March 2024

Most agents know what’s happening.

Good agents understand what’s happening. Great agents can explain what’s happening.

Mortgage Rates

What Determines the Mortgage Rate?

The 10-Year Yield and the Spread Above It

Spread (Difference Between the Mortgage Rate and the 10-Year Yield)

10-Year Treasury Yield

4.21 2.89 Actual Rate Friday, 3/1/2024

Source: Freddie Mac and CNBC

Mortgage Rate 7.1%

A primary driver of the increase in the yield over 2023 was inflation expectations.

. . .

So the higher the current rate of inflation and, more importantly, the higher the expected future rates of inflation, the higher the yield on the 10-year as investors demand to be compensated for that inflation risk into the future.

- Mark Fleming, Chief Economist, First American

CPI History Pausing Rate Cuts Today

Source: The Fed

Core Price Index Challenges in

Late 1970s Causing Concerns Today -4.0 -2.0 0.0 2.0 4.0 6.0 8.0 10.0 12.0 14.0 16.0 1970 1980 1990 Today 2010 2000

the

Consumer Price Index Pausing Rate Cuts

Source: The Fed

Challenges Over the Last Few Months Causing Concerns Today 2.0 3.0 4.0 5.0 6.0 7.0 8.0 9.0 10.0 June 2022 June 2023 Today

Policymakers now risk committing another policy error, this time by waiting too long to begin cutting interest rates. It is unclear why Fed officials feel it necessary to take this risk. After all, they’ve all but achieved their dual mandates of a full-employment economy and low and stable inflation.

- Mark Zandi, Chief Economist, Moody’s Analytics

Mortgage Rate Projections

Fannie Mae

Quarter December 2023 February 2024 2024 Q1 7.0% 6.5% 2024 Q2 6.8% 6.3% 2024 Q3 6.6% 6.1% 2024 Q4 6.5% 5.9%

“A leader is one who knows the way, goes the way, and shows the way.”

- John Maxwell

The Economy

More Economists Now See “Soft Landing”

Percent of Economists Seeing a Recession in the Next 12 Months

January 2023

61%

39%

January 2024

39%

61%

No on Recession in Next 12 Months

Yes on Recession in Next 12 Months

No on Recession in Next 12 Months

Yes on Recession in Next 12 Months

Source: Wall Street Journal

Source: Wall Street Journal Unemployment Expected To Stay Below 5% Economists Projections for Unemployment Rates 4.11% 4.30% 4.22% 4.13% 4.04% 3.99% June 2024 December 2024 June 2025 December 2025 June 2026 December 2026

At least right now, the fundamentals of the economy, despite some hiccups, are doing pretty good. While things are far from perfect, the economy is probably doing better than people want to give it credit for.

- Jacob Channel, Senior Economist, LendingTree

Foreclosures

-2.2%*

-17.2%

Source: Black Knight

All Foreclosure Metrics Are Down Each Metric Shows December Compared to Previous Year

Inventory Foreclosure

-17.9% Active Foreclosure

Sales Foreclosure Starts

* 25% below prepandemic levels

U.S. Foreclosure Activity Increases From 2022 But Still Below Pre-Pandemic Levels

Source: ATTOM

U.S. Properties with Foreclosure Filings 533K 718K 1.3M 2.3M 2.8M 2.9M 1.9M 1.8M 1.4M 1.1M 1.1M 933K 677K 624K 493K 214K 151K 324K 357K 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022 2023

1,450,749

676,535 624,753 493,066 214,323 151,153 324,237 357,062 2017 2018 2019 2020 2021 2022 2023 Short 383,795 Foreclosures Short 446,965 Foreclosures Short 241,056 Foreclosures Short 105,052 Short 273,881 Foreclosures Source: ATTOM

1M Fewer Foreclosures in

Properties with Foreclosure Filings

(Average: 2017 – 2019)

Over

Last 5 Years U.S.

598,118

Fewer Foreclosures in Last 5 Years

The prospect of any kind of nearterm surge in foreclosure activity remains low, with start volumes still nearly 40% below prepandemic levels.

- Black Knight, December 2023, Mortgage Monitor

Equity

Americans Sitting on Tremendous Equity

67.4% Have Paid off Their Mortgage or Have at Least 50% Equity

28.7%

38.7% Mortgage Homes w/ > 50% Equity

Own the Home Free and Clear

33.0%

Mortgage Homes w/ < 50% Equity

Source: Census, ATTOM

Home Prices Final 2023 Home Price Appreciation & A Peek Ahead To 2024

Consumer Confidence in Home Prices

Source: Fannie Mae

0% 5% 10% 15% 20% 25% 30% 35% 40% Jan '15 Jan '16 Jan '17 Jan '18 Jan '19 Jan '20 Jan '21 Jan '22 Jan '23 Jan '24

Percent Who Believe Home Prices Will Go Down in the Next 12 Months

Pandemic

Talk of Repeat of 2008 Crash

> 1 of 5 Still Believe Prices Will Depreciate

Case-Shiller: Prices

Month-Over-Month Percent Change in Home Values (Seasonally Adjusted)

-0.2 0.2 0.4 0.5 0.7 0.7 0.6 0.9 0.7 0.6 0.2 0.2 Jan '23 Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec

Final 2023 Home Price Appreciation Rates

December 2022 – December 2023 Price Change

Case-Shiller 5.5%

CoreLogic 5.5%

Black Knight 5.6%

Freddie Mac 7.0%

FHFA 6.6%

%

Entity

Increase

Source: Case-Shiller

Final 2023 Percent Appreciation in the SA Case-Shiller 20-City Index Metro % Change Metro % Change Atlanta 6.3% Miami 7.8% Boston 7.2% Minneapolis 2.9% Charlotte 8.0% New York 7.6% Chicago 8.1% Phoenix 3.8% Cleveland 7.4% Portland 0.3% Dallas 2.1% San Diego 8.8% Denver 2.3% San Francisco 3.2% Detroit 8.3% Seattle 3.0% Las Vegas 4.2% Tampa 4.1% Los Angeles 8.3% Washington, D.C. 5.1% U.S. National: 5.5%

Case-Shiller 2023 Home Price Appreciation

Looking back at the year, 2023 appears to have exceeded average annual home price gains over the past 35 years . . . While we are not experiencing the double-digit gains seen in the previous two years, above trend growth should be well received considering the rising costs of financing home mortgages.

- Brian D. Luke, Head of Commodities, S&P Dow Jones Indices

Percent of Annual Home Appreciation

Source: Freddie Mac

-15% -10% -5% 0% 5% 10% 15% 20% 1980 1990 2000 2010 2023 Each December as compared to previous December 4.86% 43-Year Average

1980–2023, Seasonally Adjusted, Rounded To Nearest Full Number

FHFA: Prices

Month-Over-Month Percent Change in Home Values (Seasonally Adjusted)

0.1 0.5 0.6 0.8 0.8 0.5 0.8 0.7 0.6 0.3 0.3 0.1 Jan '23 Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec

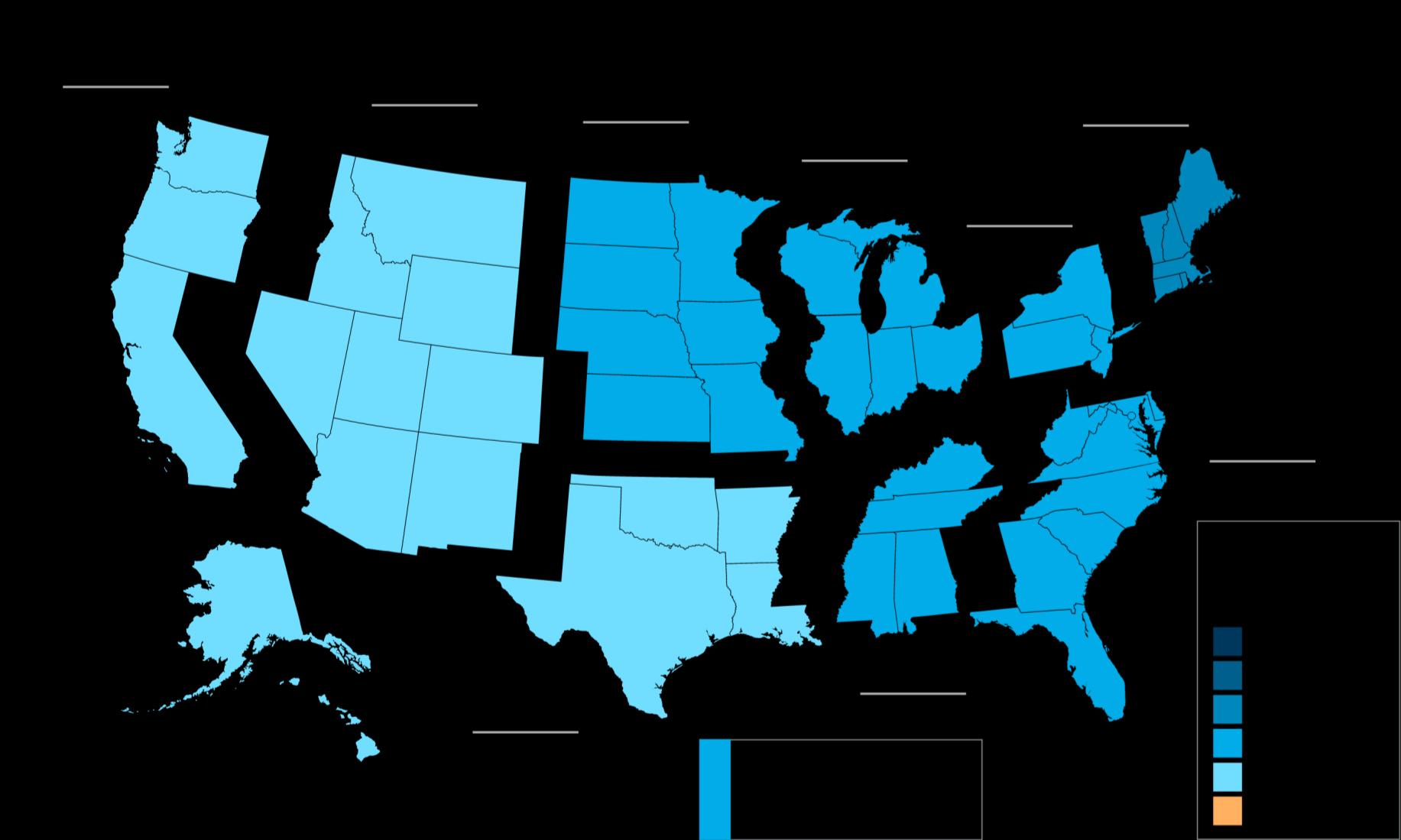

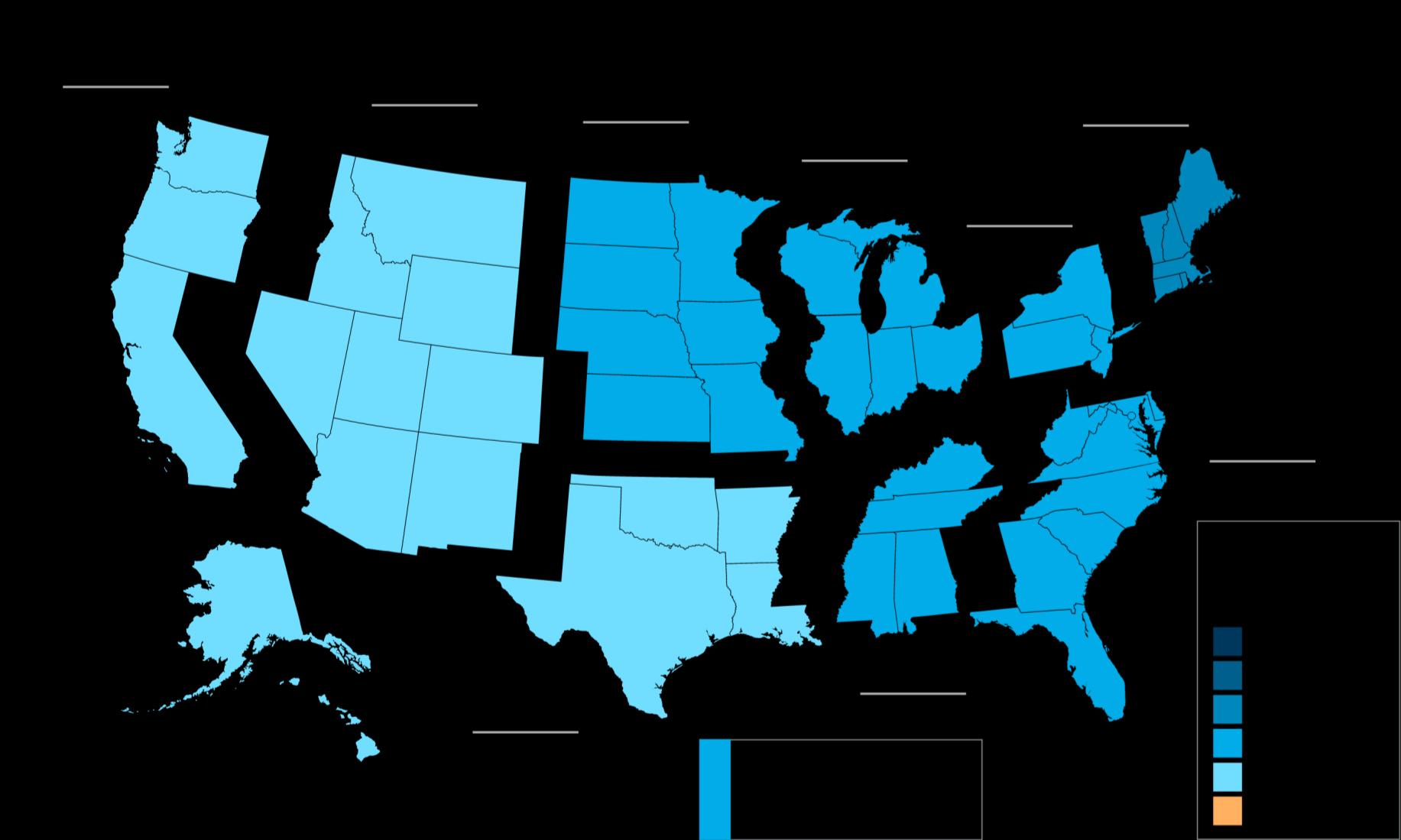

House prices rose in 49 states between Q4 of 2022 and Q4 2023 . . . (Hawaii, -3.4%) . . .

House prices rose in 96 of the top 100 largest metropolitan areas over the last four quarters . . .

All nine census divisions had positive house price changes year-over-year.

- FHFA Home Price Index

Percent Change in Home Prices

Source: FHFA

Year-Over-Year, Q3 2023

Percent Change in Home Prices

Source: FHFA

Year-Over-Year, Q4 2023

Percent Change in Home Values

-0.2 0.2 0.4 0.5 0.7 0.7 0.6 0.9 0.7 0.6 0.2 0.2 Case-Shiller 0.1 0.5 0.6 0.8 0.8 0.5 0.8 0.7 0.6 0.3 0.3 0.1 Jan '23 Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec

FHFA Month-Over-Month

Home Prices Going Forward

As mortgage rates continue to hover in the 7% range, it will be difficult to convince existing homeowners to move at the current time. Nevertheless, as recent surge in mortgage application data has shown, following a drop in rates, buyers are anxiously waiting to jump into the market. That means that 2024 is likely to show another year of home price highs.

- Selma Hepp, Chief Economist, CoreLogic

2024 Home Price Forecasts

Percent Appreciation/Depreciation as of 2/26/2024 3.2 5.5 4.1 3.5 3.2 2.6 2.4 1.4 Average of All 7 Goldman Sachs MBA Zillow Fannie Mae Freddie Mac HPES NAR

2024 Home Price Forecasts

Forecasts from 11/2023 vs. Current Forecasts

Entity Original Forecast Current Forecast Goldman Sachs 1.9% 5.5% Mortgage BankersAssociation 1.1% 4.1% Zillow 0.2% 3.5% Fannie Mae 2.8% 3.2% Freddie Mac 2.6% 2.6% Home Price Expectation Survey 2.2% 2.4% National Association of Realtors 0.7% 1.4%

Home Price Expectation Survey

A nationwide panel of over one hundred economists, real estate experts and investment & market strategists.

Estimated Home Price Performance

Pre-Bubble Bubble Bust Recovery To Date 3.78% 3.36% 3.87% 4.18% 4.11% 2024 2025 2026 2027 2028 Source: HPES

December – December, as Forecast in Q1 2024

Potential growth in household wealth over the next 5 years based solely on increased home equity if you purchase a $400K home in January 2024 Pre-Bubble

Based on price appreciation projected by the Home Price Expectation Survey

Source: HPES

Bubble Bust Recovery To Date $400,000 $415,120 $429,068 $445,673 $464,302 $483,385 2024 2025 2026 2027 2028 2029

$83,385

90-Day Work Plan

▪ Stay on Top of Mortgage Rates

▪ Be Able To Speak to the Economy

▪ Understand the Foreclosure Numbers

▪ Promote Home Price Stability

▪ Work!

DEEP DIVE THE

4

5

6

7

8

9

https://www.cnbc.com/quotes/US10Y

https://www.freddiemac.com/home

https://blog.firstam.com/reconomy-podcast/is-the-housingmarket-poised-to-rebound-in-2024

https://fred.stlouisfed.org/graph/?g=rocU#0

https://fred.stlouisfed.org/graph/?g=rocU#0

https://www.inquirer.com/economy/federal-reserve-waitingto-cut-rates-recession-unemployment-housing-costs20240222.html

https://www.fanniemae.com/media/49866/display

https://www.fanniemae.com/media/50406/display 12

https://www.wsj.com/economy/economic-forecastingsurvey-archive-11617814998

Resources Slide(s) Description Link(s)

What Determines Mortgage Rate Graph

Mark Fleming Quote

CPI Rate Cuts Graph

Consumer Price Index Graph

Mark Zandi Quote

Mortgage Rate Projections Table

Economists See Soft Landing Pie Charts

13

https://www.wsj.com/economy/economic-forecastingsurvey-archive-11617814998

14

https://www.builderonline.com/data-analysis/how-theelection-and-unemployment-could-impact-the-2024housing-market_c 16

https://www.blackknightinc.com/wpcontent/uploads/2024/02/ICE_MM_FEB2024_Report.pdf

17-18

https://www.attomdata.com/news/markettrends/foreclosures/attom-2023-year-end-u-s-foreclosuremarket-report/

https://www.blackknightinc.com/wpcontent/uploads/2024/02/ICE_MM_FEB2024_Report.pdf

https://data.census.gov/cedsci/all?q=mortgage

https://www.attomdata.com/news/market-trends/homesales-prices/attoms-q4-2023-home-equity-and-underwaterreport/

https://www.fhfa.gov/Media/Blog/Pages/HomeownersEquity-Remains-High.aspx

Resources Slide(s) Description Link(s)

Unemployment Below 5% Graph

Jacob Channel

Quote

Foreclosure Metrics Down Graph

ForeclosureActivity Below Pre-Pandemic Levels Graphs

Black Knight Quote

19

Americans Tremendous Equity Pie Chart

21

https://www.fanniemae.com/research-and-insights/surveysindices/national-housing-survey

https://www.spglobal.com/spdji/en/indices/indicators/spcorelogic-case-shiller-us-national-home-price-nsaindex/#news-research

https://www.spglobal.com/spdji/en/documents/indexnews/a nnouncements/20240227-1470765/1470765_cshomepricerelease-0227.pdf

https://www.businesswire.com/news/home/2024022038888 0/en/Peak-National-House-Price-Appreciation-May-beBehind-Us-According-to-First-American-Data-AnalyticsMonthly-Home-Price-Index-Report

https://www.corelogic.com/category/intelligence/reports/ho me-price-insights/

https://www.blackknightinc.com/wpcontent/uploads/2024/02/ICE_MM_FEB2024_Report.pdf

https://www.freddiemac.com/research/indices/house-priceindex

https://www.spglobal.com/spdji/en/documents/indexnews/a nnouncements/20240227-1470765/1470765_cshomepricerelease-0227.pdf

Slide(s) Description Link(s)

Consumer Confidence in Prices Graph

Resources

23

25 Case-Shiller: Prices Graph

26 2023 Final Appreciation Rates Table

27 Case-Shiller 2023 Appreciation Table

https://www.spglobal.com/spdji/en/documents/indexnews/a nnouncements/20240227-1470765/1470765_cshomepricerelease-0227.pdf

29

https://www.freddiemac.com/research/indices/house-priceindex 30

https://www.fhfa.gov/DataTools/Downloads/Pages/HousePrice-Index.aspx

https://www.fhfa.gov/AboutUs/Reports/ReportDocuments/H PI_2023Q4.pdf

32-33

https://www.fhfa.gov/DataTools/Tools/Pages/House-PriceIndex-(HPI).aspx 34

https://www.spglobal.com/spdji/en/indices/indicators/spcorelogic-case-shiller-us-national-home-price-nsaindex/#news-research

https://www.fhfa.gov/DataTools/Downloads/Pages/HousePrice-Index.aspx 36

https://www.corelogic.com/intelligence/us-corelogic-caseshiller-index-continues-strengthen-with-annual-gaindecember/

Resources Slide(s) Description Link(s)

Brian Luke Quote

28

Home Appreciation Graph

FHFA: Prices Graph

FHFA Home Price Index Quote

31

FHFA Maps

Home Values Graph

Selma Hepp Quote

37-38

40-41

https://twitter.com/NewsLambert/status/1762144404448461 232

https://www.mba.org/news-and-research/forecasts-andcommentary/mortgage-finance-forecast-archives

https://www.zillow.com/research/2024-housing-predictions33447/

https://www.fanniemae.com/media/50406/display

https://www.freddiemac.com/research/forecast/20240226us-economy-defied-expectations

https://pulsenomics.com/surveys/

https://cdn.nar.realtor//sites/default/files/documents/forecast -q1-2024-us-economic-outlook-01-26-2024.pdf

https://pulsenomics.com/surveys/#home-price-expectations

Resources Slide(s) Description Link(s)

2024 Home Price Forecasts Graph & Table

Estimated Home Price Performance Graphs

Updates

53

54-56, 63, 65, 66, 73-76

57-59

60

61-62

https://www.nar.realtor/research-and-statistics/researchreports/realtors-confidence-index

https://www.nar.realtor/topics/existing-home-sales

http://www.census.gov/construction/nrs/pdf/newressales.pdf

http://www.census.gov/newhomesales

http://www.census.gov/construction/nrs/pdf/newressales.pdf

https://www.nar.realtor/topics/existing-home-sales

https://www.nar.realtor/research-and-statistics/housingstatistics/pending-home-sales

67-69

https://www.spglobal.com/spdji/en/indices/indicators/spcorelogic-case-shiller-20-city-composite-home-price-nsaindex/#news-research 70

https://www.corelogic.com/intelligence/u-s-home-priceinsights/

Description Link(s)

Resources Slide(s)

Confidence Index

Existing Home Sales

New

Home Sales

Total Home Sales

Pending Home Sales

Case Shiller

CoreLogic Price Forecast

72-78 Inventory

80 Showing Activity

82, 83, 85, 86 Mortgage Rates

84 Mortgage Rate Projections

https://www.nar.realtor/topics/existing-home-sales

http://www.census.gov/construction/nrs/pdf/newressales.pdf

https://www.realtor.com/research/data/

https://www.showingtime.com/blog/

http://www.freddiemac.com/pmms/pmms_archives.html

http://www.freddiemac.com/research/forecast/

https://www.mba.org/news-research-andresources/research-and-economics/forecasts-andcommentary

http://www.fanniemae.com/portal/researchinsights/forecast.html

https://www.mba.org/news-research-andresources/research-and-economics/forecasts-andcommentary

https://www.nar.realtor/research-and-statistics

88, 89 Mortgage Credit Availability

https://www.mba.org/news-research-andresources/newsroom

https://www.mba.org/news-research-andresources/research-and-economics/single-familyresearch/mortgage-credit-availability-index

Description

Resources Slide(s)

Link(s)

Home Sales

41 41 36 29 27 26 24 22 22 21 21 21 21 20 18 17 17 17 17 17 17 18 18 19 19 18 17 17 16 14 14 16 19 24 26 33 34 29 22 18 18 20 20 21 23 25 29 36 Jan-20 Feb Mar Apr May June July Aug Sept Oct Nov Dec Jan-21 Feb Mar Apr May June July Aug Sept Oct Nov Dec Jan-22 Feb Mar Apr May June July Aug Sept Nov Dec Jan-23 Feb Mar Apr May June July Aug Sept Oct Nov Dec Jan-24 Source: NAR Average Days on the Market

January 2024

Existing Home Sales

Source: NAR

Since January 2014 3,800,000 4,300,000 4,800,000 5,300,000 5,800,000 6,300,000 6,800,000 Jan 2014 Jan 2015 Jan 2016 Jan 2017 Jan 2018 Jan 2019 Jan 2020 Jan 2021 Jan 2022 Jan 2023 Jan 2024

Existing Home Sales

Year-Over-Year, by Region

Source: NAR

-1.7% -5.9% -3.1% -1.6% 4.3% U.S. Northeast Midwest South West West

Existing Home Sales

Source: NAR

In Thousands 0 100 200 300 400 500 600 January February March April May June July August September October November December 2022 2023 2024

New Home Sales

Source: Census

Annualized in Thousands 360 460 560 660 760 860 960 1060 jun-14 Jan15 Jan16 Jan17 Jan18 Jan19 Jan20 Jan21 Jan22 Jan23 Jan24

New Home Sales

Percent

Source: Census

500 Units or Less

0.5 Percent 0% 8% 17% 11% 12% 8% Under $150K $150-$199K $200-299K $300-$399K $400-$499K $500-$749K Over $750K * 1%

of Distribution by Price Range * Less Than

Than

New Homes Selling Fast

Source: Census

Median Months from Completion to Sold 3.2 3.6 3.6 3.4 3.5 3.6 3.4 3.2 3.5 3.1 3.2 3.0 3.4 3.4 3.4 3.3 3.6 4.2 4.3 4.5 4.5 4.2 4.0 3.6 3.2 3.7 5.1 4.9 4.5 4.1 4.5 3.6 3.1 2.5 2.9 3.2 2.8 2.7 3.5 3.5 2.8 2.9 2.4 1.9 1.5 1.5 1.7 1.9 2.4 2.6 2.7 2.5 2.8 2.6 2.3 2.3 2.3 2.5 2.7 2.5 2.8 Jan-19 Feb Mar Apr May Jun Jul Aug Sept Oct Nov Dec Jan-20 Feb Mar Apr May June July Aug Sept Oct Nov Dec Jan-21 Feb Mar Apr May June July Aug Sept Oct Nov Dec Jan-22 Feb Mar Apr May June July Aug Sept Oct Nov Dec Jan-23 Feb Mar Apr May June July Aug Sept Oct Nov Dec Jan-24

Total Home Sales

Source: Census

In Thousands 422 423 524 517 557 575 495 528 477 419 372 374 286 325 421 397 475 491 432 453 403 383 342 347 291 January February March April May June July August September October November December 2022 2023 2024

Source: NAR

Sales 60 70 80 90 100 110 120 130 140 January 2012 January 2013 January 2014 January 2015 January 2016 January 2017 January 2018 January 2019 January 2020 January 2021 January 2022 January 2023 January 2024 100 = Historically Healthy Level

Pending Home

Pending Home Sales

Year-Over-Year by Region

Source: NAR

100 = Historically Healthy Level -8.8% -5.5% -11.6% -9.0% -7.0% U.S. Northeast Midwest South West

Source: NAR Percentage of Distressed Property Sales Distressed Sales (Foreclosures and Short Sales) Represented 2% of sales in January. 0% 5% 10% 15% 20% 25% 30% 35% Jan 2012 Jan 2013 Jan 2014 Jan 2015 Jan 2016 Jan 2017 Jan 2018 Jan 2019 Jan 2020 Jan 2021 Jan 2022 Jan 2023 Jan 2024 4%

Home Prices

Sales Price of Existing Homes

Year-Over-Year, by Region

5.1% 10.1% 7.6% 4.1% 6.3%

Source: NAR

U.S. Northeast Midwest South West

% Change in Sales

Year-Over-Year, by Price Range

Source: NAR

$0-100K $100-250K $250-500K $500-750K $750K-1M $1M+ % change in sales -13.1% -7.9% 4.6% 11.4% 22.5% 27.1% -13.1% -7.9% 4.6% 11.4% 22.5% 27.1%

Change

Home Prices

Source: S&P Case-Shiller

in

Year-Over-Year -3% 2% 7% 12% 17% 22% Jan 2013 Jan 2014 Jan 2015 Jan 2016 Jan 2017 Jan 2018 Jan 2019 Jan 2020 Jan 2021 Jan 2022 Jan 2023

Source: S&P Case-Shiller -3% 2% 7% 12% 17% 22% Jan 2015 Feb Mar Apr May Jun Jul Aug Sept Oct Nov Dec Jan 2016 Feb Mar Apr May Jun Jul Aug Sept Oct Nov Dec Jan 2017 Feb Mar Apr May Jun Jul Aug Sept Oct Nov Dec Jan 2018 Feb Mar Apr May Jun Jul Aug Sept Oct Nov Dec Jan 2019 Feb Mar Apr May Jun Jul Aug Sept Oct Nov Dec Jan 2020 Feb Mar Apr May Jun Jul Aug Sept Oct Nov Dec Jan 2021 Feb Mar Apr May June July Aug Sept Oct Nov Dec Jan 2022 Feb Mar Apr May June July Aug Sept Oct Nov Dec Jan 2023 Feb Mar Apr May June July August Sept Oct Nov Dec Change in Home Prices Year-Over-Year, 20 City Composite

Change in Home Prices

Source: S&P Case-Shiller

Year-Over-Year, 20 City Composite 18.9% 20.3% 21.1%21.2% 20.5% 18.7% 16.0% 13.1% 10.4% 8.6% 6.8% 4.6% 2.6% 1.0% 1.6% 1.7% 1.5% 0.9% 0.6% 0.4% 0.2% 0.1% -0.2%-0.3% Jan 2022 Feb Mar Apr May Jun Jul Aug Sept Oct Nov Dec Jan 2023 Feb Mar Apr May Jun Jul Aug Sept Oct Nov Dec

Source: CoreLogic

% Change in Price US Home Price Insights – December 2023 5.5% 2.8%

Forecast

Year-Over-Year

Current

Housing Inventory

Change in Inventory

Source: Realtor.com

Month-Over-Month, January 2024

Source: NAR Months Inventory of Homes for Sale 2011 - Today 1.5 2.5 3.5 4.5 5.5 6.5 7.5 8.5 9.5 January 2011 January 2012 January 2013 January 2014 January 2015 January 2016 January 2017 January 2018 January 2019 January 2020 January 2021 January 2022 January 2023 January 2024

Months Inventory of Homes for Sale

Since 2019

Source: NAR

3.8 3.6 3.8 4.2 4.3 4.3 4.2 4.0 4.0 3.9 3.7 3.0 3.1 3.1 3.3 4.0 4.6 3.9 3.1 3.0 2.7 2.5 2.3 1.9 1.9 2.0 2.1 2.3 2.5 2.5 2.6 2.6 2.4 2.4 2.1 1.7 1.6 1.7 1.9 2.2 2.6 2.9 3.2 3.2 3.2 3.3 3.3 2.9 2.9 2.6 2.6 2.9 3.0 3.1 3.3 3.3 3.4 3.6 3.5 3.1 3.0 1.5 2.0 2.5 3.0 3.5 4.0 4.5 5.0 5.5 6.0

Year-Over-Year Inventory Levels

Source: NAR

-30% -20% -10% 0% 10% 20% 30% January 2014 January 2015 January 2016 January 2017 January 2018 January 2019 January 2020 January 2021 January 2022 January 2023 January 2024

Year-Over-Year Inventory Levels

Last 12 Months

Source: NAR

15.3% 5.4% 1.0% -6.1% -13.6% -14.6% -14.1% -8.1% -5.7% 0.9% 4.2% 3.1% Feb Mar Apr Jan-24 July May June Aug Sept Oct Nov Dec

New Home Monthly Inventory

Seasonally Adjusted, Last 13 Months

Source: Census

8.5 8.1 8.4 8.1 7.6 7.2 7.5 7.1 7.9 7.5 7.9 8.9 8.3 8.3 Dec Jan 23 Feb Mar Apr May June July Aug Sept Oct Nov Dec Jan 24

New Home Monthly Inventory

Source: Census

7.9 7.6 6.9 7 6.3 7.5 7.2 8.4 8 8.9 10.9 9.2 8.1 Jan Feb Mar Apr May June July Aug Sept Oct Nov Dec 2023 2024

Non-Seasonally Adjusted

Buyer Demand

Showing Index Still Remain Above Pre-pandemic Levels

Source: ShowingTime

Showing Index over Last 7 Januarys 141.1 127.6 152.5 235.8 252.1 189.9 173.5 2018 2019 2020 2021 2022 2023 2024

Mortgage Rates

2.0 2.5 3.0 3.5 4.0 4.5 5.0 5.5 6.0 6.5 7.0 7.5 8.0 1/3/2019 1/24/2019 2/14/2019 3/7/2019 3/28/2019 4/18/2019 5/9/2019 5/30/2019 6/20/2019 7/11/2019 8/1/2019 8/22/2019 9/12/2019 10/3/2019 10/24/2019 11/14/2019 12/5/2019 12/26/2019 1/16/2020 2/6/2020 2/27/2020 3/19/2020 4/9/2020 4/30/2020 5/21/2020 6/11/2020 7/2/2020 7/23/2020 8/13/2020 9/3/2020 9/24/2020 10/15/2020 11/5/2020 11/25/2020 12/17/2020 1/7/2021 1/28/2021 2/18/2021 3/11/2021 4/1/2021 4/22/2021 5/13/2021 6/3/2021 6/24/2021 7/15/2021 8/5/2021 8/26/2021 9/16/2021 10/7/2021 10/28/2021 11/18/2021 12/9/2021 12/30/2021 1/20/2022 2/10/2022 3/3/2022 3/24/2022 4/14/2022 5/5/2022 5/26/2022 6/16/2022 7/7/2022 7/28/2022 8/18/2022 9/8/2022 9/29/2022 10/20/2022 11/10/2022 12/1/2022 12/22/2022 1/12/2023 2/2/2023 2/23/2023 3/16/2023 4/6/2023 4/27/2023 5/18/2023 6/8/2023 6/29/2023 7/20/2023 8/10/2023 8/31/2023 9/21/2023 10/12/2023 11/02/2023 11/22/2023 12/14/2023 1/4/2024 1/25/2024 2/15/2024 Source: Freddie Mac Mortgage Rates 30-Year Fixed Rate, January 2018–Today 6.94%

2.0 2.5 3.0 3.5 4.0 4.5 5.0 5.5 6.0 6.5 7.0 7.5 8.0 Source: Freddie Mac Mortgage Rates 30-Year Fixed Rate, January 2016–Today 6.94%

Mortgage Rate Projections

Quarter Fannie Mae MBA NAR Average of All Three 2024 Q1 6.50% 6.90% 6.80% 6.73% 2024 Q2 6.30% 6.60% 6.60% 6.50% 2024 Q3 6.10% 6.30% 6.30% 6.23% 2024 Q4 5.90% 6.10% 6.10% 6.03%

January 2023

2.0 3.0 4.0 5.0 6.0 7.0 8.0 2019 1/31 3/7 4/4 5/2 6/6 7/3 8/1 9/5 10/3 11/7 12/5 2020 2/6 3/5 4/2 5/7 6/4 7/2 8/6 9/3 10/1 11/5 12/3 2021 2/4 3/4 4/1 5/6 6/3 7/1 8/5 9/2 10/7 11/4 12/2 2022 2/3 3/3 4/7 5/5 6/2 7/7 8/4 9/1 10/6 11/3 12/1 1/5 2/2 3/2 4/6 5/4 6/1 7/6 8/3 9/710/5 11/9 12/7 1/4 2/8 6.6 6.3 6.3 6.1 2024 Q1 2024 Q2 2024 Q3 2024 Q4 Source: Freddie Mac, MBA Mortgage Rates 30-Year Fixed Rate January 2019 – Today Actual Interest Rates Where Are They Going?

Mortgage Rates

Source: MBA

30-Year Fixed Rate 2018 Q1 2018 Q2 2018 Q3 2018 Q4 2019 Q1 2019 Q2 2019 Q3 2019 Q4 2020 Q1 2020 Q2 2020 Q3 2020 Q4 2021 Q1 2021 Q2 2021 Q3 2021 Q4 2022 Q1 2022 Q2 2022 Q3 2022 Q4 2023 Q1 2023 Q2 2023 Q3 2023 Q4 2024 Q1 2024 Q2 2024 Q3 2024 Q4 2025 Q1 2025 Q2 2025 Q3 2025 Q4 Rate 4.3 4.5 4.6 4.8 4.4 4 3.7 3.7 3.5 3.2 3.0 2.8 2.9 3.0 2.9 3.1 3.9 5.3 5.7 6.6 6.4 6.5 7.0 7.3 6.9 6.6 6.3 6.1 5.9 5.8 5.7 5.5 2.5 3 3.5 4 4.5 5 5.5 6 6.5 7 7.5 - Actual - Projected 2018 2019 2020 2021 2022 2024 2023 2025

Mortgage Credit Availability

Mortgage Credit Availability Index (MCAI)

Source: MBA

January 2024 90 100 110 120 130 140 150 160 170 180 190 Apr 2013 Jan 2014 Jan 2015 Jan 2016 Jan 2017 Jan 2018 Jan 2019 Jan 2020 Jan 2021 Jan 2022 Jan 2023 Jan 2024

Lending Standards Still Under Control

Source: MBA

Historic Data for the Mortgage Credit Availability Index (MCAI) 0 100 200 300 400 500 600 700 800 900 June 2004 June 2006 June 2008 June 2010 June 2012 June 2014 June 2016 June 2018 June 2020 June 2022 January 2024 Housing Bubble: 868.7 92.7