The moment has finally arrived – the launch of SME Review Magazine! We couldn't be more thrilled to bring you this digital publication that is dedicated to showcasing the incredible world of small and medium-sized enterprises. Our magazine is designed to provide a platform for entrepreneurs, both seasoned and aspiring, to share their stories, insights, and expertise.

In this edition, you'll discover inspiring success stories from women in business who have defied the odds and achieved remarkable milestones. We believe in celebrating their achievements and shining a light on their journeys as they navigate the challenges of entrepreneurship.

But why did we choose Women's Month for our launch? Well, it's simple – we want to pay homage to the trailblazing women who are making waves in various industries. This month is all about recognizing their contributions and empowering others through their stories.

In addition to highlighting successful entrepreneurs, we aim to provide practical advice, tips, and resources that can help SMEs thrive in today's competitive landscape. From marketing strategies to financial management tips, our goal is to equip you with valuable knowledge that will fuel your business growth.

So whether you're an established entrepreneur looking for fresh perspectives or someone dreaming of starting your own venture someday, SME Review Magazine promises something for everyone. Join us as we embark on this exciting journey together!

LUNGA KAKAZA EDITOR IN CHIEF

Founder & Editor in Chief

Lunga Kakaza lunga@houseofkumkanimedia.co.za

Content writer

Mthokozisi Mthethwa Mthokozisi@houseofkumkanimedia co za

Sales Director

Thabang Kobue

Thabang.kobue@houseofkumkanimedia.co.za

Social Media Manager Daisy Heynes daisy@houseofkumkanimedia.co.za

Publisher

House Of Kumkani media

www houseofkumkanimedia co za

advertise@sme-reviewmag co za

Palesa Mabasa FNB Business Development Head: SME Funding

Palesa Mabasa FNB Business Development Head: SME Funding

In a difficult economic environment, it may make sense to downsize your business rather than closing doors altogether. Load shedding, inflation, and the current high interest rate environment have left little disposable income in consumers’ pockets making it very challenging for SMEs to be as profitable as before. Downscaling a business may result in better profitability in the short to medium term.

Larger companies may find it more difficult to retain control over the products and services they offer. If your company is smaller, you are able to maintain tighter control If you are choosing to let staff go, review their performance levels instead of simply going with the adage of “last in, first out”. This will allow you to trim your workforce to retain the most efficient staff. Also consider offering voluntary retirement where it is possible.

Often, outsourcing a job rather than having a full-time employee can cut down on costs since you are paying for the work done and not for any fringe benefits. This can help you release capital for your business but be sure to draw up a clear contract with specific deliverables, so that both parties are clear on what they have committed to.

The last thing you want to do is end up on the wrong side of the law. You need to have a concrete reason for choosing to let someone go or have a rule if you are going to adopt a strategy of periodically downsizing to keep your company small. “For example, you can set certain key performance indicators for employees and review every six months. If an employee fails to meet or achieve anything near their key performance indicators (KPIs), you can use this as a legitimate reason to let them go when you downsize,” Mabasa says. The last thing you want is a lawsuit for wrongful termination or a bitter employee trashing your reputation.

You aren’t the first company to downsize and unlikely to be the last. Look at how other companies have managed the process and learn from their mistakes.

“Finally, remember that although your decision may be focused on your business, downsizing often affects your employees directly and you are dealing with people first Be compassionate and treat them with respect,” Mabasa concludes.

Western Cape minister of finance and economic opportunities, Mireille Wenger, said, “It is a great pleasure to officially launch the SME Accelerator Programme, a unique collaboration with the public and private sector, between the highly esteemed Johannesburg Stock Exchange and the Western Cape Government (WCG), to ensure that a targeted 100 small and medium-sized businesses have access to the expertise they need to expand and to create many more jobs in South Africa.”

The three-year programme will focus on numerous initiatives to facilitate the development and growth of SMEs in the province The first year (2023) will focus on a capital matching initiative where SMEs will be introduced to capital providers who are interested in funding SME businesses in their growth phases.

There are three phases in the initiative: recruitment of SMEs, capital or investor readiness support for the SMEs, and an event in Cape Town where SMEs will get the opportunity to present their investment cases to investors for funding consideration

“Small and medium-sized businesses are the heart and soul of our economy If they succeed so too does our economy. I welcome all initiatives and measures that help SMEs realise their full potential," said Premier Alan Winde.

"The JSE is focused on making a continuous meaningful contribution to the country’s national agenda and economy We devote significant resources in our business to provide tangible solutions to fast-track SME growth and facilitate access to capital," said JSE group CEO, Leila Fourie.

"This new initiative with the WCG is a significant aspect of the JSE’s strategy to align our activities and services with the needs of our clients and country We will continue to work tirelessly to collaborate with the government to bring enhanced services that can add much-needed value to economic growth."

“At the very heart of our ambitious economic plan, G4J is the understanding that it is the private sector, and particularly, citizens, entrepreneurs, and SMMEs, that create jobs. To put it simply: it is the private sector that creates jobs, and it is our job as government, to make this as easy as possible. I look forward to tracking the progress of this exciting collaboration, as well as the benefits and expansion of those SMEs participating. There is much to look forward to,” concluded Wenger

Struggling to secure employment after what felt like a thousand interviews following her voluntary retrenchment in 2009, Thuli

Magubane concluded that this may just be God’s way of saying that her journey of being an employee had run its course. Little did she know that 13 years later her brainchild Mint Fresh Advisory Services would boast clients of such high caliber as Standard bank, Sasol, Transnet Port Terminals and the NEF amongst others. Through her company Thuli and her team assist their clients to execute Enterprise and Supplier Development (ESD) programmes

Thuli says that White males dominate her industry, however, she has proven that there are many competent people of colour from various industries, whom she has recruited to become part of her team

Having attended Instituto de Impressa (IE) Business school in Madrid, Thuli was extremely impressed with how IE sourced their lecturers globally from countries such as Korea, the USA as well as across Europe IE only selected individuals who were leaders in their fields. Today this same model inspires her design at Mint Fresh Advisory Services

Her team is comprised of qualified industry experts who are Masters graduates or higher This approach has been instrumental in attracting high profile individuals to the program as they recognize the quality and value thereof. The main attraction to ESD spaces for most people is the size of the financial pie in and what sets the Mint Fresh team apart from competitors is that they are driven by passion and a deep-seated hunger to develop and grow SMEs.

Thuli Magubane CEO : Mint Fresh Advisor Services

“

We are entrepreneurs ourselves and we are going through our own journey while guiding other entrepreneurs through journeys of their own” she says In a country like South Africa where unemployment is the driving force behind the birth of numerous businesses, many people are entrepreneurs by default The start-up programme that Mint Fresh offers has been the saving grace for thousands of entrepreneurs, since our education system is one that is designed to produce employees. Thuli says that it has been a blessing to witness how some of the entrepreneurs who are products of her and her team’s program were able to survive Covid with their businesses remaining sustainable even today. This is a major milestone considering how Covid was able to sink various major businesses, some of which have been in existence for over a decade

Thuli says that entrepreneurship is best approached from an angle of identifying a problem, a need or challenge and providing a solution for it Many South Africans do not have the right exposure, training or knowledge. “Our free 6-8 week programme covers finance, compliance, marketing, social media and is basically just an all-round business programme” With several businesses going online post Covid, Mint Fresh’s ever-evolving programme now includes e-commerce

Mint Fresh’s entrepreneurship training programme is intentionally not accredited, even though it has attracted MBA and PHD graduates but it also caters for those who do not even have a Matric certificate This goes a long way in promoting inclusivity. Not having the programme accredited has resulted in the loss of business, including a multinational in the beverages sector Thuli understands the value of the programmes offered by Mint Fresh, they are not the cheapest but certainly not the most expensive She shared a story of how Mint Fresh lost out on a municipality tender where they were the only company that scored 100% due to pricing. The municipality appointed the cheapest company.

Through it all, Thuli says that what humbles and gives her the most pride, is seeing and reading about success stories of entrepreneurs who have gone through various Mint Fresh programmes Seeing entrepreneurs succeed really makes everything that Mint Fresh undertakes worthwhile Talking about success, Thuli is launching her podcast on the 17th of September, which happens to be her birthday. The podcast is aptly named The Success Rate, where she will have conversations with an array of individuals from across sectors chatting and discovering their journeys to success

“Giving your people independence is a great catalyst to positive mental health in the workplace.”

One of the best options to consider is the DTI fund It is a collection of funding schemes that the Department of Trade and Industry (DTI) makes available to South Africans with new business ventures and those with already existing ones

Much of the funding schemes take the form of loans and grants, with a few being set up as cost-sharing incentives Some of the options under the DTI fund include the Agro-Processing Support Scheme (APSS), Automotive Investment Scheme (AIS), Business Process Services (BPS), Support Program for Industrial Innovation (SPII), the Critical Infrastructure Program (CIP), and the Manufacturing Investment Programme (MIP) Those seeking DTI funding for a small business can begin their applications by visiting the department's official website

The NYDA (National Youth Development Agency) Grant Programme is designed to provide young entrepreneurs with an opportunity to access both financial and non-financial business development support to enable them to establish or grow their businesses

Besides the financial assistance, the non-financial services provided by the NYDA include mentoring, cooperative development, business management programmes, and consultancy services The maximum amount of funding for a small business one can receive in a single cycle is R250,000

This agency was set up to foster the establishment and growth of Small and Medium Enterprises. SEFA provides development finance to SMEs and Cooperatives that are not able to attract commercial credit.

SEFA grants, loans, and other forms of business development financing range between R50,000 and R5 million

This is one of the South African government's financial assistance schemes It is an exclusive fund that aims to accelerate women's economic empowerment by providing more affordable, usable, and responsive finance than is currently available The IWF is targeted at businesses that are wholly or majorly womenowned

The fund provides financing ranging from R30,000 to R2 million An individual or business seeking the Isivande Women's Fund begins by making an application that fund managers review before the funds can be released

Khula is a South African state-owned enterprise that was established in 1996 to focus on promoting and developing small and medium enterprises (SMEs) While the body does not give out loans and grants directly, it makes it possible for deserving individuals and enterprises to get funding from other South African financial institutions

Besides providing government small business funding, the body also provides mentorship to entrepreneurs, helping them to manage their businesses successfully

You need funding upfront; you need it within hours Funding for your business is one of the most important financial choices you’ll make As a business owner, you know this

But when seeking business funding, you don’t want to risk your assets, right? And you want to use the funding as you need it You want to be able to pay it back in a way that matches your business turnover You want a funding solution that is on your terms, that you can control You want options You want business funding that is unsecured, unrestricted, flexible, and safe – with the support of our expertise

Retail Capital business funding opens your eyes to possibilities and empowers you to seize them

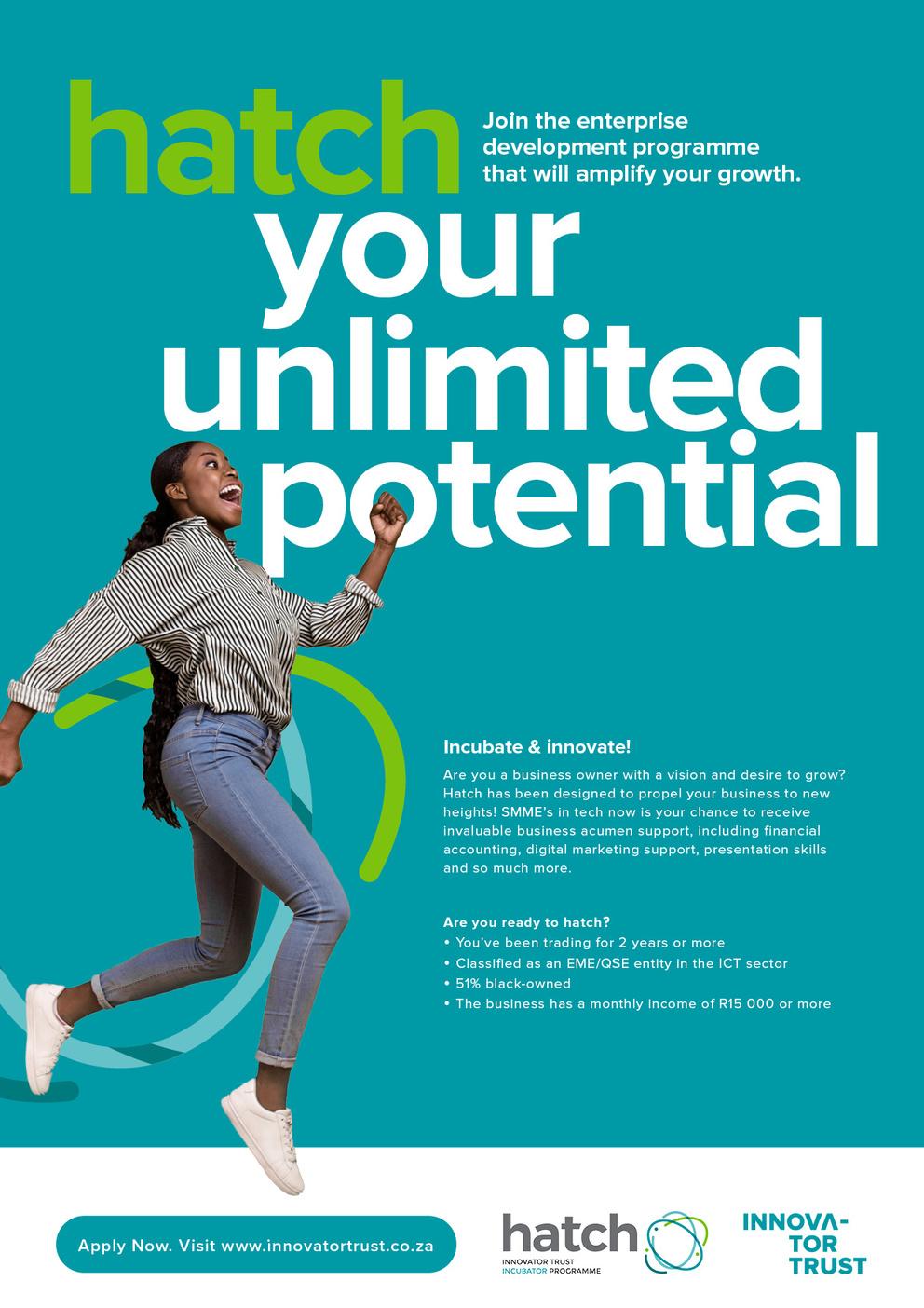

Economic growth and sustainable entrepreneurship are paramount. Are you a small business owner in South Africa's dynamic ICT space? Hungry for success and desperately seeking to boost your business growth? Innovator Trust, the pioneers in empowering ICT entrepreneurs and fostering innovation, presents its groundbreaking Enterprise Development Programme (HATCH), now accepting applications for 2024 until 14 September 2023

Innovator Trust, powering entrepreneurial success

Innovator Trust is based in South Africa and focuses on developing and supporting technology-enabled businesses. The Innovator Trust is enabled by Vodacom to support the growth of sustainable small businesses in the ICT sector. Since inception, the programme has been instrumental in increasing job creation, driving innovation among small businesses and contributing to the greater economic transformation of South Africa through their support of SMMEs.

With a mission to educate and empower entrepreneurs in the ICT space, Innovator Trust aims to bridge the gap in the technology sector and create a sustainable ecosystem for growth. Positioned at the forefront of the industry, Innovator Trust’s comprehensive Enterprise Development programme (HATCH) has propelled businesses to thrive and succeed in the face of adversity.

For the last decade, this sophisticated initiative has been meticulously designed to provide holistic entrepreneurial support aimed at unleashing your potential as a business owner, and amplifying your business's growth.

Ignite your skills and level up: Experience an immersive personal and professional growth journey through tailored training sessions delivered by industry experts Delve into cutting-edge ICT strategies, refined management techniques, and advanced business acumen

Mastermind mentorship: Immerse yourself in the knowledge, insights, and guidance of seasoned mentors who have conquered the ICT landscape, helping you navigate challenges and seize opportunities with finesse.

The recruitment drive for 2024 is targeted at SMMEs in the following categories: IOT/AI, fintech, e-commerce, and digital and software development, supporting an even more significant number of SMMEs nationwide, with a particular emphasis on female entrepreneurs in the ICT sector who meet the qualifying criteria. Business criteria:

The business must have been trading for more than 24 months.

Be classified as an EME/QSE entity in the ICT sector, focusing on software, AI, cloud, IoT, analytics, virtual reality, or digital commerce.

The entity must be at least 51% black owned.

The business must have a minimum monthly income of R15,000.

One of the myths that surround cyber security is that SMEs don't need it to the same extent larger enterprises do The perceived wisdom is that cybercriminalsaiming to score a payday or cause widespread damage - target mainly large corporations, governments, and global organisations to maximise their impact

According to a report by Liquid C2, which features research and analyses across Kenya, South Africa and Zimbabwe about evolving cyber security threats, cyber-attacks against large enterprises have ramped up dramatically

The report further reveals that the number of cyber-attacks on businesses in Kenya, South Africa and Zambia increased by 76%, and while the research was compiled using data from large corporations, SMEs should sit up and take notice too

This is because the view that small businesses needn’t worry about implementing cyber security strategies and supporting safeguards is not only inaccurate but also dangerous to both SMEs and their partners operating in the online space.

SMEs are, in fact, more attractive targets because they’re perceived to have weaker security measures, and the impact of a successful breach can be even more damaging to them than larger enterprises

In some instances, it can mean the end of the business. Cybercriminals can use a wide array of avenues to breach an SME The biggest threats are phishing attacks via email, leading to fraud, and malware (ransom) attacks that are typically linked to malicious links and/or files from unknown senders that are opened

Attacks on passwords are also common, and they typically lead to complete compromise, including elevated rights and ownership by attackers All it takes is one employee to open a malicious link, and an entire private network can be compromised

Furthermore, those SMEs that employ remote working or hybrid working models are more at risk than others Employees using unprotected networks should be a major security concern to employers, as should load shedding, which sees workers hopping between private and public Wi-Fi networks, accessing critical corporate software and data, many without any protective cyber security measures.

The negative impacts of a breach against a business that suffers a cyber-attack have been well documented – loss of data, including extorsion, liability fees, loss of revenue, damage to reputation, and loss of trust by consumers and partners In the case of SMEs, there is another concern; they can become a gateway for hackers who want to breach the larger entities they are partners with or suppliers for

In such instances, an SME can find its ability to grow its operations through a bigger partner permanently halted thanks to reputational damages incurred by a cyberattack Unfortunately, this type of occurrence has become so widespread and harmful that many larger companies refuse to conduct business with SMEs that do not have a cyber security programme in place

In addition, many countries/industries now have legislation and regulations governing data protection and privacy, so implementing cyber security measures enables SMEs to comply with these legislative/regulatory requirements and avoid fines or legal action. Every business – no matter its size – that conducts operations in the online space can afford to be without a comprehensive cyber security strategy and complementing measures or safeguards.

The good news is that implementing a cyber security programme is easier – and more cost-effective – than most SMEs may imagine

Investing in the right cyber security programme does not have to be complicated or expensive. Installing countermeasures – such as advanced endpoint protection including antivirus (malware) software, strong authentication, data backups, data encryption and managed security services – can mitigate a lot of attempted breaches and, in some instances, stop attacks even before they start

An incident response plan in the event of a cyberattack, as well as considering native cloud security solutions, are equally important – and many of these solutions are cost-effective and scalable for SMEs. It’s crucial to make these purchases from a reputable vendor with a proven track record in the cyber security space, as they provide a substantial number of native security safeguards that can be enabled and optimised to protect SMEs effectively against most attacks

Cyber security in businesses – as well as government and NGOs - is key to ensuring the growth of the digital economy It must receive the strategic priority it demands for sustainable business success. Cybercrime affects all companies, not just the big ones, and as is the case with larger enterprises, cyber security for SMEs is no longer a grudge purchase. It should be at the centre of any business conversation.

Not For Sale to Persons under the age of 18

Small-to-medium-sized enterprises (SMEs) are buckling under the pressure of load shedding and liquidity challenges.

That’s according to last year's fourth quarter SME Confidence Index It found that confidence has plummeted among SMEs as the 15year long energy crisis in South Africa escalates.

Confidence had improved after the 2020 slump because of the Covid19 pandemic lockdowns, but the onset of stage 6 load shedding last year saw businesses hit hard by interruptions in power supply.

Executive general manager for impact investing at Business Partners David Morobe said the SME sector was being hammered by headwinds both on a national and global front. It was therefore not surprising that their confidence had taken a knock

"In light of this, small businesses are now faced with the option of investing in alternatives to limit their reliance on the national grid. With load shedding expected to persist indefinitely, accessing a predictable source of power is imperative to business continuity and should be treated as a top priority, which might remain a challenge for 27% of the SMEs surveyed who indicated that their businesses could not afford to invest in alternative energy solutions,” he said.

SMEs are the heart of the economy and job creation, however, business owners confidence that their ventures will grow in the next 12 months dropped by 9% to 56%. While confidence that the domestic economy will be conducive for business growth within the next 12 months also dropped 13% to 64%

The survey found that SMEs were concerned about a lack of support from bigger private sector businesses, suggesting that big businesses themselves were under pressure from domestic and global factors such that support to grow the SMEs may not be there. “It's a red flag given the critical role of the private sector in supporting the growth of small businesses.

Many SMEs rely on supplier agreements with the private sector and structure their business models around this demand

Private sector players also provide small businesses with muchneeded access to funding for kickstarting their ventures, purchasing assets and hiring talent.As such, the return of the SME confidence in this area is a vital factor in creating an enabling environment for entrepreneurs, who are essential contributors to job creation, social empowerment and economic growth,” Morobe said

He said cashflow retains its position as the most long-standing challenge identified by South African SMEs in the SME Index. While crime was reported as the second most pressing concern, followed by funding, which replaced "economic conditions" as the third biggest roadblock to success.

This was compounded by interest rate hikes which escalated significantly towards the end of last year – for 60% of local small businesses, this market factor contributed to increased financial distress,” Morobe explained.

Outside of load shedding, the SMEs were upbeat that government was doing enough to foster small business development and that the red tape unit in the presidency may help in this regard.

Other key developments for the SME sector include the exemption of these businesses who employ less than 50 employees from the annual reporting requirements in terms of the New Employment Equity Act.

Meanwhile, there are proposals to amend the National Small Enterprise Act (1996) to level the playing field between government, big business and the SMEs and to create a statutory body to resolve SMEs-related issues. DA’s Henro Kruger welcomed the move saying the lack of adequate legislative support for the SMEs had long been a concern.

“The amendment of the Act is necessary because of the apathetic government and the department of small business development, which have been painfully slow in providing the necessary legislative support for small businesses to thrive

According to data published by the South African Reserve Bank, the accumulative loss of stage six load shedding amounts to between R204mntoR900mperday Aproportionofthese losses are incurred by the thousands of small businesses who simply do not have the resources to install backup sources of energy to continue operations during power cuts. In a bid to provide business owners with much needed reliefandfinancetoinvestinviablealternatives, Business Partners Limited has today launched a R400m Energy Fund for small- to medium-sized enterprises(SMEs).

Commentingonwhynowistheperfecttimeforsmallbusinessestoinvest inalternativeenergysystemsisJeremyLang,executivedirectorandchief investmentofficeratBusinessPartnersLimited.

As he suggests: “While the ongoing energy crisis presents many uncertainties, one thing we do know is that load shedding will continue to bearealityfortheforeseeablefuture

"South African businesses need to mitigate this risk by decreasing their reliance on the national grid and start investing in systems that will provide a consistent and reliable source of power. Not only will this be a vital contributing factor to business continuity, but it will also bring small businesses one step closer to realising their sustainability goals.”

In the recent Q4 2022 SME Index – a quarterly survey conducted by Business Partners Limited, SMEs were asked whether they have the necessary funds to invest in energy solutions such as generators, inverters and solar-powered systems.

35% of respondents revealed that they have budgeted for this investment and 37% reported that plans to divert to alternative energy systems were being put into place. Unfortunately, about 30% of small businesses, however, said that they cannot afford the large outlay required to make this investment

“These findings are a strong indicator of a dire and urgent need that exists within the SME sector,” says Lang. "Small businesses have been impacted by power cuts in a number of ways, none the least of which include loss of output, increased overheads, additional capital expenditure, operational challenges and supply chain disruptions.

Ultimately these consequences result in turnover reduction, margin shrinkage and long-term financial distress

What we also need to realise is that the intermittent return of power doesn’t always mean an immediate return to business as usual. This is particularly true for SMEs who run manufacturing plants. Some machinery takes an hour or two to ‘warm up’ and become fully operational.”

This is compounded by the need to clean machines when the energy supply is cut off and raw materials are wasted. In the case of stage six load shedding, getting up and running after a power cut only to face another blackout a mere two hours later can have devastating effects on business operations

Finding ways to access a reliable energy supply is therefore not only a matter of sustainability but also one of survival.

The Business Partners Ltd Energy Fund for SMEs will directly address this problem

Through it, small businesses will gain access to loans of between R250 000 and R2m. These loans will be offered at a competitive, riskadjusted interest rate with a repayment term of up to five years. Business Partners Limited have optimised the accessibility and affordability of these loans by offering no repayment obligations for the first six months. In preparation for making their application to the Energy Fund for SMEs, Lang urges small businesses to ensure that their financial statements are up to date, and that they have an equipment quote from a reputable accredited installer of their choice

Loans from the Energy Fund for SMEs can be used for the purpose of purchasing alternative energy solutions such as solar systems, backup batteries and inverter systems, dieselpowered generators as well as other energy generation related products. SMEs whose loans are approved may also be able to take advantage of the latest tax incentive, announced in this year’s budget speech. The incentive allows businesses to reduce their taxable income by up to 125% of the cost of their investment in renewables.

As Lang concludes: “The long-term benefits of running a more energy secure business will far outweigh the cost of the investment. With alternative energy sources, businesses can future proof their operations, position themselves as potential contributors to the impending embedded generation programme while also reducing the cost of energy.”

Loan applications for the Energy Fund for SMEs are now open and can be processed online via the following portal:

www.businesspartners.co.za.

Their entrepreneurial journey in the mining and waste management sector started because they were tired of being ignored by their male counterparts and decided to bridge the gender gap by starting businesses.

Gender bias and inequality is prevalent across the world and women are tired of being sidelined by their male counterparts.

A report by the UN Development Programme revealed that nearly half of the world’s population say that men make better political leaders while 43% say men are better business executives

Medori Julius is a fierce entrepreneur with a business that specializes in providing mining supplies and services. The Northern Cape based entrepreneur said there were instances she was ignored and had men talk down to her in her meetings. She was tired of getting sidelined and together with her husband Anthony, they started a business called BAD Group.

“They would just speak to my husband and assume I'm part of a front to tick all the right boxes for the company, but this is not the case,” said Medori She added that most men underestimated her capacity and the role she plays in the company. “I’m using this disadvantage as an advantage, it's not easy though in the mining industry as a woman,” she emphasized.

She’s played a vital role in the business since the inception and enjoys being hands instead of an office-based shareholder “I’m not deterred in meetings when I’m overlooked by my male counterparts They prefer to only speak to my husband, thinking he runs the show, they have no idea that I’m a vital part of the business too,” said Medori proudly.

BAD Group was started three years ago when the Covid19 pandemic struck. To get the business up and running, they set up shop in their lounge with a table, laptop, and printer. Today their successful business renders its services in five provinces and has three branches with its head office in Kuruman.

“We have nine main vendors with 21 sites in the five provinces, and one main major contractor in the underground mining industry. We currently have five employees, two of them are youth and all five are from local communities, “said Medori.

The mining sector is highly competitive and to stand out from competitors, BAD Group supplies environmentally friendly and unique patented tamping and stemming system.

“Tamping plugs are compulsory in underground mines, enforced and regulated by the Department of Mineral Resources and Energy (DMRE), and the ones we supply are compatible with all major explosives in South Africa.

Introducing a product that significantly enhances safety and is friendly on the pocket is important to the business. BAD Group has big plans for this product. “We want to manufacture it locally, therefore, creating permanent work in host communities,” said Medori

Through the business, Medori is challenging the stereotype that women can’t work in male dominated sectors, while creating jobs and using eco-friendly products that are not harmful to the environment.

Vanessa Wippenaar is the proud owner of Berecah Contractor, a waste management and recycling company in the Western Cape. In 2020, Vanessa started the business with her husband Stanely As a woman working in this male dominated sector, she is proud to be counted as one of the few women playing a vital role in reducing pollution.

“I’m proud to be an entrepreneur of a waste and recycling business because, for the longest time, it's been a maledominated sector. My business is bringing a positive change and it’s doing just as well if not better than my male counterparts,” said Vanessa proudly.

The Institute of Waste Management of Southern Africa (IWMSA) highlighted challenges faced by women in the waste management sector, it noted that transport was notably a barrier of entry for women trying to break into the waste sector industry.

Berecah Contractor is based in Kuilsriver, Cape Town and services up to 30 clients daily and has managed to create three permanent jobs. This is an impactful business that is making a positive impact on the environment while addressing unemployment as well.

Waste management is important because companies, individuals, and communities need help to manage their waste and to keep the environment clean. The business helps the man on the street and businesses to generate income from waste. “We sort and responsibly dispose waste through recycling and repurposing of waste,” said Vanessa.

Providing excellent customer service is important to Vanessa and this is her competitive edge “I regularly check in on my clients and I tailor services to their needs to keep them happy,” she said.

Berecah Contractor is an agile business that is switching things up and will now offer a service where waste is sorted on the premises of the client, giving them a rebate on this.

This environmentally conscious business owner loves seeing her client’s happy face when they see money generated from waste. She added that it's rewarding for her to help unemployed people generate an income from waste. "We help unskilled workers put bread on the table and a roof over their head,” she said

In the face of gender inequality, Vanessa and Medori are shining examples that women can thrive in male dominated sectors and are resilient enough to overcome challenges.

Women are starting businesses in greater numbers than ever before and are paving the way for future generations of women (and men) to succeed in little-known industries – an achievement not to be taken lightly.

Katlego Goapele and Candice Bull are two brave women who are making strides in engineering and food science technology, respectively We look at how they are thriving in these unpopular and difficult sectors.

Honey Bee Engineering opened in 2006, and Goapele invested in the business in 2014 and joined its operations fulltime in 2016 when her corporate IT job was no longer suitable for the then young mother. The leap from IT to electromechanical engineering was an excitementfilled one for Goapele as she had, in fact, always wanted to study mechanical engineering.

Today, Goapele is the co-owner of Honey Bee Engineering, an armature winding company that specialises in the repair of rotating electrical motors, the kind of equipment used to facilitate the movement of elevators, conveyor belts, and different types of pumps for example

Goapele is especially proud that her business’ service provides clients peace of mind knowing that their equipment is maintained for continuous production, but it’s not without its stresses. The business mainly subcontracts on behalf of larger businesses servicing municipalities, mining companies and hospitals in Gauteng.

Bull came across food technology by accident, she enjoyed the food aspect of home economics in high school and decided to pursue it after she matriculated.

After completing her BTech in Food Technology in 2004, Bull worked for suppliers with local and international brands. After working in the sector for almost a decade, she’s developed an interest in helping suppliers deliver products aligned with the stringent standards food manufacturers require.

Years later, this would become Bull’s niche and the main service offering of her business, which she also came into somewhat accidentally.Her clients are suppliers across the food and personal care value chain who want to ensure their products meet the expectations of their retailer clients Bull’s job is to help suppliers do just that by identifying shortcomings in their quality and safety processes and advising on how to address them –using her industry insights as a guide.

Bull is a food technology graduate and the brains behind Benevolence Consulting, a food safety, quality control and product development consultancy that was established in 2017.

“The transition to entrepreneurship was scary but it was liberating because I knew what I was talking about and could share it confidently,” says Bull.

These brave entrepreneurs value their independence and are proud about the self-employment opportunity they have created. Even when times are tough, Bull is not tempted to going back into the fulltime corporate environment.

Goapele shares this sentiment, emphasising that she wants an autonomy in her work life that a corporate gig won’t offer. Bull adds: “For me, my business is about giving back. I love being in a position to help and empower other businesses That’s what drives me.”