Foresight: The ability to see what is likely to happen in the future and to take appropriate action. At Hummel, we draw on our decades of experience, varied expertise, and relationships to help our clients exercise foresight to protect their financial futures. We hope you enjoy a small taste of that foresight through this quarterly publication.

Carriers Are Tightening Cybersecurity Control Requirements

By Rochelle Yoder, IT Director and Thomas C. Yoder, J.D., Business Account Executive

Proactive Planning for Open Enrollment Success

By Deb Schlabach and Morgan Dey, Benefits Account Executives

By Steven Thomas Smith, Benefits Account Executive

By Chris Ramsburg, CPCU, Principal & Commercial Risk Advisor

Helping People Plan with Purpose

Navigating Medicare’s Annual Election Period Licking County Alcoholism Prevention Program (LAPP)

CREDITS FOR BUSINESS OWNERS

New Ways to Incentivize Retirement Saving By Peyton Gentry, AIF, Financial Advisor

Inside the World of Hummel Group’s Passionate Collectors

With Brock Hostetler, Principal & Business Risk Advisor & Cody Mast, Principal & Chief Operating Officer

By: Rochelle Yoder, IT Director, and Thomas C Yoder, J.D., Business Account Executive

As professionals working daily at the intersection of insurance and cybersecurity, we have seen firsthand how quickly the landscape is changing. Cybercriminals are becoming more sophisticated, and insurance carriers are responding with stronger, more detailed requirements for businesses seeking cyber coverage. In this article, we outline the most critical controls insurers are requiring today, explain why they matter, and share insights from our perspectives—one rooted in insurance underwriting and claims and the other grounded in practical cybersecurity implementation.

From the carrier side, multi-factor authentication (MFA) is the number one requirement. Insurers expect MFA for all remote network access, email accounts, and—just as importantly—privileged or administrative accounts. Without this, it’s nearly impossible to secure coverage.

From a cybersecurity standpoint, not all MFA is equal. SMS text messages and email-based codes are too easily intercepted through SIM-swapping, compromised inboxes, or phishing. Stronger options, such as authenticator apps, provide more protection. However, even these can be bypassed if a user is tricked into entering a code on a fake login page. Another strong MFA option is a physical device known as a FIDO2 security key - a popular brand is YubiKey.

To strengthen MFA, we recommend adding:

• Conditional Access Policies – such as blocking impossible travel (e.g., logins from Ohio and Virginia within 10 minutes),

• Geographic Restrictions – to prevent logins from high-risk regions,

• Device Restrictions – allowing access only from companyowned and domain-joined computers.

Backups are the second most important control carriers look for. Secure backups protect against ransomware, data corruption, and human error. Still, they only work if they are separated from the primary network. Air-gapped backups (kept off the main corporate network) or cloud-based backups with separate credentials are critical. Otherwise, attackers can encrypt or delete them before launching ransomware.

In our experience, carriers often prefer businesses that use multiple backup methods—for example, one local and one cloud. They also want to know that backups are password protected, MFA enabled, and tested regularly.

From a cybersecurity perspective, we advise businesses to:

• Verify Daily – that backups have occurred,

• Test Quarterly – by restoring files or servers,

• Use Immutable Backups – that cannot be altered once created.

These practices ensure backups will actually be there—and usable—in a crisis.

3. ENDPOINT DETECTION AND RESPONSE

Traditional antivirus software is not enough. Carriers are increasingly requiring Endpoint Detection and Response (EDR), which does not just detect threats but also actively blocks or quarantines them.

Depending on size and industry, businesses may also need:

• Managed Detection and Response (MDR) – a 24/7 outsourced security team that monitors and responds in real time.

• Extended Detection and Response (XDR) – which covers endpoints, as well as networks, cloud environments, and email systems.

These practices ensure backups will be there — and usable — in a crisis.

Email remains the number one attack vector. Basic filtering reduces spam and blocks obvious malicious attachments or links, but dealing with today’s threats is far more complex.

We suggest advanced filtering that includes impersonation protection and AI-driven analysis to detect lookalike domains, fake invoices, an gift-card scams. Insurers may not always require this for smaller businesses, but as revenue grows, so does the expectation for stronger filtering.

The challenge lies in balance: Some employees will complain that filters are too strict, others not strict enough. This makes fine-tuning, education, and ongoing adjustments necessary.

Rochelle Yoder

5.

If your business stores large amounts of PII (personally identifiable information), PHI (personal health information), or PCI (payment card information), insurers will require encryption at rest.

Fortunately, many tools are built in. Microsoft BitLocker, for instance, is included in Windows and can prevent data theft if a laptop is stolen. Similarly, mobile devices have encryption tied to passcodes or biometrics.

More than 70% of breaches are caused by social engineering. Carriers know this, which is why they expect businesses to have employee training programs in place. Quarterly training is ideal, but culture is more important than frequency. Training must be supported by leadership—if executives do not follow the rules, employees will not either.

WE RECOMMEND:

• Simulated phishing campaigns, followed by immediate feedback

• Policies requiring phone verification of all payment or banking changes

• Incentives for departments that pass phishing simulations

Ultimately, people are the last line of defense, and training is critical.

A major trend we are seeing is insurers conducting their own vulnerability scans and penetration tests during underwriting. This ensures the answers on applications match reality.

We strongly support this shift. Too often, smaller companies guess when completing questionnaires. External scans give both the carrier and the business a clearer picture of risks.

While sometimes overlooked, patching policies are something insurers are asking more about. They want to know the following: How quickly do you apply emergency patches? How often do you update systems? From our perspective, critical patches should be applied immediately. Regular updates should be weekly or biweekly and never less than monthly.

Meeting carrier requirements is essential, but going further improves resilience and often reduces premiums.

WE RECOMMEND:

• Single Sign-On (SSO)– for centralized logins and auditlogs

• Conditional Access Policies – tied to geography and device compliance

• Regular Audits – to ensure MFA stays active

• Data Retention Policies – to delete unneeded sensitive information

• Centralized Logging – to streamline breachinvestigations

Despite all controls, there’s no such thing as 100% protection. People remain the biggest vulnerability. We liken cybersecurity to fire prevention: You can install alarms, sprinklers, and noncombustible materials, but human error can still cause a fire. The goal is not perfection but resilience—reducing risk and ensuring rapid recovery when incidents occur.

FINAL THOUGHTS: PRACTICAL ADVICE FOR BUSINESSES

1. Don’t Guess on Applications – inaccurate answers can lead to denied claims.

2. Prioritize MFA and Backups – these are the top requirements.

3. Test Regularly – include backups and phishing simulations.

4. Build a Culture of Security – leadership must lead by example.

5. Treat All Systems As Entry Points – don’t forget systems without regulated data.

6. You Don’t Always Need New Software –sometimes turning on the protections you already have is all it takes.

For small businesses especially, the path to coverage may feel daunting. But as Tom often reminds clients: “You don’t need an in-house IT department to qualify. Having the basics in place—MFA, secure backups, and regular updates—can be enough.”

From our combined perspectives in insurance and cybersecurity, one truth is clear: Insurers are not just underwriting risk anymore. They are driving businesses toward stronger, more consistent, and more verifiable cyber practices. For policyholders, meeting these requirements isn’t just about coverage—it’s about survival in today’s digital threat environment.

By Deb Schlabach - Benefits Account Executive and Morgan Dey - Benefits Account Executive

As the calendar turns toward fall, we know that employers and employees alike face the critical season of open enrollment. This annual period offers the chance to review, adjust, and renew health and benefits coverage for the coming year. For many organizations, the process can feel daunting—but with preparation and strategy, open enrollment can become an opportunity to engage employees, enhance satisfaction, and streamline administration.

Drawing from our experience as advisors at Hummel Group, we want to share practical guidance for navigating open enrollment effectively. Our focus is on preparation, communication, technology, and compliance—all with the goal of helping employers and employees make informed decisions.

We encourage organizations to begin preparing for open enrollment months in advance. The most effective employers debrief right after the prior enrollment closes, noting what worked well and what could be improved. By midyear, begin formal planning. In our experience, three to six months ahead is a realistic timeline. This allows time to finalize plan designs, ensure compliance, and organize communication materials.

Employees also benefit when preparation starts early. Open enrollment impacts entire households, especially when spouses have coverage opportunities of their own. Giving families enough time to compare options leads to betterinformed decisions.

COMMUNICATION:

Clear and consistent communication is one of the most important factors of successful open enrollment. We strongly recommend against a single meeting or email announcement. Instead, use multiple touchpoints—emails, printed materials, intranet updates, virtual meetings, and inperson sessions. Don’t forget spouses or partners. They are often a key part of the decision-making process, and when their families are included, employees feel more confident in their choices.

Digital benefit administration platforms (ben admin systems) have transformed how open enrollment is managed. These tools give employees a clear, user-friendly view of their options and costs—often in a format that feels as simple as an online shopping cart. Employees can instantly see how a change in their benefits will affect their paycheck, which builds confidence.

For employers, these platforms reduce paperwork, centralize compliance documents, and provide real-time tracking. At Hummel Group, we provide Employee Navigator at no additional cost to our clients, making this technology accessible to businesses of many sizes. That said, successful implementation requires planning and time. Committing fully to system is important to ensure that integration with payroll and carriers is handled well before enrollment begins.

Medical coverage remains the foundation, but employees increasingly look for added benefits that support financial security and well-being. We have seen growing demand for accident insurance, critical illness coverage, identity theft protection, and even pet insurance. These voluntary products are typically paid by employees, giving employers a cost-effective way to expand their offerings.

Think of this as a cafeteria-style approach: Employees can select what matters most to them. Listening to employee requests and considering new trends helps employers remain attractive to both current staff and prospective hires.

We believe structured planning is essential. Employers should meet with their benefits advisors throughout the year—not just during renewal. A typical cycle includes a first-quarter debrief, a midyear strategy session, and a final-

pre-renewal review. This ensures employers stay ahead of cost increases, compliance updates, and new product opportunities.

As advisors, our goal is to help clients think strategically, not just react to renewal numbers. This is the value of a true employee benefits partner.

Compliance requirements can be complex, but they are critical. Employers must distribute their Summary of Benefits and Coverage (SBCs) annually, along with required federal notices. Applicable Large Employers (ALEs) must ensure that at least one plan option meets IRS affordability guidelines.

Using a ben admin platform can simplify this process, with employees electronically acknowledging receipt of required documents. Employers should also monitor health savings account limits, Affordable Care Act reporting deadlines, and Medicare Part D disclosures. With the right tools and advisors, staying compliant becomes manageable.

When available, claims data is an invaluable resource. It helps identify cost drivers, evaluate wellness program opportunities, and inform plan design decisions. Larger groups often have access to this data, but smaller employers may not. In those cases, creative solutions—such as layering with health reimbursement arrangements—or collaborations with advisors on other innovative ideas can help manage costs.

Timing is one of the most common pitfalls. We recommend open enrollment windows of one to two weeks. Longer windows can create delays and stragglers. Employers should also account for employee access. Not everyone has easy access to a computer, so providing HR support or setting up workstations can be essential.

Changing carriers is another challenge. New ID cards, possible changes to provider networks or prescription formularies, and deductible transfers must all be addressed. We always advise employees to verify providers, update pharmacies, and refill prescriptions early.

Open enrollment does not end when selections are made. Employers should reconcile payroll deductions, confirm carrier files, and remind employees to check their first pay stub for accuracy. This is also the time to educate

employees about carrier tools, apps, and wellness programs.

We also hold follow-up meetings with clients in the first quarter to reflect on the process and start planning ahead. Continuous improvement is what turns each enrollment cycle into a smooth experience.

• Set office hours for employee questions to keep the process manageable.

• Use multiple formats—including emails, recorded sessions, and in-person meetings—to reach employees across shifts and locations.

• Gather feedback through surveys or focus groups to improve future processes.

• Stay connected with advisors to receive updates, explore new solutions, and remain compliant.

Open enrollment is more than a compliance requirement—it is a chance to strengthen employee engagement and reinforce the value of your benefits package. With early preparation, strong communication, the right technology, and proactive advisor support, employers can turn a stressful season into a successful one.

As risk advisors and partners, we help employers find creative solutions and bring confidence to the process. With planning and the right tools, open enrollment can shift from being overwhelming to empowering—for both employers and employees.

By Steven Thomas Smith, Benefits Account Executive

As we enter the Medicare Annual Election Period (AEP), which runs from October 15 to December 7, it’s essential to understand the upcoming changes and how they may impact coverage decisions for 2026. Whether you’re currently enrolled in Medicare, helping employees navigate their options, or delaying enrollment while staying on employer-sponsored coverage, the insights from this article will help you to make informed choices.

SPECIAL CONSIDERATIONS: EMPLOYEES

If you’re staying on your employer’s health plan past age 65, you may not need to act during AEP—but it’s smart to review your options each year.

Check Your Notice of Creditable Coverage: Your employer should provide this annually before October 15. It tells you whether your drug coverage is considered “creditable” compared to Medicare Part D. If it’s not, you may face penalties later.

Compare Your Options: Even if you’re not ready to switch, comparing Medicare and drug coverage options to your group plan may be worthwhile.

If you would like to review your options, call 800.860.1060 and ask to speak to a licensed insurance agent about Medicare plans.

SPECIAL CONSIDERATIONS: EMPLOYERS

If you offer group health coverage, you’re required to send a Notice of Creditable (or Non-Creditable) Coverage to any Medicare-eligible employees and dependents on the plan before October 15 each year. This helps them understand whether they need to enroll in Medicare Part D to avoid late enrollment penalties in the future.

YOU SHOULD ALSO SEND THIS NOTICE:

• When the plan’s creditable status changes

• Before a Medicare-eligible individual joins the plan

• Before an individual starts their Medicare Initial Enrollment Period (IEP)

• Upon request

For more information about these requirements, contact your Benefits Risk Advisor or myself at the contact information listed below.

Medicare’s Annual Election Period is a chance to ensure your coverage still fits your needs. Whether you’re enrolled, delaying Medicare, or supporting employees through the process, staying informed is key.

Review your current plan for changes, and don’t hesitate to reach out for guidance. Our team is here to help you navigate the options and make confident decisions for 2026.

BY: Chris Ramsburg, CPCU, Principal & Commercial Risk Advisor

About a year ago, The Wall Street Journal published an interview with Dr. Robert Waldinger, which led me to watch his TED Talk. Waldinger is the director of the Harvard Study of Adult Development, which has been ongoing for 85 years. It originally tracked 724 men and now includes more than 1,300 of their male and female descendants across three generations.

Participants complete a comprehensive questionnaire every 2 years, authorize the disclosure of medical records every 5 years, and agree to a face-to-face interview every 15 years. The questions cover various aspects of their lives, including family, employment, mental and physical health, views on life, politics, and religion. This data provides a detailed picture of their lives over time.

Meaningful work, a sense of purpose, and lifelong learning are crucial for a fulfilling life.

Here are my seven key insights from the book:

1. Good relationships are essential for happiness. Building and maintaining positive connections is as important as good nutrition, exercise, sleep, and avoiding bad habits such as smoking.

2. Quality Over Quantity in Relationships. Having people in your life with whom you can share deeply, beyond superficial conversations, is essential.

3. Social Connections Matter. These can take many forms. For example, my wife Lynn and I are part of a life group through our church, where we share our blessings and adversities with fellow believers.

4. Happiness Is More Than Pleasure. Meaningful work, a sense of purpose, and lifelong learning are crucial for a fulfilling life.

5. Material Wealth and Professional Success Aren’t the Keys to Happiness. The story of the three bricklayers illustrates this: One focuses on the task, another on the outcome, and the third on the larger purpose.

7. Aging can be a time of growth and fulfillment. Focusing on what you can still do, rather than what you cannot do, can give you a greater sense of meaning and purpose.

In summary, good relationships are vital for our health and happiness—period!

What do you enjoy most about your job?

Talking with people—hands down. Every day, I get to meet with individuals and families at different stages of life. I might start the day with a young couple just getting started, meet with a business owner in growth mode by lunch, and wrap up the day with retirees reviewing their drawdown strategy. Every conversation is different, and that keeps things fun. It’s like putting together a puzzle—figuring out what each person needs and how we can help them reach their goals.

On the flip side, what’s the most challenging part of your work?

Honestly, it’s shifting gears between all those conversations and making sure I follow through on the back end to put the pieces in place. I’m a go-go-go kind of person. I love meeting and talking with people, but I’ve had to learn to slow down and take things one at a time to ensure our clients get the follow-through they deserve. Luckily, I have an incredible team on my side, and we complement each other very well.

do you often encounter about

One of the biggest ones is the idea that you shouldn’t meet with a financial advisor until you’re close to retirement. In reality, I love working with young couples and families who are just getting started. That’s when the biggest difference can be made. You may not have a lot of investable assets yet, but you can absolutely benefit from a plan—paying down student loans, building an emergency fund, planning for your kids’ education, buying a house. The earlier we start, the better your financial picture will look down the road.

What is often misunderstood about retirement plans?

A lot of business owners don’t realize the tax benefits available to them for starting retirement plans, especially under the SECURE Act 2.0. The government is incentivizing businesses—small ones, in particular—to offer plans. There are tax credits just for starting a plan, and it’s also a great tool for the business owner to start saving for their own retirement. Many business owners pour everything into the business and forget to build a personal retirement safety net. Starting a 401(k) can be a great way to solve both of those issues.

Let’s shift gears—what is life outside of work like for you?

I have been with my lovely wife, Darian, for a decade now. In late 2023, we completed construction on our dream home in Westfield Township, and we have spent countless evenings and weekends since then on projects. Finishing the basement (from studs to paint), building a deck, landscaping, cutting trails through our woods—you name it. Home improvement projects have become some of our favorite pastimes.

Outside of that, we are both washed-up athletes, so we spend a lot of time playing pickup sports, golfing, and bow-hunting. No matter the season, we have some kind of recreational activity in full swing.

Before Hummel, what kind of work did you do?

I was homeschooled and finished high school early, so I started working at Tumbleweed Restaurant when I was 15. I worked there all the way through college—server, cook, manager—you name it. There was even a Tumbleweed near my college in Circleville, so I transferred there while I studied. I’ve basically only had two jobs: Tumbleweed and Hummel. I loved waiting tables—it’s a lot like what I do now. You talk to people and deliver an awesome experience, and then you are off to the next table (or meeting) to help others experience the same thing.

Any last thoughts you want to share?

Financial planning isn’t just for people at the end of their career. Whether you’re 25 or 65, there’s value in having a plan. I love what I do because it’s all about helping people align their finances with their goals. If we can make someone feel more confident about their future, then we’ve done our job.

By: Peyton Gentry, AIF, CRPS®, Financial Advisor

I hope that title was enough to get you curious. If you are a business owner and you like giving Uncle Sam a tip each year, then this article is not for you. The US Treasury thanks you for your generous donations. However, if you are interested in strategies that can help you attract and retain employees while also putting some money back into your pocket, then please read on.

In a rare moment of bipartisan clarity, Congress has realized that working Americans are facing a real problem: They do not have enough money saved to be able to retire. Social Security was never intended to fully provide for people during retirement, but sadly, that is the reality for millions of Americans. One of the reasons for this is that many people who work for small businesses are never offered any kind of workplace retirement plan that they can contribute to. When money is invested out of each paycheck, especially through payroll deduction, people are much more likely to stay the course and build a retirement nest egg than if they are on their own to figure out where to save.

“The SECURE Act became law in 2019 and brought about several changes to retirement planning—but it didn’t go far enough to entice small business owners to establish new group retirement plans for their employees.”

Recognizing this issue, Congress has been trying to find ways to incentivize retirement saving. The Setting Every Community Up for Retirement Enhancement (SECURE) Act became law in 2019 and brought about several changes to retirement planning but it didn’t go far enough to entice small business owners to establish new group retirement plans for their employees. However, the SECURE Act 2.0 went into effect in 2023, and it included three distinct and generous tax credits for employers who establish new plans especially those who are willing to contribute to their employees’ accounts.

Here is the breakdown:

What is it? Businesses can receive direct credit for qualified expenses associated with establishing and operating a new retirement plan.

What is a “qualified expense”? These may include recordkeeping fees, plan administration fees, support services from your retirement vendor, and the costs of educating your employees about the plan.

How much can I get? You can get up to $5,000 per year for the first three years that the plan is in place and a total tax credit of up to $15,000 over the course of three years.

Who gets it? – Businesses with 50 or fewer employees receive 100% of qualified expenses up to the $5,000 limit. Businesses with 51–100 employees may receive 50% of qualified expenses up to the $5,000 limit.

What is it? Businesses that adopt an automatic enrollment feature on their retirement plans can receive a tax credit for doing so. This is designed to encourage and increase participation in the plan.

How much can I get? You can get $500 per year for the first three years after adding the feature—and a total tax credit of up to $1,500 across three years.

Who gets it? Any business that adds an automatic enrollment feature to their plan—whether it is a brand-new plan or an existing plan that is being amended to include the feature.

What is it? Businesses that contribute to their employees’ retirement accounts can receive a tax credit for those contributions. Think matching or profit-sharing contributions.

How much can I get? In years 1 and 2, you are eligible to receive up to $1,000 per eligible employee that receives matching contributions. In year 3 it is up to $750 per eligible employee, $500 per eligible employee in year 4, and $250 per eligible employee in year 5.

Who gets it? To be eligible for this tax credit, you have to meet the following criteria:

• Have no more than 100 employees who received compensation of $5,000 or more in the preceding year

• Not have offered a plan covering substantially the same employees during the previous three tax years

• Only those employees who earned less than $100,000 per year can be included in the calculation for the tax credit

I know that was a lot of information to throw at you, but let’s look at a hypothetical example that will illustrate just how massive these tax credits can be.

Take a business that is establishing a new plan. They have 25 employees, 20 of which earn less than $100,000 per year and are not considered “Highly Compensated” in the eyes of ERISA. The business decides they will make contributions of at least $1,000 per year to each of the employee’s accounts. Let’s say their total administrative costs for the plan are $10,000 per year, all-in.

If the idea of offering a retirement plan for you to save for your own future, to take care of your employees, and to get a nice chunk of change credited back on your tax bill sounds great, then you would be correct! It is great!

If you think this is a bit confusing and would like to see how this works for your business, that is where I come in. Please reach out and we will be happy to run the numbers for you.

Any day that I can help business owners and their employees save for retirement—while also putting more money back in their pocket—is a good day for me.

“LAPP was always there to help, not only when I could do it on my own, but when I failed and tried again. Without this, there was no hope.”

-Anonymous LAPP Client

Since its beginnings in 1968 as a single-counselor initiative under the United Way of Licking County, the Licking County Alcoholism Prevention Program (LAPP) has been a steadfast force in helping individuals and families overcome substance use and behavioral health challenges. Officially incorporated as a private nonprofit in 1978, LAPP has evolved from a focus on alcohol prevention to a comprehensive behavioral health provider addressing a full spectrum of needs. These include treatment for all substance use disorders, process addictions (such as gambling) and co-occurring mental health conditions.

LAPP’s mission is clear: to provide integrated treatment and recovery services for individuals and families experiencing behavioral health issues, including alcohol and drug-related problems. The organization’s vision is to be recognized as the leader in providing first-class outpatient services in Central Ohio. Guided by this mission, LAPP’s leadership and board of directors aim to create a barrier-free environment where individuals can access quality care, reclaim their lives, and contribute meaningfully to their communities.

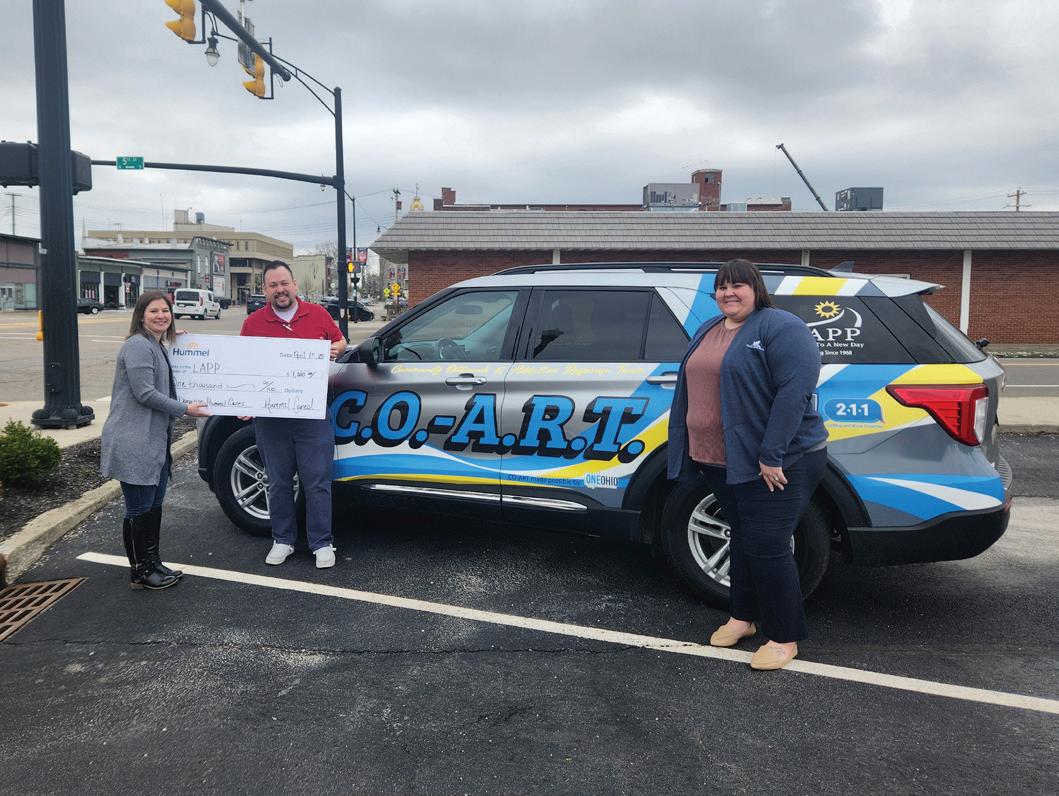

Among these is the Community Outreach and Addiction Response Team, launched in 2025 with funding from the OneOhio Recovery Foundation—an initiative fueled by settlement dollars from pharmaceutical companies related to the opioid crisis. This mobile unit, staffed by a licensed counselor or social worker and a counseling assistant, meets people where they are, offering assessments, transportation to treatment, and connections to critical resources—such as housing, food assistance, and healthcare program navigation.

“Addiction does not discriminate, and we are here to fight that disease just the same.”

With locations in Newark and Pataskala, as well as an active community outreach presence, LAPP serves individuals in need from all walks of life—rich, poor, homeless, justice involved, blue-collar, or professionals. As Executive Director John B. Jordan explains, “Addiction does not discriminate, and we are here to fight that disease just the same.”

LAPP operates with the belief that recovery is possible for anyone, regardless of their circumstances. Its four main programs help address clients’ needs across various stages of illness.

LAPP’s work transforms lives every day. One remarkable example involves a couple—clients in separate men’s and women’s programs—who initially entered treatment under court and children’s services mandates. Both felt hopeless

and resistant. Through persistence, small victories, and mutual support, they achieved sobriety, regained their driver’s licenses, secured stable housing, reunited with their children, and rebuilt their lives. They credit LAPP’s staff for believing in them through setbacks and successes alike, “LAPP was always there to help, not only when I could do it on my own, but when I failed and tried again. Without this, there was no hope.”

LAPP builds strong, personal relationships with donors, supporters, and community partners. Rather than relying on impersonal appeals, the organization engages through public events, educational sessions, and the active involvement of its board members. Partnerships with professional service providers and local vendors have been vital to the organization’s success. Many board members began as contracted service providers who saw the impact of LAPP’s work firsthand.

One such board member is Heather Stoffer, an employee of Hummel Group, who serves as LAPP’s vice president of the board of directors. Her leadership and commitment exemplify the deep community investment that sustains LAPP’s mission.

Like many nonprofits, LAPP faces funding challenges, particularly in an uncertain political climate where healthcare benefits for clients may be at risk. As a fee-forservice provider, LAPP only receives funds when care is delivered, limiting its ability to invest in critical infrastructure improvement and expanded services. The organization is actively seeking financial support, capital funding for a new facility, and professional expertise to guide its growth.

Individuals can support LAPP through volunteer projects, donations of goods and funds, and direct contributions to client needs—such as food, clothing, and transportation. Businesses can offer specialized expertise, sponsor initiatives, or encourage employees to serve on the board of directors.

LAPP is excited about expanding its Outreach and Addiction Response Team and hopes to sustain its growth beyond the initial grant period. Plans are also underway for a comprehensive case management program to better address social determinants of health. The organization looks forward to its annual Evening of Giving, a celebration of recovery and community support.

For nearly six decades, the LAPP has stood as a lifeline for individuals and families battling addiction and behavioral health challenges. With dedicated staff, strong community partners, and leaders helping guide its path, LAPP continues to offer hope, healing, and a vision of a healthier future for Central Ohio.

WEBSITE: LAPP.CC | 800-872-6281 | INFO@LAPP.CC

Brock Hostetler and Cody Mast have taken their childhood love of trading cards and turned it into a full-blown passion that rivals the intensity of any championship game. What began as youthful excitement—mowing lawns to buy packs of cards and scouring garage sales for hidden gems—has evolved into a sophisticated hobby with serious investment potential.

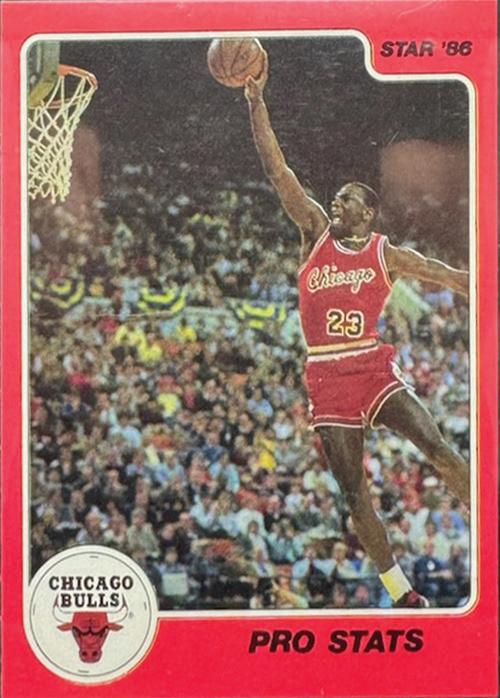

Brock’s journey started with flea market finds and a love for legends like Michael Jordan and Shaquille O’Neal. “I’d spend everything I earned on packs or buy from the flea market,” he recalled. That early enthusiasm never truly faded. Years later, a surprise pack of football cards tucked into a shipment of Homage T-shirts reignited the spark. “The kids thought it was fun. I told them, ‘You know I have hundreds of thousands of these in the basement, right?’”

That rediscovery led to a full-blown resurgence. Brock now estimates that his collection now includes over 2 million cards, with more than one million still sealed in boxes. “From an investment standpoint, sealed boxes hold their value better. You never know what’s inside, and that mystery keeps the market strong.”

Cody’s story mirrors Brock’s in many ways. “For birthdays and Christmas, I’d get packs or boxes. I had my binder and my sleeves, and I’d trade at school like a little businessperson,” he said. His early collecting days were filled with excitement, even if the garage sale boxes he bought were mostly filled with scraps. “I didn’t know better, but it was fun.”

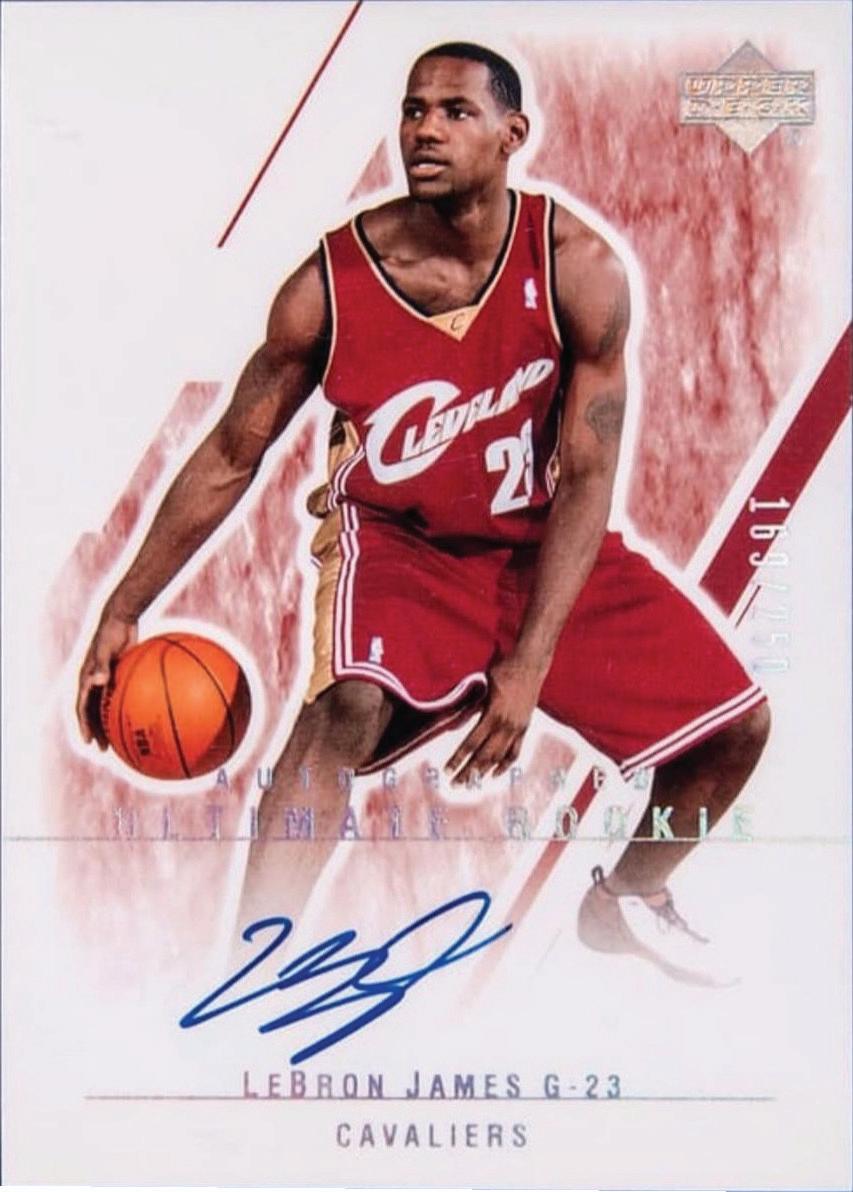

After a detour into sports memorabilia—think signed NFL helmets stacked in his basement—Cody returned to cards, inspired by Brock and other friends. Today, his collection is laser-focusedon 2003 LeBron James rookie cards, including a coveted Ultimate Collection Rookie Auto.

Today, Brock and Cody are not just collectors; they’re curators, strategists, and storytellers in what has become a massive industry.

When asked about their most prized possessions, both collectors lit up. Brock’s favorite? A 1986 Fleer Michael Jordan rookie card, a long-sought treasure he finally acquired. “I wanted one for years. It’s iconic.” He also shared a lucky childhood memory: finding $5 after a baseball game, buying a pack at Walmart, and pulling out a rare Jordan diecut card—later graded a perfect 10 by Professional Sports Authenticator (PSA).

Cody’s crown jewel is his LeBron Rookie Auto. “It’s one of his best rookie cards. I worked my way up through buying, selling, and trading to eventually get it. My daughter will probably sell it someday, but it’s not leaving my collection anytime soon.”

His ultimate goal? The elusive 2003 Topps Finest LeBron Gold Refractor, one of only 25 in existence. “I’d trade my whole collection for it,” he admitted. “I saw one in person for the first time in New York. It was incredible.”

Collecting isn’t just about nostalgia—it’s about strategy. Brock and Cody shared tips for beginners and seasoned collectors alike. First rule? Storage matters. “Cool, dark, climate-controlled spaces are key,” Cody explained. “Light can fade autographs, and temperature swings can damage cards.” Brock added that graded card holders often include UV protection, but even those need proper care.

For protection, they recommend starting with penny sleeves—soft plastic covers—and then place these in hard sleeves for added security. “Always sleeve rookies,” Brock advised. “You never know who’s going to blow up in a few years.”

Grading is another essential step. Brock uses PSA, a leading grading company, and has a membership for submissions. “You clean the card, put it in a card saver, submit it online, and ship it carefully. It can take weeks—or months—but it’s worth it.”

Cody takes it a step further with insurance. “I issued a collector’s policy for my inventory. It covers items in transit and off-site. It’s peace of mind.”

While Brock has scaled back his card show attendance, Cody remains active in the scene. “I used to set up tables, and buy, sell, and trade. It was a side hustle and a great way to meet others who share the passion.”

The card show community is vibrant. “It’s an industry now,” Cody said. “In July alone, online card sales through marketplaces like eBay and Fanatics were in excess of $300 million.”

2003 TOPPS FINEST LEBRON JAMES GOLD REFRACTOR - Cody Mast’s “white whale”

Every collector has a “white whale”—a dream card they chase. For Brock, it’s completing the set of Michael Jordan Star cards, a rare series from early in Jordan’s career. “They weren’t sold in packs. You got them at games or select shops. The print runs were low, and the quality wasn’t great, but they’re special.”

Cody’s white whale remains the LeBron Gold Refractor. “Only 25 exist. The last sale was in 2022. It’s rare, expensive, and visually stunning.”

When asked for advice for new collectors, Cody offered the classic mantra: “Buy what you like.” Brock agreed: “Have fun with it. If you enjoy it, go for it.”

Whether it’s a childhood binder or a million-card vault, fro Brock and Cody, the joy of collecting lies in the stories, the strategy, and the shared passion. At Hummel Group’s Berlin office, Brock and Cody are proving that sometimes, the best investments aren’t just financial—they’re personal.