to 13.4% (after growth) in the 10 Year Plan.

The rates revenue rise equates to an average increase of $8.90 per week per household, or an average increase of $463 per year.

Investment in infrastructure for water services makes up more than half of the increase at $248. The remaining $215 covers cost increases for all the other services we provide, such as roading, parks, community facilities, rubbish and recycling. The table below provides more detail about the increase and impact on an average property by category.

Indicative rates impact on average property by category:

Wastewater

and water supply targeted rates

Targeted rates have increased to fund the higher operational cost of these activities largely for interest costs related to the higher capital spend.

or

Waste services targeted rates

Targeted rates have increased to fund the higher operational costs of this activity. The main drivers of this are contract cost escalations, disposal cost for the landfill, and waste levy increase, all higher than planned.

*Separately used or inhabited part of a rating unit

Council does not meet the legislative balanced budget requirement as defined in s100 of the Local Government Act 2002 until 2028 of the plan (you can refer to our Financial Strategy for further details). The legislative calculation includes capital grants and subsidies which can only be applied to capital projects and cannot be used to fund everyday operational costs over the period. As Council is projecting to receive significant capital grants and subsidies over the period of the plan, the legislative calculation makes it appear that there is more income available to meet everyday operational costs than there actually is. Therefore, we have excluded capital improvement subsidies and capital grants from the graph to only show the projected operating balanced budget for everyday operational income and costs.

Graph 3 Forecast net debt

Hō Mātou Mahi

Our work

Oranga taiao Environmental wellbeing

Ngā puna wai

Water supply

Statements of service performance

What we do

Ensuring consistent and secure access to safe drinking water is an important concern for our community. To achieve this, Council’s committed to providing a sustainable, high-quality water supply for domestic and commercial needs. Our ongoing efforts involve close monitoring of water quality and undertaking necessary maintenance and upgrades to meet the required service standards.

The Greater Wellington Regional Council oversees the extraction, treatment, and bulk water supply to feed the city’s water supply system.

Why we do it

By delivering water that is of high quality and affordable, Council actively contributes to several crucial outcomes including:

• enhancing the overall health of the community

• ensuring community safety, particularly through the water supply system’s firefighting capabilities

• supporting industrial and residential development initiatives

Key performance indicators

Water supply

We want to ensure our community has access to a safe, clean, reliable water supply:

The extent to which the water supply will comply with part 4 of the New Zealand drinking water standards and the drinking water quality assurance rules (bacteria and protozoal compliance criteria). 1

Number of complaints received about water clarity, taste, odour, pressure, flow, and continuity of supply per 1,000 connections.

Resident satisfaction with the water supply service they receive.

Where the local authority attends a callout in response to a fault or unplanned interruption to its networked reticulation system, the following median response times are measured:

Attendance for urgent callouts: from the time the local authority receives notification to the time service personnel reach the site.

Resolution of urgent callouts: from the time the local authority receives notification to the time service personnel confirm resolution of the fault or interruption.

Attendance for non-urgent callouts: from the time the local authority receives notification to the time service personnel reach the site.

Resolution of non-urgent callouts: from the time the local authority receives notification to the time service personnel confirm resolution of the fault or interruption.

We need to ensure we have a sustainable water supply for the future:

drinking water consumption per resident per day.

Percentage of real water loss from networked reticulation system.

Kilometres of renewals for three waters infrastructure.

20 working days

20 working days

1 (Compliance with The Water Services (Drinking Water Standards for New Zealand) Regulations 2022 and DWQAR (Drinking Water Quality Assurance Rules 2022).

Capital projects Water supply

Prospective statement of comprehensive revenue and expense –

Prospective funding requirement

Rates funding requirement

Loan funding requirement

(funding)/ repayment

Waiparu Wastewater

Statements of service performance

What we do

Council plays a crucial role in the community’s wellbeing by collecting, treating, and responsibly disposing of wastewater. This service supports the growth and development of our city while ensuring the health of our residents and the protection of the environment.

We operate an extensive pipe network, and efficiently manage the flow of household and commercial effluent to the Seaview Wastewater Treatment Plant before the treated effluent is discharged into Cook Strait at the Pencarrow outfall.

Why we do it

By providing a reliable and responsible wastewater solution, we contribute to the development of our community and uphold the highest standards of public health and environmental protection.

This activity aligns with our commitment to fostering a thriving, sustainable city that prioritises the wellbeing of both residents and the natural environment.

Key performance indicators

It is critical our community is not exposed to any health or environmental risks associated with wastewater. We provide a safe, reliable, quality wastewater network:

Where the territorial authority attends to sewerage overflows resulting from a blockage or other fault in the territorial authority’s sewerage system, the following median response times are measured:

Attendance time: from the time the territorial authority receives notification to the time service personnel reach the site.

Resolution time: from the time the territorial authority receives notification to the time service personnel confirm resolution of the blockage or other fault.

Compliance with resource consents measured by the number of abatement notices, infringement notices, enforcement orders, and convictions from wastewater system.

enforcement action

enforcement action

Prospective statement of comprehensive revenue and expense –Wastewater

LOAN FUNDING REQUIREMENT

repayment

Waiāwhā Stormwater

Statements of service performance

What we do

Everyone is feeling the effects of a changing climate. Council is focused on controlling stormwater to keep people safe and minimise property damage during extreme weather events.

Through the provision of a comprehensive stormwater drainage pipe network, we effectively manage surface water run-off, offering flood protection and control.

Why we do it

Controlling stormwater is an important step in safeguarding the wellbeing of the community. Council’s objective is to create a resilient and safe environment by managing stormwater effectively.

By doing this, we also protect people, property, and the environment, while managing costs responsibly for the benefit of the community.

Key performance indicators Stormwater

We want to ensure our community can enjoy recreational assets:

Achieve water quality at main recreational beaches: percentage of days that monitored beaches are suitable for recreational use during bathing season – 1 December to 31 March.

We want to ensure our city has a safe, reliable, quality stormwater system:

Number of flooding events (where stormwater enters a habitable floor).

Number of habitable floors affected by flooding events (per 1,000 connections).

Number of complaints about stormwater system performance (per 1,000 connections).

Median response time to attend a flooding event, measured from the time the territorial authority receives notification to the time service personnel reach the site.

Resident satisfaction with the city’s stormwater system.

Compliance with resource consents for discharges from stormwater system (number of abatement notices, infringement notices, enforcement orders, and convictions).

Capital projects to meet additional demand

Capital projects to improve level of service

projects to replace existing assets

Prospective statement of comprehensive revenue and expense –Stormwater

Prospective funding requirement Rates funding requirement

Total rates funding requirement

LOAN FUNDING REQUIREMENT

Para Solid waste

Statements of service performance

What we do

Council’s role in solid waste management is important for keeping the community healthy, ensuring a high quality of life, and supporting a thriving environment.

The solid waste activity delivers on Council’s waste management objectives by:

• operating Council’s kerbside rubbish, recycling, and green waste collection service

• operating Silverstream Landfill

• monitoring and managing all of Council’s closed landfills

• investigating, trialling, and/or implementing new initiatives to reduce waste

Over the next 10 years, Council is working to improve our waste minimisation by partnering with other councils in the region to implement a Food and Green Organic collection service.

Why we do it

Solid waste management is integral to maintaining a healthy, vibrant community. By actively participating in waste management, we directly contribute to the overall wellbeing of our residents and the preservation of the environment.

Our commitment to waste minimisation reflects our dedication to creating a sustainable and eco-friendly community. Through the ownership and operation of the Silverstream Landfill, we take a comprehensive approach to managing solid waste.

Key performance indicators Solid waste

We are working to minimise the harmful effects of refuse:

Number of resource consent-related infringement notices received from Greater Wellington Regional Council.

We want to reduce litter and the negative impacts it can have on our natural environment and on our community’s health:

Number of illegal dumping complaints.

Tonnes of kerbside waste to landfill (tonnes per person).

Percentage of kerbside recycling that is contaminated and diverted to landfill.

Tonnes of kerbside recycling collected.

Overall resident satisfaction with Council’s rubbish and recycling services.

Prospective statement of comprehensive revenue and expense –

ending 30 June

Prospective funding requirement

Rates

Whakauka me te Manawaroa Sustainability and resilience

Statements of service performance

What we do

The climate change and sustainability activity is focused on changing the way we do things to improve climate outcomes across Council and for the community. This includes delivering on our Carbon Reduction Plan 20212031 and the Lower Hutt Climate Action Pathway.

The climate change activity delivers on Council’s climate change objectives by:

• providing advice to Council on climate change-related projects (such as the setting up of a Green Star requirement for the new Te Ngaengae pool)

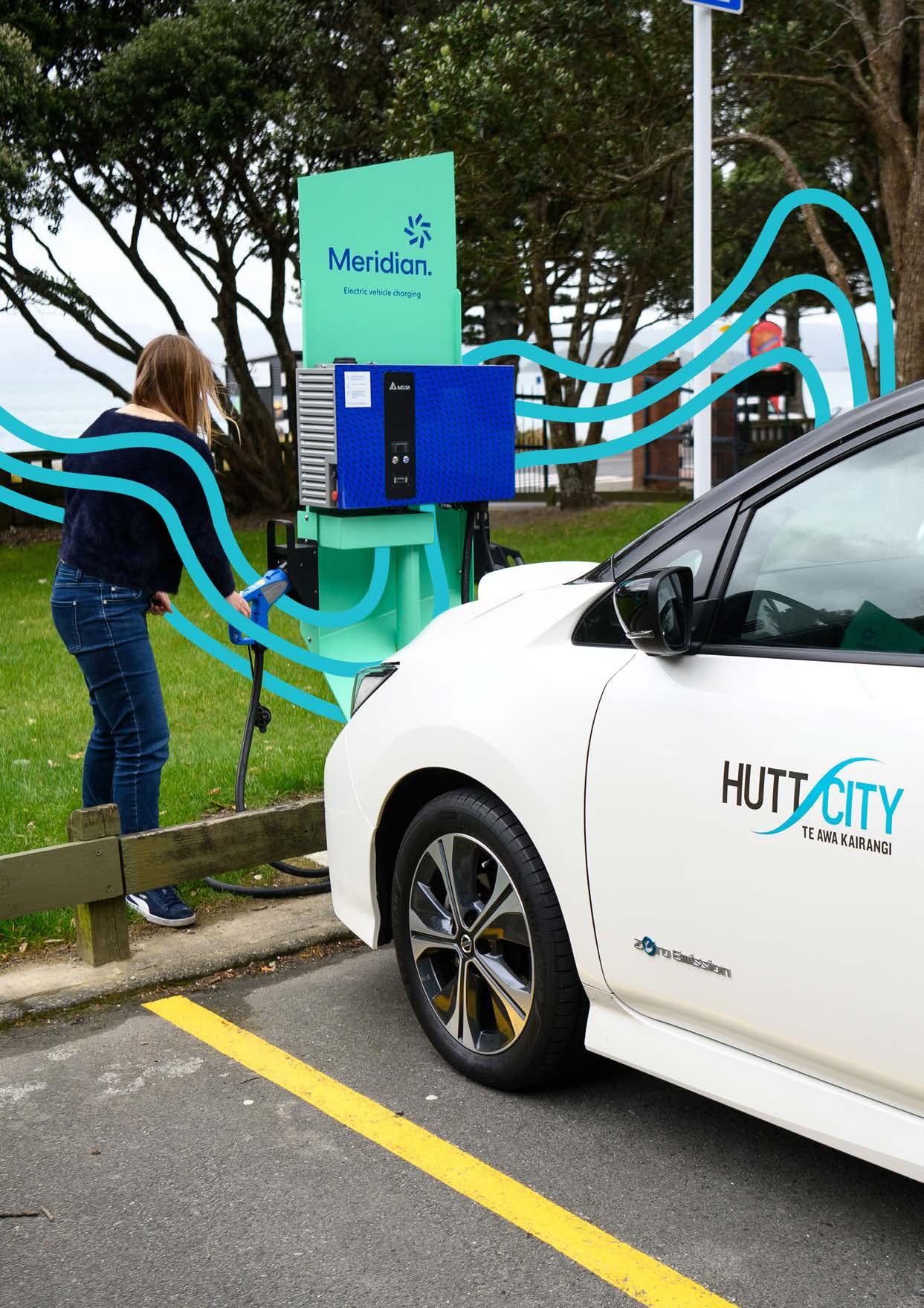

• managing and supporting projects to implement carbon reductions in line with Council’s Carbon Reduction Plan 2021-2031 and the Lower Hutt Climate Action Pathway (such as the EV charging station roll-out)

• delivering the Low Carbon Acceleration Fund to support the city to reduce its emissions faster

• managing and supporting regional projects, in collaboration with neighbouring councils (including the regional climate change impact and risk assessment, Regional Adaptation Plan, and Regional Emissions Reduction Plan

• monitoring Council’s carbon emissions (annual carbon footprint)

Why we do it

In order for Council’s climate change actions to be meaningful, Council and communities in Te Awa Kairangi ki Tai Lower Hutt must ultimately align with good practice.

The sustainability and resilience activities enable the delivery of emission reductions, in line with Council’s organisational zero by 2050 carbon target.

Key performance indicators

Sustainability and resilience Performance measure

Council is responding to the impact of climate change and contributing to the goal of a carbon zero city by 2050:

Emissions from Council-owned facilities (tCO2-e).1 30% reduction by 2025

Emissions from Council-owned fossil fuel vehicles (tCO2-e).2

Our city is prepared for an emergency and can respond appropriately:

reduction by 2025

EOC resourcing levels maintained at least at WREMO competency level targets. Advanced – 6

reduction by 2026

reduction by 2026

– 12 Foundation – 12 Controller – 6

– 18

– 16 Foundation – 50

1. Emission targets compared to 2016-2017 baseline.

2. Emission targets compared to 2016-2017 baseline.

Operating projects >$250K per year

Sustainability and resilience

Capital projects

Sustainability and resilience

Prospective statement of comprehensive revenue and expense –

Sustainability and resilience

Ngā Ratonga Waeture Regulatory services

Statements of service performance

What we do

Our statutory activities are essential for cultivating a clean, healthy, appealing, safe, and sustainable environment for residents and visitors. These activities encompass building and resource consents, environmental health, trade waste management, animal services, and parking control. We are implementing new systems and processes to improve the customer experience and speed of our consent processing. For example, our new customer portal, “Objective Build”, and new processing software, “Go Get”, will help streamline consenting processes in the future.

We ensure the safety of the community by inspecting various establishments to guarantee cleanliness and hygienic practices. This reduces the risk of food-borne illnesses and alcohol-related harm.

Additionally, we oversee health-related activities in industries such as tattoo studios and beauty therapy shops to mitigate potential health hazards.

We also address health nuisances and noise issues to maintain a healthy living environment for everyone.

Why we do it

Most of our functions are required through various pieces of legislation. While primarily focused on environmental wellbeing, these activities contribute directly to economic, social, and community safety outcomes. They play a crucial role in establishing and maintaining standards, promoting health and safety, and ensuring the welfare of our community. They are also aligning with our commitment to a vibrant and secure city.

Our activities aim to protect public health and the environment. Through the trade waste function, we manage wastewater and chemical hazards, responding promptly to water pollution incidents. By registering commercial properties that discharge liquid waste and charging users accordingly, we cover the expenses associated with waste treatment and disposal and ensure the safety of our waterways and surroundings.

Our animal services activities focus on enforcing regulations to ensure the safety of residents and the welfare of animals.

Finally, our parking services promote safe and efficient parking, ensuring fair access to public car parking spaces and enhance overall traffic management in the city.

Key performance indicators

Regulatory services

We need to ensure that new housing is safe and meets standards without delaying the process:

Percentage of building consents processed within statutory timeframe. 100% within 20 days 100% within 20 days

Code of compliance certificates issued within the statutory timeframe. 100% within 20 days 100% within 20 days

Percentage of non-notified resource consents processed within the statutory timeframe. 100% within 20 days 100% within 20 days

We want a community where everyone feels safe:

Existing food premises verified within timeframes (one month of due date). 85% by due date 85% by due date

Sale and supply of liquor (high-risk premises) inspected. 95% checked 95% checked

Noise control (excessive noise) complaints (%) investigated within 45 minutes. ≥ 85% ≥ 85%

Number of animal management community education programmes carried out yearly. ≥ 20 visits annually ≥ 20 visits annually

Prospective statement of comprehensive revenue and expense –Regulatory services

Capital Expenditure

Oranga ōhanga Economic wellbeing

Ngā waka Transport

Statements of service performance

What we do

The transport team oversees essential programmes aimed at maintaining, operating, and enhancing our transport system, and a continuous improvement approach for infrastructure development. Our focus prioritises road safety, encourages mode-shift in transport choice, improved travel options, with a specific emphasis on mitigating climate change and delivery of infrastructure projects in a timely manner. Our goal is to have a well-connected and modern transport system that accommodates all modes of transportation and ensures accessibility and connectivity throughout the city.

Why we do it

Our commitment is to future-proof our growing city for future generations. We strive to establish a resilient and interconnected transport system that offers increased accessibility and encourages alternative modes of transport (for example, Tupua Horo Nuku). Our efforts in road and traffic asset management, maintenance contracts, road safety services, and active modes aim to provide well-maintained roads, footpaths, and streetlights. This infrastructure facilitates efficient and secure travel for motor vehicles, bicycles, and pedestrians, aligning with our vision of a vibrant and connected city. We are also investing in projects to improve the resilience of our networks in the face of a changing climate. A good example is the work on Eastern Hutt Road which, when finished, will improve the reliability of the road to Council’s Northern suburbs.

Key performance indicators

We need to be able to travel along key routes efficiently:

Road condition index which measures the condition of the road surface.

The average quality of ride on a sealed local road network, measured by smooth travel exposure.

Percentage of sealed local road network that is resurfaced annually.

Percentage of footpaths that fall within the service standard for footpath condition.

Percentage of customer service requests relating to roads and footpaths that are responded to within the statutory timeframe. 80% within 7 days

Kilometres of shared pathways and cycle lanes added annually.

Kilometres of renewals for footpaths.

within 7 days

Infrastructure contracts managed by Council contribute to social outcomes:

of contracts – number of contracts audited.

Audit of contracts – percentage of audited contract specifications that met contractual obligations.

measure

We are working to strengthen our active transport network: Resident satisfaction with the footpath condition.

Resident satisfaction with on-road cycleway condition.

Resident satisfaction with shared path condition.

Resident satisfaction with the availability of car parking to access services and facilities (does not include access to residences).

Road safety services:

The number of fatalities and serious injury crashes on the local road network.

Capital projects

Capital projects to replace existing assets

Prospective statement of comprehensive revenue and expense –

Prospective funding requirement

Rates funding requirement

Loan funding requirement

asset sales

loan (funding)/ repayment

Whanake tāone City development

Statements of service performance

What we do

Providing essential services that cater for the needs of residents, businesses, and visitors is crucial for the economic development of Te Awa Kairangi ki Tai Lower Hutt. The City Development Group oversees various activities, including urban design, business support and city growth, housing, and the District Plan. This multifaceted approach ensures a comprehensive strategy for the city’s development and wellbeing.

Why we do it

Our commitment to enhancing the quality of life for residents drives our efforts. Easy access to recreational green spaces, Te Awa Kairangi Hutt River, and Te Whanganui a Tara Harbour contributes to our distinctive appeal. By supporting the business sector and promoting our city as a vibrant business location, we create a positive ripple effect, benefiting local enterprises and residents alike. Initiatives like placemaking, supported events, and collaborations not only add vibrancy to the city but also attract visitors. Collaborating with partners fosters better connectedness within our business community, facilitating skill development and capability enhancement for future growth. Overall, our work aims to create a thriving and interconnected community that contributes to the city’s economic prosperity and cultural richness.

Operating projects >$250K per year

City development

Capital projects City development

Wai Takamori o Te Awa Kairangi (Formerly RiverLink)

Prospective Statement of Comprehensive Revenue and Expense –City development

Oranga Hapori me te

Oranga Ahurea

Social & Cultural wellbeing

Hō mātou rangapū hapori me te mahi ngātahi

Community partnering and support

Statements of service performance

What we do

Ensuring the prosperity of our city hinges on the creation of secure, interconnected, healthy, inclusive, and resilient neighbourhoods and communities. Recognising the important role communities play in fostering a sense of belonging and purpose, Council is committed to supporting local groups to improve their overall wellbeing.

Through our hubs, recreation, and digital connection, community and agency initiatives we actively support wellbeing-focused services and programs. Collaborative initiatives aimed at enhancing social and cultural wellbeing play a crucial role in fostering community connectedness and a sense of belonging.

Council’s role is to oversee the implementation and ongoing review of the Homelessness Strategy for Te Awa Kairangi ki Tai Lower Hutt. We collaborate closely with partners and service providers to address homelessness effectively, with a particular focus on supporting individuals and families experiencing homelessness.

Why we do it

Our commitment to community wellbeing is seen through collaborative efforts with local communities to facilitate and support local initiatives. We want to help establish a collective community voice on specific issues and foster collaboration with groups and agencies across Te Awa Kairangi ki Tai Lower Hutt.

Council’s facilities such as hubs contribute to the wellbeing of our people and vitality of the city by:

• providing recreation opportunities that enhance individual health and wellbeing, including personal development and quality of life

• attracting visitors and therefore providing economic benefits to the district

A primary objective is to ensure that individuals and families facing homelessness have the necessary support and resources to secure stable housing. We prioritise prevention efforts to minimise the occurrence of homelessness and strive to create a community where everyone has access to safe and secure housing.

Key performance indicators

Community partnering and support

We are working to help people facing homelessness and housing hardship:

Number of Te Awa Kairangi ki Tai Lower Hutt households assisted into more settled accommodation.

Number of households provided with legal housing advice and advocacy. 80

Number of households assisted by the homelessness prevention programme. 75

We provide safe spaces for social, leisure, and educational activities:

Number of neighbourhood hubs that met visitor number targets. 9 of 9

Resident satisfaction with neighbourhood hubs.

Number of community wellbeing activities delivered by, or in partnership with Council.

Number of overall loans from hubs/libraries.

Number of digital literacy programmes/activities delivered/ enabled.

Number of early years literacy programmes/activities delivered/ enabled.

Number of Neighbourhood Support member households.

80%

5,000

790,000

of 9

5,000

790,000

Capital projects

Community partnering and support

Prospective

Papa rēhia me ngā whenua tāpui Open spaces, parks and reserves

Statements of service performance

What we do

We are responsible for creating an attractive living environment in Te Awa Kairangi ki Tai Lower Hutt. This is seen through the provision, development, maintenance, and protection of open spaces, parks, reserves, sportsgrounds, street gardens, and street trees.

These areas not only enhance the aesthetic appeal of our city but also serve as important venues for recreation, gatherings, and informal social occasions.

Why we do it

Council understands the impact of sport and recreation on the wellbeing of individuals, both physically and psychologically. We actively contribute to the development and maintenance of an extensive reserve network. These reserves not only foster a healthy natural environment but also serve as a platform for bringing people together for social activities. Through sportsgrounds, civic parks, neighbourhood parks, bush reserves, cemeteries, playgrounds, the foreshore, street trees, and gardens, we strive to create a pleasant environment accessible to the entire community.

For example, in Council’s bush reserves, we focus on creating connected native habitats that host a diverse range of native species. This collaborative effort aligns with the broader initiatives of entities such as Greater Wellington Regional Council and the Department of Conservation (DOC), collectively contributing to the preservation and enhancement of our natural heritage.

Key performance indicators

Open spaces, parks and reserves

We provide leisure and recreational opportunities to our community

Number of days Council-owned/maintained artificial turf sports fields are closed (due to maintenance issues).

Number of days Council-owned/maintained grass sports fields are closed (due to maintenance or drainage issues).

Capital projects

Open spaces, parks and reserves

the year ending 30 June

Prospective funding requirement

Rates

Ngā herengatanga, auahatanga, akoranga me ngā mahi a te rēhia

Connectivity, creativity, learning, and recreation

What we do

Council plays an important role in providing spaces and facilities that serve as hubs for connection, creativity, learning, and enjoyment. Our extensive network of swimming pools, fitness centres, art spaces, and museums form the beating heart of the communities they serve.

Community wellbeing is enhanced through swimming pools, fitness suites, Swim City Swim School, and related programmes.

These facilities provide spaces where residents and visitors can recreate, relax, connect, improve fitness and health, build water confidence and the ability to swim, and have fun.

Why we do it

Overall, facilities contribute to enhancing cultural life, diversity, and wellbeing. They foster civic pride and promote strong community values. This focus on community strength and resilience ensures a sustainable and prosperous future for our city.

Council’s focus on providing high-quality library services, and museums stems from the belief that everyone should access information, knowledge, arts, and culture. By offering these resources, we aim to support and enrich individuals and the broader community.

Recognising the positive impact of recreation, sport, and fitness on people’s lives, we ensure the provision of high-quality services at a cost that helps make them accessible for the entire community.

Aquatic and fitness facilities contribute to the wellbeing of our people and vitality of the city by:

• increasing social cohesion and people’s sense of belonging and healthy communities that can result from the social interaction that occurs at aquatic facilities

• providing learn to swim programmes (particularly for children) which is considered a vital public service to promote safety and prevent accidental drowning

Key performance indicators

Connectivity, creativity, learning, and recreation

We provide our community with access to a leisure and recreational opportunities:

of pools that met visitor number targets.

of 6

Capital projects

Connectivity, creativity, learning, and recreation

Kāwanatanga, ko te rautaki me ngā kīwei o te kete

Governance, strategy, and partnerships

Statements of service performance

What we do

Council plays a crucial role in local democracy, defined by the Local Government Act (2002), and has two primary objectives:

• firstly, we are committed to enabling democratic local decision-making

• secondly, we are dedicated to promoting the wellbeing of communities through a sustainable development approach

Our aim is to empower diverse communities to participate actively in local decisions. This is how we ensure democratic processes are upheld and remain accountable to our community.

We provide elected members with the essential support and professional advice they need to make sound decisions for the city. Our dedication to democratic principles isn’t just a legal requirement, but a representation of our aspirations for a city that’s inclusive and promotes active public involvement.

Why we do it

Council’s governance activities are driven by a commitment to enhancing the wellbeing of our communities both in the present and for future generations. The Local Government Act (2002) requires us to recognise and respect the principles of the Treaty of Waitangi, emphasising the Crown’s responsibility to incorporate these principles. As a result, our partnership with Mana Whenua is essential in meeting our obligations and fostering a city where everyone thrives.

To achieve these goals, we engage in comprehensive governance-related services, strategic planning, policy development, and continuous monitoring and reporting. Our work aims not only to fulfil legal obligations but to create an inclusive, resilient environment that supports the diverse needs of our community members.

Key performance indicators Governance, strategy, and partnerships

Our community is provided with the information they require to participate in the democratic process:

Percentage of Council agendas made available to the public within statutory timeframes (four clear working days under Council’s standing orders).

Resident satisfaction with access to the decision-making process.

Residents feel they have enough information to participate in democratic process.

80% ≥ 80%

80%

the year ending 30 June

Ratonga Rangatōpū

Operating projects >$250K per year Corporate services

Capital projects

Prospective statement of comprehensive revenue and expense –

Prospective funding requirement

Loan funding requirement

Ngā whakapae hirahira kua matapaetia Significant forecasting assumptions

Assumption Risk

Environmental impacts

The Annual Plan is prepared on the basis that Council services are operating in an environment not impacted directly by any pandemic events like COVID-19.

Disruption caused by COVID-19 or a similar pandemic will result in changes or closure of Council operations, resulting in reduced revenue or delays in projects.

Wider economic disruption will impact the affordability of rates and levels of non-payment.

Inflation

Annual inflationary increases are based on the annual Local Government Cost Indices (LGCI), as published in the final October 2024 BERL Report. LGCI for each year is detailed below.

Actual LGCI for the year significantly differs from that included in the budgets.

Level of uncertainty

Low

Moderate

Pandemic events are by nature unanticipated; however any uncertainty will be higher in the short term and decrease over time.

Financial impact of the uncertainty

Disruption to Council operations may result in reduced revenue from fees to fund Council activities.

The LGCI estimates used are the forecasts issued by BERL in 2024.

Unanticipated inflationary pressure could arise outside of the forecast LGCI range which is not included in the 10 Year Plan 2024–2034, resulting in higher costs to deliver services or projects.

Assumption Risk

Employee cost assumptions

The salary increase assumption is 3.5% for the first two years of the Annual Plan with 2.5% for the remaining years. This is to enable Council to retain staff and meet market conditions as well as our obligations as a Living Wage accredited employer. This is offset with a vacancy savings assumption of 5.5%.

Growth

Council projections for income from rates revenue include an allowance for growth and inflation. Average growth of 0.9% per annum in the rating base is assumed. This is considered to be a reasonable estimate given population growth forecasts and increases in the number of households in Lower Hutt and Sense Partners data from March 2023. When the next dataset becomes available this assumption will be reviewed.

Population growth

The population of the city at the 2018 Census was 104,532. Our current population at the 50th percentile is estimated at 113,034 (8% increase) and is projected to reach 125,000 around 2033 and 149,760 in 2053. This is based on Sense Partners data from March 2023. When the next dataset becomes available this assumption will be reviewed.

Interest rates

The long-term cost of borrowing is assumed to be an average of 5% through the period of the Annual Plan.

Due to the volatility in market conditions this requires regular reviews and updates.

The actual employee costs are significantly different from the projected costs or vacancy savings are not realised.

Level of uncertainty

Moderate

The actual rates for growth are significantly different from the projected rates of growth.

Moderate

Uncertainty exists as the ability to attract and retain staff is dictated by the labour market conditions.

Financial impact of the uncertainty

Higher employee costs or lower vacancy savings will result in unbudgeted financial pressures.

Population growth rates exceed or are less than forecast.

Moderate

Uncertainty exists as the projected increases in population and the associated number of houses may not be realised.

Rates of growth that vary significantly from the assumed level will result in unbudgeted financial pressures.

Uncertainty exists as the projected increases in population and the associated number of houses may not be realised.

Rates of growth that vary significantly from the assumed level will result in unbudgeted financial pressures.

Interest rates and swap rates are significantly different from those budgeted.

Moderate Council has interest rate swaps in place to minimise the fluctuation of interest rate movements. As debt projections are forecast to increase significantly over the remaining period oof the plan there will be further interest rate swaps to be put in place; there is uncertainty about the future market conditions that will exist.

Higher interest rates provide the ability to earn higher income from cash holdings. Higher interest rates may lead to higher interest cost on debt.

Based on Council’s planned borrowing profile, a 0.1% movement in interest rates will increase/decrease annual interest expense by between $0.6M to just over $1.2M per annum across the 9-year period of this plan. The impact of this annual change would translate to an indicative rates impact of around 0.4% - 0.8%.

Natural disasters and insurance costs

Council has comprehensive insurance policies, which are designed to provide substantial, but not total, cover from the financial impact of natural disasters. The level of insurance cover is calculated by extensive loss modelling, which estimates the maximum probable loss.

Council collectively purchases insurance with the Wellington Councils Insurance Group (includes Kāpiti Coast District, Porirua City, Upper Hutt City, and Greater Wellington Regional Councils).

Asset revaluation

It is Council’s policy to assess the carrying value of its revalued assets annually to ensure they do not differ materially from the assets’ fair value. Revaluations are carried out every three years. For further information see Council’s accounting policies. Council engaged two valuers to independently value various significant classes of Council assets in accordance with its accounting policies to support the preparation of the Annual Report 30 June 2024. The valuers finalised the work in October 2024. Value of three waters assets in particular and depreciation costs have increased significantly as a result. These changes are incorporated into the Annual Plan 2025-2026. The prospective Financial Statements currently include estimated revaluations based on indicative information received from our valuers as at October 2024. This assumption is unchanged from the 10 Year Plan 20242034.

The damage exceeds the cover obtained by Council and its ability to fund the repair/ reconstruction out of normal budgetary provisions. The cost of insurance increases more than budgeted.

Moderate The timing or scale of a natural disaster event cannot be predicted.

Should an event occur, there is uncertainty over whether the city is able to recover sufficiently or quickly enough in order to prevent long-term adverse effects on the population or local economy.

The damage exceeds the cover obtained by Council and its ability to fund the repair/reconstruction out of normal budgetary provisions. The cost of insurance increases more than budgeted.

Asset revaluations differ from those budgeted; depreciation charges resulting may differ. Low Market buoyancy and property pricing influences the value of the property assets. Contract and construction prices influence the value of infrastructure assets.

A higher level of asset valuation means more depreciation to use to fund asset renewals and some improvements, however this is limited by the actual level of depreciation funded through rates.

Lower levels of valuation and depreciation reduce Council’s ability to fund capital from depreciation and place more reliance on funding improvements from other funding mechanisms, such as debt or rates. Depreciation rates are contained in accounting policies.

Assumption Risk

Asset sales

A small amount of asset sales is planned for surplus land following completion of Council projects.

Asset lives

The estimated useful lives of significant assets will be as shown in the Statement of Accounting Policies. The assets will continue to be revalued every three years. It is assumed that assets will be replaced at the end of their useful life. Ranges in average ages relate to the variability of component parts of assets and changing material and design of assets over time.

Property prices are higher or lower than the planned sales amount.

Level of uncertainty

Moderate Market buoyancy and property pricing influences the value of the property assets.

Financial impact of the uncertainty

A higher sales price would result in a gain on the sale made by the Council. Lower prices would result in greater costs having to be absorbed by rates.

Assets wear out earlier or later than estimated.

Moderate-Low

The level of certainty of useful lives of assets ranges across different asset types. Underground assets that are not easily accessible have lower levels of confidence on their current condition and therefore expected remaining useful lives whereas aboveground assets have more certainty on their condition assessment and the useful life.

Depreciation and interest costs would increase if capital expenditure was required earlier than anticipated.

Asset condition

The condition of the network is expected to improve over the period of the 10 Year Plan. Assumptions have been made regarding the average useful lives (per assumption around asset lives above) and remaining lives of the asset groups, based on the current local knowledge and experience, asset condition information and historical trends.

Detailed condition assessments for underground three waters assets may reveal that they have aged faster than our theoretical modelling anticipates.

Moderate By their nature underground assets are not visible and therefore condition information of these assets is not easily obtainable.

In the Annual Plan additional funding continues to be assigned for investigative works to ensure we have a sufficient understanding of our underground assets.

Sources of funds

See Council’s Revenue and Financing Policy, included in the 10 Year Plan 2024–2034.

Waka Kotahi NZ Transport Agency (NZTA)

The Waka Kotahi New Zealand Transport Agency subsidy is 51% for both operating and capital works. For projects not fully subsidised by NZTA, a lower subsidy applies.

Based on the actual funding approved for the next three years the subsidy rates have not changed but funding of $22M has been reduced. As a result of this, programmes have been revised, delayed, and stopped over the next three years to minimise negative financial impacts.

Current funding patterns and subsidy percentages may change during the life of the Annual Plan.

Low

The impact of funding priorities on projects may change criteria based on new legislation or government priority settings.

Assets that have aged faster than planned may result in the requirement for renewal work to be brought forward to avoid the impact of asset failures.

Any reduction in subsidy rate would lead to a reduction in the work programme, reprioritisation of projects, or Council having to fund a higher share of the costs.

Assumption Risk

Fees and charges

Fees and charges are expected to be increased at a minimum to cover the costs of operating the activity (in line with the Revenue and Financing Policy) and factor in rising costs.

Central government funding

Budgets have been prepared including funding from the COVID-19 Response and Recovery Fund for Tupua Horo Nuku (Eastern Bays Shared Path) of $12.7M ($30M in total over the life of the project).

Budgets also include funding from the Infrastructure Acceleration Fund of $99M towards growth wastewater and stormwater projects on the valley floor.

Level of debt

The Financial Strategy sets limits on net debt* at 250% of total revenue* for the period of the 10 Year Plan. Net interest must be less than 15% of total revenue* and less than 25% of rates revenue.

*as per the Financial Strategy

Climate change

The changing climate will affect the city and Council infrastructure due to a wide variety of climate impacts.

Fees and charges do not increase in line with the Revenue and Financing policy recovery rates.

Level of uncertainty

Reason for the uncertainty

Low Funding choices for individual activities lead to lower than required increases in fees and charges.

Financial impact of the uncertainty

Cost increases at a higher rate than the increases set for fees and charges would result in the need for funding from other sources such as rates to cover shortfalls.

Funding requirements are not met and therefore funding from central government does not eventuate.

Low Receipt of this funding is dependent on continued government support for the scheme, as well as Council meeting specific milestones as the projects are completed.

Any change in the level of grants received would require the funding gap to be made up from borrowing or for projects to reduce in scope.

Higher debt levels lead to higher servicing costs.

Moderate Council’s ability to service debt from existing funding sources reduces.

Change in the capital programme, the service levels offered by Council, or rates revenue requirements may lead to a change in debt levels.

Climate change impacts such as sea-level rise and increased rainfall intensity will impact on the city, including Council infrastructure.

This has flow-on effects, such as capital and operational cost increases to maintain functional infrastructure.

Social, economic, cultural and environmental impacts will also be felt by residents, businesses and visitors.

Moderate In the short to medium term (10–30 years), impacts are relatively certain (eg, the sea level is rising slowly), but resulting impacts are still fairly limited. Impacts are less certain in the longer term, but likely to be more severe.

The timing of when climate change impacts will significantly impact the city and Council’s infrastructure is relatively uncertain. In addition, if global emissions are not reduced quickly, the scale of impacts is likely to increase beyond those that are already reasonably certain.

Initiatives to optimise environmental outcomes for Lower Hutt inhabitants may be too expensive to progress in a financially constrained environment; but lack of investment now is very likely to lead to worse outcomes in the future (eg reducing emissions quickly comes at a cost but can avoid those climate impacts that are not yet locked in).

Uncertainty of the timing and ultimate scale of impacts will affect the timing and scale of forecast capital and operational expenditure, asset impairment, and reduced useful life of infrastructure assets in areas vulnerable to the harm of climate change-related events.

Water Services transition

The Water Services transition programme with Council moving to a new entity with a regional Water Services Delivery Plan (WSDP) is in planning with a range of uncertainties that are being worked through. It is currently proposed to be effective 1 July 2026.

It is important that investment in the council’s water services is continued in the interim and has been included in the Annual Plan. Once the regional model is further progressed this assumption will be revised and updated to reflect any approved changes.

The delivery model may not be feasible resulting in the transition not being progressed or may not result in as large finance benefits for Council as envisaged. Low

There is some degree of uncertainty around the nature of this change.

Any resulting change may impact revenue, expenditure assets and liabilities that Council presents, however the activity will continue, led by any new entity created.

Capital programme achievability

Our plan largely assumes that the programme can be achieved over the life of the plan with an adjustment to budgets to reflect 75% funding and delivery assumption per year.

Three Waters programme is assumed to be 100% delivered for the first two years of the plan and reverts to 75% delivery per year thereafter.

Council is projecting a significant capital programme to achieve the outcomes proposed in its 10 year Plan 2024-34.

The planned capital programme is not able to be fully achieved over the life of the Annual Plan.

The increase in demand on contractors to achieve the programme may result in cost increases.

While investments have been made in funding resources to support delivery and taking actions alongside our partners to manage the increased expenditure effectively, there are risks due to the increase in scale of the capital programme that there is not sufficient contractor availability or internal Council resource to support the delivery of the programme within the timeframes and projected costs included in the Annual Plan.

Delays in projects can result in additional costs, including costs of retaining project staff for longer periods and inflationary impacts.

The additional demand for contractors from the Council and in the region may impact market conditions and increase the cost of obtaining contractor services.

Ngā ringaringa me ngā

waewae o Te Kaunihera

Council-controlled organisations

Seaview Marina Limited

Objectives:

Council’s objective for Seaview Marina Limited (SML) is for it to own and operate Seaview Marina.

Nature and scope of its activities:

SML is responsible for the operation of the boating facilities and services, the maintenance of infrastructural assets, and the development of additional facilities and services as demand dictates.

Council requires SML to own and operate Seaview Marina as a facility for the enjoyment of Te Awa Kairangi ki Tai Lower Hutt community and to support charitable non-profit ventures with a marine focus without compromising its commercial objectives and environmental responsibilities.

Key performance indicators

Non-financial

12 To provide financial or non-financial support to at least three charitable (non-profit) ventures with a marine focus during any given financial year.

13 Public benefit

Environmental

14 Reduce direct emissions by 50% by 2030, and achieve net zero emissions by 2050: targets to be updated following initial analysis

Support for at least three organisations

Perform survey of public opinion on marina facilities (during third quarter)

Support for at least three organisations

Annually

Biannually

15 Fleet and equipment

Using 2024-25 analysis, identify the emission sources, and complete a 5-year plan for 50% emissions reduction

Equipment or vehicles utilising fossil fuels to be phased out by equipment or vehicles that are electric or utilise other low carbon alternative

Implement quick, low cost, and effective changes while planning continues for major upgrades. Finalise 3-year emission reduction targets

Equipment or vehicles utilising fossil fuels to be phased out by equipment or vehicles that are electric or utilise other low carbon alternative

Annual carbon footprint report provided to HCC

Annually

Notes to Performance Measures

1. Return on equity is defined as surplus/(deficit) before tax and dividends and excluding losses or gains arising from the revaluation of similar assets within an asset class, divided by the opening balance of equity at the start of the year.

2. Excludes carry forward of expenses on projects from prior years, unless specifically budgeted for (eg, where the project spans two or more fiscal periods). Refers to the total capital budget.

Urban Plus Limited

The Urban Plus Group comprises Urban Plus Ltd (UPL), UPL Developments Ltd, and UPL Ltd Partnership.

Objectives:

Council’s objective for UPL is for it to own and operate a portfolio of rental housing and develop property in preparation for sale or lease. The company’s activities include property development, rental property management, provision of strategic property advice to Council, and the purchase of surplus property from Council for development.

Nature and scope of its activities:

UPL was established in 2007 as a specialist property company charged with supporting the objectives of Council by providing housing outcomes for Te Awa Kairangi ki Tai Lower Hutt. UPL has managed and invested into its portfolio of social housing since it took ownership of the portfolio from Council in 2007. UPL also provides specialist property services and advice to Council and is involved in a range of development activities.

UPL’s primary focus has been on delivering social housing for low-income elderly and releasing affordable and market housing for sale. Council’s expectation is that UPL continues the delivery of wider housing outcomes and benefits.

Key performance indicators:

Rental housing

1.1 Capital expenditure within budget.

1.2 Operational expenditure within budget.

1.3 Net surplus before depreciation and tax and after finance expenses as a proportion of the net book value of residential land and buildings at the start of the year – greater than 1.5%.

1.4 Tenant satisfaction with the provision of the company’s rental housing greater than or equal to 90%.

1.5 Percentage of total housing units occupied by predominately low-income elderly1 greater than or equal to 80%.

1.6 Annual rental increases to be no greater than $50 per week per unit.

1.7 Increasing the portfolio size by a minimum of ten units per annum.

1.8 Any rental housing units purchased and not already utilising electricity or renewable sources of energy for space heating, water heating, and cooking facilities shall be converted to utilise only electricity or renewable sources of energy within five years of acquisition.

1.9 New rental housing units constructed by UPL to utilise only electricity or renewable sources of energy for space heating, water heating, and cooking facilities.

Property development

1.10 Capital expenditure within budget.

1.11 Operational expenditure within budget.

1.12 All new developments shall only utilise electricity or renewable sources of energy for space heating, water heating, and cooking facilities.

1.13 All new housing units (standalone house or townhouse) shall achieve a certified HomeStar design rating of at least six stars or equivalent.2

1.14 A pre-tax return of not less than 15% on development costs including margin and contingency on housing released to market (except where the Board and Shareholder agree otherwise to achieve specified objectives).

1.15 Value of divestment to Community Housing Providers (or socially like-minded organisations) set at each project’s development cost (includes contingency and GST) plus a margin of no greater than 12.5% (except where the UPL Board and Shareholder agree otherwise to achieve specified objectives).

1.16 Long-term public rental accommodation pre-tax returns at no less than (or equal to) 3.0% after depreciation (delivery of new housing units via UPL development projects).3

Professional property advice